Use these links to rapidly review the document

Table of Contents

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191493

This preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, but the information in this prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying base prospectus are not an offer to sell the securities described herein and therein and are not soliciting offers to buy such securities in any state where such offer or sale is not permitted.

Subject to Completion, dated September 6, 2016

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 8, 2013)

Summit Midstream Partners, LP

5,500,000 Common Units

Representing Limited Partner Interests

We are offering 5,500,000 common units representing limited partner interests in Summit Midstream Partners, LP.

Our common units trade on the New York Stock Exchange under the symbol "SMLP." On September 2, 2016, the last reported trading price of our common units was $24.91.

Investing in our common units involves risks. See "Risk Factors" beginning on page S-14 of this prospectus supplement and on page 2 of the accompanying base prospectus and the other risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.

| | | | |

| | | | |

| |

| | Per Common Unit

| | Total

|

|---|

| |

Price to the public | | $ | | $ |

| |

Underwriting discounts and commissions | | $ | | $ |

| |

Proceeds to Summit Midstream Partners, LP (before expenses) | | $ | | $ |

|

We have granted the underwriter the option to purchase 825,000 additional common units from us on the same terms as set forth above within 30 days from the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities described herein or passed on the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the common units on or about , 2016, through the book-entry facilities of The Depository Trust Company.

Goldman, Sachs & Co.

Prospectus Supplement dated , 2016.

Table of Contents

Table of Contents

Neither we nor the underwriter have authorized anyone to provide you with any information or to make any representations other than those contained or incorporated by reference in this prospectus supplement, the accompanying base prospectus and any free writing prospectus that we may provide to you. You should not assume that the information contained in this prospectus supplement or the accompanying base prospectus is accurate as of any date other than the date on the front of this prospectus supplement or the accompanying base prospectus. You should not assume that the information contained in the documents incorporated by reference in this prospectus supplement or the accompanying base prospectus is accurate as of any date other than the respective dates of those documents (or, with respect to particular information contained in such document, as of any date other than the date set forth within such document as the date as of which such particular information is provided). Our business, financial condition, results of operations and prospects may have changed since those dates. We are not, and the underwriter is not, making an offer to sell the securities described herein in any jurisdiction where the offer or sale is not permitted.

Table of Contents

Prospectus Supplement

| | | | |

| | Page | |

|---|

ABOUT THIS PROSPECTUS SUPPLEMENT | | | S-ii | |

SUMMARY | | | S-1 | |

RISK FACTORS | | | S-14 | |

USE OF PROCEEDS | | | S-15 | |

CAPITALIZATION | | | S-16 | |

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS | | | S-17 | |

MATERIAL TAX CONSIDERATIONS | | | S-18 | |

UNDERWRITING | | | S-24 | |

VALIDITY OF THE COMMON UNITS | | | S-29 | |

EXPERTS | | | S-29 | |

WHERE YOU CAN FIND MORE INFORMATION | | | S-29 | |

INCORPORATION BY REFERENCE | | | S-30 | |

FORWARD-LOOKING STATEMENTS | | | S-30 | |

Base Prospectus | |

About this Prospectus | | |

ii | |

Where You Can Find More Information | | | ii | |

Forward-Looking Statements | | | iv | |

Who We Are | | | 1 | |

Risk Factors | | | 2 | |

Use of Proceeds | | | 3 | |

Ratio of Earnings to Fixed Charges | | | 4 | |

Description of Our Common Units | | | 5 | |

Description of Debt Securities and Guarantees | | | 7 | |

Provisions of Our Partnership Agreement Relating to Cash Distributions | | | 15 | |

The Partnership Agreement | | | 29 | |

Material U.S. Federal Income Tax Consequences | | | 43 | |

Tax Consequences of Ownership of Debt Securities | | | 60 | |

Selling Unitholder | | | 61 | |

Investment in Summit Midstream Partners, LP by Employee Benefit Plans | | | 63 | |

Plan of Distribution | | | 65 | |

Validity of the Securities | | | 67 | |

Experts | | | 67 | |

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common units. The second part is the accompanying base prospectus, which provides more general information about the securities we may offer from time to time, some of which may not apply to this offering of common units. Generally, when we use the term "prospectus," we are referring to both parts combined. If the information varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

In making an investment decision, prospective investors must rely on their own examination of us and the terms of the offering, including the merits and risks involved. Summit Midstream Partners, LP, the underwriter and their respective representatives are not making any representation to you regarding the legality of an investment in our common units by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in our common units.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Where You Can Find More Information" in this prospectus supplement.

The information in this prospectus supplement is not complete. You should review carefully all of the detailed information appearing in this prospectus supplement, the accompanying base prospectus and the documents we have incorporated by reference before making any investment decision.

S-ii

Table of Contents

SUMMARY

This summary highlights information included or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before investing in our common units. For a more complete understanding of this offering and our common units, you should read the entire prospectus supplement, the accompanying base prospectus and the documents incorporated by reference, including our historical financial statements and the notes to those financial statements, which are incorporated herein by reference from our Current Report on Form 8-K/A dated September 1, 2016 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 (as amended by the Form 10-Q/A filed on September 1, 2016) and June 30, 2016. Please read "Where You Can Find More Information" on page S-29 of this prospectus supplement. Please read "Risk Factors" beginning on page S-14 of this prospectus supplement and the other documents incorporated by reference in that section for more information about important risks that you should consider carefully before investing in our common units.

Unless the context otherwise requires, references in this prospectus to the "Partnership," "we," "our," "us" or like terms, refer to Summit Midstream Partners, LP and its subsidiaries. Unless the context otherwise requires, references in this prospectus to "Summit Investments" refer to Summit Midstream Partners, LLC, a Delaware limited liability company, the ultimate owner of our general partner, and its subsidiaries. "SMP Holdings" refers to Summit Midstream Partners Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of Summit Investments. Our "general partner" refers to Summit Midstream GP, LLC, a Delaware limited liability company and wholly owned subsidiary of SMP Holdings. References in this prospectus to "Energy Capital Partners" or our "Sponsor" refer collectively to Energy Capital Partners II, LLC and its parallel and co-investment funds.

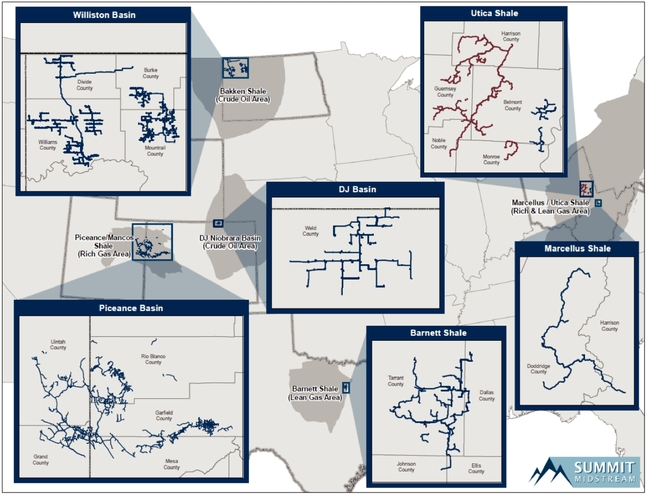

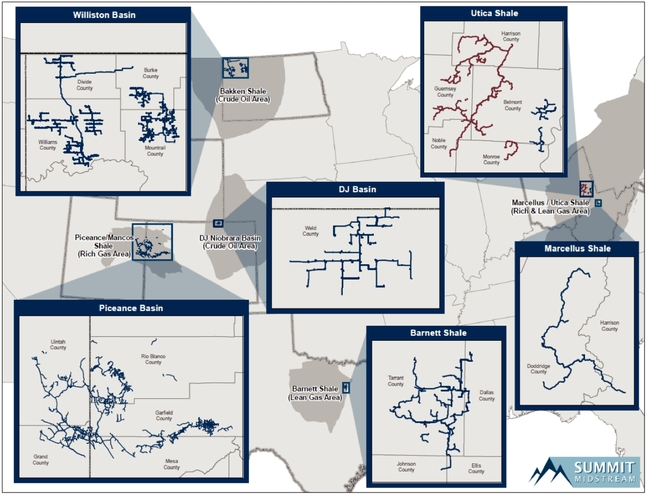

Summit Midstream Partners, LP

We are a growth-oriented limited partnership focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in the continental United States. We provide natural gas gathering, treating and processing services as well as crude oil and produced water gathering services pursuant to primarily long-term and fee-based agreements with our customers. Our results are driven primarily by the volumes of natural gas that we gather, treat, compress and process as well as by the volumes of crude oil and produced water that we gather. We currently operate in five unconventional resource basins:

- •

- the Appalachian Basin, which includes the Marcellus Shale formation in northern West Virginia and the Utica and Point Pleasant shale formations in southeastern Ohio;

- •

- the Williston Basin, which includes the Bakken and Three Forks shale formations in northwestern North Dakota;

- •

- the Fort Worth Basin, which includes the Barnett Shale formation in north-central Texas;

- •

- the Piceance Basin, which includes the Mesaverde formation and the Mancos and Niobrara shale formations in western Colorado and eastern Utah; and

- •

- the Denver-Julesburg ("DJ") Basin, which includes the Niobrara and Codell shale formations in northeastern Colorado and Wyoming.

