UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

First Trust Variable Insurance Trust

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

| (a) | Following is a copy of the semi-annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act. |

First Trust/Dow Jones Dividend

& Income Allocation Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust/Dow Jones Dividend & Income Allocation Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTDJDI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust/Dow Jones Dividend & Income Allocation Portfolio | $60 | 1.20%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $870,404,638% |

| Total number of portfolio holdings | $523% |

| Portfolio turnover rate | $72% |

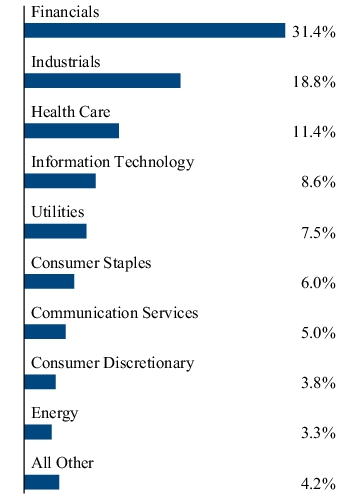

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

| Corporate Bonds and Notes | 48.4% |

| Common Stocks | 46.7% |

| Foreign Corporate Bonds and Notes | 3.3% |

| U.S. Government Bonds and Notes | 0.3% |

| Net Other Assets and Liabilities | 1.3% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTDJDI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

The Dow Jones U.S. Total Stock Market Index℠, Dow Jones Equal Weight U.S. Issued Corporate Bond Index℠ and Dow Jones Composite Average™ are products of S&P Dow Jones Indices LLC (“SPDJI”), and have been licensed for use by First Trust Advisors L.P. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by First Trust Advisors L.P. The First Trust/Dow Jones Dividend & Income Allocation Portfolio is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the Dow Jones U.S. Total Stock Market Index℠, Dow Jones Equal Weight U.S. Issued Corporate Bond Index℠ and Dow Jones Composite Average™.

First Trust Multi Income

Allocation Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust Multi Income Allocation Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTMII. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Multi Income Allocation Portfolio | $42 | 0.83%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $17,139,700% |

| Total number of portfolio holdings | $174% |

| Portfolio turnover rate | $20% |

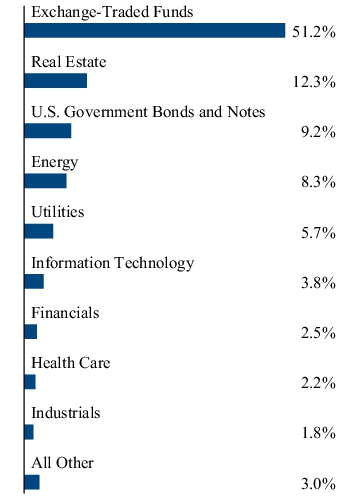

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| First Trust Senior Loan ETF | 13.3% |

| First Trust Tactical High Yield ETF | 9.0% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | 7.9% |

| First Trust Institutional Preferred Securities and Income ETF | 7.8% |

| First Trust Intermediate Government Opportunities ETF | 4.2% |

| iShares MBS ETF | 4.1% |

| First Trust Preferred Securities and Income ETF | 2.5% |

| First Trust Limited Duration Investment Grade Corporate ETF | 2.1% |

| Enterprise Products Partners, L.P. | 1.3% |

| Energy Transfer, L.P. | 1.0% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTMII to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Dorsey Wright

Tactical Core Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust Dorsey Wright Tactical Core Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTDWTCI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Dorsey Wright Tactical Core Portfolio | $40 | 0.77%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $51,919,127% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate | $21% |

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| First Trust Nasdaq Semiconductor ETF | 10.5% |

| First Trust Large Cap Growth AlphaDEX® Fund | 10.5% |

| First Trust Large Cap Core AlphaDEX® Fund | 9.9% |

| First Trust Mid Cap Core AlphaDEX® Fund | 9.7% |

| First Trust NASDAQ-100-Technology Sector Index Fund | 9.6% |

| First Trust Dow Jones Internet Index Fund | 9.3% |

| First Trust Industrials/Producer Durables AlphaDEX® Fund | 8.8% |

| First Trust Consumer Discretionary AlphaDEX® Fund | 8.5% |

| iShares Core U.S. Aggregate Bond ETF | 5.4% |

| SPDR Bloomberg Investment Grade Floating Rate ETF | 3.3% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTDWTCI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

The Fund is not sponsored, endorsed, sold or promoted by Dorsey, Wright & Associates, LLC or its affiliates (“Dorsey Wright”). Dorsey Wright makes no representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of trading in the Fund. Dorsey Wright’s only relationship to First Trust is the licensing of certain trademarks and trade names of Dorsey Wright and of the Dorsey Wright Tactical Tilt Moderate Core™ Index (the "Index") which is determined, composed and calculated by Dorsey Wright, or its agent, without regard to First Trust or the Fund. Dorsey Wright has no obligation to take the needs of First Trust or the owners of the Fund into consideration in determining, composing or calculating the Index. Dorsey Wright is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the Fund to be listed or in the determination or calculation of the equation by which the Fund is to be converted into cash. Dorsey Wright has no obligation or liability in connection with the administration, marketing or trading of the Fund.

