UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22671

AB MULTI-MANAGER ALTERNATIVE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2018

Date of reporting period: March 31, 2018

ITEM 1. REPORTS TO STOCKHOLDERS.

MAR 03.31.18

ANNUAL REPORT

AB MULTI-MANAGER ALTERNATIVE FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

Sanford C. Bernstein & Company LLC (SCB) and AllianceBernstein Investments, Inc. (ABI) are the distributors of the AB family of mutual funds. SCB and ABI are members of FINRA and are affiliates of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

ANNUAL REPORT

May 29, 2018

This report provides certain performance data for AB Multi-Manager Alternative Fund (the “Fund”) for the annual reporting period ended March 31, 2018.

As a result of new portfolio managers, effective June 30, 2017, the portfolio composition is expected to evolve over time. However, given—among other factors—the limited ability of the Fund to quickly withdraw funds from the Underlying Portfolios, the change in portfolio managers had only a limited impact on the Fund’s performance for the period ended March 31, 2018.

The Fund’s investment objective is to seek long-term capital appreciation.

RETURNS AS OF MARCH 31, 2018 (unaudited)

| | | | | | | | |

| | | 6 Months | | | 12 Months | |

| AB MULTI-MANAGER ALTERNATIVE FUND | | | 0.72% | | | | 4.33% | |

| Benchmark: HFRI FOF Composite Index | | | 2.99% | | | | 6.21% | |

| S&P 500 Index | | | 5.84% | | | | 13.99% | |

| MSCI World Index (net) | | | 4.15% | | | | 13.59% | |

| Bloomberg Barclays US Aggregate Index | | | -1.08% | | | | 1.20% | |

INVESTMENT RESULTS

The table above provides performance data for the Fund and its benchmark, the HFRI Fund of Funds (“HFRI FOF”) Composite Index, for the six- and 12-month periods ended March 31, 2018. The table also includes the performance of the Standard and Poor’s (“S&P”) 500 Index, the Morgan Stanley Capital International (“MSCI”) World Index (net) and the Bloomberg Barclays US Aggregate Index.

For both periods, the Fund underperformed the HFRI FOF as well as the S&P 500 Index and the MSCI World Index (net), but outperformed the Bloomberg Barclays US Aggregate Index.

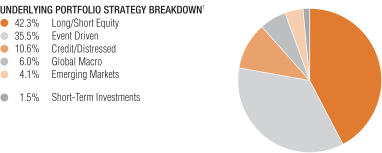

During the 12-month period, core allocations to Long/Short Equity and Event Driven Underlying Portfolios, which account for nearly 80% of the Fund, outperformed their respective strategy-specific HFRI indices, while underperformance from allocations to Emerging Markets, Credit/Distressed and Global Macro Underlying Portfolios outweighed these contributions. A hedge position, entered to lower the Fund’s equity beta risk in advance of redemption dates for some of the more directional Underlying Portfolios, also negatively impacted returns. The Fund’s Emerging Markets Underlying Portfolios were the largest underperformers relative to their

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 1 |

respective strategy-specific HFRI indices, experiencing losses from currency and fixed-income positioning, as well as net long equity positioning, especially towards the end of the period. Both Emerging Markets Underlying Portfolios positions are being redeemed subject to their notice periods and liquidity terms. The Credit/Distressed Underlying Portfolios were only slightly positive, underperforming their respective strategy-specific HFRI indices. Much of this relative underperformance stemmed from one outlier position; this Credit/Distressed Underlying Portfolio is also being redeemed subject to its liquidity terms. The Fund’s Long/Short Equity Underlying Portfolios benefited from diverse styles, such as funds focused on technology and health care sectors, as well as activist managers. Event Driven Underlying Portfolios also contributed positively as the Fund continued to benefit from positive trends in global corporate activity including mergers, restructurings and liquidations. The performance for the Global Macro Underlying Portfolio was in line with its respective strategy-specific HFRI index. However, the impact on returns was not meaningful given the relatively small allocation over the period.

During the six-month period, the Fund’s underperformance was more broad, with only Credit/Distressed meeting its respective strategy-specific HFRI index. The Long/Short Equity and Event Driven Underlying Portfolios slightly underperformed while Global Macro and Emerging Markets fell more notably short. Despite their modest underperformance, the Long/Short Equity and Event Driven Underlying Portfolios had a noticeable impact on performance because of the proportion of Fund assets they represent. The Emerging Markets and Global Macro allocations accounted for the largest underperformance relative to their respective strategy-specific HFRI indices, and had a larger impact on the Fund falling short of its benchmark. The Emerging Markets Underlying Portfolios were negatively impacted by positioning around select election outcomes, short exposures in emerging Asian countries and positioning around the US dollar. The Global Macro Underlying Portfolio detracted due to positioning in late 2017 around Brexit and short positions in US fixed-income markets. Event Driven Underlying Portfolios broadly fared well, but were limited by idiosyncratic risks from positions in the US and Europe. Long/Short Equity Underlying Portfolios benefited from a positive tailwind from global equity markets for much of the period, including historically low equity volatility through January. However, starting in February, equity markets experienced higher levels of volatility and negative returns, which limited the total contribution for the period.

For both periods, the Fund utilized derivatives for hedging purposes in the form of written options, which added to absolute returns, while purchased options detracted from absolute performance.

| | |

| 2 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

MARKET REVIEW AND INVESTMENT STRATEGY

Global stocks gained during the 12-month period ended March 31, 2018, but experienced increased volatility and declines toward the end of the period. Emerging-market equities gained the most, followed by non-US stocks. Large-cap stocks outperformed small-cap stocks, and growth outperformed value, in terms of style.

Strong corporate earnings and accelerating growth buoyed stocks globally, despite some geopolitical tensions. Tax reform in the US added to equity performance, propelling global stocks to all-time highs. However, volatility returned to the market as investors began to fear accelerating inflation and tighter monetary policy on the horizon. Additionally, President Trump’s early-March announcement of import tariffs on Chinese steel and aluminum weighed on capital markets worldwide, as investors feared the possible onset of a global trade war. Increased political and regulatory scrutiny of US mega-cap technology stocks also negatively affected market sentiment.

Fixed-income markets gained over the period. Emerging-market debt rallied, helped by increasing oil prices and improving global growth. Global high yield also performed well, followed by emerging-market local-currency government bonds, developed-market treasuries and investment-grade corporates. Outside of the eurozone, developed-market treasury yields generally flattened, with shorter maturities rising as long maturities fell. Eurozone treasury yields moved in different directions (bond yields move inversely to price).

The US Federal Reserve raised interest rates three times during the period and began to formally reduce its balance sheet by letting some of the bonds it holds mature without reinvesting the proceeds received. The European Central Bank confirmed that its newly reduced pace of asset purchases would continue through September 2018 and further, if necessary. Elsewhere, the Bank of England said that it too could increase rates faster than previously expected, depending on the strength of the UK’s economy.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 3 |

INVESTMENT POLICIES

There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors.

The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in a diversified portfolio of private investment vehicles commonly referred to as hedge funds (“Underlying Portfolios”). The Fund will invest primarily in Underlying Portfolios pursuing the following strategies: Long/Short Equity, Event Driven, Credit/Distressed, Emerging Markets and Global Macro. For more information on these strategies, please see “Portfolio of Investments” on pages 8-11. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 5-7 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on pages 25-27.

| | |

| 4 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The HFRI FOF Composite Index is an equal-weighted performance index that includes over 650 constituent funds of hedge funds that report their monthly net-of-fee returns to Hedge Fund Research, have at least $50 million under management and have been actively trading for at least 12 months. The S&P 500 Index includes 500 US stocks and is a common representation of the performance of the overall US stock market. The MSCI World Index is a free float-adjusted market capitalization weighted index provided by MSCI that is designed to measure the equity market performance of developed markets. The Bloomberg Barclays US Aggregate Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities, and commercial mortgage-backed securities. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word about Risk

An investment in the Fund’s shares may be speculative in that it involves a high degree of risk and should not constitute a complete investment program. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in the prospectus. At any point in time, an investment in the Fund’s shares may be worth less than the original amount invested, even after taking into account the distributions paid, if any, and the ability of shareholders to reinvest distributions. If any of the risks discussed below occurs, the Fund’s results of operations could be materially and adversely affected. If this were to happen, the price of Fund shares could decline significantly and you could lose all or a part of your investment.

Investment in this Fund is highly speculative and involves substantial risk, including loss of principal, and therefore may not be suitable for all investors.

General Risk Factors: Underlying Portfolios may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments by Underlying Portfolios in illiquid assets and foreign markets and

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 5 |

DISCLOSURES AND RISKS (continued)

the use of short sales, options, leverage, futures, swaps and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in Underlying Portfolios are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Underlying Portfolios are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation payable to an Underlying Portfolio investment advisor may create an incentive to make riskier or more speculative investments. Underlying Portfolios typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any Underlying Portfolio will achieve its investment objectives.

Tax Risks: The Fund intends to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code. However, in order to qualify as a RIC and also to avoid having to pay an “excise tax,” the Fund will be subject to certain limitations on its investments and operations, including a requirement that a specified proportion of its income come from qualifying sources, an asset diversification requirement and minimum distribution requirements. Satisfaction of the various requirements requires significant support and information from the Underlying Portfolio funds, and such support and information may not be available, sufficient, verifiable, or provided on a timely basis.

Limited Liquidity: The Fund’s shares are not listed on any securities exchange or traded in any other market, and are subject to substantial restrictions on transfer. Although the Fund has offered to repurchase shares on a quarterly basis, such periodic repurchase offers are at the sole discretion of the Fund’s Board of Trustees, and there is no assurance that these repurchase offers will continue. It will normally be four to six months between the time an investor tenders shares for repurchase (i.e., requests that the Fund repurchase shares as part of a repurchase offer) and the investor’s receipt of any cash proceeds associated with the repurchase.

Fund of Funds Considerations: The Fund will have no control rights over and limited transparency into the investment programs of the Underlying Portfolio in which it invests. In valuing the Fund’s holdings, the Investment Manager will generally rely on financial information provided by underlying portfolios, which may be unaudited, estimated and/or may not involve third parties. The Fund’s investment opportunities may be limited as a result of withdrawal terms or anticipated liquidity needs (e.g., withdrawal restrictions imposed by underlying hedge funds may delay, preclude or involve expense in connection with portfolio adjustments by the Investment Manager).

| | |

| 6 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 7 |

PORTFOLIO SUMMARY

March 31, 2018 (unaudited)

Net Assets ($mil): $1,155.1

| 1 | All data are as of March 31, 2018. The Fund’s strategy breakdown is expressed as a percentage of total investments and may vary over time. |

| | |

| 8 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS

March 31, 2018

| | | | | | | | | | | | | | |

Underlying Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

|

Long/Short Equity | | | | | | | | | | | | | | |

Aravt Global Fund Ltd. | | | 12,759 | | | $ | 14,875,211 | | | | 1.3 | % | | Semi-Annual |

Coatue Offshore Fund, Ltd. | | | 242,243 | | | | 45,138,384 | | | | 3.9 | | | Quarterly |

Corvex Offshore Ltd. | | | 15,377 | | | | 15,882,833 | | | | 1.4 | | | Quarterly |

Darsana Overseas Fund Ltd. | | | 20,362 | | | | 26,474,946 | | | | 2.3 | | | Quarterly |

Jana Nirvana Offshore Fund, Ltd. | | | 20,543 | | | | 24,083,934 | | | | 2.1 | | | Quarterly |

Janchor Partners Pan-Asian Fund | | | 216,000 | | | | 28,127,659 | | | | 2.4 | | | Triennially |

Luminus Energy Partners, Ltd. | | | 20,077 | | | | 44,485,060 | | | | 3.9 | | | Quarterly |

Marble Arch Offshore Partners, Ltd. | | | 30,000 | | | | 27,974,743 | | | | 2.4 | | | Quarterly |

Nokota Capital Offshore Fund, Ltd. | | | 13,737 | | | | 24,000,208 | | | | 2.1 | | | Quarterly |

OrbiMed Partners, Ltd. | | | 15,968 | | | | 33,298,509 | | | | 2.9 | | | Quarterly |

Pershing Square International, Ltd. | | | 914 | | | | 1,578,779 | | | | 0.1 | | | Quarterly |

PFM Healthcare Offshore Fund, Ltd. | | | 53,003 | | | | 53,816,791 | | | | 4.7 | | | Quarterly |

Sheffield International Partners, Ltd. | | | 17,000 | | | | 17,266,579 | | | | 1.5 | | | Anniversary |

Starboard Leaders Fund LP. | | | 7,324 | | | | 8,455,713 | | | | 0.7 | | | At Fund’s Discretion |

The Children’s Investment Fund | | | 200,000 | | | | 23,450,000 | | | | 2.0 | | | Triennially |

Think Investments Offshore Ltd. | | | 24,769 | | | | 37,205,538 | | | | 3.2 | | | Semi-Annual |

Two Creeks Capital Offshore Fund, Ltd. | | | 23,226 | | | | 26,094,415 | | | | 2.3 | | | Quarterly |

Tybourne Equity (Offshore) Fund | | | 26,550 | | | | 44,142,570 | | | | 3.8 | | | Quarterly |

Wellington Management Investors (Bermuda) Ltd. | | | 92,776 | | | | 0 | ^ | | | 0.0 | | | At Fund’s Discretion |

| | | | | | | | | | | | | | |

Total | | | | | | | 496,351,872 | | | | 43.0 | | | |

| | | | | | | | | | | | | | |

| | | | |

Event Driven | | | | | | | | | | | | | | |

Canyon Balanced Fund (Cayman), Ltd. | | | 7,302 | | | | 15,474,203 | | | | 1.3 | | | Quarterly |

CQS Directional Opportunities Feeder Fund Limited. | | | 6,064 | | | | 37,317,801 | | | | 3.2 | | | Monthly |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 9 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

|

Empyrean Capital Overseas Fund, Ltd. | | | 18,781 | | | $ | 27,503,494 | | | | 2.4 | % | | Quarterly |

Fir Tree International Value Fund, Ltd. | | | 46 | | | | 2,214,718 | | | | 0.2 | | | Biennially |

Governors Lane Offshore Fund Ltd. | | | 27,548 | | | | 30,203,964 | | | | 2.6 | | | Quarterly |

Indaba Capital Partners (Cayman), LP | | | 22,572 | | | | 24,742,716 | | | | 2.2 | | | Quarterly |

King Street Capital, Ltd. | | | 191,853 | | | | 32,901,773 | | | | 2.9 | | | Quarterly |

Lion Point International, Ltd. | | | 36,002 | | | | 37,356,035 | | | | 3.2 | | | Semi-Annual |

Luxor Capital Partners Offshore Liquidating SPV, Ltd. | | | 2,410 | | | | 2,692,627 | | | | 0.2 | | | At Fund’s Discretion |

Manikay Offshore Fund, Ltd. | | | 22,546 | | | | 35,128,362 | | | | 3.0 | | | Quarterly |

Myriad Opportunities Offshore Fund Limited | | | 48,797 | | | | 59,678,555 | | | | 5.2 | | | Quarterly |

Pentwater Event Fund Ltd. | | | 4,748 | | | | 14,017,152 | | | | 1.2 | | | Monthly |

Roystone Capital Offshore Fund Ltd. | | | 625 | | | | 571,743 | | | | 0.1 | | | Quarterly |

Senator Global Opportunity Offshore Fund II Ltd. | | | 35,134 | | | | 39,728,976 | | | | 3.4 | | | Quarterly |

TBC Offshore Ltd. | | | 15,644 | | | | 16,929,046 | | | | 1.5 | | | Quarterly |

Third Point Offshore Fund, Ltd. | | | 98,152 | | | | 40,523,657 | | | | 3.5 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 416,984,822 | | | | 36.1 | | | |

| | | | | | | | | | | | | | |

| | | | |

Credit/Distressed | | | | | | | | | | | | | | |

Claren Road Credit Fund, Ltd. | | | 37 | | | | 25,944 | | | | 0.0 | | | At Fund’s Discretion |

Elliott International Limited | | | 23,648 | | | | 32,491,761 | | | | 2.8 | | | Quarterly |

Oaktree Value Opportunities (Cayman) Fund, Ltd. | | | 3,750 | | | | 4,006,403 | | | | 0.3 | | | Every 18 Months |

Panning Overseas Fund, Ltd. | | | 9,098 | | | | 9,269,333 | | | | 0.8 | | | Quarterly |

Silver Point Capital Offshore Fund, Ltd. | | | 3,520 | | | | 53,217,402 | | | | 4.6 | | | Annual |

Warlander Offshore Fund, Ltd. | | | 30,000 | | | | 25,221,430 | | | | 2.2 | | | Quarterly |

Wingspan Overseas Fund, Ltd. | | | 953 | | | | 638,227 | | | | 0.1 | | | Fund in Liquidation |

| | | | | | | | | | | | | | |

Total | | | | | | | 124,870,500 | | | | 10.8 | | | |

| | | | | | | | | | | | | | |

| | |

| 10 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

|

Global Macro | | | | | | | | | | | | | | |

Graticule Asia Macro Fund Ltd. | | | 33,000 | | | $ | 32,787,622 | | | | 2.8 | % | | Quarterly |

Light Sky Macro Offshore Fund Ltd. | | | 20,000 | | | | 18,535,751 | | | | 1.6 | | | Quarterly |

Rokos Global Macro Fund Limited | | | 305,720 | | | | 18,592,663 | | | | 1.6 | | | Monthly |

| | | | | | | | | | | | | | |

Total | | | | | | | 69,916,036 | | | | 6.0 | | | |

| | | | | | | | | | | | | | |

| | | | |

Emerging Markets | | | | | | | | | | | | | | |

Discovery Global Opportunity Fund, Ltd. | | | 190,553 | | | | 28,665,607 | | | | 2.5 | | | Semi-Annual |

Spinnaker GEM Holdings Ltd. | | | 138,864 | | | | 19,712,002 | | | | 1.7 | | | Annual |

| | | | | | | | | | | | | | |

Total | | | | | | | 48,377,609 | | | | 4.2 | | | |

| | | | | | | | | | | | | | |

Total Underlying Portfolios (cost $984,783,941) | | | | | | | 1,156,500,839 | | | | 100.1 | | | |

| | | | | | | | | | | | | | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | |

AB Fixed Income Shares, Inc. – Government Money Market Portfolio – Class AB, 1.41%(a)(b)(c) (cost $17,300,000) | | | 17,300,000 | | | | 17,300,000 | | | | 1.5 | | | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments (cost $1,002,083,941) | | | | | | | 1,173,800,839 | | | | 101.6 | | | |

Liabilities in excess of other assets | | | | | | | (18,741,011 | ) | | | (1.6 | ) | | |

| | | | | | | | | | | | | | |

| | | | |

Net Assets | | | | | | $ | 1,155,059,828 | | | | 100.0 | % | | |

| | | | | | | | | | | | | | |

| (a) | Affiliated investments. |

| (b) | The rate shown represents the 7-day yield as of period end. |

| (c) | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov, or call AB at (800) 227-4618. |

| * | The investment strategies and liquidity of the Underlying Portfolios in which the Fund invests are as follows: |

Long/Short Equity Underlying Portfolios seek to buy securities with the expectation that they will increase in value (called “going long”) and sell securities short in the expectation that they will decrease in value (“going short”). Underlying Portfolios within this strategy are generally subject to 45 – 120 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to three years.

Event Driven Underlying Portfolios seek to take advantage of information inefficiencies resulting from a particular corporate event, such as a takeover, liquidation, bankruptcy, tender offer, buyback, spin-off, exchange offer, merger or other type of corporate reorganization. Underlying Portfolios within this strategy are generally subject to 60 – 180 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of up to two years.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 11 |

PORTFOLIO OF INVESTMENTS (continued)

Credit/Distressed Underlying Portfolios invest in a variety of fixed income and other securities, including bonds (corporate and government), bank debt, asset-backed financial instruments, mortgage-backed securities and mezzanine and distressed securities, as well as securities of distressed companies and high yield securities. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of up to three years.

Emerging Markets Underlying Portfolios invest in a range of emerging markets asset classes including debt, equity and currencies, and may use a broad array of hedging techniques involving both emerging markets and non-emerging markets securities with the intention of reducing volatility and enhancing returns. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. Underlying Portfolios may have lock up periods of up to one year.

Global Macro Underlying Portfolios aim to identify and exploit imbalances in global economics and asset classes, typically utilizing macroeconomic and technical market factors rather than “bottom-up” individual security analysis. The Underlying Portfolios within this strategy are subject to 30 – 90 day redemption notice periods. Certain Underlying Portfolios have a lock up period of one year.

The Fund may also make direct investments in securities (other than securities of Underlying Portfolios), options, futures, options on futures, swap contracts, or other derivative or financial instruments.

See notes to financial statements.

| | |

| 12 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

STATEMENT OF ASSETS & LIABILITIES

March 31, 2018

| | | | |

| Assets | | | | |

Investments in unaffiliated Underlying Portfolios, at value (cost $984,783,941) | | $ | 1,156,500,839 | |

Investments in affiliated Underlying Portfolios, at value (cost $17,300,000) | | | 17,300,000 | |

Cash | | | 6,030,028 | |

Receivable for investments sold | | | 3,146,503 | |

Investment in Underlying Portfolios paid in advance (see Note A2) | | | 1,800,000 | |

Affiliated dividends receivable | | | 19,756 | |

| | | | |

Total assets | | | 1,184,797,126 | |

| | | | |

| Liabilities | | | | |

Payable for shares of beneficial interest redeemed | | | 26,150,454 | |

Subscriptions received in advance | | | 1,588,400 | |

Management fee payable | | | 1,492,437 | |

Administrative fee payable | | | 126,455 | |

Transfer Agent fee payable | | | 19,938 | |

Accrued expenses | | | 359,614 | |

| | | | |

Total liabilities | | | 29,737,298 | |

| | | | |

Net Assets | | $ | 1,155,059,828 | |

| | | | |

| Composition of Net Assets | | | | |

Shares of beneficial interest, at par | | $ | 103,161 | |

Additional paid-in capital | | | 1,130,560,893 | |

Distributions in excess of net investment income | | | (83,404,223 | ) |

Accumulated net realized loss on investment transactions | | | (63,916,901 | ) |

Net unrealized appreciation on investments | | | 171,716,898 | |

| | | | |

Net Assets | | $ | 1,155,059,828 | |

| | | | |

Shares of beneficial interest outstanding—unlimited shares authorized, with par value of $.001 (based on 103,161,149 shares outstanding) | | $ | 11.20 | |

| | | | |

See notes to financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 13 |

STATEMENT OF OPERATIONS

Year Ended March 31, 2018

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends—Affiliated issuers | | | | | | $ | 153,097 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Management fee (see Note B) | | $ | 18,427,232 | | | | | |

Custodian | | | 506,975 | | | | | |

Administrative | | | 303,267 | | | | | |

Credit facility fees | | | 450,322 | | | | | |

Transfer agency | | | 245,696 | | | | | |

Trustee’s fees | | | 145,307 | | | | | |

Legal | | | 120,021 | | | | | |

Audit and tax | | | 115,850 | | | | | |

Registration fees | | | 94,987 | | | | | |

Printing | | | 68,512 | | | | | |

Miscellaneous | | | 147,983 | | | | | |

| | | | | | | | |

Total expenses before interest expense | | | 20,626,152 | | | | | |

Interest expense | | | 26,713 | | | | | |

| | | | | | | | |

Total expenses | | | 20,652,865 | | | | | |

Less: expenses waived and reimbursed by the Investment Manager (see Note B) | | | (30,558 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 20,622,307 | |

| | | | | | | | |

Net investment loss | | | | | | | (20,469,210 | ) |

| | | | | | | | |

| Realized and Unrealized Gain on Investment Transactions | | | | | | | | |

Net realized gain on: | | | | | | | | |

Investment transactions | | | | | | | 43,644,394 | |

Options written | | | | | | | 3,425,731 | |

Net change in unrealized appreciation/depreciation of investments in Underlying Portfolios | | | | | | | 26,237,629 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 73,307,754 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 52,838,544 | |

| | | | | | | | |

See notes to financial statements.

| | |

| 14 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

March 31,

2018 | | | Year Ended

March 31,

2017 | |

Increase (Decrease) in Net Assets

from Operations | | | | | | | | |

Net investment loss | | $ | (20,469,210 | ) | | $ | (21,898,469 | ) |

Net realized gain (loss) on investment transactions | | | 47,070,125 | | | | (4,934,421 | ) |

Net change in unrealized appreciation/depreciation of investments in Underlying Portfolios | | | 26,237,629 | | | | 140,394,236 | |

| | | | | | | | |

Net increase in net assets from operations | | | 52,838,544 | | | | 113,561,346 | |

Dividends and Distributions

to Shareholders from | | | | | | | | |

Net investment income | | | (12,605,284 | ) | | | (2,836,645 | ) |

Return of capital | | | (2,494,217 | ) | | | – 0 | – |

Net realized gain on investment transactions | | | – 0 | – | | | (7,994,182 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net decrease (see Note D) | | | (131,497,085 | ) | | | (164,559,951 | ) |

| | | | | | | | |

Total decrease | | | (93,758,042 | ) | | | (61,829,432 | ) |

| Net Assets | | | | | | | | |

Beginning of period | | | 1,248,817,870 | | | | 1,310,647,302 | |

| | | | | | | | |

End of period (including distributions in excess of net investment income of ($83,404,223) and ($90,100,298), respectively) | | $ | 1,155,059,828 | | | $ | 1,248,817,870 | |

| | | | | | | | |

See notes to financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 15 |

STATEMENT OF CASH FLOWS

For the Year Ended March 31, 2018

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 52,838,544 | |

| Reconciliation of net increase in net assets from operations to net increase in cash from operating activities | | | | | | | | |

Purchases of Underlying Portfolio shares | | $ | (233,529,995 | ) | | | | |

Purchases of short-term investments | | | (256,061,010 | ) | | | | |

Sales of Underlying Portfolio shares | | | 419,857,023 | | | | | |

Proceeds from disposition of short-term investments | | | 230,343,108 | | | | | |

Net realized gain on investment transactions | | | (47,070,125 | ) | | | | |

Net change in unrealized appreciation/depreciation on investments in Underlying Portfolio shares | | | (26,237,629 | ) | | | | |

Increase in receivable for investments sold | | | (2,786,503 | ) | | | | |

Increase in affiliated dividends receivable | | | (19,756 | ) | | | | |

Decrease in receivable due from custodian | | | 27 | | | | | |

Decrease in investments in Underlying Portfolios paid in advance | | | 18,200,000 | | | | | |

Decrease in management fee payable | | | (128,684 | ) | | | | |

Increase in administrative fee payable | | | 15,211 | | | | | |

Decrease in Transfer Agent fee payable | | | (1,677 | ) | | | | |

Increase in accrued expenses | | | 12,888 | | | | | |

Proceeds from options written, net | | | 3,425,731 | | | | | |

| | | | | | | | |

Total adjustments | | | | | | | 106,018,609 | |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | | 158,857,153 | |

| Cash flows from financing activities | | | | | | | | |

Subscriptions, including change in subscriptions received in advance | | | 26,455,258 | | | | | |

Redemptions, net of payable for shares of beneficial interest redeemed | | | (197,498,984 | ) | | | | |

Distributions | | | (1,915,367 | ) | | | | |

Borrowing on credit facility | | | 18,000,000 | | | | | |

Paydowns on credit facility | | | (18,000,000 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | | | | | (172,959,093 | ) |

| | | | | | | | |

Net decrease in cash | | | | | | | (14,101,940 | ) |

Cash at beginning of year | | | | | | | 20,131,968 | |

| | | | | | | | |

Cash at end of year | | | | | | $ | 6,030,028 | |

| | | | | | | | |

* Reinvestment of dividends | | $ | 13,184,134 | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

Interest expense paid during the year | | $ | 26,713 | | | | | |

See notes to financial statements.

| | |

| 16 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS

March 31, 2018

NOTE A

Significant Accounting Policies

AB Multi-Manager Alternative Fund (the “Fund”) is a statutory trust formed under the laws of the State of Delaware and registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The Fund commenced operations on October 1, 2012. The Fund’s investment objective is to seek long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors. The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in private investment vehicles (“Underlying Portfolios”), commonly referred to as hedge funds, that are managed by unaffiliated asset managers that employ a broad range of investment strategies. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates, and such differences could be material. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Valuation of Investments

The Fund’s Board of Trustees (the “Board”) has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments in Underlying Portfolios are valued at fair value (the “Valuation Procedures”). Among other matters, the Valuation Procedures set forth the Fund’s valuation policies and the mechanisms and processes to be employed on a monthly basis to implement such policies. In accordance with the Valuation Procedures, fair value of an Underlying Portfolio as of each valuation time ordinarily is the value determined as of such month-end for each Underlying Portfolio in accordance with the Underlying Portfolio’s valuation policies and reported at the time of the Fund’s valuation. Open end mutual funds are valued at the closing net asset value per share.

On a monthly basis, the Fund generally uses the net asset value (“NAV”), provided by the Underlying Portfolios, to determine the fair value of all Underlying Portfolios which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 17 |

NOTES TO FINANCIAL STATEMENTS (continued)

interest in an Underlying Portfolio represents the amount that the Fund could reasonably expect to receive from an Underlying Portfolio if its interest were redeemed at the time of valuation. In the unlikely event that an Underlying Portfolio does not report a month-end value to the Fund on a timely basis, the Fund would determine the fair value of such Underlying Portfolio based on the most recent value reported by the Underlying Portfolio, and any other relevant information available at the time the Fund values its portfolio. In making a fair value determination, the Fund will consider all appropriate information reasonably available to it at the time and that AllianceBernstein L.P. (the “Investment Manager”) believes to be reliable. The Fund may consider factors such as, among others: (i) the price at which recent subscriptions for or redemptions of the Underlying Portfolio’s interests were effected; (ii) information provided to the Fund by the manager of an Underlying Portfolio, or the failure to provide such information as the Underlying Portfolio manager agreed to provide in the Underlying Portfolio’s offering materials or other agreements with the Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when an Underlying Portfolio imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Underlying Portfolio interests, the Fund may determine that it is appropriate to apply a discount to the NAV reported by the Underlying Portfolio. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the financial statements.

The Investment Manager has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund accounting, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities include: 1) fair value determinations (and oversight of any third parties to whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any Underlying Portfolio, and periodically thereafter, the Investment Manager will conduct a due diligence review of the valuation methodology utilized by the Underlying Portfolio. In addition, there are several processes outside of the pricing process that are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency

| | |

| 18 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs |

| | • | | Level 3—significant unobservable inputs |

In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its equivalent), as an amendment to Accounting Standards Codification (ASC) 820, Fair Value Measurement. The amendments in this ASU apply to reporting entities that elect to measure the fair value of an investment using the net asset value per share (or its equivalent) practical expedient, as the Fund does for its investments in Underlying Portfolios. The amendments in this ASU remove the requirement to categorize within the fair value hierarchy, as described above, all investments for which fair value is measured using the net asset value per share practical expedient.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of March 31, 2018:

| | | | | | | | | | | | | | | | |

Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Short-Term Investments: | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 17,300,000 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 17,300,000 | |

Investments valued at NAV** | | | | | | | | | | | | | | | 1,156,500,839 | |

| | | | | | | | | | | | | | | | |

Total(a) | | $ | 17,300,000 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 1,173,800,839 | |

| | | | | | | | | | | | | | | | |

| (a) | There were no transfers between any levels during the reporting period. |

| ** | In May 2015, the Financial Accounting Standards Board issued an Accounting Standards Update, ASU 2015-07 (the “ASU”) which removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The ASU is effective for annual periods beginning after December 15, 2015 and interim periods within those annual periods, with application of the amendments noted above retrospectively to all periods presented. The retrospective approach requires that an investment for which fair value is measured using the net asset value per share practical expedient be removed from the fair value hierarchy in all periods presented herein. Accordingly, the total investments of the Underlying Portfolios with a fair value of $1,156,500,839 have not been categorized in the fair value hierarchy. |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 19 |

NOTES TO FINANCIAL STATEMENTS (continued)

The Fund recognizes all transfers between levels of the fair value hierarchy assuming the financial instruments were transferred at the beginning of the reporting period.

2. Cash Committed

As of March 31, 2018, the Fund has committed to purchase the following Underlying Portfolios for effective date April 1, 2018:

| | |

Underlying Portfolios | | Amount Committed |

Rokos Global Macro Fund Limited* | | $1,800,000 |

| * | Investments paid in advance amounted to $1,800,000. |

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Fund will not be subject to federal and state income taxes to the extent that all of its income is distributed.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

4. Investment Income and Investment Transactions

Income and capital gain distributions, if any, are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date or effective date. Investment gains and losses are determined on the identified cost basis.

5. Expenses

Expenses included in the accompanying statements of operations do not include any expenses of the Underlying Portfolios.

6. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these

| | |

| 20 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

The character of fiscal year-end distributions is based on estimated tax information provided by certain Underlying Portfolios. The character may materially change as the Fund receives final 2017 tax reporting from Underlying Portfolios.

NOTE B

Management Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement (the “Advisory Agreement”), the Fund pays the Investment Manager a management fee at an annual rate of 1.50% of the Fund’s net assets determined as of the last day of a calendar month and adjusted for subscriptions and repurchases accepted as of the first day of the subsequent month (the “Management Fee”). The Management Fee is payable in arrears as of the last day of the subsequent month.

Under a separate administrative agreement, the Fund may use the Investment Manager and its personnel to provide certain administrative services to the Fund and, in such event, the services and payments will be subject to approval by the Fund’s Board. For the year ended March 31, 2018, the reimbursement for such fees amounted to $303,267.

The Fund may engage one or more distributors to solicit investments in the Fund. Sanford C. Bernstein & Company LLC (“Bernstein”) and AllianceBernstein Investments, Inc. (“ABI”), each an affiliate of the Investment Manager, have been selected as distributors of the Fund under Distribution Services Agreements. The Distribution Services Agreements do not call for any payments to be made to Bernstein or ABI by the Fund.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Investment Manager, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. Such compensation paid to ABIS amounted to $245,696 for the year ended March 31, 2018.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. In connection with the investment by the Fund in the Government Money Market Portfolio, the Investment Manager has contractually agreed to waive its advisory fee from the Fund in an amount

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 21 |

NOTES TO FINANCIAL STATEMENTS (continued)

equal to the Fund’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the year ended March 31, 2018, such waiver amounted to $30,558.

A summary of the Fund’s transactions in AB mutual funds for the year ended March 31, 2018 is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Fund | | Market Value

3/31/17 (000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

3/31/18 (000) | | | Dividend

Income

(000) | |

Government Money Market Portfolio | | $ | – 0 | – | | $ | 247,000 | | | $ | 229,700 | | | $ | 17,300 | | | $ | 153 | |

NOTE C

Investment Transactions

1. Purchases and Sales

Purchases and sales of investments in the Underlying Portfolios, aggregated $233,529,995 and $420,076,421, respectively, for the year ended March 31, 2018.

The cost of investments and gross unrealized appreciation and unrealized depreciation for federal income tax purposes.

| | | | |

Cost | | $ | 1,139,111,677 | |

| | | | |

Gross unrealized appreciation | | $ | 181,762,724 | |

Gross unrealized depreciation | | | (147,073,562 | ) |

| | | | |

Net unrealized appreciation | | $ | 34,689,162 | |

| | | | |

The differences between book and tax cost of investments is primarily due to investments in passive foreign investment companies and partnerships.

2. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The principal types of derivatives utilized by the Fund, as well as the methods in which they may be used are:

For hedging and investment purposes, the Fund may purchase and write (sell) put and call options on U.S. and foreign securities, including government securities, and foreign currencies that are traded on U.S. and foreign securities exchanges and over-the-counter

| | |

| 22 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

markets. Among other things, the Fund may use options transactions for non-hedging purposes as a means of making direct investments in foreign currencies, as described below under “Currency Transactions” and may use options strategies involving the purchase and/or writing of various combinations of call and/or put options, for hedging and investment purposes.

The risk associated with purchasing an option is that the Fund pays a premium whether or not the option is exercised. Additionally, the Fund bears the risk of loss of the premium and change in market value should the counterparty not perform under the contract. If a put or call option purchased by the Fund were permitted to expire without being sold or exercised, its premium would represent a loss to the Fund. Put and call options purchased are accounted for in the same manner as portfolio securities. The cost of securities acquired through the exercise of call options is increased by premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid.

When the Fund writes an option, the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from written options which expire unexercised are recorded by the Fund on the expiration date as realized gains from options written. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium received is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium received is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium received reduces the cost basis of the security or currency purchased by the Fund. In writing an option, the Fund bears the market risk of an unfavorable change in the price of the security or currency underlying the written option. Exercise of an option written by the Fund could result in the Fund selling or buying a security or currency at a price different from the current market value.

During the year ended March 31, 2018, the Fund held purchased options for hedging purposes.

During the year ended March 31, 2018, the Fund held written options for hedging purposes.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 23 |

NOTES TO FINANCIAL STATEMENTS (continued)

During the year ended March 31, 2018, the Fund had entered into the following derivatives:

| | | | | | | | | | |

Derivative Type | | Location of Gain or (Loss) on

Derivatives Within

Statement of

Operations | | Realized Gain

or (Loss) on

Derivatives | | | Change in

Unrealized

Appreciation or

(Depreciation) | |

Equity contracts | | Net realized gain (loss) on investment transactions; Net change in unrealized appreciation/depreciation of investments | | $ | (8,417,902 | ) | | $ | – 0 | – |

| | | |

Equity contracts | | Net realized gain (loss) on options written; Net change in unrealized appreciation/depreciation of options written | | | 3,425,731 | | | | – 0 | – |

| | | | | | | | | | |

Total | | | | $ | (4,992,171 | ) | | $ | – 0 | – |

| | | | | | | | | | |

The following table represents the average monthly volume of the Fund’s derivative transactions during the year ended March 31, 2018:

| | | | |

Purchased Options: | | | | |

Average notional amount | | $ | 1,595,005 | (a) |

Options Written: | | | | |

Average notional amount | | $ | 1,595,005 | (a) |

| (a) | Positions were open for four months during the period. |

3. Currency Transactions

The Fund may invest in non-U.S. Dollar-denominated securities on a currency hedged or unhedged basis through its investments in an Underlying Portfolio. The Fund or an Underlying Portfolio may seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives, including forward currency exchange contracts, futures and options on futures, swaps, and other options. The Fund or an Underlying Portfolio may enter into transactions for investment opportunities when it anticipates that a foreign currency will appreciate or depreciate in value but securities denominated in that currency are not held by the Fund or the Underlying Portfolio and do not present attractive investment opportunities. Such transactions may also be used when the Investment Manager or the manager of an Underlying Portfolio believes that it may be more efficient than a direct investment in a foreign currency-denominated security. A Fund or an Underlying Portfolio may

| | |

| 24 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

also conduct currency exchange contracts on a spot basis (i.e., for cash at the spot rate prevailing in the currency exchange market for buying or selling currencies).

NOTE D

Shares of Beneficial Interest

Generally, initial and additional subscriptions for shares may be accepted as of the first day of each month. The Fund reserves the right to reject any subscription for shares. The Fund intends to repurchase shares from shareholders in accordance with written tenders by shareholders at those times, in those amounts, and on such terms and conditions as the Board of Trustees may determine in its sole discretion. When a repurchase offer occurs, a shareholder will generally be required to provide notice of their tender of shares for repurchase to the Fund more than three months in advance of the date that the shares will be valued for repurchase (the “Valuation Date”). Valuation Dates are generally expected to be the last business days of March, June, September or December, and payment for tendered shares will generally be made by the Fund approximately 45 days following the Valuation Date.

Transactions in shares of beneficial interest were as follows for the year ended March 31, 2018 and year ended March 31, 2017:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares | | | | | | Amount | | | | |

| | | Year Ended

March 31, 2018 | | | Year Ended

March 31, 2017 | | | | | | Year Ended

March 31, 2018 | | | Year Ended

March 31, 2017 | | | | |

| | | | | | | | |

Shares sold | | | 2,637,812 | | | | 5,206,026 | | | | | | | $ | 29,519,509 | | | $ | 53,981,872 | | | | | |

| | | | | |

Shares issued in reinvestment of dividends and distributions | | | 1,178,207 | | | | 903,268 | | | | | | | | 13,184,134 | | | | 9,538,513 | | | | | |

| | | | | |

Shares redeemed | | | (15,585,132 | ) | | | (21,593,486 | ) | | | | | | | (174,200,728 | ) | | | (228,080,336 | ) | | | | |

| | | | | |

Net decrease | | | (11,769,113 | ) | | | (15,484,192 | ) | | | | | | $ | (131,497,085 | ) | | $ | (164,559,951 | ) | | | | |

| | | | | |

NOTE E

Risks Involved in Investing in the Fund

Limitations on the Fund’s ability to withdraw its assets from Underlying Portfolios may limit the Fund’s ability to repurchase its shares. For example, many Underlying Portfolios impose lock-up periods prior to allowing withdrawals, which can be two years or longer. After expiration of the lock-up period, withdrawals typically are permitted only on a limited basis, such as monthly, quarterly, semi-annually or annually. Many Underlying Portfolios may also indefinitely suspend redemptions or establish restrictions on the ability to fully receive proceeds from redemptions through the application of a redemption restriction or “gate”. In instances where the primary

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 25 |

NOTES TO FINANCIAL STATEMENTS (continued)

source of funds to repurchase shares will be withdrawals from Underlying Portfolios, the application of these lock-ups and withdrawal limitations may significantly limit the Fund’s ability to repurchase its shares. Although the Investment Manager will seek to select Underlying Portfolios that offer the opportunity to have their shares or units redeemed within a reasonable timeframe, there can be no assurance that the liquidity of the investments of such Underlying Portfolios will always be sufficient to meet redemption requests as, and when, made.

The Fund invests primarily in Underlying Portfolios that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques that may involve significant risks. Such risks include those related to the volatility of the equity, credit, and currency markets, the use of leverage associated with certain investment strategies, derivative contracts and in connection with short positions, the potential illiquidity of certain instruments and counterparty and broker arrangements.

Some of the Underlying Portfolios in which the Fund invests may invest all or a portion of their assets in securities that are illiquid or are subject to an anticipated event. These Underlying Portfolios may create “side pockets” in which to hold these securities. Side pockets are series or classes of shares which are not redeemable by the investors but which are automatically redeemed or converted back into the Underlying Portfolio’s regular series or classes of shares upon the realization of those securities or the happening of some other liquidity event with respect to those securities.

These “side pockets” can often be held for long periods before they are realized, and may therefore be much less liquid than the general liquidity offered on the Underlying Portfolio’s regular series or classes of shares. Should the Fund seek to liquidate its investment in an Underlying Portfolio that maintains investments in a side pocket arrangement or that holds a substantial portion of its assets in illiquid securities, the Fund might not be able to fully liquidate its investments without delay, which could be considerable. In such cases, during the period until the Fund is permitted to fully liquidate the investment in the Underlying Portfolio, the value of the investment could fluctuate.

The Underlying Portfolios may utilize leverage in pursuit of achieving a potentially greater investment return. The use of leverage exposes an Underlying Portfolio to additional risk including (i) greater losses from investments than would otherwise have been the case had the Underlying Portfolio not used leverage to make the investments; (ii) margin calls or interim margin requirements may force premature liquidations of investment positions; and (iii) losses on investments where the investment fails to

| | |

| 26 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

earn a return that equals or exceeds the Underlying Portfolio’s cost of leverage related to such investment. In the event of a sudden, precipitous drop in the value of an Underlying Portfolio’s assets, the Underlying Portfolio might not be able to liquidate assets quickly enough to repay its borrowings, further magnifying the losses incurred by the Underlying Portfolio.

The Underlying Portfolios may invest in securities of foreign companies that involve special risks and considerations not typically associated with investments in the United States, due to concentrated investments in a limited number of countries or regions, which may vary throughout the year depending on the Underlying Portfolio. Such concentrations may subject the Underlying Portfolios to additional risks resulting from political or economic conditions in such countries or regions, and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their prices to be more volatile than those of comparable U.S. securities.

The Underlying Portfolios may invest a higher percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Underlying Portfolios may be more susceptible to economic, political and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Underlying Portfolio’s net asset value.

The Fund invests in a limited number of Underlying Portfolios. Such concentration may result in additional risk. Various risks are also associated with an investment in the Fund, including risks relating to compensation arrangements and risks relating to limited liquidity of the Interests.

The Fund is subject to credit risk arising from its transactions with its custodian, State Street Bank and Trust, related to holding the Fund’s cash. This credit risk arises to the extent that the custodian may be unable to fulfill its obligation to return the Fund’s cash held in its custody.

In the ordinary course of business, the Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these indemnification provisions and expects the risk of loss thereunder to be remote. Therefore, the Fund has not accrued any liability in connection with these indemnification provisions.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 27 |

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE F

Tax Information

The tax character of fiscal year-end distributions for 2018 is based on estimated tax information provided by certain Underlying Portfolios. The character may materially change as the Fund receives final 2017 tax reporting from Underlying Portfolios. The tax character of distributions paid during the fiscal years ended March 31, 2018 and March 31, 2017 were as follows:

| | | | | | | | |

| | | 2018 | | | 2017 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 12,605,284 | | | $ | 2,840,922 | |

Return of capital | | $ | 2,494,217 | | | | | |

Long-term capital gains | | $ | – 0 | – | | | 7,989,905 | |

| | | | | | | | |

Total taxable distributions paid | | $ | 15,099,501 | | | $ | 10,830,827 | |

| | | | | | | | |

As of March 31, 2018, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | | |

Undistributed net investment income | | $ | – 0 | – |

Accumulated capital and other losses | | | (10,293,384 | )(a) |

Unrealized appreciation/(depreciation) | | | 34,689,162 | (b) |

| | | | |

Total accumulated earnings/(deficit) | | $ | 24,395,778 | |

| | | | |

| (a) | At March 31, 2018, the Fund had a qualified late-year ordinary loss deferral of $5,363,236 and a post-October short-term capital loss deferral of $3,031,761. These losses are deemed to arise on April 1, 2018. |

| (b) | The differences between book-basis and tax-basis unrealized appreciation/(depreciation) are attributable primarily to the tax treatment of passive foreign investment companies (PFICs) and partnerships. |

For tax purposes, net capital losses may be carried over to offset future capital gains, if any. Funds are permitted to carry forward capital losses for an indefinite period, and such losses will retain their character as either short-term or long-term capital losses. During the current fiscal year, the Fund utilized $8,399,038 of prior year capital losses. As of March 31, 2018, the Fund has $1,898,387 in short-term carry forward capital losses.

During the current fiscal year, permanent differences primarily due to the tax treatment of a net operating loss and, the tax treatment of passive foreign investment companies, resulted in a net decrease in distributions in excess of net investment income, a net increase in accumulated net realized loss on investments and foreign currency transactions and a corresponding decrease to paid in capital. This reclassification had no effect on net assets.

| | |

| 28 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE G

Credit Facility

The Fund is a party to a $75 million revolving credit facility (the “Facility”) intended to provide short term financing, if necessary, subject to certain restrictions in connection with, among other matters, abnormal redemption activity. Credit Facility fees are paid by the Fund and are included in the statement of operations. The Fund had no borrowings outstanding from the Facility at March 31, 2018. For the year ended March 31, 2018, the Fund had borrowings under the Agreement as follows:

| | | | |

Average Daily

Loan Balance* | | Maximum Daily

Loan Outstanding | | Weighted

Average

Interest Rate |

| $ 9,105,263 | | $ 11,000,000 | | 2.78% |

| * | For 38 days borrowings were outstanding. |

NOTE H

Subsequent Events

The Fund’s Board has approved certain changes to the Fund’s investment policies, including to permit an increased portion of the Fund’s assets to be invested directly in securities and derivatives rather than in Underlying Portfolios. These changes are expected to take effect during the third quarter of 2018.

In addition, the Investment Manager has agreed to waive a portion of its management fee so that the Fund pays management fees at an annual rate of 1.00% of the Fund’s net assets determined as of the last day of a calendar month and adjusted for subscriptions and repurchases accepted as of the first day of the subsequent month. This fee waiver is expected to take effect on June 1, 2018 and will continue until July 31, 2019 unless sooner terminated by the Board.

Management has evaluated subsequent events for possible recognition or disclosure in the financial statements through the date the financial statements are issued. Management has determined that there are no other material events that would require disclosure in the Fund’s financial statements through this date.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 29 |

FINANCIAL HIGHLIGHTS

Selected Data For A Share Of Beneficial Interest Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended March 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 10.87 | | | | $ 10.05 | | | | $ 11.64 | | | | $ 11.41 | | | | $ 10.75 | |

| | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss(a) | | | (.19 | ) | | | (.18 | ) | | | (.19 | ) | | | (.20 | )(b) | | | (.20 | )(b) |

Net realized and unrealized gain (loss) on investment transactions | | | .66 | | | | 1.09 | | | | (1.12 | ) | | | .56 | | | | 1.06 | |

| | | | |

Net increase (decrease) in net asset value from operations | | | .47 | | | | .91 | | | | (1.31 | ) | | | .36 | | | | .86 | |

| | | | |

Less: Dividends and Distributions | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (.12 | ) | | | (.02 | ) | | | (.01 | ) | | | (.02 | ) | | | (.17 | ) |

Distributions from net realized gain on investment transactions | | | – 0 | – | | | (.07 | ) | | | (.27 | ) | | | (.11 | ) | | | (.03 | ) |

Return of capital | | | (.02 | ) | | | – 0 | – | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | |

Total dividends and distributions | | | (.14 | ) | | | (.09 | ) | | | (.28 | ) | | | (.13 | ) | | | (.20 | ) |

| | | | |

Net asset value, end of period | | | $ 11.20 | | | | $ 10.87 | | | | $ 10.05 | | | | $ 11.64 | | | | $ 11.41 | |

| | | | |

Total Return | | | | | | | | | | | | | | | | | | | | |

Total investment return based on net asset value(c) | | | 4.33 | % | | | 9.06 | % | | | (11.38 | )% | | | 3.16 | % | | | 8.04 | % |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | | $1,155,060 | | | | $1,248,818 | | | | $1,310,647 | | | | $1,376,552 | | | | $980,537 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | | | | | | |

Expenses, net of waivers/reimbursements(d)(e) | | | 1.68 | % | | | 1.67 | % | | | 1.66 | % | | | 1.75 | %(b) | | | 1.75 | %(b) |

Expenses, before waivers/reimbursements(d)(e) | | | 1.68 | % | | | 1.67 | % | | | 1.66 | % | | | 1.75 | % | | | 1.79 | % |

Net investment loss(e) | | | (1.66 | )% | | | (1.67 | )% | | | (1.66 | )% | | | (1.75 | )%(b) | | | (1.75 | )%(b) |

Portfolio turnover rate | | | 19 | % | | | 3 | % | | | 7 | % | | | 8 | % | | | 0 | %(f) |

Asset coverage ratio | | | N/A | | | | N/A | | | | N/A | | | | 33,674 | % | | | N/A | |

Bank borrowing outstanding (in millions) | | | N/A | | | | N/A | | | | N/A | | | | $4 | | | | N/A | |

See footnote summary on page 31.

| | |

| 30 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

FINANCIAL HIGHLIGHTS (continued)

Selected Data For A Share Of Beneficial Interest Outstanding Throughout Each Period

| (a) | Based on average shares outstanding. |

| (b) | Net of fees and expenses waived/reimbursed by the Investment Manager. |

| (c) | Total investment return is calculated assuming a purchase of beneficial shares on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (d) | The expense ratios presented below exclude interest expense: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended March 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | |

Expenses | | | 1.68 | % | | | 1.66 | % | | | 1.66 | % | | | 1.75 | % | | | N/A | |

| (e) | The expense and net investment loss ratios do not include income earned or expenses incurred by the Fund through its Underlying Portfolios. |

| (f) | Amount is less than .50%. |

See notes to financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 31 |

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

AB Multi-Manager Alternative Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of AB Multi-Manager Alternative Fund (the “Fund”) as of March 31, 2018, the related statements of operations and cash flows for the year ended March 31, 2018, the statement of changes in net assets for each of the two years in the period ended March 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended March 31, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2018, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period ended March 31, 2018 and the financial highlights for each of the five years in the period ended March 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.