UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22671

ALLIANCEBERNSTEIN MULTI-MANAGER

ALTERNATIVE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2015

Date of reporting period: September 30, 2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMI-ANNUAL REPORT

AllianceBernstein

Multi-Manager Alternative Fund

Semi-Annual Report

Investment Products Offered

|

• Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s website at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

Sanford C. Bernstein & Company LLC (“SCB”) and AllianceBernstein Investments, Inc. (ABI) are the distributors of the Fund. SCB and ABI are members of FINRA and are affiliates of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

November 20, 2014

Semi-Annual Report

This report provides certain performance data for AllianceBernstein Multi-Manager Alternative Fund (the “Fund”) for the semi-annual reporting period ended September 30, 2014.

Investment Objectives and Policies

This closed-end fund seeks to provide long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors.

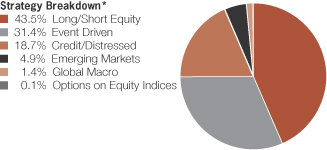

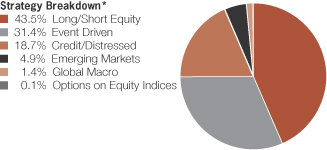

The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in a diversified portfolio of private investment vehicles, commonly referred to as hedge funds. The Fund will invest primarily hedge funds pursuing the following strategies: long/short equity, event driven, credit distressed, emerging markets, global macro and other strategies. For more information on these strategies, please see “Portfolio of Investments” on pages 7-11. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 3-4 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on pages 29-31.

Investment Results

The table on page 5 provides performance data for the Fund and its benchmark, the Hedge Fund Research (HFRI) Fund of Funds Composite Index, for the six- and 12-month periods ended September 30, 2014.

The Fund underperformed its benchmark for the six- and 12-month periods. Over the 12-month period, all strategies but global macro contributed positively to the Fund’s results. Over the six-month period, the credit/distressed strategy was a negative contributor. The Fund’s underperformance relative to the benchmark was primarily due to an underweight to global macro strategies which, after lagging other strategies significantly over the last three- and five-year periods, experienced strong positive returns during the third quarter of 2014. Fund selection within the global macro strategy also impacted relative returns as the global macro funds invested in by the Fund lagged their peers.

Long/short equity and event driven strategies were the Fund’s top performing strategies during both periods. The long/short equity funds invested in by the Fund were able to generate returns primarily through fundamental security selection on the long side and the short side. Event driven funds benefitted from a resurgence of corporate activity including mergers and acquisitions, spin-outs, restructurings and share buybacks. Over the 12-month period, global macro generated negative returns for the Fund due to long positions in European equities and short positions in U.S. rates and duration developed- market growth companies. Over the six-month period, the returns of credit/distressed managers were impacted by their short credit positions as interest rates generally fell throughout the 12-month period.

The Fund used derivatives in the form of purchased and written options, and

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 1 | |

credit default swaps, for hedging purchases, which had no material impact on returns for either period.

As of September 30, 2014, the Fund was allocated 46% to long/short equity among 21 managers; 28% to event driven among 13 managers; 22% to credit/distressed among 8 managers; 3% among 2 emerging markets managers; and 1% to one global macro manager.

Market Review and Investment Strategy

The 12-month period ended September 30, 2014 was characterized by generally rising equity markets, but with wide dispersion in results among geographies and market capitalization as economic growth, monetary policies and investor appetite began to diverge. U.S. large-capitalization equities paced

returns for the period. Meanwhile, global developed and emerging markets posted positive results but lagged U.S. markets notably. Small capitalization stocks were also positive during the 12-month period, but gave back a significant amount of gains during the six-month period. Bonds posted solid results with yields generally declining across maturities over the 12-month period.

Consistent with the expectations of the Alternative Investment Management Team (the “Team”) for hedge funds in a bull market, the Fund’s performance lagged that of the sharply rising equity market but outperformed bonds. In line with the Team’s goal to capitalize on return opportunities across the spectrum and limit risk, the Fund remains highly diversified by manager and by fund strategy.

| | |

| 2 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

DISCLOSURES AND RISKS

AllianceBernstein Multi-Manager Alternative Fund Shareholder Information

Benchmark Disclosure

The unmanaged HFRI Fund of Funds Composite Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The HFRI Fund of Funds Composite Index is an equal-weighted performance index that includes over 650 constituent funds of hedge funds that report their monthly net-of-fee returns to Hedge Fund Research, have at least $50 million under management and have been actively trading for at least 12 months. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word about Risk

An investment in the Fund’s shares may be speculative in that it involves a high degree of risk and should not constitute a complete investment program. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in the Fund’s prospectus. At any point in time, an investment in the Fund’s shares may be worth less than the original amount invested, even after taking into account the distributions paid, if any, and the ability of shareholders to reinvest distributions. If any of the risks discussed in this prospectus occurs, the Fund’s results of operations could be materially and adversely affected. If this were to happen, the price of Fund shares could decline significantly and you could lose all or a part of your investment.

Investment in this Fund is highly speculative and involves substantial risk, including loss of principal, and therefore may not be suitable for all investors.

General Risk Factors. Underlying funds may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps, and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in underlying funds are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Underlying funds are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation may create an incentive to make riskier or more speculative investments. Underlying funds typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any underlying fund will achieve its investment objectives.

Tax Risks. The Fund intends to be treated as a regulated investment company (a “RIC”) under the Internal Revenue Code. However, in order to qualify as a RIC and also to avoid having to pay an “excise tax,” the Fund will be subject to certain limitations on its investments and operations, including a requirement that a specified proportion of its income come from qualifying sources, an asset diversification requirement, and minimum distribution requirements. Satisfaction of the various requirements requires significant support and information from the underlying portfolio funds, and such support and information may not be available, sufficient, verifiable, or provided on a timely basis.

Limited Operating History. The Fund has little operating history upon which prospective investors can evaluate the performance of the Fund. There can be no assurance that the Fund will achieve its investment objective. The past investment performance of other accounts managed by the Investment Manager and its affiliates should not be construed as an indication of the future results of an investment in the Fund.

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 3 | |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

Fund of Funds Considerations. The Fund will have no control rights over and limited transparency into the investment programs of the underlying funds in which it invests. In valuing the Fund holdings, the Investment Manager will generally rely on financial information provided by underlying funds, which may be unaudited, estimated, and/or may not involve third parties. The Fund’s investment opportunities may be limited as a result of withdrawal terms or anticipated liquidity needs (e.g., withdrawal restrictions imposed by underlying hedge funds may delay, preclude, or involve expense in connection with portfolio adjustments by the Investment Manager).

These risks are more fully discussed in the Fund’s prospectus.

