UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22692

American Funds College Target Date Series

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: October 31

Date of reporting period: April 30, 2018

Steven I. Koszalka

American Funds College Target Date Series

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

| American Funds College

Target Date Series® Semi-annual report

for the six months ended

April 30, 2018 |

A balanced approach

to building and

preserving wealth

for higher education

American Funds College 2036 Fund,® American Funds College 2033 Fund,® American Funds College 2030 Fund,® American Funds College 2027 Fund,® American Funds College 2024 Fund,® American Funds College 2021 Fund®: Each fund seeks to achieve the following objectives to varying degrees: growth, income and preservation of capital, depending on the proximity to its target date. The target date is meant to roughly correspond to the year in which the fund beneficiary will start to withdraw funds to meet higher education expenses. Each fund will increasingly emphasize income and preservation of capital by investing a greater portion of its assets in bond, equity-income and balanced funds as it approaches and passes its target date. In this way, each fund seeks to achieve an appropriate balance of total return and stability during different time periods.

American Funds College Enrollment Fund®: The fund’s investment objective is to provide current income, consistent with preservation of capital.

American Funds, from Capital Group, is one of the nation’s largest mutual fund families. For more than 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class 529-A shares at net asset value. If a sales charge had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit americanfunds.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended March 31, 2018 (the most recent calendar quarter-end). Gross expense ratios, which are restated to reflect current fees, are as of the series prospectus dated February 9, 2018:

| | | Cumulative | | Average annual | | |

| | | total returns | | total returns | | Gross |

| Class 529-A shares | | 1 year | | 5 years | | Lifetime1 | | expense ratio |

| | | | | | | | | | | | | | | | | |

| Reflecting 4.25% maximum initial sales charge: | | | | | | | | | | | | | | | | |

| American Funds College 2036 Fund | | | — | | | | — | | | | –2.68 | % | | | 0.93 | %2 |

| American Funds College 2033 Fund | | | 7.82 | % | | | — | | | | 5.76 | | | | 0.84 | |

| American Funds College 2030 Fund | | | 5.22 | | | | 7.41 | % | | | 8.00 | | | | 0.82 | |

| American Funds College 2027 Fund | | | 2.36 | | | | 6.08 | | | | 6.62 | | | | 0.80 | |

| American Funds College 2024 Fund | | | –0.73 | | | | 4.66 | | | | 5.12 | | | | 0.73 | |

| American Funds College 2021 Fund | | | –3.90 | | | | 2.88 | | | | 3.40 | | | | 0.73 | |

| |

| Reflecting 2.50% maximum initial sales charge: | | | | | | | | | | | | | | | | |

| American Funds College Enrollment Fund3 | | | –2.87 | % | | | 0.09 | % | | | 0.09 | % | | | 0.76 | % |

| 1 | Since September 14, 2012, for all funds except College 2036 Fund, which commenced operations on February 9, 2018, and College 2033 Fund, which commenced operations on March 27, 2015. |

| 2 | The net expense ratio was 0.90%. |

| 3 | College 2018 Fund® merged into College Enrollment Fund on April 20, 2018. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

The college target date funds invest in Class R-6 shares of the underlying funds. The investment adviser is currently reimbursing a portion of other expenses for College 2036 Fund. This reimbursement will be in effect until February 9, 2019. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. The investment adviser has in the past reimbursed certain expenses for other funds, without which results would have been lower.

The funds’ allocation strategy does not guarantee that investors’ education savings goals will be met. Investors and their advisors should periodically evaluate their investment to determine whether it continues to meet their needs. Investment allocations may not achieve fund objectives. There are expenses associated with the underlying funds in addition to fund of funds expenses. The funds’ risks are directly related to the risks of the underlying funds. Refer to the series prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the series.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Fellow investors:

Although geopolitical concerns weighed on investor sentiment, a tailwind of generally positive economic data and better-than-expected company earnings in the U.S. helped boost returns for those funds further from enrollment. Rising interest rates toward the end of the six-month period held back bond-heavy funds closer to enrollment. Returns ranged from –1.89% (for College 2021 Fund) to 2.90% (for College 2033 Fund). Results for the series can be found on page 3.

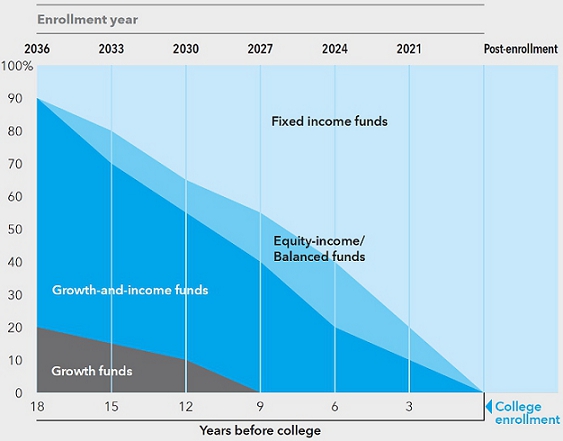

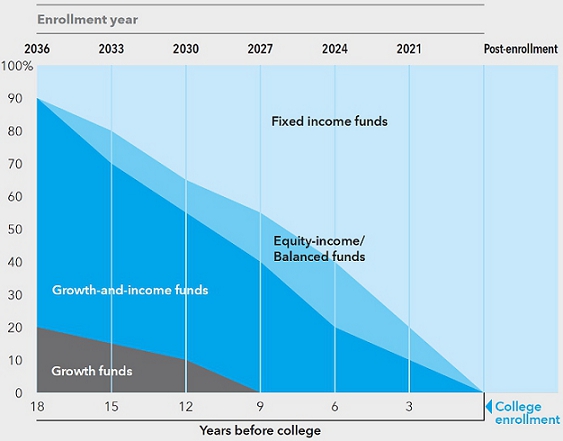

The glide path

The series was created by the American Funds Portfolio Oversight Committee, a group of seasoned investment professionals with varied backgrounds, diverse investment approaches and decades of experience. In creating the series, the Committee carefully selects a mix of individual American Funds, employing an objective-based process and rigorous analysis. The Committee regularly monitors each fund in the series.

A few events this past year reflect the age and time frame of new college-bound beneficiaries. College 2036 Fund launched in February, and College 2018 Fund merged into College Enrollment Fund on April 20, 2018.

The Portfolio Oversight Committee created the glide path that details the investment mix of American Funds College Target Date Series. This glide path was designed to grow savings while weathering market volatility. We remind investors that the series glide path focuses on providing growth in the early years, while placing greater emphasis on preservation of capital as beneficiaries approach the start of college.

The economy

For the first half of the funds’ fiscal year, the global economy continued to grow at a moderate pace. Most major economies were healthy. In the United States, the unemployment rate continued to fall and stood at 4.1% in March, while gross domestic product rose 2.9% in the fourth quarter of 2017. Consumer confidence was steady, and inflation remained low.

The picture was similar overseas. In the eurozone, fourth quarter GDP gained 2.7%, while unemployment stood at 8.5% for February — still high, but the lowest figure reported since 2008. Economic activity in Japan continued to increase modestly, while in China growth has stabilized at a strong rate over the past several years.

The stock market

Over the six months, volatility returned to a number of equity markets — some for the first time in years. In several instances it could be attributed to geopolitical concerns, such as continuing conflicts in Syria and changes to U.S. trade policies. Corporate earnings were generally sound throughout much of the world, however.

Domestically, the Standard & Poor’s 500 Composite Index, a market capitalization-weighted index based on the results of approximately 500 widely held common stocks, gained 3.82% during the period. The MSCI ACWI (All Country World Index) ex USA, which reflects the returns of more

| American Funds College Target Date Series | 1 |

than 40 developed and developing country stock markets, climbed 3.47%, while the MSCI Emerging Markets Index, measuring markets in more than 20 developing countries, advanced 4.80%.

The bond market

With the U.S. economy on sound footing, the Federal Reserve continued its slow, steady progression of rate hikes, the most recent of which increased the benchmark (the rate at which the central bank loans money to other banks) to a range of 1.50% to 1.75%. This remains well below historical norms.

