Exhibit 99.27

GOLDMINING INC.

Notice of Annual GENERAL Meeting of shareholders

and Management INFORMATION Circular

| | Time: May 21, 2020, at 12:00 p.m. (Vancouver time) Place: 1000 - 925 West Georgia Street Vancouver, British Columbia Canada | |

April 3, 2020

GOLDMINING INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 21, 2020

TO: | The Shareholders of GoldMining Inc. |

NOTICE IS HEREBY GIVEN that the annual general meeting of Shareholders of GoldMining Inc. (the "Corporation") will be held at 1000 Cathedral Place, 925 West Georgia Street, Vancouver, British Columbia, Canada, on Thursday, May 21, 2020, at 12:00 p.m. (Vancouver time) (the "Meeting") for the following purposes:

1. | Financial Statements: to receive the financial statements of the Corporation for its last financial year, together with the report of the auditors thereon; |

2. | Election of Directors: to elect and fix the number of directors of the Corporation for the ensuing year – see "Election of Directors" in the Corporation's Management Information Circular dated April 3, 2020 (the "Circular"); |

3. | Appointment of Auditors: to appoint PricewaterhouseCoopers LLP as auditors of the Corporation for the ensuing year and to authorize the directors to fix their remuneration - see "Appointment of Auditors" in the Circular; and |

4. | Other Business: to transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof – see "Other Business" in the Circular. |

Pursuant to an exemption obtained by the Corporation under the Canada Business Corporations Act (the "CBCA"), the Corporation is using notice-and-access to provide shareholders with electronic access to the Notice of Meeting, Circular, audited annual financial statements of the Corporation for the year ended November 30, 2019 and the accompanying management's discussion and analysis (collectively, the "Meeting Materials"), instead of mailing paper copies. The Meeting Materials are available on the Corporation's website at: http://www.goldmining.com/investors/financials/ and under the Corporation's profile on www.sedar.com. The use of the notice-and-access provisions reduces costs to the Corporation.

To request a paper copy of the Meeting Materials by mail or to receive additional information about notice-and-access, please call the Corporation toll free at 1-855-630-1001 (extension 409). There is no cost to you for requesting a paper copy of the Meeting Materials. Any Shareholder wishing to request a paper copy of the Meeting Materials should do so by 4:00 p.m. (Vancouver time) on May 7, 2020, in order to receive and review the Meeting Materials and submit their vote by 12:00 p.m. on May 19, 2020, as set out in the proxy or voting instruction form accompanying this Notice. Please retain the proxy or voting instruction form accompanying this Notice as another will not be sent.

The Corporation's board of directors have fixed March 23, 2020, as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournment(s) or postponement(s) thereof. Each Registered Shareholder at the close of business on that date is entitled to such notice and to vote at the Meeting in the circumstances set out in the Circular.

Registered Shareholders are entitled to vote at the Meeting in person or by proxy. Registered Shareholders who are unable to attend the Meeting, or any adjournment(s) or postponement(s) thereof, are requested to complete, sign, date and return the proxy accompanying this Notice in accordance with the instructions set out therein and in the Circular. A proxy will not be valid unless it is received by Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 12:00 p.m. (Vancouver time) on May 19, 2020, or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof. The chairman of the Meeting has the discretion to accept proxies received after that time.

Non-registered Shareholders who received a voting instruction form accompanying this Notice through a broker or other intermediary must deliver the voting instruction form in accordance with the instructions provided by such intermediary. Failure to do so may result in your shares not being eligible to be voted by proxy at the Meeting. Non-registered Shareholders must make additional arrangements through such intermediary to vote in person at the Meeting.

The Company is continuing to monitor the potential impact of the coronavirus (COVID-19) on the upcoming Meeting and may decide to forego the physical Meeting in favor of a virtual-only Meeting or some other alternative depending on the situation. In such event, shareholders will be notified by press release or other means with additional details as soon as reasonably practicable.

Shareholders are reminded to review the Meeting Materials prior to voting.

DATED at Vancouver, British Columbia, this 3rd day of April, 2020.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Amir Adnani

Amir Adnani, Chairman

Table of Contents

VOTING INFORMATION | 3 |

| | |

Solicitation of Proxies | 3 |

Record Date | 4 |

Quorum and Approval | 4 |

Appointment of Proxyholders | 4 |

Revocability of Proxy | 4 |

Voting of Common Shares and Proxies and Exercise of Discretion by Designated Persons | 5 |

Voting by Non-Registered Holders | 5 |

| | |

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 6 |

| | |

RECEIPT OF FINANCIAL STATEMENTS | 7 |

| | |

ELECTION OF DIRECTORS | 7 |

| | |

Corporate Cease Trade Orders or Bankruptcies | 9 |

| | |

APPOINTMENT OF AUDITORS | 10 |

| | |

STATEMENT OF EXECUTIVE COMPENSATION | 10 |

| | |

Compensation Discussion and Analysis | 10 |

Elements of Compensation | 10 |

Risk Management | 12 |

Anti-Hedging and Anti-Pledging Policy | 12 |

Compensation Governance | 12 |

Summary Compensation Table | 12 |

Performance Graph | 13 |

Outstanding Share-based Awards and Option-based Awards | 14 |

Incentive Plan Awards – Value Vested or Earned During the Year for NEOs | 14 |

Pension Plan Benefits | 15 |

Termination and Change of Control Benefits and Employment Agreements | 15 |

Compensation of Directors | 15 |

Outstanding Share-based Awards and Option-based Awards | 16 |

Incentive Plan Awards – Value Vested or Earned During the Year for Directors | 17 |

| | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 18 |

| | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 22 |

| | |

MANAGEMENT CONTRACTS | 22 |

| | |

AUDIT COMMITTEE | 22 |

| | |

Corporation's Audit Committee Charter | 22 |

Composition of the Audit Committee | 22 |

Relevant Education and Experience | 22 |

Audit Committee Oversight | 23 |

Pre-Approval Policies and Procedures | 23 |

External Auditor Service Fees | 23 |

| | |

CORPORATE GOVERNANCE | 23 |

| | |

Board of Directors | 23 |

Board Mandate | 25 |

Position Descriptions | 25 |

Orientation and Continuing Education | 25 |

Ethical Business Conduct | 26 |

Nomination of Directors | 26 |

Compensation | 26 |

Other Committees of the Board of Directors | 27 |

Assessments | 27 |

Board Renewal | 27 |

Diversity | 27 |

Majority Voting Policy | 28 |

| | |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 28 |

| | |

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 29 |

| | |

REGISTRAR AND TRANSFER AGENT | 29 |

| | |

OTHER BUSINESS | 29 |

| | |

ADDITIONAL INFORMATION | 29 |

| | |

SHAREHOLDER PROPOSALS | 29 |

| | |

SHAREHOLDER NOMINATIONS | 30 |

| | |

APPROVAL OF CIRCULAR | 30 |

| | |

SCHEDULE "A" CHANGE IN AUDITOR REPORTING PACKAGE | 31 |

| | |

SCHEDULE "B" AUDIT COMMITTEE CHARTER | 34 |

GOLDMINING INC.

MANAGEMENT INFORMATION CIRCULAR

April 3, 2020

This Management Information Circular ("Circular") is being furnished to holders ("Shareholders") of common shares in the capital of GoldMining Inc. (the "Corporation") in connection with the solicitation of proxies by the board of directors and management of the Corporation for use at the annual general meeting to be held at 12:00 p.m. (Vancouver time) on Thursday, May 21, 2020, at 1000 Cathedral Place, 925 West Georgia Street, Vancouver, British Columbia, Canada, and any adjournment(s) or postponement(s) thereof (the "Meeting") for the purposes set forth in the Notice of Meeting dated April 3, 2020 (the "Notice of Meeting"), which accompanies and is part of this Circular.

