- PBF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

PBF Energy (PBF) S-1/AIPO registration (amended)

Filed: 22 Feb 12, 12:00am

Exhibit 10.8

SPECIFIC TERMS IN THIS EXHIBIT HAVE BEEN REDACTED BECAUSE CONFIDENTIAL TREATMENT FOR THOSE TERMS HAS BEEN REQUESTED. THE REDACTED MATERIAL HAS BEEN SEPARATELY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, AND THE TERMS HAVE BEEN MARKED AT THE APPROPRIATE PLACE WITH THE WORD “[REDACTED]”.

CRUDE OIL/FEEDSTOCK SUPPLY/DELIVERY

AND SERVICES AGREEMENT

between

STATOIL MARKETING & TRADING (US) INC.

and

DELAWARE CITY REFINING COMPANY LLC

TABLE OF CONTENTS

| Page | ||||

1. CONTRACT PARTIES | 1 | |||

2. DEFINITIONS AND CONSTRUCTION | 2 | |||

3. TERM OF OIL AND FEEDSTOCK SUPPLY AND SERVICES | 16 | |||

4. QUALITY | 16 | |||

5. ACQUISITION OF OIL AND FEEDSTOCK | 18 | |||

6. NOMINATIONS | 25 | |||

7. TITLE; CONTROL; RISK OF LOSS | 26 | |||

8. STORAGE FACILITIES | 27 | |||

9. PRICE AND PRICING | 28 | |||

10. PAYMENT AND THE EPQ PROCESS | 35 | |||

11. RECONCILIATION OF MONTH END VOLUMES AND ADJUSTMENT | 36 | |||

12. PETTY CASH BANKS | 38 | |||

13. VESSEL, BERTH AND SUPPLY PORT | 39 | |||

14. SHIPPING AND LIGHTERING | 43 | |||

15. DETERMINATION OF QUANTITY AND QUALITY | 45 | |||

16. LAYTIME AND DEMURRAGE | 47 | |||

17. UNSCHEDULED DISRUPTION TO NORMAL REFINERY OPERATIONS | 49 | |||

18. FORCE MAJEURE | 49 | |||

19. CREDIT CONDITIONS | 51 | |||

20. TAXES, DUTIES AND CHARGES | 53 | |||

21. INSURANCE | 54 | |||

22. REPRESENTATIONS, WARRANTIES AND COVENANTS | 55 | |||

23. AUDITING AND INSPECTION RIGHTS | 60 | |||

24. DEFAULT, SUSPENSION AND TERMINATION | 60 | |||

25. OBLIGATIONS AT TERMINATION | 63 | |||

26. INDEMNIFICATION AND CLAIMS | 65 | |||

27. DAMAGES | 68 | |||

28. ASSIGNMENT | 68 | |||

29. NOTICES AND ADDRESSES | 69 | |||

30. WARRANTIES; DISCLAIMER | 70 | |||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||

31. APPLICABLE LAW, LITIGATION AND ARBITRATION | 70 | |||

32. HSE, DRUG AND ALCOHOL POLICY | 72 | |||

33. MATERIAL SAFETY DATA SHEETS | 73 | |||

34. VOICE RECORDING | 73 | |||

35. DISPOSAL | 73 | |||

36. CONFIDENTIALITY | 74 | |||

37. SOVEREIGN IMMUNITY | 75 | |||

38. ANTI-CORRUPTION AND FACILITATION PAYMENTS | 75 | |||

39. CONFLICT OF INTEREST | 76 | |||

40. MISCELLANEOUS | 76 | |||

-ii-

APPENDICES

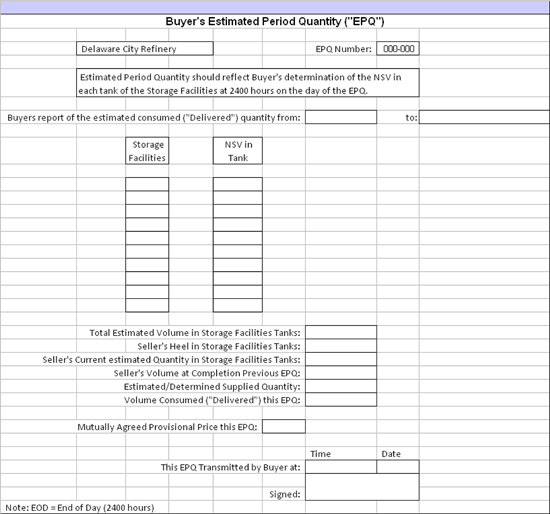

APPENDIX 1 | – | FORM OF ESTIMATED PERIOD QUANTITY (EPQ) STATEMENT | ||

APPENDIX 2 | – | INTERCREDITOR AGREEMENT | ||

APPENDIX 3 | – | PAYMENT DIRECTION AGREEMENT | ||

APPENDIX 4 | – | REFINERY DESCRIPTION | ||

APPENDIX 5 | – | STORAGE FACILITIES USE PROVISIONS | ||

APPENDIX 6 | – | GENERAL PRINCIPLES OF SERVICE | ||

APPENDIX 7 | – | LIST OF APPROVED FUNGIBLE GRADES | ||

APPENDIX 8 | – | REQUIREMENTS SCHEDULE | ||

APPENDIX 9 | – | GRADE PECKING ORDER | ||

APPENDIX 10 | – | CARGO CONFIRMATION NOTICE | ||

APPENDIX 11 | – | COMMENCEMENT INVENTORY ACQUISITION | ||

APPENDIX 12 | – | TERMINATION OF DELIVERIES NOTICE | ||

APPENDIX 13 | – | (INTENTIONALLY OMITTED) | ||

APPENDIX 14 | – | CARGO BANKS AND HEDGE MONTHS SPREADSHEET | ||

APPENDIX 15 | – | CARGO TABLE SPREADSHEET | ||

APPENDIX 16 | – | (INTENTIONALLY OMITTED) | ||

APPENDIX 17 | – | FORM OF BUYER’S INVENTORY STATEMENT | ||

APPENDIX 18 | – | FORM OF PETTY CASH SPREADSHEET | ||

APPENDIX 19 | – | REFINERY MARINE TERMS | ||

APPENDIX 20 | – | STANDBY LETTER OF CREDIT | ||

APPENDIX 21 | – | HSE AND ETHICS POLICY | ||

APPENDIX 22 | – | PBF ENERGY COMPANY LLC GUARANTY | ||

APPENDIX 23 | – | PBF HOLDING COMPANY GUARANTY | ||

-iii-

| 1. | CONTRACT PARTIES |

THIS CRUDE OIL/FEEDSTOCK SUPPLY, DELIVERY AND SERVICES AGREEMENT is made and entered into this 7th day of April 2011 (“Effective Date”) between:

Buyer:

Delaware City Refining Company LLC

1 Sylvan Way, 2nd Floor

Parsippany, NJ 07054-3887

Seller:

Statoil Marketing & Trading (US) Inc.

1055 Washington Boulevard – 7th Floor

Stamford, CT 06901

WHEREAS, Buyer, a wholly-owned subsidiary of PBF Holding Company LLC, owns the Refinery (as herinafter defined) which is currently shut down and undergoing maintenance with a view to commencing restart of operations on or about April 2011; and

WHEREAS, Buyer and Seller each desire to enter into an agreement, pursuant to which Seller shall (a) purchase from third parties, Affiliates of Buyer or Affiliates of Seller and then subsequently sell to Buyer crude oil and feedstock, (b) provide certain commodity-related services to Buyer, and (c) extend a line of credit, each for use by Buyer in connection with the procurement of Oil and Feedstock for the Refinery;

WHEREAS, Buyer and Seller wish to cooperate with one another to seek out and make use of opportunities associated with optimizing the Refinery’s use of various grades and types of crude oil and feedstock;

WHEREAS, Buyer’s Affiliate PRC (as hereinafter defined) entered into a Crude Oil/Feedstock Supply, Delivery and Services Agreement on December 16, 2010 related to the supply of Oil and Feedstock to the Paulsboro Refinery (as hereinafter defined); and

WHEREAS, concurrently with the execution of this Agreement, Seller, Buyer and PRC are entering into a Bridging Agreement, which Bridging Agreement controls the interaction of certain terms of this Agreement and the Paulsboro CSA (as hereinafter defined), including terms dealing with the delivery of Oil and Feedstock to the Refinery and the Paulsboro Refinery, and the joint line of credit provided by Seller that is being shared by Buyer and PRC.

NOW, THEREFORE, in consideration of the premises and the respective promises, conditions and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Parties hereby agree as follows:

| 2. | DEFINITIONS AND CONSTRUCTION |

(a)Definitions. For purposes of this Agreement, the following terms shall have the meanings indicated below and shall include the plural and singular forms of the terms:

“Acquisition Discussion” means the technical dialogue between Buyer and Seller covering all relevant issues pertinent to the decisions needed to allow Seller to acquire the optimal Cargo to cover its appropriate Requirement.

