united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22710

Total Income+ Real Estate Fund

(Exact name of registrant as specified in charter)

712 Fifth Avenue, 9th floor, New York NY 10019

(Name and address of agent for service)

Registrant's telephone number, including area code: 1- 888-459-1059

Date of fiscal year end: 9/30

Date of reporting period: 9/30/16

Item 1. Reports to Stockholders.

| | | |

| | | |

| | | |

| | | |

| | | |

| |  | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Annual Report | |

| | September 30, 2016 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Investor Information: 1-888-459-1059 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Total Income+ Real Estate Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | | |

| | Distributed by Northern Lights Distributors, LLC | |

| | Member FINRA | |

| | | |

| | | |

| | | |

| |  |

| | | |

| | | 2016 ANNUAL REPORT: (4Q 2015-3Q 2016) |

| | | Letter from the TI+ Portfolio Managers |

To Our Valued Shareholders:

We are pleased to report that TI+ has surpassed $500 million in assets under management in October 2016. We believe this validates our 4+ year track record of income, low volatility, capital appreciation, and low correlation to the broader markets.

Specifically, TI+ has paid 15 consecutive distributions, has experienced 85% less volatility than leading stock and REIT indexes since inception, and has performed similar to the public REIT market since inception, with a minimal 1.29% maximum drawdown and with approximately ½ the correlation to the S&P 500 relative to the public REIT market.

The low volatility combined with the Fund’s performance allows TI+ to have a risk-adjusted return 4 and 5 times higher than the S&P 500 and the MSCI US REIT Index, respectively. This indicates that for each unit of volatility, a TI+ investor has generated four to five times the return produced by the index.

By investing in low leverage, lower volatility, institutional real estate investments, in keeping with our investment thesis, TI+ has been able to produce stable cash flows that are not highly correlated to daily stock market fiuctuations.

| + | DISTRIBUTIONS1: TI+ has paid fifteen consecutive quarterly distributions beginning in the first full quarter of Fund operations (first quarter 2013). The latest distribution of $0.3834 per share is equivalent to a 5.25% annualized distribution rate on the 9/29/2016 ex-dividend date NAV of $29.21 per share. This distribution also represents a 6.13% distribution rate on the inception NAV of $25.00 per share. |

| + | ASSETS UNDER MANAGEMENT: As of October 18, 2016, TI+ assets exceeded $500 million. |

footnotes:

| 1 | The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed. However, this distribution policy is subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. A portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. The Fund’s distribution amounts were calculated based on income received from underlying investments including capital gains and return of capital realized from the disposition of such investments. |

This is an actively managed dynamic portfolio. There is no guarantee that any investment (or this investment) will achieve its objectives or goals, pay dividends and/or capital gains, generate positive returns, or avoid losses. Prior performance is not a guarantee of future results.

CORPORATE HEADQUARTERS | 712 FIFTH AVENUE | 9TH FLOOR | NEW YORK, NY 10019 | 877.826.BLUE (2583) | WWW.BLUEROCKRE.COM

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

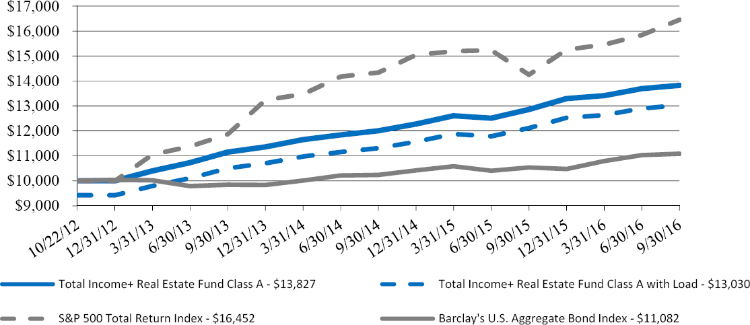

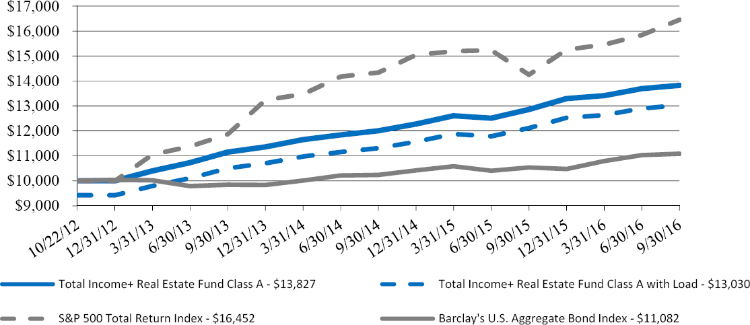

PERFORMANCE

From inception (10/22/2012) through 9/30/2016, TI+ experienced a total return of 38.27%, or 8.57% annualized. The Fund was able to accomplish this primarily through investments in unique, institutional private equity real estate (iPERE) vehicles. These investments with best-in-class real estate, supplemented by select public real estate securities, have generated attractive returns through income and capital appreciation.

| | Performance as of 9.30.2016 |

| | Year-to-Date2 | One Year | Two Years | Three Years | Since Inception3 |

| TI+ Fund- Class A | 4.00% | 7.51% | 7.32% | 7.44% | 8.57% |

TI+ Fund- Class A1

with Max Sales Charge | - 1.97% | 1.31% | 4.19% | 5.34% | 6.95% |

| 1 The maximum sales charge for the Fund is 5.75%. Investors may be eligible for a reduction in sales charges. | 2 | Performance for periods less than one year is not annualized. |

| | 3 | Inception date of the Fund is October 22, 2012. |

| | | |

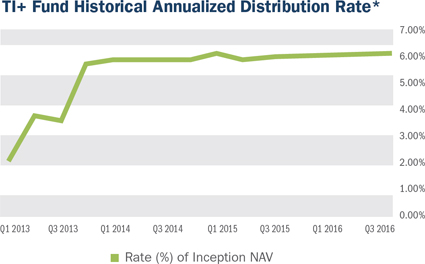

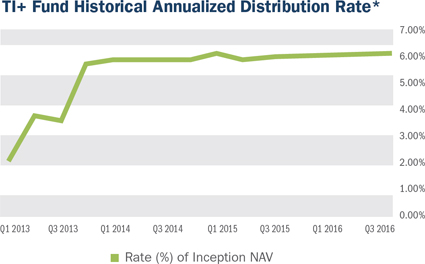

INCOME

TI+ Fund offers attractive cash distribution potential.

TI+ Fund Historical Annualized Distribution Rate*

| * | The Fund’s distribution policy is to make quarterly distributions to shareholders. The Fund’s inception date is 10/22/12; however, its first distribution was made 3/27/13. The level of quarterly distributions (including any return of capital) is not fixed. However, this distribution policy is subject to change. The Fund’s distribution amounts were calculated based on the ordinary income received from the underlying investments, including short-term capital gains realized from the disposition of such investments. Shareholders should not assume that the source of a distribution from the Fund is net profit. |

A portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of the year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Company will continue to declare distributions or that they will continue at these rates.

Inception date of the Fund is October 22, 2012. The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.46% for Class A shares (per the May 16, 2016 prospectus).

The performance data quoted herein represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until February 1, 2017, to ensure that the net annual fund Class A operating expenses will not exceed 1.91% for TIPRX, subject to possible recoupment from the Fund.

Please review the Fund’s Prospectus for more detail on the expense waiver. Results shown reflect the full fee waiver, without which the results could have been lower. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. Total returns are calculated using SEC form N-1A instructions and reflect all fees and charges.

