… a better banking experience CU Bancorp 2015 Annual Shareholder Meeting Exhibit 99.1

Forward-Looking Statements This press release contains certain forward-looking information about CU Bancorp (the “Company”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. Forward-looking statements speak only as of the date they are made and we assume no duty to update such statements. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied or projected by, such forward-looking statements. Risks and uncertainties include, but are not limited to: lower than expected revenues; credit quality deterioration or a reduction in real estate values which could cause an increase in the allowance for credit losses and a reduction in net earnings; increased competitive pressure among depository institutions; the Company’s ability to complete future acquisitions, successfully integrate acquired entities, or achieve expected beneficial synergies and/or operating efficiencies within expected time-frames or at all; the cost of additional capital is more than expected; a change in the interest rate environment reduces net interest margins; asset/liability repricing risks and liquidity risks; legal matters could be filed against the Company and could take longer or cost more than expected to resolve or may be resolved adversely to the Company; general economic conditions, either nationally or in the market areas in which the Company does or anticipates doing business, are less favorable than expected; environmental conditions, including natural disasters and drought, may disrupt our business, impede our operations, negatively impact the values of collateral securing the Company’s loans and leases or impair the ability of our borrowers to support their debt obligations; the economic and regulatory effects of the continuing war on terrorism and other events of war; legislative or regulatory requirements or changes adversely affecting the Company’s business; changes in the securities markets; regulatory approvals for any capital activities cannot be obtained on the terms expected or on the anticipated schedule; and, other risks that are described in CU Bancorp’s public filings with the U.S. Securities and Exchange Commission (the “SEC”). If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, CU Bancorp’s results could differ materially from those expressed in, implied or projected by such forward-looking statements. CU Bancorp assumes no obligation to update such forward-looking statements. For a more complete discussion of risks and uncertainties, investors and security holders are urged to read CU Bancorp’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed by CU Bancorp with the SEC. The documents filed by CU Bancorp with the SEC may be obtained at CU Bancorp’s website at www.cubancorp.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CU Bancorp by directing a request to: CU Bancorp c/o California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, CA 91436. Attention: Investor Relations. Telephone 818-257-7700.

Corporate Overview California United Bank (CUB) is a premier community-based commercial bank serving the LA Basin (Los Angeles, Orange, San Bernardino, Riverside and Ventura county markets) Established by local business owners and entrepreneurs in 2005 Ten full-service offices in Los Angeles, San Fernando Valley, Conejo Valley, Santa Clarita Valley, Simi Valley, South Bay, Anaheim, Irvine/Newport Beach, West Los Angeles and the Inland Empire Serving businesses, non-profit organizations, entrepreneurs and professionals Total assets of $2.6 billion CUB grew total assets at a 41% CAGR and total deposits at a 47% CAGR since inception in 2005 through December 31, 2014 CUB is a “well capitalized” institution, as defined by federal regulations, the highest regulatory classification

