UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22678

Salient MF Trust

(Exact name of registrant as specified in charter)

4265 San Felipe, 8th Floor

Houston, TX 77027

(Address of principal executive offices) (Zip code)

Gregory A. Reid, Principal Executive Officer Salient MF Trust 4265 San Felipe, 8th Floor Houston, TX 77027 (Name and address of agent for service) | With a Copy To: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. Boston, MA 02111-2950 (617) 261-3231 |

Registrant’s telephone number, including area code: (713) 993-4001

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a) The following is a copy of the report transmitted to shareholders of the Salient MLP & Energy Infrastructure Fund and Salient Tactical Plus Fund (collectively, the “Funds”), each a series of the registrant, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

The series of funds under the Salient MF Trust (“Salient Funds”) are distributed by:

Foreside Fund Services, LLC

Portland, Maine

The report has been prepared for the general information of the Funds’ shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Funds’ Prospectus, which contains more complete information about Funds’ investment policies, management fees and expenses, experience of the management teams and other information. Investors are reminded to read the Prospectus before investing or sending money.

Dear Shareholder:

We enter 2021 with gratitude for the trust that you, the shareholders of the Salient Funds, have placed in us. It is our aim to build strategies that enable you to act as good stewards of wealth, and it is our hope that you have found value in your partnership with us over the past year. Thank you.

To say that 2020 was unique would be an understatement. We started the year optimistically, but this optimism did not last long as the global economy experienced an unprecedented shutdown to try and curb the spread of the coronavirus. By mid-March, Salient had successfully transitioned the majority of our staff to a work-from-home format, which continues to this day. We implemented new collaboration tools, introduced weekly all-staff calls and streamlined our reporting structure. These efforts ensured that we could continue to be effective stewards of the capital entrusted to us.

The past year has been profitable for many investors, including those in most financial markets in which the Salient Funds invest. It has also been a year of further disconnects between those markets and the economies, businesses and political systems that underlie them. We have been on what seems like a political roller coaster with close elections and subsequent political turbulence in our Capitol. Economies worldwide basically shut down for parts of the year due to the pandemic and many businesses folded as a result. In response to these issues, both foreign and domestic central banks have kept interest rates at zero and governments around the world have implemented substantial stimulus programs in an effort to bridge the slack in the economy.

We believe we are well-positioned to take advantage of new opportunities created in the wake of COVID-19 while managing the risk associated with the gap between financial markets and what we observe in the “real” economy. We enter the new year hopeful on the back of approved COVID-19 vaccines. We wish you a healthy and prosperous 2021.

Sincerely,

William Enszer

Chief Executive Officer

Salient Partners, L.P.

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

COVID-19 is an infectious disease caused by a new strain of coronavirus. The virus was first identified in late 2019 in Wuhan, the capital of China’s Hubei province, and has since spread globally, resulting in the ongoing 2019–2021 coronavirus pandemic.

Salient is the trade name for Salient Partners, L.P., which together with its subsidiaries provides asset management and advisory services. This information is being provided solely for educational purposes and is not an offer to sell or solicitation of an offer to buy an interest in any investment fund. Any such offer or solicitation may only be made by means of a confidential private offering memorandum or prospectus relating to a particular fund and only in a manner consistent with federal and applicable state securities laws.

1

The Salient Funds offered under the Salient MF Trust are distributed by Foreside Fund Services, LLC.

Not FDIC Insured | No Bank Guarantee | May Lose Value

©2021 Salient. All rights reserved.

The discussions concerning the Funds included in this shareholder report may contain certain forward-looking statements about the factors that may affect performance of the Funds in the future, including the portfolio managers’ outlook regarding economic, financial, market, petroleum, political and other factors relevant to investment performance in the U.S. and abroad. These statements are based on the portfolio managers’ expectations concerning certain future events and their expected impact on the Funds and are current only through the date on the cover of this report. Forward-looking statements are inherently uncertain and are not intended to predict the future performance of the Funds. Actual events may cause adjustments in the portfolio managers’ strategies from those currently expected to be employed, and the outlook of the portfolio managers is subject to change.

2

Fund Commentary and Performance (Unaudited)

Salient MLP & Energy Infrastructure Fund

As of December 31, 2020

For the year ended December 31, 2020, Salient MLP & Energy Infrastructure Fund’s Class I shares returned -17.32%, outperforming the Fund’s benchmark, the Alerian Midstream Energy Select Index (AMEI), which returned -23.42%.

Master limited partnerships and midstream energy companies (businesses involved with the processing, storing, transporting and marketing of oil, natural gas and natural gas liquids) struggled during 2020 primarily due to pressures on energy demand as a result of the coronavirus pandemic. Almost from the very beginning of 2020, the coronavirus and the various governmental preventive measures taken to contain the spread of the virus dominated all facets of life. By the middle of January, China sealed off the city of Wuhan and several other cities and it wasn’t long before an aggregate population of over 50 million in the world’s second largest economy was offline. Even worse, the spread of the virus was showing no sign of slowing down. At the Fund level, we began to worry that we may have an energy demand issue arising. By the end of January, flights from China to the U.S. were grounded and our worries were rapidly coming to fruition.

The decline in the energy markets quickened in February as the virus spread around the globe, increasing fears that an unprecedented decrease in energy demand was possible. Investors began selling in February and the AMEI fell -10.26% in the month. The fear wasn’t limited to energy. Reports out of China showed that its economic activity had fallen 60% year over year (y/y), indicating the sharpest decline ever measured. The broader market, as represented by the S&P 500 Index, set an all-time high close of 3,386 on February 19, 2020. By the end of the month, the S&P 500 finished down -8.23%, falling -13% over the last seven trading days.

In March, investors began to panic as the global economy came to a screeching halt. International flights were grounded and states didn’t allow residents of certain other states entry without quarantining first. More importantly, many school systems shut down and switched to online instruction. Many employers closed their offices and allowed their employees to work from home in order to attempt to limit the spread of the virus. All these measures had a devastating impact on energy demand. Analysts estimated that crude oil demand was on pace to fall by an unthinkable 30% y/y. When the dust settled, crude oil closed March at $20.48 per barrel (bbl), the lowest price since January 2002. Midstream suffered the worst month in its history with the AMEI declining -41.48% and ending March down just shy of -50% for the year.

As bad as everything looked at the end of March, there was a glimmer of hope. The AMEI bottomed on March 18, 2020, and then rallied 30% over the last nine trading days of the month. The “positive” momentum carried over into April and the worst month in the history of the index was followed by the best in April. The AMEI soared 32.79% in April as opportunistic investors began to enter the space. Part of the optimism was due to the tone of many midstream first quarter 2020 earnings reports and guidance. Many midstream companies stated that they only expected to see EBITDA (earnings before interest, taxes, depreciation and amortization) down roughly 10%–15% y/y for 2020. Many of the stocks in the midstream space were down greater than 50% at this point so with operations only being guided down in the 15% range there was a disconnect that had risk-tolerant investors buying stocks and driving the sector strongly off the bottom.

The recovery in midstream continued through the summer as the global economy gradually reopened. By the first week of June, the AMEI had rallied 115% off the bottom and was down “only” -16.45% for 2020. The broader market, as represented by the S&P 500, also recovered quite nicely, erasing its entire decline and turning positive for the year on June 8, 2020. Energy demand outside of jet fuel had already returned to within roughly 10% of 2019 levels while U.S. crude oil production had bottomed at about 11 million barrels per day (mmbpd), down roughly 15% from the 13 mmbpd peak set in early 2020.

After a three-month rebound into mid-June, midstream had another pullback in the fall as all eyes turned toward the U.S. presidential election. President Trump trailed in the polls and since his administration was considered to be friendlier toward traditional energy than a Biden administration would be, midstream slumped into the election with the AMEI declining -9.11% from the end of July through October. Crude oil, which had stabilized around $40/bbl since June, slumped to $37.66/bbl on Election Day.

