UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22691 | |

F/m Funds Trust

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Betsy Stanton

c/o Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | June 30 | |

| | | |

| Date of reporting period: | June 30, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a)

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | |  | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | F/m Investments | | | |

| | | | Large Cap Focused Fund | | | |

| | | | | | | |

| | | | Investor Class Shares (Ticker Symbol: IAFMX) | | | |

| | | | Institutional Class Shares (Ticker Symbol: IAFLX) | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | ANNUAL REPORT | | | |

| | | | June 30, 2023 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

F/m Investments Large Cap Focused Fund

Letter to Shareholders (Unaudited) |

| June 30, 2023 |

| |

Dear Shareholders,

Market Update and One Year Fund Performance Review (as 6/30/23)

We hope this letter finds you in good health and high spirits. As your dedicated investment team, we would like to take this opportunity to provide you with an update on the market conditions and the performance of our Large Cap Focused Fund (the “Fund”).

The Fund has exhibited strong performance, outpaced its benchmark, and achieved excellent results. As of June 30, 2023 the Fund’s total return over one year, for Institutional Class (IAFLX) is 29.31% and 28.91% for our Investor Class (IAFMX), while the Russell 1000 Growth returned 27.11%. This outperformance can be attributed to our disciplined investment approach, rigorous research process, and our commitment to identifying attractive active investment opportunities.

Over the last year, global financial markets have exhibited a mixed and dynamic landscape. Monetary tightening continued to shape investment sentiments while past challenges stemming from supply chain disruptions and inflationary pressures subsided as we expected. The Fund was well-positioned to take advantage of the associated market rally. We started 2023 with active positioning in information technology, consumer discretionary, health care and communication services that, as a whole, paid off handsomely for the conviction we demonstrated in the second half of 2022. Please refer to Brinson Attribution tables below for a more detailed view.

Large Cap Focused Mutual Fund vs. iShares Russell 1000 Growth ETF

| | Large Cap Focused Mutual Fund |

| | Port. Average | Port. Total | Port. Contrib. |

| | Weight | Return | To Return |

| Total | 100.00 | 16.10 | 16.10 |

| | | | |

| Information Technology | 58.64 | 21.61 | 14.90 |

| Consumer Discretionary | 12.56 | -1.08 | 0.59 |

| Communication Services | 4.03 | -9.78 | 0.52 |

| Industrials | 3.94 | 4.21 | 0.37 |

| Health Care | 8.41 | 2.53 | 0.28 |

| [Cash] | 4.08 | 3.69 | 0.02 |

| Consumer Staples | — | — | — |

| Real Estate | — | — | — |

| Utilities | — | — | — |

| Materials | 1.02 | -6.52 | -0.14 |

| Financials | 7.07 | 19.36 | -0.19 |

| Energy | 0.24 | -19.25 | -0.44 |

| | | | |

| | iShares Russell 1000 Growth ETF |

| | Bench. | | Bench. |

| | Average | Bench. Total | Contrib. To |

| | Weight | Return | Return |

| Total | 100.00 | 13.76 | 13.76 |

| | | | |

| Information Technology | 39.86 | 26.15 | 10.88 |

| Consumer Discretionary | 14.82 | 2.61 | -0.55 |

| Communication Services | 7.28 | 9.07 | 0.71 |

| Industrials | 8.37 | 13.27 | 1.16 |

| Health Care | 12.04 | 6.29 | 1.00 |

| [Cash] | -0.03 | 3.95 | -0.00 |

| Consumer Staples | 6.15 | -0.36 | 0.02 |

| Real Estate | 1.56 | -13.84 | -0.30 |

| Utilities | 0.05 | -0.12 | 0.00 |

| Materials | 1.34 | 6.74 | 0.09 |

| Financials | 6.91 | 8.21 | 0.68 |

| Energy | 1.50 | -1.91 | -0.04 |

| | Attribution Analysis |

| | Allocation | Selection | Interaction | |

| | Effect | Effect | Effect | Total Effect |

| Total | 8.10 | -6.06 | 0.30 | 2.34 |

| | | | | |

| Information Technology | 3.01 | -1.67 | -0.72 | 0.62 |

| Consumer Discretionary | 0.59 | -0.67 | -0.05 | -0.13 |

| Communication Services | -0.24 | -0.81 | 0.99 | -0.05 |

| Industrials | 1.39 | -0.47 | 0.29 | 1.20 |

| Health Care | -0.01 | -0.42 | 0.44 | 0.01 |

| [Cash] | -0.22 | — | — | -0.22 |

| Consumer Staples | 0.87 | — | — | 0.87 |

| Real Estate | 0.46 | — | — | 0.46 |

| Utilities | 0.01 | — | — | 0.01 |

| Materials | 0.16 | -0.06 | -0.04 | 0.06 |

| Financials | 1.59 | -1.86 | 0.74 | 0.47 |

| Energy | -0.19 | -0.02 | -0.01 | -0.22 |

| | | | | |

We remain bullish for the rest of 2023. As you know from prior communications, we were not expecting a recession in 2022 and, given the strong economic data, we do not expect one in 2023. The portfolio is positioned as expected with concentration on our alpha scores and holdings that are projected to do well regardless of what the FED does.

As we move forward, we anticipate the investment landscape to remain dynamic, requiring vigilance and agility in managing the fund’s assets. We will continue to adhere to our disciplined investment approach, emphasizing our QuantACTIVE investment process to mitigate risks and capture potential opportunities.

Our commitment to transparency and effective communication remains unwavering. Should you have any questions or require additional information, please do not hesitate to reach out.

We extend our heartfelt gratitude for your continued trust and confidence in the Fund.

