UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to §240.14a-12

MACKENZIE REALTY CAPITAL, INC.

(Name of Registrant as Specified In Its Charter)

____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

| [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| MACKENZIE REALTY CAPITAL, INC. 1640 SCHOOL STREET MORAGA, CA 94556 |

| | February __, 2017 |

Re: Your VOTE is very IMPORTANT! Please vote online, via telephone, or by returning the enclosed card ASAP!

Dear Stockholder:

You are cordially invited to attend the 2017 Special Meeting of Stockholders of MacKenzie Realty Capital, Inc., a Maryland corporation, to be held on March __, 2017, at 11 a.m., local time, at 1640 School Street, Moraga, CA.

This notice of a special meeting and the proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. At the meeting, you will be asked to (i) approve certain amendments to, and clarifications of, the advisory agreement between us and our investment adviser, and (ii) transact such other business as may properly come before the meeting and any postponement or adjournment thereof.

We encourage stockholders to approve this proposal so that the terms of the advisory agreement are clear and properly reflect the intended deal between us, our shareholders, and the adviser. Because of the way the agreement was previously drafted, it could result in the adviser receiving an incentive fee even if the Company's overall investment and capital gains income failed to exceed the 7% threshold. Please vote ASAP.

It is important that your shares be represented, either in person or by proxy, at the Special Meeting. We urge you to vote your shares as soon as possible even if you currently plan to attend the meeting. The enclosed proxy card contains instructions for voting by telephone or by returning your proxy card via mail. This will not prevent you from voting in person but will assure that your vote is counted if you are unable to attend the meeting. Your vote and participation in our governance are very important to us. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person. You have the option to revoke your proxy at any time prior to the meeting, or to vote your shares personally on request if you attend the meeting. If there are not sufficient shares present for a quorum or sufficient votes to approve the foregoing proposals at the time of the meeting, the chairman of the meeting may move for one or more adjournments of the meeting in order to permit further solicitation of proxies by the Company.

The foregoing item of business is more fully described in the proxy statement accompanying this notice. Stockholders may also transact any other business that properly comes before the meeting. The accompanying proxy statement and proxy card are being distributed to our stockholders on or about February __, 2017.

The Board of Directors has fixed the close of business on February __, 2017, as the record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting and any postponements or adjournments of the meeting.

THE BOARD OF DIRECTORS, INCLUDING THE INDEPENDENT DIRECTORS, RECOMMENDS THAT YOU VOTE "FOR" THE AMENDMENTS AND CLARIFICATIONS TO THE ADVISORY AGREEMENT.

Sincerely yours,

C.E. "Pat" Patterson

Chairman of the Board

February __, 2017

Moraga, California

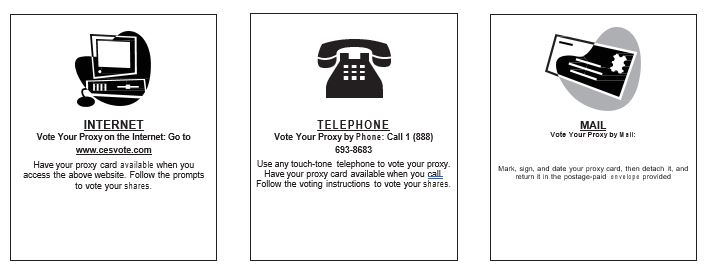

P.S. You can vote online at www.cesvote.com using the "control number" printed on your proxy card. It's fast and easy. You can also call (888) 693-8683 to vote by phone.

| MACKENZIE REALTY CAPITAL, INC. 1640 SCHOOL STREET MORAGA, CA 94556 |

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

MARCH __, 2017

This proxy statement contains information relating to the special meeting (the "Special Meeting") of stockholders of MacKenzie Realty Capital, Inc., a Maryland corporation (the "Company," "we" or "us"), to be held on March __, 2017, beginning at 11 a.m., local time, at our offices at 1640 School Street, Moraga, CA, and any postponements or adjournments thereof, and is furnished in connection with the solicitation of proxies by our Board of Directors to be voted at the Special Meeting. Stockholders of record at the close of business on February __, 2017 (the "Record Date") are entitled to vote at the meeting as set forth in this proxy statement. This proxy statement and accompanying proxy card are first being mailed to stockholders on or about February __, 2017.

