August 14, 2012

H. Roger Schwall

Assistant Director, Natural Resources

Ronald Winfrey

Petroleum Engineer

Securities and Exchange Commission

100 F Street NE

Washington DC 20549

Via Fax: 703-813-6982

| Re: | Richfield Oil & Gas Company |

Supplemental Engineering Information

Comment letter dated July 30, 2012

File No. 0-54576

Dear Mr. Schwall and Mr. Winfrey,

Pursuant to our conversation this morning, the following information is being provided to you. You may contact Jeremiah Burton at 801-519-8500, or on his cell at 801-680-7663, if you have any further questions.

Our engineering report will reflect the date the report was updated, as well as the effective date of the report. We have also removed any references in the engineering report where the Proved and Probable reserves were summed together. This updated report will be submitted with our revised Amendment No. 4 to Form 10, through the EDGER system.

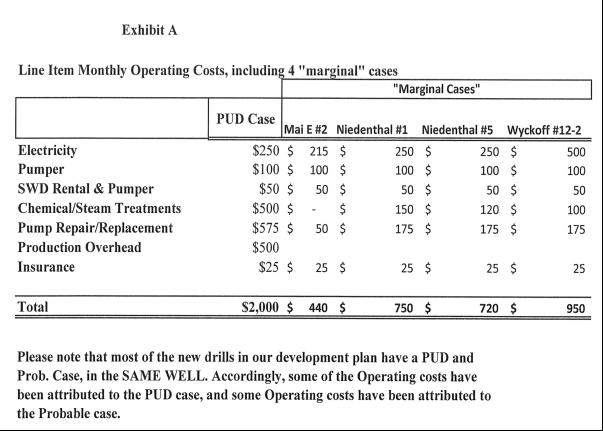

For clarification, our last letter to you referenced four marginally producing wells. These wells are being operated primarily to maintain certain leases, while keeping operating costs low and keeping the wells economical. The Lease Operating Expenses (LOEs) for these four (4) marginal PDP wells that we discussed have lower monthly lease operating expenses compared to the $2,000 per month LOEs for the PUD cases in our engineering report. I have attached a spreadsheet, “Exhibit A” that details the LOEs for those for wells as well as the PUD cases.

Two of the marginally producing wells are analogs for the PUD reserves in the Gorham Field. If the LOEs were set to the $2,000 per month for the marginally producing wells, as in the PUD cases, we would have larger pumps, moving larger volumes of fluid. Our production would increase, and therefore, our EURs and PUD reserves would also increase. Our current PUD reserves reflect existing economics. Please note, that these two marginally producing wells are not our only analogs for the PUD reserves in the Gorham Field.

Finally, you noted that our financial statements show production expenses of $1,024,355 for 2011, while our engineering report only projects Lease Operating Expenses for 2012, for our PDP reserves, of $121,590. There are three main reasons why our Production Expenses for 2011 were high, and why they should not be considered a part of our Lease Operating Expenses.

| 15West South Temple Suite 1050, Salt Lake City, Utah 84010 |

| office 801.519.8500 | fax 801.519.6703 | www.richfieldoilandgas.com |

| 1. | We have high fixed operating expenses in the field, which will be spread amongst more wells in the future and is reflected in our engineering report. In 2011, we had approximately $217,000 of these high fixed expenses which included $64,000 for our field production manager, who also oversees non-producing wells and properties being worked on for regulatory compliance. The remaining $153,000 is our fixed charge for electricity in our fields. As we put more wells into production, our fixed stand-by charge for electricity costs will remain the same, and will be spread over several additional wells bringing the per well lease operating expenses down as is the assumption in the engineering report. |

| 2. | In 2011, we had significant one-time completion costs of approximately $648,000 which included: (a) $493,000 we incurred on completion costs for several wells to start our rework program. Our engineering report includes these types of costs under capital costs or investments and not part of the LOEs; (b) $131,000 for work required by the Kansas regulatory compliance authority (“Kansas Corporation Commission – KCC”) issues relating to leases that we recently acquired; and (c) $24,000 for work that we completed on wells which we no longer own. |

| 3. | We use the “Successful Efforts Method” under our GAAP Accounting Policy in the accounting for oil and natural gas properties and not the “Full Cost Method” which is typically used by other small U.S. oil and gas companies. Under the Successful Efforts Method, generally expenses more of our initial production costs, than we would if we used the Full Cost Method. |

Removing the fixed and one-time costs, noted above, our adjusted LOEs for 2011 is approximately $159,355. These costs are comparable but still high due to the fact that we are a new and small operator in Kansas and we believe our vendors are charging us a 30% to 40% premium for services which will reduce as our work volume increases.

For reference, our second Quarter financial report states that our Production Expenses were only $122,598, which again does include some fixed and one-time completion expenses and premium pricing charges.

We recognize that it is the Company’s responsibility to respond through the EDGER system to the July 30, 2012 comment letter. The company will respond to the Comment Letter and file Amendment No. 4 to Registration Statement on Form 10.

We appreciate your review of the attached well economics and assistance. You may contact us for further information.

Sincerely

/S/: Michael A. Cederstrom

Michael A. Cederstrom, JD

General Counsel and Corporate Secretary

Richfield Oil & Gas Company

| 15West South Temple Suite 1050, Salt Lake City, Utah 84010 |

| office 801.519.8500 | fax 801.519.6703 | www.richfieldoilandgas.com |

I agree with paragraphs two, three and four, and the remaining comments do not affect the engineering report.

| /S/: J.P. Dick | |

| J.P. Dick, Owner and Manager | |

| Pinnacle Energy Services, LLC |

| 15West South Temple Suite 1050, Salt Lake City, Utah 84010 |

| office 801.519.8500 | fax 801.519.6703 | www.richfieldoilandgas.com |