Pursuant to exemptions obtained by the Corporation under the Canada Business Corporations Act (the "CBCA"), the Corporation is using notice-and-access to provide Shareholders with electronic access to the Notice of Meeting, Circular, audited annual financial statements of the Corporation for the year ended November 30, 2019 and the accompanying management's discussion and analysis (collectively, the "Meeting Materials") pursuant to National Instrument 51-102 Continuous Disclosure Obligations ("National Instrument 51-102") and National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer ("National Instrument 54-101") of the Canadian Securities Administrators. Pursuant to notice-and-access provisions, registered and non-registered holders of common shares will be sent a notice package explaining how to access the Meeting Materials and containing a form of proxy or voting instruction form, as applicable and in each case with a supplemental mail list return box for shareholders to request they be included in the Corporation's supplementary mailing list for receipt of the Corporation's annual and interim financial statements for the 2020 fiscal year. The Meeting Materials are available on the Corporation's website at www.goldmining.com and under the Corporation's profile on www.sedar.com. Shareholders may contact the Corporation to request a paper copy of the Meeting Materials toll free at 1-855-630-1001 (extension 409).

The information contained in this Circular is given as of April 3, 2020, unless otherwise indicated. All dollar amounts set forth in this Circular are expressed in Canadian dollars, unless otherwise indicated.

VOTING INFORMATION

Solicitation of Proxies

The solicitation of proxies by management of the Corporation will be conducted by mail, using notice-and-access provisions, and may be supplemented by telephone or other personal contact, and such solicitation will be made without special compensation granted to the directors, officers and employees of the Corporation. The Corporation does not reimburse Shareholders, nominees or agents for costs incurred in obtaining, from the principals of such persons, authorization to execute forms of proxy, except that the Corporation has requested brokers and nominees who hold stock in their respective names to furnish this Circular and related proxy materials to their customers, and the Corporation will reimburse such brokers and nominees for their related out of pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Corporation.

No person has been authorized to give any information or to make any representation other than as contained in this Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Corporation. The delivery of this Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Circular. This Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

Record Date

The board of directors of the Corporation has set the close of business on March 23, 2020, as the record date (the "Record Date") for determining which Shareholders of the Corporation shall be entitled to receive notice of and to vote at the Meeting. Only Shareholders of record ("Registered Shareholders") as of the Record Date are entitled to receive notice of and to vote at the Meeting.

Quorum and Approval

We need a quorum of shareholders to transaction business at the Meeting. Under the Corporation's By-Laws, a quorum is two or more persons present and holding or representing by proxy not less than five percent (5%) of the total number of issued common shares of the Corporation having voting rights at the meeting. We require a simple majority (50% plus 1) of the votes cast at the Meeting to approve all items of business, unless otherwise stated.

Appointment of Proxyholders

Registered Shareholders are entitled to vote at the Meeting. A Shareholder is entitled to one vote for each common share that such Shareholder held on March 23, 2020, on the resolutions to be voted upon at the Meeting and any other matter to come before the Meeting.

The persons named as proxyholders (the "Designated Persons") in the enclosed form of proxy are directors and/or officers of the Corporation.

A Shareholder has the right to appoint a person or corporation (who need not be a Shareholder) to attend and act for or on behalf of that Shareholder at the Meeting, other than the Designated Persons named in the enclosed form of proxy. A Shareholder may exercise this right by striking out the printed names and inserting the name of such other person and, if desired, an alternate to such person, in the blank space provided in the form of proxy. In order to be voted, the completed form of proxy must be received by the Corporation, by mail or by hand, to the attention of Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, by 12:00 p.m. (Vancouver time) on May 19, 2020, or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof. The time limit for the deposit of proxies may be waived by the board of directors at its discretion without notice.

A proxy may not be valid unless it is dated and signed by the Shareholder who is giving it or by that Shareholder's attorney-in-fact duly authorized by that Shareholder in writing or, in the case of a corporation, dated and executed by a duly authorized officer, or attorney-in-fact, for the corporation. If a form of proxy is executed by an attorney-in-fact for an individual Shareholder or joint Shareholders, or by an officer or attorney-in-fact for a corporate Shareholder, the instrument so empowering the officer or attorney-in-fact, as the case may be, or a notarially certified copy thereof, should accompany the form of proxy.

Revocability of Proxy

Any Registered Shareholder who has returned a form of proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a form of proxy may be revoked by instrument in writing, including a form of proxy bearing a later date, executed by the Registered Shareholder or by his or her attorney duly authorized in writing or, if the Registered Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney thereof. The instrument revoking the form of proxy must be deposited at the same address where the original form of proxy was delivered at any time up to and including the last business day preceding the date of the Meeting, or any adjournment(s) thereof, or with the Chairman of the Meeting on the date of the Meeting but prior to the commencement of the Meeting. A Shareholder who has submitted a form of proxy may also revoke it by attending the Meeting in person (or, if the Shareholder is a corporation, by a duly authorized representative of the corporation attending the Meeting) and registering with the scrutineer thereat as a Registered Shareholder present in person, whereupon such form of proxy shall be deemed to have been revoked. A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

Voting of Common Shares and Proxies and Exercise of Discretion by Designated Persons

A Shareholder may indicate the manner in which the Designated Persons are to vote with respect to a matter to be voted upon at the Meeting by marking the appropriate space on the form of proxy. If the instructions as to voting indicated in the proxy are certain, the common shares represented by the form of proxy will be voted or withheld from voting in accordance with the instructions given in the form of proxy. If the Shareholder specifies a choice in the form of proxy with respect to a matter to be acted upon, then the common shares represented will be voted or withheld from the vote on that matter accordingly. The common shares represented by a form of proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for, and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the common shares will be voted accordingly.

If no choice is specified in the form of proxy with respect to a matter to be acted upon, the form of proxy confers discretionary authority with respect to that matter upon the Designated Persons named in the form of proxy. It is intended that the Designated Persons will vote the common shares represented by the form of proxy in favour of each matter identified in the form of proxy, including the vote for the election of the nominee(s) to the board of directors and for the appointment of the independent auditors of the Corporation.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to other matters which may properly come before the Meeting, including any amendments or variations to any matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Corporation is not aware of any such amendments, variations, or other matters to come before the Meeting.

In the case of abstentions from, or withholding of, the voting of the common shares on any matter, the common shares that are the subject of the abstention or withholding will be counted for the determination of a quorum, but will not be counted as affirmative or negative on the matter to be voted upon.

Voting by Non-Registered Holders

Only Registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders are "non-registered" Shareholders because the common shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the common shares. More particularly, a person is not a Registered Shareholder in respect of common shares which are held on behalf of that person (the "Non-Registered Holder") but which are registered either: (a) in the name of an intermediary (an "Intermediary") that the Non-Registered Holder deals with in respect of the common shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators or self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depositary Services Inc.) of which the Intermediary is a participant. In accordance with the requirements set out in National Instrument 54-101, the Corporation has distributed copies of the Meeting Materials and form of proxy to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders and has posted the Meeting Materials on the Corporation's website at www.goldmining.com and under the Corporation's profile at www.sedar.com.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| | (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of common shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deposit it with the Corporation as provided above; or |

| | (b) | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a "proxy authorization form") which the Intermediary must follow. Typically, the proxy authorization form will consist of a one-page pre-printed form. Sometimes, instead of a one-page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions, which contains a removable label containing a bar-code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the common shares which they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the management proxyholders named in the form and insert the Non-Registered Holder's name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered.

There are two kinds of beneficial owners – those who object to their name being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called NOBOs for Non-Objecting Beneficial Owners). Pursuant to National Instrument 54-101, issuers can obtain a list of their NOBOs from Intermediaries for distribution of proxy-related materials directly to NOBOs. Pursuant to National Instrument 54-101, the Corporation does not intend to pay for Intermediaries to forward the Meeting Materials to Objecting Beneficial Owners. Accordingly, Objecting Beneficial Owners will not receive the Meeting Materials unless the Intermediary holding shares on their behalf assumes the cost of delivery.

These securityholder materials are being sent to both Registered Shareholders and Non-Registered Holders, using notice-and-access provisions. If you are a Non-Registered Holder and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Corporation's authorized capital consists of an unlimited number of common shares and an unlimited number of preferred shares issuable in series. As of the close of business on March 23, 2020, the Corporation had 145,953,179 common shares issued and outstanding and no preferred shares issued and outstanding. The common shares are the only shares entitled to be voted at the Meeting. On a show of hands, every person present and entitled to vote at the Meeting will be entitled to one vote. On a ballot, every person present and entitled to vote will be entitled to one vote for each common share held.

To the knowledge of management of the Corporation, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities carrying more than 10% of all voting rights of the Corporation as of the date hereof.

RECEIPT OF FINANCIAL STATEMENTS

The board of directors will place before the Shareholders at the Meeting, the financial statements of the Corporation, including comparative financial statements, for its last financial year, together with the auditors' report thereon.

ELECTION OF DIRECTORS

The number of directors to be elected at the Meeting is determined from time to time by resolution of the board of directors, such number being not more than twenty and not less than three. The directors have fixed the size of the board of directors at six directors.

The board of directors is recommending six persons (the "Nominees") for election at the Meeting. Each of the six persons whose name appears below is proposed by the board of directors to be nominated for election as a director of the Corporation to serve until the next annual general meeting of the Shareholders or until the director sooner ceases to hold office.

The following table sets forth the names of the Nominees, all offices of the Corporation now held by the Nominees, the Nominees' principal occupations, the period of time for which each Nominee has been a director of the Corporation and the number of common shares of the Corporation, warrants exercisable into common shares of the Corporation ("Warrants"), stock options to purchase common shares of the Corporation ("Options"), issued and outstanding under the Corporation's second amended and restated stock option plan dated April 5, 2019 (the "Option Plan"), and restricted share rights to acquire common shares of the Corporation ("RSRs") beneficially owned by the Nominees, directly or indirectly, or over which each Nominee exercises control or direction, as of the date hereof.

Amir Adnani(1) British Columbia, Canada Age: 42 Director since 2010 Non-Independent | Mr. Adnani is a founder and serves as the President, Chief Executive Officer, Principal Executive Officer and a director of Uranium Energy Corp., a uranium mining and exploration company listed on the NYSE American, since January 2005. Mr. Adnani also serves as Chairman and Director of Uranium Royalty Corp., a uranium royalty company listed on the TSX Venture Exchange, since August 2019. Other public company board/committee memberships in the past five years: ● Uranium Energy Corp. (2005 to present) ● Uranium Royalty Corp (2019 – present) |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 6,500,154(2) 2,200,000 Nil Nil |

Garnet Dawson(1) British Columbia, Canada Age: 62 Director since 2018 Non-Independent | Mr. Dawson has served as Chief Executive Officer of the Corporation since 2015 and before this as Technical Director of the Corporation in 2014. Prior to this, Mr. Dawson held executive and technical roles with several organizations including Brazilian Gold Corporation, EuroZinc Mining Corporation, Battle Mountain Canada Inc., BC Geological Survey and Esso Minerals Canada. Mr. Dawson is a registered Professional Geologist with the Association of Professional Engineers and Geoscientists of British Columbia and holds a Bachelor of Science in Geology from the University of Manitoba and a Master of Science in Economic Geology from the University of British Columbia. Other public company board/committee memberships in the past five years: ● Freegold Ventures Limited (2010 – present) ● Bullman Minerals Inc. (2010 - 2017) |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 159,722 1,110,000 Nil 55,389 |

David Kong(3)(4) British Columbia, Canada Age: 73 Director since 2010 Independent | Mr. Kong has served as a director of New Pacific Metals Corp., a mining and exploration company, since November 2010, Uranium Energy Corp., a uranium mining and exploration company, since January 2011 and Silvercorp Metals Inc., a mining company, since November 2011. Mr. Kong was a partner at Ellis Foster, Chartered Accountants from 1981 to 2004, before merging with Ernst & Young LLP in 2005, where he was a partner until 2010. Mr. Kong served as a director of New Era Minerals Inc. from June 2014 to April 2016. Other public company board/committee memberships in the past five years: ● New Pacific Metals Corp. (2010 – present) ● Uranium Energy Corp. (2011 – present) ● Silvercorp Metals Inc. (2011 – present) |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 448,700(5) 375,000 Nil 3,701 |

Gloria Ballesta(3)(4)(6) Bogotá, Capital District, Colombia Age: 44 Director since 2010 Independent | Ms. Ballesta has served as Chief Executive Officer of Content Mode SAS, a private Colombian company and contact center, since January 2016. Ms. Ballesta served as a paralegal for Uranium Energy Corp. from May 2010 to December 2012. Other public company board/committee memberships in the past five years: ● Uranium Energy Corp. (2018 – present) |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 21,000 220,000 Nil 3,152 |

Hon. Herb Dhaliwal(3),(4),(6) British Columbia, Canada Age: 67 Director since 2013 Independent | Mr. Dhaliwal has served as the Chief Executive Officer of Dynamic Facility Services Ltd., a private maintenance company servicing government institutions and large corporations since 2004. Mr. Dhaliwal served as a director of East West Petroleum Corp., a public company listed on the TSX Venture Exchange from July 2010 to October 2017. Other public company board/committee memberships in the past five years: ● East West Petroleum Corp. (2010 – 2017) ● Advantage Lithium (2015 – 2016) |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 5,000 260,000 Nil 3,282 |

Mario Bernardo Garnero(6) New York, United States of America Age: 54 Director since 2018 Independent | Mr. Mario Bernardo Garnero serves as Marketing Director and Superintendent Director of the Brasilinvest Group, a Brazilian business established in 1975 as a private merchant bank. Mr. Garnero also serves as Vice President of Brasilinvest USA, a company which represents the interests of Brasilinvest Group in the United States. Mr. Garnero is also President of Fórum das Américas, a Brazilian company established in 1978 dedicated to important discussions related to the American continent such as sustainable development, human rights and the environment. Other public company board/committee memberships in the past five years: ● None |

| | Securities Held |

| | Common Shares Options Warrants RSRs | 50,000 175,000 Nil 3,000 |

Notes:

| | (1) | As non-independent directors, Mr. Adnani and Mr. Dawson do not sit on any committees. |

| | (2) | Includes 1,402,654 common shares held by Amir Adnani Corp. and 150,000 common shares owned by Mr. Adnani's spouse. |

| | (3) | Member of the Audit Committee. |

| | (4) | Member of the Compensation Committee. |

| | (5) | Includes 248,700 common shares owned by Mr. Kong's spouse. |

| | (6) | Member of the Nominating and Corporate Governance Committee. |

Corporate Cease Trade Orders or Bankruptcies

To the knowledge of the Corporation, no Nominee is or has been, within the past 10 years, a director, chief executive officer or chief financial officer of any corporation (including the Corporation) that:

| | (a) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the corporation access to any exemption under securities legislation that was in effect for a period of more than thirty (30) consecutive days and was issued while the Nominee was acting in the capacity of director, chief executive officer or chief financial officer of the corporation; or |

| | (b) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant corporation access to any exemption under securities legislation that was issued after the Nominee ceased to be a director, chief executive officer or chief financial officer of the corporation and resulted from an event that occurred while the Nominee was acting in the capacity as director, chief executive officer or chief financial officer of the corporation. |

To the knowledge of the Corporation, no Nominee:

| | (a) | is, as at the date hereof, or has been within 10 years before the date of this Circular, a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | (b) | has, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

APPOINTMENT OF AUDITORS

Effective August 30, 2019, Ernst & Young LLP ("EY") resigned as the auditor for the Corporation (at the request of the Corporation) and PricewaterhouseCoopers LLP ("PwC") was appointed as auditor of the Corporation, to hold office until the Meeting. In accordance with National Instrument 51-102, a copy of the prescribed reporting package relating to the change in auditors is attached to this Circular as Schedule "A", including the Corporation's notice of change in auditors dated August 30, 2019 and letters of acknowledgement from each of EY and PwC. As noted in the reporting package, no "reportable events" (within the meaning of NI 51-102) have occurred and EY did not express a modified opinion on any of their reports on the Corporation's financial statements for the two most recently completed fiscal years preceding August 30, 2019 or any period subsequent to the two most recently completed fiscal years and ending on August 30, 2019.

Management of the Corporation will recommend at the Meeting that Shareholders appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants ("PricewaterhouseCoopers LLP"), as auditors of the Corporation until the next annual meeting of Shareholders and to authorize the directors to fix their remuneration.

STATEMENT OF EXECUTIVE COMPENSATION

The following information is presented in accordance with National Instrument 51-102 and Form 51-102F6 – Statement of Executive Compensation, and sets forth the annual compensation for services in all capacities to the Corporation and its subsidiaries in respect of the individuals comprised of the Chief Executive Officer, the Chief Financial Officer and the only other executive officer, including its subsidiaries, whose individual total compensation for the most recently completed financial year exceeded $150,000, and any individual who would have satisfied these criteria but for the fact that the individual was not serving as our officer or an officer of any of our subsidiaries at the end of the most recently completed financial year (together, the "Named Executive Officers" or "NEOs").

Compensation Discussion and Analysis

The goal of the Corporation's executive compensation philosophy is to attract, motivate, retain and reward an energetic, goal driven, highly qualified and experienced management team and to encourage them to meet and exceed performance expectations within a calculated risk framework. The Compensation Committee periodically reviews the adequacy and form of compensation to ensure it realistically reflects the responsibilities and risks involved in being an effective director or officer and that compensation allows the Corporation to attract qualified candidates.

Elements of Compensation

The compensation program is designed to reward each executive based on individual, business and corporate performance and is also designed to incent such executives to drive the annual and long-term business goals of the organization to enhance the sustainable profitability and growth of the Corporation in a manner which is fair and reasonable to the Shareholders.

The following key principles guide the Corporation's overall compensation philosophy:

| | ● | compensation is designed to align executives to the critical business issues facing the Corporation; |

| | ● | compensation is fair and reasonable to Shareholders and is set with reference to the local market; |

| | ● | the compensation design supports and rewards executives for entrepreneurial and innovative efforts and results; |

| | ● | an appropriate portion of total compensation is equity-based, aligning the interests of executives with Shareholders; and |

| | ● | compensation is transparent to the board of directors, executives and Shareholders. |

The Corporation does not assess its compensation through benchmarks or peer groups at this time. When reviewing the compensation of executive officers, the Compensation Committee considers the following objectives:

| | ● | to engage individuals critical to the growth and success of the Corporation; |

| | ● | to reward performance of individuals by recognizing their contributions to the Corporation's growth and achievements; and |

| | ● | to compensate individuals based on performance. |

For executive officers who are offered compensation, such compensation is primarily comprised of a base salary, bonus, restricted share rights and options to purchase common shares.

Salary: For executive officers who are offered compensation, the base salary is the foundation of such compensation and is intended to compensate competitively. The desire is for base salary to be high enough to secure talented, qualified and effective personnel which, when coupled with performance-based compensation, provides for a direct correlation between individual accomplishment and the success of the Corporation as a whole. Salaries are fixed and therefore not subject to uncertainty and are used as the base to determine other elements of compensation.

Bonus: Annual bonuses are a variable component of total cash compensation, designed to reward executives for individual achievements, maximizing annual operating performance, including in relation to the Company’s acquisition and growth initiatives. Annual bonuses (if any) are discretionary and are to incentivize management during the year to take actions and make decisions within their control, and, as a result, the performance criteria do not include matters outside of the control of management, most notably commodity pricing.

Options: The Option Plan is a variable and discretionary component of compensation that provides that the board of directors may from time to time, in its discretion, grant Options to directors, officers, employees and consultants of the Corporation, or any subsidiary of the Corporation. Grants of Options seek to align the interests of management with the interests of the Company’s Shareholders through the possible increase in the price of the Shares over time. For information in respect of the Option Plan, please refer to the section entitled "Securities Authorized for Issuance Under Equity Compensation Plans".

RSRs: The restricted share plan of the Corporation (the "Restricted Share Plan") is a variable and discretionary component of compensation that provides that the board of directors may from time to time, in its discretion, grant RSRs to directors, officers, employees and consultants of the Corporation, or any subsidiary of the Corporation for accretively growing the Company and increasing the value of the Shares. Awards of RSRs seek to align the interests of management with the interests of the Company’s Shareholders through the possible increase in the price of the Shares over time. For information in respect of the Restricted Share Plan, please refer to the section entitled "Securities Authorized for Issuance Under Equity Compensation Plans".

The Compensation Committee makes recommendations to the board of directors regarding the periodic grant of Options and RSRs to key employees and executive officers. The Compensation Committee makes those recommendations on a discretionary basis, given the size of the Corporation, based on individual performance, positions held within the Corporation and the overall performance of the Corporation. The Compensation Committee takes into consideration previous grants when it considers new grants of Options and RSRs to employees and executives of the Corporation. The board of directors relies solely on the recommendation of the Compensation Committee regarding the periodic grant of Options and RSRs to key employees and executive officers.

Risk Management

The Corporation has taken steps to ensure its executive compensation program does not incent inappropriate risks. Some of the risk management initiatives currently employed by the Corporation are as follows:

| | ● | appointing a Compensation Committee comprised of all independent directors to oversee the executive compensation program; and |

| | ● | use of discretion in adjusting bonus payments (if any) up or down as the Compensation Committee deems appropriate and recommends. |

Anti-Hedging and Anti-Pledging Policy

We adopted an anti-hedging and anti-pledging policy (the "Anti-Hedging and Anti-Pledging Policy"). The Anti-Hedging and Anti-Pledging Policy provides that, unless otherwise previously approved by the Nominating and Corporate Governance Committee, no director, officer or employee of the Corporation or its subsidiaries or, to the extent practicable, any other person (or their associates) in a special relationship (within the meaning of applicable securities laws) with the Corporation, may, at any time: (i) purchase financial instruments, including prepaid variable forward contracts, instruments for the short sale or purchase or sale of call or put options, equity swaps, collars, or units of exchangeable funds that are based on fluctuations of the Corporation's debt or equity instruments and that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Corporation; or (ii) purchase the Corporation's securities on a margin or otherwise pledge the Corporation's securities as collateral for a loan. Any violation of our Anti-Hedging and Anti-Pledging Policy will be regarded as a serious offence. Our Anti-Hedging and Anti-Pledging Policy is available on the Corporation's website at www.goldmining.com.

Compensation Governance

The Compensation Committee is comprised of David Kong, Gloria Ballesta and the Hon. Herb Dhaliwal, all of whom are "independent" members as that term is used in National Instrument 52-110 – Audit Committees ("NI 52-110"). David Kong is the Chair of the Compensation Committee.

The Compensation Committee operates under a written charter. Among other things, the Compensation Committee has the responsibility of assessing the performance of the Chief Executive Officer, evaluating the Chief Executive Officer's contribution to our overall success and recommending to the board of directors the Chief Executive Officer's level of compensation. It is also responsible for reviewing and approving the compensation of other key executive officers including salary, bonus, incentive and other compensation levels. For further information relating to the Compensation Committee's responsibilities and the policies and practices used to determine compensation for our directors and executive officers, see the sections of this Circular entitled "Statement of Executive Compensation – Compensation Discussion and Analysis" above and "Corporate Governance – Compensation" below.

All members of the Compensation Committee have experience in compensation matters, either as members of compensation committees of other public companies and/or from having served as senior executives with significant responsibility for or involvement in compensation matters. For further information, see the profiles of our directors above under the section entitled "Election of Directors".

Summary Compensation Table

The following table sets out all compensation paid, payable, awarded, granted, given or otherwise provided, directly or indirectly, by the Corporation to each NEO, in any capacity, for the three most recently completed financial years.

Name and principal position | Year | Salary ($) | Share-based awards(1) ($) | Option- based awards(2) ($) | Non-equity incentive plan compensation ($) | All other compensation ($) | Total compensation ($) |

| | | | | | Annual incentive plans | | |

Garnet Dawson Chief Executive Officer and Director (3) | 2019 2018 2017 | 165,000 165,000 165,000 | 58,158 46,800 Nil | 94,974 106,333 258,000 | Nil Nil Nil | Nil Nil Nil | 318,133 318,133 423,000 |

Pat Obara Secretary,

Chief Financial Officer and former Director (4) | 2019 2018 2017 | 36,000 38,800 36,000 | 47,954 39,000 Nil | 82,189 91,143 258,000 | Nil Nil 15,000 | 2,880(5) 2,880(5) 12,612(5) | 169,023 171,903 321,612 |

Paulo Valle Pereira Neto President | 2019 2018 2017 | 77,882 88,448 92,845 | 39,024 Nil Nil | 32,876 41,014 110,571 | Nil 26,083 Nil | 7,788(5) Nil Nil | 149,782 155,545 203,416 |

Notes:

| | (1) | The "Share-based awards" consist of RSRs. Mr. Dawson, Mr. Obara and Mr. Pereira received 55,389, 45,670 and 37,166 RSRs, respectively, on November 25, 2019. The fair value of the RSRs at the grant date is calculated using the closing price of the Corporation's common shares on the Toronto Stock Exchange (the "TSX") on November 22, 2019, being the date prior to the date of grant. |

| | (2) | The Black-Scholes option valuation model has been used to determine the fair value on the date of grant. The Black-Scholes option valuation is determined using the expected life of the stock option, expected volatility of the common share price, expected dividend yield and risk free interest rate. The Black-Scholes pricing model was used to estimate the fair value as it is the most accepted methodology. The inputs used by the Corporation in the Black-Scholes pricing model for options granted during the year ended November 30, 2019 were: a risk free interest rate of 1.38%; expected life of 2.88 years; and annualized volatility of 57.35%. |

| | (3) | Mr. Dawson does not receive any compensation for services as a director. |

| | (4) | Amounts stated reflect the annual salary received by Mr. Obara in his capacity as Chief Financial Officer. Mr. Obara did not receive any compensation for services as a former director. |

| | (5) | Represents amounts paid for unused vacation. |

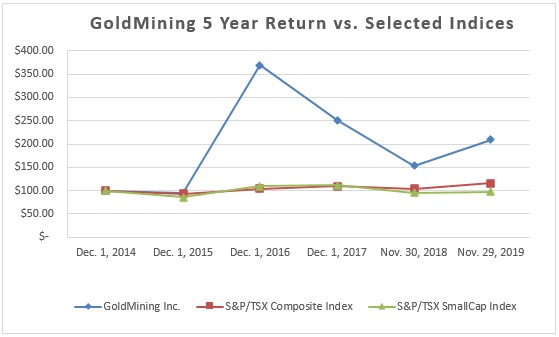

Performance Graph

The following graph compares the total cumulative return for a Shareholder who invested $100 in common shares of the Corporation for the five year period beginning on December 1, 2014 through November 29, 2019 with the cumulative total return of the S&P/TSX Composite Index and the S&P/TSX SmallCap Index for the same period.

Our executive compensation is generally linked to initiatives completed year-over-year and our financial performance. Trends in our returns to Shareholders are not generally determinative of total compensation to our NEOs.

Outstanding Share-based Awards and Option-based Awards

The following table states the name of each NEO, the number of options available for exercise, the exercise price and expiration date for each option as at November 30, 2019.

| | Option-based Awards(1) | Share-based Awards(2) |

Name and Principal Position | Number of securities underlying unexercised options(3) (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the- money options(4) ($) | Shares or units of Shares that have not vested(5) ($) | Market or payout value of share- based awards that have not vested(6) ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

Garnet Dawson Chief Executive Officer and Director | 260,000 350,000 350,000 150,000 100,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 20,800 122,500 — 60,000 42,000 | 55,389 | 58,158 | — |

Pat Obara Secretary and

Chief Financial Officer and former Director | 225,000 300,000 350,000 150,000 100,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 18,000 105,000 — 60,000 42,000 | 45,670 | 47,954 | — |

Paulo Valle Pereira Neto President | 90,000 135,000 150,000 150,000 100,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 7,200 47,250 — 60,000 42,000 | 37,166 | 39,024 | — |

Notes:

| | (1) | Stock Options vesting as to 25% immediately and on each day which is 6, 12 and 18 months from the date of grant. 977,500 of the Options held by Mr. Dawson have vested, 881,250 of the Options held by Mr. Obara have vested, and 523,750 of the Options held by Mr. Pereira have vested. |

| | (2) | The "Share-based Awards" consist of RSRs. Each RSR entitles the holder to receive one common share upon the expiry of the restricted periods applicable to the RSRs, as may be determined by the board of directors of the Corporation, during the holder's continual service with the Corporation. |

| | (3) | Each stock option entitles the holder to one common share upon exercise. |

| | (4) | The "Value of Unexercised in-the-Money Options" is calculated on the basis of the difference between the closing price of $1.13 of the Corporation's common shares on the TSX on November 30, 2019 and the exercise price of the Options. |

| | (5) | The RSRs granted to Mr. Dawson, Mr. Obara and Mr. Pereira will vest as to 50% six months from the date of grant, and 50% twelve months from the date of grant, in accordance with the expiry of the restricted periods applicable to such RSRs as determined by the board of directors of the Corporation. |

| | (6) | The market value of share-based awards that have not vested is calculated using the closing price of the Corporation's common shares on the TSX on November 22, 2019, being the date prior to the date of grant of the RSRs. During the year ended November 30, 2019, all RSRs that vested were paid out during the year. |

Incentive Plan Awards – Value Vested or Earned During the Year for NEOs

The table below discloses the aggregate dollar value that would have been realized by a NEO if stock options under option-based awards had been exercised on the vesting date, as well as the aggregate dollar value realized upon vesting of share-based awards by a NEO.

Name and Principal Position | Option-based awards – value vested during the year(1) ($) | Share-based awards – value vested during the year ($) |

Garnet Dawson Chief Executive Officer and Director | 126,259 | 47,221 |

Pat Obara Secretary and Chief Financial Officer nd Former Director | 109,524 | 39,340 |

Paulo Valle Pereira Neto President | 47,066 | — |

Notes:

| | (1) | Value vested during the year is calculated by subtracting the exercise price of the option (being the market price of the Corporation's shares on the award date) from the market price of the Corporation's shares on the date the option vested (being the closing price of the Corporation's shares on the TSX on the last trading day prior to the vesting date). |

The following table provides details on compensation securities that were exercised by the NEOs of the Corporation during the most recently completed financial year.

Name and Principal Position | Type of Compensation Security | Number of Underlying Securities Exercised | Exercise Price Per Security ($) | Date of Exercise | Closing Price per Security on Date of Exercise ($) | Difference Between Exercise Price and Closing Price on Date of Exercise ($) | Total Value on Exercise Date ($) |

Garnet Dawson Chief Executive Officer and Director | RSR RSR | 30,000 30,000 | 0.78 0.78 | 06-06-2019 11-27-2019 | 0.86 1.11 | 0.08 0.33 | 25,800 33,300 |

Pat Obara Secretary and Chief Financial Officer and Former Director | RSR RSR | 25,000 25,000 | 0.78 0.78 | 06-06-2019 11-27-2019 | 0.86 1.11 | 0.08 0.33 | 21,500 27,750 |

Paulo Valle Pereira Neto President | — | — | — | — | — | — | — |

Pension Plan Benefits

The Corporation does not presently provide any defined benefit or pension plan to its directors, executive officers, employees or consultants.

Termination and Change of Control Benefits and Employment Agreements

The Corporation and its subsidiaries do not have any employment, consulting or management agreements with any of the Corporation's NEOs. Neither the Corporation nor its subsidiaries have a contract agreement, plan or arrangement that provides for payments to a NEO following or in connection with any change of control of the Corporation or any of its subsidiaries, severance, termination or constructive dismissal.

Compensation of Directors

The Corporation's directors are entitled to receive remuneration for serving on the board of directors as the board of directors or the Shareholders may from time to time determine, and the Corporation is required to reimburse each director for reasonable expenses that he or she may incur in and about the business of the Corporation. The Corporation's directors may award special remuneration, without confirmation by the Shareholders, to any director undertaking any special services on the Corporation's behalf other than routine work ordinarily required of a director, and such remuneration will be in addition to any other remuneration that such director may be entitled to receive. Unless the Shareholders determine otherwise, the board of directors may pay a gratuity or pension or allowance on retirement to any director who has held any salaried office or place of profit with the Corporation and may make contributions to any fund and pay premiums for the purchase or provision of any such gratuity, pension or allowance.

No director compensation was paid to directors who are members of management of the Corporation.

The following table provides information regarding compensation paid to the directors in our most recently completed financial year.

Name | Fees earned ($) | Share- based awards(1) ($) | Option- based awards(2) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total(3) ($) |

Amir Adnani | 120,000 | — | 273,965 | — | — | 139,600(3) | 533,565 |

David Kong | 9,750 | 3,886 | 31,049 | — | — | — | 44,685 |

Gloria Ballesta | 7,800 | 3,310 | 16,438 | — | — | — | 27,547 |

Hon. Herb Dhaliwal | 9,613 | 3,446 | 16,438 | — | — | — | 29,496 |

Mario B. Garnero | 64,837 | 3,150 | 16,438 | — | — | — | 84,424 |

Notes:

| | (1) | RSRs were awarded on November 25, 2019 at a price of $1.05 and are subject to restricted periods schedule which is 6 and 12 months from the date of grant. The fair value of the RSRs at the grant date is calculated using the closing price of the Corporation’s common shares on the TSX on November 25, 2019, being the date prior to the date of grant. |

| | (2) | The Black-Scholes option valuation model has been used to determine the fair value on the date of grant. The Black-Scholes option valuation is determined using the expected life of the stock option, expected volatility of the common share price, expected dividend yield and risk free interest rate. The Black-Scholes pricing model was used to estimate the fair value as it is the most accepted methodology. The inputs used by the Corporation in the Black-Scholes pricing model for options granted during the year ended November 30, 2019 were: a risk free interest rate of 1.38%; expected life of 2.88 years; and annualized volatility of 57.35%. The Options were awarded on August 7, 2019, and expires on August 7, 2024. |

| | (3) | Includes an accrual of $130,000 pertaining to a bonus for services provided for the 2019 financial year. On December 1, 2018 $130,000 cash bonus was paid to Mr. Adnani for the year ended November 30, 2018. |

| | (4) | Before deduction of applicable taxes. |

Outstanding Share-based Awards and Option-based Awards

The following table states the name of each director, the number of options available for exercise, the exercise price and expiration date for each option as at November 30, 2019.

| | Option-based Awards(1) | Share-based Awards |

Name and Principal Position | Number of securities underlying unexercised options(2) (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the- money options(3) ($) | Shares or units of Shares that have not vested(4) ($) | Market or payout value of share- based awards that have not vested(5) ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

Amir Adnani | 750,000 850,000 475,000 125,000 150,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 60,000 297,500 — 50,000 63,000 | N/A | N/A | N/A |

David Kong | 85,000 115,000 125,000 100,000 100,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 6,800 40,250 — 40,000 42,000 | 3,701 | 3,886 | N/A |

Gloria Ballesta | 45,000 65,000 75,000 35,000 50,000 | 1.05 0.78 1.69 0.73 0.71 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 06-Feb-20 | 3,600 22,750 — 14,000 21,000 | 3,152 | 3,310 | N/A |

Hon. Herb Dhaliwal | 45,000 65,000 75,000 75,000 | 1.05 0.78 1.69 0.73 | 07-Aug-24 26-Nov-23 22-Jul-22 01-Apr-21 | 3,600 22,750 — 30,000 | 3,282 | 3,446 | N/A |

Mario B. Garnero | 45,000 30,000 100,000 | 1.05 0.78 1.21 | 07-Aug-24 26-Nov-23 29-Mar-23 | 3,600 10,500 — | 3,000 | 3,150 | N/A |

Notes:

| | (1) | Stock Options vesting as to 25% immediately and on each day which is 6, 12 and 18 months from the date of grant. As at November 30, 2019, 1,575,000 of the Options held by Mr. Adnani have vested, 432,500 of the Options held by Mr. Kong have vested, 191,250 of the Options held by Ms. Ballesta have vested, 210,000 of the Options held by Hon. Dhaliwal have vested and 133,750 of the Options held by Mr. Mario B. Garnero have vested. |

| | (2) | Each stock option entitles the holder to one common share upon exercise. |

| | (3) | The "Value of unexercised in-the-money options" is calculated on the basis of the difference between the closing price of $1.13 of the Corporation's common shares on the TSX on November 30, 2019 and the exercise price of the Options. |

| | (4) | The RSRs granted to Mr. Kong, Mr. Dhaliwal, Ms. Ballesta and Mr. Garnero will vest as to 50% six months from the date of grant, and 50% twelve months from the date of grant, in accordance with the expiry of the restricted periods applicable to such RSRs as determined by the board of directors of the Corporation. |

| | (5) | The market value of share-based awards that have not vested is calculated using the closing price of the Corporation's common shares on the TSX on November 22, 2019, being the date prior to the date of grant of the RSRs. During the year ended November 30, 2019, there were no RSRs that vested, but were not paid out during the year. |

Incentive Plan Awards – Value Vested or Earned During the Year for Directors

The table below discloses the aggregate dollar value that would have been realized by a director if stock options under option-based awards had been exercised on the vesting-date, as well as the aggregate dollar value realized upon vesting of share-based awards by a director.

Name and Principal Position | Option-based awards – value vested during the year(1) ($) | Share-based awards – value vested during the year ($) |

Amir Adnani Director (Chairman) | 321,803 | — |

David Kong Director | 41,587 | 80 |

Gloria Ballesta Director | 23,020 | 68 |

Hon. Herb Dhaliwal Director | 23,020 | 71 |

Mario B. Garnero Director | 25,918 | 65 |

Notes:

| | (1) | Value vested during the year is calculated by subtracting the exercise price of the option (being the market price of the Corporation's shares on the award date) from the market price of the Corporation's shares on the date the option vested (being the closing price of the Corporation's shares on the TSX on the last trading day prior to the vesting date). |

The following table provides details on the compensation securities exercised by the directors of the Corporation during the most recently completed financial year.

Name and Principal Position | Type of Compensation Security | Number of Underlying Securities Exercised | Exercise Price Per Security ($) | Date of Exercise | Closing Price per Security on Date of Exercise ($) | Difference Between Exercise Price and Closing Price on Date of Exercise ($) | Total Value on Exercise Date ($) |

Amir Adnani Director (Chairman) | Warrants(1) | 550,000 | 0.75 | 12-24-2018 | 0.80 | 0,05 | 440,000 |

David Kong Director | Options | 50,000 | 0.75 | 10-16-2019 | 1.04 | 0.29 | 52,000 |

Gloria Ballesta Director | — | — | — | — | — | — | — |

Hon. Herb Dhaliwal Director | Options | 25,000 | 0.71 | 06-21-2019 | 0.91 | 0.20 | 22,750 |

Mario B. Garnero Director | — | — | — | — | — | — | — |

Notes:

| | (1) | Warrants held by Amir Adnani Corp. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth the securities authorized for issuance under compensation plans as of November 30, 2019, the end of the Corporation's most recently completed financial year.

Plan Category | Class of Securities | Number of securities to be issued upon exercise of outstanding awards

(#) | Weighted- average exercise price/value of outstanding awards

($) | Number of securities remaining available for future issuance under equity compensation plan

(#) |

Equity compensation plans approved by securityholders(1) | Options RSRs | 12,463,000(2) 207,488(3) | $1.16 $1.05 | 2,076,155 2,352,512 |

Equity compensation plans not approved by security holders | Bellhaven Options | 26,738(4) | $1.00 | Nil |

TOTAL | | 12,697,226 | $1.15 | 4,428,667 |

Notes:

| | (1) | The Shareholders of the Corporation most recently approved the Option Plan on May 24, 2018, and the Shareholders of the Corporation most recently approved certain amendments to the Option Plan and the Restricted Share Plan on May 23, 2019. |

| | (2) | The maximum number of common shares reserved for issuance under the Option Plan is 10% of the outstanding common shares of the Corporation on a rolling basis. |

| | (3) | The maximum number of common shares reserved for issuance under the Restricted Share Plan is 2,700,000 common shares. |

| | (4) | Includes 26,738 shares of the Corporation issuable pursuant to the exercise of 106,952 options having an exercise price of $0.25 and a remaining term of 1.65 years assumed by the Corporation in connection with the acquisition of Bellhaven Copper & Gold Inc. on May 30, 2017 and outstanding on November 30, 2019, which were not issued pursuant to, and are not subject to the terms and conditions of, the Corporation's Option Plan. |

Stock Option Plan

The board of directors of the Corporation first implemented the Option Plan on January 28, 2011, as amended and restated on October 30, 2012, October 11, 2013, and October 18, 2016. On April 5, 2019, the board of directors of the Corporation adopted certain further amendments to the Option Plan. The Option Plan was originally adopted by the Shareholders of the Corporation on August 31, 2011 and most recently, the Option Plan, as amended and restated, was ratified and approved by the Shareholders on May 23, 2019. In accordance with the policies of the TSX, a rolling plan requires the approval of the Shareholders every three years.

The purpose of the Option Plan is to attract, retain and motivate qualified directors, executives, employees and consultants and to reward them for their contributions toward the goals and success of the Corporation. Pursuant to the terms of the Option Plan, the board of directors may designate directors, senior officers, employees and consultants of the Corporation eligible to receive Options to acquire such numbers of common shares as the board of directors may determine, each Option so granted being for a term specified by the board of directors up to a maximum of five years from the date of grant. The maximum number of common shares reserved for issuance for Options granted under the Option Plan at any time is 10% of the issued and outstanding common shares in the capital of the Corporation. As of the date hereof, the Corporation had 145,972,554 common shares outstanding and may issue up to a maximum of 14,597,255 common shares pursuant to the Option Plan.

In accordance with its terms, in no case may the grant of Options under the Option Plan result in: (i) the grant to any one individual, within any 12-month period (unless the Corporation has obtained disinterested Shareholder approval) of Options reserving for issuance a number of common shares exceeding in the aggregate 5% of the issued and outstanding common shares; (ii) the grant to all persons engaged by the Corporation to provide investor relations activities, within any twelve month period, of Options reserving for issuance a number of common shares exceeding in the aggregate 2% of the issued and outstanding common shares; or (iii) the grant to any one consultant, in any twelve month period, of Options reserving for issuance a number of common shares exceeding in the aggregate 2% of the issued and outstanding common shares. The Option Plan limits insider participation such that the number of common shares: (i) issuable to Insiders (as defined in the Option Plan) at any time, under all security based compensation arrangements of the Corporation does not exceed 10% of the issued and outstanding common shares of the Corporation; and (ii) issued to Insiders (as defined in the Option Plan) within a twelve-month period, under all security based compensation arrangements of the Corporation does not exceed 10% of the issued and outstanding common shares of the Corporation. As of the date hereof, 11,214,500 Options are outstanding under the Option Plan (representing 7.7% of the Corporation's outstanding common shares), and a further 3,337,755 Options are available for grant under the Option Plan (representing 2.3% of the Corporation's outstanding common shares).

The price at which a holder of Options (an "Optionholder") may purchase common shares upon the exercise of an Option is determined by the board of directors, provided that such exercise price cannot be less than the closing price of the common shares on the last trading day prior to the date on which such Options are granted. Options granted under the Option Plan may contain vesting provisions at the discretion of the board of directors of the Corporation. If an Option expires during one of the Corporation's self-imposed blackout periods, such Option will automatically be extended for ten business days following expiration of the blackout period.

Subject to certain exceptions, an Option will not be exercisable unless the Optionholder remains an eligible director, senior officer, employee or consultant continuously throughout the term of such Option. Should the Optionholder cease to be an eligible director, senior officer, employee or consultant of the Corporation during the term of an Option for any reason other than death or cause, the Option will be exercisable for a maximum of ninety days thereafter. If an Optionholder dies during the term of an Option, such Option will be exercisable by the executor or administrator of the Optionholder's estate for a maximum of one year following such death. Should the Optionholder cease to be an eligible director, senior officer, employee, consultant or management company employee of the Corporation or any of its subsidiaries as a result of having been dismissed from any such position for cause, all unexercised Options of such Optionholder under the Option Plan shall immediately become terminated and shall lapse, notwithstanding the original term of the Option granted to such Optionholder under the Option Plan. In the event of a proposal of a change of control, all Options granted shall immediately vest provided that such vesting is not in violation of the current policies of the TSX. Upon consummation of a change of control, the Option Plan shall terminate and any unexercised Options shall also terminate.

In no event may the Option under the Option Plan be assigned or transferred, except to the extent that certain rights may pass to a legal representative upon death of an Optionee.

The Option Plan provides for: (i) a "cashless exercise" feature that permits an Optionholder to elect to deliver a copy of irrevocable instructions to a broker to sell the common shares of the Corporation otherwise deliverable upon the exercise of the Options and to deliver to the Corporation an amount equal to the exercise price of the Options against delivery of the common shares of the Corporation to settle the applicable trade; and (ii) a "net exercise" feature that permits an Optionholder to elect to exercise an Option or a portion thereof by surrendering such Option or a portion thereof in consideration for the Corporation delivering common shares of the Corporation to the Optionee but withholding the minimum number of common shares otherwise deliverable in respect of the Options that are needed to pay for the exercise price of such Options.

The board of directors of the Corporation may at any time, in its sole and absolute discretion and without the approval of Shareholders, amend, suspend, terminate or discontinue the Option Plan and may amend the terms and conditions of any grants thereunder, subject to: (a) any required approval of any applicable regulatory authority or the TSX; and (b) approval of our Shareholders as required by the rules of the TSX or applicable law, provided that Shareholder approval shall not be required for the following amendments and the board of directors of the Corporation may make changes which may include but are not limited to:

| | (i) | amendments of a "housekeeping nature"; |

| | (ii) | any amendment for the purpose of curing any ambiguity, error or omission in the Option Plan or to correct or supplement any provision of the Option Plan that is inconsistent with any other provision of the Option Plan; |

| | (iii) | an amendment which is necessary to comply with applicable law or TSX requirements; |

| | (iv) | amendments respecting administration and eligibility for participation under the Option Plan; |

| | (v) | changes to terms and conditions on which Options may be or have been granted pursuant to the Option Plan, including changes to the vesting provisions and terms of any Options; |

| | (vi) | amendments which alter, extend or accelerate the terms of vesting applicable to any Options granted pursuant to the Option Plan; and |

| | (vii) | changes to the termination provisions of an Option or the Option Plan which do not entail an extension beyond the original fixed term. |

Stock Option Burn Rate

For the years ended November 30, 2019, 2018 and 2017, the Corporation's annual burn rate under the Option Plan was 1.95%, 2.61% and 3.10%, respectively.

Financial Year | Number of options awarded under Plan during financial year (a) | Weighted average number of common shares outstanding for financial year (b) | Burn Rate ((a)/(b)) |

2019 | 2,691,000 | 137,873,334 | 1.95% |

2018 | 3,520,000 | 135,074,277 | 2.61% |

2017 | 3,843,000 | 124,100,317 | 3.10% |

Restricted Share Plan

The board of directors of the Corporation implemented the Restricted Share Plan on November 27, 2018, and was approved by the Shareholders of the Corporation on May 23, 2019. In accordance with the policies of the TSX, increases in a plan maximum will be subject to Shareholder approval.

The purpose of the Restricted Share Plan is to attract, retain and motivate qualified employees, directors, management, employees and consultants of the Corporation and the Designated Affiliates (as defined in the Restricted Share Plan) and to reward them for their contributions toward the goals and success of the Corporation. Pursuant to the terms of the Restricted Share Plan, the board of directors may designate directors, management, employees and consultants of the Corporation and the Designated Affiliates eligible to receive RSRs (an "eligible Participant") to acquire such numbers of common shares as the board of directors may determine, each RSR so granted being for a term specified by the board of directors up to a maximum of three years from the date of grant. The Restricted Share Plan provides that RSRs may be granted by the Board to eligible Participants as a discretionary payment in consideration of past services to the Company. Each RSR entitles the holder to receive one common share of the Corporation without payment of additional consideration on the later of: (i) the end of a restricted period of time as determined by the board of directors of the Corporation (a "Restricted Period"); and (ii) a date determined by an eligible Participant that is after the Restricted Period (a "Deferred Payment Date"). The maximum number of common shares reserved for issuance for RSRs granted under the Restricted Share Plan is 2,700,000 common shares.

In accordance with its terms, in no case may the grant of RSRs under the Restricted Share Plan result in the grant to any director, who is not also an employee, of RSRs for issuance exceeding $100,000 in any fiscal year and may only be granted in lieu of their cash based annual retainers. The Restricted Share Plan limits insider participation such that the number of common shares: (i) issuable to Insiders (as defined in the Restricted Share Plan), at any time, under all security based compensation arrangements of the Corporation does not exceed 10% of the issued and outstanding common shares of the Corporation; and (ii) issued to Insiders (as defined in the Restricted Share Plan), within a twelve-month period, under all security based compensation arrangements of the Corporation, does not exceed 10% of the issued and outstanding common shares of the Corporation. As of the date hereof, 347,488 RSRs have been granted, representing 0.2% of the current outstanding common shares of the Corporation, and 2,352,512 RSRs remain outstanding under the Restricted Share Plan, representing 2% of the current outstanding common shares of the Corporation.

Subject to certain exceptions, RSRs will not be issuable unless the RSRs holder remains an eligible director, senior officer, employee or consultant continuously throughout the Restricted Period of the RSRs. Should the RSR holder cease to be an eligible director, senior officer, employee or consultant of the Corporation during the Restricted Period for any reason other than death, the RSRs shall immediately terminate. If an RSR holder dies during the term of a RSRs, such RSRs will be immediately issuable by the Corporation. Except as otherwise may be expressly provided for under the Restricted Share Plan or pursuant to a will or by the laws of descent and distribution, no RSR and no other right or interest of an RSR holder is assignable or transferrable.

If a RSR holder holds RSRs that are subject to a Restricted Period, the board of directors of the Corporation will have the discretion to pay the RSR holder cash equal to any cash dividends declared on the common shares of the Corporation that would be payable on the common shares issuable in accordance with the RSRs at the time such dividends are ordinarily paid to holders of the common shares of the Corporation. The Corporation, at its discretion, may pay such cash dividends, if any, to those RSR holders that hold RSRs that are no longer subject to a Restricted Period, but are exercisable at a Deferred Payment Date.

For eligible employees, vesting upon a change of control contains a double trigger provision. For all other RSR holders, upon a change of control, all their outstanding RSRs will immediately vest, and the common shares underlying the RSRs will be immediately issuable by the Corporation. In the event any Restricted Period expires or a Deferred Payment Date occurs during a self-imposed blackout period, such Restricted Period or Deferred Payment Date will be automatically extended for 48 hours after such black out period has expired.

The board of directors of the Corporation may from time to time in their absolute discretion amend, modify and change the provisions of the Restricted Share Plan without Shareholder approval, provided that any amendment, modification or change to the provisions of the Restricted Share Plan which would:

| | (i) | materially increase the benefits under the Restricted Share Plan; |

| | (ii) | increase the number of common shares of the Corporation which may be issued pursuant to the Restricted Share Plan; |

| | (iii) | make any amendment which increases the Non-Employee Director Participation Limit as set out in the Restricted Share Plan; |

| | (iv) | materially modify the requirements as to eligibility for participation in the Restricted Share Plan; or |