Important Notice Regarding the Availability of Proxy Materials for the 2017 Special Meeting of Stockholders to be held on March __, 2017. The Notice of 2017 Special Meeting of Stockholders, Proxy Statement and Proxy Card are available at http://www.mackenzierealty.com. On this site, you will be able to access our Proxy Statement and any amendments or supplements to the foregoing materials that are required to be furnished to stockholders.

We encourage you to vote your shares, either by voting in person at the meeting or by authorizing a proxy (i.e., authorizing someone to vote your shares). You may authorize a proxy by telephone by using the toll-free number listed on the proxy card or you may mark, date, sign and mail the enclosed proxy card. If you vote by authorizing a proxy, the proxy holders will vote the shares according to your instructions. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted "FOR" the proposal to amend and clarify the advisory agreement.

Our Board of Directors (the "Board") is not aware of any matter to be properly presented for consideration at the Special Meeting other than the matter described herein. If any motion properly presented at the meeting requiring a vote of stockholders arises, the persons named as proxies will vote on such matter in accordance with their discretion. The stockholders of the Company have no dissenter's or appraisal rights in connection with the proposal described herein.

You may change your proxy instructions at any time prior to the vote at the Special Meeting. You may accomplish this by submitting a properly executed, later-dated proxy, (which automatically revokes the earlier proxy instructions) by sending a written revocation of proxy to the Company at its principal executive office via mail or submitting a subsequent proxy by telephone, or by attending the Special Meeting and voting in person. Attendance at the Special Meeting will not cause your previously authorized proxy to be revoked unless you specifically request to vote the shares.

If you receive more than one proxy or voting instruction card, it means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. We will announce preliminary voting results at the Special Meeting and publish the final results in a Current Report on Form 8-K filed within four business days after the Special Meeting.

Special Meeting Purpose

At our Special Meeting, stockholders will be asked to consider and vote upon (i) clarifications and amendments to the advisory agreement with MCM Advisers, LP; and (ii) to consider such other business which may properly come before the Special Meeting or any postponement or adjournment thereof.

Record Date & Quorum

Only stockholders of record at the close of business on the Record Date for the Special Meeting are entitled to receive notice of and to vote at the Special Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you owned of record on that date at the Special Meeting and at any postponements or adjournments thereof. There were ______________ shares of our common stock outstanding on the Record Date. Each share of common stock entitles the holder thereof to one vote.

A quorum must be present at the Special Meeting for any business to be conducted. The presence at the Special Meeting, in person or by proxy, of holders of shares of stock entitled to cast at least 50% of the votes entitled to be cast will constitute a quorum.

Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present.

Submitting Voting Instructions for Shares Held Through a Nominee

If you hold shares of common stock through a bank or other nominee, you must follow the voting instructions you receive from your bank or nominee. If you hold shares of common stock through a bank or other nominee and you want to vote in person at the Special Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Special Meeting. You may also authorize a proxy to vote your shares by telephone if your bank or other nominee makes these methods available, in which case your bank or other nominee has provided applicable instructions to do so. If you do not submit voting instructions to your bank or other nominee, your bank or other nominee is not permitted to vote your shares on any proposal properly presented at the Special Meeting.

Authorizing a Proxy for Shares Held in Your Name

Shares held by a bank or other nominee for which the nominee has not received voting instructions from the record holder and does not have discretionary authority to vote the shares on certain proposals (which are considered "broker non-votes" with respect to such proposals) will be treated as shares present for quorum purposes. Abstentions will also be treated as shares present for purposes of calculating whether a quorum is present at the meeting.

If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. "Broker non-votes" represent votes that could have been cast on a particular matter by a brokerage firm, as a stockholder of record, but that were not cast because the brokerage firm lacked discretionary voting authority on the matter and did not receive voting instructions from the beneficial owner of the shares.

Revoking Your Proxy

Whether you vote in person, by mail or by telephone you may change your proxy instructions at any time prior to the vote at the Special Meeting. You may accomplish this by submitting by mail or by telephone, a properly executed, later-dated proxy, which automatically revokes the earlier proxy instructions, by giving notice of revocation to the Company in writing before or at the Special Meeting or by attending the Special Meeting and voting in person. Attendance at the Special Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

Votes Required to Adopt the Proposals

Amend and Clarify Advisory Agreement. This proposal must be approved by (a) the affirmative vote of "a majority" of the Common Shares outstanding on the Record Date, and (b) the affirmative vote of "a majority" of the Common Shares outstanding on the Record Date which are not held by "affiliated persons" of the Company, which under the Investment Company Act of 1940, as amended (the "1940 Act"), include our directors, officers, 5% stockholders and persons who control or who are controlled by us. For these purposes, the 1940 Act defines "a majority" of our Common Shares as either (y) 67% or more of the Common Shares present at the Special Meeting if the holders of more than 50% of the outstanding Common Shares are present or represented by proxy, or (z) 50% of the outstanding Common Shares, whichever is less. For the purpose of determining whether a majority of the Common Shares approved this proposal, abstentions and broker non-votes, if any, recorded by record owners will have the effect of a vote against the proposal.

Information Regarding this Solicitation

The proxies being solicited hereby are being solicited by our Board. The cost of soliciting proxies in the enclosed form will be paid by us. We have retained Alliance Advisors, LLC to aid in the solicitation of proxies. We will pay Alliance Advisors a fee of approximately $15,000 in addition to certain variable costs related to proxy solicitation and reimbursement of out-of-pocket expenses. Our officers and regular employees and MCM Advisers, LP, which we refer to as "MCMA" or our "Adviser" and MacKenzie Capital Management, LP, which we refer to as our "Manager," may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or electronic means. We will, upon request, reimburse others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our stock.

Security Ownership of Certain Beneficial Owners & Management

As of the Record Date, to our knowledge, there were no persons that owned 25% or more of our outstanding voting securities and no person would be deemed to control us, as such term is defined in the 1940 Act. Our directors are divided into two groups — interested directors and independent directors. Interested directors are "interested persons" of us, as defined in the 1940 Act.

The following table shows the amount of our common stock beneficially owned and based on a total of _________________ shares of our common stock outstanding on February __, 2017, the percentage ownership as of that date by (1) any person known to us to be the beneficial owner of more than 5% of the outstanding shares of our common stock, (2) each of our directors, (3) our executive officers and (4) all directors and executive officers as a group. The number of shares beneficially owned by each entity, person, director or executive officer is determined under the rules of the Securities and Exchange Commission (the "SEC") and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares that the individual has the right to acquire within 60 days of February __, 2017, through the exercise of any instrument. Unless otherwise indicated, each person has the sole investment and voting power, or shares such powers with his spouse, with respect to the shares set forth in the table. Unless known otherwise by us, the beneficial ownership information is based on each beneficial owner's most recent Form 3, Form 4, Form 5, Schedule 13D or Schedule 13G, as applicable. The address of each beneficial owner is 1640 School Street, Moraga, CA 94556.

| Name and Address of Beneficial Owner | | Number of Shares Beneficially Owned | | Percent of Class | | Dollar Range of Equity Securities Beneficially Owned by Directors(1) |

| Independent Directors: | | | | | | |

| Tim Dozois | | _ | | _ | | _ |

| Tom Frame | | _ | | _ | | _ |

| Interested Director: | | | | | | |

| C.E. "Pat" Patterson | | (2) | | %(2) | | $100,001 - $500,000(2) |

| Executive Officers: | | | | | | |

| Paul Koslosky | | (3) | | *(3) | | |

| Glen Fuller | | (4) | | *(4) | | |

| Chip Patterson | | (4) | | *(4) | | |

| Robert Dixon | | (4) | | *(4) | | |

| Directors and Officers as a group (6 persons) | | | | % | | |

| * | Represents less than 1% of the number of shares outstanding. |

| (1) | Dollar ranges are as follows: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, $100,001 – $500,000, $500,001 – $1,000,000; or Over $1,000,000. |

| (2) | Mr. Patterson owns an interest in MPF Successors, LP ("MPF"), which holds ______________ shares of the Company. Accordingly, Mr. Patterson may be deemed to beneficially own all of the Company shares held by MPF. Mr. Patterson is also a beneficial owner of ______________ Shares through a real estate holding company. |

| (3) | Mr. Koslosky owns an interest in MPF, which holds shares of the Company. Accordingly, Mr. Koslosky may be deemed to beneficially own a portion of the Company shares held by MPF. |

| (4) | Messrs. Fuller, Dixon, and Patterson own equal interests in MPF, which holds shares of the Company. Accordingly, they may be deemed to beneficially own a portion of the Company shares held by MPF. |

Certain Relationships & Related Transactions

Advisory & Administration Agreements

We entered into the Advisory Agreement with the Adviser, which is owned by MPF Founders LP, MPF Principals LP, and MPF Successors LP. Our executive officers are employees of the Adviser, and our Interested Director has extensive relationships with the Adviser. Together, Mssrs. Pattersons, Dixon, Fuller, and Koslosky own a majority in interest of the limited partnerships that own of the Adviser and the Manager. None of the Directors of the Company have acquired or disposed of any securities of the Adviser or its parents or subsidiaries during the fiscal year ended June 30, 2016. The Adviser's address is 1640 School Street, Moraga, CA 94556. The Adviser's affiliates manage approximately 50 private funds, and it and its affiliates may also manage other funds in the future that may have investment mandates that are similar, in whole and in part, with ours. The general partner of the Adviser is MCM-GP, Inc., a California corporation with the same address, and which is owned by the same persons as the Adviser's limited partners. The executive officers of the Adviser and its general partner and their principal occupations are listed below. The address of each is the same as the Adviser.

| Name and Age | Position(s) Held with the Company | Principal Occupation(s) During Past 5 Years |

| C.E. "Pat" Patterson†, 75 | Chairman of the Board of Directors | Mr. Patterson is co-founder and president of the Adviser, and a director of its general partner, and a beneficial owner of both companies, all since 1982. He is also the Chairman of the Board of the Company. |

| Robert Dixon, 46 | Managing Director and Chief Investment Officer | Robert E. Dixon is the chief investment officer of the Adviser, and has been employed by it since 2005. He is a director of its general partner and a beneficial owner. He is the President of the Company. |

| Paul Koslosky, 54 | Chief Financial Officer and Treasurer | Mr. Koslosky has been the chief financial officer and treasurer for the Adviser since 2004. He owns a beneficial interest in the Adviser and its general partner. He is the chief financial officer of the Company. |

| Glen Fuller, 43 | Chief Operating Officer | Mr. Fuller is chief operating officer and secretary of the Adviser, and a director of its general partner, and a beneficial owner. He has been employed by the Adviser since 2000. He is the chief operating officer of the Company. |

| Chip Patterson, 46 | Managing Director and General Counsel | Chip Patterson is managing director and general counsel of the Adviser, a director of the general partner, and a beneficial owner. He has been employed by the Adviser since 2003. He is the secretary and general counsel of the Company. |

| Jeri Bluth, 41 | Chief Compliance Officer | Ms. Bluth is the Chief Compliance Officer for the Adviser. She owns a beneficial interest in the Adviser. She has been employed by the Adviser since 1996. She is the chief compliance officer of the Company. |

| Christine Simpson, 51 | Chief Portfolio Manager | Mrs. Simpson is the Chief Portfolio Manager of the Adviser. She has been employed by the Adviser since 1990. She owns a beneficial interest in the Adviser and its general partner. She is chief portfolio manager of the Company. |

PROPOSAL 1 — CLARIFICATION AND AMENDMENT AND RESTATEMENT OF INVESTMENT ADVISORY AGREEMENT

Our Investment Advisory Agreement was initially approved by stockholders on February 28, 2013, subsequently amended on August 6, 2014 and September 27, 2016, and renewed on October 23, 2014, October 23, 2015, and September 27, 2016 by the Board, including all the independent directors. However, the language of the agreement has some ambiguity as to the actual calculation of the fees, so the Board and the Adviser have determined that the agreement should be clarified. Thus, we are proposing to amend and restate it. The Board met on February __, 2017, and reviewed and approved the amendment and restatement subject to approval by shareholders and recommended it for submission to the shareholders at the special meeting.

The Investment Advisory Agreement, as currently in effect, provides for the payment of fees to our Adviser as follows: (1) a portfolio structuring fee equal to 3% of amounts raised in any offering of common stock; (2) a base management fee, calculated as a percentage of "Managed Funds" (as defined in the Investment Advisory Agreement) of 3% on the first $20 million of Managed Funds, 2% on the next $80 million of Managed Funds and 1.5% of Managed Funds in excess of $100 million; and (3) a subordinated incentive fee in two parts – an income fee and a capital gains fee (discussed in detail below). There was no income fee and no capital gains fee paid to the Adviser during the fiscal year ended June 30, 2016, and the aggregate amount of the base management and portfolio structuring fees paid to the Adviser by the Company during the fiscal year ended June 30, 2016 was $1,421,225.

The Board does not believe the proposed Amendment and Restatement will result in any increase in the level of fees to be charged by the Adviser compared to the Board and the Adviser's interpretation of the Investment Advisory Agreement, but both want the language to be clarified for the avoidance of any doubt. In fact, one of the changes will have the effect of causing the Adviser to refund the $24,958 Income Fee paid in the fiscal year ended June 30, 2015 (the only incentive fee paid since inception). Upon stockholder approval, the Company will recalculate all fees back to inception to insure consistent application, and the recalculation is not expected to result in the payment of any incentive fee for any period prior to June 30, 2016. Thus, the Amended and Restated Investment Advisory Agreement will have retroactive application.

When stockholders approved the Advisory Agreement in 2013, the written consent expressed the following expectation:

WHEREAS, the Stockholders desire to enter into an Advisory Agreement with MCM Advisers, LP (the "Adviser") pursuant to which the Adviser shall receive an advisory fee from the Corporation for its advisory services. After such time as Stockholders have received dividends equal to 7% per annum on their Contributed Capital as calculated from time to time, the Adviser shall receive an advisory fee as follows: after net investment income and capital gains equal 7% per year on Contributed Capital as calculated from time to time, the Adviser shall receive a "catch-up" payment until the advisory fee is equal to 20% of the net income and capital gains generated by the Corporation's investments (which would be all such income between 7% and 8.75% per annum), after which time the Adviser shall receive 20% of all additional such income and capital gains. At liquidation of the portfolio, the Adviser would receive 20% of all capital gains after returning capital to investors.

WHEREAS, the Stockholders desire to enter into a Portfolio Structuring Agreement with the Adviser pursuant to which the Adviser shall receive a one-time fee in the amount of 3.5% of the gross amount the Company receives from selling its common stock in the Offering, separate from and in addition to the compensation received by the Adviser under the Advisory Agreement.

The language of the Investment Advisory Agreement, however, currently discusses the advisory fee prior to liquidation in two parts, as follows:

| . | (i) The Adviser will receive an Income Fee calculated on the amount of the Preliminary Net Investment Income for each calendar quarter, as follows: |

| . | (A) The Adviser will receive 100% of the Preliminary Net Investment Income in the quarter that exceeds 1.75% (7% annualized) of Contributed Capital but is less than 2.1875% (8.75% annualized) of Contributed Capital.

|

| . | (B) The Adviser will receive 20% of the Preliminary Net Investment Income in the quarter that exceeds 2.1875% (8.75% annualized) of Contributed Capital.

|

and

| . | (i) For each fiscal year of the Company, the Adviser shall receive a Capital Gains Fee equal to: |

| . | (A) (1) All Capital Gains exceeding 7% of Contributed Capital up to 8.75% of Contributed Capital as of the end of such fiscal year, and (2) 20% of all Capital Gains exceeding 8.75% of Contributed Capital as of the end of such fiscal year, less |

| . | (B) the aggregate amount of all Capital Gains Fees paid to the Adviser in prior fiscal years; but in no event exceeding 20% of all Capital Gains for such fiscal year. |

There is nothing in the current language of the Investment Advisory Agreement that explicitly "links" the two fees together, even though in February 2013, the resolutions relating to the agreement approved by the stockholders expressed that intention. Further, in each of the three places in the prospectus (both for the first offering and the current offering) where the incentive fees are described, the intention is clearly described at the end as follows:

The effect of the "catch-up" (where the Adviser gets 100% of net investment income or realized capital gains, respectively, between 7% and 8.75% of contributed capital on an annualized basis) is to make the Adviser's overall incentive compensation equal 20% of all net investment income or realized capital gains, respectively, without regard to the 7% "hurdle," so long as the overall return is at least 8.75%. (emphasis added).

Thus, the Advisory Agreement amendment would be to change the language to make explicit the connection between investment income and realized capital gains. The Amended and Restated Advisory Agreement will also incorporate several non-substantive amendments, both proposed and previously approved, which are intended to simplify the agreement and to incorporate the previously documented fee waiver.

Attached as Exhibit A is the proposed Amended and Restated Investment Advisory Agreement, marked to show revisions from the current Investment Advisory Agreement (as restated to reflect all prior amendments). Words are underlined to indicate their addition and struck through to indicate their deletion. Stockholders are encouraged to read Exhibit A in its entirety, but the remainder of this section of the proxy will explain changes made to certain sections of the agreement.

Section 10 of the Agreement is amended to change the definition of "Capital Gains" to simply clarify the computation of unrealized capital depreciation. The inclusion of the new defined terms "Capital Gains Fee First Threshold" and "Capital Gains Fee Second Threshold" simplifies the agreement by separating out the 7% hurdle into the definitions, and also creates the "link" between the Income Fee and the Capital Gains Fee. The change of the term "Qualifying Distribution" to "Special Distribution" more accurately describes the kind of distribution and the method for determining it. The change to the definition of "Preliminary Net Investment Income" makes clear that the Portfolio Structuring Fee is not deducted from the calculation, just as the Income and Capital Gains Fees are not, and just as the rest of the "sales load" is not. It was never intended that the Portfolio Structuring Fee would be considered an operating expense for purposes of this calculation because it is paid upfront at the time of the sale of shares of the Company's common stock. Since the Company has changed its accounting practices to treat the Portfolio Structuring Fee as an operating expense in its financial statements, this clarification is necessary.

Other than the small refund to be paid back to the Company, there is no net effect from these amendments and clarifications to the amount of the fee that would have been payable to the Adviser under the current Advisory Agreement. There are two main reasons for this. First, the Adviser believes that the initial agreement, as previously approved by stockholders and the Board, was intended to be read as if the above clarifications were incorporated. Second, failing to make these clarifications could result in a higher fee being paid to the Adviser because of the way the Company generates income—the vast majority of the Company's income is not from Investment Income (dividends, interest, etc.) but from realized Capital Gains. Thus, under the terms of the agreement as drafted, all of the identified operating expenses of the Company are subtracted from the Investment Income in determining the Income Fee. The result in most quarters of our operations in a negative number for Net Investment Income, and we anticipate that this would continue to be a negative number in the future, if calculated this way. Because the terms of the advisory agreement do not "tie" the two fees together, this could result in the Adviser receiving a Capital Gains fee equal to 20% of the Capital Gains Income without taking into account all of the identified Operating Expenses of the Company. This is clearly unintended and unfair to the Company. So, the Board and the Adviser want to amend the agreement to clarify the correct and intended calculation.

Below is an example showing the calculation of the Incentive Fee under the proposed amendment:

Capital Gains Fee Portion of Incentive Fee (during operations) with tie-in to Income Fee:

Note: The fair market value ("FMV") of investments used in the following alternatives is as determined according to our valuation procedures. In the example below, we assume no other losses or gains on our investments. We assume that Contributed Capital is $50,000,000, so the 7% threshold is $3,500,000 per year and the 8.75% threshold is $4,375,000 per year. Thus, the difference between the Capital Gains Fee Second Threshold and the First Threshold is $875,000 per year. We assume that we have paid dividends in excess of 7%. Note that the following portrayal of gains is necessary to demonstrate the incentive fees, but there is no guarantee that we will recognize positive returns. |

| Year | | Alternative 1 Assumptions | | Impact on the Capital Gains Fee | | Resulting Capital Gains Fee |

| 1* | | $2 million investment made in Company A ("Investment A") $3 million investment in Company B ("Investment B") $2.5 million investment made in Company C ("Investment C") Year 1 Cumulative Net Investment Income (Loss) is ($500,000) | | None | | ‑‑ |

| 2* | | Investment A sold for $5 million after 1 year Investment B sold for $5 million after 1 year FMV of Investment C determined to be $2.5 million Assume no additional Net Investment Income. | | Fee on Investment A and B triggered; no impact from increase on Investment C; negative investment income increases Capital Gains Threshold | | Capital Gains Fee First Threshold is $3,500,000 – ($500,000) = $4,000,000. $5,000,000 in gains, less $4,000,000 threshold=$1,000,000 gains $875,000 + ($1,000,000 - $875,000) x 20.0% = $900,000 |

| 3* | | Investment C sold for $4.5 million Assume no additional Net Investment Income | | None | | Additional 1 year of First Threshold is $3,500,000, so not met, no fee. |

*Assuming purchase or calculation date of June 30 in each year. Thus, in "year 2" one year has passed from purchase to sale and in "year 3" two years have passed.

Recommendation of the Board of Directors

The Board recommends that each stockholder vote "FOR" the clarification and amendment of the Advisory Agreement.

The Directors of the Company, including all of the directors who are not interested persons (as that term is used in the 1940 Act) of the Company or the Adviser (the "Independent Directors") have received information and considered such factors as they deem relevant in light of the operations of Adviser, including the substantial information provided to them by the Adviser. Based upon the review of the materials and after consideration of such other information as the Directors of the Fund (including the Independent Directors) deem appropriate, including:

(i) a description of Adviser's business, which the Board concluded demonstrated the appropriate level of expertise and size, which would benefit the Fund by providing the level of service the Board expects to receive from its portfolio manager;

(ii) biographical information respecting Adviser's personnel, which the Board concluded demonstrated the appropriate level of experience and qualification of Adviser's personnel;

(iii) Adviser's financial condition, including its audited financial statements, which the Board concluded demonstrated that Adviser is able to perform its obligations under the proposed Advisory Agreements and otherwise service the needs of its clients;

(iv) the nature, quality and extent of services to be provided by Adviser, including its reputation, expertise and resources in real estate securities markets, which the Board concluded would benefit the Fund by achieving above-average performance (as compared to other portfolio managers of similar asset classes using similar strategies for portfolios of similar size) while providing responsiveness to the Board's and the Fund's shareholders' concerns;

(v) the advisory fees payable to and profits to be realized by Adviser under the proposed Advisory Agreements, which the Board concluded (A) were reasonable in comparison to the fees charged by other portfolio managers of funds of similar size having similar investment strategies, and (B) were in the middle range of the comparisons to the closest-to-peer funds identified for the Board;

(vi) Adviser's investment performance so far, and with respect to its other fund clients, which have similar investment strategies as the Fund, which the Board concluded demonstrated that Adviser's investment strategies and principles have shown superior performance over time;

(vii) Adviser's allocation practices, which the Board concluded demonstrated that Adviser appropriately allocates investment opportunities among its clients and seeks to treat its clients fairly;

(vii) the overall high quality of the personnel, operations, financial condition, investment management capabilities, methodologies, and performance of Adviser, which the Board concluded demonstrated that Adviser will be able to perform as it anticipates, which will enable the Fund to attract and enhance assets;

(ix) a description of Adviser's internal compliance program, which the Board concluded demonstrated that Adviser devotes an appropriate level of time and resources to detecting, preventing and remedying violations of the federal securities laws;

(x) any possible conflicts of interest arising out a relationship with Adviser; the Board concluded that no conflicts of interest appeared to be present or anticipated as a result of Adviser's business affiliations that will negatively impact the Fund;

(xi) Adviser and its affiliates' regulatory examination history, which the Board concluded demonstrated Adviser's commitment to operate according to the regulatory regime it is subject to;

(xii) the benefits to be realized by Adviser and its affiliates as a result of its management of the Fund, which the Board concluded would be limited to its receipt of the advisory fees and administrative reimbursements made to its affiliate, and would not provide other benefits such as soft dollars to Adviser; and

(xiii) the terms of the proposed Advisory Agreements which the Board concluded were at least or more beneficial to the Fund as compared to agreements respecting similar levels of service for similar levels of advisory fees;

The Board of Directors of the Fund, including a majority of the Independent Directors, in the exercise of their reasonable business judgment made in the best interests of the shareholders of the Fund, based on information presented to the Directors, approve that Adviser be, and it hereby is, selected to serve as investment adviser to the Fund upon the terms and conditions described to the Board, and that the Amended and Restated Advisory Agreement as presented to this meeting be, and hereby are, approved and submitted to stockholders for approval.

OTHER MATTERS

The Board knows of no matters other than those listed in the Notice of Special Meeting of Stockholders that are likely to come before the Special Meeting. If, however, any other motion properly presented at the meeting requiring a vote of stockholders arises, the persons named as proxies will vote on such procedural matter in accordance with their discretion.

In the event that sufficient votes in favor of the proposals set forth in the Notice of the Special Meeting are not received by the time scheduled for the Special Meeting, the chairman of the meeting or the individuals named as proxies may move for one or more adjournments of the meeting to permit further solicitation of proxies.

ANNUAL REPORT

We will furnish, without charge, a copy of the most recent annual report to stockholders, upon request. Please direct any requests for copies of annual reports to MacKenzie Realty Capital, Inc., 1640 School Street, Moraga, California 94556, (800) 854-8357, or via email at investors@mackenzierealty.com.

STOCKHOLDER PROPOSALS FOR THE 2017 ANNUAL MEETING

The proxy rules adopted by the SEC provide that certain stockholder proposals must be included in the Proxy Statement for the Company's 2017 annual meeting of stockholders. Stockholders interested in submitting a proposal for inclusion in the proxy materials for the 2017 Annual Meeting may do so by following the procedures prescribed in SEC Rule 14a-8. Proposals should be sent to us at 1640 School Street, Moraga, California 94556, Attention: Corporate Secretary no later than May 24, 2017, to be eligible for inclusion in our proxy materials. Submission of a stockholder proposal does not guarantee inclusion in our proxy statement or form of proxy because certain SEC rules must be satisfied.

As more specifically provided in the Bylaws, a stockholder making a nomination of a candidate for director or a proposal of other business to be considered by the stockholders (other than proposals to be included in our proxy materials as discussed in the previous paragraph) for our 2017 annual meeting must deliver to the Corporate Secretary at the address set forth in the following paragraph not earlier than the 150th day prior to the first anniversary of the date of mailing of the notice for the preceding year's annual meeting nor later than 5:00 p.m., Pacific Time, on the 120th day prior to the first anniversary of the date of mailing of the notice for the preceding year's annual meeting; provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year's annual meeting, notice by the stockholder to be timely must be so delivered not earlier than the 150th day prior to the date of such annual meeting and not later than 5:00 p.m., Pacific Time, on the later of the 120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made. Accordingly, a stockholder's nomination of a candidate for director or other proposal of business must be received no earlier than April 24, 2017, and no later than 5:00 p.m., Pacific Time, on May 24, 2017, in order to be considered at the 2017 annual meeting.

Under the Bylaws, if you are a stockholder and desire to make a director nomination or a proposal of other business to be considered by the stockholders at a meeting of stockholders, you must deliver written notice of your intent to make such a nomination either by personal delivery or by U.S. mail, postage prepaid, to Corporate Secretary, MacKenzie Realty Capital, Inc., 1640 School Street, Moraga, California 94556, within the time limits described above for delivering of notice of a stockholder proposal and comply with the information requirements in the bylaws relating to stockholder nominations.

These requirements are separate from and in addition to the SEC's requirements that a stockholder must meet in order to have a stockholder proposal included in our proxy statement.

Proxies granted by a stockholder will give discretionary authority to the proxy holders to vote on any matters introduced pursuant to the above-described advance notice provisions, subject to the applicable rules of the SEC. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with the requirements described above and other applicable requirements.

A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to MacKenzie Realty Capital, Inc., Attention: Corporate Secretary, 1640 School Street, Moraga, California 94556.

PROXY

MACKENZIE REALTY CAPITAL, INC.

PROXY FOR SPECIAL MEETING OF STOCKHOLDERS TO BE HELD MARCH __, 2017

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED

The undersigned hereby constitutes and appoints Chip Patterson or Robert Dixon or either of them, each with full power of substitution, to represent and vote all of the shares the undersigned is entitled to vote at the Special Meeting of Stockholders (the "Special Meeting") of MacKenzie Realty Capital (the "Company") in such manner as they, or any of them, may determine on any matters which may properly come before the Special Meeting or any adjournments thereof and to vote on the matters set forth on the reverse side as directed by the undersigned. The Special Meeting will be held at 1640 School Street, Moraga, CA on March __, 2017 at 11 A.M. local time and at any and all adjournments thereof. The undersigned hereby revokes any proxies previously given.

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED "FOR" PROPOSAL 1. THE PROXIES ARE AUTHORIZED TO VOTE IN THEIR DISCRETION UPON SUCH OTHER BUSINESS NOT KNOWN AS MAY PROPERLY COME BEFORE THE SPECIAL MEETING OR ANY ADJOURNMENTS THEREOF.

(Continued and to be marked, dated and signed on the reverse side)

p FOLD AND DETACH HERE AND READ THE REVERSE SIDEp

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Stockholders to be held March __, 2017

The Proxy Statement is available at: http://www.mackenzierealty.com/sec-filings

Please mark votes as in this example ☒

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE PROPOSAL:

Proposal I – To amend and restate the Advisory Agreement

☐ FOR ☐ AGAINST ☐ ABSTAIN

WILL ATTEND THE MEETING ☐

Date _______________________________________ , 2017

Signature _________________________________________

Signature

(Joint Owners)

Note: Please sign exactly as your name or names appear on this card. Joint owners should each sign personally. If signing as a fiduciary or attorney, please give your exact title.

p PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED.p

As a stockholder of MacKenzie Realty Capital, Inc. you have the option of voting your shares electronically through the Internet or by telephone, eliminating the need to return the proxy card. Your electronic vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and returned the proxy card. Votes submitted electronically over the Internet or by telephone must be received by 11:59 p.m., Eastern Standard Time, on March __, 2017.

PROXY VOTING INSTRUCTIONS

Please have your 11-digit control number ready when voting by Internet or Telephone