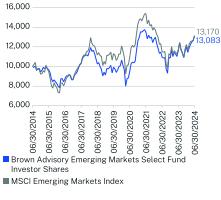

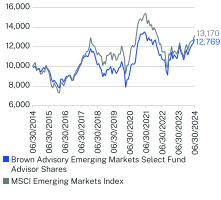

0001548609 tsr:C000118724Member tsr:bench2024080736143_531Member 2024-06-30 0001548609 tsr:C000120208Member tsr:bench2024080736370_241Member 2024-06-30

As filed with the Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811-22708)

Brown Advisory Funds

(Exact name of Registrant as specified in charter)

901 South Bond Street Suite 400

Baltimore, MD 21231

(Address of principal executive offices) (Zip code)

Paul J. Chew

Principal Executive Officer

Brown Advisory Funds

901 South Bond Street Suite 400

Baltimore, MD 21231

(Name and address of agent for service)

(410) 537-5400

Registrant’s telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| | |

| Brown Advisory Growth Equity Fund | |

| Institutional Shares | BAFGX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Growth Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

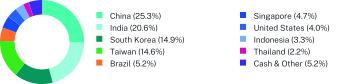

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $75 | 0.68% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Underperformance in the Fund was driven primarily by health care. Sentiment within health care was weak during the 3rd quarter of 2023, as investors continued to deliberate any potential impacts from GLP-1s. Information Technology was the best performing sector both in absolute terms and from a relative perspective, driven by NVIDIA Corporation, a market leader in advanced graphic processing units. The stock traded up sharply over the period following robust financial results and investor excitement for Artificial Intelligence, broadly.

The Fund’s allocation to Information Technology increased during the period, primarily from strong absolute performance and the additions of Cadence Design Systems, Marvell Technology and Workday. Our exposure to health care also decreased during the period due to the exit of DexCom. While DexCom executed on penetrating several patient populations during our 7-year ownership period, there are fewer unserved patient population into which the company can expand.

The Fund delivered strong absolute performance during the period, underperforming the benchmark.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Costco Wholesale Corporation |

↑ | ServiceNow, Inc. |

| |

Top Detractors |

↓ | Estee Lauder Companies Inc. Class A |

↓ | Chewy, Inc. Class A |

↓ | DexCom, Inc. |

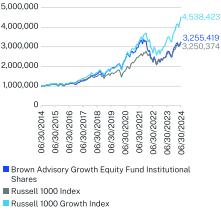

How did the Fund perform over the past 10 years?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Shares | 19.68 | 11.50 | 12.53 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Growth Equity Fund | PAGE 1 | TSR-AR-115233702 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $1,144,404,469 |

Number of Holdings | 32 |

| |

Net Advisory Fee | $11,163,764 |

Portfolio Turnover | 33% |

Visit https://www.brownadvisory.com/mf/funds/growth-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 35.5% |

Health Care | 15.9% |

Industrials | 14.4% |

Financials | 10.8% |

Consumer Discretionary | 8.9% |

Consumer Staples | 4.7% |

Communication Services | 4.0% |

Real Estate | 2.7% |

Cash & Other | 3.1% |

| |

Top 10 Issuers | (%) |

Amazon.com, Inc. | 5.0% |

Microsoft Corp. | 4.9% |

NVIDIA Corp. | 4.9% |

Costco Wholesale Corp. | 4.7% |

ServiceNow, Inc. | 4.2% |

Intuitive Surgical, Inc. | 4.2% |

Intuit, Inc. | 4.0% |

Alphabet, Inc. | 4.0% |

Hilton Worldwide Holdings, Inc. | 3.9% |

Mastercard, Inc. | 3.7% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Growth Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Growth Equity Fund | PAGE 2 | TSR-AR-115233702 |

100000010973311102733125608216190111889218232141431372302262523272004532554191000000107366911051801304441149406916437621766727252770121982132623862325037410000001105561113898313715991680367187457923110453293180267493934000224538423

| | |

| Brown Advisory Growth Equity Fund | |

| Investor Shares | BIAGX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Growth Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $91 | 0.83% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Underperformance in the Fund was driven primarily by health care. Sentiment within health care was weak during the 3rd quarter of 2023, as investors continued to deliberate any potential impacts from GLP-1s. Information Technology was the best performing sector both in absolute terms and from a relative perspective, driven by NVIDIA Corporation, a market leader in advanced graphic processing units. The stock traded up sharply over the period following robust financial results and investor excitement for Artificial Intelligence, broadly.

The Fund’s allocation to Information Technology increased during the period, primarily from strong absolute performance and the additions of Cadence Design Systems, Marvell Technology and Workday. Our exposure to health care also decreased during the period due to the exit of DexCom. While DexCom executed on penetrating several patient populations during our 7-year ownership period, there are fewer unserved patient population into which the company can expand.

