UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to §240.14a-12

MACKENZIE REALTY CAPITAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

| [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| MACKENZIE REALTY CAPITAL, INC. 1640 SCHOOL STREET MORAGA, CA 94556 |

| | ____________, 2017 |

Re: Your VOTE is very IMPORTANT! Please vote online, via telephone, or by returning the enclosed card ASAP!

Dear Stockholder:

You are cordially invited to attend the 2017 Annual Meeting of Stockholders of MacKenzie Realty Capital, Inc., a Maryland corporation, to be held on _________________, 2017, at 11 a.m., local time, at 1640 School Street, Moraga, CA.

The notice of annual meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. At the meeting, you will be asked to (i) elect three directors to the Board of Directors; (ii) consider and vote upon the ratification of the selection of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018; (iii) to approve an amendment and restatement of the investment advisory agreement between us and our adviser; (iv) to grant the Company authority to sell its common shares for less than net asset value, subject to certain conditions, and (v) transact such other business as may properly come before the meeting and any postponement or adjournment thereof.

We encourage stockholders to approve these proposals. The principal changes proposed to be made as part of the amendment and restatement of the Advisory Agreement are: (i) to reflect a conclusion reached by the Board of Directors of the Company (the "Board") that no incentive fee should be paid unless distributions to stockholders at the rate of 7% per annum have actually been made for the relevant period; (ii) to exclude the portfolio structuring fee from calculation of the preliminary net investment income (on which the income incentive fee is based); (iii) to provide that the Company's preliminary net investment income will impact the obligation of the Company to pay a capital gains incentive fee; (iv) to provide that the Company's capital gains will impact the obligation of the Company to pay an income incentive fee; (v) to cause the income incentive fee to be calculated based on preliminary net investment income since inception of the Company, as opposed to calculating that fee for a quarter based on the preliminary net investment income for that quarter; and (vi) to make a series of definitional, clarification, and reorganization changes intended to conform and simplify the text of the agreement. Some of these changes will make it more likely that the Adviser will earn an incentive fee. Some of these changes will make it less likely that the Adviser will earn an incentive fee. The consequences of, and logic the Board used in recommending these changes, is explained in detail in the enclosed Proxy Statement. We are also seeking approval to have the flexibility to continue to sell Shares below NAV, if the independent directors of our Board determine it is in the best interests of the Company and its stockholders. Without stockholder approval, we may not be able to continue to raise capital in any public offering of our Shares and therefore may be limited in the number and type of investments we make in our portfolio. Please vote ASAP.

It is important that your shares be represented, either in person or by proxy, at the annual meeting. We urge you to vote your shares as soon as possible even if you currently plan to attend the annual meeting. The enclosed proxy card contains instructions for voting by telephone or by returning your proxy card via mail. This will not prevent you from voting in person but will assure that your vote is counted if you are unable to attend the annual meeting. Your vote and participation in our governance are very important to us. Any sale of Common Shares at a price below NAV would result in an immediate dilution on the NAV per outstanding Common Share to existing common stockholders of as much as 5.94%, depending on several factors described below in the proxy statement. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

THE BOARD OF DIRECTORS, INCLUDING THE INDEPENDENT DIRECTORS, RECOMMENDS THAT YOU VOTE "FOR" THE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS, "FOR" THE RATIFICATION OF THE SELECTION OF MOSS ADAMS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2018, "FOR" THE AMENDMENT AND RESTATEMENT OF THE INVESTMENT ADVISORY AGREEMENT, AND "FOR" THE PROPOSAL TO GRANT THE COMPANY AUTHORITY TO SELL OR ISSUE SHARES OF COMMON STOCK TO INVESTORS AT A PER SHARE PRICE THAT IS LESS THAN THE COMPANY'S THEN-CURRENT NET ASSET VALUE PER SHARE.

Sincerely yours,

C.E. "Pat" Patterson

Chairman of the Board

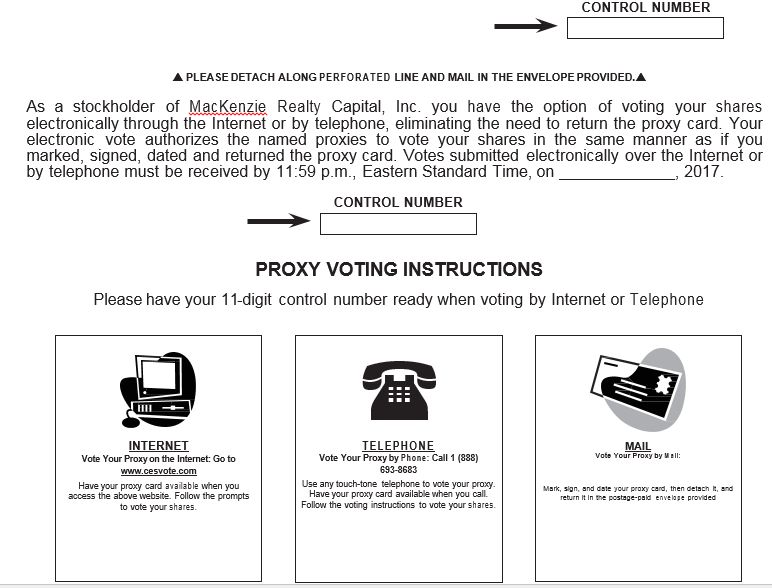

P.S. You can vote online at www.cesvote.com using the "control number" printed on your proxy card. It's fast and easy. You can also call (888) 693-8683 to vote by phone.

| MACKENZIE REALTY CAPITAL, INC. 1640 SCHOOL STREET MORAGA, CA 94556 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of MacKenzie Realty Capital, Inc.:

NOTICE IS HEREBY GIVEN that the 2017 annual meeting (the "Annual Meeting") of stockholders of MacKenzie Realty Capital, Inc., a Maryland Corporation (the "Company"), will be held on ______________, 2017, at 11 a.m. Pacific Time at 1640 School Street, Moraga, CA for the following purposes:

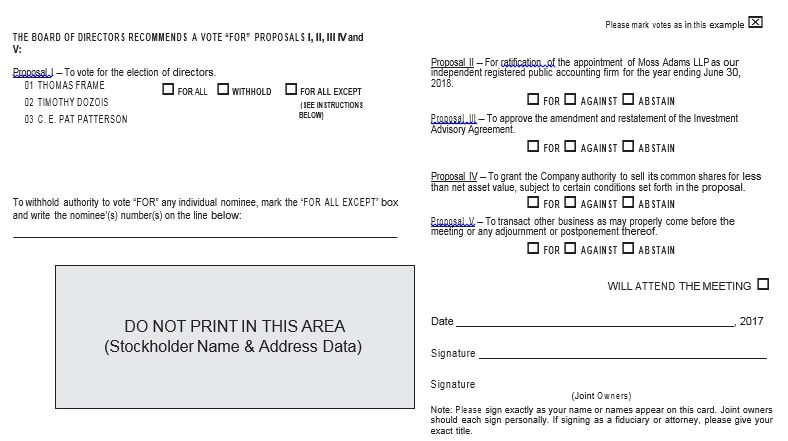

| 1. | To consider and vote upon the election of three directors to hold office until the 2018 annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | To consider and vote upon the ratification of the selection of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018; |

| 3. | To approve an amendment and restatement of the investment advisory agreement between us and our investment adviser; |

| 4. | To grant the Company authority to sell or issue shares of common stock to investors at a per share price that is less than the Company's then-current net asset value per share; and |

| 5. | To transact any other business that may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. Stockholders may also transact any other business that properly comes before the meeting.