“Actual Refinery Slate” has the meaning given such term in Clause 9(a)(ii).

“Additional Acceptable Security” has the meaning given such term in Clause 19(b)(v).

“Adjustment” has the meaning given such term in Clause 11(a).

“Affiliate” means, with respect to a given Person, any other Person (i) that directly or indirectly (through one or more intermediaries) controls, is controlled by, or is under common control with, such first mentioned Person, (ii) that beneficially owns or holds more than 50% of the interest of such first mentioned Person, or (iii) for which more than 50% of the interest therein is beneficially owned or held by such first mentioned Person. For the purposes of this definition, “control” when used with respect to any specified Person means the right or power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Agreed Delivery Route” has the meaning given such term in Clause 5(c)(iv).

“Agreement” or“this Agreement” means this Crude Oil/Feedstock Supply/Delivery and Services Agreement, including the Appendices hereto, as it may be amended, modified, supplemented, extended, renewed or restated from time to time in accordance with the terms hereof.

“API” means American Petroleum Institute.

“ASTM” means American Society for Testing and Materials.

“Bankrupt” means, with respect to a Person if such Person (i) dissolves, other than pursuant to a consolidation, amalgamation or merger, (ii) becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due, (iii) makes a general assignment or arrangement for the benefit of its creditors, (iv) has instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any similar Law affecting creditor’s rights, or a petition is presented against it for its winding-up or liquidation, (v) institutes a proceeding seeking a judgment of insolvency or bankruptcy of such Person or any other relief under any bankruptcy or insolvency Law or for reorganization relief under the winding-up or liquidation for such Person, (vi) has a resolution passed for its winding-up or liquidation, other than pursuant to a consolidation, amalgamation or merger, (vii) seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for all or substantially all of its

-2-

assets, (viii) has a secured party take possession of all or substantially all of its assets, or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all of its assets, (ix) files an answer or other pleading admitting or failing to contest the allegations of a petition filed against it in any proceeding of the foregoing nature, (x) has a proceeding against it seeking reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any Law, if 120 days after the commencement of such proceeding it has not been dismissed, or if within 90 days after the appointment, without its consent or acquiescence, of a trustee, receiver, or liquidator of it or of all or any substantial part of its properties, the appointment is not vacated or stayed, or within 90 days after the expiration of any such stay, the appointment is not vacated, or (xi) takes any other action to authorize any of the actions set forth above.

“Bankruptcy Code” means Chapter 11 of Title 11, US Code, as amended.

“Barrel” or“Bbl” means a volume of 42 Gallons corrected for temperature to 60° F, and atmospheric pressure unless stated otherwise.

“Base Rate” means the lesser of (i) LIBOR plus [REDACTED]% and (ii) the maximum rate of interest permitted by Law.

“Berth” means the mooring, dock, anchorage, wharf, submarine line, single point or single buoy or single berth mooring facility, offshore location, offshore facility, alongside barges, lighters or any other mooring facility.

“Blended Price” has the meaning given such term in Clause 9(b).

“Bridging Agreement” means that certain Bridging Agreement dated as of the Effective Date, by and among Seller, Buyer, PRC and PBF Holding Company.

“Business Day” means any Monday, Tuesday, Wednesday, Thursday or Friday on which commercial banks are open for business (including dealings in foreign exchange and foreign currency deposits) in New York, New York.

“Buyer” has the meaning given such term in Clause 1.

“Buyer’s Credit Agreement” means collectively: Term Loan and Credit Agreement and Revolving Credit Agreement, each dated December 17, 2010 and each by and between PBF Holding Company, Buyer, PRC and the other Guarantors Party thereto, and UBS Securities LLC, Deutsche Bank Trust Company Americas, Morgan Stanley Funding, Inc. and UBS AG, Stamford Branch; and Senior Secured Note Agreement by and between PRC, Paulsboro Natural Gas Pipeline Company LLC, PBF Energy Company LLC and PBF Holding Company, and Valero Energy Corporation; and the Loan and Security Agreement between Buyer and The Delaware Economic Development Authority dated as of June 1, 2010; including any amendment, renewal, modification or replacement of any of the foregoing.

“Buyer’s Guarantor” means PBF Energy Company LLC.

“Buyer’s Requirements Schedule” has the meaning given such term in Clause 6.

-3-

“Buyer’s Tentative Requirements Schedule” has the meaning given such term in Clause 5(a)(i).

“Calculated Payment Obligation” has the meaning given such term in Clause 11(b).

“Capital Leases” means, with respect to any Person, any lease of any property by such Person which would, in accordance with GAAP, be required to be classified and accounted for as a capital lease on the balance sheet of such Person.

“Cargo” means a specifically identified volume of Oil or Feedstock ascertained within the nomination process provided for herein, Supplied to, or to be Supplied to Buyer, whether located in the Storage Facilities, in any Statoil Storage Facility, on a Vessel, in a third party facility, in a pipeline or at any other location or facility.

“Cargo Bank” has the meaning given such term in Clause 9(a)(iii).

“Cargo Bank Differential” has the meaning given such term in Clause 9(b)(ii).

“Cargo Bank Hedge-Month” has the meaning given such term in Clause 9(a)(iii)(4).

“Cargo Bank Withdrawal” has the meaning given such term in Clause 9(a)(ii).

“Cargo Basis Differential” means the differential amount agreed to by the Parties relative to the Cargo Bank Hedge-Month.

“Cargo Confirmation Notice” has the meaning given such term in Clause 5(f)(iii).

“Cargo Final Price” means the estimated per Barrel Price for Oil or Feedstock delivered by Seller hereunder, calculated as the price per Barrel for the Cargo agreed on by Seller and Buyer [REDACTED].

“Change in Law” has the meaning given such term in Clause 31(g).

“Closing Inventory” has the meaning given such term in Clause 11(a)(i).

“Code” has the meaning given such term in Clause 20(b).

“Commercial Services” has the meaning given such term in Clause 3(a)(ii).

“Commodity Exchange Act” means 7 U.S.C. § 1, et seq.

“Completion of Supply” means, in respect of a Cargo, the final disconnection of the transfer hose(s)/arms(s) of the Vessel carrying such Cargo following Supply.

“Confidential Information” means all information (whether written, oral, visual, electronic or delivered by any other means) furnished either before or after the date hereof, either directly or indirectly, in connection with the performance of this Agreement by one Party (the“Disclosing Party”) or any of its directors, officers, employees, Affiliates, representatives (including without limitation a Disclosing Party’s real estate agents/brokers, financial advisors,

-4-

attorneys and accountants), agents, or Affiliated, subsidiary or parent companies (the“Disclosing Party Representatives”) to the other Party (the“Receiving Party”) or any of its directors, officers, employees, Affiliates, representatives (including without limitation its real estate agents/brokers, financial advisors, attorneys, accountants and consultants), agents, or Affiliated, subsidiary or parent corporations (individually and collectively, the“Receiving Party Recipients”) and all analyses, compilations, forecasts, studies or other documents prepared by Receiving Party Recipients which contain any such information. Each of (i) the fact that such information has been delivered to the Receiving Party or Receiving Party Recipients, (ii) this Agreement, and (iii) the other agreements entered into in connection with this Agreement, are “Confidential Information”. Notwithstanding the foregoing, “Confidential Information” shall not include any information which: (a) at the time of disclosure is in the public domain; (b) after disclosure to the Receiving Party Recipients enters the public domain, except as a result of any Receiving Party Recipient’s breach of this Agreement or any other agreement of confidentiality, it being understood and agreed, that information that is public or has, to the Receiving Party’s knowledge, become public through an unauthorized disclosure by a third party under a confidentiality obligation with respect to such information shall not be deemed to be public information or otherwise generally available to the public; or (c) is independently obtained by Receiving Party Recipients free from any obligation of confidentiality.

“Consolidated Average EBITDA” means the consolidated EBITDA of the PBF Entities.

“Credit Default” has the meaning given such term in Clause 24(c).

“Credit Usage” has the meaning given such term in Clause 19(b)(ii).

“Crude Slops” means partially refined Oil and Feedstock that is delivered to the Storage Facilities by Buyer and shall be treated for all purposes under this Agreement as “Oil” following such delivery by Buyer to the Storage Facilities.

[REDACTED]

“Daily Default Pricing Volume” has the meaning given such term in Clause 9(c)(i)(1).

“Day 1” has the meaning given such term in Clause 10(c)(i).

“Day 2” has the meaning given such term in Clause 10(c)(ii).

“Deemed Volume” means the provisional estimate of the volume of Oil which the Buyer intends to take Delivery of during month M. This is to be provided before the end of month M-1 by Buyer, and is the volume upon which Seller shall base the hedging schedule.”

“Default” has the meaning given such term in Clause 24(a).