The Fund delivered strong absolute performance during the period, underperforming the benchmark.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Costco Wholesale Corporation |

↑ | ServiceNow, Inc. |

| |

Top Detractors |

↓ | Estee Lauder Companies Inc. Class A |

↓ | Chewy, Inc. Class A |

↓ | DexCom, Inc. |

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Investor Shares | 19.53 | 11.33 | 12.36 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Growth Equity Fund | PAGE 1 | TSR-AR-115233504 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $1,144,404,469 |

Number of Holdings | 32 |

| |

Net Advisory Fee | $11,163,764 |

Portfolio Turnover | 33% |

Visit https://www.brownadvisory.com/mf/funds/growth-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 35.5% |

Health Care | 15.9% |

Industrials | 14.4% |

Financials | 10.8% |

Consumer Discretionary | 8.9% |

Consumer Staples | 4.7% |

Communication Services | 4.0% |

Real Estate | 2.7% |

Cash & Other | 3.1% |

| |

Top 10 Issuers | (%) |

Amazon.com, Inc. | 5.0% |

Microsoft Corp. | 4.9% |

NVIDIA Corp. | 4.9% |

Costco Wholesale Corp. | 4.7% |

ServiceNow, Inc. | 4.2% |

Intuitive Surgical, Inc. | 4.2% |

Intuit, Inc. | 4.0% |

Alphabet, Inc. | 4.0% |

Hilton Worldwide Holdings, Inc. | 3.9% |

Mastercard, Inc. | 3.7% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Growth Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Growth Equity Fund | PAGE 2 | TSR-AR-115233504 |

100001095410991125041609118745230013104722348268243206310000107371105213044149411643817667252772198226239325041000011056113901371616804187462311032932267493400045384

| | |

| Brown Advisory Growth Equity Fund | |

| Advisor Shares | BAGAX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Growth Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Shares | $118 | 1.08% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Underperformance in the Fund was driven primarily by health care. Sentiment within health care was weak during the 3rd quarter of 2023, as investors continued to deliberate any potential impacts from GLP-1s. Information Technology was the best performing sector both in absolute terms and from a relative perspective, driven by NVIDIA Corporation, a market leader in advanced graphic processing units. The stock traded up sharply over the period following robust financial results and investor excitement for Artificial Intelligence, broadly.

The Fund’s allocation to Information Technology increased during the period, primarily from strong absolute performance and the additions of Cadence Design Systems, Marvell Technology and Workday. Our exposure to health care also decreased during the period due to the exit of DexCom. While DexCom executed on penetrating several patient populations during our 7-year ownership period, there are fewer unserved patient population into which the company can expand.

The Fund delivered strong absolute performance during the period, underperforming the benchmark.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Costco Wholesale Corporation |

↑ | ServiceNow, Inc. |

| |

Top Detractors |

↓ | Estee Lauder Companies Inc. Class A |

↓ | Chewy, Inc. Class A |

↓ | DexCom, Inc. |

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Shares | 19.22 | 11.06 | 12.08 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Growth Equity Fund | PAGE 1 | TSR-AR-115233603 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $1,144,404,469 |

Number of Holdings | 32 |

| |

Net Advisory Fee | $11,163,764 |

Portfolio Turnover | 33% |

Visit https://www.brownadvisory.com/mf/funds/growth-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 35.5% |

Health Care | 15.9% |

Industrials | 14.4% |

Financials | 10.8% |

Consumer Discretionary | 8.9% |

Consumer Staples | 4.7% |

Communication Services | 4.0% |

Real Estate | 2.7% |

Cash & Other | 3.1% |

| |

Top 10 Issuers | (%) |

Amazon.com, Inc. | 5.0% |

Microsoft Corp. | 4.9% |

NVIDIA Corp. | 4.9% |

Costco Wholesale Corp. | 4.7% |

ServiceNow, Inc. | 4.2% |

Intuitive Surgical, Inc. | 4.2% |

Intuit, Inc. | 4.0% |

Alphabet, Inc. | 4.0% |

Hilton Worldwide Holdings, Inc. | 3.9% |

Mastercard, Inc. | 3.7% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Growth Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Growth Equity Fund | PAGE 2 | TSR-AR-115233603 |

100001092810937124171593418518226643051321910262393128310000107371105213044149411643817667252772198226239325041000011056113901371616804187462311032932267493400045384

| | |

| Brown Advisory Flexible Equity Fund | |

| Institutional Shares | BAFFX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Flexible Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $60 | 0.53% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the S&P 500 Index.

The largest market capitalization companies continue to dominate investors’ interest and have led the returns in the marketplace. Fund holdings Microsoft and Apple each surpassed a $3 trillion market valuation, a feat unimaginable just a few years ago. Within the larger capitalization category, growth stocks have significantly outperformed value stocks.

WHAT FACTORS INFLUENCED PERFORMANCE

Security selection had a larger effect on the portfolio than sector allocation. The outperformance of the Fund was driven by Communication Services, Consumer Discretionary and Industrials sectors. These sectors had a significantly higher return than the sectors in the Index. Within these sectors, Alphabet, Meta Platforms, Amazon, GE Aerospace and United Rentals were top contributors to the Fund’s return. Interestingly, the Information Technology sector was the Fund’s second biggest contributor to return but the largest detractor as compared to the Index. The sector in the Fund had a lower weighting and lower return than the Index.

The sector weightings did not change meaningfully during the twelve-month period. We focus on individual company selection and seek to incorporate a reasonable balance of sector exposure as part of our risk management process. We believe that companies in the same sectors can vary as greatly in their business economics and profiles as companies in completely different sectors.

The portfolio return exceeded the S&P 500 Index. Security selection had a larger effect on the portfolio than sector allocation.

| |

Top Contributors |

↑ | Meta Platforms Inc Class A |

↑ | Microsoft Corporation |

↑ | KKR & Co Inc |

| |

Top Detractors |

↓ | Align Technology, Inc. |

↓ | CarMax, Inc. |

↓ | Edwards Lifesciences Corporation |

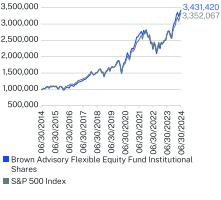

How did the Fund perform over the past 10 years?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Shares | 27.63 | 15.72 | 13.12 |

S&P 500 Index | 24.56 | 15.05 | 12.86 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Brown Advisory Flexible Equity Fund | PAGE 1 | TSR_AR_115233843 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $926,396,606 |

Number of Holdings | 47 |

| |

Net Advisory Fee | $3,382,149 |

Portfolio Turnover | 15% |

Visit https://www.brownadvisory.com/mf/funds/flexible-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Financials | 26.2% |

Information Technology | 21.1% |

Communication Services | 12.7% |

Health Care | 11.7% |

Consumer Discretionary | 11.5% |

Industrials | 8.5% |

Energy | 2.9% |

Consumer Staples | 1.0% |

Real Estate | 0.8% |

Cash & Other | 3.6% |

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

Alphabet, Inc. | 6.8% |

Meta Platforms, Inc. | 4.7% |

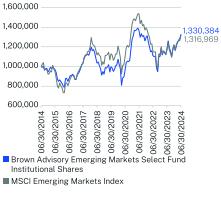

Visa, Inc. | 4.2% |

Mastercard, Inc. | 4.2% |

Amazon.com, Inc. | 4.1% |

Berkshire Hathaway, Inc. | 3.8% |

KKR & Co., Inc. | 3.8% |

Taiwan Semiconductor Manufacturing Co., Ltd. | 3.5% |

First American Government Obligations Fund | 3.4% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Flexible Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Flexible Equity Fund | PAGE 2 | TSR_AR_115233843 |

1000000108093810360131274788151792916536821840376267330622139622688530343142010000001074228111711813170381506351166327417881032517545225028826912103352067

| | |

| Brown Advisory Flexible Equity Fund | |

| Investor Shares | BIAFX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Flexible Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $77 | 0.68% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the S&P 500 Index.

The largest market capitalization companies continue to dominate investors’ interest and have led the returns in the marketplace. Fund holdings Microsoft and Apple each surpassed a $3 trillion market valuation, a feat unimaginable just a few years ago. Within the larger capitalization category, growth stocks have significantly outperformed value stocks.

WHAT FACTORS INFLUENCED PERFORMANCE

Security selection had a larger effect on the portfolio than sector allocation. The outperformance of the Fund was driven by Communication Services, Consumer Discretionary and Industrials sectors. These sectors had a significantly higher return than the sectors in the Index. Within these sectors, Alphabet, Meta Platforms, Amazon, GE Aerospace and United Rentals were top contributors to the Fund’s return. Interestingly, the Information Technology sector was the Fund’s second biggest contributor to return but the largest detractor as compared to the Index. The sector in the Fund had a lower weighting and lower return than the Index.

The sector weightings did not change meaningfully during the twelve-month period. We focus on individual company selection and seek to incorporate a reasonable balance of sector exposure as part of our risk management process. We believe that companies in the same sectors can vary as greatly in their business economics and profiles as companies in completely different sectors.

The portfolio return exceeded the S&P 500 Index. Security selection had a larger effect on the portfolio than sector allocation.

| |

Top Contributors |

↑ | Meta Platforms Inc Class A |

↑ | Microsoft Corporation |

↑ | KKR & Co Inc |

| |

Top Detractors |

↓ | Align Technology, Inc. |

↓ | CarMax, Inc. |

↓ | Edwards Lifesciences Corporation |

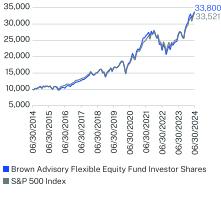

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Investor Shares | 27.46 | 15.55 | 12.95 |

S&P 500 Index | 24.56 | 15.05 | 12.86 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Brown Advisory Flexible Equity Fund | PAGE 1 | TSR_AR_115233868 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $926,396,606 |

Number of Holdings | 47 |

| |

Net Advisory Fee | $3,382,149 |

Portfolio Turnover | 15% |

Visit https://www.brownadvisory.com/mf/funds/flexible-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Financials | 26.2% |

Information Technology | 21.1% |

Communication Services | 12.7% |

Health Care | 11.7% |

Consumer Discretionary | 11.5% |

Industrials | 8.5% |

Energy | 2.9% |

Consumer Staples | 1.0% |

Real Estate | 0.8% |

Cash & Other | 3.6% |

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

Alphabet, Inc. | 6.8% |

Meta Platforms, Inc. | 4.7% |

Visa, Inc. | 4.2% |

Mastercard, Inc. | 4.2% |

Amazon.com, Inc. | 4.1% |

Berkshire Hathaway, Inc. | 3.8% |

KKR & Co., Inc. | 3.8% |

Taiwan Semiconductor Manufacturing Co., Ltd. | 3.5% |

First American Government Obligations Fund | 3.4% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Flexible Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Flexible Equity Fund | PAGE 2 | TSR_AR_115233868 |

10000107921032712692150881641218237264532187226518338001000010742111711317015064166331788125175225032691233521

| | |

| Brown Advisory Flexible Equity Fund | |

| Advisor Shares | BAFAX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Flexible Equity Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Shares | $106 | 0.93% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the S&P 500 Index.

The largest market capitalization companies continue to dominate investors’ interest and have led the returns in the marketplace. Fund holdings Microsoft and Apple each surpassed a $3 trillion market valuation, a feat unimaginable just a few years ago. Within the larger capitalization category, growth stocks have significantly outperformed value stocks.

WHAT FACTORS INFLUENCED PERFORMANCE

Security selection had a larger effect on the portfolio than sector allocation. The outperformance of the Fund was driven by Communication Services, Consumer Discretionary and Industrials sectors. These sectors had a significantly higher return than the sectors in the Index. Within these sectors, Alphabet, Meta Platforms, Amazon, GE Aerospace and United Rentals were top contributors to the Fund’s return. Interestingly, the Information Technology sector was the Fund’s second biggest contributor to return but the largest detractor as compared to the Index. The sector in the Fund had a lower weighting and lower return than the Index.

The sector weightings did not change meaningfully during the twelve-month period. We focus on individual company selection and seek to incorporate a reasonable balance of sector exposure as part of our risk management process. We believe that companies in the same sectors can vary as greatly in their business economics and profiles as companies in completely different sectors.

The portfolio return exceeded the S&P 500 Index. Security selection had a larger effect on the portfolio than sector allocation.

| |

Top Contributors |

↑ | Meta Platforms Inc Class A |

↑ | Microsoft Corporation |

↑ | KKR & Co Inc |

| |

Top Detractors |

↓ | Align Technology, Inc. |

↓ | CarMax, Inc. |

↓ | Edwards Lifesciences Corporation |

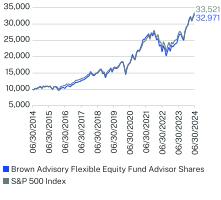

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Shares | 27.13 | 15.26 | 12.67 |

S&P 500 Index | 24.56 | 15.05 | 12.86 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Brown Advisory Flexible Equity Fund | PAGE 1 | TSR-AR-115233850 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $926,396,606 |

Number of Holdings | 47 |

| |

Net Advisory Fee | $3,382,149 |

Portfolio Turnover | 15% |

Visit https://www.brownadvisory.com/mf/funds/flexible-equity-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Financials | 26.2% |

Information Technology | 21.1% |

Communication Services | 12.7% |

Health Care | 11.7% |

Consumer Discretionary | 11.5% |

Industrials | 8.5% |

Energy | 2.9% |

Consumer Staples | 1.0% |

Real Estate | 0.8% |

Cash & Other | 3.6% |

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

Alphabet, Inc. | 6.8% |

Meta Platforms, Inc. | 4.7% |

Visa, Inc. | 4.2% |

Mastercard, Inc. | 4.2% |

Amazon.com, Inc. | 4.1% |

Berkshire Hathaway, Inc. | 3.8% |

KKR & Co., Inc. | 3.8% |

Taiwan Semiconductor Manufacturing Co., Ltd. | 3.5% |

First American Government Obligations Fund | 3.4% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Flexible Equity Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Flexible Equity Fund | PAGE 2 | TSR-AR-115233850 |

10000107681027712596149401621217969259982144525935329711000010742111711317015064166331788125175225032691233521

| | |

| Brown Advisory Sustainable Growth Fund | |

| Institutional Shares | BAFWX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Sustainable Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $68 | 0.60% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Sector positioning and stock selection positively impacted relative returns against the Russell 1000 Index. The strategy benefited from its overweight in information technology and lack of exposure to consumer staples, outweighing the negative effects of underweighting communication services and overweighting health care. Inclusive of stock selection and interaction, strong performance in information technology, industrials, and consumer discretionary overshadowed underperformance in health care and financials. Semiconductor holdings, such as NVDA, MPWR, CDNS, and KLAC, performed well due to investor enthusiasm for artificial intelligence and demand for data center technologies. The strategy’s sector exposures result from bottom-up stock-picking, not sector preferences or macro inputs.

Adhering to the strategy’s portfolio construction philosophy, we balanced durable and rapid growth companies while ensuring diversification by business model, end market exposure, and growth theme. Trading activity increased slightly, with nine name swaps and strategic position re-sizing trades to optimize the upside potential to downside risk ratio at the security and portfolio levels. These actions are seen as upgrades that position the strategy for future success.

The Fund’s outperformance was driven by strong stock selection, beneficial sector positioning, and favorable exposure to the emerging artificial intelligence megatrend.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Amazon.com, Inc. |

↑ | Microsoft Corporation |

| |

Top Detractors |

↓ | Block, Inc. Class A |

↓ | Bio-Rad Laboratories, Inc. Class A |

↓ | West Pharmaceutical Services, Inc. |

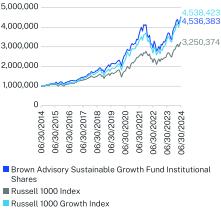

How did the Fund perform over the past 10 years?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Shares | 27.47 | 16.39 | 16.32 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Sustainable Growth Fund | PAGE 1 | TSR-AR-115233207 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $9,953,876,192 |

Number of Holdings | 34 |

| |

Net Advisory Fee | $44,709,096 |

Portfolio Turnover | 35% |

Visit https://www.brownadvisory.com/mf/funds/sustainable-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 41.7% |

Financials | 16.2% |

Health Care | 13.9% |

Consumer Discretionary | 11.4% |

Industrials | 9.1% |

Communication Services | 4.1% |

Materials | 1.8% |

Cash & Other | 1.8% |

| |

Top 10 Issuers | (%) |

NVIDIA Corp. | 8.3% |

Microsoft Corp. | 7.3% |

Amazon.com, Inc. | 6.6% |

Intuit, Inc. | 4.6% |

Alphabet, Inc. | 4.1% |

ServiceNow, Inc. | 4.1% |

Visa, Inc. | 3.9% |

Danaher Corp. | 3.1% |

KKR & Co., Inc. | 3.1% |

Monolithic Power Systems, Inc. | 3.1% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Sustainable Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Sustainable Growth Fund | PAGE 2 | TSR-AR-115233207 |

100000011350291216446144550017864662123940259149436131712925899355867045363831000000107366911051801304441149406916437621766727252770121982132623862325037410000001105561113898313715991680367187457923110453293180267493934000224538423

| | |

| Brown Advisory Sustainable Growth Fund | |

| Investor Shares | BIAWX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Sustainable Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $85 | 0.75% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Sector positioning and stock selection positively impacted relative returns against the Russell 1000 Index. The strategy benefited from its overweight in information technology and lack of exposure to consumer staples, outweighing the negative effects of underweighting communication services and overweighting health care. Inclusive of stock selection and interaction, strong performance in information technology, industrials, and consumer discretionary overshadowed underperformance in health care and financials. Semiconductor holdings, such as NVDA, MPWR, CDNS, and KLAC, performed well due to investor enthusiasm for artificial intelligence and demand for data center technologies. The strategy’s sector exposures result from bottom-up stock-picking, not sector preferences or macro inputs.

Adhering to the strategy’s portfolio construction philosophy, we balanced durable and rapid growth companies while ensuring diversification by business model, end market exposure, and growth theme. Trading activity increased slightly, with nine name swaps and strategic position re-sizing trades to optimize the upside potential to downside risk ratio at the security and portfolio levels. These actions are seen as upgrades that position the strategy for future success.

The Fund’s outperformance was driven by strong stock selection, beneficial sector positioning, and favorable exposure to the emerging artificial intelligence megatrend.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Amazon.com, Inc. |

↑ | Microsoft Corporation |

| |

Top Detractors |

↓ | Block, Inc. Class A |

↓ | Bio-Rad Laboratories, Inc. Class A |

↓ | West Pharmaceutical Services, Inc. |

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Investor Shares | 27.31 | 16.22 | 16.15 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Sustainable Growth Fund | PAGE 1 | TSR-AR-115233306 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $9,953,876,192 |

Number of Holdings | 34 |

| |

Net Advisory Fee | $44,709,096 |

Portfolio Turnover | 35% |

Visit https://www.brownadvisory.com/mf/funds/sustainable-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 41.7% |

Financials | 16.2% |

Health Care | 13.9% |

Consumer Discretionary | 11.4% |

Industrials | 9.1% |

Communication Services | 4.1% |

Materials | 1.8% |

Cash & Other | 1.8% |

| |

Top 10 Issuers | (%) |

NVIDIA Corp. | 8.3% |

Microsoft Corp. | 7.3% |

Amazon.com, Inc. | 6.6% |

Intuit, Inc. | 4.6% |

Alphabet, Inc. | 4.1% |

ServiceNow, Inc. | 4.1% |

Visa, Inc. | 3.9% |

Danaher Corp. | 3.1% |

KKR & Co., Inc. | 3.1% |

Monolithic Power Systems, Inc. | 3.1% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Sustainable Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Sustainable Growth Fund | PAGE 2 | TSR-AR-115233306 |

100001133412128143901775921076256763576028913351054469310000107371105213044149411643817667252772198226239325041000011056113901371616804187462311032932267493400045384

| | |

| Brown Advisory Sustainable Growth Fund | |

| Advisor Shares | BAWAX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Sustainable Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Shares | $113 | 1.00% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund outperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Sector positioning and stock selection positively impacted relative returns against the Russell 1000 Index. The strategy benefited from its overweight in information technology and lack of exposure to consumer staples, outweighing the negative effects of underweighting communication services and overweighting health care. Inclusive of stock selection and interaction, strong performance in information technology, industrials, and consumer discretionary overshadowed underperformance in health care and financials. Semiconductor holdings, such as NVDA, MPWR, CDNS, and KLAC, performed well due to investor enthusiasm for artificial intelligence and demand for data center technologies. The strategy’s sector exposures result from bottom-up stock-picking, not sector preferences or macro inputs.

Adhering to the strategy’s portfolio construction philosophy, we balanced durable and rapid growth companies while ensuring diversification by business model, end market exposure, and growth theme. Trading activity increased slightly, with nine name swaps and strategic position re-sizing trades to optimize the upside potential to downside risk ratio at the security and portfolio levels. These actions are seen as upgrades that position the strategy for future success.

The Fund’s outperformance was driven by strong stock selection, beneficial sector positioning, and favorable exposure to the emerging artificial intelligence megatrend.

| |

Top Contributors |

↑ | NVIDIA Corporation |

↑ | Amazon.com, Inc. |

↑ | Microsoft Corporation |

| |

Top Detractors |

↓ | Block, Inc. Class A |

↓ | Bio-Rad Laboratories, Inc. Class A |

↓ | West Pharmaceutical Services, Inc. |

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Shares | 26.95 | 15.93 | 15.86 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 1000 Growth Index | 33.48 | 19.34 | 16.33 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Sustainable Growth Fund | PAGE 1 | TSR-AR-115233405 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $9,953,876,192 |

Number of Holdings | 34 |

| |

Net Advisory Fee | $44,709,096 |

Portfolio Turnover | 35% |

Visit https://www.brownadvisory.com/mf/funds/sustainable-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Information Technology | 41.7% |

Financials | 16.2% |

Health Care | 13.9% |

Consumer Discretionary | 11.4% |

Industrials | 9.1% |

Communication Services | 4.1% |

Materials | 1.8% |

Cash & Other | 1.8% |

| |

Top 10 Issuers | (%) |

NVIDIA Corp. | 8.3% |

Microsoft Corp. | 7.3% |

Amazon.com, Inc. | 6.6% |

Intuit, Inc. | 4.6% |

Alphabet, Inc. | 4.1% |

ServiceNow, Inc. | 4.1% |

Visa, Inc. | 3.9% |

Danaher Corp. | 3.1% |

KKR & Co., Inc. | 3.1% |

Monolithic Power Systems, Inc. | 3.1% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Sustainable Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Sustainable Growth Fund | PAGE 2 | TSR-AR-115233405 |

100001130312065142751757620808252873512928330343204356810000107371105213044149411643817667252772198226239325041000011056113901371616804187462311032932267493400045384

| | |

| Brown Advisory Mid-Cap Growth Fund | |

| Institutional Shares | BAFMX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Mid-Cap Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $88 | 0.82% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

The main factor influencing performance is our style and area of focus. Our strategy tends to look for small-capitalization equities that have an opportunity to grow at an above average rate over the long-term. Due to our focus on smaller companies, we do not purchase mid-cap or large-cap stocks. Thus, we never considered some of the most prolific gainers in the large-cap space such as Microsoft, Nvidia, Alphabet and other mega-cap technology names along with a number of the best performers in Healthcare.

Our philosophy harnesses the power of compounding, focusing on “3G” businesses (durable Growth, sound Governance, scalable Go-to-market strategies) that have a higher than average probability of making the journey from small-cap to mid-cap (and perhaps large-cap) than most companies. Since we are more closely aligned with the smaller capitalization universe, we are massively underweight Information Technology and considerably overweight Healthcare.

The 12-month period ending June 30, 2024 was challenging due to our lack of ownership of any of the large-cap stocks that drove the Russell 1000 Index over this period. This produced a massive underweight to strong performing sectors such as Information Technology, Communication Services and Financials.

| |

Top Contributors |

↑ | CrowdStrike Holdings, Inc. Class A |

↑ | Fair Isaac Corporation |

↑ | Pinterest, Inc. Class A |

| |

Top Detractors |

↓ | Paycom Software, Inc. |

↓ | agilon health inc |

↓ | CoStar Group, Inc. |

How did the Fund perform since inception?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(07/02/2018) |

Institutional Shares | 14.48 | 6.81 | 8.36 |

Russell 1000 Index | 23.88 | 14.61 | 13.79 |

Russell Midcap Growth Index | 15.05 | 9.93 | 10.52 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Mid-Cap Growth Fund | PAGE 1 | TSR-AR-115233413 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $96,923,868 |

Number of Holdings | 59 |

| |

Net Advisory Fee | $600,794 |

Portfolio Turnover | 63% |

Visit https://www.brownadvisory.com/mf/funds/mid-cap-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Health Care | 22.1% |

Information Technology | 21.9% |

Industrials | 20.4% |

Consumer Discretionary | 9.6% |

Financials | 8.7% |

Communication Services | 3.6% |

Real Estate | 3.1% |

Energy | 3.0% |

Materials | 2.2% |

Cash & Other | 5.4% |

| |

Top 10 Issuers | (%) |

Dexcom, Inc. | 3.8% |

Marvell Technology, Inc. | 3.6% |

First American Government Obligations Fund | 3.4% |

Waste Connections, Inc. | 3.1% |

Cheniere Energy, Inc. | 3.0% |

Copart, Inc. | 2.6% |

CoStar Group, Inc. | 2.6% |

Edwards Lifesciences Corp. | 2.6% |

Gartner, Inc. | 2.5% |

Fair Isaac Corp. | 2.5% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Mid-Cap Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Mid-Cap Growth Fund | PAGE 2 | TSR-AR-115233413 |

116360312296881758853120406314133191617906109685711789101686695146683317508622168924113443812695631825269128545815828091821056

| | |

| Brown Advisory Mid-Cap Growth Fund | |

| Investor Shares | BMIDX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Mid-Cap Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $104 | 0.97% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

The main factor influencing performance is our style and area of focus. Our strategy tends to look for small-capitalization equities that have an opportunity to grow at an above average rate over the long-term. Due to our focus on smaller companies, we do not purchase mid-cap or large-cap stocks. Thus, we never considered some of the most prolific gainers in the large-cap space such as Microsoft, Nvidia, Alphabet and other mega-cap technology names along with a number of the best performers in Healthcare.

Our philosophy harnesses the power of compounding, focusing on “3G” businesses (durable Growth, sound Governance, scalable Go-to-market strategies) that have a higher than average probability of making the journey from small-cap to mid-cap (and perhaps large-cap) than most companies. Since we are more closely aligned with the smaller capitalization universe, we are massively underweight Information Technology and considerably overweight Healthcare.

The 12-month period ending June 30, 2024 was challenging due to our lack of ownership of any of the large-cap stocks that drove the Russell 1000 Index over this period. This produced a massive underweight to strong performing sectors such as Information Technology, Communication Services and Financials.

| |

Top Contributors |

↑ | CrowdStrike Holdings, Inc. Class A |

↑ | Fair Isaac Corporation |

↑ | Pinterest, Inc. Class A |

| |

Top Detractors |

↓ | Paycom Software, Inc. |

↓ | agilon health inc |

↓ | CoStar Group, Inc. |

How did the Fund perform since inception?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(10/02/2017) |

Investor Shares | 14.23 | 6.63 | 9.37 |

Russell 1000 Index | 23.88 | 14.61 | 13.69 |

Russell Midcap Growth Index | 15.05 | 9.93 | 11.22 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Mid-Cap Growth Fund | PAGE 1 | TSR-AR-115233439 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $96,923,868 |

Number of Holdings | 59 |

| |

Net Advisory Fee | $600,794 |

Portfolio Turnover | 63% |

Visit https://www.brownadvisory.com/mf/funds/mid-cap-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Health Care | 22.1% |

Information Technology | 21.9% |

Industrials | 20.4% |

Consumer Discretionary | 9.6% |

Financials | 8.7% |

Communication Services | 3.6% |

Real Estate | 3.1% |

Energy | 3.0% |

Materials | 2.2% |

Cash & Other | 5.4% |

| |

Top 10 Issuers | (%) |

Dexcom, Inc. | 3.8% |

Marvell Technology, Inc. | 3.6% |

First American Government Obligations Fund | 3.4% |

Waste Connections, Inc. | 3.1% |

Cheniere Energy, Inc. | 3.0% |

Copart, Inc. | 2.6% |

CoStar Group, Inc. | 2.6% |

Edwards Lifesciences Corp. | 2.6% |

Gartner, Inc. | 2.5% |

Fair Isaac Corp. | 2.5% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Mid-Cap Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Mid-Cap Growth Fund | PAGE 2 | TSR-AR-115233439 |

113601326813993199951365816014182931091712011129101847016063191732375111200127621428220533144611780620486

| | |

| Brown Advisory Small-Cap Growth Fund | |

| Institutional Shares | BAFSX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Small-Cap Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Shares | $96 | 0.95% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its regulatory benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

The main factor influencing performance is our style and area of focus. Our strategy tends to look for small-capitalization equities that have an opportunity to grow at an above average rate over the long-term. Due to our focus on smaller companies, we do not purchase mid-cap or large-cap stocks. Thus, we never considered some of the most prolific gainers in the large-cap space such as Microsoft, Nvidia, Alphabet and other mega-cap technology names along with a number of the best performers in Healthcare.

Our philosophy harnesses the power of compounding, focusing on “3G” businesses (durable Growth, sound Governance, scalable Go-to-market strategies) that have a higher than average probability of making the journey from small-cap to mid-cap (and perhaps large-cap) than most companies. Since we are more closely aligned with the smaller capitalization universe, we are massively underweight Information Technology and considerably overweight Healthcare.

The 12-month period ending June 30, 2024 was challenging due to our lack of ownership of any of the large-cap stocks that drove the Russell 1000 Index over this period. This produced a massive underweight to strong performing sectors such as Information Technology, Communication Services and Financials.

| |

Top Contributors |

↑ | Casey’s General Stores, Inc. |

↑ | Pinterest, Inc. Class A |

↑ | Neurocrine Biosciences, Inc. |

| |

Top Detractors |

↓ | Accolade, Inc. |

↓ | SI-BONE, Inc. |

↓ | agilon health inc |

How did the Fund perform over the past 10 years?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Shares | 2.32 | 5.39 | 8.89 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Small-Cap Growth Fund | PAGE 1 | TR-AR-115233819 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $1,620,616,853 |

Number of Holdings | 80 |

| |

Net Advisory Fee | $17,495,020 |

Portfolio Turnover | 28% |

Visit https://www.brownadvisory.com/mf/funds/small-cap-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Industrials | 25.3% |

Health Care | 23.7% |

Information Technology | 20.6% |

Consumer Discretionary | 7.7% |

Financials | 4.7% |

Energy | 3.8% |

Materials | 3.7% |

Communication Services | 3.0% |

Consumer Staples | 2.8% |

Cash & Other | 4.7% |

| |

Top 10 Issuers | (%) |

Bright Horizons Family Solutions, Inc. | 3.8% |

First American Government Obligations Fund | 2.9% |

Waste Connections, Inc. | 2.7% |

HealthEquity, Inc. | 2.6% |

Prosperity Bancshares, Inc. | 2.6% |

ChampionX Corp. | 2.6% |

Casey’s General Stores, Inc. | 2.5% |

Valmont Industries, Inc. | 2.5% |

Neurocrine Biosciences, Inc. | 2.3% |

Dynatrace, Inc. | 2.2% |

| * | The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC. |

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brown Advisory, LLC documents not be householded, please contact Brown Advisory, LLC at 1-800-540-6807, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brown Advisory, LLC or your financial intermediary.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.brownadvisory.com/mf/how-to-invest.

The Brown Advisory Small-Cap Growth Fund is distributed by ALPS Distributors, Inc.

| Brown Advisory Small-Cap Growth Fund | PAGE 2 | TR-AR-115233819 |

100000011298311147968133823715743351803517184287126410572004244229138823444481000000107366911051801304441149406916437621766727252770121982132623862325037410000001123402100261712472741519956151250615651182368963157699918692442040031

| | |

| Brown Advisory Small-Cap Growth Fund | |

| Investor Shares | BIASX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Brown Advisory Small-Cap Growth Fund (the “Fund”) for the period of July 1, 2023, to June 30, 2024. You can find additional information about the Fund at https://www.brownadvisory.com/mf/how-to-invest. You can also request this information by contacting us at 1-800-540-6807.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $111 | 1.10% |

How did the Fund perform last year and what affected its performance?

For the 12-month period ended June 30, 2024, the Fund underperformed its regulatory benchmark, the Russell 1000 Index.

WHAT FACTORS INFLUENCED PERFORMANCE

The main factor influencing performance is our style and area of focus. Our strategy tends to look for small-capitalization equities that have an opportunity to grow at an above average rate over the long-term. Due to our focus on smaller companies, we do not purchase mid-cap or large-cap stocks. Thus, we never considered some of the most prolific gainers in the large-cap space such as Microsoft, Nvidia, Alphabet and other mega-cap technology names along with a number of the best performers in Healthcare.

Our philosophy harnesses the power of compounding, focusing on “3G” businesses (durable Growth, sound Governance, scalable Go-to-market strategies) that have a higher than average probability of making the journey from small-cap to mid-cap (and perhaps large-cap) than most companies. Since we are more closely aligned with the smaller capitalization universe, we are massively underweight Information Technology and considerably overweight Healthcare.

The 12-month period ending June 30, 2024 was challenging due to our lack of ownership of any of the large-cap stocks that drove the Russell 1000 Index over this period. This produced a massive underweight to strong performing sectors such as Information Technology, Communication Services and Financials.

| |

Top Contributors |

↑ | Casey’s General Stores, Inc. |

↑ | Pinterest, Inc. Class A |

↑ | Neurocrine Biosciences, Inc. |

| |

Top Detractors |

↓ | Accolade, Inc. |

↓ | SI-BONE, Inc. |

↓ | agilon health inc |

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Investor Shares | 2.12 | 5.22 | 8.73 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.In accordance with new regulatory requirements, the Fund has selected a new primary benchmark. The former primary benchmark is also included for comparison. |

| Brown Advisory Small-Cap Growth Fund | PAGE 1 | TSR-AR-115233835 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $1,620,616,853 |

Number of Holdings | 80 |

| |

Net Advisory Fee | $17,495,020 |

Portfolio Turnover | 28% |

Visit https://www.brownadvisory.com/mf/funds/small-cap-growth-fund for more recent performance information.

What did the Fund invest in? (% of net assets, as of June 30, 2024)

| |

Top Sectors* | (%) |

Industrials | 25.3% |

Health Care | 23.7% |

Information Technology | 20.6% |

Consumer Discretionary | 7.7% |

Financials | 4.7% |

Energy | 3.8% |

Materials | 3.7% |

Communication Services | 3.0% |

Consumer Staples | 2.8% |

Cash & Other | 4.7% |

| |

Top 10 Issuers | (%) |

Bright Horizons Family Solutions, Inc. | 3.8% |

First American Government Obligations Fund | 2.9% |

Waste Connections, Inc. | 2.7% |

HealthEquity, Inc. | 2.6% |

Prosperity Bancshares, Inc. | 2.6% |

ChampionX Corp. | 2.6% |

Casey’s General Stores, Inc. | 2.5% |

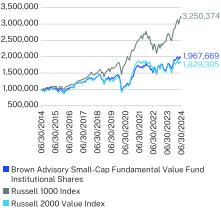

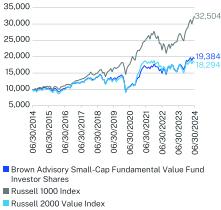

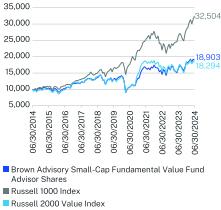

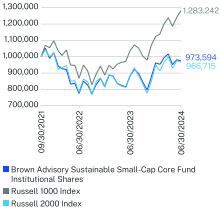

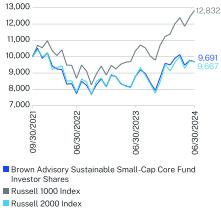

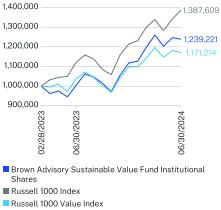

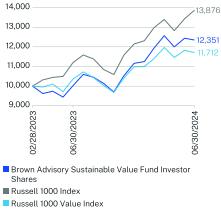

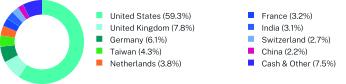

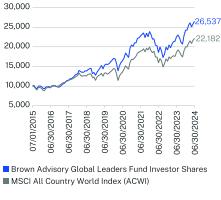

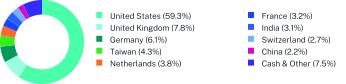

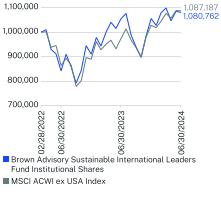

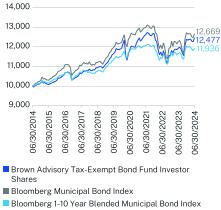

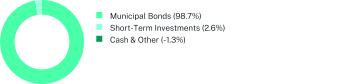

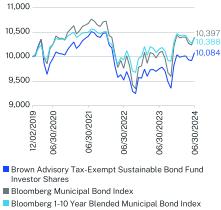

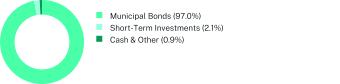

Valmont Industries, Inc. | 2.5% |