UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22710

BLUEROCK TOTAL INCOME+ REAL ESTATE FUND

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, 32nd Floor, New York, NY 10105

(Address of principal executive offices) (Zip code)

Bluerock Fund Advisor, LLC

1345 Avenue of the Americas, 32nd Floor,

New York, NY 10105

(Name and address of agent for service)

1-844-819-8287

(Registrant’s telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

Annual Report

September 30, 2021

Investor Information: 1-844-819-8287

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Bluerock Total Income+ Real Estate Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by ALPS Distributors, Inc.

Member FINRA

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Review | 9 |

| Portfolio of Investments | 11 |

| Statement of Assets and Liabilities | 15 |

| Statement of Operations | 16 |

| Statements of Changes in Net Assets | 17 |

| Statement of Cash Flows | 19 |

| Financial Highlights | 20 |

| Notes to Financial Statements | 25 |

| Report of Independent Registered Public Accounting Firm | 33 |

| Additional Information | 34 |

| Supplemental Information | 35 |

| Privacy Policy | 37 |

ANNUAL REPORT: (4Q 2020-3Q 2021) (unaudited)

Letter from the TI+ Portfolio Managers

To Our Valued Shareholders:

We thank you for your continued support of the Bluerock Total Income+ Real Estate Fund (“TI+” or the “Fund”). While globally we are still dealing with the pandemic and its impact on a return to “normalcy,” the U.S. economy has rebounded sharply from the 2020 low of the COVID-led recession with equity markets reaching new highs in September. Institutional private real estate has also performed well, led by high demand for industrial, apartments, life science and other specialty sectors coupled with constrained supply, which is characteristic of prior post-recession years. As of the end of Q3 2021, institutional private real estate generated higher yields than leading stock, investment grade bond, and even the highest rated junk bond indexes.^This yield premium combined with rental growth opportunities, particularly in the high demand sectors listed above, have attracted more capital to the asset class, which is continuing to drive performance. We believe institutional private real estate may continue to offer attractive investment opportunities relative to traditional debt and equity investments due to higher yields supported by longterm demographic and technological demand drivers.

Looking back on the Fund’s year ended September 30, 2021, we note the following highlights:

| FUND HIGHLIGHTS |

| | |

| STRONG PERFORMANCE POST RECESSION:

The Fund posted a 15%+ total net return in the trailing 12 months through September 30, 2021 after weathering the recession as the highest returning institutional real estate interval fund in 2020 (01.01.2020 - 12.31.2020)1.The Fund also celebrated its nine-year anniversary on 10.22.2021 and surpassed $3 billion in net assets under management. |

| | |

| BLUEROCK’S ACTIVE MANAGEMENT:

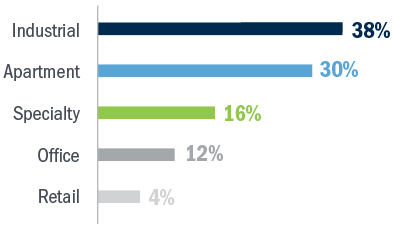

The Fund maintained a strategic overweight to sectors we believe have strong secular tailwinds driven by evolving consumer preferences, demographic changes, and technological advancement, including industrial, apartments, life science and other specialty sectors. We also maintained a significant underweight to sectors with challenging fundamentals, such as commodity office and retail. |

| | |

| A FOCUS ON INSTITUTIONAL PRIVATE REAL ESTATE:

Approximately 95% of the total portfolio remains in institutional private real estate. TI+ has consistently focused on providing investors a diversified portfolio of institutional private real estate as opposed to public real estate securities. Historical evidence indicates that the two asset classes tend to perform similarly over long periods of time, but institutional private real estate has done so with 80% less volatility over the past 20 years.2 We believe access to a fund more heavily weighted to institutional private real estate is a valuable tool for investors in constructing their portfolios. |

| | |

| 1) | Source: Morningstar Direct; Institutional real estate interval funds are those identified as real estate by interval fund tracker and those that invest in institutional real estate. |

| 2) | Source: Morningstar Direct. Institutional real estate as measured by the NCREIF Property Index (NPI) and public real estate securities as measured by the MSCI U.S. Real Estate Investment Trust Index. For the 20 years ended 9.30.2021, the NPI generated an 8.40% return and a 4.67% standard deviation and the MSCI U.S. REIT Index generated a 10.17% return and 22.01% standard deviation. |

TI+ A-shares as of 9.30.2021: 1 year no load: 15.53%, with load: 8.90%, 3 year no load: 7.46%, with load: 5.36%, 5 year no load: 7.41%, with load: 6.15%, since inception (10.22.2012) no load: 7.92%, with load: 7.21%. Past Performance is not a guarantee of future results.

CORPORATE HEADQUARTERS | 1345 AVENUE OF THE AMERICAS | 32ND FLOOR | NEW YORK, NY 10105 | 877.826.BLUE (2583) | BLUEROCK.COM

1

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

TI+ Active Overweights vs. the Index in Targeted Sectors Have Contributed to the Fund’s Performance

| 3) | National Council of Real Estate Investment Fiduciaries Property Index, Q3 2021 sector total returns. |

| 4) | Average quarterly return for specialty sector is the arithmetic average of all alternative property sectors including self storage, health care, and other categories. |

Market Overview

Given the economic rebound, market focus has shifted to inflation, rising interest rates, supply chain obstacles, and an accommodative Federal Reserve. Our view is that inflation may end up being stickier than the Fed had initially hoped, in part driven by supply chain bottlenecks and labor shortages. The Fed recently stated it will reduce its bond purchases (begin tapering) by $15 billion per month with a target of ending bond purchases by the middle of next year. Additionally, the Fed voted not to raise the Fed Funds rate in the fourth quarter, due in large part to a still recovering labor market and a desire to conclude bond purchases before raising rates.

Accommodative fiscal and monetary policies have turned a low interest environment into a negative real yield environment that is likely to have broad effects on all asset classes. Negative real yields for Treasuries and investment grade credit are unappealing for many bond market investors. Given the recent run up in equity prices and historically high stock valuations, institutional real estate looks particularly attractive.

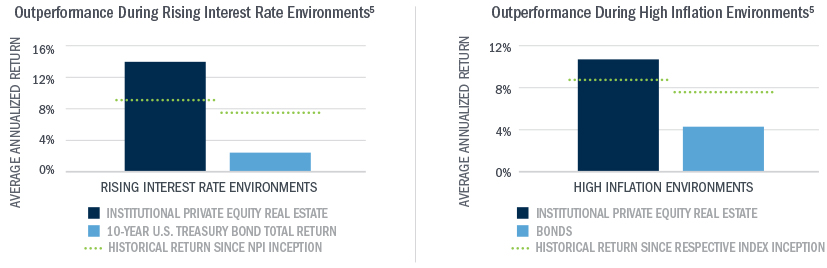

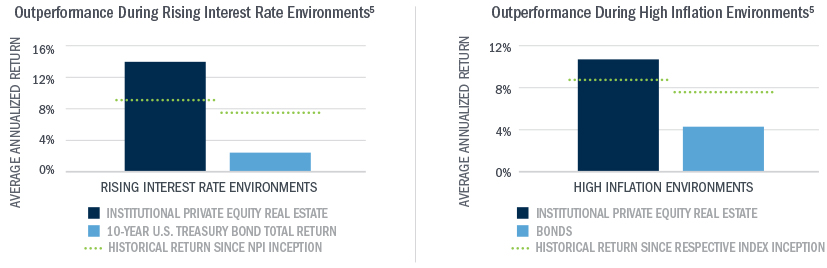

While the Fed may see inflation as transitory, we recognize investors are concerned about inflation and how it might impact their investment portfolios. We believe our shareholders should feel confident in this environment due to institutional real estate’s historical performance in inflationary environments and the inherent benefits of inflation on real estate.

Historically, real estate has performed above its long terms averages in inflationary and rising rate periods, while investment grade bonds have performed below their long term average.

| 5) | Source: NCREIF, US Federal Reserve. A rising interest rate environment is defined as quarters when the Effective Federal Funds Rate (FFR) increased 25 basis points or more; NCREIF Property Index (NPI) and 10-year US Treasury Bond Total Return (ICE BofA US Treasury 7-10 yr.) tallied, averaged and annualized for those quarters. Analysis since NPI inception (Jan 1978) through Dec 2020. A high inflation environment is defined as quarters when the Consumer Price Index (CPI) increased 100 basis points or more; NCREIF Property Index (NPI) and Bloomberg Aggregate Bond Index tallied, averaged and annualized for those quarters. Analysis since Bloomberg Aggregate Bond Index inception (Jan 1980) through Dec 2020. |

2

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Outlook

We believe the current outlook presents tremendous opportunities for both institutional private real estate and TI+. While bond markets grapple with negative real yields and stock markets battle high valuations, institutional private real estate appears to be a beneficiary of the broader economic landscape where economic growth and inflation have pushed rental rates and values higher.