“Default Interest Rate” means the lesser of (i) LIBOR plus [REDACTED]% and (ii) the maximum rate of interest permitted by Law.

“Defaulting Party” has the meaning given such term in Clause 24(a).

-5-

“Delivered” or“Delivery” or“Deliver” means when the Oil or Feedstock passes the title transfer point from Seller to Buyer.

“Delivered Volume” has the meaning given such term in Clause 11(a)(i).

“Delivery Month” means the month in which Oil or Feedstock was actually Delivered to Buyer at the Refinery.

“Direct Payment Excess” has the meaning given such term in Clause 10(e).

“Disclosing Party” has the meaning given such term in the definition of “Confidential Information”.

“Disclosing Party Representatives” has the meaning given such term in the definition of “Confidential Information”.

“Dispute” has the meaning given such term in Clause 31(b).

“Dollars” or“USD” or“US Dollars” or“$” means dollars of the US.

“EBITDA” means, with respect to any Person, and for any period of its determination, the consolidated net income of such Person for such period, plus the consolidated interest expense and income and franchise taxes of such Person for such period, plus the consolidated depreciation and amortization of such Person for such period, less extraordinary gains and interest income, as determined in accordance with GAAP.

“Effective Date” has the meaning given such term in Clause 1.

“Environmental Law” means any Law that governs or purports to govern the protection of Persons, natural resources or the environment (including the protection of ambient air, surface water, groundwater, land surface or subsurface strata, endangered species or wetlands), occupational health and safety and the manufacture, processing, distribution, use, generation, handling, treatment, storage, disposal, transportation, release or management of solid waste, industrial waste or hazardous substances or materials, as may be amended or modified from time to time.

“EPQ” means estimated period quantity.

“EPQ Form” means an EPQ form prepared per the format set forth in Appendix 1.

“EST” means the applicable, local Eastern Time in New York, New York.

“Estimated Credit Usage” has the meaning given such term in Clause 19(b)(iii).

“Event of Default” has the meaning given such term in Clause 24(a).

“Execution Method” has the meaning given such term in Clause 5(f)(i).

“Excess Indigenous Feedstock” has the meaning given such term in Clause 5(i)(iii).

-6-

“Feedstock” means VGO and VTB intended to be run through the Refinery for further processing into finished products, and which may from time to time be sold to third parties or Affiliates of Buyer by Seller at Buyer’s direction in accordance with Clause 9(e) as if such transactions involved Oil.

“Feedstock Tank” means the storage tank(s) listed on Appendix 4 that will be used for storing Indigenous Feedstock as such list may be modified from time-to-time in accordance with the terms of Clause 5(d) of Appendix 5.

“Feedstock Virtual Tank Heel” has the meaning given such term in Clause 5(i)(i).

“FIFO” means the first-in first-out accounting principle for the valuation of inventories and the calculation of TVM Payments.

“Final Quality Differential” has the meaning given such term in Clause 9(b)(ii)(1).

“Force Majeure” has the meaning given such term in Clause 18(a).

“GAAP” means generally acceptable accounting principles in the US, applied on a consistent basis.

“Gallon” means a US standard gallon of 231 cubic inches at 60° F at atmospheric pressure.

“Governmental Authority” means any federal, state, regional, local, or municipal governmental body, agency, instrumentality, authority or entity established or controlled by a governmental or subdivision thereof, including any legislative, administrative or judicial body, or any Person purporting to act therefor.

“GPO”or “Grade Pecking Order” has the meaning given such term in Clause 5(a)(v).

“Grade” has the meaning given such term in Clause 4(b).

“Guarantors” means each Person required to guaranty the obligations of Buyer or any of its Affiliates under this Agreement, including Buyer’s Guarantor and PBF Holding Company.

“Hazardous Substances” means any pollutant, contaminant, petroleum or petroleum product, dangerous or toxic substance, hazardous or extremely hazardous chemical, or otherwise hazardous material or waste regulated under Environmental Laws, including crude oil and feedstock.

“Hedge-Month” has the meaning given such term in Clause 9(b)(ii)(2).

“Hedge-Month Pool” has the meaning given such term in Clause 9(b)(iii).

“HSE” means health, safety and environmental.

“ICC” has the meaning given such term in Clause 40(g).

-7-

“Indemnified Party” has the meaning given such term in Clause 26(a)(iii).

“Indemnifying Party” has the meaning given such term in Clause 26(a)(iii).

“Independent Inspector” means a company that is approved by US Customs and Border Protection and that is mutually acceptable to the Parties for reporting the measurement of quality and quantity of Oil and Feedstock.

“Indigenous Feedstock” means Feedstock produced in the Refinery.

“Initial TLA” has the meaning given such term in Clause 14(e).

“Intercreditor Agreement(s)” means the Intercreditor Agreement(s) substantially in the form attached hereto as Appendix 2.

“Inventory” or“Inventories” means the Oil and Feedstock inventories that Seller owns and intends to sell to Buyer under this Agreement, wherever located, including at the Refinery, in any Statoil Storage Facility, carried upon Vessels and/or injected into or received from pipelines or other transport.

“Inventory Assessment” has the meaning given such term in Clause 11(a)(i).

“ISGOTT” means International Safety Guide for Oil Tankers and Terminals, as published by the International Chamber of Shipping, the Oil Companies International Marine Forum and the International Association of Ports and Harbors.

“ISPS Code” has the meaning given such term in Clause 13(a)(iii).

“Knowledge” means, with respect to a Party, the actual knowledge of the officers and directors of such Party, after making reasonable inquiry with respect to the particular matter in question, and“Know” has the correlative meaning.

“Law” means (i) any law, statute, regulation, code, ordinance, license, decision, order, writ, injunction, decision, directive, judgment, policy, decree of any Governmental Authority and any judicial or administrative interpretations thereof, (ii) any agreement, concession or arrangement with any Governmental Authority and (iii) any license, permit or compliance requirement, in each case as amended or modified from time to time.

“Liabilities” means any losses, claims, charges, damages, deficiencies, assessments, interests, penalties, costs and expenses of any kind (including reasonable attorneys’ fees and other fees, court costs and other disbursements), including any liabilities directly or indirectly arising out of or related to any suit, action, cause of action, proceeding, judgment, settlement or judicial or administrative order and any liabilities with respect to Environmental Law.

“LIBOR” means the rate of interest (expressed as a percentage per annum) for deposits in USD for a three-month period as provided by the British Bankers Association interest settlement rates (or the successor thereto) as of 11:00 a.m. (London time) on the date of

-8-

determination, or, if such rate is not available, a reasonably comparable and available published rate as reasonably agreed by the Parties.

“Liens” means any lien (including judgment liens and liens arising by operation of law), mortgage, pledge, assignment, security interest, charge or encumbrance of any kind (including any agreement to give any of the foregoing) and any option, call, trust or other preferential arrangement having the practical effect of any of the foregoing.

“Lightering” means the operation wherein Oil or Feedstock is transferred from one Vessel to another at an approved and recognized offshore location so as to allow the first Vessel (the“Mother Vessel”) to reach a draft which allows it to safely proceed to and berth at the Supply Port.

“Loading Terminal”means the port of loading of the Vessel for the applicable Oil or Feedstock being Supplied.

“Long-Term Debt” means, with respect to any Person or group of Persons on a consolidated basis, without duplication, in each case excluding the current liabilities of such Person, (i) indebtedness of such Person for borrowed money, (ii) obligations of such Person evidenced by bonds, debentures, notes, or other similar instruments, (iii) obligations of such Person to pay the deferred purchase price of property or services (other than trade debt and normal operating liabilities incurred in the ordinary course of business), (iv) obligations of such Person as lessee under Capital Leases, (v) obligations of such Person under or relating to letters of credit, guaranties, purchase agreements, or other creditor assurances assuring a creditor against loss in respect of indebtedness or obligations of others of the kinds referred to in clauses (i) through (iv) of this definition, and (vi) nonrecourse indebtedness or obligations of others of the kinds referred to in clauses (i) through (v) of this definition secured by any Lien on or in respect of any property of such Person. For the purposes of determining the amount of any Long-Term Debt, the amount of any Long-Term Debt described in clause (v) of the definition of Long-Term Debt shall be valued at the maximum amount of the contingent liability thereunder and the amount of any Long-Term Debt described in clause (vi) that is not covered by clause (v) shall be valued at the lesser of the amount of the Long-Term Debt secured or the book value of the property securing such Long-Term Debt.

“LP” means a linear program computer model which simulates refinery operations and is used to perform economic analysis that includes crude selection and optimization.

“LPG” means liquefied petroleum gas.

“LVEF” has the meaning given such term in Clause 15(d).

“Market Feedstock Price” has the meaning given such term in Clause 5(i)(iii).

