October 20, 2020

VIA EDGAR TRANSMISSION

Mr. Scott W. Lee

Senior Counsel

Securities and Exchange Commission

Division of Investment Management

100 F. Street, N.E.

Washington, D.C. 20549-0506

Re: Northern Lights Fund Trust III, File Nos. 333-178833 and 811-22655

Dear Mr. Lee:

On August 28, 2020, the Registrant, on behalf of its series, Boyd Watterson Limited Duration Enhanced Income Fund (the “Fund”), filed a registration statement under the Securities Act of 1933 on Form N-1A (the “Amendment”). In a telephone conversation on October 9, 2020, you provided me with the Securities and Exchange Commission’s (“SEC”) comments to the Amendment. Below, please find a summary of the SEC’s comments and the Registrant’s response, which the Registrant has authorized Thompson Hine LLP to make on its behalf. Additional or revised disclosures are italicized.

Prospectus

Fee Table

Comment 1: It appears that the reference to footnote 4 was struck from the Fee Table. Please either add the corresponding reference in the appropriate place or delete footnote 4.

Response: Footnote 4 has been deleted from the Fee Table.

Principal Investment Strategies

Comment 2: In the second sentence of the Fund’s principal investment strategies, please define was is meant by “hybrid corporate securities” and identify the types of hybrid corporate securities in which the Fund will invest.

Response: The Registrant has amended its disclosure to state the following:

| Philip.Sineneng@ThompsonHine.com Direct: 614.469.3217 | |

|

Mr. Scott W. Lee October 20, 2020 Page 2 |

Under normal market conditions, the Fund invests a majority of its assets in investments in domestic, and U.S. dollar denominated foreign, income-producing securities. These securities are (i) below investment-grade (also known as “junk” bonds) and investment grade fixed income securities, asset-backed securities, hybrid corporate securities that combine equity and debt characteristics such as preferred stocks, bank loans, and U.S. government securities, and (ii) equity securities.

Comment 3: Please confirm whether the Fund invests in leveraged loans as part of its principal investment strategy. If so, please articulate such strategy in plain-English. The Staff may have additional comments on such strategy.

Response: The Fund will not invest in bank loans that employ leverage as part of the Fund’s principal investment strategy.

Comment 4: Please include risk disclosures associated with LIBOR and the anticipated discontinuation of LIBOR to correspond with the Fund’s disclosure of duration management.

Response: The Registrant has amended its principal risk disclosure of “Fixed Income Risk” to state the following:

Fixed Income Risk: Typically, a rise in interest rates causes a decline in the value of fixed income securities and typically falls when an issuer’s credit quality declines and may even become worthless if an issuer defaults. Recently, interest rates have been historically low. Current conditions may result in a rise in interest rates, which in turn may result in a decline in the value of the bond investments held by the Fund. As a result, for the present, interest rate risk may be heightened.

The Fund may have exposure to LIBOR-linked investments and anticipates that LIBOR will be phased out by the end of 2021. While some instruments may contemplate a scenario where LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments may have such provisions and there is significant uncertainty regarding the effectiveness of any such alternative methodologies and potential for short-term and long-term market instability. Because of the uncertainty regarding the nature of any replacement rate, the Fund cannot reasonably estimate the impact of the anticipated transition away from LIBOR at this time. If the LIBOR replacement rate is lower than market expectations, there could be an adverse impact on the value of preferred and debt securities with floating or fixed-to-floating rate coupons.

Mr. Scott W. Lee October 20, 2020 Page 3 |

Comment 5: In the paragraph under the heading “Duration Management,” please explain how seeking to maintain a limited duration in fixed income products impacts the Fund’s portfolio turnover rate. If appropriate, please include risk disclosure for turnover rate risk.

Response: The Registrant has amended its disclosures to state the following:

Effective duration takes into account that expected cash flows will fluctuate as interest rates change. The duration decision for the Fund is based on optimizing the positioning of the portfolio across the credit curve. The decision is dependent, in part, on the economic outlook of the market as determined by the Adviser. The Fund may engage in frequent trading of its portfolio, resulting in a higher turnover rate.

The Registrant has added the following risk disclosure to its principal investment risks:

Portfolio Turnover Risk: A higher portfolio turnover may result in higher transactional and brokerage costs.

Principal Investment Risks

Comment 6: The Staff’s position on risk disclosures for the past several years has been to disclose risks in the order of significance or prominence to a fund’s strategy. Disclosing risks in alphabetical order suggests that each are equally imminent, whereas the risk disclosures should give shareholders which risks are of greater concern or salient to the fund. Pursuant to remarks from Dalia Blass, Director of the Division of Investment Management, please re-order each Fund’s principal risk disclosures so that the most significant risks appear first followed by the remaining risks in alphabetical order. See ADI 2019-08, “Improving Principal Risks Disclosure” at www.sec.gov.

Response: The Registrant has given the Staff’s position, as well as Ms. Blass’s remarks and ADI 2019-08, thoughtful consideration. The Registrant respectfully declines to re-order the Fund’s risk disclosures as requested. The materiality of each risk is fluid, i.e., what is the most material risk today may not be the most material risk tomorrow. Recent market disruptions and volatility as a result of the global COVID-19 pandemic demonstrate that it is not possible to identify which risk will present the greatest concern to the Fund at any given moment. Therefore, the Registrant believes that emphasizing one risk over another may be misleading to investors.

Comment 7: Please tailor the Fund’s disclosures of Derivative Risk to the Fund’s principal investment strategies. Please consider the Division of Investment Management's observations on

Mr. Scott W. Lee October 20, 2020 Page 4 |

derivatives-related disclosure in the letter from Barry D. Miller, Associate Director, Office of Legal and Disclosure, to Karrie McMillan, General Counsel, Investment Company Institute dated July 30, 2010. Barry Miler Letter July 30, 2010.

Response: The Registrant has amended its disclosures to state the following:

Derivatives Risk: The Fund may use credit default swaps to hedge against market or security-specific declines. The Fund’s use ofderivative instruments credit default swaps involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to aderivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of thederivative credit default swap may not correlate perfectly with the underlying asset.

Comment 8: Please rename “Equity Risk” to either “Equities Risk” or “Equity Securities Risk.”

Response: The Registrant has renamed “Equity Risk” to “Equity Securities Risk.”

Comment 9: Given the Fund’s investments in junk bonds, please provide liquidity risk disclosure or explain supplementally why such risk would not be appropriate:

Response: The Registrant has given the Staff’s comment thoughtful consideration and respectfully declines to amend its disclosures. The Registrant believes that its disclosure of “Junk Bonds Risk” adequately and sufficiently states that the lack of a liquid market for junk bonds specifically may decrease the Fund’s share price. The Registrant does not believe it is accurate to impute liquidity risk to all of the Fund’s investments.

Comment 10: Please include principal investment strategy disclosures to correspond with the Fund’s disclosure of “Preferred Securities Risk.”

Response: The Registrant refers to its response to Comment 2.

Comment 11: Please include principal strategy disclosures to correspond with the Fund’s disclosure of “Small and Medium Capitalization Stock Risk” or include risk disclosure for “Large Capitalization Stock Risk.”

Response: The Registrant has added the following risk disclosure to its principal investment risks:

Mr. Scott W. Lee October 20, 2020 Page 5 |

Large Capitalization Stock Risk: Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large capitalization companies has trailed the overall performance of the broader securities markets.

Performance

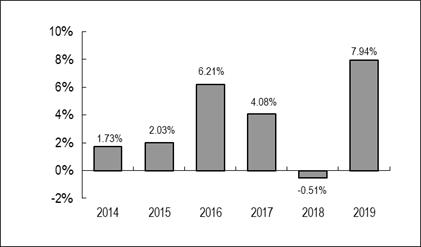

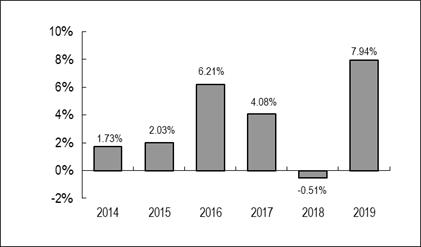

Comment 12: Please provide the updated Bar Chart and Performance Table.

Response: The Fund’s performance disclosures have been updated to state the following:

Class I2 Performance Bar Chart For Calendar Years Ended December 31

| Best Quarter | 3/31/2019 | 3.68% |

| Worst Quarter | 12/31/2018 | (1.96)% |

The Fund’s year-to-date return as of September 30, 2020, was 2.79%.

Mr. Scott W. Lee October 20, 2020 Page 6 |

Performance Table

Average Annual Total Returns

(For periods ended December 31, 2019)

| | One Year | Five Years | Since Inception(2) | Since Inception(3) |

| Class I2 shares(1) | | | | |

| Return before taxes | 7.94% | 3.92% | 3.59% | - |

| Return after taxes on distributions | 6.42% | 2.91% | 2.81% | - |

| Return after taxes on distributions and sale of fund shares | 4.68% | 2.57% | 2.44% | - |

| Class I shares | | | | |

| Return before taxes | 7.75% | - | - | 3.63% |

Bloomberg Barclays Capital U.S.

1-3 Year Government/Credit Bond Index(4)

(reflects no deduction for fees, expenses or taxes) | 4.03% | 1.67% | 1.49% | 2.15% |

Bloomberg Barclays Capital U.S.

1-5 Year Government/Credit Bond Index(5)

(reflects no deduction for fees, expenses or taxes) | 5.01% | 2.03% | 1.89% | 2.44% |

Bloomberg Barclays U.S. Treasury 1-3 Years(6) (reflects no deduction for fees, expenses or taxes) | 3.59% | 1.39% | 1.22% | 1.88% |

| (1) | As a result of the different tax treatment of the Predecessor Fund, we are unable to calculate after-tax returns for the Predecessor Fund. The Predecessor Fund did not have a distribution |

Mr. Scott W. Lee October 20, 2020 Page 7 |

policy. It was an unregistered limited liability company, did not qualify as a regulated investment company for federal income tax purposes, and it did not pay dividends and distributions.

| (4) | The Bloomberg Barclays 1-3 Year Govt/Credit Index is an unmanaged index which is a component of the US Government/Credit Index, which includes Treasury and agency securities (US Government Bond Index) and publicly issued US corporate and foreign debentures and secured notes (US Credit Bond Index). The bonds in the index are investment grade with a maturity between one and three years. Formerly known as Bloomberg Barclays Capital U.S. 1-3 Year Govt/Credit Bond Index. Investors cannot invest directly in an index. |

| (5) | The Bloomberg Barclays 1-5 Year Govt/Credit Index is an unmanaged index which is a component of the US Government/Credit Index, which includes Treasury and agency securities (US Government Bond Index) and publicly issued US corporate and foreign debentures and secured notes (US Credit Bond Index). The bonds in the index are investment grade with a maturity between one and five years. Formerly known as Bloomberg Barclays 1-5 Year Govt/Credit Bond Index. Investors cannot invest directly in an index. |

| (6) | The Bloomberg Barclays U.S. Treasury 1-3 Years Index is an unmanaged index measures the performance of the US government bond market and includes public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years. Investors cannot invest directly in an index. |

After-tax returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After tax returns for the share classes which are not presented will vary from the after-tax returns of Class I2 shares. The table above illustrates how the Fund’s average annual total returns over time compare with two domestic broad-based market indices.

Additional Information about the Fund’s Principal Investment Strategies and Related Risks

Comment 13: Please include disclosure for “Cash Positions Risks” since the Fund discloses it may invest in “money market mutual funds for cash positions” in the paragraph under the heading “Temporary Investments.”

Response: The Registrant has given the Staff’s comment thoughtful consideration and respectfully declines to amend its disclosures. The Fund’s investment in cash positions is not a principal investment strategy.

Mr. Scott W. Lee October 20, 2020 Page 8 |

Statement of Additional Information

Comment 14: Please confirm whether the Fund will include investments in asset-backed securities when determining compliance with its concentration policy as stated on page 28.

Response: The Registrant views asset-backed securities (“ABS”) as a broad asset class representing a diverse and heterogeneous pool of borrowers and loan types and believes that ABS should not be classified as an “industry.” However, in light of the Staff’s comment, the Fund will, with respect to ABS, look through to the underlying pool of borrowers, and classify the securities based on traditional industry classifications.

Part C

Comment 15: Per the requirements of the FAST Act, please include Securities Act File Numbers for all hyperlinked documents.

Response: The Registrant will update the Part C accordingly.

If you have any questions, please call JoAnn M. Strasser at (614) 469-3265 or the undersigned at (614) 469-3217.

Very truly yours,

/s/ Philip B. Sineneng

Philip B. Sineneng

cc: JoAnn M. Strasser