August 9, 2012

Ronald Winfrey

Petroleum Engineer

Securities and Exchange Commission

100 F Street NE

Washington DC 20549

| Re: | Richfield Oil & Gas Company |

Supplemental Engineering Information

Comment letter dated July 30, 2012

File No. 0-54576

Dear Mr. Winfrey,

Enclosed is a drive containing two files:

| 1. | “Richfield Engineering Report”. It contains our full engineering report, with Geological and other exhibits required. |

| 2. | “Explanatory Materials” that will contain the Operating Expense and other explanations from J P Dick. |

I have also enclosed a letter from J.P. Dick.

This information is being provided to you pursuant to our conversation on August 9, 2012. You may contact Jeremiah Burton at 801-519-8500.

We recognize that it is the Company’s responsibility to respond through the EDGER system to the July 30, 2012 comment letter. The company will respond to the Comment Letter and file Amendment No. 4 to Registration Statement on Form 10.

We appreciate your review of the attached well economics and assistance. You may contact us for further information.

Sincerely

/S/: Michael A. Cederstrom

Michael A. Cederstrom, JD

General Counsel and Corporate Secretary

Richfield Oil & Gas Company

| 15WestSouthTempleSuite 1050,SaltLakeCity,Utah 84010 |

|Office 801.519.8500 |Fax 801.519.6703 | WWW.RICHFIELDOILANDGAS.COM |

August 9, 2012

Richfield Oil & Gas Company

15 W. South Temple, Suite 1050

Salt Lake City UT 84101

Attn: Mr. Doug Hewitt

| Re: Reserves and Engineering Evaluation | |

| Richfield Oil & Gas Company | |

| Response to SEC Questions |

In response to additional questions posed by the SEC during a conversation on August 9, 2012 with Richfield Oil & Gas Company, below are items requested by the SEC (italicized) to be addressed that are related to the reserve analysis conducted by Pinnacle Energy Services, and answers to said issues.

.

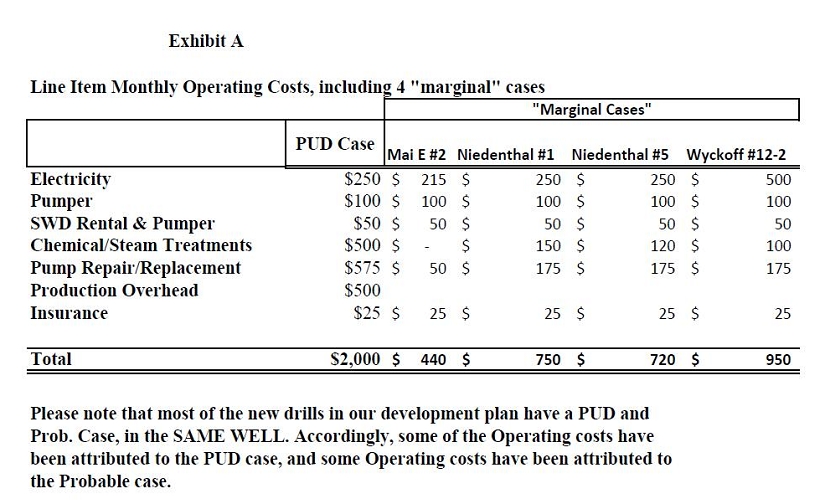

| 1. | A brief explanation for the varying costs on the PDP wells. |

The operating costs for the PDP wells were derived from financial and expense information provided by Richfield on these wells. The expense information was reviewed and non-reoccurring (workover and capital) expenses were subtracted and the monthly operating expenses were averaged. Four of the wells are marginal producers and were operated in a manner to keep the wells economic. The operating expenses for the remaining PDP wells are considered to be normal reoccurring operating expenses and were reviewed and averaged to determine the estimated monthly cost for beam unit operations.

| 2 | Explanation on the LOEs for the PUD cases |

The PUD reserves are projected for a well producing using a beam unit, which we have estimated would be approximately $2,000 per month based on PDP wells. However, instead of using beam units, submersible pumps will be utilized and these incremental expenses are based primarily on the expected fluid volumes, depths, and size of pump – which is largely dictated by casing (4.5”, 5.5” or 7”), tubing size and disposal capacity. The estimated incremental costs largely range from 4,750$/mo to 6,152 $/mo. Each reentry or new well was evaluated independently and the incremental costs were added to the $2,000 per month to arrive at a total estimated monthly operating cost.

At the point where the PUD case reaches its reserves estimate and end, its accompanying Probable case carries all operating costs from the PUD case.

| 3 | “Exhibit B” – projected type-well operating expenses |

The Exhibit B was an example of typical operating costs projected for a well with 7” casing and a high volume submersible pump. For smaller casing sizes and smaller submersible pumps, projected expenses are expected to be less for electricity and chemical expenses.

| 4 | Hoffman and Niedenthal Capital Expenditures. |

The projected capital expenditures for the Hoffman 1,4 and Niedenthal 1 PUD cases are less than is projected for other Re-Entries and New Drills. Some preparation and re-entry work on these wells had already been performed prior to the effective date but had not been completed; thus less capital and work is necessary on these wells to finish the operations.

Please advise with additional questions.

Pinnacle Energy Services, LLC

John Paul Dick, P.E.

Petroleum Engineer

Disclaimer: Pinnacle Energy Services, L.L.C. nor any of its subsidiaries, affiliates, officers, directors, shareholders, employees, consultants, advisors, agents, or representatives make any representation or warranty, express or implied, in connection with any of the information made available herein, including, but not limited to, the past, present or future value of the anticipated reserves, cash flows, income, costs, expense, liabilities and profits, if any, to be derived from the properties described herein. All statements, estimates, projections and implications as to future operations are based upon best judgments of Pinnacle Energy Services; however, there is no assurance that such statements, estimates, projections or implications will prove to be accurate. Accordingly, any company, or other party receiving such information will rely solely upon its own independent examination and assessment of said information. Neither Pinnacle Energy Services nor any of its subsidiaries, affiliates, officers, directors, shareholders, employees, consultants, advisors, agents, or representatives shall have any liability to any party receiving the information herein, nor to any affiliate, partner, member, officer, director, shareholder, employee, consultant, advisor, agent or representative of such party from any use of such information. The property description and other information attached hereto are for the sole, confidential use of the person to whom this copy has been made available. It may not be disseminated or reproduced in any matter whatsoever, whether in full or in part, without the prior written consent of Pinnacle Energy Services, L.L.C. This evaluation and all descriptions and other information attached hereto are for information purposes only and do not constitute an evaluation of or offer to sell or a solicitation of an offer to buy any securities.