UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22710

BLUEROCK TOTAL INCOME+ REAL ESTATE FUND

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, 32nd Floor, New York, NY 10105

(Address of principal executive offices) (Zip code)

Bluerock Fund Advisor, LLC

1345 Avenue of the Americas, 32nd Floor,

New York, NY 10105

(Name and address of agent for service)

1-844-819-8287

(Registrant’s telephone number, including area code)

Date of fiscal year end:September 30

Date of reporting period: September 30, 2019

Item 1. Reports to Stockholders.

Annual Report

September 30, 2019

Investor Information: 1-844-819-8287

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Bluerock Total Income+ Real Estate Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by ALPS Distributors, Inc.

Member FINRA

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Review | 11 |

| Portfolio of Investments | 13 |

| Statement of Assets and Liabilities | 17 |

| Statement of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Statement of Cash Flows | 21 |

| Financial Highlights | 22 |

| Notes to Financial Statements | 26 |

| Report of Independent Registered Public Accounting Firm | 34 |

| Additional Information | 35 |

| Supplemental Information | 36 |

| Privacy Policy | 38 |

Electronic Report Disclosure Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website www.bluerockfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by calling the Fund at (844) 819-8287, or submit a signed letter of instruction requesting paperless reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, you may contact your financial intermediary to request your shareholder reports electronically.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling the Fund at (844) 819-8287, or by submitting a signed letter of instruction requesting paper reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, contact the financial intermediary to request paper copies. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

| | ANNUAL REPORT:(4Q 2018-3Q 2019)(UNAUDITED) |

| | Letter from the TI+ Portfolio Managers |

To Our Valued Shareholders:

For the fiscal year 2019, the Bluerock Total Income+ Real Estate Fund (“TI+” or the “Fund”) continued to meed its investment objectives, generating current income, capital appreciation, and low-moderate volatility and correlation to the broader markets.

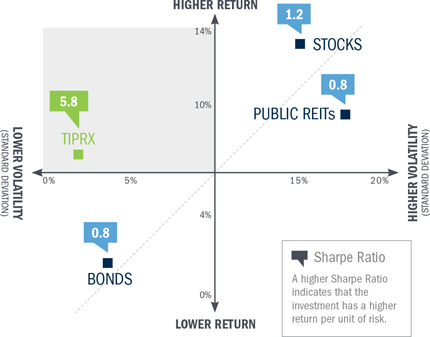

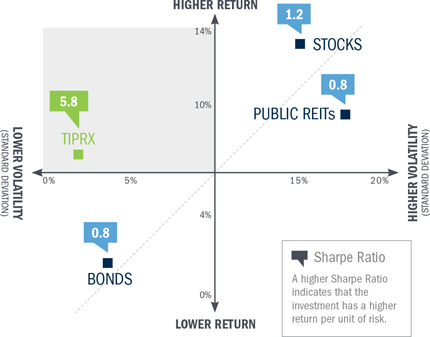

We are pleased to report that TI+’s risk-adjusted performance continued to excel relative to major financial market indexes as of 9/30/2019. Since inception (10/22/2012), TI+ generated approximately 90% lower volatility than leading stock and public REIT indices and approximately 50% lower volatility than the Bloomberg Barclays U.S. Aggregate Bond Index. In fact, the Fund’s Sharpe Ratio (which measures risk relative to return) was nearly five times that of the S&P 500 and more than seven times that of the MSCI US REIT Index as reported by Morningstar. Simply put, this means that a TI+ investor received five and seven times the return for each unit of volatility in these indices from Fund inception (10/22/2012) through 9/30/2019.

In keeping with our investment thesis, the Fund continued to invest primarily in institutional private equity real estate (iPERE), previously available for investment only by the largest pension funds and institutional investors. TI+ is now invested in a diversified portfolio of 24 private real estate investments, with an aggregate underlying gross asset value of approximately $208 billion of real estate holdings. This is up from 23 private real estate investments valued at approximately $192 billion last year.

By investing in low leverage, lower volatility iPERE investments, TI+ has been able to produce stable cash flows that are not highly correlated to daily stock market fluctuations.

We are pleased to share these highlights with you:

| NEW INVESTMENTS:New iPERE investments include Bain Capital Real Estate Fund and Clarion Gables Multifamily Trust, both among the most respected institutional real estate managers. The Fund also added investments in Freddie Mac Securitized Multifamily Notes during the fiscal year. |

| | |

| DISTRIBUTIONS*:TI+ has paid 27 consecutive quarterly distributions. The latest distribution (for A Shares) of $0.3973 per share is equivalent to a 5.25% annualized distribution rate on the 9/13/2019 record date NAV of $30.27 per share. |

| | |

| ASSETS UNDER MANAGEMENT:As of 9/30/2019, the Fund had over $2.0 billion in AUM. We believe this to be a continued validation by investors that TI+ is meeting its mandate to deliver current income and total return with lower volatility and correlation to the broader markets. |

| * | The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed. The distribution policy is thus subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. A portion of the distributions consists of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. The Fund’s distribution amounts were calculated based on income received from underlying investments including capital gains and return of capital realized from the disposition of such investments. |

| ** | Please refer to the full descriptions and risks of select asset classes on page 9. |

This is an actively managed, dynamic portfolio. There is no guarantee that any investment (or this investment) will achieve its objectives or goals, pay dividends and/or capital gains, generate positive returns, or avoid losses. Prior performance is not a guarantee of future results.

CORPORATE HEADQUARTERS | 1345 AVENUE OF THE AMERICAS | 32ND FLOOR | NEW YORK, NY 10105 | 877.826.BLUE (2583) | BLUEROCKRE.COM

1

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

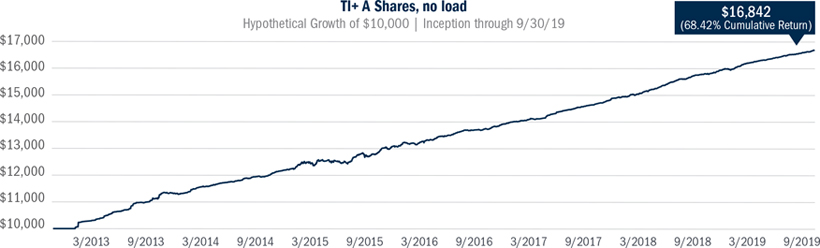

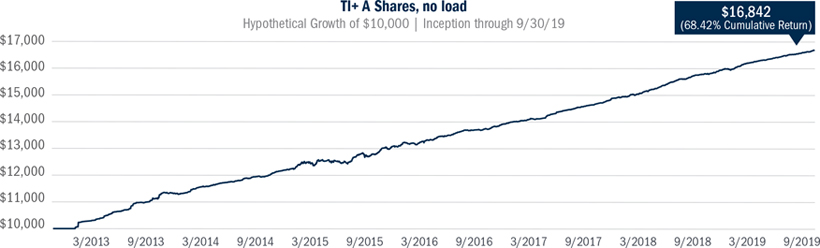

PERFORMANCE

From inception (10/22/2012) through 9/30/2019, TI+ (A Shares) generated a cumulative total return of 68.42%, or 7.80% annualized. The Fund was able to accomplish this primarily through investments in private real estate investments, which own best-in-class real estate, generating both income and capital appreciation. Private investments are supplemented with select public real estate securities. The Fund currently offers four share classes: A, C, I and L Shares. A summary of the performance of each share class is presented below.

Fund Performance thru 9/30/2019†

| | One Year | Three Year | Five Year | Since Inception2 |

| TI+ Fund - Class A | 5.71% | 6.80% | 7.00% | 7.80% |

| TI+ Fund - Class A with Max Sales Charge1 | -0.36% | 4.71% | 5.74% | 6.88% |

| TI+ Fund - Class C | 4.95% | 6.01% | 6.21% | 7.01% |

| TI+ Fund - Class C with Load3 | 3.96% | 6.01% | 6.21% | 7.01% |

| TI+ Fund - Class I | 5.98% | 7.05% | 7.31% | 8.05% |

| TI+ Fund - Class L | 5.43% | 6.52% | 6.73% | 7.53% |

| TI+ Fund - Class L with Max Sales Charge1 | 0.96% | 4.99% | 5.81% | 6.86% |

| 1 | The maximum sales charge for the A Shares is 5.75% and for L Shares is 4.25%. Investors may be eligible for a reduction in sales charges. |

| 2 | Since Inception returns as of October 22, 2012. Actual Inception date of the A Shares is October 22, 2012. Actual Inception date of the Fund’s C and I Shares is April 1, 2014. Actual Inception date for the L Shares is June 1, 2017 |

| 3 | Adjusted for early withdrawal charge of 1.00%. |

| † | Returns for Class C, Class I and Class L Shares prior to their inception dates are based on the performance of Class A Shares. For Class C and Class L Shares, prior performance has been adjusted to reflect differences in expenses between the respective classes and Class A. The actual returns of Class I would have been different than those shown because Class I has lower expenses than Class A. |

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.43% for Class A, 3.18% for Class C, 2.22% for Class I and 2.74% for Class L per the March 27, 2019 prospectuses.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is not a guarantee of future results. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2020, for Class A, C, I and L shares to ensure that the net annual fund operating expenses will not exceed 1.95% for Class A, 2.70% for Class C and 1.70% for Class I, and 2.20% for Class L, subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectuses for more detail on the expense waiver. Results shown reflect the full fee waiver, without which the results could have been lower. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call toll-free 1-844-819-8287.