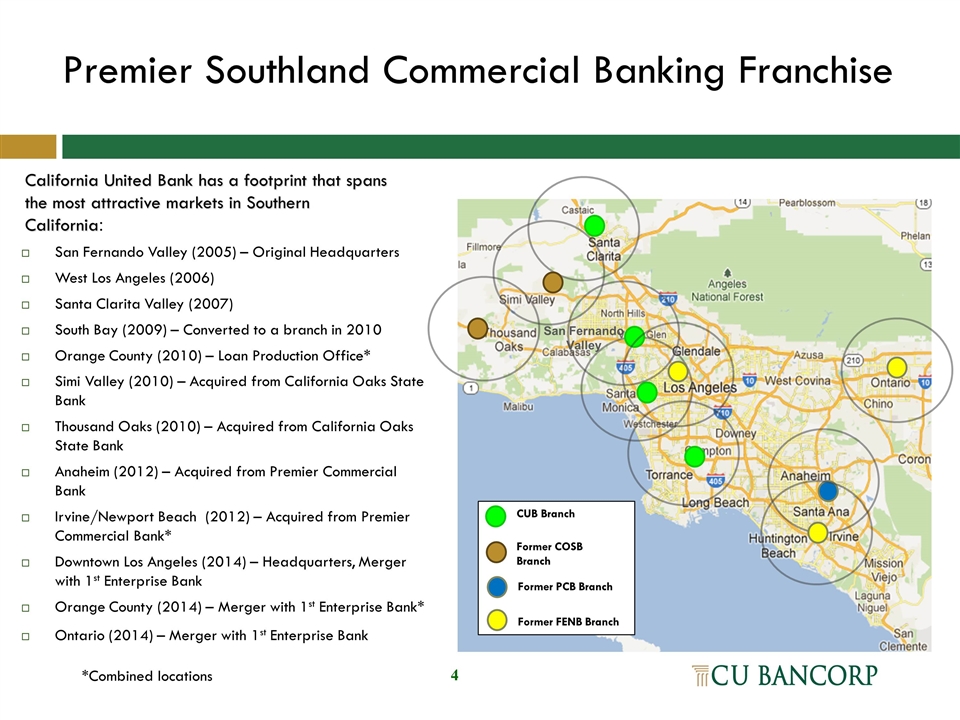

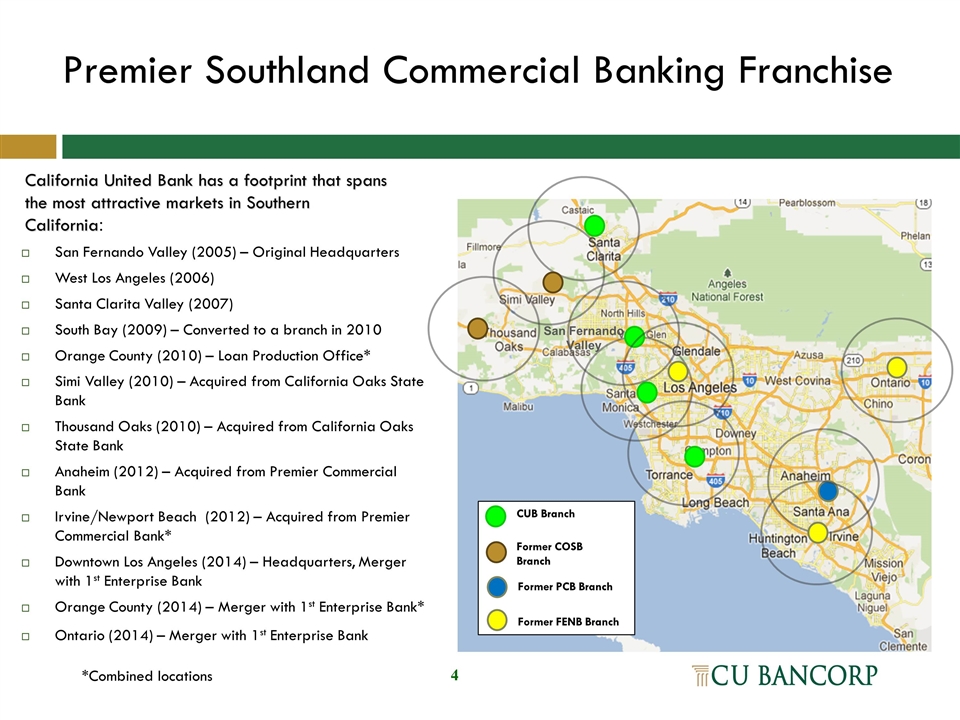

California United Bank has a footprint that spans the most attractive markets in Southern California: Premier Southland Commercial Banking Franchise San Fernando Valley (2005) – Original Headquarters West Los Angeles (2006) Santa Clarita Valley (2007) South Bay (2009) – Converted to a branch in 2010 Orange County (2010) – Loan Production Office* Simi Valley (2010) – Acquired from California Oaks State Bank Thousand Oaks (2010) – Acquired from California Oaks State Bank Anaheim (2012) – Acquired from Premier Commercial Bank Irvine/Newport Beach (2012) – Acquired from Premier Commercial Bank* Downtown Los Angeles (2014) – Headquarters, Merger with 1st Enterprise Bank Orange County (2014) – Merger with 1st Enterprise Bank* Ontario (2014) – Merger with 1st Enterprise Bank CUB Branch Former COSB Branch Former PCB Branch Former FENB Branch *Combined locations San Fernando Valley 4

