ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

There are not and have not been any disagreements between the Company and its accountants on any matter of accounting principles, practices or financial statement disclosure. On December 17, 2012 the Board of Directors dismissed Peter Messineo, CPA, as our registered public accountants. The Board elected Anton & Chia, LLP, Newport Beach CA. as our auditor. Prior to Board approval, we had not consulted with Anton & Chia, LLP on any accounting or audit matters.

Item 9A(T). Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

We conducted an evaluation, under the supervision and with the participation of management, including our chief executive officer (our principal executive officer principal financial officer and principle accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this annual report.

Based on this evaluation, our chief executive officer (our principal executive officer principal financial officer and principal accounting officer) concluded that as of March 31, 2014 our disclosure controls and procedures were not effective. Our procedures were designed to ensure that the information relating to our company required to be disclosed in our SEC reports is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms, and is accumulated and communicated to our management, including our chief executive officer, as appropriate to allow for timely decisions regarding required disclosure. Management is currently evaluating the current disclosure controls and procedures in place to see where improvements can be made.

The determination that our disclosure of controls and procedures were not effective as of March 31, 2014 are a result of:

| | 1. | Insufficient segregation of duties due to the limited size of our staff and budget; and |

| | 2. | No independent audit committee oversight of the company's external financial reporting and internal control over financial reporting; and |

Continuing Remediation Efforts to address deficiencies in Company's Internal Control over Financial Reporting

Once the Company is engaged in a business of merit and has sufficient personnel available, then our Board of Directors, in particular and in connection with the aforementioned deficiencies, will establish the following remediation measures:

| | 1. | Our Board of Directors will nominate an audit committee or a financial expert on our Board of Directors in the next fiscal year. |

| | 2. | We will appoint additional personnel to assist with the preparation of the Company's financial reporting. |

Changes in Internal Control Over Financial Reporting

There were no changes (including corrective actions with regard to significant deficiencies or material weaknesses) in our internal controls over financial reporting that occurred during the fiscal quarter ended March 31, 2014 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Management’s report on internal control over financial reporting pursuant to section 404 of the US Sarbanes-Oxley Act

The Board of Management of Greentech Mining International, Inc. (the Company) is responsible for establishing and maintaining an adequate system of internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the US Securities Exchange Act). Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of our financial reporting for external purposes in accordance with the United States Generally Accepted Accounting Principles (US GAAP) Standards.

Internal control over financial reporting includes maintaining records that, in reasonable detail, accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected on a timely basis. Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that a misstatement of our financial statements would be prevented or detected.

The Board of Management conducted an assessment of the Company’s internal control over financial reporting based on the “Internal Control-Integrated Framework” established by the Committee of Sponsoring Organizations of the Treadway Commission (COSO 1992). Based on that assessment, the Board of Management concluded that, as of March 31, 2014, the Company’s internal control over financial reporting is considered not effective.

The effectiveness of the Company’s internal control over financial reporting as of March 31, 2014, has not been audited by Anton &Chia, LLP, an independent registered public accounting firm.

Board of Management

March 31, 2014.

ITEM 9B. OTHER INFORMATION

In our fiscal year ended March 31, 2014, we had no events that were required to be reported on Form 8-K that were not filed to date.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following individuals currently serve as our executive officers and directors:

| Name | Age | Positions |

| | | |

| Matthew Neher | 50 | Director, CEO, Treasurer, Secretary |

| | |

Matthew Neher

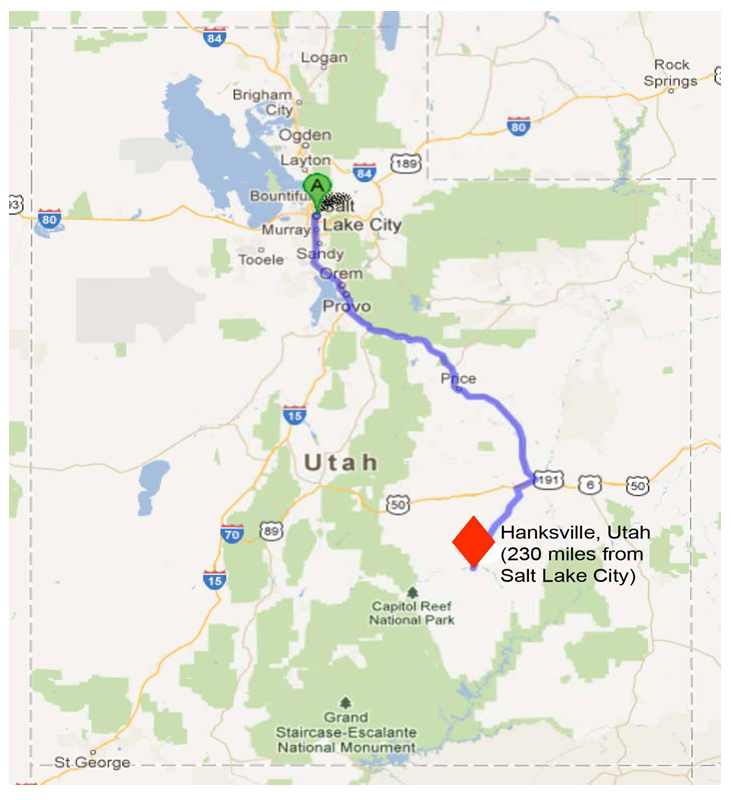

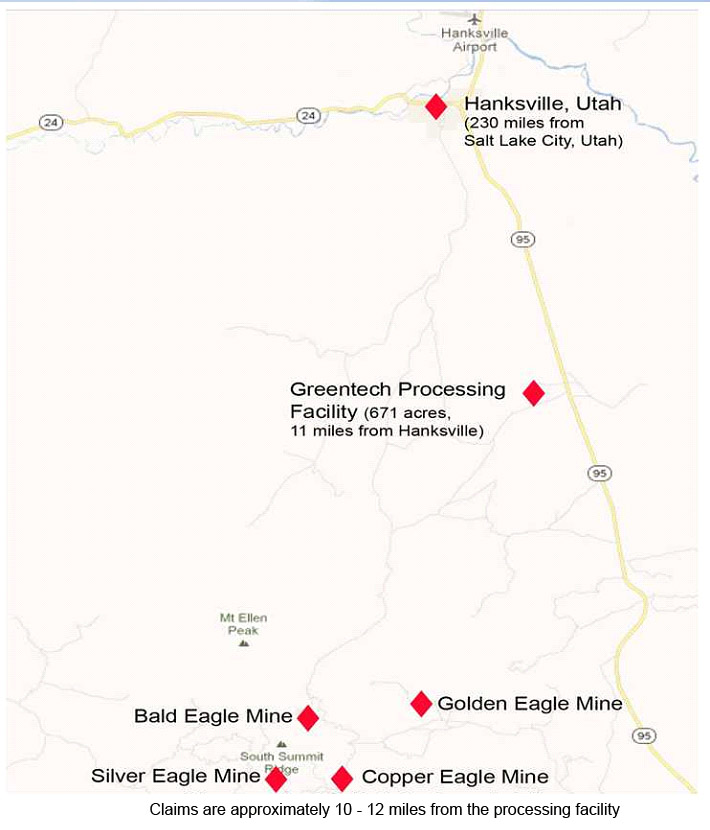

Serves as Chief Executive Officer, President, Secretary, Treasurer and director of the Company since June 26, 2012. Mr. Neher is also founder and Chief Executive Officer of Greentech Mining Inc., since 2010 and Greentech Mining Utah, LLC since 2011. Mr. Neher has focused on all aspects of the mining industry for the past 3 years with hands on experience, working with seasoned experts in all areas of permitting and environmental issues, process engineering, mineralogy, ore studies, economic geology, mine engineering, circuit design and implementation. Mr. Neher has extensive experience working with Local, State and Federal Government agencies and has secured multiple mining permits in the State of Utah. The permits in Utah have been issued for the Golden Eagle Placer Mine and the Greentech processing facility near Hanksville, Utah. Mr. Neher has a well-rounded knowledge base to support green mining technology implementation for sustainable mining and processing. Mr. Neher is a serial entrepreneur and seasoned executive with more than 15 years of experience in corporate governance and business development and from 2008 through 2010 used his expertise to consult start-up companies. Prior to consulting companies and co‐founding the Greentech Mining companies, Mr. Neher was Vice President of Wherify Wireless from 1997 through 2008.. Having led the teams that successfully launched products and services in over 19 countries, Mr. Neher has an extensive knowledge base that includes business development, sales and marketing, channel management, contract manufacturing and in country logistics.Mr. Neher has extensive experience in developing new business opportunities, including the fostering of strategic partnerships and relationships in the emerging technology markets.