First Trust Capital

Strength® Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust Capital Strength® Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTACSI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Capital Strength® Portfolio | $56 | 1.10%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $133,714,071% |

| Total number of portfolio holdings | $50% |

| Portfolio turnover rate | $46% |

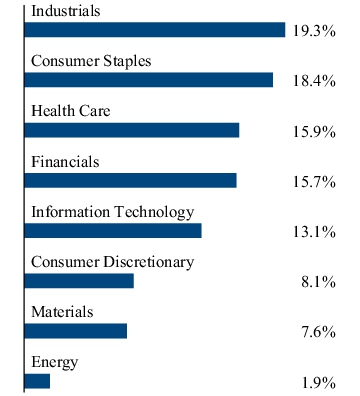

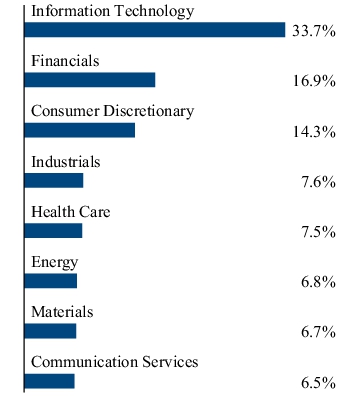

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Apple, Inc. | 2.5% |

| Amphenol Corp., Class A | 2.4% |

| Costco Wholesale Corp. | 2.3% |

| TJX (The) Cos., Inc. | 2.3% |

| Regeneron Pharmaceuticals, Inc. | 2.3% |

| Walmart, Inc. | 2.2% |

| Motorola Solutions, Inc. | 2.2% |

| Moody's Corp. | 2.2% |

| Microsoft Corp. | 2.2% |

| Colgate-Palmolive Co. | 2.2% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTACSI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

Nasdaq® and The Capital Strength™ Index are registered trademarks and service marks of Nasdaq, Inc. (together with its affiliates hereinafter referred to as the “Corporations”) and are licensed for use by First Trust. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

First Trust International

Developed Capital Strength® Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust International Developed Capital Strength® Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTAIDCSI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust International Developed Capital Strength® Portfolio | $60 | 1.20%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $14,768,430% |

| Total number of portfolio holdings | $51% |

| Portfolio turnover rate | $44% |

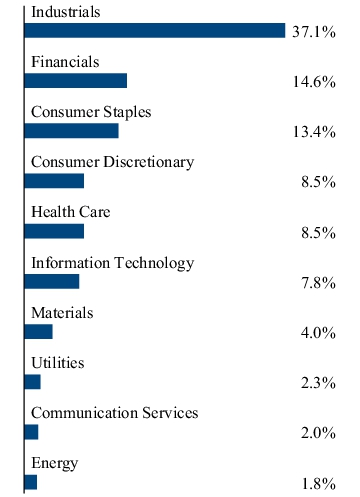

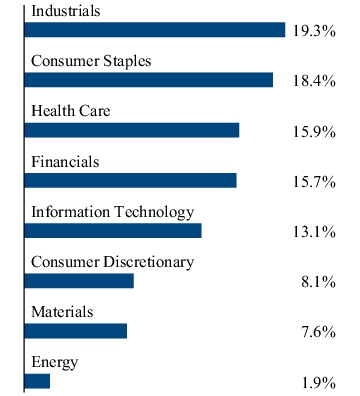

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Aristocrat Leisure Ltd. | 2.5% |

| Unilever PLC | 2.3% |

| Origin Energy Ltd. | 2.3% |

| Swiss Re AG | 2.2% |

| CSL Ltd. | 2.2% |

| Novartis AG | 2.2% |

| Roche Holding AG | 2.2% |

| Muenchener Rueckversicherungs-Gesellschaft AG | 2.2% |

| ABB Ltd. | 2.2% |

| Thomson Reuters Corp. | 2.2% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTAIDCSI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

Nasdaq® and The International Developed Capital Strength™ Index are registered trademarks and service marks of Nasdaq, Inc. (together with its affiliates hereinafter referred to as the “Corporations”) and are licensed for use by First Trust. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

First Trust Growth

StrengthTM Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust Growth StrengthTM Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTGSTI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Growth StrengthTM Portfolio | $63 | 1.20%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $12,195,545% |

| Total number of portfolio holdings | $50% |

| Portfolio turnover rate | $61% |

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| NVIDIA Corp. | 3.0% |

| Arista Networks, Inc. | 2.7% |

| Monolithic Power Systems, Inc. | 2.6% |

| Tesla, Inc. | 2.5% |

| Broadcom, Inc. | 2.5% |

| KLA Corp. | 2.5% |

| Applied Materials, Inc. | 2.3% |

| Amphenol Corp., Class A | 2.3% |

| Palo Alto Networks, Inc. | 2.3% |

| Netflix, Inc. | 2.3% |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTGSTI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

Nasdaq® and The Growth Strength™ Index are registered trademarks and service marks of Nasdaq, Inc. (together with its affiliates hereinafter referred to as the “Corporations”) and are licensed for use by First Trust. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

First Trust Capital Strength®

Hedged Equity Portfolio

Class I

SEMI-ANNUAL SHAREHOLDER REPORT | JUNE 30, 2024

This semi-annual shareholder report contains important information about the First Trust Capital Strength® Hedged Equity Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024 (the "Period"). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/VA/FTCSHI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Capital Strength® Hedged Equity Portfolio | $62 | 1.25%(1) |

KEY FUND STATISTICS (As of June 30, 2024)

| Fund net assets | $5,511,339% |

| Total number of portfolio holdings | $56% |

| Portfolio turnover rate | $79% |

WHAT DID THE FUND INVEST IN? (As of June 30, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments, respectively, of the Fund.

| Common Stocks | 103.3)% |

| Put Options Purchased | 0.0)% |

| Call Options Written | (5.1)% |

| Put Options Written | (0.0)% |

| Net Other Assets and Liabilities | 1.8)% |

Any amount shown as 0.0% represents less than 0.1%.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/VA/FTCSHI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

OTHER INFORMATION

Nasdaq® and The Capital Strength™ Index are registered trademarks and service marks of Nasdaq, Inc. (together with its affiliates hereinafter referred to as the “Corporations”) and are licensed for use by First Trust. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

(b) Not applicable.

Item 2. Code of Ethics.

