Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 6 DATED AUGUST 18, 2014

TO THE PROSPECTUS DATED APRIL 15, 2014

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 15, 2014, as supplemented by Prospectus Supplement No. 1, dated May 19, 2014, Prospectus Supplement No. 2, dated June 30, 2014, Prospectus Supplement No. 3, dated July 7, 2014, Prospectus Supplement No. 4, dated July 23, 2014, and Prospectus Supplement No. 5, dated July 28, 2014 (the “Prospectus”).

The purposes of this Supplement are as follows:

| A. | To provide information regarding our public offering; |

| B. | To provide information regarding distributions declared; |

| C. | To update the section of the Prospectus titled “Business;” and |

| D. | To update the section of the Prospectus titled “Management of the Company.” |

| A. | Status of Our Public Offering |

As of August 15, 2014, we had raised gross proceeds of approximately $42.2 million from the sale of approximately 4.5 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

| B. | Declaration of Distributions |

On August 8, 2014, with the authorization of our board of managers, the Company declared distributions for all classes of units for the period from August 1 through August 31, 2014. These distributions will be calculated based on unitholders of record for each day in an amount equal to $0.00197808 per unit per day (less the distribution fee with respect to Class C units). On or around September 4, 2014, these distributions will be paid in cash, or reinvested in the Company’s units for those investors participating in the Company’s unit reinvestment plan. Some or all of the Company’s distributions have been and may continue to be paid from sources other than cash flow from operations, such as capital contributions from the Sponsor, cash resulting from a waiver or deferral of fees, and/or proceeds from this offering.

| C. | Update to the Section Titled “Business” |

| 1. | The following information updates and supplements the “Business — Investments — Overview” section of the Prospectus to provide certain information regarding the Company’s investment portfolio as of July 31, 2014: |

Investments

Since the Company commenced operations and through July 31, 2014, the Company has funded in excess of $40.9 million in term loans and trade finance facilities. Given the Company’s weighted average portfolio duration of less than a year, a significant portion of the secured borrower debt has paid off and been reinvested in new transactions.

As of July 31, 2014, the Company had the following investments:

| | | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Maturity | | Interest

Rate1 | | | Total Loan

Commitment2 | | | Total Amount

Outstanding3 | | | Primary Impact

Objective |

| | | | | | | | |

Agriculture Distributor | | Agricultural Products | | Argentina | | Trade Finance | | 7/28/2015 | | | 9.00 | % | | $ | 5,000,000 | | | $ | 5,000,000 | | | Job Creation |

| | | | | | | | |

Beef Exporter | | Meat, Poultry & Fish | | Argentina | | Trade Finance | | 6/4/2015 | | | 11.98 | % | | $ | 5,000,000 | | | $ | 4,000,000 | | | Job Creation |

| | | | | | | | |

Consumer Goods Distributor | | Packaged Foods & Meats | | Namibia | | Trade Finance | | 11/15/2014 | | | 12.50 | % | | $ | 2,000,000 | | | $ | 2,000,000 | | | Job Creation |

| | | | | | | | |

Dairy Co-Operative | | Consumer Products | | Argentina | | Trade Finance | | 8/1/2014 | | | 10.33 | % | | $ | 5,000,000 | | | $ | 3,142,820 | | | Job Creation |

| | | | | | | | |

Diaper Manufacturer | | Personal Products | | Peru | | Term Loan | | 07/15/2016 | | | 13.10 | % | | $ | 2,750,000 | | | $ | 2,750,000 | | | Job Creation |

| | | | | | | | |

Fertilizer Distributor | | Fertilizers & Agricultural Chemicals | | Zambia | | Trade Finance | | 10/6/2014 | | | 12.00 | % | | $ | 3,000,000 | | | $ | 3,000,000 | | | Agricultural

Productivity &

Food Security |

| | | | | | | | |

Food Processor | | Food Products | | Peru | | Term Loan | | 11/29/2014 | | | 13.00 | % | | $ | 464,000 | | | $ | 464,000 | | | Job Creation |

| | | | | | | | |

Frozen Seafood Exporter | | Meat, Poultry & Fish | | Ecuador | | Trade Finance | | 09/21/2014 | | | 12.55 | % | | $ | 500,000 | | | $ | — | | | Job Creation |

| | | | | | | | |

Fruit & Nut Distributor | | Food Products | | South Africa | | Trade Finance | | 10/2/2014 | | | 17.50 | % | | $ | 1,250,000 | | | $ | 1,250,000 | | | Job Creation |

| | | | | | | | |

Insulated Wire Manufacturer | | Electrical Equipment | | Peru | | Trade Finance | | 9/25/2014 | | | 8.00 | % | | $ | 3,000,000 | | | $ | 1,991,000 | | | Job Creation |

| | | | | | | | |

International Tuna Exporter | | Meat, Poultry & Fish | | Ecuador | | Trade Finance | | 10/18/2014 | | | 12.46 | % | | $ | 3,000,000 | | | $ | — | | | Job Creation |

| | | | | | | | |

Meat Processor | | Meat, Poultry & Fish | | South Africa | | Trade Finance | | 11/1/2014 | | | 12.50 | % | | $ | 1,000,000 | | | $ | 1,000,000 | | | Job Creation |

| | | | | | | | |

Rice & Bean Importer | | Food Products | | South Africa | | Trade Finance | | 10/30/2014 | | | 12.50 | % | | $ | 1,000,000 | | | $ | 1,000,000 | | | Agricultural

Productivity &

Food Security |

| | | | | | | | |

Sugar Producer | | Agricultural Products | | Brazil | | Term Loan | | 12/15/2016 | | | 12.43 | % | | $ | 3,000,000 | | | $ | 3,000,000 | | | Capacity-

Building |

| | | | | | | | |

Textile Distributor | | Textiles, Apparel & Luxury Goods | | South Africa | | Trade Finance | | 11/3/2014 | | | 15.00 | % | | $ | 1,500,000 | 4 | | $ | 420,000 | | | Equality &

Empowerment |

| | | | | | | | |

Timber Exporter | | Forest Products | | Chile | | Trade Finance | | 7/31/2014 | | | 9.85 | % | | $ | 500,000 | | | $ | — | | | Job Creation |

| | | | | | | | |

| Portfolio Totals | | | | | | | | | | | | | | $ | 37,964,000 | | | $ | 29,017,820 | | | |

| 1 | Interest rates are as of July 31, 2014. Interest rates include contractual rates and accrued fees where applicable. |

| 2 | The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. |

| 3 | The total amount outstanding represents the actual amount borrowed under the loan as of July 31, 2014. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again. |

| 4 | In addition, on August 12, 2014, the Company funded a $286,000 draw against an existing revolving trade finance facility at a fixed interest rate of 15.00% to a South African textile distributor. The transaction, set to mature on November 4, 2014, is secured by specific clothing inventory being imported into South Africa from Asia and sold to large retailers. |

Certain Portfolio Characteristics

| | | | |

Total Assets (est.): | | $ | 33,552,039 | |

Current Loan Commitments: | | $ | 37,964,000 | |

Leverage: | | | 0 | % |

Average Portfolio Loan Size: | | $ | 3,044,960 | |

Weighted Average Portfolio Duration1: | | | 0.93 years | |

Weighted Average Position Yield: | | | 11.5 | % |

USD Denominated: | | | 100 | % |

Countries2: | | | 8 | |

S-2

| 1 | Duration is calculated through the average turn of trade finance transactions and the contracted amortization of term loans. |

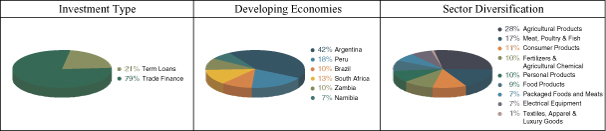

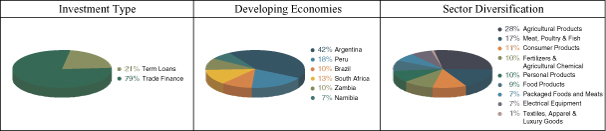

| 2 | The figure represents all countries where the Company has a loan commitment as of July 30, 2014. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the Developing Economies chart below, which represents invested capital. |

Top Five Investments by Percentage

| | | | | | |

| | |

| Company Description | | Country | | % of Net Assets | |

Agricultural Distributor | | Argentina | | | 14.9 | % |

Beef Exporter | | Argentina | | | 11.9 | % |

Dairy Co-Operative | | Argentina | | | 9.4 | % |

Sugar Producer | | Brazil | | | 8.9 | % |

Fertilizer Distributor | | Zambia | | | 8.9 | % |

| 2. | The following information updates and supplements the “Business — Investments — Overview—Impact Overview” section of the Prospectus to provide impact overview of the Company’s investment portfolio as of June 30, 2014: |

Impact Overview as of June 30, 2014

The Company’s borrower companies currently employ a total of 10,423 employees.

| | | | |

| Percentage of TriLinc borrowers that: | | | | |

Comply with local environmental, labor, health, safety and business laws, standards and regulations | | | 100 | % |

Demonstrate their positive impact on the community through community service and/or community donations | | | 90 | % |

Commit to working towards implementing international environmental and health and safety best practices | | | 100 | % |

Implement environmentally sustainable practices, including energy savings, waste reduction and/or water conservation | | | 90 | % |

| |

Top 5 Borrower Impact Objectives: (may total over 100% as borrowers can choose multiple) | | | | |

Job Creation | | | 90 | % |

Agricultural Productivity & Food Security | | | 30 | % |

Capacity Building | | | 20 | % |

Health Improvement | | | 10 | % |

Wage Increase | | | 10 | % |

| |

Additional Borrower Impact Highlights: | | | | |

Percentage of employees receiving training or technical assistance | | | 41 | % |

Percentage of female employees | | | 20 | % |

S-3

Brazilian Sugar Producer

| | |

| Security Type: | | Term Loan |

| Structure: | | Three Year Term Loan Due 12/15/16 |

| Current Loan Commitment: | | $3,000,000 |

| Total Outstanding Amount: | | $3,000,000 |

| Interest Rate: | | 12.43% |

| Sector: | | Agricultural Products |

| Collateral Coverage Ratio1: | | 1.42X |

| Primary Impact Objectives: | | Capacity-Building, Increased Wages |

| 1 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

According to the World Bank’s 2012 Report, Brazil has the seventh largest economy in the world, but economic productivity and prosperity vary widely throughout the country. Pernambuco State in northeast Brazil is one of the most marginalized regions, with a poverty rate that is double the national average. Almost 90% of Brazil’s sugarcane production occurs in its south-central region, but in 1958 a sugar producer commenced milling sugar in Pernambuco, and today it manages one of the most modern mills in the state.

In 2009, this sugar producer began receiving financing from the Brazilian representatives of the Company’s sub-advisor. Building on this relationship, and with an appreciation for the outsized social and economic impact of the borrower, the Company extended a loan to the borrower in 2013 to support crop cultivation and improve its milling operations.

The borrower’s activities generate stable employment for workers at wages that are higher than Pernambuco’s average local wage - which is, according to Instituto Brasileiro de Geografia e Estatística, among Brazil’s lowest. In addition to creating much-needed jobs, the borrower provides health, safety and specialization training to all employees. It also offers more than 250 rent-free houses and free on-site medical services to employees and their families. The borrower is equally committed to the broader community where it operates. It pays the rent and building maintenance costs for a local school and contributes to a nonprofit organization that offers health care to children, women and men in Pernambuco.

The borrower actively engages in minimizing its environmental impact. Sugarcane processing byproducts include ethanol, a clean-burning, renewable fuel, and bagasse, a fibrous waste. The borrower uses the bagasse to generate electricity, with the capacity to create 40,000 megawatts per year. In addition, the borrower collaborates with IBAMA (Brazilian Institute of Environment and Natural Resources) to reforest the region and has planted 19.83 hectares of trees to date.

| D. | Update to the Section Titled “Management of the Company” |

| 1. | The following sentence is inserted as the fourth sentence in the first paragraph of Cynthia Hostetler’s biography on page 98 of the Prospectus: |

“Additionally, Ms. Hostetler has served on the Board of Directors of Vulcan Materials Company (NYSE: VMC), a producer of construction aggregates and other construction materials, since July 2014.”

| 2. | The third sentence in the second paragraph of R. Michael Barth’s biography on page 99 of the Prospectus is deleted in its entirety and replaced with the following: |

“Mr. Barth is currently Chairman of the Board of SFC Ltd., part of the AfricInvest Group, and is also a member of the Boards of Directors of FINCA Microfinance Holding and SNV (USA), Bamboo Finance (Luxembourg), and SNU (USA).”

S-4

| 3. | The table under “Our Advisor” heading on page 102 of the Prospectus is deleted in its entirety and replaced with the following: |

| | | | | | |

Name | | Age | | Position | | |

| Gloria S. Nelund | | 52 | | Chairman, Chief Executive Officer and Chief Compliance Officer | | |

| Mark Torline | | 57 | | President and Manager | | |

| Brent VanNorman | | 53 | | Chief Operating Officer and Chief Financial Officer | | |

| Paul Sanford | | 38 | | Chief Investment Officer | | |

| Patrick Miller | | 50 | | Executive Vice President | | |

| Michael Dean | | 43 | | Head of Credit | | |

| Marni Hodder | | 41 | | Chief Impact Officer and Compliance Officer | | |

| Jean-Marc Plantier | | 46 | | Director of Finance | | |

| 4. | In connection with the recent appointment of Jean-Marc Plantier to serve as the Advisor’s and Sponsor’s Director of Finance, the following biographical information for Jean-Marc Plantier is added following the biographical information for Marni Hodder on page 103 of the Prospectus: |

Jean-Marc Plantier, Director of Finance

Jean-Marc Plantier has served as Director of Finance of our Advisor and Sponsor since August 2014. From January 2011 until August 2011 and from June 2013 until August 2014, Mr. Plantier was employed by Resource Global Professionals as a consultant specializing in accounting, SEC and financial reporting and audit quality control and in such capacity served as Interim Controller for the Advisor and Sponsor from December 2013 until August 2014. From April 2009 until January 2011 and from August 2011 until June 2013, Mr. Plantier was self-employed and served as a consultant to small private and public companies, as well as public accounting firms. He has over 20 years of professional accounting experience, in both the public and private accounting industries. Previously, Mr. Plantier served as an Audit Partner for Cacciamatta Accountancy Corporation, where he was primarily responsible for the financial statement audits of the firm’s public and private clients. Additionally, his responsibilities also included: SEC reporting, accounting for complex debt and equity transactions, derivative accounting, accounting for business combinations, and compliance with PCAOB auditing standards. Mr. Plantier’s professional career also has included working for Hall & Company, CPAs, McGladrey & Pullen, LLP, and Moore Stephens Frazer and Torbet, LLP. He started his accounting career with Fidelity National Title Insurance Company, where he was promoted to Assistant Vice President in charge of Cash Management and Trust Accounting.

Mr. Plantier is a Certified Public Accountant. He holds a Bachelor of Arts in Business Administration (accounting concentration) from California State University, Fullerton.

S-5