united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22655 |

| Northern Lights Fund Trust III |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| The Corporation Trust Company |

| 1209 Orange Street, Wilmington, DE 19801 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-490-4300 |

| Date of fiscal year end: | 6/30 |

| Date of reporting period: | 6/30/2024 |

Item 1. Reports to Stockholders.

(a)

Boyd Watterson Limited Duration Enhanced Income Fund - Class I2 (BWDTX)

Class I2 (BWDTX)

Annual Shareholder Report - June 30, 2024

Fund Overview

This annual shareholder report contains important information about Boyd Watterson Limited Duration Enhanced Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://boydwattersonfunds.com/. You can also request this information by contacting us at (216)-771-3450.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class I2 | $41 | 0.41% |

How did the Fund perform during the reporting period?

The Boyd Watterson Limited Duration Enhanced Income Fund (the “Fund”) generated a total return of 8.89% for the year ended June 30, 2024. The Fund’s benchmark, the Bloomberg 1-3 Year Govt Credit Index(1) returned 4.87% for the same period. Longer duration assets were negatively impacted by higher rates with the Bloomberg Aggregate Index returning only 2.63%. Credit returns were mixed as the ICE BofA US Corp Index, an investment grade corporate bond index with a duration of almost seven years, returned 5.04% while the ICE BofA US High Yield Index returned 10.45%. Across the credit spectrum lower quality generally outperformed higher quality. Highlighting Boyd Watterson’s cautious macroeconomic view, the Fund’s average credit quality is BBB+, with a duration of about 2.0 years. As we cross the midpoint of 2024, we reiterate our view that economic growth will likely remain resilient in 2024 and stickier-than-expected inflation will persist. We do acknowledge some pockets of the economy could offer underwhelming results in the near term. We believe the Federal Reserve will exercise patience, which supports a “higher for longer” view on the Federal Funds rate and a relatively rangebound interest rate environment. Within the “higher for longer” context, we think one rate cut by the Federal Reserve is quite likely this year, but we also think it is unlikely inflation will slow enough or economic fundamentals will deteriorate enough to justify interest rate cuts at consecutive meetings. Thematically, with our expectation of higher interest rates for longer we continued to focus on maintaining floating rate exposure, mostly through CLOs. Our macro views support consumer resiliency, so we increased our consumer-related ABS holdings to about 20% of the Fund. Over the course of the last year, we began taking positions in Treasury securities which are now up to 5% of the Fund, the highest level in many years. The Fund seeks income generation as a principal objective and capital preservation and total return as secondary objectives. From a credit perspective, the Fund continues to experience more credit agency upgrades than downgrades and does not have any individual holdings trading at distressed levels. We meticulously apply our credit process to every security before we purchase it, recognizing that we may likely hold the security during future, tumultuous times, and want to feel comfortable with every security as a long-term holder.

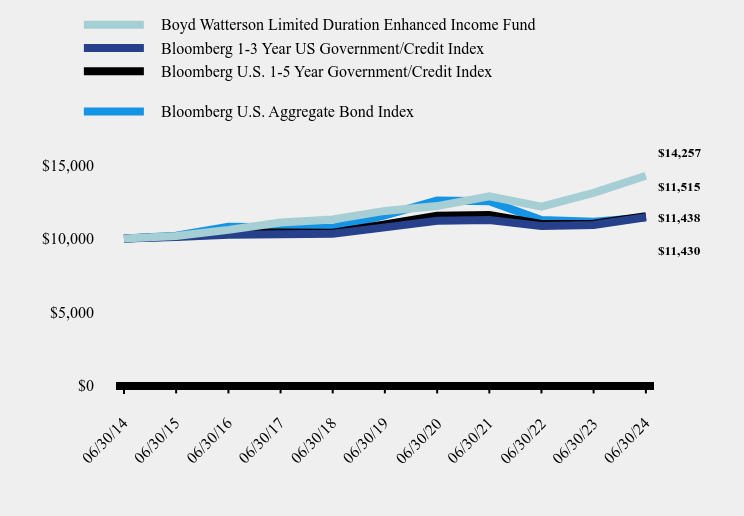

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Boyd Watterson Limited Duration Enhanced Income Fund | Bloomberg 1-3 Year US Government/Credit Index | Bloomberg U.S. 1-5 Year Government/Credit Index | Bloomberg U.S. Aggregate Bond Index | |

|---|---|---|---|---|

| 06/30/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 06/30/15 | $10,161 | $10,093 | $10,131 | $10,186 |

| 06/30/16 | $10,579 | $10,253 | $10,398 | $10,797 |

| 06/30/17 | $11,082 | $10,289 | $10,409 | $10,763 |

| 06/30/18 | $11,291 | $10,310 | $10,388 | $10,720 |

| 06/30/19 | $11,870 | $10,750 | $10,943 | $11,564 |

| 06/30/20 | $12,199 | $11,202 | $11,537 | $12,575 |

| 06/30/21 | $12,865 | $11,251 | $11,583 | $12,533 |

| 06/30/22 | $12,153 | $10,850 | $10,981 | $11,243 |

| 06/30/23 | $13,094 | $10,907 | $11,002 | $11,137 |

| 06/30/24 | $14,257 | $11,438 | $11,515 | $11,430 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| Boyd Watterson Limited Duration Enhanced Income Fund | 8.89% | 3.73% | 3.61% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.87% | 1.25% | 1.35% |

| Bloomberg U.S. 1-5 Year Government/Credit Index | 4.66% | 1.02% | 1.42% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | -0.23% | 1.35% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

- Net Assets$446,781,609

- Number of Portfolio Holdings157

- Advisory Fee (net of waivers)$928,461

- Portfolio Turnover28%

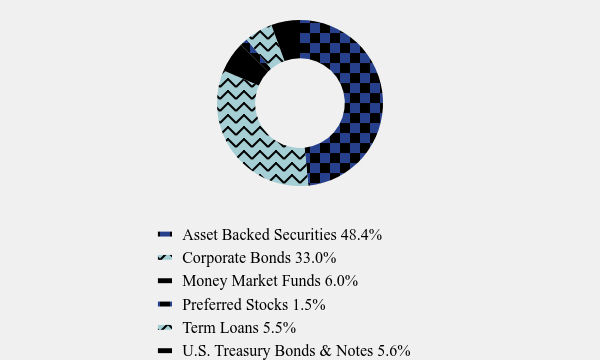

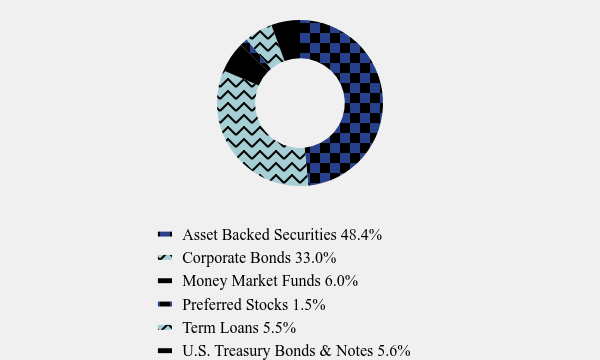

Asset Weighting (% of total investments)

| Value | Value |

|---|---|

| Asset Backed Securities | 48.4% |

| Corporate Bonds | 33.0% |

| Money Market Funds | 6.0% |

| Preferred Stocks | 1.5% |

| Term Loans | 5.5% |

| U.S. Treasury Bonds & Notes | 5.6% |

What did the Fund invest in?