The First Trust Variable Insurance Trust (“Registrant”) has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions (“Code of Ethics”). During the period covered by this Form N-CSR, there were no substantive amendments to the Code of Ethics and there were no waivers from the Code of Ethics granted to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

A copy of the currently effective Code of Ethics will be filed with the Registrant’s annual Form N-CSR.

Item 3. Audit Committee Financial Expert.

Not applicable to semi-annual reports on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Not applicable to semi-annual reports on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

| (a) | Not applicable to semi-annual reports on Form N-CSR. |

| (b) | Not applicable to the Registrant. |

Item 6. Investments.

| (a) | The Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included in the Financial Statements and Other Information filed under Item 7 of this Form N-CSR. |

| (b) | Not applicable to the Registrant. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) Following is a copy of the semi-annual financial statements required, and for the periods specified, by Regulation S-X.

First Trust Variable Insurance Trust

Semi-Annual Financial Statements and Other Information

First Trust Variable Insurance Trust

Semi-Annual Financial Statements and Other Information

June 30, 2024

Performance and Risk Disclosure

There is no assurance that any series (individually called a “Fund” and collectively the “Funds”) of the First Trust Variable Insurance Trust will achieve its investment objectives. Each Fund is subject to market risk, which is the possibility that the market values of securities owned by each Fund will decline and that the value of a Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in a Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns and net asset value will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

First Trust Advisors L.P., the Funds’ advisor, may also periodically provide additional information on Fund performance on each Fund’s web page at www.ftportfolios.com.

This report contains information that may help you evaluate your investment in each Fund. It includes details about each Fund and presents data that provides insight into each Fund’s performance and investment approach.

The material risks of investing in each Fund are spelled out in its prospectus, statement of additional information, and other Fund regulatory filings.

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES – 48.4% |

| Aerospace & Defense – 2.5% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| Bank of America Corp. (a) | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PNC Financial Services Group (The), Inc. (a) | | | |

| PNC Financial Services Group (The), Inc. (a) | | | |

| PNC Financial Services Group (The), Inc. (a) | | | |

| Truist Financial Corp. (a) | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| Anheuser-Busch Cos., LLC/Anheuser-Busch InBev Worldwide, Inc. | | | |

| Anheuser-Busch Cos., LLC/Anheuser-Busch InBev Worldwide, Inc. | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | |

| Constellation Brands, Inc. | | | |

| Constellation Brands, Inc. | | | |

| Molson Coors Beverage Co. | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| Capital Markets (Continued) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| Goldman Sachs Group (The), Inc. (a) | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Communications Equipment – 0.9% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Construction Materials – 0.1% | | | |

| CRH America Finance, Inc. | | | |

| | | | |

| | | | |

| | | | |

| | |

| Containers & Packaging – 0.5% | | | |

| | | | |

| Diversified Telecommunication Services – 1.5% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| Diversified Telecommunication Services (Continued) | | | |

| | | | |

| | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| Verizon Communications, Inc. | | | |

| | |

| Electric Utilities – 5.6% | | | |

| | | | |

| AEP Transmission Co., LLC | | | |

| AEP Transmission Co., LLC | | | |

| AEP Transmission Co., LLC | | | |

| AEP Transmission Co., LLC | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| American Transmission Systems, Inc. (b) | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Duke Energy Carolinas, LLC | | | |

| Duke Energy Carolinas, LLC | | | |

| Duke Energy Carolinas, LLC | | | |

| Duke Energy Carolinas, LLC | | | |

| | | | |

| | | | |

| Duke Energy Progress, LLC | | | |

| Duke Energy Progress, LLC | | | |

| FirstEnergy Transmission, LLC (b) | | | |

| Florida Power & Light Co. | | | |

| Florida Power & Light Co. | | | |

| | | | |

| | | | |

| Indiana Michigan Power Co. | | | |

| Indiana Michigan Power Co. | | | |

| Indiana Michigan Power Co. | | | |

| Northern States Power Co. | | | |

| | | | |

| | | | |

| | | | |

| Public Service Electric and Gas Co. | | | |

| Public Service Electric and Gas Co. | | | |

| Public Service Electric and Gas Co. | | | |

| Public Service Electric and Gas Co. | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| Electric Utilities (Continued) | | | |

| Trans-Allegheny Interstate Line Co. (b) | | | |

| | |

| Financial Services – 0.5% | | | |

| Fidelity National Information Services, Inc. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Ground Transportation – 0.8% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Health Care Equipment & Supplies – 0.9% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Health Care Providers & Services – 4.6% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| Health Care Providers & Services (Continued) | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Universal Health Services, Inc. | | | |

| Universal Health Services, Inc. | | | |

| | |

| Hotels, Restaurants & Leisure – 0.3% | | | |

| | | | |

| Household Products – 0.3% | | | |

| Procter & Gamble (The) Co. | | | |

| Industrial Conglomerates – 0.3% | | | |

| Honeywell International, Inc. | | | |

| | | | |

| Aon Corp./Aon Global Holdings PLC | | | |

| | | | |

| | | | |

| | | | |

| Arthur J. Gallagher & Co. | | | |

| Arthur J. Gallagher & Co. | | | |

| Arthur J. Gallagher & Co. | | | |

| Arthur J. Gallagher & Co. | | | |

| Arthur J. Gallagher & Co. | | | |

| Arthur J. Gallagher & Co. | | | |

| | | | |

| | | | |

| Marsh & McLennan Cos., Inc. | | | |

| Marsh & McLennan Cos., Inc. | | | |

| | |

| Life Sciences Tools & Services – 0.9% | | | |

| | | | |

| | | | |

| Thermo Fisher Scientific, Inc. | | | |

| Thermo Fisher Scientific, Inc. | | | |

| Thermo Fisher Scientific, Inc. | | | |

| | |

| | | | |

| Caterpillar Financial Services Corp. | | | |

| Caterpillar Financial Services Corp. | | | |

| Caterpillar Financial Services Corp. | | | |

| | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| | | | |

| Charter Communications Operating, LLC/Charter Communications Operating Capital | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| Consolidated Edison Co. of New York, Inc. | | | |

| Oil, Gas & Consumable Fuels – 1.1% | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| BP Capital Markets America, Inc. | | | |

| | | | |

| | | | |

| Sabine Pass Liquefaction, LLC | | | |

| Sabine Pass Liquefaction, LLC | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Professional Services – 0.3% | | | |

| | | | |

| Semiconductors & Semiconductor Equipment – 0.6% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