Respectfully,

Francisco J. Bido

SVP and Senior Portfolio Manager

F/m Investments Large Cap Focused

F/M Investments, LLC

| F/m Investments Large Cap Focused Fund |

| Performance Information |

| June 30, 2023 (Unaudited) |

| |

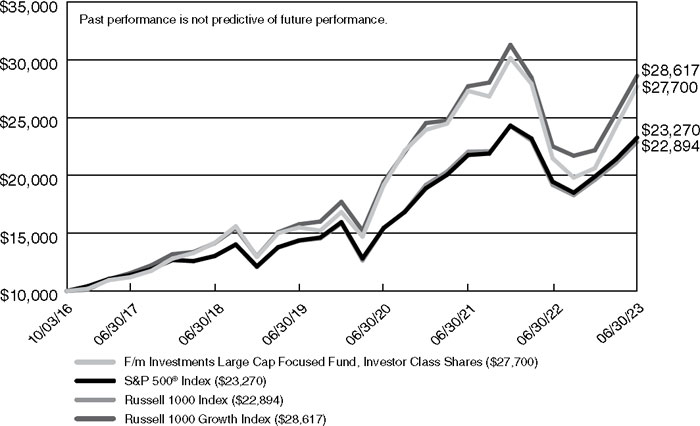

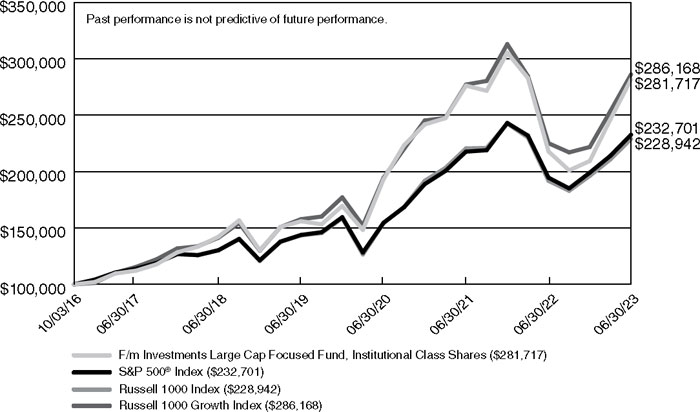

Comparison of the Change in Value of a $10,000 Investment

in F/m Investments Large Cap Focused Fund - Investor Shares versus the

S&P 500® Index, Russell 1000 Index and the Russell 1000 Growth Index

Average Annual Total Returns

(for periods ended June 30, 2023)

| | | | | | | Since |

| | | 1 Year | | 5 Years | | Inception (b) |

| F/m Investments Large Cap Focused Fund - Investor Shares (a) | | 28.91% | | 14.35% | | 16.32% |

| S&P 500® Index | | 19.59% | | 12.31% | | 13.35% |

| Russell 1000 Index | | 19.36% | | 11.92% | | 13.08% |

| Russell 1000 Growth Index | | 27.11% | | 15.14% | | 16.88% |

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Represents the period from the commencement of operations (October 3, 2016) through June 30, 2023. |

F/m Investments Large Cap Focused Fund

Performance Information (Continued) |

| June 30, 2023 (Unaudited) |

| |

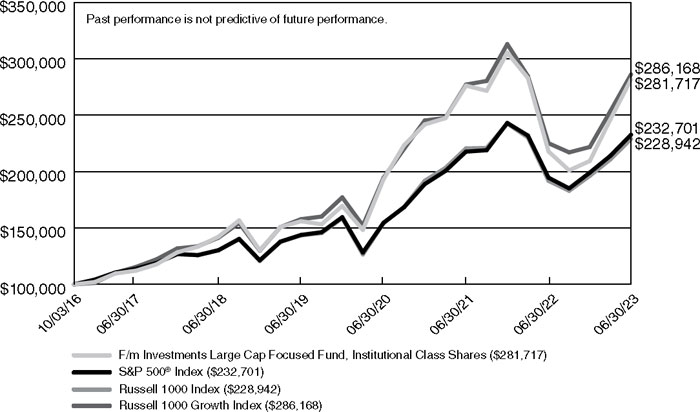

Comparison of the Change in Value of a $100,000 Investment

in F/m Investments Large Cap Focused Fund - Institutional Shares versus the

S&P 500® Index, Russell 1000 Index and the Russell 1000 Growth Index

Average Annual Total Returns

(for periods ended June 30, 2023)

| | | | | | | Since |

| | | 1 Year | | 5 Years | | Inception (b) |

| F/m Investments Large Cap Focused Fund - Institutional Shares (a) | | 29.31% | | 14.65% | | 16.61% |

| S&P 500® Index | | 19.59% | | 12.31% | | 13.35% |

| Russell 1000 Index | | 19.36% | | 11.92% | | 13.08% |

| Russell 1000 Growth Index | | 27.11% | | 15.14% | | 16.88% |

| (a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Represents the period from the commencement of operations (October 3, 2016) through June 30, 2023. |

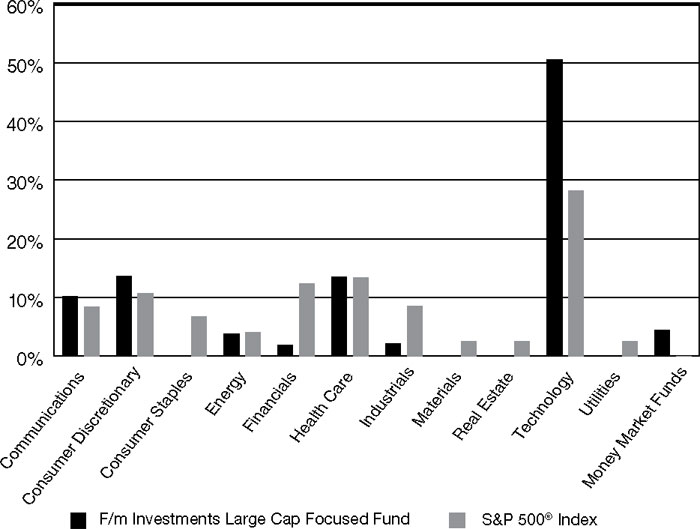

| F/m Investments Large Cap Focused Fund |

| Portfolio Information |

| June 30, 2023 (Unaudited) |

| |

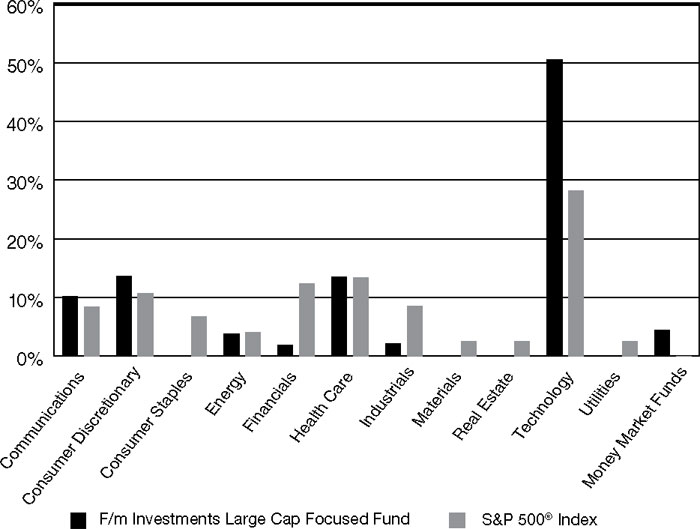

Sector Allocation (% of Net Assets)

| Top 10 Long-Term Holdings |

| | | % of |

| Security Description | | Net Assets |

| Apple, Inc. | | 14.0% |

| Microsoft Corporation | | 10.7% |

| Amazon.com, Inc. | | 8.0% |

| Alphabet, Inc. - Class A | | 4.5% |

| Adobe, Inc. | | 4.0% |

| NVIDIA Corporation | | 3.9% |

| Netflix, Inc. | | 3.2% |

| Palo Alto Networks, Inc. | | 3.2% |

| Advanced Micro Devices, Inc. | | 3.2% |

| Penumbra, Inc. | | 2.9% |

| F/m Investments Large Cap Focused Fund |

| Schedule of Investments |

| June 30, 2023 |

| COMMON STOCKS — 95.7% | | Shares | | | Value | |

| Communications - 10.2% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 22,995 | | | $ | 2,752,501 | |