3

Fund Commentary and Performance, continued (Unaudited)

Salient MLP & Energy Infrastructure Fund

As of December 31, 2020

Election Day removed some of the uncertainty hanging over the market. It has often been stated that the thing the market hates most is uncertainty. With the election results, the market got some clarity and investors reacted favorably. Then, in quick succession, news of a COVID-19 vaccine helped propel energy stocks meaningfully higher. During November, the AMEI spiked 19.51% higher as investors viewed energy, and more specifically, midstream, as undervalued and likely to benefit from an improving economy.

The strong November performance allowed the AMEI to rebound into year-end to finish 2020 down -23.42%, which, while obviously not optimal, is somewhat of a victory given that it was down more than 62% at the bottom. Crude oil also rallied and traded at a level above where it was in early March. If crude oil remains in the high $40s to low $50s range per barrel, we believe U.S. producers will continue to practice capital discipline and be in no hurry to bring new production online absent a significant price incentive.

There is a degree of irony to recognize that a slowdown in production growth could have a positive impact on free cash flow for midstream companies. This is even more true today as the “growth” in production over the next 12 months or so will just represent a return to prior production levels and will require even less capital spending from midstream than before. We believe midstream equities are significantly undervalued, and, with the continued reopening of the global economy, they represent a potentially positive risk-adjusted opportunity as we move into 2021.

For 2020, the Fund outperformed the AMEI by 6.10%, which is significant. Several factors drove relative performance during the year. First, the Fund raised cash by meaningfully underweighting sectors with higher commodity sensitivity such as gathering and processing (G&P) in February, prior to the decline in equity prices. Cash levels rose above 10% for a short period of time and holding cash contributed approximately 400 basis points of the Fund’s outperformance versus the AMEI. Second, the Fund purchased put options in February to further protect principal. The puts, while small in size, contributed just over 110 basis points to performance. Additionally, the Fund periodically sold covered call options to generate additional income for investors. The use of these options added approximately six basis points to the Fund’s performance in 2020. Finally, the Fund’s increased allocation to clean energy infrastructure also contributed to relative performance during the year, as the economics of clean energy improved and offered long-term growth opportunities.

Top clean energy contributors included Enphase Energy Inc. (ENPH), a manufacturer of solar power solutions that help increase the productivity and reliability of solar modules, and NextEra Energy Partners LP (NEP), an owner and operator of wind and solar projects. The Fund’s weight in ENPH averaged about 1% for the year and the position contributed over 220 basis points to relative performance during 2020. The Fund’s weight in NEP averaged 2.2% for the year and the position contributed over 40 basis points to relative performance for the year.

Other large contributors of relative return included MPLX LP (MPLX), a liquids transportation provider, Antero Midstream Corp. (AM), a G&P company, and Targa Resources Corp. (TRGP), an integrated natural gas and natural gas liquids (NGLs) transportation company. The Fund purchased MPLX in March during the sharp decline in equity prices and held an average position of about 2% for the year. MPLX contributed over 160 basis points while the AM and TRGP positions contributed over 150 and 140 basis points, respectively, to relative performance for the year.

In addition to owning positions that provided strong relative returns, some of the Fund’s outperformance came from avoiding companies at the right times throughout the year. An underweight position in Inter Pipeline Ltd. (IPL CN), an operator of major petroleum transportation, storage and NGLs extraction assets, provided the Fund with over 140 basis points of outperformance relative to the AMEI. The Fund’s IPL CN weight averaged just below 2% for the year, less than half the average 4% weight in the AMEI.

On the downside, several of the Fund’s positions detracted from relative performance for the year. The Fund’s overweight positions in ONEOK Inc. (OKE), a provider of G&P and NGL transportation and fractionation services, Pembina Pipeline Corp. (PPL CN), a provider of petroleum transportation, storage and marketing services, and Keyera Corp. (KEY CN), a provider of petroleum transportation, storage and marketing of petroleum services, were the largest detractors of relative performance. All three companies operate in the more commodity-sensitive sectors of the midstream industry and underperformed as oil prices fell. The OKE position detracted about 400 basis points while the PPL CN and KEY CN positions detracted approximately 200 and 120 basis points, respectively, from relative performance for 2020.

4

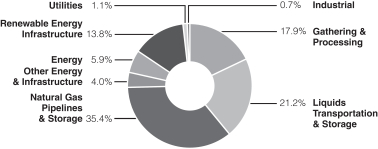

Salient MLP & Energy Infrastructure Fund

Asset Allocation as a Percentage of Total Investments

as of December 31, 2020

These allocations may not reflect the current or future position of the portfolio.

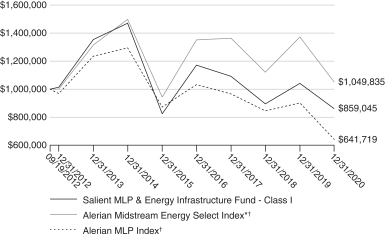

Hypothetical Growth of $1,000,000 Investment in the Fund

The chart above shows how a hypothetical investment of $1,000,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $1,000,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

* Effective January 1, 2019, the Alerian Midstream Energy Select Index replaced the Alerian MLP Index as the Fund’s primary benchmark index.

† The Index’s inception date differs from the inception date of the Fund’s Investor Class.

5

Salient MLP & Energy Infrastructure Fund(a)

| 1 Year | 5 Year | Since Inception | Inception Date | |||||||||||||||||

| Average Annual Total Return | ||||||||||||||||||||

Class A (with sales load)(b) | -21.95% | -0.46% | -3.03% | 12/21/12 | ||||||||||||||||

Class A (without sales load)(c) | -17.43% | 0.66% | -2.34% | 12/21/12 | ||||||||||||||||

Class C (with CDSC)(d) | -18.94% | -0.15% | -3.49% | 01/08/13 | ||||||||||||||||

Class C (without CDSC)(e) | -18.16% | -0.15% | -3.49% | 01/08/13 | ||||||||||||||||

Class I | -17.32% | 0.86% | -1.82% | 09/19/12 | ||||||||||||||||

Class R6 | -17.27% | 0.92% | -1.78% | 01/04/16 | ||||||||||||||||

(a) Returns with sales charge reflect the deduction of current maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge of 1.00%, which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. The total annual operating expense ratios for the Fund, based on the current Fund prospectus dated May 1, 2020, are as follows: Class A shares are 1.53%, Class C shares are 2.28%, Class I shares are 1.28% and Class R6 shares are 1.18%. The advisor has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until April 30, 2021. Additional information pertaining to the December 31, 2020, expense ratios can be found in the financial highlights. Returns do not reflect the taxes that investors may pay on Fund distributions or the sale of Fund shares.

(b) Includes the effect of the maximum 5.50% sales charge.

(c) Excludes sales charge.

(d) Includes the 1.00% contingent deferred sales charge.

(e) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6

Fund Commentary and Performance (Unaudited)

Salient Tactical Plus Fund

As of December 31, 2020

For the year ended December 31, 2020, Salient Tactical Plus Fund’s Class I shares returned 7.15%, outperforming the Fund’s benchmark, the HFRX Equity Hedge Index, which returned 4.60%.

The stock market environment in 2020 was one of unprecedented volatility as the result of the global coronavirus pandemic. The S&P 500 Index rose to a new high in the first six weeks of the year. However, as it became evident that the virus was rapidly spreading throughout the United States, the S&P 500 experienced one of its steepest drops ever, falling nearly -34% in the next six weeks. U.S. gross domestic product (GDP) declined at an annualized rate of -31.4% during the second quarter, the largest such decline in U.S. history.

The stock market reached a low point in March and then turned strongly upward. While experiencing several steep and quick setbacks along the way, the major stock market averages rose steadily into the end of the year. Most major stock market indices set new all-time highs. The catalyst for the rapid recovery included Congress’s passage of a massive government stimulus program and the U.S. Federal Reserve’s (Fed’s) accommodative zero interest rate policy. These factors produced one of the strongest economic rebounds in U.S. history with GDP increasing at an annual rate of 33.4% in the third quarter of 2020.

