Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 10 DATED DECEMBER 12, 2016

TO THE PROSPECTUS DATED APRIL 28, 2016

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 28, 2016, as supplemented by Prospectus Supplement No. 1, dated May 11, 2016, Prospectus Supplement No. 2, dated June 9, 2016, Prospectus Supplement No. 3, dated July 7, 2016, Prospectus Supplement No. 4, dated August 17, 2016, Prospectus Supplement No. 5, dated September 14, 2016, Prospectus Supplement No. 6, dated September 22, 2016, Prospectus Supplement No. 7 dated October 13, 2016, Prospectus Supplement No. 8 dated October 20, 2016, and Prospectus Supplement No. 9 dated November 16, 2016, (the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

| A. | To provide information regarding our public offering; |

| B. | To provide information regarding distributions declared; |

| C. | To update the section of the Prospectus titled “Prospectus Summary” |

| D. | To update the section of the Prospectus titled “Business” |

| E. | To update the section of the Prospectus titled “Management of the Company” |

| A. | Status of Our Public Offering |

As of December 12, 2016 we had raised gross proceeds of approximately $286.5 million from the sale of approximately 29.8 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

| B. | Declaration of Distributions |

On November 10, 2016, with the authorization of our board of managers, the Company declared distributions for all classes of units for the period from November 1 through November 30, 2016. These distributions were calculated based on unitholders of record for each day in an amount equal to $0.00197268 per unit per day (less the distribution fee with respect to Class C units). On December 1, 2016, $873,865 of these distributions were paid in cash and on November 30, 2016, $743,078 were reinvested in the Company’s units for those investors participating in the Company’s unit Distribution Reinvestment Plan. Some or all of the Company’s distributions have been and may continue to be paid from sources other than cash flow from operations, such as capital contributions from the Sponsor, cash resulting from a waiver or deferral of fees, and/or proceeds from this offering.

| C. | Update to the Section Titled “Prospectus Summary” |

| 1. | The following information updates and supplements the “Prospectus Summary—TriLinc Global Impact Fund” section of the Prospectus as of November 30, 2016. |

TriLinc Global Impact Fund, LLC is a Delaware limited liability company that makes impact investments in Small and Medium Enterprises, or SMEs, which we define as those businesses having less than 500 employees, primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. To a lesser extent, we may also make impact investments in companies that may not meet our technical definition of SMEs due to a larger number of employees but that also provide the opportunity to achieve both competitive financial returns and positive measurable impact. We generally expect that such investments will have similar investment characteristics as SMEs as defined by us. We have used and intend to continue to use the proceeds of this offering to invest in SMEs and similar impact investments through local

market sub-advisors in a diversified portfolio of financial assets, including trade finance, direct loans, convertible debt instruments, structured credit and preferred and common equity investments. The majority of our assets consist of collateralized private debt instruments, which we believe offer opportunities for competitive risk-adjusted returns through income generation. We are externally managed and advised by TriLinc Advisors.

| 2. | Update to the Section Titled “Business” |

| 1. | The following information updates and supplements the first paragraph of the “Business—Overview” section of the Prospectus as of November 30, 2016. |

The Company is a Delaware limited liability company formed on April 30, 2012, that makes impact investments in SMEs primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. To a lesser extent, we may also make impact investments in companies that may not meet our technical definition of SMEs due to a larger number of employees but that also provide the opportunity to achieve both competitive financial returns and positive measurable impact. We generally expect that such investments will have similar investment characteristics as SMEs as defined by us. We use the proceeds of this offering to invest in SMEs and similar impact investments through local market sub-advisors in a diversified portfolio of financial assets, including direct loans, convertible debt instruments, trade finance, structured credit and preferred and common equity investments. We anticipate that a substantial portion of our assets will consist of collateralized private debt instruments, which we believe offer opportunities for competitive risk-adjusted returns through income generation. We are externally managed and advised by TriLinc Advisors.

| 2. | The following information updates and supplements the “Business—Investments—Overview” section of the Prospectus to provide certain information regarding the Company’s investment portfolio as of November 30, 2016: |

Investments

Since the Company commenced operations and through November 30, 2016, the Company has funded $471.1 million in aggregate investments, including $28 million in temporary investments. Of the aggregate investment amount, the Company has received $245.2 million in full aggregate transaction repayments from existing and exited trade finance, term loan, and temporary investment facilities. Of the aggregate transaction repayment amount, approximately $112.6 million represents transactions of trade finance, term loan, and temporary investment facilities that are closed and no longer part of the Company’s portfolio.

As of November 30, 2016 the Company had the following investments:

| | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Maturity1 | | Interest

Rate2 | | | Total Loan

Commitment3 | | | Total

Amount

Outstanding4 | |

Agriculture Distributor | | Farm-Product Raw Materials | | Argentina | | Trade

Finance | | 7/16/2017 | | | 9.00 | % | | $ | 15,000,000 | | | $ | 10,000,000 | |

Agricultural Products Exporter II | | Farm-Product Raw Materials | | Singapore | | Trade

Finance | | 7/02/2017 | | | 11.50 | % | | $ | 10,000,000 | | | $ | 10,000,000 | |

Beef Exporter | | Meat Products | | Argentina | | Trade

Finance | | 6/30/2017 | | | 11.50 | % | | $ | 9,000,000 | | | $ | 9,000,000 | |

Chia Seed Exporter | | Field Crops, Except Cash Grains | | Chile | | Trade

Finance | | 12/11/2016-

3/11/2017 | | | 10.90 | % | | $ | 2,500,000 | | | $ | 2,234,915 | |

Clean Diesel Distributor | | Bulk Fuel Stations and Terminals | | Peru | | Term

Loan | | 8/1/2019 | | | 11.50 | % | | $ | 15,000,000 | | | $ | 15,000,000 | |

Consumer Goods Distributor5 | | Groceries and Related Products | | Namibia | | Trade

Finance | | 10/29/2017 | | | 12.00 | % | | $ | 2,000,000 | | | $ | 500,000 | |

Dairy Co-Operative | | Dairy Products | | Argentina | | Trade

Finance | | 7/29/2017 | | | 10.67 | % | | $ | 6,000,000 | | | $ | 6,000,000 | |

Diaper Manufacturer | | Converted Paper and Paperboard Products | | Peru | | Term

Loan | | 12/22/2016-

7/5/2017 | | | 12.61 | % | | $ | 4,500,000 | | | $ | 3,950,000 | |

Electronics Assembler6 | | Communications Equipment | | South

Africa | | Trade

Finance | | 9/23/2017-

11/20/2017 | | | 12.85 | % | | $ | 11,000,000 | | | $ | 6,468,041 | |

Farm Supplies Distributor7 | | Miscellaneous Non-Durable Goods | | Zambia | | Trade

Finance | | 10/25/2015-

5/3/2016 | | | 12.43 | % | | $ | 10,000,000 | | | $ | 5,078,526 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | | Investment

Type | | | Maturity1 | | | Interest

Rate2 | | | Total Loan

Commitment3 | | | Total

Amount

Outstanding4 | |

Fish Processor & Exporter8 | | Commercial Fishing | | | Ecuador | | |

| Trade

Finance |

| | | 6/19/2017 | | | | 9.00 | % | | $ | 2,000,000 | | | $ | 1,202,465 | |

FMCG Manufacturer9 | | Soap, Detergents, and Cleaning Preparations | | | Zambia | | |

| Term

Loan |

| | | 11/16/2019 | | | | 11.00 | % | | $ | 6,500,000 | | | $ | 2,000,000 | |

Fruit & Nut Distributor | | Groceries and Related Products | |

| South

Africa |

| |

| Trade

Finance |

| | | 5/22/201510 | | | | 12.00 | % | | $ | 1,250,000 | | | $ | 646,844 | |

Hospitality Service Provider | | Hotels and Motels | |

| Cabo

Verde |

| |

| Term

Loan |

| | | 8/21/2021 | | | | 13.50 | % | | $ | 17,000,000 | | | $ | 17,000,000 | |

Integrated Steel Producer | | Steel Works, Blast Furnaces, and Rolling and Finishing Mills | | | Zambia | | |

| Trade

Finance |

| |

| 8/14/2017-

9/2/2017 |

| | | 13.00 | % | | $ | 6,000,000 | | | $ | 6,000,000 | |

Infrastructure and Logistics Provider11 | | Highway and Street Construction, Except Elevated Highways | | | Indonesia | | |

| Term

Loan |

| | | 11/22/2019 | | | | 18.00 | % | | $ | 15,000,000 | | | $ | 15,000,000 | |

International Development Logistics Provider12 | | Lumber and Other Construction Materials | | | Italy | | |

| Trade

Finance |

| | | N/A | | | | N/A | | | $ | 0 | | | $ | 0 | |

IT Service Provider | | Computer Programming and Data Processing | | | Brazil | | |

| Term

Loan |

| | | 10/31/2019 | | | | 13.50 | % | | $ | 14,000,000 | | | $ | 10,524,788 | |

Machinery and Equipment Provider | | Machinery, Equipment, and Supplies | |

| United

Kingdom |

| |

| Trade

Finance |

| | | 1/29/2017 | | | | 12.00 | % | | $ | 1,500,000 | | | $ | 667,613 | |

Marine Logistics Provider13 | | Services Incidental to Water Transportation | | | Nigeria | | |

| Term

Loan |

| | | 9/16/2020 | | | | 15.18 | %14 | | $ | 16,050,000 | | | $ | 13,184,756 | |

Meat Processor II | | Meat Products | |

| South

Africa |

| |

| Trade

Finance |

| | | 5/19/2017 | | | | 14.50 | % | | $ | 2,800,000 | | | $ | 675,717 | |

Metals Trader15 | | Metals and Minerals, Except Petroleum | |

| United

Kingdom |

| |

| Trade

Finance |

| |

| 2/25/2017-

12/31/2017 |

| | | 9.82 | % | | $ | 8,000,000 | | | $ | 5,863,828 | |

Mine Remediation Company | | Metal Mining Services | |

| South

Africa |

| |

| Trade

Finance |

| |

| 6/15/2016-

8/15/2016 |

| | | 17.50 | % | | $ | 2,500,000 | | | $ | 2,234,145 | |

Oilseed Distributor | | Fats and Oils | | | Argentina | | |

| Trade

Finance |

| |

| 10/15/2016-

12/15/2016 |

| | | 8.75 | % | | $ | 6,000,000 | | | $ | 6,000,000 | |

Plastic Products Manufacturer | | Miscellaneous Plastics Products | | | Kenya | | |

| Trade

Finance |

| | | 10/9/2017 | | | | 11.50 | % | | $ | 1,500,000 | | | $ | 161,018 | |

Power Producer | | Electric Services | | | Ghana | | |

| Trade

Finance |

| |

| 3/10/2017-

10/9/2017 |

| | | 11.50 | % | | $ | 20,000,000 | | | $ | 19,500,000 | |

Railway Equipment Provider | | Rental of Railroad Cars | |

| South

Africa |

| |

| Term

Loan |

| | | 1/31/2020 | | | | 12.00 | % | | $ | 5,000,000 | | | $ | 4,412,222 | |

Scrap Metal Recycler16 | | Secondary Nonferrous Metals | | | Morocco | | |

| Trade

Finance |

| | | 7/17/2017 | | | | 11.00 | % | | $ | 8,500,000 | | | $ | 6,649,944 | |

Sesame Seed Exporter17 | | Farm-Product Raw Materials | | | Guatemala | | |

| Trade

Finance |

| | | 3/31/2016 | | | | 12.00 | % | | $ | 2,000,000 | | | $ | 907,565 | |

Shrimp Exporter18 | | Fresh or Frozen Packaged Fish | | | Ecuador | | |

| Trade

Finance |

| |

| 6/6/2017-

7/24/2017 |

| | | 9.25 | % | | $ | 5,000,000 | | | $ | 5,156,406 | |

Sugar Producer19 | | Field Crops, Except Cash Grains | | | Brazil | | |

| Term

Loan |

| |

| 12/15/2016-

5/15/2017 |

| | | 12.43 | % | | $ | 3,000,000 | | | $ | 2,683,223 | |

Tin Producer | | Primary Nonferrous Metals | | | Indonesia | | |

| Term

Loan |

| | | 6/30/2020 | | | | 12.00 | % | | $ | 3,000,000 | | | $ | 3,000,000 | |

Vanilla Exporter20 | | Groceries and Related Products | | | Mauritius | | |

| Trade

Finance |

| |

| 7/31/2017-

11/23/2017 |

| | | 11.03 | % | | $ | 12,000,000 | | | $ | 11,195,862 | |

Investment Portfolio Total | | | | | | | | | | | | | | | | | | | | $ | 243,600,000 | | | $ | 202,897,878 | |