| Meta Platforms, Inc. - Class A (a) | | | 5,464 | | | | 1,568,059 | |

| Netflix, Inc. (a) | | | 4,477 | | | | 1,972,074 | |

| | | | | | | | 6,292,634 | |

| Consumer Discretionary — 13.7% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 37,521 | | | | 4,891,238 | |

| McDonald’s Corporation | | | 4,323 | | | | 1,290,026 | |

| Royal Caribbean Cruises Ltd. (a) | | | 12,798 | | | | 1,327,664 | |

| Starbucks Corporation | | | 9,276 | | | | 918,881 | |

| | | | | | | | 8,427,809 | |

| Energy — 3.8% | | | | | | | | |

| First Solar, Inc. (a) | | | 4,013 | | | | 762,831 | |

| SolarEdge Technologies, Inc. (a) | | | 5,776 | | | | 1,554,033 | |

| | | | | | | | 2,316,864 | |

| Financials — 1.9% | | | | | | | | |

| American Express Company | | | 6,654 | | | | 1,159,127 | |

| | | | | | | | | |

| Health Care — 13.5% | | | | | | | | |

| Align Technology, Inc. (a) | | | 3,703 | | | | 1,309,529 | |

| Cardinal Health, Inc. | | | 13,223 | | | | 1,250,499 | |

| HCA Healthcare, Inc. | | | 4,611 | | | | 1,399,346 | |

| Intuitive Surgical, Inc. (a) | | | 4,239 | | | | 1,449,484 | |

| Penumbra, Inc. (a) | | | 5,139 | | | | 1,768,124 | |

| Stryker Corporation | | | 3,587 | | | | 1,094,358 | |

| | | | | | | | 8,271,340 | |

| Industrials — 2.1% | | | | | | | | |

| TransDigm Group, Inc. | | | 1,443 | | | | 1,290,287 | |

| | | | | | | | | |

| Technology — 50.5% | | | | | | | | |

| Adobe, Inc. (a) | | | 4,965 | | | | 2,427,835 | |

| Advanced Micro Devices, Inc. (a) | | | 17,100 | | | | 1,947,861 | |

| Apple, Inc. | | | 44,222 | | | | 8,577,741 | |

| Datadog, Inc. - Class A (a) | | | 16,476 | | | | 1,620,909 | |

| Microsoft Corporation | | | 19,207 | | | | 6,540,752 | |

| MongoDB, Inc. (a) | | | 3,959 | | | | 1,627,110 | |

| NVIDIA Corporation | | | 5,653 | | | | 2,391,332 | |

| Palo Alto Networks, Inc. (a) | | | 7,671 | | | | 1,960,017 | |

| Salesforce, Inc. (a) | | | 5,970 | | | | 1,261,222 | |

| F/m Investments Large Cap Focused Fund |

| Schedule of Investments (Continued) |

| COMMON STOCKS — 95.7% (Continued) | | Shares | | | Value | |

| Technology — 50.5% (Continued) | | | | | | | | |

| Synopsys, Inc. (a) | | | 2,621 | | | $ | 1,141,210 | |

| Zscaler, Inc. (a) | | | 10,097 | | | | 1,477,191 | |

| | | | | | | | 30,973,180 | |

| | | | | | | | | |

| Total Common Stocks (Cost $49,967,694) | | | | | | $ | 58,731,241 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 4.5% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class X, 5.03% (b) (Cost $2,741,721) | | | 2,741,721 | | | $ | 2,741,721 | |

| | | | | | | | | |

| Total Investments at Value — 100.2% (Cost $52,709,415) | | | | | | $ | 61,472,962 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.2%) | | | | | | | (108,824 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 61,364,138 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of June 30, 2023. |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Statement of Assets and Liabilities |

| June 30, 2023 |

| ASSETS | | | |

| Investments in securities: | | | | |

| At cost | | $ | 52,709,415 | |

| At value (Note 2) | | $ | 61,472,962 | |

| Dividends receivable | | | 19,915 | |

| Other assets | | | 12,040 | |

| TOTAL ASSETS | | | 61,504,917 | |

| | | | | |

| LIABILITIES | | | | |

| Payable to Adviser (Note 4) | | | 96,406 | |

| Payable to administrator (Note 4) | | | 9,390 | |

| Accrued trustee fees (Note 4) | | | 5,800 | |

| Accrued distribution (12b-1) fees (Note 4) | | | 3,745 | |

| Other accrued expenses | | | 25,438 | |

| TOTAL LIABILITIES | | | 140,779 | |

| | | | | |

| NET ASSETS | | $ | 61,364,138 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 58,539,994 | |

| Distributed earnings | | | 2,824,144 | |

| NET ASSETS | | $ | 61,364,138 | |

| | | | | |

| Investor Class Shares: | | | | |

| Net assets | | $ | 12,887,140 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 932,230 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 13.82 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets | | $ | 48,476,998 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 3,448,754 | |

| Net asset value, offering and redemption price per share (Note 2) | | $ | 14.06 | |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Statement of Operations |

| For the Year Ended June 30, 2023 |

| INVESTMENT INCOME | | | |

| Dividends (net of foreign tax withheld of $2,083) | | $ | 621,443 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 411,082 | |

| Administration fees (Note 4) | | | 46,938 | |

| Fund accounting fees (Note 4) | | | 41,873 | |

| Trustees’ fees and expenses (Note 4) | | | 36,377 | |

| Distribution (12b-1) fees - Investor Class (Note 4) | | | 25,292 | |

| Transfer agent fees (Note 4) | | | 24,000 | |

| Audit and tax services fees | | | 22,086 | |

| Legal fees | | | 16,310 | |

| Registration and filing fees | | | 13,923 | |

| Compliance service fees (Note 4) | | | 12,581 | |

| Insurance expense | | | 10,661 | |

| Shareholder reporting expenses | | | 10,460 | |

| Custodian and bank service fees | | | 6,751 | |

| Borrowing fees (Note 6) | | | 782 | |

| Other expenses | | | 18,775 | |

| TOTAL EXPENSES | | | 697,891 | |

| Less fee reductions by Adviser (Note 4) | | | (93,827 | ) |

| Less fee waivers by the administrator (Note 4) | | | (50,000 | ) |

| NET EXPENSES | | | 554,064 | |

| | | | | |

| NET INVESTMENT INCOME | | | 67,379 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| Net realized losses from investment transactions | | | (1,383,722 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 15,737,874 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 14,354,152 | |

| | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 14,421,531 | |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Statements of Changes in Net Assets |

| | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | |

| | | 2023 | | | 2022 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income (loss) | | $ | 67,379 | | | $ | (214,284 | ) |

| Net realized gains (losses) from investment transactions | | | (1,383,722 | ) | | | 7,786,791 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 15,737,874 | | | | (24,552,304 | ) |

| Net increase (decrease) in net assets from operations | | | 14,421,531 | | | | (16,979,797 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Investor Class | | | (1,103,801 | ) | | | (2,785,751 | ) |

| Institutional Class | | | (6,385,005 | ) | | | (14,836,978 | ) |

| Total distributions | | | (7,488,806 | ) | | | (17,622,729 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 2,882,866 | | | | 1,498,612 | |

| Reinvestments of distributions to shareholders | | | 1,103,801 | | | | 2,785,751 | |

| Payments for shares redeemed | | | (2,559,333 | ) | | | (2,471,370 | ) |

| Total Investor Class | | | 1,427,334 | | | | 1,812,993 | |

| | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 279,786 | | | | 2,772,798 | |

| Reinvestments of distributions to shareholders | | | 6,385,005 | | | | 14,812,160 | |

| Payments for shares redeemed | | | (19,639,968 | ) | | | (8,216,571 | ) |

| Total Institutional Class | | | (12,975,177 | ) | | | 9,368,387 | |

| Net increase (decrease) in net assets from capital share transactions | | | (11,547,843 | ) | | | 11,181,380 | |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (4,615,118 | ) | | | (23,421,146 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 65,979,256 | | | | 89,400,402 | |

| End of year | | $ | 61,364,138 | | | $ | 65,979,256 | |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Statements of Changes in Net Assets (Continued) |

| | | Year Ended | | | Year Ended | |

| | | June 30, | | | June 30, | |

| | | 2023 | | | 2022 | |

| CAPITAL SHARE ACTIVITY | | | | | | |

| Investor Class | | | | | | | | |

| Shares sold | | | 247,255 | | | | 93,445 | |

| Shares issued in reinvestment of distributions to shareholders | | | 107,269 | | | | 163,868 | |

| Shares redeemed | | | (212,368 | ) | | | (150,932 | ) |

| Net increase in shares outstanding | | | 142,156 | | | | 106,381 | |

| Shares outstanding, beginning of year | | | 790,074 | | | | 683,693 | |

| Shares outstanding, end of year | | | 932,230 | | | | 790,074 | |

| | | | | | | | | |

| Institutional Class | | | | | | | | |

| Shares sold | | | 21,103 | | | | 202,047 | |

| Shares issued in reinvestment of distributions to shareholders | | | 611,005 | | | | 862,175 | |

| Shares redeemed | | | (1,588,452 | ) | | | (428,325 | ) |

| Net increase (decrease) in shares outstanding | | | (956,344 | ) | | | 635,897 | |

| Shares outstanding, beginning of year | | | 4,405,098 | | | | 3,769,201 | |

| Shares outstanding, end of year | | | 3,448,754 | | | | 4,405,098 | |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Investor Class |

| Financial Highlights |

| |

| Per share data for a share outstanding throughout each year: |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value at beginning of year | | $ | 12.57 | | | $ | 19.96 | | | $ | 15.90 | | | $ | 13.42 | | | $ | 12.98 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | (0.01 | ) | | | (0.08 | ) | | | (0.12 | ) | | | (0.03 | ) | | | 0.05 | |

| Net realized and unrealized gains (losses) on investments | | | 3.04 | | | | (3.07 | ) | | | 6.59 | | | | 3.10 | | | | 1.05 | |

| Total from investment operations | | | 3.03 | | | | (3.15 | ) | | | 6.47 | | | | 3.07 | | | | 1.10 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | (0.05 | ) | | | — | |

| Net realized gains on investments | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.54 | ) | | | (0.66 | ) |

| Total distributions | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.59 | ) | | | (0.66 | ) |

| Net asset value at end of year | | $ | 13.82 | | | $ | 12.57 | | | $ | 19.96 | | | $ | 15.90 | | | $ | 13.42 | |

| Total return (b) | | | 28.91 | % | | | (21.33 | )% | | | 42.64 | % | | | 23.56 | % | | | 9.42 | % |

| Net assets at end of year (000’s) | | $ | 12,887 | | | $ | 9,934 | | | $ | 13,643 | | | $ | 11,157 | | | $ | 9,788 | |

| Ratio of total expenses to average net assets (c) | | | 1.39 | % | | | 1.39 | % | | | 1.41 | % | | | 1.50 | % | | | 1.49 | % |

| Ratio of net expenses to average net assets | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

| Ratio of net investment income (loss) to average net assets | | | (0.11 | )% | | | (0.46 | )% | | | (0.63 | )% | | | (0.24 | )% | | | 0.36 | % |

| Portfolio turnover rate | | | 113 | % | | | 169 | % | | | 195 | % | | | 139 | % | | | 230 | % |

| (a) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Had the Adviser and/or administrator not reduced/waived its fees, the total returns would have been lower. |

| (c) | Ratios were determined based on expenses prior to any fee reductions/waivers by the Adviser and/ or administrator (Note 4). |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Institutional Class |

| Financial Highlights |

| |

| Per share data for a share outstanding throughout each year: |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value at beginning of year | | $ | 12.72 | | | $ | 20.10 | | | $ | 15.96 | | | $ | 13.47 | | | $ | 13.02 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | 0.02 | | | | (0.02 | ) | | | (0.05 | ) | | | — | (b) | | | 0.07 | |

| Net realized and unrealized gains (losses) on investments | | | 3.10 | | | | (3.12 | ) | | | 6.60 | | | | 3.11 | | | | 1.06 | |

| Total from investment operations | | | 3.12 | | | | (3.14 | ) | | | 6.55 | | | | 3.11 | | | | 1.13 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | (0.08 | ) | | | (0.02 | ) |

| Net realized gains on investments | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.54 | ) | | | (0.66 | ) |

| Total distributions | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.62 | ) | | | (0.68 | ) |

| Net asset value at end of year | | $ | 14.06 | | | $ | 12.72 | | | $ | 20.10 | | | $ | 15.96 | | | $ | 13.47 | |

| Total return (c) | | | 29.31 | % | | | (21.12 | )% | | | 43.00 | % | | | 23.84 | % | | | 9.64 | % |

| Net assets at end of year (000’s) | | $ | 48,477 | | | $ | 56,045 | | | $ | 75,757 | | | $ | 41,963 | | | $ | 35,795 | |

| Ratio of total expenses to average net assets (d) | | | 1.14 | % | | | 1.14 | % | | | 1.16 | % | | | 1.25 | % | | | 1.24 | % |

| Ratio of net expenses to average net assets | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.16 | % | | | (0.21 | )% | | | (0.38 | )% | | | 0.01 | % | | | 0.61 | % |

| Portfolio turnover rate | | | 113 | % | | | 169 | % | | | 195 | % | | | 139 | % | | | 230 | % |

| (a) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Had the Adviser and/or administrator not reduced/waived its fees, the total returns would have been lower. |

| (d) | Ratios were determined based on expenses prior to any fee reductions/waivers by the Adviser and/ or administrator (Note 4). |

See accompanying notes to financial statements.

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements |

| June 30, 2023 |

The F/m Investments Large Cap Focused Fund (the “Fund”) is a non-diversified series of the F/m Funds Trust (the “Trust”), an open-end management investment company established as an Ohio business trust under a Declaration of Trust dated April 2, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is long-term growth of capital.

The Fund currently offers two classes of shares: Investor Class shares (sold without any sales loads, but subject to a distribution and/or shareholder servicing fee of up to 0.25% of the average daily net assets attributable to Investor Class shares and requiring a $1,000 initial investment) and Institutional Class shares (sold without any sales loads and distribution and/or shareholder servicing fees and requiring a $100,000 initial investment). Each share class represents an ownership interest in the same investment portfolio.

| 2. | Significant Accounting Policies |

The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities, including common stocks, on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted bid price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value as determined by F/m Investments, LLC (the “Adviser”) as the valuation designee, in accordance with procedures established by and under the general supervision of the Board of Trustees of the Trust (the “Board”) pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended, (the “1940 Act”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors:

a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade size; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

Investments in registered investment companies, including money market funds, are reported at their respective NAV as reported by those companies.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – unadjusted quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments based on inputs used to value the investments as of June 30, 2023:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 58,731,241 | | | $ | — | | | $ | — | | | $ | 58,731,241 | |

| Money Market Funds | | | 2,741,721 | | | | — | | | | — | | | | 2,741,721 | |

| Total | | $ | 61,472,962 | | | $ | — | | | $ | — | | | $ | 61,472,962 | |

| | | | | | | | | | | | | | | | | |

The Fund did not hold any derivative instruments or assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended June 30, 2023.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

Common expenses – Common expenses of the Trust are allocated among the Fund and other series of the Trust based on relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Allocation between Classes – Investment income earned, realized capital gains and losses, and unrealized appreciation and depreciation are allocated daily to each Class of the Fund based upon its proportionate share of total net assets of the Fund. Class-specific expenses are charged directly to the Class incurring the expense. Common expenses which are not attributable to a specific Class are allocated daily to the Class of shares of the Fund based upon its proportionate share of total net assets of the Fund.

Investment income – Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income, if any, is accrued as earned. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Distributions to shareholders – Distributions to shareholders arising from net investment income and realized capital gains, if any, are declared and paid annually to shareholders. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid to shareholders during the years ended June 30, 2023 and 2022 was as follows:

| | | | | | Long Term | | | Total | |

| Years Ended | | Ordinary Income | | | Capital Gain | | | Distributions | |

| June 30, 2023 | | $ | — | | | $ | 7,488,806 | | | $ | 7,488,806 | |

| June 30, 2022 | | | 6,873,320 | | | | 10,749,409 | | | | 17,622,729 | |

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal income tax provision is provided in the Fund’s financial statements.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of June 30, 2023:

| | | | |

| Tax cost of portfolio investments | | $ | 52,812,221 | |

| Gross unrealized appreciation | | $ | 10,264,839 | |

| Gross unrealized depreciation | | | (1,604,098 | ) |

| Net unrealized appreciation | | | 8,660,741 | |

| Accumulated capital and other losses | | | (5,836,597 | ) |

| Distributed earnings | | $ | 2,824,144 | |

| | | | | |

The difference between the federal income tax cost of investments and the financial statement cost of investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/ tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales.

As of June 30, 2023, the Fund had short-term capital loss carryforwards (“CLCFs”) in the amount of $5,836,597 for income tax purposes. These CLCFs, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

For the year ended June 30, 2023, the Fund reclassified $7,055 of distributable earnings against paid-in capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, had no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on Federal income tax returns for all open tax years (generally, three years) and has

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next year. The Fund identifies its major tax jurisdiction as U.S. Federal.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations. During the year ended June 30, 2023, the Fund did not incur any interest or penalties.

| 3. | Investment Transactions |

During the year ended June 30, 2023, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $63,766,146 and $81,730,091, respectively.

| 4. | Transactions with Related Parties |

On January 31, 2023, Diffractive Managers Group (“Diffractive”), a multi-boutique asset management company, acquired the assets of F/m Acceleration, LLC, the parent company of F/m Investments, LLC (“F/m” or the “Adviser”), the Fund’s investment adviser (the “F/m Transaction”).

In connection with the F/m Transaction, the investment advisory agreement (the “Previous Advisory Agreement”) between F/m and the Trust, on behalf of the Fund was terminated, effective January 31, 2023, and the Board approved (i) an interim investment advisory agreement (the “Interim Advisory Agreement”) between F/m and the Trust on behalf of the Fund, effective January 31, 2023; and (ii) a new investment advisory agreement (the “New Advisory Agreement”) between F/m and the Trust on behalf of the Fund. The Interim Advisory Agreement has the same material terms and fee arrangements as the Previous Advisory Agreement. The New Advisory Agreement was approved by the shareholders of the Fund at a Special Meeting of Shareholders held on June 29, 2023.

PREVIOUS INVESTMENT ADVISORY AGREEMENT

Prior to January 31, 2023, under the terms of the Previous Investment Advisory Agreement, the Fund paid the Adviser a fee, which was computed and accrued daily and paid monthly, at the annual rate of 0.70% of its average daily net assets.

The Adviser contractually agreed until January 18, 2024 to reduce its investment advisory fees and to pay other operating expenses to the extent necessary to limit annual ordinary operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses) to 1.15% of the average daily net assets allocable to Investor Class shares and 0.90% of Institutional Class

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

shares of the Fund. During the period from July 1, 2022 through January 31, 2023, the Adviser waived advisory fees of $28,612. This amount is not recoverable by the Adviser. All prior year fees waived by the Adviser are not recoverable.

INTERIM INVESTMENT ADVISORY AGREEMENT AND NEW INVESTMENT ADVISORY AGREEMENT

Effective January 31, 2023 through June 29, 2023, under the terms of the Interim Advisory Agreement, the Fund paid the Adviser a fee, which was computed and accrued daily and paid monthly, at the annual rate of 0.70% of its average daily net assets.

Effective June 29, 2023, under the terms of the New Advisory Agreement, the Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at the annual rate of 0.70% of its average daily net assets.

The Adviser has contractually agreed until January 18, 2024 to reduce its investment advisory fees and to pay other operating expenses to the extent necessary to limit annual ordinary operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses) to 1.15% of the average daily net assets allocable to Investor Class shares and 0.90% of Institutional Class shares of the Fund. During the period from February 1, 2023 through June 30, 2023, the Adviser reduced advisory fees by $65,215.

Advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause the Fund’s ordinary operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses) to exceed the agreed upon expense limitations. As of June 30, 2023, the Adviser may in the future recover advisory fee reductions and expense reimbursements totaling $65,215. The Adviser may recover this amount no later than June 30, 2026.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities. During the year ended June 30, 2023, Ultimus voluntarily waived fees in the amount of $50,000. These voluntary waivers are not subject to recoupment by Ultimus.

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

Pursuant to the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (“UFD”) serves as principal underwriter and exclusive agent for the distribution of shares of the Fund. UFD is a wholly-owned subsidiary of Ultimus. UFD is compensated by the Adviser (not the Fund) for its services to the Trust.

Certain officers of the Trust are also employees of Ultimus and are not paid by the Fund for serving in such capacities.

Pursuant to a Compliance Consulting Agreement with Key Bridge Compliance, LLC (“Key Bridge”), Key Bridge provides the Chief Compliance Officer and compliance services to the Trust.

DISTRIBUTION PLAN

The Fund has adopted a plan of distribution (the “Plan”), pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) which permits Investor Class shares of the Fund to make payments to securities dealers and other financial organizations (including payments directly to the Adviser and UFD) for expenses related to the distribution and servicing of the Fund’s Investor Class shares. The annual limitation for payment of expenses pursuant to the Plan is 0.25% of the Fund’s average daily net assets allocable to Investor Class shares. The Fund has not adopted a plan of distribution with respect to Institutional Class shares. During the year ended June 30, 2023, Investor Class shares of the Fund incurred $25,292 of distribution fees under the Plan.

TRUSTEES’ COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives from the Trust an annual fee of $46,000, payable quarterly (except that amount is $47,000 for the Chair of the Committee of Independent Trustees) and reimbursement of travel and other expenses incurred in attending meetings.

Trustees who are affiliated with the Adviser do not receive compensation from the Trust. Each Fund pays its proportionate share of the Independent Trustees’ fees and expenses.

PRINCIPAL HOLDERS OF FUND SHARES

As of June 30, 2023, the following shareholders owned of record 25% or more of the outstanding shares of each Class:

| NAME OF RECORD OWNER | | % Ownership |

| Investor Class shares | | |

| Charles Schwab & Company, Inc. (for the benefit of its customers) | | 87% |

| | | |

| Institutional Class shares | | |

| National Financial Services, LLC (for the benefit of its customers) | | 99% |

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

A beneficial owner of 25% or more of a Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

If the Fund has significant investments in the securities of issuers in industries within a particular business sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, or other developments may negatively impact all companies in a particular sector and therefore the value of the Fund’s portfolio would be adversely affected. As of June 30, 2023, the Fund had 50.5% of its net assets invested in the Technology sector.

From time to time, the Fund may have an overdrawn cash balance at the custodian due to redemptions or market movements. When this occurs, the Fund will incur borrowing costs charged by the custodian. During the year ended June 30, 2023, the Fund incurred $782 of borrowing cost charged by the custodian.

| 7. | Contingencies and Commitments |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

The Fund is a non-diversified fund. A non-diversified fund may or may not have a diversified portfolio of investments at any given time and may have large amounts of assets invested in a very small number of companies, industries or securities. Such lack of diversification substantially increases market risks and the risk of loss associated with an investment in the Fund, because the value of each security will

| F/m Investments Large Cap Focused Fund |

| Notes to Financial Statements (Continued) |

have a greater impact on the Fund’s performance and the value of each shareholder’s investment. When the value of a security in a non-diversified fund falls, it may have a greater impact on the Fund than it would have in a diversified fund.

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events except for the following.

On March 29, 2023, the Board approved an Agreement and Plan of Reorganization for the Fund relating to the reorganization of the Fund (the “Reorganization”) into a newly created series of The RBB Fund, Inc. (the “Acquiring Fund”). The Acquiring Fund will have substantially similar investment objectives, investment policies and restrictions as the Fund and will continue to be managed by the same investment management team that currently manages the Fund. The Reorganization was approved by shareholders of the Fund at a Special Meeting of Shareholders held on June 29, 2023. The Reorganization is expected to occur on or about October 27, 2023. The Reorganization is expected to be a tax-free reorganization for federal income tax purposes. Shareholders of the Fund should consult their own tax advisers regarding possible tax consequences of the Reorganization, including possible state and local tax consequences.

| F/m Investments Large Cap Focused Fund |

| Report of Independent Registered Public |

| Accounting Firm |

To the Shareholders of F/m Investments Large Cap Focused Fund and Board of Trustees of F/m Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of F/m Investments Large Cap Focused Fund (the “Fund”), a series of F/m Funds Trust, as of June 30, 2023, the related statement of operations for the year then ended and the statements of changes in net assets, the related notes, and the financial highlights for each of the two years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2023, the results of its operations for the year then ended and the changes in net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the years ended June 30, 2021, and prior, were audited by other auditors whose report dated August 27, 2021, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2023, by correspondence with the custodian. Our audits also

| F/m Investments Large Cap Focused Fund |

| Report of Independent Registered Public |

| Accounting Firm (Continued) |

included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more funds in F/m Funds Trust since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

August 24, 2023

| F/m Investments Large Cap Focused Fund |

| About Your Fund’s Expenses (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (January 1, 2023) and held until the end of the period (June 30, 2023).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor do they carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| F/m Investments Large Cap Focused Fund |

| About Your Fund’s Expenses (Unaudited) (Continued) |

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | Beginning | | | Ending | | | | | | |

| | | Account Value | | | Account Value | | | Net | | Expenses | |

| | | January 1, | | | June 30, | | | Expense | | Paid During | |

| | | 2023 | | | 2023 | | | Ratio(a) | | Period(b) | |

| Investor Class | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | $ | 1,000.00 | | | $ | 1,343.10 | | | 1.15% | | $ | 6.68 | |

| Based on Hypothetical 5% Return (before expenses) | | $ | 1,000.00 | | | $ | 1,019.09 | | | 1.15% | | $ | 5.76 | |

| | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | $ | 1,000.00 | | | $ | 1,345.50 | | | 0.90% | | $ | 5.23 | |

| Based on Hypothetical 5% Return (before expenses) | | $ | 1,000.00 | | | $ | 1,020.33 | | | 0.90% | | $ | 4.51 | |

| (a) | Annualized, based on each Class’s most recent one-half year expenses. |

| (b) | Expenses are equal to each Class’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| F/m Investments Large Cap Focused Fund |

| Other Information (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-553-4233, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-888-553-4233, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit on Form N-PORT. These filings are available upon request by calling 1-888-553-4233. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov and the Fund’s website www.fm-funds.com.

| Federal Tax Information (Unaudited) |

For the fiscal year ended June 30, 2023, the Fund designated $7,488,806 as long-term capital gain distributions.

| F/m Investments Large Cap Focused Fund |

| Results of Special Meeting of Shareholders (Unaudited) |

On June 29, 2023, a Special Meeting of Shareholders (the “Meeting”) of the F/m Investments Large Cap Focus Fund (the “Fund”), a series of F/m Funds Trust (the “Trust”). At the Meeting, each proposal was approved by shareholders of the Fund and the following votes were recorded:

Proposal 1: To approve an Agreement and Plan of Reorganization by and among the Trust, on behalf of the Fund, The RBB Fund, Inc. on behalf of its newly formed series (the “Acquiring Fund”), and F/m Investments, LLC, pursuant to which the Fund will transfer that portion of its assets attributable to each class of its shares (in aggregate, all of its assets) to the Acquiring Fund, in exchange for shares of a corresponding class of shares of the Acquiring Fund and the assumption by the Acquiring Fund of all liabilities and obligations of the Fund, in each case as described in the Agreement and Plan of Reorganization, followed by the distribution of the Acquiring Fund’s shares of each class to the Fund’s shareholders of the corresponding class in complete liquidation of the Fund.

| Number of Shares |

| For | | Against | | Abstain |

| 3,130,640.860 | | 29,255.000 | | 0 |

Proposal 2: To approve a new investment advisory agreement between the Trust and F/m Investments, LLC.

| Number of Shares |

| For | | Against | | Abstain |

| 3,130,640.860 | | 29,255.000 | | 0 |

| F/m Investments Large Cap Focused Fund |

| Trustees and Officers of the Trust |

| (Unaudited) |

Overall responsibility for management of the Trust rests with its Trustees. The Trustees serve for terms of indefinite duration until death, resignation, retirement or removal from office. The Trustees, in turn, elect the officers of the Trust to actively supervise the Trust’s day-to-day operations. The officers are elected annually.

The Trustees and executive officers of the Trust, their addresses and their principal occupations during the past five years are as follows:

Name, Address

and Age | Length

of Time

Served | Position(s)

Held with

Trust | Principal Occupation(s)

During Past 5 Years | Directorships

of Public

Companies

During Past

5 Years |

| Interested Trustee: |

Alexander Morris*

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1984 | Since December 2020 | Trustee | President and Chief Investment Officer of F/m Acceleration and F/m Investments since March 2019. Director of Key Bridge Compliance, LLC since January 2019. Founder of Rowhouse Capital Partners LLC, the predecessor of F/m Investments in 2014. President of the Trust from December 2020 until April 2022. | None |

| Independent Trustees: |

Debra Lee

McGinty-Poteet**

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1956 | Since May 2015 | Trustee | Retired since 2012. Currently serves on the Board for a number of non-profit organizations. | Trustee and Audit Committee Chair of Series Portfolios Trust, a registered investment company (2015 to present) |

E. Keith Wirtz

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1960 | Since October 2016 | Trustee | Vice President and Chief Investment Officer of Union Savings Bank of Connecticut since July 2019. Principal of Walrus Partners, LLC, a registered investment adviser from 2013 until 2019. Currently serves on the Board or Committee for a number of non-profit organizations. | None |

| F/m Investments Large Cap Focused Fund |

| Trustees and Officers of the Trust |

| (Unaudited) (Continued) |

Name, Address

and Age | Length

of Time

Served | Position(s)

Held with

Trust | Principal Occupation(s)

During Past 5 Years | Directorships

of Public

Companies

During Past

5 Years |

John R. Hildebrand

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1956 | Since October 2019 | Trustee | Retired since 2016. Partner in the Financial Services/Investment Management Practice of PricewaterhouseCoopers from 1994 until 2016. | None |

| * | Alexander Morris is considered an “interested person” of the Trust within the meaning of Section 2(a) (19) under the 1940 Act due to his affiliation with the Adviser. |

| ** | Debra McGinty-Poteet is a member of the Board of Trustees and Audit Committee Chair of Series Portfolios Trust, a series trust that includes the Oakhurst Strategic Defined Risk Fund, which is managed by an affiliate of the Adviser. |

Name, Address

and Age | Length

of Time

Served | Position(s)

Held with

Trust | Principal Occupation(s)

During Past 5 Years | Directorships

of Public

Companies

During Past

5 Years |

| Executive Officers: |

Matthew Swendiman

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1973 | Since April 2022 | President | Chairman and Chief Compliance Officer of the Sub-Adviser since March 2019. Chairman of F/m Acceleration, LLC (investment adviser support services) since March 2019. Director of Key Bridge Compliance, LLC and its predecessor firm since November 2018. President and CEO of JCM Financial Services Consulting, LLC from November 2018 to present. Of Counsel for Graydon law firm from September 2012 until November 2018. Chief Compliance Officer of the Trust from April 2021 until April 2022. | N/A |

Dennis Mason

c/o 3050 K Street NW,

Ste. 201

Washington, D.C. 20007

Year of birth: 1967 | Since April 2022 | Chief Compliance Officer | Senior Compliance Officer, Key Bridge Compliance, LLC since April 2021. Fund Compliance Officer, Apex Fund Services, July 2013 – April 2021. | N/A |

| F/m Investments Large Cap Focused Fund |

| Trustees and Officers of the Trust |

| (Unaudited) (Continued) |

Name, Address

and Age | Length

of Time

Served | Position(s)

Held with

Trust | Principal Occupation(s)

During Past 5 Years | Directorships

of Public

Companies

During Past

5 Years |

Angela A. Simmons

Ultimus Fund

Solutions, LLC

225 Pictoria Drive

Suite 450

Cincinnati, OH 45246

Year of Birth: 1975 | Since March 2022 | Treasurer | Vice President - Financial Administration of Ultimus Fund Solutions, LLC. She has worked at Ultimus since 2007 in a number of roles, including Assistant Vice President - Financial Administration and Assistant Mutual Fund Controller - Fund Accounting Manager. | N/A |

Bernard Brick

Ultimus Fund

Solutions, LLC

225 Pictoria Drive

Suite 450

Cincinnati, OH 45246

Year of Birth: 1974 | Since January 2023 | Secretary | Vice President and Senior Counsel, Ultimus Fund Solutions, LLC (2022 – Present); Vice President and Senior Counsel, State Street Bank and Trust Company (2011 - 2022). | N/A |

Additional Information about members of the Board of Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call toll-free 1-888-553-4233.

| F/m Investments Large Cap Focused Fund |

| Approval of Investment Advisory Agreement (Unaudited) |

On January 31, 2023, Diffractive Managers Group (“Diffractive”), a multi-boutique asset management company, acquired the assets of F/m Acceleration, LLC (“F/m Acceleration”), the parent company of F/m Investments, LLC, d/b/a Oakhurst Capital Advisors (“F/m” or the “Adviser”), the Fund’s investment adviser (the “F/m Transaction”). In conjunction with the Transaction, F/m d/b/a Oakhurst Capital Advisors was renamed F/m d/b/a Oakhurst Capital Management. The Transaction resulted in a change in “control” of F/m (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), and the automatic termination of the current investment advisory agreement between F/m and F/m Funds Trust (the “Trust”), on behalf of the Fund (the “Current Advisory Agreement”). In anticipation of the closing of the Transaction, at a meeting held by video conference on January 23, 2023 (the “Meeting”), the Board of Trustees (the “Board”) of the Trust, including the Trustees who are not “interested persons” of the Trust, as defined by the 1940 Act (the “Independent Trustees”) voting separately, approved an interim investment advisory agreement between F/m and the Trust, on behalf of the Fund (the “Interim Advisory Agreement”). The Interim Advisory Agreement, having the same material terms and fee arrangements as the Fund’s Current Advisory Agreement, became effective upon the closing of the Transaction on January 31,2023.