Past performance is no guarantee of future results

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

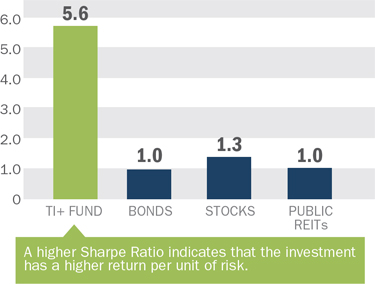

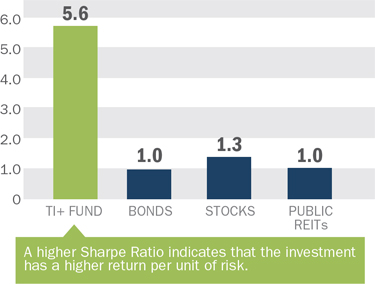

HIGHER RISK-ADJUSTED RETURNS

TI+ Fund has delivered higher risk-adjusted returns than stocks, bonds, or public REITs since its inception, evidenced by its Sharpe Ratio (a risk adjusted performance measure that determines unit of return per unit of risk) of more than four times the nearest competitive asset class.

Higher Risk-Adjusted Return Measured by Sharpe Ratio

(Since inception through 9/30/2016)

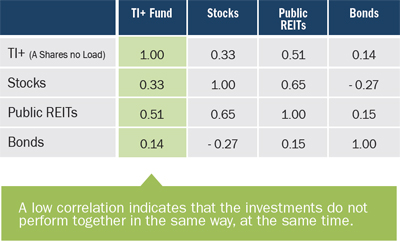

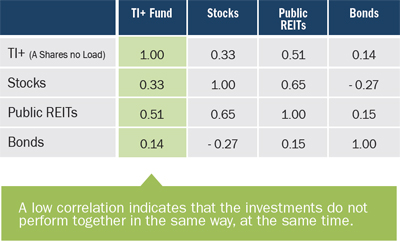

LOWER CORRELATION

TI+ Fund has exhibited lower correlation compared to other asset classes since its inception.

TI+ Fund Correlation vs. Other Asset Classes

(Since inception through 9/30/2016)

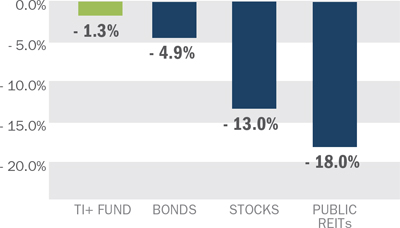

| LOWER VOLATILITY |

| |

| TI+ Fund has experienced lower daily volatility (as measured by standard deviation) than competing asset classes since its inception, with over 85% less volatility than stocks and public REITs. |

| |

| Lower Volatility Measured by Standard Deviation |

| (Since inception through 9/30/2016) |

| |

|

| |

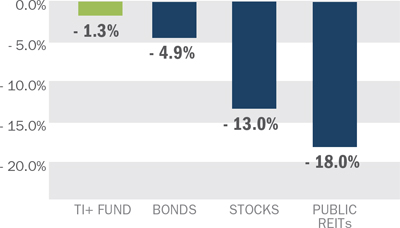

| LOW MAXIMUM DRAWDOWN |

| |

| Maximum drawdown is the maximum decline a security experiences prior to reaching its previous peak. |

| |

| Maximum Drawdown vs. Other Asset Classes |

| (Since inception through 9/30/2016) |

| |

|

| |

Page Sources: Morningstar Direct

TI+ Fund: A-Shares, no load | Stocks: S&P 500 Total Return | REITs: MSCI U.S. REIT Index | Bonds: Barclays U.S. Aggregate Bond Index

Please see page 8 for a description of the risks and comparisons of the investment indexes selected.

| * | Percentage of days in period in which the index/investment has increased or stayed the same as the prior days’ closing price. |

Past performance is no guarantee of future results

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

| | » Fund Sub-Advisor |

| | |

| |  |

| | |

| | Mercer Investment Management, Inc., a sub-advisor to the Fund, has a 40+ year track record as a leading advisor to the world’s most sophisticated institutional investors, including endowments, pension funds, sovereign wealth funds and family offices. Mercer has more than 3,300 clients worldwide and over $9.0 trillion in assets under advisement. |

| | |

| | Mercer’s analysis incorporates a comprehensive, disciplined process beginning with the evaluation of over 5,400 investment managers and 26,200 individual investments across all sectors from which it selects a strategic combination of ‘best in class’ institutional real estate managers and investments for TI+. |

| | |

LOOKING AHEAD

The U.S. economy has been characterized by moderate growth, low inflation, and low interest rates for the last several years, a mix of conditions that have proven favorable to commercial real estate pricing and fundamentals. The upcoming Presidential inauguration introduces uncertainty for the financial markets as participants weigh the macro effects of potential new policies. A sharp rise in interest rates since the election, especially the 10-year U.S. Treasury rate, has not gone unnoticed; although this needs to be placed in context, as the 10-year Treasury was still trading below levels where it was last December. These, among other market factors, have impacted the public REIT market, increasing volatility, while private market, institutional property pricing remains mostly unchanged.

A review of the determinants and fundamentals of commercial real estate values remains favorable. Institutional real estate has experienced above-trend returns during this latest expansion cycle. As this phase matures, the appreciation component gives way to primarily income returns, historically the source of about 70% of the total return. As illustrated in the charts to the right, income drivers are strong with 5%+ annual net operating income (NOI) growth throughout all sectors and vacancy rates near the bottom of their 25-year averages. Favorable demographic trends combined with limited new supply are driving this NOI growth. With new supply forecast to remain low compared to historical trends and strong demand from tenants, we expect to see favorable NOI growth continue. In constructing the portfolio, we have been focused on investing where NOI growth is robust and insulated from downside risk.

Source: J.P. Morgan Guide to the Markets, Q2 2016

The Millennial cohort is forming households at a rapid rate and is largely choosing to rent, creating unprecedented demand for apartments, particularly highly amenitized, urban in-fill communities. E-commerce sales have been accelerating, creating a need for timely deliveries and is driving industrial demand, especially for those properties that give retailers access to the last mile of distribution. CBD office properties have been experiencing strong demand and we are encouraged to see the retail sector continue to recover.

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

Property market fundamentals are solid and capital markets have been quite restrained, helping to inhibit possible unhealthy and unsustainable price appreciation. Cap rate spread, the spread between the average cap rate and the 10-year U.S. Treasury yield, remains comfortably above its long term average, a historical indicator of above-trend returns in coming years. Loan markets also remain disciplined with tighter lending standards and higher debt service coverage requirements, a marked change from the pre-Recession years.

We are cognizant of the potential effects that changing governmental policies may have on commercial

real estate values. Additionally, we understand long term value and returns are driven by property sector fundamentals, including job growth, demographic demand drivers, high occupancy rates, and rising rents. To this end, we are focused on constructing an underlying portfolio of high-quality, diversified institutional real estate that continues to benefit from the aforementioned fundamentals. Thus, we remain optimistic that TI+ will continue to perform well on a risk-adjusted basis in the next fiscal year. We thank you for the trust and confidence represented by your investment in the Total Income+ Real Estate Fund.