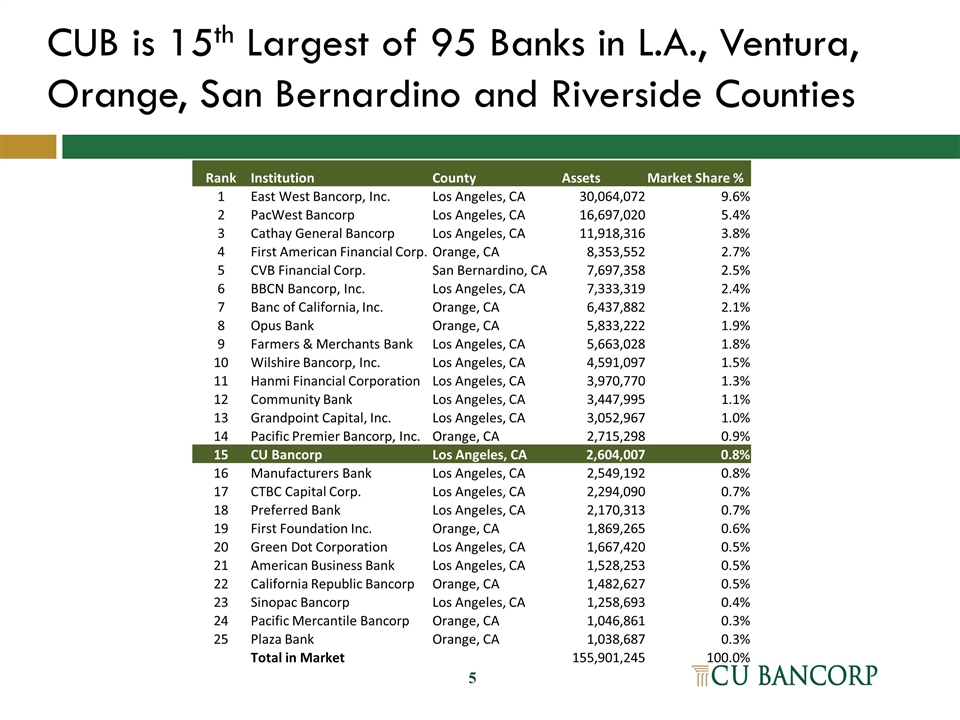

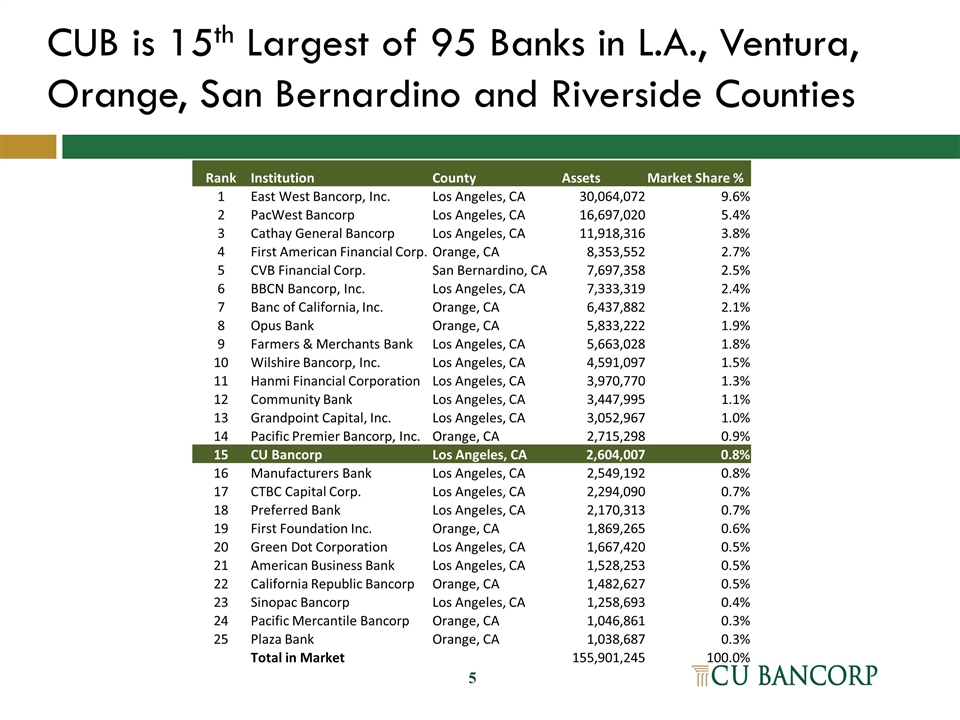

CUB is 15th Largest of 95 Banks in L.A., Ventura, Orange, San Bernardino and Riverside Counties Rank Institution County Assets Market Share % 1 East West Bancorp, Inc. Los Angeles, CA 30,064,072 9.6% 2 PacWest Bancorp Los Angeles, CA 16,697,020 5.4% 3 Cathay General Bancorp Los Angeles, CA 11,918,316 3.8% 4 First American Financial Corp. Orange, CA 8,353,552 2.7% 5 CVB Financial Corp. San Bernardino, CA 7,697,358 2.5% 6 BBCN Bancorp, Inc. Los Angeles, CA 7,333,319 2.4% 7 Banc of California, Inc. Orange, CA 6,437,882 2.1% 8 Opus Bank Orange, CA 5,833,222 1.9% 9 Farmers & Merchants Bank Los Angeles, CA 5,663,028 1.8% 10 Wilshire Bancorp, Inc. Los Angeles, CA 4,591,097 1.5% 11 Hanmi Financial Corporation Los Angeles, CA 3,970,770 1.3% 12 Community Bank Los Angeles, CA 3,447,995 1.1% 13 Grandpoint Capital, Inc. Los Angeles, CA 3,052,967 1.0% 14 Pacific Premier Bancorp, Inc. Orange, CA 2,715,298 0.9% 15 CU Bancorp Los Angeles, CA 2,604,007 0.8% 16 Manufacturers Bank Los Angeles, CA 2,549,192 0.8% 17 CTBC Capital Corp. Los Angeles, CA 2,294,090 0.7% 18 Preferred Bank Los Angeles, CA 2,170,313 0.7% 19 First Foundation Inc. Orange, CA 1,869,265 0.6% 20 Green Dot Corporation Los Angeles, CA 1,667,420 0.5% 21 American Business Bank Los Angeles, CA 1,528,253 0.5% 22 California Republic Bancorp Orange, CA 1,482,627 0.5% 23 Sinopac Bancorp Los Angeles, CA 1,258,693 0.4% 24 Pacific Mercantile Bancorp Orange, CA 1,046,861 0.3% 25 Plaza Bank Orange, CA 1,038,687 0.3% Total in Market 155,901,245 100.0%