The coronavirus continued to spread throughout the year and infections accelerated into year-end. At the end of 2020, there were 20 million coronavirus cases in the United States and over 350,000 deaths. The first vaccine was successfully developed in record time, however, and it was quickly authorized for use by the U.S. Food and Drug Administration. Distribution of the vaccine had begun by the end of the year, which was an encouraging development for investors. Investors were also relieved that Congress passed another stimulus program in December 2020.

During the year, equity valuations rose to levels not seen since the dot-com bubble of 2000 and the financial crisis of 2008. However, with interest rates so low, stocks remained attractive relative to the low yield on bonds. Almost two-thirds of all stocks in the S&P 500 had a higher yield than the 10-year U.S. Treasury Note at year-end. The Fed indicated that it would keep interest rates low into 2023, providing a positive monetary and credit environment.

Stock market momentum, as measured by the Fund’s volume and breadth measures, remained positive. While technology and communication services stocks led the way up in the first six months of the recovery, small cap stocks and other previously lagging sectors of the market joined in the rally in the second half of 2020. By year-end, small cap stocks and several other previously lagging indices registered all-time highs.

The investment team’s concerns at year-end were that absolute equity valuations were elevated and could be adversely affected if interest rates were to rise. In addition, investor sentiment had climbed to very optimistic levels, which is negative from a contrary point of view. The investment team believes that some correction is therefore likely in early 2021 prior to a resumption of the uptrend.

The Fund regularly used options and futures during the year. A meaningful portion of the Fund’s return can be attributed to these derivative instruments.

The Fund’s investment strategy strives to capture a portion of the market’s growth while aiming to preserve capital during market corrections. The tactical investment approach has had its greatest success in volatile markets that involved market corrections of 10% or more. For instance, in early 2020, the strategy largely sidestepped the steep February–March stock market decline. The Fund declined only -3.38% for the first quarter of 2020 versus a loss of -13.33% for the HFRX Equity Hedge Index and a loss of -19.60% for the S&P 500 for that same time period. During these volatile periods, the Fund’s flexible and responsive risk management process can be a powerful tool toward the goal of producing positive risk-adjusted returns.

7

Fund Commentary and Performance, continued (Unaudited)

Salient Tactical Plus Fund

As of December 31, 2020

As the Salient Tactical Plus Fund’s investment team looks ahead to 2021, there are several factors within its “Four Pillar Process” that the team will be watching:

| 1. | Valuation: Equity valuations are high by any absolute measure. Any significant rise in interest rates in 2021 would be a potentially negative factor for equity valuations. |

| 2. | Monetary factors and credit conditions: The Fed continues to maintain an accommodative low interest rate policy. Intermediate- to long-term interest rates declined in 2020, which provided a positive environment for the capital markets. Credit spreads also remained narrow, indicating no immediate dislocations in the economy or the credit markets. Any significant increase in interest rates accompanied by a widening of credit spreads would be a negative for the markets in 2021. |

| 3. | Sentiment: Investor sentiment has risen to high levels of optimism. This is negative from a contrary point of view and suggests that a stock market pullback may be necessary in early 2021 to recycle investor sentiment back to more normal levels. |

| 4. | Momentum: The severity of the stock market’s decline for the first quarter of 2020 set the stage for the market’s subsequent strength for the remainder of the year. Salient Tactical Plus Fund’s volume and breadth momentum models turned positive in late March and early April and remained so into the end of the year. Upside volume remained strong while downside volume abated. The rising relative strength of some of the lagging sectors during the second half of the year contributed to the market’s improved breadth, which was also a positive. |

At the end of 2020, however, the market’s strong rise had become extended and both volume and breadth momentum measures showed an overbought condition. We believe some type of normal pullback would be expected in early 2021 to bring these indicators back into more neutral territory. Nonetheless, the Fund’s momentum models continue to point to potential further gains after a normal market correction. |

8

Salient Tactical Plus Fund

Allocation of Portfolio Holdings

as of December 31, 2020

These allocations may not reflect the current or future position of the portfolio.

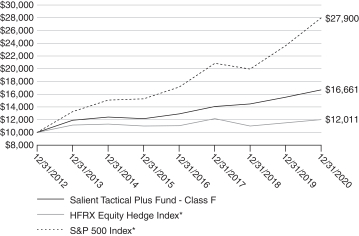

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

* Effective January 1, 2019, the HFRX Equity Hedge Index replaced the S&P 500 Index as the Fund’s primary benchmark index.

9

Salient Tactical Plus Fund(a)

| 1 Year | 5 Year | Since Inception | Inception Date | |||||||||||||||||

| Average Annual Total Return | ||||||||||||||||||||

Class A (with sales load)(b) | 1.04% | 4.80% | 5.29% | 12/31/12 | ||||||||||||||||

Class A (without sales load)(c) | 6.95% | 6.00% | 6.03% | 12/31/12 | ||||||||||||||||

Class C (with CDSC)(d) | 5.13% | 5.18% | 5.22% | 12/31/12 | ||||||||||||||||

Class C (without CDSC)(e) | 6.13% | 5.18% | 5.22% | 12/31/12 | ||||||||||||||||

Class I | 7.15% | 6.23% | 6.26% | 12/31/12 | ||||||||||||||||

Class F | 7.46% | 6.54% | 6.60% | 12/31/12 | ||||||||||||||||

(a) Returns with sales charge reflect the deduction of current maximum front-end sales charge of 5.50% for Class A shares and the maximum contingent deferred sales charge of 1.00%, which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated May 1, 2020 are as follows: Class A shares are 2.37% and 1.82%, respectively, Class C shares are 3.12% and 2.57%, respectively, Class I shares are 2.12% and 1.57%, respectively and Class F shares are 2.12% and 1.26%, respectively. The advisor has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.65% for Class A, 2.40% for Class C, 1.40% for Class I and 1.09% for Class F shares, excluding certain expenses, until April 30, 2021. Additional information pertaining to the December 31, 2020, expense ratios can be found in the financial highlights. Returns do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Class A/C/I shares of the Fund commenced operations on December 15, 2014. The returns prior to that date are those of the predecessor fund’s Investor Class shares, which commenced operations on December 31, 2012. Performance for the period from December 31, 2012, to December 14, 2014, reflects the gross performance of the Investor Class shares of the predecessor fund adjusted to apply the fees and anticipated expenses of Class A/C/I shares of the Fund. All share classes of the Fund are invested in the same portfolio of securities and returns only differ to the extent that fees and expenses of the classes are different. In the reorganization, Investor Class and Institutional Class shares of the Broadmark Tactical Fund were exchanged for Class F shares of the Salient Tactical Plus Fund.

(b) Includes the effect of the maximum 5.50% sales charge.

(c) Excludes sales charge.

(d) Includes the 1.00% contingent deferred sales charge.

(e) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

10

Fund Risk Disclosures

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Asset allocation does not assure profit or protect against risk.

Diversification does not assure profit or protect against risk.

This document does not constitute an offering of any security, product, service or fund, including the Funds, for which an offer can be made only by the Funds’ prospectuses.

No fund is a complete investment program and you may lose money investing in a fund. The Funds may engage in other investment practices that may involve additional risks and you should review the Funds’ prospectuses for a complete description.

Salient MLP & Energy Infrastructure Fund

Equity securities are subject to the financial and operational risks faced by individual companies, the risk that stock markets, sectors and industries may experience periods of turbulence and instability and the general risk that domestic and global economies may go through periods of decline and cyclical change.

