UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | February 28 | |

| | | |

| Date of reporting period: | August 31, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Blueprint Adaptive

Growth Allocation Fund

Institutional Class: (BLUIX)

Investor Class: (BLUPX)

Semi-Annual Report

August 31, 2023

(Unaudited)

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| LETTER TO SHAREHOLDERS | September 7, 2023 |

Dear Shareholders,

The Fund’s return for the six months ended August 31, 2023 was 9.27% versus the Morningstar Global Allocation Index return of 6.36%, due in large part to the Fund’s strategy of increased exposure in the growth and technology sectors and the overall equity market.

Currently, it appears the market will be driven by a potential soft landing in the economy combined with visibility on interest rates (how high and how long). We believe the equity markets have been boosted by the change in sentiment from a year ago that a recession was a foregone conclusion to now being less and less likely. Stubborn inflation and higher rate talk from the Fed has not significantly hampered equity returns as economic data has remained robust yet just weak enough to show interest rate hikes are working. On the other hand, higher rates have negatively affected real estate securities and the bond market. As a result, the fund’s portfolio continues to be overweight equities, particularly in the U.S. but underweight real estate and bonds of any duration.

We often say that the best indication of what will happen in the near future is what is happening now, as trends tend to persist. Consequently, we expect continued strength in U.S. stocks, particularly technology names and growth segments. If inflation forecasts maintain their trajectory in the right direction and the Fed can declare or at least hint at a peak in interest rates, without the odds of recession increasing, we believe that the equity and bond markets will respond positively. Regardless, we believe the fund’s tactical approach will allow it to capitalize on current trends or adjust to changing market conditions should they occur.

Thank you for your continued confidence and support of the Blueprint Adaptive Growth Allocation Fund.

Best,

|  |

| Jon Robinson | Brandon Langley |

Blueprint Fund Management, LLC

www.blueprintmutualfunds.com

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-866-983-4525.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.blueprintmutualfunds.com or call 1-866-983-4525 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of August 31st, 2023, please see the Schedule of Investments section of the semi-annual report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward- looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates.

Blueprint Adaptive Growth Allocation Fund (the “Fund”) is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to individuals who invest in the Fund or any member of the public regarding the advisability of investing in equity securities generally or in the Fund in particular of the ability of the Fund to track the Morningstar Indices or general equity market performance. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE FUND OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| PORTFOLIO INFORMATION |

| August 31, 2023 (Unaudited) |

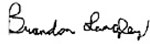

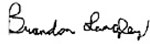

Sector Diversification (% of Net Assets)

| Top 10 Equity Holdings |

| | % of |

| | Net Assets |

| Apple, Inc. | 9.1% |

| Microsoft Corporation | 8.3% |

| Alphabet, Inc. - Classes A & C | 4.4% |

| Amazon.com, Inc. | 3.7% |

| NVIDIA Corporation | 3.6% |

| iShares Gold Trust | 2.5% |

| Tesla, Inc. | 2.3% |

| iShares MSCI India ETF | 2.2% |

| Berkshire Hathaway, Inc. - Class B | 2.1% |

| Meta Platforms, Inc. - Class A | 2.0% |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS |

| August 31, 2023 (Unaudited) |

| COMMON STOCKS — 90.0% | | Shares | | | Value | |

| Communications — 9.4% | | | | | | | | |

| Cable & Satellite — 0.7% | | | | | | | | |

| Charter Communications, Inc. - Class A (a) | | | 318 | | | $ | 139,322 | |

| Comcast Corporation - Class A | | | 13,155 | | | | 615,128 | |

| | | | | | | | 754,450 | |

| Internet Media & Services — 7.6% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 18,111 | | | | 2,466,175 | |

| Alphabet, Inc. - Class C (a) | | | 16,269 | | | | 2,234,547 | |

| Booking Holdings, Inc. (a) | | | 116 | | | | 360,183 | |

| Meta Platforms, Inc. - Class A (a) | | | 7,405 | | | | 2,191,065 | |

| Netflix, Inc. (a) | | | 1,495 | | | | 648,352 | |

| Shopify, Inc. - Class A (a) | | | 3,993 | | | | 265,495 | |

| | | | | | | | 8,165,817 | |

| Publishing & Broadcasting — 0.2% | | | | | | | | |

| Scholastic Corporation | | | 1,219 | | | | 52,966 | |

| World Wrestling Entertainment, Inc. - Class A | | | 1,339 | | | | 129,280 | |

| | | | | | | | 182,246 | |

| Telecommunications — 0.9% | | | | | | | | |

| Deutsche Telekom AG - ADR | | | 20,253 | | | | 433,212 | |

| SoftBank Group Corporation - ADR | | | 22,951 | | | | 514,102 | |

| | | | | | | | 947,314 | |

| Consumer Discretionary — 9.7% | | | | | | | | |

| Apparel & Textile Products — 0.2% | | | | | | | | |

| LVMH Moet Hennessy Louis Vuitton SE - ADR | | | 1,491 | | | | 252,396 | |

| | | | | | | | | |

| Automotive — 3.0% | | | | | | | | |

| Mercedes-Benz Group AG - ADR | | | 13,989 | | | | 255,439 | |

| Tesla, Inc. (a) | | | 9,518 | | | | 2,456,406 | |

| Toyota Motor Corporation - ADR | | | 3,132 | | | | 539,111 | |

| | | | | | | | 3,250,956 | |

| Consumer Services — 0.1% | | | | | | | | |

| Perdoceo Education Corporation | | | 1,302 | | | | 21,574 | |

| Stride, Inc. (a) | | | 1,267 | | | | 53,835 | |

| | | | | | | | 75,409 | |

| E-Commerce Discretionary — 3.7% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 28,470 | | | | 3,929,145 | |

| | | | | | | | | |

| Home Construction — 0.0% (b) | | | | | | | | |

| Griffon Corporation | | | 1,272 | | | | 53,259 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Consumer Discretionary — 9.7% (Continued) | | | | | | | | |