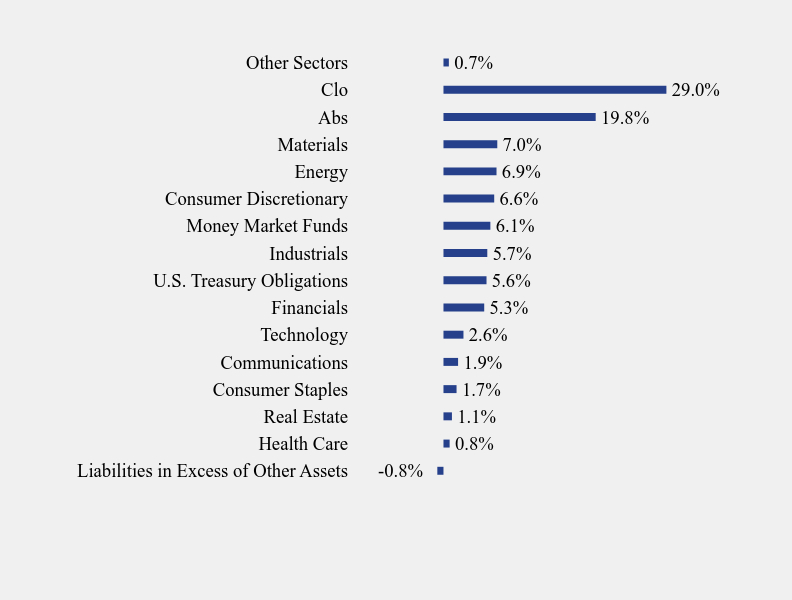

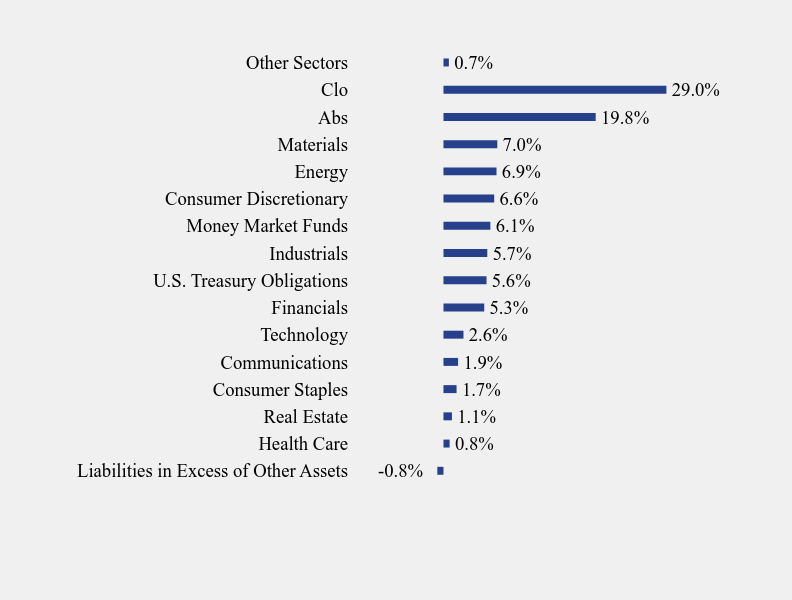

Sector Weighting (% of net assets)

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | -0.8% |

| Health Care | 0.8% |

| Real Estate | 1.1% |

| Consumer Staples | 1.7% |

| Communications | 1.9% |

| Technology | 2.6% |

| Financials | 5.3% |

| U.S. Treasury Obligations | 5.6% |

| Industrials | 5.7% |

| Money Market Funds | 6.1% |

| Consumer Discretionary | 6.6% |

| Energy | 6.9% |

| Materials | 7.0% |

| Abs | 19.8% |

| Clo | 29.0% |

| Other Sectors | 0.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Government Obligations Fund, Class X | 6.1% |

| United States Treasury Note | 5.6% |

| Exeter Automobile Receivables Trust 2021-4, E | 2.3% |

| First Investors Auto Owner Trust 2023-1, D | 2.0% |

| Neuberger Berman CLO XVII Ltd., CR3 | 1.7% |

| Ares XLIX CLO Ltd., B | 1.6% |

| MasTec, Inc. | 1.4% |

| Morgan Stanley | 1.4% |

| OHA Credit Partners XIV Ltd., D1R | 1.2% |

| Elmwood CLO 21 Ltd., AR | 1.2% |

Material Fund Changes

No material changes occurred during the year ended June 30, 2024.

Boyd Watterson Limited Duration Enhanced Income Fund - Class I2 (BWDTX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://boydwattersonfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

TSR-AR 063024-BWDTX

Boyd Watterson Limited Duration Enhanced Income Fund - Class I (BWDIX )

Class I (BWDIX )

Annual Shareholder Report - June 30, 2024

Fund Overview

This annual shareholder report contains important information about Boyd Watterson Limited Duration Enhanced Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://boydwattersonfunds.com/. You can also request this information by contacting us at (216)-771-3450.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class I | $60 | 0.60% |

How did the Fund perform during the reporting period?

The Boyd Watterson Limited Duration Enhanced Income Fund (the “Fund”) generated a total return of 8.57% for the year ended June 30, 2024. The Fund’s benchmark, the Bloomberg 1-3 Year Govt Credit Index(1) returned 4.87% for the same period. Longer duration assets were negatively impacted by higher rates with the Bloomberg Aggregate Index returning only 2.63%. Credit returns were mixed as the ICE BofA US Corp Index, an investment grade corporate bond index with a duration of almost seven years, returned 5.04% while the ICE BofA US High Yield Index returned 10.45%. Across the credit spectrum lower quality generally outperformed higher quality. Highlighting Boyd Watterson’s cautious macroeconomic view, the Fund’s average credit quality is BBB+, with a duration of about 2.0 years. As we cross the midpoint of 2024, we reiterate our view that economic growth will likely remain resilient in 2024 and stickier-than-expected inflation will persist. We do acknowledge some pockets of the economy could offer underwhelming results in the near term. We believe the Federal Reserve will exercise patience, which supports a “higher for longer” view on the Federal Funds rate and a relatively rangebound interest rate environment. Within the “higher for longer” context, we think one rate cut by the Federal Reserve is quite likely this year, but we also think it is unlikely inflation will slow enough or economic fundamentals will deteriorate enough to justify interest rate cuts at consecutive meetings. Thematically, with our expectation of higher interest rates for longer we continued to focus on maintaining floating rate exposure, mostly through CLOs. Our macro views support consumer resiliency, so we increased our consumer-related ABS holdings to about 20% of the Fund. Over the course of the last year, we began taking positions in Treasury securities which are now up to 5% of the Fund, the highest level in many years. The Fund seeks income generation as a principal objective and capital preservation and total return as secondary objectives. From a credit perspective, the Fund continues to experience more credit agency upgrades than downgrades and does not have any individual holdings trading at distressed levels. We meticulously apply our credit process to every security before we purchase it, recognizing that we may likely hold the security during future, tumultuous times, and want to feel comfortable with every security as a long-term holder.

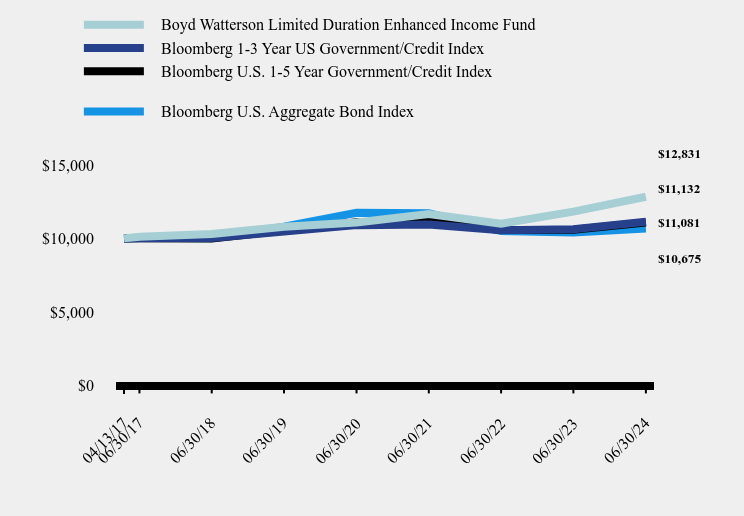

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Boyd Watterson Limited Duration Enhanced Income Fund | Bloomberg 1-3 Year US Government/Credit Index | Bloomberg U.S. 1-5 Year Government/Credit Index | Bloomberg U.S. Aggregate Bond Index | |

|---|---|---|---|---|

| 04/13/17 | $10,000 | $10,000 | $10,000 | $10,000 |

| 06/30/17 | $10,114 | $10,013 | $10,017 | $10,051 |

| 06/30/18 | $10,295 | $10,034 | $9,997 | $10,011 |

| 06/30/19 | $10,791 | $10,462 | $10,531 | $10,799 |

| 06/30/20 | $11,081 | $10,902 | $11,103 | $11,743 |

| 06/30/21 | $11,656 | $10,950 | $11,147 | $11,704 |

| 06/30/22 | $10,993 | $10,560 | $10,568 | $10,499 |

| 06/30/23 | $11,817 | $10,615 | $10,588 | $10,401 |

| 06/30/24 | $12,831 | $11,132 | $11,081 | $10,675 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (4/13/2017) | |

|---|---|---|---|

| Boyd Watterson Limited Duration Enhanced Income Fund | 8.57% | 3.52% | 3.52% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.87% | 1.25% | 1.50% |

| Bloomberg U.S. 1-5 Year Government/Credit Index | 4.66% | 1.02% | 1.43% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | -0.23% | 0.91% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

- Net Assets$446,781,609

- Number of Portfolio Holdings157

- Advisory Fee (net of waivers)$928,461

- Portfolio Turnover28%

Asset Weighting (% of total investments)

| Value | Value |

|---|---|

| Asset Backed Securities | 48.4% |

| Corporate Bonds | 33.0% |

| Money Market Funds | 6.0% |

| Preferred Stocks | 1.5% |

| Term Loans | 5.5% |

| U.S. Treasury Bonds & Notes | 5.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | -0.8% |

| Health Care | 0.8% |

| Real Estate | 1.1% |

| Consumer Staples | 1.7% |

| Communications | 1.9% |

| Technology | 2.6% |

| Financials | 5.3% |

| U.S. Treasury Obligations | 5.6% |

| Industrials | 5.7% |

| Money Market Funds | 6.1% |

| Consumer Discretionary | 6.6% |

| Energy | 6.9% |

| Materials | 7.0% |

| Abs | 19.8% |

| Clo | 29.0% |

| Other Sectors | 0.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Government Obligations Fund, Class X | 6.1% |

| United States Treasury Note | 5.6% |

| Exeter Automobile Receivables Trust 2021-4, E | 2.3% |

| First Investors Auto Owner Trust 2023-1, D | 2.0% |

| Neuberger Berman CLO XVII Ltd., CR3 | 1.7% |

| Ares XLIX CLO Ltd., B | 1.6% |

| MasTec, Inc. | 1.4% |

| Morgan Stanley | 1.4% |

| OHA Credit Partners XIV Ltd., D1R | 1.2% |

| Elmwood CLO 21 Ltd., AR | 1.2% |

Material Fund Changes

No material changes occurred during the year ended June 30, 2024.