Total returns are calculated using SEC Form N-2 instructions and reflect all fees and charges.

Past performance is not a guarantee of future results

2

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

LONG-TERM CAPITAL APPRECIATION

The Fund’s A Shares 7.80% annualized total net return has provided capital appreciation in addition to current income. TI+ generated this appreciation with a positive or neutral return89% of all daysfrom inception through 9/30/19.

PERFORMANCE METRICS

Investment returns should be analyzed with regard to volatility (risk) and other performance indicators, including up period percent and maximum drawdown.

| | | | |

Risk-Adjusted Returns:As depicted in the quadrant chart below, traditional asset classes exhibit either lower return/low volatility or higher return/high volatility. TI+, however, has generated a return/risk profile in the desirable upper left (higher return/lower volatility) quadrant.

Quadrant chart illustrates total annualized returns and volatility from TI+ inception (10/22/12) through 9/30/19. | | | Up Period Percent and Maximum Drawdown:TI+ also experienced more up/neutral days than other asset classes and generated far less drawdown, the maximum amount a security declines before reaching its prior peak.

Down Period Percent is the percentage of days a security/index decreases. Up Period Percent is the percentage of days a security/index increases or is unchanged. |

Page Sources:Morningstar Direct

TI+ Fund:A-Shares, no load |Stocks:S&P 500 Total Return |REITs:MSCI U.S. REIT Index |Bonds:Bloomberg Barclays U.S. Aggregate Bond Index

| ** | Please refer to the full descriptions and risks of select asset classes on page 9. |

Past performance is not a guarantee of future results. Risk and liquidity factors vary significantly between asset classes.

3

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

GROWTH IN INCOME AND NET ASSET VALUE

The Fund seeks a 5.25% annualized distribution rate based on current NAV. As NAV has increased, the distribution amount has also increased. The Fund has paid 27 consecutive quarterly distributions.

REALIZED DISTRIBUTIONS AND NAV GROWTH

| * | The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed. However, this distribution policy is subject to change. The Fund’s distribution amounts were calculated based on the ordinary income received from the underlying investments, including short-term capital gains realized from the disposition of such investments. Shareholders should not assume that the source of a distribution from the Fund is net profit. A portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Company will continue to declare distributions or that they will continue at these rates. |

| 4 | 67% is the simple average of the calendar year return of capital portion of distributions from 01.01.2013-12.31.2018, which are tax deferred and paid upon sale. |

| 5 | Cumulative Distributions: The collective sum of the Fund’s A shares distributions since Fund inception, reflected as of each quarter end. This does not necessarily represent actual investment results for any individual investor. |

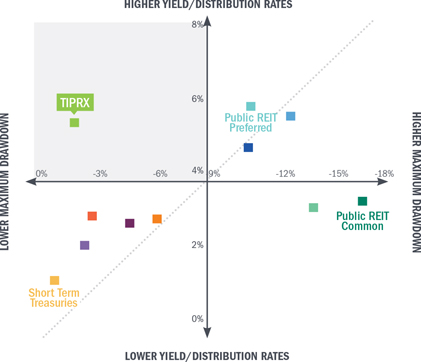

GENERATING INCOME IN A LOW YIELD ENVIRONMENT

With U.S. Treasury yields reaching new lows below 2%, investors search for higher yields has extended beyond traditional fixed income asset classes. The potential consequence of this is that higher yields tend to bring additional risk. The chart below illustrates several income oriented index yields and corresponding total return maximum drawdowns. The higher yielding indexes have experienced much larger maximum drawdowns in the previous 5 years than the lower yielding indexes. TI+, however, has an annual distribution rate near the higher range of the indexes, but among the lowest maximum drawdown.

Source:Morningstar Direct; Yahoo Finance for yield information; exchange traded funds yields used where index yields aren’t published.

Maximum Drawdown:The maximum decline an investment experiences prior to reaching its previous peak.

| ** | Please refer to the full descriptions and risks of select asset classes on page 9. |

4

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Fund Sub-Advisors Fund Sub-Advisors |

| | |

| About Mercer Investment Management |

| Mercer Investment Management, Inc., acts as sub-advisor to the TI+ Fund’s private real estate equity investments. For more than 75 years, Mercer has been one of the world’s leading advisors to endowments, pension funds, sovereign wealth funds and family offices globally, with over 3,700 clients worldwide, and $15.0 trillion in assets under advisement. Mercer works to evaluate over 7,100 investment managers and 35,000 individual investments/ strategies and works with Bluerock to select a strategic combination of ‘best-in-class’ institutional real estate managers and investments for the Fund. |

| | |

| About DWS |

DWS (formerly Deutsche Asset Management), through its indirect subsidiary RREEF America, LLC, acts as sub-advisor to the TI+ Fund’s public real estate securities investments and is a registered investment adviser under the Advisers Act. DWS’ real estate business in the U.S. dates back to 1975. Today, DWS has $800+ billion in assets under management and works with 550+ institutional clients. Of that total, approximately $68 billion of AUM is invested in public and private real estate globally, making DWS one of the largest real estate managers in the world. |

LOOKING AHEAD

The longest U.S. economic expansion in history continued in Q4 2019, climbing the “wall of worry.” Financial market pundits fret about global recession, tariffs, trade wars, and political tensions, while key fundamental economic indicators remain positive. Forward looking indicators such as low initial jobless claims and retail sales, for example, were also positive.6 We are mindful of the recent inversion and un-inversion in the yield curve and its potential implications, however, we believe this is a reflection of a more complicated global financial environment, such as low to negative sovereign debt yields around the developed world, as opposed to a U.S. deflationary signal. U.S. GDP growth remained relatively stable at 1.9% in the third quarter, coupled with low unemployment and low interest rates, providing an attractive environment for institutional real estate investment. As has typically been the case historically, daily turmoil and volatility in the financial markets did not extend to the private real estate market. Overarching conditions and the thesis for institutional real estate has remained unchanged.

The trailing 12 month return ending 9.30.2019 for the NCREIF Property Index (NPI), the flagship institutional private equity real estate (iPERE) index, was 6.2%. Approximately 73% of that return was from the income component solidifying the fact that cap rates are holding steady and real estate returns are being driven by healthy income gains from rental rate increases, a sign of high occupancy rates.7 Indeed, national occupancy rates for all major property sectors are above long-term historical averages.8 High occupancy rates reflect stable demand in most sectors with constrained supply. While demand has remained firm for most asset classes, this cycle has also seen lower levels of new construction, stemming from a disciplined financial market and rising construction costs.9

We believe the overall market to be on solid ground, the performance of iPERE has varied significantly by sector. The Fund continues to benefit from outperformance in the industrial sector, which posted a 13.6% total return in the trailing 12-month period, more than double the next closest sector. The Fund has additionally benefited from its retail sector underweight, the lowest returning sector in the trailing 12-month period at 1.4%.9 The industrial sector thesis remains intact, as e-commerce sales gobble up a larger share of retail sales and demand for shorter delivery times increases. Retail sector performance has varied across subsectors; regional malls and power centers, which comprise much of the NPI Retail Index, have faced significant headwinds, while destination and lifestyle retail continue to generate foot traffic. The Fund has remained strategically under allocated to the retail sector and within the sector has targeted experiential assets whose performance is less sensitive to e-commerce sales. The Fund has also pursued attractive risk-adjusted return opportunities in real estate debt and alternative sectors not historically linked to economic cycles such as self-storage, student housing, and medical office.10

5

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Our outlook for private institutional real estate remains positive. We believe there are strong demand drivers in the industrial and multifamily sectors, which should drive long term outperformance against other sectors. Additionally, we believe that institutional real estate is fairly priced as an asset class given historically low bond yields and historically high equity market valuations.