| Leisure Facilities & Services — 0.5% | | | | | | | | |

| McDonald’s Corporation | | | 1,926 | | | $ | 541,495 | |

| | | | | | | | | |

| Retail - Discretionary — 2.1% | | | | | | | | |

| Avis Budget Group, Inc. (a) | | | 837 | | | | 178,607 | |

| Builders FirstSource, Inc. (a) | | | 2,781 | | | | 403,356 | |

| Home Depot, Inc. (The) | | | 3,422 | | | | 1,130,287 | |

| Lowe’s Companies, Inc. | | | 2,208 | | | | 508,900 | |

| | | | | | | | 2,221,150 | |

| Wholesale - Discretionary — 0.1% | | | | | | | | |

| ePlus, Inc. (a) | | | 480 | | | | 31,862 | |

| Veritiv Corporation | | | 545 | | | | 91,740 | |

| | | | | | | | 123,602 | |

| Consumer Staples — 4.8% | | | | | | | | |

| Beverages — 0.8% | | | | | | | | |

| Coca-Cola Consolidated, Inc. | | | 76 | | | | 53,117 | |

| MGP Ingredients, Inc. | | | 657 | | | | 78,774 | |

| National Beverage Corporation (a) | | | 617 | | | | 31,658 | |

| PepsiCo, Inc. | | | 3,663 | | | | 651,721 | |

| | | | | | | | 815,270 | |

| Food — 0.4% | | | | | | | | |

| Mondelez International, Inc. - Class A | | | 3,477 | | | | 247,771 | |

| Pilgrim’s Pride Corporation (a) | | | 1,269 | | | | 31,928 | |

| Post Holdings, Inc. (a) | | | 1,665 | | | | 149,367 | |

| | | | | | | | 429,066 | |

| Household Products — 1.8% | | | | | | | | |

| Inter Parfums, Inc. | | | 152 | | | | 21,239 | |

| L’Oreal S.A. - ADR | | | 2,887 | | | | 253,652 | |

| Procter & Gamble Company (The) | | | 8,730 | | | | 1,347,388 | |

| Unilever plc - ADR | | | 4,984 | | | | 254,284 | |

| | | | | | | | 1,876,563 | |

| Retail - Consumer Staples — 1.8% | | | | | | | | |

| Costco Wholesale Corporation | | | 1,570 | | | | 862,370 | |

| Grocery Outlet Holding Corporation (a) | | | 2,082 | | | | 64,230 | |

| Murphy USA, Inc. | | | 880 | | | | 279,523 | |

| Walmart, Inc. | | | 4,704 | | | | 764,917 | |

| | | | | | | | 1,971,040 | |

| Wholesale - Consumer Staples — 0.0% (b) | | | | | | | | |

| Andersons, Inc. (The) | | | 826 | | | | 42,423 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Energy — 5.4% | | | | | | | | |

| Oil & Gas Producers — 4.9% | | | | | | | | |

| Baytex Energy Corporation (a) | | | 1,984 | | | $ | 8,075 | |

| BP plc - ADR | | | 6,893 | | | | 256,282 | |

| Civitas Resources, Inc. | | | 1,456 | | | | 119,712 | |

| CNX Resources Corporation (a) | | | 3,873 | | | | 86,562 | |

| ConocoPhillips | | | 4,057 | | | | 482,905 | |

| DT Midstream, Inc. | | | 3,261 | | | | 170,518 | |

| Exxon Mobil Corporation | | | 13,150 | | | | 1,462,148 | |

| HF Sinclair Corporation | | | 5,231 | | | | 288,176 | |

| Matador Resources Company | | | 4,096 | | | | 260,096 | |

| Murphy Oil Corporation | | | 4,303 | | | | 195,356 | |

| PBF Energy, Inc. - Class A | | | 4,461 | | | | 209,176 | |

| Range Resources Corporation | | | 8,848 | | | | 286,498 | |

| Shell plc - ADR | | | 8,321 | | | | 516,651 | |

| SM Energy Company | | | 3,806 | | | | 161,032 | |

| Southwestern Energy Company (a) | | | 21,563 | | | | 146,197 | |

| Talos Energy, Inc. (a) | | | 1,857 | | | | 31,977 | |

| TotalEnergies SE - ADR | | | 8,138 | | | | 511,962 | |

| Woodside Energy Group Ltd. - ADR | | | 1,543 | | | | 36,847 | |

| | | | | | | | 5,230,170 | |

| Oil & Gas Services & Equipment — 0.5% | | | | | | | | |

| Helmerich & Payne, Inc. | | | 3,719 | | | | 148,723 | |

| Nov, Inc. | | | 10,181 | | | | 215,125 | |

| Patterson-UTI Energy, Inc. | | | 9,094 | | | | 128,589 | |

| RPC, Inc. | | | 3,978 | | | | 31,784 | |

| | | | | | | | 524,221 | |

| Financials — 7.6% | | | | | | | | |

| Asset Management — 0.2% | | | | | | | | |

| BlackRock, Inc. | | | 392 | | | | 274,612 | |

| | | | | | | | | |

| Banking — 3.6% | | | | | | | | |

| BancFirst Corporation | | | 751 | | | | 71,781 | |

| BNP Paribas S.A. - ADR | | | 15,574 | | | | 503,819 | |

| City Holding Company | | | 235 | | | | 21,470 | |

| CVB Financial Corporation | | | 4,031 | | | | 70,381 | |

| First BanCorporation | | | 5,358 | | | | 74,262 | |

| Home BancShares, Inc. | | | 2,390 | | | | 53,010 | |

| HSBC Holdings plc - ADR | | | 6,827 | | | | 254,784 | |

| International Bancshares Corporation | | | 705 | | | | 31,570 | |

| JPMorgan Chase & Company | | | 10,929 | | | | 1,599,240 | |

| Mitsubishi UFJ Financial Group, Inc. - ADR | | | 70,584 | | | | 559,731 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Financials — 7.6% (Continued) | | | | | | | | |

| Banking — 3.6% (Continued) | | | | | | | | |

| OFG Bancorp | | | 1,059 | | | $ | 31,939 | |

| Preferred Bank | | | 516 | | | | 32,049 | |

| ServisFirst Bancshares, Inc. | | | 954 | | | | 53,462 | |

| Southside Bancshares, Inc. | | | 352 | | | | 10,595 | |

| Wells Fargo & Company | | | 9,527 | | | | 393,370 | |

| Wintrust Financial Corporation | | | 822 | | | | 63,795 | |

| | | | | | | | 3,825,258 | |

| Institutional Financial Services — 0.0% (b) | | | | | | | | |

| StoneX Group, Inc. (a) | | | 563 | | | | 52,854 | |

| | | | | | | | | |

| Insurance — 3.4% | | | | | | | | |

| Allianz SE - ADR | | | 21,578 | | | | 524,130 | |

| American Equity Investment Life Holding Company | | | 1,169 | | | | 62,752 | |

| American International Group, Inc. | | | 2,567 | | | | 150,221 | |

| Assured Guaranty Ltd. | | | 1,790 | | | | 105,323 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 6,294 | | | | 2,267,099 | |