Boyd Watterson Limited Duration Enhanced Income Fund - Class I (BWDIX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://boydwattersonfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

TSR-AR 063024-BWDIX

Item 2. Code of Ethics.

(a) The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) During the period covered by this report, there were no amendments to any provision of the code of ethics.

(c) During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s board of trustees has determined that Mark H. Taylor is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Taylor is independent for purposes of this Item 3.

(a)(2) Not applicable.

(a)(3) Not applicable.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

2024 - $21,000

2023 - $21,000

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

2024 - None

2023 - None

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

2024 - $3,750

2023 - $3,750

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended June 30, 2024 and 2023 respectively. |

(e)(1) The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant.

(e)(2) There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable. The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was zero percent (0%).

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended June 30, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants. Not applicable to open-end investment companies.

Item 6. Investments. The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| (a) |

Boyd Watterson Limited Duration

Enhanced Income Fund

Class I Shares – BWDIX

Class I2 Shares – BWDTX

Annual Financial Statements

June 30, 2024

1-877-345-9597

www.boydwattersonfunds.com

Boyd Watterson Asset Management, LLC

1301 East 9th Street, Suite 2900

Cleveland, Ohio 44114

Distributed by Northern Lights Distributors, LLC

Member FINRA

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| June 30, 2024 |

| Coupon Rate | ||||||||||||||

| Shares | (%) | Maturity | Fair Value | |||||||||||

| PREFERRED STOCKS — 1.5% | ||||||||||||||

| ASSET MANAGEMENT — 0.5% | ||||||||||||||

| 1 20,000 | Charles Schwab Corporation (The) - Series J | 1.113 | 06/01/26 | $ | 2,404,800 | |||||||||

| BANKING — 1.0% | ||||||||||||||

| 1 17,000 | Huntington Bancshares Inc - Series H | 1.125 | 2,090,790 | |||||||||||

| 1 22,135 | US Bancorp, B - Series M | 1.000 | 04/15/26 | 2,128,813 | ||||||||||

| 4,219,603 | ||||||||||||||

| TOTAL PREFERRED STOCKS (Cost $9,080,956) | 6,624,403 | |||||||||||||

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 48.6% | ||||||||||||||

| AUTO LOAN — 19.5% | ||||||||||||||

| 5,000,000 | American Credit Acceptance Receivables Trust Series 4 F(a) | 4.2100 | 07/13/28 | 4,892,186 | ||||||||||

| 737,729 | AmeriCredit Automobile Receivables Trust 2020-2 Series 2 C | 1.4800 | 02/18/26 | 732,482 | ||||||||||

| 2,030,000 | AmeriCredit Automobile Receivables Trust 2020-2 Series 2020-2 D | 2.1300 | 03/18/26 | 2,005,836 | ||||||||||

| 4,720,000 | CarMax Auto Owner Trust 2023-1 Series 1 D | 6.2700 | 11/15/29 | 4,769,549 | ||||||||||

| 650,140 | Exeter Automobile Receivables Trust 2021-3 Series 3A C | 0.9600 | 10/15/26 | 643,879 | ||||||||||

| 2,645,000 | Exeter Automobile Receivables Trust 2021-3 Series 2021-3A D | 1.5500 | 06/15/27 | 2,516,608 | ||||||||||

| 10,597,000 | Exeter Automobile Receivables Trust 2021-4 Series 4A E(a) | 4.0200 | 01/17/28 | 10,127,358 | ||||||||||

| 2,650,000 | Exeter Automobile Receivables Trust 2022-1 Series 1A D | 3.0200 | 06/15/28 | 2,550,407 | ||||||||||

| 4,000,000 | Exeter Automobile Receivables Trust 2022-1 Series 1A E(a) | 5.0200 | 10/15/29 | 3,780,942 | ||||||||||

| 3,653,000 | Exeter Automobile Receivables Trust 2022-4 Series 4A D | 5.9800 | 12/15/28 | 3,645,730 | ||||||||||

| 2,000,000 | First Investors Auto Owner Trust Series 2021-1A E(a) | 3.3500 | 04/15/27 | 1,955,593 | ||||||||||

| 689,380 | First Investors Auto Owner Trust 2021-1 Series 1A C(a) | 1.1700 | 03/15/27 | 678,658 | ||||||||||

| 2,230,000 | First Investors Auto Owner Trust 2021-2 Series 2021-2A D(a) | 1.6600 | 12/15/27 | 2,098,034 | ||||||||||

| 4,720,000 | First Investors Auto Owner Trust 2022-1 Series 1A D(a) | 3.7900 | 06/15/28 | 4,498,639 | ||||||||||

| 2,000,000 | First Investors Auto Owner Trust 2022-1 Series 1A E(a) | 5.4100 | 06/15/29 | 1,882,997 | ||||||||||

| 2,000,000 | First Investors Auto Owner Trust 2022-2 Series 2A D(a) | 8.7100 | 10/16/28 | 2,088,150 | ||||||||||

| 8,400,000 | First Investors Auto Owner Trust 2023-1 Series 1A D(a) | 7.7400 | 01/15/31 | 8,722,023 | ||||||||||

| 266,087 | Flagship Credit Auto Trust 2019-3 Series 3 D(a) | 2.8600 | 12/15/25 | 264,779 | ||||||||||

| 1,000,000 | PFS Financing Corporation Series C A(a),(b) | SOFR30A + 0.800% | 6.1330 | 04/17/28 | 1,001,740 | |||||||||

| 356,770 | Santander Drive Auto Receivables Trust 2020-3 Series 2020-3 D | 1.6400 | 11/16/26 | 353,862 | ||||||||||

| 3,701,200 | Santander Drive Auto Receivables Trust 2021-3 Series 2021-3 D | 1.3300 | 09/15/27 | 3,597,807 | ||||||||||

See accompanying notes to financial statements.

1

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 48.6% (Continued) | ||||||||||||||

| AUTO LOAN — 19.5% (Continued) | ||||||||||||||

| 3,000,000 | Westlake Automobile Receivables Trust 2020-3 Series 2020-3A F(a) | 5.1100 | 05/17/27 | $ | 2,992,978 | |||||||||

| 3,675,000 | Westlake Automobile Receivables Trust 2021-1 Series 2021-1A E(a) | 2.3300 | 08/17/26 | 3,573,713 | ||||||||||

| 2,000,000 | Westlake Automobile Receivables Trust 2021-2 Series 2021-2A E(a) | 2.3800 | 03/15/27 | 1,924,139 | ||||||||||

| 3,000,000 | Westlake Automobile Receivables Trust 2021-2 Series 2021-2A F(a) | 3.6600 | 12/15/27 | 2,899,340 | ||||||||||

| 1,114,891 | Westlake Automobile Receivables Trust 2021-3 Series 2021-3A C(a) | 1.5800 | 01/15/27 | 1,100,996 | ||||||||||

| 3,660,000 | Westlake Automobile Receivables Trust 2021-3 Series 2021-3A E(a) | 3.4200 | 04/15/27 | 3,542,391 | ||||||||||

| 4,750,000 | Westlake Automobile Receivables Trust 2023-1 Series 1A D(a) | 6.7900 | 11/15/28 | 4,829,137 | ||||||||||

| 3,650,000 | Westlake Automobile Receivables Trust 2024-2 Series 2A D(a) | 5.9100 | 04/15/30 | 3,648,574 | ||||||||||

| 87,318,527 | ||||||||||||||

| CLO — 29.0% | ||||||||||||||

| 3,000,000 | AGL CLO 25 Ltd. Series 25A D(a),(b) | TSFR3M + 5.300% | 10.6250 | 07/21/36 | 3,102,201 | |||||||||

| 289,000 | Apidos Clo XL Ltd. Series 40A A1(a),(b) | TSFR3M + 1.800% | 7.1290 | 07/15/35 | 289,041 | |||||||||

| 5,000,000 | Apidos CLO XXIX Series 29A B(a),(b) | TSFR3M + 2.162% | 7.4850 | 07/25/30 | 5,000,165 | |||||||||