“Material Adverse Change” means, with respect to a Party, an event, change, development, effect, condition, or circumstance, which individually or in the aggregate with other events, changes, developments, effects, or circumstances, has resulted in or could be reasonably expected to result in a material adverse change in the business, operations, assets, properties, financial condition or prospects of such Party.

-9-

“Month” means a calendar month. Where a specified Month is defined as Month “M”, Month M-1 shall mean the Month prior to Month M and Month M+1 shall mean the Month subsequent to Month M.

“MonthEnd” has the meaning given such term in Clause 11(a).

“Monthly Quality and Basis Differential” has the meaning given such term in Clause 9(b)(i).

“Mother Vessel” has the meaning given such term in the definition of “Lightering”.

“MSCG” means Morgan Stanley Capital Group, Inc.

“MSCG Sales Agreement” means that certain Products Offtake Agreement applicable to the Refinery to be effective as of April 7, 2011, and entered into between Buyer and MSCG, together with all amendments, modifications and successor or replacement agreements entered into from time to time with respect thereto.

“MSDS” has the meaning given such term in Clause 33(a).

“MTSA” has the meaning given such term in Clause 13(a)(iii).

“New Grade Initial Period” has the meaning given such term in Clause 4(b).

“New Grades” has the meaning given such term in Clause 4(b).

“Non-Defaulting Party” has the meaning given such term in Clause 24(a).

“Non-Fungible Grades” has the meaning given such term in Clause 4(b).

“NOR” means Notice of Readiness.

“Normal Refinery Operations” means periods of time when the Refinery is operated in a routine manner with all operating units on-line. Normal Refinery Operations exclude maintenance turnarounds and shutdown periods.

“NSV” means net standard volume of Oil or Feedstock.

“NYMEX” means the New York Mercantile Exchange.

“Off-Taker” or“Off-Takers” means the company or companies that purchase the Refined Products produced at the Refinery.

“Oil” means crude oil or straight run fuel oil, but does not include Feedstock.

“Opening Inventory” has the meaning given such term in Clause 11(a)(i).

“Optimization Account” has the meaning given such term in Clause 5(g)(ii).

-10-

“OSG” has the meaning given such term in Clause 14(e).

“OSP” means the Official Selling Price as defined by the third party supplier of certain Oil or Feedstock for the relevant time period and destination, as applicable.

“Part Cargo” means a Cargo Delivered on a Vessel such that the volume of the Cargo does not substantially fill the Vessel.

“Party” means each of Buyer and Seller, and“Parties” means collectively, both Buyer and Seller.

“Paulsboro CSA” means that certain Crude Oil/Feedstock Supply/Delivery and Services Agreement between Seller and PRC, dated December 16, 2010 as amended by that certain First Amendment to Crude Oil/Feedstock Supply/Delivery and Services Agreement, together with all other amendments, modifications and successor or replacement agreements entered into from time to time with respect thereto.

“Paulsboro Refinery” means the petroleum processing and refining facilities located in Paulsboro, New Jersey 08066, including all storage tanks, docks, platforms, pipelines, and any other associated equipment or facilities.

“PBF Entities” has the meaning given such term in Clause 19(b)(ii)(1).

“PBF Holding Company” means PBF Holding Company LLC, a Delaware limited liability company.

“PBF Line of Credit” means a $50,000,000 line of credit, initially established under the Paulsboro CSA, from Seller to Buyer and PRC, subject to the conditions in Clause 24(c) and the terms of the Bridging Agreement.

“PDA” means a Payment Direction Agreement substantially in the form attached hereto as Appendix 3.

“Person” means an individual, corporation, partnership, limited liability company, joint venture, trust or unincorporated organization, joint stock company or any other private entity or organization, including a Governmental Authority.

“Petty Cash Bank” has the meaning given such term in Clause 12(d).

“PRC” means Paulsboro Refining Company LLC, a Delaware limited liability company, which is an Affiliate of Buyer and owns the Paulsboro Refinery.

“Pre-Adjustment Payments” has the meaning given such term in Clause 11(b).

“Predicted Refinery Slate” has the meaning given such term in Clause 9(a)(i).

[REDACTED]

-11-

“Pricing Day” means a day on which Buyer instructs to price Oil or Feedstock to be Delivered hereunder in accordance with Clause 9(c)(i)(1).

“Production Week” means, each period from Friday at 12:00 midnight until the following Friday at 12:00 midnight during the term of this Agreement;provided, however, the first Production Week shall commence on the Effective Date and shall continue until 12:00 midnight on the first Friday following the Effective Date.

“Property Taxes” means any and all tangible personal property taxes, ad valorem property taxes or the like imposed on the value of the Oil and Feedstock held for sale by Seller to Buyer under this Agreement.

“Proposed Storage Site” has the meaning given such term in Clause 8(b).

“Provisional Invoice” has the meaning given such term in Clause 10(c)(iii).

“Provisional Price” has the meaning given such term in Clause 10(c)(iii) and shall be based on the estimated price of Oil and Feedstock that make up the EPQ.

“PSI” means pounds per square inch.

“Qualified Institution” shall mean a major U.S. commercial bank or foreign bank with a U.S. branch office having an asset base of at least $[REDACTED] billion, with such bank having a Credit Rating of at least [REDACTED] by S&P or [REDACTED] by Moody’s Investor Services, Inc., or otherwise acceptable to the Party receiving such collateral, as such party shall determine in its sole discretion.

“Receiving Party” has the meaning given such term in the definition of “Confidential Information”.

“Receiving Party Recipients” has the meaning given such term in the definition of “Confidential Information”.

“Refined Products” means finished gasoline, heating oil, diesel, jet fuel, kerosene and Specialty Grades.

“Refined Products Percentage” has the meaning given such term in Clause 19(d)(ii).

“Refinery” means the petroleum processing and refining facilities located in Delaware City, Delaware 19706, including all storage tanks (including the Storage Facilities), docks, platforms, pipelines, and any other associated equipment or facilities, as further described in Appendix 4.

“Refinery Subsidiaries” means subsidiaries of PBF Holding Company, including Buyer and PRC, that own or operate a refinery that is being supplied Oil and/or Feedstock by Seller, including the Refinery.

“Replacement Grade Pecking Order” or “RGPO” has the meaning given such term in Clause 5(a)(x).

-12-

“Requirement” has the meaning given such term in Clause 4(a).

“ROB” has the meaning given such term in Clause 15(d).

“Seller” has the meaning given such term in Clause 1.

“Shareholders Equity” means shareholders’ equity determined in accordance with GAAP.

“Shipping Services” has the meaning given such term in Clause 3(a)(ii).

“SMA” has the meaning given such term in Clause 31(e).

“Specialty Grades” has the meaning given such term in the Payment Direction Agreement by and among Morgan Stanley Capital Group Inc., Seller and Buyer dated as of April 7, 2011.

“Standby Letter of Credit” means any commercial or standby letter of credit issued for the account of Seller pursuant to the terms of this Agreement.

“Start Up” means the first date that feed is introduced to a process unit to initiate refining operations at the Refinery.

“Statoil Storage Facility” means any facility in which Seller or its Affiliates owns, leases or otherwise has storage rights, including any facility where such rights are given by a PBF Entity.

“Storage Facilities” means the storage tanks described on Appendix 4, as such list may be modified from time-to-time in accordance with the terms of Clause 5(d) of Appendix 5, and which storage tanks Seller has exclusive rights all as provided for herein and in Storage Facilities Use Provisions attached hereto as Appendix 5. Appendix 4 shall reflect any storage tanks to be used to store Feedstock.

“Supplied” or“Supply” or“Supplies” means or refers to when the Oil or Feedstock passes the flange connection between a Vessel’s permanent discharge manifold and the receiving pipeline or hose at the Supply Port.

“Supplied Volume” has the meaning given such term in Clause 11(a)(ii).

“Supply Point Method” has the meaning given such term in Clause 5(f)(ii).

“Supply Port” means the customary dockage, anchorage or place where a Vessel may safely lie in connection with Supply of a Cargo to the Refinery.

“Tank Heels” means the greater of: (i) the volume of Oil or Feedstock below the lowest suction in a tank, unless the tank is equipped with a regular side entry pipe in which case “Tank Heels” means the volume below the middle of the lowest suction in such tank, or (ii) the volume of Oil or Feedstock required to safely float a roof in a floating roof tank.

-13-

“Taxes” means any and all (i) US federal, state and local taxes, duties, fees and charges of every description, including all fuel, excise, environmental, spill, gross earnings, gross receipts and sales and use taxes, however designated (except for taxes on income), paid or incurred with respect to the purchase, storage, exchange, use, transportation, resale, importation or handling of the Oil or Feedstock held for sale by Seller or Buyer under this Agreement and (ii) Property Taxes.

“Termination Date” has the meaning given such term in Clause 25(a)(i).

“Termination of Deliveries Notice” has the meaning given such term in Clause 7(f).

“TH Conclusion Date” has the meaning given such term in Clause 5(j)(iii)(1).

“TH Ending Price” has the meaning given such term in Clause 5(j)(i)(2).

“TH Exposure” has the meaning given such term in Clause 5(j)(iii)(2).

“TH Market Value” has the meaning given such term in Clause 5(j)(ii)(2).

“TH Per Barrel Storage Charge” has the meaning set forth in Clause 5(j)(iii)(1).

“TH Starting Volume” has the meaning given such term in Clause 5(j)(i)(1).

“TH Storage Fee” has the meaning given such term in Clause 5(j)(iii)(1).

“Third Party Claim” has the meaning given such term in Clause 26(b).

“Time Chartered Vessel” means a Vessel chartered for a fixed period of time instead of for a certain number of voyages or trips.

“TLA” has the meaning given such term in Clause 14(f).

“Transparent Contractual Terms” means the contractual terms derived using either the Execution Method or the Supply Point Method.

“Trigger Event” has the meaning given such term in Clause 19(d)(ii).

“TVM” means the time value of money.

“TVM Payment” has the meaning given such term in Clause 19(g)(i).

“TVM Payment Date” means, with respect to a given Production Week, the first Thursday following the end of such Production Week, provided, that if such TVM Payment Date is not a Business Day, the TVM Payment Date shall mean the next following Business Day.

“TVM Statement Delivery Date” has the meaning given such term in Clause 19(g)(ii).

“Type” has the meaning given such term in Clause 4(b).

-14-

“UCC” means the Uniform Commercial Code in effect in the relevant state jurisdiction.

“Vessel” means a tankship, barge or other water-borne conveyance, as applicable, used for the Supply of a Cargo, whether owned or chartered or otherwise obtained by Seller to transport Oil or Feedstock for the benefit of Buyer.

“VTB” means vacuum tower bottoms or other similar residual materials.

“Win3” has the meaning given such term in Clause 6(e).

“Win5” has the meaning given such term in Clause 6(d).

“Win8” has the meaning given such term in Clause 6(a).

“Worldscale” means the applicable standard freight rate stated in the most recent edition of the New Worldwide Tanker Nominal Freight Scale jointly published by Worldscale Association (London) Limited and Worldscale Association (NYC) Inc., or if Worldscale Association (London) Limited and Worldscale Association (NYC) Inc. shall no longer publish the New Worldwide Tanker Nominal Freight Scale, the equivalent replacement scale used in the shipping industry, expressed in USD per metric ton for the route specified.

“WTI” means West Texas Intermediate Oil, with specifications in accordance with the NYMEX futures contract.

“Year” means a period of 12 consecutive Months.

(b)Construction.

(i) All headings herein are intended solely for convenience of reference and shall not affect the meaning or interpretation of the provisions of this Agreement.

(ii) Unless expressly provided otherwise, the word “including” as used herein does not limit the preceding words or terms.

(iii) Unless expressly provided otherwise, all references to days, weeks, months, quarters and years mean calendar days, weeks, months, quarters and years, respectively. For purposes of this Agreement, a calendar day shall begin at 12:00 midnight and end at 11:59 p.m.

(iv) Unless expressly provided otherwise, references herein to “consent” mean the prior written consent of the Party at issue, which shall not be unreasonably withheld, delayed or conditioned.

(v) Unless expressly provided otherwise, all references to time in this Agreement are EST.

-15-

| 3. | TERM OF OIL AND FEEDSTOCK SUPPLY AND SERVICES |

(a) Beginning on the Effective Date, and continuing through the term of this Agreement, and subject to the provisions of this Agreement:

(i) Seller will have the exclusive right to, and will, provide Oil and Feedstock for Delivery to the Refinery and Buyer will purchase such Oil and Feedstock in accordance with the terms set forth herein.

(ii) Seller shall provide Buyer with certain operational services (the “Commercial Services”) and certain shipping-related services (the “Shipping Services”) with respect to all purchases and sales of Oil and Feedstock reasonably necessary to enable Buyer to perform the manufacturing and operational processes at the Refinery as detailed in Appendix 6.

(b) This Agreement shall be binding on the Parties from the Effective Date and shall continue for an initial term ending on December 31, 2012. Seller may extend the term of this Agreement for a period of up to 3 additional years (through December 31, 2015) by delivering notice to Buyer by no later than June 30, 2012, stating the additional term.

| 4. | QUALITY |

(a)Oil and Feedstock Requirements. The Parties will agree upon the Oil and Feedstock supply requirements of the Refinery in accordance with the process described in Clause 5. Such Oil and Feedstock supply requirements are referred to herein as the Requirements. Each “Requirement” shall be an identified volume of a specified Type and a corresponding Supply time period (e.g. 500,000 Barrels of Type A Oil to be Supplied in the window of 1-10 March 2011).

(b)Oil and Feedstock Types. Oil and Feedstock Supplied and Delivered under this Agreement will be grouped in the following general categories, referred to herein as “Types”.

(i)Type A: sour crude oil with a sulfur content equal to or greater than zero point eight percent by weight (0.8% weight), as per ASTM.

(ii)Type B: sweet crude oil with a sulfur content less than zero point eight percent by weight (0.8% weight), as per ASTM. Type B Oil Requirements typically will be covered by crude oil Grades sourced from the East Coast Canadian Grand Banks as a base case, with light and medium sweet crudes as optimization alternatives, including, but not limited to, sourcing from the North Sea and Angola.

(iii)Type C: heavy crude oil, sweet or sour, with an API Gravity of < 24. Type C Oil Requirements typically will be covered by crude oil grades sourced from South America, such as Peregrino.

(iv)Type D: straight run fuel oil and Feedstocks, for example VGO or VTB.

-16-

Within each Type of Oil/Feedstock described herein there are multiple “Grades”. For example the Oil Grades Kirkuk, Urals and Vasconia could each be Type A Oil. Some Grades may meet the specifications of more than one Type. To avoid any misunderstanding the Parties shall clearly communicate which Requirement or Type a proposed Grade or Cargo is to cover. A summary of fungible Grades approved by both Seller and Buyer for sale hereunder is attached as Appendix 7.

Within each Type of Oil/Feedstock there (a) will from time-to-time be new Grades that become available in the market (“New Grades”) and (b) Grades which are not regularly or routinely available for convenient purchasing (the “Non-Fungible Grades”), each of which require additional effort by Seller to secure Cargoes to be purchased at the mandate of Buyer. All Grades that are not listed in Appendix 7 shall be considered either New Grades, Non-Fungible Grades or both. If Seller identifies a New Grade which is not currently listed in Appendix 7, and Buyer approves such New Grade for Supply and Delivery to the Refinery (which Buyer may approve or not approve in each case in its sole discretion), then for an initial period of between 3 months and 12 months (to be mutually agreed upon by the Parties based on the anticipated supply) (the “New Grade Initial Period”) after Seller receives such approval any Cargoes of such New Grade will be Supplied and Delivered via the Supply Point Method unless otherwise mutually agreed by the Parties. After the New Grade Initial Period, provided such New Grade is a fungible grade, such New Grade shall be added to the list in Appendix 7, and Buyer may thereafter mandate that Seller acquire Cargoes of such Grade under either the Supply Point Method or the Execution Method. All Non-Fungible Grades will only be Supplied and Delivered under the Supply Point Method, unless otherwise mutually agreed by the Parties.

(c) Term Supply / Spot Supply.

(i)Term Supply. The Parties expect that over time approximately [REDACTED]% of Oil and Feedstock Supplied to Buyer at the Refinery will be sourced from term agreements entered into by Seller. Buyer will use its reasonable efforts in support of Seller’s efforts to enter into such term agreements with counterparties. To the extent Seller is unable to enter into term agreements with specified counterparties or for specified Types or Grades, the Parties will work together to determine an appropriate arrangement for supply of the affected Type and Grade.

[REDACTED]

(ii)Spot Supply. The Parties agree that the balance of the Oil and Feedstock supplied to the Refinery will be sourced from the spot market for Oil and Feedstock.

(d)Quality Optimization Principle. The Parties agree that a fundamental part of this Agreement is, within the Cargo acquisition process, for (i) the flexibility of Buyer to receive different Grades within a certain Type, as generally listed in the appropriate GPO / RGPO, without disrupting Normal Refinery Operations allowing a commercial benefit of that flexibility to Buyer, and (ii) the flexibility for Seller to be able to have a range of options among such Grades to cover the Requirements of the Refinery allowing a commercial benefit to Seller. Specifically this shall mean that Seller shall be able to acquire different Grades at generally available market prices in order to cover a particular Requirement provided such price is reasonably acceptable to Buyer as listed in the appropriate GPO / RGPO. The Parties also agree that a fundamental objective of this Agreement is, that after a Requirement has been covered by a Cargo, in the event that either:

(i) Buyer’s refining economics for said Requirement change substantially, or

(ii) the market conditions for trading that Cargo with third parties change substantially and such change cause an economic benefit to be derivable from optimizing said Cargo into an alternative Cargo,

then the Parties shall make commercially reasonable efforts to change that Cargo into an economically beneficial alternative. If successful, the Parties shall agree on commercial terms such that, under the RGPO process, the economic benefit of the optimization is shared in an appropriately equitable manner consistent with Clause 5.

If a substantial portion of the spot Cargoes being Supplied of a certain Type of Oil/Feedstock are being Supplied and Delivered pursuant to the Execution Method and ultimately Supplied and Delivered Grades are the same Grades as were originally selected from the GPO without RGPO optimizations, then Seller is not realizing some of the optimization opportunities that are an important element of this Agreement, and therefore the Parties shall have good faith discussions regarding the potential for (x) Seller to provide future Cargoes of that Type under the Supply regarding the potential for (y) Seller providing future Cargoes of that Type under a term supply agreement.

-17-

| 5. | ACQUISITION OF OIL AND FEEDSTOCK |

(a)Acquisition Process Steps. The process for selecting and then acquiring a Cargo of Oil or Feedstock to supply the Refinery shall comprise the following steps:

(i) Buyer and Seller shall mutually agree on the “Buyer’s Tentative Requirements Schedule” for any Month of Delivery of Oil and Feedstock to the Refinery, which shall consist of a list of Requirements with each Requirement being a volume of a Type to be delivered during a specified period in such Month, in a format following that in Appendix 8.

(ii) The Parties shall discuss the different Grade options for each Requirement.

(iii) The Parties shall agree on the volume, term, price and other key elements for term contract commitments, and Buyer shall give a written mandate to Seller to enter into such term contract(s), and Seller shall enter into such term contract(s). Thereafter, the Parties shall follow the term contract procedures set forth in Clause 5(c) below, which will result in Seller purchasing term Cargoes to cover certain Requirements in Buyer’s Tentative Requirements Schedule.

(iv) The Parties shall identify target Grades and a number of target Cargoes that shall be acceptable for each Requirement that is not to be covered by term contract volumes.

(v) Buyer, in discussion with Seller, shall issue, and continue to update, a grade pecking order (a“Grade Pecking Order” or“GPO”), outlining the Grades that could cover each Requirement and the corresponding differences in price at which such Grades would have equal economics for Buyer.

(vi) As to each target Cargo, Seller shall provide Buyer with the appropriate contractual terms in accordance with Clause 5(e)(ii).

(vii) Thereafter, Buyer shall give an oral or written mandate to Seller in accordance with Clause 5(e)(iii).

(viii) Seller shall purchase the Cargo covered by such mandate or, with respect to a Cargo acquired from Seller or Seller’s Affiliates, make appropriate internal allocations to reflect that such Cargo will cover a Requirement hereunder.

(ix) Seller shall send formal notification to Buyer of the purchase of the Cargo, or if the Cargo is acquired from Seller or Seller’s Affiliates portfolio, the internal allocation of such Cargo to cover a Requirement, covered by the mandate. Details of that notification shall be as described in Clause 5(f)(iii) below.

(x) In connection with seeking potential optimizations, following the purchase of each term or spot Cargo to cover a Requirement, Buyer, in discussion with Seller, shall issue, and continue to update a replacement grade pecking order (“Replacement Grade Pecking Order” or“RGPO”) for such covered Requirement outlining the Grades that could replace the purchased Cargo and the corresponding differences in price at which such replacement Grades would have equal economics for Buyer, which RGPO shall use the Cargo Bank Differential of the purchased Cargo as the basis for such price differences.

(b)Grade Pecking Order. The GPO and RGPO (each a list of Grades and differences in price) shall reflect the relative refining economics of different Grades for each Requirement in Buyer’s Tentative Requirement Schedule. The determination of the GPO or RGPO as applicable shall be based on:

(i) Seller’s advice to Buyer of the volumes available of different Grades in standard Cargo sizes and corresponding price estimates.

(ii) Buyer’s output from LP runs for the Refinery based on Seller’s Grade availability lists.

(iii) For each Requirement, Buyer shall prepare a GPO or RGPO that contains a base Grade and a minimum of four alternative Grades that Seller shall be reasonably able to acquire. Each alternative Grade shall have a value that reflects the difference in price delivered at the Refinery that has to be achieved by Buyer for that Grade to be of equal value to the base Grade for that Requirement. A Requirement shall remain relevant for the GPO or RGPO from its initial identification in Buyer’s Tentative Requirements Schedule for a Month of Supply, up and until the end of its Acquisition Discussion and this time may include time after a Cargo has been purchased to cover the Requirement in order to allow for possible optimizations of that Requirement. The GPO and RGPO shall be generated by Buyer in the format specified in Appendix 9. The GPO and RGPO shall be issued once per week, in accordance with the following process steps:

(1) Seller shall communicate to Buyer no later than noon every Tuesday pertinent information containing the availability of different Grades and estimates of market prices for those Grades.

(2) Buyer shall issue the GPO/RGPO in the correct format no later than noon on the following day (Wednesday), whereupon any previous GPO/RGPO shall be superseded.

(c)Term Commitment Discussion Procedure. Subject to the provisions set forth in the term Oil or Feedstock supply contracts previously entered into under this Agreement, the Parties shall agree, at the appropriate times to:

-18-

(i) The volumes to be nominated to cover Buyer’s Tentative Requirements Schedule.

(ii) The Requirements that shall be covered by such term volumes (after the third party supplier of Oil or Feedstock under such term Oil or Feedstock supply contract confirms the final nomination of such Oil or Feedstock with the loading dates and final volume).

(iii) The Final Quality Differential for such volume. If such Cargo will be Supplied under the Execution Method then the FOB price will be set in principle to match the price reached by Seller with the supplier of the term volume, which if OSP-related will match the OSP of the respective Oil or Feedstock at the appropriate Loading Terminal, including any premium or discount. If the Cargo will be Supplied under the Supply Point Method then the price will be agreed between the Parties.

(iv) The costs for Supplying a term Cargo under the Execution Method will be agreed between the Parties based on the Agreed Delivery Route for each specific Oil or Feedstock term contract Cargo. The “Agreed Delivery Route” will define the salient factors attributable to that Cargo, including, but not limited to; (1) the Loading Terminal, (2) Vessel size, (3) transportation route and (4) any Lightering requirements. For example for a Urals Cargo, the Agreed Delivery Route might be: (1) Oil Loading Terminal to be Primorsk, (2) Cargo to be loaded on an Aframax vessel, (3) Vessel to be routed by the most expeditious method (always allowing for carrier’s safety requirements) to Bigstone Lightering Point, (4) where one or two Lightering Vessel(s) will be taken off prior to the mother Vessel Berthing at the Refinery. Each term contract Cargo under this Agreement will have a similar corresponding Agreed Delivery Route. If the Execution Method is used, Seller shall use [REDACTED], etc. Except as otherwise set forth in this Agreement, if the Supply Point Method is used all Supply costs up to the Supply Port [REDACTED].

(d)Acquisition Discussion.

(i) Each Requirement will have an associated Acquisition Discussion that will commence upon Buyer advising Seller of Buyer’s Tentative Requirement Schedule and shall end when a Cargo or Cargoes covering the Requirement are Supplied to Buyer.

(ii) Until Buyer’s Tentative Requirements Schedule has become Buyer’s Requirements Schedule (as described in Clause 6), Buyer shall have the right to adjust the dates with the exception of any Requirements covered with Cargoes, which shall not be adjusted or modified without Seller’s consent.

(iii) As long as the relevant Acquisition Discussion has not concluded, the GPO / RGPO shall contain the alternatives as described in this Clause 5 for each Requirement.

(e)Acquisition Process and Target Cargo.

(i) Prior to the conclusion of the Acquisition Discussion, the Parties shall agree on a target Cargo for that Requirement within sufficient time to allow Seller to purchase such target Cargo in accordance with Clause 5(a)(viii). Buyer acknowledges that different Grades of Oil and Feedstock typically trade at different periods of time ahead of when such Cargo is to be delivered and that Seller may not be able to acquire a target Cargo if Buyer and Seller are unable to agree on a target Cargo in a timely manner. Seller shall keep Buyer apprised of such time periods.

(ii) Seller shall advise Buyer of all pertinent commercial details necessary with respect to each target Cargo, so that the Transparent Contractual Terms can be fully understood. If Seller is to provide the target Cargo from its or its Affiliates’ portfolio, then Seller shall notify Buyer of such fact.

(iii) Buyer shall give an oral (by way of a recorded means including recording of a telephone conversation with or without the consent of the other Party in

-19-

accordance with Clause 34) or written mandate to Seller to fulfill the Requirement with such Cargo, such mandate shall include all of the information appropriate to fix the commercial terms for such Cargo, including the Grade of Oil or Feedstock, volume to be Supplied, Supply window and price. Such mandate, whether oral or written, shall be fully binding on Buyer, and Buyer thereafter shall be required to accept Delivery of such Cargo (unless Seller fails to acquire such Cargo) in accordance with this Agreement.

(iv) If Seller cannot acquire a target Cargo under the agreed contractual terms in accordance with Clauses 5(a), the Parties shall continue the Acquisition Discussion until either (1) it concludes with revised terms for the same target Cargo, (2) it concludes with terms for an alternative Cargo of the same Grade or (3) it concludes with terms for an alternative Cargo of an alternative Grade in the relevant GPO. This process shall continue until the Requirement is successfully covered.

(v) At any time during the Acquisition Discussion, Seller can propose that a Requirement be covered by an alternative Grade in the GPO / RGPO. Buyer shall accept such proposal as long as the alternate Grade Cargo will maintain equal or improved refining economics for that Requirement based on the GPO / RGPO. Furthermore, Seller may propose an alternate Grade not included in the GPO / RGPO, however, use of such alternate Grade requires Buyer’s consent.

(vi) The Parties shall make reasonable efforts to cover a Requirement with a suitable Cargo. Until the Requirement is covered by a Cargo, Seller shall continue to advise Buyer of potential target Cargoes to fulfill such Requirement. If Seller is unable to procure a Cargo to meet a Requirement, Buyer shall have the option to amend the Requirement so that Seller can continue to use its reasonable efforts to procure a Cargo to cover such Requirement. If Seller cannot procure a Cargo to cover a Requirement (either an original Requirement or an amended Requirement) Seller shall have no liability for such failure.

(f)Transparent Contractual Terms. For any potential Cargo to be acquired by Seller, a set of Transparent Contractual Terms shall be agreed to, thereby providing a clear mandate to Seller to purchase such Cargo. These Transparent Contractual Terms shall be established under one of the following two methods, in Buyer’s option:

(i)The “Execution Method”.Under the Execution Method, the Transparent Contractual Terms shall include all of the terms necessary for Seller to negotiate and acquire a Cargo directly from a third party. The additional costs incurred to have such Cargo Supplied to the Refinery including, without limitation, freight, pricing elements, outturn loss, negotiated pricing basis and period shall be agreed upon at the appropriate time by the Parties and added as incurred in order to establish Buyer’s final price for such Cargo. If Buyer and Seller are unable to agree in a timely manner on such additional costs, then Seller can contract for such additional items and the related costs in a commercially reasonable manner and such costs shall be added to Buyer’s final price for such Cargo. At any time any of the additional costs may be fixed between Buyer and Seller by mutual agreement, with such fixed cost being used to establish Buyer’s final price for such Cargo. When an additional cost is so fixed, any difference between the cost actually incurred and the agreed fixed cost will be for the Seller’s account.

(ii)The “Supply Point Method”.Under the Supply Point Method, the Transparent Contractual Terms shall include all the terms necessary for the Parties to agree on a price for the Cargo supplied to an agreed-upon supply point. The Supply Point Method terms shall include:

(1) the terms on which the Cargo will be purchased from a third party, and

(2) Seller’s offer for all other costs from the third party’s delivery point up to the agreed-upon supply point, including the cost of any difference between the agreed pricing basis and pricing period and that negotiated with the third party.

Under the Supply Point Method, any additional costs, including, but not limited to, Lightering barges in the Delaware River, outturn losses and storage costs, between the pre-defined supply point and such Cargo’s Supply to the Refinery shall be determined in the same manner as for Cargoes delivered under the Execution Method. The Supply Point Method shall be used whenever Buyer agrees to purchase a Cargo from Seller’s or its Affiliates’ portfolio.

(iii)Cargo Confirmation. Whether a Cargo is purchased under the Execution Method or the Supply Point Method above, Seller shall promptly complete and communicate to Buyer a notice in the format set forth in Appendix 10 (a “Cargo Confirmation Notice”) after a Cargo has been purchased. At any point where a transaction relevant to that Cargo is agreed to between the Parties thereafter, the Cargo Confirmation Notice and / or relevant Cargo Table (Appendix 15) shall be updated accordingly. For example, if a freight cost is negotiated and established at a time after the Cargo was purchased under the Execution Method, that freight cost shall be added to the Cargo Table. If there is a material change to the original deal, such as a change in delivery method, then the Cargo Confirmation Notice shall be updated. This process shall continue until the entire price of the Cargo is built up and fully agreed and finalized.

-20-

(iv)Establishment of the Final Quality Differential for a Cargo. The Final Quality Differential shall be identified in the Cargo Confirmation Notice. This Final Quality Differential is to be used in the pricing process as described in Clause 9. This Final Quality Differential shall be set by agreement between the Parties. Any further cost items or adjustments that are applied to the Cargo Confirmation Notice shall thereafter follow the “Petty Cash” process in Clause 12. The general principle in the Parties agreeing to the point at which the Final Quality Differential is established and fixed shall be that further anticipated costs and adjustments are small in nature and would have a low expected probability of having a significant impact on the value of the Final Quality Differential.

(g)RGPO Optimization and the Other Optimization Account.

(i)Replacement Pecking Order Cargo Optimizations. To the extent any Replacement Pecking Order Cargo replaces a Cargo originally purchased for Supply to the Refinery in Month M, which is subsequently disposed of by Seller due to an alternative Cargo or alternative Cargoes (which shall be of equivalent volume to the original purchased Cargo and may consist of different Grades of Oil or Feedstock) being acquired by agreement between the Parties, Buyer will pay for the replacement Cargo or Cargoes the price specified by Buyer in the RGPO and Seller will retain all profit and loss associated with: (1) disposing of the Cargo originally purchased for Supply to the Refinery and (2) the price differences between the RGPO terms and the terms executed between Seller and the third party supplier of such replacement Cargo or Cargoes. To the extent Seller identifies a potential replacement Cargo or Cargoes that is not on the RGPO for the current Cargo, then such RGPO can be modified to add such replacement Cargo or Cargoes upon the Parties’ mutual agreement.

(ii)Other Optimizations. The“Optimization Account” has been established in order to capture any profit or loss from an optimization that is proposed by Seller and agreed to by Buyer, other than optimizations in connection with the replacement of Cargoes originally purchased for Supply to the Refinery by use of the RGPO as described in Clause 5(g)(i) above. This Optimization Account shall contain separate accounts for all Cargoes concerned and show in detail any commercial activity and its result, including, but not limited to, profit or loss from the purchase and resale of a Cargo, profit or loss from fixing and subsequent re-letting of any shipping, or other expenses arising from the optimization of a Cargo. Furthermore, any working capital considerations shall be included in the Optimization Account. Should the Parties agree that any other economic benefit to be shared between the Parties can most easily be reflected in the Optimization Account, then such economic activity shall also be recorded accordingly. For sake of clarity, all transactions that use the Optimization Account method for accounting for the economic result of an optimization implicitly require that all pricing and costs associated with the original transaction that was optimized be treated as though there were no optimization and be generally unaffected by any optimization process, so that all the benefits and costs of such optimization are aggregated in the Optimization Account for sharing between the Parties.

-21-

(h)Commencement Inventory. On the Effective Date, Seller shall acquire the Oil and Feedstock held in inventory at the Refinery in accordance with the procedures set forth in Appendix 11 unless already owned by Seller.

(i)Feedstock and Crude Slops Obligations.

(i) Feedstock at the Refinery can be subdivided into two types, VGO and VTB, but Feedstock shall not include Crude Slops. For each type of Feedstock, Buyer and Seller shall agree on a volume for a Feedstock Virtual Tank Heel, in addition to the actual Tank Heel applicable to such type of Feedstock. The volume of such“Feedstock Virtual Tank Heel” will be set [REDACTED]

(ii) All Feedstock volumes that are in excess of the sum of: [REDACTED]

(iii) The Parties anticipate that the Refinery will generally over each month-long period consume a net amount of each type of Feedstock, but that in some shorter time periods the Refinery may produce more of one or more types of Feedstock than it consumes. The Parties hereby agree that the monthly reconciliation performed under Clause 11 will determine the total net purchases by Buyer for such period, and payments will be made based on the net consumption of such type of Feedstock. However, to the extent the monthly reconciliation performed under Clause 11 indicates that the Refinery produced more of one or more types of Feedstock than it consumed, then the Parties shall mutually agree upon a price for such type of Feedstock based on [REDACTED] All Feedstock shall be [REDACTED]

(iv) As part of the Refinery’s processes Crude Slops will be delivered to the Storage Facilities with the intent that such Crude Slops will be further processed by the Refinery in the same manner as Oil. Such Crude Slops will be treated for all purposes of this Agreement as [REDACTED]

-22-

(v) For purposes of clarification the Parties agree that all Feedstock and Crude Slops delivered to Seller will be owned by Seller who shall retain title thereto unless and until such Feedstock and Crude Slops are subsequently purchased by Buyer from Seller at the title transfer point, as described in Clause 7.