An Important Note About Historical Performance

The performance on the following page represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| 4 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Disclosures and Risks

HISTORICAL PERFORMANCE

| | | | | | | | | | |

| | | | | | | | | | |

THE FUND VS. ITS BENCHMARK PERIODS ENDED SEPTEMBER 30, 2014 (unaudited) | | Returns | | | |

| | 6 Months | | | 12 Months | | | |

| AllianceBernstein Multi-Manager Alternative Fund (NAV) | | | 0.79% | | | | 5.84% | | | |

|

| HFRI FOF Composite | | | 1.80% | | | | 6.14% | | | |

| | | | | | | | | | |

The Fund’s prospectus fee table shows the Fund’s total annual operating expense ratios as 7.75%, (including the Fund’s proportionate share of underlying fund fees and expenses) gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements served to limit the Fund’s annual operating expenses to 7.71%. These waivers/reimbursements may not be terminated prior to July 31, 2015. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period.

See Disclosures, Risks and Note about Historical Performance on pages 3-4.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 5 | |

Historical Performance

PORTFOLIO SUMMARY

September 30, 2014 (unaudited)

Net Assets ($mil): $1,231

| * | | All data are as of September 30, 2014. The Fund’s strategy breakdown is expressed as a percentage of total investments and may vary over time. |

| | |

| 6 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

September 30, 2014 (unaudited)

| | | | | | | | | | | | |

Underlying Portfolios | | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

| | | | | | | | | | | | |

Long/Short Equity | | | | | | | | | | | | |

Aravt Global Fund Ltd. | | | | $ | 24,291,946 | | | | 2.0 | % | | Semi-Annual |

Cadian Offshore Fund, Ltd. | | | | | 21,639,250 | | | | 1.8 | | | Semi-Annual |

Coatue Offshore Fund, Ltd. | | | | | 29,608,430 | | | | 2.4 | | | Quarterly |

Corvex Offshore Ltd. | | | | | 38,852,716 | | | | 3.2 | | | Quarterly |

Criterion Horizons Offshore, Ltd. | | | | | 27,960,328 | | | | 2.3 | | | Monthly |

Darsana Overseas Fund Ltd. | | | | | 25,192,888 | | | | 2.0 | | | Quarterly |

Egerton Long-Short Fund (USD) Limited | | | | | 15,143,013 | | | | 1.2 | | | Monthly |

Falcon Edge Global, Ltd. | | | | | 31,069,304 | | | | 2.5 | | | Quarterly |

JANA Nirvana Offshore Fund, Ltd. | | | | | 32,666,817 | | | | 2.7 | | | Quarterly |

Luminus Energy Partners Ltd. | | | | | 34,490,064 | | | | 2.8 | | | Quarterly |

Nokota Capital Offshore Fund, Ltd. | | | | | 34,993,545 | | | | 2.8 | | | Quarterly |

OrbiMed Partners, Ltd. | | | | | 39,101,438 | | | | 3.2 | | | Quarterly |

Pershing Square International, Ltd. | | | | | 17,703,336 | | | | 1.4 | | | Quarterly |

Sheffield International Partners, Ltd. | | | | | 22,745,350 | | | | 1.8 | | | Quarterly |

Starboard Leaders Fund LP | | | | | 8,247,448 | | | | 0.7 | | | at Fund’s discretion |

Starboard Value and Opportunity Fund Ltd | | | | | 21,602,853 | | | | 1.8 | | | Quarterly |

Think Investments Offshore Ltd. | | | | | 21,625,767 | | | | 1.8 | | | Semi-Annual |

Two Creeks Capital Offshore Fund, Ltd. | | | | | 15,378,781 | | | | 1.2 | | | Quarterly |

Tybourne Equity (Offshore) Fund | | | | | 30,040,001 | | | | 2.4 | | | Quarterly |

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 7 | |

Portfolio of Investments

| | | | | | | | | | | | |

Underlying

Portfolios | | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

| | | | | | | | | | | | |

Wellington Management Investors (Bermuda), Ltd. | | | | $ | 21,357,728 | | | | 1.7 | % | | Semi-Annual |

White Elm Capital Offshore, Ltd. | | | | | 20,734,593 | | | | 1.7 | | | Semi-Annual |

| | | | | | | | | | | | |

Total | | | | | 534,445,596 | | | | 43.4 | | | |

| | | | | | | | | | | | |

Event Driven | | | | | | | | | | | | |

Canyon Balanced Fund (Cayman), Ltd. | | | | | 41,112,310 | | | | 3.4 | | | Quarterly |

CQS Directional Opportunities Feeder Fund, Limited | | | | | 31,433,482 | | | | 2.6 | | | Monthly |

Empyrean Capital Overseas Fund, Ltd. | | | | | 15,015,079 | | | | 1.2 | | | Quarterly |

Fir Tree International Value Fund, Ltd. | | | | | 29,807,526 | | | | 2.4 | | | Anniversary |

Indaba Capital Partners (Cayman), L.P. | | | | | 20,166,523 | | | | 1.6 | | | Quarterly |

King Street Capital, Ltd. | | | | | 28,121,138 | | | | 2.3 | | | Quarterly |

Luxor Capital Partners Offshore, Ltd. | | | | | 25,881,221 | | | | 2.1 | | | Quarterly |

Manikay Offshore Fund, Ltd. | | | | | 30,986,746 | | | | 2.5 | | | Quarterly |

Pentwater Event Fund Ltd. | | | | | 34,899,691 | | | | 2.8 | | | Monthly |

Roystone Capital Offshore Fund Ltd. | | | | | 25,251,116 | | | | 2.1 | | | Quarterly |

Senator Global Opportunity Offshore Fund, Ltd. | | | | | 33,582,591 | | | | 2.7 | | | Quarterly |

TBC Offshore Ltd. | | | | | 33,040,097 | | | | 2.7 | | | Quarterly |

Third Point Offshore Fund, Ltd. | | | | | 35,647,157 | | | | 2.9 | | | Quarterly |

| | | | | | | | | | | | |

Total | | | | | 384,944,677 | | | | 31.3 | | | |

| | | | | | | | | | | | |

Credit/Distressed | | | | | | | | | | | | |

Claren Road Credit Fund, Ltd. | | | | | 32,836,410 | | | | 2.7 | | | Quarterly |

| | |

| 8 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Portfolio of Investments

| | | | | | | | | | | | |

Underlying

Portfolios | | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

| | | | | | | | | | | | |

Halcyon Offshore Asset-Backed Value Fund, Ltd. | | | | $ | 13,648,566 | | | | 1.1 | % | | Quarterly |

JMB Capital Partners Offshore, Ltd. | | | | | 31,555,442 | | | | 2.6 | | | Quarterly |

Oaktree Value Opportunities (Cayman) Fund, Ltd. | | | | | 26,904,793 | | | | 2.2 | | | Semi-Annual |

Panning Overseas Fund, Ltd. | | | | | 32,694,956 | | | | 2.7 | | | Quarterly |

Silver Point Capital Offshore Fund, Ltd. | | | | | 28,984,008 | | | | 2.3 | | | Quarterly |