| 2,650,000 | Apidos CLO XXVII Series 27A CR(a),(b) | TSFR3M + 3.412% | 8.7290 | 07/17/30 | 2,650,151 | |||||||||

| 3,500,000 | Apidos CLO XXXV Series 2021-35A E(a),(b) | TSFR3M + 6.012% | 11.3360 | 04/20/34 | 3,544,618 | |||||||||

| 530,476 | Ares XL CLO Ltd. Series 2016-40A A1RR(a),(b) | TSFR3M + 1.132% | 6.4600 | 01/15/29 | 530,926 | |||||||||

| 3,675,000 | Ares XL CLO Ltd. Series 2016-40A BRR(a),(b) | TSFR3M + 2.062% | 7.3900 | 01/15/29 | 3,680,744 | |||||||||

| 7,000,000 | Ares XLIX CLO Ltd. Series 49A B(a),(b) | TSFR3M + 1.912% | 7.2360 | 07/22/30 | 7,024,051 | |||||||||

| 2,700,000 | Bain Capital Credit CLO 2022-1 Ltd. Series 1A A1(a),(b) | TSFR3M + 1.320% | 6.6470 | 04/18/35 | 2,703,850 | |||||||||

| 2,250,000 | CARLYLE US CLO 2019-2 LTD Series 2019-2A A2R(a),(b) | TSFR3M + 1.912% | 7.2400 | 07/15/32 | 2,261,570 | |||||||||

| 637,707 | CIFC Funding 2014-II-R Ltd. Series 2014-2RA A1(a),(b) | TSFR3M + 1.312% | 6.6350 | 04/24/30 | 638,560 | |||||||||

| 2,200,000 | CIFC Funding 2017-IV Ltd. Series 2017-4A A2R(a),(b) | TSFR3M + 1.812% | 7.1350 | 10/24/30 | 2,203,648 | |||||||||

| 3,000,000 | CIFC Funding 2017-IV Ltd. Series 2017-4A CR(a),(b) | TSFR3M + 3.412% | 8.7350 | 10/24/30 | 3,025,542 | |||||||||

| 1,000,000 | Dryden 30 Senior Loan Fund Series 2013-30A CR(a),(b) | TSFR3M + 1.962% | 7.2840 | 11/15/28 | 999,929 | |||||||||

| 3,500,000 | Dryden 30 Senior Loan Fund Series 2013-30A DR(a),(b) | TSFR3M + 2.862% | 8.1840 | 11/15/28 | 3,472,367 | |||||||||

| 2,500,000 | Dryden 70 CLO Ltd. Series 70A C(a),(b) | TSFR3M + 2.412% | 7.7390 | 01/16/32 | 2,501,860 | |||||||||

| 85,391 | Dryden Senior Loan Fund Series 2017-47A A1R(a),(b) | TSFR3M + 1.242% | 6.5700 | 04/15/28 | 85,456 | |||||||||

| 39,059 | Elevation CLO 2014-2 Ltd. Series 2014-2A A1R(a),(b) | TSFR3M + 1.492% | 6.8200 | 10/15/29 | 39,063 | |||||||||

| 1,700,000 | Elmwood CLO 20 Ltd. Series 7A BR(a),(b) | TSFR3M + 2.050% | 7.3730 | 01/17/37 | 1,705,156 | |||||||||

| 5,500,000 | Elmwood CLO 21 Ltd. Series 8A AR(a),(b) | TSFR3M + 1.650% | 6.9750 | 10/20/36 | 5,539,627 | |||||||||

| 2,750,000 | Goldentree Loan Management US CLO 1 Ltd. Series 2017-1A DR2(a),(b) | TSFR3M + 3.412% | 8.7360 | 04/20/34 | 2,772,333 | |||||||||

| 4,500,000 | Goldentree Loan Management US Clo 17 Ltd. Series 17A B(a),(b) | TSFR3M + 2.450% | 7.7750 | 07/20/36 | 4,525,020 | |||||||||

See accompanying notes to financial statements.

2

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 48.6% (Continued) | ||||||||||||||

| CLO — 29.0% (Continued) | ||||||||||||||

| 2,500,000 | HalseyPoint CLO 4 Ltd. Series 4A E(a),(b) | TSFR3M + 6.972% | 12.2960 | 04/20/34 | $ | 2,493,808 | ||||||||

| 3,205,187 | Halseypoint CLO II Ltd. Series 2A A1(a),(b) | TSFR3M + 1.362% | 6.6860 | 07/20/31 | 3,205,187 | |||||||||

| 3,137,500 | HPS Loan Management 6-2015 Ltd. Series 2015 CR(a),(b) | TSFR3M + 2.762% | 8.0980 | 02/05/31 | 3,114,910 | |||||||||

| 2,200,000 | HPS Loan Management 8-2016 Ltd. Series 2016 CR(a),(b) | TSFR3M + 2.212% | 7.5360 | 07/20/30 | 2,203,676 | |||||||||

| 5,250,000 | ICG US CLO 2014-3 Ltd. Series 3A A2RR(a),(b) | TSFR3M + 1.762% | 7.0850 | 04/25/31 | 5,257,943 | |||||||||

| 1,250,000 | ICG US CLO 2022-1i Ltd. Series 1A D1(a),(b) | TSFR3M + 4.060% | 9.3850 | 07/20/35 | 1,243,322 | |||||||||

| 175,318 | LCM XXII Ltd. Series 22A A1R(a),(b) | TSFR3M + 1.422% | 6.7460 | 10/20/28 | 175,365 | |||||||||

| 2,000,000 | Madison Park Funding XXIV Ltd. Series 24A BR2(a),(b) | TSFR3M + 1.550% | 6.8790 | 10/20/29 | 1,999,948 | |||||||||

| 2,000,000 | Neuberger Berman CLO XV Series 2013-15A CR2(a),(b) | TSFR3M + 2.112% | 7.4400 | 10/15/29 | 2,000,068 | |||||||||

| 7,600,000 | Neuberger Berman CLO XVII Ltd. Series 17A CR3(a),(b) | TSFR3M + 2.150% | 7.4830 | 07/22/38 | 7,600,000 | |||||||||

| 2,000,000 | Neuberger Berman Loan Advisers CLO 32 Ltd. Series 2019-32A DR(a),(b) | TSFR3M + 2.962% | 8.2880 | 01/19/32 | 1,987,538 | |||||||||

| 3,165,000 | OCP CLO 2014-7 Ltd. Series 2014-7A CRR(a),(b) | TSFR3M + 3.362% | 8.6860 | 07/20/29 | 3,170,399 | |||||||||

| 1,750,000 | OCP CLO 2014-7 Ltd. Series 7A DRR(a),(b) | TSFR3M + 6.092% | 11.4160 | 07/20/29 | 1,753,743 | |||||||||

| 5,075,000 | OHA Credit Partners XIV Ltd. Series 14A D(a),(b) | TSFR3M + 2.962% | 8.2860 | 01/21/30 | 5,075,000 | |||||||||

| 5,575,000 | OHA Credit Partners XIV Ltd. Series 14A D1R(a),(b),(f) | TSFR3M + 2.900% | — | 07/21/37 | 5,575,000 | |||||||||

| 117,885 | Race Point VIII CLO Ltd. Series 2013-8A AR2(a),(b) | TSFR3M + 1.302% | 6.6270 | 02/20/30 | 117,942 | |||||||||

| 2,500,000 | Regatta XIII Funding Ltd. Series 2A CR(a),(b) | TSFR3M + 2.700% | 8.0462 | 07/15/31 | 2,500,000 | |||||||||

| 2,250,000 | Regatta XIII Funding Ltd. Series 2018-2A C(a),(b) | TSFR3M + 3.362% | 8.6900 | 07/15/31 | 2,252,448 | |||||||||

| 87,500 | Riserva Clo Ltd. Series 2016-3A XRR(a),(b) | TSFR3M + 1.062% | 6.3890 | 01/18/34 | 87,498 | |||||||||

| 2,075,000 | Sound Point CLO IX Ltd. Series 2A ARRR(a),(b) | TSFR3M + 1.472% | 6.7960 | 07/20/32 | 2,078,212 | |||||||||

| 3,000,000 | Venture 41 Clo Ltd. Series 41A C(a),(b) | TSFR3M + 2.862% | 8.1860 | 01/20/34 | 3,019,686 | |||||||||

| 2,000,000 | Venture XVII CLO Ltd. Series 2014-17A DRR(a),(b) | TSFR3M + 3.082% | 8.4100 | 04/15/27 | 2,008,754 | |||||||||

| 2,425,000 | Voya CLO 2014-1 Ltd.(a),(b) | TSFR3M + 3.062% | 8.3890 | 04/18/31 | 2,405,639 | |||||||||

| 1,390,000 | Wellfleet CLO 2016-1 Ltd. Series 2016-1A DR(a),(b) | TSFR3M + 3.162% | 8.4860 | 04/20/28 | 1,390,528 | |||||||||

