June 29, 2012

Via Edgar and Federal Express

U.S. Securities and Exchange Commission

Division of Corporation Finance

Attention: H. Roger Schwall, Assistant Director

100 F Street, N.E.

Washington, DC 20549

| Re: | Richfield Oil & Gas Company |

Amendment No. 2 to Registration Statement on Form 10

Filed June 6, 2012

File No. 0-54576

Dear Mr. Schwall:

On behalf of Richfield Oil & Gas Company (the “Company”), I am pleased to submit this response to the comments of the Staff on the above-referenced filing, as set forth in your letter dated June 21, 2012.

In responding to your comments, the Company acknowledges that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

The supplemental information set forth herein has been supplied by the Company for use in connection with the Staff’s review of the responses described below, and all such responses have been reviewed and approved by the Company. For convenience, each of the Staff’s consecutively numbered comments is set forth herein, followed by the Company’s response in bold.

Amendment No. 2 to Registration Statement on Form 10

General

| 1. | Comment:Since you appear to qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, please disclose in the beginning of your registration statement that you are an emerging growth company and revise your registration statement to: |

| · | Describe how and when a company may lose emerging growth company status; |

| · | Briefly describe the various exemptions that are available to you, such as exemptions from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934; and |

| · | State your election under Section 107(b) of the JOBS Act: |

| o | If you have elected to optout of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b), include a statement that the election is irrevocable; or |

| o | If you have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1), provide a risk factor explaining that this election allows you to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. Please state in your risk factor that, as a result of this election, your financial statements may not be comparable to companies that comply with public company effective dates. Include a similar statement in your critical accounting policy disclosures. |

| 1 |

In addition, consider describing the extent to which any of these exemptions are available to you as a Smaller Reporting Company.

Response: The Company has included the following disclosure in the beginning of the registration statement on page 2, in the Risk Factors section on page 29, and in the Critical Accounting Policies section on page 44 of Amendment No. 3 to the Form 10.

“We qualify as an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are permitted to rely on exemptions from various reporting requirements including, but not limited to, the requirement to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, and the requirement to submit certain executive compensation matters to shareholder advisory votes such as “say on pay” and “say on frequency.”

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company up to the fifth anniversary of our first registered sale of common equity securities, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.”

Glossary of Terms, page 2

| 2. | Comment: We note that the descriptions of proved developed and proved undeveloped reserves appear to be those that were superseded by our new definitions which were effective January 1, 2010 year-end 2009. Please amend your document to either cross reference these terms or include the correct text. Refer to FASB ASC Section 932-235-20 Glossary. |

Response: The Company has amended the definitions of proved developed reserves and proved undeveloped reserves in the Glossary of Terms on page 4 of Amendment No. 3 to the Form 10 to conform to the new definitions in FASB ASC Section 932-235-20 Glossary.

Business, page 5

| 2 |

Summary of Oil and Gas Reserves, page 20

| 3. | Comment: We note that the 19 Gorham project proved undeveloped entities have average gross proved oil reserves of about 29 thousand barrels each while the five largest (of six) proved producing wells have an average estimated ultimate recovery of 22 thousand barrels. Please explain this difference to us. Include demonstrated support for increased oil recovery due to larger perforation intervals, if applicable. Explain your methodology in determining locations for your PUD reserves. |

Response: The wells used to develop the PUD typecurves applied were abandoned at a time of lower product prices and thus higher economic abandonment rates. When utilizing a higher oil price (current conditions) and the resulting lower abandonment producing rate, the typecurve based on the analogy offset well production will recover additional oil reserves (approximately 25%) utilizing the same forecast; i.e., due to higher oil prices, abandonment rates are lower and wells would recover additional hydrocarbons due to commerciality.

Future drilling locations were selected in areas currently without wells but consistent with historical development spacing of the field. There are two cases for each future drilling location – one PUD location case assuming historical type completion and production operations with lower production volumes, and one incremental Probable Undeveloped case whereby dewatering methods of larger stimulation, more fluid production, and submersible pumps were utilized. The addition of more perforation intervals within the Arbuckle are planned in conjunction with the larger dewatering process activities.