The Board of Directors has fixed the close of business on ______________, 2017, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments of the meeting.

Please authorize a proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. You may authorize your proxy by telephone or mail. For specific instructions, please refer to the Proxy Statement on page 1 and the instructions on the proxy card.

THE BOARD OF DIRECTORS, INCLUDING THE INDEPENDENT DIRECTORS, RECOMMENDS THAT YOU VOTE "FOR" THE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS, "FOR" THE RATIFICATION OF THE SELECTION OF MOSS ADAMS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2018, "FOR" THE AMENDMENT AND RESTATEMENT OF THE INVESTMENT ADVISORY AGREEMENT, AND "FOR" THE PROPOSAL TO GRANT THE COMPANY AUTHORITY TO SELL OR ISSUE SHARES OF COMMON STOCK TO INVESTORS AT A PER SHARE PRICE THAT IS LESS THAN THE COMPANY'S THEN-CURRENT NET ASSET VALUE PER SHARE.

You have the option to revoke your proxy at any time prior to the meeting, or to vote your shares personally on request if you attend the meeting. If there are not sufficient shares present for a quorum or sufficient votes to approve the foregoing proposals at the time of the annual meeting, the chairman of the meeting may move for one or more adjournments of the meeting in order to permit further solicitation of proxies by the Company.

By Order of the Board of Directors of the Company,

/s/ Chip Patterson

Chip Patterson

Secretary

____________, 2017

Moraga, California

The accompanying proxy statement and proxy card are being distributed to our stockholders on or about ______________, 2017.

| MACKENZIE REALTY CAPITAL, INC. 1640 SCHOOL STREET MORAGA, CA 94556 |

PROXY STATEMENT

2017 ANNUAL MEETING OF STOCKHOLDERS

______________, 2017

This proxy statement contains information relating to the 2017 annual meeting (the "Annual Meeting") of stockholders of MacKenzie Realty Capital, Inc., a Maryland corporation (the "Company," "we" or "us"), to be held on ___________, 2017 beginning at 11 a.m., local time, at our offices at 1640 School Street, Moraga, CA, and any postponements or adjournments thereof, and is furnished in connection with the solicitation of proxies by our Board of Directors to be voted at the Annual Meeting. Stockholders of record at the close of business on ___________, 2017 (the "Record Date") are entitled to vote at the meeting as set forth in this proxy statement. This proxy statement and accompanying proxy card are first being mailed to stockholders on or about ______________, 2017.

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting of Stockholders to be held on __________________, 2017. The Notice of 2017 Annual Meeting of Stockholders, Proxy Statement and Proxy Card are available at http://www.mackenzierealty.com. On this site, you will be able to access our Proxy Statement and any amendments or supplements to the foregoing materials that are required to be furnished to stockholders.

We encourage you to vote your shares, either by voting in person at the meeting or by authorizing a proxy (i.e., authorizing someone to vote your shares). You may authorize a proxy by telephone by using the toll-free number listed on the proxy card or you may mark, date, sign and mail the enclosed proxy card. If you vote by authorizing a proxy, the proxy holders will vote the shares according to your instructions. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted "FOR" the election of the director nominees, "FOR" the ratification of the selection of Moss Adams LLP as the Company's independent registered public accounting firm for the fiscal year ending June 30, 2018, "FOR" the amendment and restatement of the investment advisory agreement, and "FOR" the proposal to grant the Company authority to sell or issue shares of common stock to investors at a per share price that is less than the Company's then-current net asset value per share.

Our Board of Directors (the "Board") is not aware of any matter to be properly presented for consideration at the Annual Meeting other than the matters described herein. If any motion properly presented at the meeting requiring a vote of stockholders arises, the persons named as proxies will vote on such matter in accordance with their discretion. The stockholders of the Company have no dissenter's or appraisal rights in connection with any of the proposals described herein.

You may change your proxy instructions at any time prior to the vote at the Annual Meeting. You may accomplish this by submitting a properly executed, later-dated proxy, (which automatically revokes the earlier proxy instructions) by sending a written revocation of proxy to the Company at its principal executive office via mail or submitting a subsequent proxy by telephone, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously authorized proxy to be revoked unless you specifically request to vote the shares.

If you receive more than one proxy or voting instruction card, it means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. We will announce preliminary voting results at the Annual Meeting and publish the final results in a Current Report on Form 8-K filed within four business days after the Annual Meeting.

Annual Meeting Purpose

At our Annual Meeting, stockholders will be asked to consider and vote upon the following matters: (i) the election of three directors to serve until the 2018 annual meeting of stockholders and until their successors are duly elected and qualified; (ii) the ratification of the selection of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018; (iii) the approval of an amendment and restatement of the investment advisory agreement between us and our investment adviser; (iv) the granting to the Company of authority to sell its common shares for less than net asset value, subject to certain conditions; and (v) to consider such other business which may properly come before the Annual Meeting or any postponement or adjournment thereof.

Record Date & Quorum

Only stockholders of record at the close of business on _________________, 2017, the Record Date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you owned of record on that date at the Annual Meeting and at any postponements or adjournments thereof. There were _____________________ shares of our common stock outstanding on the Record Date. Each share of common stock entitles the holder thereof to one vote.

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of holders of shares of stock entitled to cast at least 50% of the votes entitled to be cast will constitute a quorum.

Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present.

Submitting Voting Instructions for Shares Held Through a Nominee

If you hold shares of common stock through a bank or other nominee, you must follow the voting instructions you receive from your bank or nominee. If you hold shares of common stock through a bank or other nominee and you want to vote in person at the Annual Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the Annual Meeting. You may also authorize a proxy to vote your shares by telephone if your bank or other nominee makes these methods available, in which case your bank or other nominee has provided applicable instructions to do so. If you do not submit voting instructions to your bank or other nominee, your bank or other nominee is not permitted to vote your shares on any proposal properly presented at the Annual Meeting (other than Proposal 2).

Authorizing a Proxy for Shares Held in Your Name

Shares held by a bank or other nominee for which the nominee has not received voting instructions from the record holder and does not have discretionary authority to vote the shares on certain proposals (which are considered "broker non-votes" with respect to such proposals) will be treated as shares present for quorum purposes. Abstentions will also be treated as shares present for purposes of calculating whether a quorum is present at the meeting.

If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. "Broker non-votes" represent votes that could have been cast on a particular matter by a brokerage firm, as a stockholder of record, but that were not cast because the brokerage firm lacked discretionary voting authority on the matter and did not receive voting instructions from the beneficial owner of the shares.

Revoking Your Proxy

Whether you vote in person, by mail or by telephone you may change your proxy instructions at any time prior to the vote at the Annual Meeting. You may accomplish this by submitting by mail or by telephone, a properly executed, later-dated proxy, which automatically revokes the earlier proxy instructions, by giving notice of revocation to the Company in writing before or at the Annual Meeting or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

Votes Required to Adopt the Proposals

Election of Directors. The election of a director requires the vote of a plurality of all the votes cast. Each share may be voted for as many individuals as there are directors to be elected and for whose election the share is entitled to be voted. If you vote to withhold authority with respect to a nominee, your shares will not be voted with respect to the person indicated. Abstentions and broker non-votes will not be counted towards a nominee's achievement of a plurality.