Institutional real estate as an asset class, like stocks, has typically exhibited differentiation across sectors and today’s environment is no different. The Fund’s investment strategy is thematic-based, attempting to capitalize on long-term structural trends, not just economic cycles. Accordingly, the Fund plans to maintain its focus on the industrial, apartment, life science and other specialty sectors. The growth of E-commerce is an undeniable long-term catalyst for industrial demand. Demographics and overall housing shortages continue to push apartment and single family rental housing demand higher, while specialty property sectors such as life sciences stand to benefit from increased pharmaceutical research and development.

The Fund offers access to a diversified, actively managed, institutional private real estate portfolio, supported by a 9-year track record of positive returns, low volatility and 35 consecutive quarterly distributions,* all of which we believe are essential components of a balanced investment portfolio. We believe these accomplishments and thematic approach may offer continued benefit to our shareholders and distinguish us from our peers.

Sincerely,

| | | | |

|  |  |  |

| Adam Lotterman | Jordan Ruddy |

| Co-Chief Investment Officer and Senior Portfolio Manager | Co-Chief Investment Officer and Senior Portfolio Manager |

| Bluerock Total Income+ Real Estate Fund | Bluerock Total Income+ Real Estate Fund |

| FUND SUB-ADVISORS |

| | | |

| |  | About Mercer Investment Management | |

| | Mercer Investment Management, Inc. (“Mercer”), acts as sub-advisor to the Fund’s private real estate investments. For more than 75 years, Mercer has been one of the world’s leading advisors to endowments, pension funds, sovereign wealth funds and family offices globally, with over 10,600 clients worldwide, and over $15.5 trillion in assets under advisement (as of 12.31.2020). Mercer works to evaluate over 6,700 investment managers and over 35,600 individual investments/strategies (as of 6.30.2021) and works with Bluerock to select a strategic combination of ‘best-in-class’ institutional real estate managers and investments for the Fund. | |

| | | |

| |  | About DWS | |

| | DWS Group GmbH and Co. KGaA (“DWS”) formerly Deutsche Asset Management), through its indirect subsidiary RREEF Investment, LLC, acts as sub-advisor to the Fund’s public real estate securities investments and is a registered investment adviser under the Investment Advisers Act of 1940. DWS’ real estate business in the U.S. dates back to 1975. Today, DWS has $1.0 trillion in assets under management and works with 675+ institutional clients. Of that total, approximately $81.8 billion of AUM is invested in public and private real estate globally, making DWS one of the largest real estate managers in the world (as of 6.30.2021). | |

| | | | | |

3

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Performance

From inception (10.22.2012) through 9.30.2021, TI+ (A Shares) generated a cumulative total return of 97.68%, or 7.92% annualized (load waived). The Fund was able to accomplish this primarily through private real estate investments, generating both income and capital appreciation. Private investments are supplemented with select public real estate securities. The Fund currently offers four share classes outstanding: A, C, I and L Shares.** A summary of the performance of each share class is presented below.

Fund Performance thru 9.30.2021†

| | One Year | Three Year | Five Year | Since Inception6 |

| TI+ Class A | 15.53% | 7.46% | 7.41% | 7.92% |

| TI+ Class A with Max Sales Charge7 | 8.90% | 5.36% | 6.15% | 7.21% |

| TI+ Class C | 14.65% | 6.66% | 6.61% | 7.13% |

| TI+ Class C with Load8 | 13.65% | 6.66% | 6.61% | 7.13% |

| TI+ Class I | 15.81% | 7.73% | 7.68% | 8.17% |

| TI+ Fund - Class L | 15.21% | 7.19% | 7.14% | 7.65% |

| TI+ Class L with Max Sales Charge8 | 10.32% | 5.65% | 6.22% | 7.13% |

| 6 | Since Inception returns as of October 22, 2012. Actual Inception date of the A Shares is October 22, 2012. Actual Inception date of the Fund’s C and I Shares is April 1, 2014. Actual Inception date for the L Shares is June 1, 2017 |

| 7 | The maximum sales charge for the A Shares is 5.75% and for L Shares is 4.25%. Investors may be eligible for a reduction in sales charges. |

| 8 | Adjusted for early withdrawal charge of 1.00%. |

| † | Returns for Class C, Class I and Class L Shares prior to their inception dates are based on the performance of Class A Shares. For Class C and Class L Shares, prior performance has been adjusted to reflect differences in expenses between the respective classes and Class A. The actual returns of Class I would have been different than those shown because Class I has lower expenses than Class A. |

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.18% for Class A, 2.93% for Class C, 1.92% for Class I and 2.42% for Class L per the February 1, 2021 prospectuses.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is not a guarantee of future results. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2022, for Class A, C, I and L shares to ensure that the net annual fund operating expenses will not exceed 1.95% for Class A, 2.70% for Class C and 1.70% for Class I, and 2.20% for Class L, subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectuses for more detail on the expense waiver. Results shown reflect the full fee waiver, without which the results could have been lower. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call toll-free 1-844-819-8287.

Total returns are calculated using SEC Form N-2 instructions and reflect all fees and charges.

** The Fund registered the offering of its Class M shares on February 1, 2020, however as of September 30, 2021 no such shares have been issued and therefore are not included in the Fund’s performance information.

4

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

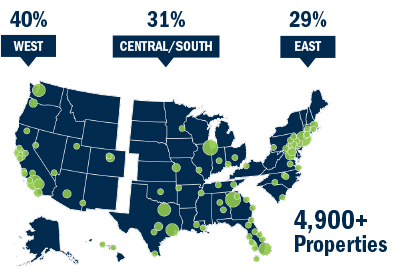

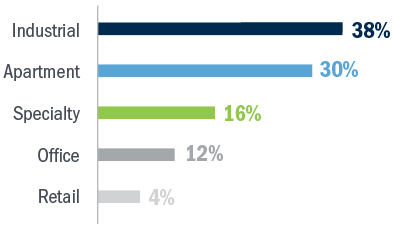

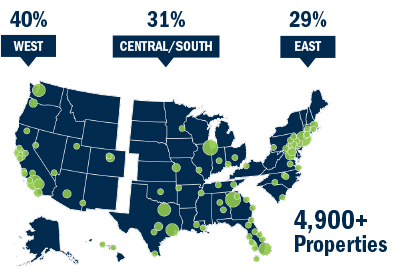

| Geographic Diversification | | Sector Diversification |

| | |

| The regions and allocations presented represent the Fund’s institutional fund investments as of 9.30.2021, but is subject to change at any time. | | The sector diversification presented represents examples of how the Fund’s institutional fund investments are allocated as of 9.30.2021, but is subject to change at any time. |

| |  |

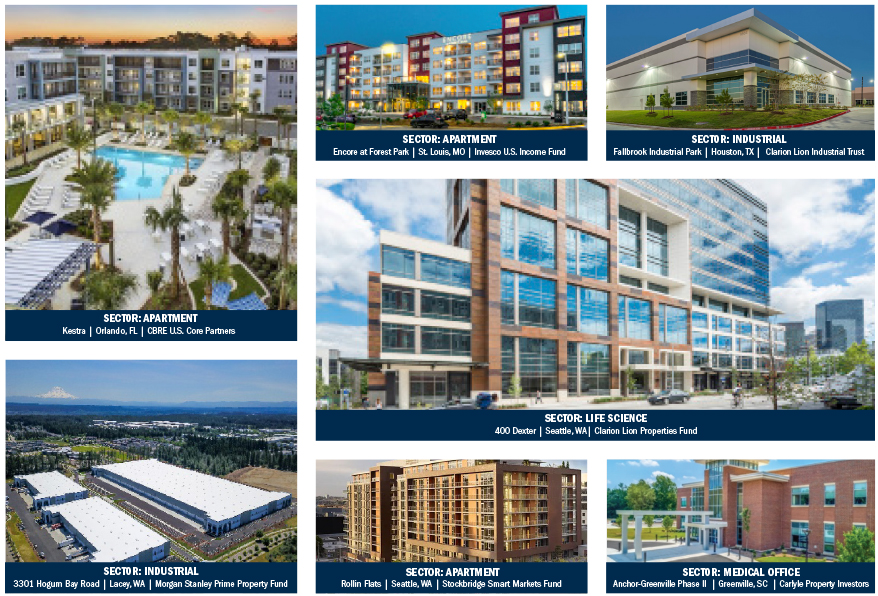

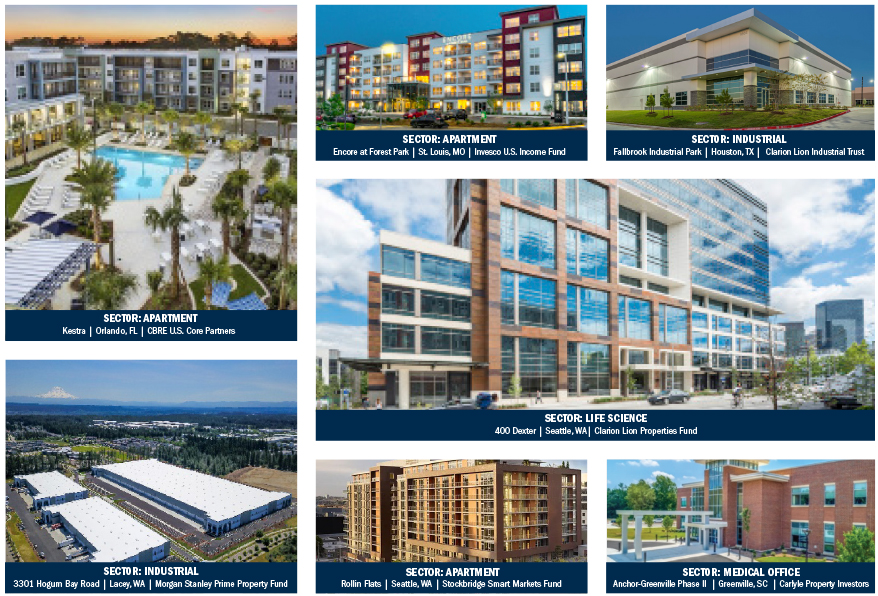

Highlighted Assets

As of 9.30.2021. The properties shown here are currently owned by the underlying third party institutional private equity real estate funds described herein. Diversification does not ensure profit and Holdings are subject to change.