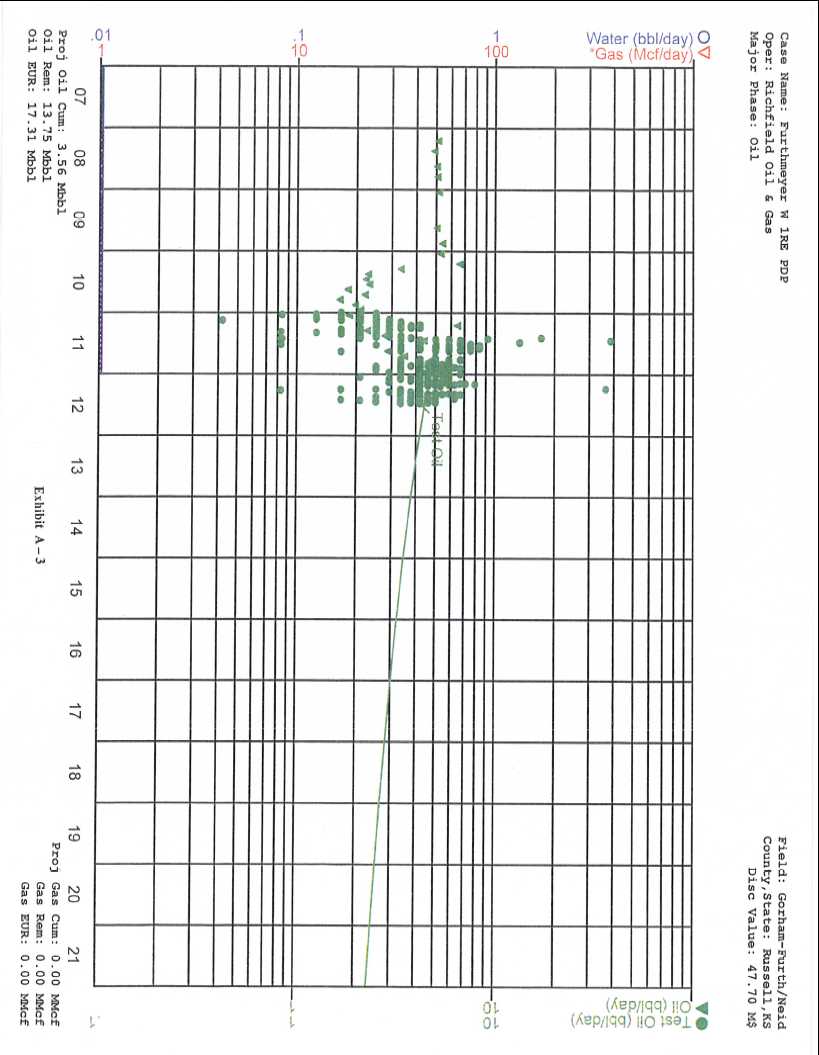

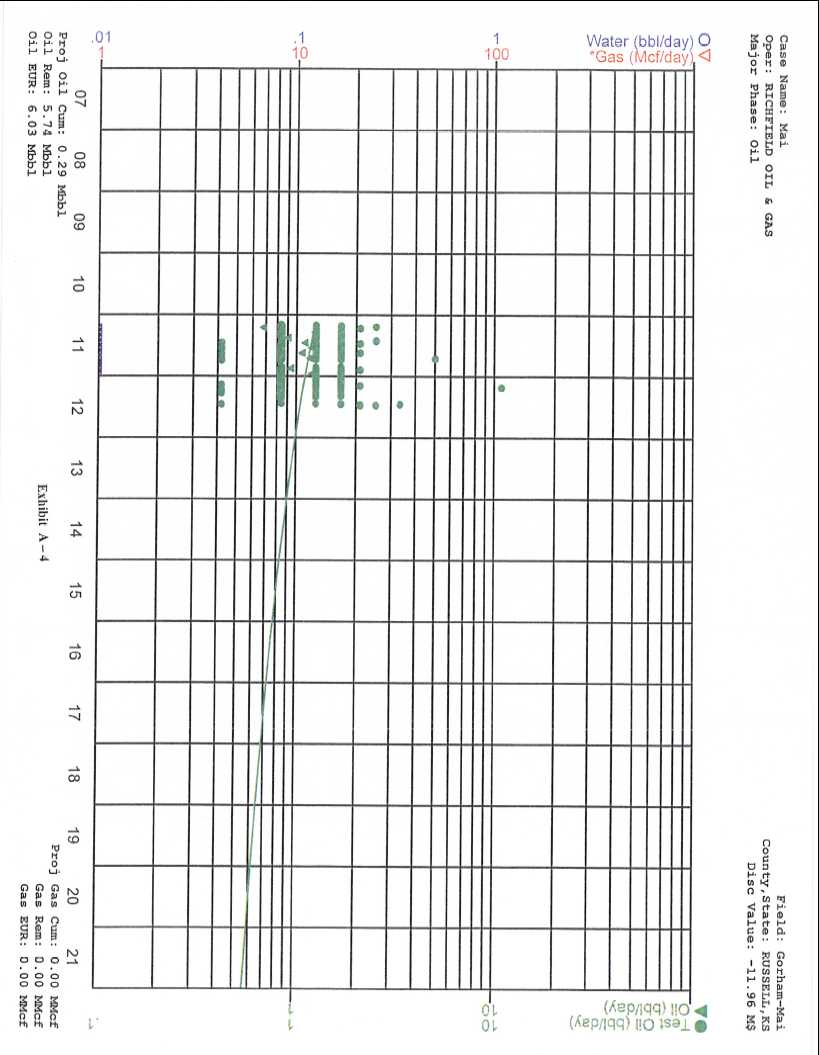

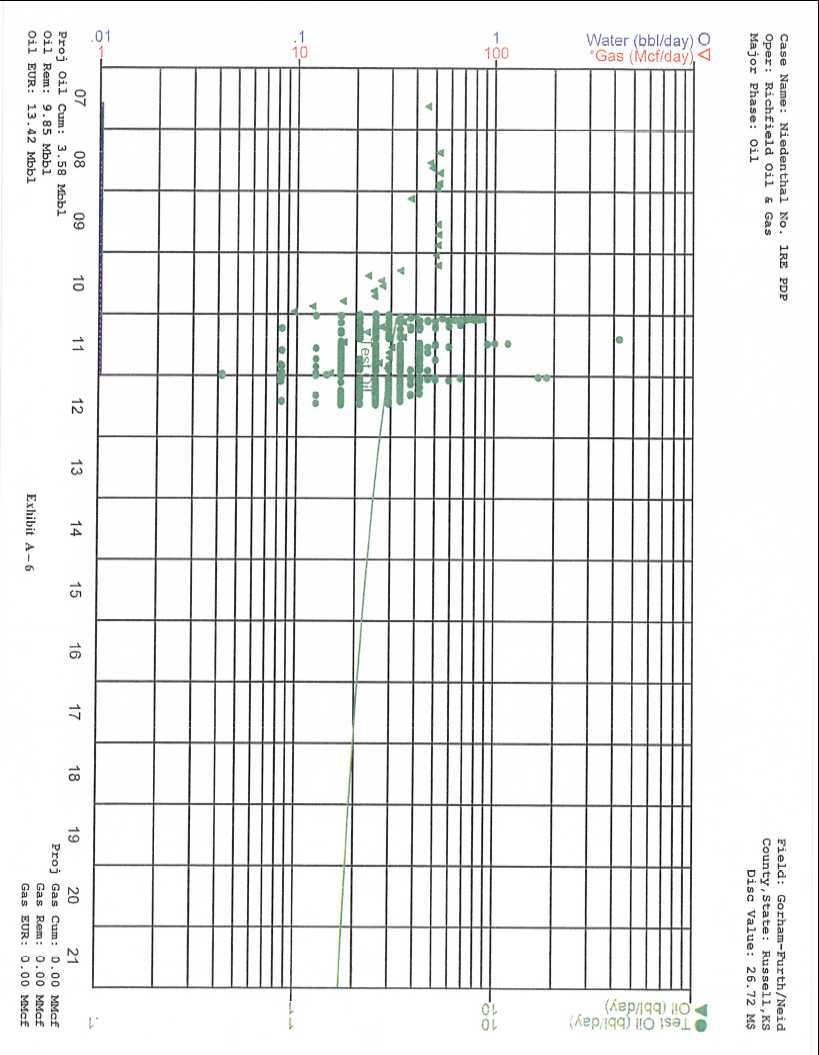

| 4. | Comment: Please furnish to us producing rate vs. time curves for the six producing Gorham wells that have been updated with the most recent oil and water production. Please ensure that the plots use a 15 year time scale. |

Response: Included with this letter are Exhibits A-1 through A-6, which include rate vs. time curves plotted on a 15 year time scale for the six producing Gorham wells. These curves have been updated with the most recent oil production data. Additional copies of this information were also sent to Mr. Ronald Winfrey on June 28, 2012. The Company does not currently have the capability to track water production volumes, and as such, is unable to provide this information.

| 5. | Comment: Explain the reasons for your use of hyperbolic decline type curves for these high permeability reservoirs. |

Response: The Company believes that hyperbolic declines are appropriate for the subject wells because the Arbuckle formation has multiple porosity/permeability regimes due to natural fractures and varying matrix porosity, as well as observances of hyperbolic declines in other dewatering projects in other (similar) carbonate reservoirs in the Mid-Continent region including the Simpson and Hunton formations.

| 6. | Comment:The description of the Fountain Green project on page 12 includes the statement, “There are no wells currently on the Fountain Green Project.” Per our prior comment 21, Question 117.02 in Compliance and Disclosure Interpretations presents the requirement that the attribution of unproved – probable and/or possible – reserves generally requires the assignment of proved reserves. It appears that the Fountain Green project does not have proved reserves assigned. Please amend your document to remove the Fountain Green possible oil reserves. |

Response: The Company has removed references to the Fountain Green Project possible reserves on page 12 and page 20 of Amendment No. 3 to the Form 10 and has caused the Pinnacle Energy Services, LLC Engineering Report to be amended to remove references to possible reserves associated with the Fountain Green Project. The Company has attached the amended engineering report as Exhibit 99.4 to Amendment No. 3 to the Form 10, and has sent a copy of the amended report to Mr. Ronald Winfrey on June 28, 2012.

| 3 |

| 7. | Comment: We note the omission of disclosure pertaining to changes in your PUD reserves. Please amend your document to fulfill the requirements of Item 1203 of Regulation S-K. |

| Response: The Company has included the following language on page 20 of Amendment No. 3 to the Form 10. |

“During 2011, several factors impacted our total Proved Undeveloped Reserves. We modified the economic prices used in our engineering report from $3.282/MCF for gas, and $72.36/bbl for oil, to $4.163/MCF and $96.19/bbl respectively. We also removed several wells from our development plan, in order to reduce the demands on our Company relating to the management and financing of our planned development. We also sold several properties, including our Boyd Field Leases in Barton County, Kansas, our Chase-Silica Field Leases in Rice County, Kansas, our H. Boxberger Lease in the Gorham Field in Russell County, Kansas, and a 26.5% working interest in the Koelsch Field in Stafford County, Kansas. Although our actual production in 2011 resulted in a small change in Proved Undeveloped Reserves, we have completed no significant work to convert Proved Undeveloped Reserves into Proved Developed Reserves.”

Our Production History and Costs of Production, page 23

| 8. | Comment: We note that your disclosed historical unit oil production cost for 2011 is about $143 per barrel. Your third party engineering report presents unit production costs of $14.65/BO for year 1 of total proved producing while your unit production costs for the first quarter of 2012 are about $112/BO. Please explain these differences to us, including justification for attribution of proved producing reserves, and amend your document if it is appropriate. Address the apparent omission of costs for insurance, submersible pump replacement/repair and production overhead. Please explain the allocation of costs for salt water disposal and electric power. |

Response: There are several reasons for the apparent discrepancy of the Company’s historical unit production costs for 2011 and the first quarter of 2012 against our third party engineering report dated January 1, 2012.

We have fixed field operating costs, such as (a) the costs of our Kansas field supervisor, geologist and engineer; (b) the monthly minimum charge for utilities and other costs for approximately 32 currently non-producing wells; (c) ad valorem taxes (property taxes); (d) operating costs of salt water disposal wells; and (e) other general field overhead costs, that have been spread over fewer units of production or bopd. In 2011 and thus far in 2012, we have had lower amounts of daily production (approximately 20 and 25 bopd respectively) because we have not completed our projected full year of development. Whereas our engineering report reflects a full year of development (approximately 934 boepd). Any operating expenses with minor production volumes will yield a significant operating expense $/BBl metric. As production is increased, this metric value decreases. Start-up expenses for reactivations and workovers are not reoccurring expenses.

Reiterating the fact that the PUD cases assume similar producing methods as existing wells with pumping units, primarily gas engines, and lower fluid volumes at an estimated monthly cost of $2,000 per month per well, which includes insurance, production overhead and allocation of electric power. Pumping unit costs (for PUD cases) are capital expenditures

The incremental Probable cases reflect the additional intervals and the dewatering process, with incremental additional monthly operating expenses of $6,152 per month per case. For incremental Probable cases, additional expenses were included to account for electricity and annual repairs for submersible pumps. Historical expenses included remedial and preparatory work to putting wells on.

With a disposal well, especially one that takes significant salt water volumes without the need for surface pressure (pumps), salt water disposal expenses are negligible for the PUD locations (lower volumes) and are near negligible for higher projected volume producing PROB locations. The capital expenditures to drill and complete/equip the salt water disposal wells are included and allocated to the capital expenditures of the future wells since multiple wells can produce into a single disposal well.

| 4 |

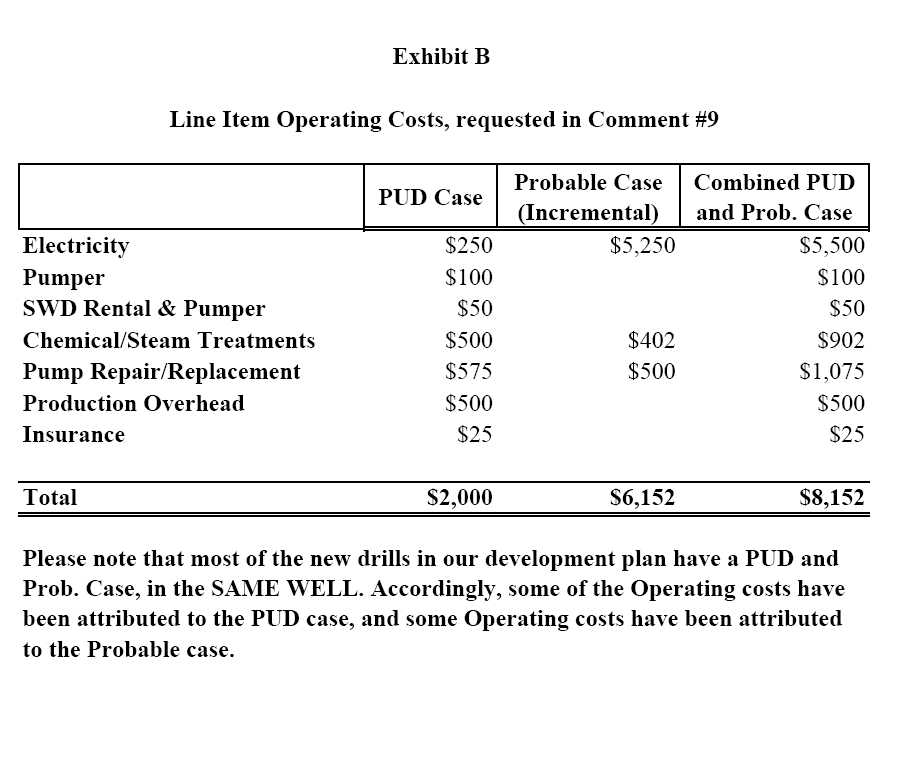

| 9. | Comment: Your third party engineering report presents unit production costs of $7.30/BOE for the first three years of total projected proved undeveloped reserves. Please furnish us with line item schedules for the components of your estimated future production cost – for the first four years – used in your total PUD estimated future net cashflow. Explain significant differences. Please include salt water disposal costs separately as well as your estimated future annual water production. |

Response: Included with this letter is Exhibit B, which provides the information requested by the Staff.

The Company has estimated operating costs at $2,000 per month for PUD locations, which is consistent with the Company’s historical experience of producing low volumes of oil and water via pumping units. The attached figures reflect projected monthly costs for chemicals, overhead, pumper and annual repairs. The Company applied monthly incremental expenses of $6,152 relating to production of probable reserves. This figure also reflects additional reserves and rates as a result of larger stimulations and significant fluid production using submersible pumps in the same PUD wellbores. With respect to a disposal well, particularly a disposal well that is capable of accepting significant salt water volumes without the need for surface pressure (pumps), it is the Company’s experience that salt water disposal expenses are negligible for PUD locations (lower volumes) and are only slightly higher for higher projected volume producing PROB locations.

| 10. | Comment: Your third party report presents PUD future development costs of about $2.3 million for 2012 and for 2013, while your year-end 2011 cash assets are $37 thousand and your auditor states (in Note 2) that there is “substantial doubt about the Company’s ability to continue as a going concern.” Rule 4-10(a)(26) of Regulation S-X, in part, defines “Reserves” as oil and gas quantities where “…there must exist, or there must be a reasonable expectation that there will exist…installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project.” Please explain to us how you will secure the financing required to develop your disclosed PUD reserves. Address your historical activities in obtaining such financing. |

Response: The Company in the past has been able to arrange financing by selling working interests in the Company’s oil and gas properties and by conducting private placements of debt and equity. A summary of the Company’s transactions involving sales of working interests and issuance of equity and debt instruments are summarized in Item 10. Recent Sales of Unregistered Securities, as well as the financial statements included in Amendment No. 3 to the Form 10. The Company believes it has a reasonable expectation that these financing activities will continue in the future enabling it to acquire the necessary capital to develop its PUD reserves in 2012 and beyond.

Certain Relationships and Related Transactions, and Director Independence, page 53

Certain Relationships and Related Transactions, page 53

| 11. | Comment: We note you disclose that “[a]ll related-party transactions have been reviewed and approved by a majority vote of our Board of Directors. With respect to transactions in which the related party is also a member of our Board of Directors, such director is required to abstain from voting to approve the transaction.” Please explain how a majority vote was obtained for transactions with Mountain Home Petroleum Business Trust and Zions Energy Corporation. We also note that Mr. Douglas Hewitt Sr. and your former director, J. David Gowdy, hold interests in such entities. |

Response: During the period from December 12, 2011 to March 31, 2012 when both Douglas Hewitt and J. David Gowdy served on the Company’s Board of Directors, the Company’s Board of Directors was comprised of four directors. Pursuant to the Company’s bylaws, a quorum exists when at least a majority of the Board is present (3 or more). During that period, Mr. Hewitt and Mr. Gowdy abstained from voting on each related party transaction involving Mountain Home Petroleum Business Trust and/or Zions Energy Corporation requiring approval by the Board. The remaining two members of the Board unanimously approved each such related party transaction.

| 5 |

Annual Financial Statements

Notes to Consolidated Financial Statements

Note 18. Unaudited Pro Forma Condensed Consolidated Financial Statements, page F-55

| 12. | Comment: We note you provide pro forma results of operations for the year ended December 31, 2010 and for the interim period ended March 31, 2011 (on pages F-18 and F-19 of your filing). Please note that pro forma presentation for periods other than the fiscal year ended December 31, 2011 does not need to be presented. Refer to Rule 11-02(c)(2)(i) of Regulation S-X. |

Response: In response to the Commission’s comment, the Company has removed Note 16 entitled “Unaudited Pro Forma Condensed Consolidated Financial Statements” from its Notes to Condensed Consolidated Financial Statements (Unaudited) for the Three Months Ended March 31, 2012 and 2011.

The Company has also modified Note 18 entitled “Unaudited Pro Forma Condensed Consolidated Financial Statements" of its Notes to Consolidated Financial Statements December 31, 2011 and 2010 in order to remove the pro forma results of operations for the year ended December 31, 2010.

| 13. | Comment:We note your pro forma adjustment (a) reflects the elimination of Freedom’s general and administrative expenses incurred during the fiscal year ended December 31, 2011. Please note that pro forma adjustments that give effect to actions taken by management or expected to occur after a business combination, including termination of employees, closure of facilities, and other restructuring charges are generally not deemed to be appropriate. Please remove this pro forma adjustment or explain to us how the adjustment meets the three criteria outlined in Rule 11-02(b)(6) of Regulation S-X for pro forma income statement adjustments (i.e., directly attributable, expected to have a continuing impact and factually supportable). |

Response: The Company has removed pro forma adjustment (a) reflecting the elimination of Freedom’s general and administrative expenses incurred during the fiscal year ended December 31, 2011. Please see page F-55 of Amendment No. 3 to the Form 10.

| 14. | Comment: We also note your pro forma adjustment (b) reflects the elimination of a loss on the carrying value of HPI stock held by Freedom during the fiscal year ended December 31, 2011. Please remove this pro forma adjustment or explain to us how the adjustment meets the three criteria outlined in Rule 11-02(b)(6) of Regulation S-X for pro forma income statement adjustment (i.e., directly attributable, expected to have a continuing impact, and factually supportable). |

Response: The Company has removed pro forma adjustment (b) reflecting the elimination of a loss on carrying value of HPI stock held by Freedom during the fiscal year ended December 31, 2011. Please see page F-55 of Amendment No. 3 to the Form 10.

Note 20. Supplemental Oil and Natural Gas Information (Unaudited), page F-59

| 15. | Comment: Please amend your document to disclose your proved developed and proved undeveloped reserves. Refer to FASB ASC paragraph 932-235-50-4. |

Response: The Company has amended the Form 10 to disclose its proved developed and proved undeveloped reserves in accordance with FASB ASC paragraph 932-235-50-4. Please see the chart inserted on page F-57 of Amendment No. 3 to the Form 10.

| 6 |

| 16. | Comment: Please amend your document to explain the circumstances of the 2011 revisions to your proved reserves. Refer to FASB ASC paragraph 932-235-50-5. |

Response: The Company has inserted the following paragraph on page F-57 of Amendment No. 3 to the Form 10.