The Fund’s investments are concentrated in the energy infrastructure industry with an emphasis on securities issued by MLPs, which may increase price fluctuation. The value of commodity-linked investments such as the MLPs and energy infrastructure companies (including midstream MLPs and energy infrastructure companies) in which the Fund invests are subject to risks specific to the industry they serve, such as fluctuations in commodity prices, reduced volumes of available natural gas or other energy commodities, slowdowns in new construction and acquisitions, a sustained reduced demand for crude oil, natural gas and refined petroleum products, depletion of the natural gas reserves or other commodities, changes in the macroeconomic or regulatory environment, environmental hazards, rising interest rates and threats of attack by terrorists on energy assets, each of which could affect the Fund’s profitability.

Liquidity refers to how easy it is to buy and sell shares of a security without affecting its price. Investing in securities that are less actively traded or over time experience decreased trading volume may restrict the Fund’s ability to take advantage of other market opportunities or to dispose of securities.

Market risk is the risk that the markets on which the Fund’s investments trade will lose value in response to company, market or economic news.

MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment including the risk that an MLP could lose its tax status as a partnership. If an MLP were to be obligated to pay federal income tax on its income at the corporate tax rate, the amount of cash available for distribution would be reduced and such distributions received by the Fund would be taxed under federal income tax laws applicable to corporate dividends received (as dividend income, return of capital or capital gain).

Investing in MLPs involves additional risks as compared to the risks of investing in common stock, including risks related to cash flow, dilution and voting rights. Such companies may trade less frequently than larger companies due to their smaller capitalizations, which may result in erratic price movement or difficulty in buying or selling.

Additional management fees and other expenses are associated with investing in MLP funds. The tax benefits received by an investor investing in the Fund differ from that of a direct investment in an MLP by an investor.

Salient Tactical Plus Fund

The Fund invests in fixed-income securities, which are generally subject to credit risk and interest rate risk. Credit risk refers to the possibility that the issuer of a security will be unable to make interest payments and/or repay the principal on its debt. Interest rate risk refers to fluctuations in the value of a fixed-income security resulting from changes in the general level of interest rates. When the general level of interest rates goes up, the prices of most fixed-income securities go down. When the general level of interest rates goes down, the prices of most fixed-income securities go up.

| 11 |

Investment Disclosures, continued

Salient Tactical Plus Fund (continued)

The use of derivative instruments exposes the Fund to additional risks and transaction costs. These instruments come in many varieties and have a wide range of potential risks and rewards, and may include futures contracts, options on futures contracts, options (both written and purchased), swaps and swaptions. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with the overall securities markets. Derivatives also provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss.

Equity securities may be subject to general movements in the stock market. The Fund may have exposure to or invest in equity securities of companies with small or medium capitalization, which involve certain risks that may differ from, or be greater than, those for larger companies, such as higher volatility, lower trading volume, lack of liquidity, fewer business lines and lack of public information.

The Fund invests in exchange-traded funds (ETFs) and in options on ETFs, exposing it to the risks associated with the investments held by such ETFs. The value of any investment in an ETF will fluctuate according to the performance of that ETF. In addition, the Fund will indirectly bear a proportionate share of expenses paid by each ETF in which the Fund invests. Further, individual shares of an ETF may be purchased and sold only on a national securities exchange through a broker-dealer. ETF shares trade at market prices rather than net asset value (“NAV”) and shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). The market price of an ETF’s shares, like the price of any exchange-traded security, includes a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the particular security.

The Fund may make foreign investments, which often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money.

Manager risk is the risk that the Fund’s portfolio managers may make poor investment decisions, which would negatively affect the Fund’s investment performance.

Market events in the U.S. and global financial markets may result in unusually high market volatility, which could negatively impact the Fund’s performance and cause the Fund to experience illiquidity, shareholder redemptions or other potentially adverse effects.

Market risk is the risk that the markets on which the Fund’s investments trade will lose value in response to company, market or economic news.

Relying on proprietary or third-party quantitative models and information and data supplied by third-party vendors that later prove to be inaccurate or incorrect exposes the Fund to additional investment risks.

To the extent that the Fund makes investments on a shorter-term basis, the Fund may as a result trade more frequently and incur higher levels of brokerage fees and commissions.

The Fund may take a short position in a derivative instrument, such as a future, forward or swap. A short position on a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying instrument. The Fund may also from time to time sell securities short, which involves borrowing and selling a security and covering such borrowed security through a later purchase. A short sale creates the risk of an unlimited loss, in that the price of the underlying security could theoretically increase without limit, thus increasing the cost of buying those securities to cover the short position.

Fund Benchmark Definitions

Alerian Midstream Energy Select Index (AMEI) is a composite of North American midstream energy infrastructure companies that are engaged in activities involving energy commodities. The capped, float-adjusted, capitalization-weighted index is disseminated in real time on a price-return basis.

HFRX Equity Hedge Index is comprised of private funds with strategies that maintain both long and short positions primarily in equity securities and equity derivatives.

One cannot invest directly in an index.

12

Investment Disclosures, continued

Definition of Terms

10-year U.S. Treasury Note is a debt obligation issued by the U.S. Treasury that has a term of 10 years.

Alerian MLP Index (AMZ) is the leading gauge of large- and mid-cap energy master limited partnerships (MLPs). The float-adjusted, capitalization-weighted index includes some of the most prominent companies and captures approximately 75% of available market capitalization.

Basis point is a unit of measure that is equal to 1/100th of 1% and used to denote a change in the value or rate of a financial instrument.

Breadth is a technique used in technical analysis that attempts to gauge the direction of the overall market by analyzing the number of companies advancing relative to the number declining.

Covered call option is an options strategy in which an investor holds a long position in an asset and then sells call options on that same asset in an attempt to generate increased income from the asset.

Credit spread is the spread between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating.

Derivative is a security whose price is dependent upon or derived from one or more underlying assets.

Earnings before interest, taxes, depreciation and amortization (EBITDA) is a standard measure of profitability and reflects a company’s financial health.

Federal Reserve (Fed) is the central bank of the United States that is responsible for regulating the U.S. monetary and financial systems.

Free cash flow represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

Futures are financial contracts that obligate the buyer to purchase an asset (or the seller to sell an asset), such as a physical commodity or a financial instrument, at a predetermined future date and price.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced in a country in a given year. GDP is one way of measuring the size of a country’s economy.

Master limited partnerships (MLPs) are publicly traded limited partnerships and limited liability companies that are treated as partnerships for federal income tax purposes.

Momentum is the rate of acceleration of a security’s price or volume.

Options are contracts sold by one party to another party. A contract offers the buyer the right, but not the obligation, to buy or sell a security or other financial asset at an agreed upon price during a certain period of time or on a specific date.

Put option is a contract giving the owner the right, but not the obligation, to sell, or sell short, a specified amount of an underlying security at a predetermined price within a specified time frame.

S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries in the U.S. economy.

Valuation is the process of determining the value of an asset or company based on earnings and the market value of assets.

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

Volume is the number of shares or contracts traded in a security or an entire market during a given period of time.

Yield is the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost or on the U.S. government’s debt obligations.

| 13 |

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2020

As a shareholder of the Salient Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2020 through December 31, 2020.

Actual Expenses

The first line for each share class of each Fund in the table provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line for each share class of each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| Salient MLP & Energy Infrastructure Fund | Beginning Account Value 07/01/20 | Ending Account Value 12/31/20 | Expense Ratios(a) | Expenses Paid During Period(b) 07/01/20 – 12/31/20 | ||||||||||||||||

| Class A | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,108.50 | 1.55% | $ | 8.22 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,017.34 | 1.55% | $ | 7.86 | |||||||||||||

| Class C | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,104.70 | 2.30% | $ | 12.17 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,013.57 | 2.30% | $ | 11.64 | |||||||||||||

| Class I | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,109.80 | 1.30% | $ | 6.89 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,018.60 | 1.30% | $ | 6.60 | |||||||||||||

| Class R6 | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,110.30 | 1.27% | $ | 6.74 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,018.75 | 1.27% | $ | 6.44 | |||||||||||||

| Salient Tactical Plus Fund | ||||||||||||||||||||

| Class A | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,064.90 | 1.65% | $ | 8.56 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,016.84 | 1.65% | $ | 8.36 | |||||||||||||

| Class C | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,060.30 | 2.40% | $ | 12.43 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,013.07 | 2.40% | $ | 12.14 | |||||||||||||

14

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2020

| Salient Tactical Plus Fund (continued) | Beginning Account Value 07/01/20 | Ending Account Value 12/31/20 | Expense Ratios(a) | Expenses Paid During Period(b) 07/01/20 – 12/31/20 | ||||||||||||||||

| Class I | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,065.00 | 1.40% | $ | 7.27 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,018.10 | 1.40% | $ | 7.10 | |||||||||||||

| Class F | ||||||||||||||||||||

Actual | $ | 1,000.00 | $ | 1,067.30 | 1.09% | $ | 5.66 | |||||||||||||

Hypothetical | $ | 1,000.00 | $ | 1,019.66 | 1.09% | $ | 5.53 | |||||||||||||

(a) Annualized, based on the Fund’s most recent fiscal half year expenses.

(b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account values over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 366.

15

Schedule of Investments (See Note 11)

Salient MLP & Energy Infrastructure Fund

December 31, 2020

| Shares | Value (See Note 2) | |||||||||

| Master Limited Partnerships—23.8%(a) |

| |||||||||

| Gathering & Processing—6.9% | ||||||||||

| United States—6.9% | ||||||||||

Crestwood Equity Partners LP | 184,227 | $ | 3,496,628 | |||||||

Enable Midstream Partners LP | 1,778,753 | 9,356,241 | ||||||||

Noble Midstream Partners LP | 783,885 | 8,168,082 | ||||||||

Western Midstream Partners LP | 1,038,213 | 14,348,103 | ||||||||

|

| |||||||||

| 35,369,054 | ||||||||||

|

| |||||||||

| Liquids Transportation & Storage—7.6% | ||||||||||

| United States—7.6% | ||||||||||

Genesis Energy LP | 1,673,472 | 10,392,261 | ||||||||

MPLX LP | 750,298 | 16,243,952 | ||||||||

NGL Energy Partners LP | 261,388 | 627,331 | ||||||||

NuStar Energy LP | 260,680 | 3,756,399 | ||||||||

Phillips 66 Partners LP | 207,793 | 5,487,813 | ||||||||

Shell Midstream Partners LP | 224,913 | 2,267,123 | ||||||||

|

| |||||||||

| 38,774,879 | ||||||||||

|

| |||||||||

| Natural Gas Pipelines & Storage—8.5% | ||||||||||

| United States—8.5% | ||||||||||

DCP Midstream LP | 147,932 | 2,739,701 | ||||||||

Energy Transfer LP | 3,825,627 | 23,642,375 | ||||||||

Enterprise Products Partners LP | 861,006 | 16,867,107 | ||||||||

|

| |||||||||

| 43,249,183 | ||||||||||

|

| |||||||||

| Renewable Energy Infrastructure—0.8% | ||||||||||

| United States—0.8% | ||||||||||

Enviva Partners LP | 94,023 | 4,270,525 | ||||||||

|

| |||||||||

Total Master Limited Partnerships (Cost $105,774,968) | 121,663,641 | |||||||||

|

| |||||||||

| MLP Related Companies—76.0% | ||||||||||

| Energy—5.8% | ||||||||||

| Denmark—1.6% | ||||||||||

Vestas Wind Systems A/S, ADR | 109,086 | 8,533,798 | ||||||||

|

| |||||||||

| United States—4.2% | ||||||||||

Plug Power, Inc.(b) | 46,371 | 1,572,440 | ||||||||

Sunnova Energy International, Inc.(b) | 130,795 | 5,902,778 | ||||||||

SunPower Corp.(b) | 133,748 | 3,429,299 | ||||||||

Sunrun, Inc.(b) | 118,674 | 8,233,602 | ||||||||

TPI Composites, Inc.(b) | 42,379 | 2,236,764 | ||||||||

|

| |||||||||

| 21,374,883 | ||||||||||

|

| |||||||||

| Gathering & Processing—11.0% | ||||||||||

| United States—11.0% | ||||||||||

Antero Midstream Corp. | 1,527,125 | 11,774,134 | ||||||||

EnLink Midstream LLC | 729,998 | 2,708,292 | ||||||||

See accompanying Notes to Financial Statements. | 16 |

Schedule of Investments (See Note 11)

Salient MLP & Energy Infrastructure Fund

December 31, 2020

| Shares | Value (See Note 2) | |||||||||

Targa Resources Corp.(c) | 1,573,989 | $ | 41,521,830 | |||||||

|

| |||||||||

| 56,004,256 | ||||||||||

|

| |||||||||

| Industrial—0.7% | ||||||||||

| United States—0.7% | ||||||||||

Bloom Energy Corp.(b) | 132,592 | 3,800,087 | ||||||||

|

| |||||||||

| Liquids Transportation & Storage—13.6% | ||||||||||

| Canada—4.1% | ||||||||||

Enbridge, Inc. | 328,275 | 10,501,517 | ||||||||

Gibson Energy, Inc. | 558,951 | 9,028,229 | ||||||||

TC Energy Corp. | 34,402 | 1,400,849 | ||||||||

|

| |||||||||

| 20,930,595 | ||||||||||

|

| |||||||||

| United States—9.5% | ||||||||||

Marathon Petroleum Corp. | 155,979 | 6,451,292 | ||||||||

Plains GP Holdings LP, Class A(c) | 4,962,554 | 41,933,581 | ||||||||

|

| |||||||||

| 48,384,873 | ||||||||||

|

| |||||||||

| Natural Gas Pipelines & Storage—26.9% | ||||||||||

| Canada—10.5% | ||||||||||

Keyera Corp. | 1,190,054 | 21,147,790 | ||||||||

Pembina Pipeline Corp. (CAD) | 1,379,321 | 32,616,515 | ||||||||

|

| |||||||||

| 53,764,305 | ||||||||||

|

| |||||||||

| United States—16.4% | ||||||||||

Cheniere Energy, Inc.(b) | 749,421 | 44,987,743 | ||||||||

Equitrans Midstream Corp. | 2,208,271 | 17,754,499 | ||||||||

ONEOK, Inc. | 413,104 | 15,854,931 | ||||||||

Williams Cos., Inc. | 262,377 | 5,260,659 | ||||||||

|

| |||||||||

| 83,857,832 | ||||||||||

|

| |||||||||

| Other Energy & Infrastructure—4.0% | ||||||||||

| United States—4.0% | ||||||||||

Phillips 66 | 74,527 | 5,212,418 | ||||||||

Rattler Midstream LP | 1,080,765 | 10,245,652 | ||||||||

Valero Energy Corp. | 85,173 | 4,818,237 | ||||||||

|

| |||||||||

| 20,276,307 | ||||||||||

|

| |||||||||

| Renewable Energy Infrastructure—12.9% | ||||||||||

| Israel—3.3% | ||||||||||

SolarEdge Technologies, Inc.(b) | 52,372 | 16,712,953 | ||||||||

|

| |||||||||

| United States—9.6% | ||||||||||

Brookfield Renewable Corp., Class A | 146,445 | 8,533,350 | ||||||||

Enphase Energy, Inc.(b) | 136,686 | 23,984,292 | ||||||||

NextEra Energy Partners LP | 248,673 | 16,673,525 | ||||||||

|

| |||||||||

| 49,191,167 | ||||||||||

|

| |||||||||

See accompanying Notes to Financial Statements. | 17 |

Schedule of Investments (See Note 11)

Salient MLP & Energy Infrastructure Fund

December 31, 2020

| Shares | Value (See Note 2) | |||||||||

| Utilities—1.1% | ||||||||||

| Denmark—1.1% | ||||||||||

Orsted AS, ADR | 80,536 | $ | 5,504,636 | |||||||

|

| |||||||||

Total MLP Related Companies (Cost $315,772,067) | 388,335,692 | |||||||||

|

| |||||||||

| Total Investments—99.8% (Cost $421,547,035) | 509,999,333 | |||||||||

| Other Assets and Liabilities—0.2% | 841,725 | |||||||||

|

| |||||||||

| Total Net Assets—100.0% | $ | 510,841,058 | ||||||||

|

| |||||||||

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) The security is considered a non-income producing security as the dividends received during the last 12 months are treated as return of capital per the Generally Accepted Accounting Principles.

(b) Non-income producing security.

(c) All or a portion of this security is pledged as collateral for the written call options. As of December 31, 2020, the total fair value of securities pledged as collateral for the written call options is $6,992,262, representing 1.4% of net assets.

Written Call Options:

| Description | Counterparty | Exercise Price | Expiration Date | Number of Contracts | Notional Value | Value | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||||||||||||||

Plains GP Holdings LP | Morgan Stanley & Co. LLC | $ | 10 | January 2021 | 5,000 | $ | 4,225,000 | $ | (12,500 | ) | $ | 133,568 | |||||||||||||||||||||||

Targa Resources Corp. | Morgan Stanley & Co. LLC | $ | 30 | January 2021 | 1,049 | 2,767,262 | (18,358 | ) | 95,156 | ||||||||||||||||||||||||||

|

|

|

|

|

| ||||||||||||||||||||||||||||||

| $ | 6,992,262 | $ | (30,858 | ) | $ | 228,724 | |||||||||||||||||||||||||||||

|

|

|

|

|

| ||||||||||||||||||||||||||||||

Allocation of Portfolio Holdings:

Salient MLP & Energy Infrastructure Fund invested in securities with exposure to the following countries as of December 31, 2020:

| Value | % of Total Investments | |||||||||

United States | $ | 404,553,046 | 79.4 | % | ||||||

Canada | 74,694,900 | 14.6 | % | |||||||

Israel | 16,712,953 | 3.3 | % | |||||||

Denmark | 14,038,434 | 2.7 | % | |||||||

|

|

|

| |||||||

| $ | 509,999,333 | 100.0 | % | |||||||

|

|

|

| |||||||

See accompanying Notes to Financial Statements. | 18 |

Schedule of Investments (See Note 11)

Salient Tactical Plus Fund

December 31, 2020

| Shares | Value (See Note 2) | |||||||||

| Exchange-Traded Funds—52.0% | ||||||||||

| United States—52.0% | ||||||||||

SPDR S&P 500® ETF Trust | 96,936 | $ | 36,242,432 | |||||||

|

| |||||||||

Total Exchange-Traded Funds (Cost $34,389,539) | 36,242,432 | |||||||||

|

| |||||||||

| Money Market Fund—47.2% | ||||||||||

| United States—47.2% | ||||||||||

Fidelity Government Portfolio—Institutional Class, 0.01%(a) | 32,936,835 | 32,936,835 | ||||||||

|

| |||||||||

Total Money Market Fund (Cost $32,936,835) | 32,936,835 | |||||||||

|

| |||||||||

| Purchased Call Options—0.4% | ||||||||||

E-Mini S&P® 500 | 527 | 268,770 | ||||||||

|

| |||||||||

Total Purchased Call Options (Cost $234,380) | 268,770 | |||||||||

|

| |||||||||

| Purchased Put Options—0.0%(b) |

| |||||||||

E-Mini S&P® 500 | 105 | 31,500 | ||||||||

|

| |||||||||

Total Purchased Put Options (Cost $126,925) | 31,500 | |||||||||

|

| |||||||||

| Total Investments—99.6% (Cost $67,687,679) | 69,479,537 | |||||||||

| Other Assets and Liabilities—0.4%(c) | 229,431 | |||||||||

|

| |||||||||

| Total Net Assets—100.0% | $ | 69,708,968 | ||||||||

|

| |||||||||

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) The rate shown is the 7-day effective as of December 31, 2020.

(b) Amount represents less than 0.01%.

(c) Includes cash which is being held as collateral for futures and options contracts.

Investment Abbreviations:

S&P — Standard & Poor’s

SPDR — Standard & Poor’s Depositary Receipt

Futures Contracts Purchased:

| Description | Contracts | Expiration Date | Notional Value | Value and Unrealized Appreciation/ (Depreciation) | ||||||||||||||||

E-Mini S&P 500® | 40 | March 2021 | $ | 7,497,600 | $ | (3,293 | ) | |||||||||||||

|

|

|

| |||||||||||||||||

| $ | 7,497,600 | $ | (3,293 | ) | ||||||||||||||||

|

|

|

| |||||||||||||||||

Salient Tactical Plus Fund invested in securities with exposure to the following countries as of December 31, 2020:

| Value | % of Total Investments | |||||||||

United States | $ | 69,479,537 | 100.0 | % | ||||||

|

|

|

| |||||||

| $ | 69,479,537 | 100.0 | % | |||||||

|

|

|

| |||||||

See accompanying Notes to Financial Statements | 19 |

Statements of Assets and Liabilities

December 31, 2020

| Salient MLP & Energy Infrastructure Fund | Salient Tactical Plus Fund | |||||||||

Assets: | ||||||||||

Investments, at value | $ | 509,999,333 | $ | 69,479,537 | ||||||

Cash | 748,749 | — | ||||||||

Deposit with brokers for options and futures contracts | — | 146,711 | ||||||||

Interest and dividends receivable | 483,398 | 153,168 | ||||||||

Receivable for shares sold | 1,517,940 | 16,920 | ||||||||

Receivable for investments sold | 2,616,588 | — | ||||||||

Prepaids and other assets | 26,490 | 29,371 | ||||||||

|

|

|

| |||||||

Total Assets | 515,392,498 | 69,825,707 | ||||||||

|

|

|

| |||||||

Liabilities: | ||||||||||

Written options, at value (premiums received $259,582 and —) | 30,858 | — | ||||||||

Payable for shares redeemed | 3,630,029 | — | ||||||||

Variation margin on futures contracts | — | 17,231 | ||||||||

Payable to advisor | 473,304 | 42,609 | ||||||||

Payable for distribution and service fees | 30,706 | 601 | ||||||||

Payable to custodian | — | 3,293 | ||||||||

Accrued expenses and other liabilities | 386,543 | 53,005 | ||||||||

|

|

|

| |||||||

Total Liabilities | 4,551,440 | 116,739 | ||||||||

|

|

|

| |||||||

Total Net Assets | $ | 510,841,058 | $ | 69,708,968 | ||||||

|

|

|

| |||||||

Net Assets Consist of: | ||||||||||

Paid-in capital | $ | 1,294,347,699 | $ | 68,604,929 | ||||||

Total distributable earnings | (783,506,641 | ) | 1,104,039 | |||||||

|

|

|

| |||||||

Total Net Assets | $ | 510,841,058 | $ | 69,708,968 | ||||||

|

|

|

| |||||||

Investments, At Cost | 421,547,035 | 67,687,679 | ||||||||

Pricing of Shares | ||||||||||

Class A Shares: | ||||||||||

Net Assets | $ | 63,680,848 | $ | 668,257 | ||||||

Shares of beneficial interest outstanding | 11,518,450 | 58,080 | ||||||||

Net Asset Value, offering and redemption price per share | $ | 5.53 | $ | 11.51 | ||||||

Maximum offering price per share (NAV/0.9450, based on maximum sales charge of 5.50% of the offering price) | $ | 5.85 | $ | 12.18 | ||||||

Class C Shares: | ||||||||||

Net Assets | $ | 20,467,547 | $ | 575,160 | ||||||

Shares of beneficial interest outstanding | 3,719,259 | 52,441 | ||||||||

Net Asset Value, offering and redemption price per share | $ | 5.50 | $ | 10.97 | ||||||

Class F Shares: | ||||||||||

Net Assets | — | $ | 38,158,019 | |||||||

Shares of beneficial interest outstanding | — | 3,211,723 | ||||||||

Net Asset Value, offering and redemption price per share | $ | — | $ | 11.88 | ||||||

Class I Shares: | ||||||||||

Net Assets | $ | 393,743,354 | $ | 30,307,532 | ||||||

Shares of beneficial interest outstanding | 71,562,288 | 2,600,770 | ||||||||

Net Asset Value, offering and redemption price per share | $ | 5.50 | $ | 11.65 | ||||||

Class R6 Shares: | ||||||||||

Net Assets | $ | 32,949,309 | — | |||||||

Shares of beneficial interest outstanding | 5,987,030 | — | ||||||||

Net Asset Value, offering and redemption price per share | $ | 5.50 | $ | — | ||||||

See accompanying Notes to Financial Statements. | 20 |

For the Year Ended December 31, 2020

| Salient MLP & Energy Infrastructure Fund | Salient Tactical Plus Fund | |||||||||

Investment Income: | ||||||||||

Distributions from master limited partnerships | $ | 13,400,813 | $ | — | ||||||

Less return of capital on dividends | (13,400,813 | ) | — | |||||||

|

|

|

| |||||||

Net investment income from master limited partnerships | — | — | ||||||||

Dividends from master limited partnership related companies | 24,106,754 | — | ||||||||

Less return of capital on dividends | (7,377,369 | ) | — | |||||||

|

|

|

| |||||||

Net investment income from master limited partnership related companies | 16,729,385 | — | ||||||||

Interest | 109,222 | 5,806 | ||||||||

Dividends | — | 405,600 | ||||||||

Foreign taxes withheld | (1,602,408 | ) | — | |||||||

|

|

|

| |||||||

Total Investment Income | 15,236,199 | 411,406 | ||||||||

|

|

|

| |||||||

Expenses: | ||||||||||

Investment advisory fee | 5,084,731 | 945,404 | ||||||||

Administration fees and expenses | 412,973 | 65,492 | ||||||||

Distribution and service fees | ||||||||||

Class A | 166,887 | 1,699 | ||||||||

Class C | 237,929 | 5,092 | ||||||||

Administrative services fees | ||||||||||

Class A | 39,767 | 584 | ||||||||

Class C | 17,557 | 486 | ||||||||

Class I | 321,701 | 26,608 | ||||||||

Class F | — | 34,732 | ||||||||

Registration/filing fees | 93,793 | 69,946 | ||||||||

Transfer agent fees and expenses | 49,241 | 5,877 | ||||||||

Audit and tax preparation fee | 196,479 | 44,130 | ||||||||

Custodian fee | 48,744 | 4,494 | ||||||||

Legal fee | 195,205 | 24,320 | ||||||||

Reports to shareholders and printing fees | 123,219 | 8,772 | ||||||||

Compliance fees | 107,890 | 14,362 | ||||||||

Trustees’ fees and expenses | 170,881 | 19,587 | ||||||||

ReFlow fees (Note 2(o)) | 5,444 | — | ||||||||

Other expenses | 180,771 | 34,340 | ||||||||

|

|

|

| |||||||

Total expenses before waivers | 7,453,212 | 1,305,925 | ||||||||

|

|

|

| |||||||

Less fees waived/reimbursed by investment advisor (See Note 4) | (116,141 | ) | (499,052 | ) | ||||||

|

|

|

| |||||||

Total Expenses | 7,337,071 | 806,873 | ||||||||

|

|

|

| |||||||

| Net Investment Income/(Loss) | 7,899,128 | (395,467 | ) | |||||||

|

|

|

| |||||||

Realized and Unrealized Gain/(Loss) | ||||||||||

Net realized loss on investments and foreign currency translations | (126,616,994 | ) | (6,688,189 | ) | ||||||

Net realized gain on written options | 2,265,344 | 965,362 | ||||||||

Net realized gain on futures contracts | — | 9,046,094 | ||||||||

Net realized loss on foreign currency | (292,857 | ) | — | |||||||

Net realized loss on short sales | — | (75,287 | ) | |||||||

|

|

|

| |||||||

Net realized gain(loss) | (124,644,507 | ) | 3,247,980 | |||||||

Change in unrealized appreciation/depreciation on: | ||||||||||

Investments | (33,930,576 | ) | 1,791,858 | |||||||

Written options | 251,977 | — | ||||||||

Futures contracts | — | 30,632 | ||||||||

Translation of other assets and liabilities in foreign currency transactions | (6,666 | ) | — | |||||||

|

|

|

| |||||||

Change in unrealized appreciation/depreciation | (33,685,265 | ) | 1,822,490 | |||||||

|

|

|

| |||||||

Net Realized and Unrealized Gain/(Loss) on Investments, Written Options, Futures Contracts, and Foreign Currency Translations | (158,329,772 | ) | 5,070,470 | |||||||

|

|

|

| |||||||

| Net Increase/(Decrease) in Net Assets Resulting From Operations | $ | (150,430,644 | ) | $ | 4,675,003 | |||||

|

|

|

| |||||||

See accompanying Notes to Financial Statements. | 21 |

Statements of Changes in Net Assets

| Salient MLP & Energy Infrastructure Fund | Salient Tactical Plus Fund | |||||||||||||||||||

| For the Year Ended December 31, 2020 | For the Year Ended December 31, 2019 | For the Year Ended December 31, 2020 | For the Year Ended December 31, 2019 | |||||||||||||||||

Operations: | ||||||||||||||||||||

Net investment income/(loss) | $ | 7,899,128 | $ | 3,943,663 | $ | (395,467 | ) | $ | 434,374 | |||||||||||

Net realized gain/(loss) | (124,644,507 | ) | (72,478,397 | ) | 3,247,980 | 3,631,563 | ||||||||||||||

Net change in unrealized appreciation/depreciation | (33,685,265 | ) | 208,301,630 | 1,822,490 | 6,062 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase/(decrease) in net assets resulting from operations | (150,430,644 | ) | 139,766,896 | 4,675,003 | 4,071,999 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Distributions to Shareholders: | ||||||||||||||||||||

From distributable earnings | ||||||||||||||||||||

Class A | — | (2,402,147 | ) | (39,507 | ) | (40,368 | ) | |||||||||||||

Class C | — | (888,386 | ) | (35,042 | ) | (24,160 | ) | |||||||||||||

Class I | — | (18,786,742 | ) | (1,776,535 | ) | (1,395,814 | ) | |||||||||||||

Class F | — | — | (2,196,181 | ) | (1,996,230 | ) | ||||||||||||||

Class R6 | — | (611,864 | ) | — | — | |||||||||||||||

From return of capital | ||||||||||||||||||||

Class A | (3,800,203 | ) | (1,912,345 | ) | — | — | ||||||||||||||

Class C | (1,087,858 | ) | (707,236 | ) | — | — | ||||||||||||||

Class I | (24,820,608 | ) | (14,955,876 | ) | — | — | ||||||||||||||

Class R6 | (1,792,903 | ) | (487,107 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total distributions | (31,501,572 | ) | (40,751,703 | ) | (4,047,265 | ) | (3,456,572 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Capital Transactions: | ||||||||||||||||||||

Class A | ||||||||||||||||||||

Proceeds from shares issued | 20,594,967 | 37,449,197 | 195,201 | 427,200 | ||||||||||||||||

Dividends reinvested | 3,675,622 | 4,188,834 | 39,507 | 40,369 | ||||||||||||||||

Value of shares redeemed | (44,948,937 | ) | (27,992,776 | ) | (324,952 | ) | (346,337 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class A capital transactions | (20,678,348 | ) | 13,645,255 | (90,244 | ) | 121,232 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class C | ||||||||||||||||||||

Proceeds from shares issued | 3,337,814 | 3,313,584 | 129,799 | 269,839 | ||||||||||||||||

Dividends reinvested | 1,064,434 | 1,564,929 | 35,042 | 24,160 | ||||||||||||||||

Value of shares redeemed | (12,702,677 | ) | (16,672,408 | ) | (73,083 | ) | (433,879 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class C capital transactions | (8,300,429 | ) | (11,793,895 | ) | 91,758 | (139,880 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class I | ||||||||||||||||||||

Proceeds from shares issued | 319,855,114 | 330,664,601 | 8,719,948 | 7,493,349 | ||||||||||||||||

Dividends reinvested | 21,470,890 | 25,201,900 | 1,776,533 | 1,395,814 | ||||||||||||||||

Value of shares redeemed | (418,334,829 | ) | (550,014,767 | ) | (5,199,076 | ) | (2,753,774 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class I capital transactions | (77,008,825 | ) | (194,148,266 | ) | 5,297,405 | 6,135,389 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class F | ||||||||||||||||||||

Proceeds from shares issued | — | — | 3,897,926 | 6,666,948 | ||||||||||||||||

Dividends reinvested | — | — | 2,196,181 | 1,996,229 | ||||||||||||||||

Value of shares redeemed | — | — | (2,759,134 | ) | (2,382,766 | ) | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class F capital transactions | — | — | 3,334,973 | 6,280,411 | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

See accompanying Notes to Financial Statements. | 22 |

Statements of Changes in Net Assets

| Salient MLP & Energy Infrastructure Fund (continued) | Salient Tactical Plus Fund (continued) | |||||||||||||||||||

| For the Year Ended December 31, 2020 | For the Year Ended December 31, 2019 | For the Year Ended December 31, 2020 | For the Year Ended December 31, 2019 | |||||||||||||||||

Class R6 | ||||||||||||||||||||

Proceeds from shares issued | $ | 12,794,595 | $ | 1,210,794 | $ | — | $ | — | ||||||||||||

Dividends reinvested | 705,926 | 549,211 | — | — | ||||||||||||||||

Value of shares redeemed | (4,303,969 | ) | (1,047,499 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class R6 capital transactions | 9,196,552 | 712,506 | — | — | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Change in Net Assets resulting from capital transactions | (96,791,050 | ) | (191,584,400 | ) | 8,633,892 | 12,397,152 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Change in Net Assets | $ | (278,723,266 | ) | $ | (92,569,207 | ) | $ | 9,261,630 | $ | 13,012,579 | ||||||||||

Net Assets: | ||||||||||||||||||||

Beginning of period | $ | 789,564,324 | $ | 882,133,531 | $ | 60,447,338 | $ | 47,434,759 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

End of period | $ | 510,841,058 | $ | 789,564,324 | $ | 69,708,968 | $ | 60,447,338 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Changes in shares outstanding: | ||||||||||||||||||||

Class A | ||||||||||||||||||||

Sold | 4,036,088 | 5,401,997 | 17,179 | 36,373 | ||||||||||||||||

Distributions reinvested | 659,367 | 591,759 | 3,435 | 3,529 | ||||||||||||||||

Redeemed | (8,811,733 | ) | (3,961,660 | ) | (27,470 | ) | (29,424 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase/(decrease) in shares outstanding | (4,116,278 | ) | 2,032,096 | (6,856 | ) | 10,478 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class C | ||||||||||||||||||||

Sold | 639,704 | 481,412 | 11,415 | 23,889 | ||||||||||||||||

Distributions reinvested | 191,640 | 221,326 | 3,197 | 2,192 | ||||||||||||||||

Redeemed | (2,433,804 | ) | (2,382,512 | ) | (6,464 | ) | (39,354 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase/(decrease) in shares outstanding | (1,602,460 | ) | (1,679,774 | ) | 8,148 | (13,273 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class I | ||||||||||||||||||||

Sold | 65,355,514 | 47,372,068 | 740,696 | 643,426 | ||||||||||||||||

Distributions reinvested | 3,906,968 | 3,558,455 | 152,623 | 120,850 | ||||||||||||||||

Redeemed | (85,360,720 | ) | (78,448,516 | ) | (446,003 | ) | (231,810 | ) | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase/(decrease) in shares outstanding | (16,098,238 | ) | (27,517,993 | ) | 447,316 | 532,466 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class F | ||||||||||||||||||||

Sold | — | — | 328,246 | 564,075 | ||||||||||||||||

Distributions reinvested | — | — | 185,020 | 170,182 | ||||||||||||||||

Redeemed | — | — | (228,447 | ) | (199,035 | ) | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase in shares outstanding | — | — | 284,819 | 535,222 | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Class R6 | ||||||||||||||||||||

Sold | 3,373,572 | 161,331 | — | — | ||||||||||||||||

Distributions reinvested | 130,765 | 77,849 | — | — | ||||||||||||||||

Redeemed | (904,321 | ) | (147,903 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase in shares outstanding | 2,600,016 | 91,277 | — | | — | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

See accompanying Notes to Financial Statements. | 23 |

For a share outstanding throughout the periods presented.

Salient MLP & Energy Infrastructure Fund

| Class A | |||||||||||||||||||||||||

| Year Ended December 31, 2020 | Year Ended December 31, 2019 | Year Ended December 31, 2018 | Year Ended December 31, 2017 | Year Ended December 31, 2016(a) | |||||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 7.07 | $ | 6.36 | $ | 8.18 | $ | 9.31 | $ | 7.08 | |||||||||||||||

Income/(Loss) from Operations: | |||||||||||||||||||||||||

Net investment income(b) | 0.07 | 0.02 | 0.06 | 0.04 | 0.08 | ||||||||||||||||||||

Net realized and unrealized gain/(loss) on investments | (1.31 | ) | 1.00 | (1.50 | ) | (0.69 | ) | 2.71 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total from Investment Operations | (1.24 | ) | 1.02 | (1.44 | ) | (0.65 | ) | 2.79 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Less Distributions: | |||||||||||||||||||||||||

From investment income | — | (0.17 | ) | (0.07 | ) | (0.04 | ) | (0.19 | ) | ||||||||||||||||

From return of capital | (0.30 | ) | (0.14 | ) | (0.31 | ) | (0.44 | ) | (0.37 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Distributions | (0.30 | ) | (0.31 | ) | (0.38 | ) | (0.48 | ) | (0.56 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net increase/(decrease) in Net Asset Value | (1.54 | ) | 0.71 | (1.82 | ) | (1.13 | ) | 2.23 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net Asset Value, End of Period | $ | 5.53 | $ | 7.07 | $ | 6.36 | $ | 8.18 | $ | 9.31 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Return(c) | (17.43 | )% | 16.03 | % | (18.33 | )% | (6.92 | )% | 41.90 | % | |||||||||||||||

Ratios/Supplemental Data: | |||||||||||||||||||||||||

Net Assets, End of Period (000s) | $ | 63,681 | $ | 110,549 | $ | 86,552 | $ | 157,413 | $ | 210,688 | |||||||||||||||

Ratios to Average Net Assets: | |||||||||||||||||||||||||

Gross expenses (including tax expense/benefit) | 1.56 | % | 1.47 | % | 1.40 | % | 1.38 | % | 1.51 | % | |||||||||||||||

Net expenses (including tax expense/benefit) | 1.55 | % | 1.47 | % | 1.40 | % | 1.38 | % | 1.51 | % | |||||||||||||||

Net expenses (excluding tax expense/benefit) | 1.55 | % | 1.49 | % | 1.46 | % | 1.43 | % | 1.44 | % | |||||||||||||||

Net investment income | 1.29 | % | 0.24 | % | 0.77 | % | 0.49 | % | 0.98 | % | |||||||||||||||

Portfolio Turnover Rate(d) | 260 | % | 66 | % | 48 | % | 32 | % | 23 | % | |||||||||||||||

(a) Prior to May 1, 2016, Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund II.

(b) Calculated based on average shares outstanding.

(c) Total return calculations do not include any sales or redemption charges.