UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22698

KraneShares Trust

(Exact name of registrant as specified in charter)

280 Park Avenue, 32nd Floor

New York, New York 10017

(Address of principal executive offices) (Zip code)

Jonathan Krane

KraneShares Trust

280 Park Avenue, 32nd Floor

New York, New York 10017

(Name and address of agent for service)

Copy to:

Stacy L. Fuller

K&L Gates LLP

1601 K Street NW

Washington, DC 20006-1600

Registrant’s telephone number, including area code: (212) 933-0393

Date of fiscal year end: March 31, 2023

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (the “Act”) [17 CFR § 270.30e-1], is attached hereto. |

| (b) | Not applicable to the Registrant. |

| |  |

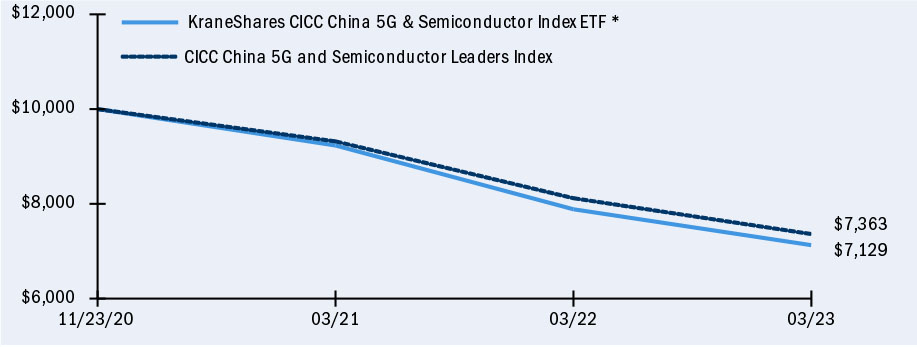

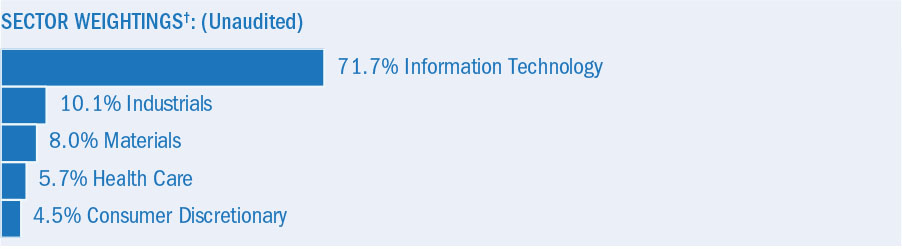

| | Annual Report KraneShares CICC China Leaders 100 Index ETF KraneShares CSI China Internet ETF KraneShares Bosera MSCI China A 50 Connect Index ETF KraneShares Bloomberg China Bond Inclusion Index ETF KraneShares MSCI All China Index ETF KraneShares MSCI One Belt One Road Index ETF KraneShares Emerging Markets Consumer Technology Index ETF KraneShares MSCI China Clean Technology Index ETF KraneShares Electric Vehicles and Future Mobility Index ETF KraneShares MSCI All China Health Care Index ETF KraneShares Asia Pacific High Income Bond ETF KraneShares Emerging Markets Healthcare Index ETF KraneShares MSCI Emerging Markets ex China Index ETF KraneShares MSCI China ESG Leaders Index ETF KraneShares CICC China 5G & Semiconductor Index ETF KraneShares CICC China Consumer Leaders Index ETF KraneShares SSE STAR Market 50 Index ETF KraneShares Hang Seng TECH Index ETF KraneShares China Innovation ETF KraneShares S&P Pan Asia Dividend Aristocrats Index ETF KraneShares China Internet and Covered Call Strategy ETF March 31, 2023 | | |

Table of Contents

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that KraneShares Trust uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month year ended June 30, are available (i) without charge, upon request, by calling 855-857-2638; and (ii) on the Commission’s website at http://www.sec.gov.

Fund shares may only be purchased or redeemed from a Fund in Creation Unit aggregations. Investors who cannot transact in Creation Units of a Fund’s shares must buy or sell Fund shares in the secondary market at their market price, which may be at a premium or discount to a Fund’s net asset value, with the assistance of a broker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying Fund shares and receive less than net asset value when selling Fund shares.

Shareholder Letter (Unaudited)

Dear Shareholders:

We are pleased to send you the Annual Report for the KraneShares Trust exchange-traded funds (ETFs) for the 12-month period ended March 31, 2023 (the Period). For the Period, the ETFs delivered the following returns:

| Fund | | Fund

Return* | | | Underlying

Index

Return** | | | Morningstar

Peer Group

Median

Return | |

| KraneShares CICC China Leaders 100 Index ETF (KFYP) | | | -13.15 | % | | | -12.51 | %(a) | | | -8.11 | %(1) |

| KraneShares CSI China Internet ETF (KWEB) | | | 5.86 | % | | | 6.36 | %(b) | | | -8.11 | %(1) |

| KraneShares Bosera MSCI China A 50 Connect ETF (KBA) | | | -12.63 | % | | | -11.57 | %(c) | | | -8.11 | %(1) |

| KraneShares Bloomberg China Bond Inclusion Index ETF (KBND) | | | -3.98 | % | | | -4.82 | %(d) | | | -1.42 | %(2) |

| KraneShares MSCI All China Index ETF (KALL) | | | -6.44 | % | | | -6.44 | %(e) | | | -8.11 | %(1) |

| KraneShares MSCI One Belt One Road Index ETF (OBOR) | | | -14.98 | % | | | -14.69 | %(f) | | | -6.71 | %(3) |

| KraneShares Emerging Markets Consumer Technology Index ETF (KEMQ) | | | -15.30 | % | | | -14.47 | %(g) | | | -9.39 | %(4) |

| KraneShares MSCI China Clean Technology Index ETF (KGRN) | | | -20.71 | % | | | -21.68 | %(h) | | | -8.11 | %(1) |

| KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) | | | -21.78 | % | | | -21.56 | %(i) | | | -5.11 | %(5) |

| KraneShares MSCI All China Health Care Index ETF (KURE) | | | -12.65 | % | | | -12.43 | %(j) | | | -8.11 | %(1) |

| KraneShares Asia Pacific High Income Bond ETF (KHYB) | | | -0.44 | % | | | N/A | | | | -6.55 | %(6) |

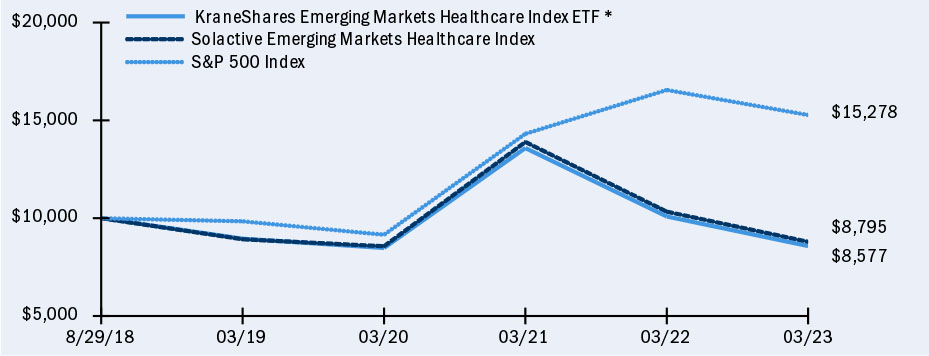

| KraneShares Emerging Markets Healthcare Index ETF (KMED) | | | -14.97 | % | | | -14.90 | %(k) | | | -9.39 | %(4) |

| KraneShares MSCI Emerging Markets ex China Index ETF (KEMX) | | | -12.12 | % | | | -13.32 | %(l) | | | -9.39 | %(4) |

| KraneShares MSCI China ESG Leaders Index ETF (KESG) | | | -10.38 | % | | | -9.62 | %(m) | | | -8.11 | %(1) |

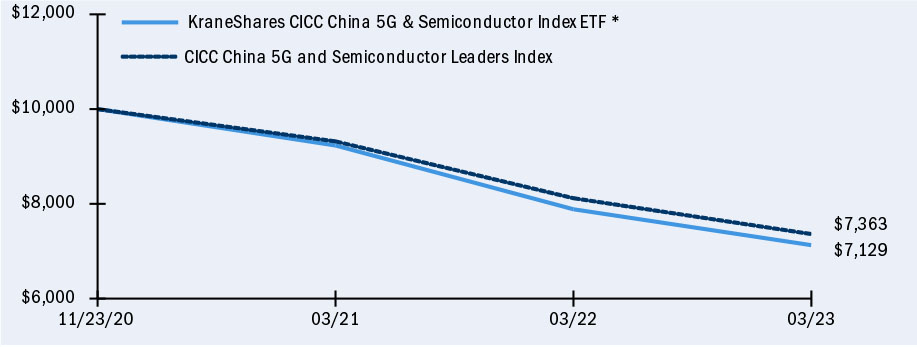

| KraneShares CICC China 5G & Semiconductor Index ETF (KFVG) | | | -9.62 | % | | | -9.32 | %(n) | | | -8.11 | %(1) |

| KraneShares CICC China Consumer Leaders Index ETF (KBUY) | | | 1.64 | % | | | 2.32 | %(o) | | | -8.11 | %(1) |

| KraneShares SSE STAR Market 50 Index ETF (KSTR) | | | -9.97 | % | | | -8.05 | %(p) | | | -8.11 | %(1) |

| KraneShares Hang Seng TECH Index ETF (KTEC) | | | -4.37 | % | | | -5.15 | %(q) | | | -8.11 | %(1) |

| KraneShares China Innovation ETF (KGRO) | | | -6.60 | % | | | N/A | | | | -8.11 | %(1) |

| KraneShares S&P Pan Asia Dividend Aristocrats Index ETF (KDIV) | | | 6.08 | %^ | | | 6.36 | %^(r) | | | -5.14 | %(7) |

| KraneShares China Internet and Covered Call Strategy ETF (KLIP) | | | -3.56 | %^ | | | N/A | | | | -8.11 | %(1) |

| * | Return based on net asset value as of March 31, 2023. |

| ** | Return as of March 31, 2023. |

| ^ | Return period since Fund inception (less than one-year period). |

Shareholder Letter (Unaudited) (continued)

| (a) | The CSI CICC Select 100 Index. |

| (b) | The CSI Overseas China Internet Index. |

| (c) | The MSCI China A 50 Connect Index. |

| (d) | The Bloomberg China Inclusion Focused Bond Index. |

| (e) | The MSCI China All Shares Index. |

| (f) | The MSCI Global China Infrastructure Exposure Index. |

| (g) | The Solactive Emerging Markets Consumer Technology Index. |

| (h) | The MSCI China IMI Environment 10/40 Index. |

| (i) | The Bloomberg Electric Vehicles Index. |

| (j) | The MSCI All Shares Health Care 10/40 Index. |

| (k) | The Solactive Emerging Markets Healthcare Index. |

| (l) | The MSCI Emerging Markets ex China Index. |

| (m) | The MSCI China ESG Leaders 10/40 Index. |

| (n) | The CICC China 5G and Semiconductor Leaders Index. |

| (o) | The CICC China Consumer Leaders Index. |

| (p) | The Shanghai Stock Exchange Science and Technology Innovation Board 50 Index. |

| (q) | The Hang Seng TECH Index. |

| (r) | The S&P Pan Asia Dividend Aristocrats Index. |

Morningstar Peer Group Information

| | Morningstar Peer Group Median | | Morningstar Peer Group Name | | Morningstar Peer Group Description |

| (1) | -8.11% | | U.S. ETF China Region | | The Morningstar Fund China Region Category portfolios invest almost exclusively in stocks from China, Taiwan, and Hong Kong. These portfolios invest at least 70% of total assets in equities and invest at least 75% of stock assets in one specific region or a combination of China and/or Taiwan. |

| | | | | | |

| (2) | -1.42% | | U.S. ETF Emerging Markets Local Currency Bond | | The Morningstar Fund Emerging Markets Local Currency Bond Category portfolios invest more than 65% of their assets in foreign bonds from developing countries in the local currency. Funds in this category have a mandate to maintain exposure to currencies of emerging markets. The largest portion of the emerging markets bond market comes from Latin America, followed by Eastern Europe, Africa, the Middle East, and Asia. |

| | | | | | |

| (3) | -6.71% | | U.S. ETF Infrastructure | | The Morningstar Fund Infrastructure Category portfolios invest more than 60% of their assets in stocks of companies engaged in infrastructure activities. Industries considered to be part of the infrastructure sector include oil & gas midstream; waste management; airports; integrated shipping; railroads; shipping & ports; trucking; engineering & construction; infrastructure operations; and the utilities sector. |