Timothy J. Neher

Founder, President, Secretary, Treasurer and sole director of the Company from its founding on February 6, 2012 through June 26, 2012 when Mr. Neher resigned his positions President, Secretary, Treasurer and remained on the Board of Directors. Mr. Neher is the founding partner of Accelerated Venture Partners, LLC, a private venture capital firm based in Foster City, California, and has over 20 years of experience in connection with the provision of debt and equity financing, mergers and public offering transactions. Timothy has been on the Board of Directors for Virolab, Inc., a public reporting company since 2010 and the acting Chief Financial Officer, Treasurer and a Director of Mikojo, Inc. a public reporting company that has not reported since May of 2011.. Mr. Neher is also Director of Pinpointed Solutions Inc. a private company since 2008, Director of Ipaypod Inc., a private company since 2007 and Director of Internet Card Present, Inc., a private company since 2007. He is also the President, Secretary and sole director of following public reporting companies: Accelerated Acquisitions XVII and XIX. Within the past five years Mr. Neher has been the founder of the following public reporting companies, Accelerated Acquisitions I, II, III, IV, V, X, XI, XII, XIII, XIV, XVI, XVIII, XX, XXI and XXII. Prior to founding Accelerated Venture Partners, Internet Card Present Industries, Pinpointed Solutions and Ipaypod, Timothy was Chairman and Chief Executive Officer of Wherify Wireless, a private to public company from 1999 to 2007.

Matthew Neher and Timothy Neher are brothers and there is a family relationship between our officers and directors. Each director is elected at our annual meeting of stockholders and holds office until the next annual meeting of stockholders, or until his successor is elected and qualified.

Board Committees

Due to the small size of our current Board of Directors, the Board has not established any committees and the full Board fulfills the responsibilities traditionally delegated to an audit committee, compensation committee, nominating committee and/or corporate governance committee. As the Board size grows and the Company increases its level of operations, the Board will consider delegating various responsibilities to committees.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities to file reports of beneficial ownership and changes in beneficial ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all reports filed under Section 16(a). To the Company’s knowledge, based on information provided to the Company, all executive officers, directors and greater than 10% stockholders were in compliance with all applicable Section 16(a) filing requirements in fiscal 2011.

ITEM 11. EXECUTIVE COMPENSATION

The following table summarizes all compensation recorded by us in 2013 for our principal executive officers, each other executive officer serving as such whose annual compensation exceeded $100,000 at March 31, 2014.

None

Outstanding Equity Awards at Fiscal Year-End

The following table provides information concerning unexercised options, stock that has not vested and equity incentive plan awards for each named executive officer outstanding from inception February 6, 2012 through March 31, 2014:

SUMMARY COMPENSATION TABLE

The table below summarizes all compensation awarded to, earned by, or paid to our Officers for all services rendered in all capacities to us for the fiscal periods indicated.

Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Nonqualified Deferred Compensation ($) | | | All Other Compensation ($) | | | Total ($) | |

Matthew Neher (1) | | 2012 | | 0 | | | 0 | | | 0 | | | | 1,750,000 | | | 0 | | | | 0 | | | | 0 | | | 1,750,000 | |

Timothy Neher (2) | | 2012 | | 0 | | | 0 | | | 0 | | | | 0 | | | 0 | | | | 0 | | | | 0 | | | 0 | |

______________

(1) Chairman and Chief Executive Officer

(2) Founder, former Chairman and Chief Executive Officer

Our director and officers have not received monetary compensation since our inception to the date of this prospectus. We currently do not pay any compensation to our director or officer for serving on our board of directors or as management.

STOCK OPTION GRANTS

We currently have 1,750,000 options issued under our 2012 Stock Option Plan which have been granted to key employees, Matthew Neher, All options awarded will vest in equal annual installments over a four year period of the grant. All of the options are exercisable at a purchase price of $.0001 per share.

EMPLOYMENT AGREEMENTS

On September 10, 2012 the Company entered into an employment agreement with Matthew J. Neher that provides, upon completion of two million dollars in financing, the Company shall begin to pay Neher a base salary of $250,000 per year, to be paid at the times and subject to the Company’s standard payroll practices, subject to applicable withholding. Base salary shall be reviewed at least annually, and increased as determined by the Board. So long as Mr. Neher has not been terminated for cause, as defined in the employment agreement, he will be eligible for bonus compensation, payable immediately following completion of the Company’s financial statements for each full fiscal year, commencing with the 2012 fiscal year. Mr. Neher’s annual bonus target shall be 100% of his base salary, as adjusted from time to time, based upon the Company’s achieving 120% of certain financial metrics (“Plan Targets”) to be determined by the Board.

In consideration of the services, the Company agreed to issue a non-qualified option to Mr. Neher to purchase 1,750,000 shares of the Company’s common stock at an exercise price of $0.0001 per share, vesting over a four year period. The stock option shall vest with respect to 6.25% of the total number of shares which are the subject of the option (109,375 shares) three (3) months after the effective date of the agreement, thereafter the remaining shares granted under the option shall vest ratably on a monthly basis (36,458 shares per month) at the end of each month over a 45-month period. Notwithstanding the foregoing, in the event of a closing of a Change of Control transaction, all options from this agreement and others shall immediately vest and become fully exercisable.

If after ninety days of employment Neher is terminated other than for “Cause” or if he resigns as a result of a “Constructive Termination,” then Neher shall be offered, in exchange for a release of all claims, a lump sum severance payment equal to 12 months base salary and a lump sum payment equal to 50% of all bonus payments made in the 12 months prior to the end of employment date, as then determined

Compensation of Directors

We have not established standard compensation arrangements for our directors and the compensation, if any, payable to each individual for their service on our Board will be determined from time to time by our Board of Directors based upon the amount of time expended by each of the directors on our behalf. None of our directors received any compensation for their services.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of March 31, 2013, by: (2)each current directors; each nominee for director, and executive officers of the Company; (ii) all directors and executive officers as a group; and (iii) each shareholder who owns more than five percent of the outstanding shares of the Company's Common Stock. Except as otherwise indicated, the Company believes each of the persons listed below possesses sole voting and investment power with respect to the shares indicated.

The percentages below are calculated based on 41,000,000 shares of our common stock issued and outstanding as of the date of this filing.

| | | Name and Address | | Number of Shares | | | Beneficial Ownership | | Percent of | |

| Title of Class | | of Beneficial Owner | | Owned Beneficially | | | within 60 days | | Class Owned | |

| | | | | | | | | | | |

| Common Stock: | | Novus Aurum Trust | | | 35,000,000 | | | | | | 85.36% | |

| | | 1840 Gateway Drive, Suite 200 Foster City CA, 94404 (3) | | | | | | | | | | |

| | | | | | | | | | | | | |

| Common Stock: | | Matthew Neher (4) | | | 35,000,000 | | | | | | 85.36% | |

| | | | | | | | | | | | | |

| Common Stock: | | Matthew Neher, CEO (5) | | | | | | 765,625 | | | | |

| | | | | | | | | | | | | |

| Common Stock | | Accelerated Venture Partners LLC | | | 6,000,000 | | | | | | 14.63% | |

| | | 1840 Gateway Dr. Suite 200 | | | | | | | | | | |

| | | Foster City, CA 94404 (6) | | | | | | | | | | |

| | | | | | | | | | | | | |

| Common Stock: | | Timothy Neher (7) | | | 6,000,000 | | | | | | 14.63% | |

| | | | | | | | | | | | | |

| All executive officers and directors as a group | | | | | 41,000,000 | | | 765,625 | | | 100% | |

_______________

(1) This table is based upon 41,000,000 shares issued and outstanding as March 31, 2014

(2) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to the shares. Shares of Common Stock subject to options or warrants currently exercisable or exercisable within 60 days are deemed outstanding for computing the percentage of the person holding such options or warrants, but are not deemed outstanding for computing the percentage of any other person.

(3) Shares are owned directly by Novus Aurum Trust. Matthew Neher, is Principal of Novus Aurum Trust and holds voting and dispositive power for these shares.

(4) Matthew Neher is Principal of Novus Aurum Trust and holds voting and dispositive power for these shares.

(5) Matthew Neher is the CEO of the Company and has 1,750,000 vesting stock options over four years.

(6) Shares are owned directly by Accelerated Venture Partners, LLC. Timothy Neher, is Managing Partner of Accelerated Venture Partners and holds voting and dispositive power for these shares.

(7) Timothy Neher is founder and Managing Partner of Accelerated Venture Partners, LLC and holds voting and dispositive power for these shares.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related Transactions

On February 6, 2012, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

On June 26, 2012, Novus Aurum Trust agreed to (“Purchaser”) agreed to acquire 26,500,000 shares of the Company’s common stock par value $0.0001 (the “Shares”) for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 1,500,000 of its 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, Novus Aurum Trust owned 88.33% of the Company’s 30,000,000, issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 11.66% of the total issued and outstanding shares. Simultaneously with the share purchase, Timothy Neher resigned as an officer of the Company effective immediately and remained on the Company’s Board of Directors and the Board appointed and elected Matthew Neher as President, Chief Executive Officer, Secretary, Treasurer and Director of the Company. The Purchaser used its working capital to acquire the Shares. The Purchaser did not borrow any funds to acquire the Shares.

Prior to the purchase of the Shares, the Purchaser was not affiliated with the Company. However, the Purchaser is now deemed an affiliate of the Company as a result of its stock ownership interest in the Company. The purchase of the shares by the Purchaser was completed pursuant to a written Subscription Agreement with the Company. The purchase was not subject to any other terms and conditions other than the sale of the Shares in exchange for the cash payment.

Mr. Timothy Neher, the Company’s Chief Executive Officer prior to June 26, 2012, controls Accelerated Venture Partners, LLC (“AVP”), an entity which has agreed to provide financial advisory services to the Company (outlined below). AVP owns 4,500,000 shares of the Company’s outstanding common stock, representing a 14.51% ownership interest in the Company (collectively, Novus Aurum Trust and AVP own 100% of the Company as there are no other stockholders).

On June 27, 2012 the Company entered into a twelve month Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy Neher that has one other similar agreement within the mining industry. The agreement requires AVP to provide the Company with certain advisory services that include reviewing the Company’s business plan, identifying and introducing prospective financial and business partners, and providing general business advice regarding the Company’s operations and business strategy in consideration of (a) an option granted by the Company to AVP to purchase 1,000,000 shares of the Company’s common stock at a price of $0.0001 per share (the “AVP Option”) (which was immediately exercised by the holder) subject to a repurchase option granted to the Company to repurchase the shares at a price of $0.0001 per share in the event the Company fails to complete funding within twelve months as detailed in the agreement subject to the following milestones:

Milestone 1 – | Company’s right of repurchase will lapse with respect to 60% of the shares upon securing $10 million in available cash from funding; |

| | |

Milestone 2 – | Company’s right of repurchase will lapse with respect to 40% of the Shares upon securing $15 million in available cash (inclusive of any amounts attributable to Milestone 1); |

and (b) cash compensation at a rate of $37,500 per month. The payment of such compensation is subject to Company’s achievement of certain designated milestones, specifically, cash compensation of $600,000 is due consultant upon the achievement of Milestone 1, and $300,000 upon the achievement of Milestone 2. Upon achieving each Milestone, the cash compensation is to be paid to consultant in the amount then due at the rate of $37,500 per month. The total cash compensation to be received by the consultant is not to exceed $900,000 unless Company receives an amount of funding in excess of the amount specified in Milestone 2. If the Company receives equity or debt financing that is an amount less than Milestone 1, in between any of the above Milestones or greater than the above Milestones, the cash compensation earned by the Consultant under this Agreement will be prorated according to the above Milestones. The Company will allow the Consultant to invest up to an additional $5 million in any future debt or equity offering of the Company on the same terms and conditions offered to other participants in such offerings. The Consultant will not be obligated to participate in any such offerings. Accelerated Venture Partners has executed ten consulting agreements with public shell companies it formally controlled and none of the milestones under consulting agreements have been timely achieved. Of the ten consulting services agreements, Accelerated Venture Partners terminated one, one is expired and the company has not elected to terminate the agreement and repurchase the consulting share. Furthermore, the remaining eight companies have either renewed consulting agreements with Accelerated Venture Partners or are under the original consulting agreement.

On September 10, 2012 the Company entered into an employment agreement with Matthew J. Neher that provides, upon completion of two million dollars in financing, the Company shall begin to pay Neher a base salary of $250,000 per year, to be paid at the times and subject to the Company’s standard payroll practices, subject to applicable withholding. Base salary shall be reviewed at least annually, and increased as determined by the Board. So long as Mr. Neher has not been terminated for cause, as defined in the employment agreement, he will be eligible for bonus compensation, payable immediately following completion of the Company’s financial statements for each full fiscal year, commencing with the 2012 fiscal year. Mr. Neher’s annual bonus target shall be 100% of his base salary, as adjusted from time to time, based upon the Company’s achieving 120% of certain financial metrics (“Plan Targets”) to be determined by the Board.

In consideration of the services, the Company agreed to issue a non-qualified option to Mr. Neher to purchase 1,750,000 shares of the Company’s common stock at an exercise price of $0.0001 per share, vesting over a four year period. The stock option shall vest with respect to 6.25% of the total number of shares which are the subject of the option (109,375 shares) three (3) months after the effective date of the agreement, thereafter the remaining shares granted under the option shall vest ratably on a monthly basis (36,458 shares per month) at the end of each month over a 45-month period. Notwithstanding the foregoing, in the event of a closing of a Change of Control transaction, all options from this agreement and others shall immediately vest and become fully exercisable.

If after ninety days of employment Neher is terminated other than for “Cause” or if he resigns as a result of a “Constructive Termination,” then Neher shall be offered, in exchange for a release of all claims, a lump sum severance payment equal to 12 months base salary and a lump sum payment equal to 50% of all bonus payments made in the 12 months prior to the end of employment date, as then determined.

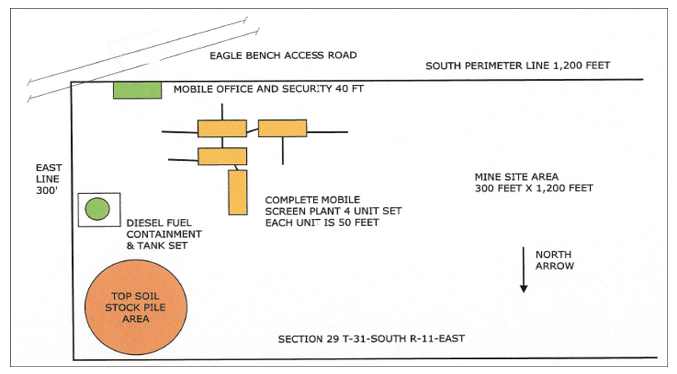

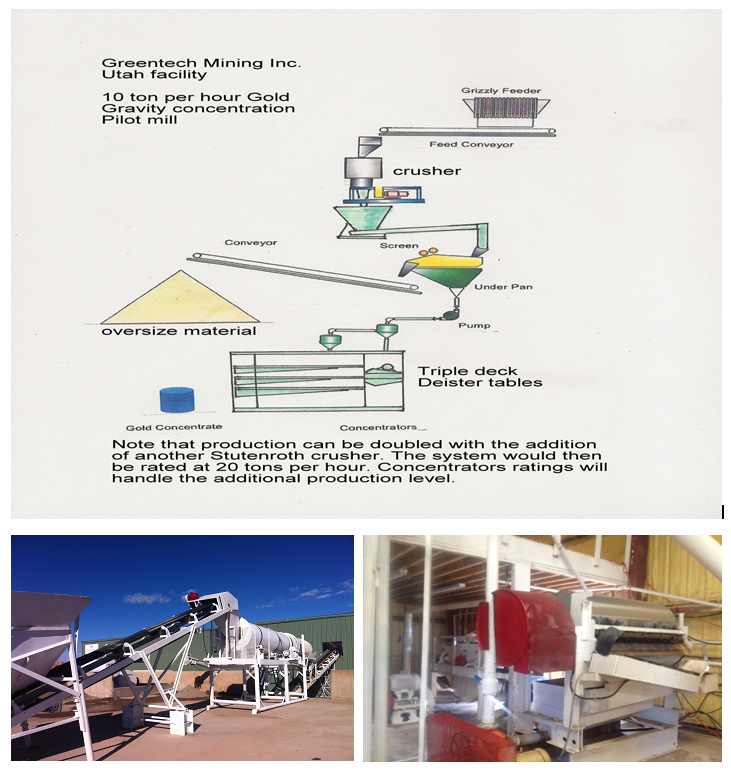

On September 17, 2012, the Company entered into the Option Agreement with Greentech Mining, Inc. a Delaware Corporation and Greentech Mining Utah, LLC a Utah limited liability company, Matthew Neher is the founder and Chief Executive Officer of Greentech Mining, Inc. and Greentech Mining Utah and is the Chief Executive Officer and director of the Company since June 26, 2012.Pursuant to the agreement the Company was exclusively contracted to explore, mine and process minerals that may be found on Contracted Premises. In addition the Company was granted the option to purchase the Henry Mountain Project as outlined in the agreement. The general principles in determining the operating, exploration and option to purchase price was the amount of capital Greentech Mining, Inc. and Greentech Mining Utah have spent on the mining claims and the processing plant which is an estimated $5 million dollars. The agreement was negotiated between Matthew Neher acting on behalf of Greentech Mining, Inc. and Greentech Mining Utah as CEO and Timothy Neher acting on behalf of the Company as a director and only other stockholder. Greentech Mining, Inc. and Greentech Mining Utah located the Henry Mountain claim group in April 2011 and paid approximately $30,000 to the BLM and $300,000 for the 670 acres of private property that included the 40 foot x 80 foot metal building structure upon which the plant is today. The amount of expenses that Greentech Mining, Inc. and Greentech Mining Utah subsequently incurred on the claims and the plant are approximately $4.7 million dollars.

Under the terms of the Option Agreement the Company shall make payment to Owner for the initial consideration of three million dollars ($3,000,000) with the first payment of one million dollars being made on or before November 1, 2012 and the remaining balance paid in ten (10) consecutive payments of $200,000 beginning on December 1, 2012. In addition to the consideration set forth herein, the Company shall pay Owner a Five Percent (5%) Net Smelter Royalty on all mineral bearing ores once Commercial Production has commenced. “Commercial Production” means the commercial-scale operation of any part of the Henry Mountain Project as a Mine by, or on behalf of, the Company. The Company shall perform exploration, mining, development, production, processing or any other activity (“Work” herein) which benefits the Henry Mountain Project at a minimum cost of $3,000,000 for the first year, $3,000,000 for the second year, and $3,000,000 for the third year of the Option Agreement. Additionally, the Owners granted to Company the sole and exclusive option to purchase all of the Owner’s rights, title and interest in the Henry Mountain Project for a total purchase price of two million dollars ($2,000,000), plus a perpetual two percent (2%) Net Smelter Royalty (“NSR”).

The term of the Option Agreement is for three (3) years from the effective date set forth above, and may be renewed by the Company for successive three (3) year periods upon substantially the same terms and provisions as set forth herein based upon the then-capital structure of the Company, until declared forfeited and canceled by Owner or relinquished by GMI as provided herein. The Company shall give Owner written notice of each renewal at least thirty (30) days prior to expiration of the respective three-year term. The Option Agreement shall automatically renew and continue so long as minerals, or metals are produced or sold from the Henry Mountain Project on a continuous basis. GMI shall have the continuing right to terminate the Option Agreement at any time and to surrender the Henry Mountain Project to Owner by giving Owner written notice thereof at least 30 days prior to the stated date of termination. Termination of the Option Agreement shall not relieve GMI of its obligation to pay all royalties due to Owner as well as its pro-rata share of taxes and fees.

Aside from the Owner, Greentech Mining, Inc., Greentech Mining Utah, LLC, AVP, Novus Aurum Trust, Matthew Neher and Timothy Neher, no other parties have an interest related to the Share Purchase Agreement or the Option Agreement. The parties are brothers and prior to Share Purchase Agreement Timothy Neher, AVP or the Company had no business relationship with Greentech Mining, Inc., Greentech Mining Utah, LLC, Novus Aurum Trust or Matthew Neher.

Other.

Matthew Neher is the founder and Chief Executive Officer of Greentech Mining, Inc. and Greentech Mining Utah since 2010 and 2011, respectively. Although Mr. Neher does not have employment agreements with these companies, he has received approximately $150,000 in loans (with no formal written agreement) and expense reimbursements over the last 24 months. Mr. Neher will receive compensation of an estimated combine total of $10,000 per months from Greentech Mining, Inc. and Greentech Mining Utah until a new CEO is indemnified and hired by these companies.

The officers and directors for the Company are involved in other business activities and may, in the future, become involved in other business opportunities. If a specific business opportunity becomes available, such persons may face a conflict in selecting between the Company and their other business interest. The Company has not formulated a policy for the resolution of such conflicts.

Director Independence

As of March 31, 2014, the Board consisted of Matthew Neher and Timothy Neher. The Board has determined that none of the members are independent director as defined by the rules of The Nasdaq Stock Market.

Related Party Transaction Review and Approval

We have entered into indemnification agreement with our director for the indemnification of them to the fullest extent permitted by law. The indemnification agreements also allow advancement of expenses to the directors.

Our Board of Directors has not adopted formal policies and procedures for the review and approval of related party transactions. Our Board of Directors has reviewed and approved the material terms of our related party transactions.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

The aggregate fees billed by Peter Messineo, CPA our prior auditor, for professional services rendered for the audit of our annual financial statement and limited review of financial statements included in our quarterly reports on Form 10-Q or services that are normally provided in connection with statutory and regulatory filings were $2,000 for the period from July 6, 2011 to March 31.2013. Anton & Chia LLP was elected as our auditor in December 2012 for our 2013 and 2014 Form 10k’s, estimated costs will be $300 for our year end.

Audit-Related Fees

There were no fees billed or to be filled by Messineo for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements for the period from July 6, 2011 to March 31.2014

Tax Fees

There were no fees billed or to be filled by Messineo for professional services for tax compliance, tax advice, and tax planning or the period from July 6, 2011 to March 31, 2014.

All Other Fees

There were no fees billed or to be billed by Messineo for other products and services for the period from July 6, 2011 to March 31, 2014.

Audit Committee’s Pre-Approval Process

The Board of Directors acts as the audit committee of the Company, and accordingly, all services are approved by all the members of the Board of Directors.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

| (a) | Financial Statements and Schedules: |

Financial statements as of March 31, 2014 and for the period then ended are included in Item 8. All schedules are omitted because they are not applicable or the required information is shown in the financial statements or notes thereto.

The following exhibits are incorporated by reference or filed as part of this report.

| NUMBER | | DESCRIPTION |

| | | |

| | Certificate of Incorporation |

| | | |

| | |

| | | |

| | Certificate of Amendment of Certificate of Incorporation dated June 22, 2012 |

| | | |

| | Employment Agreement dated September 10, 2012 between Greentech Mining International, Inc. and Mathew Neher |

| | | |

| | Operating, Exploration and Option to Purchase Agreement dated September 17, 2012 |

| | | |

| | Mineral Claim Option Agreement dated September 22, 2012 |

| | | |

| | Consulting Agreement dated as of June 28, 2012 by and among Greentech Mining International, Inc. and Accelerated Venture Partners LLC |

| | | |

| | 2012 Employee, Director and Consultant Stock Plan |

| | | |

| 10.6****** | | Joint Venture Agreement dated July 4, 2013 |

| | | |

| | Financial Statements (Audited) for the period from inception February 6, 2012 to period ended March 31, 2012 filed June 26,2012 on form 10K |

| | | |

| 101 | | XBRL Exhibits |

*Previously filed on February 28, 2012

**Previously filed on June 25 , 2012

***Previously filed on June 29, 2012

****Previously filed on September 14, 2012

*****Previously filed on September 20, 2012

******Filed on July 12, 2013 in Report 8-K

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | Greentech Mining International, Inc. |

| | | |

| | | By: | / S / Matthew Neher |

| | | Matthew Neher Chief Executive Officer |

POWER OF ATTORNEY AND SIGNATURES

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Matthew Neher as his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments to this report, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his substitute may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| | | | | |

| Signature | | Title | | Date |

| | | |

/ S / Matthew Neher | | Chief Executive Officer (Principal Executive Officer) | | |

| Matthew Neher | | | | |

| | | |

| | | | | |

/ S / Matthew Neher | | Chief Financial Officer (Principal Financial and Accounting Officer) | | |

| Matthew Neher | | | | |