During the period, the yield on the 10-year U.S. Treasury bond — a widely regarded benchmark for the U.S. bond market — increased 58 basis points to 2.95%, despite the volatility in equities. The Bloomberg Barclays U.S. Aggregate Index, which measures investment-grade U.S. bonds (rated BBB/Baa and above), fell 1.87% — not unexpected in the wake of the Fed’s moves. Global bonds fared better, with the Bloomberg Barclays Global Aggregate Index, a measure of global investment-grade bonds (rated BBB/Baa and above), rising 1.19%.

The series

Higher interest rates and inflation weighed on returns for our near-dated funds, which have a greater allocation to fixed income, while most of the distant-dated funds achieved their primary goal of capital growth.

We maintain a long-term perspective on behalf of our shareholders and their college-bound beneficiaries. The series’ positive lifetime results are a testament to the strength of our time-tested approach to investing led by bottom-up research.

We appreciate your investment in American Funds College Target Date Series.

Moving forward

Looking ahead, we believe the global economy will continue to grow over the short term, buoyed by a general trend toward deregulation and lower taxes in the United States. However, trade policy remains a concern. While current disputes between the U.S. and China have had little real economic impact, the possibility of escalation is worrisome.

In light of this and other geopolitical issues, we expect to see higher levels of volatility in equity markets. This is not necessarily a sign of trouble, but rather a return to normalcy as the past year’s lack of volatility was unusual. Overall we believe the market environment, given a foundation of strong corporate earnings, will be positive.

As always, we thank you for placing your trust in American Funds, and look forward to reporting to you again in six months.

Cordially,

Bradley J. Vogt

Vice Chairman of the Board

Walter R. Burkley

President

June 13, 2018

For current information about the series, visit americanfunds.com.

| 2 | American Funds College Target Date Series |

Results at a glance

For periods ended April 30, 2018, with all distributions reinvested for Class 529-A shares

| | | Cumulative total returns | | Average annual total returns |

| | | 6 months | | 1 year | | 5 years | | Lifetime1 |

| | | | | | | | | |

| American Funds College 2036 Fund2 | | | — | | | | — | | | | — | | | | 2.00 | % |

| American Funds College 2033 Fund | | | 2.90 | % | | | 11.29 | % | | | — | | | | 7.20 | |

| American Funds College 2030 Fund | | | 2.10 | | | | 8.70 | | | | 7.73 | % | | | 8.74 | |

| American Funds College 2027 Fund | | | 0.77 | | | | 5.85 | | | | 6.45 | | | | 7.34 | |

| American Funds College 2024 Fund | | | –0.49 | | | | 3.00 | | | | 5.03 | | | | 5.82 | |

| American Funds College 2021 Fund | | | –1.89 | | | | –0.41 | | | | 3.27 | | | | 4.07 | |

| American Funds College Enrollment Fund3 | | | –1.62 | | | | –1.23 | | | | 0.46 | | | | 0.45 | |

| Standard & Poor’s 500 Composite Index4,5 | | | 3.82 | | | | 13.27 | | | | 12.96 | | | | 13.43 | |

| Bloomberg Barclays U.S. Aggregate Index5,6 | | | –1.87 | | | | –0.32 | | | | 1.47 | | | | 1.65 | |

| Bloomberg Barclays U.S. Aggregate 1–5 Years Index5,7 | | | –1.04 | | | | –0.45 | | | | 0.93 | | | | 0.94 | |

| 1 | Since September 14, 2012, for all funds except College 2036 Fund, which commenced operations on February 9, 2018, and College 2033 Fund, which commenced operations on March 27, 2015. |

| 2 | Six-month and one-year returns for College 2036 Fund are unavailable since the fund commenced operations on February 9, 2018. |

| 3 | College 2018 Fund merged into College Enrollment Fund on April 20, 2018. |

| 4 | Source: S&P Dow Jones Indices LLC. The Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. |

| 5 | The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. |

| 6 | Source: Bloomberg Index Services Ltd. Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. |

| 7 | Source: Bloomberg Index Services Ltd. Bloomberg Barclays U.S. Aggregate 1–5 Years Index represents securities in the one- to five-year maturity range of the U.S. investment-grade fixed-rate bond market. |

| American Funds College Target Date Series | 3 |

Investment approach for American Funds College Target Date Series

About the series

Launched in September 2012, American Funds College Target Date Series was designed to provide a low maintenance investment option for parents who want to use a 529 savings plan to save for college.

An investor simply needs to select the Target Date Series fund that most closely corresponds to the projected enrollment year of the student. American Funds takes care of the fund selection and the asset allocation, adjusting them over time as the enrollment date approaches. The only thing investors should need to worry about is making contributions.

For dates far from enrollment, the respective funds-of-funds have an emphasis on long-term growth of capital. For dates close to enrollment, the funds-of-funds have an emphasis on near-term preservation of capital.

The funds in the series have a conservative tilt, with a preference toward funds holding equities that pay dividends. The automatic rebalancing is disciplined and frequent to ensure that the funds are consistent with their stated investment objectives.

The fund’s portfolio managers don’t attempt to be tactical asset allocators —that is, buy or sell based on market changes. They work out the rebalancing schedule, or “glide path,” that would make sense through the cycle, and they stick to it.

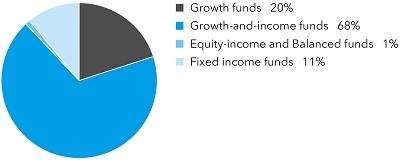

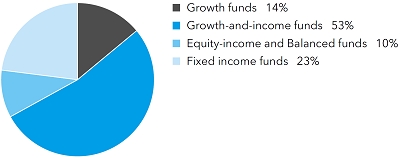

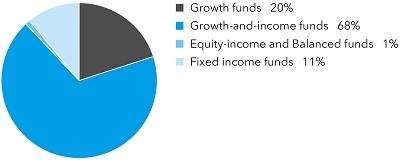

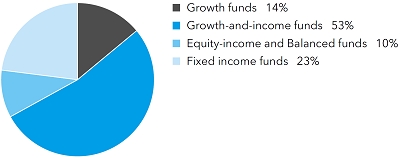

American Funds College Target Date Series glide path

The target allocations shown are as of February 9, 2018. The investment adviser anticipates that the fund will invest its assets within a range that deviates no more than 10% above or below the investment approach set forth above. For example, a 20% target allocation to growth funds is not expected to be greater than 30% or less than 10%. The investment adviser will continuously monitor the fund and may make modifications to either the investment approach or the underlying fund allocations that the investment adviser believes could benefit shareholders.

| 4 | American Funds College Target Date Series |

| American Funds College 2036 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth funds 20% | | Shares | | | Value

(000) |

|

| The Growth Fund of America, Class R-6 | | | 33,743 | | | $ | 1,748 | |

| EuroPacific Growth Fund, Class R-6 | | | 28,958 | | | | 1,647 | |

| | | | | | | | 3,395 | |

| | | | | | | | | |

| Growth-and-income funds 68% | | | | | | | | |

| Fundamental Investors, Class R-6 | | | 54,865 | | | | 3,395 | |

| Capital World Growth and Income Fund, Class R-6 | | | 65,533 | | | | 3,393 | |

| The Investment Company of America, Class R-6 | | | 65,411 | | | | 2,623 | |

| International Growth and Income Fund, Class R-6 | | | 71,719 | | | | 2,521 | |

| | | | | | | | 11,932 | |

| | | | | | | | | |

| Equity-income and Balanced funds 1% | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 6,284 | | | | 204 | |

| | | | | | | | | |

| Fixed income funds 11% | | | | | | | | |

| U.S. Government Securities Fund, Class R-6 | | | 80,909 | | | | 1,077 | |

| Capital World Bond Fund, Class R-6 | | | 43,881 | | | | 874 | |

| | | | | | | | 1,951 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $17,599,000) | | | | | | | 17,482 | |

| Other assets less liabilities 0% | | | | | | | (5 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 17,477 | |

See Notes to Financial Statements

| American Funds College Target Date Series | 5 |

| American Funds College 2033 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth funds 14% | | Shares | | | Value

(000) | |

| The Growth Fund of America, Class R-6 | | | 1,374,824 | | | $ | 71,230 | |

| EuroPacific Growth Fund, Class R-6 | | | 562,555 | | | | 31,992 | |

| | | | | | | | 103,222 | |

| |

| Growth-and-income funds 53% | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 2,678,243 | | | | 107,371 | |

| Capital World Growth and Income Fund, Class R-6 | | | 2,005,735 | | | | 103,857 | |

| Fundamental Investors, Class R-6 | | | 1,560,220 | | | | 96,546 | |

| International Growth and Income Fund, Class R-6 | | | 2,013,566 | | | | 70,777 | |

| Washington Mutual Investors Fund, Class R-6 | | | 232,151 | | | | 10,514 | |

| | | | | | | | 389,065 | |

| |

| Equity-income and Balanced funds 10% | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 2,244,942 | | | | 73,073 | |

| |

| Fixed income funds 23% | | | | | | | | |

| U.S. Government Securities Fund, Class R-6 | | | 8,288,010 | | | | 110,313 | |

| Capital World Bond Fund, Class R-6 | | | 1,837,883 | | | | 36,611 | |

| The Bond Fund of America, Class R-6 | | | 1,538,473 | | | | 19,262 | |

| | | | | | | | 166,186 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $687,467,000) | | | | | | | 731,546 | |

| Other assets less liabilities 0% | | | | | | | (217 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 731,329 | |

See Notes to Financial Statements

| 6 | American Funds College Target Date Series |

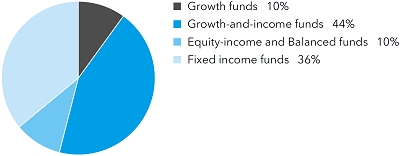

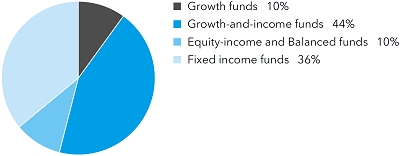

| American Funds College 2030 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth funds 10% | | Shares | | | Value

(000) | |

| The Growth Fund of America, Class R-6 | | | 2,547,055 | | | $ | 131,963 | |

| EuroPacific Growth Fund, Class R-6 | | | 85,621 | | | | 4,869 | |

| | | | | | | | 136,832 | |

| |

| Growth-and-income funds 44% | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 4,673,956 | | | | 187,379 | |

| Washington Mutual Investors Fund, Class R-6 | | | 2,960,300 | | | | 134,072 | |

| Capital World Growth and Income Fund, Class R-6 | | | 2,529,404 | | | | 130,973 | |

| International Growth and Income Fund, Class R-6 | | | 3,609,541 | | | | 126,875 | |

| Fundamental Investors, Class R-6 | | | 231,326 | | | | 14,314 | |

| American Mutual Fund, Class R-6 | | | 257,214 | | | | 10,289 | |

| | | | | | | | 603,902 | |

| |

| Equity-income and Balanced funds 10% | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 4,398,436 | | | | 143,169 | |

| |

| Fixed income funds 36% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 17,979,505 | | | | 225,104 | |

| U.S. Government Securities Fund, Class R-6 | | | 14,831,168 | | | | 197,403 | |

| Capital World Bond Fund, Class R-6 | | | 3,223,307 | | | | 64,208 | |

| American Funds Mortgage Fund, Class R-6 | | | 1,635,141 | | | | 16,024 | |

| | | | | | | | 502,739 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $1,311,205,000) | | | | | | | 1,386,642 | |

| Other assets less liabilities 0% | | | | | | | (523 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 1,386,119 | |

See Notes to Financial Statements

| American Funds College Target Date Series | 7 |

| American Funds College 2027 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth-and-income funds 38% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 4,784,511 | | | $ | 191,380 | |

| Washington Mutual Investors Fund, Class R-6 | | | 3,511,352 | | | | 159,029 | |

| International Growth and Income Fund, Class R-6 | | | 3,067,678 | | | | 107,829 | |

| | | | | | | | 458,238 | |

| |

| Equity-income and Balanced funds 15% | | | | | | | | |

| American Funds Global Balanced Fund, Class R-6 | | | 5,065,254 | | | | 164,874 | |

| The Income Fund of America, Class R-6 | | | 590,404 | | | | 13,450 | |

| | | | | | | | 178,324 | |

| |

| Fixed income funds 47% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 23,409,249 | | | | 293,084 | |

| American Funds Mortgage Fund, Class R-6 | | | 13,676,509 | | | | 134,030 | |

| U.S. Government Securities Fund, Class R-6 | | | 8,020,016 | | | | 106,746 | |

| Intermediate Bond Fund of America, Class R-6 | | | 1,856,868 | | | | 24,325 | |

| | | | | | | | 558,185 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $1,165,081,000) | | | | | | | 1,194,747 | |

| Other assets less liabilities 0% | | | | | | | (478 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 1,194,269 | |

See Notes to Financial Statements

| 8 | American Funds College Target Date Series |

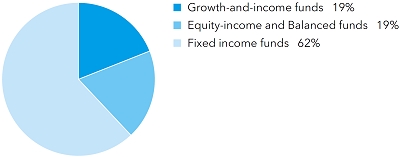

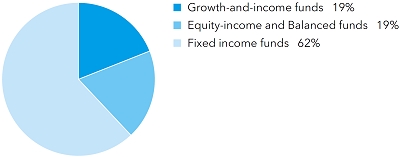

| American Funds College 2024 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth-and-income funds 19% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 6,483,546 | | | $ | 259,342 | |

| Washington Mutual Investors Fund, Class R-6 | | | 337,914 | | | | 15,304 | |

| International Growth and Income Fund, Class R-6 | | | 285,715 | | | | 10,043 | |

| | | | | | | | 284,689 | |

| |

| Equity-income and Balanced funds 19% | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 11,350,619 | | | | 258,567 | |

| American Funds Global Balanced Fund, Class R-6 | | | 457,560 | | | | 14,894 | |

| | | | | | | | 273,461 | |

| |

| Fixed income funds 62% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 27,798,240 | | | | 348,034 | |

| American Funds Mortgage Fund, Class R-6 | | | 29,846,129 | | | | 292,492 | |

| Intermediate Bond Fund of America, Class R-6 | | | 19,662,940 | | | | 257,584 | |

| U.S. Government Securities Fund, Class R-6 | | | 701,429 | | | | 9,336 | |

| | | | | | | | 907,446 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $1,460,357,000) | | | | | | | 1,465,596 | |

| Other assets less liabilities 0% | | | | | | | (619 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 1,464,977 | |

Investments in affiliates

This holding is an affiliate of the fund under the Investment Company Act of 1940 since the fund holds 5% or more of its outstanding voting shares. Further details on this holding and related transactions during the six months ended April 30, 2018, appear below.

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

gain

(000) | | | Net

unrealized

depreciation

(000) | | | Dividend

income

(000) | | | Value of

affiliate at

4/30/2018

(000) | |

| Fixed income funds 20% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6 | | | 25,252,829 | | | 4,593,300 | | | — | | | 29,846,129 | | $ | — | | | $ | (8,753 | ) | | $ | 2,492 | | | $ | 292,492 | |

See Notes to Financial Statements

| American Funds College Target Date Series | 9 |

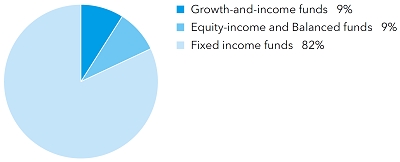

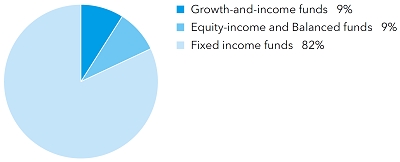

| American Funds College 2021 Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Growth-and-income funds 9% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 3,553,482 | | | $ | 142,139 | |

| |

| Equity-income and Balanced funds 9% | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 6,215,875 | | | | 141,598 | |

| |

| Fixed income funds 82% | | | | | | | | |

| Intermediate Bond Fund of America, Class R-6 | | | 41,179,716 | | | | 539,454 | |

| American Funds Mortgage Fund, Class R-6 | | | 40,012,927 | | | | 392,127 | |

| The Bond Fund of America, Class R-6 | | | 22,494,859 | | | | 281,636 | |

| Short-Term Bond Fund of America, Class R-6 | | | 7,450,609 | | | | 72,941 | |

| | | | | | | | 1,286,158 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $1,607,096,000) | | | | | | | 1,569,895 | |

| Other assets less liabilities 0% | | | | | | | (722 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 1,569,173 | |

Investments in affiliates

This holding is an affiliate of the fund under the Investment Company Act of 1940 since the fund holds 5% or more of its outstanding voting shares. Further details on this holding and related transactions during the six months ended April 30, 2018, appear below.

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

loss

(000) | | | Net

unrealized

depreciation

(000) | | | Dividend

income

(000) | | | Value of

affiliate at

4/30/2018

(000) | |

| Fixed income funds 25% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Funds Mortgage Fund, Class R-6 | | | 41,569,309 | | | 2,897,306 | | | 4,453,688 | | | 40,012,927 | | $ | (257 | ) | | $ | (13,140 | ) | | $ | 3,675 | | | $ | 392,127 | |

See Notes to Financial Statements

| 10 | American Funds College Target Date Series |

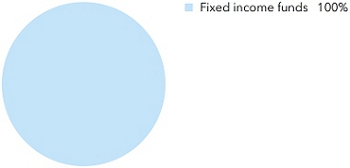

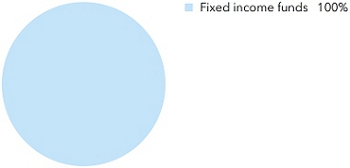

| American Funds College Enrollment Fund | unaudited |

| Investment portfolio April 30, 2018 | |

| Fixed income funds 100% | | Shares | | | Value

(000) | |

| Short-Term Bond Fund of America, Class R-6 | | | 49,546,514 | | | $ | 485,061 | |

| Intermediate Bond Fund of America, Class R-6 | | | 37,027,509 | | | | 485,060 | |

| American Funds Mortgage Fund, Class R-6 | | | 42,425,105 | | | | 415,766 | |

| | | | | | | | 1,385,887 | |

| |

| Total investment securities 100% (cost: $1,429,405,000) | | | | | | | 1,385,887 | |

| Other assets less liabilities 0% | | | | | | | (845 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 1,385,042 | |

Investments in affiliates

These holdings are affiliates of the fund under the Investment Company Act of 1940 since the fund holds 5% or more of each fund’s outstanding voting shares. Further details on these holdings and related transactions during the six months ended April 30, 2018, appear below.

| | | Beginning

shares | | Additions | | Reductions | | Ending

shares | | Net

realized

loss

(000) | | | Net

unrealized

depreciation

(000) | | | Dividend

income

(000) | | | Value of

affiliates at

4/30/2018

(000) | |

| Fixed income funds 65% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Term Bond Fund of America, Class R-6 | | | 13,012,887 | | | 38,046,381 | | | 1,512,754 | | | 49,546,514 | | $ | (134 | ) | | $ | (8,539 | ) | | $ | 1,268 | | | $ | 485,061 | |

| American Funds Mortgage Fund, Class R-6 | | | 10,955,513 | | | 32,688,376 | | | 1,218,784 | | | 42,425,105 | | | (116 | ) | | | (15,012 | ) | | | 1,119 | | | | 415,766 | |

| Total 65% | | | | | | | | | | | | | | $ | (250 | ) | | $ | (23,551 | ) | | $ | 2,387 | | | $ | 900,827 | |

See Notes to Financial Statements

| American Funds College Target Date Series | 11 |

Financial statements

Statements of assets and liabilities

at April 30, 2018

| | | College 2036 Fund | | | College 2033 Fund | |

| | | | | | | |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers | | $ | 17,482 | | | $ | 731,546 | |

| Affiliated issuers | | | — | | | | — | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | — | | | | — | |

| Sales of fund’s shares | | | 522 | | | | 1,304 | |

| Dividends | | | 2 | | | | 252 | |

| Total assets | | | 18,006 | | | | 733,102 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 524 | | | | 950 | |

| Repurchases of fund’s shares | | | — | * | | | 606 | |

| Services provided by related parties | | | 4 | | | | 177 | |

| Trustees’ deferred compensation | | | — | * | | | 1 | |

| Other | | | 1 | | | | 39 | |

| Total liabilities | | | 529 | | | | 1,773 | |

| Net assets at April 30, 2018 | | $ | 17,477 | | | $ | 731,329 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | $ | 17,583 | | | $ | 667,524 | |

| Undistributed net investment income | | | 11 | | | | 1,555 | |

| Undistributed (accumulated) net realized gain (loss) | | | — | | | | 18,171 | |

| Net unrealized (depreciation) appreciation | | | (117 | ) | | | 44,079 | |

| Net assets at April 30, 2018 | | $ | 17,477 | | | $ | 731,329 | |

| | | | | | | | | |

| Investment securities, at cost: | | | | | | | | |

| Unaffiliated issuers | | $ | 17,599 | | | $ | 687,467 | |

| Affiliated issuers | | | — | | | | — | |

| | | | | | | | | |

Shares of beneficial interest issued and outstanding

(no stated par value) — unlimited shares authorized | | | | | | | | |

| | | | | | | | | |

| Class 529-A: | Net assets | | $ | 14,375 | | | $ | 594,778 | |

| | Shares outstanding | | | 1,409 | | | | 50,628 | |

| | Net asset value per share | | $ | 10.20 | | | $ | 11.75 | |

| Class 529-C: | Net assets | | $ | 957 | | | $ | 70,743 | |

| | Shares outstanding | | | 94 | | | | 6,077 | |

| | Net asset value per share | | $ | 10.19 | | | $ | 11.64 | |

| Class 529-E: | Net assets | | $ | 874 | | | $ | 18,818 | |

| | Shares outstanding | | | 86 | | | | 1,607 | |

| | Net asset value per share | | $ | 10.20 | | | $ | 11.71 | |

| Class 529-T: | Net assets | | $ | 10 | | | $ | 11 | |

| | Shares outstanding | | | 1 | | | | 1 | |

| | Net asset value per share | | $ | 10.20 | | | $ | 11.75 | |

| Class 529-F-1: | Net assets | | $ | 1,261 | | | $ | 46,979 | |

| | Shares outstanding | | | 123 | | | | 3,985 | |

| | Net asset value per share | | $ | 10.21 | | | $ | 11.79 | |

| * | Amount less than one thousand. |

See Notes to Financial Statements

| 12 | American Funds College Target Date Series |

unaudited

(dollars and shares in thousands, except per-share amounts)

| College 2030 Fund | | | College 2027 Fund | | | College 2024 Fund | | | College 2021 Fund | | | College Enrollment Fund | |

| | | | | | | | | | | | | | |

| $ | 1,386,642 | | | $ | 1,194,747 | | | $ | 1,173,104 | | | $ | 1,177,768 | | | $ | 485,060 | |

| | — | | | | — | | | | 292,492 | | | | 392,127 | | | | 900,827 | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | 383 | |

| | 1,764 | | | | 954 | | | | 2,014 | | | | 2,284 | | | | 838 | |

| | 886 | | | | 1,118 | | | | 1,742 | | | | 2,388 | | | | 2,541 | |

| | 1,389,292 | | | | 1,196,819 | | | | 1,469,352 | | | | 1,574,567 | | | | 1,389,649 | |

| | | | | | | | | | | | | | | | | | | |

| | 1,966 | | | | 1,773 | | | | 3,386 | | | | 3,908 | | | | 2,541 | |

| | 684 | | | | 299 | | | | 370 | | | | 765 | | | | 1,217 | |

| | 446 | | | | 412 | | | | 537 | | | | 634 | | | | 760 | |

| | 3 | | | | 2 | | | | 3 | | | | 3 | | | | 5 | |

| | 74 | | | | 64 | | | | 79 | | | | 84 | | | | 84 | |

| | 3,173 | | | | 2,550 | | | | 4,375 | | | | 5,394 | | | | 4,607 | |

| $ | 1,386,119 | | | $ | 1,194,269 | | | $ | 1,464,977 | | | $ | 1,569,173 | | | $ | 1,385,042 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 1,276,701 | | | $ | 1,142,388 | | | $ | 1,435,836 | | | $ | 1,592,409 | | | $ | 1,427,061 | |

| | 4,096 | | | | 4,980 | | | | 6,996 | | | | 7,124 | | | | 1,751 | |

| | 29,885 | | | | 17,235 | | | | 16,906 | | | | 6,841 | | | | (252 | ) |

| | 75,437 | | | | 29,666 | | | | 5,239 | | | | (37,201 | ) | | | (43,518 | ) |

| $ | 1,386,119 | | | $ | 1,194,269 | | | $ | 1,464,977 | | | $ | 1,569,173 | | | $ | 1,385,042 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 1,311,205 | | | $ | 1,165,081 | | | $ | 1,157,570 | | | $ | 1,199,398 | | | $ | 502,905 | |

| | — | | | | — | | | | 302,787 | | | | 407,698 | | | | 926,500 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 1,076,884 | | | $ | 898,284 | | | $ | 1,078,495 | | | $ | 1,087,275 | | | $ | 906,264 | |

| | 79,104 | | | | 71,718 | | | | 92,058 | | | | 99,531 | | | | 93,872 | |

| $ | 13.61 | | | $ | 12.53 | | | $ | 11.72 | | | $ | 10.92 | | | $ | 9.65 | |

| $ | 186,990 | | | $ | 173,869 | | | $ | 230,851 | | | $ | 300,532 | | | $ | 291,730 | |

| | 13,929 | | | | 14,056 | | | | 19,940 | | | | 27,814 | | | | 30,282 | |

| $ | 13.42 | | | $ | 12.37 | | | $ | 11.58 | | | $ | 10.81 | | | $ | 9.63 | |

| $ | 38,372 | | | $ | 31,416 | | | $ | 49,347 | | | $ | 57,394 | | | $ | 56,091 | |

| | 2,835 | | | | 2,524 | | | | 4,229 | | | | 5,276 | | | | 5,824 | |

| $ | 13.54 | | | $ | 12.45 | | | $ | 11.67 | | | $ | 10.88 | | | $ | 9.63 | |

| $ | 11 | | | $ | 11 | | | $ | 10 | | | $ | 10 | | | $ | 10 | |

| | 1 | | | | 1 | | | | 1 | | | | 1 | | | | 1 | |

| $ | 13.61 | | | $ | 12.53 | | | $ | 11.72 | | | $ | 10.92 | | | $ | 9.65 | |

| $ | 83,862 | | | $ | 90,689 | | | $ | 106,274 | | | $ | 123,962 | | | $ | 130,947 | |

| | 6,138 | | | | 7,211 | | | | 9,041 | | | | 11,316 | | | | 13,530 | |

| $ | 13.66 | | | $ | 12.58 | | | $ | 11.75 | | | $ | 10.95 | | | $ | 9.68 | |

| American Funds College Target Date Series | 13 |

Statements of operations

for the six months ended April 30, 2018

| | | College 2036 Fund1 | | | College 2033 Fund | |

| | | | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends: | | | | | | | | |

| Unaffiliated issuers | | $ | 19 | | | $ | 5,902 | |

| Affiliated issuers | | | — | | | | — | |

| | | | 19 | | | | 5,902 | |

| Fees and expenses2: | | | | | | | | |

| Distribution services | | | 5 | | | | 921 | |

| Transfer agent services | | | 1 | | | | 359 | |

| 529 plan services | | | 1 | | | | 212 | |

| Reports to shareholders | | | — | 3 | | | 18 | |

| Registration statement and prospectus | | | 19 | | | | 95 | |

| Trustees’ compensation | | | — | 3 | | | 1 | |

| Auditing and legal | | | — | 3 | | | 3 | |

| Custodian | | | — | 3 | | | 3 | |

| Other | | | — | | | | 2 | |

| Total fees and expenses before reimbursements | | | 26 | | | | 1,614 | |

| Less reimbursements of fees and expenses: | | | | | | | | |

| Miscellaneous fee reimbursements | | | 18 | | | | — | |

| Total fees and expenses after reimbursements | | | 8 | | | | 1,614 | |

| Net investment income | | | 11 | | | | 4,288 | |

| | | | | | | | | |

| Net realized gain and unrealized depreciation: | | | | | | | | |

| Net realized gain (loss) on sale of investments: | | | | | | | | |

| Unaffiliated issuers | | | — | | | | — | |

| Affiliated issuers | | | — | | | | — | |

| Capital gain distributions received | | | — | | | | 18,172 | |

| | | | — | | | | 18,172 | |

| Net unrealized depreciation on investments: | | | | | | | | |

| Unaffiliated issuers | | | (117 | ) | | | (7,765 | ) |

| Affiliated issuers | | | — | | | | — | |

| | | | (117 | ) | | | (7,765 | ) |

| Net realized gain and unrealized depreciation | | | (117 | ) | | | 10,407 | |

| Net (decrease) increase in net assets resulting from operations | | $ | (106 | ) | | $ | 14,695 | |

| 1 | For the period February 9, 2018, commencement of operations, through April 30, 2018. |

| 2 | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

| 3 | Amount less than one thousand. |

See Notes to Financial Statements

| 14 | American Funds College Target Date Series |

unaudited

(dollars in thousands)

| College 2030 Fund | | | College 2027 Fund | | | College 2024 Fund | | | College 2021 Fund | | | College Enrollment Fund | |

| | | | | | | | | | | | | | |

| $ | 12,535 | | | $ | 12,122 | | | $ | 13,503 | | | $ | 11,745 | | | $ | 1,257 | |

| | — | | | | — | | | | 2,492 | | | | 3,675 | | | | 2,387 | |

| | 12,535 | | | | 12,122 | | | | 15,995 | | | | 15,420 | | | | 3,644 | |

| | | | | | | | | | | | | | | | | | | |

| | 2,033 | | | | 1,847 | | | | 2,378 | | | | 2,778 | | | | 756 | |

| | 749 | | | | 643 | | | | 792 | | | | 856 | | | | 306 | |

| | 433 | | | | 373 | | | | 460 | | | | 498 | | | | 132 | |

| | 38 | | | | 33 | | | | 40 | | | | 43 | | | | 11 | |

| | 107 | | | | 84 | | | | 85 | | | | 84 | | | | 22 | |

| | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 1 | |

| | 3 | | | | 3 | | | | 5 | | | | 5 | | | | 1 | |

| | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | |

| | 4 | | | | 4 | | | | 4 | | | | 5 | | | | 1 | |

| | 3,372 | | | | 2,992 | | | | 3,769 | | | | 4,274 | | | | 1,233 | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | 3,372 | | | | 2,992 | | | | 3,769 | | | | 4,274 | | | | 1,233 | |

| | 9,163 | | | | 9,130 | | | | 12,226 | | | | 11,146 | | | | 2,411 | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | 2,162 | | | | — | | | | 1,850 | | | | (200 | ) |

| | — | | | | — | | | | — | | | | (257 | ) | | | (250 | ) |

| | 29,893 | | | | 15,080 | | | | 16,918 | | | | 5,258 | | | | 262 | |

| | 29,893 | | | | 17,242 | | | | 16,918 | | | | 6,851 | | | | (188 | ) |

| | | | | | | | | | | | | | | | | | | |

| | (14,564 | ) | | | (20,401 | ) | | | (30,177 | ) | | | (34,985 | ) | | | (15,145 | ) |

| | — | | | | — | | | | (8,753 | ) | | | (13,140 | ) | | | (23,551 | ) |

| | (14,564 | ) | | | (20,401 | ) | | | (38,930 | ) | | | (48,125 | ) | | | (38,696 | ) |

| | 15,329 | | | | (3,159 | ) | | | (22,012 | ) | | | (41,274 | ) | | | (38,884 | ) |

| $ | 24,492 | | | $ | 5,971 | | | $ | (9,786 | ) | | $ | (30,128 | ) | | $ | (36,473 | ) |

| American Funds College Target Date Series | 15 |

Statements of changes in net assets

| | | College 2036 Fund | | | College 2033 Fund | |

| | | | | | | |

| | | Period | | | Six months | | | | |

| | | ended | | | ended | | | Year ended | |

| | | April 30 | | | April 30 | | | October 31 | |

| | | 20181,2 | | | 20182 | | | 2017 | |

| Operations: | | | | | | | | | | | | |

| Net investment income | | $ | 11 | | | $ | 4,288 | | | $ | 5,264 | |

| Net realized gain (loss) | | | — | | | | 18,172 | | | | 6,295 | |

| Net unrealized (depreciation) appreciation | | | (117 | ) | | | (7,765 | ) | | | 49,131 | |

| Net (decrease) increase in net assets resulting from operations | | | (106 | ) | | | 14,695 | | | | 60,690 | |

| | | | | | | | | | | | | |

| Dividends and distributions paid to shareholders: | | | | | | | | | | | | |

| Dividends from net investment income: | | | | | | | | | | | | |

| Class 529-A | | | — | | | | (5,455 | ) | | | (2,681 | ) |

| Class 529-B3 | | | — | | | | — | | | | — | 4 |

| Class 529-C | | | — | | | | (272 | ) | | | (256 | ) |

| Class 529-E | | | — | | | | (139 | ) | | | (70 | ) |

| Class 529-T | | | — | | | | — | 4 | | | — | |

| Class 529-F-1 | | | — | | | | (459 | ) | | | (221 | ) |

| Total dividends from net investment income | | | — | | | | (6,325 | ) | | | (3,228 | ) |

| Distributions from net realized gains: | | | | | | | | | | | | |

| Short-term net realized gains: | | | | | | | | | | | | |

| Class 529-A | | | — | | | | — | | | | — | |

| Class 529-B3 | | | — | | | | — | | | | — | |

| Class 529-C | | | — | | | | — | | | | — | |

| Class 529-E | | | — | | | | — | | | | — | |

| Class 529-T | | | — | | | | — | | | | — | |

| Class 529-F-1 | | | — | | | | — | | | | — | |

| Long-term net realized gains: | | | | | | | | | | | | |

| Class 529-A | | | — | | | | (4,916 | ) | | | (1,704 | ) |

| Class 529-B3 | | | — | | | | — | | | | — | 4 |

| Class 529-C | | | — | | | | (634 | ) | | | (283 | ) |

| Class 529-E | | | — | | | | (156 | ) | | | (53 | ) |

| Class 529-T | | | — | | | | — | 4 | | | — | |

| Class 529-F-1 | | | — | | | | (380 | ) | | | (131 | ) |

| Total distributions from net realized gains | | | — | | | | (6,086 | ) | | | (2,171 | ) |

| Total dividends and distributions paid to shareholders | | | — | | | | (12,411 | ) | | | (5,399 | ) |

| | | | | | | | | | | | | |

| Net capital share transactions | | | 17,583 | | | | 196,901 | | | | 263,666 | |

| | | | | | | | | | | | | |

| Total increase (decrease) in net assets | | | 17,477 | | | | 199,185 | | | | 318,957 | |

| | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | |

| Beginning of period | | | — | | | | 532,144 | | | | 213,187 | |

| End of period | | $ | 17,477 | | | $ | 731,329 | | | $ | 532,144 | |

| Undistributed net investment income | | $ | 11 | | | $ | 1,555 | | | $ | 3,592 | |

| 1 | For the period February 9, 2018, commencement of operations, through April 30, 2018. |

| 2 | Unaudited. |

| 3 | Class 529-B shares were fully liquidated on May 5, 2017. |

| 4 | Amount less than one thousand. |

See Notes to Financial Statements

| 16 | American Funds College Target Date Series |

(dollars in thousands)

| College 2030 Fund | | | College 2027 Fund | | | College 2024 Fund | | | College 2021 Fund | | | College Enrollment Fund | |

| | | | | | | | | | | | | | |

| Six months | | | | | | Six months | | | | | | Six months | | | | | | Six months | | | | | | Six months | | | | |

| ended | | | Year ended | | | ended | | | Year ended | | | ended | | | Year ended | | | ended | | | Year ended | | | ended | | | Year ended | |

| April 30 | | | October 31 | | | April 30 | | | October 31 | | | April 30 | | | October 31 | | | April 30 | | | October 31 | | | April 30 | | | October 31 | |

| 20182 | | | 2017 | | | 20182 | | | 2017 | | | 20182 | | | 2017 | | | 20182 | | | 2017 | | | 20182 | | | 2017 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9,163 | | | $ | 14,838 | | | $ | 9,130 | | | $ | 13,541 | | | $ | 12,226 | | | $ | 18,176 | | | $ | 11,146 | | | $ | 17,237 | | | $ | 2,411 | | | $ | 3,480 | |

| | 29,893 | | | | 30,781 | | | | 17,242 | | | | 26,740 | | | | 16,918 | | | | 15,634 | | | | 6,851 | | | | 15,373 | | | | (188 | ) | | | 1,716 | |

| | (14,564 | ) | | | 89,129 | | | | (20,401 | ) | | | 49,341 | | | | (38,930 | ) | | | 44,621 | | | | (48,125 | ) | | | 4,495 | | | | (38,696 | ) | | | (4,945 | ) |

| | 24,492 | | | | 134,748 | | | | 5,971 | | | | 89,622 | | | | (9,786 | ) | | | 78,431 | | | | (30,128 | ) | | | 37,105 | | | | (36,473 | ) | | | 251 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (12,635 | ) | | | (10,523 | ) | | | (11,670 | ) | | | (8,804 | ) | | | (15,501 | ) | | | (12,177 | ) | | | (13,893 | ) | | | (13,046 | ) | | | (2,792 | ) | | | (3,236 | ) |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | (1,013 | ) | | | (1,187 | ) | | | (1,141 | ) | | | (1,193 | ) | | | (1,699 | ) | | | (1,958 | ) | | | (1,524 | ) | | | (2,730 | ) | | | — | | | | (668 | ) |

| | (383 | ) | | | (316 | ) | | | (349 | ) | | | (280 | ) | | | (621 | ) | | | (501 | ) | | | (636 | ) | | | (599 | ) | | | (160 | ) | | | (199 | ) |

| | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | |

| | (1,140 | ) | | | (804 | ) | | | (1,314 | ) | | | (812 | ) | | | (1,706 | ) | | | (1,168 | ) | | | (1,783 | ) | | | (1,608 | ) | | | (605 | ) | | | (744 | ) |

| | (15,171 | ) | | | (12,830 | ) | | | (14,474 | ) | | | (11,089 | ) | | | (19,527 | ) | | | (15,804 | ) | | | (17,836 | ) | | | (17,983 | ) | | | (3,557 | ) | | | (4,847 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (49 | ) | | | — | | | | (496 | ) | | | (355 | ) | | | (98 | ) | | | (147 | ) | | | (145 | ) | | | — | | | | — | | | | (19 | ) |

| | — | | | | — | | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | | | | — | | | | — | 4 |

| | (9 | ) | | | — | | | | (102 | ) | | | (86 | ) | | | (22 | ) | | | (38 | ) | | | (41 | ) | | | — | | | | — | | | | (9 | ) |

| | (1 | ) | | | — | | | | (18 | ) | | | (13 | ) | | | (5 | ) | | | (7 | ) | | | (8 | ) | | | — | | | | — | | | | (1 | ) |

| | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | | | | — | |

| | (4 | ) | | | — | | | | (49 | ) | | | (30 | ) | | | (10 | ) | | | (13 | ) | | | (16 | ) | | | — | | | | — | | | | (4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (22,934 | ) | | | (17,295 | ) | | | (18,795 | ) | | | (14,372 | ) | | | (10,266 | ) | | | (11,549 | ) | | | (8,474 | ) | | | (10,363 | ) | | | (365 | ) | | | (452 | ) |