Shareholder Letter (Unaudited) (continued)

| | Morningstar Peer Group Median | | Morningstar Peer Group Name | | Morningstar Peer Group Description |

| (4) | -9.39% | | U.S. ETF Diversified Emerging Markets | | The Morningstar Fund Diversified Emerging Markets Category portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than those of the Middle East, Africa, or Europe. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income instruments among emerging markets. |

| | | | | | |

| (5) | -5.11% | | U.S. ETF Industrials | | The Morningstar Fund Industrials Category portfolios seek capital appreciation by investing inequity securities of U.S. or non-U.S. companies that are engaged in services related to cyclical industries. This includes and is not limited to companies in aerospace and defense, automotive, chemicals, construction, environmental services, machinery, paper, and transportation. |

| | | | | | |

| (6) | -6.55% | | U.S. ETF Emerging Markets Bond | | The Morningstar Fund Emerging Markets Bond portfolios invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East, and Asia make up the rest. |

| | | | | | |

| (7) | -5.14% | | U.S. ETF Diversified Pacific/Asia | | The Morningstar Fund Diversified Pacific/Asia Category portfolios have a wider investment range than other Asia-oriented portfolios. These portfolios can invest throughout the Pacific Rim, including Australia and New Zealand. As a results, country weightings for these portfolios vary tremendously, though most retain some exposure to Japan and Hong Kong. These portfolios invest at least 70% of their total assets in equities and invest at least 75% of assets in Pacific countries, including at least 10% in Japan. |

We are encouraged by recent developments in China’s capital markets. The challenging macroeconomic environment and resulting volatility in global equity markets that ensued over the past year led many U.S. and global investors to seek diversified sources of return, including China equities.

| ● | We believe that China’s capital markets will continue to grow and become an essential element of a well-designed investment portfolio. |

| ● | We believe that investors should have low-cost, transparent tools to obtain exposure to China’s equity and fixed income markets. |

| ● | China’s National Party Congress (NPC), held last year, resulted in positive policy changes including the removal of COVID restrictions and the provision of support for the real estate industry. |

| ● | We believe the further development of China’s capital markets offers a long-term value proposition. |

Shareholder Letter (Unaudited) (concluded)

| ● | We are dedicated to helping investors obtain more complete passive and active market exposures and more balanced investment portfolios that include exposure to China. |

Thank you for investing with us.

Jonathan Krane, CEO

March 31, 2023

Management Discussion of Fund Performance (Unaudited)

KraneShares CICC China Leaders 100 Index ETF

The KraneShares CICC China Leaders 100 Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the CSI CICC Select 100 Index (the Underlying Index).

The Underlying Index takes a smart-beta approach to systematically investing in companies listed in Mainland China. This quantitative approach reflects CICC’s top down and bottom-up research process, seeking to deliver the 100 leading companies in Mainland China.

China A Share Leaders Review

During the 12-month period ended March 31, 2023 (the Period), the Fund’s holdings were somewhat skewed towards growth and consumer industries. As a result, they were negatively impacted by China’s pandemic lockdowns at the beginning of the Period. Furthermore, declines in the prices of equities of real estate developers in connection with the government’s campaign to deleverage real estate developers also negatively impacted the Fund’s performance for the Period.

Still, during the Period the Fund outperformed the broader China equity market, as represented by the MSCI China Index. Further, we remain confident in the smart-beta approach to investing in China’s onshore (A Share/Mainland) equity market and CICC’s research process as represented in the Underlying Index, including because the Underlying Index generated a return profile that was significantly less volatile than the MSCI China Index during the Period.

The best performing sector within the Fund was Communication Services. Meanwhile, companies in the Real Estate sector detracted the most of any single sector from the Fund’s performance.

For the Period, the NAV of the Fund decreased by -13.15% while the Underlying Index decreased by -12.51%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CICC China Leaders 100 Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares CICC China Leaders 100 Index ETF | | | -13.15 | % | | | -12.86 | %‡ | | | 4.78 | %‡ | | | 5.20 | %‡ | | | 0.47 | %‡ | | | 0.67 | %‡ | | | 7.13 | %‡ | | | 7.08 | %‡ |

| Hybrid KFYP Index (Net)** | | | N/A | | | | -12.51 | %‡ | | | N/A | | | | 6.54 | %‡ | | | N/A | | | | 1.66 | %‡ | | | N/A | | | | 7.47 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.68 | %‡ |

| * | The Fund commenced operations on July 22, 2013. |

| ** | The Hybrid KFYP Index (Net) consists of the CSI China Overseas Five Year Plan Index from the inception of the Fund through May 31, 2016, the Zacks New China Index from June 1, 2016 through November 1, 2018, and the CSI CICC Select 100 Index going forward. From June 1, 2016 to November 1, 2018, the Fund sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the Zacks New China Index. Prior to June 1, 2016, the Fund was known as the KraneShares CSI New China ETF and sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the CSI Overseas China Five Year Plan Index. Hybrid KFYP Index (Net) reflects reinvested dividends net of withholding taxes, but reflects no deduction for fees, expenses, or other taxes. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CICC China Leaders 100 Index ETF (concluded)

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.68%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CSI China Internet ETF

The KraneShares CSI China Internet ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the CSI Overseas China Internet Index (the Underlying Index).

The Underlying Index is designed to measure the performance of the investable universe of publicly traded, China-based companies whose primary business or businesses are in the Internet and Internet-related sectors (China Internet Companies), as defined by the index sponsor, China Securities Index Co., Ltd. (CSI).

China Internet Review

Although global markets saw declines due to rising global interest rates, U.S. and Hong Kong-listed stocks of Chinese internet issuers saw positive catalysts during the 12-month period ended March 31, 2023 (the Period) as many of the geopolitical and policy-related issues that had been weighing on the sector in prior periods were resolved. We believe that the two most important developments for the sector during the Period were the China government’s removal of pandemic restrictions and the achievement of full access to the audit books of U.S.-listed, China-based firms by the U.S. Public Company Accounting Oversight Board (PCAOB).

Following the National Party Congress, held in October of 2022, China’s government removed all domestic, pandemic-related restrictions. This development improved the outlook for China’s consumer market and led to a rebound in the stock price of certain China Internet Companies.

On December 15th, 2022, the PCAOB announced that the agency had secured complete access to inspect and investigate China-based firms and their auditors for the first time in history. This announcement was significant for China Internet Companies, many of which are listed publicly in the U.S., because the U.S. Congress in 2022, required U.S.-listed foreign companies to allow the PCAOB to inspect their audit books to remain listed publicly on U.S. exchanges. This development significantly reduced the risk of the American depositary receipts (ADRs) of China Internet Companies being delisted from U.S. exchanges.

We see three potential positive catalysts for China Internet Companies in the year to come:

| ● | We believe that The People’s Bank of China (PBOC) is likely to maintain a dovish monetary policy stance, to the benefit of growth equities. |

| ● | China retail sales increased +10.6% year-over-year (YoY) in March, setting the stage for a potential rebound in consumer spending this year, which we would expect to benefit China Internet Companies. |

| ● | Alibaba’s recent restructuring into six separate business groups, each individually able to raise capital, indicates the company’s focus on generating shareholder value; and a resulting IPO would likely result in at least one new issuer, which would be included in the Fund in the future. |

China capital market overview (April 1, 2022 to March 31, 2023)

| ● | China’s equity market, as measured by the MSCI China All Shares Index, was down for the Period, returning -6.44%, while China’s currency, the Renminbi (RMB) depreciated -8.4% against the U.S. dollar. |

| ● | The best-performing sectors across China’s equity markets included Energy (+23.08%), Communication Services (+8.93%), and Utilities (+0.18%). |

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CSI China Internet ETF (continued)

| ● | The worst-performing sectors across China’s equity markets included Real Estate (-29.55%), Materials (-18.28%), and Information Technology (-10.98%). |

For the Period, the NAV of the Fund increased by 5.86%, while the Underlying Index increased by 6.36%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CSI China Internet ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares CSI China Internet ETF | | | 5.86 | % | | | 9.40 | %‡ | | | -9.30 | %‡ | | | -9.38 | %‡ | | | -10.61 | %‡ | | | -10.67 | %‡ | | | 3.83 | %‡ | | | 3.81 | %‡ |

| CSI Overseas China Internet | | | N/A | | | | 6.36 | %‡ | | | N/A | | | | -8.78 | %‡ | | | N/A | | | | -10.18 | %‡ | | | N/A | | | | 4.04 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.77 | %‡ |

| * | The Fund commenced operations on July 31, 2013. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.69%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares CSI China Internet ETF (concluded)

Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bosera MSCI China A 50 Connect Index ETF

The KraneShares Bosera MSCI China A 50 Connect Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China A 50 Connect Index (the Underlying Index).

The Underlying Index is constructed from the MSCI China A Index (the Parent Index), a broad-based benchmark index, which captures large and mid-cap China A shares listed on the Shanghai and Shenzhen exchanges and accessible through the Northbound Stock Connect channel. The Underlying Index aims to reflect the performance of the 50 largest securities representing each Global Industry Classification Standard (GICS®) sector and reflecting the sector weight allocation of the Parent Index.

China A Share Review

Several macroeconomic headwinds impacted the Fund’s performance during the 12-month period ended March 31, 2023 (the Period), including a slump in consumer demand stemming from pandemic restrictions in China and the strengthening of the U.S. dollar due to the most aggressive interest rate hiking cycle in history from the U.S. Federal Reserve, which weighed on the value of assets denominated in currencies other than the U.S. Dollar, including China’s Renminbi. Although pandemic restrictions were removed during the period, benefiting consumer-oriented holdings, the Fund’s holdings in other sectors, such as Information Technology and Financials, nonetheless detracted from its overall performance for the period.

We see three potential positive catalysts for China’s A share equity market in the year to come:

| ● | We believe that there will be continued government support for key industries that are captured by the Fund’s holdings. |

| ● | The potential relative attractiveness of China A shares due to the dovish monetary policy stance we expect from the People’s Bank of China (PBOC) as compared to other global central banks. |

| ● | China’s retail sales increased +10.6% year-over-year in March, setting the stage for a rebound in consumer spending during the coming year, which should, in turn, lead to increased revenue for some of the companies held by the Fund, which would contribute to Fund performance. |

China capital market overview (April 1, 2022 to March 31, 2023)

| ● | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period returning -6.44%, while China’s currency, the renminbi (RMB) depreciated -8.4% against the U.S. dollar. |

| ● | The best-performing sectors across China’s equity markets included Energy (+23.08%), Communication Services (+8.93%), and Utilities (+0.18%). |

| ● | The worst-performing sectors across China’s equity markets included Real Estate (-29.55%), Materials (-18.28%), and Information Technology (-10.98%). |

The Fund had exposure to Communication Services and Consumer Discretionary, which contributed positively to its performance, and to Real Estate and Information Technology, which detracted from its performance. The Fund’s performance was also negatively impacted by the decline in the value of China’s currency, the Renminbi, compared to the U.S. dollar.

For the Period, the NAV of the Fund decreased by -12.63% while the Underlying Index decreased by -11.57%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees and currency translations.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bosera MSCI China A 50 Connect Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares Bosera MSCI China A 50 Connect Index ETF | | | -12.63 | % | | | -12.10 | %‡ | | | 6.45 | %‡ | | | 6.33 | %‡ | | | 1.71 | %‡ | | | 1.34 | %‡ | | | 6.03 | %‡ | | | 6.00 | %‡ |

| Hybrid KBA Index (Net)** | | | N/A | | | | -11.57 | %‡ | | | N/A | | | | 7.24 | %‡ | | | N/A | | | | 1.96 | %‡ | | | N/A | | | | 7.04 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.13 | %‡ |

| * | The Fund commenced operations on March 4, 2014. |

| ** | The Hybrid KBA Index consists of the MSCI China A Index from the inception of the Fund through October 23, 2014, the MSCI China A International Index from October 23, 2014 through December 26, 2017, the MSCI China A Inclusion Index from December 27, 2017 to May 29, 2019, the MSCI China A Index from May 29, 2019 to January 5, 2022, and the MSCI China A 50 Connect Index going forward. From October 23, 2014 through December 26, 2017, the Fund sought investment results that, before fees and expenses, corresponded to the price and yield performance of the MSCI China A International Index. Prior to October 23, 2014, the Fund sought investment results that, before fees and expenses, corresponded to the price and yield performance of the MSCI China A Index. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bosera MSCI China A 50 Connect Index ETF (concluded)

representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s gross operating expense ratio is 0.79% and its net expense ratio is 0.56% due to a Fee Waiver whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee by 0.23% of the Fund’s average daily net assets until August 1, 2023. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bloomberg China Bond Inclusion Index ETF

The KraneShares Bloomberg China Bond Inclusion Index ETF (the Fund) seeks to provide investment results that, before expenses and fees, correspond generally to the price and yield performance of the Bloomberg China Inclusion Focused Bond Index (the Underlying Index).

The underlying index is designed to track the performance of China’s onshore, renminbi-denominated bond market.

China Investment Grade & Government Bond Market Review

China’s high-quality bonds moved lower during the 12-month period ended March 31, 2023 (the Period) primarily due to global central banks hiking interest rates while China kept rates steady, making China’s risk-free rate less attractive to investors. Nonetheless, as the People’s Bank of China’s target rates remain relatively unchanged since the end of 2021, high quality bonds were remarkably stable during the period, especially compared to high quality bonds in the U.S., realized losses on which resulted in the collapse or near-collapse of multiple banks.

We see three potential positive catalysts for China’s investment grade and government bond market going forward:

| ● | Increased demand for China’s currency, the Renminbi, stemming from the recent commitments from multiple countries, especially oil-exporters, to transact in the currency as opposed to the U.S. dollar. |

| ● | The Renminbi may also appreciate as the U.S. dollar comes down from its recent highs and as the U.S. Federal Reserve could pivot on rate hikes in the event of a recession or other market signals. |

| ● | China’s government is currently urging businesses to increase borrowing, which may lead to an increase in issuance in the high-quality corporate bond segment, which is the focus of the Fund. |

For the Period, the NAV of the Fund decreased by -3.98% while the Underlying Index decreased by -4.82%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees and the Fund sampling the Underlying Index rather than replicating it.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bloomberg China Bond Inclusion Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares Bloomberg China Bond Inclusion Index ETF | | | -3.98 | % | | | -4.04 | %‡ | | | 3.44 | %‡ | | | 3.44 | %‡ | | | 0.97 | %‡ | | | 0.90 | %‡ | | | 1.50 | %‡ | | | 1.42 | %‡ |

| Bloomberg China Inclusion Focused Bond Index | | | N/A | | | | -4.82 | %‡ | | | N/A | | | | 4.37 | %‡ | | | N/A | | | | 1.60 | %‡ | | | N/A | | | | 2.29 | %‡ |

| S&P U.S. Treasury Bill 3-6 Month Index** | | | N/A | | | | 2.57 | %‡ | | | N/A | | | | 0.90 | %‡ | | | N/A | | | | 1.49 | %‡ | | | N/A | | | | 1.12 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 10.67 | %‡ |

| Bloomberg Global Aggregate Index | | | N/A | | | | -8.07 | %‡ | | | N/A | | | | -3.43 | %‡ | | | N/A | | | | -1.34 | %‡ | | | N/A | | | | 0.05 | %‡ |

| * | The Fund commenced operations on December 2, 2014. |

| ** | Index added to provide a fixed income benchmark for fixed income funds. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Bloomberg China Bond Inclusion Index ETF (concluded)

assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s gross operating expense ratio is 0.68% and its net expense ratio is 0.48% due to a Fee Waiver Agreement whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee by 0.20% of the Fund’s average daily net assets until August 1, 2023. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI All China Index ETF

The KraneShares MSCI All China Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China All Shares Index (the Underlying Index).

The Underlying Index seeks to track the equity market performance of companies based in China and listed in Mainland China, Hong Kong, and the United States. Companies available for inclusion must be headquartered in China and meet the market capitalization minimums required by the MSCI Global Investable Market Indexes Methodology.

Broad China Equity Market Review

Offshore China equities outpaced onshore China (Mainland/A Shares) during the 12-month period ended March 31, 2023 (the Period) due to a strong rebound from 2022 lows. Meanwhile, onshore China (Mainland/A Shares) exhibited significantly less volatility, though underperformed. We believe the past 12 months’ performance disparity between onshore China (Mainland/A Shares) and offshore China demonstrates why a balanced allocation to both is important to achieve a well-rounded China allocation.

We see three potential positive catalysts for broad China equities in the year to come:

| ● | Ample liquidity in Mainland China, driven by what we expect to be dovish central bank policy in China, in contrast to the hawkish policy in the U.S. and Europe. |

| ● | The recent resolution of multiple macroeconomic headwinds that had weighed on China’s offshore equity markets in past periods. These headwinds included China’s restrictive COVID policy and the achievement of full access to the audit books of U.S.-listed China-based firms by the Public Company Accounting Oversight Board, significantly lowering the risk that certain ADRs in the Fund’s portfolio may be delisted from U.S. exchanges. |

| ● | China retail sales increased +10.6% year-over-year in March, setting the stage for a rebound in consumer spending this year, which may benefit both onshore China (Mainland/A Shares) and offshore China equities. |

China capital market overview (April 1, 2022 to March 31, 2023)

| ● | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period returning -6.44%, while China’s currency, the renminbi (RMB) depreciated -8.4% against the U.S. dollar. |

| ● | The best performing sectors across China’s equity markets included Energy (+23.08%), Communication Services (+8.93%), and Utilities (+0.18%). |

| ● | The worst performing sectors across China’s equity markets included Real Estate (-29.55%), Materials (-18.28%), and Information Technology (-10.98%). |

Within the Fund, as a result, the best-performing sectors for the Period were Energy and Communication Services. Meanwhile, the worst-performing sectors were Real Estate and Materials.

For the Period, the NAV of the Fund decreased by -6.44% while the Underlying Index decreased by -6.44%.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI All China Index ETF (continued)

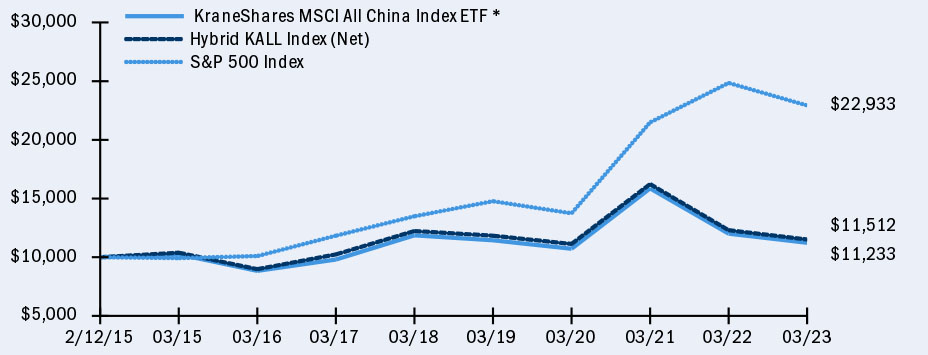

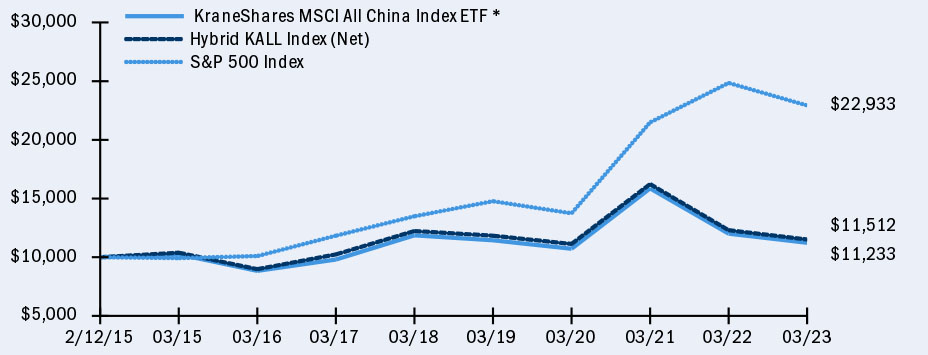

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares MSCI All China Index ETF | | | -6.44 | % | | | -5.01 | %‡ | | | 1.55 | %‡ | | | 1.72 | %‡ | | | -1.09 | %‡ | | | -1.33 | %‡ | | | 1.44 | %‡ | | | 1.48 | %‡ |

| Hybrid KALL Index (Net)** | | | N/A | | | | -6.44 | %‡ | | | N/A | | | | 1.13 | %‡ | | | N/A | | | | -1.21 | %‡ | | | N/A | | | | 1.75 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 10.74 | %‡ |

| * | The Fund commenced operations on February 12, 2015. |

| ** | The Hybrid KALL Index (Net) consists of the FTSE Emerging incl. China Overseas non-R/QFII GDP Weighted Index from the inception of the Fund through July 31, 2018, and the MSCI China All Shares Index going forward. Prior to July 31, 2018, the Fund was known as the KraneShares FTSE Emerging Markets Plus ETF and sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the FTSE Emerging incl. China Overseas non-R/QFII GDP Weighted Index. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI All China Index ETF (concluded)

expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s gross operating expense ratio is 0.68% and its net expense ratio is 0.48% due to an a Fee Waiver whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee by 0.20% of the Fund’s average daily net assets until August 1, 2023. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI One Belt One Road Index ETF

The KraneShares MSCI One Belt One Road Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI Global China Infrastructure Exposure Index (the Underlying Index).

The Underlying Index aims to identify potential beneficiaries of the “Belt & Road” or “One Belt One Road” (OBOR) initiative based on how their geography, revenue, and sector attributes align with the broad theme. OBOR seeks to capture the economic growth and monetize the potential upside for the companies involved in China’s One Belt One Road initiative.

Emerging Markets/Belt & Road Review

China launched the “Belt & Road Initiative” or “One Belt One Road” (OBOR) in 2013. The Belt & Road Initiative is an infrastructure development strategy that was designed by the government to allow China to export any excess infrastructure construction capacity to other regions of the world.

The emerging markets (EM) economies included in China’s Belt & Road Initiative were adversely impacted by a steady increase in the value of the U.S. dollar during the 12-month period ended March 31, 2023 (the Period). In this regard, their U.S. dollar-denominated debts became more of a burden across the board, although certain commodity-exporting EM countries in the Belt & Road Initiative contemporaneously benefitted from rising oil prices.

The challenges faced by Belt & Road Initiative countries and issuers during the Period have included economic crises in Pakistan and Sri Lanka. These crises have threatened ongoing projects in both countries. In response, China’s Export-Import Bank has extended the deadline for repayment of principal and interest on loans to Sri Lanka by two years, and the China Development Bank has extended another $700 million in loans to Pakistan to help the country whether further challenges. Compounding the challenges for Belt & Road Initiative countries, however, has been the unclear status of Italy as a signatory within the Initiative.

Nonetheless, OBOR-related projects are likely to continue as various EM economies emerge from economic crises, and Italy’s new center-right ruling coalition may clarify the status of the partnership. Moreover, OBOR-funded energy projects in the Middle East may continue to benefit from China’s reopening and heightened prices for oil and gas.

We see three potential positive catalysts for OBOR-related equities in the year to come:

| ● | The International Monetary Fund has predicted that the growth gap between developed and emerging markets will reverse in favor of EM for the first time in nearly a decade, forecasting growth of 4% for EM in 2023 compared to 1.2% for developed markets. |

| ● | Recent events suggest to us that key state-backed lenders are ready and willing to extend additional credit and restructure debt agreements when necessary to ensure that projects are completed, which could benefit OBOR-related companies. |

| ● | The significant rise in the value of the U.S. dollar over the past year makes borrowing in Renminbi more attractive to developing countries, which may lead to continued demand for China-originated financing for infrastructure projects across the developing world, a key component of the OBOR initiative. |

Emerging Markets Overview (April 1, 2022 to March 31, 2023)

Emerging Market equities, as measured by the MSCI Emerging Markets Index, were down for the period, returning -10.39%.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI One Belt One Road Index ETF (continued)

The best performing sectors across the Emerging Market equity market included Energy (+4.22%), Consumer Staples (-0.08%), and Consumer Discretionary (-3.86%).

The worst performing sectors across the Emerging Market equity market included Health Care (-15.02%), Materials (-15.21%), and Real Estate (-16.16%).

Within the Fund, the best-performing sectors for the period were Energy and Industrials. Meanwhile, the worst-performing sectors were Consumer Staples and Materials. At the end of the Period, the top country weights within the Fund were China, Singapore, and Kuwait.

For the Period, the NAV of the Fund decreased by -14.98% while the Underlying Index decreased by -14.69%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI One Belt One Road Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares MSCI One Belt Road Index ETF | | | -14.98 | % | | | -15.53 | %‡ | | | 11.71 | %‡ | | | 12.05 | %‡ | | | 0.72 | %‡ | | | 0.32 | %‡ | | | 1.13 | %‡ | | | 1.05 | %‡ |

| MSCI Global China Infrastructure Exposure Index (Net) | | | N/A | | | | -14.69 | %‡ | | | N/A | | | | 12.25 | %‡ | | | N/A | | | | 1.81 | %‡ | | | N/A | | | | 2.18 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.58 | %‡ |

| * | The Fund commenced operations on September 7, 2017. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.78%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI One Belt One Road Index ETF (concluded)

not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Emerging Markets Consumer Technology Index ETF

The KraneShares Emerging Markets Consumer Technology Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Solactive Emerging Markets Consumer Technology Index (the Underlying Index).

The Underlying Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transactions.

Emerging Markets Consumer Technology Review

Many emerging markets (EM) countries were adversely impacted by a steady increase in the value of the U.S. dollar during the 12-month period ended March 31, 2023 (the Period), which meant that their U.S. dollar-denominated debts became more of a burden. However, certain commodity-exporting EM countries benefitted from rising oil prices, and e-commerce companies held by the Fund, especially those which derive significant revenues from China, experienced a recovery during the Period when China removed pandemic restrictions.

The International Monetary Fund has predicted that the growth gap between developed and emerging markets will favor the latter for the first time in nearly a decade. Developed economies are anticipated to experience a slowdown in growth from 2.7% in 2022 to 1.2% and 1.4% in 2023 and 2024, respectively. On the other hand, EM economies are expected to experience growth, increasing from 3.9% in 2022 to 4.0% in 2023 and 4.3% in 2024.

We see three potential positive catalysts for EM consumer technology companies in the year to come:

| ● | The U.S. dollar may see declines in the year ahead given its current high level versus EM currencies, which may improve the economic outlook for many EM countries. |

| ● | China retail sales increased +10.6% year-over-year (YoY) in March, setting the stage for a rebound in consumer spending this year, which we expect to benefit consumer technology companies, among others. |

| ● | Alibaba’s recent restructuring into six separate business groups, each individually able to raise capital, indicates the company’s focus on generating shareholder value; and a resulting IPO would likely result in a new issuer, which would be included in the Underlying Index and Fund in the future. |

Emerging Markets Overview (April 1, 2022 to March 31, 2023)

| ● | Emerging Market equities, as measured by the MSCI Emerging Markets Index, were down for the period, returning -10.39%. |

| ● | The best performing sectors across EM equity markets included Energy (+4.22%), Consumer Staples (-0.08%), and Consumer Discretionary (-3.86%). |

| ● | The worst performing sectors across EM equity markets included Health Care (-15.02%), Materials (-15.21%), and Real Estate (-16.16%). |

Within the Fund, exposure to the Consumer Discretionary and Consumer Staples sectors contributed positively to performance, while its exposure to the Communication Services and Financials sectors detracted from performance.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Emerging Markets Consumer Technology Index ETF (continued)

For the Period, the NAV of the Fund decreased by -15.30% while the Underlying Index decreased by -14.47%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees and currency translations.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Emerging Markets Consumer Technology Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares Emerging Markets Consumer Technology Index ETF | | | -15.30 | % | | | -14.60 | %‡ | | | -7.08 | %‡ | | | -7.32 | %‡ | | | -9.63 | %‡ | | | -9.89 | %‡ | | | -7.88 | %‡ | | | -7.96 | %‡ |

| Solactive Emerging Markets Consumer Technology Index | | | N/A | | | | -14.47 | %‡ | | | N/A | | | | -6.00 | %‡ | | | N/A | | | | -8.76 | %‡ | | | N/A | | | | -6.73 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.02 | %‡ |

| * | The Fund commenced operations on October 11, 2017. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s gross operating expense ratio is 0.79% and its net expense ratio

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Emerging Markets Consumer Technology Index ETF (concluded)

is 0.59% due to a Fee Waiver whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee by 0.20% of the Fund’s average daily net assets until August 1, 2023.

Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI China Clean Technology Index ETF

The KraneShares MSCI China Clean Technology Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China IMI Environment 10/40 Index (the Underlying Index).

The Underlying Index is comprised of securities that derive at least 50% of their revenues from environmentally beneficial products and services. The Underlying Index is based on five key Clean Technology environmental themes: Alternative Energy, Sustainable Water, Green Building, Pollution Prevention, and Energy Efficiency. The Underlying Index aims to serve as a benchmark for investors seeking exposure to Chinese companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. Constituent selection is based on data from MSCI Environment, Social, and Governance (ESG).

China Clean Technology Review:

Several macroeconomic headwinds impacted the Fund’s performance during the 12-month period ending March 31, 2023 (the Period), including the most aggressive interest rate hiking cycle in history from the U.S. Federal Reserve. On the other hand, the passage of the Inflation Reduction Act (IRA) in the U.S. favors U.S. suppliers of clean energy technologies, such as solar panels, and the clean technology companies generally held by the Fund.

The best-performing sector within the Fund was Information Technology, while the worst-performing sectors were Real Estate and Utilities. Information technology company Kingsoft Cloud was one of the best-performing companies in the Fund. Meanwhile, real estate developers YueXiu and Soho saw declines following a slump in China’s real estate sector.

We see three potential positive catalysts for China’s clean technology equities in the year to come:

| ● | Increasing domestic demand for solar panels as China ramps up its efforts to achieve peak carbon emissions by 2030 and net zero emissions by 2060. Solar currently makes up less than 5% of China’s total energy mix, but we believe that sales have the potential to increase. |

| ● | A rebound in China’s real estate development industry, which may uplift sustainable developers as well. |

| ● | China’s continued leadership in the transition to electric vehicles (EVs) as 6 million EVs were sold in the country in 2022 compared to only 2.6 million in Europe and 800,000 in the U.S. |

For the Period, the NAV of the Fund decreased by -20.71% while the Underlying Index decreased by -21.68%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees and currency translations.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI China Clean Technology Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares MSCI China Clean Technology Index ETF | | | -20.71 | % | | | -20.31 | %‡ | | | 20.76 | %‡ | | | 20.82 | %‡ | | | 5.81 | %‡ | | | 5.53 | %‡ | | | 4.40 | %‡ | | | 4.45 | %‡ |

| MSCI China IMI Environment 10/40 Index (Net) | | | N/A | | | | -21.68 | %‡ | | | N/A | | | | 17.38 | %‡ | | | N/A | | | | 4.21 | %‡ | | | N/A | | | | 3.01 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 11.06 | %‡ |

| * | The Fund commenced operations on October 12, 2017. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s gross operating expense ratio is 0.78%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI China Clean Technology Index ETF (concluded)

not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Electric Vehicles and Future Mobility Index ETF

The KraneShares Electric Vehicle and Future Mobility Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg Electric Vehicles Index (the Underlying Index).

The Underlying Index seeks to measure the performance of companies that are engaged in the production of electric vehicles, their components, or other initiatives that may change the future of mobility. This includes issuers engaged in electric vehicles, autonomous driving, lithium and/ or copper production, lithium-ion/lead acid battery production, hydrogen fuel cell manufacturing, and/or electric infrastructure businesses.

Global Electric Vehicle Market Review:

Global electric vehicles equities were mostly flat during the 12-month period ended March 31, 2023 (the Period) as higher U.S. interest rates made growth equities appear less attractive. Nonetheless, sales of electric vehicles (EVs) continued to rise. EV sales increased +60% to reach 10.3 million vehicles in 2022, up from 6.5 million vehicles in 2021. China continued to lead in sales as 6 million EVs were sold in China during 2022. Meanwhile, Europe and the U.S. tracked behind, logging sales of 2.6 million and 800,000 EVs, respectively.

We see three potential positive catalysts for EV equities in the year to come:

| ● | The passage of the Inflation Reduction Act (IRA) in the United States, which includes over $300 billion in investment in the transition from fossil fuels to renewable energy, including incentives for manufacturers and buyers of EVs. |

| ● | At least six provinces in China have launched their own EV subsidy programs following the expiration at the end of 2022 of national subsidies for purchases of new EVs. |

| ● | The potential for a pivot from the U.S. Federal Reserve on interest rate hikes and for new metals supply to come online, both of which would provide support to EV manufacturers on both a fundamental and sentimental level. |

For the Period, the NAV of the Fund decreased by -21.78% while the Underlying Index decreased by -21.56%. The deviation between the Fund’s performance and that of the Underlying Index can be mainly attributed to management fees.

Companies involved in battery production were among the best performing of the Fund’s holdings during the Period. Meanwhile, companies involved in hydrogen and fuel cell technologies, charging technologies, and vehicle production detracted the most from the Fund’s performance for the period.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Electric Vehicles and Future Mobility Index ETF (continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIOD ENDED MARCH 31, 2023*

| | | One Year

Return | | | Three Year

Return | | | Five Year

Return | | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | | | Net

Asset

Value | | | Market

Price^ | |

| KraneShares Electric Vehicles and Future Mobility Index ETF | | | -21.78 | % | | | -21.35 | %‡ | | | 20.30 | %‡ | | | 20.81 | %‡ | | | 7.97 | %‡ | | | 7.77 | %‡ | | | 6.20 | %‡ | | | 6.26 | %‡ |

| Hybrid KARS Index (Net)** | | | N/A | | | | -21.56 | %‡ | | | N/A | | | | 21.70 | %‡ | | | N/A | | | | 8.68 | %‡ | | | N/A | | | | 6.80 | %‡ |

| S&P 500 Index | | | N/A | | | | -7.73 | %‡ | | | N/A | | | | 18.60 | %‡ | | | N/A | | | | 11.19 | %‡ | | | N/A | | | | 9.59 | %‡ |

| * | The Fund commenced operations on January 18, 2018. |

| ** | The Hybrid KARS Index consists of the Solactive Electric Vehicles and Future Mobility Index from the inception of the Fund through June 15, 2021 and the Bloomberg Electric Vehicles Total Return Index going forward. |

| ‡ | Unaudited. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if it more accurately reflects the market value of an ETF share at the time as of which the ETF calculates current NAV per share, the midpoint between the national best bid and national best offer (“NBBO”) as of that time. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, shares may be worth less than their original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.70%. Please note that

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares Electric Vehicles and Future Mobility Index ETF (concluded)

one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI All China Health Care Index ETF

The KraneShares MSCI All China Health Care Index ETF (the Fund) seeks to provide investment results that, before fees and expenses, track the price and yield performance of the MSCI China All Shares Health Care 10/40 Index (the Underlying Index).

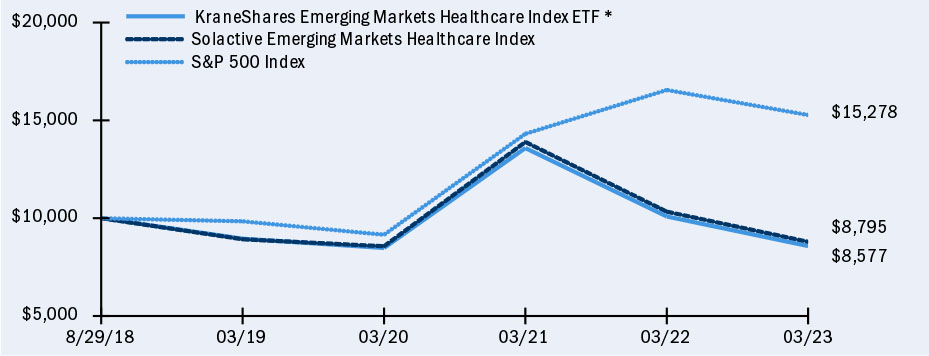

The Underlying Index is a free float-adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies engaged in the health care sector. The securities in the Index include all types of publicly issued shares of Chinese issuers, which are listed in Mainland China, Hong Kong, and the United States. Issuers eligible for inclusion must be classified under the Global Industry Classification Standard (GICS®) as engaged in the healthcare sector. The issuers included in the Underlying Index may include small-cap, mid-cap, and large-cap companies.

China Health Care Review:

Several macroeconomic headwinds impacted the Fund’s performance during the 12-month period ended March 31, 2023 (the Period), including an aggressive rate hiking cycle pursued by global central banks, which made growth equities appear less attractive due to the resulting increase in the risk-free rates in many countries, the placement of some China-based pharmaceutical companies on the U.S. “unverified list,” indicating that the end-use of imported materials could not be verified by U.S. inspectors due to COVID restrictions, and regulatory changes to China’s central procurement program, especially the inclusion of medical devices in the program.

We see three potential positive catalysts for China’s healthcare equities in the year to come:

| ● | Wuxi Biologics has been removed from the U.S. “unverified list,” which is a list of companies that import sensitive materials from the U.S. and are unable to submit to inspections. Wuxi Biologics was removed from the unverified list following the end of China’s pandemic restrictions, which enabled U.S. inspectors to gain access to Wuxi’s facilities. We believe that this means that being added to the unverified list is no longer a material risk to China’s pharmaceutical companies as COVID restrictions were the only reason for the companies’ inclusion on the list. |

| ● | On December 15th, 2022, the Public Company Accounting Oversight Board (PCAOB) announced that the agency had secured complete access to inspect and investigate China-based firms and their auditors for the first time in history. This announcement was significant for China healthcare companies, many of which are listed publicly in the U.S., because the U.S. Congress in 2022 required U.S.-listed foreign companies to allow the PCAOB to inspect their audit books to remain listed publicly on U.S. exchanges. Thus, the achievement of full access to the audit books of U.S.-listed China-based firms by the PCAOB significantly lowers the risk that certain ADRs in the Fund’s portfolio may be delisted from U.S. exchanges. |

| ● | According to a paper published by Lancet Public Health this year, life expectancy in China is likely to increase to over 80 by 2035 and to potentially as high as 90 for women in certain areas. This could create long-term, steadily growing demand for healthcare in China for the foreseeable future. |

The best-performing industries within the Fund were medical/nursing services and medical distributors. Meanwhile, pharmaceuticals and biotechnology were the worst-performing industries within the Fund.

Management Discussion of Fund Performance (Unaudited) (continued)

KraneShares MSCI All China Health Care Index ETF (continued)