During the six months ended June 30, 2016, we gathered an average of 1,518 MMcf/d of natural gas, and our aggregate crude oil and produced water volume throughput averaged 90.5 Mbbl/d.

S-1

Table of Contents

We conduct and report our operations in the midstream energy industry through five reportable segments. Each of our reportable segments provides midstream services in a specific geographic region. As of June 30, 2016, our five reportable segments were:

- •

- the Utica Shale, which is served by the Summit Utica system and our joint ventures, which own and operate a gathering system and a condensate stabilization facility (collectively "Ohio Gathering").

- •

- the Williston Basin, which is served by the Bison Midstream, Polar and Divide and Tioga systems;

- •

- the Piceance/DJ Basins, which is served by the Grand River Gathering and the Niobrara G&P systems;

- •

- the Barnett Shale, which is served by the DFW Midstream system; and

- •

- the Marcellus Shale, which is served by the Mountaineer Midstream system.

The following table provides information regarding our reporting segments for the six months ended, June 30 for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Utica

Shale | | Williston

Basin | | Piceance/DJ

Basins | | Barnett

Shale | | Marcellus

Shale | |

|---|

| | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 | |

|---|

Average throughput—Natural Gas (MMcf/d) | | | 150 | | | 14 | | | 24 | | | 22 | | | 568 | | | 617 | | | 341 | | | 379 | | | 435 | | | 545 | |

Average throughput—Liquids (Mbbl/d) | | | — | | | — | | | 90.5 | | | 58.1 | | | — | | | — | | | — | | | — | | | — | | | — | |

We have a diverse group of customers and counterparties comprising affiliates and/or subsidiaries of some of the largest natural gas and crude oil producers in the United States. A significant percentage of our revenue is attributable to our anchor customers. Our anchor customers and the systems that serve them are as follows:

- •

- XTO Energy, Inc. is the anchor for the Summit Utica system;

- •

- Whiting Petroleum Corp. and SM Energy Company are the anchors for the Polar and Divide system;

- •

- Hess Corp. is the anchor for the Tioga Midstream system;

- •

- Oasis Petroleum, Inc. and a large U.S. independent crude oil and natural gas company are the anchors for the Bison Midstream system;

- •

- Encana Corporation and Terra Energy Partners LLC are the anchors for the Grand River Gathering system;

- •

- A large U.S. independent crude oil and natural gas company is the anchor for the Niobrara G&P system;

- •

- Chesapeake Energy Corporation is the anchor for the DFW Midstream system; and

- •

- Antero Resources Corp. is the anchor for the Mountaineer Midstream system.

A substantial majority of the volumes that we gather, treat and/or process have a fixed-fee rate per volume structure thereby enhancing the stability of our cash flows by providing a revenue stream that is not subject to direct commodity price risk. The vast majority of our gathering and processing agreements contain areas of mutual interest, or AMIs. As of June 30, 2016, our AMIs cover more than 2.9 million acres in the aggregate. Many of our gathering and processing agreements include minimum volume commitments or minimum revenue commitments, or collectively MVCs. To the extent a customer does not meet its MVC, it must make payments to cover the shortfall of production not

S-2

Table of Contents

shipped or processed on our systems, either on a monthly, quarterly or annual basis. We have designed our MVC provisions to ensure that we will generate a minimum amount of revenue from certain customers over the life of the respective gathering or processing agreement, whether by collecting gathering or processing fees on actual throughput or from cash payments to cover any MVC shortfall. As of June 30, 2016, we had remaining MVCs totaling 3.4 Tcfe. These MVCs had a weighted-average remaining life of 8.4 years (assuming minimum throughput volumes for the remainder of the term) and average approximately 1,249 MMcfe/d through 2020.

We believe that we are positioned for growth through the increased utilization and further development of our existing midstream assets. In addition, we intend to grow our business through the execution of new, and the expansion of existing, strategic partnerships with large producers to provide midstream services for their upstream exploration and production projects. We also intend to continue expanding our operations and diversifying our geographic footprint through asset acquisitions from third parties.

Our Business Strategies

Our principal business strategy is to increase the amount of cash distributions we make to our unitholders over time. Our plan for continuing to execute this strategy includes the following key components:

- •

- Maintaining our focus on fee-based revenue with minimal direct commodity price exposure. As we expand our business, we intend to maintain our focus on providing midstream energy services under fee-based arrangements. Our midstream services are provided under primarily long-term and fee-based contracts with original terms up to 25 years. We believe that our focus on fee-based revenues with minimal direct commodity price exposure is essential to maintaining stable cash flows.

- •

- Capitalizing on organic growth opportunities to maximize throughput on our existing systems. We intend to continue to leverage our management team's expertise in constructing, developing and optimizing our midstream assets to grow our business through organic development projects. We believe that our broad and geographically diverse operating footprint provides us with a competitive advantage to pursue organic development projects that are designed to extend our geographic reach, diversify our customer base, expand our midstream service offerings, increase the number of our hydrocarbon receipt points and maximize volume throughput.

- •

- Diversifying our asset base by expanding our midstream service offerings to new geographic areas. Our gathering operations in the Utica Shale, the Williston Basin, the Piceance/DJ Basins, the Barnett Shale and Marcellus Shale currently represent our core business. We intend to diversify our operations into other geographic regions, through both greenfield development projects and acquisitions from third parties.

- •

- Partnering with producers to provide midstream services for their development projects in high-growth, unconventional resource plays. We seek to promote commercial relationships with established and well-capitalized producers who are willing to serve as anchor customers and commit to long-term MVCs and AMIs. We will continue to pursue partnership opportunities with established producers to develop new infrastructure in unconventional resource basins that we believe will complement our existing midstream assets and enhance our overall business by facilitating our entry into new basins. These opportunities generally consist of a strategic acreage position in an unconventional resource play that is well-positioned for accelerated production but has limited existing midstream energy infrastructure to support such growth.

S-3

Table of Contents

Our Competitive Strengths

We believe that we will be able to continue to execute the components of our principal business strategy successfully because of the following competitive strengths:

- •

- Strategically located assets in core areas of prolific unconventional basins supported by partnerships with large producers. We believe our assets are strategically positioned within the core areas of five established unconventional resource basins. The geologic formations in the basins served by our assets have either relatively low drilling and completion costs, highly economic production profiles, or a combination of both, which we believe incentivizes producers to develop more actively than in more marginal areas.

- •

- Fee-based revenues underpinned by long-term contracts with AMIs and MVCs. A substantial majority of our revenue for the year ended December 31, 2015 and the six months ended June 30, 2016 was generated under long-term and fee-based gathering and processing agreements. We believe that long-term, fee-based gathering and processing agreements enhance the stability of our cash flows by limiting our direct commodity price exposure.

- •

- Capital structure and financial flexibility. At June 30, 2016, we had $1.3 billion of total indebtedness and the unused portion of our $1.25 billion revolving credit facility totaled $529.0 million. Under the terms of our revolving credit facility, our total leverage ratio (total net indebtedness to consolidated trailing 12-month EBITDA, as defined in the credit agreement) was 4.50 to 1.0 at June 30, 2016, which compares with a total leverage ratio upper limit of not more than 5.0 to 1.0, or not more than 5.5 to 1.0 for up to 270 days following certain acquisitions (as defined in the credit agreement). Additionally, the total leverage ratio upper limit can be increased from 5.0 to 1.0 to 5.5 to 1.0 at our option, subject to the inclusion of a senior secured leverage ratio (senior secured net indebtedness to consolidated trailing 12-month EBITDA, as defined in the credit agreement) upper limit of 3.75 to 1.0.