| 4,435,000 | Wellfleet CLO 2017-1 Ltd. Series 1A BR(a),(b) | TSFR3M + 2.262% | 7.5860 | 04/20/29 | 4,435,803 | |||||||||

| 2,000,000 | Wind River 2021-2 CLO Ltd. Series 2A C(a),(b) | TSFR3M + 2.212% | 7.5360 | 07/20/34 | 2,000,050 | |||||||||

| 500,000 | Wind River 2021-2 CLO Ltd. Series 2021-2A D(a),(b) | TSFR3M + 3.412% | 8.7360 | 07/20/34 | 490,032 | |||||||||

| 1,500,000 | Wind River CLO Ltd. Series 2021-1A C(a),(b) | TSFR3M + 2.212% | 7.5360 | 04/20/34 | 1,500,038 | |||||||||

| 129,438,416 | ||||||||||||||

| RESIDENTIAL MORTGAGE — 0.1% | ||||||||||||||

| 70,376 | Towd Point Mortgage Trust 2017-5 Series 2017-5 A1(a),(b) | TSFR1M + 0.714% | 6.0600 | 02/25/57 | 71,971 | |||||||||

| 183,515 | Towd Point Mortgage Trust 2017-6 Series 2017-6 A1(a),(c) | 2.7500 | 10/25/57 | 177,172 | ||||||||||

See accompanying notes to financial statements.

3

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| ASSET BACKED SECURITIES — 48.6% (Continued) | ||||||||||||||

| RESIDENTIAL MORTGAGE — 0.1% (Continued) | ||||||||||||||

| $ | 249,143 | |||||||||||||

| TOTAL ASSET BACKED SECURITIES (Cost $214,758,166) | 217,006,086 | |||||||||||||

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 33.2% | ||||||||||||||

| AUTOMOTIVE — 1.1% | ||||||||||||||

| 975,000 | Adient Global Holdings Ltd.(a) | 4.8750 | 08/15/26 | 948,903 | ||||||||||

| 250,000 | Dana, Inc. | 5.3750 | 11/15/27 | 244,620 | ||||||||||

| 3,700,000 | Volkswagen Group of America Finance, LLC(a) | 5.9000 | 09/12/33 | 3,774,406 | ||||||||||

| 4,967,929 | ||||||||||||||

| BANKING — 0.9% | ||||||||||||||

| 3,995,000 | Bank of America Corporation Series FF(c) | TSFR3M + 3.193% | 5.8750 | Perpetual | 3,979,163 | |||||||||

| BIOTECH & PHARMA — 0.1% | ||||||||||||||

| 342,000 | Prestige Brands, Inc.(a) | 5.1250 | 01/15/28 | 332,871 | ||||||||||

| CABLE & SATELLITE — 0.9% | ||||||||||||||

| 3,000,000 | CCO Holdings, LLC / CCO Holdings Capital(a) | 5.1250 | 05/01/27 | 2,882,896 | ||||||||||

| 1,000,000 | CCO Holdings, LLC / CCO Holdings Capital(a) | 5.0000 | 02/01/28 | 935,691 | ||||||||||

| 3,818,587 | ||||||||||||||

| CHEMICALS — 0.7% | ||||||||||||||

| 770,000 | HB Fuller Company | 4.2500 | 10/15/28 | 729,833 | ||||||||||

| 2,675,000 | Ingevity Corporation(a) | 3.8750 | 11/01/28 | 2,430,455 | ||||||||||

| 3,160,288 | ||||||||||||||

| COMMERCIAL SUPPORT SERVICES — 1.1% | ||||||||||||||

| 2,000,000 | AMN Healthcare, Inc.(a) | 4.6250 | 10/01/27 | 1,907,609 | ||||||||||

| 2,945,000 | Korn Ferry(a) | 4.6250 | 12/15/27 | 2,811,006 | ||||||||||

| 4,718,615 | ||||||||||||||

| CONSTRUCTION MATERIALS — 1.2% | ||||||||||||||

| 3,592,000 | Advanced Drainage Systems, Inc.(a) | 5.0000 | 09/30/27 | 3,517,000 | ||||||||||

| 2,000,000 | Advanced Drainage Systems, Inc.(a) | 6.3750 | 06/15/30 | 2,009,940 | ||||||||||

| 5,526,940 | ||||||||||||||

See accompanying notes to financial statements.

4

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 33.2% (Continued) | ||||||||||||||

| CONSUMER SERVICES — 0.8% | ||||||||||||||

| 3,885,000 | Service Corp International | 5.1250 | 06/01/29 | $ | 3,785,271 | |||||||||

| CONTAINERS & PACKAGING — 1.2% | ||||||||||||||

| 2,420,000 | Silgan Holdings, Inc. | 4.1250 | 02/01/28 | 2,290,305 | ||||||||||

| 3,350,000 | TriMas Corporation(a) | 4.1250 | 04/15/29 | 3,072,228 | ||||||||||

| 5,362,533 | ||||||||||||||

| ELECTRIC UTILITIES — 0.7% | ||||||||||||||

| 2,940,000 | National Rural Utilities Cooperative Finance(c) | H15T5Y + 3.533% | 7.1250 | 09/15/53 | 3,028,923 | |||||||||

| ENGINEERING & CONSTRUCTION — 1.8% | ||||||||||||||

| 2,035,000 | Installed Building Products, Inc.(a) | 5.7500 | 02/01/28 | 1,991,988 | ||||||||||

| 6,500,000 | MasTec, Inc.(a) | 4.5000 | 08/15/28 | 6,204,930 | ||||||||||

| 8,196,918 | ||||||||||||||

| FOOD — 0.9% | ||||||||||||||

| 4,009,000 | Darling Ingredients, Inc.(a) | 5.2500 | 04/15/27 | 3,931,715 | ||||||||||

| FORESTRY, PAPER & WOOD PRODUCTS — 0.7% | ||||||||||||||

| 3,472,000 | Louisiana-Pacific Corporation(a) | 3.6250 | 03/15/29 | 3,153,694 | ||||||||||

| HEALTH CARE FACILITIES & SERVICES — 0.5% | ||||||||||||||

| 2,500,000 | Molina Healthcare, Inc.(a) | 4.3750 | 06/15/28 | 2,355,311 | ||||||||||

| HOME CONSTRUCTION — 0.4% | ||||||||||||||

| 2,000,000 | LGI Homes, Inc.(a) | 4.0000 | 07/15/29 | 1,738,593 | ||||||||||

| HOUSEHOLD PRODUCTS — 0.9% | ||||||||||||||

| 3,907,000 | Central Garden & Pet Company | 5.1250 | 02/01/28 | 3,806,503 | ||||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 2.3% | ||||||||||||||

| 4,185,000 | Goldman Sachs Group, Inc. (The) Series P(c) | TSFR3M + 3.136% | 8.4610 | Perpetual | 4,191,964 | |||||||||

| 6,045,000 | Morgan Stanley(c) | SOFRRATE + 1.880% | 5.4240 | 07/21/34 | 6,027,922 | |||||||||

| 10,219,886 | ||||||||||||||

See accompanying notes to financial statements.

5

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 33.2% (Continued) | ||||||||||||||

| LEISURE FACILITIES & SERVICES — 0.7% | ||||||||||||||

| 3,560,000 | Boyne USA, Inc.(a) | 4.7500 | 05/15/29 | $ | 3,324,130 | |||||||||

| MACHINERY — 0.8% | ||||||||||||||

| 4,000,000 | ATS Corporation(a) | 4.1250 | 12/15/28 | 3,656,338 | ||||||||||

| METALS & MINING — 1.4% | ||||||||||||||

| 3,603,000 | Freeport-McMoRan, Inc. | 5.0000 | 09/01/27 | 3,566,975 | ||||||||||

| 2,767,000 | Mineral Resources Ltd.(a) | 8.1250 | 05/01/27 | 2,792,506 | ||||||||||

| 6,359,481 | ||||||||||||||

| OIL & GAS PRODUCERS — 6.9% | ||||||||||||||

| 2,775,000 | Cheniere Energy Partners, L.P. | 4.5000 | 10/01/29 | 2,645,399 | ||||||||||

| 2,000,000 | Chord Energy Corporation(a) | 6.3750 | 06/01/26 | 2,001,378 | ||||||||||

| 2,000,000 | Civitas Resources, Inc.(a) | 8.6250 | 11/01/30 | 2,147,818 | ||||||||||

| 3,000,000 | EQT Corporation | 5.7500 | 02/01/34 | 2,975,380 | ||||||||||

| 3,250,000 | Hess Midstream Operations, L.P. (a) | 5.6250 | 02/15/26 | 3,227,683 | ||||||||||

| 2,000,000 | Matador Resources Company(a) | 6.8750 | 04/15/28 | 2,032,236 | ||||||||||

| 3,240,000 | Murphy Oil USA, Inc. | 5.6250 | 05/01/27 | 3,217,096 | ||||||||||

| 750,000 | Murphy Oil USA, Inc. | 4.7500 | 09/15/29 | 711,548 | ||||||||||

| 4,200,000 | Plains All American Pipeline, L.P. Series B(c) | TSFR3M + 4.372% | 9.6940 | Perpetual | 4,202,555 | |||||||||

| 2,000,000 | Sunoco, L.P.(a) | 7.2500 | 05/01/32 | 2,069,954 | ||||||||||

| 2,825,000 | Sunoco, L.P. / Sunoco Finance Corporation | 6.0000 | 04/15/27 | 2,823,107 | ||||||||||

| 2,909,000 | Targa Resources Partners, L.P. / Targa Resources | 5.0000 | 01/15/28 | 2,850,765 | ||||||||||

| 30,904,919 | ||||||||||||||

| PUBLISHING & BROADCASTING — 0.7% | ||||||||||||||

| 1,500,000 | Nexstar Media, Inc.(a) | 5.6250 | 07/15/27 | 1,426,238 | ||||||||||

| 2,000,000 | TEGNA, Inc. | 5.0000 | 09/15/29 | 1,767,991 | ||||||||||

| 3,194,229 | ||||||||||||||

| REAL ESTATE INVESTMENT TRUSTS — 1.1% | ||||||||||||||

| 3,000,000 | HAT Holdings I, LLC / HAT Holdings II, LLC(a) | 6.0000 | 04/15/25 | 2,999,456 | ||||||||||

| 2,000,000 | Iron Mountain, Inc.(a) | 5.2500 | 03/15/28 | 1,936,939 | ||||||||||

| 4,936,395 | ||||||||||||||

| RETAIL - DISCRETIONARY— 1.2% | ||||||||||||||

| 1,400,000 | Asbury Automotive Group, Inc. | 4.5000 | 03/01/28 | 1,328,505 | ||||||||||

| 945,000 | Asbury Automotive Group, Inc. | 4.7500 | 03/01/30 | 877,179 | ||||||||||

See accompanying notes to financial statements.

6

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| CORPORATE BONDS — 33.2% (Continued) | ||||||||||||||

| RETAIL - DISCRETIONARY — 1.2% (Continued) | ||||||||||||||

| 1,000,000 | Builders FirstSource, Inc.(a) | 6.3750 | 03/01/34 | $ | 991,861 | |||||||||

| 2,120,000 | Patrick Industries, Inc.(a) | 7.5000 | 10/15/27 | 2,143,379 | ||||||||||

| 5,340,924 | ||||||||||||||

| SEMICONDUCTORS — 1.4% | ||||||||||||||

| 2,180,000 | Amkor Technology, Inc.(a) | 6.6250 | 09/15/27 | 2,187,369 | ||||||||||

| 2,075,000 | ON Semiconductor Corporation(a) | 3.8750 | 09/01/28 | 1,916,601 | ||||||||||

| 2,200,000 | Synaptics, Inc.(a) | 4.0000 | 06/15/29 | 1,997,244 | ||||||||||

| 6,101,214 | ||||||||||||||

| SOFTWARE — 0.1% | ||||||||||||||

| 500,000 | Gen Digital, Inc.(a) | 6.7500 | 09/30/27 | 506,807 | ||||||||||

| SPECIALTY FINANCE — 0.6% | ||||||||||||||

| 3,000,000 | FirstCash, Inc.(a) | 4.6250 | 09/01/28 | 2,822,746 | ||||||||||

| TECHNOLOGY SERVICES — 0.7% | ||||||||||||||

| 3,500,000 | Booz Allen Hamilton, Inc.(a) | 3.8750 | 09/01/28 | 3,297,505 | ||||||||||

| TRANSPORTATION & LOGISTICS — 0.5% | ||||||||||||||

| 2,000,000 | Genesee & Wyoming, Inc.(a) | 6.2500 | 04/15/32 | 1,996,508 | ||||||||||

| TRANSPORTATION EQUIPMENT — 0.9% | ||||||||||||||

| 2,000,000 | Allison Transmission, Inc.(a) | 4.7500 | 10/01/27 | 1,934,021 | ||||||||||

| 2,000,000 | Allison Transmission, Inc.(a) | 5.8750 | 06/01/29 | 1,974,251 | ||||||||||

| 3,908,272 | ||||||||||||||

| TOTAL CORPORATE BONDS (Cost $152,154,145) | 148,433,208 | |||||||||||||

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 5.6% | ||||||||||||||

| BIOTECH & PHARMA — 0.0%(d) | ||||||||||||||

| 4,835 | Prestige Brands, Inc.(b) | TSFR1M + 2.115% | 7.4500 | 07/01/28 | 4,868 | |||||||||

| CHEMICALS — 0.8% | ||||||||||||||

| 3,477,500 | HB Fuller Company(b) | TSFR1M + 2.000% | 7.3300 | 02/15/30 | 3,484,038 | |||||||||

See accompanying notes to financial statements.

7

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | Spread | (%) | Maturity | Fair Value | ||||||||||

| TERM LOANS — 5.6% (Continued) | ||||||||||||||

| CONSTRUCTION MATERIALS — 0.9% | ||||||||||||||

| 3,908,861 | Quikrete Holdings, Inc.(b) | TSFR1M + 2.500% | 7.8150 | 03/25/31 | $ | 3,919,864 | ||||||||

| LEISURE FACILITIES & SERVICES — 0.7% | ||||||||||||||

| 2,924,812 | Hilton Grand Vacations Borrower, LLC(b) | TSFR1M + 2.500% | 8.1900 | 08/02/28 | 2,928,205 | |||||||||

| LEISURE PRODUCTS — 0.9% | ||||||||||||||

| 3,917,500 | Hayward Industries, Inc.(b) | TSFR1M + 2.865% | 8.1900 | 05/28/28 | 3,918,323 | |||||||||

| MEDICAL EQUIPMENT & DEVICES — 0.2% | ||||||||||||||

| 1,102,591 | Avantor Funding, Inc.(b) | TSFR1M + 2.100% | 7.4300 | 11/08/27 | 1,109,024 | |||||||||

| PUBLISHING & BROADCASTING — 0.3% | ||||||||||||||

| 1,549,070 | Nexstar Broadcasting, Inc.(b) | TSFR1M + 2.615% | 7.9400 | 09/19/26 | 1,554,607 | |||||||||

| RETAIL - DISCRETIONARY — 0.7% | ||||||||||||||

| 3,000,000 | Johnstone Supply, LLC(b) | TSFR1M + 3.000% | 8.3210 | 05/16/31 | 3,007,500 | |||||||||

| TECHNOLOGY HARDWARE — 0.4% | ||||||||||||||

| 1,990,000 | Ciena Corporation(b) | TSFR1M + 2.100% | 7.3300 | 10/24/30 | 2,000,368 | |||||||||

| TRANSPORTATION & LOGISTICS — 0.7% | ||||||||||||||

| 3,000,000 | Genesee & Wyoming, Inc.(b) | TSFR1M + 2.000% | 7.3010 | 04/07/31 | 3,000,285 | |||||||||

| TOTAL TERM LOANS (Cost $24,863,493) | 24,927,082 | |||||||||||||

| Principal | Coupon Rate | |||||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||||

| U.S. TREASURY BONDS & NOTES — 5.6% | ||||||||||||||

| 26,650,000 | United States Treasury Note (Cost $24,708,106) | 3.5000 | 02/15/33 | $ | 25,027,057 | |||||||||

See accompanying notes to financial statements.

8

| BOYD WATTERSON LIMITED DURATION ENHANCED INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| June 30, 2024 |

| Shares | Fair Value | |||||||

| SHORT-TERM INVESTMENTS — 6.7% | ||||||||

| MONEY MARKET FUNDS - 6.7% | ||||||||

| 29,956,200 | First American Government Obligations Fund, Class X, 5.23% (Cost $29,956,200)(e) | $ | 29,956,200 | |||||

| TOTAL INVESTMENTS – 101.2% (Cost $455,521,066) | $ | 451,974,036 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (1.2)% | (5,192,427 | ) | ||||||

| NET ASSETS - 100.0% | $ | 446,781,609 | ||||||

| CLO | - Collateralized Loan Obligation |

| LLC | - Limited Liability Company |

| LP | - Limited Partnership |

| LTD | - Limited Company |

| H15T5Y | US Treasury Yield Curve Rate T Note Constant Maturity 5 Year |

| SOFR30A | United States 30 Day Average SOFR Secured Overnight Financing Rate |

| SOFRRATE | United States SOFR Secured Overnight Financing Rate |

| TSFR1M | TSFR1M Term CME (Secured Overnight Financing Rate) 1 Month |

| TSFR3M | TSFR3M Term CME (Secured Overnight Financing Rate) 3 month |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of June 30, 2024 the total market value of 144A securities is $289,572,130 or 65.0% of net assets. |

| (b) | Floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (c) | Variable rate security; the rate shown represents the rate on June 30, 2024. |

| (d) | Percentage rounds to less than 0.1%. |

| (e) | Rate disclosed is the seven day effective yield as of June 30, 2024. |

| (f) | Zero coupon bond. |

See accompanying notes to financial statements.