Southern California is an Exceptional Environment for Middle-Market Commercial Banking The L.A. Basin (Los Angeles, Orange, Riverside, San Bernardino and Ventura counties) is the 16th largest economy in the world1, behind Spain and Mexico and ahead of the Netherlands, Indonesia and Turkey Los Angeles County would be 9th largest state in U.S. by population Orange County would be 31st largest state in U.S. by population Five-county area is home to more than 606,298 small- and middle-market businesses2 (defined as employing 1 to 499 workers) 1) Source: IMF World Economic Outlook (WEO), Oct. 7, 2014 2) Source: Los Angeles Economic Development Corp.

Relationship Banking Strategy Creates Competitive Advantage High-touch relationship management team offers what we consider “a better banking experience” for small- and medium-sized businesses Personalized and responsive service – no “800” number, customer service delivered by dedicated relationship managers Majority of new customers come from larger banks, unhappy with service Most new business results from “warm leads” provided by referrals Expertise in, and focus on, business banking C&I and owner-occupied commercial real estate are 53% of loan portfolio Non-interest bearing deposits are 55% of total deposits Strong credit culture maintains solid asset quality NPAs to total assets of 0.21% at September 30, 2015 Positioned in extraordinary market Current 10-branch footprint covers one of the largest and most attractive metropolitan areas in the U.S.

CUB Employees Have a Strong Presence in the Community CUB employees are involved in their local communities Strong cultural value demonstrates that supporting the community is also good business CUB supports over 75 charities throughout Southern California financially and with volunteer hours Local advisory board members help identify worthy charitable organizations to support “Outstanding” CRA Rating

Strategy for High Quality Growth Strong and Ongoing Organic Growth Establish a highly desirable footprint in region with tremendous opportunities for growth Leverage relationship-based banking approach and superior service Recruit experienced and connected “in market” talent Build on products and expertise acquired in strategic acquisitions, such as the SBA lending platform obtained with Premier Commercial Bank Strong capital management Result: Asset CAGR of 41% from inception in 2005 through 2014 Growth by Opportunistic Merger/Acquisition Strong management team experienced with strategic, successful acquisitions Focus on in-market and in-state acquisitions and mergers Immediately accretive to earnings Tangible book value payback under four years Result: Successfully completed three transactions since 2010