CORPORATE BONDS AND NOTES (Continued) |

| | | | |

| | | | |

| | | | |

| Crowdstrike Holdings, Inc. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Trading Companies & Distributors – 0.2% | | | |

| Ashtead Capital, Inc. (b) | | | |

| Ashtead Capital, Inc. (b) | | | |

| | |

| | | | |

| American Water Capital Corp. | | | |

| American Water Capital Corp. | | | |

| | |

| Wireless Telecommunication Services – 1.6% | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Total Corporate Bonds and Notes | |

| | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

FOREIGN CORPORATE BONDS AND NOTES – 3.3% |

| | | | |

| | | | |

| Toronto-Dominion (The) Bank | | | |

| Toronto-Dominion (The) Bank | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Construction Materials – 0.1% | | | |

| | | | |

| Consumer Staples Distribution & Retail – 0.3% | | | |

| Alimentation Couche-Tard, Inc. (b) | | | |

| Alimentation Couche-Tard, Inc. (b) | | | |

| | |

| Containers & Packaging – 0.4% | | | |

| | | | |

| Smurfit Kappa Treasury ULC (b) | | | |

| | |

| Financial Services – 0.5% | | | |

| | | | |

| | | | |

| | | | |

| | |

| Oil, Gas & Consumable Fuels – 0.2% | | | |

| | | | |

| | | | |

| | | | |

| Pfizer Investment Enterprises Pte. Ltd. | | | |

| Pfizer Investment Enterprises Pte. Ltd. | | | |

| Pfizer Investment Enterprises Pte. Ltd. | | | |

| | |

| Semiconductors & Semiconductor Equipment – 0.0% | | | |

| Broadcom Corp./Broadcom Cayman Finance Ltd. | | | |

| | | | |

| Constellation Software, Inc. (b) | | | |

| Constellation Software, Inc. (b) | | | |

| | |

| Total Foreign Corporate Bonds and Notes | |

| | | | |

U.S. GOVERNMENT BONDS AND NOTES – 0.3% |

| | | | |

| | | | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

|

| Aerospace & Defense – 0.7% | |

| | |

| | |

| | |

| Air Freight & Logistics – 1.1% | |

| C.H. Robinson Worldwide, Inc. | |

| Expeditors International of Washington, Inc. | |

| United Parcel Service, Inc., Class B | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Commerce Bancshares, Inc. | |

| Cullen/Frost Bankers, Inc. | |

| | |

| Enterprise Financial Services Corp. | |

| | |

| First Commonwealth Financial Corp. | |

| First Financial Bankshares, Inc. | |

| | |

| International Bancshares Corp. | |

| | |

| National Bank Holdings Corp., Class A | |

| | |

| | |

| | |

| Prosperity Bancshares, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Ameriprise Financial, Inc. | |

| Cboe Global Markets, Inc. | |

| | |

| | |

| PJT Partners, Inc., Class A | |

| Raymond James Financial, Inc. | |

| | |

| | |

| | |

| | |

| | |

| LyondellBasell Industries N.V., Class A | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| | |

| | |

| | |

| Commercial Services & Supplies – 1.0% | |

| | |

| | |

| | |

| | |

| Communications Equipment – 0.3% | |

| | |

| Construction & Engineering – 0.4% | |

| | |

| Construction Materials – 0.2% | |

| United States Lime & Minerals, Inc. | |

| Consumer Staples Distribution & Retail – 0.6% | |

| Casey’s General Stores, Inc. | |

| | |

| | |

| Containers & Packaging – 0.3% | |

| Graphic Packaging Holding Co. | |

| Electric Utilities – 0.4% | |

| | |

| Electrical Equipment – 0.3% | |

| | |

| Electronic Equipment, Instruments & Components – 1.5% | |

| | |

| | |

| | |

| | |

| | |

| Financial Services – 1.6% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Lamb Weston Holdings, Inc. | |

| Mondelez International, Inc., Class A | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| Ground Transportation – 2.2% | |

| JB Hunt Transport Services, Inc. | |

| Knight-Swift Transportation Holdings, Inc. | |

| | |

| | |

| Old Dominion Freight Line, Inc. | |

| Schneider National, Inc., Class B | |

| | |

| | |

| Health Care Providers & Services – 1.0% | |

| | |

| | |

| | |

| | |

| Hotel & Resort REITs – 0.3% | |

| Apple Hospitality REIT, Inc. | |

| Hotels, Restaurants & Leisure – 0.6% | |

| | |

| | |

| | |

| Household Durables – 0.3% | |

| | |

| Household Products – 0.4% | |

| Procter & Gamble (The) Co. | |

| | |

| | |

| American Financial Group, Inc. | |

| | |

| | |

| Cincinnati Financial Corp. | |

| | |

| | |

| | |

| Hartford Financial Services Group (The), Inc. | |

| Marsh & McLennan Cos., Inc. | |

| Old Republic International Corp. | |

| | |

| | |

| Selective Insurance Group, Inc. | |

| Travelers (The) Cos., Inc. | |

| | |

| | |

| | |

| | |

| | |

| Cognizant Technology Solutions Corp., Class A | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| | |

| | |

| | |

| Franklin Electric Co., Inc. | |

| | |

| | |

| | |

| | |

| | |

| Watts Water Technologies, Inc., Class A | |

| Westinghouse Air Brake Technologies Corp. | |

| | |

| | |

| Interpublic Group of (The) Cos., Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 2.0% | |