| Genworth Financial, Inc. - Class A (a) | | | 12,987 | | | | 75,195 | |

| Kinsale Capital Group, Inc. | | | 544 | | | | 216,855 | |

| MetLife, Inc. | | | 1,013 | | | | 64,163 | |

| Unum Group | | | 3,738 | | | | 183,872 | |

| | | | | | | | 3,649,610 | |

| Specialty Finance — 0.4% | | | | | | | | |

| American Express Company | | | 1,540 | | | | 243,305 | |

| Capital One Financial Corporation | | | 745 | | | | 76,281 | |

| Mr. Cooper Group, Inc. (a) | | | 1,431 | | | | 81,080 | |

| | | | | | | | 400,666 | |

| Health Care — 8.0% | | | | | | | | |

| Biotech & Pharma — 6.4% | | | | | | | | |

| AbbVie, Inc. | | | 2,884 | | | | 423,833 | |

| Amgen, Inc. | | | 1,663 | | | | 426,293 | |

| Amphastar Pharmaceuticals, Inc. (a) | | | 991 | | | | 52,830 | |

| AstraZeneca plc - ADR | | | 3,634 | | | | 246,458 | |

| Corcept Therapeutics, Inc. (a) | | | 1,626 | | | | 53,219 | |

| Dynavax Technologies Corporation (a) | | | 2,201 | | | | 31,606 | |

| Eli Lilly & Company | | | 2,308 | | | | 1,279,093 | |

| Exelixis, Inc. (a) | | | 6,347 | | | | 142,109 | |

| Halozyme Therapeutics, Inc. (a) | | | 1,753 | | | | 74,608 | |

| Johnson & Johnson | | | 9,382 | | | | 1,516,882 | |

| Merck & Company, Inc. | | | 8,461 | | | | 922,080 | |

| Novartis AG - ADR | | | 4,958 | | | | 498,180 | |

| Novo Nordisk A/S - ADR | | | 2,754 | | | | 511,197 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Health Care — 8.0% (Continued) | | | | | | | | |

| Biotech & Pharma — 6.4% (Continued) | | | | | | | | |

| Prestige Consumer Healthcare, Inc. (a) | | | 542 | | | $ | 31,615 | |

| Sanofi - ADR | | | 9,893 | | | | 526,110 | |

| United Therapeutics Corporation (a) | | | 658 | | | | 147,629 | |

| | | | | | | | 6,883,742 | |

| Health Care Facilities & Services — 1.0% | | | | | | | | |

| Acadia Healthcare Company, Inc. (a) | | | 2,749 | | | | 211,948 | |

| UnitedHealth Group, Inc. | | | 1,660 | | | | 791,123 | |

| | | | | | | | 1,003,071 | |

| Medical Equipment & Devices — 0.6% | | | | | | | | |

| Danaher Corporation | | | 1,084 | | | | 287,260 | |

| Thermo Fisher Scientific, Inc. | | | 666 | | | | 371,029 | |

| | | | | | | | 658,289 | |

| Industrials — 6.7% | | | | | | | | |

| Aerospace & Defense — 1.3% | | | | | | | | |

| AAR Corporation (a) | | | 688 | | | | 42,381 | |

| Airbus SE - ADR | | | 14,570 | | | | 534,282 | |

| Boeing Company (The) (a) | | | 2,201 | | | | 493,090 | |

| Curtiss-Wright Corporation | | | 957 | | | | 199,046 | |

| General Dynamics Corporation | | | 375 | | | | 84,990 | |

| | | | | | | | 1,353,789 | |

| Commercial Support Services — 0.8% | | | | | | | | |

| CorVel Corporation (a) | | | 145 | | | | 31,385 | |

| FTI Consulting, Inc. (a) | | | 339 | | | | 62,993 | |

| H&R Block, Inc. | | | 6,725 | | | | 268,866 | |

| Recruit Holdings Company Ltd. - ADR | | | 74,902 | | | | 532,553 | |

| | | | | | | | 895,797 | |

| Diversified Industrials — 0.8% | | | | | | | | |

| Emerson Electric Company | | | 1,839 | | | | 180,682 | |

| General Electric Company | | | 3,844 | | | | 439,984 | |

| Siemens AG - ADR | | | 3,399 | | | | 255,401 | |

| | | | | | | | 876,067 | |

| Electrical Equipment — 0.5% | | | | | | | | |

| Belden, Inc. | | | 570 | | | | 53,523 | |

| nVent Electric plc | | | 3,096 | | | | 175,048 | |

| Schneider Electric SE - ADR | | | 7,445 | | | | 255,587 | |

| | | | | | | | 484,158 | |

| Engineering & Construction — 0.8% | | | | | | | | |

| AECOM | | | 3,034 | | | | 266,233 | |

| Comfort Systems USA, Inc. | | | 904 | | | | 166,851 | |

| Dycom Industries, Inc. (a) | | | 319 | | | | 31,878 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Industrials — 6.7% (Continued) | | | | | | | | |