(j)Tank Heel Obligations.

(i)Tank Heel Starting and Closing Volume Purchases.

(1) Seller will purchase all of the usable Oil and usable Feedstock that as of the Effective Date are Tank Heels. Such usable Oil and usable Feedstock together with all Tank Heels Supplied to the Storage Facilities in the 1 month period following the Effective Date shall collectively be referred to as the“TH Starting Volume”. The purchase of the TH Starting Volume will be made in accordance with the provisions in Appendix 11. All other obligations to purchase Oil or Feedstock referred to in this Agreement shall not include the Tank Heels which shall be governed by this Clause 5(j).

(2) Buyer shall purchase from Seller on the Termination Date a volume of Tank Heels equal to the TH Starting Volume and will pay Seller a price equal to the TH Ending Price. The“TH Ending Price” shall be equal to [REDACTED]

(ii)Interim Tank Heel Transactions. If Seller reasonably believes the volume of Tank Heels may have changed (for example a tank in the Storage Facilities is removed from service or because more water and sediment has displaced the usable Oil or Feedstock that constitute the Tank Heel), then Seller can obtain a measurement or assessment of the affected Tank Heel(s):

(1) If such assessment shows there is more volume of Tank Heels than the TH Starting Volume then Seller shall [REDACTED]

(2) If such assessment shows there is less volume of Tank Heels than the TH Starting Volume then Buyer shall [REDACTED]

-23-

All Tank Heels at any time in the Storage Tanks shall be owned by Seller unless and until they are sold to Buyer in accordance with this Clause 5 or Clause 24.

The“TH Market Value” means the current market price of such Tank Heel.

(iii)Tank Heel Payments, Fees and Credit Provisions.

(1) All Tank Heels are subject to the normal service fees and TVM charges that are more fully described in Clause 19. In accordance with Clause 5(j)(i)(1) and Appendix 11, the Parties shall mutually agree upon the monthly charge per Barrel (the“TH Per Barrel Storage Charge”) to be used in calculating the TH Storage Fee through December 31, 2011 (as such date may be extended pursuant to this Clause 5(j)(iii)(1) the“TH Conclusion Date”). Seller will [REDACTED]

(2) Seller shall periodically determine the amount of exposure, if any, it has to Buyer based on Buyer’s Tank Heels purchase obligations (the“TH Exposure”) and Seller [REDACTED] “TH Exposure” shall be equal to [REDACTED]

-24-

(3) For purposes of clarification, the Parties agree that all payments calculations with respect to Tank Heels payment obligations due at or in connection with the TH Conclusion Date or the Termination Date, shall be determined [REDACTED]

(iv)Feedstock Virtual Tank Heel. As described in Clause 5(i)(i), all Feedstock Virtual Tank Heel shall be treated as Tank Heels for purposes of this Clause 5(j), including with respect to the calculations of the TH Starting Volume, TH Storage Fee and TH Exposure (and the resulting effect on Credit Usage under Clause 19).

(v)Line Fill. For the purposes of this Clause 5(j) only, all Line Fill (as defined in Appendix 11) shall be treated as “Tank Heels,” and Buyer shall at the TH Conclusion Date purchase the same amount of Line Fill from Seller as Seller purchased from Buyer at the Effective Date.

(k)Payment Offset. In a few situations Seller may have a payment obligation to Buyer under this Agreement such as in connection with Seller purchasing Feedstock or Oil from Buyer. In all such situations if Buyer owes Seller other amounts under this Agreement which have not been paid, then Seller may offset the amounts Buyer owes to Seller under this Agreement against the Seller’s payment obligations to Buyer. If Seller exercises such offset right, Seller shall promptly notify Buyer of such offset and the corresponding reduction in Buyer’s payment obligations to Seller.

| 6. | NOMINATIONS |

The following schedule outlines the process for Buyer and Seller to agree on nominations for Supply of Oil and Feedstock into the Refinery for any Month M. For sake of clarity, Buyer’s Tentative Requirements Schedule/Buyer’s Requirements Schedule for Month M are the plans for Supply of Cargoes in Month M, whereas the Predicted Refinery Slate/Actual Refinery Slate for Month M (both as defined in Clause 9) are the plans for the number of Barrels of any Grade to be Delivered in that Month. These two plans will be separate and different from one another. The nominations for each Party shall progress in the following chronological order:

(a) Buyer shall nominate to Seller no later than the [REDACTED] Buyer’s Tentative Requirements Schedule. Each nomination shall be of [REDACTED] which is the [REDACTED] that Buyer envisages acceptable fulfillment of the Requirement to meet Buyer’s planned Refinery run schedule. Each nomination shall define the Type for that Requirement. No later than the [REDACTED], Seller shall nominate to Buyer the provisional [REDACTED] for all Requirements in M. Buyer’s Tentative Requirements Schedule for Month M will at this point become “Buyer’s Requirements Schedule”. Changes of either dates or Types within this Buyer’s Requirements Schedule shall only be by agreement between the Parties.

-25-

(b) At any time when a Requirement is either first covered by a specific Cargo or optimized from one Cargo to another Cargo, Buyer’s Requirements Schedule will be updated by replacing a Requirement (or optimized out Cargo) with the appropriate Cargo purchased.

(c) Buyer shall nominate to Seller no later than the [REDACTED] (i) the Deemed Volume for Month M, and (ii) the Predicted Refinery Slate for M.

(d) For any Requirement nominated for Supply in M, then promptly after Seller has covered such Requirement with a Cargo Seller shall nominate to Buyer a [REDACTED].

(e) For any Cargo nominated for Supply in M, Seller shall narrow the [REDACTED] to the beginning of such [REDACTED].

(f) Promptly following the end of Month M, Buyer shall communicate the Actual Refinery Slate for M based on the Delivered Oil and Feedstock in M. (See Clause 9).

| 7. | TITLE; CONTROL; RISK OF LOSS |

(a) Until title is transferred in accordance with subclause (c) below, Seller shall continuously have and retain title at all times to all Oil and Feedstock Seller acquires for purposes of satisfying its Delivery obligations under this Agreement (including, without limitation, title to Oil or Feedstock that is on the water, in transport, or in the Storage Facilities). Buyer shall not take any action that adversely affects or encumbers in any way Seller’s title to or rights in such Oil and Feedstock.

(b) To further clarify Seller’s continuous title and ownership of Oil and Feedstock, as described above, including the Oil and Feedstock in the Storage Facilities, Buyer will facilitate the execution of Intercreditor Agreement(s) with any lenders, credit buyers, secured parties, debt buyers, or any other Person which seeks to obtain or maintain (i) a material security interest in the Refinery or in any related assets, operations or contracts or (iii) any security interest, lien or other rights in the Oil or Feedstock. Buyer hereby authorizes Seller to make any and all filings under the UCC that are appropriate to clarify Seller’s ownership and other rights with respect to such Oil and Feedstock. Buyer agrees to immediately notify Seller pursuant to the notice provision herein in the event that a Lien is placed upon the Refinery by any creditor of Buyer at any time during the term of this Agreement other than as described in the Intercreditor Agreement(s).

(c) Title to the Oil, Feedstock or Crude Slops shall pass upon the following actions being completed:

(i) From Seller to Buyer when Oil other than Feedstock is transferred through the Storage Facility outlet flange.

(ii) From Buyer to Seller when Crude Slops are transferred through the Storage Facility inlet flange.

(iii) From Buyer to Seller when Feedstock is transferred through the Feedstock Tank inlet flange.

-26-

(iv) From Seller to Buyer when Feedstock is transferred through the Feedstock Tank outlet flange.

(d) Delivery of Oil and Feedstock to Buyer shall be considered to be taken at the same point where title passes.

(e) During Normal Refinery Operation, subject to Seller’s right to suspend deliveries (i) under Clause 19 or (ii) pursuant to a Termination of Deliveries Notice, Buyer may take deliveries of Oil and Feedstock from the Storage Facilities solely for refining within the Refinery without prior consent of Seller.

(f) Control of Oil and Feedstock

(i) Except with respect to the daily deliveries of Oil and Feedstock contemplated by Clause 7(e) or as provided in Clause 3 of Appendix 5, Buyer shall not cause or permit Seller’s Oil and Feedstock to be withdrawn from the Storage Facilities without prior written consent of Seller. In the event that at any time Seller provides a notice to Buyer substantially in the form of Appendix 12 (a“Termination of Deliveries Notice”), Buyer shall immediately cease taking any further deliveries of Oil and Feedstock from the Storage Facilities until Seller notifies Buyer in writing that such Termination of Deliveries Notice has been canceled. Appendix 6 allows some flexibility for moving Oil and Feedstock in the case of an emergency.