Sincerely,

| Jordan Ruddy | Adam Lotterman |

| Portfolio Co-Managers |

| Total Income+ Real Estate Fund |

| FUND HOLDINGS | 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

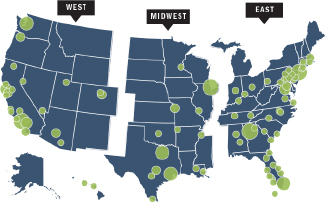

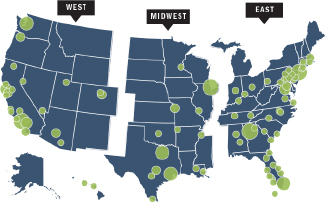

As of 10/06/16, the Gross Asset Value of the underlying real estate in the securities in which TI+ is invested is over $134 billion, comprising nearly 2,300 properties across the United States.*

| | | | Portfolio | | Gross Asset | | Number of | | Typical Minimum | | Average Investment | | Inception |

| | | | | | Value ($MM) | | Investments | | Investment Required | | Size ($MM) | | Year |

| | PRIVATE EQUITY REAL ESTATE (Target of 15-20 Select Managers) |

| ■ | 14.1% | | Clarion Lion Properties Fund | | $ | 9,251 | | | 124 | | | $ | 5,000,000 | | | $75 | | 2000 |

| ■ | 11.6% | | Morgan Stanley Prime Property Fund | | $ | 20,181 | | | 341 | | | $ | 5,000,000 | | | $59 | | 1973 |

| ■ | 8.1% | | Blackstone Property Partners | | $ | 7,000 | | | 56 | | | $ | 10,000,000 | | | $125 | | 2014 |

| ■ | 7.0% | | Stockbridge Smart Markets Fund | | $ | 1,857 | | | 50 | | | $ | 5,000,000 | | | $37 | | 2011 |

| ■ | 5.5% | | Prudential PRISA I | | $ | 22,900 | | | 273 | | | $ | 5,000,000 | | | $84 | | 1970 |

| ■ | 5.4% | | Bentall Kennedy MEPT Edgemoor | | $ | 8,144 | | | 87 | | | $ | 5,000,000 | | | $94 | | 2010 |

| ■ | 4.4% | | AEW Core Property Trust | | $ | 7,869 | | | 145 | | | $ | 5,000,000 | | | $31 | | 2007 |

| ■ | 4.4% | | Prologis Targeted U.S. Logistics Fund | | $ | 5,312 | | | 172 | | | $ | 5,000,000 | | | $54 | | 2004 |

| ■ | 4.3% | | Invesco Core Real Estate | | $ | 11,100 | | | 93 | | | $ | 5,000,000 | | | $119 | | 2004 |

| ■ | 4.2% | | JP Morgan US Real Estate Growth & Income Fund | | $ | 4,124 | | | 86 | | | $ | 10,000,000 | | | $48 | | 2002 |

| ■ | 4.2% | | RREEF America REIT II | | $ | 12,243 | | | 109 | | | $ | 5,000,000 | | | $112 | | 1998 |

| ■ | 3.6% | | Blackrock Granite Property Fund | | $ | 2,600 | | | 41 | | | $ | 1,000,000 | | | $63 | | 1981 |

| ■ | 3.6% | | Sentinel Real Estate Fund | | $ | 1,420 | | | 25 | | | $ | 250,000 | | | $57 | | 1976 |

| ■ | 3.5% | | Principal Enhanced Property Fund | | $ | 2,215 | | | 39 | | | $ | 5,000,000 | | | $57 | | 2004 |

| ■ | 3.3% | | UBS Trumbull Property Growth & Income | | $ | 816 | | | 22 | | | $ | 5,000,000 | | | $37 | | 2006 |

| ■ | 2.8% | | Heitman America REIT LP | | $ | 8,720 | | | 81 | | | $ | 5,000,000 | | | $108 | | 2007 |

| ■ | 2.7% | | Clarion Lion Industrial Trust | | $ | 7,961 | | | 562 | | | $ | 2,500,000 | | | $14 | | 2002 |

| ■ | 1.4% | | Stockbridge Value Fund II | | $ | 529 | | | 19 | | | $ | 5,000,000 | | | $28 | | 2014 |

| | Totals / Averages | | $ | 134,000 | | | 2,325 | | | $ | 88,750,000 | | | $58 | | 1999 |

| | PUBLIC REAL ESTATE SECURITIES (Target of 50-100 Real Estate Securities) |

| ■ | 2.5% | | REIT Common & Preferred Stock | | | | | | | | | | | | | | | |

| GEOGRAPHIC DIVERSIFICATION | | | SECTOR DIVERSIFICATION |

| | | | |

| The regions and allocations presented represent the Funds’ institutional fund investments as of the date herein, but is subject to change at any time. | | | The sector diversification presented above represents examples of how the Funds’ institutional fund investments are allocated as of the date herein, but is subject to change at any time. |

| | | | |

| | |  |

| | | | |

| 2,300+ Properties | | | |

Portfolio holdings are subject to change at any time and should not be considered investment advice. Data as of Q2 2016 based on allocations by the Fund on 10/4/2016. Diversification does not ensure profit. The organizations referenced above are not invested in Bluerock or the Total Income+ Real Estate Fund, and they may not be invested in the funds in which the Total Income+ Real Estate Fund invests.

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

HIGHLIGHTED ASSETS

The properties pictured below are currently owned by the underlying third-party private equity real estate securities described herein. Each of these securities has been selected as an investment for TI+ Fund’s portfolio.

Active Portfolio; subject to change.

| 2016 ANNUAL REPORT (10/1/2015 - 9/30/2016) | TOTAL INCOME+ REAL ESTATE FUND |  |

DEFINITIONS

Barclays U.S. Aggregate Bond Index: The Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States - including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Risks include rising interest rates, credit quality of the issuers and general economic conditions.

Standard Deviation: The standard deviation of the daily percentage change in an investment. Standard deviation shows how much variation from the average exists with a larger number indicating the data points are more spread out over a larger range of values.

MSCI U.S. REIT Index: A free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. (www.msci.com).

Sharpe Ratio: Measurement of the risk-adjusted performance. The annualized Sharpe ratio is calculated by subtracting the annualized risk-free rate - (3-month Treasury Bill) - from the annualized rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

S&P 500: An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/ return characteristics of the large cap universe. (Investopedia).

You cannot invest directly in an index. Benchmark performance should not be considered reflective of Fund performance.

| Total Income+ Real Estate Fund |

| Portfolio Review (Unaudited) |

| Since Inception through September 30, 2016* |

| |

| Comparison of the Change in Value of a $10,000 Investment |

The Fund’s performance figures for the year ended September 30, 2016, compared to its benchmarks:

| | | | | Since Inception | Since Inception Class C |

| | One Year | Two Years | Three Years | Class A * | and Class I ** |

| Total Income+ Real Estate | | | | | |

| Fund: | | | | | |

| Class A | | | | | |

| Without Load | 7.51% | 7.32% | 7.44% | 8.57% | — |

| With Load + | 1.31% | 4.19% | 5.34% | 6.95% | — |

| Class C | 6.71% | 6.52% | N/A | — | 6.31% |

| Class I | 7.79% | 7.69% | N/A | — | 7.45% |

| S&P 500 Total Return Index | 15.43% | 7.11% | 11.16% | 13.47% | 8.01% |

| Barclays U.S. Aggregate Bond Index | 5.19% | 4.06% | 4.03% | 2.64% | 4.19% |

| * | Class A commenced operations October 22, 2012. |

| ** | Class C and Class I commenced operations April 1, 2014. |

| + | Adjusted for initial maximum sales charge of 5.75%. |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the Advisor not waived its fees and reimbursed a portion of the Fund’s expenses. Returns greater than one year are annualized. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until February 1, 2017, to ensure that the net annual fund operating expenses and acquired fund fees and expenses (excluding taxes, interest, brokerage and extraordinary expenses) will not exceed 1.91%, 2.66% and 1.66%, respectively for Class A, Class C and Class I shares. The Fund has agreed to repay the Advisor in the amount of any fees the Advisor previously waived and or Fund expenses reimbursed, subject to the limitations that: (1) the reimbursement will be made only for fees and expenses incurred not more than three years from the end of the fiscal year in which they were incurred; (2) the reimbursement may not be made if it would cause the Expense Limitation then in effect or in effect at time of waiver to be exceeded; and (3) the reimbursement is approved by the Fund’s Board of Trustees.

| Total Income+ Real Estate Fund |

| Portfolio Review (Unaudited) (Continued) |

| Since Inception through September 30, 2016* |

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 2.46%, 3.25%, and 2.24% for Class A, Class C and Class I, respectively, per the May 16, 2016 Class A and Class C share prospectus and the February 1, 2016 prospectus with respect to Class I shares. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75% and Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-888-459-1059.