| Engineering & Construction — 0.8% (Continued) | | | | | | | | |

| Fluor Corporation (a) | | | 4,839 | | | $ | 169,317 | |

| KBR, Inc. | | | 4,252 | | | | 261,583 | |

| | | | | | | | 895,862 | |

| Industrial Intermediate Products — 0.2% | | | | | | | | |

| Chart Industries, Inc. (a) | | | 533 | | | | 96,249 | |

| Mueller Industries, Inc. | | | 1,101 | | | | 84,953 | |

| | | | | | | | 181,202 | |

| Industrial Support Services — 0.1% | | | | | | | | |

| Applied Industrial Technologies, Inc. | | | 784 | | | | 121,026 | |

| | | | | | | | | |

| Machinery — 0.4% | | | | | | | | |

| Caterpillar, Inc. | | | 1,630 | | | | 458,242 | |

| Titan International, Inc. (a) | | | 849 | | | | 10,689 | |

| | | | | | | | 468,931 | |

| Transportation & Logistics — 1.8% | | | | | | | | |

| ArcBest Corporation | | | 642 | | | | 67,789 | |

| Canadian Pacific Kansas City Ltd. | | | 9,348 | | | | 742,044 | |

| DHL Group - ADR | | | 5,486 | | | | 256,086 | |

| FedEx Corporation | | | 769 | | | | 200,724 | |

| Hub Group, Inc. - Class A (a) | | | 401 | | | | 31,294 | |

| Knight-Swift Transportation Holdings, Inc. | | | 1,575 | | | | 86,342 | |

| Marten Transport Ltd. | | | 2,007 | | | | 42,147 | |

| Matson, Inc. | | | 930 | | | | 81,728 | |

| Union Pacific Corporation | | | 2,017 | | | | 444,890 | |

| | | | | | | | 1,953,044 | |

| Materials — 3.0% | | | | | | | | |

| Chemicals — 1.3% | | | | | | | | |

| Dow, Inc. | | | 2,343 | | | | 127,834 | |

| Innospec, Inc. | | | 590 | | | | 63,378 | |

| Linde plc | | | 3,009 | | | | 1,164,603 | |

| | | | | | | | 1,355,815 | |

| Construction Materials — 0.5% | | | | | | | | |

| Carlisle Companies, Inc. | | | 2,092 | | | | 550,238 | |

| | | | | | | | | |

| Containers & Packaging — 0.0% (b) | | | | | | | | |

| Greif, Inc. - Class A | | | 597 | | | | 43,336 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Materials — 3.0% (Continued) | | | | | | | | |

| Forestry, Paper & Wood Products — 0.3% | | | | | | | | |

| Boise Cascade Company | | | 933 | | | $ | 102,042 | |

| Louisiana-Pacific Corporation | | | 680 | | | | 42,487 | |

| UFP Industries, Inc. | | | 1,280 | | | | 133,568 | |

| | | | | | | | 278,097 | |

| Metals & Mining — 0.2% | | | | | | | | |

| CONSOL Energy, Inc. | | | 1,214 | | | | 104,453 | |

| Encore Wire Corporation | | | 450 | | | | 74,164 | |

| Warrior Met Coal, Inc. | | | 1,853 | | | | 73,305 | |

| | | | | | | | 251,922 | |

| Steel — 0.7% | | | | | | | | |

| Commercial Metals Company | | | 2,760 | | | | 155,360 | |

| Reliance Steel & Aluminum Company | | | 1,287 | | | | 366,744 | |

| Steel Dynamics, Inc. | | | 2,310 | | | | 246,223 | |

| | | | | | | | 768,327 | |

| Real Estate — 3.2% | | | | | | | | |

| REITs — 3.2% | | | | | | | | |

| AvalonBay Communities, Inc. | | | 1,102 | | | | 202,570 | |

| Boston Properties, Inc. | | | 1,273 | | | | 84,998 | |

| Digital Realty Trust, Inc. | | | 4,180 | | | | 550,590 | |

| Equinix, Inc. | | | 1,316 | | | | 1,028,296 | |

| Essex Property Trust, Inc. | | | 1,029 | | | | 245,303 | |

| Invitation Homes, Inc. | | | 4,705 | | | | 160,393 | |

| Kilroy Realty Corporation | | | 868 | | | | 32,073 | |

| Regency Centers Corporation | | | 1,377 | | | | 85,649 | |

| Simon Property Group, Inc. | | | 3,794 | | | | 430,581 | |

| Welltower, Inc. | | | 7,410 | | | | 614,141 | |

| | | | | | | | 3,434,594 | |

| Technology — 31.4% | | | | | | | | |

| Semiconductors — 6.4% | | | | | | | | |

| Advanced Micro Devices, Inc. (a) | | | 5,784 | | | | 611,484 | |

| ASML Holding N.V. | | | 386 | | | | 254,965 | |

| Axcelis Technologies, Inc. (a) | | | 713 | | | | 137,003 | |

| Broadcom, Inc. | | | 1,439 | | | | 1,328,039 | |

| Intel Corporation | | | 13,998 | | | | 491,890 | |

| NVIDIA Corporation | | | 7,787 | | | | 3,843,274 | |

| Onto Innovation, Inc. (a) | | | 797 | | | | 110,767 | |

| Photronics, Inc. (a) | | | 1,790 | | | | 42,530 | |

| | | | | | | | 6,819,952 | |

| Software — 10.9% | | | | | | | | |

| Adobe, Inc. (a) | | | 1,468 | | | | 821,111 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 90.0% (Continued) | | Shares | | | Value | |

| Technology — 31.4% (Continued) | | | | | | | | |

| Software — 10.9% (Continued) | | | | | | | | |

| Aspen Technology, Inc. (a) | | | 491 | | | $ | 95,254 | |

| Microsoft Corporation | | | 27,151 | | | | 8,899,011 | |

| Oracle Corporation | | | 5,123 | | | | 616,758 | |

| PDF Solutions, Inc. (a) | | | 288 | | | | 10,466 | |

| Salesforce, Inc. (a) | | | 3,356 | | | | 743,220 | |

| SAP SE - ADR | | | 3,958 | | | | 552,893 | |

| | | | | | | | 11,738,713 | |

| Technology Hardware — 10.2% | | | | | | | | |

| Apple, Inc. | | | 51,988 | | | | 9,766,986 | |

| Avnet, Inc. | | | 2,092 | | | | 106,169 | |

| Cisco Systems, Inc. | | | 13,093 | | | | 750,883 | |

| Extreme Networks, Inc. (a) | | | 1,974 | | | | 54,186 | |

| Nintendo Company Ltd. - ADR | | | 24,025 | | | | 256,347 | |

| Sanmina Corporation (a) | | | 761 | | | | 42,388 | |

| | | | | | | | 10,976,959 | |

| Technology Services — 3.9% | | | | | | | | |

| Accenture plc - Class A | | | 2,105 | | | | 681,536 | |

| CACI International, Inc. - Class A (a) | | | 425 | | | | 139,404 | |

| CSG Systems International, Inc. | | | 770 | | | | 41,819 | |

| International Business Machines Corporation | | | 2,904 | | | | 426,394 | |

| Mastercard, Inc. - Class A | | | 3,030 | | | | 1,250,299 | |

| Science Applications International Corporation | | | 1,094 | | | | 128,720 | |

| Visa, Inc. - Class A | | | 6,019 | | | | 1,478,748 | |

| | | | | | | | 4,146,920 | |

| Utilities — 0.8% | | | | | | | | |

| Electric Utilities — 0.8% | | | | | | | | |

| Constellation Energy Corporation | | | 778 | | | | 81,037 | |

| Enel S.p.A. - ADR | | | 74,668 | | | | 497,662 | |

| Iberdrola S.A. - ADR | | | 5,370 | | | | 254,699 | |

| | | | | | | | 833,398 | |

| Gas & Water Utilities — 0.0% (b) | | | | | | | | |

| Southwest Gas Holdings, Inc. | | | 976 | | | | 60,443 | |

| | | | | | | | | |

| Total Common Stocks (Cost $82,746,978) | | | | | | $ | 96,622,684 | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| EXCHANGE-TRADED FUNDS — 7.0% | | Shares | | | Value | |