Ratification of Selection of Moss Adams LLP as Independent Registered Public Accounting Firm for the Fiscal Year Ending June 30, 2018. The ratification of the selection of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018, requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting. Stockholders may not cumulate their votes. Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

Amendment and Restatement of Investment Advisory Agreement and Authorization of the Issuance of Shares below NAV. These proposals must be approved by (a) the affirmative vote of "a majority" of the Common Shares outstanding on the Record Date, and (b) the affirmative vote of "a majority" of the Common Shares outstanding on the Record Date which are not held by "affiliated persons" of the Company, which under the Investment Company Act of 1940, as amended (the "1940 Act") include our directors, officers, 5% stockholders and persons who control or who are controlled by us. For these purposes, the 1940 Act defines "a majority" of our Common Shares as either (y) 67% or more of the Common Shares present at the Annual Meeting if the holders of more than 50% of the outstanding Common Shares are present or represented by proxy, or (z) 50% of the outstanding Common Shares, whichever is less. For the purpose of determining whether a majority of the Common Shares approved these proposals, abstentions and broker non-votes, if any, recorded by record owners will have the effect of a vote against the proposals.

Information Regarding this Solicitation

The proxies being solicited hereby are being solicited by our Board. The cost of soliciting proxies in the enclosed form will be paid by us. We have retained Alliance Advisors, LLC to aid in the solicitation of proxies. We will pay Alliance Advisors a fee of approximately $20,000 in addition to certain variable costs related to proxy solicitation and reimbursement of out-of-pocket expenses. Our officers and regular employees and MCM Advisers, LP, which we refer to as "MCMA" or our "Adviser" and MacKenzie Capital Management, LP, which we refer to as our "Manager," may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or electronic means. We will, upon request, reimburse others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

Security Ownership of Certain Beneficial Owners & Management

As of the Record Date, to our knowledge, there were no persons that owned 25% or more of the outstanding voting securities and no person would be deemed to control us, as such term is defined in the 1940 Act. Our directors are divided into two groups — interested directors and independent directors. Interested directors are "interested persons" of us, as defined in the 1940 Act.

The following table shows the amount of our common stock beneficially owned and based on a total of ___________________ shares of our common stock outstanding on _______________, 2017, as of that date, by (1) any person known to us to be the beneficial owner of more than 5% of the outstanding shares of our common stock, (2) each of our directors and nominees for director, (3) our executive officers and (4) all directors and executive officers as a group. The number of shares beneficially owned by each entity, person, director or executive officer is determined under the rules of the Securities and Exchange Commission (the "SEC") and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares that the individual has the right to acquire within 60 days of _____________, 2017, through the exercise of any instrument. Unless otherwise indicated, each person has the sole investment and voting power, or shares such powers with his spouse, with respect to the shares set forth in the table. Unless known otherwise by us, the beneficial ownership information is based on each beneficial owner's most recent Form 3, Form 4, Form 5, Schedule 13D or Schedule 13G, as applicable. The address of each beneficial owner is 1640 School Street, Moraga, CA 94556.

| Name and Address of Beneficial Owner | | Number of Shares Beneficially Owned | | Percent of Class | | Dollar Range of Equity Securities Beneficially Owned by Directors(1) |

| Independent Directors: | | | | | | |

| Tim Dozois | | | | | | |

| Tom Frame | | | | | | |

| Interested Director: | | | | | | |

| C.E. "Pat" Patterson | | | | | | |

| Executive Officers: | | | | | | |

| Paul Koslosky | | | | | | |

| Glen Fuller | | | | | | |

| Chip Patterson | | | | | | |

| Robert Dixon | | | | | | |

| Directors and Officers as a group (6 persons) | | | | % | | |

| * | Represents less than 1% of the number of shares outstanding. |

| (1) | Dollar ranges are as follows: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, $100,001 – $500,000, $500,001 – $1,000,000; or Over $1,000,000. |

PROPOSAL 1 — ELECTION OF DIRECTORS

Our First Amended and Restated Articles of Incorporation (our "Charter"), provide that we will have at least three directors, which number may be increased (or subsequently decreased after an increase) by the Board under our First Amended and Restated Bylaws (the "Bylaws"). There are currently three directors, including two directors who are not "interested persons," as that term is used in the 1940 Act (the "Independent Directors").

At each annual meeting of stockholders, each director is elected for a one-year term expiring at the following annual meeting. Each director holds office until his/her successor is elected and qualified.

Mr. Tim Dozois, Mr. Tom Frame, and Mr. C.E. "Pat" Patterson have each been nominated by the Nominating and Corporate Governance Committee (the "Nominating Committee") to stand for re-election at the Annual Meeting to hold office until the 2018 annual meeting of our stockholders and until a successor for any of them is duly elected and qualified. In the election of the directors, you may vote "FOR" the nominee or your vote may be "WITHHELD" with respect to the nominee. Each of the nominees has consented to serve if elected. As of the mailing of these proxy materials, the Board knows of no reason why any nominee would be unable to serve as a director. If, at the time of the Annual Meeting, the nominee is unable or unwilling to serve as a director, it is intended that the persons named as proxies will vote to elect a substitute nominee designated by the Board.

Recommendation of the Board of Directors

The Board recommends that each stockholder vote "FOR" the re-election of Messrs. Dozois, Frame, and Patterson as directors.

Information About the Directors

Information about the nominees for re-election at the meeting is provided below. All three nominees for re-election as director currently serve as directors of the Company. The Board believes that it is necessary for each of the Company's directors to possess many qualities and skills. If we have a vacancy, when searching for new candidates, the Nominating Committee will consider the evolving needs of the Board and will search for candidates that fill any gap. The Board also believes that all directors must possess a considerable amount of business management and educational experience. The Nominating Committee will first consider a candidate's management experience and then considers issues of judgment, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value when considering director candidates. The Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating Committee believe that it is important that the members of the Board represent diverse viewpoints. In considering candidates for the Board, the Nominating Committee considers the entirety of each candidate's credentials in the context of these standards. When nominating continuing directors for re-election, the individual's contributions to the Board are also considered.

The Board believes that each of our directors is highly qualified to serve as a member of the Board. All of our directors bring to our Board a wealth of industry experience. Our directors are highly educated and have diverse backgrounds and talents and extensive track records of success in what we believe are relevant positions with reputable organizations. Individual qualifications and skills of our directors that contribute to the Board's effectiveness as a whole are described below. None of the below directors' serves as a director for a company (other than MRC) with a class of securities registered under the Securities Exchange Act of 1934 (the "1934 Act") or that is registered as an investment company under the 1940 Act. The experience, qualifications, attributes, and skills each of the directors as listed below have led us to the conclusion that they should serve as our directors in light of our business and structure.

Board of Directors

INTERESTED DIRECTOR

| Name & Age | | Position Held with the Company | | Term of Office & Length of Time Served | | Principal Occupation(s) During Past Five Years |

| C.E. "Pat" Patterson, 76 | | Chairman of the Board, Interested Director(1) | | Since 2012 | | Mr. Patterson, an MRC director since May of 2012, is co-founder and chairman of MCMA and the Manager, and a director of their general partner, and a beneficial owner of all three companies, all since 1982. Mr. Patterson, has spent his entire business career in the financial services industry. In July 1965, following his graduation from the University of Oregon with a B.S. degree, he was selected as a junior executive trainee by Merrill Lynch, Pierce, Fenner and Smith, Inc. This intensive two-year training program was conducted in New York and included "on-the-floor" experience on all the major stock and commodity trading floors in the U.S. and Europe as well as a one-year position in Securities Research. Subsequently assigned to Merrill's Oakland, California office, Mr. Patterson had responsibility as an account executive for individual investors through September of 1971. In September 1971, Mr. Patterson joined Eastman Dillon, Union Securities, Inc. with responsibility for Institutional Accounts in San Francisco and Hawaii. Upon the merger of Blyth & Co. with Eastman Dillon, Mr. Patterson was appointed assistant manager and then resident manager of the firm's Oakland office. He became a vice president of the firm in 1975. From September 1976 to March 1978, Mr. Patterson was associated with Smith Barney, Harris Upham, Inc. as a vice president, sales; with Merrill Lynch, Pierce, Fenner and Smith, Inc. as a senior account executive from September 1978 – February 1979; and with Paine Webber, Jackson & Curtis as an account vice president from January 1979 – March 1982. During this period his primary responsibility was the counseling of individual clients, but he also was responsible for research and marketing of specialized financial products. In January 1982, Mr. Patterson founded Patterson Financial Services, Inc. (now MCM Advisers, LP) with Berniece A. Patterson as a financial planning firm. He founded Patterson Real Estate Services, a licensed California Real Estate Broker, in July 1982. As president of MCM Advisers, LP, Mr. Patterson is responsible for all investment counseling activities. He supervises the analysis of investment opportunities for the clients of the firm. In February 1988, Mr. Patterson co-founded the predecessor of the Manager. The Manager acts as the general partner and Manager to a number of prior investment funds. Mr. Patterson is the president of the Manager. Mr. Patterson is a former Certified Financial Planner, has completed the College of Financial Planning's Due Diligence course, and is a past member of both the Institute of Certified Financial Planners and the International Association for Financial Planning. We believe Mr. Patterson is qualified to serve on our Board of Directors because of his history with affiliate private funds, familiarity with our investment platform and his extensive knowledge of the real estate industry and investment valuation process. |

| | | (1) | Director is an "interested person" (as defined in the 1940 Act). Mr. Patterson is deemed to be an interested person by reason of his affiliation with MCMA and our Manager. | |

| INDEPENDENT DIRECTORS |

| | | | | | | |

| Name & Age | | Position Held with the Company | | Term of Office & Length of Time Served | | Principal Occupation(s) During Past Five Years |

| Tim Dozois, 55 | | Independent Director | | Since 2012 | | Mr. Dozois, an MRC director since May of 2012, has been the vice president and corporate counsel for Pendrell Corporation, a NASDAQ listed company specializing in intellectual property solutions, since June of 2010. He has 23 years of experience supporting leading corporations in securities law compliance, mergers, acquisitions, and real estate acquisition, financing, and management. Prior to joining Pendrell Corporation, Mr. Dozois was a partner for a brief period with Zupancic Rathbone Law Group, Inc., a firm that specializes in structured financing with a particular emphasis on the acquisition, financing and management of troubled real property assets. From January 1996 until March of 2010, Mr. Dozois served as an equity partner of Davis Wright Tremaine LLP, a Seattle-based law firm of approximately 500 lawyers. Mr. Dozois received his B.S. in Financial Management from Oregon State University and his J.D. from the University of Oregon School of Law, where he was Order of the Coif. We believe Mr. Dozois is qualified to serve on our Board of Directors because of his broad legal background and specific experience in real estate acquisitions, financings and management. |

| | | | | | | |

| Tom Frame, 74 | | Independent Director | | Since 2012 | | Mr. Frame, an MRC director since May of 2012, was a co-founder of TransCentury Property Management and solely founded Paradigm Investment Corporation. TransCentury began in May of 1973 and has syndicated and managed over 10,000 residential units. During the last 35 years, Mr. Frame has been a principal in the acquisition, financing, restoration, and sale of over $500,000,000 in residential and commercial real estate. Paradigm was founded in June 1986 to sponsor and manage private, closed end "mutual funds." Paradigm managed a portfolio of over $7,000,000 in limited partnership securities. The last of the funds successfully liquidated in December of 2000. Mr. Frame received a B.S. degree in Mathematics from the University of Kansas in June 1964, a J.D. degree from the San Francisco Law School in June 1975, and a M.B.A. with honors from Pepperdine University in April 1986. Mr. Frame is currently managing his own investments which include residential units, commercial property, and a portfolio of securities. We believe Mr. Frame is qualified to serve on our Board of Directors because of his experience in property management, real estate transactions and financing and the management of private investment funds. |

Meetings of the Board of Directors & Committees

The Board of Directors provides overall guidance and supervision with respect to our operations and performs the various responsibilities imposed on the directors of business development companies by the 1940 Act. Among other things, the Board supervises our management arrangements, the custodial arrangements with respect to portfolio securities, the selection of accountants, fidelity bonding and transactions with affiliates. All actions taken by the Board are taken by majority vote unless a higher percentage is required by law or unless the 1940 Act or our Charter or Bylaws require that the actions be approved by a majority of the directors who are not "interested persons" (as defined in the 1940 Act).

During our fiscal year ended June 30, 2017 ("Fiscal 2017"), the Board or its committees met 4 times. Each director attended at least 75% of all meetings held by the Board and of the committees of the Board on which he served. The Annual Meeting is our fourth annual stockholders' meeting.

Board Leadership Structure

Our Board monitors and performs an oversight role with respect to our business and affairs, including with respect to investment practices and performance, compliance with regulatory requirements and the services, expenses and performance of our service providers. Among other things, our Board approves the appointment of MCMA and our officers, reviews and monitors the services and activities performed by MCMA and our executive officers and approves the engagement, and reviews the performance of, our independent registered public accounting firm. Our Board also quarterly ratifies MCMA's selection of securities for our portfolio.

Under our Bylaws, our Board may designate a chairman to preside over the meetings of the Board and meetings of the stockholders and to perform such other duties as may be assigned to him by the Board. We do not have a fixed policy as to whether the chairman of the Board should be an Independent Director and believe that we should maintain the flexibility to select the chairman and reorganize the leadership structure, from time to time, based on the criteria that is in our best interests and our stockholders best interests at such times.

Presently, C.E. Patterson serves as the chairman of our Board. C.E. Patterson is an "interested person" of the Company as defined in Section 2(a)(19) of the 1940 Act because he is on the investment committee of MCMA and is the manager and managing member of MCMA and our Manager, respectively. We believe that C.E. Patterson's history with affiliated private funds, familiarity with our investment platform, and extensive knowledge of the real estate industry and the investment valuation process in particular qualify him to serve as the chairman of our Board of Directors. We believe that we are best served through this existing leadership structure, as C.E. Patterson's relationship with MCMA provides an effective bridge and encourages an open dialogue between management and the Board, ensuring that both groups act with a common purpose.

Our Board does not currently have a designated lead Independent Director. We are aware of the potential conflicts that may arise when a non-Independent Director is chairman of the board, but believe these potential conflicts are offset by our strong corporate governance policies. Our corporate governance policies include regular meetings of the Independent Directors in executive session without the presence of interested directors and management, the establishment of audit and nominating and corporate governance committees comprised solely of Independent Directors and the appointment of a Chief Compliance Officer (our "CCO"), with whom the Independent Directors may meet without the presence of interested directors and other members of management, for administering our compliance policies and procedures.

We recognize that different board leadership structures are appropriate for companies in different situations. We believe that the Board's structure is appropriate for our operations as a BDC under the 1940 Act and having a class of securities which is registered under the 1934 Act, in that its members possess an appropriate depth and breadth of experience relating to our planned investment program. We intend to re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

Board's Role In Risk Oversight

Our Board performs its risk oversight function primarily through (i) its two standing committees, which report to the entire Board of Directors and are comprised solely of Independent Directors, and (ii) active monitoring of our chief compliance officer and our compliance policies and procedures.

As described below in more detail under "Committees of the Board of Directors," the audit committee ("Audit Committee") and the Nominating Committee assist the Board in fulfilling its risk oversight responsibilities. The Audit Committee's risk oversight responsibilities include overseeing our accounting and financial reporting processes, our systems of internal controls regarding finance and accounting, our valuation process, and audits of our financial statements. The Nominating Committee's risk oversight responsibilities include selecting, researching and nominating directors for election by our stockholders, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and our management.

Our Board also performs its risk oversight responsibilities with the assistance of the CCO. The Board reviews written reports from the CCO discussing the adequacy and effectiveness of our compliance policies and procedures. The CCO's report addresses (i) the operation of our compliance policies and procedures; (ii) any material changes to such policies and procedures since the last report; (iii) any recommendations for material changes to such policies and procedures as a result of the CCO's review; and (iv) any compliance matter that has occurred since the date of the last report about which the Board would reasonably need to know to oversee our compliance activities and risks. In addition, the CCO may meet separately in executive session with the Independent Directors.

We believe that our Board's role in risk oversight is effective, and appropriate given the extensive regulation to which we are already subject as a BDC. As a BDC, we are required to comply with certain regulatory requirements that control the levels of risk in our business and operations. For example, our ability to incur indebtedness is limited such that our asset coverage must equal at least 200.0% immediately after each time we incur indebtedness, we generally have to invest at least 70.0% of our gross assets in "qualifying assets" and we are not generally permitted to invest in any portfolio company in which one of our affiliates currently has an investment.

Committees of the Board of Directors

The Audit Committee and the Nominating Committee have been established by our Board. All directors are expected to attend at least 75.0% of the aggregate number of meetings of the Board and of the respective committees on which they serve. We require each director to make a diligent effort to attend all Board and committee meetings as well as each annual meeting of our stockholders.

Audit Committee

The Audit Committee operates under a charter approved by our Board, which contains the responsibilities of the Audit Committee. The Audit Committee's responsibilities include establishing guidelines and making recommendations to our Board regarding the valuation of our loans and investments, selecting our independent registered public accounting firm, reviewing with such independent registered public accounting firm the planning, scope and results of their audit of our financial statements, pre‑approving the fees for services performed, reviewing with the independent registered public accounting firm the adequacy of internal control systems, reviewing our annual financial statements and periodic filings and receiving our audit reports and financial statements. The Audit Committee is currently composed of Messrs. Dozois and Frame, neither of whom is an "interested person" of ours as that term is defined in Section 2(a)(19) of the 1940 Act. Mr. Dozois serves as chairman of the Audit Committee.

The charter of the Audit Committee is available on our website (www.mackenzierealty.com). Information contained on or connected to our website is not incorporated by reference into this proxy statement and should not be considered a part of this proxy statement or any other filing that we file with the SEC. The Audit Committee met 4 times during Fiscal 2017.

Nominating Committee

The Nominating Committee operates under a charter approved by our Board. The members of the Nominating Committee are Messrs. Dozois and Frame, neither of whom is an "interested person" of the Company, as that term is defined in Section 2(a)(19) of the 1940 Act. Mr. Frame serves as chairman of the Nominating Committee. The Nominating Committee is responsible for selecting, researching and nominating directors for election by our stockholders, selecting nominees to fill vacancies on the Board or a committee thereof, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and our management. Stockholders have not made any nominations to the Nominating Committee of candidates for the Board.

The Nominating Committee seeks candidates who possess the background, skills and expertise to make a significant contribution to the Board, our operations, and our stockholders. In considering possible candidates for election as a director, the Nominating Committee takes into account, in addition to such other factors as it deems relevant, the desirability of selecting directors who:

| · | are of high character and integrity; |

| · | are accomplished in their respective fields, with superior credentials and recognition; |

| · | have relevant expertise and experience upon which to be able to offer advice and guidance to management; |

| · | have sufficient time available to devote to our affairs; |

| · | are able to work with the other members of the Board and contribute to our success; |

| · | can represent the long-term interests of our stockholders as a whole; and |

| · | are selected such that the Board of Directors represents a range of backgrounds and experience. |

The Nominating Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Nominating Committee considers and discusses diversity, among other factors, with a view toward the needs of the Board as a whole. The Nominating Committee generally conceptualizes diversity expansively to include concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities that contribute to the Board, when identifying and recommending director nominees. The Nominating Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Nominating Committee's goal of creating a Board that best serves our needs and the interests of our stockholders.

The charter of the Nominating Committee is available on our website (www.mackenzierealty.com). Information contained on or connected to our website is not incorporated by reference into this proxy statement and should not be considered a part of this proxy statement or any other filing that we file with the SEC. The Nominating Committee met 1 time during Fiscal 2017.

Compensation Committee

We do not have a compensation committee because our executive officers do not receive any direct compensation from us.

Communications with the Board of Directors

We provide a means for our stockholders to communicate with the Board. Stockholders may address correspondence to the Board of Directors as a whole or individual members of the Board relating to us via e-mail at board@mackenziecapital.com. Our Secretary will then forward the correspondence to the applicable addressee. Correspondence may also be directed to MacKenzie Realty Capital, Inc., Attention: Corporate Secretary, 1640 School Street, Moraga, CA 94556. At the direction of the Board, all mail received will be opened and screened for security purposes. The mail will then be logged in. All mail, other than trivial or obscene items, will be forwarded to the attention of the applicable addressee. Mail addressed to a particular director will be forwarded or delivered to that director. Mail addressed to "Outside Directors," "Independent Directors," or "Non-Management Directors" will be forwarded or delivered to our Independent Directors. Mail addressed to the "Board of Directors" will be forwarded or delivered to the Chairman of the Board. Concerns relating to accounting, internal controls or auditing matters are handled in accordance with procedures established by the Audit Committee with respect to such matters.

Corporate Governance

We are a Maryland corporation subject to the provisions of the Maryland General Corporation Law. Our day-to-day operations and requirements as to the place and time, conduct and voting at a meeting of stockholders are governed by our Charter and Bylaws, the provisions of the Maryland General Corporation Law and the provisions of the 1940 Act. A copy of the Charter and Bylaws, corporate governance guidelines and the charters of the Audit and Nominating Committees may be obtained by submitting a request in writing to MacKenzie Realty Capital, Inc., Attention: Corporate Secretary, 1640 School Street, Moraga, CA 94556.

Code of Ethics

We have also adopted a Code of Ethics which applies to, among others, our senior officers, including our Chief Executive Officer and Chief Financial Officer, as well as all of our officers, directors and employees. Our Code of Ethics requires that all employees and directors avoid any conflict, or the appearance of a conflict, between an individual's personal interests and our interests. Pursuant to our Code of Ethics, each employee and director must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to our CCO. Our Audit Committee is charged with approving any waivers under our Code of Ethics.

Independent Directors

The Board undertook its annual review of director independence in September 2016. During this review, the Board considered transactions and relationships between each director or any member of his immediate family and us. The Board also examined transactions and relationships between directors or their affiliates and members of our senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. As a result of this review, the Board affirmatively determined that all of the directors are independent of us and our management with the exception of Mr. Patterson. Mr. Patterson is considered an interested director because of his relationships with MCMA and our Manager. The board expects to conduct a similar review at its annual meeting to be held on September 11, 2017.

Involvement in Certain Legal Proceedings

No director, person nominated to become a director or executive officer of the Company has, during the last ten years: (i) been convicted in or is currently subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to any federal or state securities or banking or commodities laws including in any way limiting involvement in any business activity, or finding any violation with respect to such law, nor (iii) had any bankruptcy petition filed by or against the business of which such person was an executive officer or a general partner, whether at the time of the bankruptcy or for the two years prior thereto.

Information About Our Executive Officers

| Name & Age | | Position Held with the Company | | Term of Office & Length of Time Served | | Principal Occupation(s) During Past Five Years |

| Robert Dixon, 46 | | Chief Executive Officer and President | | Since 2012 | | Mr. Dixon is managing director and chief investment officer of MCMA and our Manager, where he has been employed since 2005. He is a director of their general partner and a beneficial owner of all three companies. Mr. Dixon is C.E. and Berniece Patterson's son-in-law. Robert Dixon served as an officer and director of Sutter Holding Company, Inc. from March 2002 until 2005. Mr. Dixon founded Sutter Capital Management, LLC, an investment management firm, in 1998 and sold it in 2005 to MCM Advisers, Inc. Mr. Dixon has been president of Sutter Capital Management since its founding. Mr. Dixon received his M.B.A. degree from Cornell University in 1998 and has held the Chartered Financial Analyst® designation since 1996. From October 1994 to June 1996 he worked for MacKenzie Patterson, Inc. as a securities research analyst. He worked for Lehman Brothers, Inc. in equity sales and trading during 1993 and 1994. Mr. Dixon received his B.A. degree in economics from the University of California at Los Angeles in 1992. |

| Name & Age | | Position Held with the Company | | Term of Office & Length of Time Served | | Principal Occupation(s) During Past Five Years | |

| Paul Koslosky, 55 | | Chief Financial Officer and Treasurer | | Since 2012 | | Mr. Koslosky is the chief financial officer for MCMA and our Manager, where he has been employed since 1997. He owns a beneficial interest in each of MCMA, our Manager, and their general partner. He is responsible for accounting and reporting for our Manager, the funds it manages, and other related business interests. Mr. Koslosky graduated from California State University, Hayward in 1983 with a B.S. degree in Business Administration. He spent five years with Zellerbach Paper Company, a billion-dollar paper distributor, as staff accountant and, eventually, financial reporting manager. Prior to joining the Manager in 1997, he worked for Doric Development, an Alameda, California real estate developer with numerous related business interests. At Doric he served as accounting manager responsible for the accounting and reporting for commercial development and construction. He served as controller from 1995 to 1997 responsible for accounting, reporting, cash management, and human resources for Doric and its related companies. |

| Glen Fuller, 44 | | Chief Operating Officer | | Since 2012 | | Mr. Fuller is managing director and chief operating officer of MCMA and our Manager, where he has been employed since 2000. He is a director of their general partner and a beneficial owner of all three companies. Mr. Fuller is Berniece Patterson's son and C.E. Patterson's stepson. Prior to becoming senior vice president of the Manager, he was with the Manager for two years as a portfolio manager and research analyst. Prior to joining the Manager, Mr. Fuller spent two years running the over the counter trading desk for North Coast Securities Corp. (previously Morgan Fuller Capital Group) with responsibility for both the proprietary and retail trading desks. Mr. Fuller was also the registered options principal and registered municipal bond principal for North Coast Securities Corp., a registered broker-dealer. Mr. Fuller previously held his NASD Series 7, general securities registration. Mr. Fuller has a B.A. degree in Management. Mr. Fuller has also spent time working on the floor of the New York Stock Exchange as a trading clerk and on the floor of the Pacific Stock Exchange in San Francisco as an assistant specialist for LIT America. |

| Chip Patterson, 46 | | General Counsel and Secretary | | Since 2012 | | Mr. Patterson is a managing director and general counsel of MCMA and our Manager, where he has been employed since 2003. He is a director of their general partner and a beneficial owner of all three companies. Mr. Patterson is C.E. Patterson's son and Berniece Patterson's stepson. Chip Patterson graduated magna cum laude from the University of Michigan Law School with a J.D. degree and with high distinction and Phi Beta Kappa from the University of California at Berkeley with a B.A. degree in Political Science. Prior to joining the Manager in July 2003, he was a securities and corporate finance attorney with the national law firm of Davis Wright Tremaine LLP. Prior to law school, Chip Patterson taught physics, chemistry, and math at the high school level for three years. He also has prior experience in sales, retail, and banking, and is a licensed California Real Estate Broker. |

| Jeri Bluth, 42 | | Chief Compliance Officer | | Since 2012 | | Ms. Bluth is the chief compliance officer for MCMA and our Manager, where she has been employed since 1996. She owns a beneficial interest in each of MCMA and our Manager, and their general partner. Mrs. Bluth oversees compliance for all the funds advised by MCMA, and she oversees our compliance with our Code of Ethics, Bylaws, Charter, and applicable rules and regulations. Mrs. Bluth began her career with MacKenzie Patterson Fuller, Inc. in July of 1996 in the Investor Services Department. During Mrs. Bluth's career with the Manager, she graduated from St. Mary's College of California in June 2001, with a B.A. degree in Business Management. |

| Name & Age | | Position Held with the Company | | Term of Office & Length of Time Served | | Principal Occupation(s) During Past Five Years | |

| Christine Simpson, 52 | | Chief Portfolio Manager | | Since 2012 | | Mrs. Simpson is senior vice president and chief portfolio manager of MCMA and our Manager, where she has been employed since 1990. Mrs. Simpson is responsible for handling the day-to-day operations of the Manager's research department. During Mrs. Simpson's career with the Manager, she graduated: with a B.A. degree in Business Management from St. Mary's College of California in October 2004 (with honors), with a M.S. degree in Financial Analysis and Investment Management in September 2006, and a M.B.A. in June 2008. As a result of these and other professional experiences, Mrs. Simpson possesses particular knowledge and experience in real estate that strengthen the investment committee's collective qualifications, skills and experience. |

Compensation Discussion & Analysis

Our executive officers do not receive any direct compensation from us. We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees of MCMA and our Manager, pursuant to the terms of the Investment Advisory Agreement with MCMA (as amended August 6, 2014 and September 27, 2016, the "Advisory Agreement") and the Administration Agreement with our Manager (the "Administration Agreement"), respectively. Each of our executive officers is an employee of either MCMA or the Manager. Our day-to-day investment operations are managed by MCMA. Most of the services necessary for the origination and administration of our investment portfolio are provided by investment professionals employed by MCMA. In addition, we reimburse our Manager for our allocable portion of expenses incurred by it in performing its obligations under the Administration Agreement, including our allocable portion of the cost of our officers and their respective staffs.

Under the Advisory Agreement, MCMA earned $2,078,162 and $ 1,421,225 in fees for the fiscal years ended June 30, 2017, and 2016, respectively. In addition, during Fiscal 2017 and our fiscal year ended June 30, 2016 ("Fiscal 2016"), we reimbursed our Manager $220,000 and $120,000, respectively, in connection with our allocable portion of certain expenses under the Administration Agreement.

Compensation of Directors

The following table provides the compensation paid to our directors in Fiscal 2017 and in Fiscal 2016, and consists only of directors' fees and does not include reimbursed expenses. We maintain no pension, equity participation or retirement plans for our directors.

| Director Name | | Fiscal 2017 Fees | | Fiscal 2016 Fees |

| C.E. "Pat" Patterson | | $0 | | $0 |

| Tim Dozois | | $30,000 | | $24,000 |

| Tom Frame | | $30,000 | | $24,000 |

| Total Fees | | $60,000 | | $48,000 |

Our Independent Directors receive an annual retainer of $28,000 effective October 2016. They also receive $1,000 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each Board meeting in person and $500 for each telephonic meeting, and also receive $500 plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each committee meeting. In addition, the chairman of the Audit Committee receives an annual fee of $1,000 and each chairman of any other committee receives an annual fee of $1,000 for their additional services, if any, in these capacities. No compensation is expected to be paid to directors who are "interested persons" as that term is defined in 1940 Act §2(a)(19).

Compensation of Executive Officers

None of our officers receives direct compensation from us. However, all of the executive officers, through their indirect financial interest in MCMA, will be entitled to a portion of any investment advisory fees paid by us to MCMA under the Advisory Agreement. The Advisory Agreement will be reapproved within two years of its effective date, and thereafter on an annual basis, by our Board, including a majority of our Independent Directors. The Advisory Agreement was most recently approved by our Board, including a majority of the Independent Directors on ___________, 2017 at which meeting the Board also approved the amendment and restatement of the Advisory Agreement, which is subject to stockholder approval and is detailed in Proposal 3 in this proxy statement.

Compensation Committee Interlocks and Insider Participation

We do not have a separate compensation committee utilized to determine the appropriate compensation payable to our executive officers and directors. The Audit Committee, however, is responsible for, among other things, annually reviewing and approving the compensation policies for our directors.

Certain Relationships & Related Transactions

Advisory & Administration Agreements

We entered into the Advisory Agreement with MCMA, which is owned by MPF Founders LP, MPF Principals LP, and MPF Successors LP. Our executive officers are employees of MCMA, and our Interested Director has extensive relationships with MCMA. MCMA's address is 1640 School Street, Moraga, CA 94556. MCMA's affiliates manage 50 private equity funds, and it and its affiliates may also manage other funds in the future that may have investment mandates that are similar, in whole and in part, with ours.

MCMA and its affiliates may determine that an investment is appropriate for us and for one or more of those other funds. In such event, depending on the availability of such investment and other appropriate factors, MCMA or its affiliates may determine that we should invest side-by-side with one or more other funds. Any such investments will be made only to the extent permitted by applicable law and interpretive positions of the SEC and its staff, and consistent with MCMA's allocation procedures, available upon request.

MacKenzie Capital Management, a California limited partnership, serves as our manager and administrator. The principal executive offices of our Manager are located at 1640 School Street, Moraga, California 94556. Our Interested Director has extensive relationships with MCMA. Pursuant to an Administration Agreement, our Manager furnishes us with office facilities, equipment and clerical, bookkeeping and record keeping services at such facilities. Under the Administration Agreement, our Manager also performs, or oversees the performance of, our required administrative services, which include, among other things, being responsible for the financial records which we are required to maintain and preparing reports to our stockholders. In addition, our Manager assists us in determining and publishing our net asset value, oversees the preparation and filing of our tax returns and the printing and dissemination of reports to our stockholders, and generally oversees the payment of our expenses and the performance of administrative and professional services rendered to us by others. Payments under the Administration Agreement are equal to an amount based upon our allocable portion of our Manager's overhead in performing its obligations under the Administration Agreement, including rent, the fees and expenses associated with performing compliance functions and our allocable portion of the compensation of our chief financial officer and our allocable portion of the compensation of any administrative support staff. All such allocations will be approved by the Independent Directors. Under the Administration Agreement, our Manager also provides on our behalf managerial assistance to those portfolio companies that request such assistance.

Our Manager also provides administrative services to MCMA. As a result, MCMA also reimburses our Manager for its allocable portion of our Manager's overhead, including rent, the fees and expenses associated with performing compliance functions for MCMA, and its allocable portion of the compensation of any administrative support staff. To the extent MCMA or any of its affiliates manage other investment vehicles in the future, no portion of any administrative services provided by our Manager to such other investment vehicles will be charged to us.

License Agreement

We have entered into the Administrative Agreement with our Manager under which it has granted to us a non-exclusive, royalty-free license to use the name "MacKenzie." Under this agreement, we have a right to use the MacKenzie name for so long as we engage MCMA to serve as our investment adviser. Other than with respect to this limited license, we will have no legal right to the "MacKenzie" name.

Transactions with Related Persons

We may not purchase property or securities from the Manager, MCMA, a director, or any affiliate, except as permitted by the 1940 Act and our Charter. In no event will the cost of an asset exceed its current appraised value. The Manager, MCMA, a director or any affiliate may not acquire assets from us, except as permitted by the 1940 Act and our Charter. No loans may be made by us to the Manager, Advisers, a director or any affiliate, except as permitted by the 1940 Act and our Charter, or to a wholly-owned subsidiary. Similarly, we may not borrow money from the Manger, MCMA, a director, or any affiliate, except as permitted by the 1940 Act and our Charter. Furthermore, we may not invest in joint ventures with the Manager, MCMA, a director, or any affiliate, except as permitted by the 1940 Act and our Charter. There will be no other transactions between us and the Manager, MCMA, a director, or any affiliate, except as permitted by the 1940 Act and our Charter. Further, affiliates meeting the definition of "Sponsor" under our Charter may only be reimbursed for expenses as provided in the 1940 Act and our Charter.

The 1940 Act extensively regulates conflicts of interests between BDCs, their directors, investment advisers and their affiliates. For example, the 1940 Act and rules thereunder generally prohibit a BDC's employees, officers, directors, investment adviser and their affiliates from (i) selling securities or property to the BDC, (ii) buying securities or property from the BDC, (iii) borrowing money or property from the BDC, or (iv) entering into joint transactions with the BDC or a company controlled by it. The 1940 Act further prohibits a wider group of persons affiliated with a BDC from entering into such transactions with a BDC unless approved by the BDC's stockholders. To enable us to improve our offering position for certain tender offers, we will seek an exemptive order from the SEC permitting us to participate in joint tender offers with certain private funds managed by our Adviser. Any such joint tender offers would provide that all offerors' terms must be the same, and that other customary conditions addressing conflicts of interest be met.

In order to ensure that we do not engage in any transactions with any persons affiliated with us that are prohibited by the 1940 Act, we have implemented certain written policies and procedures whereby our executive officers screen each of our transactions for any possible affiliations between the proposed portfolio investment, us, companies controlled by us and our executive officers and directors. We will not enter into any agreements unless and until we are satisfied that doing so will not violate our Charter or raise concerns under the 1940 Act or, if such concerns exist, we have taken appropriate actions to seek board review and approval or exemptive relief for such transaction. Our Board reviews these procedures on an annual basis.

We have also adopted a Code of Ethics which applies to, among others, our senior officers, including our Chief Executive Officer and Chief Financial Officer, as well as all of our officers, directors and employees. Our Code of Ethics requires that all employees and directors avoid any conflict, or the appearance of a conflict, between an individual's personal interests and our interests. Pursuant to our Code of Ethics, each employee and director must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to our Chief Compliance Officer. Our Audit Committee is charged with approving any waivers under our Code of Ethics.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the federal securities laws, our directors, executive (and certain other) officers and any persons holding more than 10% of our common stock are required to report their ownership of our common stock and any changes in that ownership to us and the SEC. Specific due dates for these reports have been established by regulation, and we are required to report any failure to file by these dates in Fiscal 2017. To our knowledge, based solely on a review of the copies of beneficial ownership reports furnished to us and written representations that no other reports were required, during Fiscal 2017, all of our directors, officers and more than 10% beneficial owners complied with all applicable 1934 Act §16(a) filing requirements, except for the following: (i) Messrs. Dozois and Frame were late in reporting singular purchases of the Company's common stock; (ii) Mr. Pat Patterson was late in reporting two indirect acquisitions of common stock by two limited partnerships in which Mr. Patterson and his spouse have ownership interests; (iii) Messrs. Chip Patterson, Dixon and Fuller filed late amendments to Form 4s to include the indirect acquisitions of common stock by a limited partnership that were attributable to the filers due to the ownership in the limited partnership by the filer's minor children; and (iv) Messrs. Chip Patterson, Koslosky, Dixon, Fuller and Mses. Bluth and Simpson were late in reporting the indirect acquisition in common stock by a limited partnership in which the filers have ownership interests.

Information about the Audit Committee and the Independent Registered Public Accounting Firm

Report of the Audit Committee

The following report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing by us under the Securities Act of 1933, as amended (the "1933 Act"), the 1934 Act or the 1940 Act, except to the extent that we specifically incorporate this report by reference therein.

The Audit Committee is responsible for the selection and engagement of the Company's independent auditors, the review and pre-approval of both the audit and non-audit work of the Company's independent public accountants, the review of the Company's compliance with regulations of the SEC and the Internal Revenue Service and other related matters. The Company adopted an Audit Committee Charter on May 21, 2014, which was approved by the whole Board on October 23, 2014. The full text of the Audit Committee's current charter is available on the Company's website (www.mackenzierealty.com). Information contained on or connected to the Company's website is not incorporated by reference into this proxy statement and should not be considered a part of this proxy statement or any other filing that the Company files with the SEC.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing. Members of the Audit Committee rely without independent verification on the information provided to them and on representations made by management and the independent registered public accounting firm. Accordingly, the Audit Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee's considerations and discussions referred to above do not assure that the audit of the Company's financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are prepared in accordance with generally accepted accounting principles.

The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its duties. The Audit Committee's meetings include, whenever appropriate, executive sessions with our independent auditor without the presence of management.

As part of its oversight of our financial statements, the Audit Committee reviews and discusses with both management and the Company's independent auditor all annual and quarterly financial statements prior to their issuance. During Fiscal 2017, management advised the Audit Committee that each set of financial statements reviewed had been prepared in accordance with generally accepted accounting principles, and reviewed significant accounting and disclosure issues with the Audit Committee. These reviews included discussions with Moss Adams LLP, the Company's independent registered public accounting firm for Fiscal 2017, of matters required to be disclosed pursuant to the Public Company Accounting Oversight Board's AU Section 380 (Communication with Audit Committees), including the quality of our accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee also discussed with Moss Adams LLP matters relating to its independence, including a review of audit and non-audit fees and reviewed the written disclosure and the letter from Moss Adams LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor's communications with the Audit Committee concerning independence. The Audit Committee also discussed with the Company's management and Moss Adams LLP such other matters and received such assurance from them, as the Audit Committee deemed appropriate.

Based on the review and discussions noted above, the Audit Committee recommended to the Board that the Board approve the inclusion of the Company's audited financial statements for Fiscal 2017, in the Company's Annual Report on Form 10-K for Fiscal 2017, which was filed with the SEC on _____________, 2017.

Respectfully submitted by the Audit Committee of the Board,

Tim Dozois, Chairman

Tom Frame

Relationship with Independent Registered Public Accounting Firm

The Audit Committee has selected Moss Adams LLP as our independent registered public accounting firm, as of and for the fiscal year ending June 30, 2018. The Audit Committee (composed entirely of Independent Directors) elected to retain Moss Adams LLP as our auditor given Moss Adams LLP's experience and presence in the accounting profession and in our industry.

Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees

The following table represents aggregate fees billed to us for Fiscal 2017 and Fiscal 2016 by Moss Adams LLP.

| | | | | | |

| Fee Category | | Fiscal Year 2017 Fees | | Fiscal Year 2016 Fees |

| Audit Fees | | $123,500 | | $75,000 |

| Audit-Related Fees | | $0 | | $0 |

| Tax Fees | | $0 | | $0 |

| All Other Fees | | $46,000 | | $20,000 |

| Total Fees | | $169,500 | | $95,000 |

Audit Fees were for professional services rendered for the audit of our financial statements and review of the interim financial statements included in quarterly reports and services that are normally provided by Moss Adams LLP in connection with statutory and regulatory filings or engagements and include quarterly reviews and security counts.

Audit-Related Fees were for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under "Audit Fees." These services include accounting consultations in connection with acquisitions, consultations concerning financial accounting and reporting standards.

Tax Fees were for professional services for federal, state and international tax compliance, tax advice and tax planning and include preparation of federal and state income tax returns, and other tax research, consultation, correspondence and advice.

All Other Fees are for services other than the services reported above. We paid these fees for their review of the Registration Statement, but such amounts were reimbursed by the Adviser.

The Audit Committee has concluded the provision of the non-audit services listed above is compatible with maintaining the independence of Moss Adams LLP.

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

PROPOSAL 2 — RATIFICATION OF THE SELECTION OF THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Moss Adams LLP as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending June 30, 2018, and our internal controls over financial reporting as of June 30, 2018, and the Audit Committee is submitting the selection of Moss Adams LLP to the stockholders for ratification. Moss Adams LLP has served as our independent registered public accounting firm since 2012 and also has provided certain tax and other audit-related services during that time.

Representatives of Moss Adams LLP are expected to be present at the Annual Meeting, and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

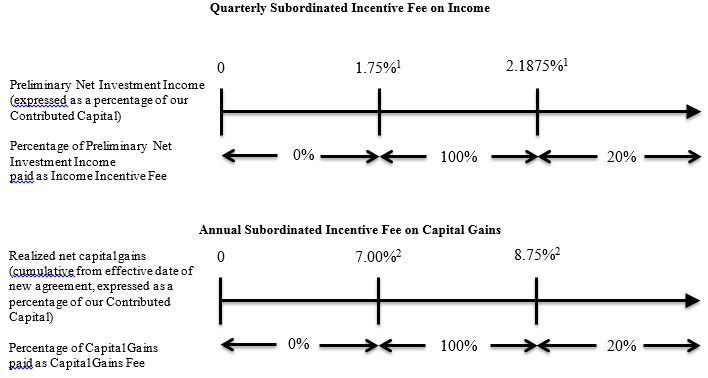

In the proposal for the ratification of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2018, you may vote "FOR" or "AGAINST" the proposal, or you may "ABSTAIN" from voting on the proposal.