- •

- Relationship with a large and committed financial sponsor. Our Sponsor, Energy Capital Partners, is an experienced energy investor with a proven track record of making substantial, long-term investments in high-quality energy assets. We believe the relationship with our Sponsor is a competitive advantage, as it brings not only significant financial and management experience, but also numerous relationships throughout the energy industry that we believe will continue to benefit us as we seek to grow our business.

- •

- Experienced management team with proven record of asset acquisition, construction, development, operation and integration expertise. Our board members and senior leadership team have extensive energy experience and a proven track record of identifying, consummating and integrating significant acquisitions in addition to partnering with major producers to construct and develop midstream energy infrastructure.

Our Sponsor

Energy Capital Partners, together with its affiliated funds, is a private equity firm with over $13.0 billion in capital commitments that is focused on investing in North America's energy infrastructure. Energy Capital Partners has significant energy and financial expertise to complement its investment in us, including investments in the power generation, midstream oil and gas, electric transmission, energy equipment and services, environmental infrastructure and other energy-related sectors.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 1790 Hughes Landing Blvd, Suite 500, The Woodlands, Texas 77380, and our telephone number is (832) 413-4770. Our website is located at www.summitmidstream.com. We make available our periodic reports and other information filed with

S-4

Table of Contents

or furnished to the Securities and Exchange Commission, or SEC, free of charge through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

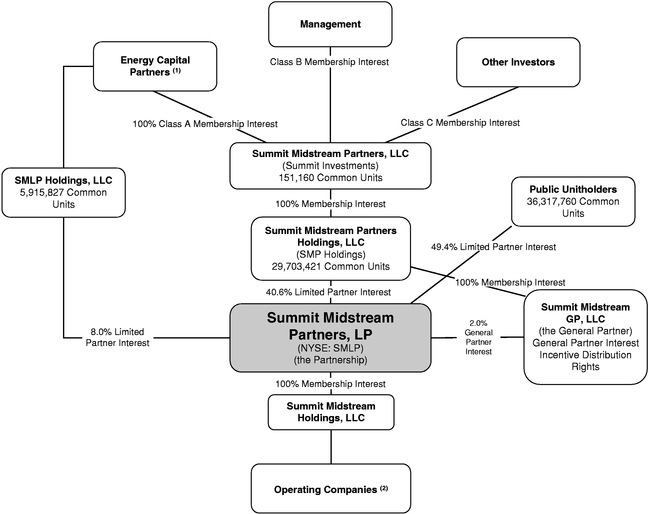

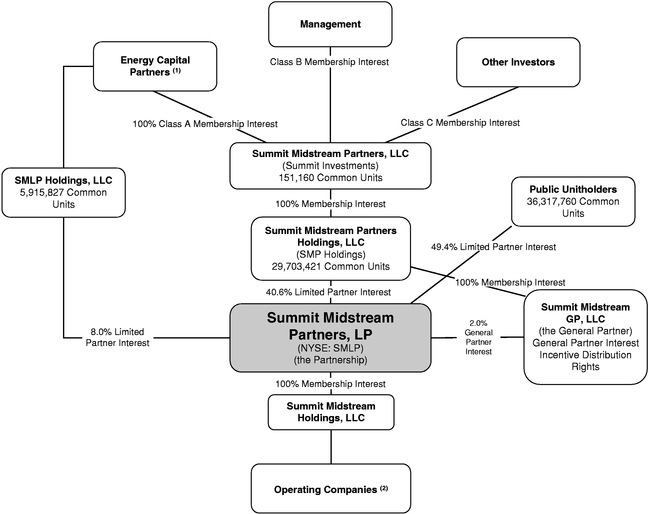

Partnership Structure

The table and diagram below illustrate our organization and ownership after giving effect to this offering, assuming that the underwriter does not exercise its option to purchase additional common units:

| | | | |

Public Common Units | | | 49.4 | % |

Sponsor Common Units | | | 48.6 | % |

General Partner Interest | | | 2.0 | % |

| | | | | |

Total | | | 100.0 | % |

| | | | | |

| | | | | |

| | | | | |

- (1)

- Energy Capital Partners, through its ownership of 100% of the Class A Membership Interests, controls Summit Midstream Partners, LLC and, therefore, Summit Midstream GP, LLC.

- (2)

- Summit Midstream Partners Holdings, LLC retains a 1% non-controlling interest in the entity that holds our interests in Summit Midstream Utica, LLC, Meadowlark Midstream Company, LLC, Tioga Midstream, LLC and Ohio Gathering.

S-5

Table of Contents

The Offering

| | |

Common units offered by us | | 5,500,000 common units; 6,325,000 common units if the underwriter exercises in full its option to purchase additional common units. |

Units outstanding before this offering | | 66,588,168 common units. |

Units outstanding after the offering | | 72,088,168 common units, 72,913,168 common units if the underwriter exercises in full its option to purchase an additional 825,000 common units from us. |

Use of proceeds | | We expect to receive net proceeds from this offering of approximately $ million, or approximately $ million if the underwriter exercises its option to purchase additional common units in full (in each case including our general partner's proportionate capital contribution to maintain its 2% general partner interest in us and deducting underwriting discounts and commissions and estimated offering expenses). We intend to use the net proceeds from this offering to repay borrowings under our revolving credit facility. |

| | Please read "Use of Proceeds" in this prospectus supplement. |

| | An affiliate of the underwriter is a lender under our revolving credit facility and, accordingly, will receive a portion of the net proceeds from this offering. Please read "Underwriting" in this prospectus supplement for further information. |

Cash distributions | | Our partnership agreement requires us to distribute all of our cash on hand at the end of each quarter, less reserves established by our general partner and payment of fees and expenses. We refer to this cash as "available cash," and it is defined in our partnership agreement. Please read "Provisions of our Partnership Agreement Relating to Cash Distributions" in the accompanying base prospectus. |

Issuance of additional units | | We can issue an unlimited number of units without the consent of our unitholders. Please read "The Partnership Agreement—Issuance of Additional Partnership Interests" in the accompanying base prospectus. |

S-6

Table of Contents

| | |

Limited voting rights | | Our general partner manages and operates us. Common unitholders have only limited voting rights on matters affecting our business. Common unitholders have no right to elect our general partner or its directors on an annual or continuing basis. Our general partner may not be removed except by a vote of the holders of at least 662/3% of the outstanding units voting together as a single class, including any units owned by our general partner and its affiliates. After giving effect to this offering and assuming that the underwriter exercises its option to purchase additional common units in full, affiliates of our general partner will own an aggregate of 49.1% of our common units, which gives them the ability to prevent the removal of our general partner. |

| | Please read "The Partnership Agreement—Voting Rights" in the accompanying base prospectus. |

Estimated ratio of taxable income to distributions | | We estimate that if you own the common units you purchase in this offering through the record date for distributions for the period ending December 31, 2018, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be 20% or less of the cash distributed to you with respect to that period. Please read "Material Tax Considerations" in this prospectus supplement. |

Material tax consequences | | For a discussion of other material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read "Material Tax Considerations" in this prospectus supplement and "Material U.S. Federal Income Tax Consequences" in the accompanying base prospectus. |

Exchange listing | | Our common units trade on the NYSE under the symbol "SMLP." |

Risk factors | | You should carefully read and consider the information beginning on page S-14 of this prospectus supplement set forth under the heading "Risk Factors" and on page 2 of the accompanying base prospectus and the other risk factors incorporated by reference into this prospectus, before deciding to invest in our common units. |

S-7

Table of Contents

Summary Historical Financial and Operating Data

The following table presents, as of the dates and for the periods indicated, the summary historical consolidated financial and operating data for us. The following table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and related notes appearing in our Current Report on Form 8-K/A filed September 1, 2016 and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, which are incorporated by reference into this prospectus supplement. Please read "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Items Affecting the Comparability of Our Financial Results" in our Current Report on Form 8-K/A filed on September 1, 2016 and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. Moreover, our historical results are not necessarily indicative of results that may be expected for any future period.

The summary historical consolidated financial data presented as of December 31, 2015 and 2014 and for the years ended December 31, 2015, 2014 and 2013 have been derived from the audited consolidated financial statements of the Partnership, which are incorporated by reference in this prospectus supplement. The summary historical consolidated financial data presented as of June 30, 2016 and for the six months ended June 30, 2016 and 2015 have been derived from our unaudited condensed consolidated financial statements, which are incorporated by reference in this prospectus supplement.

On March 3, 2016, we acquired substantially all of (i) the issued and outstanding membership interests of Summit Midstream Utica, LLC, Meadowlark Midstream Company, LLC and Tioga Midstream, LLC and (ii) SMP Holdings' 40% ownership interest in each of Ohio Gathering Company, L.L.C. and Ohio Condensate Company, L.L.C. from SMP Holdings (the "2016 Drop Down").

On May 18, 2015, we acquired all of the membership interests of Polar Midstream, LLC and Epping Transmission Company, LLC from SMP Holdings (the "Polar and Divide Drop Down").

On March 18, 2014, we acquired all of the membership interests of Red Rock Gathering Company, LLC from SMP Holdings (the "Red Rock Drop Down").

The 2016 Drop Down, Polar and Divide Drop Down and Red Rock Drop Down were transactions between entities under common control. As a result, (a) financial statements for the years ended December 31, 2015, 2014 and 2013 have been retrospectively recast to reflect the inclusion of the 2016 Drop Down, (b) financial statements for the years ended December 31, 2014 and 2013 have been retrospectively recast to reflect the inclusion of the Polar and Divide Drop Down, (c) financial statements for the years ended December 31, 2013 have been retrospectively recast to reflect the inclusion of the Red Rock Drop Down and (d) financial statements for the six months ended June 30, 2015 have been retrospectively recast to reflect the inclusion of the 2016 Drop Down.

The following table includes our historical EBITDA, adjusted EBITDA and distributable cash flow, which have not been prepared in accordance with accounting principles generally accepted in the United States, or GAAP. EBITDA, adjusted EBITDA and distributable cash flow are presented, in addition to our GAAP financial measures, because we believe they are also helpful to management, industry analysts, investors, lenders and rating agencies and may be used, in addition to our GAAP financial measures, to assess the financial performance and operating results of our fundamental business activities. For the definitions of EBITDA, adjusted EBITDA and distributable cash flow and

S-8

Table of Contents

reconciliations thereof to their most directly comparable financial measures calculated in accordance with GAAP, please see "—Non-GAAP Financial Measures" below.

| | | | | | | | | | | | | | | | |

| | Summit Midstream Partners, LP | |

|---|

| | Six months ended

June 30, | | Year ended December 31, | |

|---|

| | 2016 | | 2015 | | 2015 | | 2014 | | 2013 | |

|---|

| | (Dollars in thousands)

| |

|---|

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | |

Gathering services and related fees | | $ | 154,287 | | $ | 138,194 | | $ | 337,819 | | $ | 267,478 | | $ | 216,352 | |

Natural gas, NGLs and condensate sales | | | 16,169 | | | 24,580 | | | 42,079 | | | 97,094 | | | 88,185 | |

Other revenues | | | 9,750 | | | 10,167 | | | 20,659 | | | 22,597 | | | 21,623 | |

| | | | | | | | | | | | | | | | | |

Total revenues | | | 180,206 | | | 172,941 | | | 400,557 | | | 387,169 | | | 326,160 | |

| | | | | | | | | | | | | | | | | |

Costs and expenses: | | | | | | | | | | | | | | | | |

Cost of natural gas and NGLs | | | 13,154 | | | 18,015 | | | 31,398 | | | 72,415 | | | 68,037 | |

Operation and maintenance | | | 49,252 | | | 46,385 | | | 94,986 | | | 94,869 | | | 78,175 | |

General and administrative | | | 25,755 | | | 23,231 | | | 45,108 | | | 43,281 | | | 36,716 | |

Transaction costs | | | 1,296 | | | 932 | | | 1,342 | | | 2,985 | | | 2,841 | |

Depreciation and amortization | | | 55,691 | | | 51,549 | | | 105,117 | | | 90,878 | | | 71,232 | |

Loss (gain) on asset sales, net | | | 11 | | | (214 | ) | | (172 | ) | | 442 | | | 113 | |

Environmental remediation | | | — | | | — | | | 21,800 | | | 5,000 | | | — | |

Goodwill impairment | | | — | | | — | | | 248,851 | | | 54,199 | | | — | |

Long-lived asset impairment | | | 569 | | | — | | | 9,305 | | | 5,505 | | | — | |

| | | | | | | | | | | | | | | | | |

Total costs and expenses | | | 145,728 | | | 139,898 | | | 557,735 | | | 369,574 | | | 257,114 | |

| | | | | | | | | | | | | | | | | |

Other income | | | 41 | | | 1 | | | 2 | | | 1,189 | | | 5 | |

Interest expense | | | (31,917 | ) | | (30,503 | ) | | (59,092 | ) | | (48,586 | ) | | (21,314 | ) |

Deferred purchase price obligation expense | | | (24,928 | ) | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (22,326 | ) | | 2,541 | | | (216,268 | ) | | (29,802 | ) | | 47,737 | |

Income tax (expense) benefit | | | (283 | ) | | (167 | ) | | 603 | | | (854 | ) | | (729 | ) |

Loss from equity method investees | | | (31,611 | ) | | (7,254 | ) | | (6,563 | ) | | (16,712 | ) | | — | |

| | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (54,220 | ) | $ | (4,880 | ) | $ | (222,228 | ) | $ | (47,368 | ) | $ | 47,008 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Statement of Cash Flows Data: | | | | | | | | | | | | | | | | |

Net cash provided by (used in): | | | | | | | | | | | | | | | | |

Operating activities | | $ | 131,500 | | $ | 104,996 | | $ | 191,375 | | $ | 152,953 | | $ | 135,411 | |

Investing activities | | | (466,883 | ) | | (488,616 | ) | | (646,720 | ) | | (1,384,803 | ) | | (659,041 | ) |

Financing activities | | | 320,333 | | | 383,816 | | | 449,327 | | | 1,233,877 | | | 538,080 | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 6,743 | | | | | $ | 21,793 | | $ | 27,811 | | | | |

Accounts receivable | | | 48,305 | | | | | | 89,581 | | | 92,908 | | | | |

Property, plant, and equipment, net | | | 1,846,147 | | | | | | 1,812,783 | | | 1,622,640 | | | | |

Total assets | | | 3,081,274 | | | | | | 3,164,672 | | | 3,242,462 | | | | |

Total long-term debt | | | 1,312,539 | | | | | | 1,267,270 | | | 1,232,207 | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | |

EBITDA(1) | | $ | 33,937 | | $ | 77,801 | | $ | (57,838 | ) | $ | 93,890 | | $ | 141,310 | |

Adjusted EBITDA(1) | | | 142,396 | | | 123,476 | | | 235,491 | | | 207,975 | | | 162,690 | |

Capital expenditures(2) | | | 91,372 | | | 131,517 | | | 272,225 | | | 343,380 | | | 249,626 | |

Acquisition of gathering systems(3) | | | 866,858 | | | 292,941 | | | 288,618 | | | 315,872 | | | 458,914 | |

Distributable cash flow(1) | | | 102,535 | | | 87,617 | | | 164,931 | | | 144,711 | | | 120,611 | |

Operating data: | | | | | | | | | | | | | | | | |

Aggregate average throughput—gas (MMcf/d) | | | 1,518 | | | 1,577 | | | 1,498 | | | 1,423 | | | 1,139 | |

Aggregate average throughput—liquids (Mbbl/d) | | | 90.5 | | | 58.1 | | | 67.7 | | | 40.7 | | | 10.9 | |

- (1)

- See "—Non-GAAP Financial Measures" below for additional information on EBITDA, adjusted EBITDA and distributable cash flow as well as their reconciliations to the most directly comparable

S-9

Table of Contents

GAAP financial measure. EBITDA and adjusted EBITDA include transaction costs. These unusual expenses are settled in cash.