| Global X MSCI Greece ETF | | | 3,193 | | | $ | 119,993 | |

| iShares Gold Trust (a) | | | 71,732 | | | | 2,636,151 | |

| iShares MSCI Brazil ETF | | | 16,182 | | | | 499,215 | |

| iShares MSCI Chile ETF | | | 5,276 | | | | 148,730 | |

| iShares MSCI India ETF | | | 52,739 | | | | 2,318,934 | |

| iShares MSCI Mexico ETF | | | 7,526 | | | | 464,053 | |

| iShares MSCI Saudi Arabia ETF | | | 2,614 | | | | 106,913 | |

| iShares MSCI South Korea ETF | | | 14,152 | | | | 883,792 | |

| iShares MSCI Turkey ETF | | | 7,361 | | | | 275,817 | |

| iShares MSCI UAE ETF | | | 4,232 | | | | 63,607 | |

| Total Exchange-Traded Funds (Cost $7,029,775) | | | | | | $ | 7,517,205 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 2.6% | | Shares | | | Value | |

| Federated Government Obligations Fund - Institutional Class, 5.18% (c) | | | 524,658 | | | $ | 524,658 | |

| First American Government Obligations Fund - Class X, 5.25% (c) | | | 2,282,720 | | | | 2,282,720 | |

| Total Money Market Funds (Cost $2,807,378) | | | | | | $ | 2,807,378 | |

| | | | | | | | | |

| Investments at Value — 99.6% (Cost $92,584,131) | | | | | | $ | 106,947,267 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 376,576 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 107,323,843 | |

| (a) | Non-income producing security. |

| (b) | Percentage rounds to less than 0.1%. |

| (c) | The rate shown is the 7-day effective yield as of August 31, 2023. |

| A/S - Aktieselskab |

| |

| ADR - American Depositary Receipt |

| |

| AG - Aktiengesellschaft |

| |

| N.V. - Naamloze Vennootschap |

| |

| plc - Public Limited Company |

| |

| S.A. - Societe Anonyme |

| |

| SE - Societe Europaea |

| |

| S.p.A - Societa per azioni |

| |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| August 31, 2023 (Unaudited) |

| ASSETS | | | | |

| Investments: | | | | |

| At cost | | $ | 92,584,131 | |

| At value (Note 2) | | $ | 106,947,267 | |

| Cash | | | 314 | |

| Receivable for capital shares sold | | | 235,129 | |

| Receivable for investment securities sold | | | 17,189,741 | |

| Dividends and interest receivable | | | 133,903 | |

| Tax reclaims receivable | | | 3,935 | |

| Other assets | | | 29,910 | |

| Total assets | | | 124,540,199 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for capital shares redeemed | | | 66,599 | |

| Payable for investment securities purchased | | | 17,028,176 | |

| Payable to the Adviser (Note 4) | | | 83,683 | |

| Payable to administrator (Note 4) | | | 16,851 | |

| Accrued distribution fees (Note 4) | | | 1,336 | |

| Other accrued expenses and liabilities | | | 19,711 | |

| Total liabilities | | | 17,216,356 | |

| | | | | |

| NET ASSETS | | $ | 107,323,843 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 105,096,129 | |

| Accumulated earnings | | | 2,227,714 | |

| NET ASSETS | | $ | 107,323,843 | |

| | | | | |

| NET ASSET VALUE PER SHARE: | | | | |

| INVESTOR CLASS | | | | |

| Net assets applicable to Investor Class | | $ | 1,945,598 | |

| Investor Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 161,869 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 12.02 | |

| | | | | |

| INSTITUTIONAL CLASS | | | | |

| Net assets applicable to Institutional Class | | $ | 105,378,245 | |

| Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 8,714,746 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 12.09 | |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| STATEMENT OF OPERATIONS |

| For the Six Months Ended August 31, 2023 (Unaudited) |

| INVESTMENT INCOME | | | | |

| Dividend income (net of foreign withholding taxes of $76,354) | | $ | 1,152,724 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 4) | | | 478,531 | |

| Administration fees (Note 4) | | | 50,255 | |

| Fund accounting fees (Note 4) | | | 23,998 | |

| Registration and filing fees | | | 16,757 | |

| Transfer agent fees - Investor Class (Note 4) | | | 6,320 | |

| Transfer agent fees - Institutional Class (Note 4) | | | 9,480 | |

| Legal fees | | | 13,719 | |

| Custodian and bank service fees | | | 10,948 | |

| Trustees’ fees and expenses (Note 4) | | | 9,670 | |

| Audit and tax services fees | | | 8,665 | |

| Shareholder report expense | | | 6,170 | |

| Compliance service fees (Note 4) | | | 6,088 | |

| Postage and supplies | | | 3,371 | |

| Distribution fees - Investor Class (Note 4) | | | 2,262 | |

| Insurance expense | | | 1,823 | |

| Other expenses | | | 12,876 | |

| Total Expenses | | | 660,933 | |

| Fee reductions by the Adviser (Note 4) | | | (29,024 | ) |

| Net Expenses | | | 631,909 | |

| | | | | |

| NET INVESTMENT INCOME | | | 520,815 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES | | | | |

| Net realized losses from: | | | | |

| Investment transactions | | | (3,352,824 | ) |

| Foreign currency transactions | | | (45 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 11,757,576 | |

| Foreign currency translations | | | 61 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES | | | 8,404,768 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,925,583 | |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | August 31, 2023 | | | February 28, | |

| | | (Unaudited) | | | 2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 520,815 | | | $ | 676,510 | |

| Net realized losses from: | | | | | | | | |

| Investment transactions | | | (3,352,824 | ) | | | (7,143,695 | ) |

| Foreign currency transactions | | | (45 | ) | | | (152 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 11,757,576 | | | | (5,590,208 | ) |

| Foreign currency translations | | | 61 | | | | (61 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 8,925,583 | | | | (12,057,606 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Investor Class | | | — | | | | (4,381 | ) |

| Institutional Class | | | — | | | | (506,299 | ) |

| Decrease in net assets from distributions to shareholders | | | — | | | | (510,680 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 431,372 | | | | 1,101,743 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 4,381 | |

| Payments for shares redeemed | | | (201,335 | ) | | | (251,761 | ) |

| Net increase in Investor Class net assets from capital share transactions | | | 230,037 | | | | 854,363 | |

| | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 13,135,364 | | | | 58,518,038 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 505,883 | |

| Payments for shares redeemed | | | (10,729,274 | ) | | | (32,438,634 | ) |

| Net increase in Institutional Class net assets from capital share transactions | | | 2,406,090 | | | | 26,585,287 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 11,561,710 | | | | 14,871,364 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 95,762,133 | | | | 80,890,769 | |

| End of period | | $ | 107,323,843 | | | $ | 95,762,133 | |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Six Months Ended | | | Year Ended | |

| | | August 31, 2023 | | | February 28, | |

| | | (Unaudited) | | | 2022 | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Investor Class | | | | | | | | |

| Shares sold | | | 37,590 | | | | 94,984 | |

| Shares issued in reinvestment of distributions to shareholders | | | — | | | | 396 | |

| Shares redeemed | | | (17,142 | ) | | | (21,599 | ) |

| Net increase in shares outstanding | | | 20,448 | | | | 73,781 | |

| Shares outstanding at beginning of period | | | 141,421 | | | | 67,640 | |

| Shares outstanding at end of period | | | 161,869 | | | | 141,421 | |

| | | | | | | | | |

| Institutional Class | | | | | | | | |

| Shares sold | | | 1,129,172 | | | | 4,969,005 | |

| Shares issued in reinvestment of distributions to shareholders | | | — | | | | 45,575 | |

| Shares redeemed | | | (943,022 | ) | | | (2,769,081 | ) |

| Net increase in shares outstanding | | | 186,150 | | | | 2,245,499 | |

| Shares outstanding at beginning of period | | | 8,528,596 | | | | 6,283,097 | |

| Shares outstanding at end of period | | | 8,714,746 | | | | 8,528,596 | |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| INVESTOR CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period

| | | Six Months | | | | | | | | | | |

| | | Ended | | | | | | | | | | |

| | | August 31, | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | 2023 | | | February 28, | | | February 28, | | | February 28, | |

| | | (Unaudited) | | | 2023 | | | 2022 | | | 2021(a) | |

| Net asset value at beginning of period | | $ | 11.00 | | | $ | 12.69 | | | $ | 12.02 | | | $ | 10.00 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b)(c) | | | 0.04 | | | | 0.06 | | | | 0.04 | | | | (0.02 | ) |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | 0.98 | | | | (1.71 | ) | | | 0.68 | | | | 2.07 | |

| Total from investment operations | | | 1.02 | | | | (1.65 | ) | | | 0.72 | | | | 2.05 | |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.04 | ) | | | (0.05 | ) | | | (0.03 | ) |

| Net asset value at end of period | | $ | 12.02 | | | $ | 11.00 | | | $ | 12.69 | | | $ | 12.02 | |

| Total return (d) | | | 9.27 | % (e) | | | (13.03 | %) | | | 5.95 | % | | | 20.48 | % (e) |

| Net assets at end of period (000’s) | | $ | 1,946 | | | $ | 1,555 | | | $ | 858 | | | $ | 72 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets (f) | | | 2.60 | % (g) | | | 3.29 | % | | | 6.96 | % | | | 104.34 | % (g) |

| Ratio of net expenses to average net assets (f)(h) | | | 1.50 | % (g) | | | 1.50 | % | | | 1.50 | %(i) | | | 1.60 | %(g)(i) |

| Ratio of net investment income (loss) to average net assets (c)(f)(h) | | | 0.77 | % (g) | | | 0.55 | % | | | 0.30 | % | | | (0.16 | %) (g) |

| Portfolio turnover rate | | | 103 | % (e) | | | 278 | % | | | 130 | % | | | 95 | % (e) |

| (a) | Represents the period from the commencement of operations (March 31, 2020) through February 28, 2021. |

| (b) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (c) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying companies in which the Fund invests. |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would have been lower had the Adviser not reduced management fees and reimbursed expenses (Note 4). |

| (f) | Ratio does not include expenses of the investment companies in which the Fund invests. |

| (h) | Ratio was determined after management fees reductions and expense reimbursements (Note 4). |

| (i) | Includes costs to organize the Fund of less than 0.005% and 0.10% for the year ended February 28, 2022 and period ended February 28, 2021, respectively, which are excluded from the Expense Limitation Agreement (Note 4). |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| INSTITUTIONAL CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period

| | | Six Months | | | | | | | | | | |

| | | Ended | | | | | | | | | | |

| | | August 31, | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | 2023 | | | February 28, | | | February 28, | | | February 28, | |

| | | (Unaudited) | | | 2023 | | | 2022 | | | 2021(a) | |

| Net asset value at beginning of period | | $ | 11.05 | | | $ | 12.74 | | | $ | 12.04 | | | $ | 10.00 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (b)(c) | | | 0.06 | | | | 0.09 | | | | 0.07 | | | | 0.02 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | 0.98 | | | | (1.72 | ) | | | 0.69 | | | | 2.06 | |

| Total from investment operations | | | 1.04 | | | | (1.63 | ) | | | 0.76 | | | | 2.08 | |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.06 | ) | | | (0.06 | ) | | | (0.04 | ) |

| Net asset value at end of period | | $ | 12.09 | | | $ | 11.05 | | | $ | 12.74 | | | $ | 12.04 | |

| Total return (d) | | | 9.41 | % (e) | | | (12.82 | %) | | | 6.29 | % | | | 20.80 | % (e) |

| Net assets at end of period (000’s) | | $ | 105,378 | | | $ | 94,207 | | | $ | 80,032 | | | $ | 53,273 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets (f) | | | 1.29 | % (g) | | | 1.33 | % | | | 1.40 | % | | | 1.93 | % (g) |

| Ratio of net expenses to average net assets (f)(h) | | | 1.25 | % (g) | | | 1.25 | % | | | 1.26 | %(i) | | | 1.35 | %(g)(i) |

| Ratio of net investment income to average net assets (c)(f)(h) | | | 1.04 | % (g) | | | 0.76 | % | | | 0.54 | % | | | 0.20 | % (g) |

| Portfolio turnover rate | | | 103 | % (e) | | | 278 | % | | | 130 | % | | | 95 | % (e) |

| (a) | Represents the period from the commencement of operations (March 31, 2020) through February 28, 2021. |

| (b) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| (c) | Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends by the underlying companies in which the Fund invests. |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would have been lower had the Adviser not reduced management fees and reimbursed expenses (Note 4). |

| (f) | Ratio does not include expenses of the investment companies in which the Fund invests. |

| (h) | Ratio was determined after management fees reductions and expense reimbursements (Note 4). |

| (i) | Includes costs to organize the Fund of 0.01% and 0.10% for the year ended February 28, 2022 and period ended February 28, 2021, respectively, which are excluded from the Expense Limitation Agreement (Note 4). |

See accompanying notes to financial statements.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS |

| August 31, 2023 (Unaudited) |

Blueprint Adaptive Growth Allocation Fund (formerly Blueprint Growth Fund) (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”). The Trust is an open-end management investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. The Fund commenced operations on March 31, 2020.

