Exhibit (c)(2)

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Date of March 31, 2017

Brookfield

Canada Office Properties

Presentation to the Special Committee of the Board of Trustees

Preliminary Valuation Report

March 24, 2017

Greenhill

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Important Information

This presentation is strictly confidential and has been prepared by Greenhill & Co. Canada Ltd.

(“Greenhill”) solely for the internal use of the Special Committee (the “Committee”) of the Board of Trustees of Brookfield Canada Office Properties (the “Company”) in evaluating the potential transaction involving Brookfield Property Partners L.P. and the Company described herein, and may not be used for any other purpose or copied, reproduced, distributed or passed to others at any time or be relied upon by the Company or any other person without the prior written consent of Greenhill.

This presentation was prepared on a confidential basis in connection with an oral presentation to and for use by the Committee and not with a view toward complying with the disclosure standards under any applicable securities laws.

This presentation is for informational purposes only, does not constitute advice and is not intended to be and does not constitute a recommendation to the Company or any other person or entity as to whether to approve or undertake any of the matters described herein or enter into any transaction. This presentation is not and should not be considered as a fairness opinion. The materials contained herein are based solely on information which has not been independently verified by Greenhill. Accordingly, Greenhill does not assume any responsibility or liability therefor. No representation or warranty, express or implied, is made in relation to the accuracy or completeness of the information presented herein or its suitability for any particular purpose.

This presentation is delivered subject to the terms of our engagement letter. This presentation speaks only as of the date given, and subsequent developments may affect the information, analyses, valuations and assumptions contained herein. Greenhill does not undertake and has no obligation to update or revise the information in this presentation.

Greenhill and its affiliates do not provide legal, accounting or tax advice. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein.

Greenhill

2

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Table of Contents

1. Situation Overview

2. BOX Overview

3. Preliminary Valuation Analysis

Appendix

Greenhil

3

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

Situation Overview and Transaction Background

Brookfield Property Partners (“BPY”) currently owns approximately 83.1% of Brookfield Canada Office Properties (“BOX”)

BPY’s majority ownership position in BOX (and its predecessor companies) can be traced back to the early 2000s On January 23, 2017, BPY proposed a $30.10 per unit, all-cash acquisition of the publicly traded units of BOX it does not already own (represents a ~16.9% interest) Greenhill has been engaged as financial advisor to the Special Committee of the Board of Trustees of BOX and has been asked to provide a preliminary valuation analysis of the Company

Brookfield Canada Office Properties (“BOX” or the “Company”) is a public real estate investment trust that owns commercial office properties in Canada

Portfolio is comprised of 27 premier office properties totaling 21.7 million square feet in Toronto, Calgary and Ottawa

– Includes Brookfield Place Calgary East, a 1.4 million square foot development project in Calgary, expected to be completed in late 2017

On January 23, 2017, BPY announced a proposal to acquire the 15.8 million units, or 16.9%, of BOX it does not already own for $30.10 per unit, in cash

Represents a 14.0% premium to BOX’s pre-announcement 30 day VWAP and a 14.8% premium to the unit price on

January 20, 2017, 1-day pre-announcement (the “Unaffected Price”)

Institutional unitholders representing 23% of the unaffiliated minority unitholders have agreed to support the proposal

BPY asked the Board of Trustees of BOX to begin a process to review the proposal and appoint a special independent committee to commission an independent valuation of BOX’s units

As of February 17, 2017, Greenhill & Co. (“Greenhill”) was engaged as financial advisor to the Special Committee of BOX

Greenhill has been asked to provide a valuation of the units of BOX in accordance with the requirements of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) of the Ontario Securities Commission and the Autorité des marchés financiers

The following pages contain our preliminary valuation analysis based on the information provided to us by BOX management and our review of publicly available information

We have prepared this report solely for informational purposes for the Special Committee and it is preliminary in nature

Greenhill

Note: All financial figures are displayed in Canadian dollars (C$), unless indicated

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

Work Performed and Diligence to Date

Summary

Greenhill has conducted a preliminary valuation analysis of BOX based on available public market data as well as information provided by BOX

Management in response to

Greenhill’s due diligence requests

Review of BOX’s performance and positioning in the public markets

Unit price performance, liquidity and current and historical trading valuation Key portfolio and trading statistics versus comparable companies Equity research analyst perspectives, target prices, ratings and estimates

Top unitholders of BOX, including a review of voting lock-up agreements for RBC Global Asset Management and Morgan Stanley Investment Management

Assessment of BOX’s business and financial plan and high-level discussions with management regarding the industry and the Company’s strategy, outlook, growth initiatives, potential opportunities and challenges

Greenhill has reviewed BOX’s public filings, investor presentations, earnings call transcripts and confidential information made available by BOX Management covering topics such as the business plan, rent and occupancy forecasts, fair value calculations, lease abstracts and expiration profiles, ground lease documents, external appraisals, retail summaries, material agreements, among other topics Greenhill has reviewed financial projections and operational summaries for each asset Greenhill held an in-person meeting with BOX management on March 6, 2017 to discuss its assets, business plan, financial projections and corporate strategy, among other topics Greenhill has also participated in property tours of key assets in Toronto and Calgary

Preliminary valuation analysis of BOX

Standalone analysis based on historical trading ranges, equity research price targets and NAV estimates, and comparable trading multiples Cash flow based methodologies including a discounted cash flow analysis, distribution discount model and a net asset value analysis based on the Company’s financial plan

Greenhill has also reviewed precedent transaction multiples, premiums paid in comparable transactions, and premiums paid in precedent minority squeeze-out transactions

Greenhill

5

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

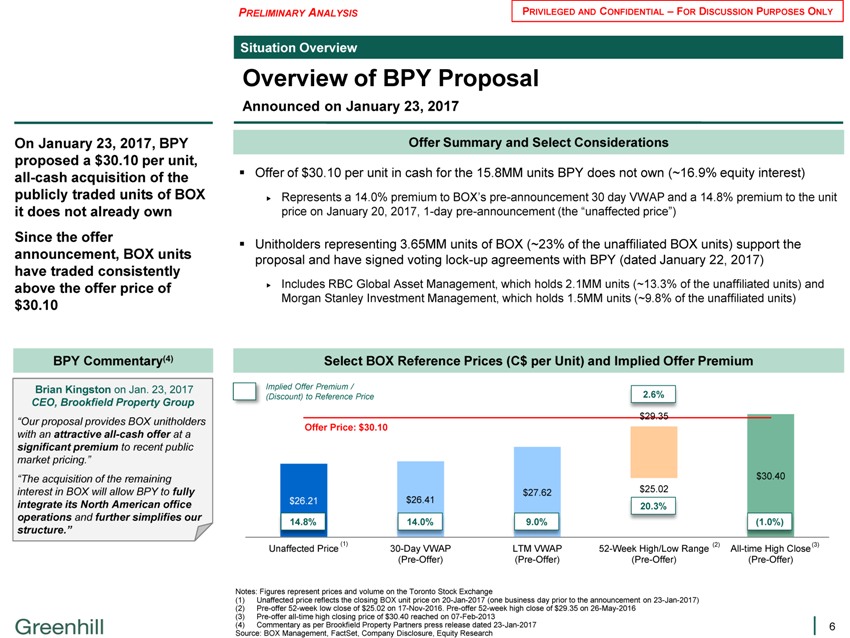

Overview of BPY Proposal

Announced on January 23, 2017

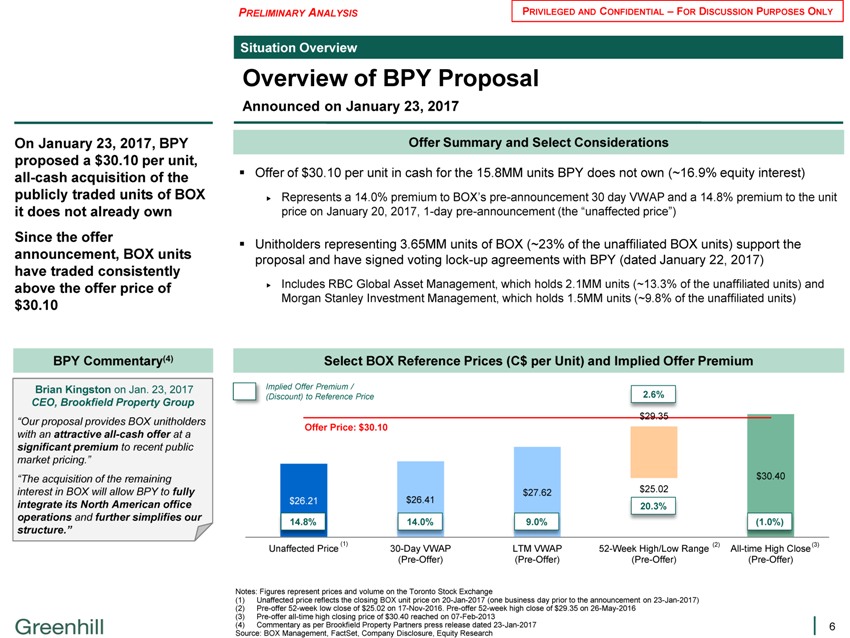

On January 23, 2017, BPY proposed a $30.10 per unit, all-cash acquisition of the publicly traded units of BOX it does not already own Since the offer announcement, BOX units have traded consistently above the offer price of $30.10

Offer Summary and Select Considerations

Offer of $30.10 per unit in cash for the 15.8MM units BPY does not own (~16.9% equity interest)

Represents a 14.0% premium to BOX’s pre-announcement 30 day VWAP and a 14.8% premium to the unit price on January 20, 2017, 1-day pre-announcement (the “unaffected price”)

Unitholders representing 3.65MM units of BOX (~23% of the unaffiliated BOX units) support the proposal and have signed voting lock-up agreements with BPY (dated January 22, 2017)

Includes RBC Global Asset Management, which holds 2.1MM units (~13.3% of the unaffiliated units) and Morgan Stanley Investment Management, which holds 1.5MM units (~9.8% of the unaffiliated units)

BPY Commentary(4)

Brian Kingston on Jan. 23, 2017

CEO, Brookfield Property Group

“Our proposal provides BOX unitholders with an attractive all-cash offer at a significant premium to recent public market pricing.” “The acquisition of the remaining interest in BOX will allow BPY to fully integrate its North American office operations and further simplifies our structure.”

Select BOX Reference Prices (C$ per Unit) and Implied Offer Premium

Implied Offer Premium / 2.6% (Discount) to Reference Price

$29.35

Offer Price: $30.10

$30.40 $27.62 $25.02 $26.21 $26.41

20.3%

14.8% 14.0% 9.0% (1.0%)

(1) (2) (3)

Unaffected Price 30-Day VWAP LTM VWAP 52-Week High/Low Range All-time High Close (Pre-Offer) (Pre-Offer) (Pre-Offer) (Pre-Offer)

Notes: Figures represent prices and volume on the Toronto Stock Exchange

(1) Unaffected price reflects the closing BOX unit price on 20-Jan-2017 (one business day prior to the announcement on 23-Jan-2017) (2) Pre-offer 52-week low close of $25.02 on 17-Nov-2016. Pre-offer 52-week high close of $29.35 on 26-May-2016 (3) Pre-offer all-time high closing price of $30.40 reached on 07-Feb-2013 (4) Commentary as per Brookfield Property Partners press release dated 23-Jan-2017 Source: BOX Management, FactSet, Company Disclosure, Equity Research

Greenhill

6

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

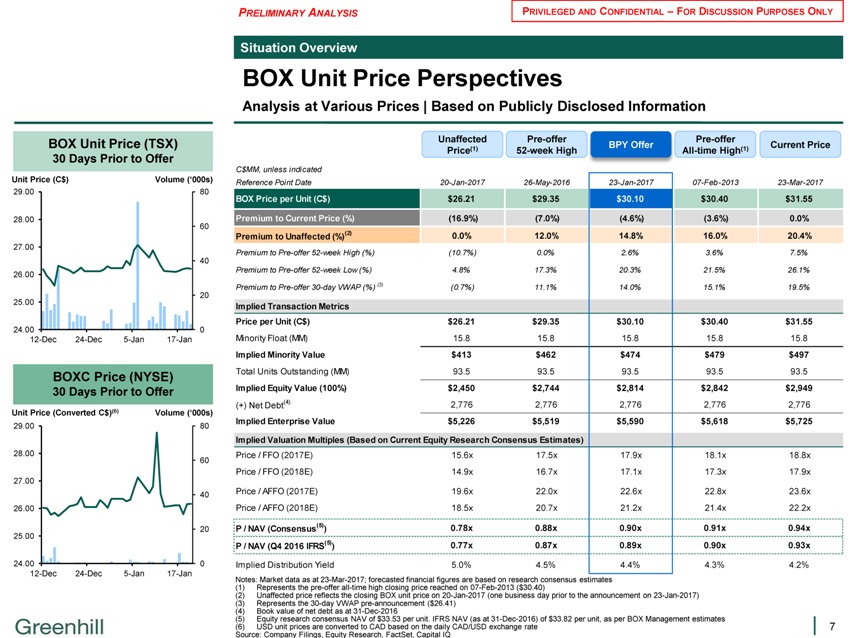

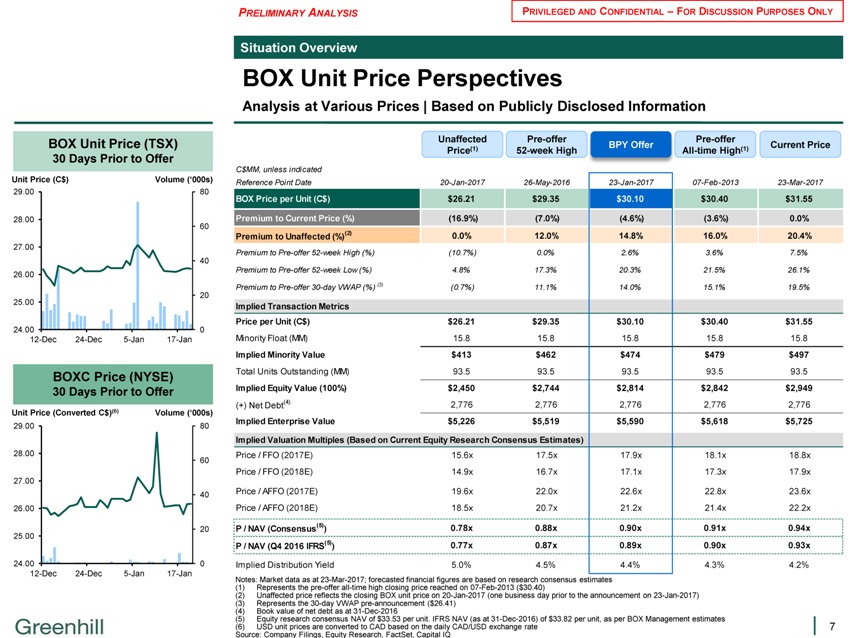

BOX Unit Price Perspectives

Analysis at Various Prices | Based on Publicly Disclosed Information

BOX Unit Price (TSX)

30 Days Prior to Offer

Unit Price (C$) Volume (‘000s)

29.00 80

28.00 60 27.00 40 26.00

25.00 20

24.00 0 12-Dec 24-Dec 5-Jan 17-Jan

BOXC Price (NYSE)

30 Days Prior to Offer

Unit Price (Converted C$)(6) Volume (‘000s)

29.00 80

28.00 60 27.00 40 26.00

25.00 20

24.00 0 12-Dec 24-Dec 5-Jan 17-Jan

Unaffected Pre-offer Pre-offer

BPY Offer Current Price Price(1) 52-week High All-time High(1)

C$MM, unless indicated

Reference Point Date 20-Jan-2017 26-May-2016 23-Jan-2017 07-Feb-2013 23-Mar-2017

BOX Price per Unit (C$) $26.21 $29.35 $30.10 $30.40 $31.55

Premium to Current Price (%) (16.9%) (7.0%) (4.6%) (3.6%) 0.0% Premium to Unaffected (%)(2) 0.0% 12.0% 14.8% 16.0% 20.4%

Premium to Pre-offer 52-week High (%) (10.7%) 0.0% 2.6% 3.6% 7.5% Premium to Pre-offer 52-week Low (%) 4.8% 17.3% 20.3% 21.5% 26.1% Premium to Pre-offer 30-day VWAP (%) (3) (0.7%) 11.1% 14.0% 15.1% 19.5%

Implied Transaction Metrics

Price per Unit (C$) $26.21 $29.35 $30.10 $30.40 $31.55

Minority Float (MM) 15.8 15.8 15.8 15.8 15.8

Implied Minority Value $413 $462 $474 $479 $497

Total Units Outstanding (MM) 93.5 93.5 93.5 93.5 93.5

Implied Equity Value (100%) $2,450 $2,744 $2,814 $2,842 $2,949

(+) Net Debt(4) 2,776 2,776 2,776 2,776 2,776

Implied Enterprise Value $5,226 $5,519 $5,590 $5,618 $5,725

Implied Valuation Multiples (Based on Current Equity Research Consensus Estimates)

Price / FFO (2017E) 15.6x 17.5x 17.9x 18.1x 18.8x Price / FFO (2018E) 14.9x 16.7x 17.1x 17.3x 17.9x

Price / AFFO (2017E) 19.6x 22.0x 22.6x 22.8x 23.6x Price / AFFO (2018E) 18.5x 20.7x 21.2x 21.4x 22.2x

P / NAV (Consensus(5)) 0.78x 0.88x 0.90x 0.91x 0.94x P / NAV (Q4 2016 IFRS(5)) 0.77x 0.87x 0.89x 0.90x 0.93x

Implied Distribution Yield 5.0% 4.5% 4.4% 4.3% 4.2%

Notes: Market data as at 23-Mar-2017; forecasted financial figures are based on research consensus estimates (1) Represents the pre-offer all-time high closing price reached on 07-Feb-2013 ($30.40)

(2) Unaffected price reflects the closing BOX unit price on 20-Jan-2017 (one business day prior to the announcement on 23-Jan-2017) (3) Represents the 30-day VWAP pre-announcement ($26.41) (4) Book value of net debt as at 31-Dec-2016

(5) Equity research consensus NAV of $33.53 per unit. IFRS NAV (as at 31-Dec-2016) of $33.82 per unit, as per BOX Management estimates (6) USD unit prices are converted to CAD based on the daily CAD/USD exchange rate Source: Company Filings, Equity Research, FactSet, Capital IQ

Greenhill

7

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

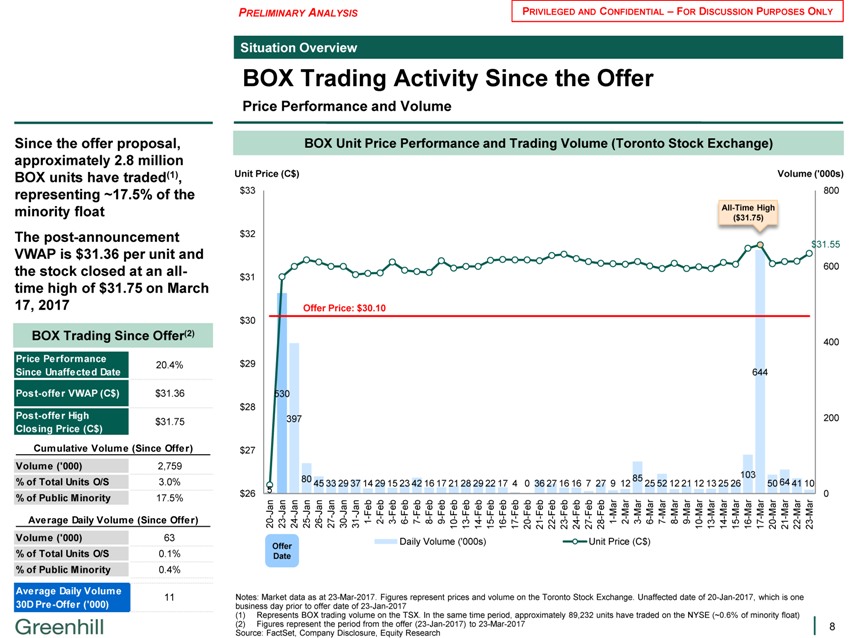

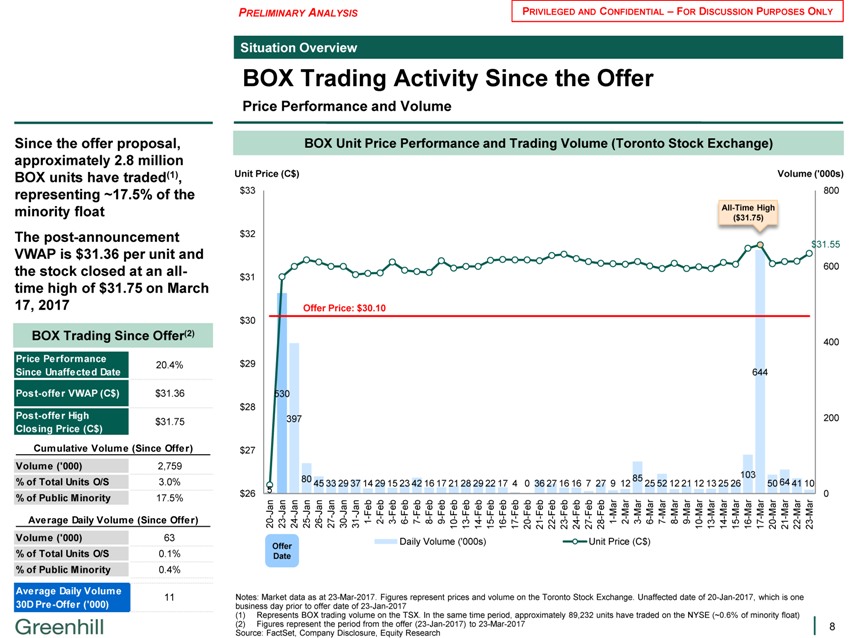

BOX Trading Activity Since the Offer

Price Performance and Volume

Since the offer proposal, approximately 2.8 million BOX units have traded(1), representing ~17.5% of the minority float The post-announcement VWAP is $31.36 per unit and the stock closed at an all-time high of $31.75 on March 17, 2017

BOX Trading Since Offer(2)

Price Performance

20.4%

Since Unaffected Date

Post-offer VWAP (C$) $31.36

Post-offer High

$31.75

Closing Price (C$)

Cumulative Volume (Since Offer) Volume (‘000) 2,759 % of Total Units O/S 3.0% % of Public Minority 17.5%

Average Daily Volume (Since Offer) Volume (‘000) 63 % of Total Units O/S 0.1% % of Public Minority 0.4%

Average Daily Volume

11

30D Pre-Offer (‘000)

BOX Unit Price Performance and Trading Volume (Toronto Stock Exchange)

Unit Price (C$) Volume (‘000s)

$33 800

All-Time High

($31.75) $32

$31.55

600 $31

Offer Price: $30.10 $30

400

$29 644 530 $28

397 200

$27

85 103

80 64

45 33 29 37 14 29 15 23 42 16 17 21 28 29 22 17 4 0 36 27 16 16 7 27 9 12 25 52 12 21 12 13 25 26 50 41 10

$26 5 0 an an an an an an an an b—J J—J — J—J—J—J—J Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Feb Fe Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar—1 2 — 3 6—7 — 8 9 — — — — — — — 8 1—2 — 3—6 7—8—9 — — — — — -

20 23 24 25 26 27 30 31 10 13 14 15 16 17 20 21 22 23 24 27 2 10 13 14 15 16 17 20 21 22 23 Daily Volume (‘000s) Unit Price (C$)

Offer Date

Notes: Market data as at 23-Mar-2017. Figures represent prices and volume on the Toronto Stock Exchange. Unaffected date of 20-Jan-2017, which is one business day prior to offer date of 23-Jan-2017 (1) Represents BOX trading volume on the TSX. In the same time period, approximately 89,232 units have traded on the NYSE (~0.6% of minority float) (2) Figures represent the period from the offer (23-Jan-2017) to 23-Mar-2017 Source: FactSet, Company Disclosure, Equity Research

Greenhill

8

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

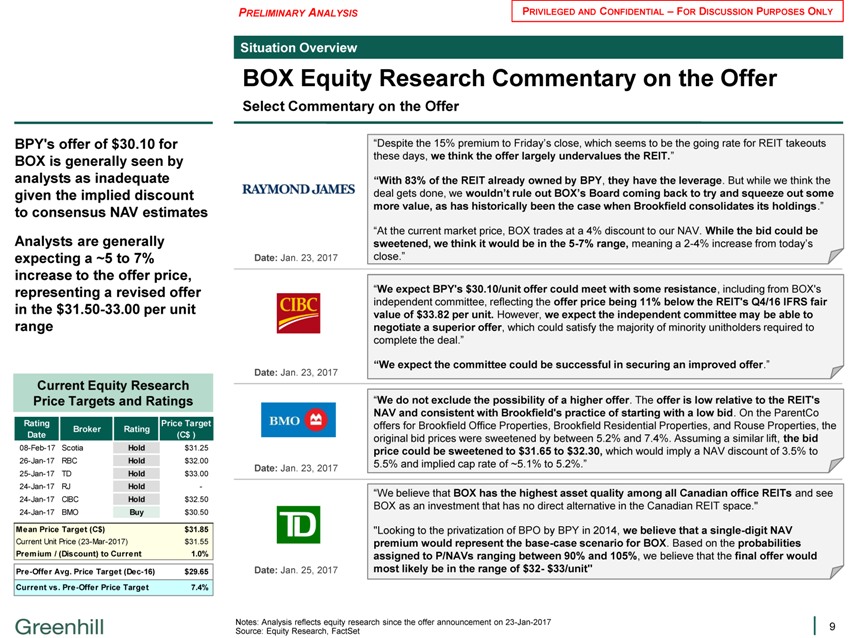

BOX Equity Research Commentary on the Offer

Select Commentary on the Offer

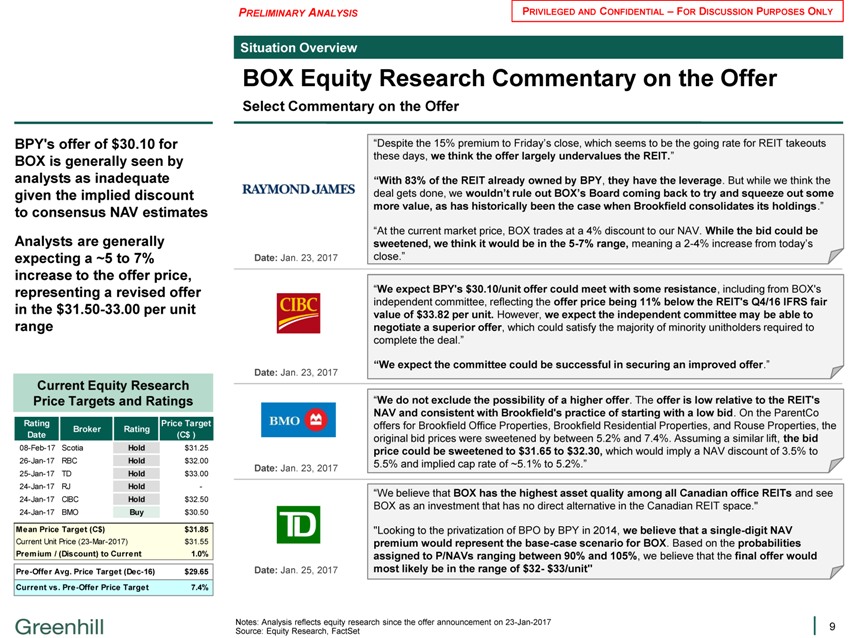

BPY’s offer of $30.10 for BOX is generally seen by analysts as inadequate given the implied discount to consensus NAV estimates

Analysts are generally expecting a ~5 to 7% increase to the offer price, representing a revised offer in the $31.50-33.00 per unit range

Current Equity Research Price Targets and Ratings

Rating Price Target Broker Rating Date (C$ )

08-Feb-17 Scotia Hold $31.25

26-Jan-17 RBC Hold $32.00

25-Jan-17 TD Hold $33.00

24-Jan-17 RJ Hold -

24-Jan-17 CIBC Hold $32.50

24-Jan-17 BMO Buy $30.50

Mean Price Target (C$) $31.85

Current Unit Price (23-Mar-2017) $31.55

Premium / (Discount) to Current 1.0% Pre-Offer Avg. Price Target (Dec-16) $29.65 Current vs. Pre-Offer Price Target 7.4%

RAYMOND JAMES

“Despite the 15% premium to Friday’s close, which seems to be the going rate for REIT takeouts these days, we think the offer largely undervalues the REIT.”

“With 83% of the REIT already owned by BPY, they have the leverage. But while we think the deal gets done, we wouldn’t rule out BOX’s Board coming back to try and squeeze out some more value, as has historically been the case when Brookfield consolidates its holdings.”

“At the current market price, BOX trades at a 4% discount to our NAV. While the bid could be sweetened, we think it would be in the 5-7% range, meaning a 2-4% increase from today’s

Date: Jan. 23, 2017 close.”

CIBC

“We expect BPY’s $30.10/unit offer could meet with some resistance, including from BOX’s independent committee, reflecting the offer price being 11% below the REIT’s Q4/16 IFRS fair value of $33.82 per unit. However, we expect the independent committee may be able to negotiate a superior offer, which could satisfy the majority of minority unitholders required to complete the deal.”

“We expect the committee could be successful in securing an improved offer.”

Date: Jan. 23, 2017

BMO

“We do not exclude the possibility of a higher offer. The offer is low relative to the REIT’s NAV and consistent with Brookfield’s practice of starting with a low bid. On the ParentCo offers for Brookfield Office Properties, Brookfield Residential Properties, and Rouse Properties, the original bid prices were sweetened by between 5.2% and 7.4%. Assuming a similar lift, the bid price could be sweetened to $31.65 to $32.30, which would imply a NAV discount of 3.5% to

Date: Jan. 23, 2017 5.5% and implied cap rate of ~5.1% to 5.2%.”

“We believe that BOX has the highest asset quality among all Canadian office REITs and see

BOX as an investment that has no direct alternative in the Canadian REIT space.”

“Looking to the privatization of BPO by BPY in 2014, we believe that a single-digit NAV premium would represent the base-case scenario for BOX. Based on the probabilities assigned to P/NAVs ranging between 90% and 105%, we believe that the final offer would Date: Jan. 25, 2017 most likely be in the range of $32- $33/unit”

Notes: Analysis reflects equity research since the offer announcement on 23-Jan-2017 Source: Equity Research, FactSet

Greenhill

9

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

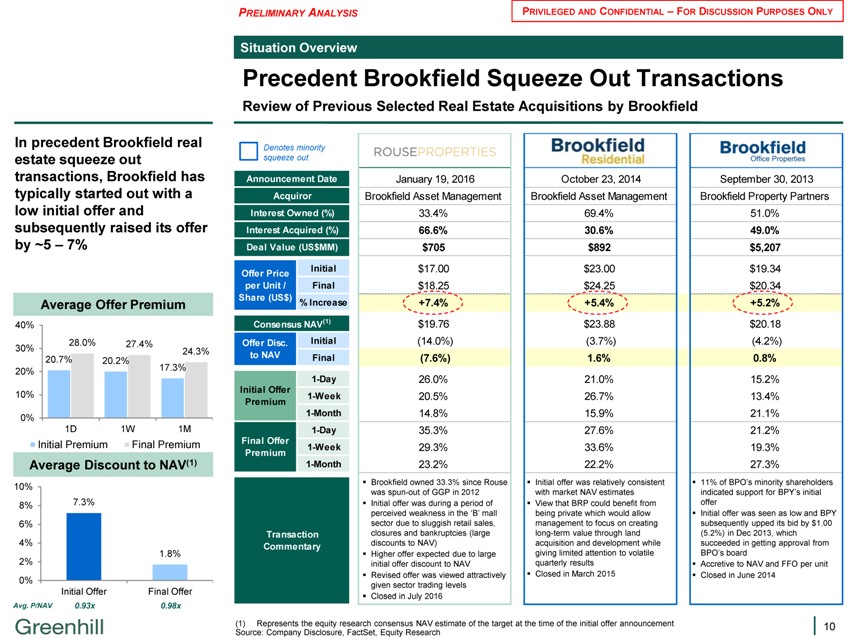

Precedent Brookfield Squeeze Out Transactions

Review of Previous Selected Real Estate Acquisitions by Brookfield

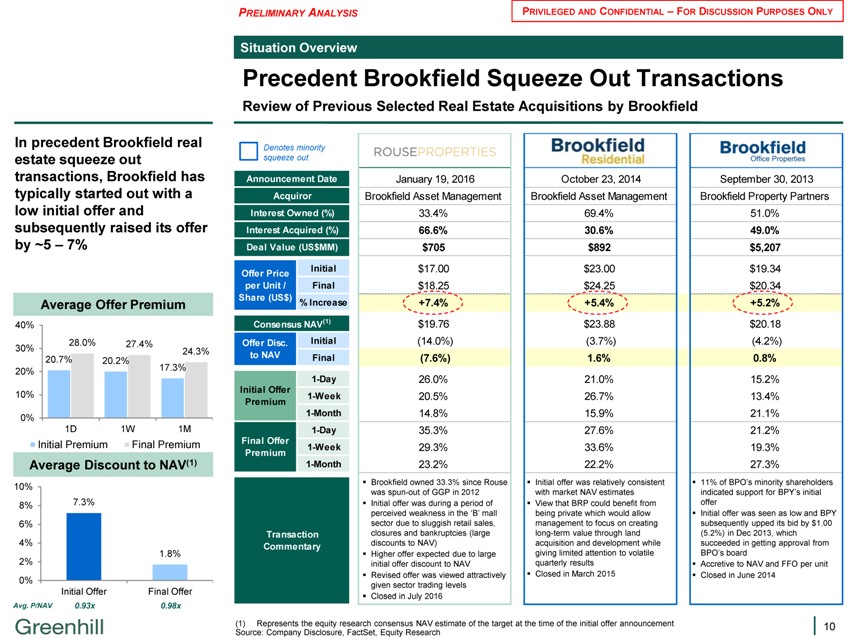

In precedent Brookfield real estate squeeze out transactions, Brookfield has typically started out with a low initial offer and subsequently raised its offer by ~5 – 7%

Average Offer Premium

40%

28.0% 27.4%

30% 24.3%

20.7% 20.2% 17.3% 20%

10%

0%

1D 1W 1M

Initial Premium Final Premium

Average Discount to NAV(1)

10%

8% 7.3% 6%

4%

2% 1.8% 0% Initial Offer Final Offer

Avg. P/NAV 0.93x 0.98x

Denotes minority squeeze out

Announcement Date January 19, 2016 October 23, 2014 September 30, 2013 Acquiror Brookfield Asset Management Brookfield Asset Management Brookfield Property Partners

Interest Owned (%) 33.4% 69.4% 51.0% Interest Acquired (%) 66.6% 30.6% 49.0% Deal Value (US$MM) $705 $892 $5,207

Initial $17.00 $23.00 $19.34

Offer Price per Unit / Final $18.25 $24.25 $20.34

Share (US$)

% Increase +7.4% +5.4% +5.2%

Consensus NAV(1) $19.76 $23.88 $20.18 Offer Disc. Initial (14.0%) (3.7%) (4.2%) to NAV Final (7.6%) 1.6% 0.8%

1-Day 26.0% 21.0% 15.2%

Initial Offer

1-Week 20.5% 26.7% 13.4%

Premium

1-Month 14.8% 15.9% 21.1%

1-Day 35.3% 27.6% 21.2%

Final Offer

1-Week 29.3% 33.6% 19.3%

Premium

1-Month 23.2% 22.2% 27.3%

? Brookfield owned 33.3% since Rouse ? Initial offer was relatively consistent ? 11% of BPO’s minority shareholders was spun-out of GGP in 2012 with market NAV estimates indicated support for BPY’s initial? Initial offer was during a period of ? View that BRP could benefit from offer perceived weakness in the ‘B’ mall being private which would allow ? Initial offer was seen as low and BPY sector due to sluggish retail sales, management to focus on creating subsequently upped its bid by $1.00 Transaction closures and bankruptcies (large long-term value through land (5.2%) in Dec 2013, which Commentary discounts to NAV) acquisition and development while succeeded in getting approval from ? Higher offer expected due to large giving limited attention to volatile BPO’s board initial offer discount to NAV quarterly results ? Accretive to NAV and FFO per unit ? Revised offer was viewed attractively ? Closed in March 2015 ? Closed in June 2014 given sector trading levels ? Closed in July 2016

(1) Represents the equity research consensus NAV estimate of the target at the time of the initial offer announcement Source: Company Disclosure, FactSet, Equity Research

Greenhill

10

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Situation Overview

Other Factors to Consider

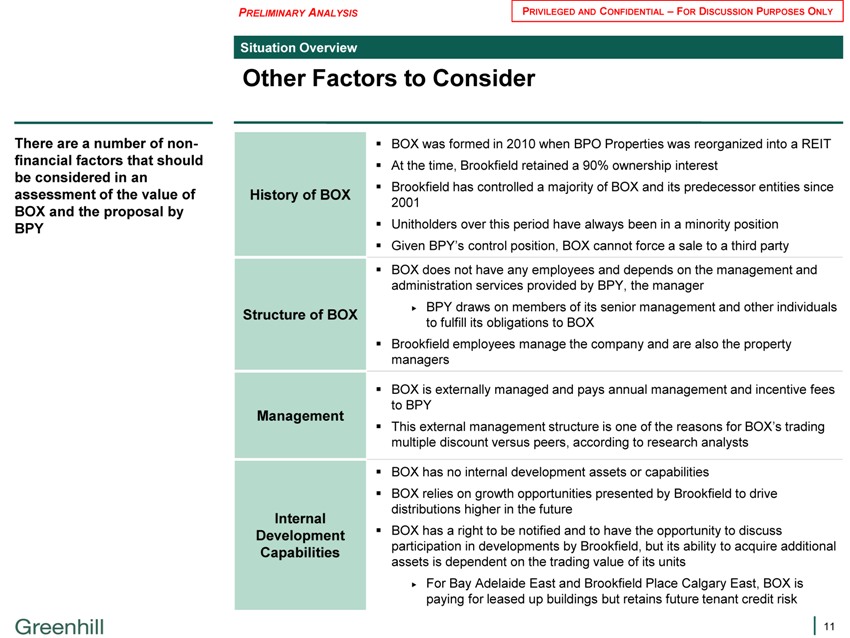

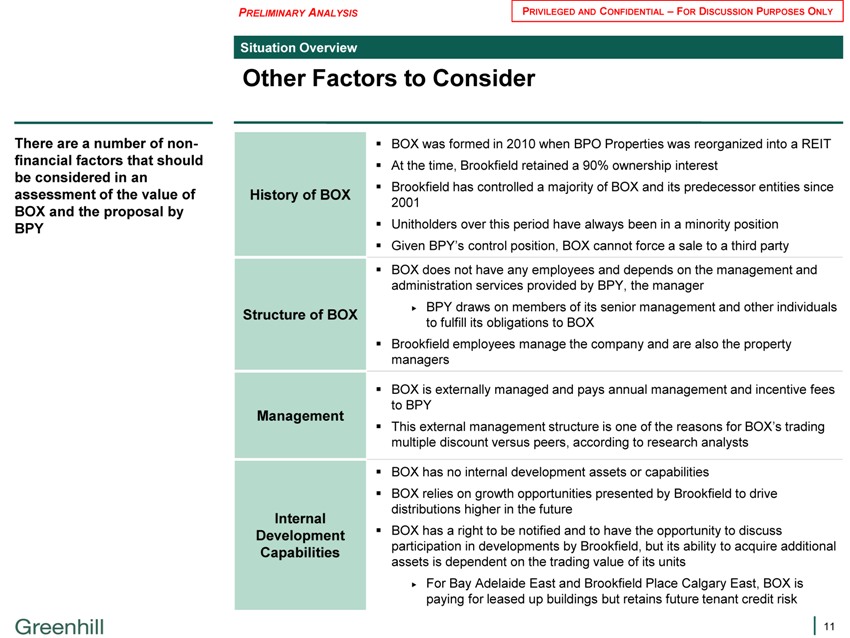

There are a number of non-financial factors that should be considered in an assessment of the value of BOX and the proposal by BPY

BOX was formed in 2010 when BPO Properties was reorganized into a REIT ? At the time, Brookfield retained a 90% ownership interest ? Brookfield has controlled a majority of BOX and its predecessor entities since

History of BOX

2001

Unitholders over this period have always been in a minority position

Given BPY’s control position, BOX cannot force a sale to a third party

BOX does not have any employees and depends on the management and administration services provided by BPY, the manager ? BPY draws on members of its senior management and other individuals

Structure of BOX to fulfill its obligations to BOX

Brookfield employees manage the company and are also the property managers

BOX is externally managed and pays annual management and incentive fees to BPY

Management

This external management structure is one of the reasons for BOX’s trading multiple discount versus peers, according to research analysts

BOX has no internal development assets or capabilities

BOX relies on growth opportunities presented by Brookfield to drive distributions higher in the future Internal BOX has a right to be notified and to have the opportunity to discuss

Development participation in developments by Brookfield, but its ability to acquire additional

Capabilities assets is dependent on the trading value of its units

For Bay Adelaide East and Brookfield Place Calgary East, BOX is paying for leased up buildings but retains future tenant credit risk

Greenhill

11

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Table of Contents

1. Situation Overview

2. BOX Overview

3. Preliminary Valuation Analysis

Appendix

Greenhill

12

PRELIMINARY DRAFT PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

BOX Overview

Brookfield Canada Office Properties

Company and Portfolio Overview

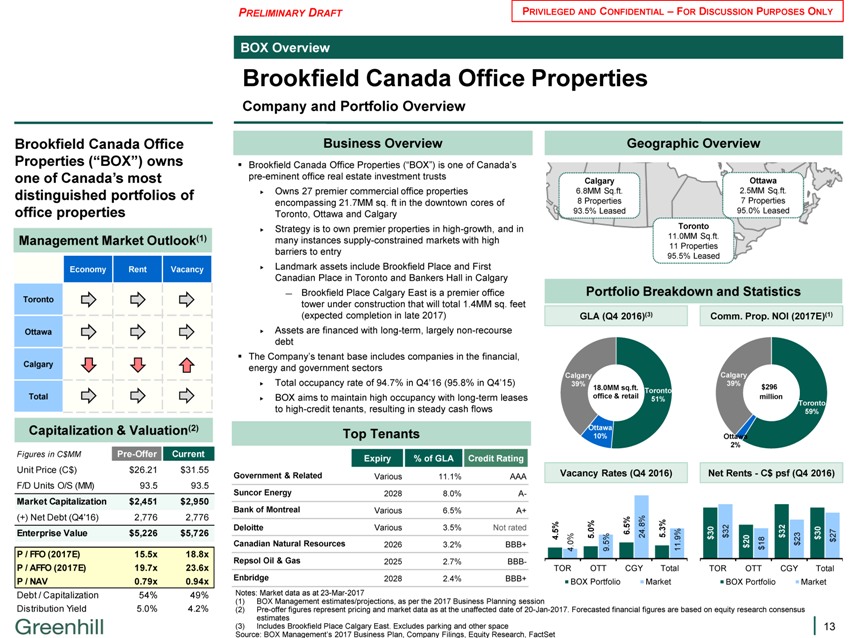

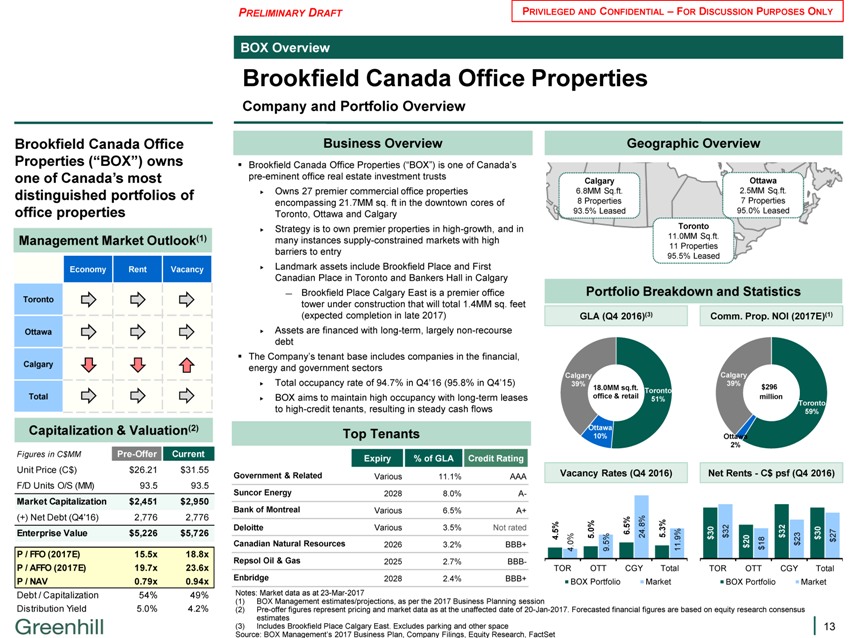

Brookfield Canada Office

Properties (“BOX”) owns one of Canada’s most distinguished portfolios of office properties

Management Market Outlook(1)

Economy Rent Vacancy

Toronto

Ottawa

Calgary

Total

Capitalization & Valuation(2)

Figures in C$MM Pre-Offer Current

Unit Price (C$) $26.21 $31.55 F/D Units O/S (MM) 93.5 93.5

Market Capitalization $2,451 $2,950

(+) Net Debt (Q4’16) 2,776 2,776

Enterprise Value $5,226 $5,726

P / FFO (2017E) 15.5x 18.8x P / AFFO (2017E) 19.7x 23.6x P / NAV 0.79x 0.94x

Debt / Capitalization 54% 49% Distribution Yield 5.0% 4.2%

Business Overview

? Brookfield Canada Office Properties (“BOX”) is one of Canada’s pre-eminent office real estate investment trusts ? Owns 27 premier commercial office properties encompassing 21.7MM sq. ft in the downtown cores of Toronto, Ottawa and Calgary ? Strategy is to own premier properties in high-growth, and in many instances supply-constrained markets with high barriers to entry ? Landmark assets include Brookfield Place and First Canadian Place in Toronto and Bankers Hall in Calgary

— Brookfield Place Calgary East is a premier office tower under construction that will total 1.4MM sq. feet (expected completion in late 2017) ? Assets are financed with long-term, largely non-recourse debt

? The Company’s tenant base includes companies in the financial, energy and government sectors

? Total occupancy rate of 94.7% in Q4’16 (95.8% in Q4’15)

? BOX aims to maintain high occupancy with long-term leases to high-credit tenants, resulting in steady cash flows

Top Tenants

Expiry % of GLA Credit Rating

Government & Related Various 11.1% AAA Suncor Energy 2028 8.0% A- Bank of Montreal Various 6.5% A+

Deloitte Various 3.5% Not rated

Canadian Natural Resources 2026 3.2% BBB+ Repsol Oil & Gas 2025 2.7% BBB-

Enbridge 2028 2.4% BBB+

Geographic Overview

Calgary Ottawa

6.8MM Sq.ft. 2.5MM Sq.ft.

| 8 | Properties 7 Properties 93.5% Leased 95.0% Leased |

Toronto

11.0MM Sq.ft.

11 Properties 95.5% Leased

Portfolio Breakdown and Statistics

GLA (Q4 2016)(3) Comm. Prop. NOI (2017E)(1)

Calgary Calgary 39% 39%

18.0MM sq.ft. $296 Toronto office & retail 51% million

Toronto 59%

Ottawa

10% Ottawa 2%

Vacancy Rates (Q4 2016) Net Rents—C$ psf (Q4 2016)

% 5% . 8%

5% 0 . 3%

. . 6 24 5 . 30 $ 32 $ 32 30 27

0% 5% . 20 18 $ $ 4 . 9 . 11 $ $

TOR OTT CGY Total TOR OTT CGY Total BOX Portfolio Market BOX Portfolio Market

Notes: Market data as at 23-Mar-2017

| (1) | BOX Management estimates/projections, as per the 2017 Business Planning session |

(2) Pre-offer figures represent pricing and market data as at the unaffected date of 20-Jan-2017. Forecasted financial figures are based on equity research consensus estimates (3) Includes Brookfield Place Calgary East. Excludes parking and other space

Source: BOX Management’s 2017 Business Plan, Company Filings, Equity Research, FactSet

Greenhill

13

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

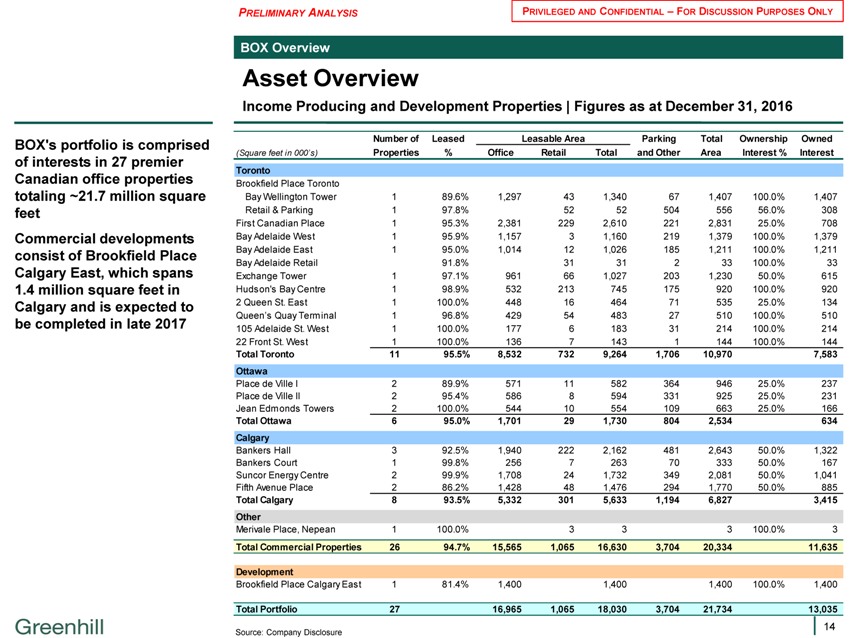

BOX Overview

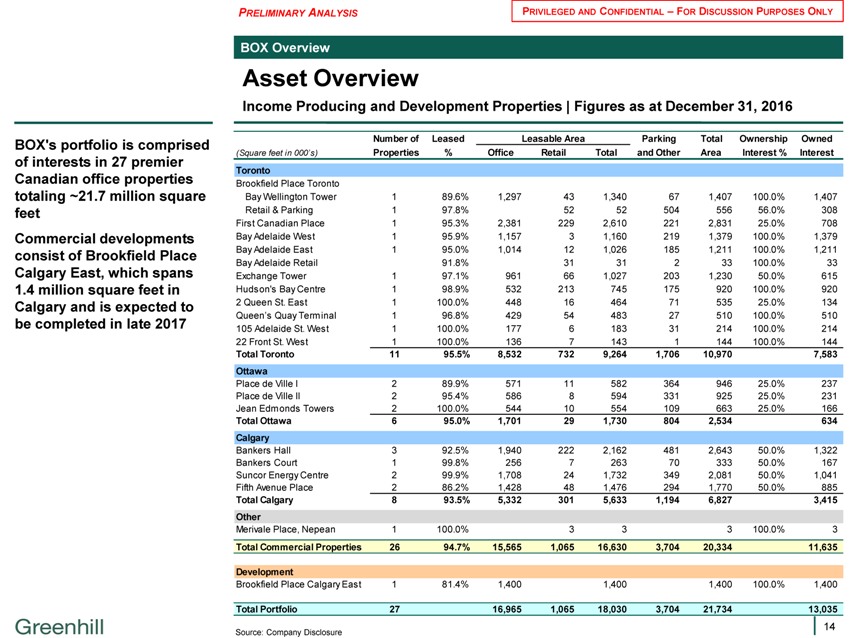

Asset Overview

Income Producing and Development Properties | Figures as at December 31, 2016

BOX’s portfolio is comprised of interests in 27 premier Canadian office properties totaling ~21.7 million square feet Commercial developments consist of Brookfield Place Calgary East, which spans 1.4 million square feet in Calgary and is expected to be completed in late 2017

Number of Leased Leasable Area Parking Total Ownership Owned (Square feet in 000’s) Properties % Office Retail Total and Other Area Interest % Interest Toronto

Brookfield Place Toronto

Bay Wellington Tower 1 89.6% 1,297 43 1,340 67 1,407 100.0% 1,407 Retail & Parking 1 97.8% 52 52 504 556 56.0% 308 First Canadian Place 1 95.3% 2,381 229 2,610 221 2,831 25.0% 708 Bay Adelaide West 1 95.9% 1,157 3 1,160 219 1,379 100.0% 1,379 Bay Adelaide East 1 95.0% 1,014 12 1,026 185 1,211 100.0% 1,211 Bay Adelaide Retail 91.8% 31 31 2 33 100.0% 33 Exchange Tower 1 97.1% 961 66 1,027 203 1,230 50.0% 615 Hudson’s Bay Centre 1 98.9% 532 213 745 175 920 100.0% 920

2 Queen St. East 1 100.0% 448 16 464 71 535 25.0% 134 Queen’s Quay Terminal 1 96.8% 429 54 483 27 510 100.0% 510 105 Adelaide St. West 1 100.0% 177 6 183 31 214 100.0% 214

22 Front St. West 1 100.0% 136 7 143 1 144 100.0% 144

Total Toronto 11 95.5% 8,532 732 9,264 1,706 10,970 7,583 Ottawa

Place de Ville I 2 89.9% 571 11 582 364 946 25.0% 237 Place de Ville II 2 95.4% 586 8 594 331 925 25.0% 231 Jean Edmonds Towers 2 100.0% 544 10 554 109 663 25.0% 166

Total Ottawa 6 95.0% 1,701 29 1,730 804 2,534 634 Calgary

Bankers Hall 3 92.5% 1,940 222 2,162 481 2,643 50.0% 1,322 Bankers Court 1 99.8% 256 7 263 70 333 50.0% 167 Suncor Energy Centre 2 99.9% 1,708 24 1,732 349 2,081 50.0% 1,041 Fifth Avenue Place 2 86.2% 1,428 48 1,476 294 1,770 50.0% 885

Total Calgary 8 93.5% 5,332 301 5,633 1,194 6,827 3,415 Other

Merivale Place, Nepean 1 100.0% 3 3 3 100.0% 3

Total Commercial Properties 26 94.7% 15,565 1,065 16,630 3,704 20,334 11,635

Development

Brookfield Place Calgary East 1 81.4% 1,400 1,400 1,400 100.0% 1,400

Total Portfolio 27 16,965 1,065 18,030 3,704 21,734 13,035

Source: Company Disclosure

Greenhill

14

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

BOX Overview

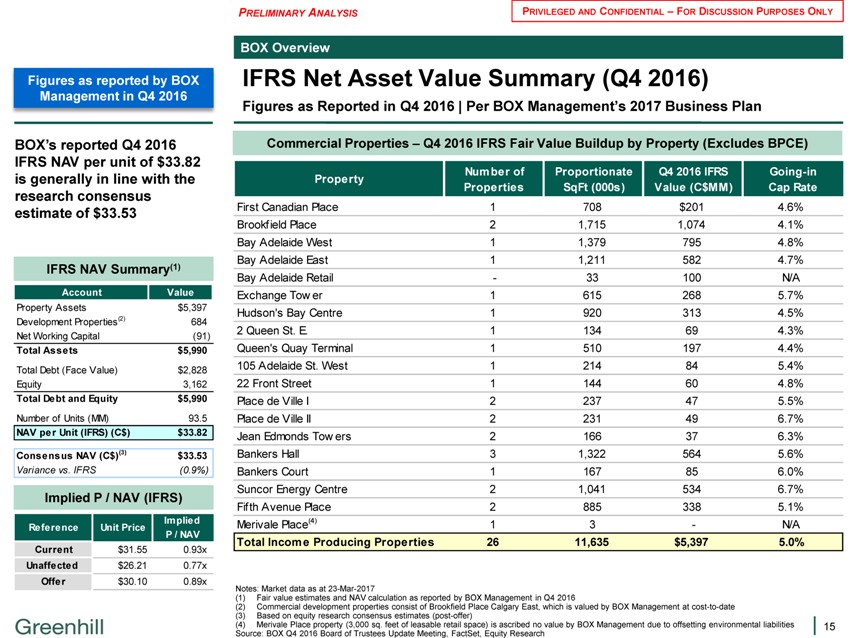

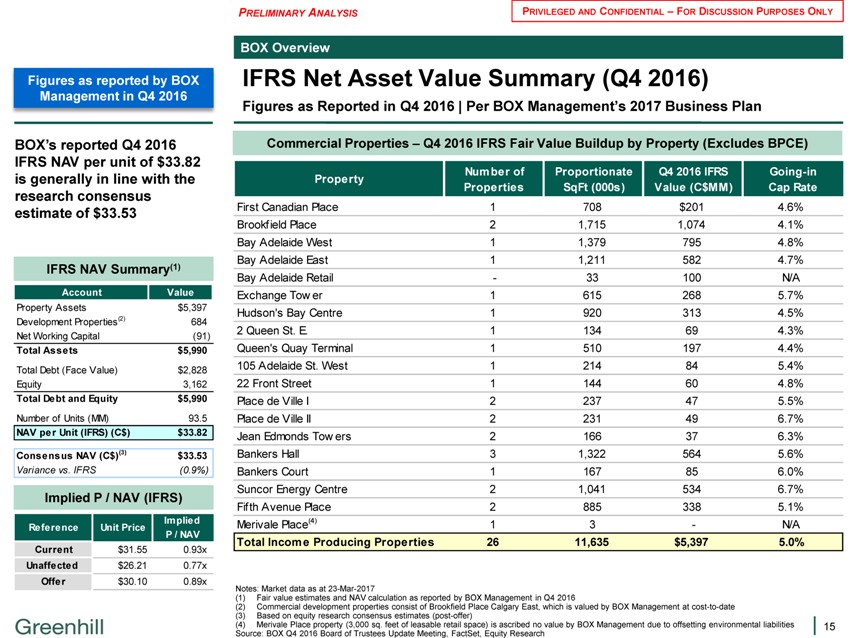

IFRS Net Asset Value Summary (Q4 2016)

Figures as Reported in Q4 2016 | Per BOX Management’s 2017 Business Plan

Figures as reported by BOX Management in Q4 2016

BOX’s reported Q4 2016

IFRS NAV per unit of $33.82 is generally in line with the research consensus estimate of $33.53

IFRS NAV Summary(1)

Account Value

Property Assets $5,397 Development Properties(2) 684 Net Working Capital (91)

Total Assets $5,990

Total Debt (Face Value) $2,828 Equity 3,162

Total Debt and Equity $5,990

Number of Units (MM) 93.5

NAV per Unit (IFRS) (C$) $33.82

Consensus NAV (C$)(3) $33.53

Variance vs. IFRS (0.9%)

Implied P / NAV (IFRS)

Implied Reference Unit Price P / NAV

Current $31.55 0.93x Unaffected $26.21 0.77x Offer $30.10 0.89x

Commercial Properties – Q4 2016 IFRS Fair Value Buildup by Property (Excludes BPCE)

Number of Proportionate Q4 2016 IFRS Going-in Property Properties SqFt (000s) Value (C$MM) Cap Rate

First Canadian Place 1 708 $201 4.6% Brookfield Place 2 1,715 1,074 4.1% Bay Adelaide West 1 1,379 795 4.8% Bay Adelaide East 1 1,211 582 4.7% Bay Adelaide Retail—33 100 N/A Exchange Tow er 1 615 268 5.7% Hudson’s Bay Centre 1 920 313 4.5%

2 Queen St. E. 1 134 69 4.3% Queen’s Quay Terminal 1 510 197 4.4% 105 Adelaide St. West 1 214 84 5.4%

22 Front Street 1 144 60 4.8% Place de Ville I 2 237 47 5.5% Place de Ville II 2 231 49 6.7% Jean Edmonds Tow ers 2 166 37 6.3% Bankers Hall 3 1,322 564 5.6% Bankers Court 1 167 85 6.0% Suncor Energy Centre 2 1,041 534 6.7% Fifth Avenue Place 2 885 338 5.1% Merivale Place(4) 1 3—N/A

Total Income Producing Properties 26 11,635 $5,397 5.0%

Notes: Market data as at 23-Mar-2017

(1) Fair value estimates and NAV calculation as reported by BOX Management in Q4 2016

(2) Commercial development properties consist of Brookfield Place Calgary East, which is valued by BOX Management at cost-to-date (3) Based on equity research consensus estimates (post-offer)

(4) Merivale Place property (3,000 sq. feet of leasable retail space) is ascribed no value by BOX Management due to offsetting environmental liabilities Source: BOX Q4 2016 Board of Trustees Update Meeting, FactSet, Equity Research

Greenhill

15

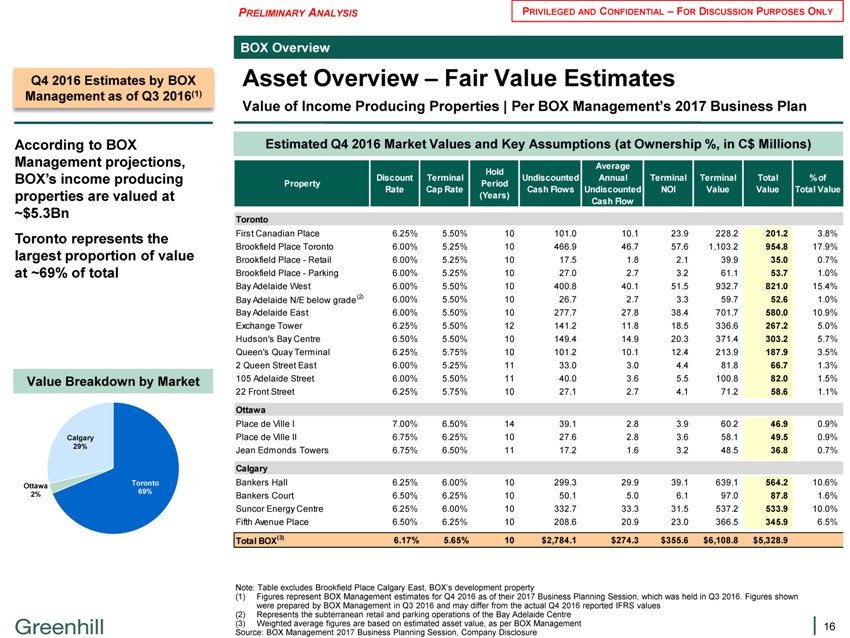

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

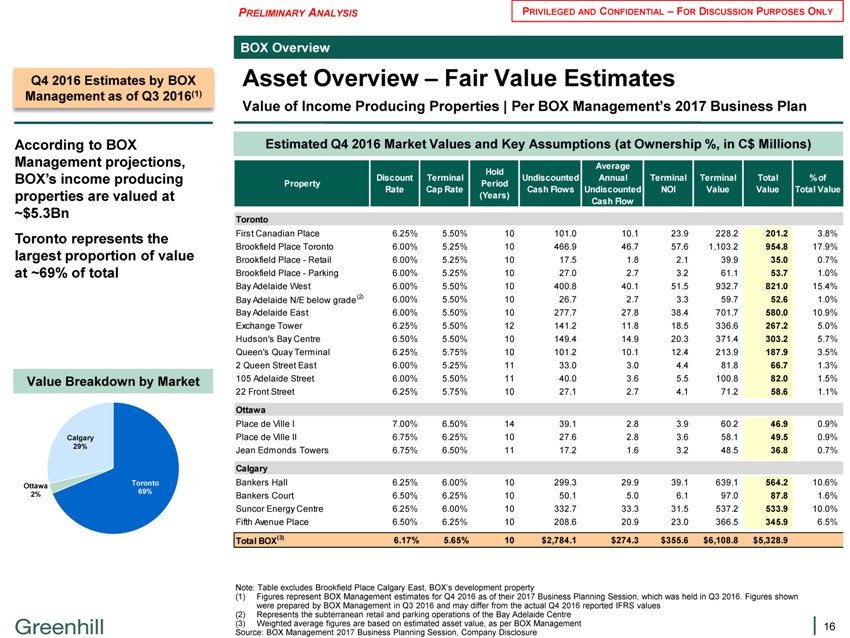

Q4 2016 Estimates by BOX Management as of Q3 2016(1)

According to BOX

Management projections,

BOX’s income producing properties are valued at

~$5.3Bn

Toronto represents the largest proportion of value at ~69% of total

Value Breakdown by Market

Calgary 29%

Ottawa Toronto

2% 69%

Estimated Q4 2016 Market Values and Key Assumptions (at Ownership %, in C$ Millions)

Average Hold

Discount Terminal Undiscounted Annual Terminal Terminal Total % of Property Period Rate Cap Rate Cash Flows Undiscounted NOI Value Value Total Value (Years) Cash Flow

Toronto

First Canadian Place 6.25% 5.50% 10 101.0 10.1 23.9 228.2 201.2 3.8% Brookfield Place Toronto 6.00% 5.25% 10 466.9 46.7 57.6 1,103.2 954.8 17.9% Brookfield Place—Retail 6.00% 5.25% 10 17.5 1.8 2.1 39.9 35.0 0.7% Brookfield Place—Parking 6.00% 5.25% 10 27.0 2.7 3.2 61.1 53.7 1.0% Bay Adelaide West 6.00% 5.50% 10 400.8 40.1 51.5 932.7 821.0 15.4% Bay Adelaide N/E below grade(2) 6.00% 5.50% 10 26.7 2.7 3.3 59.7 52.6 1.0% Bay Adelaide East 6.00% 5.50% 10 277.7 27.8 38.4 701.7 580.0 10.9% Exchange Tower 6.25% 5.50% 12 141.2 11.8 18.5 336.6 267.2 5.0% Hudson’s Bay Centre 6.50% 5.50% 10 149.4 14.9 20.3 371.4 303.2 5.7% Queen’s Quay Terminal 6.25% 5.75% 10 101.2 10.1 12.4 213.9 187.9 3.5%

2 Queen Street East 6.00% 5.25% 11 33.0 3.0 4.4 81.8 66.7 1.3% 105 Adelaide Street 6.00% 5.50% 11 40.0 3.6 5.5 100.8 82.0 1.5%

22 Front Street 6.25% 5.75% 10 27.1 2.7 4.1 71.2 58.6 1.1%

Ottawa

Place de Ville I 7.00% 6.50% 14 39.1 2.8 3.9 60.2 46.9 0.9% Place de Ville II 6.75% 6.25% 10 27.6 2.8 3.6 58.1 49.5 0.9% Jean Edmonds Towers 6.75% 6.50% 11 17.2 1.6 3.2 48.5 36.8 0.7%

Calgary

Bankers Hall 6.25% 6.00% 10 299.3 29.9 39.1 639.1 564.2 10.6% Bankers Court 6.50% 6.25% 10 50.1 5.0 6.1 97.0 87.8 1.6% Suncor Energy Centre 6.25% 6.00% 10 332.7 33.3 31.5 537.2 533.9 10.0% Fifth Avenue Place 6.50% 6.25% 10 208.6 20.9 23.0 366.5 345.9 6.5%

Total BOX(3) 6.17% 5.65% 10 $2,784.1 $274.3 $355.6 $6,108.8 $5,328.9

Note: Table excludes Brookfield Place Calgary East, BOX’s development property

(1) Figures represent BOX Management estimates for Q4 2016 as of their 2017 Business Planning Session, which was held in Q3 2016. Figures shown were prepared by BOX Management in Q3 2016 and may differ from the actual Q4 2016 reported IFRS values (2) Represents the subterranean retail and parking operations of the Bay Adelaide Centre (3) Weighted average figures are based on estimated asset value, as per BOX Management Source: BOX Management 2017 Business Planning Session, Company Disclosure

Greenhill

16

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

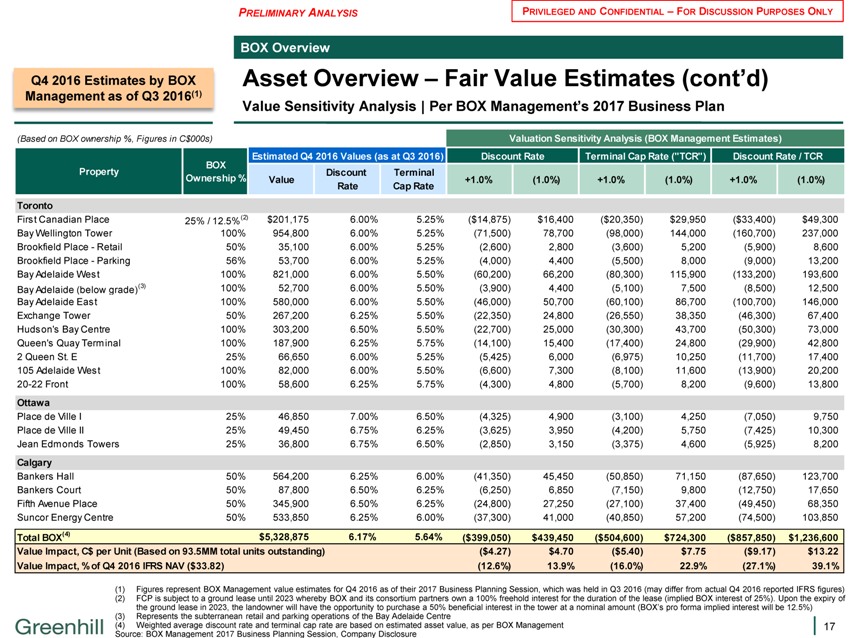

BOX Overview

Asset Overview – Fair Value Estimates (cont’d)

Value Sensitivity Analysis | Per BOX Management’s 2017 Business Plan

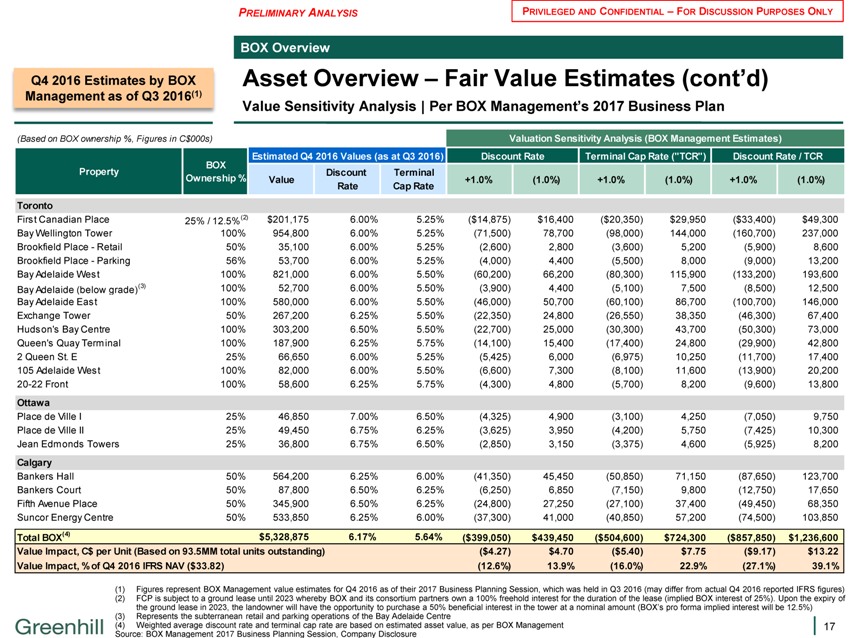

Q4 2016 Estimates by BOX Management as of Q3 2016(1)

(Based on BOX ownership %, Figures in C$000s) Valuation Sensitivity Analysis (BOX Management Estimates)

BOX Estimated Q4 2016 Values (as at Q3 2016) Discount Rate Terminal Cap Rate (“TCR”) Discount Rate / TCR Property Discount Terminal Ownership % Value Rate Cap Rate +1.0% (1.0%) +1.0% (1.0%) +1.0% (1.0%) Toronto

First Canadian Place 25% / 12.5%(2) $201,175 6.00% 5.25% ($14,875) $16,400 ($20,350) $29,950 ($33,400) $49,300 Bay Wellington Tower 100% 954,800 6.00% 5.25% (71,500) 78,700 (98,000) 144,000 (160,700) 237,000 Brookfield Place—Retail 50% 35,100 6.00% 5.25% (2,600) 2,800 (3,600) 5,200 (5,900) 8,600 Brookfield Place—Parking 56% 53,700 6.00% 5.25% (4,000) 4,400 (5,500) 8,000 (9,000) 13,200 Bay Adelaide West 100% 821,000 6.00% 5.50% (60,200) 66,200 (80,300) 115,900 (133,200) 193,600 Bay Adelaide (below grade)(3) 100% 52,700 6.00% 5.50% (3,900) 4,400 (5,100) 7,500 (8,500) 12,500 Bay Adelaide East 100% 580,000 6.00% 5.50% (46,000) 50,700 (60,100) 86,700 (100,700) 146,000 Exchange Tower 50% 267,200 6.25% 5.50% (22,350) 24,800 (26,550) 38,350 (46,300) 67,400 Hudson’s Bay Centre 100% 303,200 6.50% 5.50% (22,700) 25,000 (30,300) 43,700 (50,300) 73,000 Queen’s Quay Terminal 100% 187,900 6.25% 5.75% (14,100) 15,400 (17,400) 24,800 (29,900) 42,800

2 Queen St. E 25% 66,650 6.00% 5.25% (5,425) 6,000 (6,975) 10,250 (11,700) 17,400 105 Adelaide West 100% 82,000 6.00% 5.50% (6,600) 7,300 (8,100) 11,600 (13,900) 20,200

20-22 Front 100% 58,600 6.25% 5.75% (4,300) 4,800 (5,700) 8,200 (9,600) 13,800

Ottawa

Place de Ville I 25% 46,850 7.00% 6.50% (4,325) 4,900 (3,100) 4,250 (7,050) 9,750 Place de Ville II 25% 49,450 6.75% 6.25% (3,625) 3,950 (4,200) 5,750 (7,425) 10,300 Jean Edmonds Towers 25% 36,800 6.75% 6.50% (2,850) 3,150 (3,375) 4,600 (5,925) 8,200

Calgary

Bankers Hall 50% 564,200 6.25% 6.00% (41,350) 45,450 (50,850) 71,150 (87,650) 123,700 Bankers Court 50% 87,800 6.50% 6.25% (6,250) 6,850 (7,150) 9,800 (12,750) 17,650 Fifth Avenue Place 50% 345,900 6.50% 6.25% (24,800) 27,250 (27,100) 37,400 (49,450) 68,350 Suncor Energy Centre 50% 533,850 6.25% 6.00% (37,300) 41,000 (40,850) 57,200 (74,500) 103,850

Total BOX(4) $5,328,875 6.17% 5.64% ($399,050) $439,450 ($504,600) $724,300 ($857,850) $1,236,600 Value Impact, C$ per Unit (Based on 93.5MM total units outstanding) ($4.27) $4.70 ($5.40) $7.75 ($9.17) $13.22 Value Impact, % of Q4 2016 IFRS NAV ($33.82) (12.6%) 13.9% (16.0%) 22.9% (27.1%) 39.1%

(1) Figures represent BOX Management value estimates for Q4 2016 as of their 2017 Business Planning Session, which was held in Q3 2016 (may differ from actual Q4 2016 reported IFRS figures) (2) FCP is subject to a ground lease until 2023 whereby BOX and its consortium partners own a 100% freehold interest for the duration of the lease (implied BOX interest of 25%). Upon the expiry of the ground lease in 2023, the landowner will have the opportunity to purchase a 50% beneficial interest in the tower at a nominal amount (BOX’s pro forma implied interest will be 12.5%) (3) Represents the subterranean retail and parking operations of the Bay Adelaide Centre (4) Weighted average discount rate and terminal cap rate are based on estimated asset value, as per BOX Management Source: BOX Management 2017 Business Planning Session, Company Disclosure

Greenhill

17

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

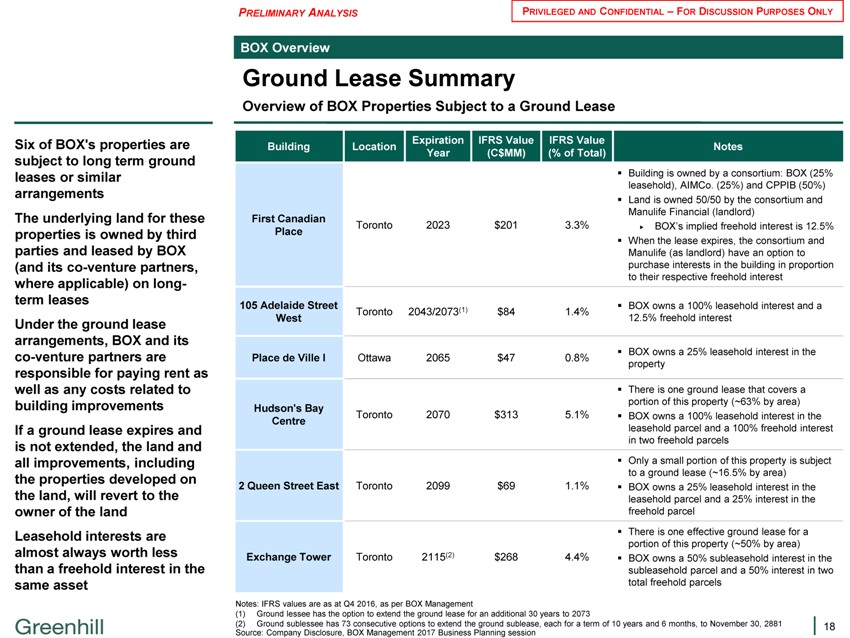

BOX Overview

Ground Lease Summary

Overview of BOX Properties Subject to a Ground Lease

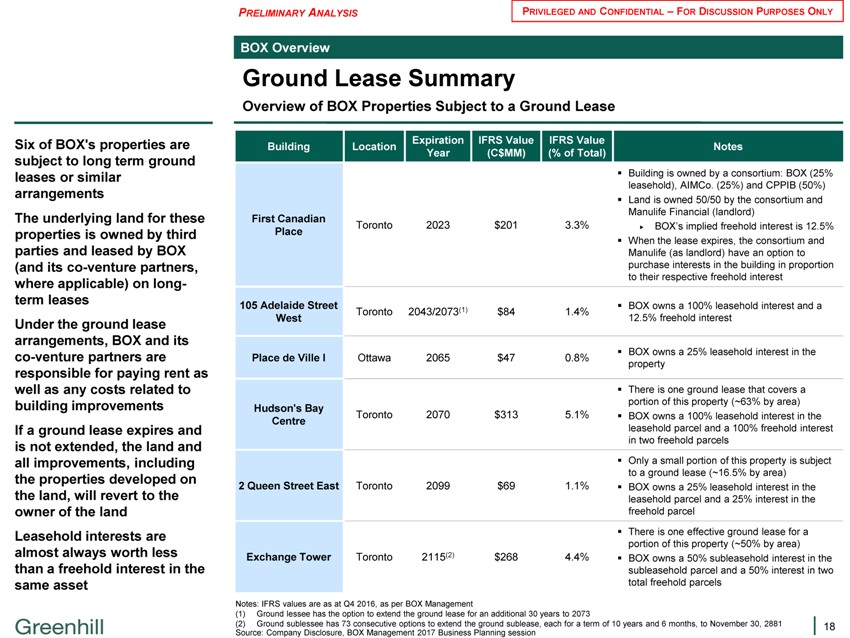

Six of BOX’s properties are subject to long term ground leases or similar arrangements The underlying land for these properties is owned by third parties and leased by BOX (and its co-venture partners, where applicable) on long-term leases Under the ground lease arrangements, BOX and its co-venture partners are responsible for paying rent as well as any costs related to building improvements If a ground lease expires and is not extended, the land and all improvements, including the properties developed on the land, will revert to the owner of the land Leasehold interests are almost always worth less than a freehold interest in the same asset

Expiration IFRS Value IFRS Value

Building Location Notes Year (C$MM) (% of Total)

? Building is owned by a consortium: BOX (25% leasehold), AIMCo. (25%) and CPPIB (50%) ? Land is owned 50/50 by the consortium and Manulife Financial (landlord)

First Canadian

Toronto 2023 $201 3.3% ? BOX’s implied freehold interest is 12.5%

Place ? When the lease expires, the consortium and Manulife (as landlord) have an option to purchase interests in the building in proportion to their respective freehold interest

105 Adelaide Street ? BOX owns a 100% leasehold interest and a

West Toronto 2043/2073(1) $84 1.4% 12.5% freehold interest

? BOX owns a 25% leasehold interest in the

Place de Ville I Ottawa 2065 $47 0.8% property

? There is one ground lease that covers a portion of this property (~63% by area)

Hudson’s Bay

Toronto 2070 $313 5.1% ? BOX owns a 100% leasehold interest in the

Centre leasehold parcel and a 100% freehold interest in two freehold parcels

? Only a small portion of this property is subject to a ground lease (~16.5% by area)

2 Queen Street East Toronto 2099 $69 1.1% ? BOX owns a 25% leasehold interest in the leasehold parcel and a 25% interest in the freehold parcel

? There is one effective ground lease for a portion of this property (~50% by area) Exchange Tower Toronto 2115(2) $268 4.4% ? BOX owns a 50% subleasehold interest in the subleasehold parcel and a 50% interest in two total freehold parcels

Notes: IFRS values are as at Q4 2016, as per BOX Management

(1) Ground lessee has the option to extend the ground lease for an additional 30 years to 2073

(2) Ground sublessee has 73 consecutive options to extend the ground sublease, each for a term of 10 years and 6 months, to November 30, 2881 Source: Company Disclosure, BOX Management 2017 Business Planning session

Greenhill

18

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY BOX Overview Historical Price Performance Price Performance of BOX and Select Canadian and U.S. Office-weighted REIT Peers(2) Prices Prior to Offer Unaffected Date(1) BOX Price Statistics C$ per Unit; Based on TSX closing pricesTime Trading Range Avg. VWAP Period Price(3) Low High Last 30 $25.60 $27.07 $26.27 $26.41Days Last 90 $25.02 $28.28 $26.49 $26.39DaysLTM $25.02 $29.35 $27.58 $27.62 L3Y $23.65 $30.39 $27.19 $27.26 L5Y $23.65 $30.40 $27.22 $27.32Peer Price Performance Cdn US BOXPeers PeersLast 5 Years 5.5% (3.9%) 52.3% Last 3 Years 0.0% (4.4%) 37.1% Last 12 Months 4.8% 23.2% 26.6% Last 6 Months (9.4%) (6.0%) 1.8% Last 3 Months (3.8%) (1.4%) 4.2%BOX – Unit Price Performance (Last 5 Years Prior to Unaffected Date) $32 700 Offer: $30.10$28 $27.26 $27.62 $26.39 350 $24$20 0 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Volume (000s) Unit Price (C$) VWAP (90D) VWAP (LTM) VWAP (L3Y)Relative Price Performance (Last 5 Years Prior to Unaffected Date) Indexed to 100180160 US Peers 52% 140120 BOX 5% 100(4%)Cdn Peers 8060Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Brookfield Canada Office Properties Canadian Office-weighted REIT Peers US Office-weighted REIT Peers(1) Unaffected date of 20-Jan-2017 (one business day prior to the offer announcement on 23-Jan-2017) (2) Based on selected peers with available 5-year historical trading data. Canadian office-weighted REIT peer group includes H&R REIT, Dream Office REIT and Allied Properties. US office-weighted REIT peer group includes Vornado Realty, Boston Properties, SL Green Realty, Douglas Emmett, Kilroy Realty, Alexandria Real Estate Equities and Piedmont Office Realty (3) Calculated as an arithmetic mean of the closing unit prices over each time period Source: FactSet, Capital IQ Greenhill19

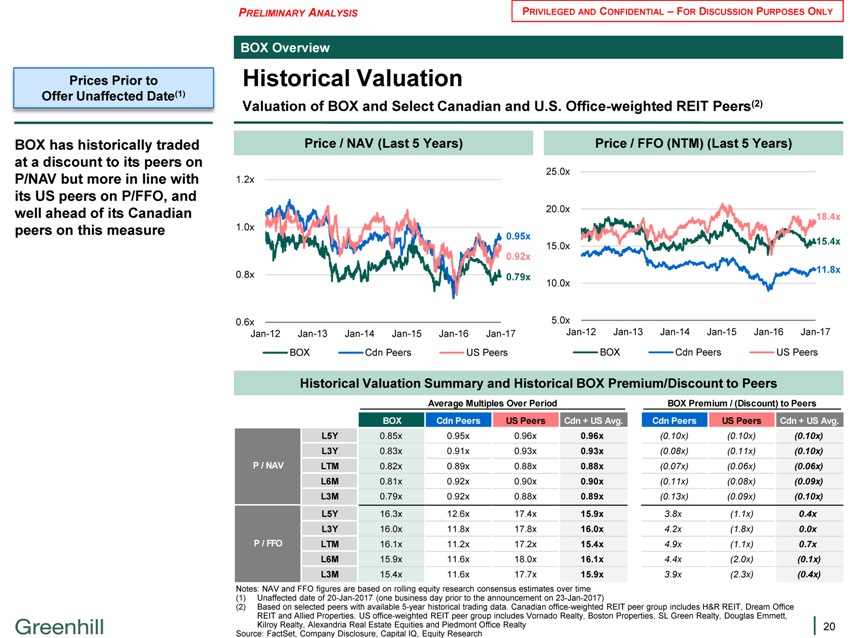

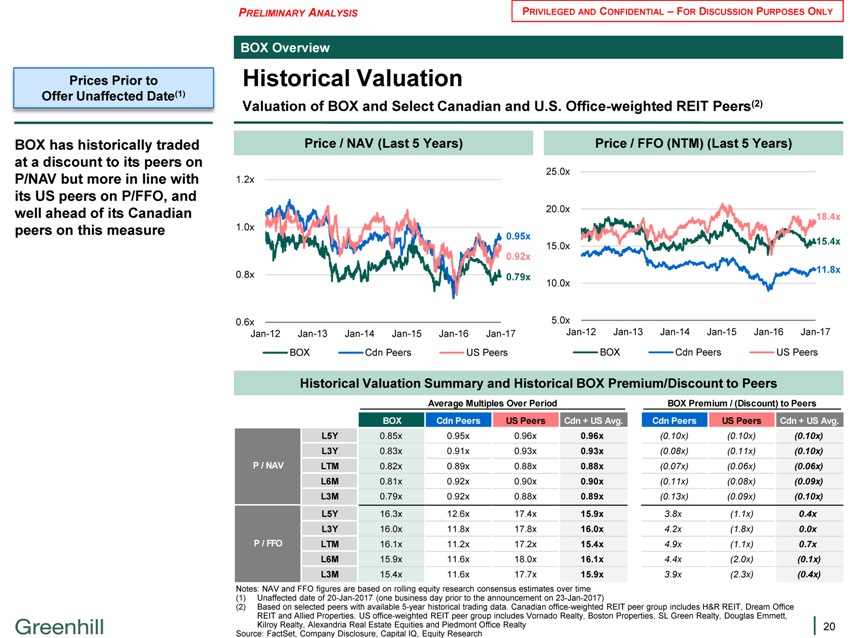

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY BOX Overview Historical Valuation Valuation of BOX and Select Canadian and U.S. Office-weighted REIT Peers(2) Prices Prior to Offer Unaffected Date(1) BOX has historically traded at a discount to its peers on P/NAV but more in line with its US peers on P/FFO, and well ahead of its Canadian peers on this measure Price / NAV (Last 5 Years) Price / FFO (NTM) (Last 5 Years) 25.0x1.2x20.0x18.4x 1.0x0.95x 15.4x 15.0x0.92x 11.8x 0.8x 0.79x 10.0x0.6x 5.0xJan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 BOX Cdn Peers US Peers BOX Cdn Peers US PeersHistorical Valuation Summary and Historical BOX Premium/Discount to Peers Average Multiples Over Period BOX Premium / (Discount) to Peers BOX Cdn Peers US Peers Cdn + US Avg. Cdn Peers US Peers Cdn + US Avg.L5Y 0.85x 0.95x 0.96x 0.96x (0.10x) (0.10x) (0.10x) L3Y 0.83x 0.91x 0.93x 0.93x (0.08x) (0.11x) (0.10x) P / NAV LTM 0.82x 0.89x 0.88x 0.88x (0.07x) (0.06x) (0.06x) L6M 0.81x 0.92x 0.90x 0.90x (0.11x) (0.08x) (0.09x) L3M 0.79x 0.92x 0.88x 0.89x (0.13x) (0.09x) (0.10x) L5Y 16.3x 12.6x 17.4x 15.9x 3.8x (1.1x) 0.4x L3Y 16.0x 11.8x 17.8x 16.0x 4.2x (1.8x) 0.0x P / FFO LTM 16.1x 11.2x 17.2x 15.4x 4.9x (1.1x) 0.7x L6M 15.9x 11.6x 18.0x 16.1x 4.4x (2.0x) (0.1x) L3M 15.4x 11.6x 17.7x 15.9x 3.9x (2.3x) (0.4x)Notes: NAV and FFO figures are based on rolling equity research consensus estimates over time (1) Unaffected date of 20-Jan-2017 (one business day prior to the announcement on 23-Jan-2017) (2) Based on selected peers with available 5-year historical trading data. Canadian office-weighted REIT peer group includes H&R REIT, Dream Office REIT and Allied Properties. US office-weighted REIT peer group includes Vornado Realty, Boston Properties, SL Green Realty, Douglas Emmett, Kilroy Realty, Alexandria Real Estate Equities and Piedmont Office Realty Source: FactSet, Company Disclosure, Capital IQ, Equity Research Greenhill20

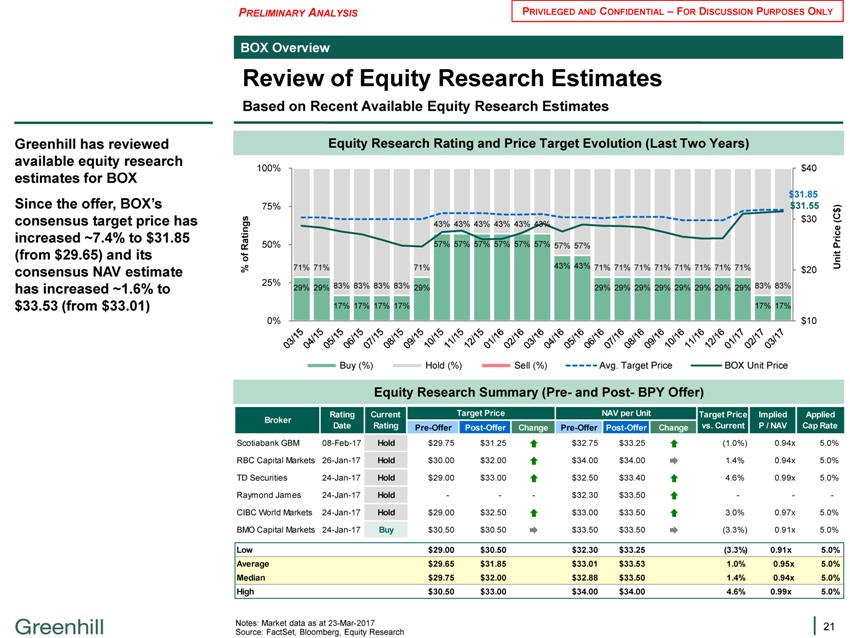

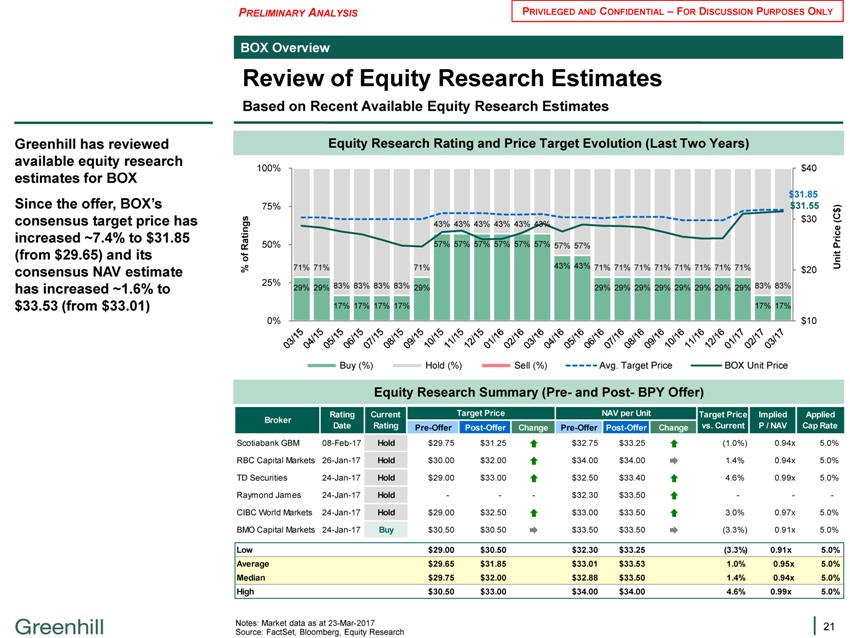

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY BOX Overview Review of Equity Research Estimates Based on Recent Available Equity Research Estimates Greenhill has reviewed available equity research estimates for BOX Since the offer, BOX’s consensus target price has increased ~7.4% to $31.85 (from $29.65) and its consensus NAV estimate has increased ~1.6% to $33.53 (from $33.01) Equity Research Rating and Price Target Evolution (Last Two Years) 100% $40$31.85 75% $31.55 $ )$30(C43% 43% 43% 43% 43% 43% tings c e a 50% 57% 57% 57% 57% 57% 57% Pri R 57% 57% of t ni% 71% 71% 71% 43% 43% 71% 71% 71% 71% 71% 71% 71% 71% $20 U25% 83% 83% 83% 83% 83% 83% 29% 29% 29% 29% 29% 29% 29% 29% 29% 29% 29% 17% 17% 17% 17% 17% 17% 0% $10Buy (%) Hold (%) Sell (%) Avg. Target Price BOX Unit PriceEquity Research Summary (Pre- and Post- BPY Offer) Broker Rating Current Target Price NAV per Unit Target Price Implied Applied Date Rating Pre-Offer Post-Offer Change Pre-Offer Post-Offer Change vs. Current P / NAV Cap RateScotiabank GBM 08-Feb-17 Hold $29.75 $31.25? $32.75 $33.25? (1.0%) 0.94x 5.0% RBC Capital Markets 26-Jan-17 Hold $30.00 $32.00? $34.00 $34.00? 1.4% 0.94x 5.0% TD Securities 24-Jan-17 Hold $29.00 $33.00? $32.50 $33.40? 4.6% 0.99x 5.0% Raymond James 24-Jan-17 Hold ——$32.30 $33.50? — -CIBC World Markets 24-Jan-17 Hold $29.00 $32.50? $33.00 $33.50? 3.0% 0.97x 5.0% BMO Capital Markets 24-Jan-17 Buy $30.50 $30.50? $33.50 $33.50? (3.3%) 0.91x 5.0%Low $29.00 $30.50 $32.30 $33.25 (3.3%) 0.91x 5.0% Average $29.65 $31.85 $33.01 $33.53 1.0% 0.95x 5.0% Median $29.75 $32.00 $32.88 $33.50 1.4% 0.94x 5.0% High $30.50 $33.00 $34.00 $34.00 4.6% 0.99x 5.0%Notes: Market data as at 23-Mar-2017 Source: FactSet, Bloomberg, Equity Research Greenhill21

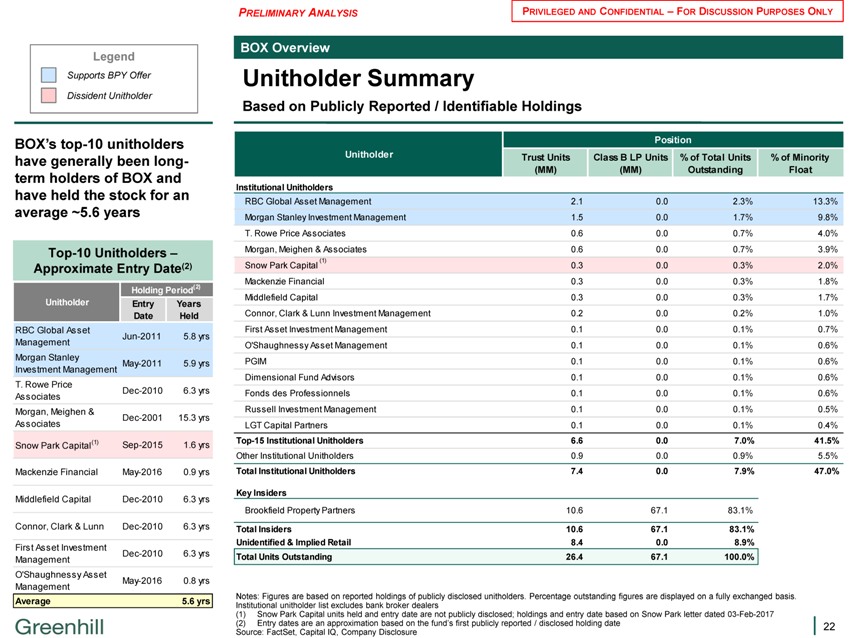

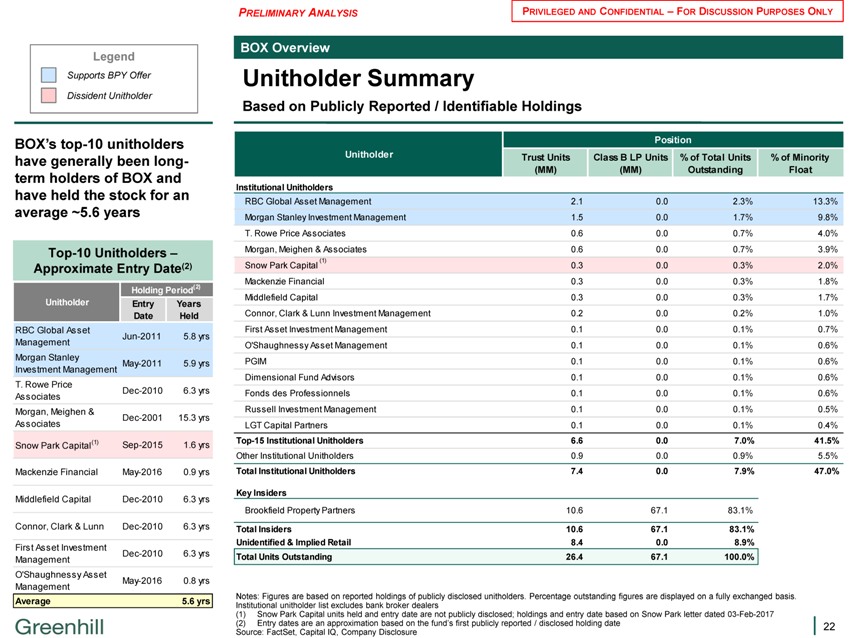

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY BOX Overview Unitholder Summary Based on Publicly Reported / Identifiable Holdings Legend Supports BPY Offer Dissident Unitholder BOX’s top-10 unitholders have generally been long-term holders of BOX and have held the stock for an average ~5.6 years Top-10 Unitholders – Approximate Entry Date(2) Holding Period(2) Unitholder Entry Years Date HeldRBC Global Asset Jun-2011 5.8 yrs Management Morgan Stanley May-2011 5.9 yrs Investment Management T. Rowe Price Dec-2010 6.3 yrs Associates Morgan, Meighen & Dec-2001 15.3 yrs AssociatesSnow Park Capital(1) Sep-2015 1.6 yrsMackenzie Financial May-2016 0.9 yrsMiddlefield Capital Dec-2010 6.3 yrsConnor, Clark & Lunn Dec-2010 6.3 yrsFirst Asset Investment Dec-2010 6.3 yrs Management O’Shaughnessy Asset May-2016 0.8 yrs ManagementAverage 5.6 yrsPositionUnitholder Trust Units Class B LP Units % of Total Units % of Minority (MM) (MM) Outstanding FloatInstitutional UnitholdersRBC Global Asset Management 2.1 0.0 2.3% 13.3% Morgan Stanley Investment Management 1.5 0.0 1.7% 9.8% T. Rowe Price Associates 0.6 0.0 0.7% 4.0% Morgan, Meighen & Associates 0.6 0.0 0.7% 3.9%(1)Snow Park Capital 0.3 0.0 0.3% 2.0% Mackenzie Financial 0.3 0.0 0.3% 1.8% Middlefield Capital 0.3 0.0 0.3% 1.7% Connor, Clark & Lunn Investment Management 0.2 0.0 0.2% 1.0% First Asset Investment Management 0.1 0.0 0.1% 0.7% O’Shaughnessy Asset Management 0.1 0.0 0.1% 0.6% PGIM 0.1 0.0 0.1% 0.6% Dimensional Fund Advisors 0.1 0.0 0.1% 0.6% Fonds des Professionnels 0.1 0.0 0.1% 0.6% Russell Investment Management 0.1 0.0 0.1% 0.5% LGT Capital Partners 0.1 0.0 0.1% 0.4%Top-15 Institutional Unitholders 6.6 0.0 7.0% 41.5%Other Institutional Unitholders 0.9 0.0 0.9% 5.5%Total Institutional Unitholders 7.4 0.0 7.9% 47.0%Key InsidersBrookfield Property Partners 10.6 67.1 83.1%Total Insiders 10.6 67.1 83.1% Unidentified & Implied Retail 8.4 0.0 8.9% Total Units Outstanding 26.4 67.1 100.0%Notes: Figures are based on reported holdings of publicly disclosed unitholders. Percentage outstanding figures are displayed on a fully exchanged basis. Institutional unitholder list excludes bank broker dealers (1) Snow Park Capital units held and entry date are not publicly disclosed; holdings and entry date based on Snow Park letter dated 03-Feb-2017 (2) Entry dates are an approximation based on the fund’s first publicly reported / disclosed holding date Source: FactSet, Capital IQ, Company Disclosure Greenhill22

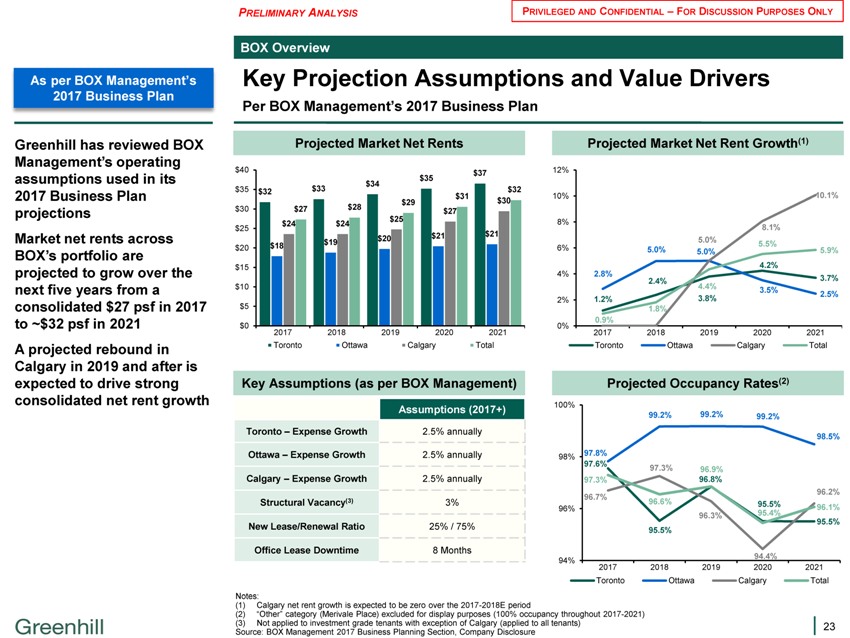

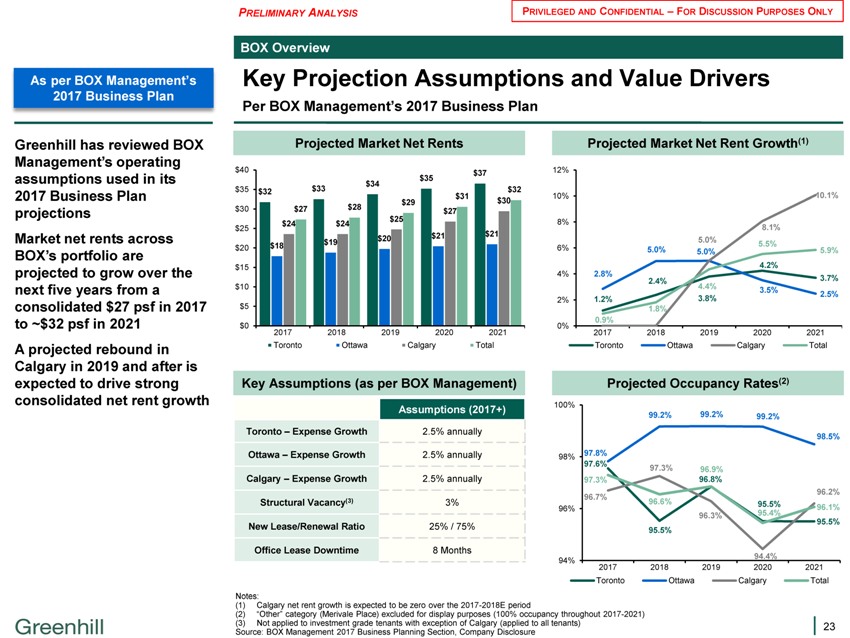

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY BOX Overview Key Projection Assumptions and Value Drivers Per BOX Management’s 2017 Business Plan As per BOX Management’s2017 Business Plan Greenhill has reviewed BOX Management’s operating assumptions used in its 2017 Business Plan projections Market net rents across BOX’s portfolio are projected to grow over the next five years from a consolidated $27 psf in 2017 to ~$32 psf in 2021 A projected rebound in Calgary in 2019 and after is expected to drive strong consolidated net rent growth Projected Market Net Rents $40 $37 $35 $34 $35 $32 $33 $31 $32 $29 $30 $30 $27 $28 $27 $25 $24 $24 $25$21 $21 $20 $18 $19 $20$15 $10 $5$0 2017 2018 2019 2020 2021 Toronto Ottawa Calgary TotalKey Assumptions (as per BOX Management) Assumptions (2017+) Toronto – Expense Growth 2.5% annually Ottawa – Expense Growth 2.5% annually Calgary – Expense Growth 2.5% annually Structural Vacancy(3) 3% New Lease/Renewal Ratio 25% / 75% Office Lease Downtime 8 Months Projected Market Net Rent Growth(1) 12%10% 10.1% 8%8.1% 5.0% 5.5% 6% 5.0% 5.9% 5.0% 4.2% 4% 2.8% 2.4% 3.7% 4.4% 3.5% 2.5% 2% 1.2% 3.8% 1.8% 0.9% 0% 2017 2018 2019 2020 2021 Toronto Ottawa Calgary TotalProjected Occupancy Rates(2) 100%99.2% 99.2% 99.2%98.5%97.8% 98% 97.6%97.3% 96.9% 97.3% 96.8%96.2% 96.7% 96.6% 95.5% 96% 96.1% 96.3% 95.4% 95.5% 95.5%94.4%94% 2017 2018 2019 2020 2021 Toronto Ottawa Calgary TotalNotes: (1) Calgary net rent growth is expected to be zero over the 2017-2018E period (2) “Other” category (Merivale Place) excluded for display purposes (100% occupancy throughout 2017-2021) (3) Not applied to investment grade tenants with exception of Calgary (applied to all tenants) Source: BOX Management 2017 Business Planning Section, Company Disclosure Greenhill23

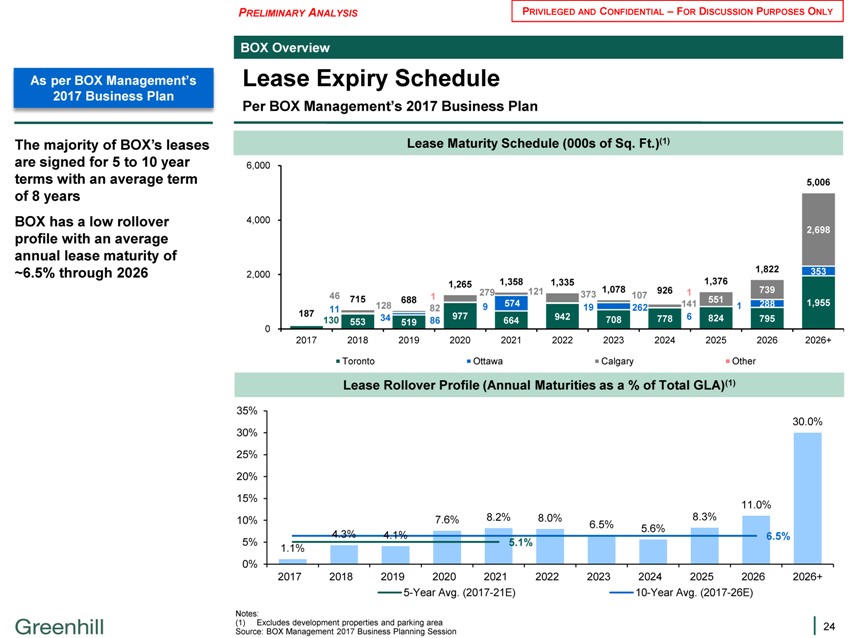

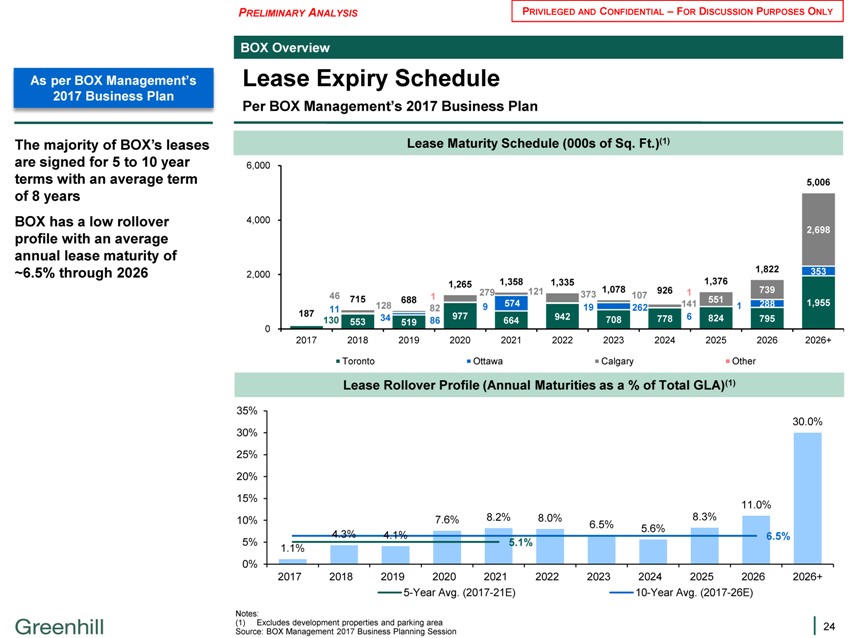

As per BOX Management’s

2017 Business Plan

The majority of BOX’s leases are signed for 5 to 10 year terms with an average term of 8 years BOX has a low rollover profile with an average annual lease maturity of ~6.5% through 2026

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

BOX Overview

Lease Expiry Schedule

Per BOX Management’s 2017 Business Plan

Lease Maturity Schedule (000s of Sq. Ft.)(1)

6,000

5,006

4,000

2,698

2,000 1,822 353

1,265 1,358 1,335 1,376

46 715 1 279 121 373 1,078 107 926 1 739

128 688 82 574 141 551 1 288 1,955

11 9 19 262

187 130 553 34 519 86 977 664 942 708 778 6 824 795

0

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2026+

Toronto Ottawa Calgary Other

Lease Rollover Profile (Annual Maturities as a % of Total GLA)(1)

35%

30.0%

30%

25%

20%

15% 11.0%

10% 7.6% 8.2% 8.0% 6.5% 8.3%

5.6%

4.3% 4.1% 6.5%

5% 5.1%

1.1%

0%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2026+

5-Year Avg. (2017-21E) 10-Year Avg. (2017-26E)

Notes:

(1) Excludes development properties and parking area Source: BOX Management 2017 Business Planning Session

24

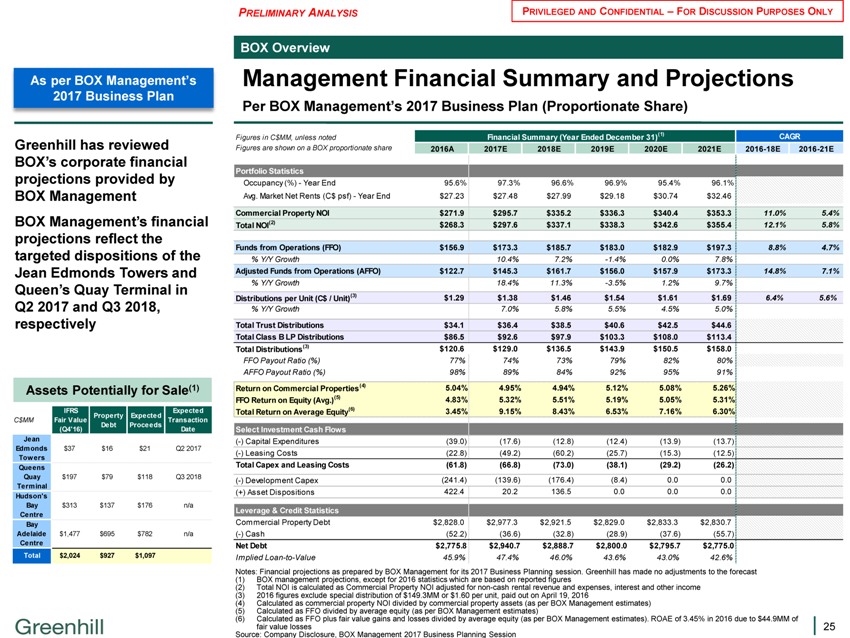

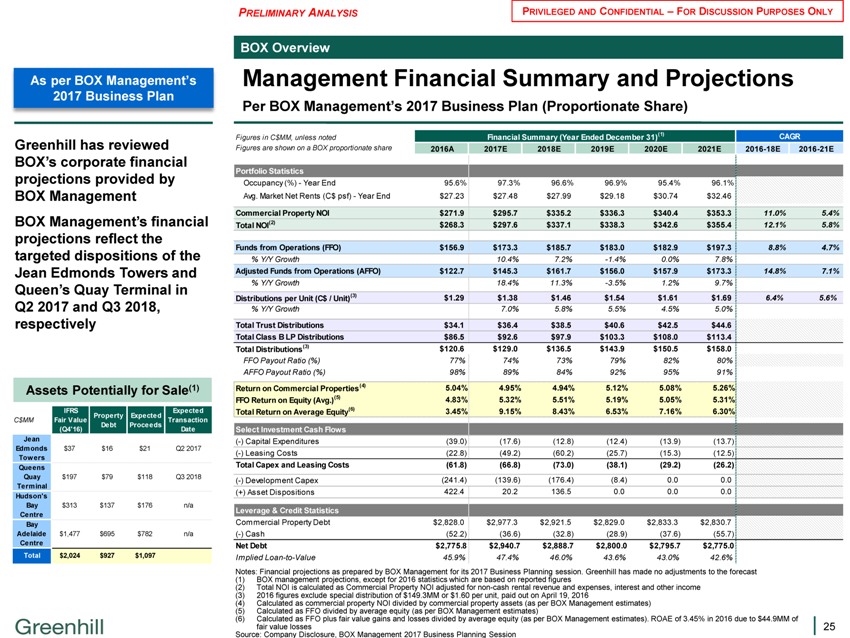

As per BOX Management’s

2017 Business Plan

Greenhill has reviewed

BOX’s corporate financial projections provided by BOX Management

BOX Management’s financial projections reflect the targeted dispositions of the Jean Edmonds Towers and

Queen’s Quay Terminal in

Q2 2017 and Q3 2018, respectively

Assets Potentially for Sale(1)

IFRS Expected

Property Expected

C$MM Fair Value Transaction

Debt Proceeds

(Q4’16) Date

Jean

Edmonds $37 $16 $21 Q2 2017

Tow ers

Queens

Quay $197 $79 $118 Q3 2018

Terminal

Hudson’s

Bay $313 $137 $176 n/a

Centre

Bay

Adelaide $1,477 $695 $782 n/a

Centre

Total $2,024 $927 $1,097

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

BOX Overview

Management Financial Summary and Projections

Per BOX Management’s 2017 Business Plan (Proportionate Share)

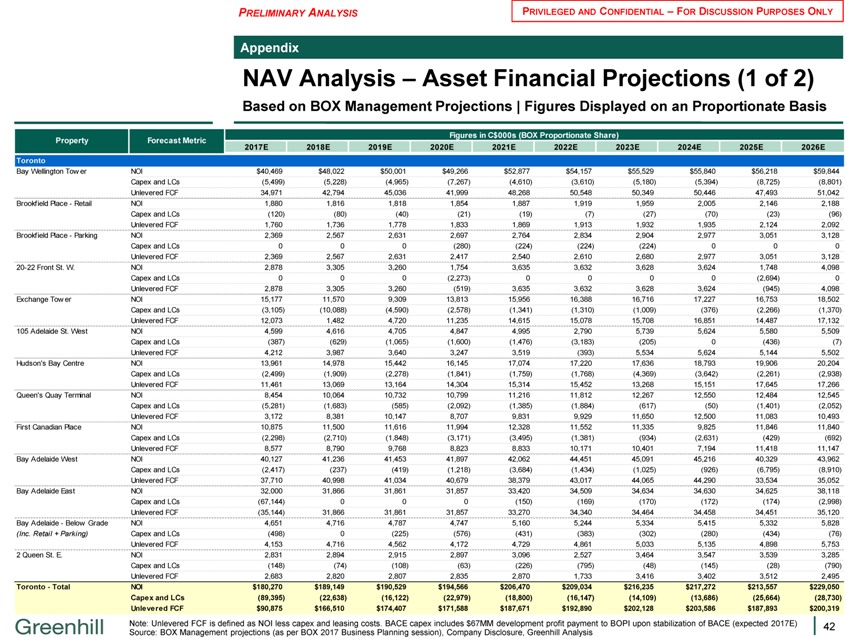

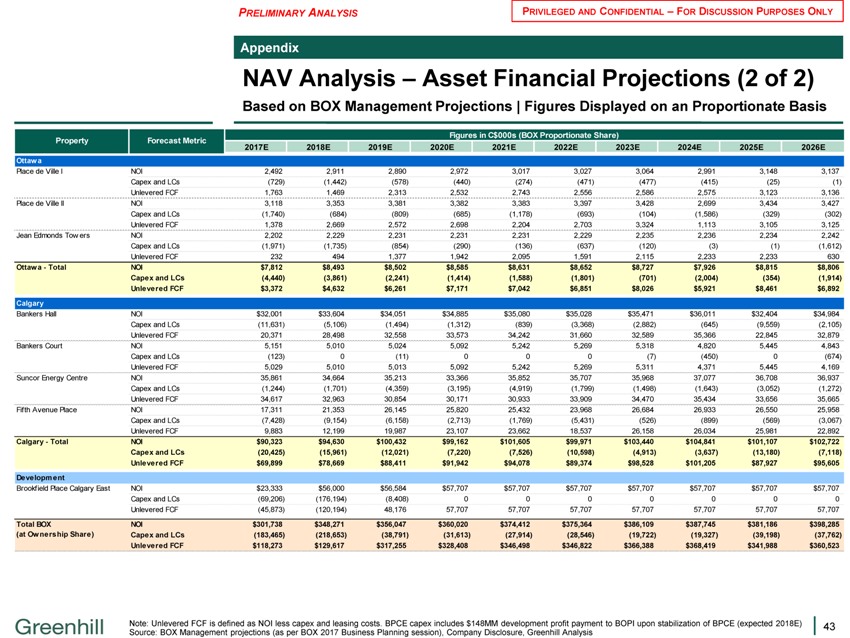

Figures in C$MM, unless noted Financial Summary (Year Ended December 31)(1) CAGR

Figures are shown on a BOX proportionate share 2016A 2017E 2018E 2019E 2020E 2021E 2016-18E 2016-21E

Portfolio Statistics

Occupancy (%)—Year End 95.6% 97.3% 96.6% 96.9% 95.4% 96.1%

Avg. Market Net Rents (C$ psf)—Year End $27.23 $27.48 $27.99 $29.18 $30.74 $32.46

Commercial Property NOI $271.9 $295.7 $335.2 $336.3 $340.4 $353.3 11.0% 5.4%

Total NOI(2) $268.3 $297.6 $337.1 $338.3 $342.6 $355.4 12.1% 5.8%

Funds from Operations (FFO) $156.9 $173.3 $185.7 $183.0 $182.9 $197.3 8.8% 4.7%

% Y/Y Growth 10.4% 7.2% -1.4% 0.0% 7.8%

Adjusted Funds from Operations (AFFO) $122.7 $145.3 $161.7 $156.0 $157.9 $173.3 14.8% 7.1%

% Y/Y Growth 18.4% 11.3% -3.5% 1.2% 9.7%

Distributions per Unit (C$ / Unit)(3) $1.29 $1.38 $1.46 $1.54 $1.61 $1.69 6.4% 5.6%

% Y/Y Growth 7.0% 5.8% 5.5% 4.5% 5.0%

Total Trust Distributions $34.1 $36.4 $38.5 $40.6 $42.5 $44.6

Total Class B LP Distributions $86.5 $92.6 $97.9 $103.3 $108.0 $113.4

Total Distributions(3) $120.6 $129.0 $136.5 $143.9 $150.5 $158.0

FFO Payout Ratio (%) 77% 74% 73% 79% 82% 80%

AFFO Payout Ratio (%) 98% 89% 84% 92% 95% 91%

Return on Commercial Properties(4) 5.04% 4.95% 4.94% 5.12% 5.08% 5.26%

FFO Return on Equity (Avg.)(5) 4.83% 5.32% 5.51% 5.19% 5.05% 5.31%

Total Return on Average Equity(6) 3.45% 9.15% 8.43% 6.53% 7.16% 6.30%

Select Investment Cash Flows

(-) Capital Expenditures(39.0)(17.6)(12.8)(12.4)(13.9)(13.7)

(-) Leasing Costs(22.8)(49.2)(60.2)(25.7)(15.3)(12.5)

Total Capex and Leasing Costs(61.8)(66.8)(73.0)(38.1)(29.2)(26.2)

(-) Development Capex(241.4)(139.6)(176.4)(8.4) 0.0 0.0

(+) Asset Dispositions 422.4 20.2 136.5 0.0 0.0 0.0

Leverage & Credit Statistics

Commercial Property Debt $2,828.0 $2,977.3 $2,921.5 $2,829.0 $2,833.3 $2,830.7

(-) Cash(52.2)(36.6)(32.8)(28.9)(37.6)(55.7)

Net Debt $2,775.8 $2,940.7 $2,888.7 $2,800.0 $2,795.7 $2,775.0

Implied Loan-to-Value 45.9% 47.4% 46.0% 43.6% 43.0% 42.6%

Notes: Financial projections as prepared by BOX Management for its 2017 Business Planning session. Greenhill has made no adjustments to the forecast (1) BOX management projections, except for 2016 statistics which are based on reported figures (2) Total NOI is calculated as Commercial Property NOI adjusted for non-cash rental revenue and expenses, interest and other income (3) 2016 figures exclude special distribution of $149.3MM or $1.60 per unit, paid out on April 19, 2016 (4) Calculated as commercial property NOI divided by commercial property assets (as per BOX Management estimates) (5) Calculated as FFO divided by average equity (as per BOX Management estimates)

(6) Calculated as FFO plus fair value gains and losses divided by average equity (as per BOX Management estimates). ROAE of 3.45% in 2016 due to $44.9MM of fair value losses Source: Company Disclosure, BOX Management 2017 Business Planning Session

25

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Table of Contents

1. Situation Overview

2. BOX Overview

3. Preliminary Valuation Analysis

Appendix

26

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

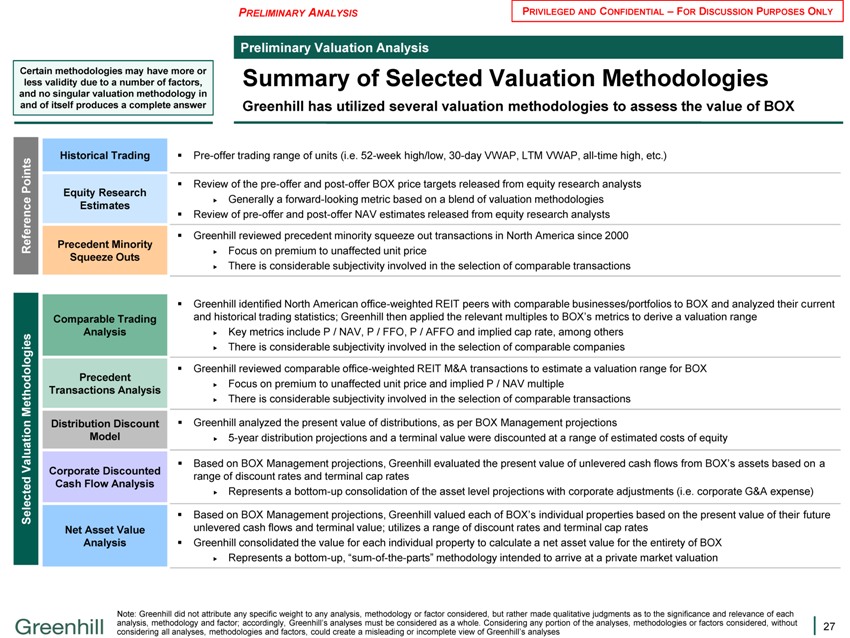

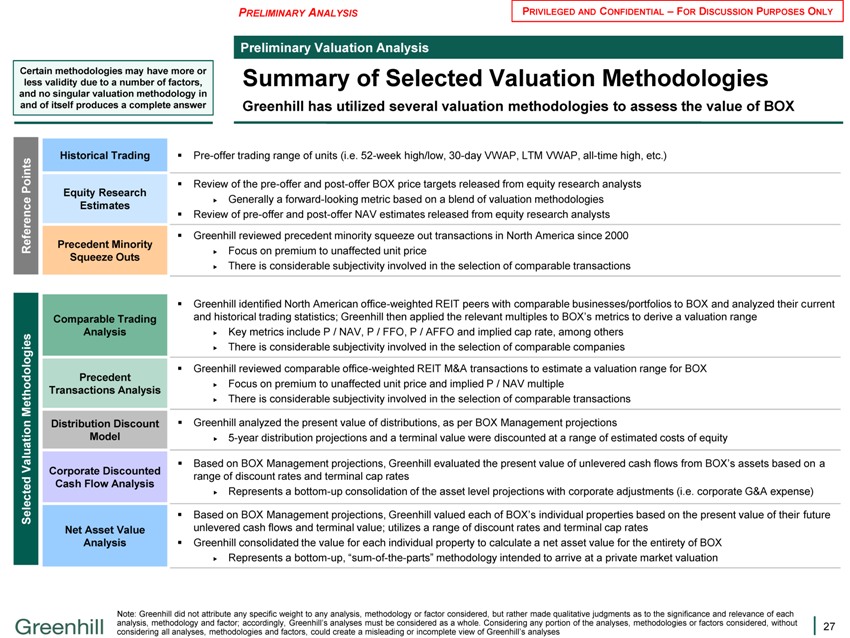

Preliminary Valuation Analysis

Summary of Selected Valuation Methodologies

Greenhill has utilized several valuation methodologies to assess the value of BOX

Certain methodologies may have more or less validity due to a number of factors, and no singular valuation methodology in and of itself produces a complete answer

Historical Trading Pre-offer trading range of units (i.e. 52-week high/low, 30-day VWAP, LTM VWAP, all-time high, etc.)

Points Review of the pre-offer and post-offer BOX price targets released from equity research analysts

Equity Research

Estimates Generally a forward-looking metric based on a blend of valuation methodologies

Review of pre-offer and post-offer NAV estimates released from equity research analysts

Greenhill reviewed precedent minority squeeze out transactions in North America since 2000

Reference Precedent Minority

Squeeze Outs Focus on premium to unaffected unit price

There is considerable subjectivity involved in the selection of comparable transactions

Greenhill identified North American office-weighted REIT peers with comparable businesses/portfolios to BOX and analyzed their current

Comparable Trading and historical trading statistics; Greenhill then applied the relevant multiples to BOX’s metrics to derive a valuation range

Analysis Key metrics include P / NAV, P / FFO, P / AFFO and implied cap rate, among others

There is considerable subjectivity involved in the selection of comparable companies

Greenhill reviewed comparable office-weighted REIT M&A transactions to estimate a valuation range for BOX

Precedent

Transactions Analysis Focus on premium to unaffected unit price and implied P / NAV multiple

Methodologies There is considerable subjectivity involved in the selection of comparable transactions

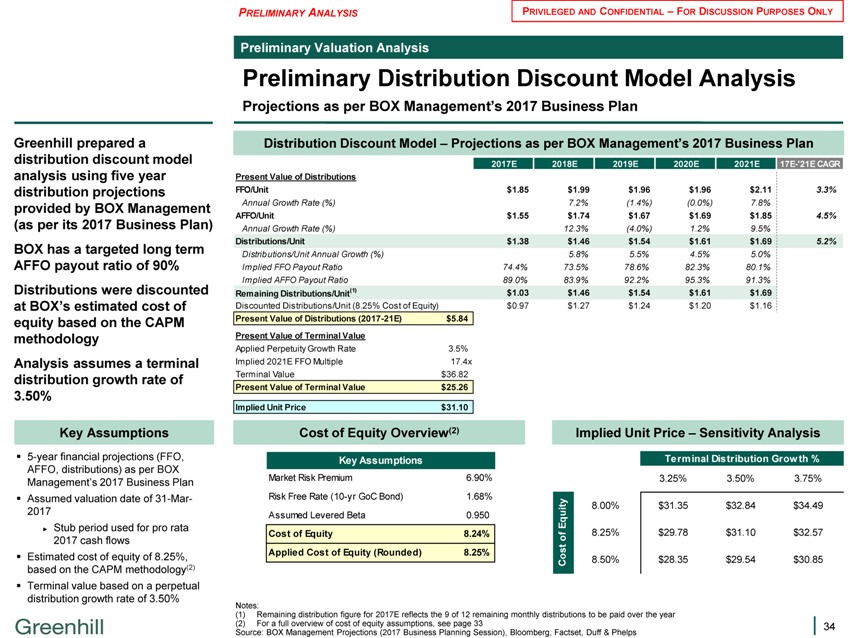

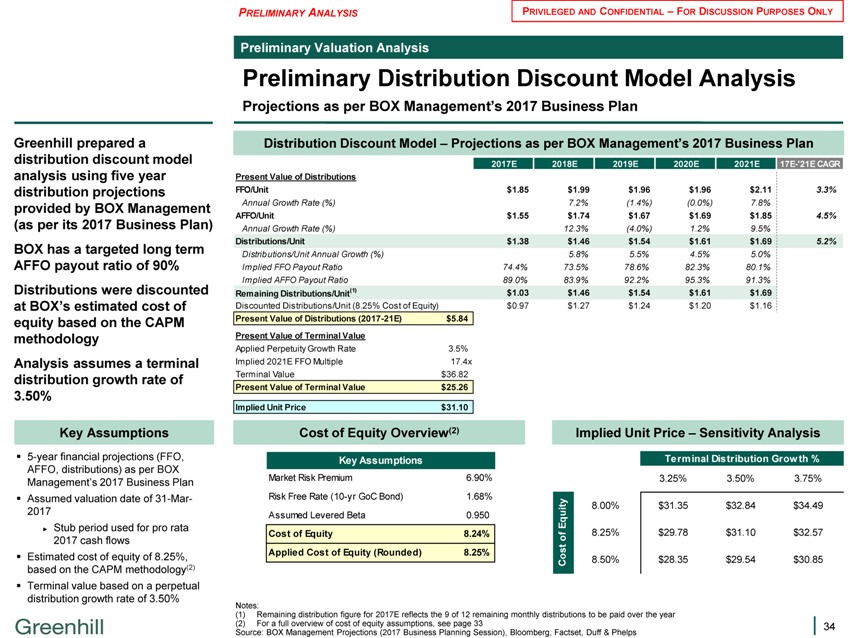

Distribution Discount Greenhill analyzed the present value of distributions, as per BOX Management projections

Model 5-year distribution projections and a terminal value were discounted at a range of estimated costs of equity

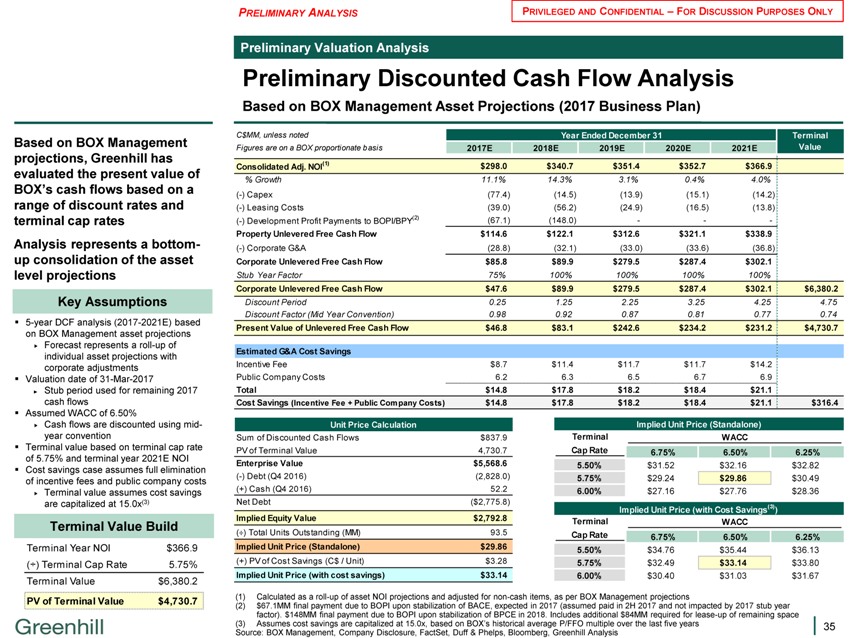

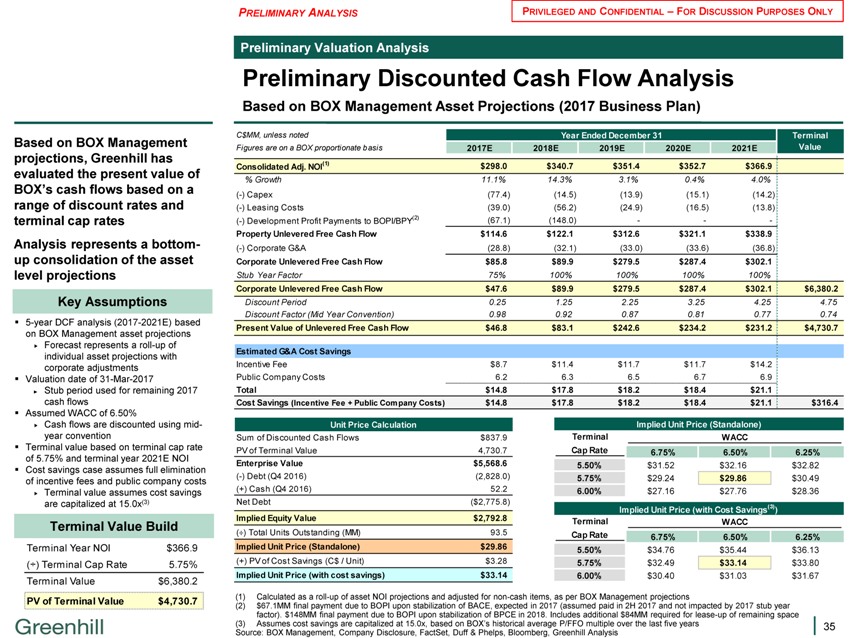

Valuation Based on BOX Management projections, Greenhill evaluated the present value of unlevered cash flows from BOX’s assets based on a

Corporate Discounted range of discount rates and terminal cap rates

Cash Flow Analysis

Represents a bottom-up consolidation of the asset level projections with corporate adjustments (i.e. corporate G&A expense)

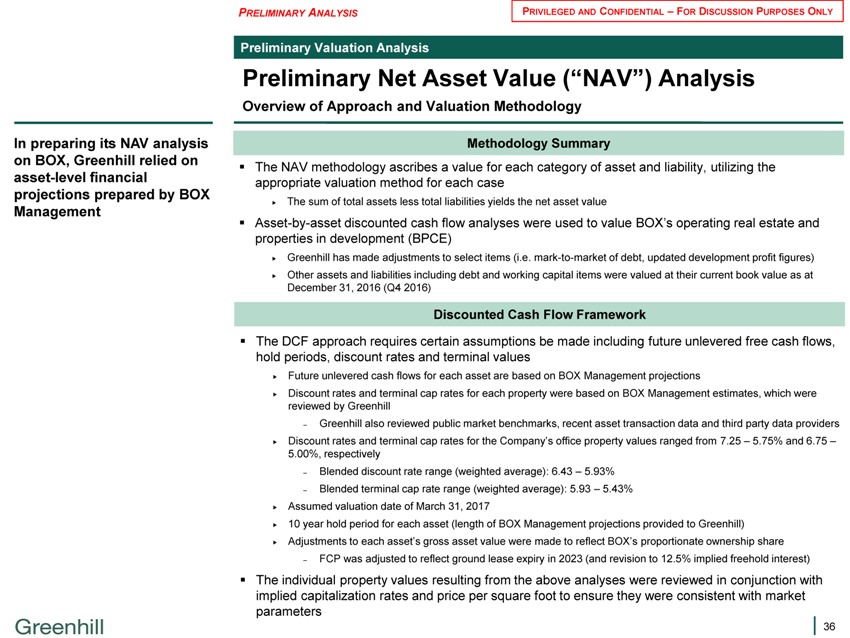

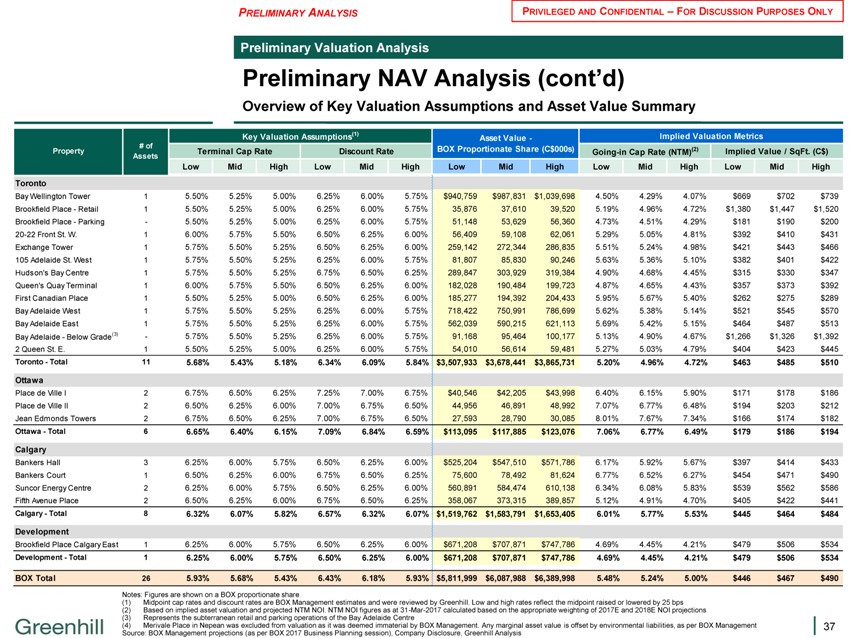

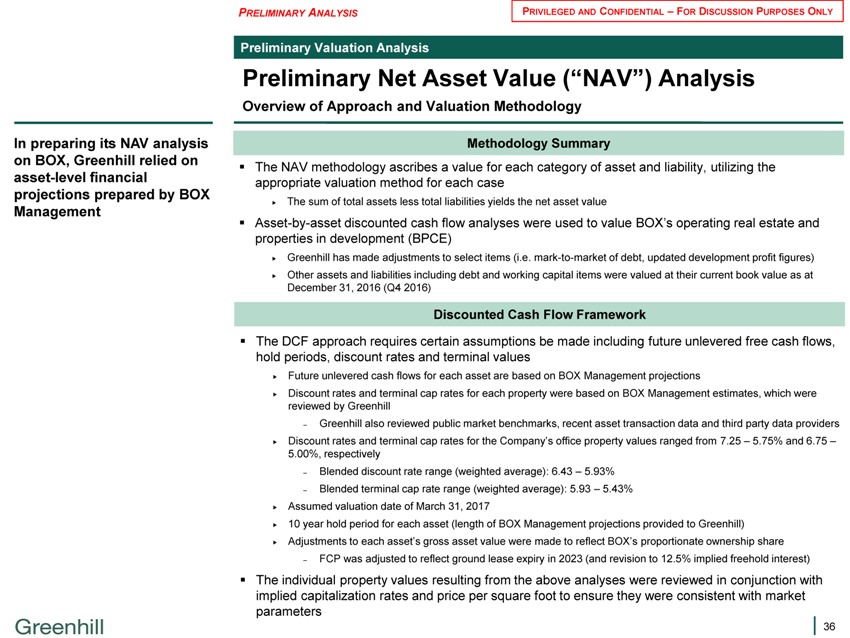

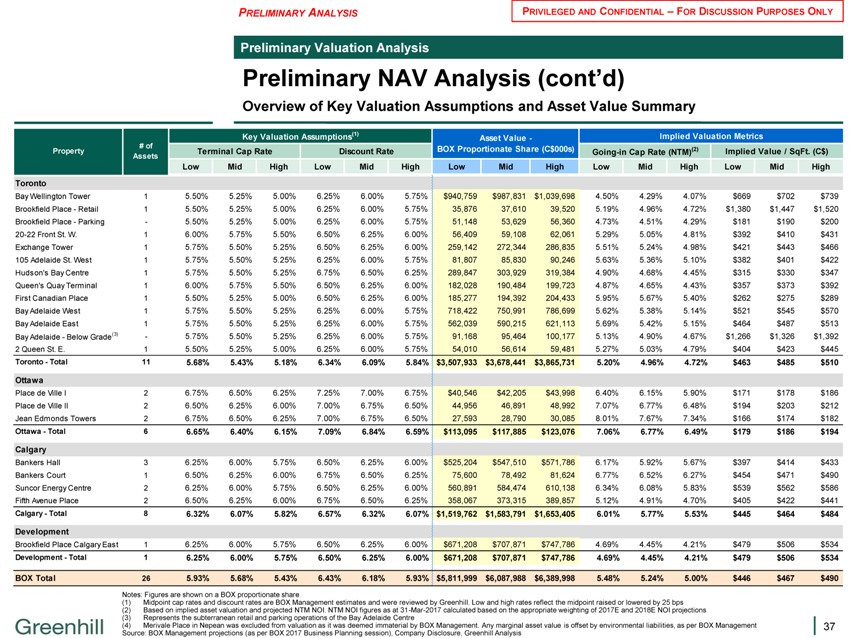

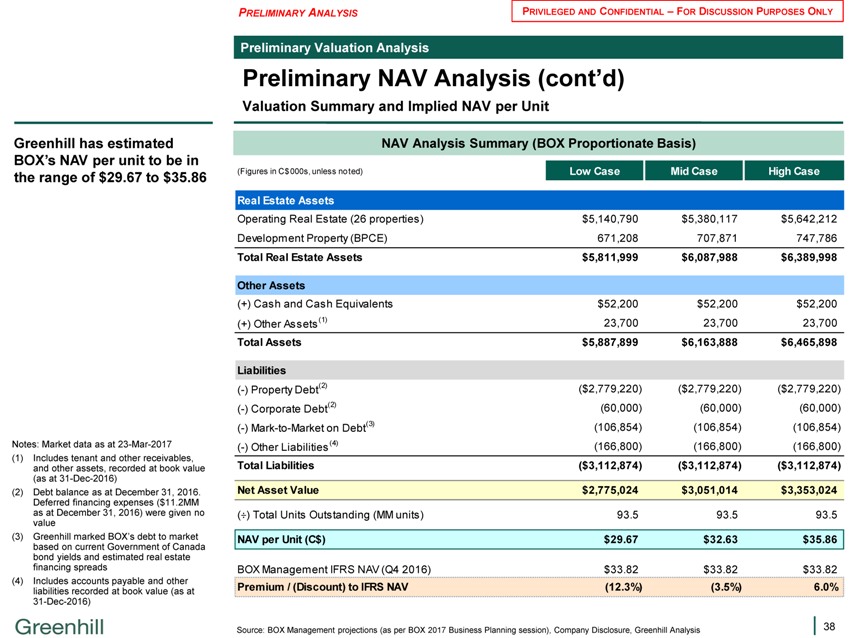

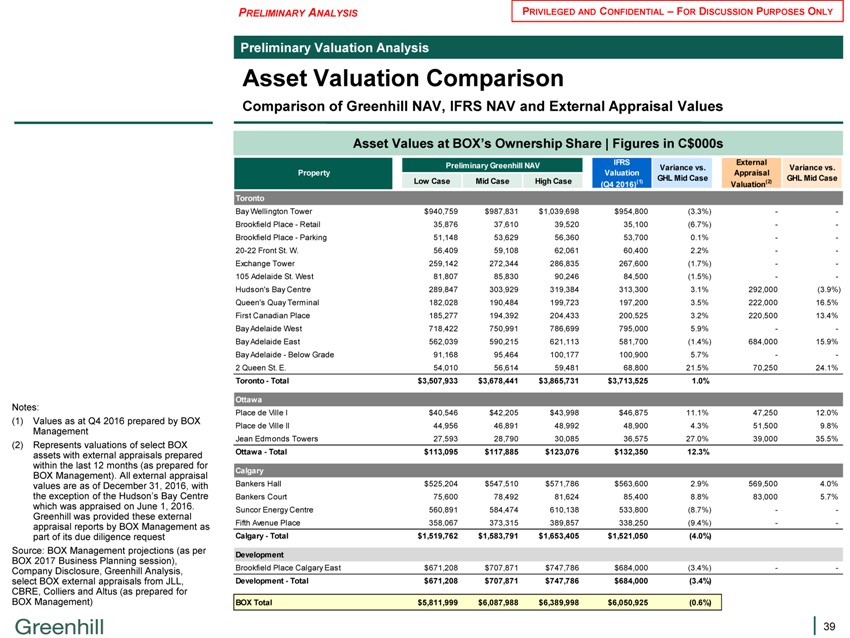

Selected Based on BOX Management projections, Greenhill valued each of BOX’s individual properties based on the present value of their future

Net Asset Value unlevered cash flows and terminal value; utilizes a range of discount rates and terminal cap rates

Analysis Greenhill consolidated the value for each individual property to calculate a net asset value for the entirety of BOX

Represents a bottom-up, “sum-of-the-parts” methodology intended to arrive at a private market valuation

Note: Greenhill did not attribute any specific weight to any analysis, methodology or factor considered, but rather made qualitative judgments as to the significance and relevance of each analysis, methodology and factor; accordingly, Greenhill’s analyses must be considered as a whole. Considering any portion of the analyses, methodologies or factors considered, without considering all analyses, methodologies and factors, could create a misleading or incomplete view of Greenhill’s analyses

27

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Analysis

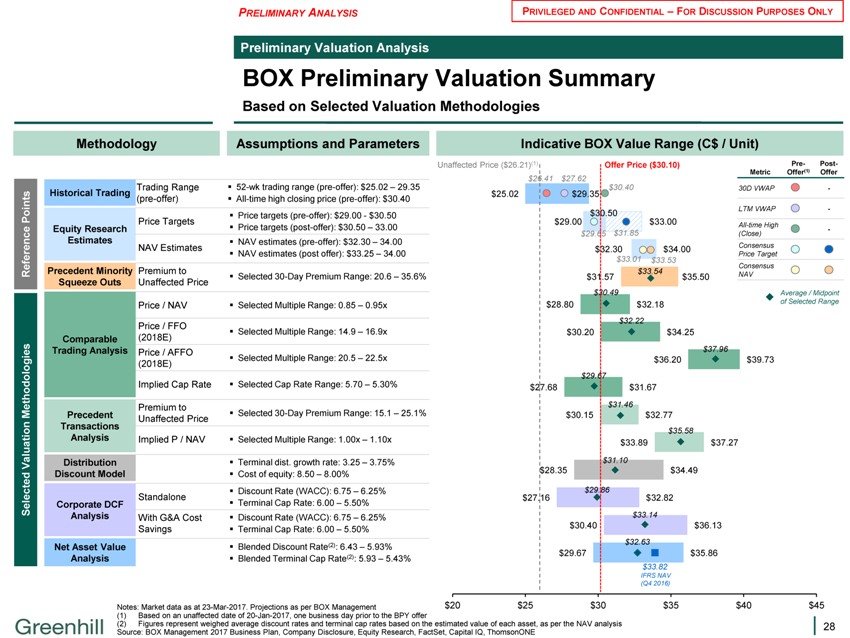

BOX Preliminary Valuation Summary

Based on Selected Valuation Methodologies

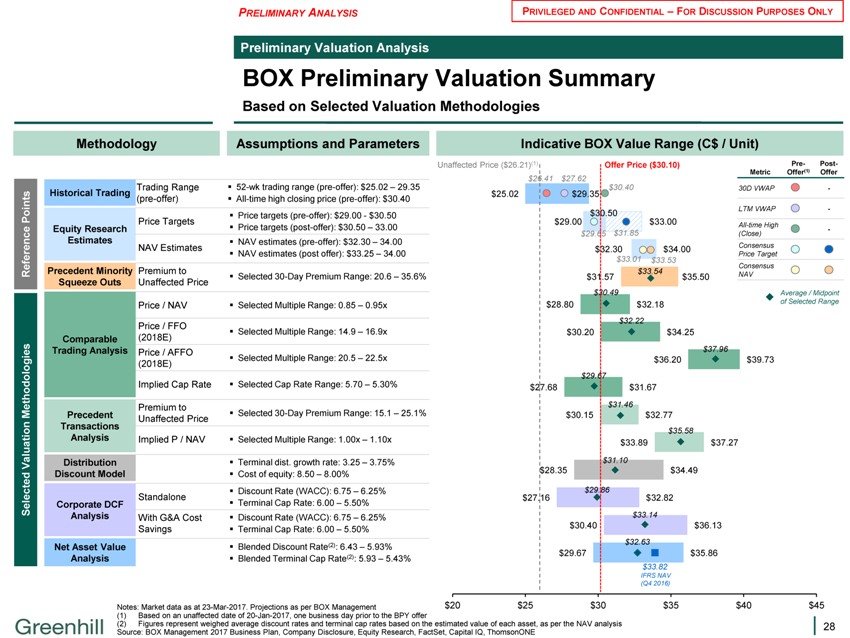

Methodology Assumptions and Parameters

Historical Trading Trading Range 52-wk trading range (pre-offer): $25.02 – 29.35

(pre-offer) All-time high closing price (pre-offer): $30.40

Points Price targets (pre-offer): $29.00—$30.50

Price Targets

Equity Research Price targets (post-offer): $30.50 – 33.00

Estimates NAV estimates (pre-offer): $32.30 – 34.00

NAV Estimates NAV estimates (post offer): $33.25 – 34.00

Reference Precedent Minority Premium to Selected 30-Day Premium Range: 20.6 – 35.6%

Squeeze Outs Unaffected Price

Price / NAV Selected Multiple Range: 0.85 – 0.95x

Price / FFO Selected Multiple Range: 14.9 – 16.9x

Comparable(2018E)

Trading Analysis Price / AFFO Selected Multiple Range: 20.5 – 22.5x

(2018E)

Implied Cap Rate Selected Cap Rate Range: 5.70 – 5.30%

Premium to

Methodologies Precedent Unaffected Price Selected 30-Day Premium Range: 15.1 – 25.1%

Transactions

Analysis Implied P / NAV Selected Multiple Range: 1.00x – 1.10x

Valuation Distribution Terminal dist. growth rate: 3.25 – 3.75%

Discount Model Cost of equity: 8.50 – 8.00%

Standalone Discount Rate (WACC): 6.75 – 6.25%

Selected Corporate DCF Terminal Cap Rate: 6.00 – 5.50%

Analysis With G&A Cost Discount Rate (WACC): 6.75 – 6.25%

Savings Terminal Cap Rate: 6.00 – 5.50%

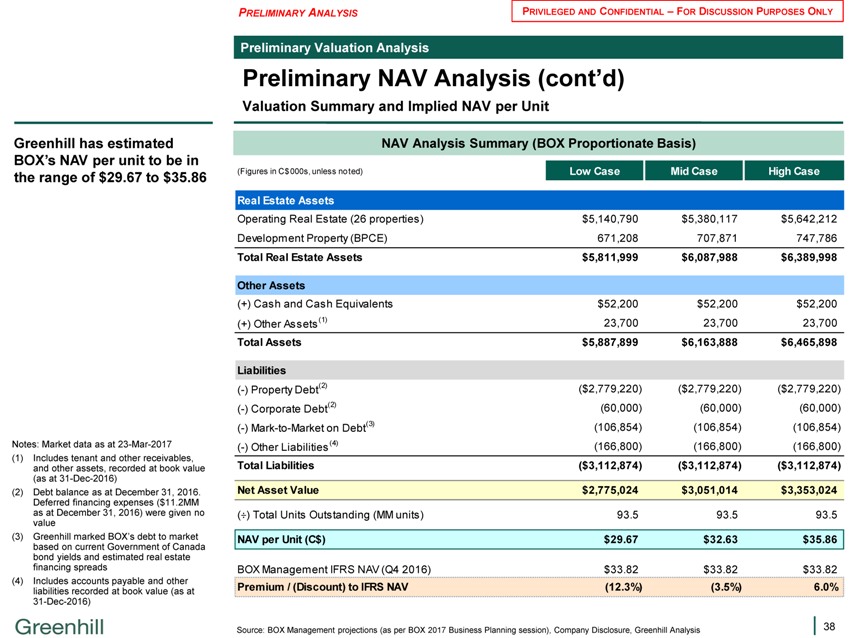

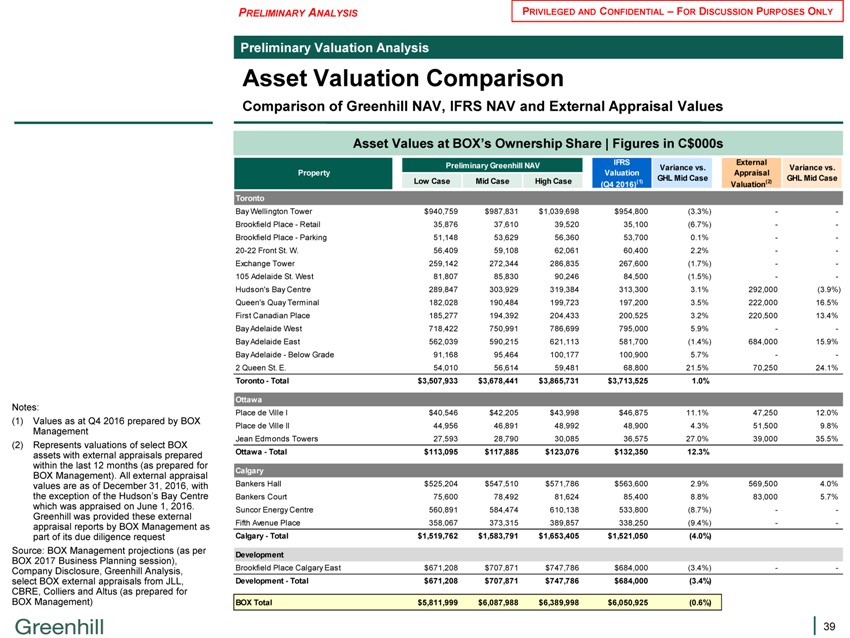

Net Asset Value Blended Discount Rate(2): 6.43 – 5.93%

Analysis Blended Terminal Cap Rate(2): 5.93 – 5.43%

Indicative BOX Value Range (C$ / Unit)

Unaffected Price ($26.21)(1) Offer Price ($30.10) Pre- Post-

Metric Offer(1) Offer

$26.41 $27.62

$30.40 30D VWAP -

$25.02 $29.35

$30.50 LTM VWAP -

$29.00 $33.00 All-time High

$29.65 $31.85(Close) -

$32.30 $34.00 Consensus

Price Target

$33.01 $33.53

Consensus

$33.54

$31.57 $35.50 NAV

$30.49 Average / Midpoint

$28.80 $32.18 of Selected Range

$32.22

$30.20 $34.25

$37.96

$36.20 $39.73

$29.67

$27.68 $31.67

$31.46

$30.15 $32.77

$35.58

$33.89 $37.27

$31.10

$28.35 $34.49

$29.86

$27.16 $32.82

$33.14

$30.40 $36.13

$32.63

$29.67 $35.86

$33.82

IFRS NAV

(Q4 2016)

$20 $25 $30 $35 $40 $45

Notes: Market data as at 23-Mar-2017. Projections as per BOX Management

(1) Based on an unaffected date of 20-Jan-2017, one business day prior to the BPY offer

(2) Figures represent weighed average discount rates and terminal cap rates based on the estimated value of each asset, as per the NAV analysis Source: BOX Management 2017 Business Plan, Company Disclosure, Equity Research, FactSet, Capital IQ, ThomsonONE

28

PRELIMINARY ANALYSIS

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

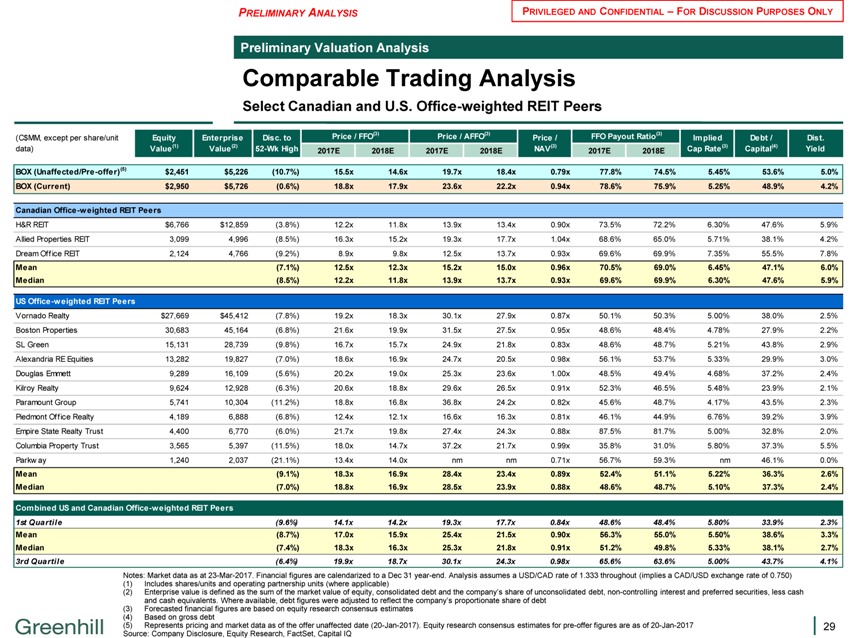

Preliminary Valuation Analysis

Comparable Trading Analysis

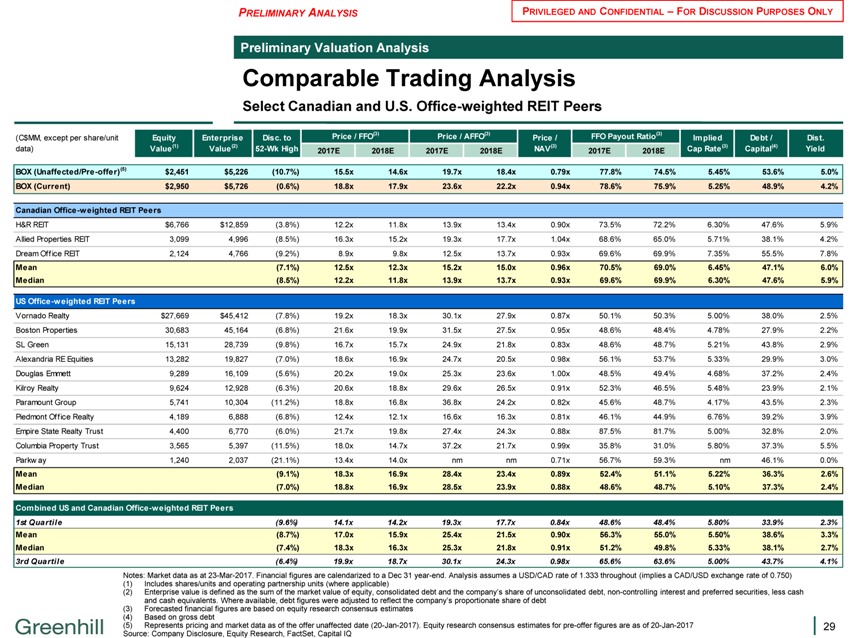

Select Canadian and U.S. Office-weighted REIT Peers

(C$MM, except per share/unit Equity Enterprise Disc. to Price / FFO(3) Price / AFFO(3) Price / FFO Payout Ratio(3) Implied Debt / Dist.

data) Value(1) Value(2) 52-Wk High 2017E 2018E 2017E 2018E NAV(3) 2017E 2018E Cap Rate(3) Capital(4) Yield

BOX (Unaffected/Pre-offer)(5) $2,451 $5,226(10.7%) 15.5x 14.6x 19.7x 18.4x 0.79x 77.8% 74.5% 5.45% 53.6% 5.0%

BOX (Current) $2,950 $5,726(0.6%) 18.8x 17.9x 23.6x 22.2x 0.94x 78.6% 75.9% 5.25% 48.9% 4.2%

Canadian Office-w eighted REIT Peers

H&R REIT $6,766 $12,859(3.8%) 12.2x 11.8x 13.9x 13.4x 0.90x 73.5% 72.2% 6.30% 47.6% 5.9%

Allied Properties REIT 3,099 4,996(8.5%) 16.3x 15.2x 19.3x 17.7x 1.04x 68.6% 65.0% 5.71% 38.1% 4.2%

Dream Office REIT 2,124 4,766(9.2%) 8.9x 9.8x 12.5x 13.7x 0.93x 69.6% 69.9% 7.35% 55.5% 7.8%

Mean(7.1%) 12.5x 12.3x 15.2x 15.0x 0.96x 70.5% 69.0% 6.45% 47.1% 6.0%

Median(8.5%) 12.2x 11.8x 13.9x 13.7x 0.93x 69.6% 69.9% 6.30% 47.6% 5.9%

US Office-w eighted REIT Peers

Vornado Realty $27,669 $45,412(7.8%) 19.2x 18.3x 30.1x 27.9x 0.87x 50.1% 50.3% 5.00% 38.0% 2.5%

Boston Properties 30,683 45,164(6.8%) 21.6x 19.9x 31.5x 27.5x 0.95x 48.6% 48.4% 4.78% 27.9% 2.2%

SL Green 15,131 28,739(9.8%) 16.7x 15.7x 24.9x 21.8x 0.83x 48.6% 48.7% 5.21% 43.8% 2.9%

Alexandria RE Equities 13,282 19,827(7.0%) 18.6x 16.9x 24.7x 20.5x 0.98x 56.1% 53.7% 5.33% 29.9% 3.0%

Douglas Emmett 9,289 16,109(5.6%) 20.2x 19.0x 25.3x 23.6x 1.00x 48.5% 49.4% 4.68% 37.2% 2.4%

Kilroy Realty 9,624 12,928(6.3%) 20.6x 18.8x 29.6x 26.5x 0.91x 52.3% 46.5% 5.48% 23.9% 2.1%

Paramount Group 5,741 10,304(11.2%) 18.8x 16.8x 36.8x 24.2x 0.82x 45.6% 48.7% 4.17% 43.5% 2.3%

Piedmont Office Realty 4,189 6,888(6.8%) 12.4x 12.1x 16.6x 16.3x 0.81x 46.1% 44.9% 6.76% 39.2% 3.9%

Empire State Realty Trust 4,400 6,770(6.0%) 21.7x 19.8x 27.4x 24.3x 0.88x 87.5% 81.7% 5.00% 32.8% 2.0%

Columbia Property Trust 3,565 5,397(11.5%) 18.0x 14.7x 37.2x 21.7x 0.99x 35.8% 31.0% 5.80% 37.3% 5.5%

Parkw ay 1,240 2,037(21.1%) 13.4x 14.0x nm nm 0.71x 56.7% 59.3% nm 46.1% 0.0%

Mean(9.1%) 18.3x 16.9x 28.4x 23.4x 0.89x 52.4% 51.1% 5.22% 36.3% 2.6%

Median(7.0%) 18.8x 16.9x 28.5x 23.9x 0.88x 48.6% 48.7% 5.10% 37.3% 2.4%

Combined US and Canadian Office-w eighted REIT Peers

1st Quartile(9.6%) 14.1avbx 14.2x 19.3x 17.7x 0.84x 48.6% 48.4% 5.80% 33.9% 2.3%

Mean(8.7%) 17.0x 15.9x 25.4x 21.5x 0.90x 56.3% 55.0% 5.50% 38.6% 3.3%

Median(7.4%) 18.3x 16.3x 25.3x 21.8x 0.91x 51.2% 49.8% 5.33% 38.1% 2.7%

3rd Quartile(6.4%) 19.9x 18.7x 30.1x 24.3x 0.98x 65.6% 63.6% 5.00% 43.7% 4.1%

Notes: Market data as at 23-Mar-2017. Financial figures are calendarized to a Dec 31 year-end. Analysis assumes a USD/CAD rate of 1.333 throughout (implies a CAD/USD exchange rate of 0.750) (1) Includes shares/units and operating partnership units (where applicable)

(2) Enterprise value is defined as the sum of the market value of equity, consolidated debt and the company’s share of unconsolidated debt, non-controlling interest and preferred securities, less cash and cash equivalents. Where available, debt figures were adjusted to reflect the company’s proportionate share of debt

(3) Forecasted financial figures are based on equity research consensus estimates (4) Based on gross debt

(5) Represents pricing and market data as of the offer unaffected date (20-Jan-2017). Equity research consensus estimates for pre-offer figures are as of 20-Jan-2017 Source: Company Disclosure, Equity Research, FactSet, Capital IQ

29

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Analysis

Comparable Trading Analysis (cont’d)

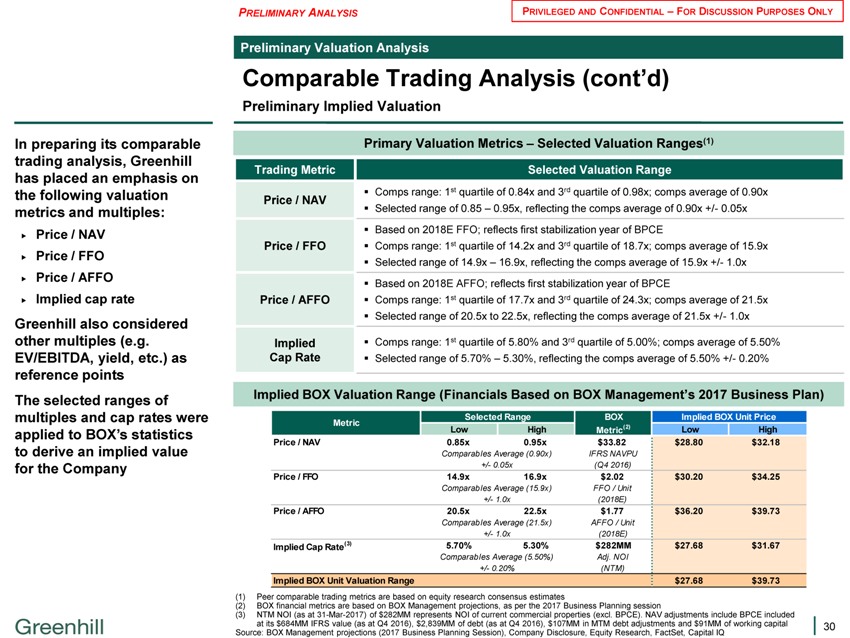

Preliminary Implied Valuation

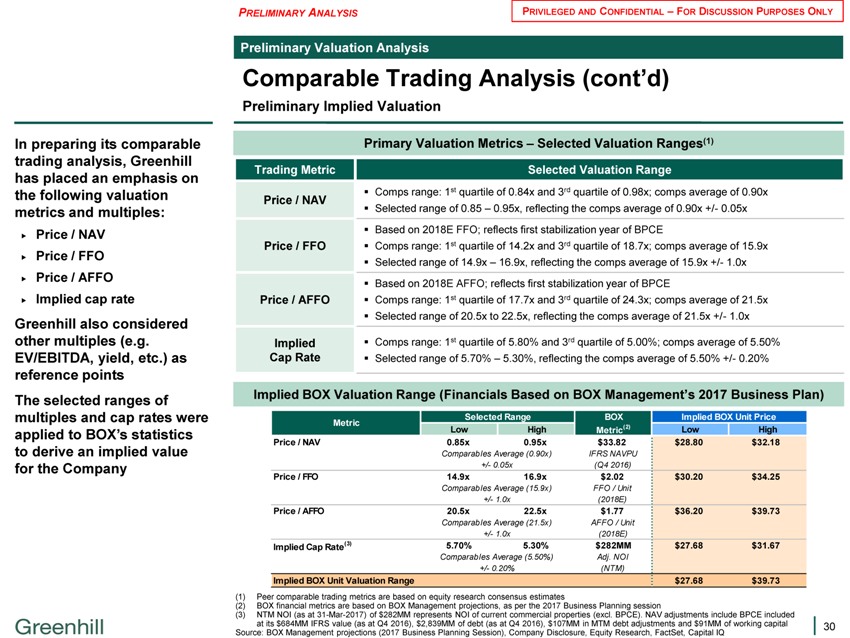

In preparing its comparable trading analysis, Greenhill has placed an emphasis on the following valuation metrics and multiples:

Price / NAV Price / FFO Price / AFFO Implied cap rate

Greenhill also considered other multiples (e.g. EV/EBITDA, yield, etc.) as reference points The selected ranges of multiples and cap rates were applied to BOX’s statistics to derive an implied value for the Company

Primary Valuation Metrics – Selected Valuation Ranges(1)

Trading Metric Selected Valuation Range

Comps range: 1st quartile of 0.84x and 3rd quartile of 0.98x; comps average of 0.90x

Price / NAV

Selected range of 0.85 – 0.95x, reflecting the comps average of 0.90x +/- 0.05x

Based on 2018E FFO; reflects first stabilization year of BPCE

Price / FFO Comps range: 1st quartile of 14.2x and 3rd quartile of 18.7x; comps average of 15.9x

Selected range of 14.9x – 16.9x, reflecting the comps average of 15.9x +/- 1.0x

Based on 2018E AFFO; reflects first stabilization year of BPCE

Price / AFFO Comps range: 1st quartile of 17.7x and 3rd quartile of 24.3x; comps average of 21.5x

Selected range of 20.5x to 22.5x, reflecting the comps average of 21.5x +/- 1.0x

Implied Comps range: 1st quartile of 5.80% and 3rd quartile of 5.00%; comps average of 5.50%

Cap Rate Selected range of 5.70% – 5.30%, reflecting the comps average of 5.50% +/- 0.20%

Implied BOX Valuation Range (Financials Based on BOX Management’s 2017 Business Plan)

Selected Range BOX Implied BOX Unit Price

Metric

Low High Metric(2) Low High

Price / NAV 0.85x 0.95x $33.82 $28.80 $32.18

Comparables Average (0.90x) IFRS NAVPU

+/- 0.05x(Q4 2016)

Price / FFO 14.9x 16.9x $2.02 $30.20 $34.25

Comparables Average (15.9x) FFO / Unit

+/- 1.0x(2018E)

Price / AFFO 20.5x 22.5x $1.77 $36.20 $39.73

Comparables Average (21.5x) AFFO / Unit

+/- 1.0x(2018E)

Implied Cap Rate(3) 5.70% 5.30% $282MM $27.68 $31.67

Comparables Average (5.50%) Adj. NOI

+/- 0.20%(NTM)

Implied BOX Unit Valuation Range $27.68 $39.73

(1) Peer comparable trading metrics are based on equity research consensus estimates

(2) BOX financial metrics are based on BOX Management projections, as per the 2017 Business Planning session

(3) NTM NOI (as at 31-Mar-2017) of $282MM represents NOI of current commercial properties (excl. BPCE). NAV adjustments include BPCE included at its $684MM IFRS value (as at Q4 2016), $2,839MM of debt (as at Q4 2016), $107MM in MTM debt adjustments and $91MM of working capital Source: BOX Management projections (2017 Business Planning Session), Company Disclosure, Equity Research, FactSet, Capital IQ

30

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Analysis

Precedent Transactions Analysis

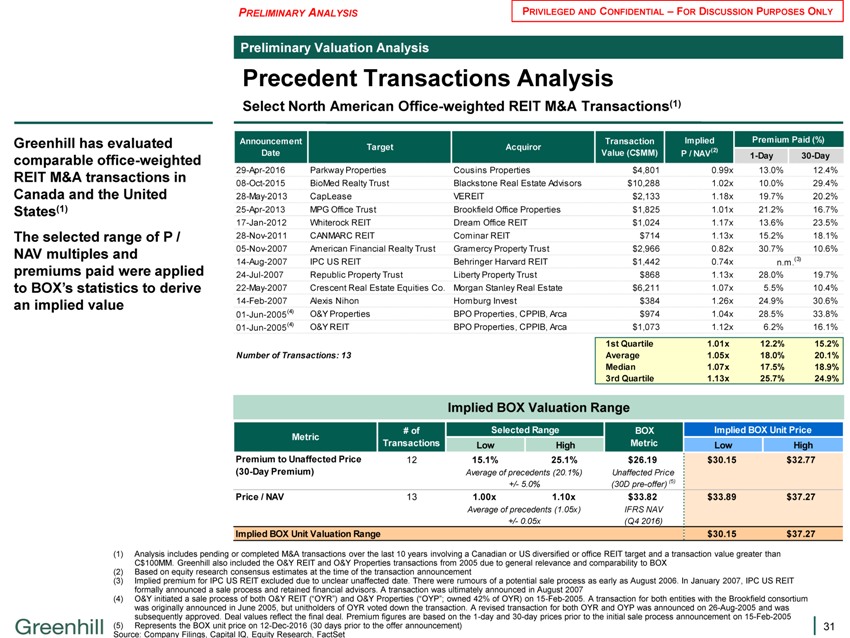

Select North American Office-weighted REIT M&A Transactions(1)

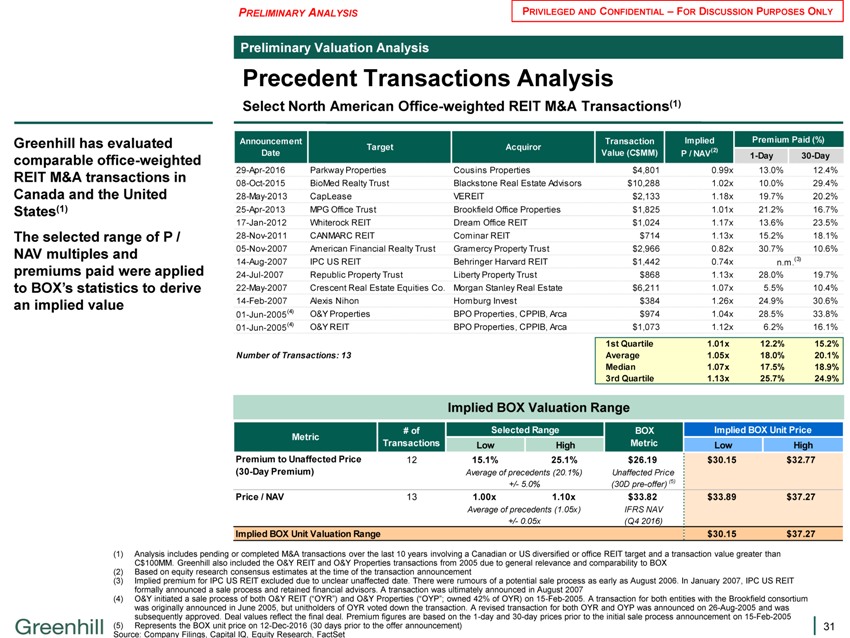

Greenhill has evaluated comparable office-weighted REIT M&A transactions in Canada and the United States(1) The selected range of P / NAV multiples and premiums paid were applied to BOX’s statistics to derive an implied value

Announcement Transaction Implied Premium Paid (%)

Target Acquiror

Date Value (C$MM) P / NAV(2) 1-Day 30-Day

29-Apr-2016 Parkway Properties Cousins Properties $4,801 0.99x 13.0% 12.4%

08-Oct-2015 BioMed Realty Trust Blackstone Real Estate Advisors $10,288 1.02x 10.0% 29.4%

28-May-2013 CapLease VEREIT $2,133 1.18x 19.7% 20.2%

25-Apr-2013 MPG Office Trust Brookfield Office Properties $1,825 1.01x 21.2% 16.7%

17-Jan-2012 Whiterock REIT Dream Office REIT $1,024 1.17x 13.6% 23.5%

28-Nov-2011 CANMARC REIT Cominar REIT $714 1.13x 15.2% 18.1%

05-Nov-2007 American Financial Realty Trust Gramercy Property Trust $2,966 0.82x 30.7% 10.6%

14-Aug-2007 IPC US REIT Behringer Harvard REIT $1,442 0.74x n.m.(3)

24-Jul-2007 Republic Property Trust Liberty Property Trust $868 1.13x 28.0% 19.7%

22-May-2007 Crescent Real Estate Equities Co. Morgan Stanley Real Estate $6,211 1.07x 5.5% 10.4%

14-Feb-2007 Alexis Nihon Homburg Invest $384 1.26x 24.9% 30.6%

01-Jun-2005(4) O&Y Properties BPO Properties, CPPIB, Arca $974 1.04x 28.5% 33.8%

01-Jun-2005(4) O&Y REIT BPO Properties, CPPIB, Arca $1,073 1.12x 6.2% 16.1%

Number of Transactions: 13

1st Quartile 1.01x 12.2% 15.2%

Average 1.05x 18.0% 20.1%

Median 1.07x 17.5% 18.9%

3rd Quartile 1.13x 25.7% 24.9%

Implied BOX Valuation Range

# of Selected Range BOX Implied BOX Unit Price

Metric

Transactions Low High Metric Low High

Premium to Unaffected Price 12 15.1% 25.1% $26.19 $30.15 $32.77

(30-Day Premium) Average of precedents (20.1%) Unaffected Price

+/- 5.0%(30D pre-offer) (5)

Price / NAV 13 1.00x 1.10x $33.82 $33.89 $37.27

Average of precedents (1.05x) IFRS NAV

+/- 0.05x(Q4 2016)

Implied BOX Unit Valuation Range $30.15 $37.27

(1) Analysis includes pending or completed M&A transactions over the last 10 years involving a Canadian or US diversified or office REIT target and a transaction value greater than C$100MM. Greenhill also included the O&Y REIT and O&Y Properties transactions from 2005 due to general relevance and comparability to BOX

(2) Based on equity research consensus estimates at the time of the transaction announcement

(3) Implied premium for IPC US REIT excluded due to unclear unaffected date. There were rumours of a potential sale process as early as August 2006. In January 2007, IPC US REIT formally announced a sale process and retained financial advisors. A transaction was ultimately announced in August 2007

(4) O&Y initiated a sale process of both O&Y REIT (“OYR”) and O&Y Properties (“OYP”; owned 42% of OYR) on 15-Feb-2005. A transaction for both entities with the Brookfield consortium was originally announced in June 2005, but unitholders of OYR voted down the transaction. A revised transaction for both OYR and OYP was announced on 26-Aug-2005 and was subsequently approved. Deal values reflect the final deal. Premium figures are based on the 1-day and 30-day prices prior to the initial sale process announcement on 15-Feb-2005 (5) Represents the BOX unit price on 12-Dec-2016 (30 days prior to the offer announcement) Source: Company Filings, Capital IQ, Equity Research, FactSet

31

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Analysis

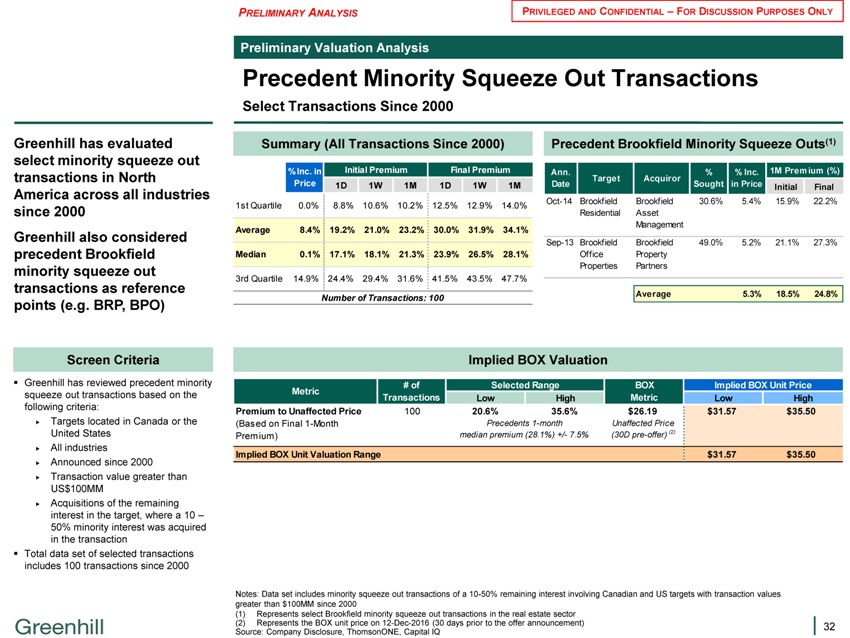

Precedent Minority Squeeze Out Transactions

Select Transactions Since 2000

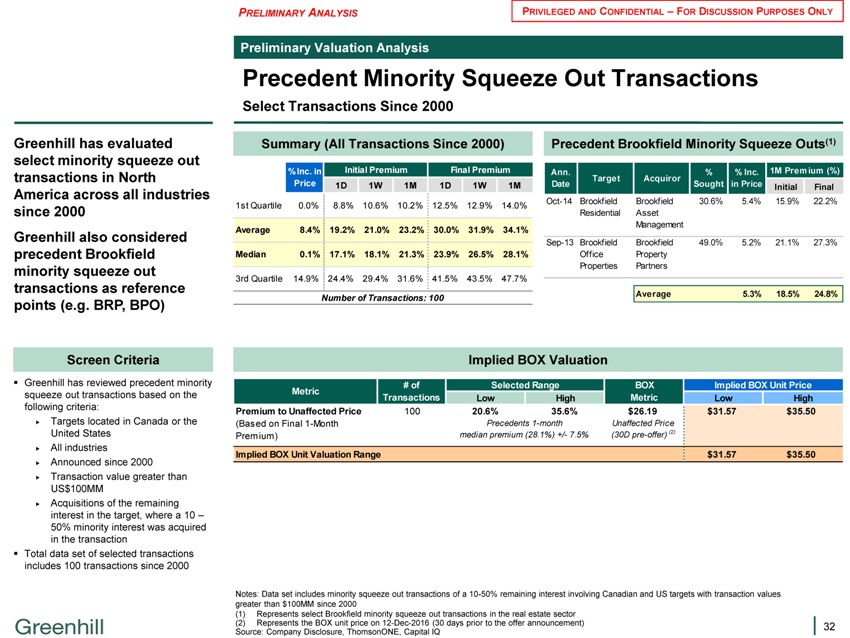

Greenhill has evaluated select minority squeeze out transactions in North America across all industries since 2000 Greenhill also considered precedent Brookfield minority squeeze out transactions as reference points (e.g. BRP, BPO)

Screen Criteria

Greenhill has reviewed precedent minority squeeze out transactions based on the following criteria: Targets located in Canada or the United States All industries Announced since 2000 Transaction value greater than US$100MM

Acquisitions of the remaining interest in the target, where a 10 – 50% minority interest was acquired in the transaction Total data set of selected transactions includes 100 transactions since 2000

Summary (All Transactions Since 2000)

% Inc. in Initial Premium Final Premium

Price 1D 1W 1M 1D 1W 1M

1st Quartile 0.0% 8.8% 10.6% 10.2% 12.5% 12.9% 14.0%

Average 8.4% 19.2% 21.0% 23.2% 30.0% 31.9% 34.1%

Median 0.1% 17.1% 18.1% 21.3% 23.9% 26.5% 28.1%

3rd Quartile 14.9% 24.4% 29.4% 31.6% 41.5% 43.5% 47.7%

Number of Transactions: 100

Precedent Brookfield Minority Squeeze Outs(1)

Ann.%% Inc. 1M Premium (%)

Target Acquiror

Date Sought in Price Initial Final

Oct-14 Brookfield Brookfield 30.6% 5.4% 15.9% 22.2%

Residential Asset

Management

Sep-13 Brookfield Brookfield 49.0% 5.2% 21.1% 27.3%

Office Property

Properties Partners

Average 5.3% 18.5% 24.8%

Implied BOX Valuation

# of Selected Range BOX Implied BOX Unit Price

Metric

Transactions Low High Metric Low High

Premium to Unaffected Price 100 20.6% 35.6% $26.19 $31.57 $35.50

(Based on Final 1-Month Precedents 1-month Unaffected Price

Premium) median premium (28.1%) +/- 7.5%(30D pre-offer) (2)

Implied BOX Unit Valuation Range $31.57 $35.50

Notes: Data set includes minority squeeze out transactions of a 10-50% remaining interest involving Canadian and US targets with transaction values greater than $100MM since 2000 (1) Represents select Brookfield minority squeeze out transactions in the real estate sector (2) Represents the BOX unit price on 12-Dec-2016 (30 days prior to the offer announcement) Source: Company Disclosure, ThomsonONE, Capital IQ

32

PRELIMINARY ANALYSIS PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY

Preliminary Valuation Analysis

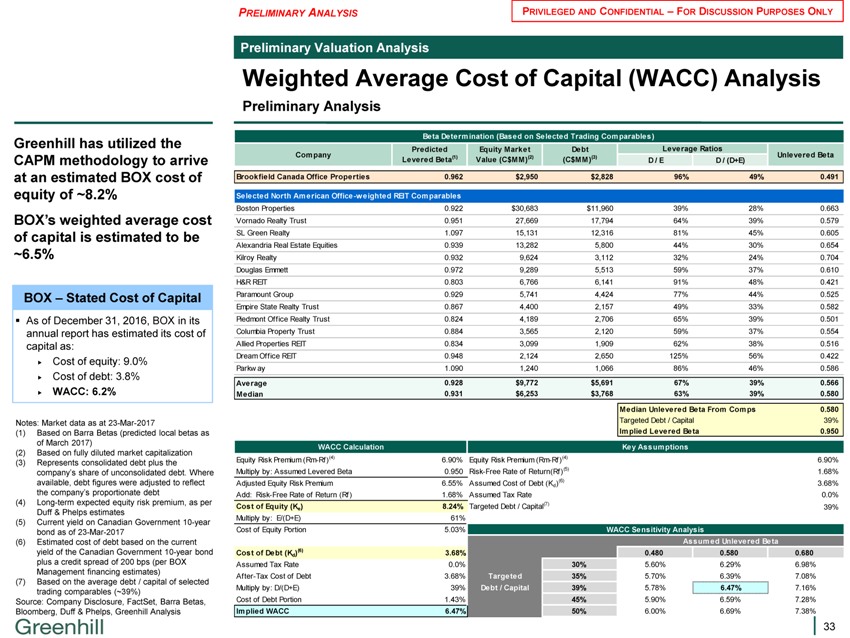

Weighted Average Cost of Capital (WACC) Analysis

Preliminary Analysis

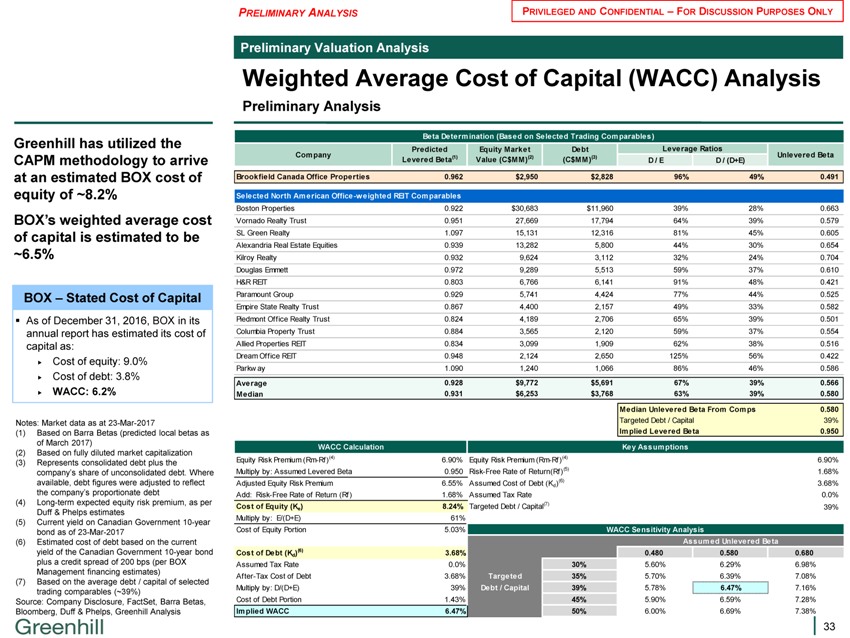

Greenhill has utilized the CAPM methodology to arrive at an estimated BOX cost of equity of ~8.2%

BOX’s weighted average cost of capital is estimated to be ~6.5%

BOX – Stated Cost of Capital

As of December 31, 2016, BOX in its annual report has estimated its cost of capital as: Cost of equity: 9.0% Cost of debt: 3.8%

WACC: 6.2%

Notes: Market data as at 23-Mar-2017

(1) Based on Barra Betas (predicted local betas as of March 2017) (2) Based on fully diluted market capitalization (3) Represents consolidated debt plus the company’s share of unconsolidated debt. Where available, debt figures were adjusted to reflect the company’s proportionate debt

(4) Long-term expected equity risk premium, as per Duff & Phelps estimates (5) Current yield on Canadian Government 10-year bond as of 23-Mar-2017 (6) Estimated cost of debt based on the current yield of the Canadian Government 10-year bond plus a credit spread of 200 bps (per BOX

Management financing estimates)

(7) Based on the average debt / capital of selected trading comparables (~39%) Source: Company Disclosure, FactSet, Barra Betas, Bloomberg, Duff & Phelps, Greenhill Analysis

Beta Determination (Based on Selected Trading Comparables)

Predicted Equity Market Debt Leverage Ratios

Company Unlevered Beta

Levered Beta(1) Value (C$MM)(2)(C$MM)(3) D / E D / (D+E)

Brookfield Canada Office Properties 0.962 $2,950 $2,828 96% 49% 0.491

Selected North American Office-w eighted REIT Comparables

Boston Properties 0.922 $30,683 $11,960 39% 28% 0.663

Vornado Realty Trust 0.951 27,669 17,794 64% 39% 0.579

SL Green Realty 1.097 15,131 12,316 81% 45% 0.605

Alexandria Real Estate Equities 0.939 13,282 5,800 44% 30% 0.654

Kilroy Realty 0.932 9,624 3,112 32% 24% 0.704

Douglas Emmett 0.972 9,289 5,513 59% 37% 0.610

H&R REIT 0.803 6,766 6,141 91% 48% 0.421

Paramount Group 0.929 5,741 4,424 77% 44% 0.525

Empire State Realty Trust 0.867 4,400 2,157 49% 33% 0.582

Piedmont Office Realty Trust 0.824 4,189 2,706 65% 39% 0.501

Columbia Property Trust 0.884 3,565 2,120 59% 37% 0.554

Allied Properties REIT 0.834 3,099 1,909 62% 38% 0.516

Dream Office REIT 0.948 2,124 2,650 125% 56% 0.422

Parkw ay 1.090 1,240 1,066 86% 46% 0.586

Average 0.928 $9,772 $5,691 67% 39% 0.566

Median 0.931 $6,253 $3,768 63% 39% 0.580

Median Unlevered Beta From Comps 0.580

Targeted Debt / Capital 39%

Implied Levered Beta 0.950

WACC Calculation Key Assumptions

Equity Risk Premium (Rm-Rf)(4) 6.90% Equity Risk Premium (Rm-Rf)(4) 6.90%

Multiply by: Assumed Levered Beta 0.950 Risk-Free Rate of Return(Rf)(5) 1.68%

Adjusted Equity Risk Premium 6.55% Assumed Cost of Debt (Kd )(6) 3.68%

Add: Risk-Free Rate of Return (Rf) 1.68% Assumed Tax Rate 0.0%

Cost of Equity (Ke ) 8.24% Targeted Debt / Capital(7) 39%

Multiply by: E/(D+E) 61%

Cost of Equity Portion 5.03% WACC Sensitivity Analysis

Assumed Unlevered Beta

Cost of Debt (Kd )(6) 3.68% 0.480 0.580 0.680