5

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

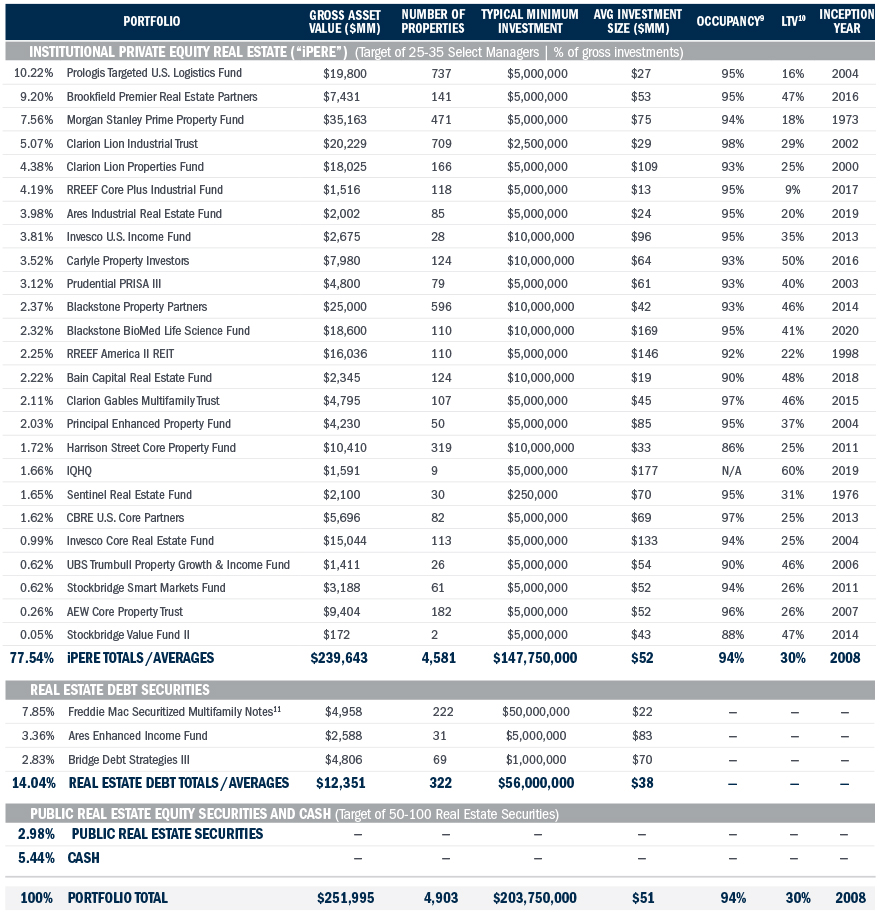

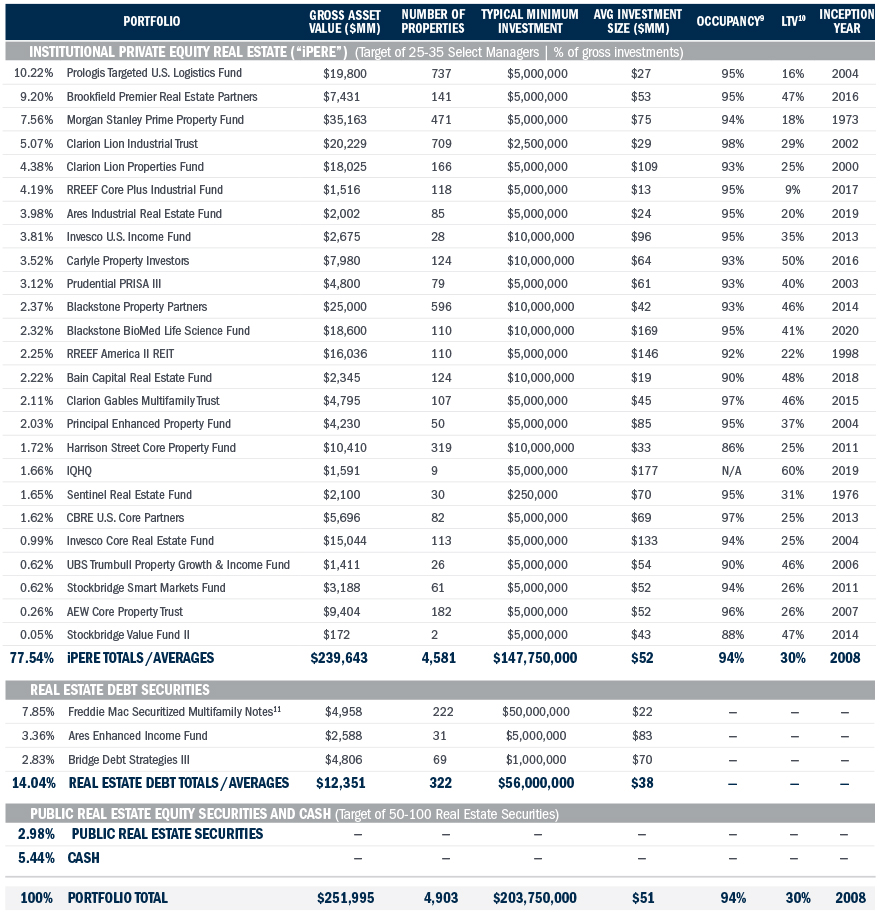

Fund Holdings

As of 9.30.2021, the Gross Asset Value of the underlying real estate in the institutional private real estate funds in which TI+ is invested is over $252 billion, comprising approximately 4,900 properties across the United States.

| 9 | Occupancy rates reported from underlying managers, average is the simple average of all private funds. Generally excludes properties under construction, but generally includes properties in lease-up. |

| 10 | Weighted average loan to value: outstanding loan balance divided by the total value of the underlying real estate. For IQHQ, estimated based on expected leverage target. |

| 11 | The Fund expects to invest in the privately offered subordinate classes of K-Notes. Because more-senior classes have payment priority over subordinate classes of K-Notes, the value of subordinate K-Notes is highly sensitive to the default rate and foreclosure recovery rate on the underlying apartment loans. Subordinate K-Notes are also subject to liquidity risk because they are not available to the investing public and have a limited secondary market composed of institutional investors. |

6

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Definitions

NFI-ODCE: a capitalization-weighted, gross of fee, time-weighted return index with an inception date of December 31, 1977. Supplemental data is also provided, such as equalweight and net of fee returns, for informational purposes and additional analysis.

Annualized Standard Deviation: The standard deviation of the daily percentage change in an investment multiplied by the square root of the number of trading days in the period. Standard deviation shows how much variation from the average exists with a larger number indicating the data points are more spread out over a larger range of values.

iPERE/NCREIF Property Index (NPI): Institutional private equity real estate (iPERE) can be described as high-quality commercial properties that are usually congregated in large investment portfolios managed professionally on behalf of third-party owners or beneficiaries. The leading benchmark index for iPERE is the National Council of Real Estate Investment Fiduciaries Price Index (NPI) which represents a collection of 7,000+ institutional properties representing all major commercial property types within the U.S. The NPI is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors - the great majority being pension funds. As such, all properties are held in a fiduciary environment.

^ Sources: Morningstar Direct, Standard & Poors, Yahoo Finance, Federal Reserve Economic Data. Institutional Real Estate: Yield is from the NCREIF Property Index (NPI) as of 9.30.2021, The NPI is a leading benchmark index for Institutional Real Estate which represents a collection of 9,700+ institutional properties representing all major commercial property types within the U.S. The NPI is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors - the great majority being pension funds. As such, all properties are held in a fiduciary environment. High Yield Bonds: Yield is from the ICE BofA U.S. High Yield BB Index Effective Yield, maximum drawdown is from the ICE BofA US High Yield. The ICE BofA US High Yield is an index that measures the performance of short-term US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have at least 18 months to final maturity at the time of issuance, at least one-year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. It is capitalization-weighted. Investment Grade Bonds: Yield is from the ICE BofA AAA US Corporate Index Effective Yield, maximum drawdown is from the ICE BofA AAA US Corporate. ICE BofA AAA US Corporate: A subset of the ICE BofA US Corporate Master Index tracks the performance of US dollar denominated investment grade rated corporate debt publicly issued in the US domestic market. This subset includes all securities with a given investment grade rating AAA. Public REITs: Yield is from the FTSE Nareit All Equity REITs, maximum drawdown is from the FTSE Nareit All Equity REITs. The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property. T-Bonds: Yield is the 10-Year U.S Treasury Bond, maximum drawdown is from the BBgBarc US Treasury 10+ Year. The BBgBarc US Treasury 10+ Year is an index that measures U.S. Dollar denominated, fixed rate, nominal debt issued by the U.S. Treasury with 10 or more years to maturity. T-Bills: Yield is from the 3-Month Treasury Bill Yield, maximum drawdown is from the BBgBarc US Treasury Bill 1-3 Month The BBgBarc US Treasury Bill 1-3 Month is an index that measures the performance of public obligations of the U.S. Treasury with maturities of 1-3 month, including securities roll up to the U.S. Aggregate, U.S. Universal, and Global Aggregate Indices. You cannot invest directly in an index and unmanaged indices do not reflect fees, expenses or sales charges. Additionally, a rise in interest rates could cause a decline in the value of fixed income securities. The referenced yields are shown for general market comparisons. Past performance is not a guarantee of future results.

* The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed. However, this distribution policy is subject to change. The Fund’s distribution amounts were calculated based on the ordinary income received from the underlying investments, including shortterm capital gains realized from the disposition of such investments. Shareholders should not assume that the source of a distribution from the Fund is net profit. All or a portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Company will continue to declare distributions or that they will continue at these rates.

You cannot invest directly in an index. Benchmark performance should not be considered reflective of Fund performance.

Risk Disclosures

Not FDIC Insured | No Bank Guarantee | May Lose Value

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment.

The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund’s assets across the various asset classes in which it invests and to select investments in each such asset class. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Since inception, the Fund has made 35 repurchase offers, of which 31 have resulted in the repurchase of all shares tendered and four have resulted in the repurchase of less than all shares tendered. In connection with the August 2021 repurchase offer, the Fund repurchased 100% of the shares tendered. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value.

An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The Fund is “non-diversified” under the Investment Company Act of 1940 and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

The Fund is subject to the risk that geopolitical and other similar events will disrupt the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and natural/environmental disasters can all negatively impact the securities markets.

7

| ANNUAL REPORT (4Q 2020 - 3Q 2021) | BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. Potential impacts on the real estate market may include lower occupancy rates, decreased lease payments, defaults and foreclosures, among other consequences. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown.

The Fund will concentrate its investments in real estate industry securities. The value of the Fund’s shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under-performance and over-performance in comparison to equity securities markets in general.

A significant portion of the Fund’s underlying investments are in private real estate investment funds managed by institutional investment managers (“Institutional Investment Funds”). Investments in Institutional Investment Funds pose specific risks, including: such investments require the Fund to bear a pro rata share of the vehicles’ expenses, including management and performance fees; the Advisor and Sub-Advisor will have no control over investment decisions may by such vehicle; such vehicle may utilize financial leverage; such investments have limited liquidity; the valuation of such investment as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party.

Additional risks related to an investment in the Fund are set forth in the “Risk Factors” section of the prospectus, which include, but are not limited to the following: convertible securities risk; correlation risk; credit risk; fixed income risk; leverage risk; risk of competition between underlying funds; and preferred securities risk.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling toll free 844-819-8287, or online at bluerockfunds.com. The prospectus should be read carefully before investing.

The Fund is distributed by ALPS Distributors, Inc (“ALPS”). Bluerock Fund Advisor, LLC is not affiliated with ALPS, Mercer Investment Management, or DWS.

Additional Fund performance details available at bluerockfunds.com/performance. Investors may be eligible for a reduction in sales charges. Please see the Fund prospectus for details. Please note that the indices are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features.

There are limitations when comparing the Fund to stock, bond, and public real estate indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity only on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. When interest rates rise, the value of bond securities tends to fall. Real estate securities may decline because of adverse developments affecting the real estate industry and real property values. You cannot invest directly in an index and unmanaged indices do not reflect fees, expenses or sales charges. Please see definitions for a description of the risks and comparisons of the investment indexes selected.

8

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

| September 30, 2021 (Unaudited) |

The Fund’s performance figures for certain periods ended September 30, 2021, compared to its benchmarks:

| Bluerock Total Income+ Real Estate Fund: | | One Year | | Three Year | | Five Year | | Since Inception Class A* | | Since Inception Class C and Class I* | | Since Inception Class L* |

| Class A | | | | | | | | | | | | |

| Without Load | | | 15.53 | % | | | 7.46 | % | | | 7.41 | % | | | 7.92 | % | | | – | | | | – | |

| With Load(a) | | | 8.90 | % | | | 5.36 | % | | | 6.15 | % | | | 7.21 | % | | | – | | | | – | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| Without Load | | | 14.65 | % | | | 6.66 | % | | | 6.61 | % | | | – | | | | 6.51 | % | | | – | |

| With Load(b) | | | 13.65 | % | | | 6.66 | % | | | 6.61 | % | | | – | | | | 6.51 | % | | | – | |

| Class I | | | 15.81 | % | | | 7.73 | % | | | 7.68 | % | | | – | | | | 7.60 | % | | | – | |

| Class L | | | | | | | | | | | | | | | | | | | | | | | | |

| Without Load | | | 15.21 | % | | | 7.19 | % | | | – | | | | – | | | | – | | | | 7.19 | % |

| With Load(c) | | | 10.32 | % | | | 5.65 | % | | | – | | | | – | | | | – | | | | 6.12 | % |

| S&P 500 Total Return Index | | | 30.00 | % | | | 15.99 | % | | | 16.90 | % | | | 15.37 | % | | | 13.86 | % | | | 16.25 | % |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | -0.90 | % | | | 5.36 | % | | | 2.94 | % | | | 2.81 | % | | | 3.36 | % | | | 3.59 | % |

| * | Class A commenced operations October 22, 2012, Class C and Class I commenced operations April 1, 2014, and Class L commenced operations June 1, 2017. |

| (a) | Adjusted for initial maximum sales charge of 5.75%. |

| (b) | Adjusted for early withdrawal charge of 1.00%. |

| (c) | Adjusted for initial maximum sales charge of 4.25%. |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

Total returns are calculated using closing Net Asset Value as of September 30, 2021, and may not match returns presented in the Financial Highlights due to adjustments under accounting principles generally accepted in the United States of America.

| Annual Report | September 30, 2021 | 9 |

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

September 30, 2021 (Unaudited)

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total returns are calculated using closing Net Asset Value as of September 30, 2021. Total returns are calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the Advisor not waived a portion of its fees. Returns greater than one year are annualized. The Advisor and the Fund have entered into an expense limitation agreement under which the Advisor has contractually agreed to reduce its fees and/or absorb expenses for Class A, Class C, Class I and Class L at least until January 31, 2022 to ensure that the net annual fund operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) will not exceed 1.95%, 2.70%, 1.70%, and 2.20% of the Fund’s average daily net assets attributable to the Class A, Class C, Class I and Class L shares, respectively. The Fund has agreed to repay the Advisor in the amount of any fees the Advisor previously waived and or Fund expenses reimbursed, pursuant to the expense limitation agreement, subject to the limitations therein that: (1) the reimbursement will be made if payable not more than three years from the date incurred; (2) the reimbursement may not be made if it would cause the Expense Limitation then in effect or in effect at time of waiver to be exceeded; and (3) the reimbursement is approved by the Fund’s Board of Trustees.

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 2.18%, 2.93%, 1.92% and 2.42% for Class A, Class C, Class I and Class L, respectively, per the February 1, 2021 prospectus. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class A shareholders who tender for repurchase Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. Class L shares are subject to a maximum sales charge imposed on purchases of 4.25%. The Fund registered the offering of its Class M shares on February 1, 2020, however as of September 30, 2021 no such shares have been issued and therefore are not included in the Fund’s performance information. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-844-819-8287.

Portfolio Composition as of September 30, 2021

| | | Percent of Net Assets |

| Private Real Estate Securities | | | 83.54 | % |

| Real Estate Debt Securities | | | 8.34 | % |

| Short-Term Investments | | | 5.33 | % |

| Public Equity Real Estate Securities | | | 2.06 | % |

| Total Investments | | | 99.27 | % |

| Other Assets in Excess of Liabilities | | | 0.73 | % |

| Total Net Assets | | | 100.00 | % |

See the Portfolio of Investments in this annual report for a more detailed account of the Fund’s holdings.

10

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments |

September 30, 2021

| Security | | Shares | | Value |

| PRIVATE REAL ESTATE SECURITIES (83.54%)(a) | | | | |

| Apartments (3.79%) | | | | |

| Clarion Gables Multifamily Trust | | | 47,284 | | | $ | 67,953,335 | |

| Sentinel Real Estate Fund | | | 490 | | | | 51,863,427 | |

| | | | | | | | 119,816,762 | |

| Diversified (51.61%) | | | | | | | | |

| AEW Core Property Trust | | | 7,239 | | | | 7,943,729 | |

| Ares Real Estate Enhanced Income Fund | | | N/A | | | | 102,128,567 | |

| Bain Capital Real Estate Fund I | | | N/A | | | | 74,398,548 | |

| Blackstone Property Partners | | | 47,161 | | | | 73,691,434 | |

| Bridge Debt Strategies Fund III, LP | | | N/A | | | | 88,309,864 | |

| Brookfield Premier Real Estate Partners | | | 191,278 | | | | 281,580,220 | |

| Carlyle Property Investors | | | 68,358 | | | | 110,516,665 | |

| CBRE U.S. Core Partners, LP | | | 31,687,739 | | | | 53,080,245 | |

| Clarion Lion Properties Fund | | | 79,857 | | | | 135,822,552 | |

| Harrison Street Core Property Fund | | | 35,400 | | | | 52,461,071 | |

| Invesco Core Real Estate Fund | | | 153 | | | | 31,202,233 | |

| Invesco U.S. Income Fund LP | | | 73,542 | | | | 116,565,114 | |

| Morgan Stanley Prime Property Fund LLC | | | 11,556 | | | | 233,186,294 | |

| PGIM PRISA III | | | 37,761 | | | | 97,576,374 | |

| Principal Enhanced Property Fund LP | | | 4,517,118 | | | | 62,008,518 | |

| RREEF America REIT II, Inc. | | | 512,415 | | | | 69,970,068 | |

| Stockbridge Smart Markets Fund | | | 10,937 | | | | 19,616,802 | |

| Stockbridge Value Fund II | | | N/A | | | | 1,315,816 | |

| UBS Trumbull Property Growth & Income Fund | | | 675 | | | | 19,453,238 | |

| | | | | | | | 1,630,827,352 | |

| Industrial (24.04%) | | | | | | | | |

| Ares Industrial Real Estate Fund | | | 56,533 | | | | 126,292,632 | |

| Clarion Lion Industrial Trust | | | 57,344 | | | | 165,184,034 | |

| Prologis Targeted U.S. Logistics | | | 131,934 | | | | 331,041,064 | |

| RREEF Core Plus Industrial Fund LP | | | 768,217 | | | | 137,231,904 | |

| | | | | | | | 759,749,634 | |

| Life Science (4.08%) | | | | | | | | |

| Blackstone BioMed Life Science Real Estate LP | | | N/A | | | | 74,914,192 | |

| IQHQ, Inc.(b)(c) | | | 2,961,021 | | | | 54,068,243 | |

| | | | | | | | 128,982,435 | |

| TOTAL PRIVATE REAL ESTATE SECURITIES (Cost $2,149,448,092) | | | | | | | 2,639,376,183 | |

| Security | | Principal | | Value |

| REAL ESTATE DEBT SECURITIES (8.34%) | | | | |

| American Campus Communities Operating Partnership LP, 3.625%, 11/15/2027 | | $ | 1,974,000 | | | | 2,155,122 | |

| Boston Properties LP, 2.900%, 3/15/2030 | | | 1,026,000 | | | | 1,063,920 | |

| Care Capital Properties, 5.125%, 8/15/2026 | | | 1,889,000 | | | | 2,114,562 | |

| EPR Properties, 4.500%, 6/01/2027 | | | 959,000 | | | | 1,041,135 | |

| Essex Portfolio LP, 3.875%, 5/01/2024 | | | 1,660,000 | | | | 1,775,498 | |

| FREMF 2018-K82 Mortgage Trust, Class X2A, IO, 0.100%, 9/25/2028(a)(c) | | | 1,072,640,380 | | | | 6,105,163 | |

| FREMF 2018-K82 Mortgage Trust, Class D, 0.000%, 10/25/2028(a)(c) | | | 100,392,906 | | | | 55,436,119 | |

| FREMF 2018-K82 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2028(a)(c) | | | 262,694,906 | | | | 1,560,362 | |

| FREMF 2019-K101 Mortgage Trust, Class X2A, IO, 0.100%, 10/25/2029(a)(c) | | | 1,185,651,224 | | | | 7,629,739 | |

| FREMF 2019-K101 Mortgage Trust, Class D, 0.000%, 1/25/2030(a)(c) | | | 109,477,635 | | | | 54,799,581 | |

| FREMF 2019-K101 Mortgage Trust, Class X2B, IO, 0.100%, 1/25/2030(a)(c) | | | 270,043,635 | | | | 1,825,493 | |

| FREMF 2019-K91 Mortgage Trust, Class X2A, IO, 0.100%, 3/25/2029(a)(c) | | | 1,131,930,876 | | | | 6,844,724 | |

| FREMF 2019-K91 Mortgage Trust, Class D, 0.000%, 10/25/2029(a)(c) | | | 103,857,565 | | | | 53,144,865 | |

| FREMF 2019-K91 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2029(a)(c) | | | 247,526,565 | | | | 1,595,243 | |

| FREMF 2019-KC03 Mortgage Trust, Class C, 4.365%, 1/25/2026(a)(c) | | | 58,088,000 | | | | 49,721,961 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2021 | 11 |

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2021

| Security | | Principal | | Value |

| MPT Operating Partnership LP / MPT Finance Corp., 5.250%, 8/01/2026 | | $ | 1,957,000 | | | $ | 2,013,264 | |

| MPT Operating Partnership LP / MPT Finance Corp., 4.625%, 8/01/2029 | | | 1,810,000 | | | | 1,942,130 | |

| Public Storage, 2.370%, 9/15/2022 | | | 968,000 | | | | 986,060 | |

| Realty Income Corp., 4.650%, 8/01/2023 | | | 911,000 | | | | 971,467 | |

| Service Properties Trust, 4.350%, 10/01/2024 | | | 978,000 | | | | 990,939 | |

| Simon Property Group LP, 3.375%, 10/01/2024 | | | 911,000 | | | | 975,000 | |

| Simon Property Group LP, 3.300%, 1/15/2026 | | | 738,000 | | | | 798,878 | |

| Simon Property Group LP, 2.650%, 7/15/2030 | | | 998,000 | | | | 1,028,717 | |

| Spirit Realty LP, 2.100%, 3/15/2028 | | | 819,000 | | | | 814,743 | |

| Spirit Realty LP, 3.200%, 2/15/2031 | | | 1,026,000 | | | | 1,065,381 | |

| Ventas Realty LP, 2.650%, 1/15/2025 | | | 1,697,000 | | | | 1,773,587 | |

| Ventas Realty LP, 3.250%, 10/15/2026 | | | 731,000 | | | | 781,655 | |

| VEREIT Operating Partnership LP, 3.400%, 1/15/2028 | | | 863,000 | | | | 933,031 | |

| Welltower, Inc., 3.625%, 3/15/2024 | | | 923,000 | | | | 984,122 | |

| Welltower, Inc., 4.250%, 4/15/2028 | | | 704,000 | | | | 799,136 | |

| TOTAL REAL ESTATE DEBT SECURITIES (Cost $259,437,134) | | | | | | | 263,671,597 | |

| Security | | Shares | | Value |

| PUBLIC EQUITY REAL ESTATE SECURITIES (2.06%) | | | | |

| Public Non-Traded Real Estate Investment Trusts (0.01%) | | | | |

| Diversified (0.01%) | | | | |

| Highlands REIT, Inc.(b)(d) | | | 140,161 | | | | 39,245 | |

| Inventrust Properties Corp.(d) | | | 14,017 | | | | 397,100 | |

| Total Public Non-Traded Real Estate Investment Trusts (Cost $429,544) | | | | | | | 436,345 | |

| Publicly Traded Real Estate Investment Trusts (1.65%) | | | | | | | | |

| Apartments (0.08%) | | | | | | | | |

| Apartment Income REIT Corp. | | | 19,210 | | | | 937,640 | |

| AvalonBay Communities, Inc. | | | 4,397 | | | | 974,551 | |

| Mid-America Apartment Communities, Inc. | | | 2,714 | | | | 506,840 | |

| | | | | | | | 2,419,031 | |

| Communications (0.14%) | | | | | | | | |

| American Tower Corp. | | | 4,962 | | | | 1,316,964 | |

| Crown Castle International Corp. | | | 17,554 | | | | 3,042,460 | |

| | | | | | | | 4,359,424 | |

| Data Centers (0.26%) | | | | | | | | |

| CoreSite Realty Corp. | | | 7,336 | | | | 1,016,329 | |

| CyrusOne, Inc. | | | 16,947 | | | | 1,311,867 | |

| Equinix, Inc. | | | 7,627 | | | | 6,026,322 | |

| | | | | | | | 8,354,518 | |

| Diversified (0.03%) | | | | | | | | |

| Safehold, Inc. | | | 14,873 | | | | 1,069,220 | |

| | | | | | | | 1,069,220 | |

| Gaming (0.06%) | | | | | | | | |

| VICI Properties, Inc. | | | 63,567 | | | | 1,805,938 | |

| | | | | | | | 1,805,938 | |

| Healthcare (0.14%) | | | | | | | | |

| Medical Properties Trust, Inc. | | | 85,944 | | | | 1,724,896 | |

| Omega Healthcare Investors, Inc. | | | 27,189 | | | | 814,582 | |

| Welltower, Inc. | | | 22,838 | | | | 1,881,851 | |

| | | | | | | | 4,421,329 | |

| Hotels (0.15%) | | | | | | | | |

| Apple Hospitality REIT, Inc. | | | 119,014 | | | | 1,872,090 | |

| MGM Growth Properties LLC, Class A | | | 23,616 | | | | 904,493 | |

The accompanying notes are an integral part of these financial statements.

12

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2021

| Security | | Shares | | Value |

| Hotels (continued) | | | | |

| Ryman Hospitality Properties, Inc. | | | 24,754 | | | $ | 2,071,910 | |

| | | | | | | | 4,848,493 | |

| Industrial (0.16%) | | | | | | | | |

| EastGroup Properties, Inc. | | | 9,757 | | | | 1,625,809 | |

| Prologis, Inc. | | | 18,450 | | | | 2,314,184 | |

| Rexford Industrial Realty, Inc. | | | 15,875 | | | | 900,906 | |

| | | | 4,840,899 | | | | | |

| Manufactured Homes (0.07%) | | | | | | | | |

| Sun Communities, Inc. | | | 12,576 | | | | 2,327,818 | |

| | | | | | | | 2,327,818 | |

| Regional Malls (0.07%) | | | | | | | | |

| Simon Property Group, Inc. | | | 18,626 | | | | 2,420,822 | |

| | | | | | | | 2,420,822 | |

| Self-Storage (0.24%) | | | | | | | | |

| Extra Space Storage, Inc. | | | 24,428 | | | | 4,103,659 | |

| Life Storage, Inc. | | | 29,005 | | | | 3,328,034 | |

| | | | | | | | 7,431,693 | |

| Shopping Center (0.04%) | | | | | | | | |

| NETSTREIT Corp. | | | 51,696 | | | | 1,222,610 | |

| | | | | | | | 1,222,610 | |

| Single Tenant (0.16%) | | | | | | | | |

| Agree Realty Corp. | | | 27,350 | | | | 1,811,391 | |

| Essential Properties Realty Trust, Inc. | | | 90,297 | | | | 2,521,093 | |

| Spirit Realty Capital, Inc. | | | 20,781 | | | | 956,757 | |

| | | | | | | | 5,289,241 | |

| Single-Family Rental (0.05%) | | | | | | | | |

| American Homes 4 Rent, Class A | | | 40,350 | | | | 1,538,142 | |

| | | | | | | | 1,538,142 | |

| Total Publicly Traded Real Estate Investment Trusts (Cost $43,925,399) | | | | | | | 52,349,178 | |

| Preferred Real Estate Securities (0.40%) | | | | | | | | |

| Data Center (0.08%) | | | | | | | | |

| Digital Realty Trust, Inc., Series L, 5.200% | | | 40,712 | | | | 1,107,366 | |

| Digital Realty Trust, Inc., Series J, 5.250% | | | 45,347 | | | | 1,173,580 | |

| | | | | | | | 2,280,946 | |

| Diversified (0.08%) | | | | | | | | |

| DigitalBridge Group, Inc., 7.125% | | | 66,991 | | | | 1,752,485 | |

| EPR Properties, Series G, 5.750% | | | 51,384 | | | | 1,331,873 | |

| | | | | | | | 3,084,358 | |

| Industrial (0.08%) | | | | | | | | |

| PS Business Parks, Inc., Series Z, 4.875% | | | 34,220 | | | | 944,472 | |

| PS Business Parks, Inc., Series X, 5.250% | | | 30,625 | | | | 810,338 | |

| Rexford Industrial Realty, Inc., Series B, 5.875% | | | 27,409 | | | | 717,842 | |

| | | | | | | | 2,472,652 | |

| Self-Storage (0.04%) | | | | | | | | |

| National Storage Affiliates Trust, Series A, 6.000% | | | 45,125 | | | | 1,182,726 | |

| | | | | | | | 1,182,726 | |

| Shopping Center (0.04%) | | | | | | | | |

| Kimco Realty Corp., Series L, 5.125% | | | 45,275 | | | | 1,180,319 | |

| | | | | | | | 1,180,319 | |

| Single Tenant (0.04%) | | | | | | | | |

| Spirit Realty Capital, Inc., Series A, 6.000% | | | 47,001 | | | | 1,223,436 | |

| | | | | | | | 1,223,436 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2021 | 13 |

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2021

| Security | | Shares | | Value |

| Single-Family Rental (0.04%) | | | | |

| American Homes 4 Rent, Series G, 5.875% | | | 47,650 | | | $ | 1,235,565 | |

| | | | | | | | 1,235,565 | |

| Total Preferred Real Estate Securities (Cost $11,743,838) | | | | | | | 12,660,002 | |

| TOTAL PUBLIC EQUITY REAL ESTATE SECURITIES (Cost $56,098,781) | | | | | | | 65,445,525 | |

| SHORT TERM INVESTMENT (5.33%) | | | | | | | | |

| Fidelity Investments Money Market Fund - Government Portfolio - Class I, 0.010%(e) (Cost $168,557,789) | | | 168,557,789 | | | | 168,557,789 | |

| TOTAL INVESTMENTS (99.27%) (Cost $2,633,541,796) | | | | | | $ | 3,137,051,094 | |

| Other Assets In Excess Of Liabilities (0.73%) | | | | | | | 22,997,221 | |

| NET ASSETS (100.00%) | | | | | | $ | 3,160,048,315 | |

Common Abbreviations

IO - Interest Only Security

PO - Principal Only Security

| (a) | All or a portion of these securities are segregated as collateral for the Line of Credit as of September 30, 2021. |

| (b) | Non-income producing security. |

| (c) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2021, the aggregate market value of those securities was $292,731,493, representing 9.26% of net assets. |

| (d) | Fair value estimated using fair valuation procedures adopted by the Board of Trustees. Total value of such securities is $436,345, representing 0.01% of net assets. |

| (e) | The rate shown is the 7-day effective yield as of September 30, 2021. |

The accompanying notes are an integral part of these financial statements.

14

| Bluerock Total Income+ Real Estate Fund | Statement of Assets and Liabilities |

September 30, 2021

| ASSETS | | |

| Investments, at value (Cost $2,633,541,796) | | $ | 3,137,051,094 | |

| Cash | | | 1,131,946 | |

| Receivable for shares sold | | | 10,601,222 | |

| Dividends and interest receivable | | | 16,760,730 | |

| Prepaid expenses and other assets | | | 85,399 | |

| Total Assets | | | 3,165,630,391 | |

| LIABILITIES | | | | |

| Line of credit interest payable | | | 94,933 | |

| Investment advisory fees payable | | | 3,695,197 | |

| Shareholder servicing fees payable | | | 225,906 | |

| Administration fees payable | | | 167,362 | |

| Transfer agency fees payable | | | 577,331 | |

| Distribution fees payable | | | 304,014 | |

| Trustees’ fees payable | | | 12,500 | |

| Accrued expenses and other liabilities | | | 504,833 | |

| Total Liabilities(a) | | | 5,582,076 | |

| NET ASSETS | | $ | 3,160,048,315 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 2,585,745,846 | |

| Total distributable earnings | | | 574,302,469 | |

| NET ASSETS | | $ | 3,160,048,315 | |

| PRICING OF SHARES | | | | |

| Class A: | | | | |

| Net asset value and redemption price | | $ | 32.66 | |

| Net assets | | $ | 573,539,730 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 17,561,636 | |

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | | $ | 34.65 | |

| Class C: | | | | |

| Net asset value, offering and redemption price | | $ | 30.90 | |

| Net assets | | $ | 486,734,118 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 15,754,446 | |

| Class I: | | | | |

| Net asset value, offering and redemption price | | $ | 33.35 | |

| Net assets | | $ | 2,012,129,304 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 60,339,974 | |

| Class L: | | | | |

| Net asset value and redemption price | | $ | 32.31 | |

| Net assets | | $ | 87,645,163 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,712,664 | |

| Maximum offering price per share ((NAV/0.9575), based on maximum sales charge of 4.25% of the offering price) | | $ | 33.74 | |

| (a) | Separately, see Note 8 Commitment and Contingencies for detail on unfunded commitments. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2021 | 15 |

| Bluerock Total Income+ Real Estate Fund | Statement of Operations |

For the Year Ended September 30, 2021

| INVESTMENT INCOME | | |

| Dividend Income | | $ | 75,967,486 | |

| Interest Income | | | 18,200,260 | |

| Total Investment Income | | | 94,167,746 | |

| | | | | |

| EXPENSES | | | | |

| Investment Advisory fees | | | 38,094,692 | |

| Administrative fees | | | 965,426 | |

| Transfer Agency fees | | | 3,068,003 | |

| Shareholder servicing fees: | | | | |

| Class A | | | 1,317,244 | |

| Class C | | | 1,095,774 | |

| Class L | | | 193,372 | |

| Distribution fees: | | | | |

| Class C | | | 3,287,323 | |

| Class L | | | 193,372 | |

| Legal fees | | | 112,705 | |

| Audit and tax fees | | | 26,000 | |

| Reports to shareholders and printing fees | | | 813,205 | |

| Custody fees | | | 123,091 | |

| Chief compliance officer fees | | | 59,659 | |

| Interest expense | | | 2,878,064 | |

| Trustees’ fees | | | 131,250 | |

| Other expenses | | | 330,399 | |

| Total Expenses | | | 52,689,579 | |

| Less: Fees waived/expenses reimbursed by Advisor (See Note 3) | | | (549,344 | ) |

| Recoupment of previously waived fees (See Note 3) | | | 32,630 | |

| Net Expenses | | | 52,172,865 | |

| Net Investment Income | | | 41,994,881 | |

| Net realized gain/(loss) on investments | | | 26,780,286 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 371,899,418 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 398,679,704 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 440,674,585 | |

The accompanying notes are an integral part of these financial statements.

16

| Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2021 | | For the Year Ended September 30, 2020 |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 41,994,881 | | | $ | 35,789,012 | |

| Net realized gain on investments | | | 26,780,286 | | | | 69,143,294 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 371,899,418 | | | | (76,946,133 | ) |

| Net Increase in Net Assets Resulting from Operations | | | 440,674,585 | | | | 27,986,173 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| From distributable earnings | | | (11,117,116 | ) | | | (19,550,413 | ) |

| From return of capital | | | (16,790,002 | ) | | | (9,366,652 | ) |

| Class C | | | | | | | | |

| From distributable earnings | | | (9,669,663 | ) | | | (15,572,816 | ) |

| From return of capital | | | (13,554,500 | ) | | | (7,494,043 | ) |

| Class I | | | | | | | | |

| From distributable earnings | | | (28,322,736 | ) | | | (45,573,427 | ) |

| From return of capital | | | (53,334,407 | ) | | | (22,312,717 | ) |

| Class L | | | | | | | | |

| From distributable earnings | | | (1,622,830 | ) | | | (2,519,359 | ) |

| From return of capital | | | (2,506,782 | ) | | | (1,237,752 | ) |

| Total Distributions to Shareholders | | | (136,918,036 | ) | | | (123,627,179 | ) |

| BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Shares sold | | | 99,334,955 | | | | 141,636,113 | |

| Distributions reinvested | | | 13,307,570 | | | | 14,577,926 | |

| Shares redeemed | | | (97,571,135 | ) | | | (80,005,865 | ) |

| Shares transferred out | | | (26,740,491 | ) | | | (64,998,822 | ) |

| Class C | | | | | | | | |

| Shares sold | | | 58,875,954 | | | | 92,956,793 | |

| Distributions reinvested | | | 14,215,722 | | | | 14,727,304 | |

| Shares redeemed | | | (63,536,358 | ) | | | (43,450,601 | ) |

| Shares transferred out | | | (6,518,764 | ) | | | (7,664,050 | ) |

| Class I | | | | | | | | |

| Shares sold | | | 732,585,726 | | | | 461,737,118 | |

| Distributions reinvested | | | 36,284,955 | | | | 33,154,791 | |

| Shares redeemed | | | (321,594,589 | ) | | | (249,555,303 | ) |

| Shares transferred in | | | 33,728,094 | | | | 106,259,987 | |

| Class L | | | | | | | | |

| Shares sold | | | 10,344,422 | | | | 21,060,878 | |

| Distributions reinvested | | | 2,733,534 | | | | 2,687,164 | |

| Shares redeemed | | | (6,683,966 | ) | | | (2,933,253 | ) |

| Shares transferred out | | | (468,839 | ) | | | (33,597,115 | ) |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 478,296,790 | | | | 406,593,065 | |

| Net increase in net assets | | | 782,053,339 | | | | 310,952,059 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 2,377,994,976 | | | | 2,067,042,917 | |

| End of year | | $ | 3,160,048,315 | | | $ | 2,377,994,976 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2021 | 17 |

| Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2021 | | For the Year Ended September 30, 2020 |

| Other Information | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Beginning shares | | | 17,973,066 | | | | 17,641,782 | |

| Shares sold | | | 3,286,699 | | | | 4,676,755 | |

| Distributions reinvested | | | 441,606 | | | | 489,722 | |

| Shares redeemed | | | (3,252,326 | ) | | | (2,653,560 | ) |

| Shares transferred out | | | (887,409 | ) | | | (2,181,633 | ) |

| Net increase/(decrease) in shares outstanding | | | (411,430 | ) | | | 331,284 | |

| Ending shares | | | 17,561,636 | | | | 17,973,066 | |

| Class C | | | | | | | | |

| Beginning shares | | | 15,677,939 | | | | 13,738,958 | |

| Shares sold | | | 2,036,019 | | | | 3,200,967 | |

| Distributions reinvested | | | 496,961 | | | | 517,575 | |

| Shares redeemed | | | (2,228,298 | ) | | | (1,511,429 | ) |

| Shares transferred out | | | (228,175 | ) | | | (268,132 | ) |

| Net increase in shares outstanding | | | 76,507 | | | | 1,938,981 | |

| Ending shares | | | 15,754,446 | | | | 15,677,939 | |

| Class I | | | | | | | | |

| Beginning shares | | | 45,032,151 | | | | 33,636,423 | |

| Shares sold | | | 23,556,038 | | | | 15,005,892 | |

| Distributions reinvested | | | 1,175,998 | | | | 1,094,180 | |

| Shares redeemed | | | (10,521,668 | ) | | | (8,177,537 | ) |

| Shares transferred in | | | 1,097,455 | | | | 3,473,193 | |

| Net increase in shares outstanding | | | 15,307,823 | | | | 11,395,728 | |

| Ending shares | | | 60,339,974 | | | | 45,032,151 | |

| Class L | | | | | | | | |

| Beginning shares | | | 2,516,381 | | | | 2,928,639 | |

| Shares sold | | | 344,076 | | | | 696,858 | |

| Distributions reinvested | | | 91,549 | | | | 91,010 | |

| Shares redeemed | | | (223,825 | ) | | | (98,561 | ) |

| Shares transferred out | | | (15,517 | ) | | | (1,101,565 | ) |

| Net increase/(decrease) in shares outstanding | | | 196,283 | | | | (412,258 | ) |

| Ending shares | | | 2,712,664 | | | | 2,516,381 | |

The accompanying notes are an integral part of these financial statements.

18

| Bluerock Total Income+ Real Estate Fund | Statement of Cash Flows |

| | | For the Year Ended September 30, 2021 |

| Cash Flows from Operating Activities: | | |

| Net increase in net assets resulting from operations | | $ | 440,674,585 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (777,151,225 | ) |

| Proceeds from disposition of investment securities | | | 621,334,595 | |

| Net proceeds from short-term investment securities | | | 64,172,748 | |

| Net realized gain on investments | | | (26,780,286 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | (371,899,418 | ) |

| Discount and premiums amortized | | | (11,024,637 | ) |

| (Increase)/Decrease in Assets: | | | | |

| Dividends and interest receivable | | | (1,720,194 | ) |

| Prepaid expenses and other assets | | | (30,811 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Shareholder servicing fees payable | | | 11,832 | |

| Investment advisory fees payable | | | 820,993 | |

| Administrative fees payable | | | (1,976 | ) |

| Transfer agency fees payable | | | 321,404 | |

| Distribution fees payable | | | 23,453 | |

| Trustees’ fees payable | | | 12,500 | |

| Interest due on line of credit payable | | | (191,327 | ) |

| Accrued expenses and other liabilities | | | 241,293 | |

| Net Cash Used in Operating Activities | | | (61,186,471 | ) |

| Cash Flows from Financing Activities: | | | | |

| Change in Line of Credit Borrowing | | | (274,000,000 | ) |

| Proceeds from shares sold | | | 893,409,360 | |

| Payment on shares redeemed | | | (489,386,048 | ) |

| Cash distributions paid | | | (70,376,255 | ) |

| Net Cash Provided by Financing Activities | | | 59,647,057 | |

| Net Change in Cash | | | (1,539,414 | ) |

| Cash Beginning of Year | | $ | 2,671,360 | |

| Cash End of Year | | $ | 1,131,946 | |

| Non-cash financing Activities not included herein consist of reinvestment of distributions of: | | $ | 66,541,781 | |

| Cash paid for interest on lines of credit during the year was: | | | 3,069,391 | |

| The accompanying notes are an integral part of these financial statements. | |

| Annual Report | September 30, 2021 | 19 |

| Bluerock Total Income+ Real Estate Fund - Class A | Financial Highlights |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented. |

| | | For the Year Ended September 30, 2021 | | For the Year Ended September 30, 2020 | | For the Year Ended September 30, 2019 | | For the Year Ended September 30, 2018 | | For the Year Ended September 30, 2017 |

| Net asset value, beginning of year | | $ | 29.26 | | | $ | 30.43 | | | $ | 30.00 | | | $ | 29.37 | | | $ | 29.13 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.50 | | | | 0.46 | | | | 0.33 | | | | 0.21 | | | | 0.23 | |

| Net realized and unrealized gain/(loss) | | | 4.50 | | | | (0.05 | ) | | | 1.69 | | | | 2.00 | | | | 1.56 | |

| Total from investment operations | | | 5.00 | | | | 0.41 | | | | 2.02 | | | | 2.21 | | | | 1.79 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.06 | ) | | | – | | | | – | | | | – | |

| From net realized gain on investments | | | (0.63 | ) | | | (1.02 | ) | | | (0.32 | ) | | | (0.54 | ) | | | (0.37 | ) |

| Return of capital | | | (0.97 | ) | | | (0.50 | ) | | | (1.27 | ) | | | (1.04 | ) | | | (1.18 | ) |

| Total distributions | | | (1.60 | ) | | | (1.58 | ) | | | (1.59 | ) | | | (1.58 | ) | | | (1.55 | ) |

| Net asset value, end of year | | $ | 32.66 | | | $ | 29.26 | | | $ | 30.43 | | | $ | 30.00 | | | $ | 29.37 | |

| TOTAL RETURN(b)(c) | | | 17.68 | % | | | 1.38 | % | | | 6.94 | % | | | 7.69 | % | | | 6.29 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 573,540 | | | $ | 525,950 | | | $ | 536,913 | | | $ | 373,488 | | | $ | 291,772 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.09 | % | | | 2.15 | % | | | 2.20 | % | | | 2.43 | % | | | 2.37 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.06 | % | | | 2.17 | % | | | 2.21 | % | | | 2.37 | % | | | 2.21 | % |

| Ratio of net investment income to average net assets(e) | | | 1.65 | % | | | 1.53 | % | | | 1.10 | % | | | 0.71 | % | | | 0.80 | % |

| Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.98 | % | | | 1.91 | % | | | 1.94 | % | | | 1.99 | % | | | 2.04 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.95 | % | | | 1.93 | % | | | 1.95 | % | | | 1.93 | % | | | 1.89 | % |

| Portfolio turnover rate | | | 26 | % | | | 27 | % | | | 8 | % | | | 13 | % | | | 16 | % |

| (a) | Per share amounts are calculated using the average shares method. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (c) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (d) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (e) | The ratios of expenses to average net assets and net investment income to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

| The accompanying notes are an integral part of these financial statements. |

| 20 |

| Bluerock Total Income+ Real Estate Fund - Class C | Financial Highlights |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented. |

| | | For the Year Ended September

30, 2021 | | For the Year Ended September

30, 2020 | | For the Year Ended September

30, 2019 | | For the Year Ended September

30, 2018 | | For the Year Ended September

30, 2017 |

| Net asset value, beginning of year | | $ | 27.89 | | | $ | 29.22 | | | $ | 29.02 | | | $ | 28.63 | | | $ | 28.61 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | 0.26 | | | | 0.23 | | | | 0.10 | | | | (0.01 | ) | | | 0.01 | |

| Net realized and unrealized gain/(loss) | | | 4.27 | | | | (0.04 | ) | | | 1.63 | | | | 1.93 | | | | 1.52 | |

| Total from investment operations | | | 4.53 | | | | 0.19 | | | | 1.73 | | | | 1.92 | | | �� | 1.53 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.06 | ) | | | – | | | | – | | | | – | |

| From net realized gain on investments | | | (0.63 | ) | | | (0.98 | ) | | | (0.32 | ) | | | (0.52 | ) | | | (0.37 | ) |

| Return of capital | | | (0.89 | ) | | | (0.48 | ) | | | (1.21 | ) | | | (1.01 | ) | | | (1.14 | ) |

| Total distributions | | | (1.52 | ) | | | (1.52 | ) | | | (1.53 | ) | | | (1.53 | ) | | | (1.51 | ) |

| Net asset value, end of year | | $ | 30.90 | | | $ | 27.89 | | | $ | 29.22 | | | $ | 29.02 | | | $ | 28.63 | |

| TOTAL RETURN(b)(c) | | | 16.81 | % | | | 0.63 | % | | | 6.15 | % | | | 6.86 | % | | | 5.50 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 486,734 | | | $ | 437,183 | | | $ | 401,507 | | | $ | 290,549 | | | $ | 232,200 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.81 | % | | | 2.90 | % | | | 2.95 | % | | | 3.18 | % | | | 3.13 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.81 | % | | | 2.92 | % | | | 2.96 | % | | | 3.12 | % | | | 2.97 | % |

| Ratio of net investment income/(loss) to average net assets(e) | | | 0.91 | % | | | 0.79 | % | | | 0.35 | % | | | (0.04 | )% | | | 0.05 | % |

| Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.70 | % | | | 2.66 | % | | | 2.69 | % | | | 2.74 | % | | | 2.79 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.70 | % | | | 2.68 | % | | | 2.70 | % | | | 2.68 | % | | | 2.63 | % |

| Portfolio turnover rate | | | 26 | % | | | 27 | % | | | 8 | % | | | 13 | % | | | 16 | % |

| (a) | Per share amounts are calculated using the average shares method. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (c) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (d) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (e) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

| The accompanying notes are an integral part of these financial statements. | |

| Annual Report | September 30, 2021 | 21 |

| Bluerock Total Income+ Real Estate Fund - Class I | Financial Highlights |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented. |

| | | For the Year Ended September

30, 2021 | | For the Year Ended September

30, 2020 | | For the Year Ended September

30, 2019 | | For the Year Ended September

30, 2018 | | For the Year Ended September

30, 2017 |

| Net asset value, beginning of year | | $ | 29.80 | | | $ | 30.92 | | | $ | 30.40 | | | $ | 29.70 | | | $ | 29.38 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.58 | | | | 0.56 | | | | 0.42 | | | | 0.29 | | | | 0.31 | |

| Net realized and unrealized gain/(loss) | | | 4.61 | | | | (0.07 | ) | | | 1.72 | | | | 2.01 | | | | 1.57 | |

| Total from investment operations | | | 5.19 | | | | 0.49 | | | | 2.14 | | | | 2.30 | | | | 1.88 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.06 | ) | | | – | | | | – | | | | – | |

| From net realized gain on investments | | | (0.63 | ) | | | (1.04 | ) | | | (0.32 | ) | | | (0.54 | ) | | | (0.37 | ) |

| Return of capital | | | (1.01 | ) | | | (0.51 | ) | | | (1.30 | ) | | | (1.06 | ) | | | (1.19 | ) |

| Total distributions | | | (1.64 | ) | | | (1.61 | ) | | | (1.62 | ) | | | (1.60 | ) | | | (1.56 | ) |

| Net asset value, end of year | | $ | 33.35 | | | $ | 29.80 | | | $ | 30.92 | | | $ | 30.40 | | | $ | 29.70 | |

| TOTAL RETURN(b)(c) | | | 17.99 | % | | | 1.61 | % | | | 7.23 | % | | | 7.91 | % | | | 6.58 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 2,012,129 | | | $ | 1,341,848 | | | $ | 1,040,017 | | | $ | 471,116 | | | $ | 257,366 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.83 | % | | | 1.91 | % | | | 1.94 | % | | | 2.22 | % | | | 2.15 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.81 | % | | | 1.91 | % | | | 1.95 | % | | | 2.15 | % | | | 1.99 | % |

| Ratio of net investment income to average net assets(e) | | | 1.89 | % | | | 1.82 | % | | | 1.38 | % | | | 0.95 | % | | | 1.06 | % |

| Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.72 | % | | | 1.67 | % | | | 1.69 | % | | | 1.75 | % | | | 1.80 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.70 | % | | | 1.67 | % | | | 1.70 | % | | | 1.68 | % | | | 1.64 | % |

| Portfolio turnover rate | | | 26 | % | | | 27 | % | | | 8 | % | | | 13 | % | | | 16 | % |

| (a) | Per share amounts are calculated using the average shares method. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (c) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (d) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (e) | The ratios of expenses to average net assets and net investment income to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

| The accompanying notes are an integral part of these financial statements. |

| 22 |

| Bluerock Total Income+ Real Estate Fund - Class L | Financial Highlights |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented. |

| | | For the Year Ended September

30, 2021 | | For the Year Ended September

30, 2020 | | For the Year Ended September

30, 2019 | | For the Year Ended September

30, 2018 | | For the Period Ended September

30, 2017(a) |

| Net asset value, beginning of period/year | | $ | 29.02 | | | $ | 30.25 | | | $ | 29.89 | | | $ | 29.34 | | | $ | 29.42 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(b) | | | 0.42 | | | | 0.37 | | | | 0.26 | | | | 0.13 | | | | (0.06 | ) |

| Net realized and unrealized gain/(loss) | | | 4.46 | | | | (0.03 | ) | | | 1.68 | | | | 1.99 | | | | 0.76 | |

| Total from investment operations | | | 4.88 | | | | 0.34 | | | | 1.94 | | | | 2.12 | | | | 0.70 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.06 | ) | | | – | | | | – | | | | – | |