“During 2011, several factors impacted our total Proved Reserves. Revisions of previous reserve estimates from December 31, 2010 and 2011 are represented by the change in the economic prices used in our engineering report which are $3.282/MCF for gas, and $72.36/bbl for oil, to $4.163/MCF and $96.19/bbl, respectively. We also removed several wells from our development plan, in order to reduce the demands on our Company relating to the management and financing of our planned development. The sales of Reserves in Place was affected by the sale of several properties, including our Boyd Field Leases in Barton County, Kansas, our Chase-Silica Field Leases in Rice County, Kansas, our H. Boxberger Lease in the Gorham Field of Russell County, Kansas, and a 26.5% working interest in the Koelsch Field of Stafford County, Kansas. Our actual production in 2011 also resulted in a small change in Proved Reserves.”

| 17. | Comment: Please expand your supplemental disclosure to include the capitalized costs relating to oil and gas producing activities as required by FASB ASC 932-235-50-12 through paragraph 15 and reflected in Example 2 in 932-235-55-3. |

Response: The Company has revised its presentation to reflect the disclosure specifically required by FASB ASC 932-235-50-12 through paragraph 15 and reflected in Example 2 in 932-235-55-3. Please see page F-57 of Amendment No. 3 to the Form 10.

| 18. | Comment: We note your disclosure under this heading in the costs incurred table includes separate line items for “Asset Retirement Obligation Capitalized” and “Disposition of Properties,” “Proved” and “Unproved.” Please revise your presentation to reflect the disclosure specifically required by FASB ASC 932-235-50-18 and reflected in Example 3 in 932-235-55-4. |

Response: The Company has revised its presentation to reflect the disclosure specifically required by FASB ASC 932-235-50-18 and reflected in Example 3 in 932-235-55-4. Please see page F-57 of Amendment No. 3 to the Form 10.

Standardized Measure of Discounted Future Net Cash Flows as of December 31, 2011 and 2010, page F-60

| 19. | Comment:We note your disclosure under this heading includes a separate line item for “Future Severance Tax Expense.” Please revise your presentation to reflect the disclosure specifically required by FASB ASC 932-235-50-31 and reflected in Example 5 in 932-235-55-6. |

Response: The Company has revised its presentation to reflect the disclosure specifically required by FASB ASC 932-235-50-31 and reflected in Example 5 in 932-235-55-6. Please see pageF-58 of Amendment No. 3 to the Form 10.

| 20. | Comment: We note your statement that “Future cash inflows were computed by applying oil and natural gas prices that were calculated by using the unweighted arithmetic average of the first day-of-the-month price for each month of the 12-month beginning January 1, 2012, to estimated future production oil and natural gas prices. Please clarify for us why the prices you used for 2010 and 2011 were an average starting on January 1, 2012, rather than the average price during the 12-month period prior to the ending date of the period. Refer to FASB ASC 932-235-50-31(a). |

Response: The Company has modified its disclosure to clarify the calculation and has amended the disclosure in Note 20 of the Notes to Consolidated Financial Statements for the years ended December 31, 2011 and 2010, page F-58 to include the prices used for the 2010 and 2011 Standardized Measure of Discounted Future Net Cash Flows. Please see also “Item 1. Business—Summary of Oil and Gas reserves—Economic Assumptions—Pricing,” on page 21 of Amendment No. 3 to the Form 10.

| 7 |

| 21. | Comment: Please expand your supplemental disclosure to include the Changes in the standardized measure of discounted future net cash flows as required by FASB ASC 932-235-50-34 through paragraph 35 and reflected in Example 6 in 932-235-55-7. |

Response: The Company has expanded its supplemental disclosure to include the changes in the standardized measure of discounted future net cash flows specifically required by FASB ASC 932-235-50-34 through paragraph 35 and reflected in Example 6 in 932-235-55-7. Please see page F-58 to Amendment No. 3 to the Form 10.

If we can facilitate the Staff’s review of this response letter, or if the Staff has any questions on any of the information set forth herein, please telephone me at (801) 519-8500. My fax number is (801) 519-6703. You may also contact Reed W. Topham or Robbie G. Yates at Stoel Rives LLP using the contact information previously provided.

Sincerely,

Richfield Oil & Gas Company

/s/ Michael A, Cederstom

Michael A. Cederstrom

General Counsel and Secretary

| 8 |