9

| Boyd Watterson Limited Duration Enhanced Income Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| June 30, 2024 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 455,521,066 | ||

| At fair value | $ | 451,974,036 | ||

| Dividends and interest receivable | 4,805,370 | |||

| Receivable for fund shares sold | 268,511 | |||

| Prepaid expenses | 21,002 | |||

| TOTAL ASSETS | 457,068,919 | |||

| LIABILITIES | ||||

| Payable for securities purchased | 10,082,500 | |||

| Payable for fund shares redeemed | 2,629 | |||

| Investment advisory fees payable | 75,195 | |||

| Payable to related parties | 74,707 | |||

| Accrued expenses and other liabilities | 52,279 | |||

| TOTAL LIABILITIES | 10,287,310 | |||

| NET ASSETS | $ | 446,781,609 | ||

| Net Assets Consist Of: | ||||

| Paid in capital ($0 par value, unlimited shares authorized) | $ | 455,700,259 | ||

| Accumulated losses | (8,918,650 | ) | ||

| NET ASSETS | $ | 446,781,609 | ||

| Net Asset Value Per Share: | ||||

| Class I Shares: | ||||

| Net Assets | $ | 98,503,116 | ||

| Shares of beneficial interest outstanding * | 10,200,218 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 9.66 | ||

| Class I2 Shares: | ||||

| Net Assets | $ | 348,278,493 | ||

| Shares of beneficial interest outstanding * | 35,472,057 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 9.82 |

| * | Unlimited number of shares of beneficial interest authorized, no par value. |

See accompanying notes to financial statements.

10

| Boyd Watterson Limited Duration Enhanced Income Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended June 30, 2024 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 366,498 | ||

| Interest, net of amortization and accretion | 23,353,592 | |||

| TOTAL INVESTMENT INCOME | 23,720,090 | |||

| EXPENSES | ||||

| Investment advisory fees | 1,522,255 | |||

| Distribution (12b-1) fees | ||||

| Class A* | 3,732 | |||

| Class C* | 12,380 | |||

| Administrative services fees | 381,675 | |||

| Third party administration servicing fees | 90,092 | |||

| Transfer agent fees | 77,722 | |||

| Registration fees | 51,825 | |||

| Custodian fees | 48,454 | |||

| Compliance officer fees | 31,062 | |||

| Audit fees | 24,814 | |||

| Legal Fees | 21,256 | |||

| Printing and postage expenses | 19,957 | |||

| Trustees’ fees and expenses | 17,570 | |||

| Insurance expense | 7,320 | |||

| Other expenses | 8,043 | |||

| TOTAL EXPENSES | 2,318,157 | |||

| Less: Fees waived by the advisor | (593,794 | ) | ||

| NET EXPENSES | 1,724,363 | |||

| NET INVESTMENT INCOME | 21,995,727 | |||

| REALIZED AND UNREALIZED GAIN (LOSS) FROM INVESTMENTS | ||||

| Net realized loss from investments | (1,554,840 | ) | ||

| Net change in unrealized appreciation on investments | 11,448,821 | |||

| NET REALIZED AND UNREALIZED GAIN FROM INVESTMENTS | 9,893,981 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 31,889,708 |

| * | As of the close of business on March 28, 2024, sales and operations of Classes A and C were suspended. Classes A and C were coverted to Class I shares. |

See accompanying notes to financial statements.

11

| Boyd Watterson Limited Duration Enhanced Income Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| June 30, 2024 | June 30, 2023 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 21,995,727 | $ | 17,471,632 | ||||

| Net realized loss from investments | (1,554,840 | ) | (1,576,329 | ) | ||||

| Net change in unrealized appreciation on investments | 11,448,821 | 11,562,739 | ||||||

| Net increase in net assets resulting from operations | 31,889,708 | 27,458,042 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total distribution paid | ||||||||

| Class A* | (83,182 | ) | (100,605 | ) | ||||

| Class C* | (59,644 | ) | (62,934 | ) | ||||

| Class I | (4,536,095 | ) | (3,203,757 | ) | ||||

| Class I2 | (17,185,743 | ) | (14,400,992 | ) | ||||

| Net decrease in net assets from distributions to shareholders | (21,864,664 | ) | (17,768,288 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A* | 84,402 | 133,855 | ||||||

| Class C* | 39,994 | — | ||||||

| Class I | 45,466,186 | 7,076,118 | ||||||

| Class I2 | 62,944,520 | 35,903,661 | ||||||

| Reinvestment of distributions to shareholders: | ||||||||

| Class A* | 83,181 | 100,541 | ||||||

| Class C* | 59,644 | 62,934 | ||||||

| Class I | 4,480,780 | 3,171,926 | ||||||

| Class I2 | 14,999,447 | 12,219,313 | ||||||

| Payments for shares redeemed: | ||||||||

| Class A* | (2,251,408 | ) | (377,099 | ) | ||||

| Class C* | (1,787,746 | ) | (126,967 | ) | ||||

| Class I | (17,282,337 | ) | (13,763,130 | ) | ||||

| Class I2 | (49,470,097 | ) | (31,524,089 | ) | ||||

| Net increase in net assets from shares of beneficial interest | 57,366,566 | 12,877,063 | ||||||

| TOTAL INCREASE IN NET ASSETS | 67,391,610 | 22,566,817 | ||||||

| NET ASSETS | ||||||||

| Beginning of Year | 379,389,999 | 356,823,182 | ||||||

| End of Year | $ | 446,781,609 | $ | 379,389,999 | ||||

| * | As of the close of business on March 28, 2024, sales and operations of Classes A and C were suspended. Classes A and C were coverted to Class I shares. |

See accompanying notes to financial statements.

12

| Boyd Watterson Limited Duration Enhanced Income Fund |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| June 30, 2024 | June 30, 2023 | |||||||

| SHARE ACTIVITY | ||||||||

| Class A:* | ||||||||

| Shares Sold | 8,816 | 14,244 | ||||||

| Shares Reinvested | 8,738 | 10,790 | ||||||

| Shares Redeemed | (233,132 | ) | (40,171 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (215,578 | ) | (15,137 | ) | ||||

| Class C:* | ||||||||

| Shares Sold | 4,170 | — | ||||||

| Shares Reinvested | 6,252 | 6,740 | ||||||

| Shares Redeemed | (184,585 | ) | (13,620 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (174,163 | ) | (6,880 | ) | ||||

| Class I: | ||||||||

| Shares Sold | 4,703,128 | 751,307 | ||||||

| Shares Reinvested | 468,637 | 341,035 | ||||||

| Shares Redeemed | (1,795,879 | ) | (1,459,809 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | 3,375,886 | (367,467 | ) | |||||

| Class I2: | ||||||||

| Shares Sold | 6,432,372 | 3,749,670 | ||||||

| Shares Reinvested | 1,546,460 | 1,295,925 | ||||||

| Shares Redeemed | (5,101,086 | ) | (3,304,822 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 2,877,746 | 1,740,773 | ||||||

| * | As of the close of business on March 28, 2024, sales and operations of Classes A and C were suspended. Classes A and C were coverted to Class I shares. |

See accompanying notes to financial statements.

13

| Boyd Watterson Limited Duration Enhanced Income Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Years Presented

| Class I | ||||||||||||||||||||

| For the | For the | For the | For the | For the | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2022 | June 30, 2021 | June 30, 2020 | ||||||||||||||||

| Net asset value, beginning of year | $ | 9.42 | $ | 9.20 | $ | 10.08 | $ | 9.89 | $ | 9.97 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (1) | 0.54 | 0.42 | 0.27 | 0.29 | 0.30 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.26 | 0.25 | (0.83 | ) | 0.22 | (0.05 | ) | |||||||||||||

| Total from investment operations | 0.80 | 0.67 | (0.56 | ) | 0.51 | 0.25 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.56 | ) | (0.45 | ) | (0.30 | ) | (0.32 | ) | (0.33 | ) | ||||||||||

| Net realized gains | — | (0.00 | ) (2) | (0.02 | ) | — | — | |||||||||||||

| Total distributions | (0.56 | ) | (0.45 | ) | (0.32 | ) | (0.32 | ) | (0.33 | ) | ||||||||||

| Net asset value, end of year | $ | 9.66 | $ | 9.42 | $ | 9.20 | $ | 10.08 | $ | 9.89 | ||||||||||

| Total return (3) | 8.69 | % (6) | 7.50 | % | (5.69 | )% | 5.19 | % | 2.58 | % | ||||||||||

| Net assets, end of year (000s) | $ | 98,503 | $ | 64,313 | $ | 66,146 | $ | 86,471 | $ | 33,653 | ||||||||||

| Ratio of gross expenses to average net assets (4,5) | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | 0.63 | % | ||||||||||