We thank you for the trust and confidence represented by your investment in the Bluerock Total Income+ Real Estate Fund.

Sincerely,

| |  | |  |

| | | | |

| |  | |  |

| | | | |

| | Jordan Ruddy | | Adam Lotterman |

| | Co-Chief Investment Officer | | Co-Chief Investment Officer |

| | Bluerock Total Income+ Real Estate Fund | | Bluerock Total Income+ Real Estate Fund |

| | | | |

| 6 | Source:U.S. Department of Labor and U.S. Census Bureau |

| 7 | Source:NCREIF NPI Flash, Q3 2019 |

| 8 | Source:UBS Real Estate Summary, Edition 2, 2019 |

| 9 | Source:Carlyle Property Investors Q2 2019 |

| 10 | Source:Carlyle Property Investors Flipbook, February 2019 |

6

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

FUND HOLDINGS

As of 9/30/19, the Gross Asset Value of the underlying real estate in the institutional private equity real estate funds in which TI+ is invested is approximately $208 billion, comprising over 4,400 properties across the United States.11

GEOGRAPHIC DIVERSIFICATION The regions and allocations presented represent the Funds’ institutional fund investments as of the date herein, but is subject to change at any time.

| | | SECTOR DIVERSIFICATION The sector diversification presented represents examples of how the Fund’s institutional fund investments are allocated as of the date herein, but is subject to change at any time.

|

| 11 | Portfolio holdings are subject to change at any time and should not be considered investment advice. Underlying iPERE data as of Q2 2019 based on allocations by the Fund on 9.30.2019. Diversification does not ensure profit. The organizations referenced above are not invested in Bluerock or the Total Income+ Real Estate Fund, and they may not be invested in the funds in which the Bluerock Total Income+ Real Estate Fund invests. |

7

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

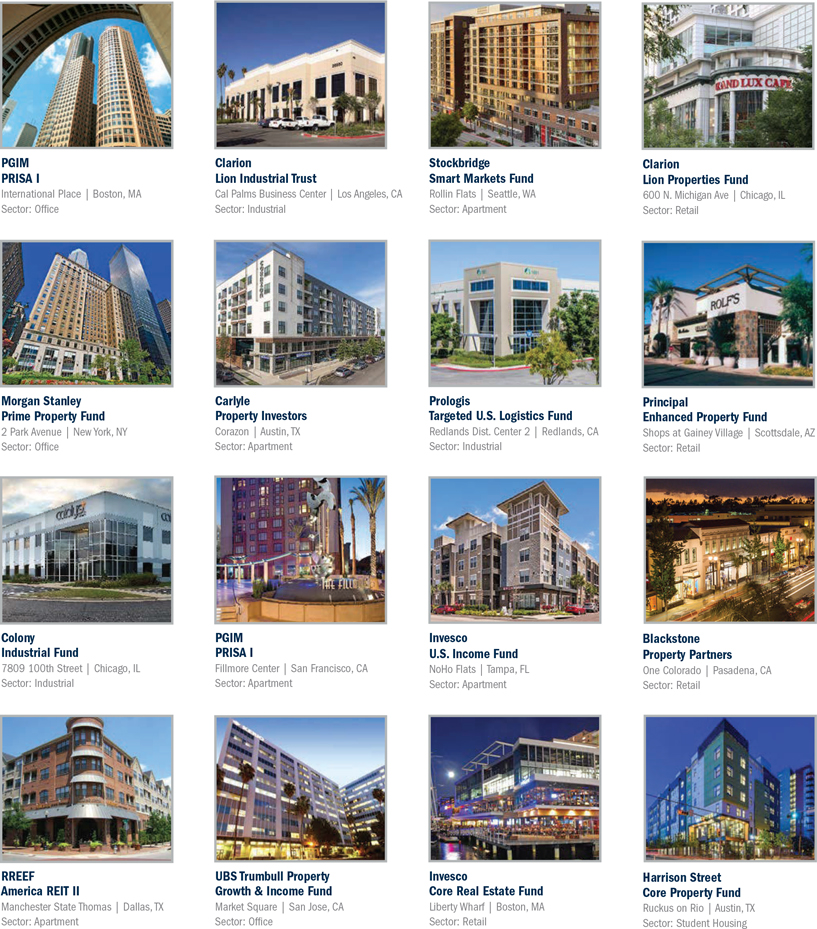

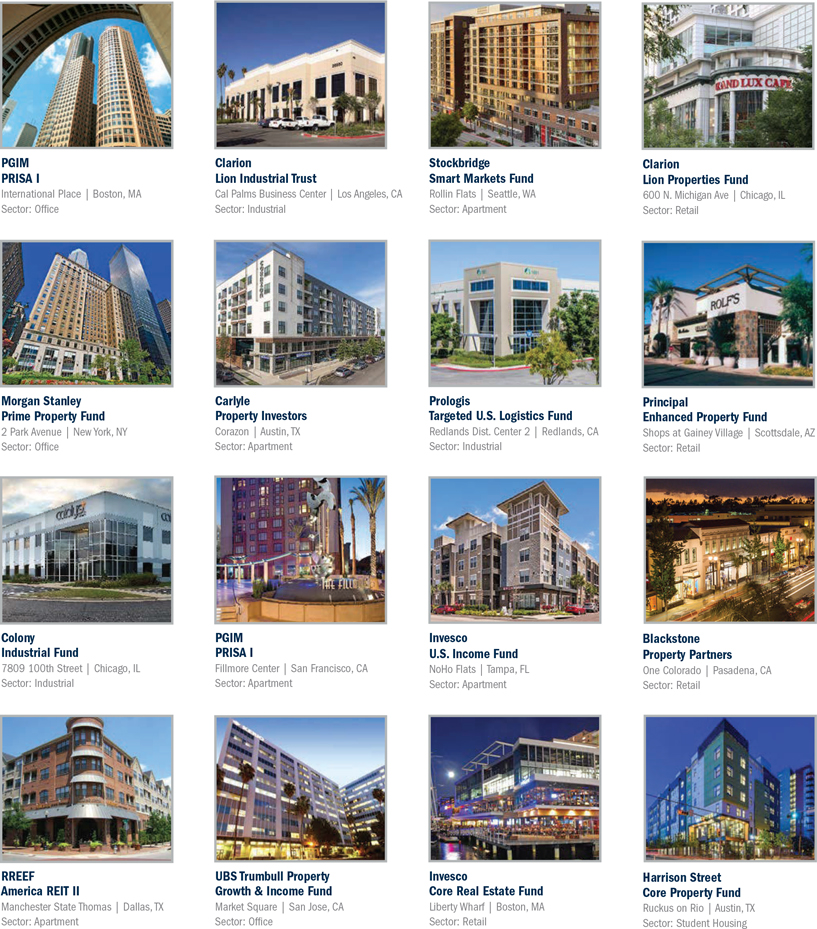

HIGHLIGHTED ASSETS

The properties pictured below are currently owned by the underlying third-party institutional private equity real estate funds described herein.

Active Portfolio; subject to change.

8

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

DEFINITIONS

Bloomberg Barclays U.S. Aggregate Bond Index:The Bloomberg Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States - including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Risks include rising interest rates, credit quality of the issuers and general economic conditions.

Bloomberg Barclays U.S. Corporate High Yield Bond Index:Measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Barclays EM country definition, are excluded.

Bloomberg Barclays U.S. Mortgage Backed Securities (MBS):Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage.

Bloomberg Barclays U.S. Treasury Inflation-Linked Bond Index (TIPS):Measures the performance of the US Treasury Inflation Protected Securities (TIPS) market. Federal Reserve holdings of US TIPS are not index eligible and are excluded from the face amount outstanding of each bond in the index.

Bloomberg Barclays 1-3 Year U.S. Treasury:1-3 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 1-2.999 years to maturity. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting.

Cap Rate:The Capitalization Rate is mathematically defined as Net Operating Income / Current Market Value; it is an indicator of value for income-producing real estate.

Correlation:The degree to which two securities move in relation to each other. Correlation is measured as a correlation coefficient, with a value falling between -1 and 1.0 = No Correlation | 1 = Perfectly Positively Correlated | -1 = Perfectly Negatively Correlated

FTSE NAREIT All Equity REIT Index:A free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

ICE BAML REIT Preferred:The ICE BofAML Fixed-Rate Preferred Securities Index tracks the performance of investment-grade only, fixed-rate U.S. dollar-denominated preferred securities issued in the U.S. domestic market.

MSCI U.S. REIT Index:A free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. (www.msci.com).

NCREIF Property Index (NPI):A leading benchmark index for institutional real estate representing a collection of 7,000+ institutional properties representing all major commercial property types within the U.S. The NPI is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors - the great majority being pension funds. As such, all properties are held in a fiduciary environment.

PCM Emerging Market Bond Index:The emerging markets bond index is a benchmark index for measuring the total return performance of international government bonds issued by emerging market countries that are considered sovereign (issued in something other than local currency) and that meet specific liquidity and structural requirements.

Sharpe Ratio:Measurement of the risk-adjusted performance. The annualized Sharpe Ratio is calculated by subtracting the annualized risk-free rate - (3-month Treasury Bill) - from the annualized rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

Standard Deviation:The measure of the daily percentage change in an investment. Standard deviation shows how much variation from the average exists with a larger number indicating the data points are more spread out over a larger range of values.

S&P National AMT-Free Muni Bond Index:A broad, comprehensive, market value-weighted index designed to measure the performance of the investment-grade tax-exempt U.S. municipal bond market. Bonds issued by U.S. territories, including Puerto Rico, are excluded from this index.

S&P High Yield Dividend Aristocrats:The S&P High Yield Dividend Aristocrats Index is comprised of the 50 highest dividend yielding constituents of the stocks of the S&P Composite 1500 Index that have increased dividends every year for at least 25 consecutive years. These stocks have both capital growth and dividend income characteristics, as opposed to stocks that are pure yield, or pure capital oriented.

S&P 500:An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. (Investopedia).

You cannot invest directly in an index. Benchmark performance should not be considered reflective of Fund performance.

| ** | Please note that the indices are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. There are limitations when comparing the Bluerock Total Income Fund to Stock, Bond, and Public Real Estate indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity only on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. When interest rates rise, the value of bond securities tends to fall. Real estate securities may decline because of adverse developments affecting the real estate industry and real property values. |

9

| ANNUAL REPORT (4Q 2018 - 3Q 2019) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

RISK DISCLOSURES

Not FDIC Insured | No Bank Guarantee | May Lose Value

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund’s assets in which it invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns.

The Fund’s investments may be negatively affected by the broad investment environment in the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “non-diversified” under the Investment Company Act of 1940 since changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value.

Investing in the Fund’s shares involves substantial risks, including the risks set forth in the “Risk Factors” section of the prospectus, which include, but are not limited to the following:

The Fund may invest in convertible securities which are subject to risks associated with both debt securities and equity securities; correlation risk such as in down markets when the prices of securities and asset classes can also fall in tandem; credit risk related to the securities held by the Fund which may be lowered if an issuer’s financial condition changes which could negatively impact the Fund’s returns on investment in such securities; interest rate risk including a rise in interest rates which could negatively impact the value of fixed income securities.

The Fund’s investment in Institutional Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees; Issuer and non-diversification risk including the value of an issuer’s securities that are held in the Fund’s portfolio may decline for a number of reasons which directly relate to the issue and as a non-diversified fund.

The Fund may invest more than 5% of its total assets in the securities of one or more issuers; lack of control over institutional private investment funds and other portfolio investments; leverage risk which could cause the Fund to incur additional expenses and may significantly magnify the Fund’s losses in the event of adverse performance of the Fund’s underlying investments; management risk including the judgments of the Advisor or Sub-Advisor about the attractiveness, value and potential appreciation of particular real estate segment and securities in which the Fund invests may prove to be incorrect and may not produce the desired results; market risk; a risk that the amount of capital actually raised by the Fund through the offering of its shares may be insufficient to achieve profitability or allow the Fund to realize its investment objectives; option writing risk; possible competition between underlying funds and between the fund and the underlying funds; preferred securities risk which are subject to credit risk and interest rate risk.

The Fund will concentrate its investments in real estate and, as such, its portfolio will be significantly impacted by the performance of the real estate market; real estate development issues; insurance risk including certain of the companies in the Fund’s portfolio may fail to carry adequate insurance; dependence on tenants to pay rent; companies in the real estate industry in which the Fund may invest may be highly leveraged and financial covenants may affect their ability to operate effectively; environmental issues; current conditions including recent instability in the United States, European and other credit markets; REIT risk including the value of investments in REIT shares may decline because of adverse developments affecting the real estate industry and real property values; underlying funds risk, use of leverage by underlying funds; and valuation of Institutional Investment Funds as of a specific date may vary from the actual sale price that may be obtained if such Investments were sold to a third party.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Bluerock Total Income+ Real Estate Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling toll free 844-819-8287, or online at bluerockfunds.com. The prospectus should be read carefully before investing. The Bluerock Total Income+ Real Estate Fund is distributed by ALPS Distributors, Inc (ALPS). Bluerock Fund Advisor, LLC is not affiliated with ALPS, Mercer Investment Management, or DWS. Neither Mercer Investment Management nor DWS are affiliated with ALPS.

| BLU000490 |

10

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

September 30, 2019 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

The Fund’s performance figures for certain periods ended September 30, 2019, compared to its benchmarks:

| Bluerock Total Income+ Real Estate Fund: | | One Year | | | Three Year | | | Five Year | | | Since Inception Class A* | | | Since Inception Class C and Class I* | | | Since Inception Class L* | |

| Class A | | | | | | | | | | | | | | | | | | |

| Without Load | | | 5.71 | % | | | 6.80 | % | | | 7.00 | % | | | 7.80 | % | | | – | | | | – | |

| With Load(a) | | | -0.36 | % | | | 4.71 | % | | | 5.74 | % | | | 6.88 | % | | | – | | | | – | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| Without Load | | | 4.95 | % | | | 6.01 | % | | | 6.21 | % | | | – | | | | 6.14 | % | | | – | |

| With Load(b) | | | 3.96 | % | | | 6.01 | % | | | 6.21 | % | | | – | | | | 6.14 | % | | | – | |

| Class I | | | 5.98 | % | | | 7.05 | % | | | 7.31 | % | | | – | | | | 7.23 | % | | | – | |

| Class L | | | | | | | | | | | | | | | | | | | | | | | | |

| Without Load | | | 5.43 | % | | | – | | | | – | | | | – | | | | – | | | | 6.43 | % |

| With Load(c) | | | 0.96 | % | | | – | | | | – | | | | – | | | | – | | | | 4.46 | % |

| S&P 500 Total Return Index | | | 4.25 | % | | | 13.39 | % | | | 10.84 | % | | | 13.44 | % | | | 10.91 | % | | | 11.26 | % |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | 10.30 | % | | | 2.92 | % | | | 3.38 | % | | | 2.76 | % | | | 3.50 | % | | | 4.12 | % |

| * | Class A commenced operations October 22, 2012, Class C and Class I commenced operations April 1, 2014, and Class L commenced operations June 1, 2017. |

| (a) | Adjusted for initial maximum sales charge of 5.75%. |

| (b) | Adjusted for early withdrawal charge of 1.00%. |

| (c) | Adjusted for initial maximum sales charge of 4.25%. |

The S&P 500 Total Return Index is an unmanaged market capitalization -weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total returns are calculated using the traded NAV on September 30, 2019. Total returns are calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the Advisor not waived a portion of its fees. Returns greater than one year are annualized. The Advisor and the Fund have entered into an expense limitation agreement under which the Advisor has contractually agreed to reduce its fees and/or absorb expenses for Class A, Class C, Class I and Class L at least until January 31, 2020 to ensure that the net annual fund operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) will not exceed 1.95%, 2.70%, 1.70%, and 2.20% of the Fund’s average daily net assets attributable to the Class A, Class C, Class I and Class L shares, respectively. The Fund has agreed to repay the Advisor in the amount of any fees the Advisor previously waived and or Fund expenses reimbursed, pursuant to the expense limitation agreement, subject to the limitations therein that: (1) the reimbursement will be made if payable not more than three fiscal years from the fiscal year in which they were incurred; (2) the reimbursement may not be made if it would cause the Expense Limitation then in effect or in effect at time of waiver to be exceeded; and (3) the reimbursement is approved by the Fund’s Board of Trustees.

| Annual Report | September 30, 2019 | 11 |

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

September 30, 2019 (Unaudited)

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 2.43%, 3.18%, 2.22% and 2.74% for Class A, Class C, Class I and Class L, respectively, per the March 27, 2019 prospectus. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class A shareholders who tender for repurchase Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. Class L shares are subject to a maximum sales charge imposed on purchases of 4.25%. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-844-819-8287.

Portfolio Composition as of September 30, 2019 (Unaudited)

| | | Percent of

Net Assets | |

| Private Equity Real Estate Securities | | | 88.03 | % |

| Real Estate Debt Securities | | | 7.48 | % |

| Short-Term Investments | | | 6.26 | % |

| Public Equity Real Estate Securities | | | 2.18 | % |

| Preferred Stocks | | | 0.64 | % |

| Exchange-Traded Funds | | | 0.27 | % |

| Common Stocks | | | 0.04 | % |

| Total Investments | | | 104.90 | % |

| Liabilities In Excess of Other Assets | | | -4.90 | % |

| Total Net Assets | | | 100.00 | % |

See the Portfolio of Investments in this annual report for a more detailed account of the Fund’s holdings.

12

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments |

September 30, 2019

| Security | | Principal | | | Value | |

| REAL ESTATE DEBT SECURITIES (7.48%)(a) | | | | | | |

| FREMF 2018-K82 Mortgage Trust, Class X2A, IO, 0.100%, 9/25/2028 | | $ | 1,074,158,772 | | | $ | 7,634,046 | |

| FREMF 2018-K82 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2028 | | | 262,694,906 | | | | 1,928,706 | |

| FREMF 2018-K82 Mortgage Trust, Class D, PO, 0.000%, 10/25/2028 | | | 100,392,906 | | | | 46,005,250 | |

| FREMF 2019-K91 Mortgage Trust, Class X2A, IO, 0.100%, 3/25/2029 | | | 1,136,800,371 | | | | 8,436,196 | |

| FREMF 2019-K91 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2029 | | | 247,526,565 | | | | 1,931,697 | |

| FREMF 2019-K91 Mortgage Trust, Class D, PO, 0.000%, 10/25/2029 | | | 103,857,565 | | | | 42,975,014 | |

| FREMF 2019-KC03 Mortgage Trust, Class C, 4.365%, 1/25/2026 | | | 58,088,000 | | | | 45,731,463 | |

| TOTAL REAL ESTATE DEBT SECURITIES (Cost $154,745,462) | | | | | | | 154,642,372 | |

| Security | | Shares | | | Value | |

| PRIVATE EQUITY REAL ESTATE SECURITIES (88.03%)(b) | | | | | | |

| Apartments (7.76%) | | | | | | |

| Clarion Gables Multifamily Trust | | | 73,173 | | | | 95,481,803 | |

| Sentinel Real Estate Fund | | | 718 | | | | 64,849,907 | |

| | | | | | | | 160,331,710 | |

| Diversified (61.61%) | | | | | | | | |

| AEW Core Property Trust | | | 22,139 | | | | 22,980,600 | |

| Bain Capital Real Estate Fund I | | | N/A | | | | 7,577,095 | |

| Blackstone Property Partners(c) | | | 143,241 | | | | 199,169,048 | |

| Carlyle Property Investors | | | 39,819 | | | | 52,166,002 | |

| CBRE U.S. Core Partners, LP | | | 64,362,015 | | | | 92,898,224 | |

| Clarion Lion Properties Fund | | | 108,240 | | | | 166,092,852 | |

| Harrison Street Core Property Fund | | | 50,957 | | | | 70,780,885 | |

| Invesco Core Real Estate Fund | | | 174 | | | | 33,020,864 | |

| Invesco U.S. Income Fund LP | | | 68,683 | | | | 95,078,228 | |

| Morgan Stanley Prime Property Fund LLC | | | 12,381 | | | | 237,024,332 | |

| PGIM PRISA I | | | 19,055 | | | | 32,879,163 | |

| PGIM PRISA III | | | 21,902 | | | | 41,106,569 | |

| Principal Enhanced Property Fund LP | | | 6,804,338 | | | | 87,381,246 | |

| RREEF America REIT II, Inc. | | | 281,886 | | | | 35,697,480 | |

| Stockbridge Smart Markets Fund | | | 26,836 | | | | 42,376,688 | |

| Stockbridge Value Fund II | | | N/A | | | | 5,683,830 | |

| UBS Trumbull Property G&I Fund | | | 1,975 | | | | 51,549,579 | |

| | | | | | | | 1,273,462,685 | |

| Industrial (18.66%) | | | | | | | | |

| Clarion Lion Industrial Trust | | | 36,632 | | | | 74,830,087 | |

| Colony Industrial | | | N/A | | | | 179,426,562 | |

| Prologis Targeted U.S. Logistics(c) | | | 34,828 | | | | 60,405,019 | |

| RREEF Core Plus Industrial Fund LP | | | 550,770 | | | | 71,068,509 | |

| | | | | | | | 385,730,177 | |

| TOTAL PRIVATE EQUITY REAL ESTATE SECURITIES (Cost $1,623,399,244) | | | | | | | 1,819,524,572 | |

| | | | | | | | | |

| PUBLIC EQUITY REAL ESTATE SECURITIES (2.18%) | | | | | | | | |

| Public Non-Traded Real Estate Investment Trusts (0.02%) | | | | | | | | |

| Diversified (0.02%) | | | | | | | | |

| Highlands REIT, Inc.(d)(e) | | | 140,161 | | | | 47,655 | |

| Inventrust Properties Corp.(e) | | | 140,161 | | | | 411,862 | |

| Total Public Non-Traded Real Estate Investment Trusts (Cost $445,781) | | | | | | | 459,517 | |

| | | | | | | | | |

| Publicly Traded Real Estate Investment Trusts (2.16%) | | | | | | | | |

| Advertising (0.03%) | | | | | | | | |

| Lamar Advertising Co., Class A | | | 8,213 | | | | 672,891 | |

| | | | | | | | 672,891 | |

| The accompanying notes are an integral part of these financial statements. |

| Annual Report | September 30, 2019 | 13 |

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2019

| Security | | Shares | | | Value | |

| Apartments (0.39%) | | | | | | |

| Apartment Investment & Management Co. | | | 11,058 | | | $ | 576,564 | |

| AvalonBay Communities, Inc. | | | 2,745 | | | | 591,081 | |

| Camden Property Trust | | | 6,762 | | | | 750,650 | |

| Equity Residential | | | 8,188 | | | | 706,297 | |

| Essex Property Trust, Inc. | | | 3,125 | | | | 1,020,781 | |

| Independence Realty Trust, Inc. | | | 75,623 | | | | 1,082,165 | |

| Invitation Homes, Inc. | | | 16,472 | | | | 487,736 | |

| Mid-America Apartment Communities, Inc. | | | 5,041 | | | | 655,380 | |

| NexPoint Residential Trust, Inc. | | | 36,122 | | | | 1,689,064 | |

| UDR, Inc. | | | 16,147 | | | | 782,807 | |

| | | | | | | | 8,342,525 | |

| Communications (0.18%) | | | | | | | | |

| American Tower Corp. | | | 6,864 | | | | 1,517,837 | |

| Crown Castle International Corp. | | | 6,727 | | | | 935,120 | |

| SBA Communications Corp. | | | 5,095 | | | | 1,228,659 | |

| | | | | | | | 3,681,616 | |

| Data Centers (0.03%) | | | | | | | | |

| Equinix, Inc. | | | 911 | | | | 525,465 | |

| | | | | | | | 525,465 | |

| Diversified (0.31%) | | | | | | | | |

| American Assets Trust, Inc. | | | 14,144 | | | | 661,091 | |

| Armada Hoffler Properties, Inc. | | | 46,869 | | | | 847,860 | |

| EPR Properties | | | 4,742 | | | | 364,470 | |

| Gaming and Leisure Properties, Inc. | | | 14,255 | | | | 545,111 | |

| Gladstone Commercial Corp. | | | 33,363 | | | | 784,031 | |

| PS Business Parks, Inc. | | | 7,232 | | | | 1,315,862 | |

| STORE Capital Corp. | | | 18,858 | | | | 705,478 | |

| WP Carey, Inc. | | | 10,437 | | | | 934,112 | |

| | | | | | | | 6,158,015 | |

| Healthcare (0.29%) | | | | | | | | |

| CareTrust REIT, Inc. | | | 42,892 | | | | 1,008,176 | |

| Community Healthcare Trust, Inc. | | | 31,464 | | | | 1,401,721 | |

| HCP, Inc. | | | 16,926 | | | | 603,073 | |

| Medical Properties Trust, Inc. | | | 38,386 | | | | 750,830 | |

| Omega Healthcare Investors, Inc. | | | 12,404 | | | | 518,363 | |

| Universal Health Realty Income Trust | | | 7,887 | | | | 810,784 | |

| Ventas, Inc. | | | 5,310 | | | | 387,789 | |

| Welltower, Inc. | | | 7,804 | | | | 707,433 | |

| | | | | | | | 6,188,169 | |

| Hotels (0.02%) | | | | | | | | |

| Ryman Hospitality Properties, Inc. | | | 5,089 | | | | 416,331 | |

| | | | | | | | 416,331 | |

| Industrial (0.40%) | | | | | | | | |

| Americold Realty Trust | | | 23,691 | | | | 878,225 | |

| Duke Realty Corp. | | | 13,678 | | | | 464,642 | |

| EastGroup Properties, Inc. | | | 9,102 | | | | 1,137,932 | |

| First Industrial Realty Trust, Inc. | | | 13,418 | | | | 530,816 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 26,372 | | | | 768,744 | |

| Liberty Property Trust | | | 12,548 | | | | 644,089 | |

| Prologis, Inc. | | | 9,931 | | | | 846,320 | |

| Rexford Industrial Realty, Inc. | | | 27,255 | | | | 1,199,765 | |

| STAG Industrial, Inc. | | | 20,485 | | | | 603,898 | |

| Terreno Realty Corp. | | | 25,032 | | | | 1,278,884 | |

| | | | | | | | 8,353,315 | |

The accompanying notes are an integral part of these financial statements.

14

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2019

| Security | | Shares | | | Value | |

| Manufactured Homes (0.16%) | | | | | | |

| Equity LifeStyle Properties, Inc. | | | 11,952 | | | $ | 1,596,787 | |

| Sun Communities, Inc. | | | 11,421 | | | | 1,695,448 | |

| | | | | | | | 3,292,235 | |

| Office (0.10%) | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 4,741 | | | | 730,304 | |

| Highwoods Properties, Inc. | | | 13,451 | | | | 604,488 | |

| VEREIT, Inc. | | | 55,211 | | | | 539,964 | |

| | | | | | | | 1,874,756 | |

| Self-Storage (0.02%) | | | | | | | | |

| National Storage Affiliates Trust | | | 13,241 | | | | 441,852 | |

| | | | | | | | 441,852 | |

| Single Tenant (0.23%) | | | | | | | | |

| Agree Realty Corp. | | | 11,983 | | | | 876,556 | |

| Essential Properties Realty Trust, Inc. | | | 43,813 | | | | 1,003,756 | |

| Four Corners Property Trust, Inc. | | | 22,139 | | | | 626,091 | |

| Getty Realty Corp. | | | 22,193 | | | | 711,508 | |

| National Retail Properties, Inc. | | | 10,796 | | | | 608,894 | |

| Realty Income Corp. | | | 10,244 | | | | 785,510 | |

| | | | | | | | 4,612,315 | |

| Total Publicly Traded Real Estate Investment Trusts (Cost $33,600,923) | | | | | | | 44,559,485 | |

| | | | | | | | | |

| TOTAL PUBLIC EQUITY REAL ESTATE SECURITIES (Cost $34,046,704) | | | | | | | 45,019,002 | |

| | | | | | | | | |

| COMMON STOCKS (0.04%) | | | | | | | | |

| InterXion Holding NV(d) | | | 11,055 | | | | 900,540 | |

| TOTAL COMMON STOCKS (Cost $629,757) | | | | | | | 900,540 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS (0.27%) | | | | | | | | |

| iShares Short Treasury Bond ETF | | | 16,686 | | | | 1,845,806 | |

| SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | | | 20,141 | | | | 1,844,714 | |

| Vanguard Short-Term Treasury ETF | | | 30,561 | | | | 1,862,693 | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $5,522,596) | | | | | | | 5,553,213 | |

| | | | | | | | | |

| PREFERRED STOCKS (0.64%) | | | | | | | | |

| American Homes 4 Rent, 6.350%, Series E | | | 33,469 | | | | 889,941 | |

| American Homes 4 Rent, 5.875%, Series G | | | 35,225 | | | | 929,588 | |

| Digital Realty Trust, Inc., 5.250%, Series J | | | 36,976 | | | | 958,048 | |

| EPR Properties, 5.750%, Series G | | | 36,751 | | | | 953,688 | |

| Kimco Realty Corp., 5.125%, Series L | | | 37,050 | | | | 962,929 | |

| National Storage Affiliates Trust, 6.000%, Series A | | | 35,202 | | | | 936,021 | |

| PS Business Parks, Inc., 5.200%, Series Y | | | 36,829 | | | | 962,710 | |

| PS Business Parks, Inc., 5.250%, Series X | | | 35,450 | | | | 931,272 | |

| PS Business Parks, Inc., 5.200%, Series W | | | 36,643 | | | | 931,465 | |

| Public Storage, 5.050%, Series G | | | 35,019 | | | | 909,443 | |

| Public Storage, 5.375%, Series V | | | 35,289 | | | | 889,636 | |

| Rexford Industrial Realty, Inc., 5.875%, Series A | | | 17,751 | | | | 456,201 | |

| Rexford Industrial Realty, Inc., 5.875%, Series B | | | 18,085 | | | | 462,976 | |

| Spirit Realty Capital, Inc., 6.000%, Series A | | | 36,576 | | | | 957,194 | |

| VEREIT, Inc., 6.700%, Series F | | | 31,386 | | | | 795,635 | |

| Vornado Realty Trust, 5.250%, Series M | | | 12,414 | | | | 320,902 | |

| TOTAL PREFERRED STOCKS (Cost $11,987,572) | | | | | | | 13,247,649 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2019 | 15 |

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

September 30, 2019

| Security | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (6.26%) | | | | | | |

| Fidelity Investments Money Market Funds - Government Portfolio - Class I, 1.86%(Cost $129,395,098) | | | 129,395,098 | | | $ | 129,395,098 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (104.90%) (Cost $1,959,726,433) | | | | | | $ | 2,168,282,446 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-4.90%) | | | | | | | (101,239,529 | ) |

| NET ASSETS (100.00%) | | | | | | $ | 2,067,042,917 | |

Common Abbreviations

IO - Interest Only Security

PO - Principal Only Security

| (a) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2019, the aggregate market value of those securities was $154,642,372, representing 7.48% of net assets. |

| (b) | All or a portion of these securities are segregated as collateral for the Line of Credit as of September 30, 2019. |

| (c) | Holding is comprised of two share classes of the same underlying investment. |

| (d) | Non-income producing security. |

| (e) | Fair value estimated using fair valuation procedures adopted by the Board of Trustees. Total value of such securities is $459,517, representing 0.02% of net assets. |

The accompanying notes are an integral part of these financial statements.

16

| Bluerock Total Income+ Real Estate Fund | Statement of Assets and Liabilities |

September 30, 2019

| ASSETS | | | |

| Investments, at value (Cost $1,959,726,433) | | $ | 2,168,282,446 | |

| Receivable for investments sold | | | 32,512,541 | |

| Receivable for shares sold | | | 6,103,497 | |

| Dividends and interest receivable | | | 11,526,911 | |

| Prepaid expenses and other assets | | | 68,291 | |

| Total Assets | | | 2,218,493,686 | |

| LIABILITIES | | | | |

| Line of credit payable | | | 148,100,000 | |

| Line of credit interest payable | | | 145,149 | |

| Investment advisory fees payable | | | 2,449,222 | |

| Shareholder servicing fees payable | | | 204,438 | |

| Administration fees payable | | | 67,205 | |

| Transfer agency fees payable | | | 77,786 | |

| Distribution fees payable | | | 256,962 | |

| Accrued expenses and other liabilities | | | 150,007 | |

| Total Liabilities | | | 151,450,769 | |

| NET ASSETS | | $ | 2,067,042,917 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 1,827,608,664 | |

| Total distributable earnings | | | 239,434,253 | |

| NET ASSETS | | $ | 2,067,042,917 | |

| PRICING OF SHARES | | | | |

| Class A: | | | | |

| Net asset value and redemption price | | $ | 30.43 | |

| Net assets | | $ | 536,913,310 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 17,641,782 | |

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | | $ | 32.29 | |

| Class C: | | | | |

| Net asset value, offering and redemption price | | $ | 29.22 | |

| Net assets | | $ | 401,506,871 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 13,738,958 | |

| Class I: | | | | |

| Net asset value, offering and redemption price | | $ | 30.92 | |

| Net assets | | $ | 1,040,017,417 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 33,636,423 | |

| Class L: | | | | |

| Net asset value and redemption price | | $ | 30.25 | |

| Net assets | | $ | 88,605,319 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,928,639 | |

| Maximum offering price per share ((NAV/0.9575), based on maximum sales charge of 4.25% of the offering price) | | $ | 31.59 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2019 | 17 |

| Bluerock Total Income+ Real Estate Fund | Statement of Operations |

For the Year Ended September 30, 2019

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 44,148,624 | |

| Interest | | | 8,420,117 | |

| Total Investment Income | | | 52,568,741 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 23,703,042 | |

| Administrative fees | | | 728,957 | |

| Transfer Agency fees | | | 892,916 | |

| Shareholder servicing fees: | | | | |

| Class A | | | 1,133,108 | |

| Class C | | | 844,042 | |

| Class L | | | 158,867 | |

| Distribution fees: | | | | |

| Class C | | | 2,532,125 | |

| Class L | | | 158,867 | |

| Legal fees | | | 91,904 | |

| Audit and tax fees | | | 23,500 | |

| Reports to shareholders and printing fees | | | 702,135 | |

| Custody fees | | | 68,039 | |

| Chief compliance officer fees | | | 54,346 | |

| Interest expense | | | 4,087,383 | |

| Trustees’ fees | | | 75,923 | |

| Other expenses | | | 344,878 | |

| Total Expenses | | | 35,600,032 | |

| Less: Fees waived/expenses reimbursed by Advisor (See Note 3) | | | (40,583 | ) |

| Recoupment of previously waived fees (See Note 3) | | | 263,069 | |

| Net Expenses | | | 35,822,518 | |

| Net Investment Income | | | 16,746,223 | |

| Net realized gain/(loss) on investments | | | 6,996,972 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 88,969,563 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 95,966,535 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 112,712,758 | |

The accompanying notes are an integral part of these financial statements.

18

| Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2019 | | | For the Year Ended September 30, 2018 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 16,746,223 | | | $ | 5,602,006 | |

| Net realized gain on investments | | | 6,996,972 | | | | 5,696,091 | |

| Long-term capital gain distributions from Real Estate Investment Trusts | | | – | | | | 3,506,209 | |

| Net change in unrealized appreciation on investments | | | 88,969,563 | | | | 55,598,433 | |

| Net Increase in Net Assets Resulting from Operations | | | 112,712,758 | | | | 70,402,739 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| From distributable earnings | | | (4,322,594 | ) | | | (5,861,317 | ) |

| From return of capital | | | (20,268,110 | ) | | | (11,773,428 | ) |

| Class C | | | | | | | | |

| From distributable earnings | | | (3,365,580 | ) | | | (4,574,206 | ) |

| From return of capital | | | (14,930,780 | ) | | | (9,203,139 | ) |

| Class I | | | | | | | | |

| From distributable earnings | | | (5,759,735 | ) | | | (6,111,881 | ) |

| From return of capital | | | (35,088,851 | ) | | | (13,722,059 | ) |

| Class L | | | | | | | | |

| From distributable earnings | | | (534,202 | ) | | | (383,276 | ) |

| From return of capital | | | (3,034,353 | ) | | | (1,065,452 | ) |

| Total Distributions to Shareholders | | | (87,304,205 | ) | | | (52,694,758 | ) |

| BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Shares sold | | | 229,930,652 | | | | 107,848,280 | |

| Distributions reinvested | | | 13,638,889 | | | | 10,486,528 | |

| Shares redeemed | | | (45,478,111 | ) | | | (43,203,702 | ) |

| Shares transferred out | | | (41,853,107 | ) | | | – | |

| Class C | | | | | | | | |

| Shares sold | | | 129,145,908 | | | | 83,112,576 | |

| Distributions reinvested | | | 11,933,103 | | | | 8,589,679 | |

| Shares redeemed | | | (31,505,469 | ) | | | (36,598,023 | ) |

| Shares transferred out | | | (1,425,778 | ) | | | – | |

| Class I | | | | | | | | |

| Shares sold | | | 555,137,710 | | | | 240,300,735 | |

| Distributions reinvested | | | 22,702,402 | | | | 10,226,400 | |

| Shares redeemed | | | (67,085,843 | ) | | | (44,327,518 | ) |

| Shares transferred in | | | 43,654,088 | | | | – | |

| Class L | | | | | | | | |

| Shares sold | | | 45,320,799 | | | | 36,874,389 | |

| Distributions reinvested | | | 2,371,314 | | | | 973,503 | |

| Shares redeemed | | | (2,605,496 | ) | | | (257,850 | ) |

| Shares transferred out | | | (375,203 | ) | | | – | |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 863,505,858 | | | | 374,024,997 | |

| Net increase in net assets | | | 888,914,411 | | | | 391,732,978 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 1,178,128,506 | | | | 786,395,528 | |

| End of year | | $ | 2,067,042,917 | | | $ | 1,178,128,506 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2019 | 19 |

| Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2019 | | | For the Year Ended September 30, 2018 | |

| Other Information | | | | | | |

| Share Transactions: | | | | | | |

| Class A | | | | | | |

| Beginning shares | | | 12,451,402 | | | | 9,933,224 | |

| Shares sold | | | 7,633,796 | | | | 3,618,649 | |

| Distributions reinvested | | | 455,793 | | | | 353,410 | |

| Shares redeemed | | | (1,509,363 | ) | | | (1,453,881 | ) |

| Shares transferred out | | | (1,389,846 | ) | | | – | |

| Net increase in shares outstanding | | | 5,190,380 | | | | 2,518,178 | |

| Ending shares | | | 17,641,782 | | | | 12,451,402 | |

| Class C | | | | | | | | |

| Beginning shares | | | 10,012,148 | | | | 8,109,758 | |

| Shares sold | | | 4,446,961 | | | | 2,873,837 | |

| Distributions reinvested | | | 414,114 | | | | 298,457 | |

| Shares redeemed | | | (1,085,210 | ) | | | (1,269,904 | ) |

| Shares transferred out | | | (49,055 | ) | | | – | |

| Net increase in shares outstanding | | | 3,726,810 | | | | 1,902,390 | |

| Ending shares | | | 13,738,958 | | | | 10,012,148 | |

| Class I | | | | | | | | |

| Beginning shares | | | 15,498,144 | | | | 8,666,409 | |

| Shares sold | | | 18,156,358 | | | | 7,965,947 | |

| Distributions reinvested | | | 747,430 | | | | 340,162 | |

| Shares redeemed | | | (2,194,162 | ) | | | (1,474,374 | ) |

| Shares transferred in | | | 1,428,653 | | | | – | |

| Net increase in shares outstanding | | | 18,138,279 | | | | 6,831,735 | |

| Ending shares | | | 33,636,423 | | | | 15,498,144 | |

| Class L | | | | | | | | |

| Beginning shares | | | 1,437,606 | | | | 172,439 | |

| Shares sold | | | 1,510,841 | | | | 1,240,939 | |

| Distributions reinvested | | | 79,640 | | | | 32,837 | |

| Shares redeemed | | | (86,907 | ) | | | (8,609 | ) |

| Shares transferred out | | | (12,541 | ) | | | – | |

| Net increase in shares outstanding | | | 1,491,033 | | | | 1,265,167 | |

| Ending shares | | | 2,928,639 | | | | 1,437,606 | |

The accompanying notes are an integral part of these financial statements.

20

| Bluerock Total Income+ Real Estate Fund | Statement of Cash Flows |

| | | For the Year Ended

September 30, 2019 | |

| Cash Flows from Operating Activities: | | | |

| Net increase in net assets resulting from operations | | $ | 112,712,758 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchase of investments securities | | | (900,571,113 | ) |

| Proceeds from disposition of investment securities | | | 101,164,266 | |

| Net purchases of short-term investment securities | | | (29,994,897 | ) |

| Net realized gain on investments | | | (6,996,972 | ) |

| Net change in unrealized appreciation on investments | | | (88,969,563 | ) |

| Discount and premiums amortized | | | (4,883,038 | ) |

| (Increase)/Decrease in Assets: | | | | |

| Dividends and interest receivable | | | (2,802,339 | ) |

| Prepaid expenses and other assets | | | (65,776 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Shareholder servicing fees payable | | | 61,700 | |

| Investment advisory fees payable | | | 1,403,059 | |

| Administrative fees payable | | | (115,635 | ) |

| Transfer agency fees payable | | | (281,825 | ) |

| Distribution fees payable | | | 71,873 | |

| Insurance fees payable | | | (40,720 | ) |

| Interest due on loan payable | | | 35,386 | |

| Accrued expenses and other liabilities | | | (176,873 | ) |

| Net Cash Used in Operating Activities | | | (819,449,709 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Increase in Line of Credit Borrowing | | | 44,900,000 | |

| Proceeds from shares sold | | | 957,779,745 | |

| Payment on shares redeemed | | | (146,674,919 | ) |

| Cash distributions paid | | | (36,658,497 | ) |

| Net Cash Provided by Financing Activities | | | 819,346,329 | |

| | | | | |

| Net Change in Cash | | | (103,380 | ) |

| | | | | |

| Cash Beginning of Year | | $ | 103,380 | |

| Cash End of Year | | $ | – | |

| | | | | |

| Non-cash financing Activities not included herin consist of reinvestment of distributions of: | | $ | 50,645,708 | |

| Cash paid for interest on lines of credit during the year was: | | | 4,051,997 | |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2019 | 21 |

| Bluerock Total Income+ Real Estate Fund - Class A | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| | | For the Year Ended September 30, 2019 | | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | | | For the Year Ended September 30, 2016 | | | For the Year Ended September 30, 2015 | |

| Net asset value, beginning of year | | $ | 30.00 | | | $ | 29.37 | | | $ | 29.13 | | | $ | 28.68 | | | $ | 27.98 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.33 | | | | 0.21 | | | | 0.23 | | | | 0.23 | | | | 0.39 | |

| Net realized and unrealized gain | | | 1.69 | | | | 2.00 | | | | 1.56 | | | | 1.75 | | | | 1.81 | |

| Total from investment operations | | | 2.02 | | | | 2.21 | | | | 1.79 | | | | 1.98 | | | | 2.20 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | – | | | | – | | | | (0.09 | ) |

| From net realized gain on investments | | | (0.32 | ) | | | (0.54 | ) | | | (0.37 | ) | | | (0.16 | ) | | | (0.29 | ) |

| Return of capital | | | (1.27 | ) | | | (1.04 | ) | | | (1.18 | ) | | | (1.37 | ) | | | (1.12 | ) |

| Total distributions | | | (1.59 | ) | | | (1.58 | ) | | | (1.55 | ) | | | (1.53 | ) | | | (1.50 | ) |

| Net asset value, end of year | | $ | 30.43 | | | $ | 30.00 | | | $ | 29.37 | | | $ | 29.13 | | | $ | 28.68 | |

| TOTAL RETURN(b)(c) | | | 6.94 | % | | | 7.69 | % | | | 6.29 | % | | | 7.08 | % | | | 8.06 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 536,913 | | | $ | 373,488 | | | $ | 291,772 | | | $ | 226,712 | | | $ | 129,287 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.20 | % | | | 2.43 | % | | | 2.37 | % | | | 2.19 | % | | | 2.25 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.21 | % | | | 2.37 | % | | | 2.21 | % | | | 1.82 | % | | | 1.79 | % |

| Ratio of net investment income to average net assets(e) | | | 1.10 | % | | | 0.71 | % | | | 0.80 | % | | | 0.79 | % | | | 1.36 | % |

| Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.94 | % | | | 1.99 | % | | | 2.04 | % | | | 2.19 | % | | | 2.24 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.95 | % | | | 1.93 | % | | | 1.89 | % | | | 1.82 | % | | | 1.78 | % |

| Portfolio turnover rate | | | 8 | % | | | 13 | % | | | 16 | % | | | 18 | % | | | 35 | % |

| (a) | Per share amounts are calculated using the average shares method. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | Represents the ratio of expenses to average net assets absent fee waivers, expense reimbursement and/or recoupment by the Advisor. |

| (e) | The ratios of expenses to average net assets and net investment income to average net assets do not directly reflect the expenses of the underlying institutional private equity real estate investments in which the Fund invests. The Fund invests in each underlying institutional private equity real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

The accompanying notes are an integral part of these financial statements.

22

| Bluerock Total Income+ Real Estate Fund - Class C | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| | | For the Year Ended September 30, 2019 | | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | | | For the Year Ended September 30, 2016 | | | For the Year Ended September 30, 2015 | |

| Net asset value, beginning of year | | $ | 29.02 | | | $ | 28.63 | | | $ | 28.61 | | | $ | 28.38 | | | $ | 27.89 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | 0.10 | | | | (0.01 | ) | | | 0.01 | | | | (0.01 | ) | | | 0.16 | |

| Net realized and unrealized gain | | | 1.63 | | | | 1.93 | | | | 1.52 | | | | 1.75 | | | | 1.82 | |

| Total from investment operations | | | 1.73 | | | | 1.92 | | | | 1.53 | | | | 1.74 | | | | 1.98 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | – | | | | – | | | | (0.09 | ) |

| From net realized gain on investments | | | (0.32 | ) | | | (0.52 | ) | | | (0.37 | ) | | | (0.16 | ) | | | (0.29 | ) |

| Return of capital | | | (1.21 | ) | | | (1.01 | ) | | | (1.14 | ) | | | (1.35 | ) | | | (1.11 | ) |

| Total distributions | | | (1.53 | ) | | | (1.53 | ) | | | (1.51 | ) | | | (1.51 | ) | | | (1.49 | ) |

| Net asset value, end of year | | $ | 29.22 | | | $ | 29.02 | | | $ | 28.63 | | | $ | 28.61 | | | $ | 28.38 | |

| TOTAL RETURN(b)(c) | | | 6.15 | % | | | 6.86 | % | | | 5.50 | % | | | 6.28 | % | | | 7.28 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 401,507 | | | $ | 290,549 | | | $ | 232,200 | | | $ | 153,859 | | | $ | 37,920 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.95 | % | | | 3.18 | % | | | 3.13 | % | | | 2.95 | % | | | 3.04 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.96 | % | | | 3.12 | % | | | 2.97 | % | | | 2.56 | % | | | 2.55 | % |

| Ratio of net investment income/(loss) to average net assets(e) | | | 0.35 | % | | | (0.04 | )% | | | 0.05 | % | | | (0.04 | )% | | | 0.55 | % |

| Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.69 | % | | | 2.74 | % | | | 2.79 | % | | | 2.95 | % | | | 3.02 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.70 | % | | | 2.68 | % | | | 2.63 | % | | | 2.56 | % | | | 2.54 | % |

| Portfolio turnover rate | | | 8 | % | | | 13 | % | | | 16 | % | | | 18 | % | | | 35 | % |

| (a) | Per share amounts are calculated using the average shares method. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | Represents the ratio of expenses to average net assets absent fee waivers, expense reimbursement and/or recoupment by the Advisor. |

| (e) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not directly reflect the expenses of the underlying institutional private equity real estate investments in which the Fund invests. The Fund invests in each underlying institutional private equity real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2019 | 23 |

| Bluerock Total Income+ Real Estate Fund - Class I | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| | | For the Year Ended September 30, 2019 | | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | | | For the Year Ended September 30, 2016 | | | For the Year Ended September 30, 2015 | |

| Net asset value, beginning of year | | $ | 30.40 | | | $ | 29.70 | | | $ | 29.38 | | | $ | 28.85 | | | $ | 28.03 | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income(a) | | | 0.42 | | | | 0.29 | | | | 0.31 | | | | 0.28 | | | | 0.45 | |

| Net realized and unrealized gain | | | 1.72 | | | | 2.01 | | | | 1.57 | | | | 1.79 | | | | 1.88 | |

| Total from investment operations | | | 2.14 | | | | 2.30 | | | | 1.88 | | | | 2.07 | | | | 2.33 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | – | | | | – | | | | (0.10 | ) |

| From net realized gain on investments | | | (0.32 | ) | | | (0.54 | ) | | | (0.37 | ) | | | (0.16 | ) | | | (0.29 | ) |

| Return of capital | | | (1.30 | ) | | | (1.06 | ) | | | (1.19 | ) | | | (1.38 | ) | | | (1.12 | ) |

| Total distributions | | | (1.62 | ) | | | (1.60 | ) | | | (1.56 | ) | | | (1.54 | ) | | | (1.51 | ) |

| Net asset value, end of year | | $ | 30.92 | | | $ | 30.40 | | | $ | 29.70 | | | $ | 29.38 | | | $ | 28.85 | |

| TOTAL RETURN(b)(c) | | | 7.23 | % | | | 7.91 | % | | | 6.58 | % | | | 7.36 | % | | | 8.51 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 1,040,017 | | | $ | 471,116 | | | $ | 257,366 | | | $ | 110,845 | | | $ | 25,274 | |

| Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |