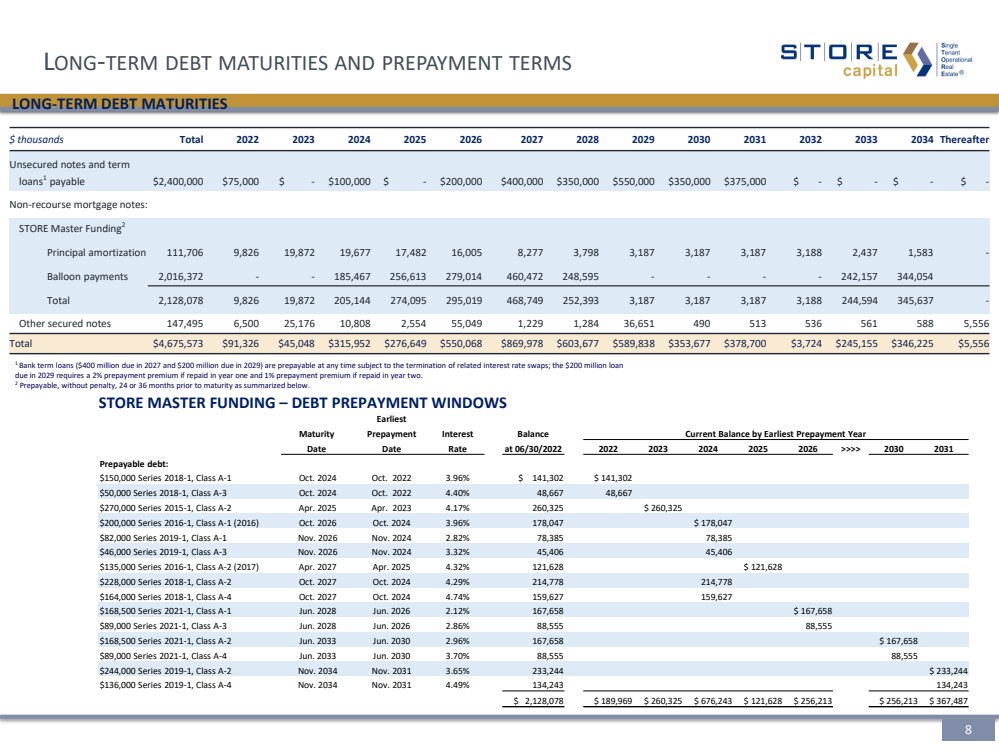

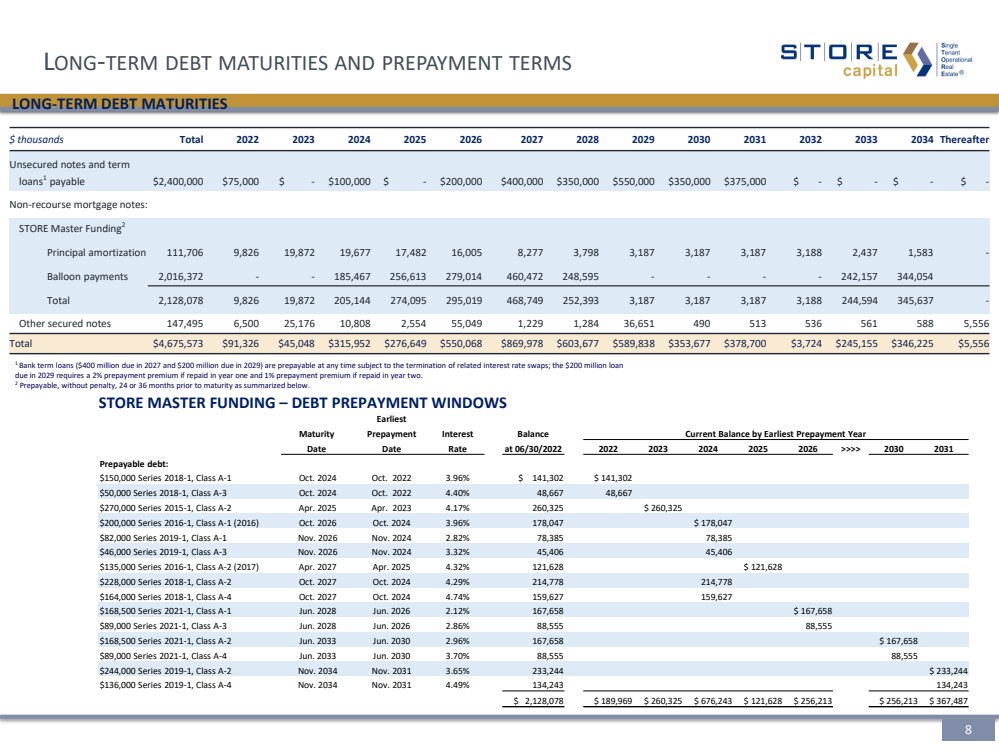

| $ thousands Total 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter Unsecured notes and term loans 1 payable $2,400,000 $75,000 $ - $100,000 $ - $200,000 $400,000 $350,000 $550,000 $350,000 $375,000 $ - $ - $ - $ - Non - recourse mortgage notes: STORE Master Funding 2 Principal amortization 111,706 9,826 19,872 19,677 17,482 16,005 8,277 3,798 3,187 3,187 3,187 3,188 2,437 1,583 - Balloon payments 2,016,372 - - 185,467 256,613 279,014 460,472 248,595 - - - - 242,157 344,054 Total 2,128,078 9,826 19,872 205,144 274,095 295,019 468,749 252,393 3,187 3,187 3,187 3,188 244,594 345,637 - Other secured notes 147,495 6,500 25,176 10,808 2,554 55,049 1,229 1,284 36,651 490 513 536 561 588 5,556 Total $4,675,573 $91,326 $45,048 $315,952 $276,649 $550,068 $869,978 $603,677 $589,838 $353,677 $378,700 $3,724 $245,155 $346,225 $5,556 Earliest Maturity Prepayment Interest Balance Current Balance by Earliest Prepayment Year Date Date Rate at 06/30/2022 2022 2023 2024 2025 2026 >>>> 2030 2031 Prepayable debt: $150,000 Series 2018 - 1, Class A - 1 Oct. 2024 Oct. 2022 3.96% $ 141,302 $ 141,302 $50,000 Series 2018 - 1, Class A - 3 Oct. 2024 Oct. 2022 4.40% 48,667 48,667 $270,000 Series 2015 - 1, Class A - 2 Apr. 2025 Apr. 2023 4.17% 260,325 $ 260,325 $200,000 Series 2016 - 1, Class A - 1 (2016) Oct. 2026 Oct. 2024 3.96% 178,047 $ 178,047 $82,000 Series 2019 - 1, Class A - 1 Nov. 2026 Nov. 2024 2.82% 78,385 78,385 $46,000 Series 2019 - 1, Class A - 3 Nov. 2026 Nov. 2024 3.32% 45,406 45,406 $135,000 Series 2016 - 1, Class A - 2 (2017) Apr. 2027 Apr. 2025 4.32% 121,628 $ 121,628 $228,000 Series 2018 - 1, Class A - 2 Oct. 2027 Oct. 2024 4.29% 214,778 214,778 $164,000 Series 2018 - 1, Class A - 4 Oct. 2027 Oct. 2024 4.74% 159,627 159,627 $168,500 Series 2021 - 1, Class A - 1 Jun. 2028 Jun. 2026 2.12% 167,658 $ 167,658 $89,000 Series 2021 - 1, Class A - 3 Jun. 2028 Jun. 2026 2.86% 88,555 88,555 $168,500 Series 2021 - 1, Class A - 2 Jun. 2033 Jun. 2030 2.96% 167,658 $ 167,658 $89,000 Series 2021 - 1, Class A - 4 Jun. 2033 Jun. 2030 3.70% 88,555 88,555 $244,000 Series 2019 - 1, Class A - 2 Nov. 2034 Nov. 2031 3.65% 233,244 $ 233,244 $136,000 Series 2019 - 1, Class A - 4 Nov. 2034 Nov. 2031 4.49% 134,243 134,243 $ 2,128,078 $ 189,969 $ 260,325 $ 676,243 $ 121,628 $ 256,213 $ 256,213 $ 367,487 L ONG - TERM DEBT MATURITIES AND PREPAYMENT TERMS STORE MASTER FUNDING – DEBT PREPAYMENT WINDOWS LONG - TERM DEBT MATURITIES 1 Bank term loans ($400 million due in 2027 and $200 million due in 2029) are prepayable at any time subject to the termination of related interest rate swaps; the $200 million loan due in 2029 requires a 2% prepayment premium if repaid in year one and 1% prepayment premium if repaid in year two. 2 Prepayable, without penalty, 24 or 36 months prior to maturity as summarized below .. .. 8 |