| | |

| | |

| | |

| | |

| International Seaways, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| Professional Services – 2.4% | |

| Automatic Data Processing, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Semiconductors & Semiconductor Equipment – 0.4% | |

| | |

| | |

| Dolby Laboratories, Inc., Class A | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust/Dow Jones Dividend & Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| | |

| | |

| | |

| Penske Automotive Group, Inc. | |

| | |

| | |

| | |

| Textiles, Apparel & Luxury Goods – 0.3% | |

| | |

| Trading Companies & Distributors – 1.5% | |

| Applied Industrial Technologies, Inc. | |

| | |

| MSC Industrial Direct Co., Inc., Class A | |

| Rush Enterprises, Inc., Class A | |

| | |

| | |

| | |

| | |

| Total Investments – 98.7% | |

| | | | |

| Net Other Assets and Liabilities – 1.3% | |

| | |

| Fixed-to-floating or fixed-to-variable rate security. The interest rate shown reflects the fixed rate in effect at June 30, 2024. At a predetermined date, the fixed rate will change to a floating rate or a variable rate. |

| This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be liquid by First Trust Advisors L.P., the Fund’s advisor. Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined based on security specific factors and assumptions, which require subjective judgment. At June 30, 2024, securities noted as such amounted to $42,193,517 or 4.8% of net assets. |

Abbreviations throughout the Portfolio of Investments: |

| – Real Estate Investment Trusts |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

Corporate Bonds and Notes* | | | | |

Foreign Corporate Bonds and Notes* | | | | |

U.S. Government Bonds and Notes | | | | |

| | | | |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

EXCHANGE-TRADED FUNDS – 50.2% |

| | |

| First Trust Institutional Preferred Securities and Income ETF (a) | |

| First Trust Intermediate Government Opportunities ETF (a) | |

| First Trust Limited Duration Investment Grade Corporate ETF (a) | |

| First Trust Preferred Securities and Income ETF (a) | |

| First Trust Senior Loan ETF (a) | |

| First Trust Tactical High Yield ETF (a) | |

| iShares 20+ Year Treasury Bond ETF | |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | |

| | |

| Total Exchange-Traded Funds | |

| | |

COMMON STOCKS (b) – 34.9% |

| Aerospace & Defense – 0.3% | |

| | |

| | |

| | |

| | |

| | |

| | |

| Intercontinental Exchange, Inc. | |

| Construction & Engineering – 0.1% | |

| | |

| | |

| | |

| Consumer Staples Distribution & Retail – 0.7% | |

| | |

| | |

| | |

| Containers & Packaging – 0.2% | |

| Packaging Corp. of America | |

| | |

| | |

| | |

| Essential Properties Realty Trust, Inc. | |

| Electric Utilities – 1.9% | |

| | |

| American Electric Power Co., Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (b) (Continued) |

| Electrical Equipment – 0.3% | |

| | |

| Energy Equipment & Services – 0.5% | |

| | |

| | |

| | |

| Financial Services – 0.4% | |

| | |

| | |

| | |

| Mondelez International, Inc., Class A | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Ground Transportation – 0.2% | |

| | |

| Health Care Equipment & Supplies – 0.2% | |

| | |

| Health Care Providers & Services – 0.9% | |

| | |

| | |

| | |

| | |

| | |

| Omega Healthcare Investors, Inc. | |

| Sabra Health Care REIT, Inc. | |

| | |

| | |

| Hotel & Resort REITs – 0.9% | |

| Apple Hospitality REIT, Inc. | |

| Host Hotels & Resorts, Inc. | |

| | |

| Hotels, Restaurants & Leisure – 0.2% | |

| | |

| Independent Power & Renewable Electricity Producers – 0.3% | |

| | |

| Clearway Energy, Inc., Class A | |

| | |

| Industrial Conglomerates – 0.1% | |

| Honeywell International, Inc. | |

| | |

| EastGroup Properties, Inc. | |

| | |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (b) (Continued) |

| Industrial REITs (Continued) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Public Service Enterprise Group, Inc. | |

| | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 4.0% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Williams (The) Cos., Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| AvalonBay Communities, Inc. | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (b) (Continued) |

| | |

| Brixmor Property Group, Inc. | |

| | |

| | |

| Simon Property Group, Inc. | |

| | |

| Semiconductors & Semiconductor Equipment – 1.1% | |

| | |

| Taiwan Semiconductor Manufacturing Co., Ltd., ADR | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Digital Realty Trust, Inc. | |

| | |

| Gaming and Leisure Properties, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Technology Hardware, Storage & Peripherals – 0.2% | |

| | |

| | |

| Essential Utilities, Inc. | |

| | |

| | |

MASTER LIMITED PARTNERSHIPS – 4.0% |

| | |

| Westlake Chemical Partners, L.P. | |

| Independent Power & Renewable Electricity Producers – 0.1% | |

| NextEra Energy Partners, L.P. (c) | |

| Oil, Gas & Consumable Fuels – 3.7% | |

| Cheniere Energy Partners, L.P. | |

| | |

| Enterprise Products Partners, L.P. | |

| Hess Midstream, L.P., Class A (c) | |

| | |

| Plains GP Holdings, L.P., Class A | |

| | |

| Total Master Limited Partnerships | |

| | |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

U.S. GOVERNMENT BONDS AND NOTES – 9.1% |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| U.S. Treasury Inflation Indexed Bond (d) | | | |

| Total U.S. Government Bonds and Notes | |

| | | | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES – 0.0% |

| Collateralized Mortgage Obligations – 0.0% | | | |

| | | | |

| | | | |

| | | | |

See Notes to Financial Statements

First Trust Multi Income Allocation PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | | | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Continued) |

| Collateralized Mortgage Obligations (Continued) | | | |

| | | | |

| Series 1996-1847, Class LL | | | |

| Series 1999-2130, Class KB | | | |

| Total U.S. Government Agency Mortgage-Backed Securities | |

| | | | |

MORTGAGE-BACKED SECURITIES – 0.0% |

| Collateralized Mortgage Obligations – 0.0% | | | |

| Credit Suisse First Boston Mortgage Securities Corp. | | | |

| | | | |

| MASTR Alternative Loan Trust | | | |

| | | | |

| Total Mortgage-Backed Securities | |

| | | | |

| Total Investments – 98.2% | |

| | | | |

| Net Other Assets and Liabilities – 1.8% | |

| | |

| Investment in an affiliated fund. |

| Securities are issued in U.S. dollars unless otherwise indicated in the security description. |

| This security is taxed as a “C” corporation for federal income tax purposes. |

| Security whose principal value is adjusted in accordance with changes to the country’s Consumer Price Index. Interest is calculated on the basis of the current adjusted principal value. |

Abbreviations throughout the Portfolio of Investments: |

| – American Depositary Receipt |

| |

| – Real Estate Investment Trusts |

| – Real Estate Mortgage Investment Conduit |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| | | | |

Master Limited Partnerships* | | | | |

U.S. Government Bonds and Notes | | | | |

U.S. Government Agency Mortgage-Backed Securities | | | | |

Mortgage-Backed Securities | | | | |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust Dorsey Wright Tactical Core PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

EXCHANGE-TRADED FUNDS – 98.6% |

| | |

| First Trust Consumer Discretionary AlphaDEX® Fund (a) | |

| First Trust Developed Markets ex-US AlphaDEX® Fund (a) | |

| First Trust Dow Jones Internet Index Fund (a) (b) | |

| First Trust Emerging Markets AlphaDEX® Fund (a) | |

| First Trust Eurozone AlphaDEX® ETF (a) | |

| First Trust India NIFTY 50 Equal Weight ETF (a) | |

| First Trust Industrials/Producer Durables AlphaDEX® Fund (a) | |

| First Trust Japan AlphaDEX® Fund (a) | |

| First Trust Large Cap Core AlphaDEX® Fund (a) | |

| First Trust Large Cap Growth AlphaDEX® Fund (a) | |

| First Trust Mid Cap Core AlphaDEX® Fund (a) | |

| First Trust Nasdaq Semiconductor ETF (a) | |

| First Trust NASDAQ-100-Technology Sector Index Fund (a) | |

| First Trust Switzerland AlphaDEX® Fund (a) | |

| First Trust United Kingdom AlphaDEX® Fund (a) | |

| iShares Core U.S. Aggregate Bond ETF | |

| SPDR Blackstone Senior Loan ETF | |

| SPDR Bloomberg High Yield Bond ETF | |

| SPDR Bloomberg Investment Grade Floating Rate ETF | |

| SPDR Portfolio Short Term Corporate Bond ETF | |

| Total Investments – 98.6% | |

| | | | |

| Net Other Assets and Liabilities – 1.4% | |

| | |

| Investment in an affiliated fund. |

| Non-income producing security. |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust Capital Strength® PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

|

| Aerospace & Defense – 3.8% | |

| | |

| | |

| | |

| | |

| | |

| Monster Beverage Corp. (a) | |

| | |

| | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc. (a) | |

| | |

| | |

| Ameriprise Financial, Inc. | |

| | |

| Raymond James Financial, Inc. | |

| | |

| | |

| | |

| | |

| | |

| Commercial Services & Supplies – 1.9% | |

| | |

| Communications Equipment – 4.0% | |

| | |

| | |

| | |

| Construction Materials – 1.8% | |

| Martin Marietta Materials, Inc. | |

| Consumer Staples Distribution & Retail – 4.4% | |

| | |

| | |

| | |

| Containers & Packaging – 1.9% | |

| Packaging Corp. of America | |

| | |

| | |

| Electronic Equipment, Instruments & Components – 2.3% | |

| | |

| | |

|

| Financial Services – 3.7% | |

| Mastercard, Inc., Class A | |

| | |

| | |

| | |

| Mondelez International, Inc., Class A | |

| Ground Transportation – 3.7% | |

| | |

| | |

| | |

| Health Care Equipment & Supplies – 3.8% | |

| | |

| | |

| | |

| Health Care Providers & Services – 5.7% | |

| | |

| | |

| | |

| | |

| Household Products – 6.2% | |

| | |

| | |

| Procter & Gamble (The) Co. | |

| | |

| Industrial Conglomerates – 2.1% | |

| Honeywell International, Inc. | |

| | |

| | |

| Marsh & McLennan Cos., Inc. | |

| | |

| | |

| | |

| Cognizant Technology Solutions Corp., Class A | |

| | |

| Illinois Tool Works, Inc. | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 1.8% | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust Capital Strength® PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| Professional Services – 3.8% | |

| Automatic Data Processing, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Technology Hardware, Storage & Peripherals – 2.4% | |

| | |

| Total Investments – 97.7% | |

| | |

| Net Other Assets and Liabilities – 2.3% | |

| | |

| Non-income producing security. |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust International Developed Capital Strength® PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (a) – 97.8% |

| Aerospace & Defense – 5.3% | |

| | |

| | |

| | |

| | |

| Air Freight & Logistics – 1.9% | |

| | |

| | |

| Carlsberg A/S, Class B (DKK) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Consumer Staples Distribution & Retail – 1.9% | |

| Alimentation Couche-Tard, Inc. (CAD) | |

| Electric Utilities – 2.2% | |

| | |

| Electrical Equipment – 6.0% | |

| | |

| | |

| Schneider Electric SE (EUR) | |

| | |

| | |

| Universal Music Group N.V. (EUR) | |

| Financial Services – 2.1% | |

| Investor AB, Class B (SEK) | |

| | |

| Chocoladefabriken Lindt & Spruengli AG (CHF) | |

| | |

| | |

| Hotels, Restaurants & Leisure – 4.3% | |

| Aristocrat Leisure Ltd. (AUD) | |

| | |

| | |

| | |

|

| Industrial Conglomerates – 1.9% | |

| | |

| | |

| | |

| | |

| Muenchener Rueckversicherungs- Gesellschaft AG (EUR) | |

| | |

| Zurich Insurance Group AG (CHF) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Schindler Holding AG (CHF) | |

| | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 1.8% | |

| | |

| Passenger Airlines – 1.6% | |

| Ryanair Holdings PLC, ADR | |

| Personal Care Products – 4.0% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Professional Services – 7.9% | |

| Bureau Veritas S.A. (EUR) | |

| | |

| Thomson Reuters Corp. (CAD) | |

| Wolters Kluwer N.V. (EUR) | |

| | |

| | |

| Constellation Software, Inc. (CAD) | |

See Notes to Financial Statements

First Trust International Developed Capital Strength® PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (a) (Continued) |

| | |

| Sage Group (The) PLC (GBP) | |

| | |

| | |

| Industria de Diseno Textil S.A. (EUR) | |

| Trading Companies & Distributors – 3.6% | |

| | |

| | |

| | |

| Transportation Infrastructure – 2.1% | |

| Aena SME S.A. (EUR) (c) (d) | |

| | |

| | |

|

| | |

| Constellation Software, Inc. (CAD) (b) (e) (f) (g) | |

| | |

| Total Investments – 97.8% | |

| | |

| Net Other Assets and Liabilities – 2.2% | |

| | |

| Securities are issued in U.S. dollars unless otherwise indicated in the security description. |

| Non-income producing security. |

| This security is exempt from registration upon resale under Rule 144A of the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. This security is not restricted on the foreign exchange where it trades freely without any additional registration. |

| This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the 1933 Act. |

| This security is fair valued by the Advisor’s Pricing Committee in accordance with procedures approved by the Trust’s Board of Trustees, and in accordance with the provisions of the Investment Company Act of 1940 and rules thereunder, as amended. At June 30, 2024, securities noted as such are valued at $0 or 0.0% of net assets. |

| Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by First Trust Advisors L.P., the Fund’s advisor. |

| This security’s value was determined using significant unobservable inputs (see Note 2A – Portfolio Valuation in the Notes to Financial Statements). |

Abbreviations throughout the Portfolio of Investments: |

| – American Depositary Receipt |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Net Other Assets and Liabilities | |

| |

† Portfolio securities are categorized based upon their country of incorporation.

Currency Exposure Diversification | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

See Notes to Financial Statements

First Trust International Developed Capital Strength® PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| | | | |

| | | | |

| See Portfolio of Investments for industry breakout. |

| Investment is valued at $0. |

Level 3 investments are fair valued by the Advisor’s Pricing Committee and are footnoted in the Portfolio of Investments. All Level 3 values are based on unobservable inputs.

See Notes to Financial Statements

First Trust Growth StrengthTM PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

|

| | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc. (a) | |

| | |

| | |

| | |

| Ameriprise Financial, Inc. | |

| | |

| | |

| | |

| CF Industries Holdings, Inc. | |

| Commercial Services & Supplies – 1.9% | |

| | |

| Communications Equipment – 2.6% | |

| Arista Networks, Inc. (a) | |

| Construction Materials – 1.7% | |

| Martin Marietta Materials, Inc. | |

| | |

| | |

| Electronic Equipment, Instruments & Components – 3.9% | |

| | |

| | |

| | |

| Energy Equipment & Services – 3.3% | |

| | |

| | |

| | |

| | |

| | |

| Financial Services – 7.2% | |

| Apollo Global Management, Inc. | |

| | |

| Mastercard, Inc., Class A | |

| | |

| | |

| Health Care Equipment & Supplies – 1.6% | |

| | |

| | |

|

| Health Care Providers & Services – 3.6% | |

| | |

| | |

| | |

| Hotels, Restaurants & Leisure – 2.0% | |

| Chipotle Mexican Grill, Inc. (a) | |

| Household Durables – 3.7% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Interactive Media & Services – 4.1% | |

| | |

| Meta Platforms, Inc., Class A | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 3.4% | |

| | |

| | |

| | |

| Semiconductors & Semiconductor Equipment – 14.4% | |

| | |

| | |

| | |

| | |

| Monolithic Power Systems, Inc. | |

| | |

| | |

| | |

| Cadence Design Systems, Inc. (a) | |

| | |

See Notes to Financial Statements

First Trust Growth StrengthTM PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (Continued) |

| | |

| Palo Alto Networks, Inc. (a) | |

| | |

| | |

| Workday, Inc., Class A (a) | |

| | |

| | |

| | |

| Textiles, Apparel & Luxury Goods – 3.7% | |

| Deckers Outdoor Corp. (a) | |

| | |

| | |

| Total Investments – 97.8% | |

| | |

| Net Other Assets and Liabilities – 2.2% | |

| | |

| Non-income producing security. |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust Capital Strength® Hedged Equity PortfolioPortfolio of Investments

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (a) – 103.3% |

| Aerospace & Defense – 4.0% | |

| | |

| | |

| | |

| | |

| | |

| Monster Beverage Corp. (b) | |

| | |

| | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc. (b) | |

| | |

| | |

| Ameriprise Financial, Inc. | |

| | |

| Raymond James Financial, Inc. | |

| | |

| | |

| | |

| | |

| | |

| Commercial Services & Supplies – 2.1% | |

| | |

| Communications Equipment – 4.3% | |

| | |

| | |

| | |

| Construction Materials – 1.9% | |

| Martin Marietta Materials, Inc. | |

| Consumer Staples Distribution & Retail – 4.7% | |

| | |

| | |

| | |

| Containers & Packaging – 2.0% | |

| Packaging Corp. of America | |

| | |

| | |

| Electronic Equipment, Instruments & Components – 2.5% | |

| | |

| Financial Services – 3.9% | |

| Mastercard, Inc., Class A | |

| | |

| | |

| | |

| Mondelez International, Inc., Class A | |

See Notes to Financial Statements

First Trust Capital Strength® Hedged Equity PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (a) (Continued) |

| Ground Transportation – 3.9% | |

| | |

| | |

| | |

| Health Care Equipment & Supplies – 4.0% | |

| | |

| | |

| | |

| Health Care Providers & Services – 6.0% | |

| | |

| | |

| | |

| | |

| Household Products – 6.5% | |

| | |

| | |

| Procter & Gamble (The) Co. | |

| | |

| Industrial Conglomerates – 2.2% | |

| Honeywell International, Inc. | |

| | |

| | |

| Marsh & McLennan Cos., Inc. | |

| | |

| | |

| | |

| Cognizant Technology Solutions Corp., Class A | |

| | |

| Illinois Tool Works, Inc. | |

| | |

| | |

| Oil, Gas & Consumable Fuels – 1.9% | |

| | |

| | |

| | |

| Professional Services – 4.0% | |

| Automatic Data Processing, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements

First Trust Capital Strength® Hedged Equity PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

| | |

COMMON STOCKS (a) (Continued) |

| Technology Hardware, Storage & Peripherals – 2.6% | |

| | |

| Total Investments – 103.3% | |

| | |

| | | | | |

|

| Put Options Purchased – 0.0% | | | | |

| | | | | |

| | | | | |

| | |

| | | | | |

|

| Call Options Written – (5.1)% | | | | |

| | | | | |

| | | | | |

| Total Call Options Written | |

| (Premiums received $91,662) | | | | |

| Put Options Written – (0.0)% | | | | |

| | | | | |

| | | | | |

| Total Put Options Written | |

| (Premiums received $11,173) | | | | |

| | |

| (Premiums received $102,835) | | | | |

| Net Other Assets and Liabilities – 1.8% | |

| | |

| All or a portion of these securities are pledged to cover index call options written. At June 30, 2024, the segregated value of these securities amounts to $2,937,544. |

| Non-income producing security. |

See Notes to Financial Statements

First Trust Capital Strength® Hedged Equity PortfolioPortfolio of Investments (Continued)

June 30, 2024 (Unaudited)

Valuation InputsA summary of the inputs used to value the Fund’s investments as of June 30, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

|

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| | | | |

| | | | |

|

|

| | | Level 2 Significant Observable Inputs | Level 3 Significant Unobservable Inputs |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

This page intentionally left blank

First Trust Variable Insurance TrustStatements of Assets and Liabilities

June 30, 2024 (Unaudited)

| First Trust/Dow Jones Dividend & Income Allocation Portfolio | First Trust Multi Income Allocation Portfolio | First Trust Dorsey Wright Tactical Core Portfolio |

| | | |

Investments, at value - Unaffiliated | | | |

Investments, at value - Affiliated | | | |

Total investments, at value | | | |

| | | |

| | | |

| | | |

Options contracts purchased, at value | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Options contracts written, at value | | | |

| | | |

| | | |

| | | |

12b-1 distribution and service fees | | | |

Administrative service fees | | | |

| | | |

| | | |

Shareholder reporting fees | | | |

| | | |

| | | |

| | | |

Commitment and administrative agency fees | | | |

| | | |

Trustees’ fees and expenses | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Accumulated distributable earnings (loss) | | | |

| | | |

Investments, at cost - Unaffiliated | | | |

Investments, at cost - Affiliated | | | |

Total investments, at cost | | | |

Premiums paid on options contracts purchased | | | |

Premiums received on options contracts written | | | |

Foreign currency, at cost | | | |

| | | |

| | | |

NET ASSET VALUE, per share | | | |

Number of Shares outstanding | | | |

See Notes to Financial Statements

First Trust Capital Strength® Portfolio | First Trust International Developed Capital Strength® Portfolio | First Trust Growth StrengthTM Portfolio | First Trust Capital Strength® Hedged Equity Portfolio |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See Notes to Financial Statements

First Trust Variable Insurance TrustStatements of Operations

For the Six Months Ended June 30, 2024 (Unaudited)

| First Trust/Dow Jones Dividend & Income Allocation Portfolio | First Trust Multi Income Allocation Portfolio | First Trust Dorsey Wright Tactical Core Portfolio |

| | | |

| | | |

| | | |

| | | |

Foreign withholding tax on dividend income | | | |

| | | |

| | | |

| | | |

| | | |

12b-1 distribution and/or service fees: | | | |

| | | |

Administrative service fees | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Commitment and administrative agency fees | | | |

Shareholder reporting fees | | | |

| | | |

Trustees’ fees and expenses | | | |

| | | |

| | | |

| | | |

Fees waived and expenses reimbursed by the investment advisor | | | |

| | | |

NET INVESTMENT INCOME (LOSS) | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | |

Net realized gain (loss) on: | | | |

Investments - Unaffiliated | | | |

| | | |

Purchased options contracts | | | |

Written options contracts | | | |

Foreign currency transactions | | | |

| | | |

Net change in unrealized appreciation (depreciation) on: | | | |

Investments - Unaffiliated | | | |

| | | |

Purchased options contracts | | | |

Written options contracts | | | |

Foreign currency translation | | | |

Net change in unrealized appreciation (depreciation) | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | |

See Notes to Financial Statements

| First Trust Capital Strength® Portfolio | First Trust International Developed Capital Strength® Portfolio | First Trust Growth StrengthTM Portfolio | First Trust Capital Strength® Hedged Equity Portfolio |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |