GUGGENHEIMINVESTMENTS.COM/GGM

... YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM CREDIT ALLOCATION FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/ggm, you will find:

| • | Daily, weekly and monthly data on share prices, net asset values, distributions and more |

| • | Portfolio overviews and performance analyses |

| • | Announcements, press releases and special notices |

| • | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are constantly updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

| | |

| DEAR SHAREHOLDER (Unaudited) | November 30, 2020 |

We thank you for your investment in the Guggenheim Credit Allocation Fund (the “Fund”). This report covers the Fund’s performance for the six-month period ended November 30, 2020, which concluded on a cautious note. Even though markets performed well for most of the period, COVID-19 became the deadliest pandemic in a century. The U.S. Federal Reserve acted quickly to restore market functioning and cushion the economy, cutting rates to zero, engaging in large-scale asset purchases, and launching an array of lending facilities. Congress also acted much faster than in previous downturns, with the budget deficit headed to the highest level since World War II.

The recovery since the spring has been faster than expected, thanks to massive fiscal support. Encouraging progress on the vaccine front bode well for vaccine take up rates and the time needed to bring the pandemic under control. We expect a sizable growth acceleration in the middle of 2021 as multiple vaccines are broadly distributed in the U.S. However, the latest COVID wave is the largest yet, which has led to renewed lockdowns and a setback in the recovery. Winter weather and holiday gatherings could cause things to get worse before they get better.

These events affected performance of the Fund for the period. To learn more about the Fund’s performance and investment strategy, we encourage you to read the Economic and Market Overview and the Questions & Answers sections of this report, which begin on page 5. There you will find information on Guggenheim’s investment philosophy, views on the economy and market environment, and detailed information about the factors that impacted the Fund’s performance.

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities, debt securities and loans (collectively, “credit securities”). The Fund seeks to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

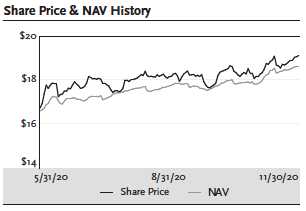

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2020, the Fund provided a total return based on market price of 21.50% and a total return based on NAV of 19.31%. As of November 30, 2020, the Fund’s market price of $19.10 per share represented a premium of 2.74% to its NAV of $18.59 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 3

| | |

| DEAR SHAREHOLDER (Unaudited) continued | November 30, 2020 |

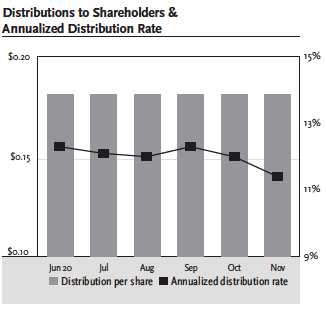

From June 2020 through November 2020, the Fund paid a monthly distribution of $0.1813 per share. The November distribution represents an annualized distribution rate of 11.39% based on the Fund’s closing market price of $19.10 per share on November 30, 2020. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. Please see the Distributions to Shareholders & Annualized Distribution Rate on page 22, and Note 2(f) on page 49 for more information on distributions for the period.

Guggenheim Funds Investment Advisors, LLC (the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Fund’s investment sub-adviser and is responsible for the management of the Fund’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 67 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ distributions in newly issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a stable monthly distribution, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/ggm.

Sincerely,

Guggenheim Funds Investment Advisors, LLC

Guggenheim Credit Allocation Fund

December 31, 2020

4 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| ECONOMIC AND MARKET OVERVIEW (Unaudited) | November 30, 2020 |

The period was marked by COVID-19, the deadliest pandemic in a century, which caused a steeper plunge in output and employment in two months than during the first two years of the Great Depression. However, the recovery since May 2020 has been faster than expected, with consumer confidence holding up well as massive fiscal support drove positive personal income growth and a swift monetary policy response led to gains in household net worth.

Nonetheless, the U.S. economy slowed in the final weeks of 2020, as the COVID-19 pandemic worsened, with the expected holiday season surge in cases leading to new restrictions and stay-at-home orders in a number of states. The ramping up of vaccine distribution may help drive recovery by the second quarter of 2021, but the pace of vaccine rollout is likely not yet fast enough to stop the current wave, risking a further slowdown in the near term.

The slowing recovery was evident in falling small business optimism in November’s National Federation of Independent Business (“NFIB”) survey, which saw a sharp contraction in the number of businesses expecting the economy to improve. One bright spot in the report was that a relatively high amount of businesses plan more hiring, consistent with the rebound in job openings data, which has bounced back much faster than in previous recessions. These positive signals of elevated labor demand suggest that once the pandemic impediment to business activity starts to fade, we could see relatively rapid job growth in 2021, one of the U.S. Federal Reserve’s (the “Fed’s”) two policy mandates. The other, inflation at 2%, remains a challenge. While the most recent reading of core Consumer Price Index was slightly stronger than expected at 1.6%, its more durable components, such as rental inflation, continue to soften, suggesting underlying inflation remains weak.

Beyond the data, the market has been focused on the recently passed federal fiscal package, which adds more support for small businesses, new stimulus payments, reinstates federal unemployment benefits, and provides some funding for state and local governments. This stimulus should be out the door relatively quickly, helping to cushion incomes in the first quarter even as the pandemic worsens. And with Democrats taking control of the Senate after the period ended, more fiscal stimulus appears to be on the way, which should drive a strong recovery by the summer as vaccines are more widely distributed and consumers and businesses can draw on buffers built up during the crisis. With a change in Senate control, there is some chance that Democratic proposals the markets had worried about under a Biden presidency, such as corporate and individual tax hikes and heavier regulations, could move forward. A Biden presidency may also mean more predictable policymaking and a scaled back trade war.

We expect the Fed to remain ultra-accommodative, continuing its current pace of asset purchases “until substantial further progress has been made” in reaching its dual mandate goals. Given the amount of labor market healing still ahead of us, and continued disinflationary headwinds, the Fed will likely continue to signal to the market it will be on hold even as we see strong economic growth rates in 2021.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 5

| | |

| QUESTIONS & ANSWERS (Unaudited) | November 30, 2020 |

Guggenheim Credit Allocation Fund (the “Fund”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM”). This team includes B. Scott Minerd, Chairman of Guggenheim Investments and Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director and Chief Investment Officer, Fixed Income; Kevin H. Gundersen, Senior Managing Director and Portfolio Manager; Thomas J. Hauser, Senior Managing Director and Portfolio Manager; and Richard de Wet, Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the six-month period ended November 30, 2020.

What is the Fund’s investment objective and how is it pursued?