| Portfolio Composition as of September 30, 2016 (Unaudited) |

| | | | |

| | | Percent of Net | |

| | | Assets | |

| Private Equity Real Estate Securities | | | 83.14 | % |

| Short-Term Investments | | | 13.41 | % |

| Public Equity Real Estate Securities | | | 2.07 | % |

| Preferred Stock | | | 0.78 | % |

| Total Investments | | | 99.40 | % |

| Other Assets Less Liabilities | | | 0.60 | % |

| Total Net Assets | | | 100.00 | % |

See the Portfolio of Investments in this annual report for a more detailed account of the Fund’s holdings.

| Total Income+ Real Estate Fund |

| PORTFOLIO OF INVESTMENTS |

| September 30, 2016 |

| Shares | | | Security | | Value | |

| | | | | PRIVATE EQUITY REAL ESTATE SECURITIES - 83.14% | | | | |

| | | | | APARTMENTS - 3.58% | | | | |

| | 212 | | | Sentinel Real Estate Fund | | $ | 17,580,176 | |

| | | | | | | | | |

| | | | | DIVERSIFIED - 75.61% | | | | |

| | 21,994 | | | AEW Core Property Trust | | | 21,334,253 | |

| | 194 | | | Blackrock Granite Property | | | 17,853,037 | |

| | 34,479 | | | Blackstone Property Partners ** | | | 40,669,880 | |

| | 61,148 | | | Clarion Lion Properties Fund | | | 82,744,041 | |

| | 11,968 | | | Heitman American Real Estate Fund | | | 13,756,985 | |

| | 127 | | | Invesco Real Estate Fund | | | 21,158,491 | |

| | 7,357,217 | | | J.P. Morgan US Real Estate Growth & Income LP | | | 10,520,821 | |

| | 12,139 | | | MEPT Edgemoor LP * | | | 22,501,755 | |

| | 1,997 | | | Morgan Stanley Prime Property Fund LLC | | | 34,169,992 | |

| | 719,857 | | | Principal Enhanced Property Fund LP | | | 8,386,330 | |

| | 15,737 | | | Prudential PRISA 1 | | | 21,987,436 | |

| | 162,069 | | | RREEF America REIT II, Inc. | | | 18,417,504 | |

| | 24,112 | | | Stockbridge Smart Markets Fund | | | 34,455,131 | |

| | — | | | Stockbridge Value Fund II | | | 7,064,344 | |

| | 765 | | | UBS Trumbull Property G&I Fund | | | 16,525,525 | |

| | | | | | | | 371,545,525 | |

| | | | | INDUSTRIAL - 3.95% | | | | |

| | 9,032 | | | Clarion Lion Industrial Trust | | | 13,399,475 | |

| | 5,209 | | | Prologis Targeted US Logistics | | | 6,001,647 | |

| | | | | | | | 19,401,122 | |

| | | | | | | | | |

| | | | | TOTAL PRIVATE EQUITY REAL ESTATE SECURITIES (Cost - $374,036,028) | | | 408,526,823 | |

| | | | | | | | | |

| | | | | PUBLIC EQUITY REAL ESTATE SECURITIES - 2.07% | | | | |

| | | | | PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS - 0.27% | | | | |

| | | | | DIVERSIFIED - 0.23% | | | | |

| | 68,376 | | | CNL Lifestyle Properties # | | | 195,556 | |

| | 61,761 | | | Dividend Capital Diversified Property Fund | | | 461,975 | |

| | 140,161 | | | Highlands REIT # | | | 49,056 | |

| | 140,161 | | | InvenTrust Properties Trust # | | | 423,285 | |

| | | | | | | | 1,129,872 | |

| | | | | OFFICE - 0.04% | | | | |

| | 27,152 | | | Hines Real Estate Investment Trust # | | | 176,489 | |

| | | | | | | | | |

| | | | | TOTAL PUBLIC NON -TRADED REAL ESTATE INVESTMENT TRUSTS (Cost - $1,189,072) | | | 1,306,361 | |

| | | | | | | | | |

| | | | | PUBLICLY TRADED REAL ESTATE INVESTMENT TRUSTS - 1.80% | | | | |

| | | | | APARTMENTS - 0.16% | | | | |

| | 2,645 | | | American Campus Communities, Inc. | | | 134,551 | |

| | 2,455 | | | Apartment Investment & Management Co | | | 112,709 | |

| | 4,913 | | | Education Realty Trust, Inc. | | | 211,947 | |

| | 2,020 | | | Mid-America Apartment Communities, Inc. | | | 189,860 | |

| | 13,206 | | | Monogram Residential Trust, Inc. | | | 140,512 | |

| | | | | | | | 789,579 | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2016 |

| Shares | | | Security | | Value | |

| | | | | DATA CENTERS - 0.22% | | | | |

| | 4,418 | | | CoreSite Realty Corp | | $ | 327,109 | |

| | 7,040 | | | CyrusOne, Inc. | | | 334,893 | |

| | 2,474 | | | Digital Realty Trust, Inc. | | | 240,275 | |

| | 4,272 | | | DuPont Fabros Technology, Inc. | | | 176,220 | |

| | | | | | | | 1,078,497 | |

| | | | | DIVERSIFIED - 0.05% | | | | |

| | 2,083 | | | PS Business Parks, Inc. | | | 236,566 | |

| | | | | | | | | |

| | | | | HEALTHCARE - 0.13% | | | | |

| | 7,862 | | | Healthcare Realty Trust, Inc. | | | 267,780 | |

| | 6,808 | | | Healthcare Trust of America, Inc. | | | 222,077 | |

| | 2,960 | | | LTC Properties, Inc. | | | 153,890 | |

| | | | | | | | 643,747 | |

| | | | | HOTELS - 0.05% | | | | |

| | 17,520 | | | Xenia Hotels & Resorts, Inc. | | | 265,954 | |

| | | | | | | | | |

| | | | | INDUSTRIAL - 0.15% | | | | |

| | 4,598 | | | DCT Industrial Trust, Inc. | | | 223,233 | |

| | 7,749 | | | Duke Realty Corp. | | | 211,780 | |

| | 7,453 | | | First Industrial Realty Trust, Inc. | | | 210,324 | |

| | 2,034 | | | Prologis, Inc. | | | 108,900 | |

| | | | | | | | 754,237 | |

| | | | | MANUFACTURED HOMES - 0.09% | | | | |

| | 4,008 | | | Equity LifeStyle Properties, Inc. | | | 309,338 | |

| | 1,841 | | | Sun Communities, Inc. | | | 144,482 | |

| | | | | | | | 453,820 | |

| | | | | OFFICE - 0.13% | | | | |

| | 1,087 | | | Alexandria Real Estate Equities, Inc. | | | 118,233 | |

| | 2,650 | | | Columbia Property Trust, Inc. | | | 59,333 | |

| | 3,439 | | | Douglas Emmett, Inc. | | | 125,970 | |

| | 3,163 | | | Highwoods Properties, Inc. | | | 164,855 | |

| | 4,839 | | | Piedmont Office Realty Trust, Inc. | | | 105,345 | |

| | 1,968 | | | Tier REIT, Inc. | | | 30,386 | |

| | | | | | | | 604,122 | |

| | | | | REGIONAL MALLS - 0.05% | | | | |

| | 1,615 | | | Macerich Co. | | | 130,605 | |

| | 650 | | | Simon Property Group, Inc. | | | 134,557 | |

| | | | | | | | 265,162 | |

| | | | | SELF STORAGE - 0.16% | | | | |

| | 6,019 | | | CubeSmart | | | 164,078 | |

| | 2,667 | | | Extra Space Storage, Inc. | | | 211,786 | |

| | 3,403 | | | Iron Mountain, Inc. | | | 127,715 | |

| | 1,103 | | | Life Storage, Inc. | | | 98,101 | |

| | 798 | | | Public Storage | | | 178,066 | |

| | | | | | | | 779,746 | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2016 |

