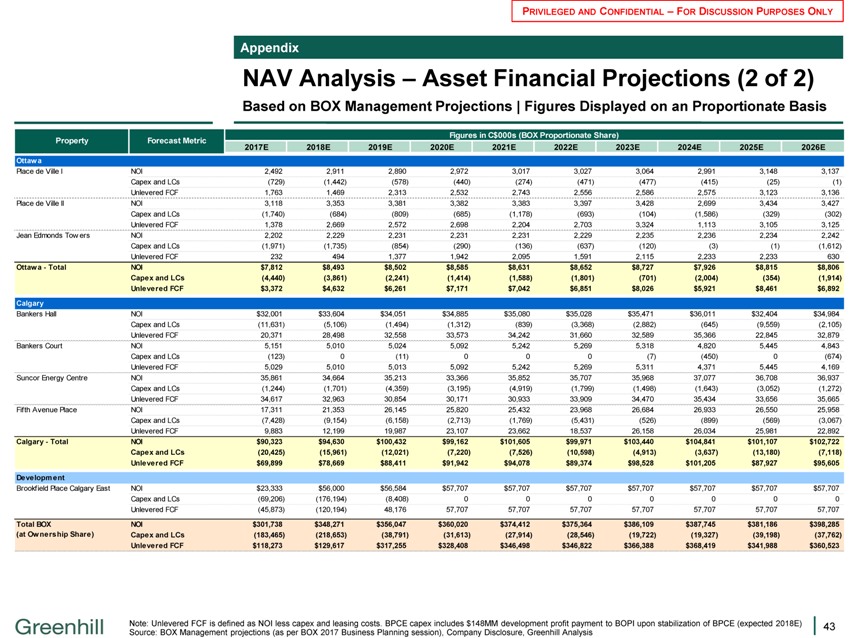

Exhibit (c)(3)

PRIVILEGED AND CONFIDENTIAL – FOR DISCUSSION PURPOSES ONLY Valuation Date of March 31, 2017 Presentation to the Special Committee of the Board of Trustees Valuation Discussion Materials April 20, 2017

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Important Information This presentation is strictly confidential and has been prepared by Greenhill & Co. Canada Ltd. (?Greenhill?) solely for the internal use of the Special Committee (the ?Committee?) of the Board of Trustees of Brookfield Canada Office Properties (the ?Company?) in evaluating the potential transaction involving Brookfield Property Partners L.P. and the Company described herein, and may not be used for any other purpose or copied, reproduced, distributed or passed to others at any time or be relied upon by the Company or any other person without the prior written consent of Greenhill. This presentation was prepared on a confidential basis in connection with an oral presentation to and for use by the Committee and not with a view toward complying with the disclosure standards under any applicable securities laws. This presentation is for informational purposes only, does not constitute advice and is not intended to be and does not constitute a recommendation to the Company or any other person or entity as to whether to approve or undertake any of the matters described herein or enter into any transaction. This presentation is not and should not be considered as a fairness opinion. The materials contained herein are based solely on information which has not been independently verified by Greenhill. Accordingly, Greenhill does not assume any responsibility or liability therefor. No representation or warranty, express or implied, is made in relation to the accuracy or completeness of the information presented herein or its suitability for any particular purpose. This presentation is delivered subject to the terms of our engagement letter. This presentation speaks only as of the date given, and subsequent developments may affect the information, analyses, valuations and assumptions contained herein. Greenhill does not undertake and has no obligation to update or revise the information in this presentation. Greenhill and its affiliates do not provide legal, accounting or tax advice. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein. 2

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Table of Contents 1. Executive Summary 2. BOX Overview 3. Valuation Analysis Appendix 3

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary Situation Overview and Transaction Background Brookfield Canada Office Properties (“BOX” or the ?Company”) is a public real estate investment trust that owns 27 premier office properties in Canada Brookfield Property Partners (“BPY”) currently owns approximately 83.1% of BOX BPY?s majority ownership position in BOX (and its predecessor companies) can be traced back to the early 2000s On January 23, 2017, BPY proposed a $30.10 per unit, all-cash acquisition of the publicly traded units of BOX it does not already own (represents a ~16.9% interest) Greenhill delivered its preliminary valuation on March 24, 2017 On April 17, 2017, BPY increased its offer to $32.50 per unit in cash, which represents an 8.0% increase from the initial offer On January 23, 2017, BPY announced a proposal to acquire the 15.8 million units, or 16.9%, of BOX it does not already own for $30.10 per unit, in cash (the ?Initial Offer?) Represented a 14.0% premium to BOX?s pre-announcement 30-day VWAP and a 14.8% premium to the unit price on January 20, 2017, 1-day pre-announcement (the ?Unaffected Price?) Institutional unitholders representing 23% of the unaffiliated minority unitholders agreed to support the proposal BPY asked the Board of Trustees of BOX to begin a process to review the proposal and appoint a special independent committee to commission an independent valuation of BOX’s units On February 17, 2017, Greenhill & Co. (“Greenhill”) was engaged as financial advisor to the Special Committee Greenhill provided a preliminary valuation (delivered on March 24, 2017) of the units of BOX in accordance with the requirements of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) of the Ontario Securities Commission and the Autorit? des march?s financiers Following a number of discussions, BPY increased its offer to $32.50 per unit, in cash (the ?Current Offer?) on April 17, 2017 Represents an 8.0% increase from the initial offer of $30.10 per unit, a 23.1% premium to BOX?s pre-announcement 30-day VWAP and a 24.0% premium to the unaffected price The current offer will include the payment of distributions on the units in the ordinary course until closing Greenhill has been asked to provide a financial opinion as to whether the consideration to be received by unitholders of BOX is fair from a financial point of view The following pages contain our valuation analysis based on the information provided to us by BOX management and our review of publicly available information We have prepared this report solely for informational purposes for the Special Committee of BOX Note: All financial figures are displayed in Canadian dollars (C$), unless indicated. References to pre-offer or pre-announcement dates and prices are based on the initial BPY offer announcement on January 23, 2017 4

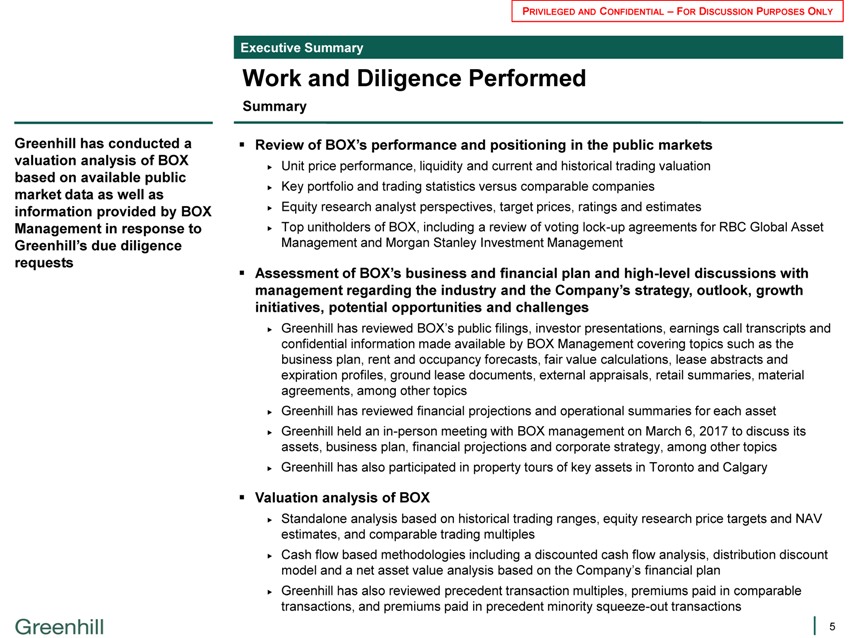

PRIVILEGED AND CONFIDENTIAL FOR DISCUSSION PURPOSES ONLY Executive Summary Work and Diligence Performed Summary Greenhill has conducted a valuation analysis of BOX based on available public market data as well as information provided by BOX Management in response to Greenhill’s due diligence requests Review of BOX’s performance and positioning in the public markets Unit price performance, liquidity and current and historical trading valuation Key portfolio and trading statistics versus comparable companies Equity research analyst perspectives, target prices, ratings and estimates Top unitholders of BOX, including a review of voting lock-up agreements for RBC Global Asset Management and Morgan Stanley Investment Management ”Assessment of BOX’s business and financial plan and high-level discussions with management regarding the industry and the Company’s strategy, outlook, growth initiatives, potential opportunities and challenges Greenhill has reviewed BOX?s public filings, investor presentations, earnings call transcripts and confidential information made available by BOX Management covering topics such as the business plan, rent and occupancy forecasts, fair value calculations, lease abstracts and expiration profiles, ground lease documents, external appraisals, retail summaries, material agreements, among other topics Greenhill has reviewed financial projections and operational summaries for each asset Greenhill held an in-person meeting with BOX management on March 6, 2017 to discuss its assets, business plan, financial projections and corporate strategy, among other topics Greenhill has also participated in property tours of key assets in Toronto and Calgary “Valuation analysis of BOX Standalone analysis based on historical trading ranges, equity research price targets and NAV estimates, and comparable trading multiples Cash flow based methodologies including a discounted cash flow analysis, distribution discount model and a net asset value analysis based on the Company?s financial plan Greenhill has also reviewed precedent transaction multiples, premiums paid in comparable transactions, and premiums paid in precedent minority squeeze-out transactions 5

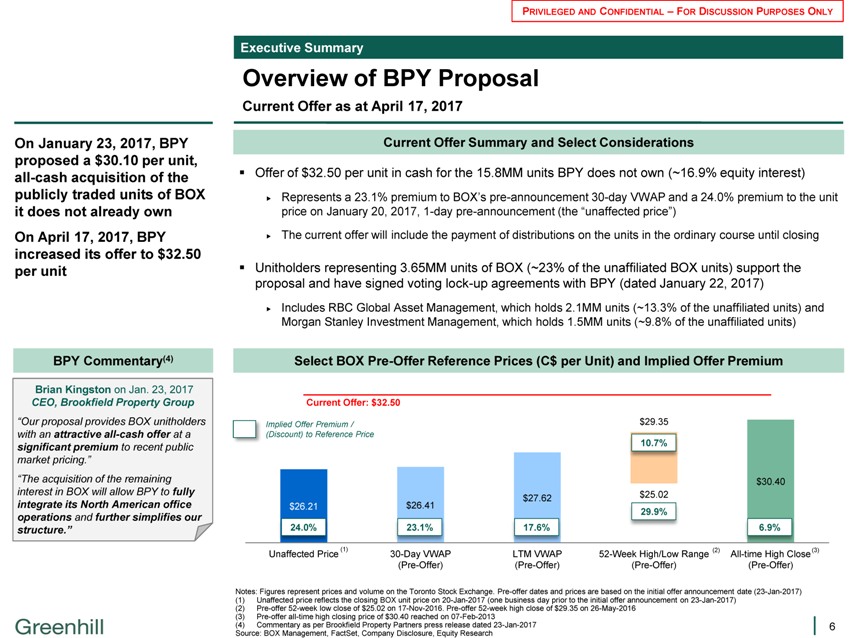

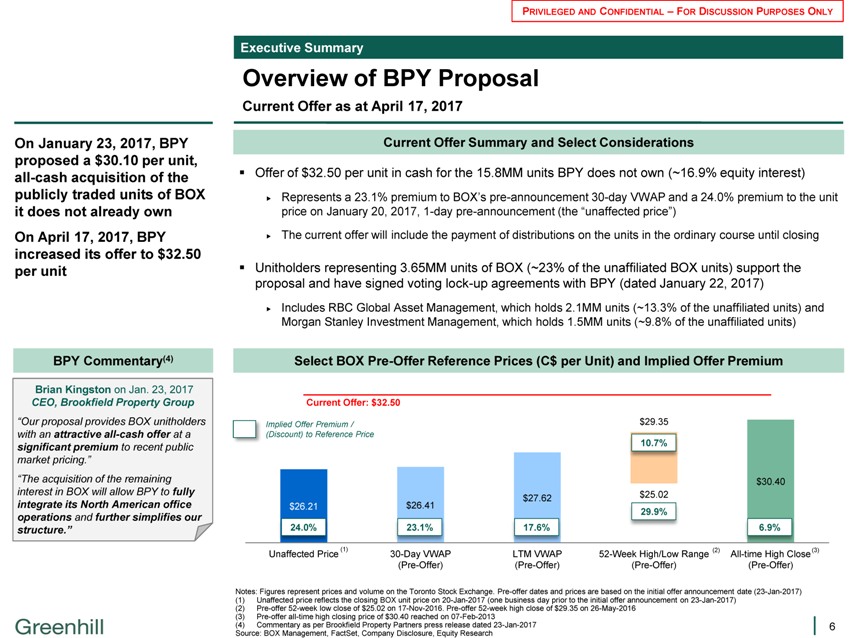

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary Overview of BPY Proposal Current Offer as at April 17, 2017 On January 23, 2017, BPY proposed a $30.10 per unit, all-cash acquisition of the publicly traded units of BOX it does not already own On April 17, 2017, BPY increased its offer to $32.50 per unit BPY Commentary(4) Brian Kingston on Jan. 23, 2017 CEO, Brookfield Property Group ‘Our proposal provides BOX unitholders with an attractive all-cash offer at a significant premium to recent public market pricing.’ ‘The acquisition of the remaining interest in BOX will allow BPY to fully integrate its North American office operations and further simplifies our structure.? Current Offer Summary and Select Considerations “Offer of $32.50 per unit in cash for the 15.8MM units BPY does not own (~16.9% equity interest) Represents a 23.1% premium to BOX’s pre-announcement 30-day VWAP and a 24.0% premium to the unit price on January 20, 2017, 1-day pre-announcement (the ?unaffected price’) The current offer will include the payment of distributions on the units in the ordinary course until closing ??Unitholders representing 3.65MM units of BOX (~23% of the unaffiliated BOX units) support the proposal and have signed voting lock-up agreements with BPY (dated January 22, 2017) Includes RBC Global Asset Management, which holds 2.1MM units (~13.3% of the unaffiliated units) and Morgan Stanley Investment Management, which holds 1.5MM units (~9.8% of the unaffiliated units) Select BOX Pre-Offer Reference Prices (C$ per Unit) and Implied Offer Premium Current Offer: $32.50 Implied Offer Premium / $29.35 (Discount) to Reference Price 10.7% $30.40 $27.62 $25.02 $26.21 $26.41 29.9% 24.0% 23.1% 17.6% 6.9% Unaffected Price (1) 30-Day VWAP LTM VWAP 52-Week High/Low Range (2) All-time High Close(3) (Pre-Offer)(Pre-Offer)(Pre-Offer)(Pre-Offer) Notes: Figures represent prices and volume on the Toronto Stock Exchange. Pre-offer dates and prices are based on the initial offer announcement date (23-Jan-2017) (1) Unaffected price reflects the closing BOX unit price on 20-Jan-2017 (one business day prior to the initial offer announcement on 23-Jan-2017) (2) Pre-offer 52-week low close of $25.02 on 17-Nov-2016. Pre-offer 52-week high close of $29.35 on 26-May-2016 (3) Pre-offer all-time high closing price of $30.40 reached on 07-Feb-2013 (4) Commentary as per Brookfield Property Partners press release dated 23-Jan-2017 Source: BOX Management, FactSet, Company Disclosure, Equity Research 6

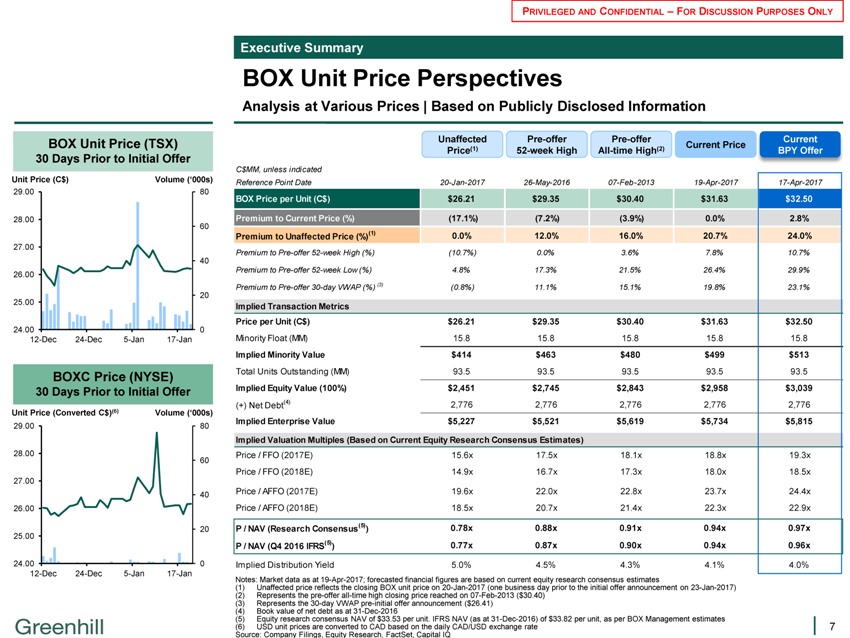

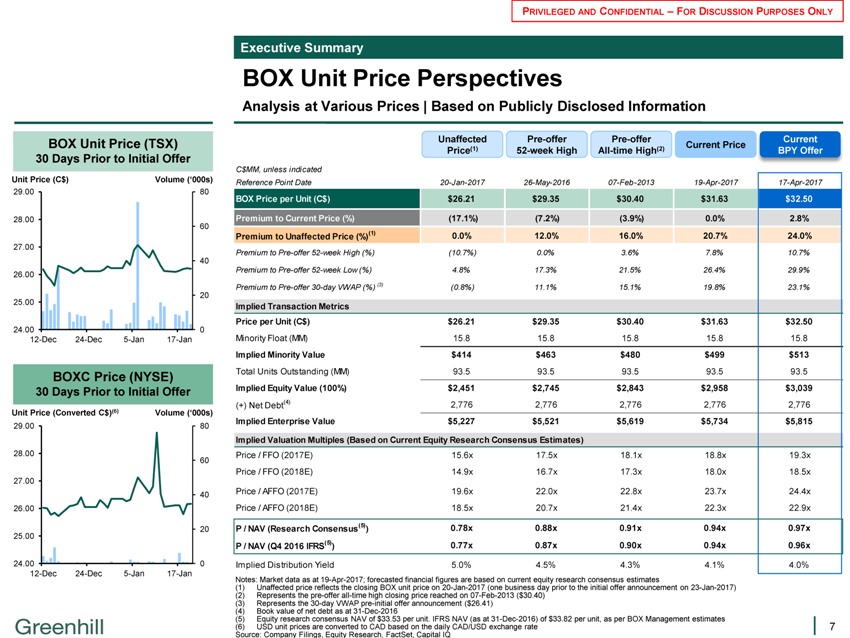

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary BOX Unit Price Perspectives Analysis at Various Prices | Based on Publicly Disclosed Information BOX Unit Price (TSX) 30 Days Prior to Initial Offer Unit Price (C$) Volume (?000s) 29.00 80 28.00 60 27.00 40 26.00 20 25.00 24.00 0 12-Dec 24-Dec 5-Jan 17-Jan BOXC Price (NYSE) 30 Days Prior to Initial Offer Unit Price (Converted C$)(6) Volume (?000s) 29.00 80 28.00 60 27.00 40 26.00 20 25.00 24.00 0 12-Dec 24-Dec 5-Jan 17-Jan Unaffected Pre-offer Pre-offer Current Current Price Price(1) 52-week High All-time High(2) BPY Offer C$MM, unless indicated Reference Point Date 20-Jan-2017 26-May-2016 07-Feb-2013 19-Apr-2017 17-Apr-2017 BOX Price per Unit (C$) $26.21 $29.35 $30.40 $31.63 $32.50 Premium to Current Price (%)(17.1%)(7.2%)(3.9%) 0.0% 2.8% Premium to Unaffected Price (%)(1) 0.0% 12.0% 16.0% 20.7% 24.0% Premium to Pre-offer 52-week High (%)(10.7%) 0.0% 3.6% 7.8% 10.7% Premium to Pre-offer 52-week Low (%) 4.8% 17.3% 21.5% 26.4% 29.9% Premium to Pre-offer 30-day VWAP (%) (3)(0.8%) 11.1% 15.1% 19.8% 23.1% Implied Transaction Metrics Price per Unit (C$) $26.21 $29.35 $30.40 $31.63 $32.50 Minority Float (MM) 15.8 15.8 15.8 15.8 15.8 Implied Minority Value $414 $463 $480 $499 $513 Total Units Outstanding (MM) 93.5 93.5 93.5 93.5 93.5 Implied Equity Value (100%) $2,451 $2,745 $2,843 $2,958 $3,039 (+) Net Debt(4) 2,776 2,776 2,776 2,776 2,776 Implied Enterprise Value $5,227 $5,521 $5,619 $5,734 $5,815 Implied Valuation Multiples (Based on Current Equity Research Consensus Estimates) Price / FFO (2017E) 15.6x 17.5x 18.1x 18.8x 19.3x Price / FFO (2018E) 14.9x 16.7x 17.3x 18.0x 18.5x Price / AFFO (2017E) 19.6x 22.0x 22.8x 23.7x 24.4x Price / AFFO (2018E) 18.5x 20.7x 21.4x 22.3x 22.9x P / NAV (Research Consensus(5) ) 0.78x 0.88x 0.91x 0.94x 0.97x P / NAV (Q4 2016 IFRS(5) ) 0.77x 0.87x 0.90x 0.94x 0.96x Implied Distribution Yield 5.0% 4.5% 4.3% 4.1% 4.0% Notes: Market data as at 19-Apr-2017; forecasted financial figures are based on current equity research consensus estimates (1) Unaffected price reflects the closing BOX unit price on 20-Jan-2017 (one business day prior to the initial offer announcement on 23-Jan-2017) (2) Represents the pre-offer all-time high closing price reached on 07-Feb-2013 ($30.40) (3) Represents the 30-day VWAP pre-initial offer announcement ($26.41) (4) Book value of net debt as at 31-Dec-2016 (5) Equity research consensus NAV of $33.53 per unit. IFRS NAV (as at 31-Dec-2016) of $33.82 per unit, as per BOX Management estimates (6) USD unit prices are converted to CAD based on the daily CAD/USD exchange rate Source: Company Filings, Equity Research, FactSet, Capital IQ 7

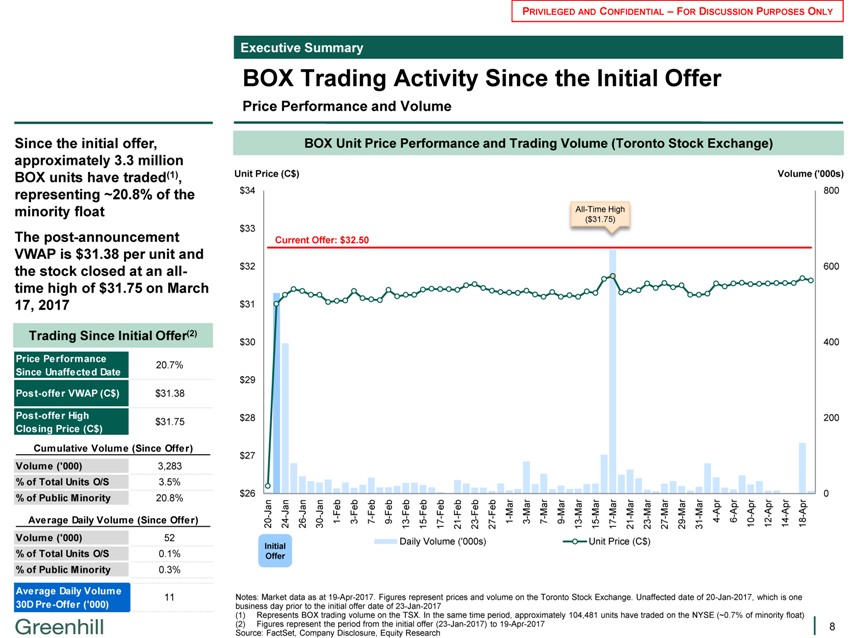

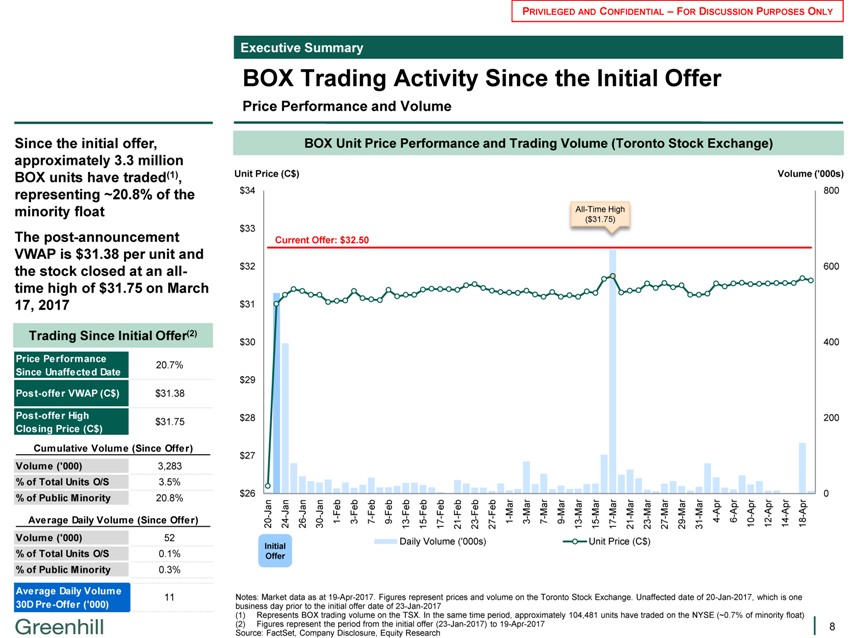

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary BOX Trading Activity Since the Initial Offer Price Performance and Volume Since the initial offer, approximately 3.3 million BOX units have traded(1), representing ~20.8% of the minority float The post-announcement VWAP is $31.38 per unit and the stock closed at an all-time high of $31.75 on March 17, 2017 Trading Since Initial Offer(2) Price Performance 20.7% Since Unaffected Date Post-offer VWAP (C$) $31.38 Post-offer High $31.75 Closing Price (C$) Cumulative Volume (Since Offer) Volume (‘000) 3,283 % of Total Units O/S 3.5% % of Public Minority 20.8% Average Daily Volume (Since Offer) Volume (‘000) 52 % of Total Units O/S 0.1% % of Public Minority 0.3% Average Daily Volume 11 30D Pre -Offer (‘000) BOX Unit Price Performance and Trading Volume (Toronto Stock Exchange) $ $ $ $ $ $ $ $ $ Unit 26 27 28 29 30 31 32 33 34 20-Jan Price 24-Jan(C $ ) 26-Jan Current 30-Jan Offer: 1-Feb $ 3-Feb 32. 7-Feb 50 9-Feb 13-Feb 15-Feb 17-Feb 21-Feb 23-Feb 27-Feb 1-Mar 3-Mar 7-Mar 9-Mar 13-Mar ( $ 15-Mar 31. All-Time 17-Mar 75) High 21-Mar 23-Mar 27-Mar 29-Mar 31-Mar 4-Apr 6-Apr 10-Apr 12-Apr 14-Apr 18-Apr Volume 0 200 400 600 800(‘000s) Initial Offer Daily Volume (‘000s) Unit Price (C$) Notes: Market data as at 19-Apr-2017. Figures represent prices and volume on the Toronto Stock Exchange. Unaffected date of 20-Jan-2017, which is one business day prior to the initial offer date of 23-Jan-2017 (1) Represents BOX trading volume on the TSX. In the same time period, approximately 104,481 units have traded on the NYSE (~0.7% of minority float) (2) Figures represent the period from the initial offer (23-Jan-2017) to 19-Apr-2017 Source: FactSet, Company Disclosure, Equity Research 8

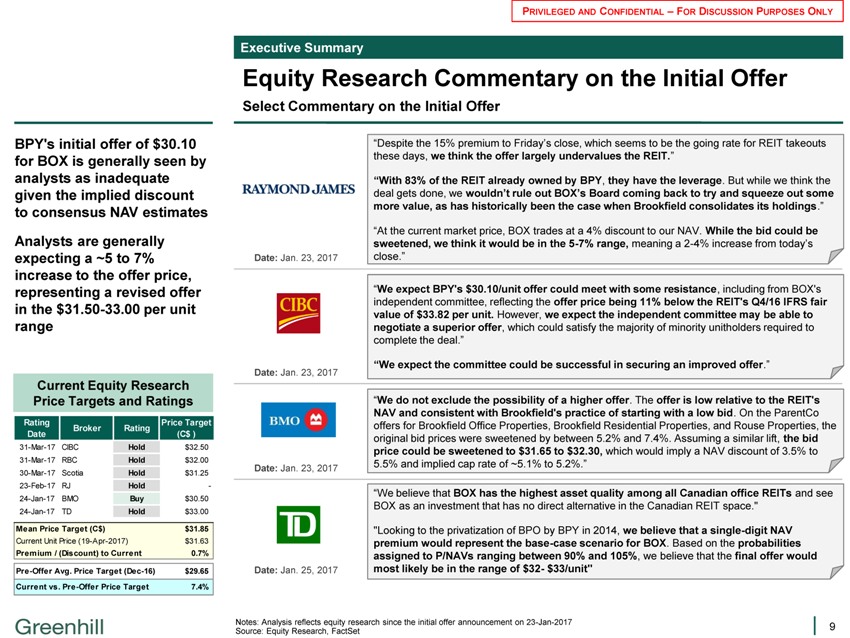

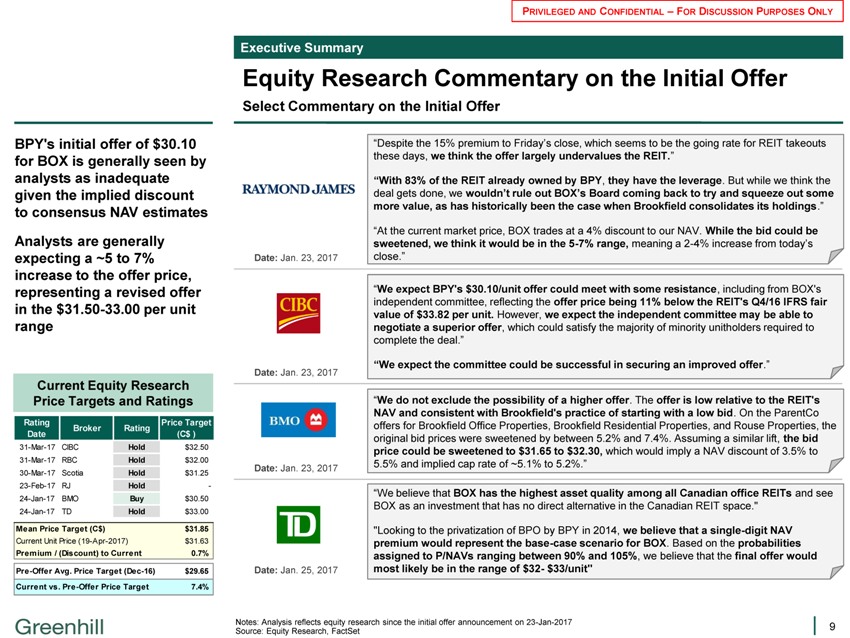

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary Equity Research Commentary on the Initial Offer Select Commentary on the Initial Offer BPY’s initial offer of $30.10 for BOX is generally seen by analysts as inadequate given the implied discount to consensus NAV estimates Analysts are generally expecting a ~5 to 7% increase to the offer price, representing a revised offer in the $31.50-33.00 per unit range Current Equity Research Price Targets and Ratings Rating Price Target Broker Rating Date(C$ ) 31-Mar-17 CIBC Hold $32.50 31-Mar-17 RBC Hold $32.00 30-Mar-17 Scotia Hold $31.25 23-Feb-17 RJ Hold—24-Jan-17 BMO Buy $30.50 24-Jan-17 TD Hold $33.00 Mean Price Target (C$) $31.85 Current Unit Price (19-Apr-2017) $31.63 Premium / (Discount) to Current 0.7% Pre-Offer Avg. Price Target (Dec-16) $29.65 Current vs. Pre-Offer Price Target 7.4% RAYMOND JAMES Date: Jan. 23, 2017 ?Despite the 15% premium to Friday?s close, which seems to be the going rate for REIT takeouts these days, we think the offer largely undervalues the REIT.? ?With 83% of the REIT already owned by BPY, they have the leverage. But while we think the deal gets done, we wouldn?t rule out BOX?s Board coming back to try and squeeze out some more value, as has historically been the case when Brookfield consolidates its holdings.? ?At the current market price, BOX trades at a 4% discount to our NAV. While the bid could be sweetened, we think it would be in the 5-7% range, meaning a 2-4% increase from today?s close.? CIBC Date: Jan. 23, 2017 ?We expect BPY’s $30.10/unit offer could meet with some resistance, including from BOX’s independent committee, reflecting the offer price being 11% below the REIT’s Q4/16 IFRS fair value of $33.82 per unit. However, we expect the independent committee may be able to negotiate a superior offer, which could satisfy the majority of minority unitholders required to complete the deal.? ?We expect the committee could be successful in securing an improved offer.? BIMO Date: Jan. 23, 2017 ?We do not exclude the possibility of a higher offer. The offer is low relative to the REIT’s NAV and consistent with Brookfield’s practice of starting with a low bid. On the ParentCo offers for Brookfield Office Properties, Brookfield Residential Properties, and Rouse Properties, the original bid prices were sweetened by between 5.2% and 7.4%. Assuming a similar lift, the bid price could be sweetened to $31.65 to $32.30, which would imply a NAV discount of 3.5% to 5.5% and implied cap rate of ~5.1% to 5.2%.? Date: Jan. 25, 2017 ?We believe that BOX has the highest asset quality among all Canadian office REITs and see BOX as an investment that has no direct alternative in the Canadian REIT space.” “Looking to the privatization of BPO by BPY in 2014, we believe that a single-digit NAV premium would represent the base-case scenario for BOX. Based on the probabilities assigned to P/NAVs ranging between 90% and 105%, we believe that the final offer would most likely be in the range of $32- $33/unit” Notes: Analysis reflects equity research since the initial offer announcement on 23-Jan-2017 Source: Equity Research, FactSet 9

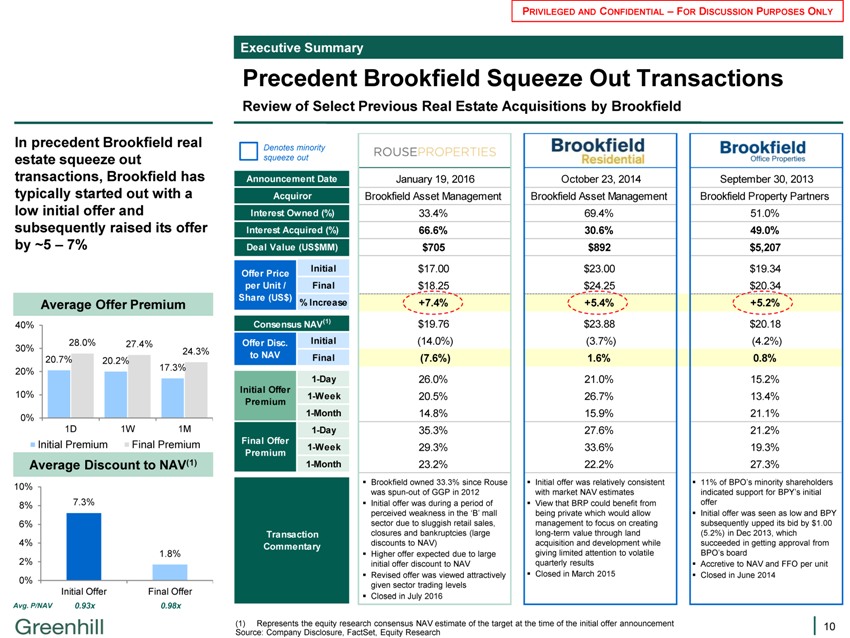

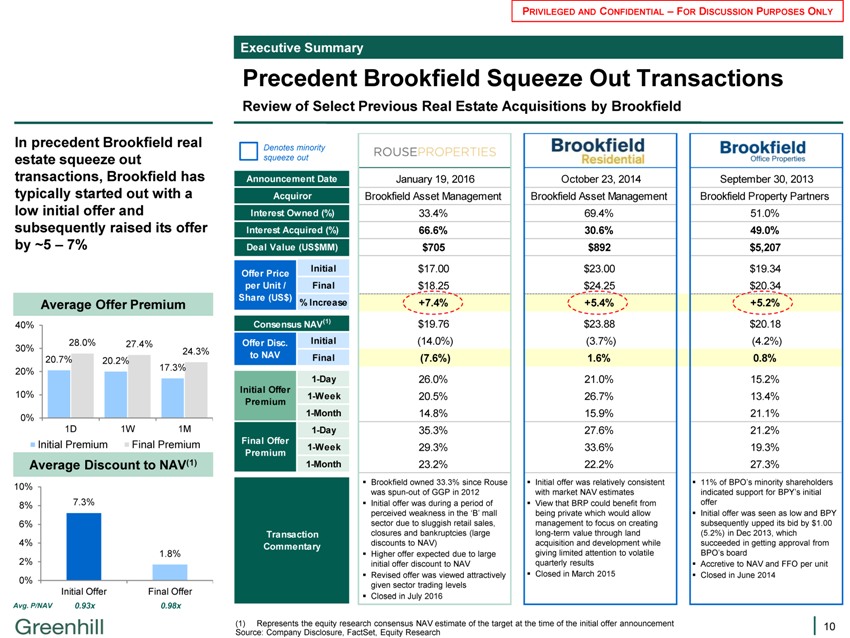

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary Precedent Brookfield Squeeze Out Transactions Review of Select Previous Real Estate Acquisitions by Brookfield In precedent Brookfield real estate squeeze out transactions, Brookfield has typically started out with a low initial offer and subsequently raised its offer by ~5 ? 7% Average Offer Premium 40% 28.0% 27.4% 30% 24.3% 20.7% 20.2% 20% 17.3% 10% 0% 1D 1W 1M Initial Premium Final Premium Average Discount to NAV(1) 10% 8% 7.3% 6% 4% 1.8% 2% 0% Initial Offer Final Offer Avg. P/NAV 0.93x 0.98x Denotes minority squeeze out Announcement Date Acquiror Interest Owned (%) Interest Acquired (%) Deal Value (US$MM) Offer Price Initial per Unit / Final Share (US$)% Increase Consensus NAV(1) Offer Disc. Initial to NAV Final 1-Day Initial Offer Premium 1-Week 1-Month 1-Day Final Offer Premium 1-Week 1-Month Transaction Commentary January 19, 2016 Brookfield Asset Management 33.4% 66.6% $705 $17.00 $18.25 +7.4% $19.76 (14.0%) (7.6%) 26.0% 20.5% 14.8% 35.3% 29.3% 23.2% ??Brookfield owned 33.3% since Rouse was spun-out of GGP in 2012 ??Initial offer was during a period of perceived weakness in the ?B? mall sector due to sluggish retail sales, closures and bankruptcies (large discounts to NAV) ??Higher offer expected due to large initial offer discount to NAV ??Revised offer was viewed attractively given sector trading levels ??Closed in July 2016 October 23, 2014 Brookfield Asset Management 69.4% 30.6% $892 $23.00 $24.25 +5.4% $23.88 (3.7%) 1.6% 21.0% 26.7% 15.9% 27.6% 33.6% 22.2% ??Initial offer was relatively consistent with market NAV estimates ??View that BRP could benefit from being private which would allow management to focus on creating long-term value through land acquisition and development while giving limited attention to volatile quarterly results ??Closed in March 2015 September 30, 2013 Brookfield Property Partners 51.0% 49.0% $5,207 $19.34 $20.34 +5.2% $20.18 (4.2%) 0.8% 15.2% 13.4% 21.1% 21.2% 19.3% 27.3% ??11% of BPO?s minority shareholders indicated support for BPY?s initial offer ??Initial offer was seen as low and BPY subsequently upped its bid by $1.00 (5.2%) in Dec 2013, which succeeded in getting approval from BPO?s board ??Accretive to NAV and FFO per unit ??Closed in June 2014 (1) Represents the equity research consensus NAV estimate of the target at the time of the initial offer announcement Source: Company Disclosure, FactSet, Equity Research 10

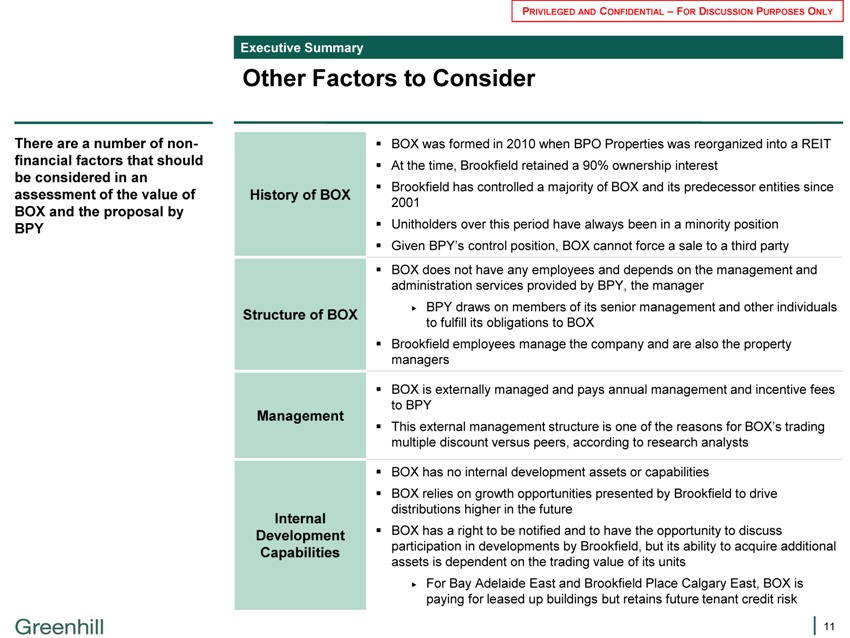

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Executive Summary Other Factors to Consider There are a number of non-financial factors that should be considered in an assessment of the value of BOX and the proposal by BPY History of BOX ??BOX was formed in 2010 when BPO Properties was reorganized into a REIT ??At the time, Brookfield retained a 90% ownership interest ??Brookfield has controlled a majority of BOX and its predecessor entities since 2001 ??Unitholders over this period have always been in a minority position ??Given BPY?s control position, BOX cannot force a sale to a third party Structure of BOX ??BOX does not have any employees and depends on the management and administration services provided by BPY, the manager BPY draws on members of its senior management and other individuals to fulfill its obligations to BOX ??Brookfield employees manage the company and are also the property managers Management ??BOX is externally managed and pays annual management and incentive fees to BPY ??This external management structure is one of the reasons for BOX?s trading multiple discount versus peers, according to research analysts Internal Development Capabilities ??BOX has no internal development assets or capabilities ??BOX relies on growth opportunities presented by Brookfield to drive distributions higher in the future ??BOX has a right to be notified and to have the opportunity to discuss participation in developments by Brookfield, but its ability to acquire additional assets is dependent on the trading value of its units For Bay Adelaide East and Brookfield Place Calgary East, BOX is paying for leased up buildings but retains future tenant credit risk 11

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Table of Contents 1. Executive Summary 2. BOX Overview 3. Valuation Analysis Appendix 12

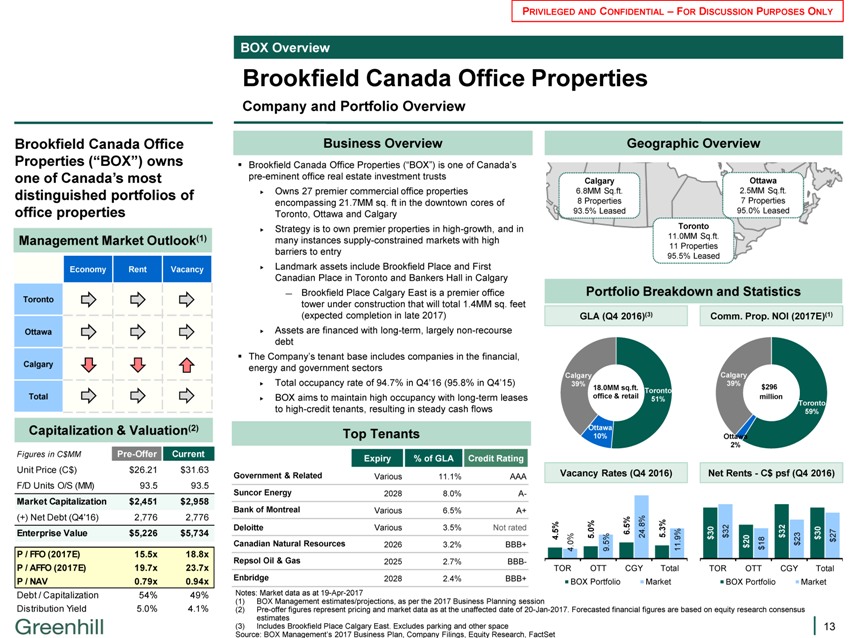

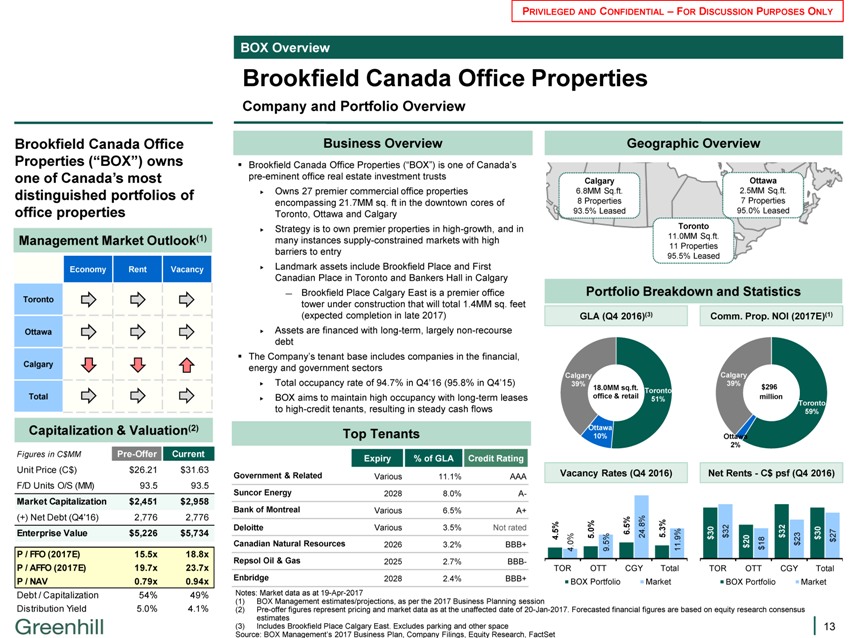

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Brookfield Canada Office Properties Company and Portfolio Overview Brookfield Canada Office Properties (?BOX?) owns one of Canada?s most distinguished portfolios of office properties Management Market Outlook(1) Economy Rent Vacancy Toronto Ottawa Calgary Total Capitalization & Valuation(2) Figures in C$MM Pre-Offer Current Unit Price (C$) $ 26.21 $ 31.63 F/D Units O/S (MM) 93.5 93.5 Market Capitalization $ 2,451 $ 2,958 (+) Net Debt (Q4’16) 2,776 2,776 Enterprise Value $ 5,226 $ 5,734 P / FFO (2017E) 15.5x 18.8x P / AFFO (2017E) 19.7x 23.7x P / NAV 0.79x 0.94x Debt / Capitalization 54% 49% Distribution Yield 5.0% 4.1% Business Overview ??Brookfield Canada Office Properties (?BOX?) is one of Canada?s pre-eminent office real estate investment trusts Owns 27 premier commercial office properties encompassing 21.7MM sq. ft in the downtown cores of Toronto, Ottawa and Calgary Strategy is to own premier properties in high-growth, and in many instances supply-constrained markets with high barriers to entry Landmark assets include Brookfield Place and First Canadian Place in Toronto and Bankers Hall in Calgary ? Brookfield Place Calgary East is a premier office tower under construction that will total 1.4MM sq. feet (expected completion in late 2017) Assets are financed with long-term, largely non-recourse debt ??The Company?s tenant base includes companies in the financial, energy and government sectors Total occupancy rate of 94.7% in Q4?16 (95.8% in Q4?15) BOX aims to maintain high occupancy with long-term leases to high-credit tenants, resulting in steady cash flows Top Tenants Expiry% of GLA Credit Rating Government & Related Various 11.1% AAA Suncor Energy 2028 8.0% A- Bank of Montreal Various 6.5% A+ Deloitte Various 3.5% Not rated Canadian Natural Resources 2026 3.2% BBB+ Repsol Oil & Gas 2025 2.7% BBB- Enbridge 2028 2.4% BBB+ Geographic Overview Calgary 6.8MM Sq.ft. 8 Properties 93.5% Leased Ottawa 2.5MM Sq.ft. 7 Properties 95.0% Leased Toronto 11.0MM Sq.ft. 11 Properties 95.5% Leased Portfolio Breakdown and Statistics GLA (Q4 2016)(3) Comm. Prop. NOI (2017E)(1) Calgary 39% Toronto 51% Ottawa 10% Calgary 39% Toronto 59% Ottawa 2% Vacancy Rates (Q4 2016) Net Rents—C$ psf (Q4 2016) 4.5% TOR 4.0% 5.0% OTT 9.5% 6.5% CGY 24.8% 5.3% Total 11.9% $30 TOR $32 $20 OTT $18 $32 CGY $23 $30 Total $27 BOX Portfolio Market BOX Portfolio Market Notes: Market data as at 19-Apr-2017 (1) BOX Management estimates/projections, as per the 2017 Business Planning session (2) Pre-offer figures represent pricing and market data as at the unaffected date of 20-Jan-2017. Forecasted financial figures are based on equity research consensus estimates (3) Includes Brookfield Place Calgary East. Excludes parking and other space Source: BOX Management?s 2017 Business Plan, Company Filings, Equity Research, FactSet 13

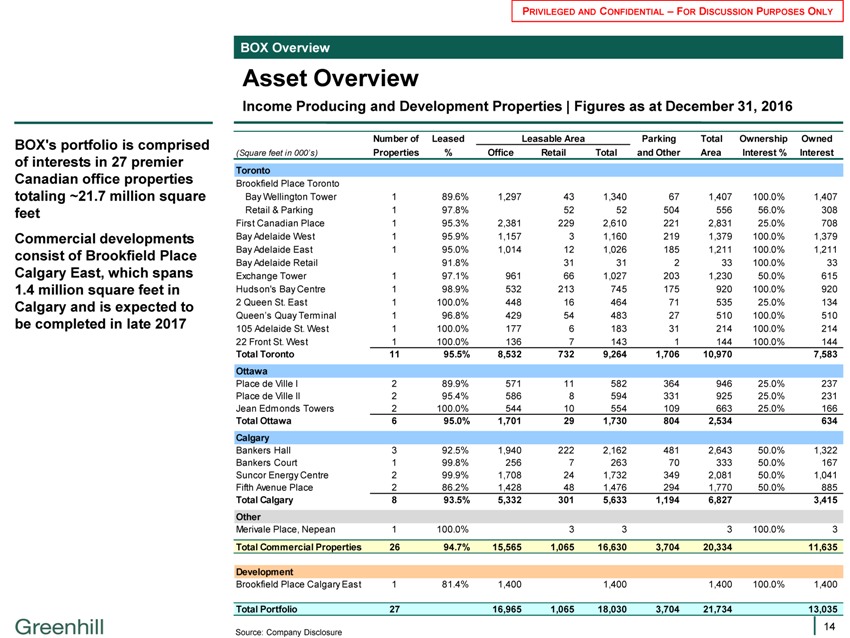

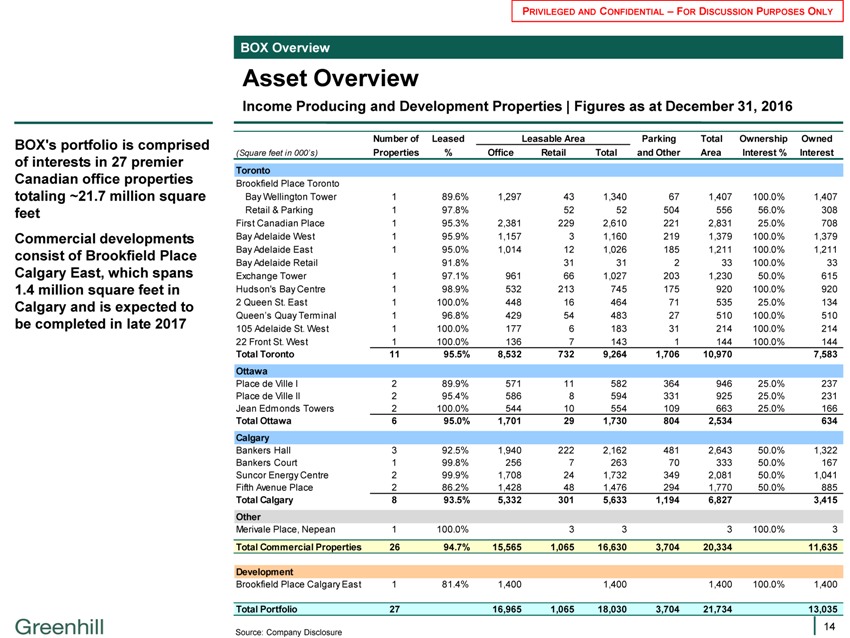

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Asset Overview Income Producing and Development Properties | Figures as at December 31, 2016 BOX’s portfolio is comprised of interests in 27 premier Canadian office properties totaling ~21.7 million square feet Commercial developments consist of Brookfield Place Calgary East, which spans 1.4 million square feet in Calgary and is expected to be completed in late 2017 Number of Leased Leasable Area Parking Total Ownership Owned (Square feet in 000?s) Properties% Office Retail Total and Other Area Interest % Interest Toronto Brookfield Place Toronto Bay Wellington Tower 1 89.6% 1,297 43 1,340 67 1,407 100.0% 1,407 Retail & Parking 1 97.8% 52 52 504 556 56.0% 308 First Canadian Place 1 95.3% 2,381 229 2,610 221 2,831 25.0% 708 Bay Adelaide West 1 95.9% 1,157 3 1,160 219 1,379 100.0% 1,379 Bay Adelaide East 1 95.0% 1,014 12 1,026 185 1,211 100.0% 1,211 Bay Adelaide Retail 91.8% 31 31 2 33 100.0% 33 Exchange Tower 1 97.1% 961 66 1,027 203 1,230 50.0% 615 Hudson’s Bay Centre 1 98.9% 532 213 745 175 920 100.0% 920 2 Queen St. East 1 100.0% 448 16 464 71 535 25.0% 134 Queen?s Quay Terminal 1 96.8% 429 54 483 27 510 100.0% 510 105 Adelaide St. West 1 100.0% 177 6 183 31 214 100.0% 214 22 Front St. West 1 100.0% 136 7 143 1 144 100.0% 144 Total Toronto 11 95.5% 8,532 732 9,264 1,706 10,970 7,583 Ottawa Place de Ville I 2 89.9% 571 11 582 364 946 25.0% 237 Place de Ville II 2 95.4% 586 8 594 331 925 25.0% 231 Jean Edmonds Towers 2 100.0% 544 10 554 109 663 25.0% 166 Total Ottawa 6 95.0% 1,701 29 1,730 804 2,534 634 Calgary Bankers Hall 3 92.5% 1,940 222 2,162 481 2,643 50.0% 1,322 Bankers Court 1 99.8% 256 7 263 70 333 50.0% 167 Suncor Energy Centre 2 99.9% 1,708 24 1,732 349 2,081 50.0% 1,041 Fifth Avenue Place 2 86.2% 1,428 48 1,476 294 1,770 50.0% 885 Total Calgary 8 93.5% 5,332 301 5,633 1,194 6,827 3,415 Other Merivale Place, Nepean 1 100.0% 3 3 3 100.0% 3 Total Commercial Properties 26 94.7% 15,565 1,065 16,630 3,704 20,334 11,635 Development Brookfield Place Calgary East 1 81.4% 1,400 1,400 1,400 100.0% 1,400 Total Portfolio 27 16,965 1,065 18,030 3,704 21,734 13,035 Source: Company Disclosure 14

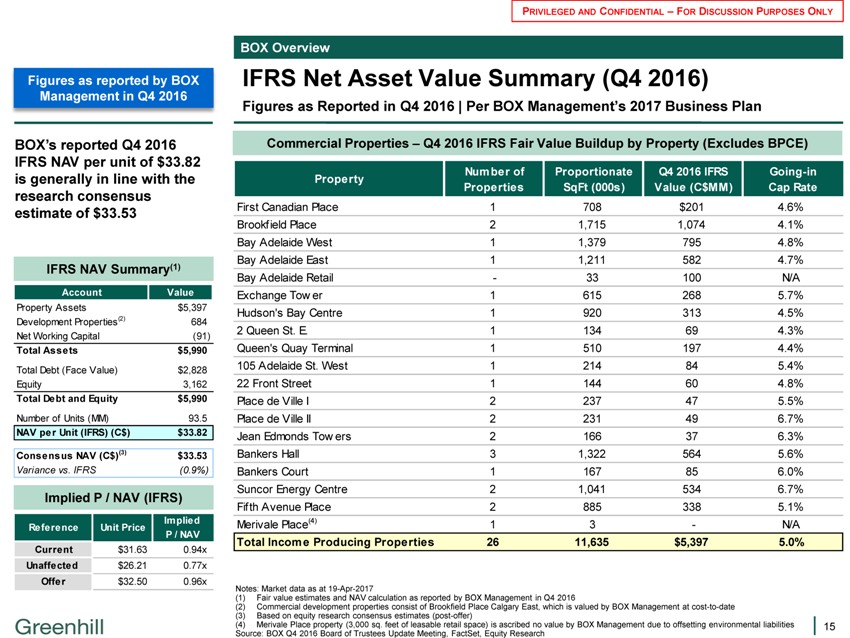

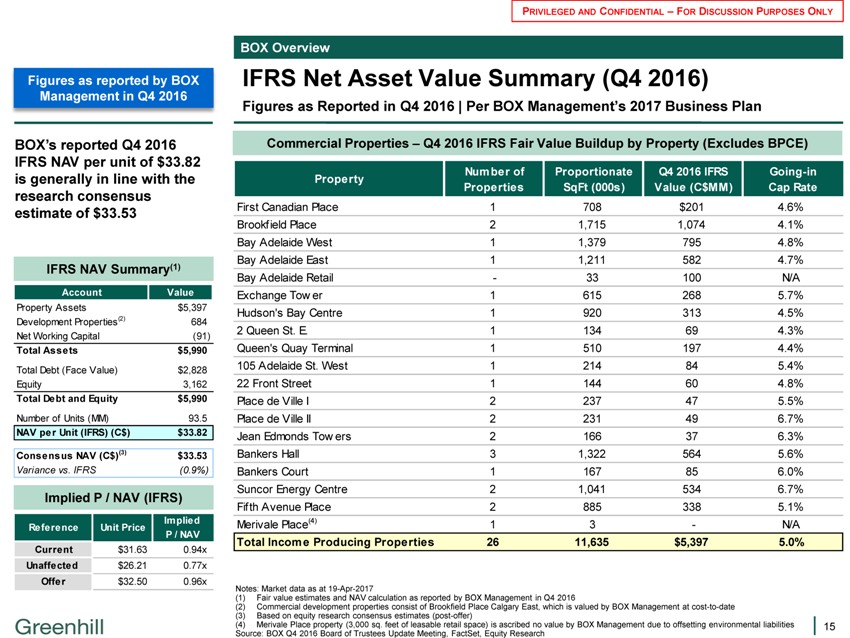

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview IFRS Net Asset Value Summary (Q4 2016) Figures as Reported in Q4 2016 | Per BOX Management?s 2017 Business Plan Figures as reported by BOX Management in Q4 2016 BOX?s reported Q4 2016 IFRS NAV per unit of $33.82 is generally in line with the research consensus estimate of $33.53 IFRS NAV Summary(1) Account Value Property Assets $5,397 Development Properties(2) 684 Net Working Capital(91) Total Assets $5,990 Total Debt (Face Value) $2,828 Equity 3,162 Total Debt and Equity $5,990 Number of Units (MM) 93.5 NAV per Unit (IFRS) (C$) $33.82 Consensus NAV (C$)(3) $33.53 Variance vs. IFRS(0.9%) Implied P / NAV (IFRS) Implied Reference Unit Price P / NAV Current $31.63 0.94x Unaffected $26.21 0.77x Offer $32.50 0.96x Commercial Properties ? Q4 2016 IFRS Fair Value Buildup by Property (Excludes BPCE) Property Number of Proportionate Q4 2016 IFRS Going-in Properties SqFt (000s) Value (C$MM) Cap Rate First Canadian Place 1 708 $201 4.6% Brookfield Place 2 1,715 1,074 4.1% Bay Adelaide West 1 1,379 795 4.8% Bay Adelaide East 1 1,211 582 4.7% Bay Adelaide Retail—33 100 N/A Exchange Tow er 1 615 268 5.7% Hudson’s Bay Centre 1 920 313 4.5% 2 Queen St. E. 1 134 69 4.3% Queen’s Quay Terminal 1 510 197 4.4% 105 Adelaide St. West 1 214 84 5.4% 22 Front Street 1 144 60 4.8% Place de Ville I 2 237 47 5.5% Place de Ville II 2 231 49 6.7% Jean Edmonds Tow ers 2 166 37 6.3% Bankers Hall 3 1,322 564 5.6% Bankers Court 1 167 85 6.0% Suncor Energy Centre 2 1,041 534 6.7% Fifth Avenue Place 2 885 338 5.1% Merivale Place(4) 1 3—N/A Total Income Producing Properties 26 11,635 $5,397 5.0% Notes: Market data as at 19-Apr-2017 (1) Fair value estimates and NAV calculation as reported by BOX Management in Q4 2016 (2) Commercial development properties consist of Brookfield Place Calgary East, which is valued by BOX Management at cost-to-date (3) Based on equity research consensus estimates (post-offer) (4) Merivale Place property (3,000 sq. feet of leasable retail space) is ascribed no value by BOX Management due to offsetting environmental liabilities Source: BOX Q4 2016 Board of Trustees Update Meeting, FactSet, Equity Research 15

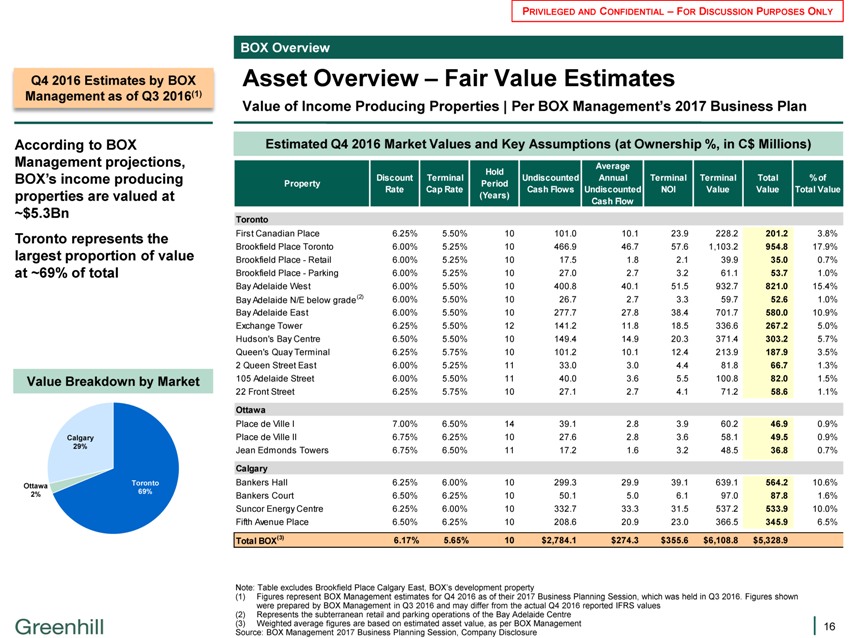

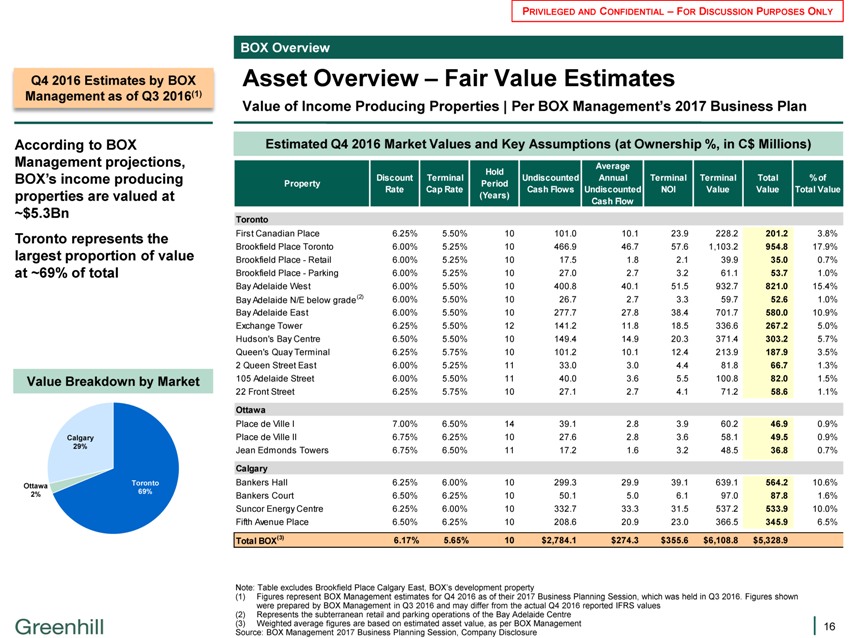

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Asset Overview ? Fair Value Estimates Value of Income Producing Properties | Per BOX Management?s 2017 Business Plan Q4 2016 Estimates by BOX Management as of Q3 2016(1) According to BOX Management projections, BOX?s income producing properties are valued at ~$5.3Bn Toronto represents the largest proportion of value at ~69% of total Value Breakdown by Market Calgary 29% Toronto 69% Ottawa 2% Estimated Q4 2016 Market Values and Key Assumptions (at Ownership %, in C$ Millions) Average Hold Discount Terminal Undiscounted Annual Terminal Terminal Total% of Property Period Rate Cap Rate Cash Flows Undiscounted NOI Value Value Total Value (Years) Cash Flow Toronto First Canadian Place 6.25% 5.50% 10 101.0 10.1 23.9 228.2 201.2 3.8% Brookfield Place Toronto 6.00% 5.25% 10 466.9 46.7 57.6 1,103.2 954.8 17.9% Brookfield Place—Retail 6.00% 5.25% 10 17.5 1.8 2.1 39.9 35.0 0.7% Brookfield Place—Parking 6.00% 5.25% 10 27.0 2.7 3.2 61.1 53.7 1.0% Bay Adelaide West 6.00% 5.50% 10 400.8 40.1 51.5 932.7 821.0 15.4% Bay Adelaide N/E below grade(2) 6.00% 5.50% 10 26.7 2.7 3.3 59.7 52.6 1.0% Bay Adelaide East 6.00% 5.50% 10 277.7 27.8 38.4 701.7 580.0 10.9% Exchange Tower 6.25% 5.50% 12 141.2 11.8 18.5 336.6 267.2 5.0% Hudson’s Bay Centre 6.50% 5.50% 10 149.4 14.9 20.3 371.4 303.2 5.7% Queen’s Quay Terminal 6.25% 5.75% 10 101.2 10.1 12.4 213.9 187.9 3.5% 2 Queen Street East 6.00% 5.25% 11 33.0 3.0 4.4 81.8 66.7 1.3% 105 Adelaide Street 6.00% 5.50% 11 40.0 3.6 5.5 100.8 82.0 1.5% 22 Front Street 6.25% 5.75% 10 27.1 2.7 4.1 71.2 58.6 1.1% Ottawa Place de Ville I 7.00% 6.50% 14 39.1 2.8 3.9 60.2 46.9 0.9% Place de Ville II 6.75% 6.25% 10 27.6 2.8 3.6 58.1 49.5 0.9% Jean Edmonds Towers 6.75% 6.50% 11 17.2 1.6 3.2 48.5 36.8 0.7% Calgary Bankers Hall 6.25% 6.00% 10 299.3 29.9 39.1 639.1 564.2 10.6% Bankers Court 6.50% 6.25% 10 50.1 5.0 6.1 97.0 87.8 1.6% Suncor Energy Centre 6.25% 6.00% 10 332.7 33.3 31.5 537.2 533.9 10.0% Fifth Avenue Place 6.50% 6.25% 10 208.6 20.9 23.0 366.5 345.9 6.5% Total BOX(3) 6.17% 5.65% 10 $2,784.1 $274.3 $355.6 $6,108.8 $5,328.9 Note: Table excludes Brookfield Place Calgary East, BOX?s development property (1) Figures represent BOX Management estimates for Q4 2016 as of their 2017 Business Planning Session, which was held in Q3 2016. Figures shown were prepared by BOX Management in Q3 2016 and may differ from the actual Q4 2016 reported IFRS values (2) Represents the subterranean retail and parking operations of the Bay Adelaide Centre (3) Weighted average figures are based on estimated asset value, as per BOX Management Source: BOX Management 2017 Business Planning Session, Company Disclosure 16

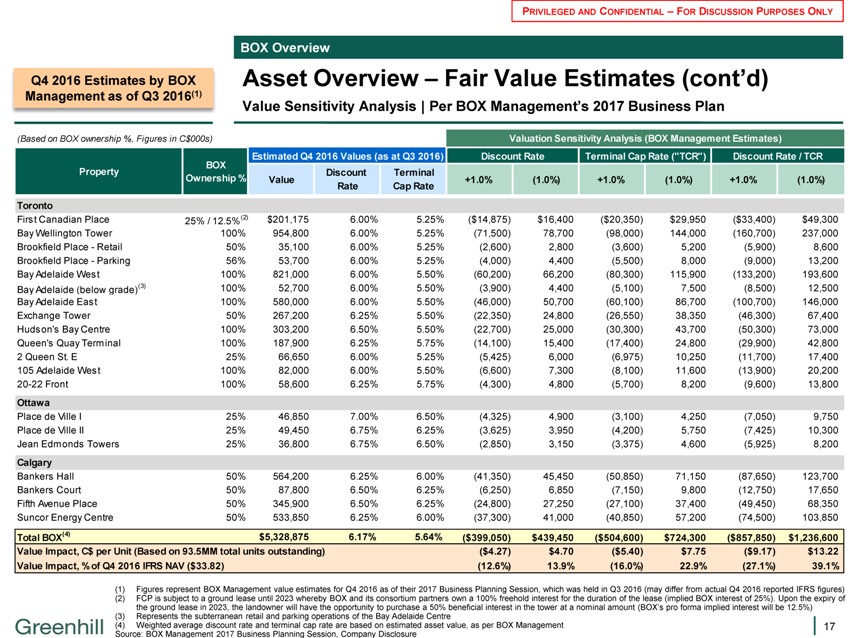

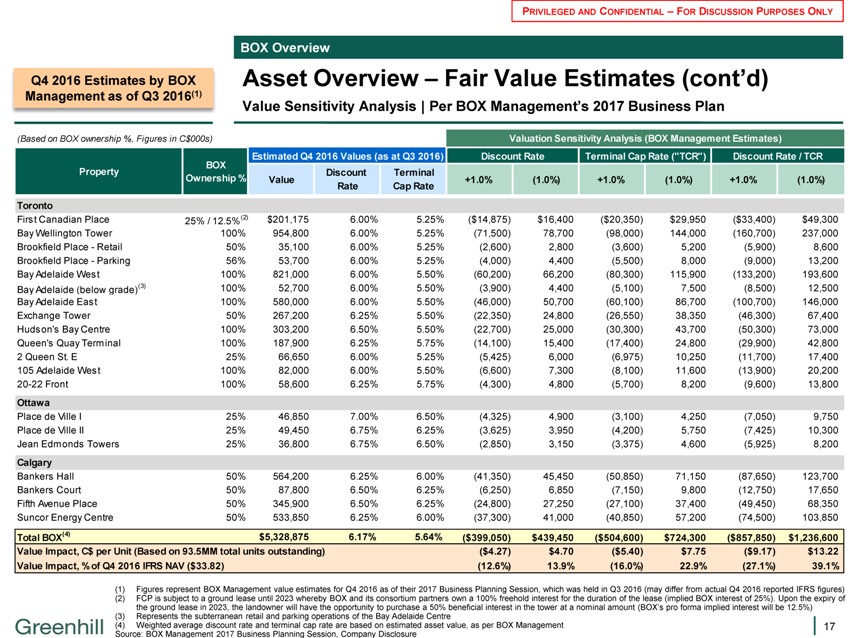

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Asset Overview ? Fair Value Estimates (cont?d) Value Sensitivity Analysis | Per BOX Management?s 2017 Business Plan Q4 2016 Estimates by BOX Management as of Q3 2016(1) (Based on BOX ownership %, Figures in C$000s) Valuation Sensitivity Analysis (BOX Management Estimates) Estimated Q4 2016 Values (as at Q3 2016) Discount Rate Terminal Cap Rate (“TCR”) Discount Rate / TCR BOX Property Discount Terminal Ownership % Value +1.0%(1.0%) +1.0%(1.0%) +1.0%(1.0%) Rate Cap Rate Toronto First Canadian Place 25% / 12.5%(2) $201,175 6.00% 5.25%($14,875) $16,400($20,350) $29,950($33,400) $49,300 Bay Wellington Tower 100% 954,800 6.00% 5.25%(71,500) 78,700(98,000) 144,000(160,700) 237,000 Brookfield Place—Retail 50% 35,100 6.00% 5.25%(2,600) 2,800(3,600) 5,200(5,900) 8,600 Brookfield Place—Parking 56% 53,700 6.00% 5.25%(4,000) 4,400(5,500) 8,000(9,000) 13,200 Bay Adelaide West 100% 821,000 6.00% 5.50%(60,200) 66,200(80,300) 115,900(133,200) 193,600 Bay Adelaide (below grade)(3) 100% 52,700 6.00% 5.50%(3,900) 4,400(5,100) 7,500(8,500) 12,500 Bay Adelaide East 100% 580,000 6.00% 5.50%(46,000) 50,700(60,100) 86,700(100,700) 146,000 Exchange Tower 50% 267,200 6.25% 5.50%(22,350) 24,800(26,550) 38,350(46,300) 67,400 Hudson’s Bay Centre 100% 303,200 6.50% 5.50%(22,700) 25,000(30,300) 43,700(50,300) 73,000 Queen’s Quay Terminal 100% 187,900 6.25% 5.75%(14,100) 15,400(17,400) 24,800(29,900) 42,800 2 Queen St. E 25% 66,650 6.00% 5.25%(5,425) 6,000(6,975) 10,250(11,700) 17,400 105 Adelaide West 100% 82,000 6.00% 5.50%(6,600) 7,300(8,100) 11,600(13,900) 20,200 20-22 Front 100% 58,600 6.25% 5.75%(4,300) 4,800(5,700) 8,200(9,600) 13,800 Ottawa Place de Ville I 25% 46,850 7.00% 6.50%(4,325) 4,900(3,100) 4,250(7,050) 9,750 Place de Ville II 25% 49,450 6.75% 6.25%(3,625) 3,950(4,200) 5,750(7,425) 10,300 Jean Edmonds Towers 25% 36,800 6.75% 6.50%(2,850) 3,150(3,375) 4,600(5,925) 8,200 Calgary Bankers Hall 50% 564,200 6.25% 6.00%(41,350) 45,450(50,850) 71,150(87,650) 123,700 Bankers Court 50% 87,800 6.50% 6.25%(6,250) 6,850(7,150) 9,800(12,750) 17,650 Fifth Avenue Place 50% 345,900 6.50% 6.25%(24,800) 27,250(27,100) 37,400(49,450) 68,350 Suncor Energy Centre 50% 533,850 6.25% 6.00%(37,300) 41,000(40,850) 57,200(74,500) 103,850 Total BOX(4) $5,328,875 6.17% 5.64%($399,050) $439,450($504,600) $724,300($857,850) $1,236,600 Value Impact, C$ per Unit (Based on 93.5MM total units outstanding)($4.27) $4.70($5.40) $7.75($9.17) $13.22 Value Impact, % of Q4 2016 IFRS NAV ($33.82)(12.6%) 13.9%(16.0%) 22.9%(27.1%) 39.1% (1) Figures represent BOX Management value estimates for Q4 2016 as of their 2017 Business Planning Session, which was held in Q3 2016 (may differ from actual Q4 2016 reported IFRS figures) (2) FCP is subject to a ground lease until 2023 whereby BOX and its consortium partners own a 100% freehold interest for the duration of the lease (implied BOX interest of 25%). Upon the expiry of the ground lease in 2023, the landowner will have the opportunity to purchase a 50% beneficial interest in the tower at a nominal amount (BOX?s pro forma implied interest will be 12.5%) (3) Represents the subterranean retail and parking operations of the Bay Adelaide Centre (4) Weighted average discount rate and terminal cap rate are based on estimated asset value, as per BOX Management 17 Source: BOX Management 2017 Business Planning Session, Company Disclosure 17

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Ground Lease Summary Overview of BOX Properties Subject to a Ground Lease Six of BOX’s properties are subject to long term ground leases or similar arrangements The underlying land for these properties is owned by third parties and leased by BOX (and its co-venture partners, where applicable) on long-term leases Under the ground lease arrangements, BOX and its co-venture partners are responsible for paying rent as well as any costs related to building improvements If a ground lease expires and is not extended, the land and all improvements, including the properties developed on the land, will revert to the owner of the land Leasehold interests are almost always worth less than a freehold interest in the same asset Expiration IFRS Value IFRS Value Building Location Notes Year(C$MM)(% of Total) ? Building is owned by a consortium: BOX (25% leasehold), AIMCo. (25%) and CPPIB (50%) ? Land is owned 50/50 by the consortium and Manulife Financial (landlord) First Canadian Toronto 2023 $201 3.3% BOX?s implied freehold interest is 12.5% Place ? ? When the lease expires, the consortium and Manulife (as landlord) have an option to purchase interests in the building in proportion to their respective freehold interest 105 Adelaide Street ? BOX owns a 100% leasehold interest and a Toronto 2043/2073(1) $84 1.4% West 12.5% freehold interest Place de Ville I Ottawa 2065 $47 0.8% ? BOX owns a 25% leasehold interest in the property ? There is one ground lease that covers a portion of this property (~63% by area) Hudson’s Bay Centre Toronto 2070 $313 5.1% ? BOX owns a 100% leasehold interest in the leasehold parcel and a 100% freehold interest in two freehold parcels ? Only a small portion of this property is subject to a ground lease (~16.5% by area) 2 Queen Street East Toronto 2099 $69 1.1% ? BOX owns a 25% leasehold interest in the leasehold parcel and a 25% interest in the freehold parcel ? There is one effective ground lease for a portion of this property (~50% by area) Exchange Tower Toronto 2115(2) $268 4.4% ? BOX owns a 50% subleasehold interest in the subleasehold parcel and a 50% interest in two total freehold parcels Notes: IFRS values are as at Q4 2016, as per BOX Management (1) Ground lessee has the option to extend the ground lease for an additional 30 years to 2073 (2) Ground sublessee has 73 consecutive options to extend the ground sublease, each for a term of 10 years and 6 months, to November 30, 2881 Source: Company Disclosure, BOX Management 2017 Business Planning session 18

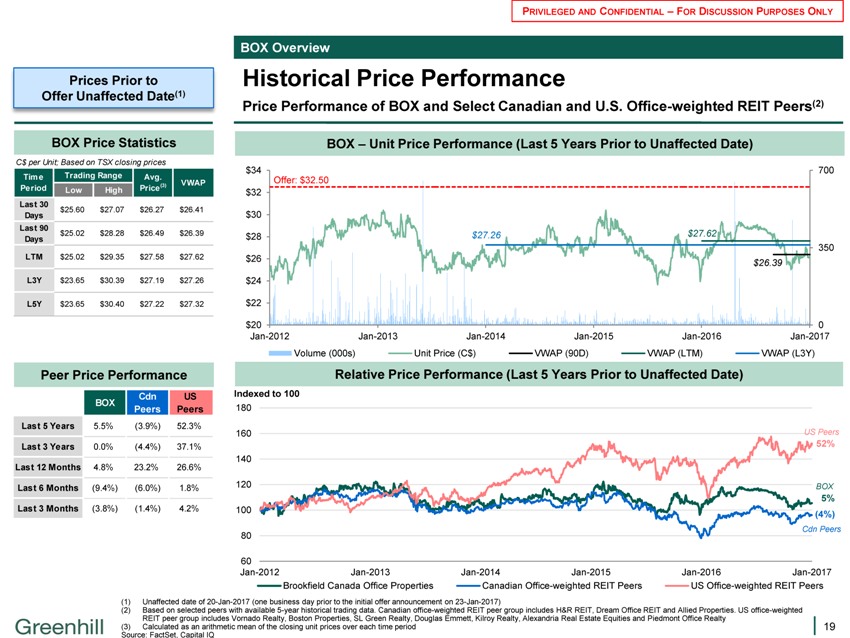

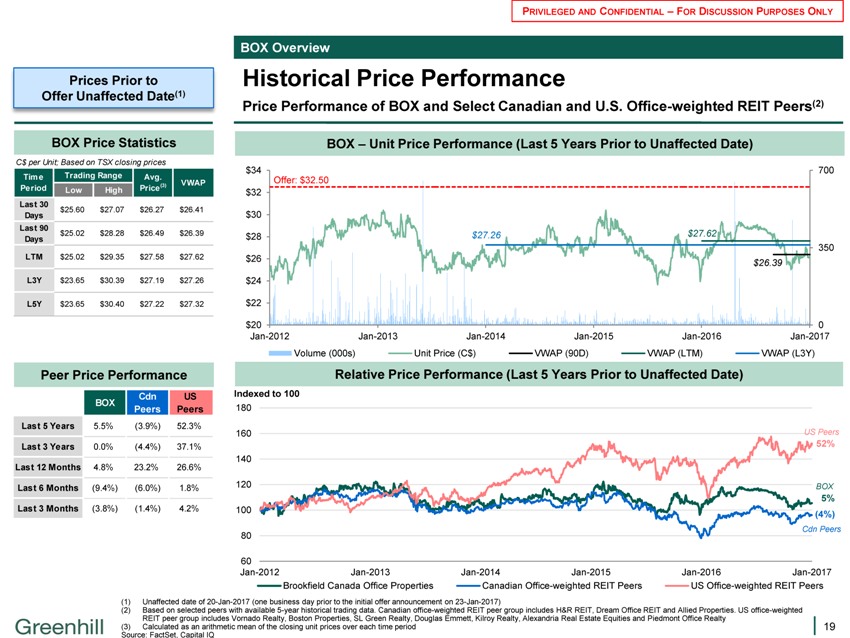

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Historical Price Performance Price Performance of BOX and Select Canadian and U.S. Office-weighted REIT Peers(2) Prices Prior to Offer Unaffected Date(1) BOX Price Statistics C$ per Unit; Based on TSX closing prices Time Trading Range Avg. VWAP Period Low High Price(3) Last 30 $25.60 $27.07 $26.27 $26.41 Days Last 90 $25.02 $28.28 $26.49 $26.39 Days LTM $25.02 $29.35 $27.58 $27.62 L3Y $23.65 $30.39 $27.19 $27.26 L5Y $23.65 $30.40 $27.22 $27.32 Peer Price Performance Cdn US BOX Peers Peers Last 5 Years 5.5%(3.9%) 52.3% Last 3 Years 0.0%(4.4%) 37.1% Last 12 Months 4.8% 23.2% 26.6% Last 6 Months(9.4%)(6.0%) 1.8% Last 3 Months(3.8%)(1.4%) 4.2% BOX ? Unit Price Performance (Last 5 Years Prior to Unaffected Date) $34 700 Offer: $32.50 $32 $30 $28 $27.26 $27.62 350 $26 $26.39 $24 $22 $20 0 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Volume (000s) Unit Price (C$) VWAP (90D) VWAP (LTM) VWAP (L3Y) Relative Price Performance (Last 5 Years Prior to Unaffected Date) Indexed to 100 180 160 US Peers 52% 140 120 BOX 5% 100(4%) Cdn Peers 80 60 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Brookfield Canada Office Properties Canadian Office-weighted REIT Peers US Office-weighted REIT Peers (1) Unaffected date of 20-Jan-2017 (one business day prior to the initial offer announcement on 23-Jan-2017) (2) Based on selected peers with available 5-year historical trading data. Canadian office-weighted REIT peer group includes H&R REIT, Dream Office REIT and Allied Properties. US office-weighted REIT peer group includes Vornado Realty, Boston Properties, SL Green Realty, Douglas Emmett, Kilroy Realty, Alexandria Real Estate Equities and Piedmont Office Realty (3) Calculated as an arithmetic mean of the closing unit prices over each time period Source: FactSet, Capital IQ 19

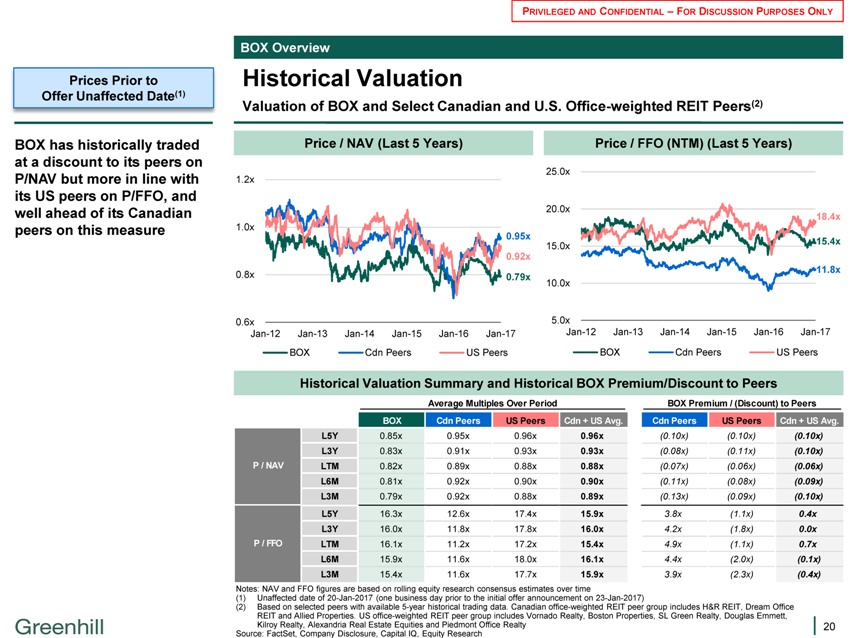

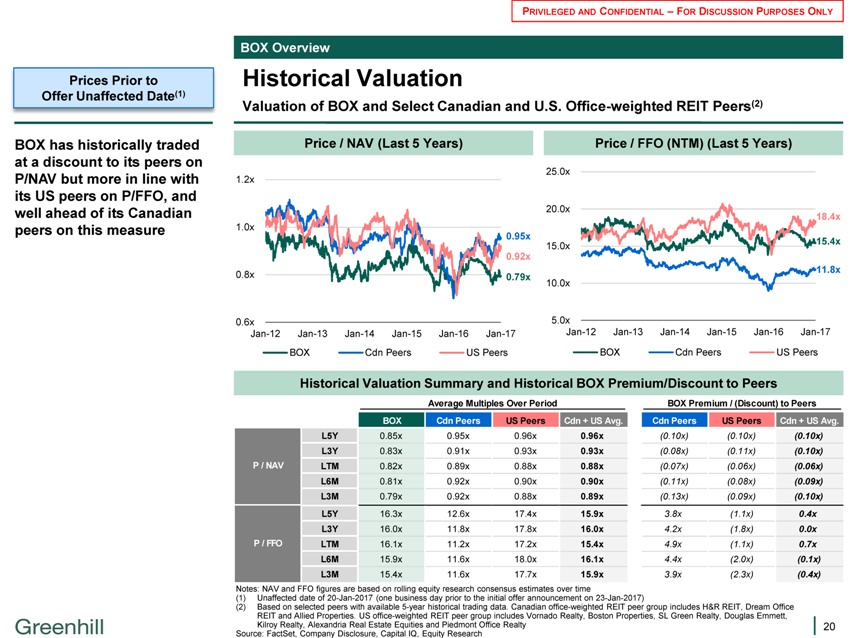

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Historical Valuation Valuation of BOX and Select Canadian and U.S. Office-weighted REIT Peers(2) Prices Prior to Offer Unaffected Date(1) BOX has historically traded at a discount to its peers on P/NAV but more in line with its US peers on P/FFO, and well ahead of its Canadian peers on this measure Price / NAV(Last 5 Years) Price / FFO (NTM) (Last 5 Years) 25.0x 1.2x 20.0x 18.4x 1.0x 0.95x 15.0x 15.4x 0.92x 0.8x 0.79x 11.8x 10.0x 0.6x 5.0x Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 BOX Cdn Peers US Peers BOX Cdn Peers US Peers Historical Valuation Summary and Historical BOX Premium/Discount to Peers Average Multiples Over Period BOX Premium / (Discount) to Peers BOX Cdn Peers US Peers Cdn + US Avg. Cdn Peers US Peers Cdn + US Avg. L5Y 0.85x 0.95x 0.96x 0.96x(0.10x)(0.10x)(0.10x) L3Y 0.83x 0.91x 0.93x 0.93x(0.08x)(0.11x)(0.10x) P / NAV LTM 0.82x 0.89x 0.88x 0.88x(0.07x)(0.06x)(0.06x) L6M 0.81x 0.92x 0.90x 0.90x(0.11x)(0.08x)(0.09x) L3M 0.79x 0.92x 0.88x 0.89x(0.13x)(0.09x)(0.10x) L5Y 16.3x 12.6x 17.4x 15.9x 3.8x(1.1x) 0.4x L3Y 16.0x 11.8x 17.8x 16.0x 4.2x(1.8x) 0.0x P / FFO LTM 16.1x 11.2x 17.2x 15.4x 4.9x(1.1x) 0.7x L6M 15.9x 11.6x 18.0x 16.1x 4.4x(2.0x)(0.1x) L3M 15.4x 11.6x 17.7x 15.9x 3.9x(2.3x)(0.4x) Notes: NAV and FFO figures are based on rolling equity research consensus estimates over time (1) Unaffected date of 20-Jan-2017 (one business day prior to the initial offer announcement on 23-Jan-2017) (2) Based on selected peers with available 5-year historical trading data. Canadian office-weighted REIT peer group includes H&R REIT, Dream Office REIT and Allied Properties. US office-weighted REIT peer group includes Vornado Realty, Boston Properties, SL Green Realty, Douglas Emmett, Kilroy Realty, Alexandria Real Estate Equities and Piedmont Office Realty Source: FactSet, Company Disclosure, Capital IQ, Equity Research 20

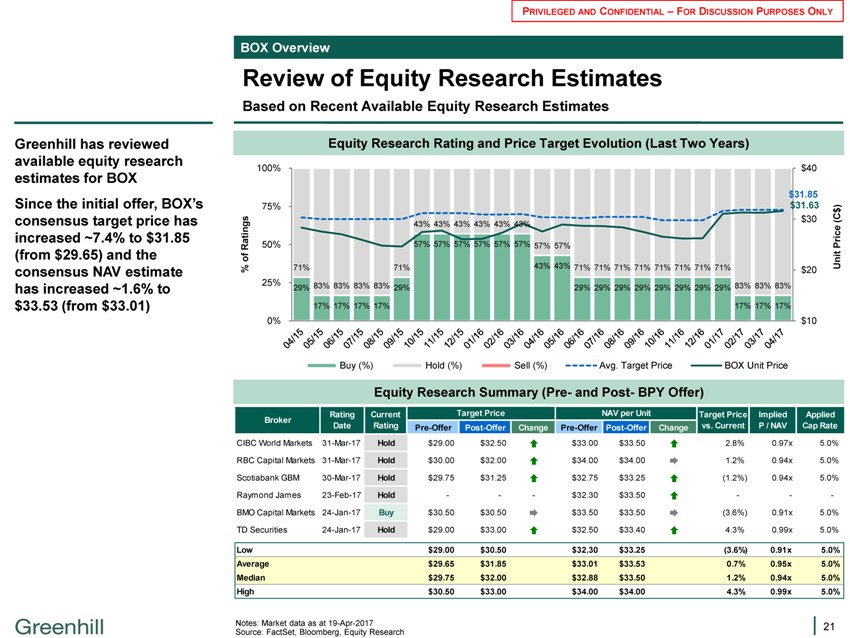

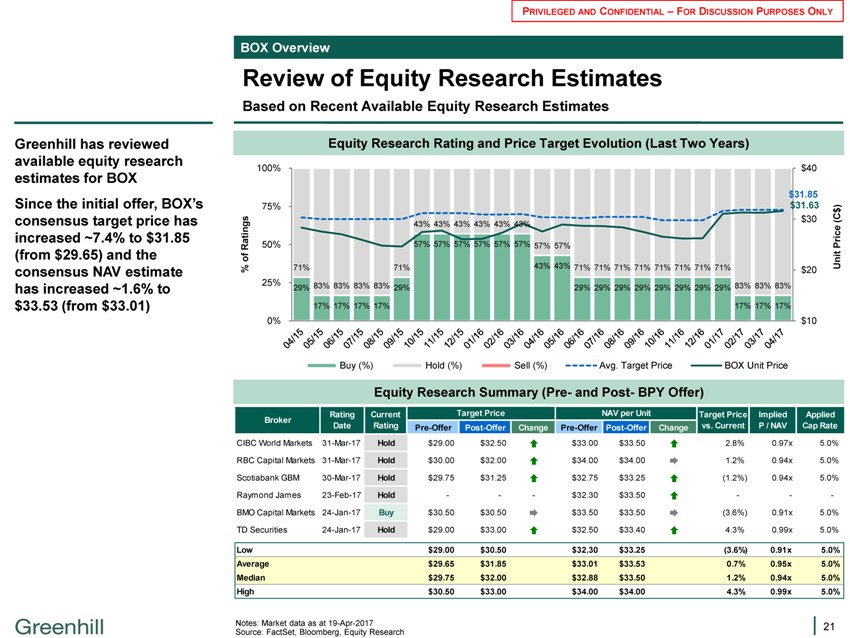

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Review of Equity Research Estimates Based on Recent Available Equity Research Estimates Greenhill has reviewed available equity research estimates for BOX Since the initial offer, BOX?s consensus target price has increased ~7.4% to $31.85 (from $29.65) and the consensus NAV estimate has increased ~1.6% to $33.53 (from $33.01) Equity Research Rating and Price Target Evolution (Last Two Years) 100% $40 $31.85 75% $31.63 ) $ 43% 43% 43% 43% 43% 43% $30(C e tings c R a 50% 57% 57% 57% 57% 57% 57% 57% 57% Pri t of ni % 71% 71% 43% 43% 71% 71% 71% 71% 71% 71% 71% 71% $20 U 25% 29% 83% 83% 83% 83% 29% 29% 29% 29% 29% 29% 29% 29% 29% 83% 83% 83% 17% 17% 17% 17% 17% 17% 17% 0% $10 04/15 05/15 06/15 07/15 08/15 09/15 10/15 11/15 12/15 01/16 02/16 03/16 04/16 05/16 06/16 07/16 08/16 09/16 10/16 11/16 12/16 01/17 02/17 03/17 04/17 Buy (%) Hold (%) Sell (%) Avg. Target Price BOX Unit Price Equity Research Summary (Pre- and Post- BPY Offer) Rating Current Target Price NAV per Unit Target Price Implied Applied Broker Date Rating Pre-Offer Post-Offer Change Pre-Offer Post-Offer Change vs. Current P / NAV Cap Rate CIBC World Markets 31-Mar-17 Hold $ 29.00 $ 32.50 ? $33.00 $ 33.50 ? 2.8% 0.97x 5.0% RBC Capital Markets 31-Mar-17 Hold $ 30.00 $ 32.00 ? $34.00 $ 34.00 ? 1.2% 0.94x 5.0% Scotiabank GBM 30-Mar-17 Hold $ 29.75 $ 31.25 ? $32.75 $ 33.25 ?(1.2%) 0.94x 5.0% Raymond James 23-Feb-17 Hold ——$32.30 $ 33.50 ? ——BMO Capital Markets 24-Jan-17 Buy $ 30.50 $ 30.50 ? $33.50 $ 33.50 ?(3.6%) 0.91x 5.0% TD Securities 24-Jan-17 Hold $ 29.00 $ 33.00 ? $32.50 $ 33.40 ? 4.3% 0.99x 5.0% Low $ 29.00 $ 30.50 $32.30 $ 33.25(3.6%) 0.91x 5.0% Average $ 29.65 $ 31.85 $33.01 $ 33.53 0.7% 0.95x 5.0% Median $ 29.75 $ 32.00 $32.88 $ 33.50 1.2% 0.94x 5.0% High $ 30.50 $ 33.00 $34.00 $ 34.00 4.3% 0.99x 5.0% Notes: Market data as at 19-Apr-2017 Source: FactSet, Bloomberg, Equity Research 21

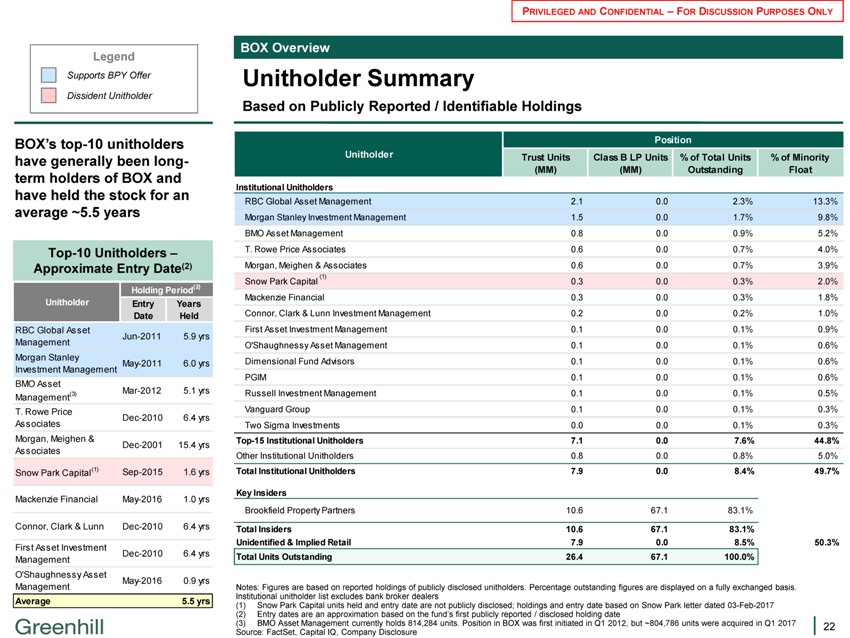

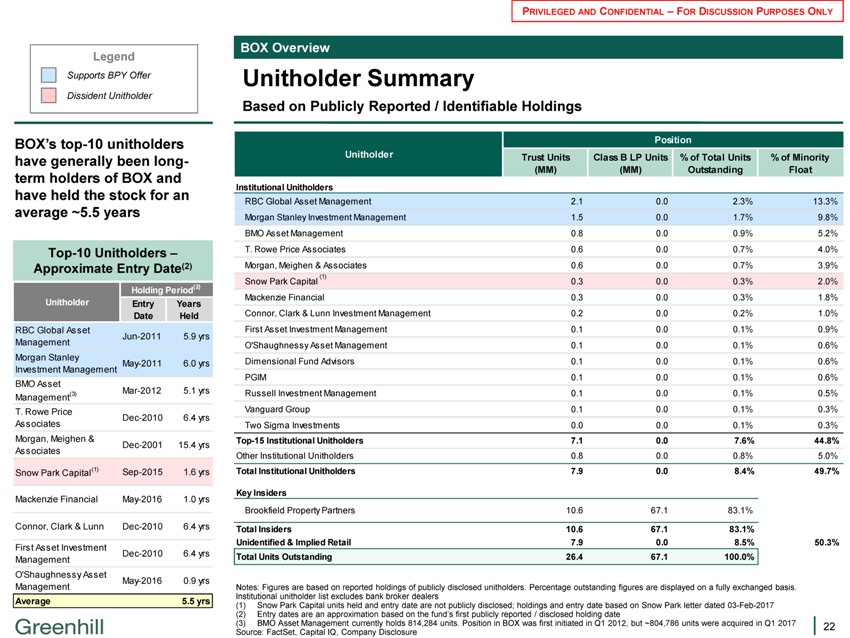

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Unitholder Summary Based on Publicly Reported / Identifiable Holdings Legend Supports BPY Offer Dissident Unitholder BOX?s top-10 unitholders have generally been long-term holders of BOX and have held the stock for an average ~5.5 years Top-10 Unitholders ? Approximate Entry Date(2) Holding Period(2) Unitholder Entry Years Date Held RBC Global Asset Jun-2011 5.9 yrs Management Morgan Stanley May-2011 6.0 yrs Investment Management BMO Asset (3) Mar-2012 5.1 yrs Management T. Rowe Price Dec-2010 6.4 yrs Associates Morgan, Meighen & Dec-2001 15.4 yrs Associates Snow Park Capital(1) Sep-2015 1.6 yrs Mackenzie Financial May-2016 1.0 yrs Connor, Clark & Lunn Dec-2010 6.4 yrs First Asset Investment Dec-2010 6.4 yrs Management O’Shaughnessy Asset May-2016 0.9 yrs Management Average 5.5 yrs Position Unitholder Trust Units Class B LP Units% of Total Units% of Minority (MM)(MM) Outstanding Float Institutional Unitholders RBC Global Asset Management 2.1 0.0 2.3% 13.3% Morgan Stanley Investment Management 1.5 0.0 1.7% 9.8% BMO Asset Management 0.8 0.0 0.9% 5.2% T. Rowe Price Associates 0.6 0.0 0.7% 4.0% Morgan, Meighen & Associates 0.6 0.0 0.7% 3.9% Snow Park Capital (1) 0.3 0.0 0.3% 2.0% Mackenzie Financial 0.3 0.0 0.3% 1.8% Connor, Clark & Lunn Investment Management 0.2 0.0 0.2% 1.0% First Asset Investment Management 0.1 0.0 0.1% 0.9% O’Shaughnessy Asset Management 0.1 0.0 0.1% 0.6% Dimensional Fund Advisors 0.1 0.0 0.1% 0.6% PGIM 0.1 0.0 0.1% 0.6% Russell Investment Management 0.1 0.0 0.1% 0.5% Vanguard Group 0.1 0.0 0.1% 0.3% Two Sigma Investments 0.0 0.0 0.1% 0.3% Top-15 Institutional Unitholders 7.1 0.0 7.6% 44.8% Other Institutional Unitholders 0.8 0.0 0.8% 5.0% Total Institutional Unitholders 7.9 0.0 8.4% 49.7% Key Insiders Brookfield Property Partners 10.6 67.1 83.1% Total Insiders 10.6 67.1 83.1% Unidentified & Implied Retail 7.9 0.0 8.5% 50.3% Total Units Outstanding 26.4 67.1 100.0% Notes: Figures are based on reported holdings of publicly disclosed unitholders. Percentage outstanding figures are displayed on a fully exchanged basis. Institutional unitholder list excludes bank broker dealers (1) Snow Park Capital units held and entry date are not publicly disclosed; holdings and entry date based on Snow Park letter dated 03-Feb-2017 (2) Entry dates are an approximation based on the fund?s first publicly reported / disclosed holding date (3) BMO Asset Management currently holds 814,284 units. Position in BOX was first initiated in Q1 2012, but ~804,786 units were acquired in Q1 2017 Source: FactSet, Capital IQ, Company Disclosure 22

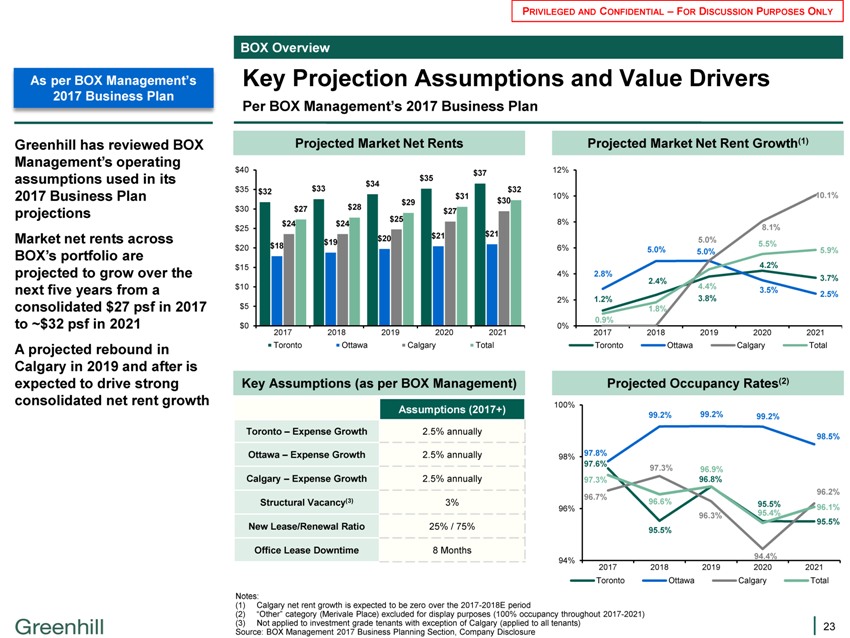

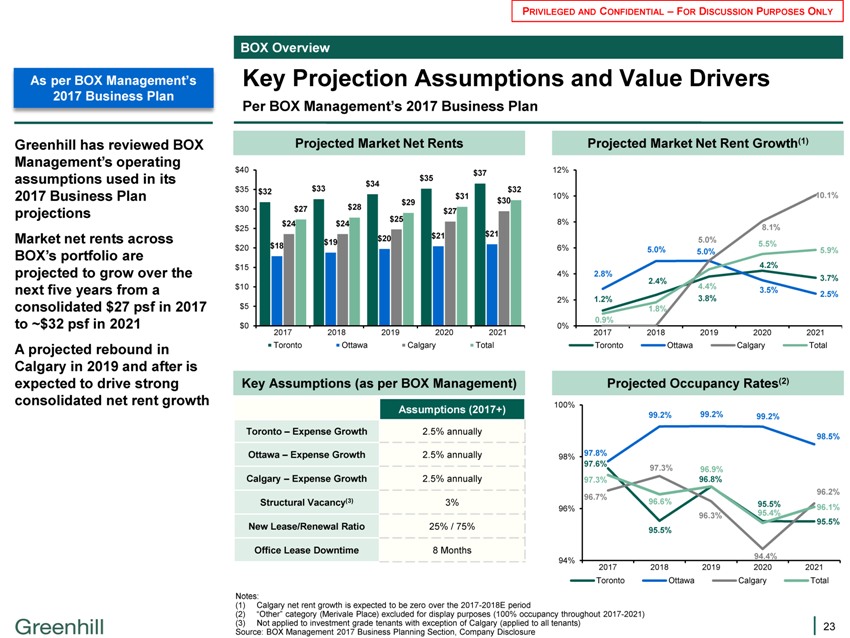

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Key Projection Assumptions and Value Drivers Per BOX Management?s 2017 Business Plan As per BOX Management?s 2017 Business Plan Greenhill has reviewed BOX Management?s operating assumptions used in its 2017 Business Plan projections Market net rents across BOX?s portfolio are projected to grow over the next five years from a consolidated $27 psf in 2017 to ~$32 psf in 2021 A projected rebound in Calgary in 2019 and after is expected to drive strong consolidated net rent growth Projected Market Net Rents Projected Market Net Rent Growth(1) $40 $37 12% $35 $33 $34 $35 $32 $32 $31 10% 10.1% $29 $30 $30 $27 $28 $27 $24 $24 $25 8% $25 8.1% $20 $21 $21 $19 5.0% 5% $20 $18 6% 5.0% 5.0% 5. 5.9% $15 4.2% 4% 2.8% 2.4% 3.7% $10 4.4% 3.5% 2% 1.2% 3.8% 2.5% $5 1.8% 0.9% $0 0% 2017 2018 2019 2020 2021 2017 2018 2019 2020 2021 Toronto Ottawa Calgary Total Toronto Ottawa Calgary Total Key Assumptions (as per BOX Management) Projected Occupancy Rates(2) Assumptions (2017+) 100% 99.2% 99.2% 99.2% Toronto ? Expense Growth 2.5% annually 98.5% Ottawa ? Expense Growth 2.5% annually 98% 97.8% 97.6% 97.3% 96.9% Calgary ? Expense Growth 2.5% annually 97.3% 96.8% 96.7% 96.2% Structural Vacancy(3) 3% 96.6% 95.5% 96% 96.1% 96.3% 95.4% 95.5% New Lease/Renewal Ratio 25% / 75% 95.5% Office Lease Downtime 8 Months 94% 94.4% 2017 2018 2019 2020 2021 Toronto Ottawa Calgary Total Notes: (1) Calgary net rent growth is expected to be zero over the 2017-2018E period (2) ?Other? category (Merivale Place) excluded for display purposes (100% occupancy throughout 2017-2021) (3) Not applied to investment grade tenants with exception of Calgary (applied to all tenants) Source: BOX Management 2017 Business Planning Section, Company Disclosure 23

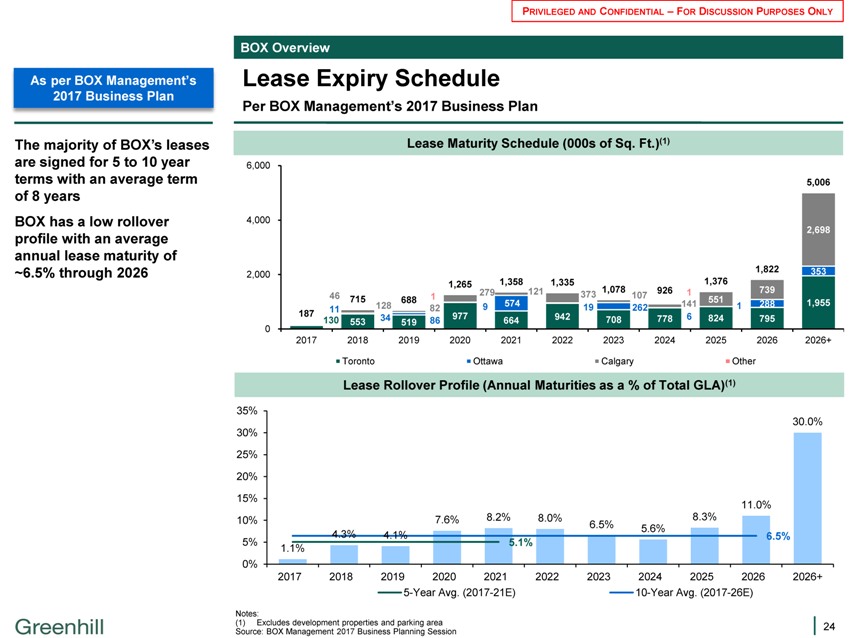

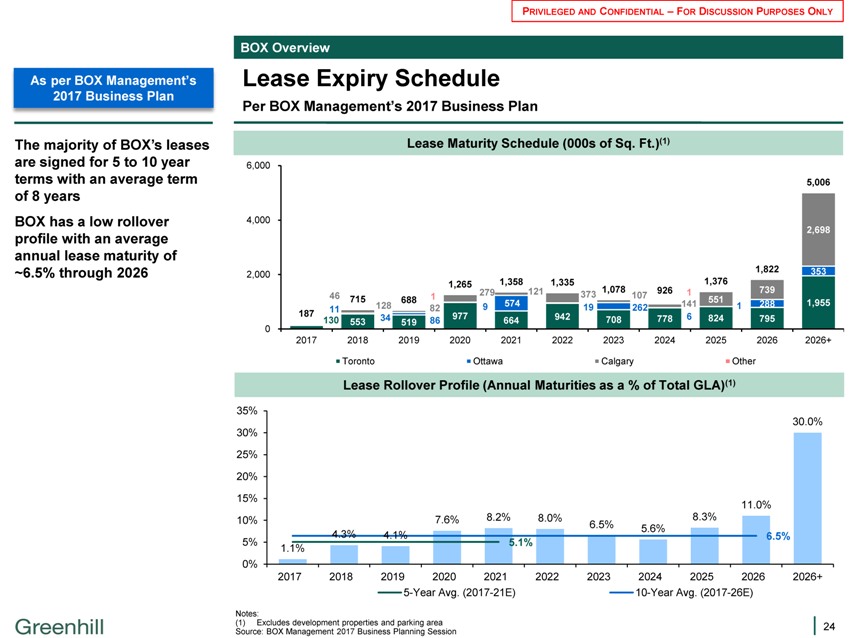

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Lease Expiry Schedule Per BOX Management?s 2017 Business Plan As per BOX Management?s 2017 Business Plan The majority of BOX?s leases are signed for 5 to 10 year terms with an average term of 8 years BOX has a low rollover profile with an average annual lease maturity of ~6.5% through 2026 Lease Maturity Schedule (000s of Sq. Ft.)(1) 6,000 5,006 4,000 2,698 2,000 1,822 353 1,265 1,358 1,335 1,376 46 715 1 279 121 373 1,078 107 926 1 739 128 688 82 574 141 551 1 288 1,955 11 9 19 262 187 130 553 34 519 86 977 664 942 708 778 6 824 795 0 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2026+ Toronto Ottawa Calgary Other Lease Rollover Profile (Annual Maturities as a % of Total GLA)(1) 35% 30.0% 30% 25% 20% 15% 11.0% 10% 7.6% 8.2% 8.0% 6.5% 8.3% 5.6% 4.3% 4.1% 6.5% 5% 5.1% 1.1% 0% 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2026+ 5-Year Avg. (2017-21E) 10-Year Avg. (2017-26E) Notes: (1) Excludes development properties and parking area Source: BOX Management 2017 Business Planning Session 24

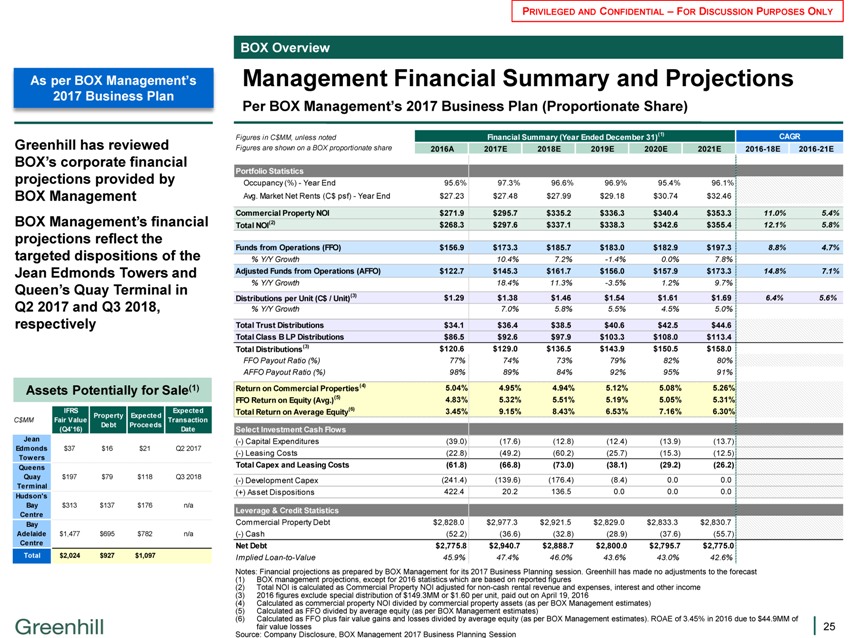

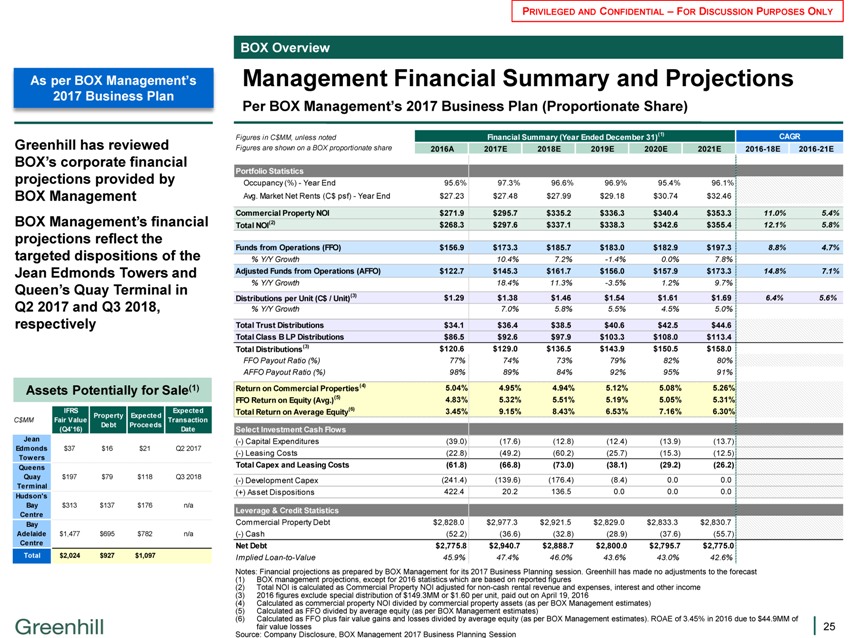

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY BOX Overview Management Financial Summary and Projections Per BOX Management?s 2017 Business Plan (Proportionate Share) As per BOX Management?s 2017 Business Plan Greenhill has reviewed BOX?s corporate financial projections provided by BOX Management BOX Management?s financial projections reflect the targeted dispositions of the Jean Edmonds Towers and Queen?s Quay Terminal in Q2 2017 and Q3 2018, respectively Assets Potentially for Sale(1) IFRS Expected Property Expected C$MM Fair Value Transaction Debt Proceeds (Q4’16) Date Jean Edmonds $37 $16 $21 Q2 2017 Tow ers Queens Quay $197 $79 $118 Q3 2018 Terminal Hudson’s Bay $313 $137 $176 n/a Centre Bay Adelaide $1,477 $695 $782 n/a Centre Total $2,024 $927 $1,097 Financial Summary (Year Ended December 31)(1) CAGR Figures in C$MM, unless noted Financial Summary (Year Ended December 31)(1) CAGR Figures are shown on a BOX proportionate share 2016A 2017E 2018E 2019E 2020E 2021E 2016-18E 2016-21E portfolioPortfolio Statistics portfolio statistics Occupancy (%)—Year End 95.6% 97.3% 96.6% 96.9% 95.4% 96.1% Avg. Market Net Rents (C$ psf)—Year End $27.23 $27.48 $27.99 $29.18 $30.74 $32.46 Commercial Property NOI $271.9 $295.7 $335.2 $336.3 $340.4 $353.3 11.0% 5.4% Total NOI(2) $268.3 $297.6 $337.1 $338.3 $342.6 $355.4 12.1% 5.8% Funds from Operations (FFO) $156.9 $173.3 $185.7 $183.0 $182.9 $197.3 8.8% 4.7% % Y/Y Growth 10.4% 7.2% -1.4% 0.0% 7.8% Adjusted Funds from Operations (AFFO) $122.7 $145.3 $161.7 $156.0 $157.9 $173.3 14.8% 7.1% % Y/Y Growth 18.4% 11.3% -3.5% 1.2% 9.7% Distributions per Unit (C$ / Unit)(3) $1.29 $1.38 $1.46 $1.54 $1.61 $1.69 6.4% 5.6% % Y/Y Growth 7.0% 5.8% 5.5% 4.5% 5.0% Total Trust Distributions $34.1 $36.4 $38.5 $40.6 $42.5 $44.6 Total Class B LP Distributions $86.5 $92.6 $97.9 $103.3 $108.0 $113.4 Total Distributions(3) $120.6 $129.0 $136.5 $143.9 $150.5 $158.0 FFO Payout Ratio (%) 77% 74% 73% 79% 82% 80% AFFO Payout Ratio (%) 98% 89% 84% 92% 95% 91% Return on Commercial Properties(4) 5.04% 4.95% 4.94% 5.12% 5.08% 5.26% FFO Return on Equity (Avg.)(5) 4.83% 5.32% 5.51% 5.19% 5.05% 5.31% Total Return on Average Equity(6) 3.45% 9.15% 8.43% 6.53% 7.16% 6.30% Select Investment Cash Flows Select investment cash flows (-) Capital Expenditures(39.0)(17.6)(12.8)(12.4)(13.9)(13.7) (-) Leasing Costs(22.8)(49.2)(60.2)(25.7)(15.3)(12.5) Total Capex and Leasing Costs(61.8)(66.8)(73.0)(38.1)(29.2)(26.2) (-) Development Capex(241.4)(139.6)(176.4)(8.4) 0.0 0.0 (+) Asset Dispositions 422.4 20.2 136.5 0.0 0.0 0.0 Leverage & Credit Statistics Leverage & credit statistics Commercial Property Debt $2,828.0 $2,977.3 $2,921.5 $2,829.0 $2,833.3 $2,830.7 (-) Cash(52.2)(36.6)(32.8)(28.9)(37.6)(55.7) Net Debt $2,775.8 $2,940.7 $2,888.7 $2,800.0 $2,795.7 $2,775.0 Implied Loan-to-Value 45.9% 47.4% 46.0% 43.6% 43.0% 42.6% Notes: Financial projections as prepared by BOX Management for its 2017 Business Planning session. Greenhill has made no adjustments to the forecast (1) BOX management projections, except for 2016 statistics which are based on reported figures (2) Total NOI is calculated as Commercial Property NOI adjusted for non-cash rental revenue and expenses, interest and other income (3) 2016 figures exclude special distribution of $149.3MM or $1.60 per unit, paid out on April 19, 2016 (4) Calculated as commercial property NOI divided by commercial property assets (as per BOX Management estimates) (5) Calculated as FFO divided by average equity (as per BOX Management estimates) (6) Calculated as FFO plus fair value gains and losses divided by average equity (as per BOX Management estimates). ROAE of 3.45% in 2016 due to $44.9MM of fair value losses Source: Company Disclosure, BOX Management 2017 Business Planning Session 25

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Table of Contents 1. Executive Summary 2. BOX Overview 3. Valuation Analysis Appendix 26

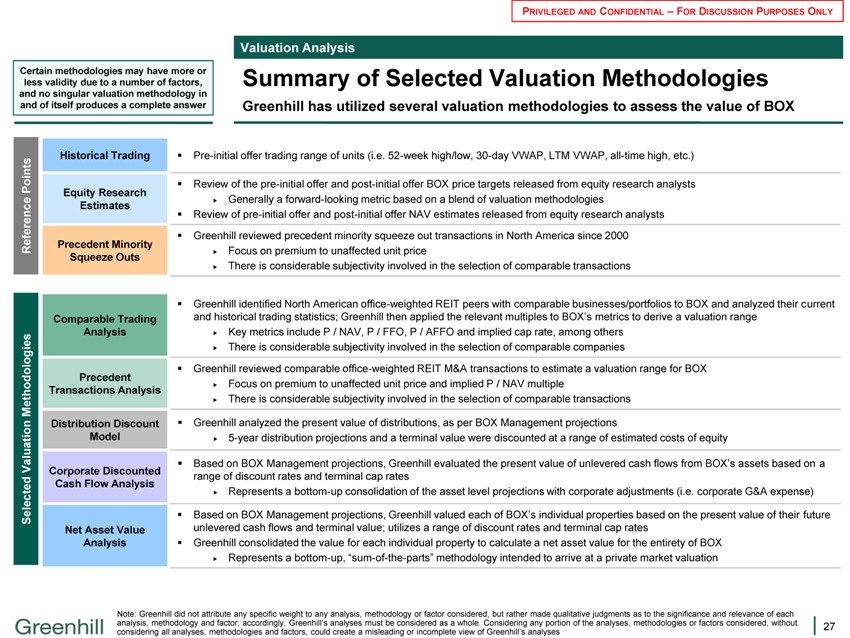

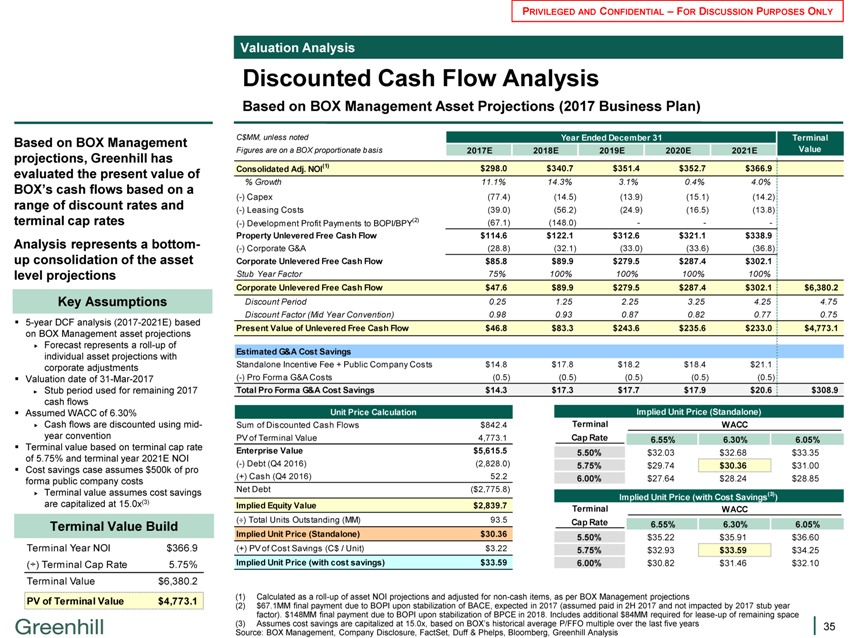

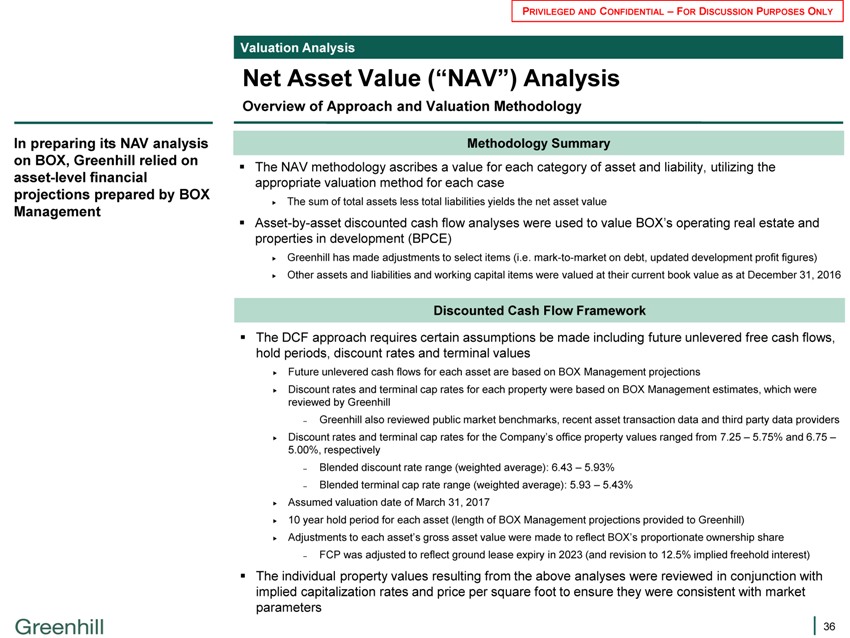

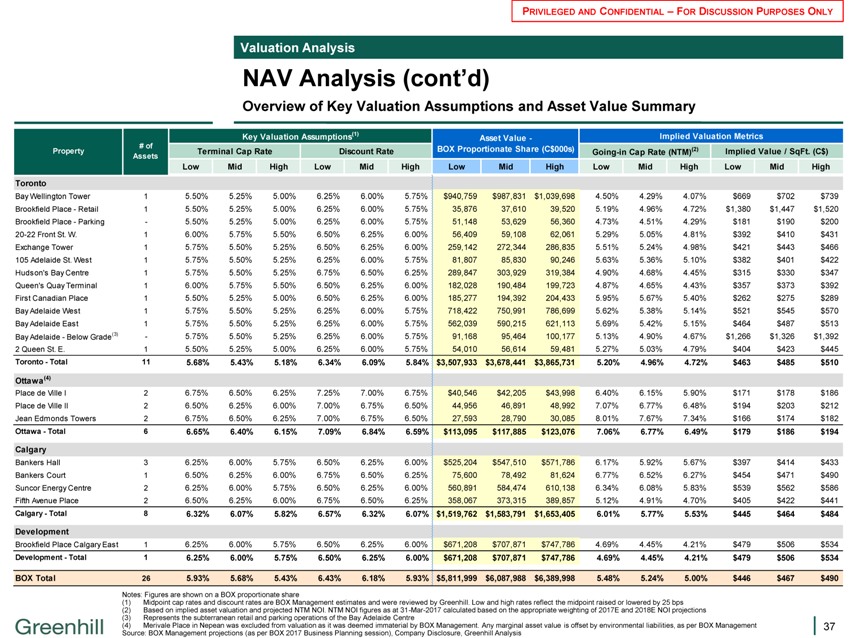

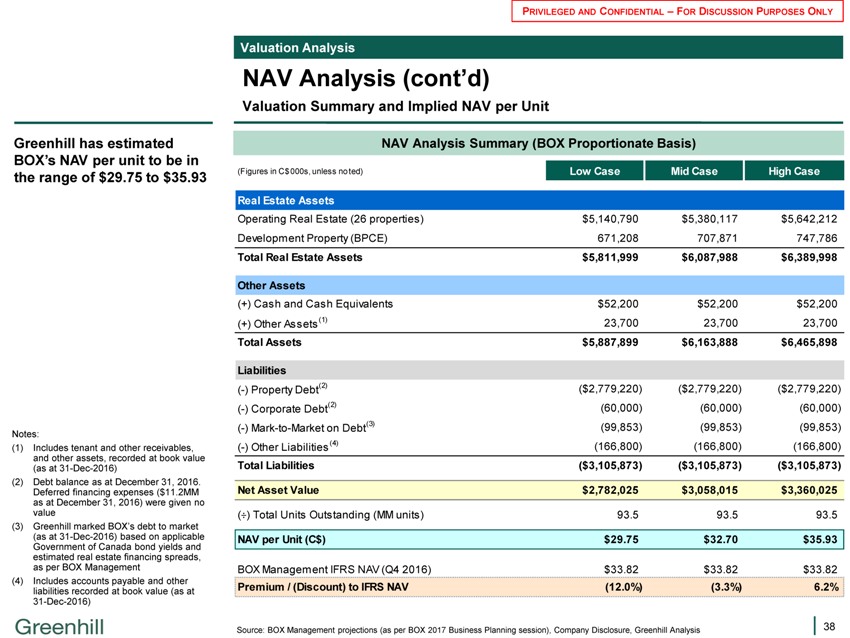

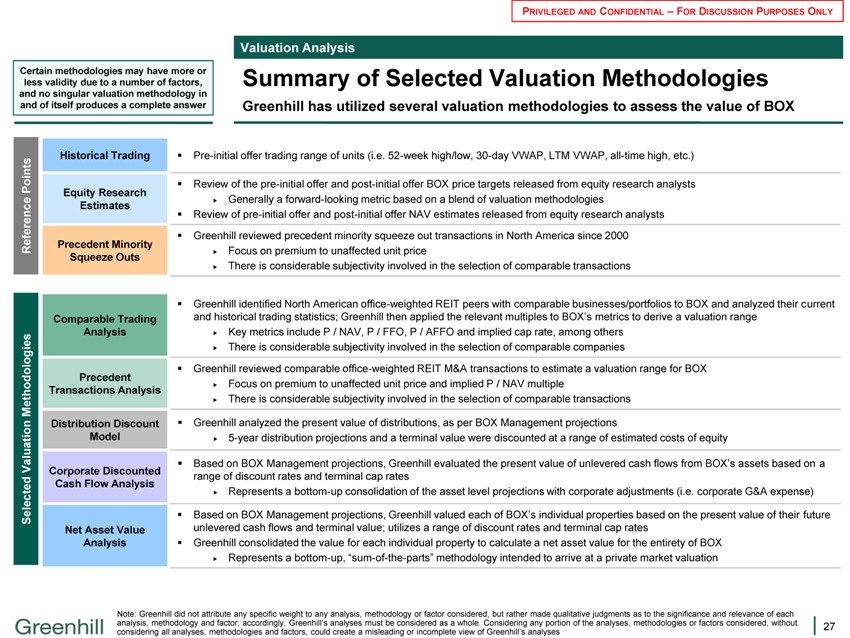

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Summary of Selected Valuation Methodologies Greenhill has utilized several valuation methodologies to assess the value of BOX Certain methodologies may have more or less validity due to a number of factors, and no singular valuation methodology in and of itself produces a complete answer Reference Points Historical Trading Equity Research Estimates Precedent Minority Squeeze Outs Selected Valuation Methodologies Comparable Trading Analysis Precedent Transactions Analysis Distribution Discount Model Corporate Discounted Cash Flow Analysis Net Asset Value Analysis ??Pre-initial offer trading range of units (i.e. 52-week high/low, 30-day VWAP, LTM VWAP, all-time high, etc.) ??Review of the pre-initial offer and post-initial offer BOX price targets released from equity research analysts Generally a forward-looking metric based on a blend of valuation methodologies ??Review of pre-initial offer and post-initial offer NAV estimates released from equity research analysts ??Greenhill reviewed precedent minority squeeze out transactions in North America since 2000 Focus on premium to unaffected unit price There is considerable subjectivity involved in the selection of comparable transactions ??Greenhill identified North American office-weighted REIT peers with comparable businesses/portfolios to BOX and analyzed their current and historical trading statistics; Greenhill then applied the relevant multiples to BOX?s metrics to derive a valuation range Key metrics include P / NAV, P / FFO, P / AFFO and implied cap rate, among others There is considerable subjectivity involved in the selection of comparable companies ??Greenhill reviewed comparable office-weighted REIT M&A transactions to estimate a valuation range for BOX Focus on premium to unaffected unit price and implied P / NAV multiple There is considerable subjectivity involved in the selection of comparable transactions ??Greenhill analyzed the present value of distributions, as per BOX Management projections 5-year distribution projections and a terminal value were discounted at a range of estimated costs of equity ??Based on BOX Management projections, Greenhill evaluated the present value of unlevered cash flows from BOX?s assets based on a range of discount rates and terminal cap rates Represents a bottom-up consolidation of the asset level projections with corporate adjustments (i.e. corporate G&A expense) ??Based on BOX Management projections, Greenhill valued each of BOX?s individual properties based on the present value of their future unlevered cash flows and terminal value; utilizes a range of discount rates and terminal cap rates ??Greenhill consolidated the value for each individual property to calculate a net asset value for the entirety of BOX Represents a bottom-up, ?sum-of-the-parts? methodology intended to arrive at a private market valuation Note: Greenhill did not attribute any specific weight to any analysis, methodology or factor considered, but rather made qualitative judgments as to the significance and relevance of each analysis, methodology and factor; accordingly, Greenhill?s analyses must be considered as a whole. Considering any portion of the analyses, methodologies or factors considered, without considering all analyses, methodologies and factors, could create a misleading or incomplete view of Greenhill?s analyses 27

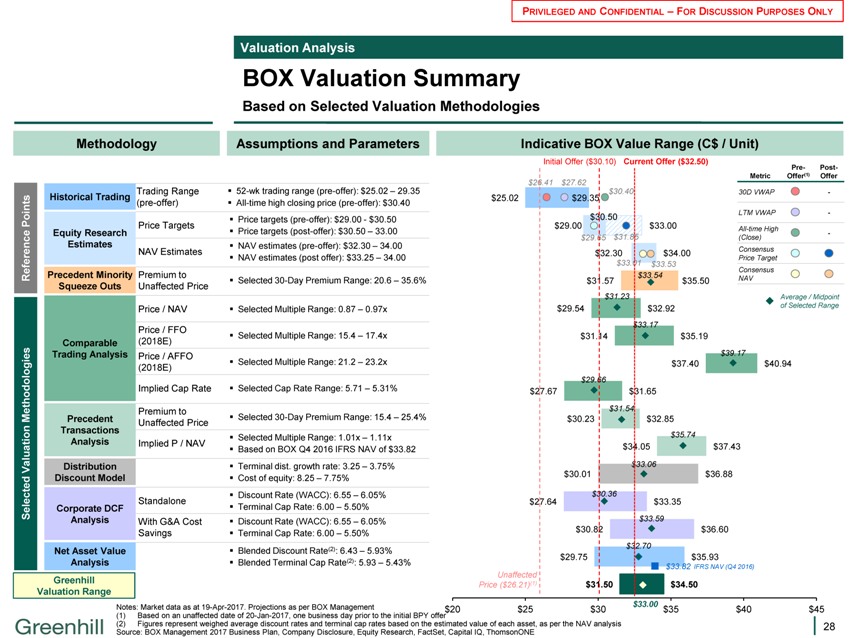

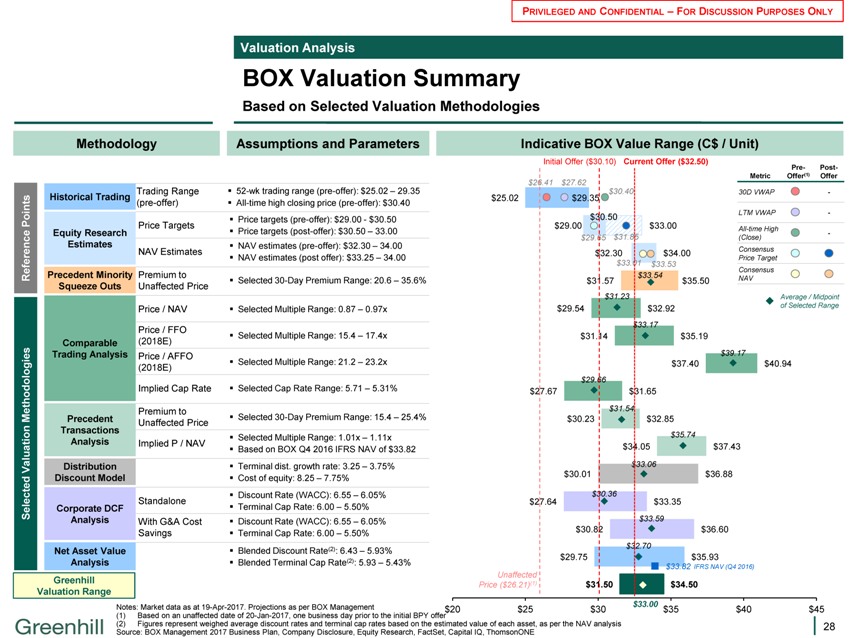

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis BOX Valuation Summary Based on Selected Valuation Methodologies Methodology Reference Points Historical Trading Equity Research Estimates Precedent Minority Squeeze Outs Selected Valuation Methodologies Comparable Trading Analysis Precedent Transactions Analysis Distribution Discount Model Corporate DCF Analysis Net Asset Value Analysis Greenhill Valuation Range Assumptions and Parameters Trading Range ??52-wk trading range (pre-offer): $25.02 ? 29.35 (pre-offer) ??All-time high closing price (pre-offer): $30.40 ??Price targets (pre-offer): $29.00—$30.50 Price Targets ??Price targets (post-offer): $30.50 ? 33.00 ??NAV estimates (pre-offer): $32.30 ? 34.00 NAV Estimates ??NAV estimates (post offer): $33.25 ? 34.00 Premium to ??Selected 30-Day Premium Range: 20.6 ? 35.6% Unaffected Price Price / NAV ??Selected Multiple Range: 0.87 ? 0.97x Price / FFO ??Selected Multiple Range: 15.4 ? 17.4x (2018E) Price / AFFO ??Selected Multiple Range: 21.2 ? 23.2x (2018E) Implied Cap Rate ??Selected Cap Rate Range: 5.71 ? 5.31% Premium to ??Selected 30-Day Premium Range: 15.4 ? 25.4% Unaffected Price ??Selected Multiple Range: 1.01x ? 1.11x Implied P / NAV ??Based on BOX Q4 2016 IFRS NAV of $33.82 ??Terminal dist. growth rate: 3.25 ? 3.75% ??Cost of equity: 8.25 ? 7.75% ??Discount Rate (WACC): 6.55 ? 6.05% Standalone ??Terminal Cap Rate: 6.00 ? 5.50% With G&A Cost ??Discount Rate (WACC): 6.55 ? 6.05% Savings ??Terminal Cap Rate: 6.00 ? 5.50% ??Blended Discount Rate(2): 6.43 ? 5.93% ??Blended Terminal Cap Rate(2): 5.93 ? 5.43% Indicative BOX Value Range (C$ / Unit) Pre- Post- Metric Offer(1) Offer 30D VWAP—LTM VWAP—All-time High—(Close) Consensus Price Target Consensus NAV Average / Midpoint of Selected Range Initial Offer ($30.10) Current Offer ($32.50) $26.41 $27.62 $30.40— $25.02 $29.35 $30.50— $29.00 $33.00 $29.65 $31.85— $32.30 $34.00 $33.01 $33.53 $33.54 $31.57 $35.50 $31.23 $29.54 $32.92 $33.17 $31.14 $35.19 $39.17 $37.40 $40.94 $29.66 $27.67 $31.65 $31.54 $30.23 $32.85 $35.74 $34.05 $37.43 $33.06 $30.01 $36.88 $30.36 $27.64 $33.35 $33.59 $30.82 $36.60 $32.70 $29.75 $35.93 $33.82 IFRS NAV (Q4 2016) Unaffected Price ($26.21)(1) $31.50 $34.50 $33.00 $20 $25 $30 $35 $40 $45 Notes: Market data as at 19-Apr-2017. Projections as per BOX Management (1) Based on an unaffected date of 20-Jan-2017, one business day prior to the initial BPY offer (2) Figures represent weighed average discount rates and terminal cap rates based on the estimated value of each asset, as per the NAV analysis Source: BOX Management 2017 Business Plan, Company Disclosure, Equity Research, FactSet, Capital IQ, ThomsonONE 28

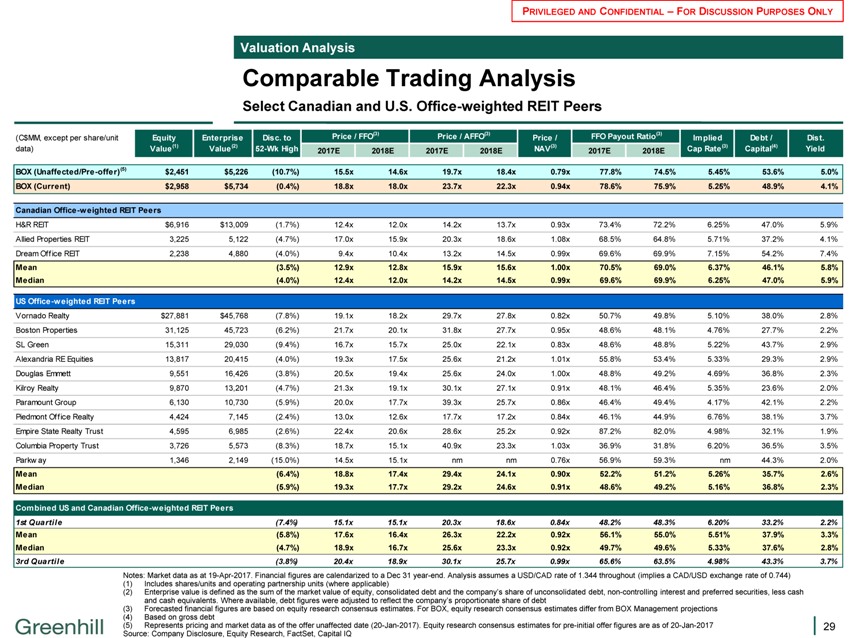

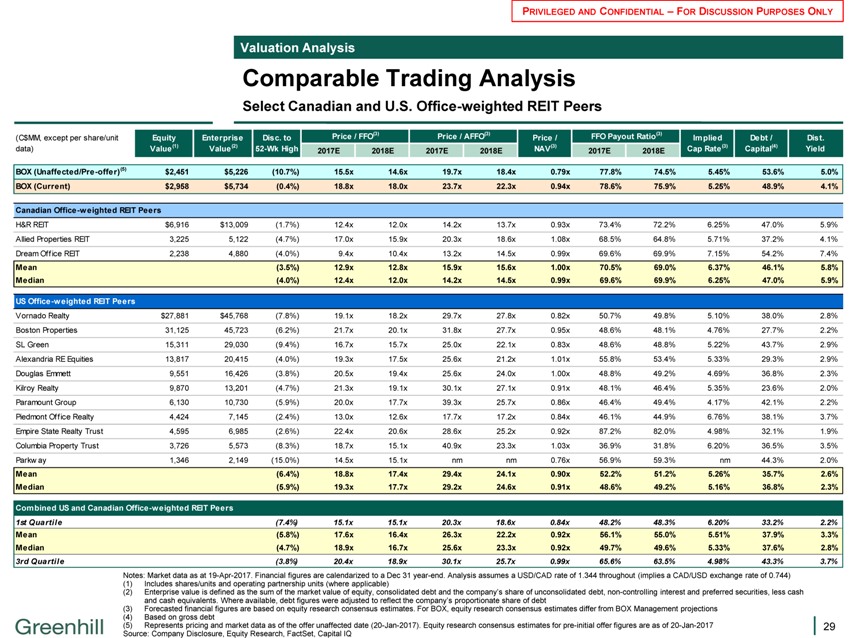

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Comparable Trading Analysis Select Canadian and U.S. Office-weighted REIT Peers (C$MM, except per share/unit Equity Enterprise Disc. to Price / FFO(3) Price / AFFO(3) Price / FFO Payout Ratio(3) Implied Debt / Dist. data) Value(1) Value(2) 52-Wk High 2017E 2018E 2017E 2018E NAV(3) 2017E 2018E Cap Rate(3) Capital(4) Yield BOX (Unaffected/Pre-offer)(5) $2,451 $5,226(10.7%) 15.5x 14.6x 19.7x 18.4x 0.79x 77.8% 74.5% 5.45% 53.6% 5.0% BOX (Current) $2,958 $5,734(0.4%) 18.8x 18.0x 23.7x 22.3x 0.94x 78.6% 75.9% 5.25% 48.9% 4.1% Canadian Office-w eighted REIT Peers H&R REIT $6,916 $13,009(1.7%) 12.4x 12.0x 14.2x 13.7x 0.93x 73.4% 72.2% 6.25% 47.0% 5.9% Allied Properties REIT 3,225 5,122(4.7%) 17.0x 15.9x 20.3x 18.6x 1.08x 68.5% 64.8% 5.71% 37.2% 4.1% Dream Office REIT 2,238 4,880(4.0%) 9.4x 10.4x 13.2x 14.5x 0.99x 69.6% 69.9% 7.15% 54.2% 7.4% Mean(3.5%) 12.9x 12.8x 15.9x 15.6x 1.00x 70.5% 69.0% 6.37% 46.1% 5.8% Median(4.0%) 12.4x 12.0x 14.2x 14.5x 0.99x 69.6% 69.9% 6.25% 47.0% 5.9% US Office-w eighted REIT Peers Vornado Realty $27,881 $45,768(7.8%) 19.1x 18.2x 29.7x 27.8x 0.82x 50.7% 49.8% 5.10% 38.0% 2.8% Boston Properties 31,125 45,723(6.2%) 21.7x 20.1x 31.8x 27.7x 0.95x 48.6% 48.1% 4.76% 27.7% 2.2% SL Green 15,311 29,030(9.4%) 16.7x 15.7x 25.0x 22.1x 0.83x 48.6% 48.8% 5.22% 43.7% 2.9% Alexandria RE Equities 13,817 20,415(4.0%) 19.3x 17.5x 25.6x 21.2x 1.01x 55.8% 53.4% 5.33% 29.3% 2.9% Douglas Emmett 9,551 16,426(3.8%) 20.5x 19.4x 25.6x 24.0x 1.00x 48.8% 49.2% 4.69% 36.8% 2.3% Kilroy Realty 9,870 13,201(4.7%) 21.3x 19.1x 30.1x 27.1x 0.91x 48.1% 46.4% 5.35% 23.6% 2.0% Paramount Group 6,130 10,730(5.9%) 20.0x 17.7x 39.3x 25.7x 0.86x 46.4% 49.4% 4.17% 42.1% 2.2% Piedmont Office Realty 4,424 7,145(2.4%) 13.0x 12.6x 17.7x 17.2x 0.84x 46.1% 44.9% 6.76% 38.1% 3.7% Empire State Realty Trust 4,595 6,985(2.6%) 22.4x 20.6x 28.6x 25.2x 0.92x 87.2% 82.0% 4.98% 32.1% 1.9% Columbia Property Trust 3,726 5,573(8.3%) 18.7x 15.1x 40.9x 23.3x 1.03x 36.9% 31.8% 6.20% 36.5% 3.5% Parkw ay 1,346 2,149(15.0%) 14.5x 15.1x nm nm 0.76x 56.9% 59.3% nm 44.3% 2.0% Mean(6.4%) 18.8x 17.4x 29.4x 24.1x 0.90x 52.2% 51.2% 5.26% 35.7% 2.6% Median(5.9%) 19.3x 17.7x 29.2x 24.6x 0.91x 48.6% 49.2% 5.16% 36.8% 2.3% Combined US and Canadian Office-w eighted REIT Peers 1st Quartile(7.4%) 15.1x 15.1x 20.3x 18.6x 0.84x 48.2% 48.3% 6.20% 33.2% 2.2% Mean(5.8%) 17.6x 16.4x 26.3x 22.2x 0.92x 56.1% 55.0% 5.51% 37.9% 3.3% Median(4.7%) 18.9x 16.7x 25.6x 23.3x 0.92x 49.7% 49.6% 5.33% 37.6% 2.8% 3rd Quartile(3.8%) 20.4x 18.9x 30.1x 25.7x 0.99x 65.6% 63.5% 4.98% 43.3% 3.7% Notes: Market data as at 19-Apr-2017. Financial figures are calendarized to a Dec 31 year-end. Analysis assumes a USD/CAD rate of 1.344 throughout (implies a CAD/USD exchange rate of 0.744) (1) Includes shares/units and operating partnership units (where applicable) (2) Enterprise value is defined as the sum of the market value of equity, consolidated debt and the company?s share of unconsolidated debt, non-controlling interest and preferred securities, less cash and cash equivalents. Where available, debt figures were adjusted to reflect the company?s proportionate share of debt (3) Forecasted financial figures are based on equity research consensus estimates. For BOX, equity research consensus estimates differ from BOX Management projections (4) Based on gross debt (5) Represents pricing and market data as of the offer unaffected date (20-Jan-2017). Equity research consensus estimates for pre-initial offer figures are as of 20-Jan-2017 Source: Company Disclosure, Equity Research, FactSet, Capital IQ 29

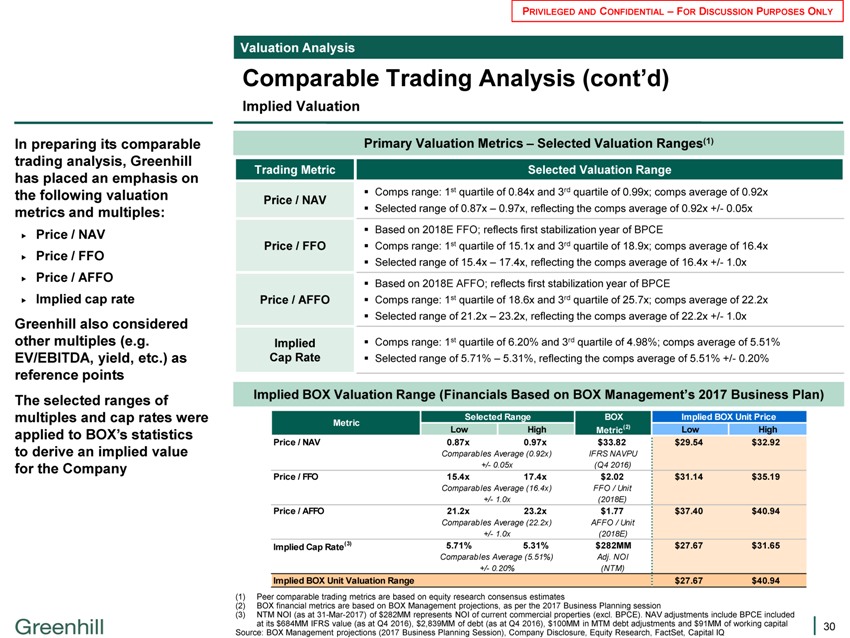

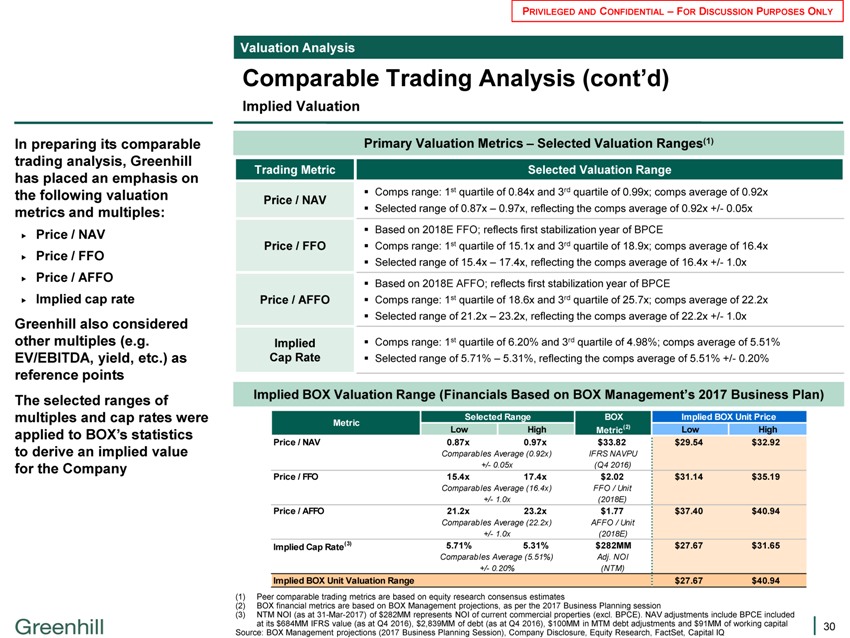

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Comparable Trading Analysis (cont?d) Implied Valuation In preparing its comparable trading analysis, Greenhill has placed an emphasis on the following valuation metrics and multiples: Price / NAV Price / FFO Price / AFFO Implied cap rate Greenhill also considered other multiples (e.g. EV/EBITDA, yield, etc.) as reference points The selected ranges of multiples and cap rates were applied to BOX?s statistics to derive an implied value for the Company Primary Valuation Metrics ? Selected Valuation Ranges(1) Trading Metric Selected Valuation Range Price / NAV ??Comps range: 1st quartile of 0.84x and 3rd quartile of 0.99x; comps average of 0.92x ??Selected range of 0.87x ? 0.97x, reflecting the comps average of 0.92x +/- 0.05x Price / FFO ??Based on 2018E FFO; reflects first stabilization year of BPCE ??Comps range: 1st quartile of 15.1x and 3rd quartile of 18.9x; comps average of 16.4x ??Selected range of 15.4x ? 17.4x, reflecting the comps average of 16.4x +/- 1.0x Price / AFFO ??Based on 2018E AFFO; reflects first stabilization year of BPCE ??Comps range: 1st quartile of 18.6x and 3rd quartile of 25.7x; comps average of 22.2x ??Selected range of 21.2x ? 23.2x, reflecting the comps average of 22.2x +/- 1.0x Implied Cap Rate ??Comps range: 1st quartile of 6.20% and 3rd quartile of 4.98%; comps average of 5.51% ??Selected range of 5.71% ? 5.31%, reflecting the comps average of 5.51% +/- 0.20% Implied BOX Valuation Range (Financials Based on BOX Management?s 2017 Business Plan) Selected Range BOX Implied BOX Unit Price Metrimetricmetrc Selected range Box metric(2) Implied box metric unit price Metric Low High Metric(2) Low High Price / NAV 0.87x 0.97x $33.82 $29.54 $32.92 Comparables Average (0.92x) IFRS NAVPU +/- 0.05x(Q4 2016) Price / FFO 15.4x 17.4x $2.02 $31.14 $35.19 Comparables Average (16.4x) FFO / Unit +/- 1.0x(2018E) Price / AFFO 21.2x 23.2x $1.77 $37.40 $40.94 Comparables Average (22.2x) AFFO / Unit +/- 1.0x(2018E) Implied Cap Rate(3) 5.71% 5.31% $282MM $27.67 $31.65 Comparables Average (5.51%) Adj. NOI +/- 0.20%(NTM) Implied BOX Unit Valuation Range $27.67 $40.94 (1) Peer comparable trading metrics are based on equity research consensus estimates (2) BOX financial metrics are based on BOX Management projections, as per the 2017 Business Planning session (3) NTM NOI (as at 31-Mar-2017) of $282MM represents NOI of current commercial properties (excl. BPCE). NAV adjustments include BPCE included at its $684MM IFRS value (as at Q4 2016), $2,839MM of debt (as at Q4 2016), $100MM in MTM debt adjustments and $91MM of working capital Source: BOX Management projections (2017 Business Planning Session), Company Disclosure, Equity Research, FactSet, Capital IQ 30

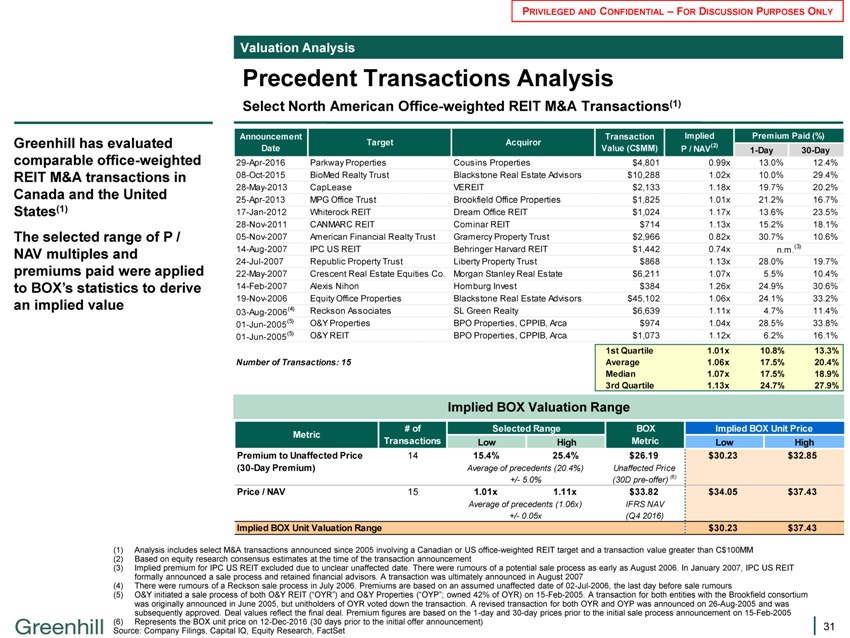

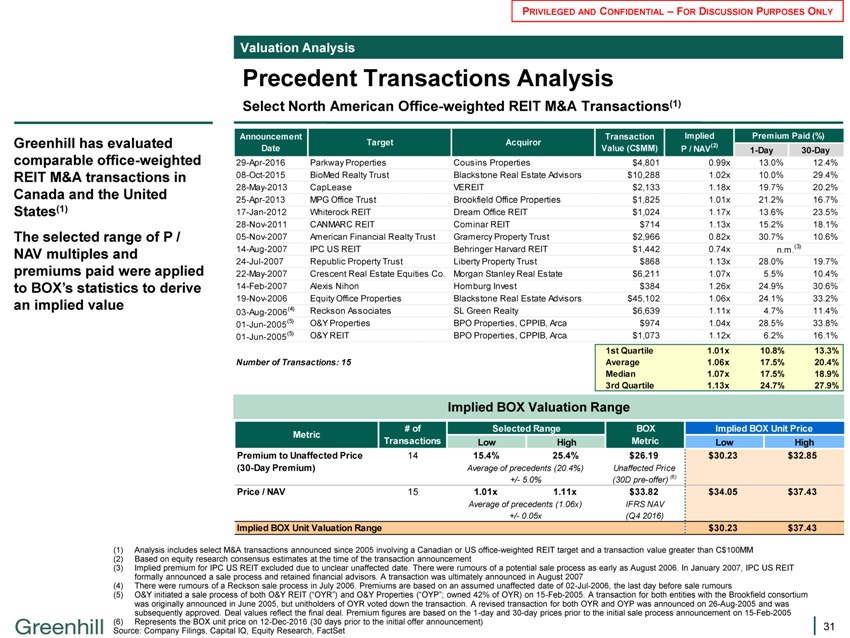

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Precedent Transactions Analysis Select North American Office-weighted REIT M&A Transactions(1) Greenhill has evaluated comparable office-weighted REIT M&A transactions in Canada and the United States(1) The selected range of P / NAV multiples and premiums paid were applied to BOX?s statistics to derive an implied value Announcement Transaction Implied Premium Paid (%) Target Acquiror Date Value (C$MM) P / NAV(2) 1-Day 30-Day 29-Apr-2016 Parkway Properties Cousins Properties $4,801 0.99x 13.0% 12.4% 08-Oct-2015 BioMed Realty Trust Blackstone Real Estate Advisors $10,288 1.02x 10.0% 29.4% 28-May-2013 CapLease VEREIT $2,133 1.18x 19.7% 20.2% 25-Apr-2013 MPG Office Trust Brookfield Office Properties $1,825 1.01x 21.2% 16.7% 17-Jan-2012 Whiterock REIT Dream Office REIT $1,024 1.17x 13.6% 23.5% 28-Nov-2011 CANMARC REIT Cominar REIT $714 1.13x 15.2% 18.1% 05-Nov-2007 American Financial Realty Trust Gramercy Property Trust $2,966 0.82x 30.7% 10.6% 14-Aug-2007 IPC US REIT Behringer Harvard REIT $1,442 0.74x n.m.(3) 24-Jul-2007 Republic Property Trust Liberty Property Trust $868 1.13x 28.0% 19.7% 22-May-2007 Crescent Real Estate Equities Co. Morgan Stanley Real Estate $6,211 1.07x 5.5% 10.4% 14-Feb-2007 Alexis Nihon Homburg Invest $384 1.26x 24.9% 30.6% 19-Nov-2006 Equity Office Properties Blackstone Real Estate Advisors $45,102 1.06x 24.1% 33.2% 03-Aug-2006(4) Reckson Associates SL Green Realty $6,639 1.11x 4.7% 11.4% 01-Jun-2005(5) O&Y Properties BPO Properties, CPPIB, Arca $974 1.04x 28.5% 33.8% 01-Jun-2005(5) O&Y REIT BPO Properties, CPPIB, Arca $1,073 1.12x 6.2% 16.1% 1st Quartile 1.01x 10.8% 13.3% Number of Transactions: 15 Average 1.06x 17.5% 20.4% Median 1.07x 17.5% 18.9% 3rd Quartile 1.13x 24.7% 27.9% Implied BOX Valuation Range # of Selected Range BOX Implied BOX Unit Price Metric Transactions Low High Metric Low High Premium to Unaffected Price 14 15.4% 25.4% $26.19 $30.23 $32.85 (30-Day Premium) Average of precedents (20.4%) Unaffected Price +/- 5.0%(30D pre-offer) (6) Price / NAV 15 1.01x 1.11x $33.82 $34.05 $37.43 Average of precedents (1.06x) IFRS NAV +/- 0.05x(Q4 2016) Implied BOX Unit Valuation Range $30.23 $37.43 (1) Analysis includes select M&A transactions announced since 2005 involving a Canadian or US office-weighted REIT target and a transaction value greater than C$100MM (2) Based on equity research consensus estimates at the time of the transaction announcement (3) Implied premium for IPC US REIT excluded due to unclear unaffected date. There were rumours of a potential sale process as early as August 2006. In January 2007, IPC US REIT formally announced a sale process and retained financial advisors. A transaction was ultimately announced in August 2007 (4) There were rumours of a Reckson sale process in July 2006. Premiums are based on an assumed unaffected date of 02-Jul-2006, the last day before sale rumours (5) O&Y initiated a sale process of both O&Y REIT (?OYR?) and O&Y Properties (?OYP?; owned 42% of OYR) on 15-Feb-2005. A transaction for both entities with the Brookfield consortium was originally announced in June 2005, but unitholders of OYR voted down the transaction. A revised transaction for both OYR and OYP was announced on 26-Aug-2005 and was subsequently approved. Deal values reflect the final deal. Premium figures are based on the 1-day and 30-day prices prior to the initial sale process announcement on 15-Feb-2005 (6) Represents the BOX unit price on 12-Dec-2016 (30 days prior to the initial offer announcement) Source: Company Filings, Capital IQ, Equity Research, FactSet 31

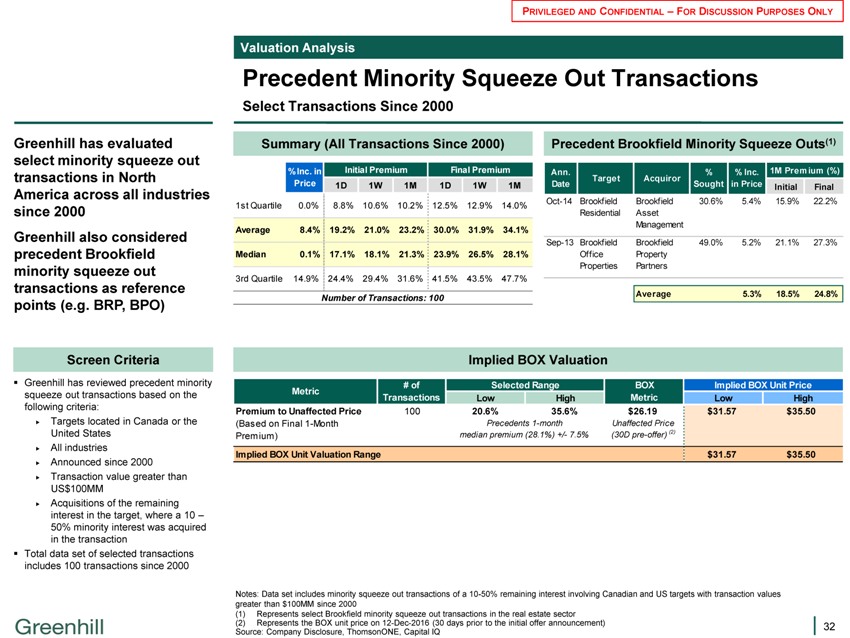

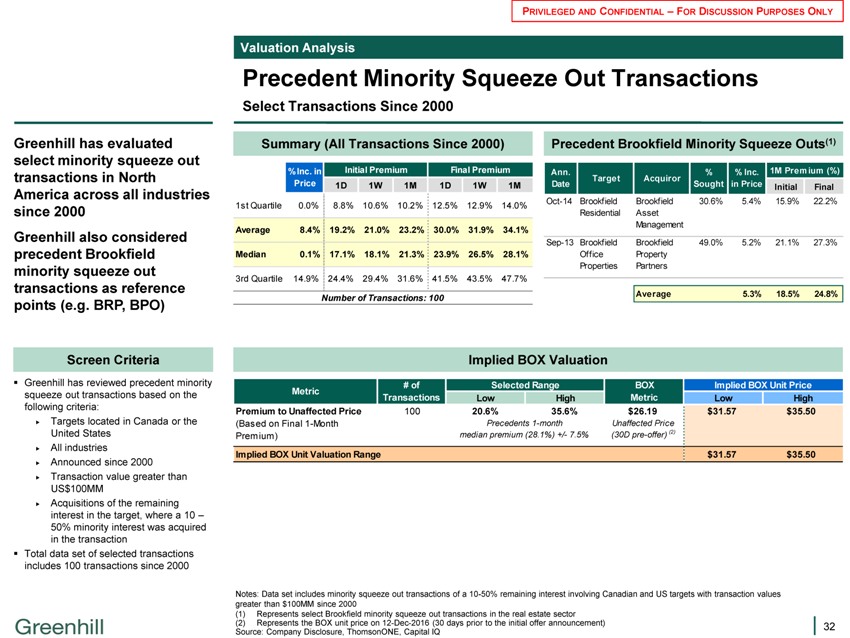

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Precedent Minority Squeeze Out Transactions Select Transactions Since 2000 Greenhill has evaluated select minority squeeze out transactions in North America across all industries since 2000 Greenhill also considered precedent Brookfield minority squeeze out transactions as reference points (e.g. BRP, BPO) Screen Criteria ??Greenhill has reviewed precedent minority squeeze out transactions based on the following criteria: Targets located in Canada or the United States All industries Announced since 2000 Transaction value greater than US$100MM Acquisitions of the remaining interest in the target, where a 10 ? 50% minority interest was acquired in the transaction ??Total data set of selected transactions includes 100 transactions since 2000 Summary (All Transactions Since 2000) % Inc. in Initial Premium Final Premium Price 1D 1W 1M 1D 1W 1M 1st Quartile 0.0% 8.8% 10.6% 10.2% 12.5% 12.9% 14.0% Average 8.4% 19.2% 21.0% 23.2% 30.0% 31.9% 34.1% Median 0.1% 17.1% 18.1% 21.3% 23.9% 26.5% 28.1% 3rd Quartile 14.9% 24.4% 29.4% 31.6% 41.5% 43.5% 47.7% Number of Transactions: 100 Precedent Brookfield Minority Squeeze Outs(1) Ann.%% Inc. 1M Premium (%) Target Acquiror Date Sought in Price Initial Final Oct-14 Brookfield Brookfield 30.6% 5.4% 15.9% 22.2% Residential Asset Management Sep-13 Brookfield Brookfield 49.0% 5.2% 21.1% 27.3% Office Property Properties Partners Average 5.3% 18.5% 24.8% Implied BOX Valuation # of Selected Range BOX Implied BOX Unit Price Metric Transactions Low High Metric Low High Premium to Unaffected Price 100 20.6% 35.6% $26.19 $31.57 $35.50 (Based on Final 1-Month Precedents 1-month Unaffected Price Premium) median premium (28.1%) +/- 7.5%(30D pre-offer) (2) Implied BOX Unit Valuation Range $31.57 $35.50 Notes: Data set includes minority squeeze out transactions of a 10-50% remaining interest involving Canadian and US targets with transaction values greater than $100MM since 2000 (1) Represents select Brookfield minority squeeze out transactions in the real estate sector (2) Represents the BOX unit price on 12-Dec-2016 (30 days prior to the initial offer announcement) Source: Company Disclosure, ThomsonONE, Capital IQ 32

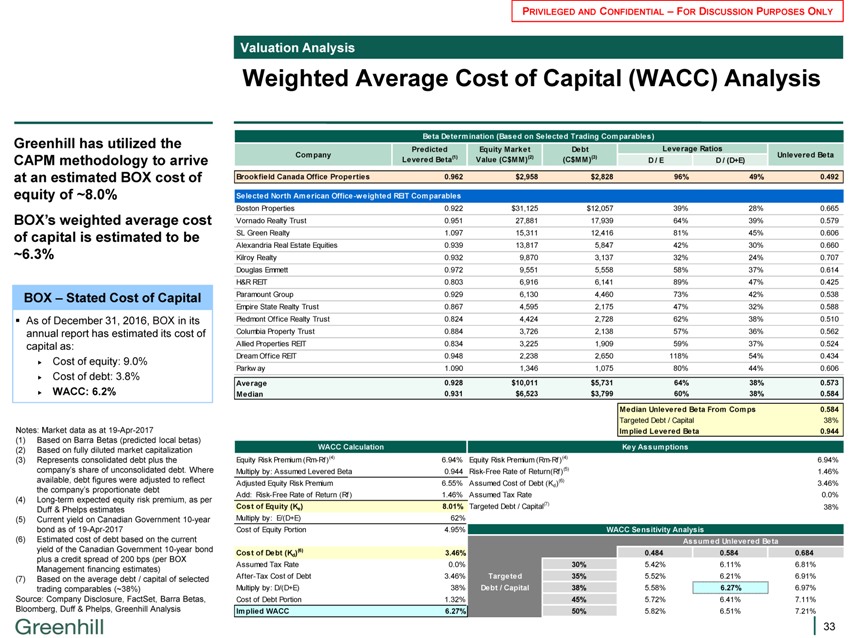

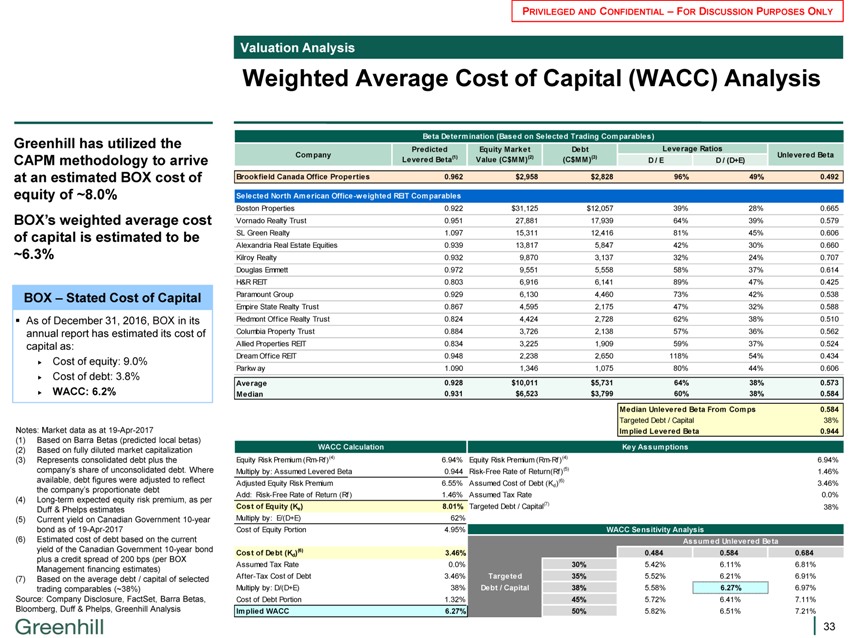

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Weighted Average Cost of Capital (WACC) Analysis Greenhill has utilized the CAPM methodology to arrive at an estimated BOX cost of equity of ~8.0% BOX?s weighted average cost of capital is estimated to be ~6.3% BOX ? Stated Cost of Capital ??As of December 31, 2016, BOX in its annual report has estimated its cost of capital as: Cost of equity: 9.0% Cost of debt: 3.8% WACC: 6.2% Notes: Market data as at 19-Apr-2017 (1) Based on Barra Betas (predicted local betas) (2) Based on fully diluted market capitalization (3) Represents consolidated debt plus the company?s share of unconsolidated debt. Where available, debt figures were adjusted to reflect the company?s proportionate debt (4) Long-term expected equity risk premium, as per Duff & Phelps estimates (5) Current yield on Canadian Government 10-year bond as of 19-Apr-2017 (6) Estimated cost of debt based on the current yield of the Canadian Government 10-year bond plus a credit spread of 200 bps (per BOX Management financing estimates) (7) Based on the average debt / capital of selected trading comparables (~38%) Source: Company Disclosure, FactSet, Barra Betas, Bloomberg, Duff & Phelps, Greenhill Analysis Beta Determination (Based on Selected Trading Comparables) Predicted Equity Market Debt Leverage Ratios Company Unlevered Beta Levered Beta(1) Value (C$MM)(2)(C$MM)(3) D / E D / (D+E) Brookfield Canada Office Properties 0.962 $2,958 $2,828 96% 49% 0.492 Selected North American Office-w eighted REIT Comparables Selected North American Office-weighted RBT Comparables Boston Properties 0.922 $31,125 $12,057 39% 28% 0.665 Vornado Realty Trust 0.951 27,881 17,939 64% 39% 0.579 SL Green Realty 1.097 15,311 12,416 81% 45% 0.606 Alexandria Real Estate Equities 0.939 13,817 5,847 42% 30% 0.660 Kilroy Realty 0.932 9,870 3,137 32% 24% 0.707 Douglas Emmett 0.972 9,551 5,558 58% 37% 0.614 H&R REIT 0.803 6,916 6,141 89% 47% 0.425 Paramount Group 0.929 6,130 4,460 73% 42% 0.538 Empire State Realty Trust 0.867 4,595 2,175 47% 32% 0.588 Piedmont Office Realty Trust 0.824 4,424 2,728 62% 38% 0.510 Columbia Property Trust 0.884 3,726 2,138 57% 36% 0.562 Allied Properties REIT 0.834 3,225 1,909 59% 37% 0.524 Dream Office REIT 0.948 2,238 2,650 118% 54% 0.434 Parkw ay 1.090 1,346 1,075 80% 44% 0.606 Average 0.928 $10,011 $5,731 64% 38% 0.573 Median 0.931 $6,523 $3,799 60% 38% 0.584 Median Unlevered Beta From Comps 0.584 Targeted Debt / Capital 38% Implied Levered Beta 0.944 WACC Calculation Key Assumptions Equity Risk Premium (Rm-Rf)(4) 6.94% Equity Risk Premium (Rm-Rf)(4) 6.94% Multiply by: Assumed Levered Beta 0.944 Risk-Free Rate of Return(Rf)(5) 1.46% Adjusted Equity Risk Premium 6.55% Assumed Cost of Debt (Kd )(6) 3.46% Add: Risk-Free Rate of Return (Rf) 1.46% Assumed Tax Rate 0.0% Cost of Equity (Ke ) 8.01% Targeted Debt / Capital(7) 38% Multiply by: E/(D+E) 62% Cost of Equity Portion 4.95% WACC Sensitivity Analysis Assumed Unlevered Beta Cost of Debt (Kd )(6) 3.46% 0.484 0.584 0.684 Assumed Tax Rate 0.0% 30% 5.42% 6.11% 6.81% After-Tax Cost of Debt 3.46% Targeted 35% 5.52% 6.21% 6.91% Multiply by: D/(D+E) 38% Debt / Capital 38% 5.58% 6.27% 6.97% Cost of Debt Portion 1.32% 45% 5.72% 6.41% 7.11% Implied WACC 6.27% 50% 5.82% 6.51% 7.21% 33

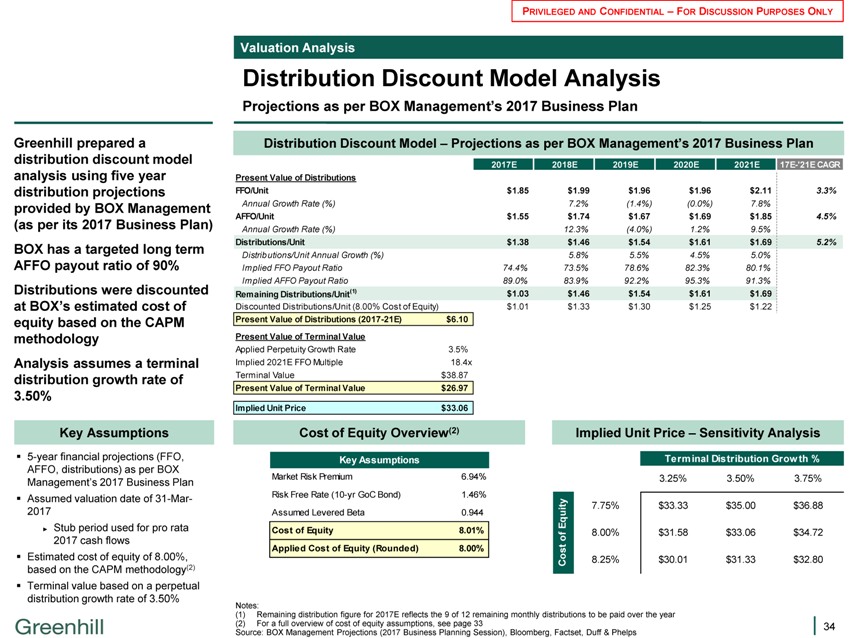

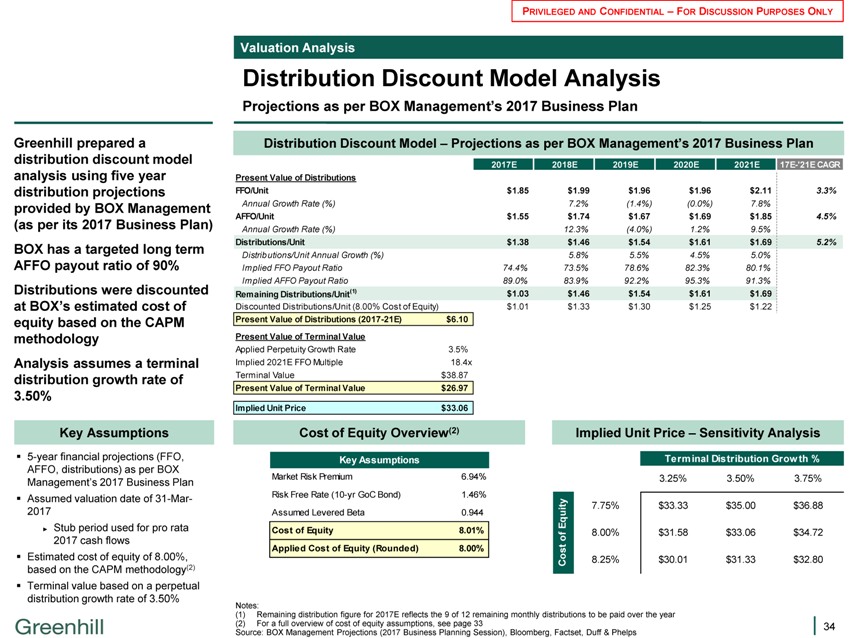

PRIVILEGED AND CONFIDENTIAL ? FOR DISCUSSION PURPOSES ONLY Valuation Analysis Distribution Discount Model Analysis Projections as per BOX Management?s 2017 Business Plan Greenhill prepared a distribution discount model analysis using five year distribution projections provided by BOX Management (as per its 2017 Business Plan) BOX has a targeted long term AFFO payout ratio of 90% Distributions were discounted at BOX?s estimated cost of equity based on the CAPM methodology Analysis assumes a terminal distribution growth rate of 3.50% Key Assumptions ??5-year financial projections (FFO, AFFO, distributions) as per BOX Management?s 2017 Business Plan ??Assumed valuation date of 31-Mar-2017 ? Stub period used for pro rata 2017 cash flows ??Estimated cost of equity of 8.00%, based on the CAPM methodology(2) ??Terminal value based on a perpetual distribution growth rate of 3.50% Distribution Discount Model ? Projections as per BOX Management?s 2017 Business Plan 2017E 2018E 2019E 2020E 2021E 17E-‘21E CAGR Present Value of Distributions 2017E 2018E 2019E 2020E 2021E 17E-?21E CAGR FFO/Unit $1.85 $1.99 $1.96 $1.96 $2.11 3.3% Annual Growth Rate (%) 7.2%(1.4%)(0.0%) 7.8% AFFO/Unit $1.55 $1.74 $1.67 $1.69 $1.85 4.5% Annual Growth Rate (%) 12.3%(4.0%) 1.2% 9.5% Distributions/Unit $1.38 $1.46 $1.54 $1.61 $1.69 5.2% Distributions/Unit Annual Growth (%) 5.8% 5.5% 4.5% 5.0% Implied FFO Payout Ratio 74.4% 73.5% 78.6% 82.3% 80.1% Implied AFFO Payout Ratio 89.0% 83.9% 92.2% 95.3% 91.3% Remaining Distributions/Unit(1) $1.03 $1.46 $1.54 $1.61 $1.69 Discounted Distributions/Unit (8.00% Cost of Equity) $1.01 $1.33 $1.30 $1.25 $1.22 Present Value of Distributions (2017-21E) $6.10 Present Value of Terminal Value Applied Perpetuity Growth Rate 3.5% Implied 2021E FFO Multiple 18.4x Terminal Value $38.87 Present Value of Terminal Value $26.97 Implied Unit Price $33.06 Cost of Equity Overview(2) Implied Unit Price ? Sensitivity Analysis Key Assumptions Terminal Distribution Grow th % Market Risk Premium 6.94% $33.06 3.25% 3.50% 3.75% Risk Free Rate (10-yr GoC Bond) 1.46% i ty 7.75% $33.33 $35.00 $36.88 Assumed Levered Beta 0.944 Equ Cost of Equity 8.01% f 8.00% $31.58 $33.06 $34.72 o Applied Cost of Equity (Rounded) 8.00% ost C 8.25% $30.01 $31.33 $32.80 Notes: (1) Remaining distribution figure for 2017E reflects the 9 of 12 remaining monthly distributions to be paid over the year (2) For a full overview of cost of equity assumptions, see page 33 Source: BOX Management Projections (2017 Business Planning Session), Bloomberg, Factset, Duff & Phelps 34