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities, debt securities and loans (collectively, “credit securities”). Credit securities in which the Fund may invest consist of corporate bonds, loans and loan participations, asset-backed securities (all or a portion of which may consist of collateralized loan obligations), mortgage-backed securities (both residential mortgage-backed securities and commercial mortgage-backed securities), U.S. Government and agency securities, mezzanine and preferred securities, convertible securities, commercial paper, municipal securities and sovereign government and supranational debt securities. The Fund will seek to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities that are rated below investment grade (commonly referred to as “high-yield” or “junk” bonds), or, if unrated, determined to be of comparable credit quality. The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

The Fund may, but is not required to, use various derivatives for hedging and risk management purposes, to facilitate portfolio management and to earn income or enhance total return. The Fund may use such transactions as a means to synthetically implement the Fund’s investment strategies. In addition, as an alternative to holding investments directly, the Fund may also obtain investment exposure by investing in other investment companies. To the extent that the Fund invests in synthetic investments with economic characteristics similar to credit securities, the value of such investments will be counted as credit securities for purposes of the Fund’s policy of investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in credit securities (the “80% Policy”).

The Fund may invest in open-end funds, closed-end funds and exchange-traded funds. For purposes of the Fund’s 80% Policy, the Fund will include its investments in other investment companies that have a policy of investing at least 80% of their net assets, plus the amount of any borrowings for investment purposes, in one or more types of credit securities.

6 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

The Fund uses financial leverage (borrowing and reverse repurchase agreements) to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

How did the Fund perform for the six months ended November 30, 2020?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended November 30, 2020, the Fund provided a total return based on market price of 21.50% and a total return based on NAV of 19.31%. In addition, the Fund had an annualized distribution rate of 11.39% based on the Fund’s closing market price of $19.10 per share. As of November 30, 2020, the Fund’s market price of $19.10 per share represented a premium of 2.74% to its NAV of $18.59 per share. As of May 31, 2020, the Fund’s market price of $16.71 per share represented a premium of 0.84% to its NAV of $16.57 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

How did other markets perform in this environment for the six-month period ended November 30, 2020?

| | |

| Index | Total Return |

Bloomberg Barclays U.S. Corporate High Yield Index | 10.36% |

Bloomberg Barclays U.S. Aggregate Bond Index | 1.79% |

Bloomberg Barclays U.S. Aggregate Bond 1-3 Year Index | 0.39% |

Credit Suisse Leveraged Loan Index | 7.96% |

ICE Bank of America Merrill Lynch Asset Backed Security Master BBB-AA Index | 7.53% |

S&P 500 Index | 19.98% |

What were the distributions over the period?

From June 2020 through November 2020, the Fund paid a monthly distribution of $0.1813 per share. The November distribution represents an annualized distribution rate of 11.39% based on the Fund’s closing market price of $19.10 per share on November 30, 2020.

The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 7

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

Please see the Distributions to Shareholders & Annualized Distribution Rate on page 22, and Note 2(f) on page 49 for more information on distributions for the period.

For the calendar year ended December 31, 2020, 66% of the distributions were characterized as ordinary income and 34% of the distributions were characterized as return of capital. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in January 2021.

What influenced the Fund’s performance?

Following the strongest quarter in over a decade, the high yield market continued its upward trajectory in the third quarter and returned 4.60%. Aided by aggressive fiscal support, the level of volatility experienced earlier in the year has subsided. Central bank action has played a critical role in supporting credit availability, which has tempered forward looking default rate expectations as many issuers have been able to access capital markets to shore up liquidity. Following a three-week period in March when it was temporarily closed, the new issue market remained extremely active with June recording the highest monthly issuance on record since 2005. This trend continued in the third quarter as new issuance volume totaled $126 billion and was nearly double the prior year’s third quarter. In addition, fund flows continue to support the high yield market. Five out of the last 6 months through November have experienced inflows which totaled $21 billion. In this environment, performance was positive across sectors with Energy and lower rated credit among the top performers.

The Fund experienced strong performance over the period with returns nearly double the high yield market with contribution from across sectors. The Fund was active in the primary market as new issuance was robust and the new issues performed well. An allocation to bank loans contributed to returns as bank loans in the Fund largely outperformed the broader market. Investments in B and CCC rated credit, which was the top performing rating category added to performance. A small exposure to select Investment Grade credit contributed to performance as well, along with increased exposure to longer dated maturities.

How is the Fund positioned for the coming months?

With the economy gradually improving and monetary policy anchoring Treasury rates at low levels, we remain constructive on below investment-grade opportunities in bonds and loans. Credit spreads have room to tighten given the lack of yield across fixed income and the Fund currently has an annualized distribution yield of 11.39%. There is, however, an overhang of a challenging credit environment as measured by market default rates, rating migration, and fundamentals which underscore the need for active security selection. We have identified opportunities in pharmaceuticals, food and beverage, and technology companies that have successfully navigated the impact of COVID-19. A healthy new-issue market has provided the opportunity remaining selective and recently underwritten deals are less likely to default, in our view.

The Fund is well-positioned across its three primary asset class exposures, with the largest allocation to high yield bonds, followed by bank loans and a small allocation to investment grade corporates. The mix

8 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

between bonds and loans varies according to the relative valuation of the two asset classes and availability of attractively priced assets. Among the high yield allocation, the Fund’s exposure to B-rated credits is its largest, and the Fund has incrementally added to BB-rated exposure while moderately reducing the CCC-rated exposure.

The Fund invests in non-U.S. dollar-denominated assets when the risk-return profile is favorable. Non-U.S. dollar-denominated assets comprise less than 2% of the Fund. The Fund uses forward foreign currency exchange contracts to hedge exchange rate risk, which minimizes the effects of currency fluctuations.

Any other comments about the Fund?

The Fund continues to avoid companies with heavy capital expenditure needs that can impair cash flow generation. Companies with recurring revenue streams, strong cash flows, and high-quality margins remain the focus. Overall, we remain concentrated on credit selection, which we believe will become increasingly important to returns in the event of market volatility.

What is the Fund’s duration?

The portfolio has consistently maintained a defensive stance to interest rate volatility with an underweight to duration. The effective duration for the Fund as of November 30, 2020, was 3.3 years which is below the broader high yield market. A sizable allocation to bank loans, whose coupons generally reset quarterly, provides some protection against changes in interest rates.

Discuss the impact of leverage for the period.

The Fund utilizes leverage as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation to common shareholders than could be achieved from a portfolio that is not leveraged. As opportunities arise, leverage may increase to add income as borrowing costs remain low.

With the low cost of borrowing, the amount of leverage used by the Fund is accretive to income generation. The Fund currently employs leverage through reverse repurchase agreements, under which the Fund temporarily transfers possession of portfolio securities and receives cash that can be used for additional investments, and borrowings.

As of November 30, 2020, the amount of leverage was approximately 31% of total managed assets (including the proceeds of leverage). While leverage increases the income of the Fund in yield terms, it also amplifies the effects of changing market prices in the portfolio and can cause the Fund’s NAV to change to a greater degree than the overall market. This can create volatility in Fund pricing but should not affect the Fund’s ability to pay dividends under normal circumstances.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 9

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), ABS, and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

The Bloomberg Barclays U.S. Aggregate Bond 1-3 Year Index measures the performance of publicly issued investment grade corporate, U.S. Treasury and government agency securities with remaining maturities of one to three years.

The Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

The ICE Bank of America Merrill Lynch Asset Backed Security Master BBB-AA Index is a subset of the Bank of America Merrill Lynch U.S. Fixed Rate Asset Backed Securities Index including all securities rated AA1 through BBB3, inclusive.

The Standard & Poor’s 500 (“S&P 500”) is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

Risks and Other Considerations

The global ongoing crisis caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. Investors should be aware that in light of the current uncertainty, volatility and distress in economies, financial markets, and labor and public health conditions all over the world, the Fund’s investments and a shareholder’s investment in the Fund are subject to sudden and substantial losses, increased volatility and other adverse events. Firms through which investors invest with the Fund, the Fund, its service providers, the markets in which it invests and market intermediaries are also impacted by quarantines and similar measures intended to contain the ongoing pandemic, which can obstruct their functioning and subject them to heightened operational risks.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

10 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully.

The Fund is subject to several risk factors. Certain of these risk factors are described below. Please see the Fund’s Prospectus, Statement of Additional Information (SAI) and guggenheiminvestments.com/ggm for a more detailed description of the risks of investing in the Fund. Shareholders may access the Fund’s Prospectus and SAI on the EDGAR Database on the Securities and Exchange Commission’s website at www.sec.gov.

The fact that a particular risk below is not specifically identified as being heightened under current conditions does not mean that the risk is not greater than under normal conditions.

Below Investment Grade Securities Risk. High yield, below investment grade and unrated high risk debt securities (which also may be known as “junk bonds”) may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. This exposure may be obtained through investments in other investment companies. Generally, the risks associated with high yield securities are heightened during times of weakening economic conditions or rising interest rates and are therefore especially heightened under current conditions.

Corporate Bond Risk. Corporate bonds are debt obligations issued by corporations and other business entities. Corporate bonds may be either secured or unsecured. Collateral used for secured debt includes real property, machinery, equipment, accounts receivable, stocks, bonds or notes. If a bond is unsecured, it is known as a debenture. Bondholders, as creditors, have a prior legal claim over common and preferred stockholders as to both income and assets of the corporation for the principal and interest due them and may have a prior claim over other creditors if liens or mortgages are involved. Interest on corporate bonds may be fixed or floating, or the bonds may be zero coupons. Interest on corporate bonds is typically paid semi-annually and is fully taxable to the bondholder. Corporate bonds contain elements of both interest-rate risk and credit risk. The market value of a corporate bond generally may be expected to rise and fall inversely with interest rates and may also be affected by the credit rating of the corporation, the corporation’s performance and perceptions of the corporation in the marketplace. Corporate bonds usually yield more than government or agency bonds due to the presence of credit risk. Depending on the nature of the seniority provisions, a senior corporate bond may be junior to other credit securities of the issuer. The market value of a corporate bond may be affected by factors directly related to the issuer, such as investors’ perceptions of the creditworthiness of the issuer, the issuer’s financial performance, perceptions of the issuer in the market place, performance of management of the issuer, the issuer’s capital structure and use of financial leverage and demand for the issuer’s goods and services. There is a risk that the issuers of corporate bonds may not be able to meet their obligations on interest or principal payments at the time called for by an instrument.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 11

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

Corporate bonds of below investment grade quality are often high risk and have speculative characteristics and may be particularly susceptible to adverse issuer-specific developments.

Credit Risk. The Fund could lose money if the issuer or guarantor of a debt instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time or defaults. Also, the issuer, guarantor or counterparty may suffer adverse changes in its financial condition or be adversely affected by economic, political or social conditions that could lower the credit quality (or the market’s perception of the credit quality) of the issuer or instrument, leading to greater volatility in the price of the instrument and in shares of the Trust. Although credit quality may not accurately reflect the true credit risk of an instrument, a change in the credit quality rating of an instrument or an issuer can have a rapid, adverse effect on the instrument’s liquidity and make it more difficult for the Trust to sell at an advantageous price or time. The risk of the occurrence of these types of events is especially heightened under current conditions.

Current Fixed-Income and Debt Market Conditions. Fixed-income and debt market conditions are highly unpredictable and some parts of the market are subject to dislocations. In response to the crisis initially caused by the outbreak of COVID-19, as with other serious economic disruptions, governmental authorities and regulators have enacted and are enacting significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. These actions present heightened risks to fixed-income and debt instruments, and such risks could be even further heightened if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes. In light of these actions and current conditions, interest rates and bond yields in the United States and many other countries are at or near historic lows, and in some cases, such rates and yields are negative. The current very low or negative interest rates are magnifying the Fund’s susceptibility to interest rate risk and diminishing yield and performance. In addition, the current environment is exposing fixed-income and debt markets to significant volatility and reduced liquidity for Fund investments.

Derivatives Transactions Risk. The Fund may utilize derivatives, including futures contracts and other strategic transactions, to seek to earn income, facilitate portfolio management and mitigate risks. Participation in derivatives markets transactions involves investment risks and transaction costs to which the Fund would not be subject absent the use of these strategies (other than its covered call writing strategy and put option writing strategy). If the Sub-Adviser (Guggenheim Partners Investment Management, LLC or GPIM) is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited.

Interest Rate Risk. Fixed-income and other debt instruments are subject to the possibility that interest rates could change (or are expected to change). Changes in interest rates, including changes in reference rates used in fixed-income and other debt instruments (such as the London Interbank Offered Rate (“LIBOR”)) may adversely affect the Fund’s investments in these instruments, such as the value or liquidity of, and income generated by, the investments. In addition, changes in interest rates, including rates that fall below zero, can have unpredictable effects on markets and can adversely affect the Fund’s

12 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

yield, income and performance. Generally, when interest rates increase, the values of fixed-income and other debt instruments decline, and when interest rates decrease, the values of fixed-income and other debt instruments rise. In response to the crisis initially caused by the outbreak of COVID-19, as with other serious economic disruptions, governmental authorities and regulators are enacting significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. These actions present heightened risks to fixed-income and debt instruments, and such risks could be even further heightened if these actions are unexpectedly or suddenly reversed or are ineffective in achieving their desired outcomes. In light of these actions and current conditions, interest rates and bond yields in the United States and many other countries are at or near historic lows, and in some cases, such rates and yields are negative. The current very low or negative interest rates are magnifying the Fund’s susceptibility to interest rate risk and diminishing yield and performance.

Investment in Loans Risk. The Fund may invest in loans directly or indirectly through assignments or participations. Investments in loans, including loan syndicates and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk, prepayment risk and extension risk, which are heightened under current conditions. Loans may offer a fixed or floating interest rate. Loans are often below investment grade and may be unrated. The Fund’s investments in loans can also be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity. Participations in loans may subject the Fund to the credit risk of both the borrower and the seller of the participation and may make enforcement of loan covenants, if any, more difficult for the Fund as legal action may have to go through the seller of the participation (or an agent acting on its behalf). Covenants contained in loan documentation are intended to protect lenders and investors by imposing certain restrictions and other limitations on a borrower’s operations or assets and by providing certain information and consent rights to lenders. The Fund invests in or is exposed to loans and other similar debt obligations that are sometimes referred to as “covenant-lite” loans or obligations, which are generally subject to more risk than investments that contain traditional financial maintenance covenants and financial reporting requirements. The terms of many loans and other instruments are tied to the London Interbank Offered Rate (“LIBOR”), which functions as a reference rate or benchmark. It is anticipated that LIBOR will ultimately be discontinued, which may cause increased volatility and illiquidity in the markets for instruments with terms tied to LIBOR or other adverse consequences, such as decreased yields and reduction in value, for these instruments. These events may adversely affect the Fund and its investments in such instruments.

Senior Loans Risk. The Fund may invest in senior secured floating rate loans made to corporations and other non-governmental entities and issuers (“Senior Loans”). Senior Loans typically hold the most senior position in the capital structure of the issuing entity, are typically secured with specific collateral and typically have a claim on the assets and/or stock of the borrower that is senior to that held by subordinated debt holders and stockholders of the borrower. The Fund’s investments in Senior Loans are generally rated below investment grade or unrated but believed by the Adviser to be of below investment grade quality and are considered speculative because of the credit risk of their issuers. The

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 13

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

risks associated with such Senior Loans are similar to the risks of other lower grade securities, although Senior Loans are typically senior and secured in contrast to subordinated and unsecured securities. Senior Loans’ higher standing has historically resulted in generally higher recoveries in the event of a corporate reorganization. In addition, because their interest payments are adjusted for changes in short-term interest rates, investments in Senior Loans generally have less interest rate risk than other lower grade securities, which may have fixed interest rates.

Second Lien Loans Risk. The Fund may invest in “second lien” secured floating rate loans made to public and private corporations and other non-governmental entities and issuers for a variety of purposes (“Second Lien Loans”). Second Lien Loans are generally subject to similar risks associated with investment in Senior Loans and other lower grade debt securities. However, Second Lien Loans are second in right of payment to Senior Loans and therefore are subject to the additional risk that the cash flow of the borrower and any property securing the Loan may be insufficient to meet scheduled payments and repayment of principal after giving effect to the senior secured obligations of the borrower. Second Lien Loans are expected to have greater price volatility and exposure to losses upon default than Senior Loans and may be less liquid.

Subordinated Secured Loans Risk. Subordinated secured loans generally are subject to similar risks as those associated with investment in Senior Loans, Second Lien Loans and below investment grade securities. However, such loans may rank lower in right of payment than any outstanding Senior Loans, Second Lien Loans or other debt instruments with higher priority of the borrower and therefore are subject to additional risk that the cash flow of the borrower and any property securing the loan may be insufficient to meet scheduled payments and repayment of principal in the event of default or bankruptcy after giving effect to the higher ranking secured obligations of the borrower. Subordinated secured loans are expected to have greater price volatility than Senior Loans and Second Lien Loans and may be less liquid.

Unsecured Loans Risk. Unsecured loans generally are subject to similar risks as those associated with investment in Senior Loans, Second Lien Loans, subordinated secured loans and below investment grade securities. However, because unsecured loans have lower priority in right of payment to any higher ranking obligations of the borrower and are not backed by a security interest in any specific collateral, they are subject to additional risk that the cash flow of the borrower and available assets may be insufficient to meet scheduled payments and repayment of principal after giving effect to any higher ranking obligations of the borrower. Unsecured loans are expected to have greater price volatility than Senior Loans, Second Lien Loans and subordinated secured loans and may be less liquid.

Leverage Risk. The Fund’s use of leverage, through borrowings or instruments such as derivatives, causes the Fund to be more volatile and riskier than if it had not been leveraged. Although the use of leverage by the Fund may create an opportunity for increased return, it also results in additional risks and can magnify the effect of any losses. The effect of leverage in a declining market is likely to cause a greater decline in the net asset value of the Fund than if the Fund were not leveraged, which may result in a greater decline in the market price of the Fund shares. There can be no assurance that a leveraging strategy will be implemented or that it will be successful during any period during which it is employed.

14 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

Recent economic and market events have contributed to severe market volatility and caused severe liquidity strains in the credit markets. If dislocations in the credit markets continue, the Fund’s leverage costs may increase and there is a risk that the Fund may not be able to renew or replace existing leverage on favorable terms or at all. If the cost of leverage is no longer favorable, or if the Fund is otherwise required to reduce its leverage, the Fund may not be able to maintain distributions at historical levels and common shareholders will bear any costs associated with selling portfolio securities. The Fund’s total leverage may vary significantly over time. To the extent the Fund increases its amount of leverage outstanding, it will be more exposed to these risks.

Management Risk. The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies.

Market Risk. The value of, or income generated by, the investments held by the Fund are subject to the possibility of rapid and unpredictable fluctuation. The value of certain investments (e.g., equity securities) tends to fluctuate more dramatically over the shorter term than do the value of other asset classes. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailing interest rates, changes in inflation or expectations about inflation, investor confidence or economic, political, social or financial market conditions, environmental disasters, governmental actions, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and other similar events, each of which may be temporary or last for extended periods. For example, the crisis initially caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, which could further increase volatility in securities and other financial markets, reduce market liquidity, heighten investor uncertainty and adversely affect the value of the Fund’s investments and the performance of the Fund. Administrative changes, policy reform and/or changes in law or governmental regulations can result in expropriation or nationalization of the investments of a company in which the Fund invests.

Options Risk. The ability of the Fund to achieve its investment objective is partially dependent on the successful implementation of its covered call and put option strategies. The Fund may write call options on individual securities, securities indices, exchange-traded funds (“ETFs”) and baskets of securities. The buyer of an option acquires the right to buy (a call option) or sell (a put option) a certain quantity of a security (the underlying security) or instrument, at a certain price up to a specified point in time or on expiration, depending on the terms. The seller or writer of an option is obligated to sell (a call option) or buy (a put option) the underlying instrument. A call option is “covered” if the Fund owns the security underlying the call or has an absolute right to acquire the security without additional cash consideration (or, if additional cash consideration is required, cash or cash equivalents in such amount are segregated by the Fund’s custodian). As a seller of covered call options, the Fund faces the risk that it will forgo the opportunity to profit from increases in the market value of the security covering the call option during

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 15

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

an option’s life. As the Fund writes covered calls over more of its portfolio, its ability to benefit from capital appreciation becomes more limited. The Fund may also sell call options on an “uncovered” basis. A call option is “uncovered” if the Fund does not own the instrument underlying the call and does not have an absolute right to acquire the security without additional cash consideration. Writing uncovered call options may subject the Fund to additional risks than writing covered call options. The Fund may also write covered put options. A put option is “covered” if the fund segregates cash or cash equivalents in an amount equal to the exercise price with the Fund’s custodian. As a seller of covered put options, the Fund bears the risk of loss if the value of the underlying instrument declines below the exercise price minus the put premium.

Prepayment Risk. Certain debt instruments, including loans and mortgage- and other asset-backed securities, are subject to the risk that payments on principal may occur more quickly or earlier than expected. In this event, the Fund might be forced to forego future interest income on the principal repaid early and to reinvest income or proceeds at generally lower interest rates, thus reducing the Fund’s yield. These types of instruments are particularly subject to prepayment risk, and offer less potential for gains, during periods of declining interest rates.

Structured Finance Investments Risk. The Fund’s structured finance investments may consist of residential mortgage-backed securities (“RMBS”) and commercial mortgage-backed securities (“CMBS”) issued by governmental entities and private issuers, asset-backed securities (“ABS”), structured notes, credit-linked notes and other types of structured finance securities. Holders of structured finance investments bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. The Fund may have the right to receive payments only from the structured product, and generally does not have direct rights against the issuer or the entity that sold the assets to be securitized. The Fund may invest in structured finance products collateralized by low grade or defaulted loans or securities. Investments in such structured finance products are subject to the risks associated with below investment grade securities. Such securities are characterized by high risk. It is likely that an economic recession could severely disrupt the market for such securities and may have an adverse impact on the value of such securities. Structured finance securities are typically privately offered and sold, and thus are not registered under the securities laws. As a result, investments in structured finance securities may be characterized by the Fund as illiquid securities; however, an active dealer market may exist which would allow such securities to be considered liquid in some circumstances.

Mortgage-Backed Securities (“MBS”) Risk. MBS represent an interest in a pool of mortgages. The risks associated with MBS include: (1) credit risk associated with the performance of the underlying mortgage properties and of the borrowers owning these properties; (2) risks associated with their structure and execution (including the collateral, the process by which principal and interest payments are allocated and distributed to investors and how credit losses affect the return to investors in such MBS); (3) risks associated with the servicer of the underlying mortgages; (4) adverse changes in economic conditions and circumstances, which are more likely to have an adverse impact on MBS secured by loans on certain types of commercial properties than on those secured by loans on residential properties; (5) prepayment risk, which can lead to significant fluctuations in the value of the MBS; (6) loss of all or part

16 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

of the premium, if any, paid; and (7) decline in the market value of the security, whether resulting from changes in interest rates, prepayments on the underlying mortgage collateral or perceptions of the credit risk associated with the underlying mortgage collateral.

Commercial Mortgage-Backed Securities Risk. CMBS are subject to particular risks, including lack of standardized terms, shorter maturities than residential mortgage loans and providing for payment of all or substantially all of the principal only at maturity rather than regular amortization of principal. In addition, commercial lending generally is viewed as exposing the lender to a greater risk of loss than residential lending. Economic downturns and other events that limit the activities of and demand for commercial retail and office spaces (such as the current crisis) adversely impact the value of such securities.

Residential Mortgage-Backed Securities Risk. Credit-related risk on RMBS arises from losses due to delinquencies and defaults by the borrowers in payments on the underlying mortgage loans and breaches by originators and servicers of their obligations under the underlying documentation pursuant to which the RMBS are issued. The rate of delinquencies and defaults on residential mortgage loans and the aggregate amount of the resulting losses will be affected by a number of factors, including general economic conditions, particularly those in the area where the related mortgaged property is located, the level of the borrower’s equity in the mortgaged property and the individual financial circumstances of the borrower. These risks are elevated given the current distressed economic, market, public health and labor conditions, notably, increased levels of unemployment, delays and delinquencies in payments of mortgage and rent obligations, and uncertainty regarding the effects and extent of government intervention with respect to mortgage payments and other economic matters.

Asset-Backed Securities Risk. ABS may be particularly sensitive to changes in prevailing interest rates. ABS involve certain risks in addition to those presented by MBS. ABS do not have the benefit of the same security interest in the underlying collateral as MBS and are more dependent on the borrower’s ability to pay and may provide the Fund with a less effective security interest in the related collateral than do MBS. There is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. The collateral underlying ABS may constitute assets related to a wide range of industries and sectors, such as credit card and automobile receivables or other assets derived from consumer, commercial or corporate sectors. If the economy of the United States deteriorates, defaults on securities backed by credit card, automobile and other receivables may increase, which may adversely affect the value of any ABS owned by the Fund. In addition, these securities may provide the Fund with a less effective security interest in the related collateral than do mortgage-related securities. Therefore, there is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities. ABS collateralized by other types of assets are subject to risks associated with the underlying collateral. These risks are elevated given the currently distressed economic, market, labor and public health conditions.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 17

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | November 30, 2020 |

CLO, CDO and CBO Risk. In addition to the general risks associated with debt securities discussed herein, collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and collateralized bond obligations (“CBOs”) are subject to additional risks. CLOs, CDOs and CBOs are subject to risks associated with the possibility that distributions from collateral securities will not be adequate to make interest or other payments; the quality of the collateral may decline in value or default; and the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results.

Valuation Risk. The Fund may invest without limitation in unregistered securities, restricted securities and securities for which there is no readily available trading market. It may be difficult for the Fund to purchase and sell a particular investment at the price at which it has been valued by the Fund for purposes of the Fund’s net asset value, causing the Fund to be unable to realize what the Fund believes should be the price of the investment. Valuation of portfolio investments may be difficult, such as during periods of market turmoil or reduced liquidity, and for investments that may, for example, trade infrequently or irregularly. In these and other circumstances, an investment may be valued using fair value methodologies, which are inherently subjective, reflect good faith judgments based on available information and may not accurately estimate the price at which the Fund could sell the investment at that time. Based on its investment strategies, a significant portion of the Fund’s investments can be difficult to value and thus particularly prone to the foregoing risks.

In addition to the foregoing risks, investors should note that the Fund reserves the right to merge or reorganize with another fund, liquidate or convert into an open-end fund, in each case subject to applicable approvals by shareholders and the Fund’s Board of Trustees as required by law and the Fund’s governing documents.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

18 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| FUND SUMMARY (Unaudited) | November 30, 2020 |

| | |

| Fund Statistics | |

Share Price | $19.10 |

Net Asset Value | $18.59 |

Premium to NAV | 2.74% |

Net Assets ($000) | $172,426 |

| | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS | | |

| FOR THE PERIOD ENDED NOVEMBER 30, 2020 | |

| Six month | | | | Since |

| (non- | One | Three | Five | Inception |

| annualized) | Year | Year | Year | (06/26/13) |

Guggenheim Credit Allocation Fund | | | | | |

| NAV | 19.31% | 10.73% | 5.15% | 9.03% | 6.82% |

| Market | 21.50% | 7.17% | 6.93% | 11.54% | 6.65% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/ggm. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 19

| | |

| FUND SUMMARY (Unaudited) continued | November 30, 2020 |

| | |

| Portfolio Breakdown | | % of Net Assets | |

| Investments | | | |

Corporate Bonds | | | 101.3 | % |

Senior Floating Rate Interests | | | 41.0 | % |

Preferred Stocks | | | 1.9 | % |

Common Stocks | | | 1.5 | % |

Asset-Backed Securities | | | 1.4 | % |

Collateralized Mortgage Obligations | | | 0.5 | % |

Money Market Fund | | | 0.2 | % |

| Total Investments | | | 147.8 | % |

| Other Assets & Liabilities, net | | | (47.8 | %) |

| Net Assets | | | 100.0 | % |

| | | | | |

| Ten Largest Holdings | | % of Net Assets | |

Teneo Holdings LLC, 6.25% | | | 3.3 | % |

Beverages & More, Inc., 11.50% | | | 2.8 | % |

KeHE Distributors LLC / KeHE Finance Corp., 8.63% | | | 2.5 | % |

NES Global Talent, 6.50% | | | 2.4 | % |

Hunt Companies, Inc., 6.25% | | | 2.2 | % |

FAGE International S.A. / FAGE USA Dairy Industry, Inc., 5.63% | | | 2.1 | % |

AmWINS Group, Inc., 7.75% | | | 2.0 | % |

Cengage Learning, Inc., 9.50% | | | 1.9 | % |

Barclays plc, 7.75% | | | 1.9 | % |

Accuride Corp., 6.25% | | | 1.8 | % |

Top Ten Total | | | 22.9 | % |

“Ten Largest Holdings” excludes any temporary cash or derivative investments.

Portfolio breakdown and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/ggm. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

20 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| FUND SUMMARY (Unaudited) continued | November 30, 2020 |

| | |

| | |

Portfolio Composition by Quality Rating1 | | | |

| | |

| | % of Total | |

| Rating | | Investments | |

| Investments | | | |

| AA | | | 0.1 | % |

| A | | | 0.2 | % |

| BBB | | | 8.9 | % |

| BB | | | 31.2 | % |

| B | | | 37.7 | % |

| CCC | | | 16.2 | % |

| CC | | | 0.0 | %* |

NR2 | | | 3.2 | % |

| Other Instruments | | | 2.5 | % |

| Total Investments | | | 100.0 | % |

| |

1 | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter.

|

2

| NR (not rated) securities do not necessarily indicate low credit quality. |

* | Less than 0.1%.

|

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 21

| | |

| FUND SUMMARY (Unaudited) continued | November 30, 2020 |

All or a portion of the above distributions may be characterized as a return of capital. For the calendar year ended December 31, 2020, 66% of the distributions were characterized as ordinary income and 34% of the distributions were characterized as return of capital. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in January 2021.

22 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) | November 30, 2020 |

|

|

|

| Shares | Value |

COMMON STOCKS† – 1.5% | | |

| Utilities – 0.9% | | |

TexGen Power LLC††† | 46,457 | $ 1,556,310 |

| Consumer, Non-cyclical – 0.4% | | |

ATD New Holdings, Inc.*,†† | 24,428 | 427,490 |

Chef Holdings, Inc.*,††† | 3,007 | 256,348 |

Targus Group International Equity, Inc.*,†††,1 | 32,060 | 65,746 |

Save-A-Lot*,††† | 24,751 | – |

| Total Consumer, Non-cyclical | | 749,584 |

|

| Energy – 0.2% | | |

Summit Midstream Partners, LP* | 16,582 | 249,393 |

Legacy Reserves, Inc.*,††† | 2,359 | 2,359 |

| Total Energy | | 251,752 |

|

| Technology – 0.0% | | |

Qlik Technologies, Inc. – Class A*,††† | 56 | 71,072 |

Qlik Technologies, Inc. – Class B*,††† | 13,812 | – |

| Total Technology | | 71,072 |

|

| Industrial – 0.0% | | |

BP Holdco LLC*,†††,1 | 65,965 | 23,258 |

Vector Phoenix Holdings, LP*,††† | 65,965 | 5,929 |

| Total Industrial | | 29,187 |

|

| Financials – 0.0% | | |

Sparta Systems*,††† | 1,922 | – |

| Total Common Stocks | | |

| (Cost $3,749,131) | | 2,657,905 |

|

PREFERRED STOCKS† – 1.9% | | |

| Financial – 1.9% | | |

American Equity Investment Life Holding Co. | | |

5.95%†† | 46,000 | 1,189,100 |

Bank of America Corp. | | |

| 4.38%* | 35,000 | 907,900 |

First Republic Bank | | |

4.13%†† | 30,000 | 762,600 |

Assurant, Inc. | | |

| 5.25% due 01/15/61* | 18,000 | 490,500 |

| Total Financial | | 3,350,100 |

| Total Preferred Stocks | | |

| (Cost $3,225,000) | | 3,350,100 |

|

MONEY MARKET FUND† – 0.2% | | |

Dreyfus Treasury Securities Cash Management Fund — Institutional | | |

Shares, 0.01%2 | 280,021 | 280,021 |

| Total Money Market Fund | | |

| (Cost $280,021) | | 280,021 |

| See notes to financial statements. |

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 23

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% | | |

| Consumer, Non-cyclical – 20.2% | | |

Beverages & More, Inc. | | |

11.50% due 06/15/223,5 | 4,695,000 | $ 4,833,502 |

KeHE Distributors LLC / KeHE Finance Corp. | | |

8.63% due 10/15/264 | 4,000,000 | 4,380,000 |

Kraft Heinz Foods Co. | | |

5.00% due 06/04/425 | 1,725,000 | 1,976,716 |

4.38% due 06/01/465 | 750,000 | 800,960 |

4.88% due 10/01/494,5 | 600,000 | 676,748 |

| 5.20% due 07/15/45 | 150,000 | 177,053 |

FAGE International S.A. / FAGE USA Dairy Industry, Inc. | | |

5.63% due 08/15/264,5 | 3,500,000 | 3,552,500 |

Vector Group Ltd. | | |

6.13% due 02/01/254,5 | 3,050,000 | 3,088,125 |

Sabre GLBL, Inc. | | |

7.38% due 09/01/254,5 | 1,500,000 | 1,616,250 |

9.25% due 04/15/254 | 650,000 | 760,175 |

Nathan's Famous, Inc. | | |

6.63% due 11/01/254 | 1,600,000 | 1,636,000 |

Nielsen Finance LLC / Nielsen Finance Co. | | |

5.88% due 10/01/304,5 | 1,350,000 | 1,483,312 |

5.00% due 04/15/224 | 45,000 | 45,000 |

Par Pharmaceutical, Inc. | | |

7.50% due 04/01/274,5 | 1,340,000 | 1,447,200 |

AMN Healthcare, Inc. | | |

4.63% due 10/01/274,5 | 725,000 | 757,625 |

4.00% due 04/15/294 | 575,000 | 588,656 |

Cheplapharm Arzneimittel GmbH | | |

5.50% due 01/15/284 | 1,250,000 | 1,292,438 |

Carriage Services, Inc. | | |

6.63% due 06/01/264,5 | 1,160,000 | 1,227,489 |

Sotheby’s | | |

7.38% due 10/15/274,5 | 1,125,000 | 1,181,250 |

US Foods, Inc. | | |

6.25% due 04/15/254,5 | 1,050,000 | 1,116,722 |

Tenet Healthcare Corp. | | |

7.50% due 04/01/254,5 | 650,000 | 711,480 |

Acadia Healthcare Company, Inc. | | |

5.00% due 04/15/294 | 525,000 | 553,219 |

Central Garden & Pet Co. | | |

| 4.13% due 10/15/30 | 450,000 | 473,929 |

Endo Dac / Endo Finance LLC / Endo Finco, Inc. | | |

9.50% due 07/31/274 | 181,000 | 199,173 |

6.00% due 06/30/284 | 228,000 | 180,120 |

| Total Consumer, Non-cyclical | | 34,755,642 |

See notes to financial statements.

24 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Consumer, Cyclical – 16.9% | | |

LBC Tank Terminals Holding Netherlands BV | | |

6.88% due 05/15/234,5 | 2,950,000 | $ 2,950,000 |

Suburban Propane Partners Limited Partnership/Suburban Energy Finance Corp. | | |

5.88% due 03/01/275 | 2,600,000 | 2,697,500 |

JB Poindexter & Company, Inc. | | |

7.13% due 04/15/264,5 | 1,775,000 | 1,883,719 |

Boyd Gaming Corp. | | |

8.63% due 06/01/254,5 | 1,500,000 | 1,666,410 |

Delta Air Lines, Inc. | | |

7.00% due 05/01/254,5 | 1,400,000 | 1,599,428 |

1011778 BC ULC / New Red Finance, Inc. | | |

4.00% due 10/15/304,5 | 725,000 | 722,281 |

3.50% due 02/15/294 | 700,000 | 699,125 |

Titan International, Inc. | | |

| 6.50% due 11/30/23 | 1,475,000 | 1,349,625 |

Hilton Domestic Operating Company, Inc. | | |

4.00% due 05/01/314 | 1,275,000 | 1,338,750 |

Wabash National Corp. | | |

5.50% due 10/01/254,5 | 1,250,000 | 1,275,000 |

Boyne USA, Inc. | | |

7.25% due 05/01/254 | 1,200,000 | 1,265,586 |

Clarios Global, LP | | |

6.75% due 05/15/254,5 | 1,100,000 | 1,183,193 |

Clarios Global Limited Partnership / Clarios US Finance Co. | | |

8.50% due 05/15/274,5 | 1,050,000 | 1,130,063 |

Wolverine World Wide, Inc. | | |

6.38% due 05/15/254,5 | 1,000,000 | 1,060,000 |

Aramark Services, Inc. | | |

6.38% due 05/01/254,5 | 975,000 | 1,038,375 |

Hanesbrands, Inc. | | |

5.38% due 05/15/254,5 | 950,000 | 1,011,161 |

Live Nation Entertainment, Inc. | | |

6.50% due 05/15/274,5 | 800,000 | 886,000 |

Yum! Brands, Inc. | | |

| 3.63% due 03/15/31 | 600,000 | 600,000 |

7.75% due 04/01/254,5 | 250,000 | 276,875 |

Allison Transmission, Inc. | | |

3.75% due 01/30/314 | 850,000 | 857,437 |

Williams Scotsman International, Inc. | | |

4.63% due 08/15/284 | 650,000 | 676,000 |

Picasso Finance Sub, Inc. | | |

6.13% due 06/15/254 | 425,000 | 454,750 |

Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd. | | |

6.50% due 06/20/274,5 | 400,000 | 433,750 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 25

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Consumer, Cyclical – 16.9% (continued) | | |

CD&R Smokey Buyer, Inc. | | |

6.75% due 07/15/254 | 400,000 | $ 429,000 |

Vail Resorts, Inc. | | |

6.25% due 05/15/254 | 400,000 | 428,000 |

Six Flags Theme Parks, Inc. | | |

7.00% due 07/01/254 | 350,000 | 379,426 |

Delta Air Lines Inc. / SkyMiles IP Ltd. | | |

4.75% due 10/20/284,5 | 350,000 | 376,590 |

Powdr Corp. | | |

6.00% due 08/01/254 | 300,000 | 312,090 |

Brookfield Residential Properties, Inc. / Brookfield Residential US Corp. | | |

4.88% due 02/15/304 | 210,000 | 207,505 |

| Total Consumer, Cyclical | | 29,187,639 |

|

| Financial – 16.7% | | |

Hunt Companies, Inc. | | |

6.25% due 02/15/264,5 | 3,725,000 | 3,766,906 |

AmWINS Group, Inc. | | |

7.75% due 07/01/264,5 | 3,250,000 | 3,510,000 |

Barclays plc | | |

7.75%5,6,7 | 3,000,000 | 3,225,000 |

NFP Corp. | | |

6.88% due 08/15/284,5 | 2,500,000 | 2,618,750 |

Jefferies Finance LLC / JFIN Company-Issuer Corp. | | |

6.25% due 06/03/264,5 | 2,000,000 | 2,106,500 |

OneMain Finance Corp. | | |

7.13% due 03/15/265 | 1,100,000 | 1,266,199 |

8.88% due 06/01/255 | 350,000 | 390,250 |

| 6.63% due 01/15/28 | 200,000 | 230,500 |

United Shore Financial Services LLC | | |

5.50% due 11/15/254,5 | 1,600,000 | 1,682,352 |

Iron Mountain, Inc. | | |

5.63% due 07/15/324 | 1,500,000 | 1,627,500 |

Quicken Loans LLC / Quicken Loans Company-Issuer, Inc. | | |

3.88% due 03/01/314,5 | 1,500,000 | 1,518,750 |

Wilton RE Ltd. | | |

6.00%4,5,6,7 | 1,500,000 | 1,505,715 |

SLM Corp. | | |

4.20% due 10/29/255 | 1,150,000 | 1,204,625 |

Cushman & Wakefield US Borrower LLC | | |

6.75% due 05/15/284 | 1,100,000 | 1,192,125 |

Bank of New York Mellon Corp. | | |

3.70%6,7 | 700,000 | 713,650 |

See notes to financial statements.

26 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Financial – 16.7% (continued) | | |

LPL Holdings, Inc. | | |

4.63% due 11/15/274,5 | 400,000 | $ 410,000 |

5.75% due 09/15/254 | 200,000 | 207,004 |

HUB International Ltd. | | |

7.00% due 05/01/264,5 | 550,000 | 574,063 |

Assurant, Inc. | | |

7.00% due 03/27/487 | 400,000 | 444,000 |

Alliant Holdings Intermediate LLC / Alliant Holdings Company-Issuer | | |

4.25% due 10/15/274 | 375,000 | 380,625 |

Hampton Roads PPV LLC | | |

6.62% due 06/15/534 | 250,000 | 294,768 |

| Total Financial | | 28,869,282 |

|

| Industrial – 15.5% | | |

New Enterprise Stone & Lime Company, Inc. | | |

9.75% due 07/15/284 | 2,692,000 | 2,934,280 |

6.25% due 03/15/264,5 | 1,125,000 | 1,160,156 |

Great Lakes Dredge & Dock Corp. | | |

8.00% due 05/15/225 | 2,700,000 | 2,767,500 |

Cleaver-Brooks, Inc. | | |

7.88% due 03/01/234,5 | 2,553,000 | 2,527,470 |

Grinding Media Inc. / MC Grinding Media Canada Inc. | | |

7.38% due 12/15/234,5 | 2,294,000 | 2,335,108 |

Howmet Aerospace, Inc. | | |

6.88% due 05/01/255 | 1,500,000 | 1,747,050 |

5.95% due 02/01/375 | 375,000 | 441,525 |

Harsco Corp. | | |

5.75% due 07/31/274,5 | 1,999,000 | 2,113,983 |

PowerTeam Services LLC | | |

9.03% due 12/04/254,5 | 1,825,000 | 2,002,938 |

TransDigm, Inc. | | |

8.00% due 12/15/254,5 | 1,750,000 | 1,911,875 |

Signature Aviation US Holdings, Inc. | | |

4.00% due 03/01/284,5 | 1,250,000 | 1,252,025 |

Standard Industries, Inc. | | |

3.38% due 01/15/314,5 | 1,100,000 | 1,104,125 |

Hillman Group, Inc. | | |

6.38% due 07/15/224,5 | 1,050,000 | 1,042,073 |

JELD-WEN, Inc. | | |

6.25% due 05/15/254 | 800,000 | 862,000 |

Mauser Packaging Solutions Holding Co. | | |

8.50% due 04/15/244 | 750,000 | 783,750 |

Amsted Industries, Inc. | | |

4.63% due 05/15/304,5 | 700,000 | 742,791 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 27

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Industrial – 15.5% (continued) | | |

EnerSys | | |

4.38% due 12/15/274,5 | 325,000 | $ 344,398 |

Summit Materials LLC / Summit Materials Finance Corp. | | |

5.25% due 01/15/294 | 325,000 | 338,813 |

Princess Juliana International Airport Operating Company N.V. | | |

5.50% due 12/20/273,5 | 292,346 | 264,386 |

| Total Industrial | | 26,676,246 |

|

| Communications – 14.4% | | |

Cengage Learning, Inc. | | |

9.50% due 06/15/244,5 | 3,560,000 | 3,301,900 |

Altice France S.A. | | |

8.13% due 02/01/274,5 | 1,300,000 | 1,433,250 |

7.38% due 05/01/264,5 | 1,000,000 | 1,050,000 |

5.13% due 01/15/294,5 | 775,000 | 801,149 |

EIG Investors Corp. | | |

10.88% due 02/01/245 | 3,041,000 | 3,164,160 |

McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance | | |

7.88% due 05/15/244,5 | 3,192,000 | 2,849,530 |

CCO Holdings LLC / CCO Holdings Capital Corp. | | |

4.50% due 05/01/324,5 | 1,750,000 | 1,849,575 |

4.25% due 02/01/314 | 275,000 | 285,285 |

LCPR Senior Secured Financing DAC | | |

6.75% due 10/15/274,5 | 1,600,000 | 1,739,360 |

Level 3 Financing, Inc. | | |

3.63% due 01/15/294,5 | 1,500,000 | 1,501,845 |

Virgin Media Secured Finance plc | | |

4.50% due 08/15/304 | 1,200,000 | 1,260,000 |

Vmed O2 UK Financing I plc | | |

4.25% due 01/31/314 | 1,225,000 | 1,257,156 |

CSC Holdings LLC | | |

4.63% due 12/01/304,5 | 1,125,000 | 1,151,663 |

QualityTech Limited Partnership / QTS Finance Corp. | | |

3.88% due 10/01/284 | 850,000 | 862,750 |

Houghton Mifflin Harcourt Publishers, Inc. | | |

9.00% due 02/15/254,5 | 800,000 | 792,000 |

Radiate Holdco LLC / Radiate Finance, Inc. | | |

4.50% due 09/15/264 | 650,000 | 675,967 |

T-Mobile USA, Inc. | | |

3.30% due 02/15/514,5 | 625,000 | 654,825 |

TripAdvisor, Inc. | | |

7.00% due 07/15/254 | 225,000 | 241,875 |

| Total Communications | | 24,872,290 |

See notes to financial statements.

28 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Energy – 6.9% | | |

NuStar Logistics, LP | | |

6.38% due 10/01/305 | 2,025,000 | $ 2,197,125 |

| 6.00% due 06/01/26 | 125,000 | 131,563 |

American Midstream Partners Limited Partnership / American Midstream Finance Corp. | | |

9.50% due 12/15/214,5 | 2,265,000 | 2,253,675 |

Indigo Natural Resources LLC | | |

6.88% due 02/15/264,5 | 1,815,000 | 1,833,150 |

Global Partners Limited Partnership / GLP Finance Corp. | | |

7.00% due 08/01/275 | 775,000 | 827,839 |

6.88% due 01/15/294 | 275,000 | 293,934 |

Exterran Energy Solutions Limited Partnership / EES Finance Corp. | | |

8.13% due 05/01/255 | 1,350,000 | 1,100,534 |

Comstock Resources, Inc. | | |

7.50% due 05/15/254 | 970,000 | 967,575 |

CVR Energy, Inc. | | |

5.75% due 02/15/284,5 | 900,000 | 753,750 |

Parkland Corp. | | |

6.00% due 04/01/264 | 450,000 | 474,057 |

Rattler Midstream, LP | | |

5.63% due 07/15/254,5 | 400,000 | 422,250 |

Unit Corp. | | |

due 05/15/21†††,8 | 2,828,000 | 339,360 |

Viper Energy Partners, LP | | |

5.38% due 11/01/274 | 200,000 | 211,574 |

Basic Energy Services, Inc. | | |

due 10/15/233,8 | 575,000 | 110,687 |

| Total Energy | | 11,917,073 |

|

| Basic Materials – 6.5% | | |

Carpenter Technology Corp. | | |

6.38% due 07/15/285 | 1,700,000 | 1,852,100 |

| 4.45% due 03/01/23 | 400,000 | 412,000 |

United States Steel Corp. | | |

12.00% due 06/01/254 | 1,400,000 | 1,596,000 |

6.88% due 08/15/255 | 600,000 | 558,750 |

Kaiser Aluminum Corp. | | |

4.63% due 03/01/284,5 | 1,800,000 | 1,856,286 |

Alcoa Nederland Holding BV | | |

6.75% due 09/30/244,5 | 1,500,000 | 1,554,375 |

Arconic Corp. | | |

6.00% due 05/15/254,5 | 850,000 | 914,855 |

Illuminate Buyer LLC / Illuminate Holdings IV, Inc. | | |

9.00% due 07/01/284 | 750,000 | 834,375 |

Minerals Technologies, Inc. | | |

5.00% due 07/01/284 | 800,000 | 831,832 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND SEMIANNUAL REPORT l 29

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | November 30, 2020 |

|

|

|

| Face | |

| Amount~ | Value |

CORPORATE BONDS†† – 101.3% (continued) | | |

| Basic Materials – 6.5% (continued) | | |

HB Fuller Co. | | |

| 4.25% due 10/15/28 | 225,000 | $ 231,188 |

Compass Minerals International, Inc. | | |

6.75% due 12/01/274,5 | 200,000 | 220,380 |