| 1 | The Company’s trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower. The Company has adjusted the disclosure in the above table to reconcile the maturity dates for its investments. Previously, the Company has presented targeted rather than maximum maturity dates for certain of its investments where such dates were different. Positions with multiple transactions may have different maximum maturity dates, which are reflected in the maturity date ranges. |

| 2 | Interest rates are as of November 30, 2016 and, where applicable, are weighted averages amongst multiple transactions. Interest rates include contractual rates and accrued fees where applicable. |

| 3 | The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. Loan commitments are subject to availability of funds and do not represent a contractual obligation to provide funds to a borrower. |

| 4 | The total amount outstanding represents the actual amount borrowed under the loan as November 30, 2016. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again. |

| 5 | On November 2, 2016, the Company funded $500,000 as part of an existing $2,000,000 purchase and repurchase trade finance facility at a fixed rate of 12.00% to a Namibian consumer goods importer and distributor. The transaction, set to mature on October 29, 2017, is secured by rice, sugar, and other FMCG inventory. |

| 6 | Between November 15, 2016 and November 25, 2016, the Company funded $4,729,799 as part of an existing $11,000,000 senior secured trade finance facility to a South African electronics assembler. With an interest rate of 13.00%, all transactions are set to mature between November 2, 2017 and November 20, 2017 and are secured by stock that is delivered to the company’s warehouse. |

| 7 | The Company’s trade finance facility with the Farm Supplies Distributor serves to finance the shipment of farm supplies to a parastatal organization of the Government of Zambia and is secured by receivables. The Company has not received any payments on this investment since January 29, 2016. The delay in repayment is due to slow payment of the receivables by the Government of Zambia. The Company has determined that there is sufficient collateral, including an insurance policy should the Farm Supplies Distributor not pay, to cover the entire balance due from borrower. On December 1, 2016, the sub-advisor has called an event of default on the investment and the Company initiated a draw against the insurance policy. |

| 8 | Between November 10, 2016 and November 17, 2016, the Company funded $593,435 to an Ecuadorian fish processing and exporting company as part of an existing $2,000,000 revolving senior secured trade finance facility at a fixed interest rate of 9.00%. With a maturity date of June 19, 2017, the transaction is secured by specific receivables and inventory destined for export. |

| 9 | On November 22, 2016, the Company funded $2,000,000 as part of a new three-year $6,500,000 senior secured term loan facility with a fast moving consumer goods (FMCG) manufacturer and distributor in Zambia. Priced at 11.00%, the transaction is set to mature on November 16, 2019 and is secured by the underlying equipment. The Company’s financing will serve to finance the purchase of existing plant, machinery, and equipment and will be leased to own to the borrower. The company is projected to strengthen its labor force by expanding production capacity in its existing production facilities for consumer goods such as laundry detergent, dish soap, and other household products. The impact objective for the FMCG manufacturer is Job Creation. |

| 10 | As of March 31, 2016, the Company, together with its sub-advisor, had agreed to further extend the principal maturity date to facilitate the strategic sale of the Fruit & Nut Distributor, which closed in June 2016. On June 30, 2016, the Company placed the Fruit & Nut Distributor on non-accrual status effective February 1, 2016 and a restructure of the loan is being documented. Small payments are scheduled to be made on a quarterly basis. The new shareholder has injected equity into the business and small principal payments derived from the operations of the company have been received. |

| 11 | On November 21, 2016, the Company funded $15,000,000 as part of a new three year term loan facility with an infrastructure and logistics provider in Indonesia. The loan will provide for a net interest rate to the Company of 18%, 20%, and 22% in year 1, 2, and 3 respectively. This is transaction is set to mature on November 22, 2019 and is secured by a first ranking pledge over the company’s shares, subsidiary company ownership, and specific port assets. The borrower anticipates that the Company’s financing for the completion of a hauling road, in addition to reinforcing bridge infrastructure, will reduce the severe local congestion that currently exists on public roads. Additionally, the borrower will continue to offer extensive capacity-building programs to their employees to enhance the sustainable operations of the company’s activities. The impact objectives for the Infrastructure and Logistics Provider are Capacity-Building and Job Creation. |

| 12 | The borrower has repaid all capital to the Company but has an outstanding fee balance that will be repaid to the Company in Q4 2016. |

| 13 | On November 17, 2016, the Company funded $200,000, through two separate transactions, as part of an existing $16,050,000 senior secured five-year term loan commitment to a locally-owned Nigerian marine logistics provider. Set to mature on September 16, 2020, one $100,000 transaction will accrue interest at one month Libor +10.50%, and the second $100,000 transaction will accrue interest at one month Libor +10.50% plus 4.68% in deferred fixed interest. |

| 14 | The interest rate is a weighted average interest rate between three separate transactions which have a variable interest rate of one month Libor +10.5%. Two of the three transactions, totaling $11.7 million, include an additional 4.68% rate in deferred fixed interest. |

| 15 | On November 21, 2016, the Company funded $1,964,684 as part of an existing $8,000,000 senior secured revolving receivables trade finance facility to the Metals Trader. With an interest rate of six month Libor + 7.50%, the transaction is set to mature on October 31, 2017 and is secured by a bill of exchange and sales contracts. |

| 16 | Between November 4, 2016 and November 23, 2016, the Company funded $1,749,945 as part of an existing $8,500,000 senior secured trade finance facility to the Scrap Metal Recycler. With an interest rate of one month Libor +10.50%, the transactions are secured by inventory and receivables and are set to mature on July 17, 2017. |

| 17 | During 2016, the Sesame Seed Exporter lost a major customer, which resulted in a slowdown in business, affecting its ability to repay the amount due under the participation. However, the Sesame Seed Exporter has been able to secure new customers to replace the lost order(s), which will enable the Sesame Seed Exporter to start making payments to the Company. The Company has determined that there is sufficient collateral to support the repayment of this facility. Repayments from these new contracts started in the month of October. |

| 18 | Between November 4, 2016 and November 30, 2016, the Company funded five separate transactions, totaling $4,292,000, as part of an existing $5,000,000 revolving trade finance facility with the Shrimp Exporter. With a fixed interest rate of 9.25%, the transactions are set to mature between June 6, 2017 and July 24, 2017 and are secured by inventory, accounts receivable, and purchase contracts. |

| 19 | On August 27, 2015, the Company was informed that the Sugar Producer had filed for judicial recuperation with the local court in Brazil. On March 31, 2016, the Company placed the Sugar Producer on non-accrual status effective August 27, 2015. On June 14, 2016, the Company reached an agreement with the Sugar Producer on a repayment plan. The details of this plan have been ratified by the court and include the full repayment of all principal and interest that is due. The first payment under this plan, which includes principal and interest, has been made in full. |

| 20 | On November 25, 2016, the Company funded $5,641,242 to the Vanilla Exporter as part of an existing $12,000,000 senior secured trade finance facility. Priced at one month Libor +10.50%, the transaction is set to mature on November 23, 2017 and is secured by inventory and receivables. |

As of November 30, 2016 the Company had exited the following investments:

| | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | Transaction

Amount | | | Payoff

Date | | Internal

Rate of

Return

(“IRR”)1 |

Agricultural Products Exporter I2 | | Farm-Product Raw

Materials | | Singapore | | Trade

Finance | | 4/23/2015 | | $ | 10,000,000 | | | 2/29/2016 | | 11.85% |

Agricultural Supplies Distributor I | | Miscellaneous Non-

Durable Goods | | South

Africa | | Trade

Finance | | 10/15/2014 | | $ | 15,202,091 | | | 8/14/2015 | | 13.11% |

Agricultural Supplies Distributor II | | Miscellaneous Non-

Durable Goods | | South

Africa | | Trade

Finance | | 10/06/2015 | | $ | 8,563,423 | | | 6/1/2016 | | 10.76% |

Candle Distributor | | Miscellaneous

Manufacturing

Industries | | South

Africa | | Trade

Finance | | 9/2/2014 | | $ | 1,400,000 | | | 9/16/2015 | | 14.27% |

Cement Distributor | | Cement, Hydraulic | | Kenya | | Trade

Finance | | 9/23/2014 | | $ | 12,000,000 | | | 10/15/2015 | | 15.29% |

Construction Materials Distributor | | Hardware, Plumbing,

and Heating

Equipment | | South

Africa | | Trade

Finance | | 10/9/2014 | | $ | 838,118 | | | 4/1/2016 | | 13.00% |

Electronics Retailer | | Radio, Television,

Consumer

Electronics, and

Music Stores | | Indonesia | | Term Loan | | 7/26/2013 | | $ | 5,000,000 | | | 6/17/2014 | | 19.59% |

Farm Supplies Wholesaler | | Miscellaneous Non-

Durable Goods | | South

Africa | | Trade

Finance | | 5/28/2015 | | $ | 2,250,000 | | | 1/19/2016 | | 13.14% |

Fertilizer Distributor | | Agricultural

Chemicals | | Zambia | | Trade

Finance | | 7/17/2014 | | $ | 3,000,000 | | | 11/4/2014 | | 12.65% |

Food Processor | | Groceries and

Related Products | | Peru | | Term Loan | | 3/25/2014 | | $ | 576,000 | | | 11/28/2014 | | 14.01% |

Frozen Seafood Exporter | | Groceries and

Related Products | | Ecuador | | Trade

Finance | | 6/17/2013 | | $ | 240,484 | | | 5/14/2014 | | 13.49% |

Industrial Materials Distributor | | Mineral and Ores | | South

Africa | | Trade

Finance | | 11/20/2014 | | $ | 4,030,000 | | | 12/15/2015 | | 13.64% |

Insulated Wire Manufacturer | | Rolling, Drawing,

and Extruding of

Nonferrous Metals | | Peru | | Trade

Finance | | 5/2/2014 | | $ | 1,991,000 | | | 12/2/2014 | | 8.43% |

International Tuna Exporter | | Groceries and

Related Products | | Ecuador | | Trade

Finance | | 7/17/2013 | | $ | 1,000,000 | | | 10/9/2013 | | 13.58% |

Meat Processor I | | Meat Products | | South

Africa | | Trade

Finance | | 7/7/2014 | | $ | 2,950,000 | | | 4/1/2016 | | 14.08% |

Meat Producer2 | | Meat Products | | South

Africa | | Trade

Finance | | 11/27/2015 | | $ | 1,500,000 | | | 2/3/2016 | | 14.83% |

Rice & Bean Importer | | Groceries and

Related Products | | South

Africa | | Trade

Finance | | 7/7/2014 | | $ | 1,000,000 | | | 8/5/2015 | | 12.97% |

Rice Importer | | Farm-Product Raw

Materials | | Kenya | | Trade

Finance | | 11/6/2015 | | $ | 399,653 | | | 5/19/2016 | | 11.50% |

Rice Producer | | Cash Grains | | Tanzania | | Trade

Finance | | 1/22/2015 | | $ | 3,900,000 | | | 4/1/2016 | | 12.04% |

Seafood Processing Company | | Miscellaneous Food

Preparations and

Kindred Products | | Ecuador | | Trade

Finance | | 6/19/2013 | | $ | 496,841 | | | 7/1/2013 | | 13.44% |

Textile Distributor | | Apparel, Piece

Goods, and Notions | | South

Africa | | Trade

Finance | | 7/25/2014 | | $ | 7,026,515 | | | 5/30/2016 | | 15.81% |

Timber Exporter | | Sawmills and

Planing Mills | | Chile | | Trade

Finance | | 7/3/2013 | | $ | 915,000 | | | 6/12/2014 | | 10.25% |

Waste Management Equipment Distributor | | Machinery,

Equipment, and

Supplies | | South

Africa | | Trade

Finance | | 2/13/2015 | | $ | 310,752 | | | 5/15/2015 | | 20.19% |

Investment Portfolio Total | | $ | 84,589,877 | | | | | |

| | | | | | | |

Temporary Investments3 | | | | | | | | | | | | | | | | |

| | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | Transaction

Amount | | | Payoff

Date | | Internal

Rate of

Return

(“IRR”) |

Agricultural Products Exporter II | | Farm-Product Raw

Materials | | Singapore | | Bridge

Loan | | 3/21/2016 | | $ | 5,000,000 | | | 9/14/2016 | | 29.84% |

| | | | | | | |

Financial Services Provider I | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Promissory

Note | | 9/23/2014 | | $ | 3,000,000 | | | 11/17/2014 | | 15.94% |

| | | | | | | |

Financial Services Provider II | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Promissory

Note | | 3/22/2016 | | $ | 15,000,000 | | | 9/14/2016 | | 32.04% |

| | | | | | | | | | | | | | | | |

| | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | Transaction

Amount | | | Payoff

Date | | Internal

Rate of

Return

(“IRR”) |

| | | | | | | |

Financial Services Provider III | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Promissory

Note | | 8/17/2016 | | $ | 5,000,000 | | | 11/30/2016 | | 10.53% |

| | | |

Temporary Investments Total | | $ | 28,000,000 | | | | | |

| | | |

Investment Portfolio and Temporary Investments Total | | $ | 112,589,877 | | | | | |

| 1 | Given that the loan has been paid off, this investment is no longer part of the Company’s portfolio. The internal rate of return is defined as the gross average annual return earned through the life of an investment. The internal rate of return was calculated by our Advisor (unaudited) as the investment (loan advance) was made and cash was received (principal, interest and fees). |

| 2 | Impact data was not tracked for this investment. The Company does not track impact data for trade finance transactions that meet standard underwriting guidelines, but generally have the maturity of less than one year and involve borrowers with whom, at the time of funding, the Company does not expect to maintain an ongoing lending relationship or otherwise provide an open loan facility. |

| 3 | Temporary investments are defined as short-term investments that are not trade finance or term loan transactions that generally expire within one year, are intended to generate a higher yield than would be realized on cash and may be unsecured positions. The temporary investments that are unsecured positions may present a higher level of risk. |

Certain Portfolio Characteristics1

| | | | |

Total Assets (est.) | | $ | 247,015,000 | |

Current Loan Commitments | | $ | 243,600,000 | |

Leverage | | $ | 1,635,000 | |

Weighted Average Portfolio Loan Size | | $ | 7,284,883 | |

Weighted Average Portfolio Duration2 | | | 1.39 years | |

Average Collateral Coverage Ratio | | | >2.0x | |

USD Denominated | | | 100 | % |

Senior Secured First-Lien | | | 100 | % |

Countries | | | 19 | |

Sectors | | | 27 | |

Top Five Investments by Percentage3

| | | | | | |

| Company Description | | Country | | % of Total Assets | |

Power Producer | | Ghana | | | 7.9 | % |

Hospitality Service Provider | | Cabo Verde | | | 6.9 | % |

Clean Diesel Distributor | | Peru | | | 6.1 | % |

Infrastructure and Logistics Provider | | Indonesia | | | 6.1 | % |

Marine Logistics Provider | | Nigeria | | | 5.3 | % |

| | | | |

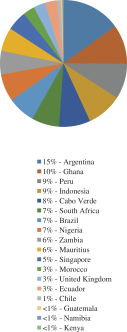

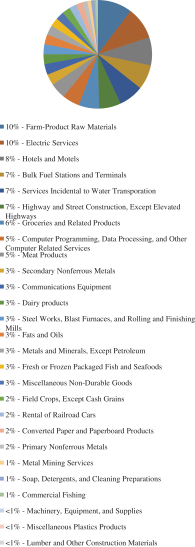

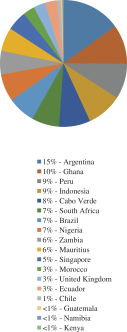

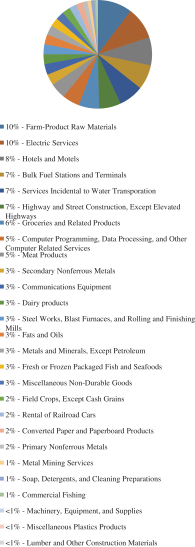

| Investment Type4 | | Developing Economies4 | | Sector Diversification4 |

| |

| |

|

| 1 | All information provided in this section, with the exception of the Total Asset (est.) figure, does not include the Company’s temporary investment commitments. |

| 2 | Weighted average duration is the average period of time before the loans in the portfolio mature or come due weighted to properly account for the difference of investment sizes within the portfolio. Duration is calculated through the average turn of trade finance transactions and the contracted amortization of term loans. |

| 3 | This represents all countries/sectors where the Company currently has a loan commitment other than through a temporary investment. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the country/sector allocation charts, which represents invested capital. |

| 4 | The above charts represent investment type, developing economy, and sector diversification as a percentage of the total amount outstanding of the Company’s investments other than the Company’s temporary investments. |

| 3. | Update to the Section Titled “Management of the Company” |

| 1. | The following information updates the “Management of the Company—Our Advisor” section of the Prospectus: |

Remove the line item for Michael Dean in the Name and Position chart and delete the section titled “Michael Dean, Head of Credit.”