Stone Lion Fund, Ltd. | | | | | 29,459,988 | | | | 2.4 | | | Quarterly |

Wingspan Overseas Fund, Ltd. | | | | | 33,468,413 | | | | 2.7 | | | Quarterly |

| | | | | | | | | | | | |

Total | | | | | 229,552,576 | | | | 18.7 | | | |

| | | | | | | | | | | | |

Emerging Markets | | | | | | | | | | | | |

Discovery Global Opportunity Fund, Ltd. | | | | | 31,534,411 | | | | 2.6 | | | Semi-Annual |

Spinnaker Global Emerging Markets Holdings, Ltd. | | | | | 28,624,161 | | | | 2.3 | | | Anniversary |

| | | | | | | | | | | | |

Total | | | | | 60,158,572 | | | | 4.9 | | | |

| | | | | | | | | | | | |

Global Macro | | | | | | | | | | | | |

Brevan Howard Multi-Strategy Fund Limited | | | | | 17,460,341 | | | | 1.4 | | | Monthly |

| | | | | | | | | | | | |

Total Underlying Portfolios

(cost $1,119,364,231) | | | | | 1,226,561,762 | | | | 99.7 | | | |

| | | | | | | | | | | | |

| | | | |

| | | Shares | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Herbalife, Ltd.

(cost $481,149) | | 7,531 | | | 329,481 | | | | 0.0 | | | |

| | | | | | | | | | | | |

| | | | |

| | | Contracts | | | | | | | | |

Options Purchased - Puts | | | | | | | | | | | | |

S&P 500 Index

Expiration: Dec 2014, Exercise Price: $1,825 (a) | | 257 | | | 478,020 | | | | 0.0 | | | |

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 9 | |

Portfolio of Investments

| | | | | | | | | | | | |

Underlying

Portfolios | | Contracts | | Fair Value ($) | | | % Net Assets | | | |

|

| | | | | | | | | | | | |

S&P 500 Index

Expiration: Dec 2014, Exercise Price: $1,875 (a) | | 212 | | $ | 597,840 | | | | 0.1 | % | | |

| | | | | | | | | | | | |

Total Options Purchased - Puts (premiums paid $2,000,656) | | | | | 1,075,860 | | | | 0.1 | | | |

| | | | | | | | | | | | |

Total Investments

(cost $1,121,846,036) | | | | | 1,227,967,103 | | | | 99.8 | | | |

Liabilities in excess of other assets | | | | | 2,914,471 | | | | 0.2 | | | |

| | | | | | | | | | | | |

Net Assets | | | | $ | 1,230,881,574 | | | | 100.0 | % | | |

| | | | | | | | | | | | |

PUT OPTIONS WRITTEN (see Note C)

| | | | | | | | | | | | | | | | | | | | |

| Description | | Contracts | | | Exercise Price | | | Premiums/

Proceeds | | | Expiration Month | | | U.S. $ Value | |

S&P 500 Index (a) | | | 257 | | | $ | 1,650 | | | $ | 436,119 | | | | December 2014 | | | $ | (164,480 | ) |

S&P 500 Index (a) | | | 212 | | | | 1,675 | | | | 253,755 | | | | December 2014 | | | | (150,520 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (315,000 | ) |

| | | | | | | | | | | | | | | | | | | | |

CENTRALLY CLEARED CREDIT DEFAULT SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

Clearing Broker/

(Exchange) &

Referenced

Obligation | | Fixed

Rate

(Pay)

Receive | | | Implied

Credit

Spread at

September 30,

2014 | | | Notional

Amount

(000) | | | Market Value | | | Unrealized

Appreciation/

(Depreciation) | |

Buy Contracts | | | | | | | | | | | | | | | | | | | | |

Morgan Stanley & Co., LLC/(INTRCONX): | | | | | | | | | | | | | | | | | | | | |

CDX-NAHY Series 22, 5 Year Index, 6/20/19** | | | (5.00 | )% | | | 3.50 | % | | $ | 9,240 | | | $ | (565,124 | ) | | $ | 242,609 | |

CDX-NAIG Series 22, 3 Year Index, 6/20/17** | | | (1.00 | ) | | | 0.37 | | | | 74,360 | | | | (1,278,050 | ) | | | 234,444 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (1,843,174 | ) | | $ | 477,053 | |

| | | | | | | | | | | | | | | | | | | | |

| (a) | | One contract relates to 100 shares. |

Glossary:

CDX-NAHY – North American High Yield Credit Default Swap Index

CDX-NAIG – North American Investment Grade Credit Default Swap Index

INTRCONX – Inter-Continental Exchange

| * | | The investment strategies and liquidity of the Underlying Portfolios in which the Fund invests are as follows: |

| | |

| 10 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Portfolio of Investments

Long/Short Equity Underlying Portfolios seek to buy securities with the expectation that they will increase in value (called “going long”) and sell securities short in the expectation that they will decrease in value (“going short”). Underlying Portfolios within this strategy are generally subject to 30 –180 day redemption notice periods. The Underlying Portfolios have monthly to biennial liquidity. The majority of the managers have initial lockups of less than a year and a half. Certain Underlying Portfolios may have lock up periods of up to five years.

Credit/Distressed Underlying Portfolios invest in a variety of fixed income and other securities, including bonds (corporate and government), bank debt, asset-backed financial instruments, mortgage-backed securities and mezzanine and distressed securities, as well as securities of distressed companies and high yield securities. Underlying Portfolios within this strategy are generally subject to 45 – 90 day redemption notice periods. The Underlying Portfolios have monthly to one and a half years’ liquidity. Certain Underlying Portfolios may have lock up periods of up to three years.

Event Driven Underlying Portfolios seek to take advantage of information inefficiencies resulting from a particular corporate event, such as a takeover, liquidation, bankruptcy, tender offer, buyback, spin-off, exchange offer, merger or other type of corporate reorganization. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. The Underlying Portfolios have monthly to biennial liquidity. Private investment vehicles within the strategy may have lock up periods of up to two years.

Emerging Markets Underlying Portfolios invest in a range of emerging markets asset classes including debt, equity and currencies, and may use a broad array of hedging techniques involving both emerging markets and non-emerging markets securities with the intention of reducing volatility and enhancing returns. Underlying Portfolios within this strategy are generally subject to 60 –120 day redemption notice periods. The Underlying Portfolios have semi-annual to annual liquidity. Private investment vehicles within the strategy may have lock up periods of up to three years.

Global Macro Underlying Portfolios aim to identify and exploit imbalances in global economics and asset classes, typically utilizing macroeconomic and technical market factors rather than “bottom-up” individual security analysis. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. The Underlying Portfolios have monthly liquidity. Private investment vehicles within the strategy may have lock up periods of up to two years.

The Fund may also make direct investments in securities (other than securities of Underlying Portfolios), options, futures, options on futures, swap contracts, or other derivative or financial instruments.