| Ratio of net expenses to average net assets (5) | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | ||||||||||

| Ratio of net investment income to average net assets | 5.58 | % | 4.57 | % | 2.67 | % | 2.89 | % | 3.07 | % | ||||||||||

| Portfolio Turnover Rate | 28 | % | 35 | % | 47 | % | 73 | % | 70 | % | ||||||||||

| (1) | Per share amounts calculated using the average shares method, which more appropriately represents the per share data for the year. |

| (2) | Amount is less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (5) | Does not include the expenses of other investment companies in which the Fund invests. |

| (6) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

14

| Boyd Watterson Limited Duration Enhanced Income Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Years Presented

| Class I2 | ||||||||||||||||||||

| For the | For the | For the | For the | For the | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2022 | June 30, 2021 | June 30, 2020 | ||||||||||||||||

| Net asset value, beginning of year | $ | 9.55 | $ | 9.30 | $ | 10.17 | $ | 9.95 | $ | 10.01 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (1) | 0.56 | 0.45 | 0.29 | 0.32 | 0.33 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | 0.27 | 0.25 | (0.84 | ) | 0.22 | (0.06 | ) | |||||||||||||

| Total from investment operations | 0.83 | 0.70 | (0.55 | ) | 0.54 | 0.27 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.56 | ) | (0.45 | ) | (0.30 | ) | (0.32 | ) | (0.33 | ) | ||||||||||

| Net realized gains | — | (0.00 | ) (2) | (0.02 | ) | — | — | |||||||||||||

| Total distributions | (0.56 | ) | (0.45 | ) | (0.32 | ) | (0.32 | ) | (0.33 | ) | ||||||||||

| Net asset value, end of year | $ | 9.82 | $ | 9.55 | $ | 9.30 | $ | 10.17 | $ | 9.95 | ||||||||||

| Total return (3) | 8.89 | % | 7.74 | % | (5.54 | )% | 5.46 | % | 2.77 | % | ||||||||||

| Net assets, end of year (000s) | $ | 348,278 | $ | 311,396 | $ | 286,882 | $ | 259,922 | $ | 227,338 | ||||||||||

| Ratio of gross expenses to average net assets (4,5) | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | 0.63 | % | ||||||||||

| Ratio of net expenses to average net assets (5) | 0.41 | % | 0.40 | % | 0.40 | % | 0.40 | % | 0.40 | % | ||||||||||

| Ratio of net investment income to average net assets | 5.77 | % | 4.78 | % | 2.88 | % | 3.10 | % | 3.27 | % | ||||||||||

| Portfolio Turnover Rate | 28 | % | 35 | % | 47 | % | 73 | % | 70 | % | ||||||||||

| (1) | Per share amounts calculated using the average shares method, which more appropriately represents the per share data for the year. |

| (2) | Amount is less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (5) | Does not include the expenses of other investment companies in which the Fund invests. |

See accompanying notes to financial statements.

15

Boyd Watterson Limited Duration Enhanced Income Fund

NOTES TO FINANCIAL STATEMENTS

June 30, 2024

| 1. | ORGANIZATION |

Boyd Watterson Limited Duration Enhanced Income Fund (the ’‘Fund’’) is a diversified series of shares of beneficial interest of Northern Lights Fund Trust III, a Delaware statutory trust organized on December 5, 2011 (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the ’’1940 Act’’). The Fund currently consists of two classes of shares. The Fund’s Class I2 is the successor to the Boyd Watterson Limited Duration Mid-Grade Fund, LLC, (the “Predecessor Fund”). The Predecessor Fund was organized under the laws of the State of Delaware as a limited liability company effective July 19, 2012 and commenced operations on July 15, 2013. Class I commenced operations on April 13, 2017. The Predecessor Fund’s investment objective was to generate current income consistent with a strategy that focuses on capital preservation, without taking significant duration risk. The Fund seeks (i) income generation as a principal objective and (ii) capital preservation and total return as secondary objectives.

Each share class represents an interest in the same assets of the Fund, has the same rights and is identical in all material respects except that (i) each class of shares may bear different distribution fees; (ii) each class of shares may be subject to different (or no) sales charges; (iii) certain other class specific expenses will be borne solely by the class to which such expenses are attributable; and (iv) each class has exclusive voting rights with respect to matters relating to its own distribution arrangements. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

Effective as of the close of business on March 28, 2024, sales and operations of Class A and C shares of the Fund’s were suspended. Classes A and C shares were converted to Class I shares. Class A transferred 201,874 shares and $1,954,364, and Class C transferred 169,333 shares and $1,642,359

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (’‘GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” including Accounting Standards Update (“ASU”) 2013-08.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) using methods which include current market quotations from a major market maker in the securities and based on methods which include the consideration of yields or prices of securities- of comparable quality, coupon, maturity and type. The independent- pricing service does not distinguish between smaller sized bond positions known as “odd lots” and larger institutional sized bond positions known as “round lots”. The Fund may fair value a particular bond if the advisor does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Short-term debt obligations having 60 days or less remaining until maturity, at the time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to the advisor as its valuation designee (the “Valuation Designee”). The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, which approval shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

16

Boyd Watterson Limited Duration Enhanced Income Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2024

Fair Valuation Process – Applicable investments are valued by the Valuation Designee pursuant to valuation procedures established by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid investments, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine, the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

Valuation of Fund of Funds - The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). Underlying open-end investment companies are valued at their respective net asset values as reported by such investment companies. The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the board of directors of the Underlying Funds. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

17

Boyd Watterson Limited Duration Enhanced Income Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2024

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs used as of June 30, 2024 for the Fund’s investments measured at fair value:

| Assets* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Preferred Stocks | $ | 6,624,403 | $ | — | $ | — | $ | 6,624,403 | ||||||||

| Asset Backed Securities | — | 217,006,086 | — | 217,006,086 | ||||||||||||

| Corporate Bonds | — | 148,433,208 | — | 148,433,208 | ||||||||||||

| Term Loans | — | 24,927,082 | — | 24,927,082 | ||||||||||||

| U.S. Treasury Bonds & Notes | — | 25,027,057 | — | 25,027,057 | ||||||||||||

| Short-Term Investments | 29,956,200 | — | — | 29,956,200 | ||||||||||||

| Total | $ | 36,580,603 | $ | 415,393,433 | $ | — | $ | 451,974,036 | ||||||||

The Fund did not hold any Level 3 securities during the year.

| * | Refer to the Schedule of Investments for industry classifications. |

Security Transactions and Related Income – Security transactions are accounted for on the trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities using the effective interest method, except certain securities that are held at premium and will be amortized to the earliest call date. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds. Gains and losses realized on principal payments of asset-backed securities and bank loans (paydown gains and losses) are classified as part of investment income.

Dividends and Distributions to Shareholders – Dividends from net investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually. Dividends and distributions to shareholders are recorded on the ex -dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (e.g., deferred losses, capital loss carryforwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax -basis treatment; temporary differences do not require reclassification. These reclassifications have no effect on net assets, results from operations or net asset values per share of the Fund.

Federal Income Taxes – It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code of 1986, as amended that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized gains to shareholders. Therefore, no federal income tax provision has been recorded. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended June 30, 2021, through June 30, 2023 or expected to be taken in the Fund’s June 30, 2024 tax returns. The Fund identifies its major tax jurisdictions as U.S. federal, Ohio and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense of the Statement of Operations. During the year ended June 30, 2024, the Fund did not incur any interest or penalties.

Fixed Income Risk - When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter- term securities. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment by the Fund, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments.

18

Boyd Watterson Limited Duration Enhanced Income Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2024

Counterparty Credit Risk - The stability and liquidity of many security transactions depends in large part on the creditworthiness of the parties to the transactions. If a counterparty to such a transaction defaults, exercising contractual rights may involve delays or costs for the Fund. Furthermore, there is a risk that a counterparty could become the subject of insolvency proceedings, and that the recovery of securities and other assets from such counterparty will be delayed or be of a value less than the value of the securities or assets originally entrusted to such counterparty.

Bank Loans Risk - The market for bank loans may not be highly liquid and the Fund may have difficulty selling them. These investments expose the Fund to the credit risk of both the financial institution and the underlying borrower. Bank loans settle on a delayed basis, potentially leading to the sale proceeds of such loans not being available to meet redemptions for a substantial period of time after the sale of the bank loans. The Fund may need a line of credit in order to meet redemptions during these periods, which may increase the Fund’s expenses. Certain bank loans may not be considered “securities,” and purchasers, such as the Fund, therefore may not be entitled to rely on the protections of federal securities laws, including anti-fraud provisions.

Market and Geopolitical Risk - The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate-change and climate-related events, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund’s portfolio. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment. Therefore, the Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. During a general market downturn, multiple asset classes may be negatively affected. Changes in market conditions and interest rates can have the same impact on all types of securities and instruments. In times of severe market disruptions, you could lose your entire investment.