Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 3 DATED JULY 7, 2014

TO THE PROSPECTUS DATED APRIL 15, 2014

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 15, 2014, as supplemented by Prospectus Supplement No. 1, dated May 19, 2014, and Prospectus Supplement No. 2, dated June 30, 2014 (the “Prospectus”).

The purpose of this Supplement is to provide information regarding the addition of a new sub-advisor for the Company.

On July 1, 2014, the Company, through a wholly-owned subsidiary, and the Company’s Advisor, TriLinc Advisors, LLC, entered into a sub-advisory agreement with Barak Fund Management Limited to become a sub-advisor for the Company’s investments in Sub-Saharan Africa.

The following information updates and supplements the “Business – Investment Strategy – Expertise” section of the Prospectus to provide certain information regarding the Company’s sub-advisors:

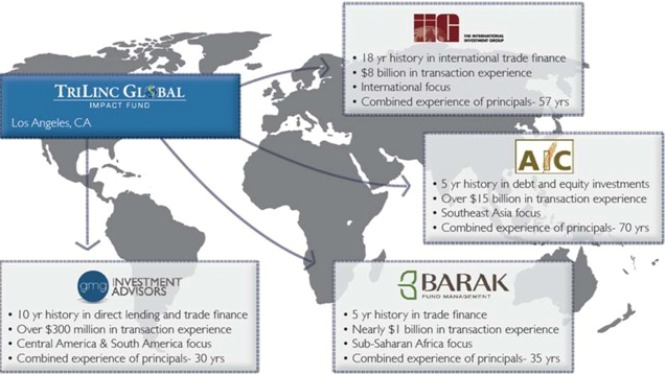

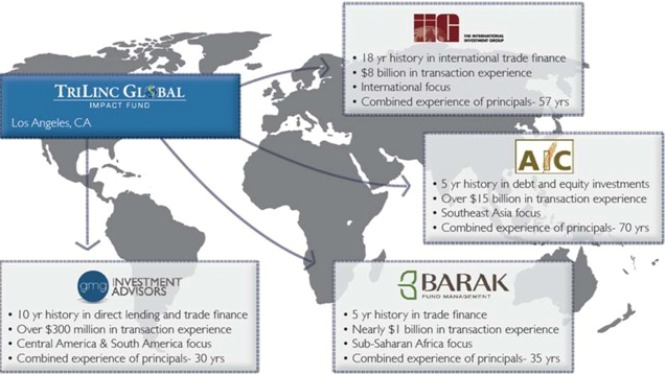

As of July 1, 2014, TriLinc Advisors has selected four institutional-class sub-advisors with access to a robust pipeline of highly selective investment opportunities. Collectively, the sub-advisors have deployed more than $24 billion in developing economy debt transactions. The management teams have an average of over 25 years of local market experience. The following are the selected managers to act as sub-advisors:

| | • | | The International Investment Group L.L.C. (IIG): is an alternative investment management firm founded in 1994 that focuses primarily on international trade finance and fixed income investments to small and medium enterprises in developing economies. The company has deployed over $8.0 billion in investments since its inception and currently manages and / or services approximately $600 million in assets. IIG is headquartered in New York with additional representatives in Argentina, Brazil, Chile, Curacao, Ecuador, Malta, Paraguay, Peru and Uruguay. |

IIG’s management team has well over 100 years of cumulative experience in trade finance and fixed income investments. They are selective in transaction sourcing and execution, and typically work in conjunction with a large network of legal teams, banks, merchants, brokers, professional organizations, investors and local representatives. IIG believes working with a well-rounded and diversified network provides greater insight into local market conditions and enables the firm to capitalize on attractive investment opportunities. IIG believes they are a leader because they perform robust due diligence, can quickly identify and capitalize on investment opportunities and carefully structure investments to minimize transactional risk. IIG serves as a primary sub-advisor.

| | • | | Asia Impact Capital Ltd (AIC): an investment firm advised by the founding principals of TAEL Partners Ltd (“TAEL”) and was established to provide investment management services to us. TAEL is a leading Southeast Asian investment firm founded in 2007 by seasoned industry veterans with long term track records and diverse investment capabilities across Southeast Asia. TAEL’s investment professionals have deep roots in Southeast Asia and extensive experience working for leading financial institutions on both international and local levels. The company has a hands-on approach and can adapt and tailor its investment structures to the nuances of the Southeast Asian markets while partnering with established, growing businesses. Leveraging its wide and established network of business relationships in the region, TAEL generally enjoys an absence of competitive bidding, and is often able to undertake investments at attractive pricing levels. |

TAEL’s founding principals have over 70 years of collective Asian market investment experience and have closed over $30 billion worth of transactions across a diverse range of industries. Importantly, TAEL’s principals have worked together as a cohesive and successful team for over 10 years and will

jointly advise AIC in its investment activities. AIC will leverage TAEL’s robust support team that includes over 20 seasoned investment professionals across 4 offices (Singapore, Kuala Lumpur, Bangkok and Jakarta) who help source, underwrite and execute transactions. AIC, through its advisor, is expected to benefit from TAEL’s strong network of over 200 relationships with leading regional business groups and owners – many of which were forged during the 1997 Asian financial crisis and further cultivated in the years since. AIC intends to operate with close alignment of interests with its borrower companies to jointly establish and achieve common business, investment and impact objectives. AIC serves as a primary sub-advisor.

| | • | | GMG Investment Advisors, LLC (GMG): headquartered in New York with strategic partners operating in Brazil, Colombia and Peru, GMG is a specialized emerging market asset management firm focused on private credit investments in Latin America. The Company’s lineage dates back to 2002 to the founding of Global Securities Advisors (“GSA”) GP – a specialized emerging market asset management firm. In 2010, Greg Gentile, former Head of Latin America Credit at both Lehman Brothers and Barclays Capital, along with several of his team members, joined forces with the GSA team, enhancing its structuring and Latin American asset management experience to create GMG. GMG, along with GSA, has originated, structured and invested over $300 million in secured private credit transactions in Latin America and operates its own in-house securitization platform which is used to obtain custom-tailored, non-recourse financing via structured notes to help achieve equity like returns. |

GMG utilizes its strategic partnership with Global Securities Group (“GSG”), a financial institution with over 300 employees in the Americas and more than $1.0 billion in client assets, to help originate a number of investment opportunities in the Latin American region. GMG serves as a secondary sub-advisor.

| | • | | Barak Fund Management Limited (Barak): is an African based asset management company founded in 2008 that is focused on providing trade finance to small and middle market companies in the agriculture and commodities sectors. Barak specializes in sourcing and originating mainly soft commodity transactions with strong collateral characteristics. With affiliate offices in Mauritius and South Africa, the Barak team is able to source and take advantage of the numerous opportunities that arise in some of the world’s fastest growing economies. The company has completed close to $1 billion in transactions across Sub-Saharan Africa since its inception. |

Barak’s two founding principals have more than 35 years of combined experience in trading, international banking and private equity investment in Africa. Both possess specialist expertise and proven track records in the agricultural and commodities sectors, developed at a variety of world class institutions such as Standard Bank, Absa, Barclays and Rand Merchant Bank. Barak serves as a secondary sub-advisor.

S-2

S-3