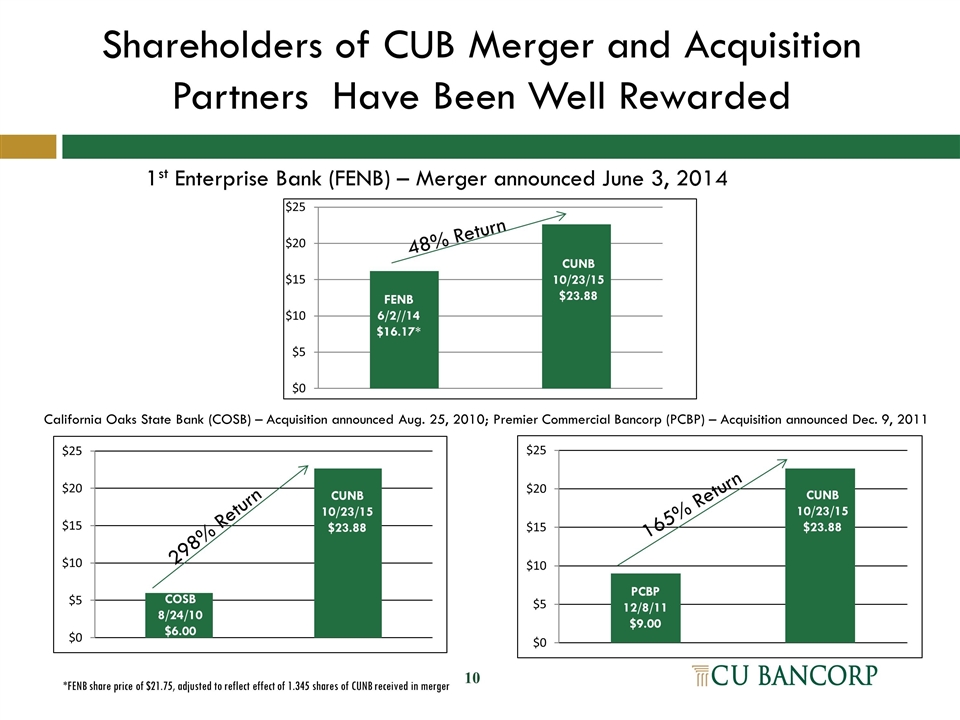

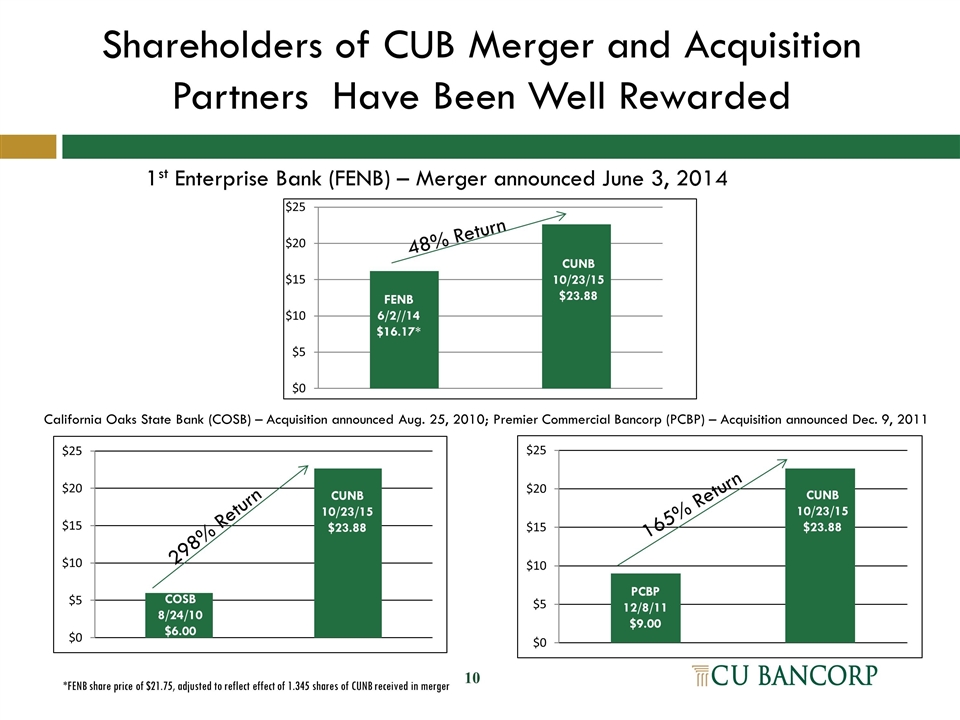

Shareholders of CUB Merger and Acquisition Partners Have Been Well Rewarded COSB 8/24/10 $6.00 CUNB 10/23/15 $23.88 PCBP 12/8/11 $9.00 CUNB 10/23/15 $23.88 1st Enterprise Bank (FENB) – Merger announced June 3, 2014 California Oaks State Bank (COSB) – Acquisition announced Aug. 25, 2010; Premier Commercial Bancorp (PCBP) – Acquisition announced Dec. 9, 2011 FENB 6/2//14 $16.17* CUNB 10/23/15 $23.88 *FENB share price of $21.75, adjusted to reflect effect of 1.345 shares of CUNB received in merger 298% Return 48% Return 165% Return

Successful Merger with 1st Enterprise Year-to-date net income available to common shareholders at 9/30/15 was $14.9 million compared to $7.6 million for the same period in the prior year Year-to-date diluted core EPS at 9/30/15 was $0.88, compared to $0.68 for the same period in the prior year Total loans have grown at an annualized rate of 12% since year-end 2014 Total deposits have grown at an annualized rate of 21% since year-end 2014 Continued strong credit quality since merger Year to date charge-offs of 0.03% of average loans

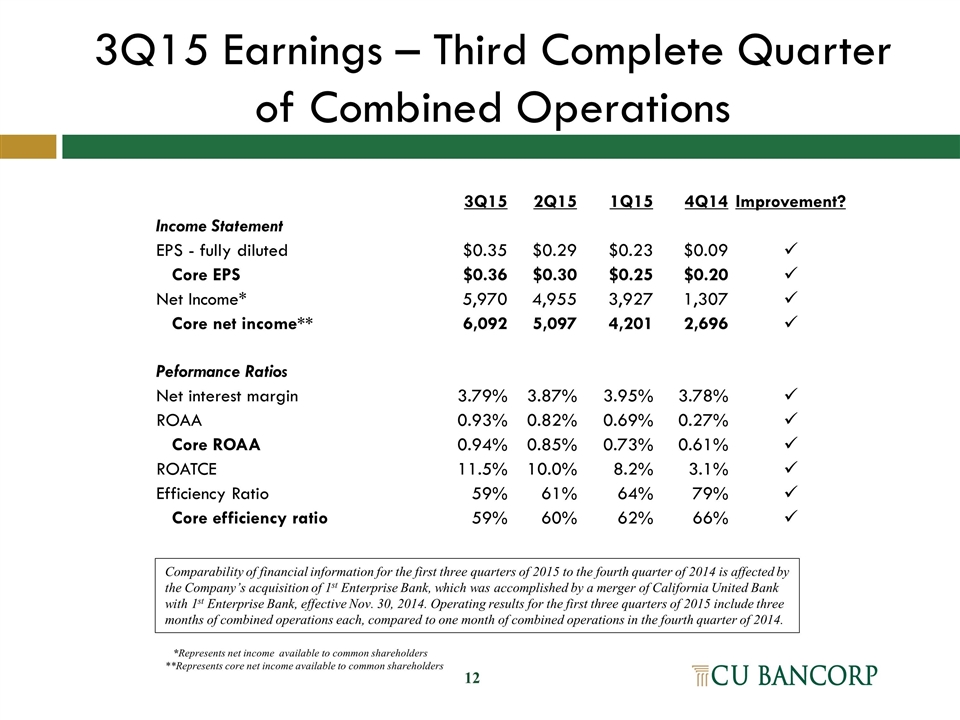

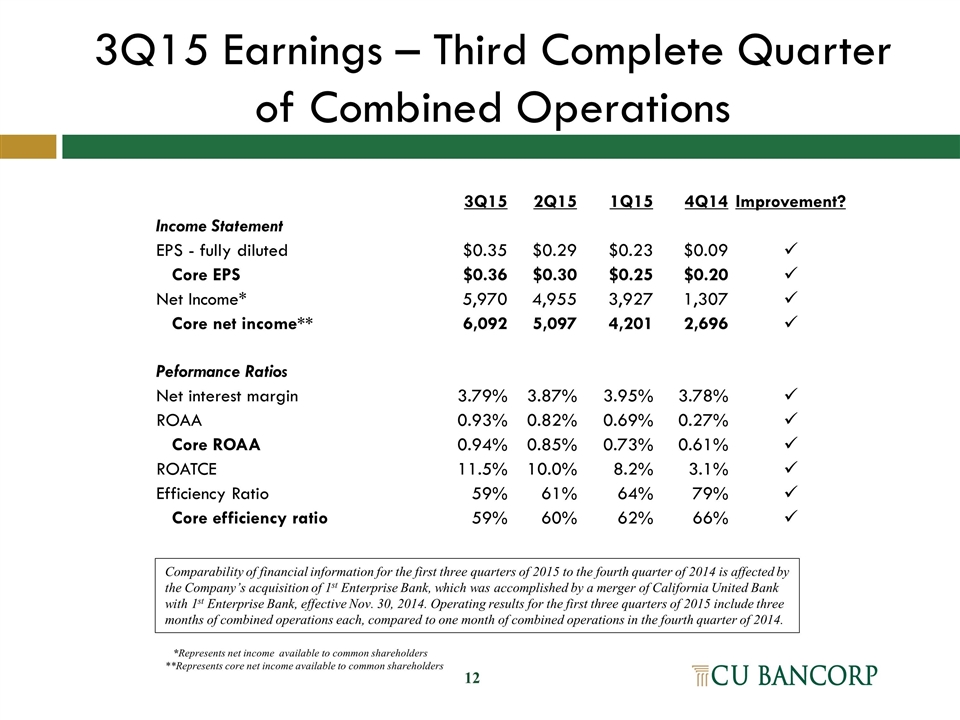

3Q15 Earnings – Third Complete Quarter of Combined Operations Comparability of financial information for the first three quarters of 2015 to the fourth quarter of 2014 is affected by the Company’s acquisition of 1st Enterprise Bank, which was accomplished by a merger of California United Bank with 1st Enterprise Bank, effective Nov. 30, 2014. Operating results for the first three quarters of 2015 include three months of combined operations each, compared to one month of combined operations in the fourth quarter of 2014. 3Q15 2Q15 1Q15 4Q14 Improvement? Income Statement EPS - fully diluted $0.35 $0.29 $0.23 $0.09 ü Core EPS $0.36 $0.30 $0.25 $0.20 ü Net Income* 5,970 4,955 3,927 1,307 ü Core net income** 6,092 5,097 4,201 2,696 ü Peformance Ratios Net interest margin 3.79% 3.87% 3.95% 3.78% ü ROAA 0.93% 0.82% 0.69% 0.27% ü Core ROAA 0.94% 0.85% 0.73% 0.61% ü ROATCE 11.5% 10.0% 8.2% 3.1% ü Efficiency Ratio 59% 61% 64% 79% ü Core efficiency ratio 59% 60% 62% 66% ü *Represents net income available to common shareholders **Represents core net income available to common shareholders

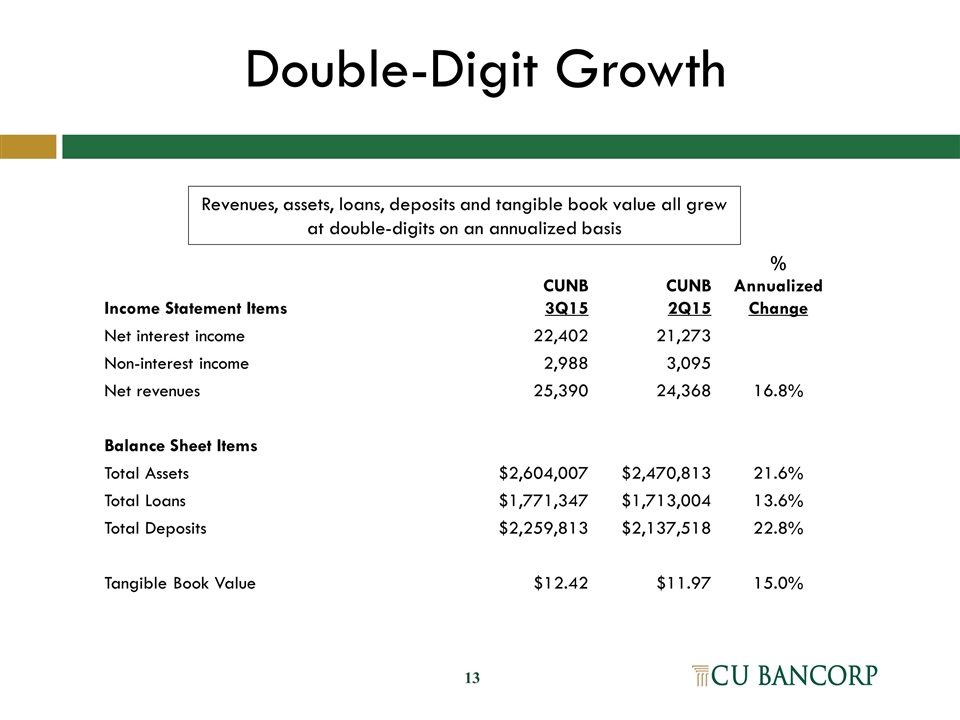

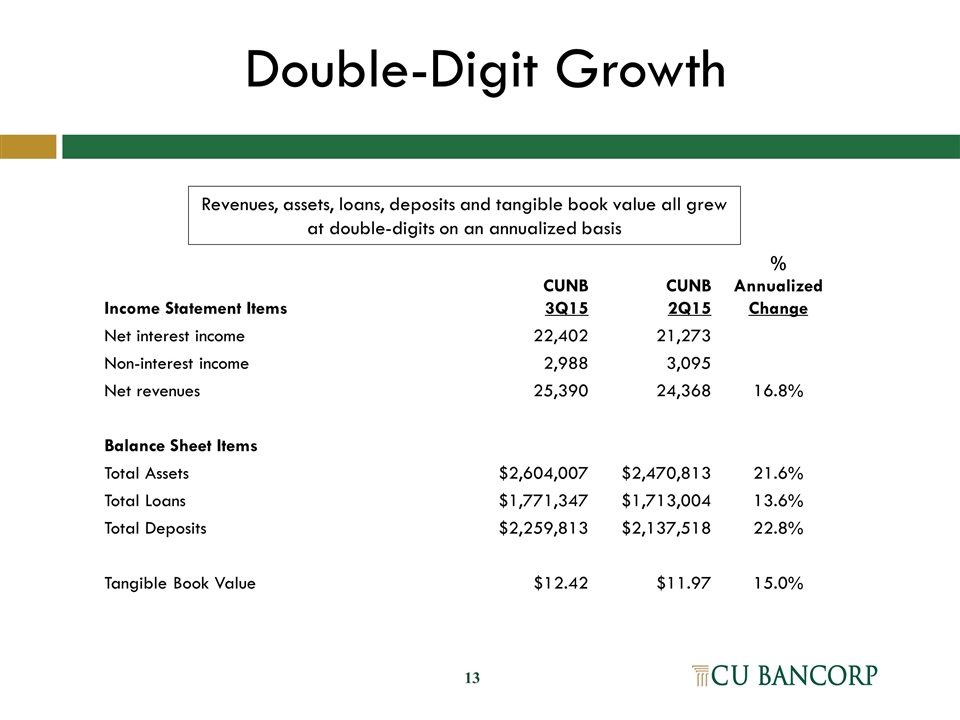

Double-Digit Growth Revenues, assets, loans, deposits and tangible book value all grew at double-digits on an annualized basis Income Statement Items CUNB 3Q15 CUNB 2Q15 % Annualized Change Net interest income 22,402 21,273 Non-interest income 2,988 3,095 Net revenues 25,390 24,368 16.8% Balance Sheet Items Total Assets $2,604,007 $2,470,813 21.6% Total Loans $1,771,347 $1,713,004 13.6% Total Deposits $2,259,813 $2,137,518 22.8% Tangible Book Value $12.42 $11.97 15.0%

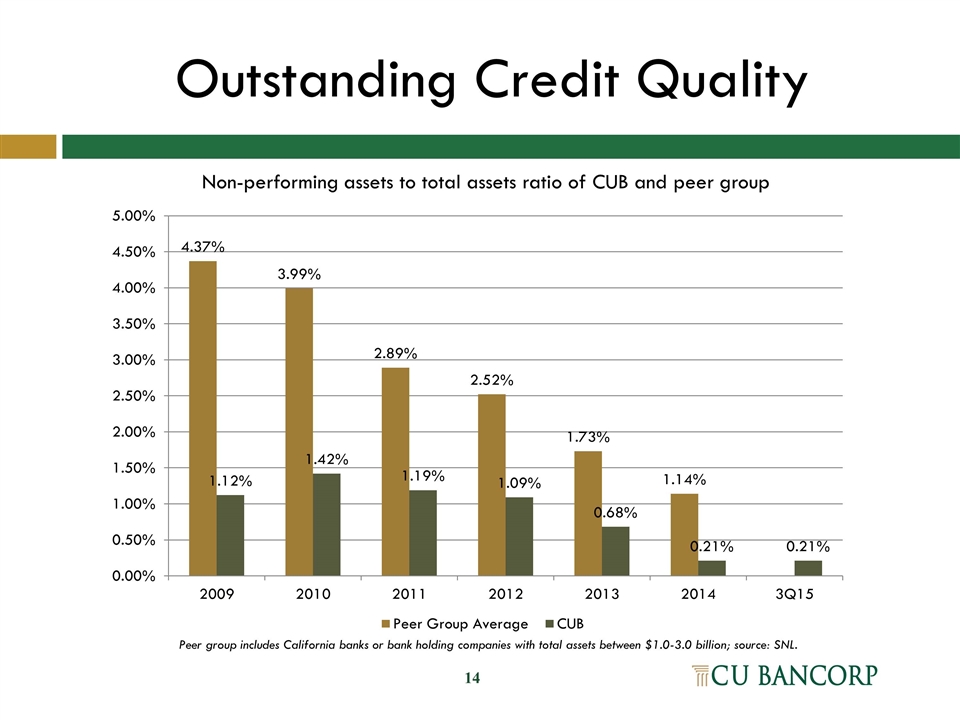

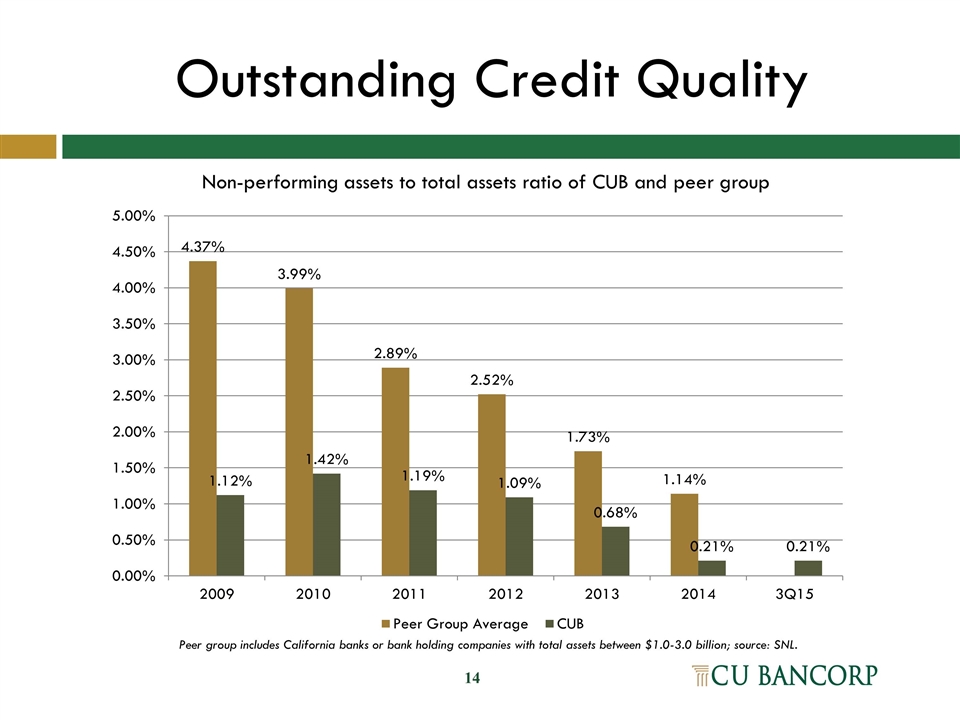

Outstanding Credit Quality Non-performing assets to total assets ratio of CUB and peer group Peer group includes California banks or bank holding companies with total assets between $1.0-3.0 billion; source: SNL.

Investment Highlights Premier community-based, business banking franchise serving large and diverse Southern California market Scarcity value of $2.6 billion “pure play” business bank in one of the country’s top markets Strong organic loan growth and attractive low-cost core deposit base Exceptional credit quality Opportunistic acquirer with successful history of transactions Improving efficiency ratio and return on average tangible equity driven by recent merger

Thank You Shareholders For more information, please contact: Karen Schoenbaum, CFO (213) 430-7000 kschoenbaum@cunb.com