- SERA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Sera Prognostics (SERA) 8-KResults of Operations and Financial Condition

Filed: 31 Jan 25, 1:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2025

Sera Prognostics, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-40606 | 26-1911522 | ||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| 2749 East Parleys Way | ||

Suite 200 Salt Lake City, Utah | 84109 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (801) 990-0520

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading | Name of each exchange on which registered | ||

| Class A Common Stock, $0.0001 par value per share | SERA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Estimated Cash Balance as of December 31, 2024 (unaudited)

Sera Prognostics, Inc. (the “Company”) is providing the following financial information. As of December 31, 2024, the Company’s cash, cash equivalents and marketable securities were approximately $68.2 million (unaudited).

The estimated cash, cash equivalents and marketable securities as of December 31, 2024 are preliminary and may change, and are based on information available to management as of the date of this Current Report on Form 8-K (“Report”) and are subject to completion by management of the financial statements as of and for the year ended December 31, 2024. There can be no assurance that the Company’s cash, cash equivalents and marketable securities as of December 31, 2024 will not differ from these estimates and any such changes could be material. The preliminary financial data included in this Report has been prepared by and is the responsibility of the Company’s management. The Company’s independent registered public accounting firm has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, the Company’s independent registered public accounting firm does not express an opinion or any other form of assurance with respect thereto. Complete annual results will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

Item 7.01 Regulation FD Disclosure

Updated Corporate Investor Presentation

On January 31, 2025, in order to reflect the results of the Prematurity Risk Assessment Combined With Clinical Interventions for Improving Neonatal outcoMEs study (the “PRIME” study) described in Item 8.01 below and other updates, the Company updated its corporate investor presentation as posted on its corporate website. A copy of the investor presentation is furnished as Exhibit 99.1 hereto and incorporated by reference herein.

Item 8.01 Other Information.

Presentation of PRIME Study Results

Overview

On January 31, 2025, final results of the Company’s PRIME study were presented at the Society for Maternal Fetal Medicine (“SMFM”) 2025 Pregnancy Meeting, and will again be presented at a subsequent virtual R&D day session hosted by the Company and the principal investigator. The study achieved both of its co-primary endpoints, showing significant reductions in the neonatal morbidity and neonatal hospital stays among low-risk patients for preterm birth, as described below. Because approximately 50% of preterm births occur in women without known risk factors, the Company believes that the PRIME study results show that the use of its PreTRM Test, combined with preventive interventions, have the potential to address a significant unmet need.

Purpose and Design of the PRIME Study

The PRIME study was a multicenter national randomized clinical trial involving 5,018 pregnant women designed to assess the efficacy of the PreTRM Test and preventive interventions in lowering the occurrence of certain adverse pregnancy outcomes among low-risk patients (i.e., women without specific known risks, such as a prior preterm birth or a short cervix). The PreTRM Test, which analyzes a participant’s blood, was administered in the middle of the second trimester of pregnancy to identify individuals at higher risk of delivering an infant preterm. The PreTRM Test classified 23.5% of participants as higher risk within the preterm birth prevention arm. In addition to the traditional standard of care, individuals identified at higher risk were given a safe and low-cost regimen of daily vaginal progesterone and low-dose aspirin and assigned weekly phone calls with a nurse. The remaining lower-risk participants in the prevention arm, and all participants in the control arm, received the usual standard of pregnancy care, which included routine checkups.

Results of the PRIME Study

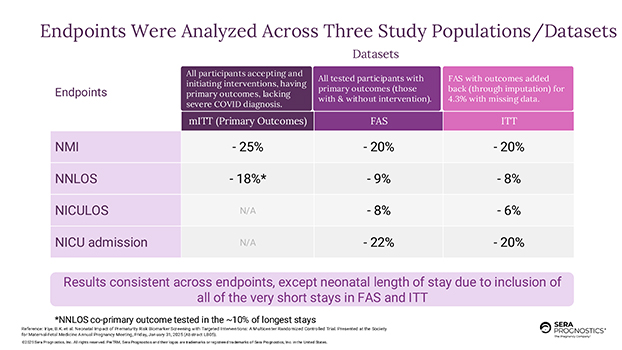

The study achieved statistically significant success and met both co-primary endpoints. Study endpoints were evaluated in three participant populations/datasets. Using the pre-specified modified Intent to Treat population (“mITT”), which excluded those subjects with severe COVID, lacking the primary outcomes or declining the intervention bundle, the study showed a 25% decrease in neonatal morbidity and mortality, according to a composite index score (“NMI”), and an 18% reduction in neonatal length of hospital stay (“NNLOS”). Using Full Analysis Set (“FAS”), which included all participants and their neonates with primary outcomes data, showed 20% reduction in NMI and 22% reduction in NICU admission. Using the full Intent to Treat population (“ITT”) which included all participants in the study, inclusive of those few who were missing outcomes (through statistical imputation), results showed a 20% reduction in NMI and an 8% reduction in neonatal length of hospital stay. These percentage reductions were achieved despite the fact that the effect size was diluted because the ITT analysis set includes all babies, including the vast majority of healthy babies that typically only stay two nights. Further, and most importantly, ITT results showed a 20% reduction in NICU admissions, while demonstrating that those infants who were admitted to the NICU had a 6% reduction in the length of stay (“NICULOS”).

PRIME results are consistent with the Company’s prior AVERT study. Preliminary aggregate data meta-analysis of both studies shows pooled mITT effect of 22% reduction in NMI, and 22% reduction in neonatal length of stay (“NNLOS”). The AVERT and PRIME results translate to a Number Needed to Screen (“NNS”) of 3 to 4 to reduce a NICU day. In other words, 3-4 expectant mothers need to be screened to save one NICU day.

The Company believes the foregoing validates the use of its PreTRM Test to implement a “screen and treat” strategy among low-risk patients to meaningfully reduce adverse neonatal clinical outcomes and provide significant savings in cost of care.

FORWARD-LOOKING STATEMENTS

This Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the future use of PreTRM based on the PRIME study results, statements about the Company’s expectations that the PreTRM Test has the potential to address a significant unmet need, and statements regarding the Company’s cash, cash equivalents and marketable securities as of December 31, 2024. These “forward-looking statements” are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by forward-looking statements. These risks and uncertainties include, but are not limited to: the need for

broad scientific and market acceptance of the PreTRM Test; a concentrated number of material customers; the Company’s ability to introduce new products; potential competition; the Company’s proprietary biobank; the availability of critical suppliers; estimates of total addressable market opportunity and forecasts of market growth; potential third-party payer coverage and reimbursement; new reimbursement methodologies applicable to the PreTRM Test, including new CPT codes and payment rates for those codes; changes in U.S. Food and Drug Administration regulation of laboratory-developed tests; the intellectual property rights protecting the Company’s tests and market position; and other factors discussed under the heading “Risk Factors” contained in the Company’s Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission on March 20, 2024, as well as any updates to those risk factors filed from time to time in the Company’s Quarterly Reports on Form 10-Q, or Current Reports on Form 8-K. All information in this Report is as of the date of the Report, and the Company undertakes no duty to update this information unless required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description | |

| 99.1 | Investor presentation posted on January 31, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

The information contained in Item 2.02 and Item 7.01 of this Report, including Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except to the extent required by applicable law or regulation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SERA PROGNOSTICS, INC. | ||||||

| Date: January 31, 2025 | By: | /s/ Austin Aerts | ||||

Austin Aerts Chief Financial Officer | ||||||