| Shares | | | Security | | Value | |

| | | | | SHOPPING CENTERS - 0.28% | | | | |

| | 5,415 | | | Equity One, Inc. | | $ | 165,753 | |

| | 1,339 | | | Federal Realty Investment Trust | | | 206,112 | |

| | 5,083 | | | Kimco Realty Corp. | | | 147,153 | |

| | 5,569 | | | Ramco-Gershenson Properties Trust | | | 104,363 | |

| | 2,742 | | | Regency Centers Corp. | | | 212,476 | |

| | 9,553 | | | Retail Opportunity Investments Corp. | | | 209,784 | |

| | 1,776 | | | Saul Centers, Inc. | | | 118,282 | |

| | 4,695 | | | Urstadt Biddle Properties, Inc. | | | 104,323 | |

| | 2,663 | | | Weingarten Realty Investors | | | 103,804 | |

| | | | | | | | 1,372,050 | |

| | | | | SINGLE TENANT - 0.18% | | | | |

| | 6,047 | | | Agree Realty Corp. | | | 298,964 | |

| | 3,993 | | | National Retail Properties, Inc. | | | 203,044 | |

| | 3,300 | | | Realty Income Corp. | | | 220,869 | |

| | 13,245 | | | Spirit Realty Capital, Inc. | | | 176,556 | |

| | | | | | | | 899,433 | |

| | | | | SPECIALITY- 0.15% | | | | |

| | 1,766 | | | Crown Castle International Corp. | | | 166,375 | |

| | 3,000 | | | EPR Properties | | | 236,220 | |

| | 923 | | | Equinix, Inc. | | | 332,511 | |

| | | | | | | | 735,106 | |

| | | | | | | | | |

| | | | | TOTAL PUBLICLY TRADED REAL ESTATE INVESTMENT TRUSTS (Cost - $8,657,269) | | | 8,878,019 | |

| | | | | | | | | |

| | | | | TOTAL PUBLIC EQUITY REAL ESTATE SECURITIES (Cost - $9,846,341) | | | 10,184,380 | |

| | | | | | | | | |

| | | | | PREFERRED STOCK - 0.78% | | | | |

| | | | | DATA CENTERS - 0.16% | | | | |

| | 14,812 | | | Digital Realty Trust, Inc. | | | 379,483 | |

| | | | | | | | | |

| | | | | INDUSTRIAL - 0.07% | | | | |

| | 14,580 | | | STAG Industrial, Inc. | | | 392,494 | |

| | 14,550 | | | Terreno Realty Corp. | | | 375,390 | |

| | | | | | | | 767,884 | |

| | | | | OFFICE PROPERTY - 0.16% | | | | |

| | 14,748 | | | Corporate Office Properties Trust | | | 381,972 | |

| | 14,766 | | | VEREIT, Inc. | | | 393,366 | |

| | | | | | | | 775,338 | |

| | | | | REGIONAL MALLS - 0.23% | | | | |

| | 15,350 | | | CBL & Associates Properties, Inc. | | | 383,904 | |

| | 14,725 | | | Taubman Centers, Inc. | | | 384,617 | |

| | 14,881 | | | Washington Prime Group, Inc. | | | 388,097 | |

| | | | | | | | 1,156,618 | |

| | | | | SHOPPING CENTERS - 0.16% | | | | |

| | 14,789 | | | Kimco Realty Corp. | | | 383,035 | |

| | 14,591 | | | Retail Properties of America, Inc. | | | 377,177 | |

| | | | | | | | 760,212 | |

| | | | | | | | | |

| | | | | TOTAL PREFERRED STOCK (Cost - $3,863,192) | | | 3,839,535 | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2016 |

| Shares | | | Security | | Value | |

| | | | | SHORT-TERM INVESTMENTS - 13.41% | | | | |

| | 65,944,645 | | | Dreyfus Cash Management - Institutional Class, 0.20% + | | $ | 65,944,645 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost - $65,944,645) | | | | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.40% (Cost - $453,690,206) (a) | | | 488,495,383 | |

| | | | | OTHER ASSETS LESS LIABILITIES - 0.60% | | | 2,921,267 | |

| | | | | NET ASSETS - 100.00% | | $ | 491,416,650 | |

| * | Non-income producing security. |

| ** | Holding is comprised of two entities with the same issuer. |

| # | Value estimated using Fair Valuation Procedures adopted by the Board of Trustees. Total value of such securities is $844,386 or 0.17% of net assets. |

| + | Money market fund; interest rate reflects the seven-day effective yield on September 30, 2016. |

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $446,496,661 and differs from the value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized appreciation: | | $ | 42,568,710 | |

| Unrealized depreciation: | | | (569,988 | ) |

| Net unrealized appreciation: | | $ | 41,998,722 | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2016 |

| Assets: | | | |

| Investments in Securities at Value (identified cost $453,690,206) | | $ | 488,495,383 | |

| Dividends and Interest Receivable | | | 2,303,698 | |

| Receivable for Fund Shares Sold | | | 1,272,356 | |

| Prepaid Expenses and Other Assets | | | 110,651 | |

| Total Assets | | | 492,182,088 | |

| | | | | |

| Liabilities: | | | | |

| Loan Payable | | | 1,326 | |

| Redemptions Payable | | | 4,937 | |

| Payable to Investment Advisor | | | 437,278 | |

| Distribution Fees Payable | | | 99,490 | |

| Shareholder Servicing Fees Payable | | | 77,247 | |

| Payable to Related Parties | | | 45,572 | |

| Other Accrued Expenses | | | 99,588 | |

| Total Liabilities | | | 765,438 | |

| | | | | |

| Net Assets | | $ | 491,416,650 | |

| | | | | |

| Class A: | | | | |

| Net Assets (no par value; unlimited number of shares authorized; 7,783,628 shares of beneficial interest outstanding) | | $ | 226,712,012 | |

| Net Asset Value and Redemption Price Per Share ($226,712,012/7,783,628 shares of beneficial interest outstanding) | | $ | 29.13 | |

Maximum Offering Price Per Share

($29.13/0.9425) | | $ | 30.91 | |

| | | | | |

| Class C: | | | | |

| Net Assets (no par value; unlimited number of shares authorized; 5,378,227 shares of beneficial interest outstanding) | | $ | 153,859,317 | |

| Net Asset Value, Offering and Redemption Price Per Share * ($153,859,317/5,378,227 shares of beneficial interest outstanding) | | $ | 28.61 | |

| | | | | |

| Class I: | | | | |

| Net Assets (no par value; unlimited number of shares authorized; 3,773,245 shares of beneficial interest outstanding) | | $ | 110,845,321 | |

| Net Asset Value, Offering and Redemption Price Per Share ($110,845,321/3,773,245 shares of beneficial interest outstanding) | | $ | 29.38 | |

| | | | | |

| Composition of Net Assets: | | | | |

| At September 30, 2016, Net Assets Consisted of: | | | | |

| Paid-in-Capital | | $ | 453,475,134 | |

| Undistributed Net Investment Income | | | 3,161,971 | |

| Accumulated Net Realized Loss on Investments | | | (25,632 | ) |

| Net Unrealized Appreciation on Investments | | | 34,805,177 | |

| Net Assets | | $ | 491,416,650 | |

| | | | | |

Commitments and Contingencies (See Note 8)

| * | Class C charges a 1.00% fee on shares redeemed less than 365 days after the purchase. |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2016 |

| Investment Income: | | | | |

| Dividend Income | | $ | 8,183,112 | |

| Interest Income | | | 77,399 | |

| Total Investment Income | | | 8,260,511 | |

| | | | | |

| Expenses: | | | | |

| Investment Advisory Fees | | | 4,808,355 | |

| Shareholder Servicing Fees | | | | |

| Class A | | | 421,956 | |

| Class C | | | 224,256 | |

| Distribution Fees | | | | |

| Class C | | | 672,767 | |

| Transfer Agent Fees | | | 265,120 | |

| Administration Fees | | | 216,337 | |

| Printing Expense | | | 211,057 | |

| Custody Fees | | | 145,663 | |

| Legal Fees | | | 92,801 | |

| Registration & Filing Fees | | | 82,863 | |

| Non 12b-1 Shareholder Servicing Fees | | | 73,328 | |

| Fund Accounting Fees | | | 33,000 | |

| Professional Fees | | | 30,000 | |

| Trustees’ Fees | | | 30,000 | |

| Insurance Expense | | | 26,070 | |

| Audit Fees | | | 22,999 | |

| Miscellaneous Expenses | | | 2,006 | |

| Total Expenses | | | 7,358,578 | |

| Less: Fees Waived by Advisor | | | (997,305 | ) |

| | | | | |

| Net Expenses | | | 6,361,273 | |

| | | | | |

| Net Investment Income | | | 1,899,238 | |

| | | | | |

| Net Realized and Unrealized Gain on Investments: | | | | |

| Net Realized Loss on Investments | | | (688,489 | ) |

| Distributions of Capital Gains From Underlying Investment Companies | | | 1,353,129 | |

| Net Change in Unrealized Appreciation on Investments | | | 20,431,438 | |

| Net Realized and Unrealized Gain on Investments | | | 21,096,078 | |

| | | | | |

| Net Increase in Net Assets Resulting From Operations | | $ | 22,995,316 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | September 30, 2016 | | | September 30, 2015 | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 1,899,238 | | | $ | 1,778,951 | |

| Net Realized Gain (Loss) on Investments | | | (688,489 | ) | | | (28,019 | ) |

| Distributions of Capital Gains From Underlying Investment Companies | | | 1,353,129 | | | | 488,862 | |

| Net Change in Unrealized Appreciation on Investments | | | 20,431,438 | | | | 8,997,981 | |

| Net Increase in Net Assets Resulting From Operations | | | 22,995,316 | | | | 11,237,775 | |

| | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | | |

| Net Investment Income | | | | | | | | |

| Class A | | | — | | | | (314,591 | ) |

| Class C | | | — | | | | (41,887 | ) |

| Class I | | | — | | | | (30,565 | ) |

| Net Realized Capital Gain | | | | | | | | |

| Class A | | | (822,963 | ) | | | (943,414 | ) |

| Class C | | | (330,241 | ) | | | (126,183 | ) |

| Class I | | | (219,114 | ) | | | (91,452 | ) |

| Return of Capital | | | | | | | — | |

| Class A | | | (8,770,796 | ) | | | (4,600,938 | ) |

| Class C | | | (5,168,710 | ) | | | (1,069,132 | ) |

| Class I | | | (3,596,707 | ) | | | (761,717 | ) |

| Total Distributions to Shareholders | | | (18,908,531 | ) | | | (7,979,879 | ) |

| | | | | | | | | |

| From Shares of Beneficial Interest: | | | | | | | | |

| Class A Shares: | | | | | | | | |

| Proceeds from Shares Issued (3,421,945 and 1,992,920 shares, respectively) | | | 112,139,126 | | | | 56,646,923 | |

| Distributions Reinvested (205,646 and 124,251 shares, respectively) | | | 5,933,035 | | | | 3,501,243 | |

| Cost of Shares Redeemed (351,623 and 801,766 shares, respectively) | | | (23,123,152 | ) | | | (22,822,086 | ) |

| Total From Beneficial Interest Transactions: Class A | | | 94,949,009 | | | | 37,326,080 | |

| | | | | | | | | |

| Class C Shares: | | | | | | | | |

| Proceeds from Shares Issued (4,070,055 and 1,110,617 shares, respectively) | | | 117,608,881 | | | | 31,331,468 | |

| Distributions Reinvested (115,459 and 26,091) shares, respectively) | | | 3,279,175 | | | | 728,782 | |

| Cost of Shares Redeemed (143,656 and 33,550 shares, respectively) | | | (5,526,767 | ) | | | (949,669 | ) |

| Total From Beneficial Interest Transactions: Class C | | | 115,361,289 | | | | 31,110,581 | |

| | | | | | | | | |

| Class I Shares: | | | | | | | | |

| Proceeds from Shares Issued (2,923,747 and 755,244 shares, respectively) | | | 85,314,866 | | | | 21,587,153 | |

| Distributions Reinvested (85,361 and 23,387 shares, respectively) | | | 2,482,023 | | | | 662,010 | |

| Cost of Shares Redeemed (111,906 and 27,267 shares, respectively) | | | (3,259,036 | ) | | | (780,971 | ) |

| Total From Beneficial Interest Transactions: Class I | | | 84,537,853 | | | | 21,468,192 | |

| | | | | | | | | |

| Net Increase in Net Assets From Shares of Beneficial Interest | | | 294,848,151 | | | | 89,904,853 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 298,934,936 | | | | 93,162,749 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Year | | | 192,481,714 | | | | 99,318,965 | |

| End of Year | | $ | 491,416,650 | | | $ | 192,481,714 | |

| | | | | | | | | |

| Undistributed Net Investment Income | | $ | 3,161,971 | | | $ | 2,125,585 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| FINANCIAL HIGHLIGHTS |

| Class A |

| |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented. |

| | | For the Year | | | For the Year | | | For the Year | | | For the Period* | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | September 30, 2016 | | | September 30, 2015 | | | September 30, 2014 | | | September 30, 2013 | |

| | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 28.68 | | | $ | 27.98 | | | $ | 27.47 | | | $ | 25.00 | |

| Increase From Operations: | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.23 | | | | 0.39 | | | | 0.26 | | | | 0.67 | |

| Net gain from investments (both realized and unrealized) | | | 1.75 | | | | 1.81 | | | | 1.70 | | | | 2.40 | |

| Total from operations | | | 1.98 | | | | 2.20 | | | | 1.96 | | | | 3.07 | |

| | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.09 | ) | | | (0.01 | ) | | | (0.40 | ) |

| From net realized gain on investments | | | (0.16 | ) | | | (0.29 | ) | | | (0.11 | ) | | | — | |

| From return of capital | | | (1.37 | ) | | | (1.12 | ) | | | (1.35 | ) | | | (0.20 | ) |

| Total Distributions | | | (1.53 | ) | | | (1.50 | ) | | | (1.47 | ) | | | (0.60 | ) |

| | | | | | | | | | | | | | | | | |

| Paid in interest from redemption fees (a) | | | — | | | | — | | | | 0.02 | | | | 0.00 | (i) |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 29.13 | | | $ | 28.68 | | | $ | 27.98 | | | $ | 27.47 | |

| | | | | | | | | | | | | | | | | |

| Total Return (b)(h) | | | 7.08 | % | | | 8.06 | % | | | 7.38 | % | | | 12.36 | % (e) |

| | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 226,712 | | | $ | 129,287 | | | $ | 89,319 | | | $ | 38,122 | |

| Ratio to average net assets(f): | | | | | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 2.19 | % | | | 2.25 | % | | | 2.54 | % | | | 4.96 | % (d) |

| Expenses, Net of Reimbursement | | | 1.82 | % | | | 1.79 | % | | | 1.76 | % | | | 0.01 | % (d) |

| Ratio to average net assets (excluding interest expense)(f): | | | | | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 2.19 | % | | | 2.24 | % | | | 2.52 | % | | | 4.96 | % (d) |

| Expenses, Net of Reimbursement | | | 1.82 | % | | | 1.78 | % | | | 1.74 | % | | | 0.01 | % (d) |

| Net investment income, Net of Reimbursement (f)(g) | | | 0.79 | % | | | 1.36 | % | | | 0.94 | % | | | 2.66 | % (d) |

| Portfolio turnover rate | | | 18 | % | | | 35 | % | | | 12 | % | | | 35 | % (e) |

| | | | | | | | | | | | | | | | | |

| * | Class A commenced operations October 22, 2012. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the Advisor not absorbed a portion of Fund expenses, total returns would have been lower. |

| (c) | Represents the ratio of expenses to average net asset absent fee waivers and/or expense reimbursements by the Advisor. |

| (f) | The ratios of expenses to average net assets and net investment income to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (g) | Recognition of net investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (i) | Less then $0.01 per share. |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| FINANCIAL HIGHLIGHTS |

| Class C |

| |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented. |

| | | For the Year | | | For the Year | | | For the Period | |

| | | Ended | | | Ended | | | Ended | |

| | | September 30, 2016 | | | September 30, 2015 | | | September 30, 2014* | |

| | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 28.38 | | | $ | 27.89 | | | $ | 27.75 | |

| Increase From Operations: | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | (0.01 | ) | | | 0.16 | | | | (0.19 | ) |

| Net gain from investments (both realized and unrealized) | | | 1.75 | | | | 1.82 | | | | 1.07 | |

| Total from operations | | | 1.74 | | | | 1.98 | | | | 0.88 | |

| | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.09 | ) | | | — | |

| From net realized gains on investments | | | (0.16 | ) | | | (0.29 | ) | | | — | |

| From return of capital | | | (1.35 | ) | | | (1.11 | ) | | | (0.74 | ) |

| Total Distributions | | | (1.51 | ) | | | (1.49 | ) | | | (0.74 | ) |

| | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 28.61 | | | $ | 28.38 | | | $ | 27.89 | |

| | | | | | | | | | | | | |

| Total Return (b)(h) | | | 6.28 | % | | | 7.28 | % | | | 3.20 | % (e) |

| | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 153,859 | | | $ | 37,920 | | | $ | 6,505 | |

| Ratio to average net assets (f): | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 2.95 | % | | | 3.04 | % | | | 3.36 | % (d) |

| Expenses, Net of Reimbursement | | | 2.56 | % | | | 2.55 | % | | | 2.61 | % (d) |

| Ratio to average net assets (excluding interest expense)(f): | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 2.95 | % | | | 3.02 | % | | | 3.34 | % (d) |

| Expenses, Net of Reimbursement | | | 2.56 | % | | | 2.54 | % | | | 2.59 | % (d) |

| Net investment Income (loss), Net of Reimbursement (f)(g) | | | (0.04 | )% | | | 0.55 | % | | | (1.36 | )% (d) |

| Portfolio turnover rate | | | 18 | % | | | 35 | % | | | 12 | % (e) |

| | | | | | | | | | | | | |

| * | Class C commenced operations April 1, 2014. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of Fund expenses, total returns would have been lower. |

| (c) | Represents the ratio of expenses to average net asset absent fee waivers and/or expense reimbursements by the Advisor. |

| (f) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (g) | Recognition of net investment income (loss) is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| FINANCIAL HIGHLIGHTS |

| Class I |

| |

| The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented. |

| | | For the Year | | | For the Year | | | For the Period | |

| | | Ended | | | Ended | | | Ended | |

| | | September 30, 2016 | | | September 30, 2015 | | | September 30, 2014* | |

| | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 28.85 | | | $ | 28.03 | | | $ | 27.75 | |

| Increase From Operations: | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | 0.28 | | | | 0.45 | | | | (0.04 | ) |

| Net gain from investments (both realized and unrealized) | | | 1.79 | | | | 1.88 | | | | 1.06 | |

| Total from operations | | | 2.07 | | | | 2.33 | | | | 1.02 | |

| | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.10 | ) | | | — | |

| From net realized gains on investments | | | (0.16 | ) | | | (0.29 | ) | | | — | |

| From return of capital | | | (1.38 | ) | | | (1.12 | ) | | | (0.74 | ) |

| Total Distributions | | | (1.54 | ) | | | (1.51 | ) | | | (0.74 | ) |

| | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 29.38 | | | $ | 28.85 | | | $ | 28.03 | |

| | | | | | | | | | | | | |

| Total Return (b)(h) | | | 7.36 | % | | | 8.51 | % | | | 3.71 | % (e) |

| | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 110,845 | | | $ | 25,274 | | | $ | 3,495 | |

| Ratio to average net assets (f): | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 1.96 | % | | | 2.03 | % | | | 2.40 | % (d) |

| Expenses, Net of Reimbursement | | | 1.56 | % | | | 1.54 | % | | | 1.61 | % (d) |

| Ratio to average net assets (excluding interest expense)(f): | | | | | | | | | | | | |

| Expenses, Gross (c) | | | 1.96 | % | | | 2.02 | % | | | 2.38 | % (d) |

| Expenses, Net of Reimbursement | | | 1.56 | % | | | 1.53 | % | | | 1.59 | % (d) |

| Net investment income (loss) , Net of Reimbursement (f)(g) | | | 0.96 | % | | | 1.59 | % | | | (0.24 | )% (d) |

| Portfolio turnover rate | | | 18 | % | | | 35 | % | | | 12 | % (e) |

| | | | | | | | | | | | | |

| * | Class I commenced operations April 1, 2014. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of Fund expenses, total returns would have been lower. |

| (c) | Represents the ratio of expenses to average net asset absent fee waivers and/or expense reimbursements by the Advisor. |

| (f) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (g) | Recognition of net investment income (loss) is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of these financial statements.

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS |

| September 30, 2016 |

Total Income+ Real Estate Fund (the “Fund” or the “Trust”) was organized as a Delaware statutory trust on May 25, 2012 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non- diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation, with low to moderate volatility and low correlation to the broader markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of assets in “real estate industry securities,” primarily in income producing equity and debt securities.

The Fund currently offers Class A, Class C, and Class I shares. Class A shares commenced operations on October 22, 2012 and are offered at net asset value plus a maximum sales charge of 5.75%. Class C and Class I shares commenced operations on April 1, 2014 and are offered at net asset value. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after purchase. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the last bid price. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

Valuation of Fund of Funds – The Fund may invest in portfolios of open-end investment companies and exchange traded funds (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds.

Open-end investment companies are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Advisor (defined below), those securities will be valued at “fair value” as determined in good faith by the Valuation Committee using procedures adopted by and under the supervision of the Fund’s Board of Trustees (the “Board”). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate a Fund’s net asset value (“NAV”).

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2016 |

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Advisor determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

Valuation of Private Equity Real Estate Securities – The Fund invests a significant portion of its assets in Private Equity Real Estate Securities (“Private ERES”). The Private ERES measure their investment assets at fair value, and report a NAV per share on a calendar quarter basis. In accordance with Accounting Standards Codification (‘ASC”) 820, the Fund has elected to apply the practical expedient and to value its investments in Private ERES at their respective NAVs at each quarter. For non-calendar quarter-end days, the Valuation Committee estimates the fair value of each Private ERES by adjusting the most recent NAV for each REIT by the change in a proprietary benchmark that the Valuation Committee has deemed to be representative of the entire Private ERES market. As of September 30, 2016, all of the Fund’s investments in Private ERES were valued at the respective NAVs of the Private ERES.

Valuation of Public Non-Traded Equity Real Estate Securities – The Fund may invest a portion of its assets in Public Non-Traded Equity Real Estate Securities (“Public Non-Traded ERES”). The Public Non-Traded ERES do not report periodic NAVs with enough frequency to be valued using the practical expedient. The Valuation Committee determines the fair value of Public Non-Traded ERES on a daily basis by considering various factors such as the most recent published NAV, the transaction price, secondary market trades, shareholder redemption and dividend reinvestment programs, and potential illiquidity discounts.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.

The values assigned to fair valued investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long- term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2016 |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly,the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. such In cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of September 30, 2016 for the Fund’s assets and liabilities measured at fair value:

| Assets* | | Total Value | | | Level 1 | | | Level 2 | | | Level 3 | |

| Public Equity Real Estate Securities | | $ | 1,306,361 | | | $ | 461,974 | | | $ | — | | | $ | 844,387 | |

| Public Real Estate Investment Trusts | | | 8,878,019 | | | | 8,878,019 | | | | — | | | | — | |

| Short-Term Investments | | | 65,944,645 | | | | 65,944,645 | | | | — | | | | — | |

| Preferred Stock | | | 3,839,535 | | | | 3,839,535 | | | | | | | | | |

| Sub-Total | | $ | 79,968,560 | | | $ | 79,124,173 | | | $ | — | | | $ | 844,387 | |

| Private Equity Real Estate Securities (1) | | | 408,526,823 | | | | | | | | | | | | | |

| Total | | $ | 488,495,383 | | | | | | | | | | | | | |

| * | Refer to the Portfolio of Investments for industry classifications. |

There were no transfers into or out of Level 1, Level 2, and Level 3 during the period.

It is the Fund’s policy to record transfers into or out of any Level at the end of the reporting period.

| (1) | Management has elected to adopt ASU 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) — a consensus of the Emerging Issues Task Force issued, on May 1, 2015. The guidance in this standard is effective for interim and annual periods beginning after December 15, 2015, however early adoption is permitted. In accordance with Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amount presented in this table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statement of assets and liabilities. |

The following is a reconciliation of assets in which Level 3 inputs were used in determining value:

| | | Public Equity Real | |

| | | Estate Securities | |

| Beginning Balance | | $ | 1,163,934 | |

| Total realized gain (loss) | | | 31,390 | |

| Appreciation (Depreciation) (a) | | | (240,270 | ) |

| Cost of Purchases | | | — | |

| Proceeds from Sales | | | (110,667 | ) |

| Return of Capital | | | — | |

| Net transfers in/out of level 3 | | | — | |

| Ending Balance | | $ | 844,387 | |

| (a) | Refer to the Statement of Operations under Net Realized Gain (Loss) on Investments section. |

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2016 |

Significant unobservable valuation inputs for material Level 3 investments as of September 30, 2016, are as follows:

| | | Fair Value at | | | Valuation | | | | | | | | |

| | | 9/30/2016 | | | Technique | | Unobservable Input | | Range | | | Weighted Average | |

| | | | | | | | | | | | | | |

| Public Non-Traded Real | | | | | | | | | | | | | | | | |

| Estate Investment Trusts | | $ | 844,387 | | | Transaction Data | | Discount for Lack of Liquidity (a) | | | 5.00% | | | | 5.00 | % |

| | | | | | | | | Mid-point of Liquidation Value | | | $6.35-$6.65 | | | | $6.50 | |

| (a) | Represents amounts used when the reporting entity has determined that market participants would take into account these discounts when pricing the investments. |

Other Investment Vehicles – The Fund may invest in other investment vehicles such as exchange traded funds (“ETFs”), index funds, closed-end funds and mutual funds. Such funds are bought and sold on a securities exchange. An ETF trades like common stock and typically represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. The Fund may purchase an investment vehicle to temporarily gain exposure to a portion of the U.S. or a foreign market. The risks of owning such investment vehicles generally reflect the risks of owning the underlying securities they are designed to track, although any lack of liquidity could result in it being more volatile. Additionally, such investment vehicles have fees and expenses that reduce their value relative to their underlying holdings.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date de basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any to shareholders. Accordingly, no provision for Federal income taxes is required in the financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions related to the open tax years (2013-2015) or expected to be taken in the Fund’s 2016 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended September 30, 2016, the Fund did not incur any interest or penalties. Generally tax authorities can examine tax returns filed for the last three years.

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2016 |

| 3. | ADVISORY FEE AND OTHER RELATED PARTY TRANSACTIONS |

Advisory Fees – Pursuant to an investment advisory agreement with the Fund, (the “Advisory Agreement”), investment advisory services are provided to the Fund by Bluerock Fund Advisor, LLC (the “Advisor”). Under the terms of the Advisory Agreement, the Advisor receives monthly fees calculated at an annual rate of 1.50% of the average daily net assets of the Fund. For the year ended September 30, 2016, the Advisor earned advisory fees of $4,808,355.

The Advisor has contractually agreed to waive all or part of its management fees and/or make payments to limit Fund operating expenses and acquired fund fees and expenses (exclusive of any taxes, interest, brokerage and extraordinary expenses, but inclusive of organizational costs and offering costs) at least until February 1, 2017, so that the total annual operating expenses of the Fund do not exceed 1.91%, 2.66% and 1.66%, of the Fund’s average daily net assets for Class A, Class C and Class I shares, respectively.

The Fund had the following expense limitations in place pursuant to Board approval since inception:

| Class A | |

| Effective Date | | Expense Limitation | |

| 10/22/2012 | | | |

| (Commencement of operations) | | | |

| until 1/31/2015 | | | 1.84 | % |

| 2/1/2015 | | | 1.75 | % |

| 2/1/2016 | | | 1.91 | %* |

*Expense limitations includes acquired fund fees and expenses |

| |

| Class C | |

| Effective Date | | | Expense Limitation | |

| 4/1/2014 | | | | |

| (Commencement of operations) | | | | |

| until 1/31/2015 | | | 2.59 | % |

| 2/1/2015 | | | 2.50 | % |

| 2/1/2016 | | | 2.66 | %* |

*Expense limitations includes acquired fund fees and expenses |

| |

| Class I | |

| Effective Date | | | Expense Limitation | |

| 4/1/2014 | | | | |

| (Commencement of operations) | | | | |

| until 1/31/2015 | | | 1.59 | % |

| 2/1/2015 | | | 1.50 | % |

| 2/1/2016 | | | 1.66 | %* |

*Expense limitations includes acquired fund fees and expenses |

Fee waivers and expense payments may be recouped by the Advisor from the Fund, upon approval by the Fund’s Board, to the extent that overall expenses fall below the lesser of the expense limitation then in place or in place at the time of the waiver, within three fiscal years of when the amounts were waived or reimbursed. During the year ended September 30, 2016, the Advisor waived and reimbursed fees of $997,305. Including amounts waived during the year ended September 30, 2016, cumulative expenses subject to recapture pursuant to the aforementioned conditions amounted to $2,168,114 and will expire on September 30 of the years indicated below:

| 2017 | | | 2018 | | | 2019 | |

| $ | 509,750 | | | $ | 661,059 | | | $ | 997,305 | |

| Total Income+ Real Estate Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2016 |

Sub-advisory services were provided to the Fund pursuant to agreements between the Advisor and each of Mercer Investment Management, Inc. and RREEF America, LLC (the “Sub-Advisors”). Under the terms of the sub-advisory agreements, the Advisor compensates the Sub-Advisors based on the Fund’s assets allocated to the respective Sub-Advisor. Under the terms of the Sub-Advisory Agreement with Mercer, the Sub-Advisor receives fees from the Advisor (not the Fund) as follows: 0.20% for up to $250 million in assets under advisement, 0.17% for $250 million to $500 million in assets under advisement, 0.12% for $500 million to $1 billion in assets under advisement, and 0.07% for $1 billion or more in assets under advisement. Under the terms of the Sub-Advisory Agreement with RREEF, the Sub-Advisor receives fees from the Advisor (not the Fund) as follows: 0.60% for up to $50 million in assets allocated to RR 0.55% EEF, for $50 million to $100 million in assets allocated to RREEF, 0.50% for greater than $100 million in assets allocated to RREEF.