| | — | | | | (1 | ) | | | — | | | | (10 | ) | | | — | | | | (11 | ) | | | — | | | | (13 | ) | | | — | | | | (1 | ) |

| | (4,183 | ) | | | (3,548 | ) | | | (3,842 | ) | | | (3,472 | ) | | | (2,288 | ) | | | (3,028 | ) | | | (2,408 | ) | | | (3,496 | ) | | | (115 | ) | | | (216 | ) |

| | (822 | ) | | | (606 | ) | | | (668 | ) | | | (532 | ) | | | (474 | ) | | | (539 | ) | | | (450 | ) | | | (538 | ) | | | (26 | ) | | | (33 | ) |

| | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | | | | — | 4 | | | — | |

| | (1,797 | ) | | | (1,184 | ) | | | (1,858 | ) | | | (1,184 | ) | | | (1,001 | ) | | | (993 | ) | | | (946 | ) | | | (1,136 | ) | | | (67 | ) | | | (87 | ) |

| | (29,799 | ) | | | (22,634 | ) | | | (25,828 | ) | | | (20,054 | ) | | | (14,164 | ) | | | (16,325 | ) | | | (12,488 | ) | | | (15,546 | ) | | | (573 | ) | | | (822 | ) |

| | (44,970 | ) | | | (35,464 | ) | | | (40,302 | ) | | | (31,143 | ) | | | (33,691 | ) | | | (32,129 | ) | | | (30,324 | ) | | | (33,529 | ) | | | (4,130 | ) | | | (5,669 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 196,770 | | | | 271,791 | | | | 182,110 | | | | 258,936 | | | | 202,543 | | | | 312,713 | | | | 180,859 | | | | 336,677 | | | | 1,056,329 | | | | (53,699 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 176,292 | | | | 371,075 | | | | 147,779 | | | | 317,415 | | | | 159,066 | | | | 359,015 | | | | 120,407 | | | | 340,253 | | | | 1,015,726 | | | | (59,117 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1,209,827 | | | | 838,752 | | | | 1,046,490 | | | | 729,075 | | | | 1,305,911 | | | | 946,896 | | | | 1,448,766 | | | | 1,108,513 | | | | 369,316 | | | | 428,433 | |

| $ | 1,386,119 | | | $ | 1,209,827 | | | $ | 1,194,269 | | | $ | 1,046,490 | | | $ | 1,464,977 | | | $ | 1,305,911 | | | $ | 1,569,173 | | | $ | 1,448,766 | | | $ | 1,385,042 | | | $ | 369,316 | |

| $ | 4,096 | | | $ | 10,104 | | | $ | 4,980 | | | $ | 10,324 | | | $ | 6,996 | | | $ | 14,297 | | | $ | 7,124 | | | $ | 13,814 | | | $ | 1,751 | | | $ | 2,897 | |

| American Funds College Target Date Series | 17 |

| Notes to financial statements | unaudited |

1. Organization

American Funds College Target Date Series (the “series”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The series consists of seven funds (the “funds”) — American Funds College 2036 Fund (“College 2036 Fund”), American Funds College 2033 Fund (“College 2033 Fund”), American Funds College 2030 Fund (“College 2030 Fund”), American Funds College 2027 Fund (“College 2027 Fund”), American Funds College 2024 Fund (“College 2024 Fund”), American Funds College 2021 Fund (“College 2021 Fund”) and American Funds College Enrollment Fund (“College Enrollment Fund”). The assets of each fund are segregated, with each fund accounted for separately.

Each fund in the series is designed for investors who plan to attend college in, or close to, the year designated in the fund’s name. Depending on its proximity to its target date, each fund will seek to achieve the following objectives to varying degrees: growth, income and preservation of capital. As each fund approaches its target date, it will increasingly emphasize income and preservation of capital by investing a greater portion of its assets in fixed income, equity-income and balanced funds. When each fund reaches its target date, it will primarily invest in fixed income funds and may merge into the College Enrollment Fund, which principally invests in fixed income funds. Each fund will attempt to achieve its investment objectives by investing in a mix of American Funds (the “underlying funds”) in different combinations and weightings. Capital Research and Management Company (“CRMC”), the series’ investment adviser, is also the investment adviser of the underlying funds.

Each fund in the series has five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1). The funds’ share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Class 529-A | | Up to 2.50% for College Enrollment Fund; up to 4.25% for all other funds | | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | | None |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | Class 529-C converts to Class 529-A after 10 years* |

| Class 529-E | | None | | None | | None |

| Class 529-T† | | Up to 2.50% | | None | | None |

| Class 529-F-1 | | None | | None | | None |

| * | Effective December 1, 2017. |

| † | Class 529-T shares are not available for purchase. |

Holders of all share classes of each fund have equal pro rata rights to the assets, dividends and liquidation proceeds of each fund held. Each share class of each fund has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution and transfer agent services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class of each fund.

2. Significant accounting policies

Each fund in the series is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. Each fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the series’ investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The funds follow the significant accounting policies in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the funds as of the date the trades are executed. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. Dividend income is recognized on the ex-dividend date.

| 18 | American Funds College Target Date Series |

Fees and expenses — The fees and expenses of the underlying funds are not included in the fees and expenses reported for each of the funds; however, they are indirectly reflected in the valuation of each of the underlying funds. These fees are included in the net effective expense ratios that are provided as supplementary information in the financial highlights tables.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes of each fund based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class of each fund.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on each fund’s ex-dividend date.

3. Valuation

Security valuation — The net asset value of each share class of each fund is calculated based on the reported net asset values of the underlying funds in which each fund invests. The net asset value of each underlying fund is calculated based on the policies and procedures of the underlying fund contained in each underlying fund’s statement of additional information. Generally, the funds and the underlying funds determine the net asset value of each share class as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Processes and structure — The series’ board of trustees has delegated authority to the series’ investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The series’ board and audit committee also regularly review reports that describe fair value determinations and methods. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The series’ investment adviser classifies each fund’s assets and liabilities into three levels based on the method used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. At April 30, 2018, all of the investment securities held by each fund were classified as Level 1.

4. Risk factors

Investing in the funds may involve certain risks including, but not limited to, those described below.

Allocation risk — Investments in the fund are subject to risks related to the investment adviser’s allocation choices. The selection of the underlying funds and the allocation of the fund’s assets could cause the fund to lose value or its results to lag relevant benchmarks or other funds with similar objectives.

Fund structure — The fund invests in underlying funds and incurs expenses related to the underlying funds. In addition, investors in the fund will incur fees to pay for certain expenses related to the operations of the fund. An investor holding the underlying funds directly and in the same proportions as the fund would incur lower overall expenses but would not receive the benefit of the portfolio management and other services provided by the fund.

Underlying fund risks — Because the fund’s investments consist of underlying funds, the fund’s risks are directly related to the risks of the underlying funds. For this reason, it is important to understand the risks associated with investing in the underlying funds, as described on the following pages.

| American Funds College Target Date Series | 19 |

Market conditions — The prices of, and the income generated by, the common stocks, bonds and other securities held by the underlying funds may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the underlying funds may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in stocks — Investing in stocks may involve larger price swings and greater potential for loss than other types of investments. As a result, the value of the underlying funds may be subject to sharp, short-term declines in value. Income provided by an underlying fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the underlying fund invests. As the fund nears its target date, a decreasing proportion of the fund’s assets will be invested in underlying funds that invest primarily in stocks. Accordingly, these risks are expected to be more significant the further the fund is removed from its target date and are expected to lessen as the fund approaches its target date.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by an underlying fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the underlying fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The underlying funds’ investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks. These risks will be more significant as the fund approaches its target date because a greater proportion of the fund’s assets will consist of underlying funds that primarily invest in bonds.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in lower quality, higher yielding debt securities rated Ba1 or below and BB+ or below by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser or unrated but determined by the investment adviser to be of equivalent quality, which securities are sometimes referred to as “junk bonds.”

Investing in small companies — Investing in smaller companies may pose additional risks. For example, it is often more difficult to value or dispose of small company stocks and more difficult to obtain information about smaller companies than about larger companies. Furthermore, smaller companies often have limited product lines, operating histories, markets and/or financial resources, may be dependent on one or a few key persons for management, and can be more susceptible to losses. Moreover, the prices of their stocks may be more volatile than stocks of larger, more established companies.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations or revenues outside the U.S., may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the U.S. In addition, the value of investments outside the U.S. may be reduced by foreign taxes, including foreign withholding taxes on interest and

| 20 | American Funds College Target Date Series |

dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by an underlying fund. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the underlying fund’s net asset value. Additionally, there may be increased settlement risks for transactions in local securities.

Investing in mortgage-related and other asset-backed securities — Mortgage-related securities, such as mortgage-backed securities, and other asset-backed securities, include debt obligations that represent interests in pools of mortgages or other income-bearing assets, such as consumer loans or receivables. Such securities often involve risks that are different from or more acute than the risks associated with investing in other types of debt securities. Mortgage-backed and other asset-backed securities are subject to changes in the payment patterns of borrowers of the underlying debt. When interest rates fall, borrowers are more likely to refinance or prepay their debt before its stated maturity. This may result in the underlying fund having to reinvest the proceeds in lower yielding securities, effectively reducing the fund’s income. Conversely, if interest rates rise and borrowers repay their debt more slowly than expected, the time in which the mortgage-backed and other asset-backed securities are paid off could be extended, reducing the underlying fund’s cash available for reinvestment in higher yielding securities.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates. Securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Investing in future delivery contracts — An underlying fund may enter into contracts, such as to-be-announced contracts and mortgage dollar rolls, that involve an underlying fund selling mortgage-related securities and simultaneously contracting to repurchase similar securities for delivery at a future date at a predetermined price. This can increase the underlying fund’s market exposure, and the market price of the securities that the underlying fund contracts to repurchase could drop below their purchase price. While an underlying fund can preserve and generate capital through the use of such contracts by, for example, realizing the difference between the sale price and the future purchase price, the income generated by the underlying fund may be reduced by engaging in such transactions. In addition, these transactions may increase the turnover rate of the underlying fund.

Investing in derivatives — The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. Changes in the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and a derivative instrument may expose the underlying fund to losses in excess of its initial investment. Derivatives may be difficult for the underlying fund to buy or sell at an opportune time or price and may be difficult to terminate or otherwise offset. The underlying fund’s use of derivatives may result in losses to the underlying fund, and investing in derivatives may reduce the underlying fund’s returns and increase the underlying fund’s price volatility. The underlying fund’s counterparty to a derivative transaction (including, if applicable, the underlying fund’s clearing broker, the derivatives exchange or the clearinghouse) may be unable or unwilling to honor its financial obligations in respect of the transaction.

Management — The investment adviser to the series and to the underlying funds actively manages each underlying fund’s investments. Consequently, the underlying funds are subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause an underlying fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

| American Funds College Target Date Series | 21 |

5. Taxation and distributions

Federal income taxation — Each fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The funds are not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended April 30, 2018, none of the funds had a liability for any unrecognized tax benefits. Each fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in their respective statements of operations. During the period, none of the funds incurred any significant interest or penalties.

Each fund’s tax returns are not subject to examination by federal, state and, if applicable, non-U.S. tax authorities after the expiration of each jurisdiction’s statute of limitations, which is generally three years after the date of filing but can be extended in certain jurisdictions.

Distributions — Distributions paid to shareholders are based on each fund’s net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; deferred expenses and cost of investments sold. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the funds for financial reporting purposes.

Dividends from net investment income and distributions from short-term net realized gains shown in the funds’ statements of changes in net assets are considered ordinary income distributions for tax purposes. Distributions from long-term net realized gains in the funds’ statements of changes in net assets are considered long-term capital gain distributions for tax purposes.

Additional tax basis disclosures for each fund are as follows (dollars in thousands):

| | | College

2036 Fund | | | College

2033 Fund | | | College

2030 Fund | | | College

2027 Fund | | | College

2024 Fund | | | College

2021 Fund | | | College

Enrollment Fund | |

| As of October 31, 2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Undistributed ordinary income | | $ | — | | | $ | 3,593 | | | $ | 10,163 | | | $ | 10,986 | | | $ | 14,423 | | | $ | 14,024 | | | $ | 2,896 | |

| Undistributed long-term capital gains | | | — | | | | 6,085 | | | | 29,734 | | | | 25,160 | | | | 14,027 | | | | 12,270 | | | | 573 | |

| As of April 30, 2018 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross unrealized appreciation on investments | | | 1 | | | | 48,533 | | | | 90,490 | | | | 46,767 | | | | 30,685 | | | | 6,486 | | | | 43 | |

| Gross unrealized depreciation on investments | | | (118 | ) | | | (4,453 | ) | | | (15,053 | ) | | | (17,101 | ) | | | (25,446 | ) | | | (43,883 | ) | | | (43,631 | ) |

| Net unrealized (depreciation) appreciation on investments | | | (117 | ) | | | 44,080 | | | | 75,437 | | | | 29,666 | | | | 5,239 | | | | (37,397 | ) | | | (43,588 | ) |

| Cost of investments | | | 17,599 | | | | 687,466 | | | | 1,311,205 | | | | 1,165,081 | | | | 1,460,357 | | | | 1,607,292 | | | | 1,429,475 | |

| 22 | American Funds College Target Date Series |

6. Fees and transactions with related parties

CRMC, the series’ investment adviser, is the parent company of American Funds Distributors®, Inc. (“AFD”), the principal underwriter of the series’ shares, and American Funds Service Company® (“AFS”), the series’ transfer agent. CRMC, AFD and AFS are considered related parties to the series.

Investment advisory services — The series has an investment advisory and service agreement with CRMC. CRMC receives fees from the underlying funds for investment advisory services. These fees are included in the net effective expense ratios that are provided as supplementary information in the financial highlights tables.

Miscellaneous fee reimbursements — CRMC has agreed to reimburse a portion of miscellaneous fees and expenses of College 2036 Fund during its startup period. At its discretion the adviser may elect to extend, modify or terminate the reimbursements. Fees and expenses in College 2036 Fund’s statement of operations are presented gross of any reimbursement from CRMC. The amounts reimbursed by CRMC are reflected as miscellaneous fee reimbursements.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are further described below:

Distribution services — The series has plans of distribution for all share classes of each fund. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.50% to 1.00% as noted in this section. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. Each share class may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

| Share class | | Currently approved limits | | Plan limits |

| Class 529-A | | | 0.30 | % | | | 0.50 | % |

| Class 529-C | | | 1.00 | | | | 1.00 | |

| Class 529-E | | | 0.50 | | | | 0.75 | |

| Classes 529-T and 529-F-1 | | | 0.25 | | | | 0.50 | |

For Class 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. This share class reimburses AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit is not exceeded. As of April 30, 2018, unreimbursed expenses subject to reimbursement for the funds’ Class 529-A shares were as follows (dollars in thousands):

| Fund | | Class 529-A | |

| College 2036 Fund | | $ | 3 | |

| College 2033 Fund | | | — | |

| College 2030 Fund | | | — | |

| College 2027 Fund | | | — | |

| College 2024 Fund | | | — | |

| College 2021 Fund | | | — | |

| College Enrollment Fund | | | — | |

Transfer agent services — The series has a shareholder services agreement with AFS under which the funds compensate AFS for providing transfer agent services to all of the funds’ share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the funds reimburse AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The series has an administrative services agreement with CRMC for providing administrative services to all of the funds’ share classes. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide services to fund shareholders. CRMC receives administrative services fees of 0.05% of average daily net assets from the Class R-6 shares of the underlying funds for administrative services provided to the series. These fees are included in the net effective expense ratios that are provided as supplementary information in the financial highlights tables.

| American Funds College Target Date Series | 23 |