UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22691 | |

F/m Funds Trust

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246 |

| (Address of principal executive offices) (Zip code) |

Jesse D. Hallee

c/o Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

Name and address of agent for service)

| Registrant's telephone number, including area code: | (513) 587-3400 |

| | |

| Date of fiscal year end: | August 31 |

| | |

| Date of reporting period: | August 31, 2022 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a)

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| |  | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Oakhurst Fixed Income Fund | |

| | | | |

| | Oakhurst Short Duration Bond Fund | |

| | | | |

| | Oakhurst Short Duration | |

| | High Yield Credit Fund | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | ANNUAL REPORT | |

| | August 31, 2022 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| F/m FUNDS |

| Letter to Shareholders |

| August 31, 2022 (Unaudited) |

| |

“Same As It Ever Was”

Released in 1981, the Talking Heads single “Once in a Lifetime,” a comment on unchecked consumerism and existential crisis, was climbing the charts. As singer David Byrne questions his possessions and life, he asks the question, “How did I get here?” At around the same time that the song could be heard on various radio stations, Federal Reserve (the “Fed”) Chairman Paul Volcker was waging war against rampant inflation, causing financial markets to sag under the pressure of severely tighter monetary policy. Now, four decades later, Fed Chairman Jerome Powell has embarked on a similar journey, attempting to quash inflation that has spread across the U.S. and impacted global financial markets. As we revisit how we got here, we must inquire, like the song posits, if this will be the “same as it ever was.”

The quick review of history will note the excessive monetary and fiscal policy responses to the Covid shutdown. Understanding the need for immediate relief as the soaring ranks of the unemployed and nearly significant (and often absolute) reduction in some business revenues, the massive stimulus was largely applauded. Few were eager to allow the markets and economy to free fall, and even the loudest proponents of free market capitalism refrained from criticism, at least at first. As the government largesse continued, both in frequency and magnitude, there was a growing contingent that began raising concerns. Inflationary pressures resulting from such easy policies was often cited, but most dismissed these fears and enjoyed the impressive rebound in the markets. Central bankers, too, expressed little regard since the Fed had just recently discussed that inflation had remained stubbornly low and below its 2% target.

Therefore, as had been the strategy since the Great Financial Crisis, the Fed and its peer central bankers continued with zero interest rate policies (ZIRP) and sizeable bond purchases (QE). The powerful combination of easy monetary policies created an ideal environment for most risky assets, generating handsome returns. Though fixed income investors decried the paltry yields, many abandoned such conservative

pursuits and opted for higher risk alternatives. Even for some that lost their jobs during early Covid, unemployment benefits and fiscal stimulus checks often went into the markets, notably cryptocurrencies and meme stocks. Economists point to the impact of the government programs and the handsome financial gains as a major influence on those that left the workforce more permanently during the Great Resignation. Even as inflation began its upward ascent, the Fed developed its “transitory narrative,” claiming that the increase in prices was due to supply chain disruptions and the reopening efforts would quickly resolve these issues, returning inflation back to its 2% target. Unfortunately, there was ample evidence to contradict this thesis, with wages, housing, commodities, and numerous industries already realizing that inflation was surging and becoming engrained in the economy.

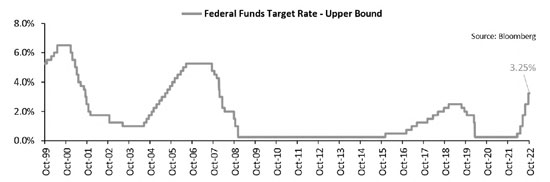

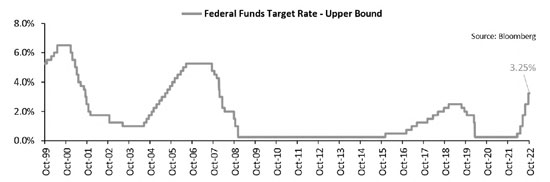

By the time the Fed and other central banks finally realized the severity of the inflationary problem, it was too late. Rather than having the ability to slowly remove accommodation and improve the odds of a soft landing, the Fed was forced to quickly ratchet up short-term rates and attempt to rebuild its inflation-fighting credibility. To date, the 300 basis point increase in the fed funds rate over six months has been difficult to digest for financial markets. Equity indices have fallen into bear market territory and bonds are on pace for their worst year ever. Reducing the Fed’s balance sheet (QT), the other significant tool at the central bank’s disposal, which has only recently begun in earnest, may worsen liquidity and cause further instability.

Earlier in the year, market participants had expected that peak inflation had passed, only to be disappointed by higher prints for CPI and core PCE price indices. After reaching 6.5% in March, core CPI fell to 5.9% in June and July only to surprise markets and move back up to 6.3% in August. This disappointing news sparked stronger Fed rhetoric and increased expectations for the terminal funds rate. Finally, though, numerous signs of weakness in the U.S. and globally indicate that further increases in the year-over-year price levels are unlikely. Companies have announced hiring freezes and layoffs, with more expected to reduce payrolls over the next few months. Though the strength in the employment sector has been mentioned as one of the lone remaining signals that we are not yet in a recession, the lagging nature of this statistic will become more evident shortly. The unemployment rate ticked up to 3.7% in August from 3.5% a month prior, yet companies continue to produce net job gains, though at a slower pace than earlier in the year. The other statistic often

used to support employment health has been the JOLTS report on job openings. Having peaked at nearly 12 million, the JOLTS job openings data was drifting lower and then fell by more than 1 million in August to its current 10 million openings. Over the next several months, the unemployment rate is likely to move above 4% as companies pare back on full-time workers. Therefore, as employment wanes and the economy weakens, inflation will come down from its lofty levels, but the lagging nature of some price inputs, such as shelter, and the stickiness of wages, will make it difficult to reach the Fed’s target any time soon.

The adoption of a much more hawkish stance, with many Fed voting members stating that tight policy is necessary until 2% inflation is reached, increases the likelihood of a hard landing. Initially late to the party, the Fed may end up being the guests that won’t leave. Compounding one policy mistake with another may be evidence that this could be the “same as it ever was.” Since monetary policy also works with a lag, the Fed could certainly raise rates well after it is warranted and worsen a recession. Some investors have predicted an early end to the tightening cycle due to weakening economic conditions and financial instability. Many point to the recent intervention by the Bank of England to shore up its sovereign debt market following wrong way bets on rates by UK pension plans. U.S. dollar strength and the negative impact on G-7 nations and emerging market currencies have also been discussed as rationale to slow or pause the Fed’s policies. However, as has been repeatedly made clear by Powell and team, the Fed intends to break the back of inflation and, thus, a pause or pivot is not on the table.

However, despite the apparent Fed resolve, many investors and strategists aren’t buying what the Fed is selling. They strongly believe that the Fed, as it has in the past, will come to the rescue should economic or market conditions warrant. Rather than anticipating tighter conditions for a longer period, they have simply pushed out the expected rate cuts by a few months, with the initial rate reduction predicted to be in late 2023 rather than in the first half. The phenomenon of bad economic news being welcomed by the markets, with the thought that the Fed will be forced to

prematurely end rate hikes and balance sheet reduction, has also returned. Careful what you wish for, though, since a deteriorating economy is actually bad for the corporate, household, and government sectors.

The pressure on central banks to curtail tight policy is sure to intensify through winter. The housing sector, recently a driving force for the bullish environment, will become a drag as 7% mortgage rates force shelter prices downward. Dollar strength will crimp corporate earnings and force global central banks to sell U.S. Treasury reserves to defend their currencies. A negative wealth effect should not be overlooked as dwindling retirement savings may force reduced spending and prompt recent retirees to re-enter the workforce. Escalating prices and shortages in both food and energy could cause civil unrest and further buoy populism. As economic challenges worsen, political changes in Sweden and Italy could be harbingers of what to expect in numerous regions.

The potential fallout resulting from the reversal of economic and market fortunes will further test the resolve of central banks. Due to a reduction of political independence for monetary policymakers over the past decade, many are convinced that easy monetary policy, engrained in the DNA of current central bankers, will win out. Gone are the likes of Paul Volcker, who remain undeterred in his fight against inflation, despite numerous protests and calls from Congress to loosen monetary conditions. As today’s talking heads speculate on the future of monetary policy, many feel strongly that central banks will revert to the “same as it ever was” and expect an early end to this tightening cycle.

Barry P. Julien, CFA®

Chief Investment Officer & Portfolio Manager

The Oakhurst Fixed Income Fund (OHFIX)

Attempting to digest 225 basis points of rate hikes over five months, financial markets and the real economy are certainly feeling the strain of tighter monetary policy. The Fed also remains under pressure from both sides, with some advocating that inflation is becoming engrained and more needs to be done, while others are arguing that additional rate hikes and quantitative tightening will deepen the recession. Although unemployment remains low at 3.7%, with job openings falling and layoffs taking hold, the prognosis has weakened. Housing, the other area of prior strength, has witnessed a dramatic slowdown as soaring mortgage rates have reduced buyer demand. The manufacturing and service sectors have slowed, and stubbornly elevated inflation has impacted corporate and household budgets.

The bond market adjusted again to tougher Fed rhetoric as the message of “higher rates for longer” took hold. As such, the two-year US Treasury yield rose to 3.50%, up from a mere 0.21% a year ago, while the ten-year Treasury yield increased, too, but to a lesser degree. Expectations for a soft landing were further damaged by the deeper inversion of the yield curve. The difficult environment proved challenging for most fixed income sectors, though corporate bond spreads only widened modestly following an earlier rally. As rates approach fair value, we have been slowly increasing the allocation to US Treasuries and lengthening maturities. Heightened volatility negatively impacted the rate-sensitive mortgage-backed securities, as the embedded option value detracted from valuations. Fortunately, the shorter duration profile continued to lessen the impact of higher rates, leading to outperformance for the year ended August 31, 2022. For the year, the Fund generated a net return of -10.59%, ahead of the -11.52% loss for the Bloomberg U.S. Aggregate Bond Index. Modest inflows offset some of the negative performance, with the Fund ending at $119.4 million, slightly below the $126.2 million at the beginning of the year.

The Oakhurst Short Duration Bond Fund (OHSDX)

The sizeable and rapid adjustment in short-term rates has greatly altered the risk-reward trade off for short duration strategies. With the expected terminal Fed funds rate approaching 4.0%, the two-year Treasury yield of nearly 3.5% has begun to factor in more future rate hikes. Now, however, even if rates increased by 200 basis points from these levels, short duration investors should still be able to generate positive returns. The improved bond math has sparked interest in short strategies, from safer government securities to higher-yielding corporate bonds. The Fund continued to focus on adding value through higher income, overweighting corporate bonds, mortgage-backed securities, and asset-backed securities. While a risk-off sentiment led to wider spreads, the income advantage helped to offset some of the negative impact from higher rates. However, since the Fund’s duration remained slightly longer than that of the index, the considerable move in rates could not be overcome and the Fund underperformed. During the past twelve months ended August 31, 2022, the Fund had a net loss of - 4.65% versus a decrease of -4.04% for the ICE BofA U.S. Corporate & Government Index. Despite the attractive yield, the Fund has experienced significant outflows over the past twelve months, ending the year at $57.8 million, well below the beginning value of $131.1 million.

The Oakhurst Short Duration High Yield Credit Fund (OHSHX)

Following a difficult first half of 2022, the high yield market began to reverse course in the third quarter. Although investors continued to withdraw money from high yield mutual funds, and the new issue market grinded to a halt, the sector held up quite well. Hopes that the Fed might pivot produced a significant high yield rally in July. However, as the Fed rhetoric intensified, risk-off sentiment returned and investors shed risky assets for safe-haven securities. With the Fed intent upon slowing down economic growth, credit metrics began to deteriorate and high yield issuers struggled. Consumer Cyclicals and Technology sectors detracted from performance, as did the Fund’s overweight in Financials and underweight in the Energy sector. Across credit ratings, despite the higher interest rate sensitivity of BB-rated issues, the Fund’s overweight to single B- rated bonds negatively impacted performance as higher-quality names held up best. Partially due to its yield advantage and lower duration, shorter duration high yield outperformed the broader market over the past year. For the year period ended August 31, 2022, the Fund generated a net return of -8.11%, trailing the decrease of -5.55% for the ICE BofA 1-5 Year U.S. Cash Pay High Yield Constrained Index. During the year, the Fund’s assets shrank from $101.4 million to $66.5 million.

| OAKHURST FIXED INCOME FUND |

| Performance Information |

| August 31, 2022 (Unaudited) |

| |

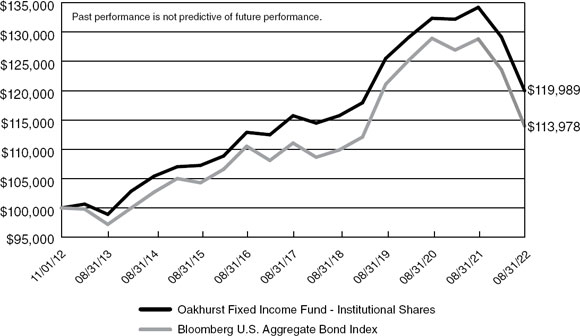

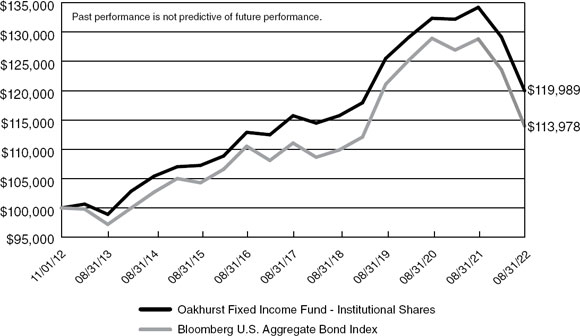

Comparison of the Change in Value of a $100,000 Investment

in Oakhurst Fixed Income Fund - Institutional Shares versus the

Bloomberg U.S. Aggregate Bond Index

Average Annual Total Returns

(for periods ended August 31, 2022) |

| | | | Since | |

| | 1 Year | 5 Years | Inception (b) | |

| | | | | |

| Oakhurst Fixed Income Fund - Institutional Shares (a) | -10.59% | 0.73% | 1.87% | |

| Bloomberg U.S. Aggregate Bond Index (c) | -11.52% | 0.52% | 1.34% | |

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Represents the period from the commencement of operations (November 1, 2012) through August 31, 2022. |

| (c) | The Bloomberg U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Bloomberg U.S. Aggregate Bond Index and may invest in other types of securities. |

| OAKHURST SHORT DURATION BOND FUND |

| Performance Information |

| August 31, 2022 (Unaudited) |

| |

Comparison of the Change in Value of a $100,000 Investment

in Oakhurst Short Duration Bond Fund - Institutional Shares

versus the ICE BofA U.S. Corp./Govt. 1-3 Years Bond Index

Average Annual Total Returns

(for periods ended August 31, 2022) |

| | | | Since | |

| | 1 Year | 5 Years | Inception (b) | |

| Oakhurst Short Duration Bond Fund - Institutional Shares (a) | -4.65% | 1.07% | 1.54% | |

| ICE BofA U.S. Corp./Govt. 1-3 Years Bond Index (c) | -4.03% | 0.94% | 0.96% | |

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Represents the period from the commencement of operations (April 26, 2013) through August 31, 2022. |

| (c) | The ICE BofA U.S. Corp./Govt. 1-3 Years Bond Index covers the U.S. investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 3 years. The Fund does not invest solely in securities included in the ICE BofA U.S. Corp./Govt. 1-3 Years Bond Index and may invest in other types of securities. |

| OAKHURST SHORT DURATION |

| HIGH YIELD CREDIT FUND |

| Performance Information |

| August 31, 2022 (Unaudited) |

| |

Comparison of the Change in Value of a $100,000 Investment

in Oakhurst Short Duration High Yield Credit Fund - Institutional Shares

versus the ICE BofA 1-5 Year U.S. Cash Pay High Yield Constrained Index

Average Annual Total Returns

(for periods ended August 31, 2022) |

| | | | Since | |

| | 1 Year | 5 Years | Inception (b) | |

| Oakhurst Short Duration High Yield Credit Fund - Institutional Shares (a) | -8.11% | 2.14% | 3.55% | |

| ICE BofA 1-5 Year U.S. Cash Pay High Yield Constrained Index (c) | -5.55% | 2.74% | 4.72% | |

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Represents the period of the commencement of operations (October 1, 2015) through August 31, 2022. |

| (c) | The ICE BofA 1-5 Year U.S. Cash Pay High Yield Constrained Index covers the performance of U.S. dollar denominated below investment grade corporate debt, currently in a coupon paying period, with a remaining term to final maturity less than 5 years but caps issuer exposure at 2%. The Fund does not invest solely in securities included in the ICE BofA 1-5 Year U.S. Cash Pay High Yield Constrained Index and may invest in other types of securities. |

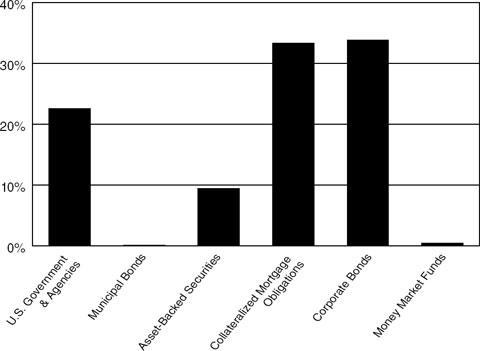

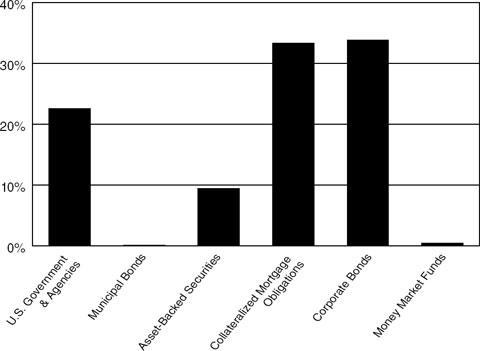

| OAKHURST FIXED INCOME FUND |

| Portfolio Information |

| August 31, 2022 (Unaudited) |

| |

Portfolio Allocation (% of Net Assets)

Top 10 Long-Term Holdings

| | | % of |

| Security Description | | Net Assets |

| U.S. Treasury Bonds, 3.000%, due 05/15/42 | | 3.4% |

| U.S. Treasury Notes, 2.750%, due 05/31/29 | | 3.2% |

| U.S. Treasury Notes, 2.375%, due 05/15/29 | | 3.2% |

| U.S. Treasury Bonds, 2.500%, due 02/15/45 | | 2.5% |

| U.S. Treasury Bonds, 5.250%, due 02/15/29 | | 2.1% |

| U.S. Treasury Notes, 2.875%, due 05/15/32 | | 1.6% |

| Federal Farm Credit Bank, 1.150%, due 08/12/30 | | 1.4% |

| U.S. Treasury Notes, 1.875%, due 02/15/32 | | 1.2% |

| FNMA, Series 2017-105-N, 3.000%, due 01/25/48 | | 1.2% |

| Rocket Mortgage, LLC, 144A, Series 2022-1-A-5, 2.500%, due 01/25/52 | | 1.2% |

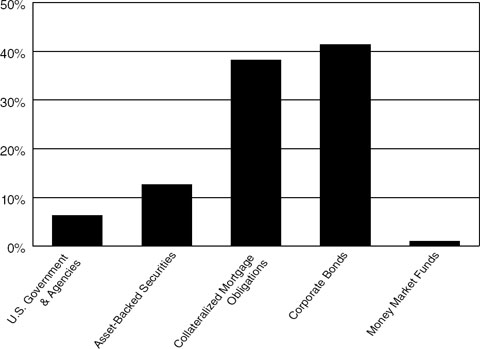

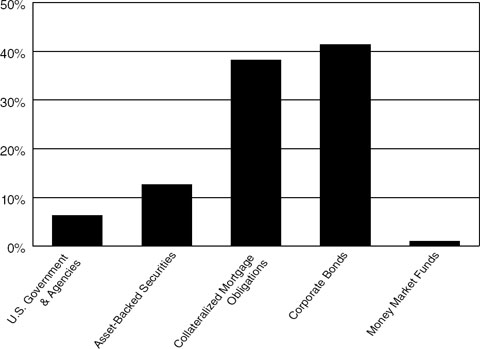

| OAKHURST SHORT DURATION BOND FUND |

| Portfolio Information |

| August 31, 2022 (Unaudited) |

| |

Portfolio Allocation (% of Net Assets)

| Top 10 Long-Term Holdings |

| | | % of |

| Security Description | | Net Assets |

| U.S. Treasury Notes, 2.500%, due 05/31/24 | | 1.7% |

| U.S. Treasury Notes, 2.250%, due 04/30/24 | | 1.7% |

| U.S. Treasury Notes, 2.500%, due 01/31/25 | | 1.7% |

| Sequoia Mortgage Trust, Series 2003-5-A-1, 2.678%(a), due 09/20/33 | | 1.6% |

| Sequoia Mortgage Trust, 144A, Series 2009-2-A1, 4.000%, due 06/25/49 | | 1.6% |

| FNMA, Pool #MA1237, 3.000%, due 11/01/32 | | 1.6% |

| Rocket Mortgage, LLC, 144A, Series 2022-1-A-5, 2.500%, due 01/25/52 | | 1.5% |

| Structured Asset Mortgage Investments, Inc., Series 2004-AR3-I-A-1, 2.720%(a), due 07/19/34 | | 1.4% |

| FHLMC, Series 4710-PA, 3.000%, due 04/15/45 | | 1.4% |

| FNMA, Series 2010-109-NB, 3.000%, due 10/25/40 | | 1.3% |

| | | |

| (a) | Variable rate security. |

| OAKHURST SHORT DURATION |

| HIGH YIELD CREDIT FUND |

| Portfolio Information |

| August 31, 2022 (Unaudited) |

| |

Portfolio Allocation (% of Net Assets)

| Top 10 Long-Term Holdings |

| | | % of |

| Security Description | | Net Assets |

| American Airlines Group Pass-Through Certificates, Series 2014-1-B, 4.375%, due 04/01/24 | | 1.8% |

| New Fortress Energy, Inc., 144A, 6.500%, due 09/30/26 | | 1.7% |

| U.S. Acute Care Solutions, LLC, 144A, 6.375%, due 03/01/26 | | 1.6% |

| NCL Corporation Ltd., 144A, 3.625%, due 12/15/24 | | 1.6% |

| HOA Funding, LLC, 144A, Series 2021-1-B, 7.432%, due 08/20/51 | | 1.6% |

| Tilray, Inc., 5.000%, due 10/01/23 | | 1.5% |

| Washington Multifamily Acquisition I, 144A, 5.750%, due 04/15/26 | | 1.5% |

| PennyMac Mortgage Investment Trust, 5.500%, due 11/01/24 | | 1.5% |

| Prime Security Services Borrower, LLC, 144A, 5.750%, due 04/15/26 | | 1.5% |

| Hughes Satellite Systems Corporation, 6.625%, due 08/01/26 | | 1.5% |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments |

| August 31, 2022 |

U.S. GOVERNMENT &

AGENCIES — 22.6% | | Coupon | | Maturity | | Par Value | | Value |

| Federal Farm Credit Bank — 1.4% | | | | | | | | | | | | |

| Federal Farm Credit Bank | | 1.150% | | 08/12/30 | | $ | 2,000,000 | | | $ | 1,653,256 | |

| | | | | | | | | | | | | |

| Federal Home Loan Bank — 1.0% | | | | | | | | | | | | |

| Federal Home Loan Bank | | 3.250% | | 05/20/27 | | | 1,250,000 | | | | 1,211,633 | |

| | | | | | | | | | | | | |

| Small Business Administration — 0.0% (a) | | | | | | | | | | | | |

| SBA | | 5.720% | | 01/01/29 | | | 30,104 | | | | 30,285 | |

| | | | | | | | | | | | | |

| Tennessee Valley Authority — 1.0% | | | | | | | | | | | | |

| Tennessee Valley Authority | | 4.650% | | 06/15/35 | | | 1,100,000 | | | | 1,175,926 | |

| | | | | | | | | | | | | |

| U.S. Treasury Bonds — 8.0% | | | | | | | | | | | | |

| U.S. Treasury Bonds | | 5.250% | | 02/15/29 | | | 2,272,000 | | | | 2,528,310 | |

| U.S. Treasury Bonds | | 3.000% | | 05/15/42 | | | 4,370,000 | | | | 4,031,667 | |

| U.S. Treasury Bonds | | 2.500% | | 02/15/45 | | | 3,608,000 | | | | 2,996,049 | |

| | | | | | | | | | | | 9,556,026 | |

| U.S. Treasury Notes — 11.2% | | | | | | | | | | | | |

| U.S. Treasury Notes | | 3.250% | | 06/30/27 | | | 1,170,000 | | | | 1,166,344 | |

| U.S. Treasury Notes | | 2.375% | | 05/15/29 | | | 3,987,000 | | | | 3,768,805 | |

| U.S. Treasury Notes | | 2.750% | | 05/31/29 | | | 4,000,000 | | | | 3,868,906 | |

| U.S. Treasury Notes | | 1.625% | | 05/15/31 | | | 1,340,000 | | | | 1,187,052 | |

| U.S. Treasury Notes | | 1.875% | | 02/15/32 | | | 1,585,000 | | | | 1,421,052 | |

| U.S. Treasury Notes | | 2.875% | | 05/15/32 | | | 2,000,000 | | | | 1,954,687 | |

| | | | | | | | | | | | 13,366,846 | |

| | | | | | | | | | | | | |

| Total U.S. Government & Agencies (Cost $29,439,853) | | | | | | | | | | $ | 26,993,972 | |

| MUNICIPAL BONDS — 0.2% | | Coupon | | Maturity | | Par Value | | Value |

| California State Health Facilities Financing Authority, Revenue Bond,Series 2019, (Cost $260,000) | | 2.704% | | 06/01/30 | | $ | 260,000 | | | $ | 232,878 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

ASSET-BACKED

SECURITIES — 9.5% | | Coupon | | Maturity | | Par Value | | Value |

| Coinstar Funding, LLC, 144A, Series 2017-1-A-2 | | 5.216% | | 04/25/47 | | $ | 1,402,300 | | | $ | 1,355,886 | |

| Countrywide Asset-Backed Certificates, Series 2004-6-2-A-3 (1*1MO LIBOR + 120) (b) | | 3.644% | | 11/25/34 | | | 148,892 | | | | 143,143 | |

| DB Master Finance, LLC, 144A, Series 2021-1-A-2-II | | 2.493% | | 11/20/51 | | | 1,466,915 | | | | 1,256,747 | |

| Domino’s Pizza Master Issuer, LLC, 144A, Series 2015-1-A-2-II | | 4.474% | | 10/25/45 | | | 1,234,675 | | | | 1,198,734 | |

| Exeter Automobile Receivables Trust, Series 2021-2A-C | | 0.980% | | 06/15/26 | | | 1,000,000 | | | | 962,695 | |

| Fat Brands GFG Royalty, LLC, 144A, Series 2021-1-A-2 | | 6.000% | | 07/25/51 | | | 1,000,000 | | | | 950,683 | |

| Flagship Credit Auto Trust, 144A, Series 2020-4-D | | 2.180% | | 02/16/27 | | | 735,000 | | | | 702,920 | |

| Focus Brands Funding, LLC, 144A, Series 2018-1-A-2 | | 5.184% | | 10/30/48 | | | 741,125 | | | | 700,297 | |

| GLS Auto Receivables Issuer Trust, 144A, Series 2020-1-C | | 2.720% | | 11/17/25 | | | 1,250,000 | | | | 1,229,275 | |

| HOA Funding, LLC, 144A, Series 2021-1-B | | 7.432% | | 08/20/51 | | | 700,000 | | | | 576,188 | |

| Jack in the Box Funding, LLC, 144A, Series 2022-1-A-2-I | | 3.445% | | 02/26/52 | | | 881,100 | | | | 799,284 | |

| Long Beach Mortgage Loan Trust, Series 2004-4-I-A1 (1*1MO LIBOR + 56) (b) | | 3.004% | | 10/25/34 | | | 726,683 | | | | 689,771 | |

| Santander Drive Auto Receivables Trust, Series 2021-4-B | | 0.880% | | 06/15/26 | | | 796,000 | | | | 773,913 | |

| | | | | | | | | | | | | |

| Total Asset-Backed Securities (Cost $11,869,652) | | | | | | | | | | $ | 11,339,536 | |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% | | Coupon | | Maturity | | Par Value | | Value |

| Federal Home Loan Mortgage Corporation — 6.6% | | | | | | | | | | | | |

| FHLMC, Series 2515-UP | | 5.500% | | 10/15/22 | | $ | 467 | | | $ | 467 | |

| FHLMC, Series 3827-HA | | 3.500% | | 11/15/25 | | | 89,369 | | | | 89,012 | |

| FHLMC, Series 4011-ML | | 3.000% | | 03/15/27 | | | 500,000 | | | | 482,369 | |

| FHLMC, Series 2569-LD | | 5.500% | | 02/15/33 | | | 34,747 | | | | 36,022 | |

| FHLMC, Series 3793-UA | | 4.000% | | 06/15/33 | | | 38,005 | | | | 37,935 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Federal Home Loan Mortgage Corporation — 6.6% (Continued) | | | | | | | | | | | | |

| FHLMC, Series 5206-DV | | 3.500% | | 06/25/33 | | $ | 1,163,254 | | | $ | 1,149,071 | |

| FHLMC, Pool #C9-1859 | | 3.500% | | 12/01/35 | | | 255,401 | | | | 253,096 | |

| FHLMC, Series 3622-WA | | 5.500% | | 09/15/39 | | | 174,856 | | | | 179,601 | |

| FHLMC, Series 3843-JA | | 4.000% | | 04/15/40 | | | 13,681 | | | | 13,711 | |

| FHLMC, Series 3940-PD | | 2.500% | | 02/15/41 | | | 146,258 | | | | 142,314 | |

| FHLMC, Series 4226-AN | | 4.000% | | 04/15/41 | | | 25,209 | | | | 25,224 | |

| FHLMC, Series 4077-AP | | 4.000% | | 01/15/42 | | | 47,078 | | | | 46,536 | |

| FHLMC, Series 4183-PA | | 3.500% | | 01/15/43 | | | 54,342 | | | | 54,094 | |

| FHLMC, Series 4566-CA | | 3.000% | | 01/15/43 | | | 148,241 | | | | 146,933 | |

| FHLMC, Series 5245-CB | | 4.000% | | 12/25/46 | | | 1,167,225 | | | | 1,161,272 | |

| FHLMC, Series 5227-JQ | | 4.000% | | 04/25/47 | | | 1,216,509 | | | | 1,207,926 | |

| FHLMC, Series 4753-JA | | 3.000% | | 12/15/47 | | | 114,799 | | | | 108,197 | |

| FHLMC, Series 4760-A | | 3.000% | | 02/15/48 | | | 806,531 | | | | 774,084 | |

| FHLMC, Series 4960-PD | | 2.000% | | 10/25/49 | | | 874,314 | | | | 779,865 | |

| FHLMC, Series 5252-BA | | 4.000% | | 02/25/50 | | | 1,250,000 | | | | 1,236,523 | |

| | | | | | | | | | | | 7,924,252 | |

| Federal National Mortgage Association — 5.7% | | | | | | | | | | | | |

| FNMA, Series 2005-80-BA | | 5.000% | | 04/25/29 | | | 24,818 | | | | 25,311 | |

| FNMA, Series 2009-96-DB | | 4.000% | | 11/25/29 | | | 96,150 | | | | 95,972 | |

| FNMA, Pool #FM5329 | | 2.000% | | 01/01/31 | | | 645,211 | | | | 609,021 | |

| FNMA, Pool #MA1201 | | 3.500% | | 10/01/32 | | | 109,224 | | | | 108,409 | |

| FNMA, Series 2022-22-EV | | 4.000% | | 07/25/33 | | | 1,192,820 | | | | 1,193,856 | |

| FNMA, Series 2004-W3-A-7 | | 5.500% | | 05/25/34 | | | 601,170 | | | | 618,148 | |

| FNMA, Pool #FS0862 | | 2.500% | | 12/01/36 | | | 1,117,490 | | | | 1,065,399 | |

| FNMA, Pool #MA0584 | | 4.500% | | 10/01/40 | | | 9,961 | | | | 9,793 | |

| FNMA, Series 2013-13-MA | | 4.000% | | 01/25/43 | | | 257,797 | | | | 259,336 | |

| FNMA, Series 2016-49-LA | | 3.500% | | 01/25/43 | | | 174,346 | | | | 172,242 | |

| FNMA, Series 2014-80-KA | | 2.000% | | 03/25/44 | | | 289,870 | | | | 239,598 | |

| FNMA, Series 2016-24-HA | | 3.000% | | 04/25/44 | | | 82,719 | | | | 81,398 | |

| FNMA, Series 2017-22-EC | | 3.000% | | 06/25/44 | | | 186,345 | | | | 183,062 | |

| FNMA, Series 2016-89-CG | | 3.000% | | 04/25/46 | | | 145,801 | | | | 140,310 | |

| FNMA, Series 2017-105-N | | 3.000% | | 01/25/48 | | | 1,483,207 | | | | 1,411,886 | |

| FNMA, Series 2019-33-N | | 3.000% | | 03/25/48 | | | 340,740 | | | | 331,477 | |

| FNMA, Series 2018-45-AB | | 3.000% | | 06/25/48 | | | 244,560 | | | | 232,804 | |

| | | | | | | | | | | | 6,778,022 | |

| Government National Mortgage Association — 9.2% | | | | | | | | | | | | |

| GNMA, Series 2020-078-CB | | 5.000% | | 09/20/34 | | | 276,140 | | | | 280,969 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Government National Mortgage Association — 9.2% (Continued) | | | | | | | | | | | | |

| GNMA, Series 2009-104-KA | | 4.500% | | 08/16/39 | | $ | 24,050 | | | $ | 24,065 | |

| GNMA, Series 2017-084-JD | | 3.000% | | 05/20/47 | | | 42,555 | | | | 41,035 | |

| GNMA, Series 2018-006-JA | | 2.750% | | 01/20/48 | | | 236,960 | | | | 223,701 | |

| GNMA, Series 2019-061-KU | | 3.500% | | 05/20/49 | | | 902,782 | | | | 862,454 | |

| GNMA, Series 2019-099-JC | | 3.000% | | 08/20/49 | | | 84,240 | | | | 80,378 | |

| GNMA, Series 2019-152-HA | | 3.500% | | 08/20/49 | | | 195,415 | | | | 189,822 | |

| GNMA, Series 2020-05-NA | | 3.500% | | 12/20/49 | | | 269,061 | | | | 257,507 | |

| GNMA, Series 2020-133-A (b) | | 5.935% | | 05/01/50 | | | 282,572 | | | | 300,721 | |

| GNMA, Series 2020-084-WA | | 3.500% | | 06/20/50 | | | 199,548 | | | | 189,806 | |

| GNMA, Series 2020-095-NB | | 4.500% | | 07/20/50 | | | 28,588 | | | | 27,247 | |

| GNMA, Series 2020-122-DP | | 2.500% | | 07/20/50 | | | 1,343,006 | | | | 1,253,366 | |

| GNMA, Series 2022-078-LA | | 4.500% | | 07/20/50 | | | 1,185,299 | | | | 1,199,166 | |

| GNMA, Series 2020-123-PB | | 2.250% | | 08/20/50 | | | 647,776 | | | | 592,658 | |

| GNMA, Series 2020-133-HA | | 3.500% | | 09/20/50 | | | 337,968 | | | | 319,217 | |

| GNMA, Series 2020-134-NP | | 2.500% | | 09/20/50 | | | 1,031,756 | | | | 961,830 | |

| GNMA, Series 2020-183-AY | | 2.000% | | 11/20/50 | | | 999,295 | | | | 894,508 | |

| GNMA, Series 2022-075-PA | | 4.000% | | 04/20/51 | | | 1,234,427 | | | | 1,229,559 | |

| GNMA, Series 2022-20-KA | | 2.500% | | 01/20/52 | | | 1,199,033 | | | | 1,121,623 | |

| GNMA, Series 2022-024-BC | | 4.000% | | 02/20/52 | | | 892,646 | | | | 879,503 | |

| | | | | | | | | | | | 10,929,135 | |

| Non-Agency — 11.8% | | | | | | | | | | | | |

| ABN AMRO Mortgage Corporation, Series 2003-12-1A | | 5.000% | | 12/25/33 | | | 100,532 | | | | 95,719 | |

| Bank of America Funding Corporation, Series 2003-J-2-A-1 (b) | | 2.564% | | 11/25/33 | | | 273,905 | | | | 251,827 | |

| Bank of America Funding Corporation, Series 2004-A-3-A-1 (b) | | 2.361% | | 02/25/34 | | | 65,315 | | | | 64,816 | |

| Bear Stearns ALT-A Trust, Series 2003-6-II-A-1 (b) | | 3.254% | | 01/25/34 | | | 189,468 | | | | 185,751 | |

| Countrywide Home Loans, Inc., Series 2003-49-A-9 (b) | | 2.579% | | 12/19/33 | | | 40,381 | | | | 37,761 | |

| Credit Suisse First Boston Mortgage Securities Company, Series 2002-AR31-IV-A-2 (b) | | 2.245% | | 11/25/32 | | | 41,210 | | | | 41,011 | |

| Credit Suisse First Boston Mortgage Securities Company, Series 2003-11-I-A-31 | | 5.500% | | 06/25/33 | | | 24,307 | | | | 23,411 | |

| CSMC Mortgage Trust, 144A, Series 2013-IVR1-A-2 | | 3.000% | | 03/25/43 | | | 390,398 | | | | 358,262 | |

| GS Mortgage-Backed Securities, 144A, Series 2021-PJ1-A-4 (b) | | 2.500% | | 06/25/51 | | | 668,363 | | | | 555,944 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 11.8% (Continued) | | | | | | | | | | | | |

| HarborView Mortgage Loan Trust, Series 2003-1-A (b) | | 2.260% | | 05/19/33 | | $ | 45,951 | | | $ | 41,211 | |

| HarborView Mortgage Loan Trust, Series 2004-4-2-A (1*1MO LIBOR + 56) (b) | | 2.646% | | 06/19/34 | | | 56,215 | | | | 51,516 | |

| Impac CMB Trust, Series 2004-10-4-A-2 (1*1MO LIBOR + 94) (b) | | 3.384% | | 03/25/35 | | | 50,281 | | | | 47,375 | |

| Impac CMB Trust, Series 2005-4-2-A-1 (1*1MO LIBOR + 30) (b) | | 2.744% | | 05/25/35 | | | 331,772 | | | | 298,497 | |

| Impac CMB Trust, 144A, Series 2007-A-A (1*1MO LIBOR + 50) (b) | | 2.944% | | 05/25/37 | | | 306,344 | | | | 293,153 | |

| Impac CMB Trust, 144A, Series 2007-A-M-1 (1*1MO LIBOR + 80) (b) | | 3.244% | | 05/25/37 | | | 304,705 | | | | 290,153 | |

| Impac Secured Assets Corporation, Series 2003-3-A-1 (b) | | 5.200% | | 08/25/33 | | | 28,209 | | | | 26,900 | |

| Impac Secured Assets Corporation, Series 2006-1-2-A-1 (1*1MO LIBOR + 70) (b) | | 3.144% | | 05/25/36 | | | 94,310 | | | | 86,800 | |

| JPMorgan Alternative Loan Trust, Series 2005-A2-1-A-1 (1*1MO LIBOR + 52) (b) | | 2.704% | | 01/25/36 | | | 16,468 | | | | 16,435 | |

| JPMorgan Mortgage Trust, Series 2003-A1-1-A-1 (b) | | 2.032% | | 10/25/33 | | | 111,731 | | | | 104,223 | |

| JPMorgan Mortgage Trust, Series 2004-A1-4-A-1 (b) | | 2.027% | | 02/25/34 | | | 80,905 | | | | 75,487 | |

| JPMorgan Mortgage Trust, Series 2004-A3-S-F-3 (b) | | 2.274% | | 06/25/34 | | | 94,474 | | | | 89,896 | |

| JPMorgan Mortgage Trust, Series 2004-A4-2-A-2 (b) | | 2.768% | | 09/25/34 | | | 626,549 | | | | 594,753 | |

| JPMorgan Mortgage Trust, Series 2004-A5-2-A-1 (b) | | 2.259% | | 12/25/34 | | | 28,957 | | | | 29,482 | |

| JPMorgan Mortgage Trust, 144A, Series 2013-3-A-3 (b) | | 3.355% | | 07/25/43 | | | 58,232 | | | | 55,191 | |

| JPMorgan Mortgage Trust, 144A, Series 2017-A-A-3 (b) | | 3.500% | | 05/25/47 | | | 123,217 | | | | 112,953 | |

| JPMorgan Mortgage Trust, 144A, Series 2018-1-A-7 (b) | | 3.500% | | 06/25/48 | | | 475,196 | | | | 446,526 | |

| Master Adjustable Rate Mortgage Trust, Series 2003-3-2-A-1 (b) | | 1.823% | | 09/25/33 | | | 52,470 | | | | 47,013 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 11.8% (Continued) | | | | | | | | | | | | |

| Master Asset Securitization Trust, Series 2004-1-3-A-7 | | 5.250% | | 01/25/34 | | $ | 43,351 | | | $ | 40,721 | |

| Merrill Lynch Mortgage Investors Trust, Series 2004-A3-I-A (b) | | 2.855% | | 05/25/34 | | | 120,591 | | | | 112,109 | |

| Merrill Lynch Mortgage Investors Trust, Series 2004-1-A-2 (1*1MO LIBOR + 90) (b) | | 3.344% | | 11/25/34 | | | 865,439 | | | | 829,956 | |

| Merrill Lynch Mortgage Investors Trust, Series 2005-A1-I-A (b) | | 2.866% | | 12/25/34 | | | 242,867 | | | | 244,133 | |

| Nationstar Mortgage Loan Trust, 144A, Series 2013-A-A (b) | | 3.750% | | 12/25/52 | | | 43,478 | | | | 40,817 | |

| New Residential Mortgage Loan Trust, 144A, Series 2015-2-A-2 (b) | | 3.750% | | 08/25/55 | | | 220,633 | | | | 209,325 | |

| New Residential Mortgage Loan Trust, 144A, Series 2017-3-A-1 (b) | | 4.000% | | 04/25/57 | | | 245,561 | | | | 236,728 | |

| Opteum Mortgage Acceptance Corporation, Series 2005-5-IIA1D2 (b) | | 5.850% | | 12/25/35 | | | 27,804 | | | | 27,544 | |

| Rocket Mortgage, LLC, 144A, Series 2022-1-A-5 | | 2.500% | | 01/25/52 | | | 1,529,810 | | | | 1,374,857 | |

| SBA Tower Trust, 144A, Series 2020-1-2-1C | | 1.884% | | 07/15/50 | | | 300,000 | | | | 270,337 | |

| SBA Tower Trust, 144A, Series 2020-1-2-2C | | 2.328% | | 07/15/52 | | | 10,000 | | | | 8,722 | |

| Sequoia Mortgage Trust, Series 2003-8-A-1 (1*1MO LIBOR + 64) (b) | | 2.766% | | 01/20/34 | | | 296,742 | | | | 285,524 | |

| Sequoia Mortgage Trust, Series 2004-6-A-2 (1*1MO LIBOR + 56) (b) | | 2.686% | | 07/20/34 | | | 114,122 | | | | 102,509 | |

| Sequoia Mortgage Trust, 144A, Series 2013-5-A-1 (b) | | 2.500% | | 05/25/43 | | | 184,621 | | | | 164,086 | |

| Sequoia Mortgage Trust, Series 2013-6-A-2 (b) | | 3.000% | | 05/25/43 | | | 231,501 | | | | 213,094 | |

| Sequoia Mortgage Trust, 144A, Series 2019-4-A-1 | | 3.500% | | 11/25/49 | | | 598,130 | | | | 550,670 | |

| Structured Adjustable Rate Mortgage Loan Trust, Series 2004-1-4-A4 (b) | | 2.543% | | 02/25/34 | | | 91,095 | | | | 87,819 | |

| Structured Asset Mortgage Investments II Trust, Series 2004-AR6-A-1A (1*1MO LIBOR + 70) (b) | | 2.716% | | 02/19/35 | | | 1,078,482 | | | | 1,036,557 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 33.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 11.8% (Continued) | | | | | | | | | | | | |

| Structured Asset Mortgage Investments, Inc., Series 2003-AR4-A-1 (1*1MO LIBOR + 70) (b) | | 2.820% | | 01/19/34 | | $ | 32,060 | | | $ | 30,862 | |

| Structured Asset Mortgage Investments, Inc., Series 2004-AR4-IA1 (1*1MO LIBOR + 70) (b) | | 2.820% | | 12/19/34 | | | 72,265 | | | | 67,629 | |

| Structured Asset Securities Corporation, Series 2003-9A-2-A1 (b) | | 2.340% | | 03/25/33 | | | 109,336 | | | | 108,196 | |

| Structured Asset Securities Corporation, Series 2003-34A-5-A4 (b) | | 2.683% | | 11/25/33 | | | 136,370 | | | | 129,074 | |

| Terwin Mortgage Trust, 144A, Series 2004-1HE-M-1 | | 3.194% | | 02/25/34 | | | 303,840 | | | | 291,549 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2003-S3-III-A1 | | 5.500% | | 05/25/33 | | | 26,513 | | | | 25,712 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2003-AR7-A-7 (b) | | 2.467% | | 08/25/33 | | | 508,891 | | | | 479,169 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2003-AR8-A (b) | | 2.765% | | 08/25/33 | | | 192,925 | | | | 189,012 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2002-AR2-A (1*COF 11 + 125) (b) | | 1.912% | | 02/27/34 | | | 109,413 | | | | 103,920 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2005-AR2-1-A-1A (1*1MO LIBOR + 66) (b) | | 3.104% | | 01/25/45 | | | 1,057,968 | | | | 1,003,540 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2005-AR13-A-1A3 (1*1MO LIBOR + 156) (b) | | 4.004% | | 10/25/45 | | | 165,451 | | | | 160,470 | |

| Wells Fargo Alternative Loan Trust, Series 2002-1-I-A-1 | | 6.250% | | 08/25/32 | | | 247,022 | | | | 236,300 | |

| Wells Fargo Mortgage-Backed Securities, 144A, Series 2021-RR1-A-3 | | 2.500% | | 12/25/50 | | | 1,186,285 | | | | 1,069,993 | |

| | | | | | | | | | | | 14,053,000 | |

| | | | | | | | | | | | | |

| Total Collateralized Mortgage Obligations (Cost $41,865,925) | | | | | | | | | | $ | 39,684,409 | |

| | | | | | | | | | | | | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

| CORPORATE BONDS — 33.8% | | Coupon | | Maturity | | Par Value | | Value |

| Communications — 2.3% | | | | | | | | |

| CBS Corporation | | 7.875% | | 07/30/30 | | $ | 765,000 | | | $ | 866,283 | |

| Magallanes, Inc., 144A | | 4.054% | | 03/15/29 | | | 1,010,000 | | | | 921,888 | |

| T-Mobile USA, Inc. | | 2.050% | | 02/15/28 | | | 1,073,000 | | | | 932,927 | |

| | | | | | | | | | | | 2,721,098 | |

| Consumer Discretionary — 0.7% | | | | | | | | | | | | |

| Genting NY, LLC, 144A | | 3.300% | | 02/15/26 | | | 1,025,000 | | | | 909,613 | |

| | | | | | | | | | | | | |

| Consumer Staples — 1.5% | | | | | | | | | | | | |

| Clorox Company | | 1.800% | | 05/15/30 | | | 989,000 | | | | 807,574 | |

| Flowers Foods, Inc. | | 2.400% | | 03/15/31 | | | 1,128,000 | | | | 941,074 | |

| | | | | | | | | | | | 1,748,648 | |

| Energy — 1.9% | | | | | | | | | | | | |

| Enbridge, Inc. | | 3.125% | | 11/15/29 | | | 1,059,000 | | | | 959,126 | |

| Grey Oak Pipeline, LLC, 144A | | 3.450% | | 10/15/27 | | | 1,013,000 | | | | 928,893 | |

| Phillips 66 Partners, L.P. | | 3.550% | | 10/01/26 | | | 399,000 | | | | 368,624 | |

| | | | | | | | | | | | 2,256,643 | |

| Financials — 13.1% | | | | | | | | | | | | |

| AerCap Ireland Capital D.A.C. | | 1.750% | | 01/30/26 | | | 980,000 | | | | 864,789 | |

| Antares Holdings, L.P. | | 3.950% | | 07/15/26 | | | 1,070,000 | | | | 948,478 | |

| Aviation Capital Group, LLC, 144A | | 1.950% | | 01/30/26 | | | 1,102,000 | | | | 952,192 | |

| Bank of America Corporation (1*3MO LIBOR + 104) (b) | | 3.419% | | 12/20/28 | | | 984,000 | | | | 913,004 | |

| Barings BDC, Inc., 144A | | 3.300% | | 11/23/26 | | | 1,040,000 | | | | 901,620 | |

| Blackstone Private Credit Fund | | 3.250% | | 03/15/27 | | | 1,050,000 | | | | 902,179 | |

| Drawbridge Special Opportunities Fund, L.P., 144A | | 3.875% | | 02/15/26 | | | 937,000 | | | | 859,999 | |

| Fairfax Financial Holdings Ltd. | | 4.850% | | 04/17/28 | | | 938,000 | | | | 910,560 | |

| Fidelity National Financial, Inc. | | 3.400% | | 06/15/30 | | | 899,000 | | | | 779,879 | |

| First American Financial Corporation | | 4.000% | | 05/15/30 | | | 1,017,000 | | | | 912,525 | |

| FS KKR Capital Corporation | | 3.400% | | 01/15/26 | | | 983,000 | | | | 895,650 | |

| Goldman Sachs Group, Inc. | | 3.800% | | 03/15/30 | | | 987,000 | | | | 912,105 | |

| Icahn Enterprises, L.P. | | 4.375% | | 02/01/29 | | | 750,000 | | | | 637,897 | |

| Jackson Financial, Inc., 144A | | 3.125% | | 11/23/31 | | | 1,100,000 | | | | 883,559 | |

| M.D.C. Holdings, Inc. | | 3.850% | | 01/15/30 | | | 779,000 | | | | 638,824 | |

| Owl Rock Capital Corporation | | 2.625% | | 01/15/27 | | | 1,072,000 | | | | 905,482 | |

| PennyMac Mortgage Investment Trust | | 5.500% | | 11/01/24 | | | 1,000,000 | | | | 962,500 | |

| Prospect Capital Corporation | | 3.437% | | 10/15/28 | | | 1,131,000 | | | | 877,624 | |

| | | | | | | | | | | | 15,658,866 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

CORPORATE BONDS — 33.8%

(Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Health Care — 1.9% | | | | | | | | | | | | |

| Bristol-Myers Squibb Company | | 5.875% | | 11/15/36 | | $ | 485,000 | | | $ | 522,927 | |

| CVS Pass-Through Trust, 144A, Series 2013 | | 4.704% | | 01/10/36 | | | 217,705 | | | | 208,950 | |

| CVS Pass-Through Trust, 144A, Series 2014 | | 4.163% | | 08/11/36 | | | 700,109 | | | | 643,426 | |

| Mylan, Inc. | | 4.550% | | 04/15/28 | | | 963,000 | | | | 905,624 | |

| | | | | | | | | | | | 2,280,927 | |

| Industrials — 4.6% | | | | | | | | | | | | |

| Air Canada Pass-Through Certificates, 144A, Series 2013-1-A | | 4.125% | | 11/15/26 | | | 487,570 | | | | 437,267 | |

| Air Canada Pass-Through Certificates, 144A, Series 2015-1-A | | 3.600% | | 09/15/28 | | | 941,554 | | | | 868,178 | |

| American Airlines Group Pass-Through Certificates, Series 2019-1-AA | | 3.150% | | 08/15/33 | | | 1,104,740 | | | | 975,251 | |

| MasTec, Inc., 144A | | 4.500% | | 08/15/28 | | | 975,000 | | | | 896,451 | |

| Roper Technologies, Inc. | | 2.950% | | 09/15/29 | | | 1,035,000 | | | | 913,642 | |

| U.S. Airways Pass-Through Trust, Series 2011-1-A | | 7.125% | | 04/22/25 | | | 371,034 | | | | 370,523 | |

| United Airlines Pass-Through Certificates, Series 2020-1-A | | 5.875% | | 04/15/29 | | | 1,068,289 | | | | 1,069,579 | |

| | | | | | | | | | | | 5,530,891 | |

| Materials — 0.8% | | | | | | | | | | | | |

| Georgia-Pacific, LLC | | 7.750% | | 11/15/29 | | | 780,000 | | | | 934,880 | |

| | | | | | | | | | | | | |

| Real Estate — 1.6% | | | | | | | | | | | | |

| American Homes 4 Rent | | 2.375% | | 07/15/31 | | | 1,128,000 | | | | 907,604 | |

| Crown Castle International Corporation | | 4.000% | | 03/01/27 | | | 875,000 | | | | 850,574 | |

| Public Storage | | 2.250% | | 11/09/31 | | | 130,000 | | | | 109,238 | |

| | | | | | | | | | | | 1,867,416 | |

| Technology — 3.8% | | | | | | | | | | | | |

| Hewlett Packard Enterprise Company | | 6.200% | | 10/15/35 | | | 857,000 | | | | 906,114 | |

| Leidos, Inc. | | 4.375% | | 05/15/30 | | | 1,000,000 | | | | 925,180 | |

| NXP B.V./NXP Funding, LLC | | 2.500% | | 05/11/31 | | | 1,167,000 | | | | 939,788 | |

| PayPal Holdings, Inc. | | 2.850% | | 10/01/29 | | | 1,021,000 | | | | 925,685 | |

| TD SYNNEX Corporation | | 2.375% | | 08/09/28 | | | 1,089,000 | | | | 916,405 | |

| | | | | | | | | | | | 4,613,172 | |

| OAKHURST FIXED INCOME FUND |

| Schedule of Investments (Continued) |

CORPORATE BONDS — 33.8%

(Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Utilities — 1.6% | | | | | | | | |

| Elwood Energy, LLC | | 8.159% | | 07/05/26 | | $ | 529,615 | | | $ | 529,615 | |

| Entergy New Orleans, LLC | | 4.000% | | 06/01/26 | | | 700,000 | | | | 681,672 | |

| NSG Holdings, LLC, 144A | | 7.750% | | 12/15/25 | | | 678,945 | | | | 656,879 | |

| | | | | | | | | | | | 1,868,166 | |

| | | | | | | | | | | | | |

| Total Corporate Bonds (Cost $46,008,170) | | | | | | | | | | $ | 40,390,320 | |

| MONEY MARKET FUNDS — 0.5% | | Shares | | | Value | |

| Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 2.17% (c) (Cost $609,987) | | | 609,987 | | | $ | 609,987 | |

| | | | | | | | | |

| Total Investments at Value — 99.9% (Cost $130,053,587) | | | | | | $ | 119,251,102 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 158,798 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 119,409,900 | |

144A - Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been deemed liquid under procedures approved by the Board of Trustees. The total value of such securities is $25,168,195 as of August 31, 2022, representing 21.1% of net assets.

COF 11 - Cost of funds for the 11th District of San Francisco.

LIBOR - London Interbank Offered Rate.

| (a) | Percentage rounds to less than 0.1%. |

| (b) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of August 31, 2022. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

| (c) | The rate shown is the 7-day effective yield as of August 31, 2022. |

See accompanying notes to financial statements.

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments |

| August 31, 2022 |

U.S. GOVERNMENT &

AGENCIES — 6.3% | | Coupon | | Maturity | | Par Value | | Value |

| Federal Home Loan Bank — 1.2% | | | | | | | | | | | | |

| Federal Home Loan Banks | | 3.000% | | 02/23/24 | | $ | 700,000 | | | $ | 691,552 | |

| | | | | | | | | | | | | |

| Small Business Administration — 0.0% (a) | | | | | | | | | | | | |

| SBA | | 5.080% | | 11/01/22 | | | 3,901 | | | | 3,905 | |

| SBA | | 5.510% | | 11/01/27 | | | 28,078 | | | | 28,273 | |

| | | | | | | | | | | | 32,178 | |

| U.S. Treasury Notes — 5.1% | | | | | | | | | | | | |

| U.S. Treasury Notes | | 2.250% | | 04/30/24 | | | 1,000,000 | | | | 980,820 | |

| U.S. Treasury Notes | | 2.500% | | 05/31/24 | | | 1,000,000 | | | | 983,867 | |

| U.S. Treasury Notes | | 2.500% | | 01/31/25 | | | 1,000,000 | | | | 977,774 | |

| | | | | | | | | | | | 2,942,461 | |

| | | | | | | | | | | | | |

| Total U.S. Government & Agencies (Cost $3,722,857) | | | | | | | | | | $ | 3,666,191 | |

ASSET-BACKED

SECURITIES — 12.6% | | Coupon | | Maturity | | Par Value | | Value |

| Accredited Mortgage Loan Trust, Series 2004-3-2A2 (1*1MO LIBOR + 120) (b) | | 3.644% | | 10/25/34 | | $ | 82,594 | | | $ | 81,196 | |

| ACE Securities Corporation, Series 2003-NC1-A-2A (1*1MO LIBOR + 84) (b) | | 2.864% | | 07/25/33 | | | 234,621 | | | | 214,042 | |

| Argent Securities, Inc., Series 2004-W10-A-2 (1*1MO LIBOR + 78) (b) | | 3.224% | | 10/25/34 | | | 295,955 | | | | 287,906 | |

| Coinstar Funding, LLC, 144A, Series 2017-1-A-2 | | 5.216% | | 04/25/47 | | | 611,138 | | | | 590,910 | |

| Countrywide Asset-Backed Certificates, Series 2004-6-2-A-3 (1*1MO LIBOR + 120) (b) | | 3.644% | | 11/25/34 | | | 152,019 | | | | 146,149 | |

| Countrywide Home Loans, Inc., Series 2004-6-2-A-5 (1*1MO LIBOR + 78) (b) | | 3.224% | | 11/25/34 | | | 579,813 | | | | 545,469 | |

| DB Master Finance, LLC, 144A, Series 2021-1-A-2-I | | 2.045% | | 11/20/51 | | | 679,863 | | | | 586,590 | |

| Domino’s Pizza Master Issuer, LLC, 144A, Series 2015-1-A-2-II | | 4.474% | | 10/25/45 | | | 612,625 | | | | 594,792 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

ASSET-BACKED

SECURITIES — 12.6% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Drive Auto Receivables Trust, Series 2020-2-D | | 3.050% | | 05/15/28 | | $ | 670,000 | | | $ | 658,462 | |

| Drive Auto Receivables Trust, Series 2021-1-C | | 1.020% | | 06/15/27 | | | 556,000 | | | | 543,035 | |

| Fat Brands GFG Royalty, LLC, 144A, Series 2021-1-A-2 | | 6.000% | | 07/25/51 | | | 700,000 | | | | 665,478 | |

| Flagship Credit Auto Trust, 144A, Series 2020-4-C | | 1.280% | | 02/16/27 | | | 610,000 | | | | 586,179 | |

| HOA Funding, LLC, 144A, Series 2021-1-B | | 7.432% | | 08/20/51 | | | 865,000 | | | | 712,004 | |

| Mortgage IT Trust, Series 2005-5-A-1 (1*1MO LIBOR + 52) (b) | | 2.704% | | 12/25/35 | | | 413,811 | | | | 396,823 | |

| Soundview Home Equity Loan Trust, Series 2003-2-A-2 (1*1MO LIBOR + 130) (b) | | 3.744% | | 11/25/33 | | | 245,319 | | | | 241,757 | |

| Thornburg Mortgage Trust, Series 2003-4-A-1 (1*1MO LIBOR + 64) (b) | | 2.764% | | 09/25/43 | | | 454,970 | | | | 439,015 | |

| Total Asset-Backed Securities (Cost $7,759,491) | | | | | | | | | | $ | 7,289,807 | |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 38.3% | | Coupon | | Maturity | | Par Value | | Value |

| Federal Home Loan Mortgage Corporation — 6.2% | | | | | | | | | | | | |

| FHLMC, Pool #J1-2630 | | 4.000% | | 07/01/25 | | $ | 204,740 | | | $ | 204,602 | |

| FHLMC, Series 2580-PY | | 4.000% | | 03/15/33 | | | 10,518 | | | | 10,408 | |

| FHLMC, Series 3664-DA | | 4.000% | | 11/15/37 | | | 370,968 | | | | 372,344 | |

| FHLMC, Series 4348-ME | | 2.500% | | 06/15/39 | | | 8,308 | | | | 8,295 | |

| FHLMC, Series 3597-LH | | 4.500% | | 07/15/39 | | | 184,374 | | | | 184,545 | |

| FHLMC, Series 4444-CH | | 3.000% | | 01/15/41 | | | 184,920 | | | | 184,497 | |

| FHLMC, Series 4312-GA | | 2.500% | | 12/15/41 | | | 68,914 | | | | 67,051 | |

| FHLMC, Series 4768-E | | 3.500% | | 09/15/42 | | | 467,005 | | | | 465,069 | |

| FHLMC, Series 4319-PM | | 3.000% | | 03/15/43 | | | 659,176 | | | | 647,464 | |

| FHLMC, Series 4710-PA | | 3.000% | | 04/15/45 | | | 801,154 | | | | 777,265 | |

| FHLMC, Series 4938-BL | | 2.250% | | 07/25/49 | | | 459,841 | | | | 424,747 | |

| FHLMC, Series 4960-PD | | 2.000% | | 10/25/49 | | | 291,438 | | | | 259,955 | |

| | | | | | | | | | | | 3,606,242 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 38.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Federal National Mortgage Association — 8.9% | | | | | | | | | | | | |

| FNMA, Series 2003-48-TC | | 5.000% | | 06/25/23 | | $ | 5,805 | | | $ | 5,802 | |

| FNMA, Series 2010-112-CY | | 4.000% | | 10/25/25 | | | 90,815 | | | | 90,789 | |

| FNMA, Pool #AL0300 | | 4.500% | | 06/01/26 | | | 112,820 | | | | 114,449 | |

| FNMA, Series 2012-41-BA | | 2.500% | | 04/25/27 | | | 342,642 | | | | 334,005 | |

| FNMA, Pool #AL4309 | | 4.000% | | 10/01/28 | | | 209,354 | | | | 209,749 | |

| FNMA, Series 2005-80-BA | | 5.000% | | 04/25/29 | | | 86,864 | | | | 88,590 | |

| FNMA, Pool #MA1237 | | 3.000% | | 11/01/32 | | | 942,217 | | | | 908,195 | |

| FNMA, Series 2005-109-PC | | 6.000% | | 12/25/35 | | | 57,873 | | | | 59,934 | |

| FNMA, Series 2008-17-PA | | 4.500% | | 10/25/37 | | | 132,853 | | | | 131,963 | |

| FNMA, Series 2008-49-PA | | 5.000% | | 04/25/38 | | | 104,496 | | | | 105,358 | |

| FNMA, Series 2010-152-DA | | 3.000% | | 05/25/39 | | | 126,922 | | | | 126,038 | |

| FNMA, Series 2009-94-DA | | 4.500% | | 10/25/39 | | | 234,428 | | | | 232,095 | |

| FNMA, Series 2010-109-NB | | 3.000% | | 10/25/40 | | | 788,887 | | | | 758,206 | |

| FNMA, Series 2012-102-PA | | 4.500% | | 03/25/41 | | | 16,577 | | | | 16,903 | |

| FNMA, Series 2012-136-PD | | 2.500% | | 11/25/42 | | | 286,905 | | | | 279,410 | |

| FNMA, Series 2013-82-BP | | 2.750% | | 12/25/42 | | | 375,240 | | | | 362,057 | |

| FNMA, Series 2014-80-KA | | 2.000% | | 03/25/44 | | | 89,882 | | | | 74,294 | |

| FNMA, Series 2016-72-AP | | 4.000% | | 07/25/44 | | | 108,636 | | | | 106,177 | |

| FNMA, Series 2018-14-PA | | 3.500% | | 04/25/47 | | | 408,778 | | | | 400,918 | |

| FNMA, Series 2019-25-PA | | 3.000% | | 05/25/48 | | | 782,520 | | | | 756,486 | |

| | | | | | | | | | | | 5,161,418 | |

| Government National Mortgage Association — 1.6% | | | | | | | | | | | | |

| GNMA, Pool #615735X | | 5.000% | | 07/15/23 | | | 9,103 | | | | 9,416 | |

| GNMA, Series 2011-26-PA | | 4.000% | | 07/20/40 | | | 63,556 | | | | 63,546 | |

| GNMA, Series 2012-10-LD | | 3.000% | | 07/20/40 | | | 62,920 | | | | 62,767 | |

| GNMA, Series 2018-131-PG | | 3.000% | | 09/20/48 | | | 102,607 | | | | 98,814 | |

| GNMA, Series 2019-024-PE | | 3.250% | | 02/20/49 | | | 224,682 | | | | 216,179 | |

| GNMA, Series 2019-065-EB | | 3.000% | | 05/20/49 | | | 200,169 | | | | 189,239 | |

| GNMA, Series 2019-152-HA | | 3.500% | | 08/20/49 | | | 193,217 | | | | 187,686 | |

| GNMA, Series 2020-095-NB | | 4.500% | | 07/20/50 | | | 80,154 | | | | 76,392 | |

| | | | | | | | | | | | 904,039 | |

| Non-Agency — 21.6% | | | | | | | | | | | | |

| Adjustable Rate Mortgage Trust, Series 2004-5-4-A-1 (b) | | 2.885% | | 04/25/35 | | | 116,252 | | | | 116,046 | |

| American Credit Acceptance Receivables Trust, 144A, Series 2020-4-D | | 1.770% | | 12/14/26 | | | 515,000 | | | | 493,120 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 38.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 21.6% (Continued) | | | | | | | | | | | | |

| American General Mortgage Loan Trust, 144A, Series 2006-1-A-5 (b) | | 5.750% | | 12/25/35 | | $ | 2,065 | | | $ | 2,162 | |

| American Home Mortgage Investment Trust, Series 2004-3-IV-A (1*6MO LIBOR + 150) (b) | | 2.876% | | 10/25/34 | | | 565,167 | | | | 563,699 | |

| American Home Mortgage Investment Trust, Series 2004-3-VI-A1 (c) | | 4.820% | | 10/25/34 | | | 15,032 | | | | 14,777 | |

| Citigroup Mortgage Loan Trust, Inc., Series 2005-6-A-1 (1*H15T1Y + 210) (b) | | 2.190% | | 09/25/35 | | | 103,792 | | | | 103,360 | |

| Credit Suisse First Boston Mortgage Securitization, Series 2004-6-II-A-1 (d) | | 0.000% | | 09/25/22 | | | 12,056 | | | | 2 | |

| Credit Suisse First Boston Mortgage Securitization, Series 2004-AR2-II-A-1 (b) | | 2.273% | | 03/25/34 | | | 34,396 | | | | 33,629 | |

| Goldman Sachs Mortgage Loan Trust, Series 2003-13-1A1 (b) | | 2.633% | | 10/25/33 | | | 83,579 | | | | 84,413 | |

| Goldman Sachs Mortgage Loan Trust, Series 2004-10F-7A-1 | | 5.500% | | 09/25/34 | | | 23,374 | | | | 22,932 | |

| Goldman Sachs Mortgage Loan Trust, Series 2005-5F-8A-2 (1*1MO LIBOR + 50) (b) | | 2.944% | | 06/25/35 | | | 48,578 | | | | 46,763 | |

| GSR Mortgage Loan Trust, Series 2003-7F-IA-4 | | 5.250% | | 06/25/33 | | | 175,694 | | | | 173,483 | |

| GSR Mortgage Loan Trust, Series 2005-AR6-1A-1 (b) | | 2.933% | | 09/25/35 | | | 12,743 | | | | 12,561 | |

| HarborView Mortgage Loan Trust, Series 2004-4-2-A (1*1MO LIBOR + 56) (b) | | 2.646% | | 06/19/34 | | | 32,123 | | | | 29,438 | |

| Impac CMB Trust, Series 2005-4-2-A-1 (1*1MO LIBOR + 30) (b) | | 2.744% | | 05/25/35 | | | 198,666 | | | | 178,741 | |

| Impac CMB Trust, 144A, Series 2007-A-A (1*1MO LIBOR + 50) (b) | | 2.944% | | 05/25/37 | | | 141,394 | | | | 135,306 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 38.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 21.6% (Continued) | | | | | | | | | | | | |

| JPMorgan Alternative Loan Trust, Series 2005-A2-1-A-1 (1*1MO LIBOR + 52) (b) | | 2.704% | | 01/25/36 | | $ | 57,203 | | | $ | 57,087 | |

| JPMorgan Mortgage Trust, Series 2003-A1-4-A-5 (b) | | 1.984% | | 10/25/33 | | | 73,679 | | | | 71,225 | |

| JPMorgan Mortgage Trust, 144A, Series 2018-1-A-7 (b) | | 3.500% | | 06/25/48 | | | 601,915 | | | | 565,600 | |

| JPMorgan Mortgage Trust, 144A, Series 2018-8-A-3 (b) | | 4.000% | | 01/25/49 | | | 116,538 | | | | 112,525 | |

| Master Adjustable Rate Mortgages Trust, Series 2004-13-2-A-1 (b) | | 2.678% | | 04/21/34 | | | 113,431 | | | | 109,601 | |

| Master Adjustable Rate Mortgages Trust, Series 2004-6-4-A-6 (b) | | 3.244% | | 07/25/34 | | | 238,017 | | | | 236,621 | |

| Master Seasoned Securitization Trust, Series 2005-1-1-A-1 (b) | | 5.975% | | 09/25/32 | | | 368,602 | | | | 362,501 | |

| MASTR Asset Alternative Loans Trust, Series 2003-1-2-A-1 | | 6.500% | | 01/25/33 | | | 345,261 | | | | 333,332 | |

| MASTR Asset Securitization Trust, Series 2003-12-1-A-1 | | 5.250% | | 12/25/24 | | | 31,789 | | | | 31,313 | |

| MASTR Asset Securitization Trust, Series 2003-11-7-A-5 | | 5.250% | | 12/25/33 | | | 268,766 | | | | 258,676 | |

| Mellon Residential Funding Corporation, Series 2000-TBC2-A-1 (1*1MO LIBOR + 48) (b) | | 2.871% | | 06/15/30 | | | 666,686 | | | | 634,912 | |

| MLCC Mortgage Investors, Inc., Series MLCC 2003-B-A-1 (1*1MO LIBOR + 68) (b) | | 2.784% | | 04/25/28 | | | 33,127 | | | | 31,687 | |

| MLCC Mortgage Investors, Inc., Series 2003-E-A-2 (1*6MO LIBOR + 66) (b) | | 3.896% | | 10/25/28 | | | 455,278 | | | | 438,949 | |

| Mortgage IT Trust, Series 2004-2-M-1 (1*1MO LIBOR + 82.5) (b) | | 2.994% | | 12/25/34 | | | 536,043 | | | | 506,301 | |

| Nationstar Mortgage Loan Trust, 144A, Series 2013-A-A (b) Provident Funding Mortgage Trust, 144A, Series 2019-2-A-2 (b) | | 3.000% | | 12/25/49 | | | 677,485 | | | | 602,350 | |

| Rocket Mortgage, LLC, 144A, Series 2022-1-A-5 | | 2.500% | | 01/25/52 | | | 956,131 | | | | 859,286 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

COLLATERALIZED MORTGAGE

OBLIGATIONS — 38.3% (Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Non-Agency — 21.6% (Continued) | | | | | | | | | | | | |

| Sequoia Mortgage Trust, Series 2003-5-A-1 (1*1MO LIBOR + 62) (b) | | 2.678% | | 09/20/33 | | $ | 955,203 | | | $ | 922,269 | |

| Sequoia Mortgage Trust, 144A, Series 2019-2-A1 | | 4.000% | | 06/25/49 | | | 928,612 | | | | 910,046 | |

| Sequoia Mortgage Trust, 144A, Series 2019-5-A | | 3.500% | | 12/25/49 | | | 756,667 | | | | 702,209 | |

| Structured Adjustable Rate Mortgage Loan Trust, Series 2004-12-3-A3 (b) | | 2.716% | | 09/25/34 | | | 33,113 | | | | 32,481 | |

| Structured Asset Mortgage Investments II Trust, Series 2004-AR6-A-1A (1*1MO LIBOR + 70) (b) | | 2.716% | | 02/19/35 | | | 371,003 | | | | 356,581 | |

| Structured Asset Mortgage Investments, Inc., Series 2004-AR3-I-A-1 (1*1MO LIBOR + 60) (b) | | 2.720% | | 07/19/34 | | | 844,297 | | | | 782,136 | |

| Structured Asset Securities Corporation, Series 2003-34A-3-A4 (b) | | 3.033% | | 11/25/33 | | | 59,778 | | | | 59,233 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2003-AR7-A-7 (b) | | 2.467% | | 08/25/33 | | | 120,015 | | | | 113,005 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2003-AR8-A (b) | | 2.765% | | 08/25/33 | | | 84,829 | | | | 83,108 | |

| Wa-Mu Mortgage Pass-Through Certificates, Series 2002-AR2-A (1*COF 11 + 125) (b) | | 1.912% | | 02/27/34 | | | 19,893 | | | | 18,895 | |

| Wells Fargo Mortgage-Backed Securities, Series 2004-K-II-A12 (b) | | 3.493% | | 07/25/34 | | | 11,284 | | | | 11,242 | |

| Wells Fargo Mortgage-Backed Securities, Series 2004-K-II-A-6 (b) | | 3.493% | | 07/25/34 | | | 271,928 | | | | 270,919 | |

| Wells Fargo Mortgage-Backed Securities, 144A, Series 2020-1-A-1 (b) | | 3.000% | | 12/25/49 | | | 820,717 | | | | 723,787 | |

| | | | | | | | | | | | 12,473,621 | |

| | | | | | | | | | | | | |

| Total Collateralized Mortgage Obligations (Cost $23,246,188) | | | | | | | | | | $ | 22,145,320 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

| CORPORATE BONDS — 41.4% | | Coupon | | Maturity | | Par Value | | Value |

| Communications — 1.5% | | | | | | | | |

| Magallanes, Inc., 144A | | 3.428% | | 03/15/24 | | $ | 420,000 | | | $ | 410,719 | |

| TFCF America, Inc. | | 3.700% | | 09/15/24 | | | 450,000 | | | | 446,345 | |

| | | | | | | | | | | | 857,064 | |

| Consumer Discretionary — 2.3% | | | | | | | | | | | | |

| AutoNation, Inc. | | 3.500% | | 11/15/24 | | | 550,000 | | | | 539,552 | |

| AutoNation, Inc. | | 4.500% | | 10/01/25 | | | 650,000 | | | | 647,139 | |

| Genuine Parts Company | | 1.750% | | 02/01/25 | | | 174,000 | | | | 163,644 | |

| | | | | | | | | | | | 1,350,335 | |

| Consumer Staples — 1.2% | | | | | | | | | | | | |

| Whole Foods Markets, Inc. | | 5.200% | | 12/03/25 | | | 650,000 | | | | 676,152 | |

| | | | | | | | | | | | | |

| Energy — 4.0% | | | | | | | | | | | | |

| Devon Energy Corporation | | 5.250% | | 09/15/24 | | | 550,000 | | | | 558,570 | |

| El Paso Natural Gas Company, LLC | | 7.500% | | 11/15/26 | | | 603,000 | | | | 663,820 | |

| Grey Oak Pipeline, LLC, 144A | | 2.000% | | 09/15/23 | | | 550,000 | | | | 535,988 | |

| Phillips 66 Partners LP | | 3.605% | | 02/15/25 | | | 589,000 | | | | 558,990 | |

| | | | | | | | | | | | 2,317,368 | |

| Financials — 19.1% | | | | | | | | | | | | |

| AerCap Ireland Capital D.A.C. | | 4.500% | | 09/15/23 | | | 550,000 | | | | 547,276 | |

| Ally Financial, Inc. | | 3.875% | | 05/21/24 | | | 550,000 | | | | 545,546 | |

| Antares Holdings L.P., 144A | | 8.500% | | 05/18/25 | | | 525,000 | | | | 549,143 | |

| Ares Capital Corporation | | 4.250% | | 03/01/25 | | | 550,000 | | | | 535,475 | |

| Aspen Insurance Holdings Ltd. | | 4.650% | | 11/15/23 | | | 550,000 | | | | 550,552 | |

| Athene Global Funding, 144A | | 2.750% | | 06/25/24 | | | 550,000 | | | | 528,106 | |

| Aviation Capital Group, LLC, 144A | | 4.125% | | 08/01/25 | | | 575,000 | | | | 539,873 | |

| Blackstone Private Credit Fund | | 2.350% | | 11/22/24 | | | 650,000 | | | | 604,123 | |

| Fairfax Financial Holdings Ltd., 144A | | 4.875% | | 08/13/24 | | | 600,000 | | | | 594,967 | |

| Fidelity & Guaranty Life Holdings, Inc., 144A | | 5.500% | | 05/01/25 | | | 550,000 | | | | 554,220 | |

| First Horizon National Corporation | | 4.000% | | 05/26/25 | | | 550,000 | | | | 540,438 | |

| FS KKR Capital Corporation | | 4.625% | | 07/15/24 | | | 575,000 | | | | 572,155 | |

| Goldman Sachs BDC, Inc. | | 3.750% | | 02/10/25 | | | 550,000 | | | | 539,746 | |

| Goldman Sachs Group, Inc. | | 3.500% | | 01/23/25 | | | 550,000 | | | | 539,398 | |

| Icahn Enterprises, L.P. | | 4.750% | | 09/15/24 | | | 400,000 | | | | 380,512 | |

| JP Morgan Chase & Company | | 3.875% | | 09/10/24 | | | 565,000 | | | | 562,798 | |

| Morgan Stanley | | 4.000% | | 07/23/25 | | | 550,000 | | | | 547,066 | |

| Owl Rock Capital Corporation | | 5.250% | | 04/15/24 | | | 550,000 | | | | 549,658 | |

| PennyMac Mortgage Investment Trust | | 5.500% | | 11/01/24 | | | 650,000 | | | | 625,625 | |

| Wells Fargo & Company | | 3.908% | | 04/25/26 | | | 650,000 | | | | 637,236 | |

| | | | | | | | | | | | 11,043,913 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

CORPORATE BONDS — 41.4%

(Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Industrials — 4.0% | | | | | | | | | | | | |

| Air Canada Pass-Through Certificates, 144A, Series 2013-1-A | | 4.125% | | 11/15/26 | | | 759,896 | | | | 681,496 | |

| American Airlines Group Pass-Through Certificates, Series 2013-1-A | | 4.000% | | 01/15/27 | | | 436,485 | | | | 378,756 | |

| Delta Air Lines Pass-Through Certificates, Series 2019-1-A | | 3.404% | | 10/25/25 | | | 146,000 | | | | 138,867 | |

| Ryder System, Inc., Series MTN | | 4.625% | | 06/01/25 | | | 550,000 | | | | 549,556 | |

| Southwest Airlines Company | | 5.250% | | 05/04/25 | | | 550,000 | | | | 565,096 | |

| | | | | | | | | | | | 2,313,771 | |

| Real Estate — 0.9% | | | | | | | | | | | | |

| American Tower Corporation | | 4.000% | | 06/01/25 | | | 550,000 | | | | 540,652 | |

| Technology — 5.6% | | | | | | | | | | | | |

| Dell International, LLC | | 5.850% | | 07/15/25 | | | 550,000 | | | | 569,825 | |

| KLA Corporation | | 4.650% | | 11/01/24 | | | 189,000 | | | | 192,117 | |

| Leidos, Inc. | | 3.625% | | 05/15/25 | | | 610,000 | | | | 596,324 | |

| Microchip Technology, Inc. | | 4.250% | | 09/01/25 | | | 663,000 | | | | 656,573 | |

| Oracle Corporation | | 2.950% | | 05/15/25 | | | 600,000 | | | | 575,454 | |

| TD SYNNEX Corporation | | 1.250% | | 08/09/24 | | | 659,000 | | | | 612,381 | |

| | | | | | | | | | | | 3,202,674 | |

| Utilities — 2.8% | | | | | | | | | | | | |

| Elwood Energy, LLC | | 8.159% | | 07/05/26 | | | 481,104 | | | | 481,104 | |

| Entergy New Orleans, LLC | | 4.000% | | 06/01/26 | | | 625,000 | | | | 608,635 | |

| NSG Holdings, LLC, 144A | | 7.750% | | 12/15/25 | | | 526,258 | | | | 509,155 | |

| | | | | | | | | | | | 1,598,894 | |

| | | | | | | | | | | | | |

| Total Corporate Bonds (Cost $25,079,021) | | | | | | | | | | $ | 23,900,823 | |

| OAKHURST SHORT DURATION BOND FUND |

| Schedule of Investments (Continued) |

| MONEY MARKET FUNDS — 1.0% | | Shares | | Value |

| Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 2.17% (e) (Cost $581,708) | | | 581,708 | | | $ | 581,708 | |

| | | | | | | | | |

| Total Investments at Value — 99.6% (Cost $60,389,265) | | | | | | $ | 57,583,849 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 204,378 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 57,788,227 | |

144A - Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been deemed liquid under procedures approved by the Board of Trustees. The total value of such securities is $14,011,323 as of August 31, 2022, representing 24.2% of net assets.

COF 11 - Cost of funds for the 11th District of San Francisco.

H15T1Y - U.S. Treasury yield curve rate for U.S. Treasury note with a constant maturity of 1 year.

LIBOR - London Interbank Offered Rate.

| (a) | Percentage rounds to less than 0.1%. |

| (b) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of August 31, 2022. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

| (c) | Step Coupon. Rate shown is the coupon in effect as of August 31, 2022. |

| (d) | Illiquid security. Total value of illiquid securities held as of August 31, 2022 was $2, representing 0.0% (a) of net assets. |

| (e) | The rate shown is the 7-day effective yield as of August 31, 2022. |

See accompanying notes to financial statements.

| OAKHURST SHORT DURATION HIGH YIELD CREDIT FUND |

| Schedule of Investments |

| August 31, 2022 |

ASSET-BACKED

SECURITIES — 7.0% | | Coupon | | Maturity | | Par Value | | Value |

| Coinstar Funding, LLC, 144A, Series 2017-1-A-2 | | 5.216% | | 04/25/47 | | $ | 544,813 | | | $ | 526,780 | |

| Fat Brands GFG Royalty, LLC, 144A, Series 2021-1-A-2 | | 6.000% | | 07/25/51 | | | 1,000,000 | | | | 950,683 | |

| Fat Brands Twin Peaks, LLC, 144A, Series 2021-1-B-2 | | 9.000% | | 07/25/51 | | | 1,000,000 | | | | 955,797 | |

| Focus Brands Funding, LLC, 144A, Series 2018-1-A-2 | | 5.184% | | 10/30/48 | | | 481,250 | | | | 454,738 | |

| HOA Funding, LLC, 144A, Series 2021-1-B | | 7.432% | | 08/20/51 | | | 1,250,000 | | | | 1,028,908 | |

| NPR Finance Ltd., 144A, Series 2019-2-C-1 | | 6.441% | | 11/19/49 | | | 774,107 | | | | 699,798 | |

| | | | | | | | | | | | | |

| Total Asset-Backed Securities (Cost $4,960,692) | | | | | | | | | | $ | 4,616,704 | |

| CORPORATE BONDS — 87.9% | | Coupon | | Maturity | | Par Value | | Value |

| Communications — 12.4% | | | | | | | | | | | | |

| Centerfield Media Parent, Inc., 144A | | 6.625% | | 08/01/26 | | $ | 1,000,000 | | | $ | 811,547 | |

| Connect Finco SARL/ U.S. Finco, LLC, 144A | | 6.750% | | 10/01/26 | | | 1,000,000 | | | | 915,737 | |

| GrubHub Holdings, Inc., 144A | | 5.500% | | 07/01/27 | | | 1,200,000 | | | | 936,000 | |

| Hughes Satellite Systems Corporation | | 6.625% | | 08/01/26 | | | 1,015,000 | | | | 960,444 | |

| iHeartCommunications, Inc. | | 8.375% | | 05/01/27 | | | 1,000,000 | | | | 877,560 | |

| Scripps Escrow, Inc., 144A | | 5.875% | | 07/15/27 | | | 750,000 | | | | 684,375 | |

| Summer (BC) BidCo B, LLC, 144A | | 5.500% | | 10/31/26 | | | 950,000 | | | | 825,892 | |

| Terrier Media Buyer, Inc, 144A | | 8.875% | | 12/15/27 | | | 1,000,000 | | | | 860,035 | |

| Uber Technologies, Inc., 144A | | 6.250% | | 01/15/28 | | | 750,000 | | | | 716,250 | |

| Zayo Group Holdings, Inc., 144A | | 4.000% | | 03/01/27 | | | 750,000 | | | | 639,375 | |

| | | | | | | | | | | | 8,227,215 | |

| Consumer Discretionary — 10.2% | | | | | | | | | | | | |

| Arrow BidCo, LLC, 144A | | 9.500% | | 03/15/24 | | | 750,000 | | | | 748,148 | |

| Carnival Corporation 144A | | 7.625% | | 03/01/26 | | | 500,000 | | | | 425,000 | |

| Carvana Company, 144A | | 5.625% | | 10/01/25 | | | 1,000,000 | | | | 749,219 | |

| Jaguar Land Rover Automotive plc, 144A | | 4.500% | | 10/01/27 | | | 250,000 | | | | 183,623 | |

| Lucid Group, Inc. | | 1.250% | | 12/15/26 | | | 1,430,000 | | | | 904,501 | |

| Merlin Entertainments plc, 144A | | 5.750% | | 06/15/26 | | | 968,000 | | | | 917,501 | |

| OAKHURST SHORT DURATION HIGH YIELD CREDIT FUND |

| Schedule of Investments (Continued) |

CORPORATE BONDS — 87.9%

(Continued) | | Coupon | | Maturity | | Par Value | | Value |

| Consumer Discretionary — 10.2% (Continued) | | | | | | | | | | | | |

| NCL Corporation Ltd., 144A | | 3.625% | | 12/15/24 | | $ | 1,200,000 | | | $ | 1,039,885 | |

| Washington Multifamily Acquisition I, 144A | | 5.750% | | 04/15/26 | | | 1,000,000 | | | | 963,970 | |

| White Cap Parent, LLC, 144A (a) | | 8.250% | | 03/15/26 | | | 1,000,000 | | | | 869,904 | |

| | | | | | | | | | | | 6,801,751 | |

| Consumer Staples — 6.2% | | | | | | | | | | | | |

| Beyond Meat, Inc., CV | | 0.000% | | 03/15/27 | | | 1,535,000 | | | | 532,645 | |

| Chobani, LLC, 144A | | 7.500% | | 04/15/25 | | | 752,000 | | | | 714,167 | |

| Coty, Inc., 144A | | 6.500% | | 04/15/26 | | | 1,000,000 | | | | 953,750 | |

| Energizer Holdings, Inc., 144A | | 6.500% | | 12/31/27 | | | 1,000,000 | | | | 930,278 | |

| Tilray, Inc. | | 5.000% | | 10/01/23 | | | 1,000,000 | | | | 971,353 | |

| | | | | | | | | | | | 4,102,193 | |

| Energy — 7.6% | | | | | | | | | | | | |

| Antero Midstream Partners, L.P., 144A | | 5.750% | | 03/01/27 | | | 500,000 | | | | 473,750 | |

| Ascent Resources Utica Holdings, LLC, 144A | | 7.000% | | 11/01/26 | | | 950,000 | | | | 923,875 | |

| Crestwood Midstream Partners, L.P., 144A | | 5.625% | | 05/01/27 | | | 1,000,000 | | | | 932,500 | |

| Howard Midstream Energy Partners, 144A | | 6.750% | | 01/15/27 | | | 1,000,000 | | | | 904,764 | |

| New Fortress Energy, Inc., 144A | | 6.500% | | 09/30/26 | | | 1,200,000 | | | | 1,130,478 | |

| Sunnova Energy Corporation, 144A | | 5.875% | | 09/01/26 | | | 750,000 | | | | 692,355 | |

| | | | | | | | | | | | 5,057,722 | |

| Financials — 13.2% | | | | | | | | | | | | |

| Acrisure, LLC, 144A | | 7.000% | | 11/15/25 | | | 944,000 | | | | 889,541 | |

| AG TTMT Escrow Issuer, LLC, 144A | | 8.625% | | 09/30/27 | | | 750,000 | | | | 750,300 | |

| Castlelake Aviation Finance Company, 144A | | 5.000% | | 04/15/27 | | | 750,000 | | | | 646,751 | |

| Enova International, Inc., 144A | | 8.500% | | 09/15/25 | | | 525,000 | | | | 489,751 | |

| Finance of America Funding, LLC, 144A | | 7.875% | | 11/15/25 | | | 500,000 | | | | 322,500 | |

| Fly Leasing Ltd., 144A | | 7.000% | | 10/15/24 | | | 1,000,000 | | | | 550,000 | |

| Icahn Enterprises, L.P. | | 6.250% | | 05/15/26 | | | 800,000 | | | | 766,908 | |

| INTL FCStone, Inc., 144A | | 8.625% | | 06/15/25 | | | 600,000 | | | | 610,500 | |

| Jefferson Capital Holdings, LLC, 144A | | 6.000% | | 08/15/26 | | | 750,000 | | | | 660,000 | |

| MBIA, Inc. | | 7.000% | | 12/15/25 | | | 500,000 | | | | 493,125 | |

| Navient Corporation | | 6.750% | | 06/15/26 | | | 500,000 | | | | 474,170 | |

| OAKHURST SHORT DURATION HIGH YIELD CREDIT FUND |

| Schedule of Investments (Continued) |

CORPORATE BONDS — 87.9%

(Continued) | | Coupon | | Maturity | | Par Value | | Value |