See notes to financial statements.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 11 | |

Portfolio of Investments

STATEMENT OF ASSETS & LIABILITIES

September 30, 2014 (unaudited)

| | | | |

| Assets | | | | |

Investments in Underlying Portfolios, at value (cost $1,121,846,036) | | $ | 1,227,967,103 | |

Cash (see Note A2) | | | 28,262,126 | |

Due from broker | | | 543,631 | |

Receivable for investments sold | | | 764,308 | |

Investment in Underlying Portfolios paid in advance (see

Note A2) | | | 18,000,000 | |

| | | | |

Total assets | | | 1,275,537,168 | |

| | | | |

| Liabilities | | | | |

Options written, at value (premiums received $689,874) | | | 315,000 | |

Subscriptions received in advance | | | 32,672,412 | |

Payable for shares of beneficial interest redeemed | | | 9,056,266 | |

Management fee payable | | | 1,570,232 | |

Payable for investments purchased | | | 729,207 | |

Payable for variation margin on exchange-traded derivatives | | | 72,627 | |

Transfer Agent fee payable | | | 20,763 | |

Accrued expenses | | | 219,087 | |

| | | | |

Total liabilities | | | 44,655,594 | |

| | | | |

Net Assets | | $ | 1,230,881,574 | |

| | | | |

| Composition of Net Assets | | | | |

Shares of beneficial interest, at par | | $ | 107,001 | |

Additional paid-in capital | | | 1,165,512,138 | |

Distributions in excess of net investment income | | | (36,481,903 | ) |

Accumulated net realized loss on investment transactions | | | (5,228,656 | ) |

Net unrealized appreciation on investments | | | 106,972,994 | |

| | | | |

Net Assets | | $ | 1,230,881,574 | |

| | | | |

Shares of beneficial interest outstanding — unlimited shares authorized, with par value of $.001 (based on 107,001,427 shares outstanding) | | $ | 11.50 | |

| | | | |

See notes to financial statements.

| | |

| 12 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Statement of Assets & Liabilities

STATEMENT OF OPERATIONS

Six Months Ended September 30, 2014 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | | | | | $ | 353 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Management fee (see Note B) | | $ | 8,610,005 | | | | | |

Administrative | | | 106,850 | | | | | |

Recoupment of previously reimbursed expenses | | | 246,757 | | | | | |

Transfer agency | | | 114,800 | | | | | |

Legal | | | 78,426 | | | | | |

Registration fees | | | 77,500 | | | | | |

Trustee’s fees | | | 69,398 | | | | | |

Custodian | | | 255,265 | | | | | |

Audit and tax | | | 40,121 | | | | | |

Printing | | | 25,400 | | | | | |

Miscellaneous | | | 420,483 | | | | | |

| | | | | | | | |

Total expenses | | | | | | | 10,045,005 | |

| | | | | | | | |

Net expenses | | | | | | | 10,045,005 | |

| | | | | | | | |

Net investment loss | | | | | | | (10,044,652 | ) |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment Transactions | | | | | | | | |

Net realized loss on: | | | | | | | | |

Investment transactions | | | | | | | (2,985,691 | ) |

Swaps | | | | | | | (271,066 | ) |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments | | | | | | | 22,403,755 | |

Options written | | | | | | | 374,874 | |

Swaps | | | | | | | 477,053 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 19,998,925 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 9,954,273 | |

| | | | | | | | |

See notes to financial statements.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 13 | |

Statement of Operations

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

September 30, 2014

(unaudited) | | | Year Ended

March 31,

2014 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment loss | | $ | (10,044,652 | ) | | $ | (12,053,888 | ) |

Net realized gain (loss) on sale of affiliated Underlying Portfolio shares | | | (3,256,757 | ) | | | 343,057 | |

Net change in unrealized appreciation/depreciation of investments in Underlying Portfolios | | | 23,255,682 | | | | 66,207,214 | |

| | | | | | | | |

Net increase in net assets from operations | | | 9,954,273 | | | | 54,496,383 | |

| Dividends to Shareholders from | | | | | | | | |

Net investment income | | | – 0 | – | | | (12,368,064 | ) |

Net realized gain on investment transactions | | | – 0 | – | | | (2,314,956 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net increase (see Note D) | | | 240,390,071 | | | | 630,204,556 | |

| | | | | | | | |

Total increase | | | 250,344,344 | | | | 670,017,919 | |

| Net Assets | | | | | | | | |

Beginning of period | | | 980,537,230 | | | | 310,519,311 | |

| | | | | | | | |

End of period (including distributions in excess of net investment income of ($36,481,903) and ($26,437,251), respectively) | | $ | 1,230,881,574 | | | $ | 980,537,230 | |

| | | | | | | | |

See notes to financial statements.

| | |

| 14 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Statement of Changes in Net Assets

STATEMENT OF CASH FLOWS

For the Six Months Ended September 30, 2014 (unaudited)

| | | | |

| Cash flows from operating activities | | | | |

Net increase (decrease) in net assets from operations | | $ | 9,954,273 | |

| | | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash used in operating activities: | | | | |

Increase in receivable for investments sold | | | (764,308 | ) |

Increase in payable for investments purchased | | | 729,207 | |

Increase in due from broker | | | (543,631 | ) |

Purchases of investments | | | (270,917,336 | ) |

Sales of investments | | | 44,599,358 | |

Proceeds from written options, net | | | 689,874 | |

Payments for exchange-traded derivatives settlements | | | 205,987 | |

Variation margin received on exchange-traded derivatives | | | 72,627 | |

Net realized (gain)/loss from investment transactions | | | 3,256,757 | |

Net change in unrealized appreciation/depreciation on investment transactions | | | (23,255,682 | ) |

Decrease in investments in Underlying Portfolios paid in advance | | | 3,000,000 | |

Increase in management fee payable | | | 207,019 | |

Decrease in accrued expenses | | | (200,116 | ) |

| | | | |

Net cash used in operating activities | | | (242,920,244 | ) |

| Cash flows from financing activities | | | | |

Subscriptions, including change in subscriptions received in advance | | | 231,083,083 | |

Redemptions, net of payable for shares of beneficial interest redeemed | | | (20,924,821 | ) |

| | | | |

Net cash provided by financing activities | | | 210,158,262 | |

| | | | |

Net change in cash | | | (22,807,709 | ) |

Cash at beginning of period | | | 51,069,835 | |

| | | | |

Cash at end of period | | $ | 28,262,126 | |

| | | | |

In accordance with U.S. GAAP, the Fund has included a Statement of Cash Flows as a result of its substantial investments in Level 3 securities throughout the period.

See notes to financial statements.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 15 | |

Statement of Cash Flows

NOTES TO FINANCIAL STATEMENTS

NOTE A

Significant Accounting Policies

AllianceBernstein Multi-Manager Alternative Fund (the “Fund”) is a statutory trust formed under the laws of the State of Delaware and registered under the Investment Company Act of 1940 as a non-diversified, closed-end management investment company. The Fund commenced operations on October 1, 2012. The Fund’s investment objective is to seek long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors. The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in private investment vehicles (“Underlying Portfolios”), commonly referred to as hedge funds, that are managed by unaffiliated asset managers that employ a broad range of investment strategies. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates, and such differences could be material. The following is a summary of significant accounting policies followed by the Fund.

1. Valuation of Investments

The Fund’s Board of Trustees (the “Board”) has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments in Underlying Portfolios are valued at fair value (the “Valuation Procedures”). Among other matters, the Valuation Procedures set forth the Fund’s valuation policies and the mechanisms and processes to be employed on a monthly basis to implement such policies. In accordance with the Valuation Procedures, fair value of an Underlying Portfolio as of each valuation time ordinarily is the value determined as of such month-end for each Underlying Portfolio in accordance with the Underlying Portfolio’s valuation policies and reported at the time of the Fund’s valuation.

On a monthly basis, the Fund generally uses the net asset value (“NAV”), provided by the Underlying Portfolios, to determine the fair value of all Underlying Portfolios which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Underlying Portfolio represents the amount that the Fund could reasonably expect to receive from an Underlying Portfolio if its interest were redeemed at the time of valuation. In the unlikely event that an Underlying Portfolio does not report a month-end value to the Fund on a timely basis, the Fund would determine the fair value of such Underlying Portfolio based on the most recent value reported by the Underlying Portfolio, and any other relevant information available at the time the Fund values its portfolio. In making a fair value determination, the Fund will

| | |

| 16 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

consider all appropriate information reasonably available to it at the time and that Alliance Bernstein L.P. (the “Investment Manager”) believes to be reliable. The Fund may consider factors such as, among others: (i) the price at which recent subscriptions for or redemptions of the Underlying Portfolio’s interests were effected; (ii) information provided to the Fund by the manager of an Underlying Portfolio, or the failure to provide such information as the Underlying Portfolio manager agreed to provide in the Underlying Portfolio’s offering materials or other agreements with the Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when an Underlying Portfolio imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Underlying Portfolio interests, the Fund may determine that it is appropriate to apply a discount to the NAV reported by the Underlying Portfolio. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the financial statements.

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Investment Manager will have discretion to determine the best valuation (e.g. last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred between the close of the foreign markets and the time at which the Fund values its securities which may materially affect the value of securities trading in such markets. To account for this, the Fund may frequently value many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 17 | |

Notes to Financial Statements

The Investment Manager has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund accounting, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities include: 1) fair value determinations (and oversight of any third parties to whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any Underlying Portfolio, and periodically thereafter, the Investment Manager will conduct a due diligence review of the valuation methodology utilized by the Underlying Portfolio. In addition, there are several processes outside of the pricing process that are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including the Fund’s ability to redeem from an Underlying Portfolio within the near term of the reporting date at fair value) |

| | • | | Level 3—significant unobservable inputs (including those investments in Underlying Portfolios which have restrictions on redemptions due to lock-up periods or redemption restrictions such that the Fund cannot redeem within the near term of the reporting date) |

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| | |

| 18 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

| | | | | | | | | | | | | | | | |

Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Underlying Portfolios: | | | | | | | | | | | | | | | | |

Long/Short Equity | | $ | – 0 | – | | $ | 159,542,016 | | | $ | 374,903,580 | | | $ | 534,445,596 | |

Event Driven | | | – 0 | – | | | 67,080,639 | | | | 317,864,038 | | | | 384,944,677 | |

Credit/Distressed | | | – 0 | – | | | 59,971,917 | | | | 169,580,659 | | | | 229,552,576 | |

Emerging Markets | | | – 0 | – | | | – 0 | – | | | 60,158,572 | | | | 60,158,572 | |

Global Macro | | | – 0 | – | | | 17,460,341 | | | | – 0 | – | | | 17,460,341 | |

Common Stocks | | | 329,481 | | | | – 0 | – | | | – 0 | – | | | 329,481 | |

Options Purchased—Puts | | | – 0 | – | | | 1,075,860 | | | | – 0 | – | | | 1,075,860 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 329,481 | | | | 305,130,773 | | | | 922,506,849 | | | | 1,227,967,103 | |

Assets: | | | | | | | | | | | | | | | | |

Centrally Cleared Credit Default Swaps | | | – 0 | – | | | 477,053 | | | | – 0 | – | | | 477,053 | |

Liabilities: | | | | | | | | | | | | | | | | |

Puts Options Written | | | – 0 | – | | | (315,000 | ) | | | – 0 | – | | | (315,000 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 329,481 | | | $ | 305,292,826 | | | $ | 922,506,849 | | | $ | 1,228,129,156 | |

| | | | | | | | | | | | | | | | |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value.

| | | | | | | | | | | | |

| | | Long/Short

Equity | | | Event

Driven | | | Credit/

Distressed | |

Balance as of 3/31/14 | | $ | 277,379,976 | | | $ | 246,270,331 | | | $ | 134,140,299 | |

Realized gain (loss) | | | – 0 | – | | | – 0 | – | | | (609,712 | ) |

Change in unrealized appreciation/depreciation | | | 6,623,575 | | | | 4,593,707 | | | | 1,440,360 | |

Purchases | | | 93,916,680 | | | | 67,000,000 | | | | 38,000,000 | |

Sales | | | – 0 | – | | | – 0 | – | | | (3,390,288 | ) |

Transfers in to Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

Transfers out of Level 3 | | | (3,016,651 | )^ | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | |

Balance as of 9/30/14 | | $ | 374,903,580 | | | $ | 317,864,038 | | | $ | 169,580,659 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from Investments held as of 9/30/14* | | $ | 7,084,903 | | | $ | 10,690,048 | | | $ | 995,655 | |

| | | | | | | | | | | | |

| | | |

| | | Emerging

Markets | | | Total | | | | |

Balance as of 3/31/14 | | $ | 44,649,252 | | | $ | 702,439,858 | | | | | |

Realized gain (loss) | | | – 0 | – | | | (609,712 | ) | | | | |

Change in unrealized appreciation/depreciation | | | 509,320 | | | | 13,166,962 | | | | | |

Purchases | | | 15,000,000 | | | | 213,916,680 | | | | | |

Sales | | | – 0 | – | | | (3,390,288 | ) | | | | |

Transfers in to Level 3 | | | – 0 | – | | | – 0 | – | | | | |

Transfers out of Level 3 | | | – 0 | – | | | (3,016,651 | ) | | | | |

| | | | | | | | | | | | |

Balance as of 9/30/14 | | $ | 60,158,572 | | | $ | 922,506,849 | | | | | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from Investments held as of 9/30/14* | | $ | 725,302 | | | $ | 19,495,908 | | | | | |

| | | | | | | | | | | | |

| ^ | | There were de minimis transfers under 1% of net assets during the reporting period. |

| * | | The unrealized appreciation/depreciation is included in net change in unrealized appreciation/depreciation of investments in the accompanying statement of operations. |

