Filed Pursuant to Rule 424(b)(3)

Registration No. 333-219196

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying base prospectus are not an offer to sell and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 6, 2017

PROSPECTUS SUPPLEMENT

(To prospectus dated November 6, 2017)

Summit Midstream Partners, LP

Units

% Series AFixed-to-Floating Rate Cumulative Redeemable

Perpetual Preferred Units

(Liquidation Preference $ per unit)

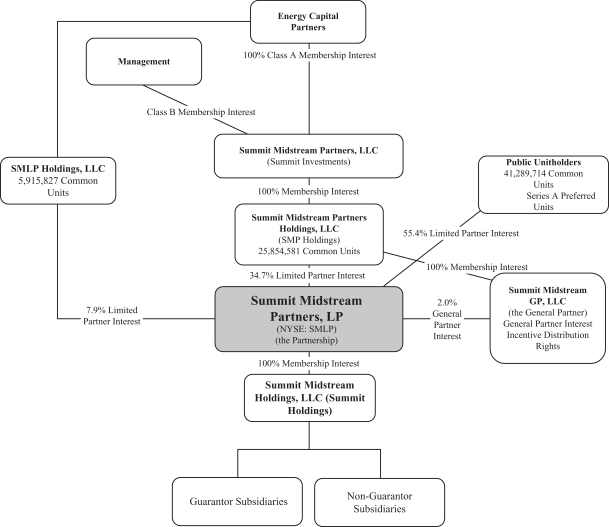

We are selling of our % Series AFixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units, liquidation preference $ per unit, representing limited partner interests in Summit Midstream Partners, LP (“Series A Preferred Units”) in this offering.

Distributions on the Series A Preferred Units are cumulative and compounding from the date of original issue and will be payable semi-annually in arrears on the day of and through and including , 2022 and, thereafter, quarterly in arrears on the day of , , and of each year, when, as and if declared by our general partner. Apro-rated initial distribution on the Series A Preferred Units offered hereby will be payable on , 2017 in an amount equal to approximately $ per Series A Preferred Unit. Distributions on the Series A Preferred Units will be payable out of amounts legally available therefor from and including the date of original issue to, but not including, , 2022, at a rate equal to % per annum of the $ liquidation preference. On and after , 2022, distributions on the Series A Preferred Units will accumulate for each distribution period at a percentage of the $ liquidation preference equal to the three-month LIBOR plus a spread of %.

At any time on or after , 2022, we may redeem the Series A Preferred Units, in whole or in part, at the redemption prices set forth and as described under the caption “Description of Our Series A Preferred Units—Redemption—Optional Redemption on or after , 2022” plus an amount equal to all accumulated and unpaid distributions thereon to, but not including, the date of redemption, whether or not declared. In addition, upon the occurrence of certain rating agency events as described under “Description of Our Series A Preferred Units—Redemption—Optional Redemption upon a Ratings Event,” we may redeem the Series A Preferred Units, in whole but not in part, at a price of $ per Series A Preferred Unit plus an amount equal to all accumulated and unpaid distributions thereon to, but not including, the date of redemption, whether or not declared. If a change of control triggering event, as described under “Description of Our Series A Preferred Units—Change of Control Triggering Event,” occurs, each holder of our Series A Preferred Units may require us to repurchase all or a portion of such holder’s Series A Preferred Units at a purchase price of $ per Series A Preferred Unit (101% of the liquidation preference) plus an amount equal to all accumulated and unpaid distributions thereon to, but not including, the date of settlement.

The Series A Preferred Units will rank, as to the payment of distributions and amounts payable on a liquidation event, senior to our common units.

Investing in our Series A Preferred Units involves risks. See “Risk Factors” onpage S-16 of this prospectus supplement.

| | | | | | | | |

| | | Per Series A Preferred Unit | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting Discount | | $ | | | | $ | | |

Proceeds to Summit Midstream Partners, LP (before expenses) | | $ | | | | $ | | |

Delivery of the Series A Preferred Units is expected to be made on or about , 2017.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| | | | | | |

| BofA Merrill Lynch | | Credit Suisse | | Morgan Stanley | | Wells Fargo Securities |

Prospectus supplement dated , 2017.