- (2)

- See "Liquidity and Capital Resources" in Exhibit 99.1 to our Current Report on Form 8-K/A filed on September 1, 2016 and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, each incorporated herein by reference, for more information on capital expenditures.

- (3)

- Reflects consideration paid and recognized, including working capital and capital expenditure adjustments paid (received), for acquisitions and/or drop downs. For additional information, see Notes 11 and 16 to the unaudited condensed consolidated financial statements accompanying our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, incorporated by reference herein.

Non-GAAP Financial Measures

We define EBITDA as net income or loss, plus interest expense, income tax expense and depreciation and amortization, less interest income and income tax benefit. We define adjusted EBITDA as EBITDA plus our proportional adjusted EBITDA for equity method investees, adjustments related to MVC shortfall payments, deferred purchase price obligation expense, impairments and other noncash expenses or losses, less income (loss) from equity method investees and other noncash income or gains. We define distributable cash flow as adjusted EBITDA plus cash interest received and cash taxes received, less cash interest paid, senior notes interest adjustment, cash taxes paid and maintenance capital expenditures.

EBITDA, adjusted EBITDA and distributable cash flow are used as supplemental financial measures by our management and by external users of our financial statements such as investors, commercial banks, research analysts and others.

EBITDA and adjusted EBITDA (including segment adjusted EBITDA) are used to assess:

- •

- the financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

- •

- the ability of our assets to generate cash sufficient to make future cash distributions and support our indebtedness;

- •

- our operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to financing or capital structure; and

- •

- the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities.

In addition, adjusted EBITDA (including segment adjusted EBITDA) is used to assess:

- •

- the financial performance of our assets without regard to (i) income or loss from equity method investees, (ii) the impact of the timing of minimum volume commitments shortfall payments under our gathering agreements or (iii) the timing of impairments of other noncash income or expense items.

Distributable cash flow is used to assess:

- •

- the ability of our assets to generate cash sufficient to make future cash distributions and support our indebtedness; and

- •

- the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities.

EBITDA, adjusted EBITDA and distributable cash flow are not financial measures presented in accordance with GAAP. We believe that the presentation of these non-GAAP financial measures provides useful information to investors in assessing our financial condition and results of operations.

S-10

Table of Contents

Net income or loss and net cash provided by operating activities are the GAAP financial measures most directly comparable to EBITDA, adjusted EBITDA and distributable cash flow. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measure. Furthermore, each of these non-GAAP financial measures has limitations as an analytical tool because it excludes some but not all items that affect the most directly comparable GAAP financial measure.

We compensate for the limitations of EBITDA, adjusted EBITDA and distributable cash flows as analytical tools by reviewing the comparable GAAP financial measures, understanding the differences between the financial measures and incorporating these data points into our decision-making process.

EBITDA, adjusted EBITDA or distributable cash flow should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Because EBITDA, adjusted EBITDA and distributable cash flow may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

The following items should be noted when reviewing our non-GAAP reconciliations:

- •

- Interest expense presented in the net income-basis non-GAAP reconciliation includes amortization of deferred loan costs while interest expense presented in the cash flow-basis non-GAAP reconciliation is adjusted to exclude amortization of deferred loan costs. See the consolidated statements of cash flows for additional information.

- •

- Deferred purchase price obligation expense represents the change in the present value of the deferred purchase price obligation.

- •

- Depreciation and amortization includes the favorable and unfavorable gas gathering contract amortization expense reported in other revenues.

- •

- Proportional adjusted EBITDA for equity method investees accounts for our pro rata share of Ohio Gathering's adjusted EBITDA, based on a one-month lag.

- •

- Adjustments related to MVC shortfall payments account for (i) the net increases or decreases in deferred revenue for MVC shortfall payments and (ii) our inclusion of expected annual MVC shortfall payments. We include a proportional amount of these historical or expected minimum volume commitment shortfall payments in each quarter prior to the quarter in which we actually receive the shortfall payment.

- •

- Senior notes interest adjustment represents the net of interest expense accrued and paid during the period.

- •

- Maintenance capital expenditures are cash expenditures (including expenditures for the addition or improvement to, or the replacement of, our capital assets or for the acquisition of existing, or the construction or development of new, capital assets) made to maintain our long-term operating income or operating capacity.

- •

- As a result of accounting for our drop down transactions similar to a pooling of interests, EBITDA, adjusted EBITDA, and distributable cash flow reflect the historical operations, financial position and cash flows of contributed subsidiaries for the periods beginning with the date that common control began and ending on the date that the respective drop down closed.

- •

- EBITDA, adjusted EBITDA and distributable cash flow include transaction costs. These unusual expenses are settled in cash.

S-11

Table of Contents

The following table presents a reconciliation of our net income to EBITDA, adjusted EBITDA and distributable cash flow for the periods indicated.

| | | | | | | | | | | | | | | | |

| | Summit Midstream Partners, LP | |

|---|

| | Six months ended

June 30, | | Year ended December 31, | |

|---|

| | 2016 | | 2015 | | 2015 | | 2014 | | 2013 | |

|---|

| | (In thousands)

| |

|---|

Reconciliation of net (loss) income to EBITDA, adjusted EBITDA and distributable cash flow: | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (54,220 | ) | $ | (4,880 | ) | $ | (222,228 | ) | $ | (47,368 | ) | $ | 47,008 | |

Add: | | | | | | | | | | | | | | | | |

Interest expense | | | 31,917 | | | 30,503 | | | 59,092 | | | 48,586 | | | 21,314 | |

Income tax expense (benefit) | | | 283 | | | 167 | | | (603 | ) | | 854 | | | 729 | |

Depreciation and amortization | | | 55,957 | | | 52,012 | | | 105,903 | | | 91,822 | | | 72,264 | |

Less: | | | | | | | | | | | | | | | | |

Interest income | | | — | | | 1 | | | 2 | | | 4 | | | 5 | |

| | | | | | | | | | | | | | | | | |

EBITDA | | $ | 33,937 | | $ | 77,801 | | $ | (57,838 | ) | $ | 93,890 | | $ | 141,310 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Add: | | | | | | | | | | | | | | | | |

Proportional adjusted EBITDA for equity method investees | | | 25,113 | | | 11,816 | | | 33,667 | | | 6,006 | | | — | |

Adjustments related to MVC shortfall payments | | | 22,277 | | | 23,268 | | | (11,902 | ) | | 26,565 | | | 17,025 | |

Unit-based and noncash compensation | | | 3,950 | | | 3,551 | | | 7,017 | | | 5,841 | | | 4,242 | |

Deferred purchase price obligation expense | | | 24,928 | | | — | | | — | | | — | | | — | |

Loss on asset sales | | | 134 | | | 24 | | | 42 | | | 442 | | | 113 | |

Goodwill impairment | | | — | | | — | | | 248,851 | | | 54,199 | | | — | |

Long-lived asset impairment | | | 569 | | | — | | | 9,305 | | | 5,505 | | | — | |

Less: | | | | | | | | | | | | | | | | |

Loss from equity method investees | | | (31,611 | ) | | (7,254 | ) | | (6,563 | ) | | (16,712 | ) | | — | |

Gain on asset sales | | | 123 | | | 238 | | | 214 | | | — | | | — | |

Impact of purchase price adjustment | | | — | | | — | | | — | | | 1,185 | | | — | |

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 142,396 | | $ | 123,476 | | $ | 235,491 | | $ | 207,975 | | $ | 162,690 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Add: | | | | | | | | | | | | | | | | |

Cash interest received | | | — | | | 1 | | | 2 | | | 4 | | | 5 | |

Cash taxes received | | | 50 | | | — | | | — | | | — | | | — | |

Less: | | | | | | | | | | | | | | | | |

Cash interest paid | | | 31,464 | | | 30,331 | | | 59,302 | | | 38,453 | | | 13,170 | |

Senior notes interest adjustment | | | — | | | (1,421 | ) | | (1,421 | ) | | 6,733 | | | 12,125 | |

Cash taxes paid | | | — | | | — | | | — | | | — | | | 660 | |

Maintenance capital expenditures | | | 8,447 | | | 6,950 | | | 12,681 | | | 18,082 | | | 16,129 | |

| | | | | | | | | | | | | | | | | |

Distributable cash flow | | $ | 102,535 | | $ | 87,617 | | $ | 164,931 | | $ | 144,711 | | $ | 120,611 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S-12

Table of Contents

The following table presents a reconciliation of our net cash provided by operating activities to EBITDA, adjusted EBITDA and distributable cash flow for the periods indicated.

| | | | | | | | | | | | | | | | |

| | Summit Midstream Partners, LP | |

|---|

| | Six months ended

June 30, | | Year ended December 31, | |

|---|

| | 2016 | | 2015 | | 2015 | | 2014 | | 2013 | |

|---|

| | (In thousands)

| |

|---|

Reconciliation of net cash provided by operating activities to EBITDA, adjusted EBITDA and distributable cash flow: | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 131,500 | | $ | 104,996 | | $ | 191,375 | | $ | 152,953 | | $ | 135,411 | |

Add: | | | | | | | | | | | | | | | | |

Loss from equity method investees | | | (31,611 | ) | | (7,254 | ) | | (6,563 | ) | | (16,712 | ) | | — | |

Interest expense, excluding deferred loan costs | | | 29,970 | | | 28,307 | | | 54,783 | | | 44,750 | | | 18,557 | |

Income tax expense (benefit) | | | 283 | | | 167 | | | (603 | ) | | 854 | | | 729 | |

Impact of purchase price adjustment | | | — | | | — | | | — | | | 1,185 | | | — | |

Changes in operating assets and liabilities | | | (42,566 | ) | | (30,481 | ) | | 3,541 | | | (18,603 | ) | | (9,027 | ) |

Gain on asset sales | | | 123 | | | 238 | | | 214 | | | — | | | — | |

Less: | | | | | | | | | | | | | | | | |

Unit-based and noncash compensation | | | 3,950 | | | 3,551 | | | 7,017 | | | 5,841 | | | 4,242 | |

Distributions from equity method investees | | | 24,181 | | | 13,869 | | | 34,641 | | | 2,992 | | | — | |

Deferred purchase price obligation expense | | | 24,928 | | | — | | | — | | | — | | | — | |

Interest income | | | — | | | 1 | | | 2 | | | 4 | | | 5 | |

Loss on asset sales | | | 134 | | | 24 | | | 42 | | | 442 | | | 113 | |

Goodwill impairment | | | — | | | — | | | 248,851 | | | 54,199 | | | — | |

Write-off of debt issuance costs | | | — | | | 727 | | | 727 | | | 1,554 | | | — | |

Long-lived asset impairment | | | 569 | | | — | | | 9,305 | | | 5,505 | | | — | |

| | | | | | | | | | | | | | | | | |

EBITDA | | $ | 33,937 | | $ | 77,801 | | $ | (57,838 | ) | $ | 93,890 | | $ | 141,310 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Add: | | | | | | | | | | | | | | | | |

Proportional adjusted EBITDA for equity method investees | | | 25,113 | | | 11,816 | | | 33,667 | | | 6,006 | | | — | |

Adjustments related to MVC shortfall payments | | | 22,277 | | | 23,268 | | | (11,902 | ) | | 26,565 | | | 17,025 | |

Unit-based and noncash compensation | | | 3,950 | | | 3,551 | | | 7,017 | | | 5,841 | | | 4,242 | |

Deferred purchase price obligation expense | | | 24,928 | | | — | | | — | | | — | | | — | |

Loss on asset sales | | | 134 | | | 24 | | | 42 | | | 442 | | | 113 | |

Goodwill impairment | | | — | | | — | | | 248,851 | | | 54,199 | | | — | |

Long-lived asset impairment | | | 569 | | | — | | | 9,305 | | | 5,505 | | | — | |

Less: | | | | | | | | | | | | | | | | |

Loss from equity method investees | | | (31,611 | ) | | (7,254 | ) | | (6,563 | ) | | (16,712 | ) | | — | |

Gain on asset sales | | | 123 | | | 238 | | | 214 | | | — | | | — | |

Impact of purchase price adjustments | | | — | | | — | | | — | | | 1,185 | | | — | |

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 142,396 | | $ | 123,476 | | $ | 235,491 | | $ | 207,975 | | $ | 162,690 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Add: | | | | | | | | | | | | | | | | |

Cash interest received | | | — | | | 1 | | | 2 | | | 4 | | | 5 | |

Cash taxes received | | | 50 | | | — | | | — | | | — | | | — | |

Less: | | | | | | | | | | | | | | | | |

Cash interest paid | | | 31,464 | | | 30,331 | | | 59,302 | | | 38,453 | | | 13,170 | |

Senior notes interest adjustment | | | — | | | (1,421 | ) | | (1,421 | ) | | 6,733 | | | 12,125 | |

Cash taxes paid | | | — | | | — | | | — | | | — | | | 660 | |

Maintenance capital expenditures | | | 8,447 | | | 6,950 | | | 12,681 | | | 18,082 | | | 16,129 | |

| | | | | | | | | | | | | | | | | |

Distributable cash flow | | $ | 102,535 | | $ | 87,617 | | $ | 164,931 | | $ | 144,711 | | $ | 120,611 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S-13

Table of Contents

RISK FACTORS

An investment in our common units involves risk. You should carefully read the risk factors included under the caption "Risk Factors" beginning on page 2 of the accompanying base prospectus, as well as the risk factors included in Item 1A. "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015, as updated by any similar sections in any subsequent Quarterly Reports on Form 10-Q, together with all of the other information included or incorporated by reference in this prospectus supplement. If any of these risks were to occur, our business, financial condition, results of operations or prospects could be materially adversely affected. In such case, the trading price of our common units could decline, and you could lose all or part of your investment.

S-14

Table of Contents

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately $ million, or approximately $ million if the underwriter exercises its option to purchase additional common units in full (in each case including our general partner's proportionate capital contribution of approximately $ million to maintain its 2% general partner interest in us and deducting underwriting discounts and commissions and estimated offering expenses). We intend to use the net proceeds from this offering to repay borrowings under our revolving credit facility.

As of August 31, 2016, we had $767.0 million of borrowings outstanding under our revolving credit facility with a weighted average interest rate of 3.03% and a November 2018 maturity date. A portion of the borrowings under the revolving credit facility was used to fund the drop down acquisition from SMP Holdings that closed in March 2016.

An affiliate of the underwriter is a lender under our revolving credit facility and, accordingly, will receive a portion of the net proceeds from this offering. Please read "Underwriting" in this prospectus supplement for further information.

S-15

Table of Contents

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2016, on an actual basis and as adjusted to reflect this offering of common units and the application of the net proceeds as described under "Use of Proceeds."

| | | | | | | |

| | As of June 30, 2016 | |

|---|

| | Actual | | As adjusted | |

|---|

| | (In thousands)

| |

|---|

Cash and cash equivalents | | $ | 6,743 | | $ | 6,743 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Debt: | | | | | | | |

Revolving credit facility(1) | | $ | 721,000 | | $ | | |

7.50% Senior notes due 2021(2) | | | 295,365 | | | 295,365 | |

5.50% Senior notes due 2022(2) | | | 296,174 | | | 296,174 | |

| | | | | | | | |

Total long-term debt | | $ | 1,312,539 | | $ | | |

| | | | | | | | |

Partners' Capital: | | | | | | | |

Limited partner capital | | | 1,068,680 | | | | |

General partner interest | | | 27,822 | | | | |

Noncontrolling interest | | | 11,037 | | | 11,037 | |

| | | | | | | | |

Total partners' capital | | $ | 1,107,539 | | $ | | |

| | | | | | | | |

Total capitalization | | $ | 2,420,078 | | $ | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (1)

- Reflects balance under our revolving credit facility at June 30, 2016. As of August 31, 2016 we had $767.0 million of borrowings outstanding under our revolving credit facility.

- (2)

- Net of issuance costs being amortized over the life of the notes.

You should read our financial statements and notes thereto that are incorporated by reference into this prospectus supplement and the accompanying base prospectus for additional information about our capital structure. The table above does not reflect any common units that may be sold to the underwriter upon exercise of its option to purchase additional common units.

S-16

Table of Contents

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS

Our common units trade on the NYSE under the symbol "SMLP." On September 2, 2016, the last reported trading price of our common units was $24.91. As of August 31, 2016, there were approximately 68 holders of record of our common units. The following table sets forth the high and low sales prices of our common units as well as the amount of cash distributions declared and paid during each quarter for the periods indicated.

| | | | | | | | | | | | | |

| | Common Unit

Price | |

| |

| |

|

|---|

| | Distributions

per Common

Unit | |

| |

|

|---|

Quarter Ended | | High | | Low | | Record Date | | Payment Date |

|---|

September 30, 2016 (Through September 2) | | $ | 25.04 | | $ | 20.88 | | | (1) | | (1) | | (1) |

June 30, 2016 | | $ | 23.85 | | $ | 15.05 | | $ | 0.5750 | | August 5, 2016 | | August 12, 2016 |

March 31, 2016 | | $ | 19.65 | | $ | 11.06 | | $ | 0.5750 | | May 6, 2016 | | May 13, 2016 |

December 31, 2015 | | $ | 21.18 | | $ | 12.82 | | $ | 0.5750 | | February 5, 2016 | | February 12, 2016 |

September 30, 2015 | | $ | 33.74 | | $ | 14.60 | | $ | 0.5750 | | November 6, 2015 | | November 13, 2015 |

June 30, 2015 | | $ | 36.82 | | $ | 30.05 | | $ | 0.5700 | | August 7, 2015 | | August 14, 2015 |

March 31, 2015 | | $ | 41.17 | | $ | 30.31 | | $ | 0.5650 | | May 8, 2015 | | May 15, 2015 |

December 31, 2014 | | $ | 51.44 | | $ | 32.30 | | $ | 0.5600 | | February 6, 2015 | | February 13, 2015 |

September 30, 2014 | | $ | 56.49 | | $ | 46.50 | | $ | 0.5400 | | November 7, 2014 | | November 14, 2014 |

June 30, 2014 | | $ | 51.25 | | $ | 40.53 | | $ | 0.5200 | | August 7, 2014 | | August 14, 2014 |

March 31, 2014 | | $ | 43.98 | | $ | 34.72 | | $ | 0.5000 | | May 8, 2014 | | May 15, 2014 |

- (1)

- The distributions attributable to the quarter ending September 30, 2016 have not yet been declared or paid. We are required to declare and pay quarterly cash distributions within 45 days following the end of the quarter.

S-17

Table of Contents

MATERIAL TAX CONSIDERATIONS

The tax consequences to you of an investment in our common units will depend in part on your own tax circumstances. Although this section updates and adds information related to certain tax considerations, it should be read in conjunction with the risk factors included under the caption "Tax Risks" in our Annual Report on Form 10-K for the year ended December 31, 2015, and with "Material U.S. Federal Income Tax Consequences" in the accompanying base prospectus, which provides a discussion of the principal federal income tax considerations associated with our operations and the purchase, ownership and disposition of our common units. The following discussion is limited as described under the caption "Material U.S. Federal Income Tax Consequences" in the accompanying base prospectus. You are urged to consult with your own tax advisor about the federal, state, local and foreign tax consequences particular to your circumstances.

Ratio of Taxable Income to Distributions

We estimate that a purchaser of common units in this offering who owns those common units from the date of closing of this offering through the record date for distributions for the period ending December 31, 2018, will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be 20% or less of the cash distributed with respect to that period. Thereafter, we anticipate that the ratio of allocable taxable income to cash distributions to the unitholders will increase. Our estimate is based upon many assumptions regarding our business operations, including assumptions as to our revenues, capital expenditures, cash flow, net working capital and anticipated cash distributions. These estimates and assumptions are subject to, among other things, numerous business, economic, regulatory, legislative, competitive and political uncertainties beyond our control. Further, the estimates are based on current tax law and tax reporting positions that we will adopt and with which the IRS could disagree. Accordingly, we cannot assure you that these estimates will prove to be correct.

The actual ratio of allocable taxable income to cash distributions could be higher or lower than expected, and any differences could be material and could materially affect the value of the common units. For example, the ratio of allocable taxable income to cash distributions to a purchaser of common units in this offering will be higher, and perhaps substantially higher, than our estimate with respect to the period described above if:

- •

- gross income from operations exceeds the amount required to make minimum quarterly distributions on all units, yet we only distribute the minimum quarterly distributions on all units; or

- •

- we make a future offering of common units and use the proceeds of the offering in a manner that does not produce substantial additional deductions during the period described above, such as to repay indebtedness outstanding at the time of this offering or to acquire property that is not eligible for depreciation or amortization for federal income tax purposes or that is depreciable or amortizable at a rate significantly slower than the rate applicable to our assets at the time of this offering.

Alternative Minimum Tax

Each unitholder will be required to take into account his distributive share of any items of our income, gain, loss or deduction for purposes of the alternative minimum tax. The current minimum tax rate for noncorporate taxpayers is 26% on the first $186,300 of alternative minimum taxable income in excess of the exemption amount and 28% on any additional alternative minimum taxable income. Prospective unitholders are urged to consult with their tax advisors as to the impact of an investment in units on their liability for the alternative minimum tax.

S-18

Table of Contents

Allocations Between Transferors and Transferee

In general, our taxable income and losses will be determined annually, will be prorated on a monthly basis in proportion to the number of days in each month and will be subsequently apportioned among our unitholders in proportion to the number of units owned by each of them as of the opening of the applicable exchange on the first business day of the month, which we refer to in this prospectus as the "Allocation Date." However, gain or loss realized on a sale or other disposition of our assets other than in the ordinary course of business will be allocated among our unitholders on the Allocation Date in the month in which that gain or loss is recognized. As a result, a unitholder transferring units may be allocated income, gain, loss and deduction realized after the date of transfer.

The U.S. Department of Treasury and the IRS have issued Treasury regulations ("Treasury Regulations") under the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code"),that permit publicly traded partnerships to use a monthly simplifying convention that is similar to ours, but they do not specifically authorize all aspects of the proration method we have adopted. Accordingly, Latham & Watkins LLP is unable to opine on the validity of this method of allocating income and deductions between transferor and transferee unitholders. If this method is not allowed under the Treasury Regulations, our taxable income or losses might be reallocated among the unitholders. We are authorized to revise our method of allocation between transferor and transferee unitholders, as well as unitholders whose interests vary during a taxable year.

A unitholder who owns units at any time during a quarter and who disposes of them prior to the record date set for a cash distribution for that quarter will be allocated items of our income, gain, loss and deductions attributable to that quarter through the month of disposition but will not be entitled to receive that cash distribution.

Tax Exempt Organizations and Other Investors

Ownership of units by employee benefit plans, other tax-exempt organizations, non-resident aliens, foreign corporations and other foreign persons raises issues unique to those investors and, as described below to a limited extent, may have substantially adverse tax consequences to them. If you are a tax-exempt entity or a foreign person, you should consult your tax advisor before investing in our common units. Employee benefit plans and most other organizations exempt from federal income tax, including individual retirement accounts and other retirement plans, are subject to federal income tax on unrelated business taxable income. Virtually all of our income allocated to a unitholder that is a tax-exempt organization will be unrelated business taxable income and will be taxable to it.

Non-resident aliens and foreign corporations, trusts or estates that own units will be considered to be engaged in business in the U.S. because of the ownership of units. As a consequence, they will be required to file federal tax returns to report their share of our income, gain, loss or deduction and pay federal income tax at regular rates on their share of our net income or gain. Moreover, under rules applicable to publicly traded partnerships, our quarterly distribution to foreign unitholders will be subject to withholding at the highest applicable effective tax rate. Each foreign unitholder must obtain a taxpayer identification number from the IRS and submit that number to our transfer agent on a Form W-8BEN, W-8BEN-E or applicable substitute form in order to obtain credit for these withholding taxes. A change in applicable law may require us to change these procedures.

In addition, because a foreign corporation that owns units will be treated as engaged in a U.S. trade or business, that corporation may be subject to the U.S. branch profits tax at a rate of 30%, in addition to regular federal income tax, on its share of our earnings and profits, as adjusted for changes in the foreign corporation's "U.S. net equity," that is effectively connected with the conduct of a U.S. trade or business. That tax may be reduced or eliminated by an income tax treaty between the U.S. and the country in which the foreign corporate unitholder is a "qualified resident." In addition, this type of

S-19

Table of Contents

unitholder is subject to special information reporting requirements under Section 6038C of the Internal Revenue Code.

A foreign unitholder who sells or otherwise disposes of a common unit will be subject to U.S. federal income tax on gain realized from the sale or disposition of that unit to the extent the gain is effectively connected with a U.S. trade or business of the foreign unitholder. Under a ruling published by the IRS, interpreting the scope of "effectively connected income," a foreign unitholder would be considered to be engaged in a trade or business in the U.S. by virtue of the U.S. activities of the partnership, and part or all of that unitholder's gain would be effectively connected with that unitholder's indirect U.S. trade or business. Moreover, under the Foreign Investment in Real Property Tax Act, a foreign common unitholder (other than certain "qualified foreign pension funds" (or an entity all of the interests of which are held by such a qualified foreign pension fund), which generally are entities or arrangements that are established and regulated by foreign law to provide retirement or other pension benefits to employees, do not have a single participant or beneficiary that is entitled to more than 5% of the assets or income of the entity or arrangement and are subject to certain preferential tax treatment under the laws of the applicable foreign country) generally will be subject to U.S. federal income tax upon the sale or disposition of a common unit if (i) he owned (directly or constructively applying certain attribution rules) more than 5% of our common units at any time during the five-year period ending on the date of such disposition and (ii) 50% or more of the fair market value of all of our assets consisted of U.S. real property interests at any time during the shorter of the period during which such unitholder held the common units or the five-year period ending on the date of disposition.

Information Returns and Audit Procedures

We intend to furnish to each unitholder, within 90 days after the close of each calendar year, specific tax information, including a Schedule K-1, which describes his share of our income, gain, loss and deduction for our preceding taxable year. In preparing this information, which will not be reviewed by counsel, we will take various accounting and reporting positions, some of which have been mentioned earlier, to determine each unitholder's share of income, gain, loss and deduction. We cannot assure you that those positions will yield a result that conforms to the requirements of the Internal Revenue Code, Treasury Regulations or administrative interpretations of the IRS. Neither we nor Latham & Watkins LLP can assure prospective unitholders that the IRS will not successfully contend in court that those positions are impermissible. Any challenge by the IRS could negatively affect the value of the units.

The IRS may audit our federal income tax information returns. Adjustments resulting from an IRS audit may require each unitholder to adjust a prior year's tax liability, and possibly may result in an audit of his return. Any audit of a unitholder's return could result in adjustments not related to our returns as well as those related to our returns.

Partnerships generally are treated as separate entities for purposes of federal tax audits, judicial review of administrative adjustments by the IRS and tax settlement proceedings. The tax treatment of partnership items of income, gain, loss and deduction are determined in a partnership proceeding rather than in separate proceedings with the partners. The Internal Revenue Code requires that one partner be designated as the "Tax Matters Partner" for these purposes. Our partnership agreement names our general partner as our Tax Matters Partner.

The Tax Matters Partner has made and will make some elections on our behalf and on behalf of unitholders. In addition, the Tax Matters Partner can extend the statute of limitations for assessment of tax deficiencies against unitholders for items in our returns. The Tax Matters Partner may bind a unitholder with less than a 1% profits interest in us to a settlement with the IRS unless that unitholder elects, by filing a statement with the IRS, not to give that authority to the Tax Matters Partner. The Tax

S-20

Table of Contents

Matters Partner may seek judicial review, by which all the unitholders are bound, of a final partnership administrative adjustment and, if the Tax Matters Partner fails to seek judicial review, judicial review may be sought by any unitholder having at least a 1% interest in profits or by any group of unitholders having in the aggregate at least a 5% interest in profits. However, only one action for judicial review will go forward, and each unitholder with an interest in the outcome may participate.

A unitholder must file a statement with the IRS identifying the treatment of any item on his federal income tax return that is not consistent with the treatment of the item on our return. Intentional or negligent disregard of this consistency requirement may subject a unitholder to substantial penalties.

Pursuant to the Bipartisan Budget Act of 2015, for tax years beginning after December 31, 2017, if the IRS makes audit adjustments to our income tax returns, it may assess and collect any taxes (including any applicable penalties and interest) resulting from such audit adjustment directly from us. Generally, we expect to elect to have our general partner and our unitholders take such audit adjustment into account in accordance with their interests in us during the tax year under audit, but there can be no assurance that such election will be effective in all circumstances. If we are unable to have our general partner and our unitholders take such audit adjustment into account in accordance with their interests in us during the tax year under audit, our current unitholders may bear some or all of the tax liability resulting from such audit adjustment, even if such unitholders did not own units in us during the tax year under audit. If, as a result of any such audit adjustment, we are required to make payments of taxes, penalties and interest, our cash available for distribution to our unitholders might be substantially reduced. These rules are not applicable to us for tax years beginning on or prior to December 31, 2017.

Additionally, pursuant to the Bipartisan Budget Act of 2015, the Internal Revenue Code will no longer require that we designate a Tax Matters Partner. Instead, for tax years beginning after December 31, 2017, we will be required to designate a partner, or other person, with a substantial presence in the United States as the partnership representative ("Partnership Representative"). The Partnership Representative will have the sole authority to act on our behalf for purposes of, among other things, federal income tax audits and judicial review of administrative adjustments by the IRS. If we do not make such a designation, the IRS can select any person as the Partnership Representative. We currently anticipate that we will designate our general partner as our Partnership Representative. Further, any actions taken by us or by the Partnership Representative on our behalf with respect to, among other things, federal income tax audits and judicial review of administrative adjustments by the IRS, will be binding on us and all of our unitholders. These rules are not applicable to us for tax years beginning on or prior to December 31, 2017.

Additional Withholding Requirements

Withholding taxes may apply to certain types of payments made to "foreign financial institutions" (as specially defined in the Internal Revenue Code) and certain other foreign entities. Specifically, a 30% withholding tax may be imposed on interest, dividends and other fixed or determinable annual or periodical gains, profits and income from sources within the United States ("FDAP Income"), or gross proceeds from the sale or other disposition of any property of a type which can produce interest or dividends from sources within the United States ("Gross Proceeds") paid to a foreign financial institution or to a "non-financial foreign entity" (as specially defined in the Internal Revenue Code), unless (i) the foreign financial institution undertakes certain diligence and reporting, (ii) the non-financial foreign entity either certifies it does not have any substantial U.S. owners or furnishes identifying information regarding each substantial U.S. owner or (iii) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the payee is a foreign financial institution and is subject to the diligence and reporting requirements in clause (i) above, it must enter into an agreement with the U.S. Treasury requiring, among other things, that it

S-21

Table of Contents

undertake to identify accounts held by certain U.S. persons or U.S.-owned foreign entities, annually report certain information about such accounts, and withhold 30% on payments to noncompliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing these requirements may be subject to different rules.

These rules generally apply to payments of FDAP Income currently and generally will apply to payments of relevant Gross Proceeds made on or after January 1, 2019. Thus, to the extent we have current FDAP Income or have Gross Proceeds on or after January 1, 2019 that are not treated as effectively connected with a U.S. trade or business (please read "—Tax-Exempt Organizations and Other Investors"), unitholders who are foreign financial institutions or certain other foreign entities, or persons that hold their units through such foreign entities, may be subject to withholding on distributions they receive from us, or their distributive share of our income, pursuant to the rules described above.

Prospective investors should consult their own tax advisors regarding the potential application of these withholding provisions to their investment in our common units.

Nominee Reporting

Persons who hold an interest in us as a nominee for another person are required to furnish to us:

- •

- the name, address and taxpayer identification number of the beneficial owner and the nominee;

- •

- whether the beneficial owner is:

- •

- a person that is not a U.S. person;

- •

- a foreign government, an international organization or any wholly owned agency or instrumentality of either of the foregoing; or

- •

- a tax-exempt entity;

- •

- the amount and description of units held, acquired or transferred for the beneficial owner; and

- •

- specific information including the dates of acquisitions and transfers, means of acquisitions and transfers, and acquisition cost for purchases, as well as the amount of net proceeds from dispositions.

Brokers and financial institutions are required to furnish additional information, including whether they are U.S. persons and specific information on units they acquire, hold or transfer for their own account. A penalty of $250 per failure, up to a maximum of $3,000,000 per calendar year, is imposed by the Internal Revenue Code for failure to report that information to us. The nominee is required to supply the beneficial owner of the units with the information furnished to us.

Legislative Developments