Also at the Meeting, the Board, including the Independent Trustees voting separately, approved a new investment advisory agreement between F/m and the Trust, on behalf of the Fund (the “New Advisory Agreement”), subject to shareholder approval.

In the course of their consideration of the Interim Advisory Agreement and the New Advisory Agreement (collectively, the “Agreements”), the Independent Trustees were advised by independent legal counsel and received materials from such counsel discussing the legal standards for their consideration of the proposed approval of the Agreements on behalf of the Fund. The Independent Trustees received and reviewed a variety of information related to the Fund and the Adviser that had been provided by the Adviser in response to requests of independent legal counsel on behalf of the Independent Trustees.

In considering the Agreements and reaching their conclusions with respect to the approval of the Agreements, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors described below.

| (i) | The nature, extent, and quality of the services to be provided by F/m. The Board considered the responsibilities that F/m would have under the Agreements, and the proposed services that F/m would provide to the Fund, including, without limitation, its procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objective and limitations, its marketing and distribution efforts, and its adherence to compliance procedures |

| F/m Investments Large Cap Focused Fund |

| Approval of Investment Advisory Agreement (Unaudited) (Continued) |

and practices. The Trustees considered the scope and quality of the in-house capabilities of F/m and other resources that F/m would continue to dedicate to performing services for the Fund. The Trustees also considered the business reputation of F/m and its affiliates, the qualifications of its key investment and compliance personnel and the financial resources of F/m and its affiliates. After reviewing the foregoing and additional information provided in the Meeting Materials, the Board concluded that the nature, extent, and quality of the services to be provided by F/m to the Fund, whether as interim adviser or new adviser, will be substantially identical to the nature, extent and quality of the services provided under the Current Advisory Agreement, and were satisfactory and adequate.

| (ii) | The investment management capabilities and experience of F/m. The Board considered the investment management experience of F/m and reviewed its discussions with F/m and Diffractive executives earlier in the Meeting regarding the investment objective and strategies for the Fund as well as F/m’s experience and plans for implementing such strategies. In particular, the Trustees noted that the Fund’s current investment management team was expected to continue management of the Fund. The Board also reviewed information from F/m, regarding prior experience in the financial industry as well as business reputation, the qualifications of key investment and compliance personnel, and financial resources. Given that the portfolio management team would remain the same under the Interim Agreement and New Agreement as was currently in place, the Trustees considered both short-term and long-term investment performance of the Fund. The Fund’s performance was compared to its performance benchmark and to that of its Morningstar category. After consideration of these and other factors, the Board determined that F/m had the requisite knowledge and experience to serve as the Interim Adviser and the New Adviser for the Fund. |

| (iii) | The costs of the services to be provided and profits to be realized by F/m and its affiliates from the relationship with the Fund. In reviewing the fees payable under the Interim Advisory Agreement and the New Advisory Agreement, the Trustees noted that such fees would be identical to those payable under the Fund’s Current Advisory Agreement. The Trustees considered certain information comparing the advisory fee and overall expense level of the Fund to those of its Morningstar category. The Board considered F/m’s financial condition and its expected level of commitment to the Fund as well as the overall expenses and fees of the Fund, including the advisory fee. The Board noted the Expense Limitation Agreement currently in effect, that F/m was currently waiving a portion of its advisory fee and the Interim Adviser’s and the New Adviser’s intent to enter into expense limitation agreements on the same terms as the current one. |

| F/m Investments Large Cap Focused Fund |

| Approval of Investment Advisory Agreement (Unaudited) (Continued) |

The Trustees also considered information provided to them concerning F/m’s estimated profitability with respect to the Fund, including the assumptions and methodology used in preparing the profitability information, in light of applicable case law relating to advisory fees. For these purposes, the Trustees took into account not only the fees to be paid by the Fund, but also so-called “fallout” benefits to F/m and its affiliates. In evaluating the fees, the Trustees took into account the complexity and quality of the investment management of the Fund. The Board concluded that the fees payable under the Agreements were fair and reasonable given the scope and quality of services to be provided by F/m. The Board also concluded that F/m’s estimated profitability and “fall out” benefits with respect to its management of the Fund was reasonable.

| (iv) | The extent to which the Fund and its investors would benefit from economies of scale. In this regard, the Independent Trustees considered the current size of the Fund and its anticipated growth trajectory, noting that the Fund would need to realize considerable growth in assets before F/m would start to receive full advisory fees from the Fund. In view of the foregoing, the extent to which economies of scale would be realized as the Fund grows, and whether fee levels reflect these economies of scale were not material factors in the Independent Trustees’ decision to approve the Agreements. |

No single factor was considered in isolation or to be determinative to the decision of the Trustees to approve the Agreements and each Trustee weighed the various factors as he or she deemed appropriate. Rather the Trustees concluded, in view of a weighing and balancing of all factors considered, that approval of the Agreements was in the best interests of the Fund and its shareholders. The Board noted that the scope, quality, and nature of services to be provided by F/m, and the fees to be paid to F/m under each of the Interim Advisory Agreement and New Advisory Agreement would be substantially identical to the scope, quality and nature of services provided, and fees paid, under the Current Advisory Agreement. After full consideration of the above factors as well as other factors, the Board, with the Independent Trustees voting separately, unanimously concluded that approval of each of the Agreements was in the best interest of the Fund and its shareholders.

This page intentionally left blank.

This page intentionally left blank.

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | F/m FUNDS TRUST | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | Investment Adviser F/m Investments, LLC 3050 K Street, NW Suite 201 Washington, DC 20007 Administrator Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, Ohio 45246-0707 1-800-292-6775 Distributor Ultimus Fund Distributors, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 | Independent Registered Public Accounting Firm Cohen & Company, Ltd. 1350 Euclid Avenue, Suite 800 Cleveland, OH 44115 Legal Counsel Sullivan & Worcester LLP 1666 K Street, NW Washington, D.C. 20006 Custodian U.S. Bank, N.A. 425 Walnut Street Cincinnati, OH 45202 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | |  | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | Fm-AR-23 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 13(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

| Item 3. | Audit Committee Financial Expert. |

The registrant’s board of trustees has determined that the registrant has three audit committee financial experts serving on its audit committee. The names of the audit committee financial experts are Keith Wirtz, Debra McGinty-Poteet and John R. Hildebrand. Messrs. Wirtz and Hildebrand and Ms. McGinty-Poteet are “independent” for purposes of this Item.

| Item 4. | Principal Accountant Fees and Services. |