The investment objective of the Fund is to seek capital appreciation while managing risk.

The Fund currently offers two classes of shares: Investor Class shares (sold without any sales loads, but subject to a distribution and/or shareholder servicing fee of up to 0.25% of the average daily net assets attributable to Investor Class shares and requiring a $5,000 initial investment) and Institutional Class shares (sold without any sales loads and distribution and/or shareholder servicing fees and requiring a $15,000 initial investment). Each share class represents an ownership interest in the same investment portfolio.

| 2. | Significant Accounting Policies |

The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Regulatory update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

Securities valuation – The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities, including common stocks and exchange-traded funds (“ETFs”), on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. Option contracts, if any, are valued at

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

the closing price on the exchanges on which they are primarily traded; if no closing price is available at the time of valuation, the option will be valued at the mean of the closing bid and ask prices for that day. When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value as determined by Blueprint Fund Management, LLC (the “Adviser”), as the Fund’s valuation designee, in accordance with procedures adopted by the Board of Trustees (the “Board”) pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended (the “1940 Act”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments and the level of inputs used to value the investments as of August 31, 2023:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 96,622,684 | | | $ | — | | | $ | — | | | $ | 96,622,684 | |

| Exchange-Traded Funds | | | 7,517,205 | | | | — | | | | — | | | | 7,517,205 | |

| Money Market Funds | | | 2,807,378 | | | | — | | | | — | | | | 2,807,378 | |

| Total | | $ | 106,947,267 | | | $ | — | | | $ | — | | | $ | 106,947,267 | |

| | | | | | | | | | | | | | | | | |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector and industry type. The Fund did not hold any derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the six months ended August 31, 2023.

Foreign currency translation – Securities and other assets and liabilities denominated in or expected to settle in foreign currencies, if any, are translated into U.S. dollars based on exchange rates on the following basis:

| A. | The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

| B. | Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern Time on the respective date of such transactions. |

| C. | The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions, and 3) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Cash – The Fund’s cash, if any, is held in a bank account with balances which, at times, may exceed United States federally insured limits set by the Federal Deposit Insurance Corporation. The Fund maintains these balances with a high quality financial institution and may incur charges on cash overdrafts.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income – Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income is accrued as earned. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

Allocation between Classes – Investment income earned, realized capital gains and losses, and unrealized appreciation and depreciation are allocated daily to each Class of the Fund based upon its proportionate share of total net assets of the Fund. Class-specific expenses are charged directly to the Class incurring the expense. Common expenses which are not attributable to a specific Class are allocated daily to the Class of shares of the Fund based upon its proportionate share of total net assets of the Fund. Distribution fees, registration and filing fees and transfer agent fees are class specific expenses.

Distributions to shareholders – The Fund distributes to shareholders any net investment income dividends and net realized capital gains on an annual basis. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid to shareholders by the Fund during the year ended February 28, 2023, was ordinary income. No distributions were paid to shareholders during the six months ended August 31, 2023.

Purchased option contracts – The Fund may use option contracts in any manner consistent with its investment objectives and as long as its use is consistent with relevant provisions of the 1940 Act, as amended. The Fund may use options for speculative purposes as well as for the purpose of seeking to reduce the overall investment risk that would otherwise be associated with the securities in which the Fund invests. When the Fund purchases a call or put option, an amount equal to the total premium (the premium plus the commission) paid by the Fund is recorded as an asset on the Fund’s Statement of Assets and Liabilities and is subsequently marked-to-market daily. Premiums paid in the purchase of options which expire are treated as realized losses. Premiums paid in the purchase of call options which are exercised increase the cost of the security purchased. Premiums paid in the purchase of put options which are exercised decrease the proceeds used to calculate the realized capital gain or loss on the sale of the security.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

Federal tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year equal to at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of February 28, 2023:

| | | | |

| Cost of investments | | $ | 92,271,836 | |

| Gross unrealized appreciation | | $ | 3,942,390 | |

| Gross unrealized depreciation | | | (1,634,383 | ) |

| Net unrealized appreciation | | | 2,308,007 | |

| Net unrealized depreciation on foreign currency translation | | | (61 | ) |

| Undistributed ordinary income | | | 115,292 | |

| Accumulated capital and other losses | | | (9,121,107 | ) |

| Accumulated deficit | | $ | (6,697,869 | ) |

| | | | | |

As of February 28, 2023, the Fund had short-term capital loss carryforwards of $9,121,107 for federal income tax purposes. These capital loss carryforwards, which do not expire, may be utilized in the current and future years to offset net realized capital gains, if any.

The federal tax cost, unrealized appreciation (depreciation) as of August 31, 2023 is as follows:

| | | | | |

| Cost of portfolio investments | | $ | 92,831,493 | |

| Gross unrealized appreciation | | $ | 14,588,736 | |

| Gross unrealized depreciation | | | (472,962 | ) |

| Net unrealized appreciation | | $ | 14,115,774 | |

| | | | | |

The difference between the federal income tax cost of investments and the financial statement cost of investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales and adjustments to basis for grantor trusts.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for current and all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax on the Statement of Operations. During the six months ended August 31, 2023, the Fund did not incur any interest of penalties.

| 3. | Investment Transactions |

During the six months ended August 31, 2023, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $104,710,803 and $101,245,946, respectively.

| 4. | Transactions with Related Parties |

ADVISORY AND SUB-ADVISORY AGREEMENTS

Pursuant to the terms of the Advisory Agreement the Adviser serves as the investment adviser to the Fund. The Adviser provides the Fund with the selection of a sub-investment advisor and the compliance and managerial oversight of that sub-adviser and its services to the Fund. The Fund pays the Adviser a management fee, computed and accrued daily and paid monthly, at the annual rate of 0.95% of average daily net assets.

