UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22715

Guggenheim Credit Allocation Fund

(Exact name of registrant as specified in charter)

2455 Corporate West Drive, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Amy J. Lee

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 505-3700

Date of fiscal year end: May 31

Date of reporting period: June 26, 2013 - November 30, 2013

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/GGM

... YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT

GUGGENHEIM CREDIT ALLOCATION FUND

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com/ggm, you will find:

| · | Daily, weekly and monthly data on share prices, distributions and more |

| · | Portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices |

| · | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are constantly updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

November 30, 2013 |

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Credit Allocation Fund (the “Fund”). This report covers the Fund’s performance for the initial fiscal period from the Fund’s inception on June 26, 2013, through November 30, 2013.

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation.

Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed-income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities, debt securities and loans (collectively, “credit securities”). The Fund seeks to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the initial fiscal period ended November 30, 2013, the Fund provided a total return based on market price of -8.70% and a total return based on NAV of 4.03%. The NAV performance of the Fund reflects fees and expenses of the Fund.

As of November 30, 2013, the Fund’s market price of $22.35 per share represented a discount of 7.99% to its NAV of $24.29 per share. As of the commencement of the Fund’s operations on June 26, 2013, the Fund’s market price was $25.00 per share and its NAV was $23.82 per share. The market value of the Fund’s shares fluctuates from time to time and it may be higher or lower than the Fund’s NAV.

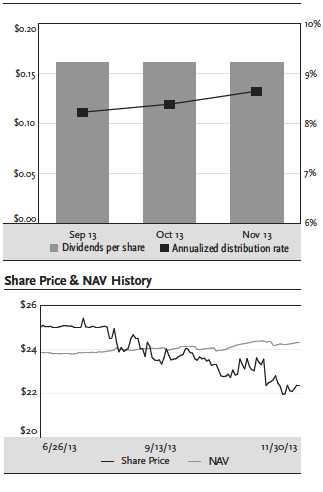

The Fund paid monthly distributions beginning in September 2013. The distribution each month was $0.16146. The distribution as of November 30, 2013, represents an annualized distribution rate of 8.67% based on the Fund’s closing market price of $22.35 on November 30, 2013. The Fund’s distribution rate is not constant and is subject to change based on the performance of the Fund.

Guggenheim Funds Investment Advisors, LLC (the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Fund’s investment sub-adviser and is responsible for the management of the Fund’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 26 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a stable monthly distribution, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

To learn more about the Fund’s performance and investment strategy, we encourage you to read the Questions & Answers section of this report, which begins on page 5. You’ll find information on GPIM’s investment philosophy, views on the economy and market environment, and detailed information about the factors that impacted the Fund’s performance.

DEAR SHAREHOLDER continued | November 30, 2013 |

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/ggm.

Sincerely,

Donald C. Cacciapaglia

Chief Executive Officer

Guggenheim Credit Allocation Fund

December 31, 2013

QUESTIONS & ANSWERS | November 30, 2013 |

Guggenheim Credit Allocation Fund (the “Fund”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM”). This team includes B. Scott Minerd, Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director; Jeffrey B. Abrams, Senior Managing Director and Portfolio Manager; Kevin H. Gundersen, Senior Managing Director and Portfolio Manager; and James W. Michal, Managing Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the initial fiscal period ended November 30, 2013.

What is the Fund’s investment objective and how is it pursued?

The Guggenheim Credit Allocation Fund’s investment objective is to seek total return through a combination of current income and capital appreciation.

Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed-income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities, debt securities and loans (collectively, “credit securities”). Credit securities in which the Fund may invest consist of corporate bonds, loans and loan participations, asset-backed securities (all or a portion of which may consist of collateralized loan obligations), mortgage-backed securities (both residential mortgage-backed securities and commercial mortgage-backed securities), U.S. Government and agency securities, mezzanine and preferred securities, convertible securities, commercial paper, municipal securities and sovereign government and supranational debt securities. The Fund will seek to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities that are rated below investment grade, or, if unrated, determined to be of comparable quality (also known as “high yield securities” or “junk bonds”). The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

The Fund may, but is not required to, use various derivatives transactions for hedging and risk management purposes, to facilitate portfolio management and to earn income or enhance total return. The Fund may use such transactions as a means to synthetically implement the Fund’s investment strategies. In addition, as an alternative to holding investments directly, the Fund may also obtain investment exposure by investing in other investment companies. To the extent that the Fund invests in synthetic investments with economic characteristics similar to credit securities, the value of such investments will be counted as credit securities for purposes of the Fund’s policy of investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in credit securities (the “80% Policy”).

The Fund may invest in open-end funds, closed-end funds and exchange-traded funds. For purposes of the Fund’s 80% Policy, the Fund will include its investments in other investment companies that have a policy of investing at least 80% of their net assets, plus the amount of any borrowings for investment purposes, in one or more types of credit securities.

The Fund uses financial leverage (borrowing) to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

What were the significant events affecting the economy and market environment over the past six months?

Speculation on the future of quantitative easing dominated financial headlines for much of the period, causing increased interest rate volatility and driving investor demand for shorter duration assets. The yield on the 10-year Treasury note hit a two-year high of 3.0% in early September, about 140 basis points above the lows seen in May.

The Federal Reserve (the “Fed”) surprised most market participants on September 18, 2013 with its inaction on what was expected to be the beginning of tapering its $85 billion per month asset purchase program. Given sluggish job growth and malaise in the housing data in recent months, the Fed announced that it would continue to maintain the pace of purchases until there was significant improvement in the aforementioned areas. Investors that were positioned in longer-duration fixed income assets benefitted as benchmark 10-year U.S. Treasury bond yields declined in the wake of the Fed announcement, closing the third quarter at 2.6%. The soft patch in economic growth added downward pressure to interest rates in the short term, but reacceleration is expected to ultimately push interest rates higher over the long term.

The fundamental outlook for the global economy continues to improve. We are seeing a synchronous global economic expansion for the first time since 2007. In Europe, the periphery has struggled through several years of contraction, but lower prices and unit labor costs have led to the start of a recovery. Germany’s economy has been weighed down by the peripheral nations, but overall, Europe has shown signs of expansion from recent manufacturing data. Asian economies, notably China and Japan, have seen substantial monetary accommodation from their respective regimes and look to return to higher levels of growth in the coming years.

Here in the United States, we continue to see strong evidence of seasonal strength in the stock market. The data-distorting effects of the October U.S. government shutdown are being flushed from the system, providing a truer reading of what is occurring domestically. Despite a shutdown that lasted far longer than originally anticipated, the U.S. economy held up fairly well, indicating a high degree of underlying strength.

QUESTIONS & ANSWERS continued | November 30, 2013 |

At period end, the likelihood of the Fed tapering quantitative easing in December appeared to be remote. However, given strong employment data released in early December, many market participants placed a higher probability of the Fed reducing purchases in the next few meetings. (After the period end, on December 18, 2013, the Fed announced that it would begin to taper in January 2014, reducing monthly asset purchases from $85 billion to $75 billion). Our expectation is interest rates are likely to remain range bound into 2014 before continuing an ascent higher.

How did the Fund perform for the initial fiscal period?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the initial fiscal period ended November 30, 2013, the Fund provided a total return based on market price of -8.70% and a total return based on NAV of 4.03%. The NAV performance of the Fund reflects fees and expenses of the Fund.

As of November 30, 2013, the Fund’s market price of $22.35 per share represented a discount of 7.99% to its NAV of $24.29 per share. As of the Fund’s commencement of operations on June 26, 2013, the Fund’s market price was $25.00 per share and its NAV was $23.82 per share. The market value of the Fund’s shares fluctuates from time to time and it may be higher or lower than the Fund’s NAV.

The Fund paid monthly distributions beginning in September 2013. The distribution each month was $0.16146. The distribution as of November 30, 2013, represents an annualized distribution rate of 8.67% based on the Fund’s closing market price of $22.35 on November 30, 2013. The Fund’s distribution rate is not constant and is subject to change based on the performance of the Fund.

Discuss how proceeds were invested and how the Fund is now allocated.

For much of the period, the Fund focused on investing proceeds from the initial public offering. Assets now are mostly in senior loans and high yield bonds. The largest sector concentration is in consumer names. The Fund regularly rebalances and cycles securities in and out of the portfolio on a relative value basis. During the ramp-up period, the Fund also insured that cash proceeds of the initial public offering were fully invested. Toward the end of the period the Fund began employing financing through borrowing to seek to enhance return.

Senior loans are currently a preferred investment for the Fund, as their floating-rate coupons help mitigate interest-rate risk, while their seniority in capital structure, maintenance covenants and secured status enhance credit quality. We continue to view single B bank loans as having risk comparable to BB corporate bonds.

The Fund purchased many senior loans in the primary market, realizing an immediate improvement in value due to original issue discounts, and loans benefited from strong demand from collateralized loan obligations (“CLOs”) and loan funds.

As the Fed continues to engineer an environment of ample liquidity, resulting in low defaults, we see this as an optimal time to take prudent credit risk. Reflecting this sentiment, investors have begun transitioning into assets with enhanced structural protections through increased allocations to bank loans. Lower rated, upper middle-market bank loans offer comparable yields to BB bonds but provide a much greater degree of comfort, in the event of rising rates and deteriorating credit quality. For investors seeking to participate in the credit rally while remaining protected on the downside, we believe bank loans are the investment vehicles best positioned to provide this flexibility. As of November 30, 2013, floating rate securities were 53.6% of long-term investments.

Volatility during the period put pressure on high yield bonds, but also presented purchase opportunities, many featuring attractive yield and credit metrics at points of temporary price weakness. When interest rates decline, the search for yield can outweigh the need to protect from rising interest rates, spurring demand for high yield bonds over senior loans.

The Fund also had a small allocation to asset-backed securities (“ABS”). This was predicated on the decline in interest rates after the Fed declined to taper, and ABS spreads were tightening. The sector also benefitted from positive trends in the broader market as uncertainty around a government shutdown and debt ceiling hike abated. In addition, overall ABS supply is down, creating favorable tightening conditions.

The Fund kept interest-rate duration short over the summer amid increased rate volatility and the potential for rising rates but later selectively added duration, especially as interest rates fell after the September 18, 2013 Fed announcement. We expect interest rates to head lower through the remainder of the year with room for further credit spread compression in the near-term.

Credit quality was also closely monitored in the wake of softening in underwriting standards, which may be a result of increased demand for new issuance.

What have market conditions been like over the past six months for the main asset classes the Fund invests in?

Issuance across corporate sectors has remained robust throughout 2013 as investors have maintained intense demand, creating a positive technical bid. As of period end, $881 billion of investment grade corporate bonds have been issued, approaching the 2012 total of $928 billion. In high yield, corporate bond issuance is $296 billion for the year compared to $347 billion for the 2012 total while leveraged loan issuance has reached $513 billion for the year compared to $274 billion in the prior year.

Much of the new issuance across the corporate credit sector has been repricings and refinancing as issuers look to lock in historically low rates. As demand for bank loans has grown in 2013, the CLO market has thrived. Over $75 billion has been issued in the U.S. CLO market year-to-date through November, which exceeds full year 2012 issuance and is the third highest year of issuance on record. Issuance slowed during the middle of the year as new regulations widened CLO liabilities making CLO economics more difficult. A robust CLO market is important for loans, as CLOs have historically represented a more sustainable, long-term source of demand.

QUESTIONS & ANSWERS continued | November 30, 2013 |

While positive fundamentals should help sustain the credit cycle in the near term, there are several notable trends that investors should continue monitoring. Particularly, the growing prominence of retail investors in the bank loan market can contribute to volatility, as we have witnessed in the high yield sector.

Fundamental factors and monetary policy are underpinning our constructive stance on leveraged credit, including attractive coverage ratios, a more distant maturity wall and low default rates. The decline in the 10-year yield since the Fed refrained from tapering has helped ease short-term interest rate concerns and may reignite the search for yield in high yield bonds. Since January 2009, high yield bonds as represented by the Credit Suisse High Yield Index have recorded 18.3% annualized total return as the result of investor search for yield. The index is designed to mirror the investable universe of the $US-denominated high yield debt market.

The ABS market showed modestly positive performance over the period as interest rate volatility led to increased demand for floating rate securities. Despite the negative effects of increased interest rate volatility and the subsequent impact on housing data, the non-Agency RMBS market also maintained positive performance for the period.

How did other markets perform in this environment?

For the initial fiscal period ended November 30, 2013, the Standard & Poor’s 500 Index (the “S&P 500”) rose 13.66% (this and all other returns cited in this section are total return). The Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index rose 17.37% and the MSCI Emerging Market Index rose 13.98%.

In the bond market, the Barclays U.S. Aggregate Bond Index returned 1.50% for the period, while the Barclays U.S. Corporate High Yield Index returned 6.16%. The return of the Barclays 1-3 Month U.S. Treasury Bill Index was 0.01%.

The Bank of America Merrill Lynch ABS AA-BBB Securities Master Index gained 1.98% for the period, while the Credit Suisse Leveraged Loan Index returned 2.70%.

What is the Fund’s leverage strategy?

Since leverage adds to performance when the cost of leverage is less than the total return generated by investments, the use of leverage contributed to the Fund’s total return during this period. The purpose of leverage (borrowing) is to fund the purchase of additional securities that provide increased income and potentially greater appreciation to common shareholders than could be achieved from an unlevered portfolio. Leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio.

As of November 30, 2013, the amount of leverage was approximately 21% of total managed assets. The Fund employs leverage through reverse repurchase agreements, under which the Fund temporarily transfers possession of portfolio securities and receives cash which can be used for additional investments. There is no guarantee that the Fund’s leverage strategy will be successful. The Fund’s use of leverage may cause the Fund’s NAV and market price of common shares to be more volatile and can magnify the effect of any losses.

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

BofA/ML ABS Master AA-BBB Index is a subset of The BofA Merrill Lynch U.S. Fixed Rate Asset Backed Securities Index including all securities rated AA1 through BBB3, inclusive.

The Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays U.S. Corporate High Yield Index is an unmanaged index of below investment grade bonds issued by U.S. corporations.

The Barclays 1-3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of one to three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the $US-denominated leveraged loan market.

The MSCI EAFE Index is a capitalization weighted measure of stock markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. There can be no assurance that the Trust will achieve its investment objectives. The value of the Trust will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. There can be no assurance that the Trust will achieve its investment objectives.

Please see guggenheiminvestments.com/ggm for a detailed discussion of the Trust’s risks and considerations.

FUND SUMMARY (Unaudited) | November 30, 2013 |

Fund Statistics | ||

Share Price | $22.35 | |

Common Share Net Asset Value | $24.29 | |

Premium/(Discount) to NAV | -7.99% | |

Net Assets Applicable to Common Shares ($000) | $160,992 | |

Total Returns | ||

(Inception 6/26/2013) | Market | NAV |

Since Inception | -8.70% | 4.03% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. For more current information, please visit guggenheiminvestments.com/ggm. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

% of Net | |

Fund Breakdown | Assets |

Corporate Bonds | 54.4% |

Asset Backed Securities | 4.8% |

Term Loans | 59.9% |

Total Investments | 119.1% |

Other Assets in excess of other Liabilities | 7.8% |

Reverse Repurchase Agreements | -26.9% |

Total Net Assets | 100.0% |

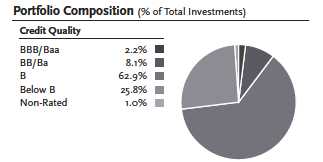

Ratings shown are assigned by one or more Nationally Recognized Statistical Credit Rating Organizations (“NRSCRO”), such as Standard & Poor’s, Moody’s and Fitch. The ratings are an indication of an issuer’s cred-itworthiness and typically range from AAA or Aaa (highest) to D (lowest). When two or more ratings are available, the lower rating is used; when only one is available, that rating is used. The Non-Rated category consists of securities that have not been rated by an NRSCRO. U.S. Treasury securities and U.S. Government Agency securities are not rated but deemed to be equivalent to securities rated AA+/Aaa.

Portfolio composition and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/ggm. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

Distributions to Shareholders & Annualized Distribution Rate

PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2013 |

Principal Amount | Description | Rating* | Coupon | Maturity | Optional Call Provisions** | Value | |

Long-Term Investments – 119.1% | |||||||

Corporate Bonds – 54.4% | |||||||

Advertising – 2.0% | |||||||

$ 3,000,000 | Sitel, LLC / Sitel Finance Corp.(a) (b) | B | 11.000% | 08/01/2017 | 08/01/14 @ 106 | $ 3,232,500 | |

Agriculture – 1.2% | |||||||

1,881,000 | Vector Group Ltd. | B+ | 7.750% | 02/15/2021 | 02/15/16 @ 106 | 1,979,753 | |

Chemicals – 2.0% | |||||||

3,000,000 | TPC Group, Inc.(a) | B | 8.750% | 12/15/2020 | 12/15/16 @ 104 | 3,168,750 | |

Commercial Services – 0.7% | |||||||

19,000 | RR Donnelley & Sons Co. | BB– | 6.500% | 11/15/2023 | N/A | 18,952 | |

1,135,000 | ServiceMaster Co. | CCC+ | 7.000% | 08/15/2020 | 08/15/15 @ 105 | 1,085,344 | |

1,104,296 | |||||||

Consumer Services – 1.3% | |||||||

1,500,000 | Travelport, LLC | CCC– | 11.875% | 09/01/2016 | 09/01/14 @ 100 | 1,518,750 | |

500,000 | Travelport, LLC / Travelport Holdings, Inc.(a) (c) | CCC– | 6.364% | 03/01/2016 | 08/23/14 @ 100 | 498,750 | |

2,017,500 | |||||||

Diversified Financial Services – 5.5% | |||||||

3,000,000 | Harbinger Group, Inc.(a) | B | 7.875% | 07/15/2019 | 01/15/16 @ 106 | 3,217,500 | |

1,000,000 | Jefferies Finance, LLC / JFIN Co-Issuer Corp.(a) (b) | B+ | 7.375% | 04/01/2020 | 04/01/16 @ 106 | 1,036,250 | |

500,000 | Nationstar Mortgage, LLC / Nationstar Capital Corp. | B+ | 6.500% | 08/01/2018 | 08/01/15 @ 103 | 508,750 | |

2,000,000 | Nationstar Mortgage, LLC / Nationstar Capital Corp.(b) | B+ | 6.500% | 07/01/2021 | 01/01/17 @ 103 | 1,900,000 | |

2,000,000 | Oxford Finance, LLC / Oxford Finance Co-Issuer, Inc.(a) | B | 7.250% | 01/15/2018 | 01/15/15 @ 104 | 2,122,500 | |

8,785,000 | |||||||

Entertainment – 0.6% | |||||||

1,000,000 | Gibson Brands, Inc.(a) (b) | B | 8.875% | 08/01/2018 | 02/01/16 @ 107 | 1,022,500 | |

Food – 2.0% | |||||||

1,100,000 | JBS USA, LLC / JBS USA Finance, Inc.(a) | BB | 7.250% | 06/01/2021 | 06/01/15 @ 105 | 1,141,250 | |

2,000,000 | KeHE Distributors, LLC / KeHE Finance Corp.(a) | B | 7.625% | 08/15/2021 | 08/15/17 @ 104 | 2,090,000 | |

3,231,250 | |||||||

Forest Products & Paper – 0.9% | |||||||

1,401,000 | Unifrax I, LLC / Unifrax Holding Co.(a) (b) | B– | 7.500% | 02/15/2019 | 02/15/15 @ 104 | 1,439,528 | |

Gas – 0.6% | |||||||

1,000,000 | NGL Energy Partners, LP / NGL Energy Finance Corp.(a) | BB– | 6.875% | 10/15/2021 | 10/15/16 @ 105 | 1,017,500 | |

Household Products & Housewares – 1.9% | |||||||

3,000,000 | Central Garden and Pet Co.(b) | CCC+ | 8.250% | 03/01/2018 | 03/01/14 @ 104 | 3,030,000 | |

Leisure Time – 1.1% | |||||||

1,550,000 | Sabre, Inc.(a) (b) | B | 8.500% | 05/15/2019 | 05/15/15 @ 106 | 1,714,688 | |

Media – 1.4% | |||||||

2,300,000 | Expo Event Transco, Inc.(a) (b) | B– | 9.000% | 06/15/2021 | 06/15/16 @ 105 | 2,328,750 | |

Mining – 0.6% | |||||||

500,000 | KGHM International Ltd. (Canada)(a) (b) | BB– | 7.750% | 06/15/2019 | 06/15/15 @ 104 | 523,750 | |

2,000,000 | Mirabela Nickel Ltd. (Australia)(a) (b) (d) | D | 8.750% | 04/15/2018 | 04/15/15 @ 104 | 480,000 | |

1,003,750 | |||||||

Oil & Gas – 13.5% | |||||||

1,026,000 | Atlas Energy Holdings Operating Co., LLC / Atlas Resource | ||||||

Finance Corp.(a) (b) | B– | 7.750% | 01/15/2021 | 01/15/17 @ 104 | 969,570 | ||

2,000,000 | Atlas Energy Holdings Operating Co., LLC / Atlas Resource | ||||||

Finance Corp.(a) | B– | 9.250% | 08/15/2021 | 08/15/17 @ 105 | 2,035,000 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 9

PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2013 |

Principal Amount | Description | Rating* | Coupon | Maturity | Optional Call Provisions** | Value | |

Oil & Gas continued | |||||||

$ 3,000,000 | BreitBurn Energy Partners, LP / BreitBurn Finance Corp. | B– | 7.875% | 04/15/2022 | 01/15/17 @ 104 | $ 3,067,500 | |

3,000,000 | Endeavor Energy Resources, LP / EER Finance, Inc.(a) | B+ | 7.000% | 08/15/2021 | 08/15/16 @ 105 | 3,000,000 | |

3,000,000 | Legacy Reserves LP / Legacy Reserves Finance Corp.(a) | B– | 8.000% | 12/01/2020 | 12/01/16 @ 104 | 3,097,500 | |

3,000,000 | Memorial Production Partners, LP / Memorial Production Finance Corp.(a) | B– | 7.625% | 05/01/2021 | 05/01/17 @ 104 | 3,082,500 | |

1,000,000 | Midstates Petroleum Co., Inc. / Midstates Petroleum Co., LLC(b) | B– | 10.750% | 10/01/2020 | 10/01/16 @ 105 | 1,090,000 | |

2,000,000 | Midstates Petroleum Co., Inc. / Midstates Petroleum Co., LLC | B– | 9.250% | 06/01/2021 | 06/01/16 @ 107 | 2,087,500 | |

3,000,000 | SandRidge Energy, Inc. | B– | 8.750% | 01/15/2020 | 01/15/15 @ 104 | 3,240,000 | |

21,669,570 | |||||||

Oil & Gas Services – 0.1% | |||||||

200,000 | IronGate Energy Services, LLC(a) (b) | NR | 11.000% | 07/01/2018 | 07/01/16 @ 105 | 196,000 | |

Other Industrials – 1.1% | |||||||

EUR 1,300,000 | Deutsche Raststatten (Denmark) | B | 6.750% | 12/30/2020 | N/A | 1,766,184 | |

Packaging & Containers – 1.3% | |||||||

$ 2,020,000 | Pretium Packaging, LLC / Pretium Finance, Inc.(b) | B– | 11.500% | 04/01/2016 | 04/01/14 @ 106 | 2,156,350 | |

Pipelines – 4.4% | |||||||

2,000,000 | Atlas Pipeline Partners, LP / Atlas Pipeline Finance Corp.(a) | B+ | 5.875% | 08/01/2023 | 02/01/18 @ 103 | 1,940,000 | |

2,000,000 | Crestwood Midstream Partners, LP(a) | BB | 6.000% | 12/15/2020 | 12/15/16 @ 103 | 2,047,500 | |

3,000,000 | Eagle Rock Energy Partners, LP/Eagle Rock Energy Finance Corp. | B | 8.375% | 06/01/2019 | 06/01/15 @ 104 | 3,090,000 | |

7,077,500 | |||||||

Property & Casualty – 0.4% | |||||||

650,000 | Prosight Global, Inc.(d) | NR | 7.500% | 11/20/2020 | N/A | 649,315 | |

Retail – 3.7% | |||||||

500,000 | Checkers & Rally’s Restaurants, Inc.(a)(d) | NR | 11.625% | 11/01/2016 | 05/01/15 @ 103 | 513,750 | |

2,000,000 | Checkers Drive-In Restaurants, Inc.(a) | B– | 11.000% | 12/01/2017 | 06/01/15 @ 108 | 2,225,000 | |

3,000,000 | GRD Holdings III Corp.(a) (b) | B | 10.750% | 06/01/2019 | 06/01/15 @ 108 | 3,270,000 | |

6,008,750 | |||||||

Software – 5.8% | |||||||

3,000,000 | Aspect Software, Inc.(b) | CCC+ | 10.625% | 05/15/2017 | 05/15/14 @ 105 | 3,067,500 | |

3,000,000 | Eagle Midco, Inc.(a) | CCC+ | 9.000% | 06/15/2018 | 12/15/14 @ 102 | 3,075,000 | |

3,000,000 | First Data Corp.(a) (e) | B– | 8.750% | 01/15/2022 | 01/15/16 @ 104 | 3,217,500 | |

9,360,000 | |||||||

Telecommunications – 2.3% | |||||||

3,000,000 | Alcatel-Lucent USA, Inc.(a) | CCC+ | 8.875% | 01/01/2020 | 07/01/16 @ 104 | 3,281,250 | |

350,000 | Level 3 Financing, Inc.(a) | CCC+ | 6.125% | 01/15/2021 | 11/15/16 @ 103 | 355,250 | |

3,636,500 | |||||||

Total Corporate Bonds – 54.4% | |||||||

(Cost $86,825,637) | 87,595,934 | ||||||

Asset Backed Securities – 4.8% | |||||||

Collateralized Debt Obligations – 1.9% | |||||||

1,191,143 | RAIT CRE CDO Ltd. (Cayman Islands) (c) | BB– | 0.498% | 11/20/2046 | N/A | 987,165 | |

2,339,407 | SRERS Funding Ltd., Series 2011-RS, Class A1B1 (Cayman Islands)(a) (b) (c) | Baa3 | 0.419% | 05/09/2046 | N/A | 2,104,843 | |

3,092,008 | |||||||

Collateralized Loan Obligations – 2.0% | |||||||

750,000 | KKR Financial CLO Ltd., Series 2007-1X, Class A(b) (c) | BBB+ | 5.241% | 05/15/2021 | N/A | 744,236 | |

1,500,000 | Newstar Trust, Series 2013-1A, Class E(a) (b) (c) | BBB– | 5.701% | 09/20/2023 | N/A | 1,500,118 |

See notes to financial statements.

10 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2013 |

Principal Amount | Description | Rating* | Coupon | Maturity | Optional Call Provisions** | Value | |

Collateralized Loan Obligations continued | |||||||

$ 500,000 | Salus CLO Ltd. (Cayman Islands)(a) (b) (c) | NR | 7.002% | 03/05/2021 | N/A | $ 499,980 | |

400,000 | Turbn, Series 2013-1A, Class B | BBB | 6.375% | 12/15/2048 | N/A | 392,580 | |

3,136,914 | |||||||

Other ABS – 0.9% | |||||||

1,492,187 | Emerald Aviation Finance Ltd. (Cayman Islands)(a) | BBB | 6.350% | 10/15/2038 | 10/15/18 @ 100 | 1,503,611 | |

Total Asset Backed Securities – 4.8% | |||||||

(Cost $7,660,145) | 7,732,533 | ||||||

Term Loans – 59.9%(f) | |||||||

Aerospace & Defense – 5.9% | |||||||

900,000 | Camp Systems International, 2nd Lien(b) | CCC | 10.000% | 11/30/2019 | N/A | 919,971 | |

4,000,000 | Doncasters Group Limited, 2nd Lien(b) | CCC+ | 9.500% | 10/09/2020 | N/A | 4,020,000 | |

1,500,000 | Nana Development, 1st Lien(b) | B+ | 8.000% | 03/15/2018 | N/A | 1,522,500 | |

3,000,000 | Total Safety U.S., Inc., 2nd Lien(b) | CCC | 9.250% | 09/13/2020 | N/A | 3,060,000 | |

9,522,471 | |||||||

Automotive – 1.0% | |||||||

1,540,000 | Keystone Automotive, 1st Lien(b) | B | 7.000% | 08/15/2019 | N/A | 1,564,063 | |

Banking – 1.9% | |||||||

3,000,000 | Ranpak, 2nd Lien(b) | B– | 8.500% | 04/23/2020 | N/A | 3,090,000 | |

Building Materials – 2.2% | |||||||

EUR 1,320,423 | Ursa Insulation B.V.(b) (d) | B | 5.233% | 04/26/2021 | N/A | 1,793,931 | |

1,250,000 | Ursa Insulation B.V., Lien 1(b) (d) | B | 7.750% | 04/26/2020 | N/A | 1,698,254 | |

3,492,185 | |||||||

Chemicals – 1.6% | |||||||

$ 2,600,000 | Royal Adhesives and Sealants(b) | B | 5.500% | 07/31/2018 | N/A | 2,624,908 | |

Consumer Products – 0.8% | |||||||

592,477 | Targus Group International, Inc.(b) | B | 12.000% | 05/24/2016 | N/A | 512,492 | |

714,665 | Totes Isotoner Corp.(b) | B | 7.252% | 07/07/2017 | N/A | 719,132 | |

1,231,624 | |||||||

Diversified Manufacturing – 1.6% | |||||||

2,600,000 | Minimax Viking, Lien 1(b) | B | 4.500% | 08/07/2020 | N/A | 2,621,658 | |

Electric – 1.9% | |||||||

2,962,500 | Astoria Generating Co. Acquisitions(b) | B | 8.500% | 10/26/2017 | N/A | 3,051,390 | |

Energy-Alternate Sources – 1.9% | |||||||

3,000,000 | Panda Temple II Power, 1st Lien(b) | B | 7.250% | 04/03/2019 | N/A | 3,093,750 | |

Entertainment – 1.9% | |||||||

3,000,000 | Steinway Musical Instruments, 2nd Lien(b) | B– | 9.250% | 09/18/2020 | N/A | 3,082,500 | |

Environmental Control – 0.3% | |||||||

500,000 | Paradigm, Ltd., 2nd Lien(b) (d) | CCC+ | 10.500% | 07/30/2020 | N/A | 505,937 | |

Food & Beverage – 8.6% | |||||||

2,910,000 | Advance Pierre Foods, Inc., Lien 2(b) | CCC+ | 9.500% | 10/10/2017 | N/A | 2,890,590 | |

1,795,500 | Arctic Glacier Holdings, 1st Lien(b) | B– | 6.000% | 05/10/2019 | N/A | 1,797,744 | |

4,000,000 | CTI Foods Holding Co. LLC, 2nd Lien(b) | CCC+ | 8.250% | 06/28/2021 | N/A | 4,040,000 | |

100,000 | Del Monte Foods Co., Lien 1 | B+ | 4.250% | 01/26/2021 | N/A | 100,688 | |

1,100,000 | DS Waters of America, 1st Lien(b) | BB– | 5.250% | 08/30/2020 | N/A | 1,108,938 | |

4,000,000 | Reddy ICE Holdings, Inc., 2nd Lien(b) | CCC+ | 10.750% | 10/01/2019 | N/A | 3,960,000 | |

13,897,960 |

See notes to financial statements.

PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2013 |

Principal Amount | Description | Rating* | Coupon | Maturity | Optional Call Provisions** | Value | |

Health Care – 1.3% | |||||||

$ 1,995,000 | Apria Healthcare, 1st Lien(b) | BB– | 6.750% | 04/06/2020 | N/A | $ 2,006,631 | |

Insurance – 0.7% | |||||||

1,100,000 | Cetera Financial Group, 1st Lien(b) | B+ | 6.500% | 08/07/2019 | N/A | 1,111,000 | |

Iron & Steel – 2.5% | |||||||

4,000,000 | Oxbow Carbon, 2nd Lien(b) | BB– | 8.000% | 01/18/2020 | N/A | 4,075,000 | |

Machinery-Construction & Mining – 1.6% | |||||||

2,500,000 | Mei Conlux Holdings, 1st Lien(b) | B | 5.000% | 08/21/2020 | N/A | 2,515,625 | |

Media – 1.5% | |||||||

1,682,761 | Endurance International Group, Lien 1(b) | B | 6.250% | 11/09/2019 | N/A | 1,694,330 | |

399,000 | Hemisphere Media Group Inc., 1st Lien(b) | B | 6.250% | 07/30/2020 | N/A | 401,745 | |

39,158 | Max Broadcast Group(b) (d) | B– | 6.250% | 02/28/2014 | N/A | 34,459 | |

398,307 | Max Broadcast Group LLC(b) (d) | B– | 6.250% | 02/28/2014 | N/A | 350,511 | |

2,481,045 | |||||||

Oil Field Services – 2.0% | |||||||

2,985,000 | Rice Energy, 2nd Lien(b) | CCC+ | 8.500% | 10/25/2018 | N/A | 3,052,162 | |

200,000 | Varel International Energy(b) | B | 9.250% | 07/17/2017 | N/A | 205,000 | |

3,257,162 | |||||||

Other Finance – 2.9% | |||||||

4,000,000 | Digital Insight, 2nd Lien(b) | CCC+ | 8.750% | 08/01/2020 | N/A | 4,033,320 | |

350,000 | Grosvenor Capital Management | BB– | 3.750% | 11/25/2020 | N/A | 350,000 | |

250,000 | Santander Asset Management, 1st Lien | BB | 4.250% | 11/26/2020 | N/A | 250,625 | |

4,633,945 | |||||||

Other Industrials – 1.3% | |||||||

2,000,000 | Mitchell International, Inc., 2nd Lien(b) | CCC | 8.500% | 10/11/2021 | N/A | 2,033,130 | |

Retail – 2.1% | |||||||

2,943,750 | Eddie Bauer Licensing Senior Secured Notes(b) (d) | B– | 9.500% | 06/28/2018 | N/A | 2,870,156 | |

500,000 | Hudson Bay Co., 2nd Lien(b) | B– | 8.250% | 11/04/2021 | N/A | 515,418 | |

3,385,574 | |||||||

Technology – 7.5% | |||||||

1,975,000 | Aspect Software, Inc.(b) | B | 7.000% | 05/07/2016 | N/A | 1,983,384 | |

2,000,000 | Greenway Medical Technology, 1st Lien(b) | B+ | 6.000% | 11/04/2020 | N/A | 2,000,000 | |

2,200,000 | Greenway Medical Technology, 2nd Lien(b) | CCC+ | 9.250% | 11/04/2021 | N/A | 2,211,000 | |

3,990,000 | Landesk Group, Inc., 1st Lien(b) | B+ | 5.250% | 08/07/2020 | N/A | 4,019,925 | |

1,900,000 | P2 Energy Solutions, 1st Lien(b) | B+ | 5.000% | 10/30/2020 | N/A | 1,913,062 | |

12,127,371 | |||||||

Transportation – 4.0% | |||||||

2,224,686 | Travelport Holdings, 2nd Lien, Tranche 1(b) | CCC+ | 9.500% | 01/31/2016 | N/A | 2,308,111 | |

3,990,000 | US Shipping Corp., Lien 1(b) | B | 9.000% | 04/30/2018 | N/A | 4,109,700 | |

6,417,811 |

See notes to financial statements.

PORTFOLIO OF INVESTMENTS (Unaudited) | November 30, 2013 |

Principal Amount | Description | Rating* | Coupon | Maturity | Optional Call Provisions** | Value | |

Wireless – 2.9% | |||||||

$ 1,595,980 | Alcatel Lucent, Lien 1(b) | B+ | 5.750% | 01/30/2019 | N/A | $ 1,612,873 | |

2,980,566 | Expert Global Solutions, Lien 1(b) | B– | 8.500% | 04/03/2018 | N/A | 3,036,452 | |

4,649,325 | |||||||

Total Term Loans – 59.9% | |||||||

(Cost $95,340,293) | 96,472,065 | ||||||

Total Long-Term Investments – 119.1% | |||||||

(Cost $189,826,075) | 191,800,532 | ||||||

Total Investments – 119.1% | |||||||

(Cost $189,826,075) | 191,800,532 | ||||||

Other Assets in excess of Liabilities – 7.8% | 12,600,851 | ||||||

Reverse Repurchase Agreements – (26.9%) | (43,409,480) | ||||||

Net Assets – 100.0% | $ 160,991,903 |

CDO – Collateralized Debt Obligation

CLO – Collateralized Loan Obligation

EUR – Euro

LLC – Limited Liability Company

LP – Limited Partnership

N/A – Not Applicable

| • | Ratings shown are per Standard & Poor’s Rating Group, Moody’s Investor Services, Inc. or Fitch Ratings. Securities classified as NR are not rated. (For securities not rated by Standard & Poor’s Rating Group, the rating by Moody’s Investor Services, Inc. is provided. Likewise, for securities not rated by Standard & Poor’s Rating Group and Moody’s Investor Services, Inc., the rating by Fitch Ratings is provided.) All ratings are unaudited. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund or its shares. |

| ** | Date and price of the earliest optional call or put provision. There may be other call provisions at varying prices at later dates. All optional call provisions are unaudited. |

| (a) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2013, these securities amounted to $62,948,588, which represents 39.1% of net assets applicable. |

| (b) | All or a portion of these securities have been physically segregated in connection with reverse repurchase agreements and unfunded loan commitments. As of November 30, 2013, the total amount segregated was $123,751,416. |

| (c) | Floating or variable rate coupon. The rate shown is as of November 30, 2013. |

| (d) | Illiquid security. |

| (e) | Paid-in-kind toggle note. The issuer in each interest period has the option to pay interest in cash or to issue payment-in-kind shares of the note. |

| (f) | Term loans held by the Fund have a variable interest rate feature which is periodically adjusted based on an underlying interest rate benchmark. In addition, term loans may include mandatory and/or optional prepayment terms. As a result, the actual maturity dates of the loan may be different than the amounts disclosed in the portfolios of investments. Term loans may be considered restricted in that the Fund may be contractually obligated to secure approval from the Agent Bank and/or Borrower prior to the sale or disposition of loan. |

See notes to financial statements.

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | November 30, 2013 | |

Assets | |

Investments in securities, at value (cost $189,826,075) | $ 191,800,532 |

Foreign currency, at value (cost $82,910) | 82,901 |

Cash | 7,440,573 |

Receivable for securities sold | 7,136,903 |

Interest receivable | 3,348,948 |

Unrealized appreciation on unfunded commitments | 5,833 |

Other assets | 4,905 |

Total assets | 209,820,595 |

Liabilities | |

Reverse repurchase agreements | 43,409,480 |

Payable for securities purchased | 5,079,742 |

Advisory fee payable | 165,287 |

Interest due on borrowings | 18,570 |

Administrative fee payable | 4,541 |

Unrealized depreciation on forward foreign currency contracts | 169 |

Accrued expenses and other liabilities | 150,903 |

Total liabilities | 48,828,692 |

Net Assets | $ 160,991,903 |

Composition of Net Assets | |

Common stock, $.01 par value per share; unlimited number of shares authorized, | |

6,629,189 shares issued and outstanding | $ 662,919 |

Additional paid-in capital | 157,277,718 |

Accumulated undistributed net investment income | 948,719 |

Accumulated net realized loss on investments and foreign currency transactions | 124,366 |

Accumulated net unrealized appreciation on investments, foreign currency translations | |

and unfunded commitments | 1,978,181 |

Net Assets | $ 160,991,903 |

Net Asset Value (based on 6,629,189 shares outstanding) | $ 24.29 |

See notes to financial statements.

14 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

STATEMENT OF OPERATIONS For the period June 26, 2013* through November 30, 2013 (Unaudited) | November 30, 2013 |

Investment Income | ||

Interest | $ 5,202,016 | |

Total income | $ 5,202,016 | |

Expenses | ||

Advisory fee | 753,920 | |

Interest expense | 69,996 | |

Fund accounting | 41,552 | |

Professional fees | 36,628 | |

Trustees’ fees and expenses | 28,655 | |

Administrative fee | 20,727 | |

Printing expenses | 20,170 | |

Custodian fee | 12,151 | |

NYSE listing fee | 9,664 | |

Transfer agent fee | 7,984 | |

Miscellaneous | 40,803 | |

Total expenses | 1,042,250 | |

Net investment income | 4,159,766 | |

Realized and Unrealized Gain (Loss) on Investments and Unfunded Commitments | ||

Net realized gain (loss) on: | ||

Investments | 278,065 | |

Foreign currency transactions | (153,699) | |

Net change in unrealized appreciation (depreciation) on: | ||

Investments | 1,974,457 | |

Foreign currency translations | (2,109) | |

Unfunded commitments | 5,833 | |

Net realized and unrealized gain (loss) on investments, foreign currency transactions | ||

and unfunded commitments | 2,102,547 | |

Net Increase in Net Assets Resulting from Operations | $ 6,262,313 |

| * | Commencement of investment operations. |

See notes to financial statements.

STATEMENT OF CHANGES IN NET ASSETS | November 30, 2013 | |

For the Period | |

June 26, 2013* through | |

November 30, 2013 | |

Increase in Net Assets from Operations | |

Net investment income | $ 4,159,766 |

Net realized gain on investments and foreign currency transactions | 124,366 |

Net change in unrealized appreciation on investments, foreign currency translations | |

and unfunded commitments | 1,978,181 |

Net increase in net assets resulting from operations | 6,262,313 |

Distributions to Common Shareholders | |

From net investment income | (3,211,047) |

Capital Share Transactions | |

Net proceeds from the issuance of common shares | 158,271,887 |

Common share offering costs charged to paid-in capital | (331,250) |

Net increase from capital share transactions | 157,940,637 |

Total increase in net assets | 160,991,903 |

Net Assets | |

Beginning of period | — |

End of period (including undistributed net investment income of $948,719) | $ 160,991,903 |

| * | Commencement of investment operations. |

See notes to financial statements.

STATEMENT OF CASH FLOWS For the period June 26, 2013* through November 30, 2013 (Unaudited) | November 30, 2013 |

Cash Flows from Operating Activities: | |

Net increase in net assets resulting from operations | $ 6,262,313 |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to | |

Net Cash Used by Operating and Investing Activities: | |

Net unrealized appreciation on investments | (1,974,457) |

Net unrealized appreciation on unfunded commitments | (5,833) |

Net unrealized depreciation on foreign currency translations | 2,109 |

Net realized gain on investments | (278,065) |

Paydowns received | (86,503) |

Net accretion of bond discount and amortization of bond premium | (106,144) |

Purchase of long-term investments | (228,090,991) |

Proceeds from sale of long-term investments | 38,319,537 |

Increase in interest receivable | (3,348,948) |

Increase in receivable for securities sold | (7,136,903) |

Increase in other assets | (4,905) |

Increase in payable for securities purchased | 5,079,742 |

Increase in advisory fee payable | 165,287 |

Increase in interest due on borrowings | 18,570 |

Increase in administration fee payable | 4,541 |

Increase in accrued expenses and other liabilities | 150,903 |

Net Cash Used by Operating and Investing Activities | (191,029,747) |

Cash Flows From Financing Activities: | |

Net proceeds from the issuance of common shares | 158,271,887 |

Distributions to common shareholders | (3,211,047) |

Increase in reverse repurchase agreements | 43,409,480 |

Net Cash Provided by Financing Activities | 198,470,320 |

Net increase in cash | 7,440,573 |

Cash at Beginning of Period | — |

Cash at End of Period | $ 7,440,573 |

Supplemental Disclosure of Cash Flow Information: Cash paid during the period for interest | $ 51,426 |

| * | Commencement of investment operations. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS | November 30, 2013 |

| For the Period | ||||

| June 26, 2013* | ||||

| through | ||||

Per share operating performance | November 30, 2013 | |||

for a share outstanding throughout the period | (Unaudited) | |||

Net asset value, beginning of period | $ | 23.82 | ||

Income from investment operations | ||||

Net investment income (a) | 0.64 | |||

Net realized and unrealized gain on investments and unfunded commitments | 0.31 | |||

Total from investment operations | 0.95 | |||

Distributions to Shareholders | ||||

From net investment income | (0.48 | ) | ||

Net asset value, end of period | $ | 24.29 | ||

Market value, end of period | $ | 22.35 | ||

Total investment return (b) | ||||

Net asset value | 4.03 | % | ||

Market value | -8.70 | % | ||

Ratios and supplemental data | ||||

Net assets, end of period (thousands) | $ | 160,992 | ||

Ratios to Average Net Assets: | ||||

Total expenses, excluding interest expense | 1.45 | %(c) | ||

Total expenses, including interest expense | 1.55 | %(c) | ||

Net investment income, including interest expense | 6.18 | %(c) | ||

Portfolio turnover rate (d) | 29 | % | ||

Senior Indebtedness: | ||||

Total Borrowings outstanding (in thousands) | $ | 43,409 | ||

Asset Coverage per $1,000 of indebtedness(e) | $ | 4,709 | ||

| * | Commencement of investment operations. |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total investment return is calculated assuming a purchase of a share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (c) | Annualized. |

| (d) | Portfolio turnover is not annualized for periods of less than one year. |

| (e) | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total borrowings. |

See notes to financial statements.

NOTES TO FINANCIAL STATEMENTS (Unaudited) | November 30, 2013 |

Note 1 – Organization:

Guggenheim Credit Allocation Fund (the “Fund”) was organized as a Delaware statutory trust on June 7, 2012, and commenced investment operations on June 26, 2013. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (“1940 Act”).

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation.

Note 2 – Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Fund.

(a) Valuation of Investments

The Fund values equity securities at the last reported sale price on the principal exchange or in the principal over-the-counter (“OTC”) market in which such securities are traded, as of the close of regular trading on the New York Stock Exchange (“NYSE”) on the day the securities are being valued or, if there are no sales, at the mean between the last available bid and asked prices on that day. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. The Fund values debt securities (including corporate bonds, asset- backed securities, collateralized mortgage obligations and term loans) at the last available bid price for such securities or, if such prices are not available, at prices for securities of comparable maturity, quality, and type. The Fund’s securities that are traded primarily in foreign markets may be traded in such markets on days that the NYSE is closed. As a result, the net asset value of the Fund may be significantly affected on days when holders of common shares have no ability to trade the common shares on the NYSE. Short-term securities with remaining maturities of 60 days or less are valued at amortized cost, which approximates fair value.

For those securities where quotations or prices are not available, the valuations are determined in accordance with procedures established in good faith by management and approved by the Board of Trustees (“Trustees”). A valuation committee consisting of representatives from investment management, fund administration, legal and compliance is responsible for the oversight of the valuation process of the Fund and convenes monthly, or more frequently as needed. The valuation committee reviews monthly Level 3 fair valued securities methodology, price overrides, broker quoted securities, price source changes, illiquid securities, unchanged valuations, halted securities, price challenges, fair valued securities sold and back testing trade prices in relation to prior day closing prices. On a quarterly basis, the valuations and methodologies of all Level 3 fair valued securities are presented to the Fund’s Trustees.

Valuations in accordance with these procedures are intended to reflect each security’s (or asset’s) “fair value.” Fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. Each such determination is based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

For fixed income securities, fair valuations may include input from Guggenheim Partners Investment Management, LLC (“GPIM”) utilizing a wide variety of market data including yields or prices of investments of comparable quality, type of issue, coupon, maturity, rating, indications of value from security dealers, evaluations of anticipated cash flows or collateral, spread over Treasuries, and other information and analysis. GPIM also uses third party service providers to model certain securities using cash flow models to represent a fair market value.

There are three different categories for valuation. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuations).

The Fund values Level 1 securities using readily available market quotations in active markets. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. In addition, the Fund values certain Level 2 fixed income securities using broker quotes. The Fund values Level 2 equity securities using various observable market inputs as described above. The fair value estimates for the Level 3 securities in the Fund are determined in accordance with the Fund’s valuation procedures described above.

Transfers between valuation levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current fiscal period.

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | November 30, 2013 |

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy at November 30, 2013.

Description | Level 1 | Level 2 | Level 3 | Total |

Valuations (in $000s) | ||||

Assets: | ||||

Corporate Bonds | $ – | $ 87,596 | $ – | $ 87,596 |

Asset Backed Securities | – | 7,733 | – | 7,733 |

Term Loans | – | 96,472 | – | 96,472 |

Unfunded Commitments | – | 6 | – | 6 |

Total Assets | $ – | $ 191,807 | $ – | $ 191,807 |

There were no transfers between valuation levels as of the report date when compared to the valuation levels at inception.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Paydown gains and losses on mortgage and asset-backed securities are treated as an adjustment to interest income. For the period ended November 30, 2013, the Fund recognized an increase of interest income and a decrease of net realized gain of $86,503. This reclassification is reflected on the Statement of Operations and had no effect on the net asset value of the Fund. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis. Discounts on debt securities purchased are accreted to interest income over the lives of the respective securities using the effective interest method. Premiums on debt securities purchased are amortized to interest income up to the next call date of the respective securities using the effective interest method.

(c) Currency Translation

Assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the mean of the bid and asked price of respective exchange rates on the last day of the period. Purchases and sales of investments denominated in foreign currencies are translated at the exchange rate on the bid and asked price of respective exchange rates on the date of the transaction.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Foreign exchange realized gain or loss resulting from holding of a foreign currency, expiration of a currency exchange contract, difference in exchange rates between the trade date and settlement date of an investment purchased or sold, and the difference between dividends or interest actually received compared to the amount shown in the Fund’s accounting records on the date of receipt is shown as net realized gains or losses on foreign currency transactions on the Fund’s Statement of Operations.

Foreign exchange unrealized gain or loss on assets and liabilities, other than investments, is shown as unrealized appreciation (depreciation) on foreign currency translation on the Fund’s Statement of Operations.

(d) Forward Exchange Currency Contracts

The Fund entered into forward exchange currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to hedge certain firm purchases and sales commitments denominated in foreign currencies and for investment purposes. Forward exchange currency contracts are agreements between two parties to buy and sell currencies at a set price on a future date. Fluctuations in the value of open forward exchange currency contracts are recorded for financial reporting purposes as unrealized appreciation and depreciation by the Fund until the contracts are closed. When the contracts are closed, realized gains and losses are recorded, and included on the Statement of Operations.

Forward exchange currency contracts involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

(e) Distributions to Shareholders

The Fund declares and pays monthly distributions to common shareholders. These distributions consist of investment company taxable income, which generally includes qualified dividend income, ordinary income and short-term capital gains. To the extent distributions exceed net investment income, the excess will be deemed a return of capital. Any net realized long-term capital gains are distributed annually to common shareholders.

Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Note 3 – Investment Advisory Agreement, Sub-Advisory Agreement and Other Agreements:

Pursuant to an Investment Advisory Agreement (the “Agreement”) between the Fund and Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”), the Adviser furnishes offices, necessary facilities and equipment, provides administrative services, oversees the activities of GPIM, provides personnel including certain officers required for the Fund’s administrative management and compensates the officers or trustees of the Fund who are affiliates of the Adviser. As compensation for these services, the Fund pays the Adviser a fee, payable monthly, in an amount equal to 1.00% of the Fund’s average daily managed assets.

Pursuant to a Sub-Advisory Agreement among the Fund, the Adviser and GPIM, GPIM under the supervision of the Fund’s Board of Trustees and the Adviser, provides a continuous investment program for the Fund’s portfolio, provides investment research, makes and executes recommendations for the purchase and sale of securities and provides certain facilities and personnel, including certain officers required for its administrative management and pays the compensation of all officers and trustees of the Fund who are GPIM’s affiliates. As compensation for its

20 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | November 30, 2013 |

services, the Adviser pays GPIM a fee, payable monthly, in an annual amount equal to 0.50% of the Fund’s average daily managed assets.

Certain officers and trustees of the Fund may also be officers, directors and/or employees of the Adviser or GPIM. The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Pursuant to a Fund Administration agreement, Rydex Fund Services, LLC (“RFS”) serves as administrator to the Fund. RFS, GPIM and GFIA are affiliates of Guggenheim Partners, LLC, a global diversified financial services firm. RFS receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund.

Managed Assets | Rate |

First $200,000,000 | 0.0275% |

Next $300,000,000 | 0.0200% |

Next $500,000,000 | 0.0150% |

Over $1,000,000,000 | 0.0100% |

For purposes of calculating the fees payable under the foregoing agreements, “average daily managed assets” means the average daily value of the Fund’s total assets minus the sum of its accrued liabilities. “Total assets” means all of the Fund’s assets and is not limited to its investment securities. “Accrued liabilities” means all of the Fund’s liabilities other than borrowings for investment purposes.

The Bank of New York Mellon (“BNY”) acts as the Fund’s custodian. As custodian, BNY is responsible for the custody of the Fund’s assets.

RFS acts as the Fund’s accounting agent. As accounting agent, RFS is responsible for maintaining the books and records of the Fund’s securities and cash. RFS receives a fund accounting fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund.

Managed Assets | Rate |

First $200,000,000 | 0.0300% |

Next $300,000,000 | 0.0150% |

Next $500,000,000 | 0.0100% |

Over $1,000,000,000 | 0.0075% |

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required.

Information on the components of investments and net assets as of November 30, 2013, is as follows:

Net Tax | ||||

Cost of | Net Tax | Unrealized | ||

Investments | Gross Tax | Gross Tax | Unrealized | Depreciation on |

for Tax | Unrealized | Unrealized | Appreciation on | Derivatives and |

Purposes | Appreciation | Depreciation | Investments | Foreign Currency |

$189,826,075 | $3,376,206 | $(1,401,749) | $1,974,457 | $(2,109) |

The net tax unrealized appreciation on unfunded commitments is $5,388.

Note 5 – Investments in Securities:

During the period ended November 30, 2013, the cost of purchases and proceeds from sales of investments, excluding short-term investments were $228,090,991 and $38,319,537, respectively.

Note 6 – Derivatives:

(a) Forward Exchange Currency Contracts

A forward exchange currency contract is a commitment to purchase or sell a foreign currency on a future date at a negotiated forward rate. The gain or loss arising from the difference between the original contracts and the closing of such contracts would be included in net realized gain or loss on foreign currency transactions. Risk may arise from the potential inability of a counterparty to meet the terms of a contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. The face or contract amount, in U.S. dollars, reflects the total exposure the Fund has in that particular currency contract.

At November 30, 2013, the following forward exchange currency contracts were outstanding:

| Contracts to Sell | Counterparty | Settlement Date | Settlement Value | Value at 11/30/13 | Net Unrealized Depreciation | |

EUR | 2,600,000 | |||||

for USD | 3,533,400 | The Bank of New York Mellon | 1/03/2014 | $3,533,400 | $3,533,569 | $ (169) |

Total unrealized depreciation for forward exchange currency contracts | $ (169) | |||||

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | November 30, 2013 |

(d) Summary of Derivatives Information

The Fund is required by GAAP to disclose: a) how and why a fund uses derivative instruments, b) how derivative instruments and related hedge fund items are accounted for, and c) how derivative instruments and related hedge items affect a fund’s financial position, results of operations and cash flows.

The following table presents the types of derivatives in the Fund by location as presented on the Statement of Assets Liabilities at November 30, 2013.

Statement of Assets and Liabilities Presentation of Fair Values of Derivative Instruments ($000s): | ||||||

Asset Derivatives | Liability Derivatives | |||||

| Statement of Assets | Statement of Assets | |||||

Primary Risk Exposure | and Liabilities Location | Fair Value | and Liabilities Location | Fair Value | ||

Unrealized appreciation on | Unrealized depreciation on | |||||

forward exchange currency | forward exchange currency | |||||

Currency risk | contracts | $ – | contracts | $169 | ||

The following table presents the effect of derivatives instruments on the Statement of Operations for the period ended November 30, 2013.

| Effect of Derivative Instruments on the Statement of Operations: | |

| Amount of Realized Gain (Loss) on Derivatives (value in $000s) | |

Primary Risk Exposure | Foreign Currency Transactions |

Currency risk | $(163) |

Change in Unrealized Appreciation (Depreciation) on Derivatives (value in $000s) | |

Primary Risk Exposure | Foreign Currency Translations |

Currency risk | $(–)* |

| * | Less than the minimum amount disclosed |

Derivative Volume | |

Forward Exchange Currency Contracts: | |

Average Settlement Value Purchased | $ – |

Average Settlement Value Sold | 2,398,394 |

Ending Settlement Value Purchased | – |

Ending Settlement Value Sold | 3,533,400 |

Note 7 – Leverage:

Reverse Repurchase Agreements

The Fund may enter into reverse repurchase agreements as part of its financial leverage strategy. Under a reverse repurchase agreement, the Fund temporarily transfers possession of a portfolio instrument to another party, such as a bank or broker-dealer, in return for cash. At the same time, the Fund agrees to repurchase the instrument at an agreed upon time and price, which reflects an interest payment. Such agreements have the economic effect of borrowings. The Fund may enter into such agreements when it is able to invest the cash acquired at a rate higher than the cost of the agreement, which would increase earned income. When the Fund enters into a reverse repurchase agreement, any fluctuations in the market value of either the instruments transferred to another party or the instruments in which the proceeds may be invested would affect the market value of the Fund’s assets. As a result, such transactions may increase fluctuations in the market value of the Fund’s assets. For the period ended November 30, 2013, the average daily balance for which reverse repurchase agreements were outstanding amounted to $32,306,948. The weighted average interest rate was 0.86%. At November 30, 2013, there was $43,409,480 in reverse repurchase agreements outstanding.

At November 30, 2013, the Fund had outstanding reverse repurchase agreements with various counterparties. Details of the reverse repurchase agreements by counterparty are as follows:

| Counterparty | Range of Interest Rates | Range of Maturity Dates | Face Value |

Barclays Capital, Inc. | 0.82% - 0.99% | 12/03/13 – 02/03/14 | 30,717,127 |

Citigroup, Inc. | 0.85% - 1.00% | 12/02/13 | 6,411,000 |

Credit Suisse Securities LLC | 0.67% - 0.92% | 12/04/13 - 12/23/13 | 6,281,353 |

| $43,409,480 |

Note 8 – Loan Commitments

Pursuant to the terms of certain Term Loan agreements, the Fund held unfunded loan commitments as of November 30, 2013. The Fund is obligated to fund these loan commitments at the borrower’s discretion. The Fund reserves against such contingent obligations by designating cash, liquid securities, and liquid term loans as a reserve. As of November 30, 2013, the total amount segregated in connection with reverse repurchase agreements and unfunded commitments was $123,751,416. The unrealized appreciation on these commitments of $5,833 as of November 30, 2013 is reported as “Unrealized appreciation on unfunded commitments” on the Statement of Assets and Liabilities.

At November 30, 2013, the Fund had the following unfunded loan commitments which could be extended at the option of the borrower:

| Borrower | Expiration Date | Principal Amount | Unrealized Appreciation |

American Stock Transfer | 06/11/2018 | $ 400,000 | $ 2,823 |

Darling International | 04/01/2014 | 1,100,000 | – |

| Digital Insight | 08/01/2018 | 350,000 | 3,010 |

National Financial Partners | 07/01/2018 | 1,500,000 | – |

| $5,833 |

Note 9 – Capital:

In connection with its organization process, the Fund sold 4,189 shares of beneficial interest to Guggenheim Funds Distributors, LLC, an affiliate of the Adviser, for consideration of $100,012 at a price of $23.88 per share. The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 6,629,189 issued and outstanding. Of this amount, the

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | November 30, 2013 |

Fund issued 6,000,000 shares of common stock in its initial public offering. These shares were issued at $23.88 per share after deducting the sales load but before underwriters’ expense reimbursement.

In connection with the initial public offering of the Fund’s common shares, the underwriters were granted an option to purchase additionalcommon shares. The underwriters purchased, at a price of $23.88 per common share (after deducting the sales load but before offering expenses incurred by the Fund), 625,000 common shares of the Fund pursuant to the over-allotment option.

Offering costs, estimated at $331,250 or $0.05 per share, in connection with the issuance of common shares have been borne by the Fund and were charged to paid-in capital. The Adviser and GPIM have agreed to pay offering expenses (other than sales load, but including reimbursement of expenses to the underwriters) in excess of $0.05 per common share.

Common Shares

The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 6,629,189 issued and outstanding.

Transactions in common shares were as follows:

Period Ended | |

November 30, 2013 | |

Beginning shares | – |

Common shares issued through organization process | 4,189 |

Common shares issued through underwritten offering | 6,000,000 |

Common shares issued through over-allotment option | 625,000 |

Ending shares | 6,629,189 |

Note 10 – Indemnifications:

In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would require future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Note 11 – Subsequent Event:

The Fund evaluated subsequent events through the date the financial statements were available for issue and determined there were no additional material events that would require disclosure in the Fund’s financial statements, except as noted below.

On December 2, 2013, the Fund declared a monthly dividend to common shareholders of $0.16146 per common share. The dividend was payable on December 31, 2013, to shareholders of record on December 12, 2013.