UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22692

American Funds College Target Date Series

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2013

Steven I. Koszalka

American Funds College Target Date Series

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Bingham McCutchen LLP

355 South Grand Avenue, Suite 4400

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

| |

| From Capital Group | |

| | |

| | |

American Funds College

Target Date SeriesSM

Semi-annual report for the six months ended April 30, 2013

American Funds College Target Date Series seeks to help investors saving for higher education. Each fund in the series is an age-appropriate portfolio of actively managed stock and bond funds, the mix of which becomes increasingly focused on preservation as the enrollment date approaches.

American Funds, from Capital Group, is one of the nation’s largest mutual fund families. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class 529-A shares at net asset value. If a sales charge had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the cumulative total returns on a $1,000 investment for the period ended March 31, 2013 (the most recent calendar quarter-end). Also shown are the estimated gross and net expense ratios as of the series’ prospectus dated January 31, 2013:

| | | | Gross | Net |

| Class 529-A shares | Lifetime* | expense ratio | expense ratio |

| | | | |

| Total returns reflecting 4.25% maximum initial sales charge: | | | | | | |

| American Funds College 2030 FundSM | 2.63 | % | 1.09 | % | 0.97 | % |

| American Funds College 2027 FundSM | 1.65 | | 1.09 | | 0.97 | |

| American Funds College 2024 FundSM | 0.59 | | 1.04 | | 0.94 | |

| American Funds College 2021 FundSM | –0.02 | | 1.03 | | 0.93 | |

| American Funds College 2018 FundSM | –0.77 | | 0.96 | | 0.86 | |

| American Funds College 2015 FundSM | –3.29 | | 0.97 | | 0.86 | |

| Total return reflecting 2.50% maximum initial sales charge: | | | | | | |

| American Funds College Enrollment FundSM | –2.50 | | 1.06 | | 0.89 | |

| *Since September 14, 2012. | | | | | | |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. The college target date funds invest in Class R-6 shares of the underlying funds. The series’ investment adviser is currently waiving its management fee of 0.10% and reimbursing a portion of other expenses in all share classes. Investment results and net expense ratios shown reflect the waiver and reimbursements, without which the results would have been lower and the expenses would have been higher. Expense ratios are estimated as of each fund’s prospectus available at the time of publication and include the weighted average expenses of the underlying funds. The waiver for all funds and the reimbursement will remain in effect at least through December 31, 2013. After that time, the adviser may elect at its discretion to extend, modify or terminate the reimbursement. The waiver may only be modified or terminated with the approval of the series’ board of trustees.

The funds’ allocation strategy does not guarantee that investors’ education savings goals will be met. Investors and their advisers should periodically evaluate their investment to determine whether it continues to meet their needs. Investment allocations may not achieve fund objectives. There are expenses associated with the underlying funds in addition to fund of funds expenses. The funds’ risks are directly related to the risks of the underlying funds. Refer to the series’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the series.

Fellow investors:

We are pleased to present the American Funds College Target Date Series semi-annual report for the six-month period ended April 30, 2013. As the College Target Date Series’ inception date was September 14, 2012, this is the first six-month period to review. However, before discussing the results, we think it would be helpful to review how the funds in the series work.

Understanding the series

American Funds College Target Date Series was designed to provide an “off-the-shelf” investment for parents or other interested investors who want to use a 529 plan to save for a beneficiary’s higher education.

An investor chooses a fund from the series corresponding to the beneficiary’s projected enrollment date. American Funds handles the asset allocation and the fund selection, adjusting these over time as the beneficiary’s enrollment date gets closer. In the distant-dated funds (furthest from the enrollment date), the primary investment objective is growth of capital; for the nearer-dated funds (closer to the enrollment date), it’s preservation of capital.

Active, disciplined and frequent rebalancing occurs to ensure that the funds are on target and the allocation makes sense. The series doesn’t attempt tactical asset rebalancing. In other words, the portfolios do not get more conservative or aggressive strictly based on market conditions.

Results for the period

In the six months ended April 30, 2013, all seven funds realized gains, and three outpaced their relevant benchmarks — the College 2015 Fund, College 2027 Fund and College 2030 Fund.

The distant-dated funds favor growth-oriented underlying funds, and their returns were primarily driven by the overall strength in the equity markets, both in the U.S. and globally, during the last six months.

The College 2018 Fund, College 2021 Fund and College 2024 Fund are invested with a conservative bias for protection; however, the series didn’t particularly need that during this period. Bonds did better than expected, yet these funds lagged their indexes because they took less credit risk* and interest rate risk† than the indexes’ investments.

American Funds College Enrollment Fund trailed the benchmark. However, this fund has, so far, been successful in achieving its primary objective — preservation of capital.

| * | Credit risk is the risk of loss of principal stemming from a borrower’s failure to meet a loan obligation. |

| † | Interest rate risk is the risk that an investment’s value will erode due to a change in interest rates. |

Results at a glance

Cumulative total returns for the period ended April 30, 2013

(with all distributions reinvested)

| | | Six months | | Lifetime |

| | | (10/31/12 to

4/30/13) | | (9/14/12 to

4/30/13) |

| American Funds College 2030 Fund (Class 529-A) | | | 12.74 | % | | | 10.37 | % |

| S&P Target Date To 2030 Index¹ | | | 10.52 | | | | 7.95 | |

| American Funds College 2027 Fund (Class 529-A) | | | 10.95 | | | | 8.95 | |

| S&P Target Date To 2025 Index¹ | | | 9.38 | | | | 7.21 | |

| American Funds College 2024 Fund (Class 529-A) | | | 8.95 | | | | 7.54 | |

| S&P Target Date To 2025 Index¹ | | | 9.38 | | | | 7.21 | |

| American Funds College 2021 Fund (Class 529-A) | | | 7.34 | | | | 6.59 | |

| S&P Target Date To 2020 Index¹ | | | 8.21 | | | | 6.46 | |

| American Funds College 2018 Fund (Class 529-A) | | | 5.41 | | | | 5.20 | |

| S&P Target Date To 2015 Index¹ | | | 6.93 | | | | 5.63 | |

| American Funds College 2015 Fund (Class 529-A) | | | 1.46 | | | | 1.66 | |

| Barclays U.S. Aggregate Index² | | | 0.90 | | | | 1.91 | |

| American Funds College Enrollment Fund (Class 529-A) | | | 0.13 | | | | 0.23 | |

| Barclays Intermediate U.S. Aggregate Index³ | | | 0.88 | | | | 1.34 | |

| 1 | The S&P Target Date Style Index series (“To” variant), a subset of the S&P Target Date Index series, comprises a set of multi-asset class indexes based on funds with glide paths that aim to emphasize market risk sensitivity around the target date. Each index is fully investable with varying levels of exposure to the asset classes determined during an annual survey process of target date funds’ holdings. The current universe of eligible asset classes includes U.S. Large-Cap, U.S. Mid-Cap, U.S. Small-Cap, International Equities, Emerging Markets, U.S. REITs, Core Fixed Income, Cash Equivalents, TIPS and High-Yield Corporate Bonds. Each asset class is represented in the indexes via a different exchange traded fund. |

| 2 | Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. |

| 3 | Barclays Intermediate U.S. Aggregate Index represents securities in the intermediate maturity range (1–10 years) of the U.S. investment-grade fixed-rate bond market. |

| American Funds College Target Date Series | 1 |

Looking forward

Our investors want to be confident about the savings they will have when the time comes to spend on their beneficiary’s education. Since it’s impossible to estimate the cost or know with certainty what the student-loan landscape will be years or even months from now, we believe that the more you can save, the more uncertainty you can avoid.

Thank you for your investment in American Funds College Target Date Series. We’re grateful for the confidence you have placed in us, and we look forward to reporting to you again at the end of the fiscal year.

Sincerely,

Bradley J. Vogt

Vice Chairman of the Board

Walter R. Burkley

President

June 17, 2013

For current information about the College Target Date Series funds, visit americanfunds.com.

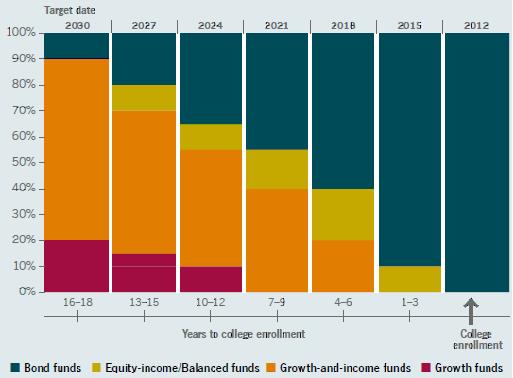

Investment strategy for American Funds College Target Date Series

What you own

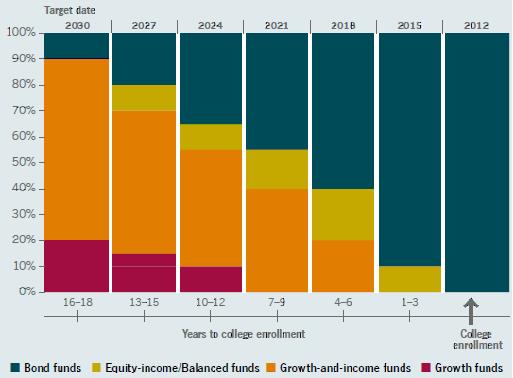

The funds in this series are designed to balance your college enrollment needs for total return and stability. Each of the seven target date fund of funds in the series contains an initial mix of individual American Funds. The mix is a diversified blend of the American Funds, which may include growth, growth-and-income, equity-income, balanced, and bond funds. The mix of funds depends on the student’s target date of enrollment into higher education.

Allocation approach

At the origin, for dates far from enrollment, the fund seeks an emphasis on long-term growth of capital. Over time, the mix of underlying American Funds adjusts every three years so that the allocations remain appropriate for the student’s remaining time horizon. The 18-year allocation approach is represented in the illustration shown below. As the expected target enrollment date nears, the fund’s mix grows more preservation-oriented. And when the enrollment date arrives, assets transition permanently into College Enrollment Fund, a portfolio of funds that invest in high-quality, shorter term bonds, increasing the emphasis on preservation of assets.

Management

American Funds College Target Date Series is actively monitored. Our Portfolio Oversight Committee continually oversees the underlying fund allocations in each target date fund and, if necessary, makes changes in response to market conditions or other considerations. Investment allocations and underlying funds are as of October 31, 2012. Underlying funds may be added or removed during the year. For quarterly updates of the underlying fund allocations, visit americanfunds.com.

| 2 | American Funds College Target Date Series |

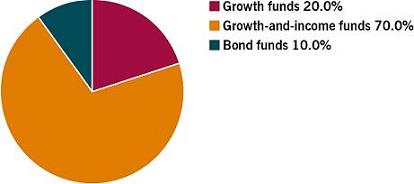

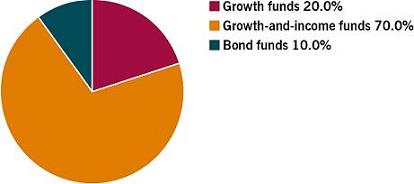

| American Funds College 2030 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Growth funds — 20.0% | | | | | | | | | | | | |

| EuroPacific Growth Fund, Class R-6 | | | 175,254 | | | $ | 7,687 | | | | 10.0 | % |

| The Growth Fund of America, Inc., Class R-6 | | | 202,440 | | | | 7,686 | | | | 10.0 | |

| | | | | | | | 15,373 | | | | 20.0 | |

| Growth-and-income funds — 70.0% | | | | | | | | | | | | |

| Capital World Growth and Income Fund, Class R-6 | | | 375,967 | | | | 15,373 | | | | 20.0 | |

| Fundamental Investors, Class R-6 | | | 339,291 | | | | 15,373 | | | | 20.0 | |

| International Growth and Income Fund, Class R-6 | | | 339,816 | | | | 11,530 | | | | 15.0 | |

| The Investment Company of America, Class R-6 | | | 340,017 | | | | 11,530 | | | | 15.0 | |

| | | | | | | | 53,806 | | | | 70.0 | |

| Bond funds — 10.0% | | | | | | | | | | | | |

| Capital World Bond Fund, Class R-6 | | | 182,062 | | | | 3,844 | | | | 5.0 | |

| U.S. Government Securities Fund, Class R-6 | | | 270,656 | | | | 3,843 | | | | 5.0 | |

| | | | | | | | 7,687 | | | | 10.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $71,963,000) | | | | | | | 76,866 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (33 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 76,833 | | | | 100.0 | % |

See Notes to Financial Statements

| American Funds College Target Date Series | 3 |

| American Funds College 2027 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Growth funds — 15.0% | | | | | | | | | | | | |

| EuroPacific Growth Fund, Class R-6 | | | 114,256 | | | $ | 5,011 | | | | 5.0 | % |

| The Growth Fund of America, Inc., Class R-6 | | | 263,959 | | | | 10,023 | | | | 10.0 | |

| | | | | | | | 15,034 | | | | 15.0 | |

| | | | | | | | | | | | | |

| Growth-and-income funds — 55.0% | | | | | | | | | | | | |

| Capital World Growth and Income Fund, Class R-6 | | | 367,619 | | | | 15,032 | | | | 15.0 | |

| Fundamental Investors, Class R-6 | | | 331,739 | | | | 15,031 | | | | 15.0 | |

| International Growth and Income Fund, Class R-6 | | | 295,586 | | | | 10,029 | | | | 10.0 | |

| The Investment Company of America, Class R-6 | | | 443,281 | | | | 15,032 | | | | 15.0 | |

| | | | | | | | 55,124 | | | | 55.0 | |

| | | | | | | | | | | | | |

| Equity-income and Balanced funds — 10.0% | | | | | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 349,949 | | | | 10,022 | | | | 10.0 | |

| | | | | | | | | | | | | |

| Bond funds — 20.0% | | | | | | | | | | | | |

| Capital World Bond Fund, Class R-6 | | | 237,388 | | | | 5,011 | | | | 5.0 | |

| U.S. Government Securities Fund, Class R-6 | | | 1,058,719 | | | | 15,034 | | | | 15.0 | |

| | | | | | | | 20,045 | | | | 20.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $94,642,000) | | | | | | | 100,225 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (46 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 100,179 | | | | 100.0 | % |

See Notes to Financial Statements

| 4 | American Funds College Target Date Series |

| American Funds College 2024 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Growth funds — 10.0% | | | | | | | | | | | | |

| The Growth Fund of America, Inc., Class R-6 | | | 375,519 | | | $ | 14,258 | | | | 10.0 | % |

| Growth-and-income funds — 45.0% | | | | | | | | | | | | |

| Capital World Growth and Income Fund, Class R-6 | | | 348,703 | | | | 14,259 | | | | 10.0 | |

| International Growth and Income Fund, Class R-6 | | | 420,231 | | | | 14,258 | | | | 10.0 | |

| The Investment Company of America, Class R-6 | | | 630,719 | | | | 21,388 | | | | 15.0 | |

| Washington Mutual Investors Fund, Class R-6 | | | 406,224 | | | | 14,258 | | | | 10.0 | |

| | | | | | | | 64,163 | | | | 45.0 | |

| Equity-income and Balanced funds — 10.0% | | | | | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 497,851 | | | | 14,258 | | | | 10.0 | |

| | | | | | | | | | | | | |

| Bond funds — 35.0% | | | | | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 1,647,741 | | | | 21,388 | | | | 15.0 | |

| Capital World Bond Fund, Class R-6 | | | 337,718 | | | | 7,129 | | | | 5.0 | |

| U.S. Government Securities Fund, Class R-6 | | | 1,506,174 | | | | 21,388 | | | | 15.0 | |

| | | | | | | | 49,905 | | | | 35.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $135,841,000) | | | | | | | 142,584 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (61 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 142,523 | | | | 100.0 | % |

See Notes to Financial Statements

| American Funds College Target Date Series | 5 |

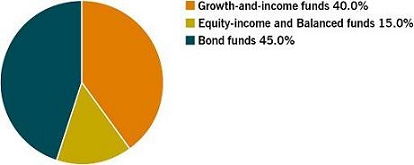

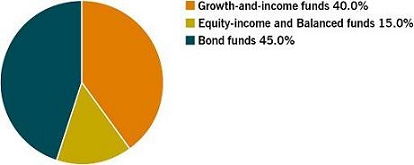

| American Funds College 2021 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Growth-and-income funds — 40.0% | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | | 843,450 | | | $ | 27,016 | | | | 15.0 | % |

| International Growth and Income Fund, Class R-6 | | | 531,665 | | | | 18,039 | | | | 10.0 | |

| Washington Mutual Investors Fund, Class R-6 | | | 769,630 | | | | 27,014 | | | | 15.0 | |

| | | | | | | | 72,069 | | | | 40.0 | |

| Equity-income and Balanced funds — 15.0% | | | | | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 943,642 | | | | 27,026 | | | | 15.0 | |

| | | | | | | | | | | | | |

| Bond funds — 45.0% | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6 | | | 1,773,354 | | | | 18,018 | | | | 10.0 | |

| The Bond Fund of America, Class R-6 | | | 3,470,200 | | | | 45,043 | | | | 25.0 | |

| U.S. Government Securities Fund, Class R-6 | | | 1,268,822 | | | | 18,017 | | | | 10.0 | |

| | | | | | | | 81,078 | | | | 45.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $172,859,000) | | | | | | | 180,173 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (78 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 180,095 | | | | 100.0 | % |

See Notes to Financial Statements

| 6 | American Funds College Target Date Series |

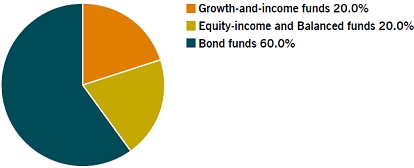

| American Funds College 2018 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

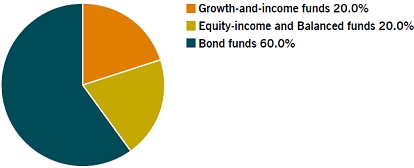

| Growth-and-income funds — 20.0% | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | | 1,220,669 | | | $ | 39,098 | | | | 20.0 | % |

| | | | | | | | | | | | | |

| Equity-income and Balanced funds — 20.0% | | | | | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 1,989,721 | | | | 39,098 | | | | 20.0 | |

| | | | | | | | | | | | | |

| Bond funds — 60.0% | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6 | | | 3,848,230 | | | | 39,098 | | | | 20.0 | |

| The Bond Fund of America, Class R-6 | | | 3,765,217 | | | | 48,873 | | | | 25.0 | |

| Intermediate Bond Fund of America, Class R-6 | | | 2,132,619 | | | | 29,323 | | | | 15.0 | |

| | | | | | | | 117,294 | | | | 60.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $189,568,000) | | | | | | | 195,490 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (86 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 195,404 | | | | 100.0 | % |

See Notes to Financial Statements

| American Funds College Target Date Series | 7 |

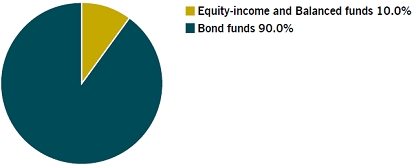

| American Funds College 2015 Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

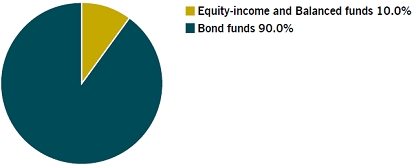

| Equity-income and Balanced funds — 10.0% | | | | | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 772,899 | | | $ | 15,188 | | | | 10.0 | % |

| | | | | | | | | | | | | |

| Bond funds — 90.0% | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6* | | | 4,484,487 | | | | 45,562 | | | | 30.0 | |

| The Bond Fund of America, Class R-6 | | | 2,340,133 | | | | 30,375 | | | | 20.0 | |

| Intermediate Bond Fund of America, Class R-6 | | | 4,418,171 | | | | 60,750 | | | | 40.0 | |

| | | | | | | | 136,687 | | | | 90.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $150,985,000) | | | | | | | 151,875 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (71 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 151,804 | | | | 100.0 | % |

| * | American Funds Mortgage Fund is considered to be an affiliate of the fund under the Investment Company Act of 1940 since the fund holds 5% or more of its outstanding voting shares. Further details on this holding and related transactions during the six months ended April 30, 2013, appear below. |

| | | Beginning

shares | | | Additions | | | Reductions | | | Ending

shares | | | Dividend

income

(000) | | | Value of

affiliate at

4/30/2013

(000) | |

| American Funds Mortgage Fund, Class R-6 | | | 806,954 | | | | 3,677,533 | | | | — | | | | 4,484,487 | | | $ | 138 | | | $ | 45,562 | |

See Notes to Financial Statements

| 8 | American Funds College Target Date Series |

| American Funds College Enrollment Fund | unaudited |

| Investment portfolio, April 30, 2013 | |

| Fund investments | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Bond funds — 100.0% | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6 | | | 1,747,863 | | | $ | 17,758 | | | | 30.0 | % |

| Intermediate Bond Fund of America, Class R-6 | | | 1,506,764 | | | | 20,718 | | | | 35.0 | |

| Short-Term Bond Fund of America, Class R-6 | | | 2,057,398 | | | | 20,718 | | | | 35.0 | |

| | | | | | | | | | | | | |

| Total investment securities (cost: $59,274,000) | | | | | | | 59,194 | | | | 100.0 | |

| Other assets less liabilities | | | | | | | (35 | ) | | | — | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 59,159 | | | | 100.0 | % |

See Notes to Financial Statements

| American Funds College Target Date Series | 9 |

Financial statements

Statements of assets and liabilities at April 30, 2013

| | | College 2030 Fund | | | College 2027 Fund | |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers | | $ | 76,866 | | | $ | 100,225 | |

| Affiliated issuer | | | — | | | | — | |

| Receivables for: | | | | | | | | |

| Sales of fund’s shares | | | 703 | | | | 310 | |

| Dividends | | | 1 | | | | 2 | |

| Other | | | — | | | | 2 | |

| Total assets | | | 77,570 | | | | 100,539 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 333 | | | | 310 | |

| Repurchases of fund’s shares | | | 369 | | | | — | |

| Services provided by related parties | | | 28 | | | | 42 | |

| Trustees’ deferred compensation | | | — | * | | | — | * |

| Other | | | 7 | | | | 8 | |

| Total liabilities | | | 737 | | | | 360 | |

| Net assets at April 30, 2013 | | $ | 76,833 | | | $ | 100,179 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | $ | 71,748 | | | $ | 94,300 | |

| Undistributed (distributions in excess of) net investment income | | | 83 | | | | 60 | |

| Undistributed net realized gain | | | 99 | | | | 236 | |

| Net unrealized appreciation (depreciation) | | | 4,903 | | | | 5,583 | |

| Net assets at April 30, 2013 | | $ | 76,833 | | | $ | 100,179 | |

| | | | | | | | | |

| Investment securities, at cost: | | | | | | | | |

| Unaffiliated issuers | | $ | 71,963 | | | $ | 94,642 | |

| Affiliated issuer | | | — | | | | — | |

| | | | | | | | | |

| Shares of beneficial interest issued and outstanding (no stated par value) — unlimited shares authorized | | | | | | | | |

| Class 529-A: | | | | | | | | |

| Net assets | | $ | 59,573 | | | $ | 74,454 | |

| Shares outstanding | | | 5,439 | | | | 6,893 | |

| Net asset value per share | | $ | 10.95 | | | $ | 10.80 | |

| Class 529-B: | | | | | | | | |

| Net assets | | $ | 76 | | | $ | 659 | |

| Shares outstanding | | | 7 | | | | 61 | |

| Net asset value per share | | $ | 10.93 | | | $ | 10.77 | |

| Class 529-C: | | | | | | | | |

| Net assets | | $ | 12,299 | | | $ | 18,235 | |

| Shares outstanding | | | 1,127 | | | | 1,694 | |

| Net asset value per share | | $ | 10.92 | | | $ | 10.77 | |

| Class 529-E: | | | | | | | | |

| Net assets | | $ | 1,582 | | | $ | 2,210 | |

| Shares outstanding | | | 144 | | | | 205 | |

| Net asset value per share | | $ | 10.95 | | | $ | 10.79 | |

| Class 529-F-1: | | | | | | | | |

| Net assets | | $ | 3,303 | | | $ | 4,621 | |

| Shares outstanding | | | 301 | | | | 427 | |

| Net asset value per share | | $ | 10.97 | | | $ | 10.82 | |

| * | Amount less than one thousand. |

See Notes to Financial Statements

| 10 | American Funds College Target Date Series |

unaudited

(dollars and shares in thousands, except per-share amounts)

| College 2024 Fund | | | College 2021 Fund | | | College 2018 Fund | | | College 2015 Fund | | | College Enrollment Fund | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 142,584 | | | $ | 180,173 | | | $ | 195,490 | | | $ | 106,313 | | | $ | 59,194 | |

| | — | | | | — | | | | — | | | | 45,562 | | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | 795 | | | | 742 | | | | 1,008 | | | | 1,009 | | | | 447 | |

| | 8 | | | | 16 | | | | 23 | | | | 25 | | | | 21 | |

| | 4 | | | | 4 | | | | 5 | | | | 4 | | | | — | * |

| | 143,391 | | | | 180,935 | | | | 196,526 | | | | 152,913 | | | | 59,662 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 791 | | | | 735 | | | | 1,003 | | | | 1,005 | | | | 446 | |

| | 3 | | | | 7 | | | | 5 | | | | 4 | | | | 16 | |

| | 62 | | | | 84 | | | | 98 | | | | 87 | | | | 35 | |

| | — | * | | | — | * | | | — | * | | | — | * | | | — | * |

| | 12 | | | | 14 | | | | 16 | | | | 13 | | | | 6 | |

| | 868 | | | | 840 | | | | 1,122 | | | | 1,109 | | | | 503 | |

| $ | 142,523 | | | $ | 180,095 | | | $ | 195,404 | | | $ | 151,804 | | | $ | 59,159 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 135,233 | | | $ | 172,150 | | | $ | 188,734 | | | $ | 150,405 | | | $ | 59,138 | |

| | 205 | | | | 364 | | | | 549 | | | | 241 | | | | (1 | ) |

| | 342 | | | | 267 | | | | 199 | | | | 268 | | | | 102 | |

| | 6,743 | | | | 7,314 | | | | 5,922 | | | | 890 | | | | (80 | ) |

| $ | 142,523 | | | $ | 180,095 | | | $ | 195,404 | | | $ | 151,804 | | | $ | 59,159 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 135,841 | | | $ | 172,859 | | | $ | 189,568 | | | $ | 105,198 | | | $ | 59,274 | |

| | — | | | | — | | | | — | | | | 45,787 | | | | — | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 103,962 | | | $ | 128,999 | | | $ | 130,197 | | | $ | 91,060 | | | $ | 32,511 | |

| | 9,740 | | | | 12,177 | | | | 12,451 | | | | 8,996 | | | | 3,253 | |

| $ | 10.67 | | | $ | 10.59 | | | $ | 10.46 | | | $ | 10.12 | | | $ | 9.99 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 2,070 | | | $ | 2,178 | | | $ | 2,147 | | | $ | 2,092 | | | $ | 419 | |

| | 195 | | | | 206 | | | | 206 | | | | 207 | | | | 42 | |

| $ | 10.64 | | | $ | 10.56 | | | $ | 10.43 | | | $ | 10.09 | | | $ | 9.96 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 24,645 | | | $ | 35,515 | | | $ | 46,722 | | | $ | 44,820 | | | $ | 18,831 | |

| | 2,317 | | | | 3,364 | | | | 4,484 | | | | 4,443 | | | | 1,890 | |

| $ | 10.64 | | | $ | 10.56 | | | $ | 10.42 | | | $ | 10.09 | | | $ | 9.96 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 4,970 | | | $ | 5,892 | | | $ | 6,619 | | | $ | 5,640 | | | $ | 2,297 | |

| | 466 | | | | 557 | | | | 633 | | | | 558 | | | | 230 | |

| $ | 10.66 | | | $ | 10.58 | | | $ | 10.45 | | | $ | 10.11 | | | $ | 9.99 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 6,876 | | | $ | 7,511 | | | $ | 9,719 | | | $ | 8,192 | | | $ | 5,101 | |

| | 643 | | | | 708 | | | | 928 | | | | 808 | | | | 510 | |

| $ | 10.69 | | | $ | 10.61 | | | $ | 10.47 | | | $ | 10.14 | | | $ | 10.01 | |

| American Funds College Target Date Series | 11 |

Statements of operations for the six months ended April 30, 2013

| | | | College 2030 Fund | | | | College 2027 Fund | |

| Investment income: | | | | | | | | |

| Dividends: | | | | | | | | |

| Unaffiliated issuers | | $ | 455 | | | $ | 591 | |

| Affiliated issuer | | | — | | | | — | |

| | | | 455 | | | | 591 | |

| | | | | | | | | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 21 | | | | 28 | |

| Distribution services | | | 83 | | | | 110 | |

| Transfer agent services | | | 26 | | | | 35 | |

| Reports to shareholders | | | 1 | | | | 2 | |

| Registration statement and prospectus | | | 11 | | | | 13 | |

| Trustees’ compensation | | | — | † | | | — | † |

| Auditing and legal | | | 1 | | | | 2 | |

| Custodian | | | 2 | | | | 2 | |

| Other | | | 22 | | | | 29 | |

| Total fees and expenses before reimbursements/waivers | | | 167 | | | | 221 | |

| Less reimbursements/waivers of fees and expenses: | | | | | | | | |

| Investment advisory services | | | 21 | | | | 28 | |

| Other | | | 3 | | | | 5 | |

| Total fees and expenses after reimbursements/waivers | | | 143 | | | | 188 | |

| Net investment income | | | 312 | | | | 403 | |

| | | | | | | | | |

| Net realized gain and unrealized appreciation (depreciation) on investments: | | | | | | | | |

| Net realized gain on sale of investments | | | — | | | | — | |

| Capital gain distributions received | | | 99 | | | | 236 | |

| Net realized gain | | | 99 | | | | 236 | |

| Net unrealized appreciation (depreciation) on investments | | | 4,951 | | | | 5,673 | |

| Net realized gain and unrealized appreciation (depreciation) on investments | | | 5,050 | | | | 5,909 | |

| Net increase in net assets resulting from operations | | $ | 5,362 | | | $ | 6,312 | |

| * | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

| † | Amount less than one thousand. |

See Notes to Financial Statements

| 12 | American Funds College Target Date Series |

unaudited

(dollars in thousands)

| College 2024 Fund | | | College 2021 Fund | | | College 2018 Fund | | | College 2015 Fund | | | College Enrollment Fund | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 904 | | | $ | 1,159 | | | $ | 1,378 | | | $ | 753 | | | $ | 220 | |

| | — | | | | — | | | | — | | | | 138 | | | | — | |

| | 904 | | | | 1,159 | | | | 1,378 | | | | 891 | | | | 220 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 41 | | | | 52 | | | | 57 | | | | 47 | | | | 18 | |

| | 153 | | | | 206 | | | | 247 | | | | 221 | | | | 92 | |

| | 51 | | | | 64 | | | | 71 | | | | 60 | | | | 23 | |

| | 2 | | | | 3 | | | | 3 | | | | 3 | | | | 1 | |

| | 17 | | | | 20 | | | | 22 | | | | 19 | | | | 9 | |

| | — | † | | | — | † | | | — | † | | | — | † | | | — | † |

| | 2 | | | | 3 | | | | 4 | | | | 3 | | | | 1 | |

| | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | |

| | 42 | | | | 53 | | | | 59 | | | | 49 | | | | 19 | |

| | 310 | | | | 403 | | | | 465 | | | | 404 | | | | 165 | |

| | | | | | | | | | | | | | | | | | | |

| | 41 | | | | 52 | | | | 57 | | | | 47 | | | | 18 | |

| | 6 | | | | 7 | | | | 8 | | | | 7 | | | | 4 | |

| | 263 | | | | 344 | | | | 400 | | | | 350 | | | | 143 | |

| | 641 | | | | 815 | | | | 978 | | | | 541 | | | | 77 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | 342 | | | | 267 | | | | 199 | | | | 268 | | | | 102 | |

| | 342 | | | | 267 | | | | 199 | | | | 268 | | | | 102 | |

| | 6,865 | | | | 7,431 | | | | 5,996 | | | | 909 | | | | (75 | ) |

| | 7,207 | | | | 7,698 | | | | 6,195 | | | | 1,177 | | | | 27 | |

| $ | 7,848 | | | $ | 8,513 | | | $ | 7,173 | | | $ | 1,718 | | | $ | 104 | |

| American Funds College Target Date Series | 13 |

Statements of changes in net assets

| | | College 2030 Fund | | | College 2027 Fund | |

| | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 312 | | | $ | (1 | ) | | $ | 403 | | | $ | — | 3 |

| Net realized gain | | | 99 | | | | — | | | | 236 | | | | — | |

| Net unrealized appreciation (depreciation) on investments | | | 4,951 | | | | (48 | ) | | | 5,673 | | | | (90 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 5,362 | | | | (49 | ) | | | 6,312 | | | | (90 | ) |

| | | | | | | | | | | | | | | | | |

| Dividends paid to shareholders: | | | | | | | | | | | | | | | | |

| Dividends from net investment income: | | | | | | | | | | | | | | | | |

| Class 529-A | | | (172 | ) | | | — | | | | (263 | ) | | | — | |

| Class 529-B | | | — | 3 | | | — | | | | (2 | ) | | | — | |

| Class 529-C | | | (36 | ) | | | — | | | | (57 | ) | | | — | |

| Class 529-E | | | (5 | ) | | | — | | | | (6 | ) | | | — | |

| Class 529-F-1 | | | (16 | ) | | | — | | | | (15 | ) | | | — | |

| Total dividends from net investment income | | | (229 | ) | | | — | | | | (343 | ) | | | — | |

| Total dividends paid to shareholders | | | (229 | ) | | | — | | | | (343 | ) | | | — | |

| | | | | | | | | | | | | | | | | |

| Net capital share transactions | | | 65,047 | | | | 6,702 | | | | 80,159 | | | | 14,141 | |

| | | | | | | | | | | | | | | | | |

| Total increase in net assets | | | 70,180 | | | | 6,653 | | | | 86,128 | | | | 14,051 | |

| | | | | | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | | | | | |

| Beginning of period | | | 6,653 | | | | — | | | | 14,051 | | | | — | |

| End of period | | $ | 76,833 | | | $ | 6,653 | | | $ | 100,179 | | | $ | 14,051 | |

| | | | | | | | | | | | | | | | | |

| Accumulated net investment loss | | | — | | | | — | | | | — | | | | — | 3 |

| Undistributed (distributions in excess of) net investment income | | $ | 83 | | | | — | | | $ | 60 | | | | — | |

| 1 | Unaudited. |

| 2 | For the period September 14, 2012, commencement of operations, through October 31, 2012. |

| 3 | Amount less than one thousand. |

See Notes to Financial Statements

| 14 | American Funds College Target Date Series |

(dollars in thousands)

| College 2024 Fund | | | College 2021 Fund | | | College 2018 Fund | | | College 2015 Fund | | | College Enrollment Fund | |

Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | | | Six months

ended April 30,

20131 | | | Period ended

October 31,

20122 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 641 | | | $ | 5 | | | $ | 815 | | | $ | 14 | | | $ | 978 | | | $ | 12 | | | $ | 541 | | | $ | 13 | | | $ | 77 | | | $ | 3 | |

| | 342 | | | | — | | | | 267 | | | | — | | | | 199 | | | | — | | | | 268 | | | | — | | | | 102 | | | | — | |

| | 6,865 | | | | (122 | ) | | | 7,431 | | | | (117 | ) | | | 5,996 | | | | (74 | ) | | | 909 | | | | (19 | ) | | | (75 | ) | | | (5 | ) |

| | 7,848 | | | | (117 | ) | | | 8,513 | | | | (103 | ) | | | 7,173 | | | | (62 | ) | | | 1,718 | | | | (6 | ) | | | 104 | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (324 | ) | | | — | | | | (349 | ) | | | — | | | | (312 | ) | | | — | | | | (214 | ) | | | — | | | | (51 | ) | | | — | |

| | (6 | ) | | | — | | | | (5 | ) | | | — | | | | (4 | ) | | | — | | | | (3 | ) | | | — | | | | —3 | | | | — | |

| | (66 | ) | | | — | | | | (77 | ) | | | — | | | | (86 | ) | | | — | | | | (71 | ) | | | — | | | | (19 | ) | | | — | |

| | (16 | ) | | | — | | | | (15 | ) | | | — | | | | (17 | ) | | | — | | | | (10 | ) | | | — | | | | (2 | ) | | | — | |

| | (29 | ) | | | — | | | | (19 | ) | | | — | | | | (22 | ) | | | — | | | | (15 | ) | | | — | | | | (9 | ) | | | — | |

| | (441 | ) | | | — | | | | (465 | ) | | | — | | | | (441 | ) | | | — | | | | (313 | ) | | | — | | | | (81 | ) | | | — | |

| | (441 | ) | | | — | | | | (465 | ) | | | — | | | | (441 | ) | | | — | | | | (313 | ) | | | — | | | | (81 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 114,530 | | | | 20,703 | | | | 143,361 | | | | 28,789 | | | | 156,461 | | | | 32,273 | | | | 122,712 | | | | 27,693 | | | | 47,496 | | | | 11,642 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 121,937 | | | | 20,586 | | | | 151,409 | | | | 28,686 | | | | 163,193 | | | | 32,211 | | | | 124,117 | | | | 27,687 | | | | 47,519 | | | | 11,640 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 20,586 | | | | — | | | | 28,686 | | | | — | | | | 32,211 | | | | — | | | | 27,687 | | | | — | | | | 11,640 | | | | — | |

| $ | 142,523 | | | $ | 20,586 | | | $ | 180,095 | | | $ | 28,686 | | | $ | 195,404 | | | $ | 32,211 | | | $ | 151,804 | | | $ | 27,687 | | | $ | 59,159 | | | $ | 11,640 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| $ | 205 | | | $ | 5 | | | $ | 364 | | | $ | 14 | | | $ | 549 | | | $ | 12 | | | $ | 241 | | | $ | 13 | | | $ | (1 | ) | | $ | 3 | |

| American Funds College Target Date Series | 15 |

| Notes to financial statements | unaudited |

1. Organization

American Funds College Target Date Series (the “series”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The series consists of seven funds (the “funds”) — American Funds College 2030 Fund (“College 2030 Fund”), American Funds College 2027 Fund (“College 2027 Fund”), American Funds College 2024 Fund (“College 2024 Fund”), American Funds College 2021 Fund (“College 2021 Fund”), American Funds College 2018 Fund (“College 2018 Fund”), American Funds College 2015 Fund (“College 2015 Fund”), and American Funds College Enrollment Fund (“College Enrollment Fund”).

Each fund in the series is designed for investors who plan to attend college in, or close to, the year designated in the fund’s name. Depending on its proximity to its target date, each fund will seek to achieve the following objectives to varying degrees: growth, income and conservation of capital. As each fund approaches its target date, it will increasingly emphasize income and conservation of capital by investing a greater portion of its assets in equity-income, balanced and bond funds. When each fund reaches its target date, it will principally invest in bond funds and may merge into the Enrollment Fund, which will also principally invest in bond funds. Each fund will attempt to achieve its investment objectives by investing in a mix of American Funds (the “underlying funds”) in different combinations and weightings. Capital Research and Management Company (“CRMC”), the series’ investment adviser, is also the investment adviser of the underlying funds.

Each fund in the series has five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E, and 529-F-1). The funds’ share classes are further described below:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Class 529-A | | Up to 2.50% for College Enrollment Fund; up to 4.25% for all other funds | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None |

| Class 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Class 529-B converts to Class 529-A after eight years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

| Class 529-F-1 | | None | | None | | None |

| * Class 529-B shares of the funds are not available for purchase. |

Holders of all share classes have equal pro rata rights to assets, dividends and liquidation proceeds. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each class.

2. Significant accounting policies

The financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The funds follow the significant accounting policies described below, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the funds as of the date the trades are executed. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

Fees and expenses — The fees and expenses of the underlying funds are not included in the fees and expenses reported for each of the funds; however, they are indirectly reflected in the valuation of each of the underlying funds. These fees are included in the net effective expense ratios that are provided as supplementary information in the Financial Highlights table on pages 27 to 29.

| 16 | American Funds College Target Date Series |

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, administrative and shareholder services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

3. Valuation

Security valuation — The value of each underlying fund is calculated based on the policies and procedures of the underlying fund contained in each underlying fund’s statement of additional information. Generally, the funds and the underlying funds determine the net asset value of each share class as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Processes and structure — The series’ board of trustees has delegated authority to the funds’ investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The series’ board and audit committee also regularly review reports that describe fair value determinations and methods. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The series’ investment adviser classifies each fund’s assets and liabilities into three levels based on the method used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. At April 30, 2013, all of the investment securities for each fund were classified as Level 1.

4. Risk factors

Investing in the funds may involve certain risks including, but not limited to, those described below.

Allocation risk — Investments in the funds are subject to risks related to the investment adviser’s allocation choices. The selection of the underlying funds and the allocation of the funds’ assets could cause the funds to lose value or their results to lag relevant benchmarks or other funds with similar objectives.

Fund structure — The funds invest in underlying funds and incur expenses related to the underlying funds. In addition, investors in the funds will incur fees to pay for certain expenses related to the operations of the funds. An investor holding the underlying funds directly and in the same proportions as the funds would incur lower overall expenses but would not receive the benefit of the portfolio management and other services provided by the funds.

Because the funds’ investments consist of underlying funds, the funds’ risks are directly related to the risks of the underlying funds. For this reason, it is important to understand the risks associated with investing in the underlying funds.

Market conditions — The prices of, and the income generated by, the common stocks, bonds and other securities held by the underlying funds may decline due to market conditions and other factors, including those directly involving the issuers of securities held by the underlying funds.

Investing in stocks — Investing in stocks may involve larger price swings and greater potential for loss than other types of investments. As a result, the value of the underlying funds may be subject to sharp, short-term declines in value. Income provided by an underlying fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the underlying fund invests.

| American Funds College Target Date Series | 17 |

Investing in growth-oriented stocks — Growth-oriented stocks may involve larger price swings and greater potential for loss than other types of investments.

Investing in income-oriented stocks — Income provided by an underlying fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the underlying fund invests.

Investing in bonds — Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Longer maturity debt securities may be subject to greater price fluctuations than shorter maturity debt securities. In addition, falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the underlying funds having to reinvest the proceeds in lower yielding securities.

Bonds and other debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/ or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Credit risk is gauged, in part, by the credit ratings of the securities in which the underlying fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk.

Investing in lower rated bonds — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in bonds rated Ba1 or BB+ or below by Nationally Recognized Statistical Rating Organizations or unrated but determined by the underlying fund’s investment adviser to be of equivalent quality. Such securities are considered speculative and are sometimes referred to as “junk bonds.” The value of the underlying funds may be similarly affected.

Investing in small companies — Investing in smaller companies may pose additional risks. For example, it is often more difficult to value or dispose of small company stocks and more difficult to obtain information about smaller companies than about larger companies. In addition, the prices of these stocks may be more volatile than stocks of larger, more established companies.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations outside the U.S., may lose value because of adverse political, social, economic or market developments in the countries or regions in which the issuer operates. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different settlement and accounting practices and different regulatory, legal and reporting standards, and may be more difficult to value, than those in the U.S. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Additionally, there may be increased settlement risks for transactions in local securities.

Investing in mortgage-backed and asset-backed securities — Many types of bonds and other debt securities, including mortgage-backed/ related securities, are subject to prepayment risk as well as the risks associated with investing in debt securities in general. If interest rates fall and the loans underlying these securities are prepaid faster than expected, the underlying fund may have to reinvest the prepaid principal in lower yielding securities, thus reducing the fund’s income. Conversely, if interest rates increase and the loans underlying the securities are prepaid more slowly than expected, the expected duration of the securities may be extended, reducing the cash flow for potential reinvestment in higher yielding securities.

| 18 | American Funds College Target Date Series |

Investing in U.S. government securities — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Investing in future delivery contracts — Contracts for future delivery of mortgage-related securities, such as to be announced contracts and mortgage dollar rolls, involve the funds selling mortgage-related securities and simultaneously contracting to repurchase similar securities for delivery at a future date at a predetermined price. This can increase the underlying fund’s market exposure, and the market price of the securities the funds contracts to repurchase could drop below their purchase price. While the fund can preserve and generate capital through the use of such contracts by, for example, realizing the difference between the sale price and the future purchase price, the income generated by the fund may be reduced by engaging in such transactions. In addition, these transactions may increase the turnover rate of the funds.

Management — The investment adviser to the funds and to the underlying funds actively manages each underlying fund’s investments. Consequently, the underlying funds are subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause an underlying fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

5. Taxation and distributions

Federal income taxation — Each fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and each intends to distribute substantially all of its net taxable income and net capital gains each year. The funds are not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended April 30, 2013, none of the funds had a liability for any unrecognized tax benefits. Each fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. During the period, none of the funds incurred any interest or penalties.

The series is not subject to examination by U.S. federal and state tax authorities for tax years before 2012, the year the series commenced operations.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as short-term capital gains and losses; and deferred expenses. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the funds for financial reporting purposes.

Dividends from net investment income shown on the accompanying financial statements are considered ordinary income distributions for tax purposes.

The components of distributable earnings on a tax basis are reported as of the funds’ most recent year-end. As of October 31, 2012, the components of distributable earnings on a tax basis were as follows (dollars in thousands):

| | | College

2030 Fund | | College

2027 Fund | | College

2024 Fund | | College

2021 Fund | | College

2018 Fund | | College

2015 Fund | | College

Enrollment Fund |

| Undistributed net investment income | | $— | | $— | | $5 | | $14 | | $12 | | $13 | | $3 |

| American Funds College Target Date Series | 19 |

As of April 30, 2013, the tax basis unrealized appreciation (depreciation) and cost of investment securities were as follows (dollars in thousands):

| | | College

2030 Fund | | College

2027 Fund | | College

2024 Fund | | College

2021 Fund | | College

2018 Fund | | College

2015 Fund | | College

Enrollment Fund |

| Gross unrealized appreciation on investment securities | | $ | 4,946 | | | $ | 5,725 | | | $ | 6,952 | | | $ | 7,536 | | | $ | 6,073 | | | $ | 1,115 | | | $ | 7 | |

| Gross unrealized depreciation on investment securities | | | (43 | ) | | | (142 | ) | | | (209 | ) | | | (222 | ) | | | (151 | ) | | | (225 | ) | | | (87 | ) |

| Net unrealized appreciation (depreciation) on investment securities | | | 4,903 | | | | 5,583 | | | | 6,743 | | | | 7,314 | | | | 5,922 | | | | 890 | | | | (80 | ) |

| Cost of investment securities | | | 71,963 | | | | 94,642 | | | | 135,841 | | | | 172,859 | | | | 189,568 | | | | 150,985 | | | | 59,274 | |

6. Fees and transactions with related parties

CRMC, the series’ investment adviser, is the parent company of American Funds Distributors®, Inc. (“AFD”), the principal underwriter of the series’ shares, and American Funds Service Company® (“AFS”), the series’ transfer agent. CRMC, AFD and AFS are considered related parties to the series.

Investment advisory services — The series has an investment advisory and service agreement with CRMC that provides for monthly fees, accrued daily. These fees are based on an annual rate of 0.10% of daily net assets. CRMC is currently waiving these fees. This waiver can be modified or terminated only with the approval of the series’ board of trustees. Investment advisory services fees are presented in the statements of operations gross of the waiver from CRMC. CRMC receives fees from the underlying funds for investment advisory services. These fees are included in the net effective expense ratios that are provided as supplementary information in the Financial Highlights table on pages 27 to 29.

Other reimbursements — CRMC has agreed to reimburse a portion of the fees and expenses of the funds during their startup period. At its discretion the adviser may elect to extend, modify or terminate the reimbursements. Fees and expenses in the statements of operations are presented gross of the reimbursement from CRMC. The amounts reimbursed by CRMC are reflected as other reimbursements.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are described below:

Distribution services — The series has plans of distribution for all share classes. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.50% to 1.00% as noted below. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

| Share class | | Currently approved limits | | Plan limits |

| Class 529-A | | | 0.30 | % | | | 0.50 | % |

| Class 529-B | | | 1.00 | | | | 1.00 | |

| Class 529-C | | | 1.00 | | | | 1.00 | |

| Class 529-E | | | 0.50 | | | | 0.75 | |

| Class 529-F-1 | | | 0.25 | | | | 0.50 | |

For Class 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. This share class reimburses AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.30% is not exceeded. As of April 30, 2013, unreimbursed expenses subject to reimbursement totaled $2,000 for the Class 529-A shares of College Enrollment Fund. There were no unreimbursed expenses subject to reimbursement on any other fund.

| 20 | American Funds College Target Date Series |

Transfer agent services — The series has a shareholder services agreement with AFS under which the funds compensate AFS for providing transfer agent services to all of the funds’ share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the funds reimburse AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The series has an administrative services agreement with CRMC for providing administrative services to all of the funds’ share classes. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide services to fund shareholders. CRMC receives administrative services fees of 0.05% of average daily net assets from the Class R-6 shares of the underlying funds for administrative services provided to the series.

529 plan services — Each share class is subject to service fees to compensate the Commonwealth of Virginia for the maintenance of the 529 college savings plan. The quarterly fee is based on a series of decreasing annual rates beginning with 0.10% on the first $30 billion of the net assets invested in Class 529 shares of the American Funds and decreasing to 0.06% on such assets between $120 billion and $150 billion. The fee for any given calendar quarter is accrued and calculated on the basis of the average net assets of Class 529 shares of the American Funds for the last month of the prior calendar quarter. The fee is included in other expenses on the accompanying financial statements. The Commonwealth of Virginia is not considered a related party.

Class-specific expenses under the agreements described above for the six months ended April 30, 2013, were as follows:

| | | Distribution

services | | Transfer agent

services | | 529 plan

services |

| College 2030 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 46,128 | | | | $ | 20,260 | | | | $ | 15,779 | |

| Class 529-B | | | | 167 | | | | | 19 | | | | | 17 | |

| Class 529-C | | | | 34,571 | | | | | 4,145 | | | | | 3,399 | |

| Class 529-E | | | | 2,399 | | | | | 441 | | | | | 472 | |

| Class 529-F-1 | | | | — | | | | | 1,210 | | | | | 955 | |

| Total | | | $ | 83,265 | | | | $ | 26,075 | | | | $ | 20,622 | |

| College 2027 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 54,235 | | | | $ | 26,844 | | | | $ | 20,652 | |

| Class 529-B | | | | 1,984 | | | | | 219 | | | | | 195 | |

| Class 529-C | | | | 51,307 | | | | | 6,036 | | | | | 5,046 | |

| Class 529-E | | | | 2,767 | | | | | 484 | | | | | 544 | |

| Class 529-F-1 | | | | — | | | | | 1,369 | | | | | 1,125 | |

| Total | | | $ | 110,293 | | | | $ | 34,952 | | | | $ | 27,562 | |

| College 2024 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 69,131 | | | | $ | 37,872 | | | | $ | 29,084 | |

| Class 529-B | | | | 6,215 | | | | | 708 | | | | | 612 | |

| Class 529-C | | | | 69,907 | | | | | 8,419 | | | | | 6,876 | |

| Class 529-E | | | | 7,844 | | | | | 1,440 | | | | | 1,543 | |

| Class 529-F-1 | | | | — | | | | | 2,569 | | | | | 2,084 | |

| Total | | | $ | 153,097 | | | | $ | 51,008 | | | | $ | 40,199 | |

| College 2021 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 90,859 | | | | $ | 48,023 | | | | $ | 36,741 | |

| Class 529-B | | | | 6,497 | | | | | 740 | | | | | 639 | |

| Class 529-C | | | | 99,843 | | | | | 11,787 | | | | | 9,826 | |

| Class 529-E | | | | 8,614 | | | | | 1,531 | | | | | 1,695 | |

| Class 529-F-1 | | | | — | | | | | 2,351 | | | | | 1,930 | |

| Total | | | $ | 205,813 | | | | $ | 64,432 | | | | $ | 50,831 | |

| College 2018 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 100,513 | | | | $ | 50,350 | | | | $ | 37,723 | |

| Class 529-B | | | | 6,696 | | | | | 782 | | | | | 659 | |

| Class 529-C | | | | 129,248 | | | | | 15,171 | | | | | 12,715 | |

| Class 529-E | | | | 10,746 | | | | | 1,992 | | | | | 2,114 | |

| Class 529-F-1 | | | | — | | | | | 3,020 | | | | | 2,548 | |

| Total | | | $ | 247,203 | | | | $ | 71,315 | | | | $ | 55,759 | |

| College 2015 Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 74,081 | | | | $ | 38,493 | | | | $ | 28,593 | |

| Class 529-B | | | | 5,873 | | | | | 667 | | | | | 578 | |

| Class 529-C | | | | 133,331 | | | | | 16,155 | | | | | 13,122 | |

| Class 529-E | | | | 8,110 | | | | | 1,437 | | | | | 1,595 | |

| Class 529-F-1 | | | | — | | | | | 2,908 | | | | | 2,374 | |

| Total | | | $ | 221,395 | | | | $ | 59,660 | | | | $ | 46,262 | |

| College Enrollment Fund | | | | | | | | | | | | | | | |

| Class 529-A | | | $ | 29,561 | | | | $ | 12,996 | | | | $ | 9,704 | |

| Class 529-B | | | | 1,459 | | | | | 175 | | | | | 144 | |

| Class 529-C | | | | 57,048 | | | | | 6,938 | | | | | 5,611 | |

| Class 529-E | | | | 3,584 | | | | | 643 | | | | | 705 | |

| Class 529-F-1 | | | | — | | | | | 1,993 | | | | | 1,613 | |

| Total | | | $ | 91,652 | | | | $ | 22,745 | | | | $ | 17,777 | |

| American Funds College Target Date Series | 21 |

Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the funds, are treated as if invested in shares of the American Funds. These amounts represent general, unsecured liabilities of the funds and vary according to the total returns of the selected American Funds. Trustees’ compensation, shown on the accompanying financial statements, includes current fees (either paid in cash or deferred) and a net increase in the value of the deferred amounts as follows:

| | | Current

fees | | Increase in value

of deferred

amounts | | Total

trustees’

compensation |

| College 2030 Fund | | $ | 44 | | | $ | 1 | | | $ | 45 | |

| College 2027 Fund | | | 78 | | | | 1 | | | | 79 | |

| College 2024 Fund | | | 116 | | | | 1 | | | | 117 | |

| College 2021 Fund | | | 158 | | | | 2 | | | | 160 | |

| College 2018 Fund | | | 174 | | | | 2 | | | | 176 | |

| College 2015 Fund | | | 160 | | | | 2 | | | | 162 | |

| College Enrollment Fund | | | 62 | | | | 1 | | | | 63 | |

Affiliated officers and trustees — Officers and certain trustees of the series are or may be considered to be affiliated with CRMC, AFD and AFS. No affiliated officers or trustees received any compensation directly from the series.

7. Investment transactions

The funds made purchases and sales of investment securities during the six months ended April 30, 2013, as follows (dollars in thousands):

| | | Purchases | | Sales |

| College 2030 Fund | | $ | 65,270 | | | $ | — | |

| College 2027 Fund | | | 80,519 | | | | — | |

| College 2024 Fund | | | 115,196 | | | | — | |

| College 2021 Fund | | | 144,131 | | | | — | |

| College 2018 Fund | | | 157,298 | | | | — | |

| College 2015 Fund | | | 123,287 | | | | — | |

| College Enrollment Fund | | | 47,702 | | | | 37 | |

| 22 | American Funds College Target Date Series |

8. Capital share transactions

Capital share transactions in the funds for the six months ended April 30, 2013, were as follows (dollars and shares in thousands):

| | | College | | | College | | | College | | | College | |

| | | 2030 Fund | | | 2027 Fund | | | 2024 Fund | | | 2021 Fund | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| Class 529-A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | $ | 51,406 | | | | 5,001 | | | $ | 60,043 | | | | 5,877 | | | $ | 84,339 | | | | 8,294 | | | $ | 103,298 | | | | 10,174 | |

| Reinvestments of dividends | | | 172 | | | | 18 | | | | 263 | | | | 27 | | | | 324 | | | | 32 | | | | 349 | | | | 35 | |

| Repurchases1 | | | (1,050 | ) | | | (100 | ) | | | (1,244 | ) | | | (121 | ) | | | (1,760 | ) | | | (171 | ) | | | (1,715 | ) | | | (168 | ) |

| Total Class 529-A transactions | | | 50,528 | | | | 4,919 | | | | 59,062 | | | | 5,783 | | | | 82,903 | | | | 8,155 | | | | 101,932 | | | | 10,041 | |

| Class 529-B | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 60 | | | | 5 | | | | 532 | | | | 53 | | | | 1,869 | | | | 185 | | | | 1,872 | | | | 185 | |

| Reinvestments of dividends | | | — | 2 | | | — | 2 | | | 2 | | | | — | 2 | | | 6 | | | | 1 | | | | 5 | | | | — | 2 |

| Repurchases1 | | | (14 | ) | | | (1 | ) | | | (4 | ) | | | (1 | ) | | | (221 | ) | | | (22 | ) | | | (276 | ) | | | (27 | ) |

| Total Class 529-B transactions | | | 46 | | | | 4 | | | | 530 | | | | 52 | | | | 1,654 | | | | 164 | | | | 1,601 | | | | 158 | |

| Class 529-C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 10,163 | | | | 992 | | | | 14,824 | | | | 1,453 | | | | 19,847 | | | | 1,954 | | | | 29,053 | | | | 2,864 | |

| Reinvestments of dividends | | | 36 | | | | 4 | | | | 57 | | | | 6 | | | | 66 | | | | 7 | | | | 77 | | | | 7 | |

| Repurchases1 | | | (62 | ) | | | (6 | ) | | | (434 | ) | | | (42 | ) | | | (135 | ) | | | (13 | ) | | | (902 | ) | | | (89 | ) |

| Total Class 529-C transactions | | | 10,137 | | | | 990 | | | | 14,447 | | | | 1,417 | | | | 19,778 | | | | 1,948 | | | | 28,228 | | | | 2,782 | |

| Class 529-E | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 1,307 | | | | 128 | | | | 1,883 | | | | 184 | | | | 4,120 | | | | 408 | | | | 4,793 | | | | 473 | |

| Reinvestments of dividends | | | 5 | | | | 1 | | | | 6 | | | | 1 | | | | 16 | | | | 1 | | | | 15 | | | | 2 | |

| Repurchases1 | | | (3 | ) | | | — | 2 | | | (2 | ) | | | — | 2 | | | (4 | ) | | | — | 2 | | | (47 | ) | | | (5 | ) |

| Total Class 529-E transactions | | | 1,309 | | | | 129 | | | | 1,887 | | | | 185 | | | | 4,132 | | | | 409 | | | | 4,761 | | | | 470 | |

| Class 529-F-1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 3,013 | | | | 296 | | | | 4,231 | | | | 413 | | | | 6,693 | | | | 660 | | | | 6,890 | | | | 678 | |

| Reinvestments of dividends | | | 15 | | | | 1 | | | | 15 | | | | 1 | | | | 28 | | | | 3 | | | | 18 | | | | 2 | |

| Repurchases1 | | | (1 | ) | | | — | 2 | | | (13 | ) | | | (1 | ) | | | (658 | ) | | | (63 | ) | | | (69 | ) | | | (7 | ) |

| Total Class 529-F-1 transactions | | | 3,027 | | | | 297 | | | | 4,233 | | | | 413 | | | | 6,063 | | | | 600 | | | | 6,839 | | | | 673 | |

| Total net increase | | $ | 65,047 | | | | 6,339 | | | $ | 80,159 | | | | 7,850 | | | $ | 114,530 | | | | 11,276 | | | $ | 143,361 | | | | 14,124 | |

See page 26 for footnotes.

| American Funds College Target Date Series | 23 |

| | | College | | | College | | | College | |

| | | 2018 Fund | | | 2015 Fund | | | Enrollment Fund | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| Class 529-A | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | $ | 104,561 | | | | 10,337 | | | $ | 74,552 | | | | 7,436 | | | $ | 28,653 | | | | 2,872 | |

| Reinvestments of dividends | | | 312 | | | | 31 | | | | 214 | | | | 22 | | | | 51 | | | | 5 | |

| Repurchases1 | | | (1,780 | ) | | | (175 | ) | | | (2,862 | ) | | | (286 | ) | | | (2,592 | ) | | | (260 | ) |

| Total Class 529-A transactions | | | 103,093 | | | | 10,193 | | | | 71,904 | | | | 7,172 | | | | 26,112 | | | | 2,617 | |

| Class 529-B | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 1,835 | | | | 182 | | | | 1,967 | | | | 197 | | | | 436 | | | | 44 | |

| Reinvestments of dividends | | | 4 | | | | — | 2 | | | 3 | | | | — | 2 | | | — | 2 | | | — | 2 |

| Repurchases1 | | | (289 | ) | | | (28 | ) | | | (269 | ) | | | (27 | ) | | | (135 | ) | | | (14 | ) |

| Total Class 529-B transactions | | | 1,550 | | | | 154 | | | | 1,701 | | | | 170 | | | | 301 | | | | 30 | |

| Class 529-C | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 39,563 | | | | 3,917 | | | | 38,700 | | | | 3,868 | | | | 16,232 | | | | 1,629 | |

| Reinvestments of dividends | | | 86 | | | | 9 | | | | 71 | | | | 7 | | | | 19 | | | | 2 | |

| Repurchases1 | | | (564 | ) | | | (56 | ) | | | (1,144 | ) | | | (114 | ) | | | (1,070 | ) | | | (107 | ) |

| Total Class 529-C transactions | | | 39,085 | | | | 3,870 | | | | 37,627 | | | | 3,761 | | | | 15,181 | | | | 1,524 | |

| Class 529-E | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 4,742 | | | | 470 | | | | 4,719 | | | | 471 | | | | 1,793 | | | | 180 | |

| Reinvestments of dividends | | | 17 | | | | 1 | | | | 10 | | | | 1 | | | | 2 | | | | — | 2 |

| Repurchases1 | | | (109 | ) | | | (11 | ) | | | (180 | ) | | | (18 | ) | | | (139 | ) | | | (14 | ) |

| Total Class 529-E transactions | | | 4,650 | | | | 460 | | | | 4,549 | | | | 454 | | | | 1,656 | | | | 166 | |

| Class 529-F-1 | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | | 8,158 | | | | 804 | | | | 7,023 | | | | 700 | | | | 4,482 | | | | 449 | |

| Reinvestments of dividends | | | 22 | | | | 2 | | | | 15 | | | | 2 | | | | 9 | | | | 1 | |

| Repurchases1 | | | (97 | ) | | | (9 | ) | | | (107 | ) | | | (11 | ) | | | (245 | ) | | | (25 | ) |

| Total Class 529-F-1 transactions | | | 8,083 | | | | 797 | | | | 6,931 | | | | 691 | | | | 4,246 | | | | 425 | |

| Total net increase | | $ | 156,461 | | | | 15,474 | | | $ | 122,712 | | | | 12,248 | | | $ | 47,496 | | | | 4,762 | |

| 24 | American Funds College Target Date Series |

Capital share transactions in the funds for the period ended October 31, 20123, were as follows (dollars and shares in thousands):

| | | College | | | College | | | College | | | College | |

| | | 2030 Fund | | | 2027 Fund | | | 2024 Fund | | | 2021 Fund | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| Class 529-A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales1 | | $ | 5,150 | | | | 522 | | | $ | 11,002 | | | | 1,112 | | | $ | 15,823 | | | | 1,593 | | | $ | 21,301 | | | | 2,136 | |