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 19 | |

Notes to Financial Statements

2. Cash Committed

As of September 30, 2014, the Fund has committed to purchase the following Underlying Portfolios for effective date October 1, 2014.

| | | | |

Underlying Investment | | Amount

Committed | |

Empryean Capital Overseas Fund, Ltd. | | $ | 8,000,000 | |

Oaktree Value Opportunities (Cayman) Fund, Ltd. | | | 5,000,000 | |

Starboard Value and Opportunity Fund, Ltd. | | | 5,000,000 | |

Third Point Offshore Fund, Ltd.* | | | 3,000,000 | |

Two Creeks* | | | 15,000,000 | |

| | | | |

| | $ | 36,000,000 | |

| | | | |

| * | | Investments paid in advance amounted to $18,000,000. |

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Fund will not be subject to federal and state income taxes to the extent that all of its income is distributed.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (all years since inception of the Fund) and has concluded that no provision for income tax is required in the Fund’s financial statements.

4. Investment Income and Investment Transactions

Income and capital gain distributions, if any, are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date or effective date. Investment gains and losses are determined on the identified cost basis.

5. Expenses

Expenses included in the accompanying statements of operations do not include any expenses of the Underlying Portfolios.

6. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

| | |

| 20 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

NOTE B

Management Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement (the “Advisory Agreement”), the Fund pays the Investment Manager a management fee at an annual rate of 1.50% of an aggregate of the Fund’s net assets determined as of the last day of a calendar month and adjusted for subscriptions and repurchases accepted as of the first day of the subsequent month, (the “Management Fee”). The Management Fee is payable in arrears as of the last day of the subsequent month.

The Investment Manager has agreed to waive its fees and bear certain expenses through July 31, 2015 to the extent necessary to limit total operating expenses, excluding the Management Fee, extraordinary expenses, interest expenses, taxes, brokerage commissions and other transaction costs, and Underlying Portfolio fees and expense, on an annual basis to 0.25% of average monthly net assets (1.75% including Management Fee). For the six months ended September 30, 2014, there was no such reimbursement. Under the Expense limitation Agreement between the Investment Manager and the Fund, fees waived and expenses borne by the Investment Manager are subject to repayment by the Fund until September 30, 2015. No repayment will be made that would cause the Fund’s total annualized operating expenses to exceed the net fee percentage set forth above or would exceed the amount of offering expenses as recorded by the Fund on or before September 30, 2013. At September 30, 2014, the Fund made repayments to the Investment Manager of the offering expenses amounting to $246,757.

Under a separate Administrative Agreement, the Fund may use the Investment Manager and its personnel to provide certain administrative services to the Fund and, in such event, the services and payments will be subject to approval by the Fund’s Board. For the six months ended September 30, 2014, such fees amounted to $298,350.

The Fund may engage one or more distributors to solicit investments in the Fund. Sanford C. Bernstein & Company LLC (“Bernstein”) and AllianceBernstein Investments, Inc. (“ABI”), each an affiliate of the Investment Manager, have been selected as distributors of the Fund under Distribution Services Agreements. The Distribution Services Agreements do not call for any payments to be made to Bernstein or ABI by the Fund.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Investment Manager, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. Such compensation paid to ABIS amounted to $0 for the six months ended September 30, 2014.

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 21 | |

Notes to Financial Statements

NOTE C

Investment Transactions

1. Purchases and Sales

Purchases and sales of investments in the Underlying Portfolios, aggregated $265,916,680 and $44,599,357, respectively, for the six months ended September 30, 2014.

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Gross unrealized appreciation | | $ | 110,754,546 | |

Gross unrealized depreciation | | | (4,633,479 | ) |

| | | | |

Net unrealized appreciation | | $ | 106,121,067 | |

| | | | |

2. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The principal types of derivatives utilized by the Fund, as well as the methods in which they may be used are:

For hedging and investment purposes, the Fund may purchase and write (sell) put and call options on U.S. and foreign securities, including government securities, and foreign currencies that are traded on U.S. and foreign securities exchanges and over-the-counter markets. The Fund may also use options transactions for non-hedging purposes as a means of making direct investments in foreign currencies, as described below under “Currency Transactions”.

The risk associated with purchasing an option is that the Fund pays a premium whether or not the option is exercised. Additionally, the Fund bears the risk of loss of the premium and change in market value should the counterparty not perform under the contract. Put and call options purchased are accounted for in the same manner as portfolio securities. The cost of securities acquired through the exercise of call options is increased by premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid.

When the Fund writes an option, the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from written options which expire unexercised are recorded by the Fund on the expiration date as realized gains from options written. The difference between the premium

| | |

| 22 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium received is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium received is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium received reduces the cost basis of the security or currency purchased by the Fund. In writing an option, the Fund bears the market risk of an unfavorable change in the price of the security or currency underlying the written option. Exercise of an option written by the Fund could result in the Fund selling or buying a security or currency at a price different from the current market value.

During the six months ended September 30, 2014, the Fund held written options for hedging purposes.

During the six months ended September 30, 2014, the Fund held purchased options for hedging purposes.

For the six months ended September 30, 2014, the Fund had the following transactions in written options:

| | | | | | | | |

| | | Number of

Contracts | | | Premiums

Received | |

Options written outstanding as of 3/31/14 | | | – 0 | – | | $ | – 0 | – |

Options written | | | 469 | | | | 315,000 | |

Options expired | | | – 0 | – | | | – 0 | – |

Options bought back | | | – 0 | – | | | – 0 | – |

Options exercised | | | – 0 | – | | | – 0 | – |

| | | | | | | | |

Options written outstanding as of 9/30/14 | | | 469 | | | $ | 315,000 | |

| | | | | | | | |

The Fund may enter into swaps to hedge their exposure to interest rates, credit risk, or currencies. Certain Fund may also enter into swaps for non-hedging purposes as a means of gaining market exposures, including by making direct investments in foreign currencies, as described below under “Currency Transactions”. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The payment flows are usually netted against each other, with the difference being paid by one party to the other. In addition, collateral may be pledged or received by the Fund in accordance with the terms of the respective swaps to provide value and recourse to the Fund or their counterparties in the event of default, bankruptcy or insolvency by one of the parties to the swap.

Risks may arise as a result of the failure of the counterparty to the swap to comply with the terms of the swap. The loss incurred by the failure of a

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 23 | |

Notes to Financial Statements

counterparty is generally limited to the net interim payment to be received by the Fund, and/or the termination value at the end of the contract. Therefore, the Fund considers the creditworthiness of each counterparty to a swap in evaluating potential counterparty risk. This risk is mitigated by having a netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund’s exposure to the counterparty. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying securities. The Fund accrues for the interim payments on swaps on a daily basis, with the net amount recorded within unrealized appreciation/depreciation of swaps on the statement of assets and liabilities, where applicable. Once the interim payments are settled in cash, the net amount is recorded as realized gain/(loss) on swaps on the statement of operations, in addition to any realized gain/(loss) recorded upon the termination of swaps. Upfront premiums paid or received in connection with credit default swaps are recognized as cost or proceeds on the statement of assets and liabilities and are amortized on a straight line basis over the life of the contract. Amortized upfront premiums are included in net realized gain/(loss) from swaps on the statement of operations. Fluctuations in the value of swaps are recorded as a component of net change in unrealized appreciation/depreciation of swaps on the statement of operations.

Certain standardized swaps, including certain interest rate swaps and credit default swaps, are (or soon will be) subject to mandatory central clearing. Cleared swaps are transacted through futures commission merchants (“FCMs”) that are members of central clearinghouses, with the clearinghouse serving as central counterparty, similar to transactions in futures contracts. Centralized clearing will be required for additional categories of swaps on a phased-in basis based on requirements published by the Securities and Exchange Commission and Commodity Futures Trading Commission.

At the time the Fund enters into a centrally cleared swap, the Fund deposits and maintains as collateral an initial margin with the broker, as required by the exchange on which the transaction is effected. Such amount is shown as due from broker on the statement of assets and liabilities. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. Risks may arise from the potential inability of a counterparty to meet the terms of the contract. The credit/counterparty risk for exchange-traded swaps is generally less than privately negotiated swaps, since the clearinghouse, which is the issuer or counterparty to each exchange-traded swap, has robust risk mitigation standards, including the requirement to provide

| | |

| 24 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

initial and variation margin. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the time it was closed.

Credit Default Swaps:

The Fund may enter into credit default swaps for multiple reasons, including to manage their exposure to the market or certain sectors of the market, to reduce their risk exposure to defaults by corporate and sovereign issuers held by the Fund, or to create exposure to corporate or sovereign issuers to which they are not otherwise exposed. The Fund may purchase credit protection (“Buy Contract”) or provide credit protection (“Sale Contract”) on the referenced obligation of the credit default swap. During the term of the swap, the Fund receives/(pays) fixed payments from/(to) the respective counterparty, calculated at the agreed upon rate applied to the notional amount. If the Fund is a buyer/(seller) of protection and a credit event occurs, as defined under the terms of the swap, the Fund will either (i) receive from the seller/(pay to the buyer) of protection an amount equal to the notional amount of the swap (the “Maximum Payout Amount”) and deliver/(take delivery of) the referenced obligation or (ii) receive/(pay) a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation.

In certain circumstances Maximum Payout Amounts may be partially offset by recovery values of the respective referenced obligations, upfront premium received upon entering into the agreement, or net amounts received from settlement of buy protection credit default swaps entered into by the Fund for the same reference obligation with the same counterparty. As of September 30, 2014, the Fund did not have any Buy Contracts with respect to the same referenced obligation and same counterparty for its Sales Contracts outstanding.

Credit default swaps may involve greater risks than if a Fund had invested in the referenced obligation directly. Credit default swaps are subject to general market risk, liquidity risk, counterparty risk and credit risk. If the Fund is a buyer of protection and no credit event occurs, it will lose the payments it made to its counterparty. If the Fund is a seller of protection and a credit event occurs, the value of the referenced obligation received by the Fund coupled with the periodic payments previously received, may be less than the Maximum Payout Amount it pays to the buyer, resulting in a net loss to the Fund.

During the six months ended September 30, 2014, the Fund held credit default swaps for hedging purposes.

Implied credit spreads over U.S. Treasuries of comparable maturity utilized in determining the market value of credit default swaps on issuers as of period end are disclosed in the schedule of investments. The implied

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 25 | |

Notes to Financial Statements

spreads serve as an indicator of the current status of the payment/performance risk and typically reflect the market’s assessment of the likelihood of default by the issuer of the referenced obligation. The implied credit spread of a particular reference obligation also reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Widening credit spreads typically represent a deterioration of the referenced obligation’s credit soundness and greater likelihood of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced obligation.

The Fund typically enters into International Swaps and Derivatives Association, Inc. Master Agreements (“ISDA Master Agreement”) or similar master agreements (collectively, “Master Agreements”) with its OTC derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. ISDA Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under an ISDA Master Agreement, the Fund typically may offset with the counterparty certain derivative financial instrument’s payables and/or receivables with collateral held and/or posted and create one single net payment (close-out netting) in the event of default or termination.

Various Master Agreements govern the terms of certain transactions with counterparties, including transactions such as exchange-traded derivative transactions, repurchase and reverse repurchase agreements. These Master Agreements typically attempt to reduce the counterparty risk associated with such transactions by specifying credit protection mechanisms and providing standardization that improves legal certainty. Cross-termination provisions under Master Agreements typically provide that a default in connection with one transaction between the Fund and a counterparty gives the non-defaulting party the right to terminate any other transactions in place with the defaulting party to create one single net payment due to/due from the defaulting party. In the event of a default by a Master Agreements counterparty, the return of collateral with market value in excess of the Fund’ net liability, held by the defaulting party, may be delayed or denied.

The Fund’s Master Agreements may contain provisions for early termination of OTC derivative transactions in the event the net assets of the Fund decline below specific levels (“net asset contingent features”). If these levels are triggered, the Fund’s counterparty has the right to terminate such transaction and require the Fund to pay or receive a settlement amount in connection with the terminated transaction.

| | |

| 26 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

At September 30, 2014, the Fund had entered into the following derivatives:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivative Type | | Statement of

Assets and

Liabilities

Location | | Fair Value | | | Statement of

Assets and

Liabilities

Location | | Fair Value | |

Credit contracts | | Receivable/Payable for variation margin on exchange-traded derivatives | | $ | 477,053 | * | | | | | | |

| | | | |

Equity contracts | | Investments in securities, at value | | | 1,075,860 | | | | | | | |

| | | | |

Equity contracts | | | | | | | | Options written, at value | | $ | 315,000 | |

| | | | | | | | | | | | |

Total | | | | $ | 1,552,913 | | | | | $ | 315,000 | |

| | | | | | | | | | | | |

| * | | Only variation margin receivable/payable at period end is reported within the statement of assets and liabilities. This amount reflects cumulative appreciation/(depreciation) of exchange-traded derivatives as reported in the portfolio of investments. |

The effect of derivative instruments on the statement of operations for the six months ended September 30, 2014:

| | | | | | | | | | |

Derivative Type | | Location of Gain

or (Loss) on

Derivatives | | Realized Gain

or (Loss) on

Derivatives | | | Change in

Unrealized

Appreciation or

(Depreciation) | |

Equity contracts | | Net realized gain (loss) on investment transactions; Net change in unrealized appreciation/depreciation of investments | | $ | – 0 | – | | $ | (924,796 | ) |

| | | |

Equity contracts | | Net realized gain (loss) on options written; Net change in unrealized appreciation/depreciation of options written | | | – 0 | – | | | 374,874 | |

| | | |

Credit contracts | | Net realized gain (loss) on swaps; Net change in unrealized appreciation/depreciation of swaps | | | (271,066 | ) | | | 477,053 | |

| | | | | | | | | | |

Total | | | | $ | (271,066 | ) | | $ | (72,869 | ) |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 27 | |

Notes to Financial Statements

The following table represents the volume of the Fund’s derivative transactions during the six months ended September 30, 2014:

| | | | |

Purchased Options: | | | | |

Average monthly cost | | $ | 1,785,315 | (a) |

Centrally Cleared Credit Default Swaps: | | | | |

Average notional amount of buy contracts | | $ | 83,507,600 | (a) |

| (a) | | Positions were open for four months during the period. |

For financial reporting purposes, the Fund does not offset derivative assets and derivative liabilities that are subject to netting arrangements in the statement of assets and liabilities.

All derivatives held during the reporting period were subject to netting arrangements. The following table presents the Fund’s derivative assets and liabilities by counterparty net of amounts available for offset under Master Agreements (“MA”) and net of the related collateral received/ pledged by the Fund as of September 30, 2014:

| | | | | | | | | | | | | | | | | | | | |

Counterparty | | Derivative

Assets

Subject

to a MA | | | Derivative

Available

for Offset | | | Cash

Collateral

Received | | | Security

Collateral

Received | | | Net

Amount of

Derivatives

Assets | |

Exchange-Traded Derivatives: | | | | | | | | | | | | | | | | | | | | |

Morgan Staley & Co., LLC | | $ | 1,075,860 | | | $ | (387,627 | ) | | $ | – 0 | – | | $ | – 0 | – | | $ | 688,233 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 1,075,860 | | | $ | (387,627 | ) | | $ | – 0 | – | | $ | – 0 | – | | $ | 688,233 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Counterparty | | Derivative

Liabilities

Subject

to a MA | | | Derivative

Available

for Offset | | | Cash

Collateral

Pledged* | | | Security

Collateral

Pledged* | | | Net

Amount of

Derivatives

Liabilities | |

Exchange-Traded Derivatives: | | | | | | | | | | | | | | | | | | | | |

Morgan Staley & Co., LLC** | | $ | 387,627 | | | $ | (387,627 | ) | | $ | – 0 | – | | $ | – 0 | – | | $ | – 0 | – |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 387,627 | | | $ | (387,627 | ) | | $ | – 0 | – | | $ | – 0 | – | | $ | – 0 | – |

| | | | | | | | | | | | | | | | | | | | |

| * | | The actual collateral received/pledged may be more than the amount reported due to overcollateralization. |

| ** | | Cash has been posted for initial margin requirements for exchange traded derivatives outstanding at September 30, 2014. |

NOTE D

Shares of Beneficial Interest

During the six months ended September 30, 2014, the Fund did not issue any shares in connection with the Fund’s dividend reinvestment plan. During the year ended March 31, 2014 the Fund issued 1,172,608 shares in connection with the Fund’s dividend reinvestment plan.

| | |

| 28 | | • ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND |

Notes to Financial Statements

Subscriptions and Repurchases

Generally, initial and additional subscriptions for shares may be accepted as of the first day of each month. The Fund reserves the right to reject any subscription for shares. The Fund intends to repurchase shares from shareholders in accordance with written tenders by shareholders at those times, in those amounts, and on such terms and conditions as the Board of Trustees may determine in its sole discretion. When a repurchase offer occurs, a shareholder will generally be required to provide notice of their tender of shares for repurchase to the Fund more than three months in advance of the date that the shares will be valued for repurchase (the “Valuation Date”). Valuation Dates are generally expected to be the last business days of March, June, September or December, and payment for tendered shares will generally be made by the Fund approximately 45 days following the Valuation Date.

Transactions in shares of beneficial interest were as follows for the six months ended September 30, 2014 and year ended March 31, 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Shares | | | | | Amount | | | |

| | | Six Months Ended

September 30, 2014

(unaudited) | | | Year Ended

March 31, 2014 | | | | | Six Months Ended

September 30, 2014 (unaudited) | | | Year Ended

March 31, 2014 | | | |

| | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 22,999,288 | | | | 57,803,640 | | | | | $ | 262,814,151 | | | $ | 638,396,570 | | | |

| | | |

Shares issued in reinvestment of dividends | | | – 0 | – | | | 1,172,608 | | | | | | – 0 | – | | | 13,297,371 | | | |

| | | |

Shares redeemed | | | (1,941,889 | ) | | | (1,912,127 | ) | | | | | (22,424,080 | ) | | | (21,489,385 | ) | | |

| | | |

Net increase | | | 21,057,399 | | | | 57,064,121 | | | | | $ | 240,390,071 | | | $ | 630,204,556 | | | |

| | | |

NOTE E

Risks Involved in Investing in the Fund

Limitations on the Fund’s ability to withdraw its assets from Underlying Portfolios may limit the Fund’s ability to repurchase its shares. For example, many Underlying Portfolios impose lock-up periods prior to allowing withdrawals, which can be two years or longer. After expiration of the lock-up period, withdrawals typically are permitted only on a limited basis, such as monthly, quarterly, semi-annually or annually. Many Underlying Portfolios may also indefinitely suspend redemptions or establish restrictions on the ability to fully receive proceeds from redemptions through the application of a redemption restriction or “gate”. In instances where the primary source of funds to repurchase shares will be withdrawals from Underlying Portfolios, the application of these lock-ups and withdrawal limitations may significantly limit the Fund’s ability to repurchase its shares. Although the Investment Manager will seek to select Underlying Portfolios that offer the opportunity to have their

| | | | |

| ALLIANCEBERNSTEIN MULTI-MANAGER ALTERNATIVE FUND • | | | 29 | |

Notes to Financial Statements

shares or units redeemed within a reasonable timeframe, there can be no assurance that the liquidity of the investments of such Underlying Portfolios will always be sufficient to meet redemption requests as, and when, made.

The Fund invests primarily in Underlying Portfolios that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques that may involve significant risks. Such risks include those related to the volatility of the equity, credit, and currency markets, the use of leverage associated with certain investment strategies, derivative contracts and in connection with short positions, the potential illiquidity of certain instruments and counterparty and broker arrangements.

Some of the Underlying Portfolios in which the Fund invests may invest all or a portion of their assets in securities that are illiquid or are subject to an anticipated event. These Underlying Portfolios may create “side pockets” in which to hold these securities. Side pockets are series or classes of shares which are not redeemable by the investors but which are automatically redeemed or converted back into the Underlying Portfolio’s regular series or classes of shares upon the realization of those securities or the happening of some other liquidity event with respect to those securities.