Blueprint Investment Partners, LLC (the “Sub-Adviser”) serves as the Funds sub-adviser. Pursuant to the Sub-Advisory Agreement, the Sub-Adviser provides the Fund with a continuous program of investing the Fund’s assets and determining the composition of the Fund’s portfolio. For its services, the Adviser pays the Sub-Adviser an investment sub-advisory fee computed at the annual rate of 0.20% of the Fund’s average daily net assets. The Fund does not directly pay the sub-advisory fee.

Pursuant to an Expense Limitation Agreement (“ELA”) between the Fund and the Adviser, the Adviser has agreed contractually, until June 30, 2024, to reduce its management fees and reimburse other expenses to the extent necessary to limit total annual fund operating expenses (excluding brokerage costs, taxes, interest, borrowing costs such as interest and dividend expenses on securities sold short, acquired fund fees and expenses, costs to organize the Fund, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to 1.50% and 1.25% of average daily net assets for Investor Class and Institutional Class shares, respectively. Accordingly, during the six months ended August 31, 2023, the Adviser reduced its management fees in the amount of $29,024.

Management reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause total annual fund operating expenses

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

(exclusive of such reductions and reimbursements) to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. Prior to June 30, 2024, the agreement may not be modified or terminated without the approval of the Board. After June 30, 2024, the ELA may continue from year-to-year provided such continuance is approved by the Board. The ELA may be terminated by the Adviser, or the Board, without approval by the other party, at the end of the then current term upon not less than 90 days’ notice to the other parties as set forth in the ELA. As of August 31, 2023, the Adviser may seek repayment of expense reimbursements no later than the dates below:

| | | | | |

| February 29, 2024 | | $ | 67,606 | |

| February 28, 2025 | | | 113,574 | |

| February 28, 2026 | | | 88,786 | |

| August 31, 2026 | | | 29,024 | |

| Total | | $ | 298,990 | |

| | | | | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated partially by the Adviser and partially by the Investor Class shares of the Fund for acting as principal underwriter.

A Trustee and certain officers of the Trust are also officers of Ultimus and are not paid by the Trust or the Fund for serving in such capacities.

DISTRIBUTION PLAN

The Fund has adopted a plan of distribution (the “Plan”), pursuant to Rule 12b-1 under the 1940 Act which permits Investor Class shares of the Fund to make payments to securities dealers and other financial organizations (including payments directly to the Adviser and the Distributor) for expenses related to the distribution and servicing of the Fund’s Investor Class shares. The annual limitation for payment of expenses pursuant to the Plan is 0.25% of the Fund’s average daily net assets allocable to Investor Class shares. The Fund has not adopted a plan of distribution with respect to Institutional Class shares. During the six months ended August 31, 2023, Investor Class shares of the Fund incurred $2,262 of distribution fees under the Plan.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

TRUSTEE COMPENSATION

Each member of the Board (a “Trustee”) who is not an “interested person” (as defined by the 1940 Act, as amended) of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,700 annual retainer from the Fund, paid quarterly and the Audit Committee Chairperson who receives $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $550 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

PRINCIPAL HOLDER OF FUND SHARES

As of August 31, 2023, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

| NAME OF RECORD OWNER | | % OWNERSHIP |

| TD Ameritrade, Inc. (for the benefit of its customers) | | 52% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

| 5. | Derivative Transactions |

Realized and unrealized gains and losses associated with transactions in derivative instruments for the Fund during the six months ended August 31, 2023 are recorded in the following locations on the Statement of Operations:

| | | | | | | | | | | | Change in | |

| | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | Appreciation | |

| Type of Derivative | | Risk | | Location | | Realized Losses | | | Location | | (Depreciation) | |

| Equity call options purchased | | Equity | | Net realized gains (losses) on investment transactions | | $ | (609,858 | ) | | Net change in unrealized appreciation (depreciation) on investments | | $ | 396,511 | |

As of August 31, 2023, the Fund did not hold any derivative securities.

From time to time, the Fund may have an overdrawn cash balance at the custodian due to redemptions or market movements. When this occurs, the Fund will incur borrowing costs charged by the custodian. Accordingly, during the six months ended August 31, 2023, the Fund did not incur any borrowing costs by the custodian.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| 7. | Contingencies and Commitments |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

| 8. | Investment in Other Investment Companies |

The Fund may invest a significant portion of its assets in shares of one or more investment companies, including ETFs, open-end mutual funds and money market mutual funds. The Fund will incur additional indirect expenses (acquired fund fees and expenses) to the extent it invests in shares of other investment companies.

If a Fund has significant investments in the securities of issuers in industries within a particular business sector, any development generally affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. This may increase the risk of loss of an investment in a Fund and increase the volatility of a Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments, may negatively impact all companies in a particular sector and therefore the value of a Fund’s portfolio could be adversely affected if it has significant holdings of securities of issuers in that sector. As of August 31, 2023, the Fund had 31.4% of the value of its net assets invested in stocks in the Technology sector.

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees, class-specific expenses (such as distribution fees) and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (March 1, 2023) and held until the end of the period (August 31, 2023).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | Beginning | | Ending | | | | |

| | | Account Value | | Account Value | | | | Expenses |

| | | March 1, | | August 31, | | Net Expense | | Paid During |

| | | 2023 | | 2023 | | Ratio(a) | | Period(b) |

| Investor Class | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | $1,092.70 | | 1.50% | | $7.91 |

| Based on Hypothetical 5% Return (before expenses) | | $1,000.00 | | $1,017.64 | | 1.50% | | $7.63 |

| Institutional Class | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | $1,094.10 | | 1.25% | | $6.60 |

| Based on Hypothetical 5% Return (before expenses) | | $1,000.00 | | $1,018.90 | | 1.25% | | $6.36 |

| (a) | Annualized, based on the most recent one-half year expenses. |

| (b) | Expenses are equal to the annualized net expense ratio of each Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND |

| OTHER INFORMATION (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-866-983-4525, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-866-983-4525, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to Form N-PORT. These filings are available upon request by calling 1-866-983-4525. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov and on the Fund’s website www.blueprintmutualfunds.com.

| CUSTOMER PRIVACY NOTICE |

| |

| FACTS | WHAT DOES THE BLUEPRINT ADAPTIVE GROWTH ALLOCATION FUND (the “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

| |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| |

| How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| |

| Reasons we can share your personal information | Does the Fund

share? | Can you limit

this sharing? |

| For our everyday business purposes – Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes – to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

| For our affiliates’ everyday business purposes – information about your transactions and experiences | No | We don’t share |

| For our affiliates’ everyday business purposes – information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| | | | |

| Questions? | Call 1-866-983-4525 |

| Who we are |

| Who is providing this notice? | Blueprint Adaptive Growth Allocation Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |