Washington, D.C. 20549

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

SANTANDER MEXICO FINANCIAL GROUP, S.A.B. de C.V.

01219 México, D.F.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de C.V.

TABLE OF CONTENTS

| I. | CEO Message / Key Highlights for the Quarter |

| II. | Summary of 3Q13 Consolidated Results |

| III. | Analysis of 3Q13 Consolidated Results |

| IV. | Relevant Events & Representative Activities and Transactions |

| VI. | 3Q13 Earnings Call Dial-In Information |

| VIII. | Notes to the Financial Statements |

| | 3Q.13 | EARNINGS RELEASE | 3 |

| | | |

| | |  |

Grupo Financiero Santander México Reports Third Quarter 2013 Net Income of Ps.5,882 Million

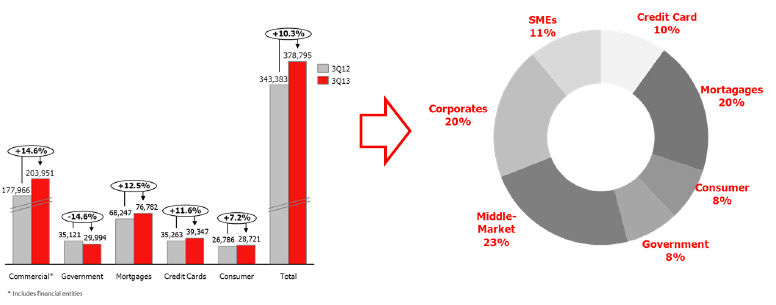

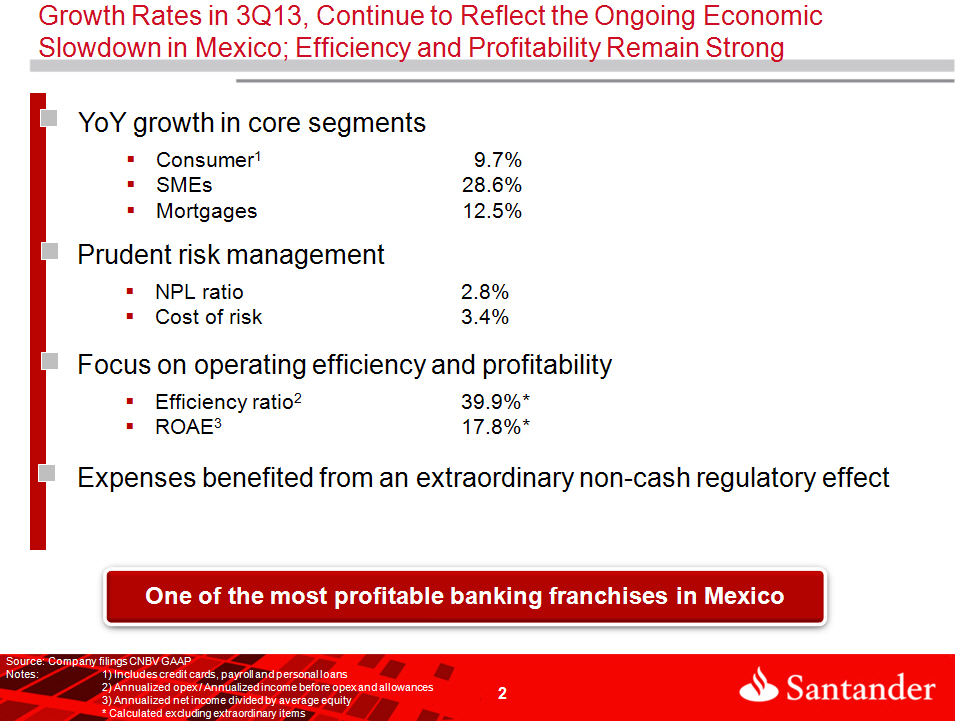

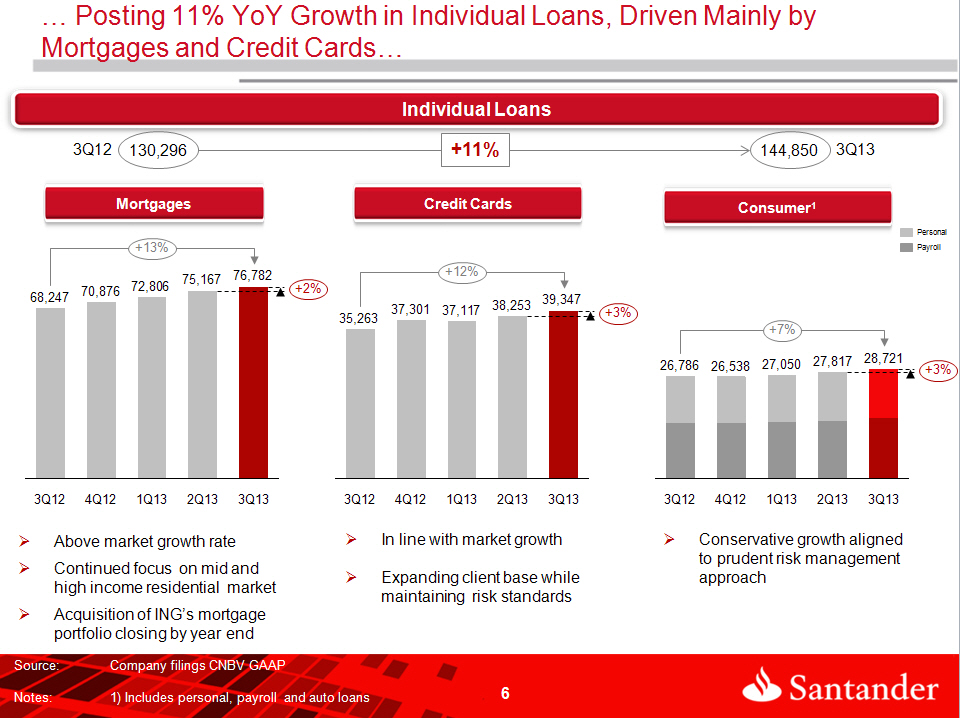

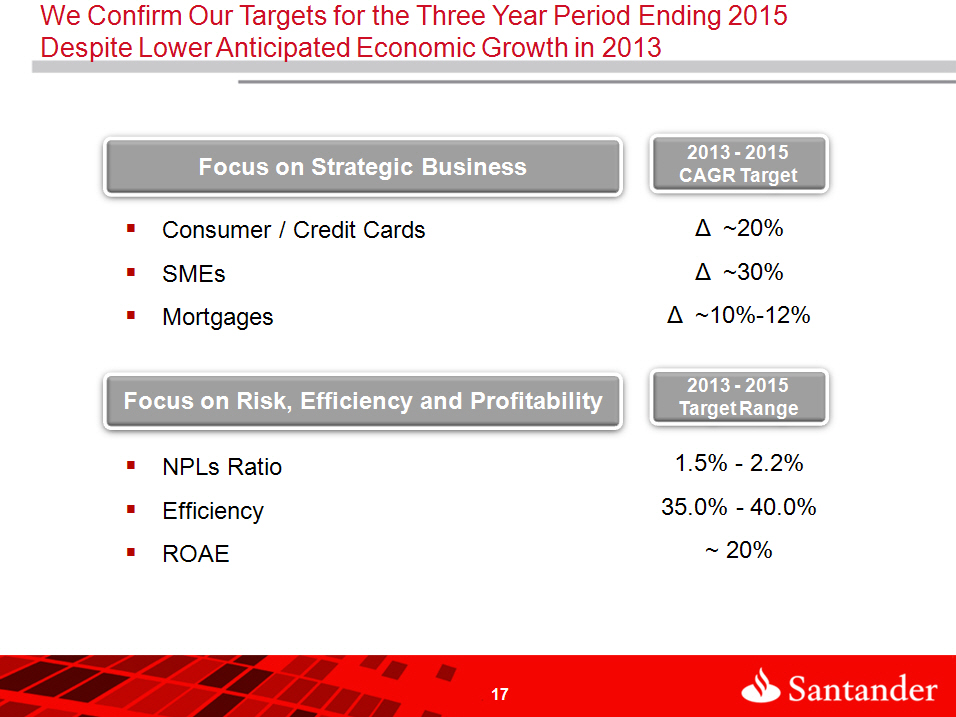

| - | Loan portfolio growth with YoY increases of 28.6% in SMEs, 11.6% in credit cards, 7.2% in consumer loans and 12.5% in mortgages |

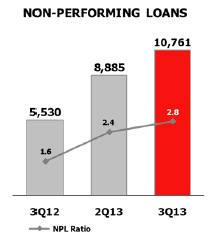

| - | Continued prudent risk management reflected in a NPL ratio of 2.8% and cost of risk of 3.4% |

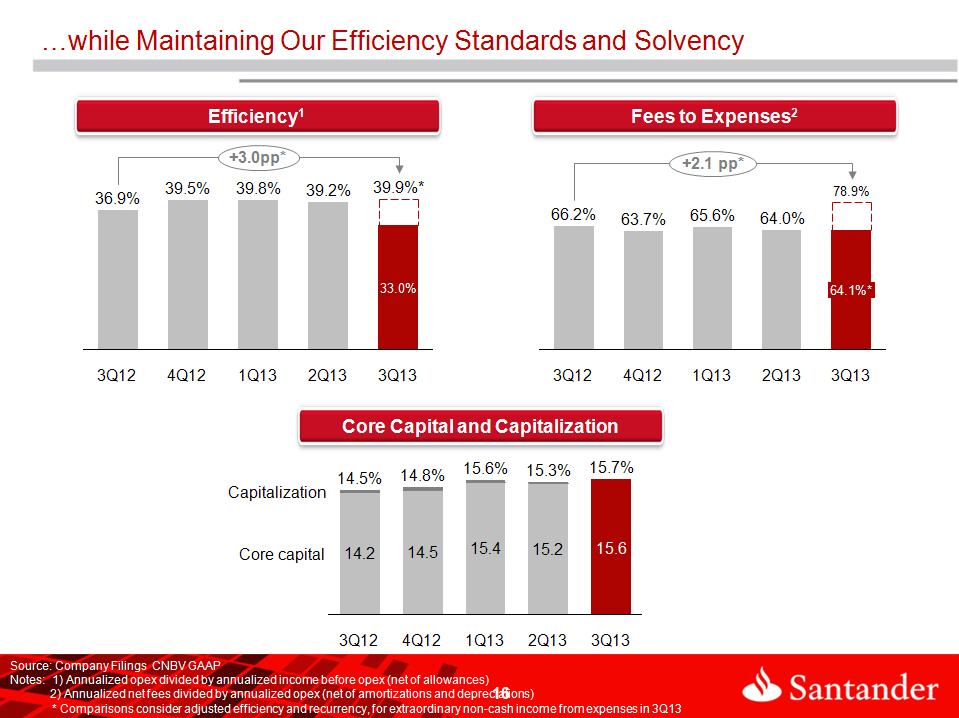

| - | Ongoing emphasis on operations reflected in a 39.9% efficiency ratio on a comparable basis |

México City – October 28, 2013, Grupo Financiero Santander México, S.A.B. de C.V., (NYSE: BSMX; BMV: SANMEX), (“Santander México”), one of the leading financial groups in the Mexican financial system, today announced financial results for the three- and nine-month periods ending September 30, 2013.

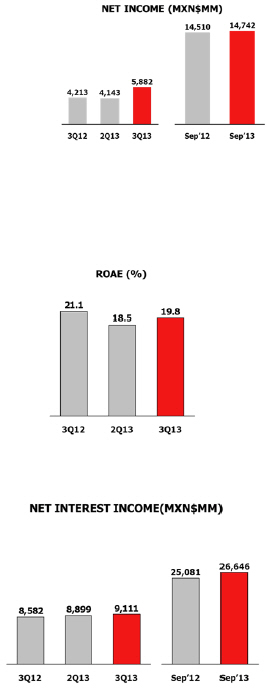

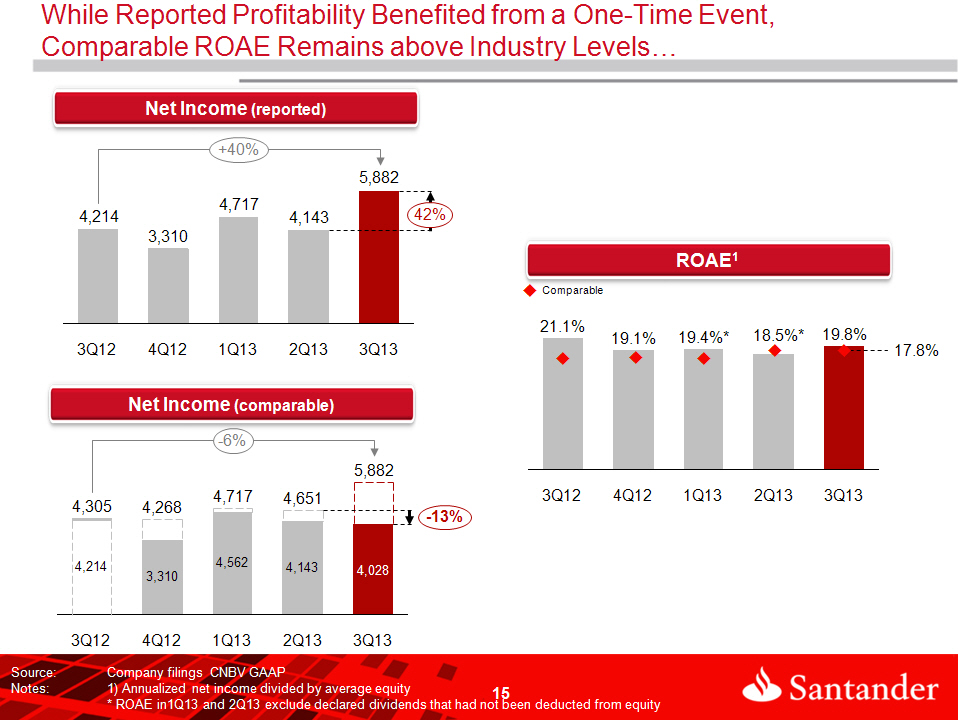

Comparable net income in 3Q13 decreased 6.4% YoY to Ps.4,028 million. Comparable 3Q13 results eliminate the following items before taxes: i) an extraordinary non-cash benefit of Ps.2,935 million related to a mandatory regulatory change in employee profit sharing (EPS) future payments, ii) a cash expense of Ps.132 million to comply with the new employee profit sharing legal criteria and iii) branch expansion expenses of Ps.154 million. Additionally, comparable 3Q12 results reflect pre-tax expenses that were adjusted downward by Ps.130 million to be consistent with the accounting methodology adopted in 2013 to normalize expenses throughout the year. Reported net income for the quarter was Ps.5,882 million, representing YoY and QoQ increases of 39.6% and 42.0%, respectively.

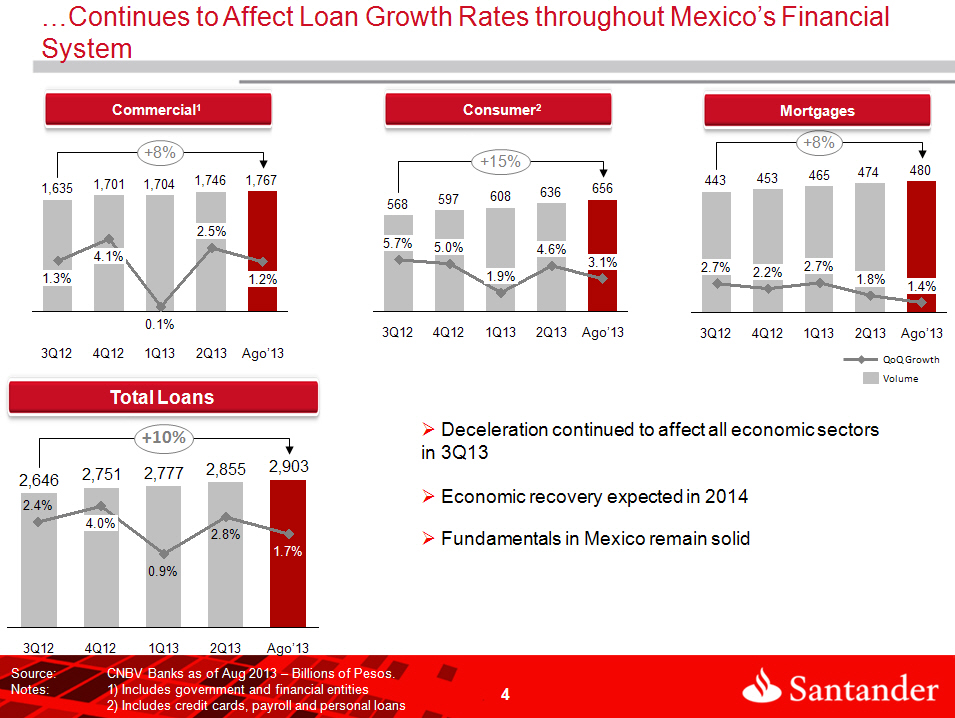

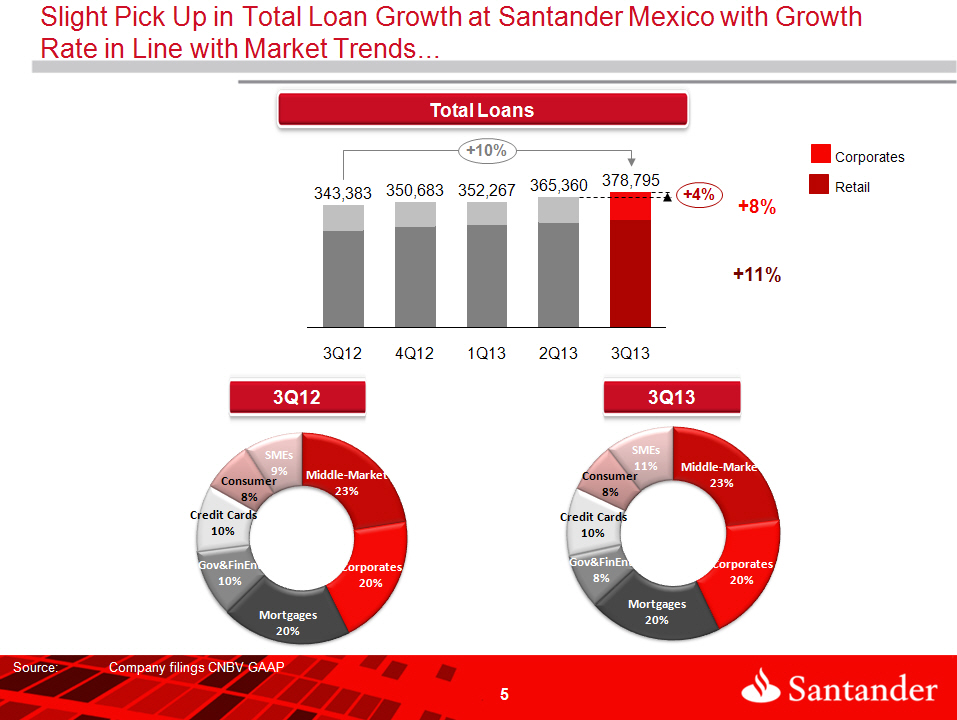

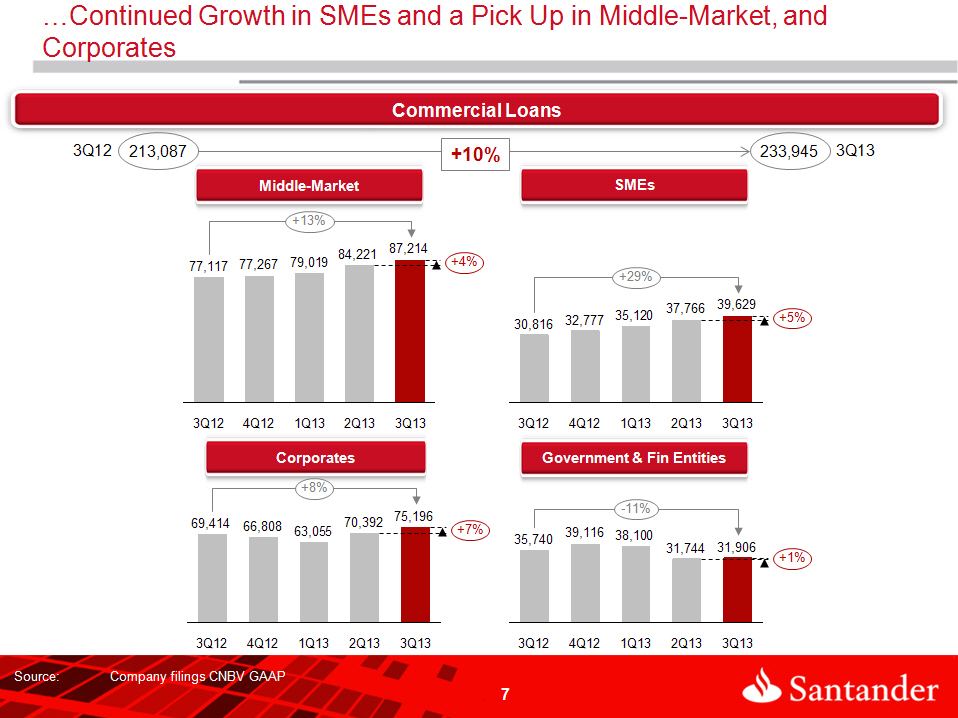

| Marcos Martínez, Executive Chairman and CEO, commented, "This quarter our retail and corporate businesses performed well despite the continuing economic slowdown in Mexico. Results, however, were affected by high volatility and overall uncertainty in the financial markets. Our loan growth picked-up slightly from 8% YoY in 2Q13 to 10% YoY in 3Q13, in line with market trends, as we continue to prioritize asset quality. Among our core products, SMEs and mortgage loans grew YoY by 29% and 13%, respectively, above the Mexican financial system during the period. Credit Card loans increased 12% YoY, in line with market growth for this category of the industry, while Consumer loans grew 7% YoY, reflecting our more conservative approach in the current economic environment. | | Grupo Financiero Santander México | | | | | | | | | | | | |

| | Highlights | | | | | | | | | | | | |

| | | | | 3Q13 | | | | 2Q13 | | | | 3Q12 | | | YoY | |

| | Income Statement Data | | | | | | | | | | | | | | | |

| | Net interest income | | | 9,111 | | | | 8,899 | | | | 8,582 | | | | 6.2 | % |

| | Fee and commission, net | | | 3,301 | | | | 3,052 | | | | 2,964 | | | | 11.4 | % |

| | Core revenues | | | 12,412 | | | | 11,951 | | | | 11,546 | | | | 7.5 | % |

| | Provisions for loan losses | | | 3,102 | | | | 3,348 | | | | 2,534 | | | | 22.4 | % |

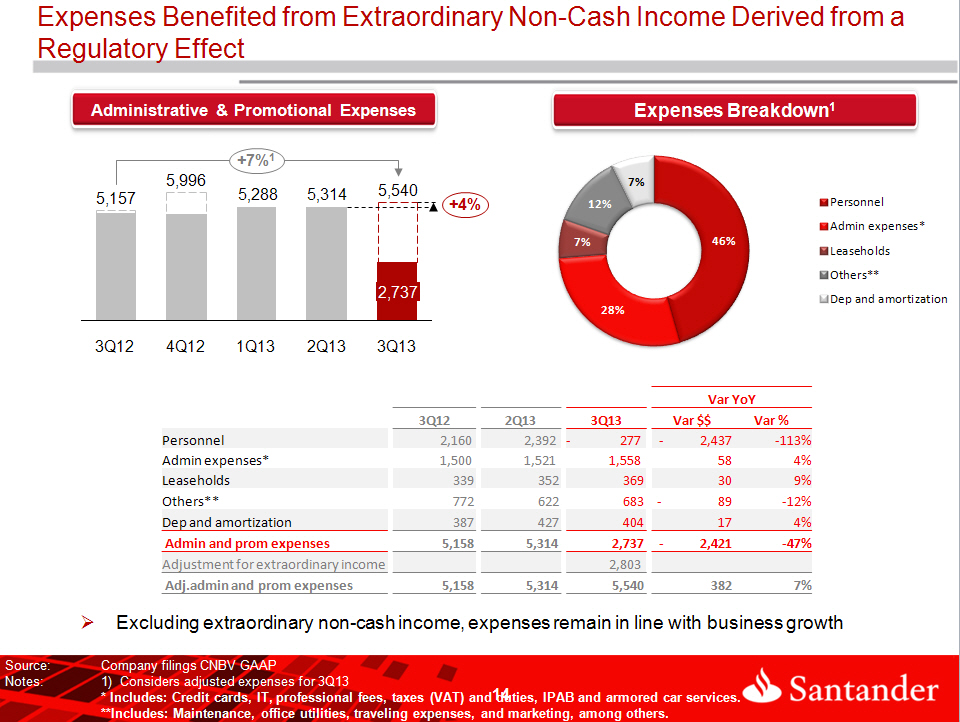

| | Administrative and promotional expenses | | | 2,737 | | | | 5,314 | | | | 5,157 | | | | -46.9 | % |

| | Net income | | | 5,882 | | | | 4,143 | | | | 4,213 | | | | 39.6 | % |

| | Net income per share1 | | | 2.18 | | | | 1.32 | | | | 2.13 | | | | 2.3 | % |

| | Balance Sheet Data | | | | | | | | | | | | | | | | |

| | Total loans | | | 378,795 | | | | 365,360 | | | | 343,383 | | | | 10.3 | % |

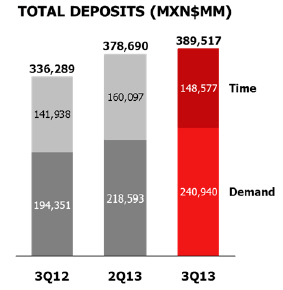

| | Deposits | | | 389,517 | | | | 378,690 | | | | 336,289 | | | | 15.8 | % |

| | Shareholders´s equity | | | 100,494 | | | | 101,697 | | | | 94,793 | | | | 6.0 | % |

| | | | | | | | | | | | | | | | | | |

| | Key Ratios | | | | | | | | | | | | | | bps | |

| | Net interest margin | | | 5.18 | % | | | 5.05 | % | | | 4.98 | % | | | 19.7 | |

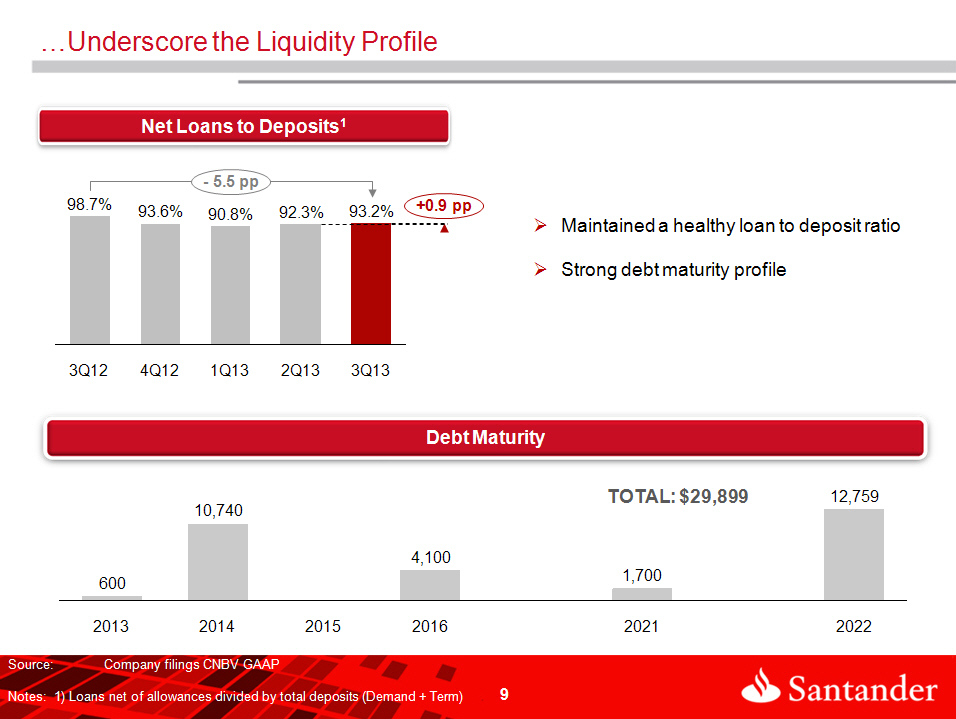

| | Net loans to deposits ratio | | | 93.2 | % | | | 92.3 | % | | | 98.7 | % | | | (553.5 | ) |

| | ROAE2 | | | 19.8 | % | | | 18.5 | % | | | 21.1 | % | | | (129.0 | ) |

| | ROAA | | | 2.5 | % | | | 2.2 | % | | | 2.6 | % | | | (3.6 | ) |

| | Efficiency ratio | | | 33.0 | % | | | 39.2 | % | | | 36.9 | % | | | (394.5 | ) |

| | Capital ratio | | | 15.7 | % | | | 15.3 | % | | | 14.5 | % | | | 123.5 | |

| | NPLs ratio | | | 2.84 | % | | | 2.43 | % | | | 1.61 | % | | | 123.0 | |

| | Coverage ratio | | | 146.6 | % | | | 180.0 | % | | | 205.4 | % | | | (5,879.4 | ) |

| | Operating Data | | | | | | | | | | | | | | % | |

| | Branches3 | | | 1,229 | | | | 1,215 | | | | 1,123 | | | | 6.0 | % |

| | ATMs | | | 5,209 | | | | 5,100 | | | | 4,840 | | | | 7.6 | % |

| | | Customers | | | 10,586,497 | | | | 10,325,561 | | | | 9,764,741 | | | | 8.4 | % |

| | | Employees | | | 13,883 | | | | 13,623 | | | | 12,766 | | | | 8.7 | % |

| | | 1) Treasury Shares and discontinued operations are not included 2) ROAE for 2Q13 excludes declared dividends from equity / ROAE for 3Q13 and 3Q12 as reported 3) As of 3Q13 includes: 991 branches + 120 cash desks + 3 select offices + 49 select units + 38 select boxes + 28 brokerage house branches |

| | 3Q.13 | EARNINGS RELEASE | 4 |

| | | |

| | |  |

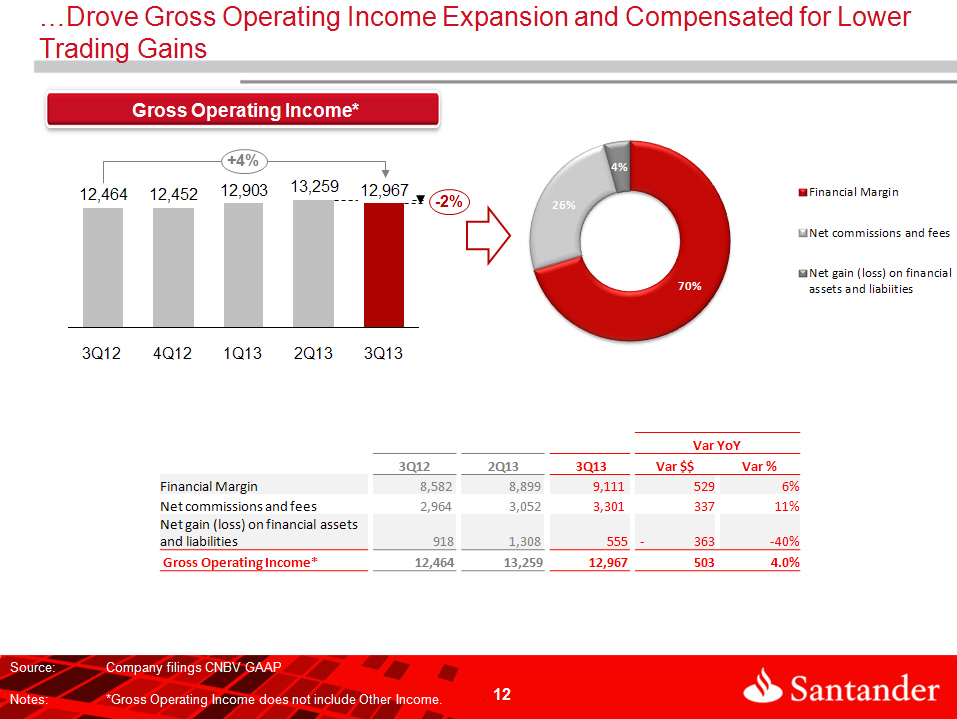

Net interest margin ratio for the quarter was 5.18% and our gross operating income remained solid, reflecting a healthy performance in our recurring business and financial margin and commissions, partially offset by lower trading gains due to capital market volatility in the period.

This quarter we remained on track with our branch expansion plan while keeping stringent cost controls in place. Excluding an extraordinary net benefit in 3Q13 related to a mandatory regulatory change in employee profit sharing future payments, we achieved an efficiency ratio of 39.9%.”

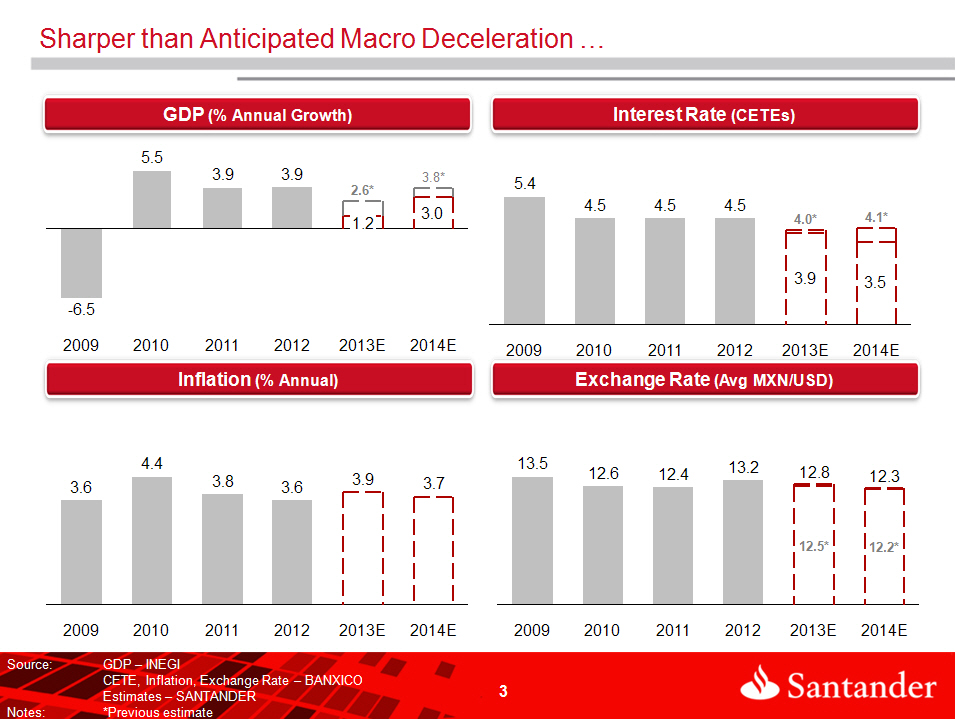

Mr. Martínez concluded, “While economic growth in 2013 has been slower than anticipated, macro and financial sector fundamentals in Mexico remain strong. We expect economic activity to pick-up next year, driven by an increase in public and private spending, the infrastructure program and by progress on the structural reform agenda the country requires.”

| | 3Q.13 | EARNINGS RELEASE | 5 |

| | | |

| | |  |

SUMMARY OF THIRD QUARTER 2013 CONSOLIDATED RESULTS

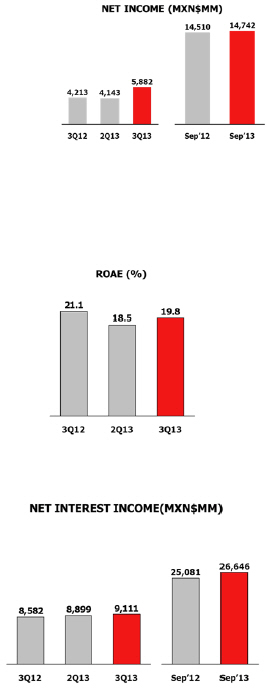

Net Income

Santander México reported net income of Ps.5,882 million in 3Q13, an increase of 39.6% YoY and 42.0% QoQ. Comparable 3Q13 results eliminate the following items before taxes: i) an extraordinary non-cash benefit of Ps.2,935 million related to a mandatory regulatory change in employee profit sharing (EPS) future payments, ii) a cash expense of Ps.132 million to comply with the new employee profit sharing legal criteria and iii) branch expansion expenses of Ps.154 million. Additionally, comparable 3Q12 results reflect pre-tax expenses that were adjusted downward by Ps.130 million to be consistent with the accounting methodology adopted in 2013 to normalize expenses throughout the year. Adjusted for the aforementioned items, comparable net income would have decreased 6.4% YoY to Ps.4,028 million in 3Q13.

Capitalization and ROAE Banco Santander (México)’s preliminary capital ratio at period end 3Q13 was 15.7%, compared to 14.5% at period end 3Q12 and 15.3% at period end 2Q13.

3Q13 ROAE was 19.8%, versus 21.1% in 3Q12 and 18.5% in 2Q13. Excluding non-comparable items, and the ones reported in previous quarters, normalized ROAE for 3Q12 and 3Q13 would have been 18.1% and 17.8%, respectively.

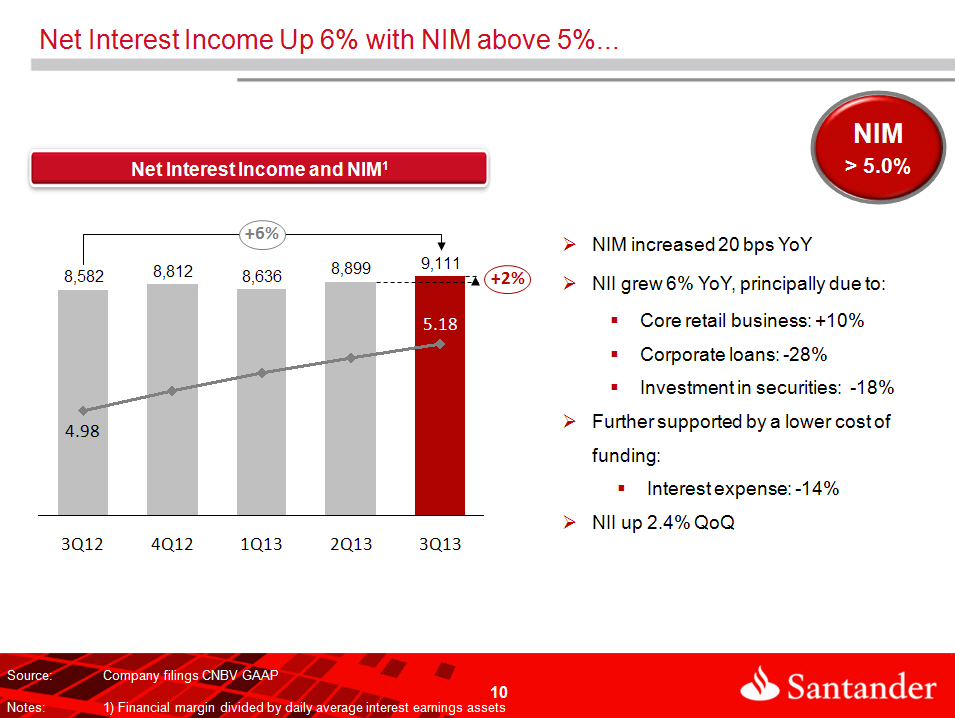

Net Interest Income Net interest income in 3Q13 increased YoY by 6.2%, or Ps.529 million, to Ps.9,111 million. On a sequential basis, net interest income increased 2.4%, or Ps.212 million, from Ps.8,899 million reported in 2Q13.

Net interest margin ratio calculated with daily average interest-earning assets for 3Q13 was 5.18%, versus 5.05% in 2Q13, and 20 basis points (“bps”) higher than 3Q12. | |  |

Interest income decreased 1.5%, or Ps.209 million, to Ps.13,664 million in 3Q13, driven by higher interest income derived from our loan portfolio which increased YoY by Ps.544 million or 5.6%, which was more than offset by a YoY decrease of Ps.497 million or 17.6% in investment in securities, together with a decline of Ps.150 million or 21.9% in sale and repurchase agreements.

Interest expense decreased 13.9%, or Ps.738 million, to Ps.4,553 million in 3Q13, primarily due to a Ps.814 million decrease in interest expense on our sale and repurchase agreements, which was partially offset by a Ps.221 million increase in interest paid on our demand deposits.

| | 3Q.13 | EARNINGS RELEASE | 6 |

| | | |

| | |  |

Loan Portfolio Growth

Santander México’s total loan portfolio in 3Q13 increased YoY by 10.3%, or Ps.35,412 million, to Ps.378,795 million, and 3.7%, or Ps.13,435 million, on a sequential basis.

In 3Q13, Santander México’s loan portfolio expanded YoY across all core products, both the commercial and individual loan segments. Individual loans were mainly driven by mortgages and credit card loans, while the consumer loan portfolio continues to grow but more conservatively, aligned with Santander México’s prudent risk management policies. Commercial loans continued to benefit from a significant YoY increase in the SMEs and middle-market loan portfolio, as well as a pick-up in lending to corporates.

Asset Quality

The NPL ratio in 3Q13 was 2.84%, a 123 bps increase from the 1.61% level reported in 3Q12 and 41 bps above the 2.43% achieved in 2Q13. The NPL ratio reported in 3Q13 continues to reflect our exposure to the homebuilders. Excluding the impact of the homebuilders, the NPL ratio for 3Q13 and 2Q13 would have been 1.97% and 1.98%, respectively, while the NPL ratio for 3Q12 remains as reported, as there was no effect from the homebuilders sector. The current NPL ratio reflects loan portfolio growth combined with Santander Mexico’s stringent credit scoring model and ongoing monitoring of the quality of its loan portfolio.

NPLs in 3Q13 increased 94.6% to Ps.10,761 million, from Ps.5,530 million reported in 3Q12. On a sequential basis, NPLs increased 21.1%, from Ps.8,885 million reported in 2Q13. The 21.1% increase was mainly due to a Ps.1,709 million, or 43.8% in non-performing loans in commercial loans, which at end of 3Q13 represented 52.1% of our total non-performing loans, principally driven by Santander México’s exposure to the homebuilder sector.

The coverage ratio for the quarter decreased to 146.6%, from 205.4% in 3Q12 and 180.0% in 2Q13.

Loans to Deposit Ratio

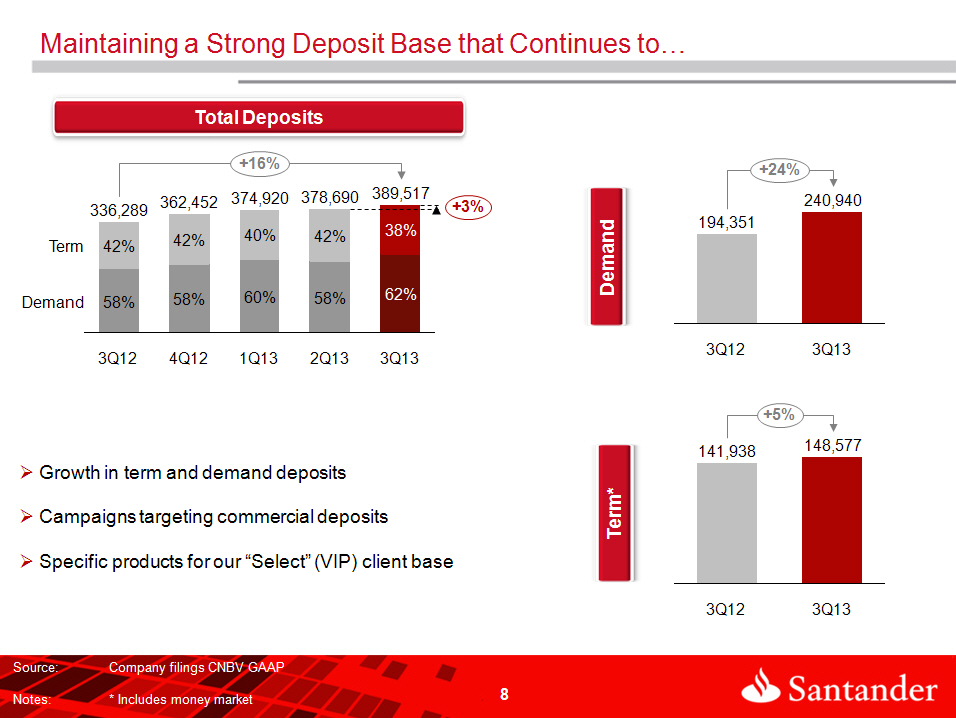

During 3Q13, deposits accounted for 55.2% of Santander Mexico’s total funding sources, and expanded 15.8% YoY and 2.9% sequentially. This deposit base provides stable, low-cost funding to support Santander Mexico’s continued growth.

The net loan to deposit ratio was 93.2% in 3Q13, decreasing from 98.7% in 3Q12 and increasing from 92.3% in 2Q13.

Contribution to Net Income by Subsidiary

Reported net income in 3Q13 was Ps.5,882 million, representing a YoY increase of 39.6% and a sequential increase of 42.0%.

Adjusting for non-comparable items, normalized net income would have decreased 6.4% YoY to Ps.4,028 million.

Casa de Bolsa Santander, the brokerage business, reported net income of Ps.12 million, compared with net income of Ps.116 million in 3Q12 and Ps.41 million in 2Q13.

Net income for the Holding and other subsidiaries reported net income of Ps.28 million in 3Q13, compared with income of Ps.30 million in 3Q12 and a deficit of Ps.137 million in 2Q13.

| | 3Q.13 | EARNINGS RELEASE | 7 |

| | | |

| | |  |

| Grupo Financiero Santander México | | | | | | | | | | | | | | | | | | |

| Earnings Contribution by Subsidiary | | | | | | | | | | | | | | | | | | |

| Millions of Mexican Pesos | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | % Change | |

| | | | 3Q13 | | | | 2Q13 | | | | 3Q12 | | | | 2013 | | | | 2012 | | | YoY % | |

Banking business1/ | | | 5,842 | | | | 4,239 | | | | 4,068 | | | | 14,655 | | | | 14,180 | | | | 3.3 | |

| Brokerage | | | 12 | | | | 41 | | | | 116 | | | | 154 | | | | 216 | | | | (28.7 | ) |

Holding and other subsidiaries2/ | | | 28 | | | | (137) | | | | 30 | | | | (67) | | | | 116 | | | | (157.8) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to Grupo Financiero Santander México | | | 5,882 | | | | 4,143 | | | | 4,214 | | | | 14,742 | | | | 14,512 | | | | 1.6 | |

1/ Includes Sofomers 2/ Asset management subsidiary and Holding.

| | 3Q.13 | EARNINGS RELEASE | 8 |

| | | |

| | |  |

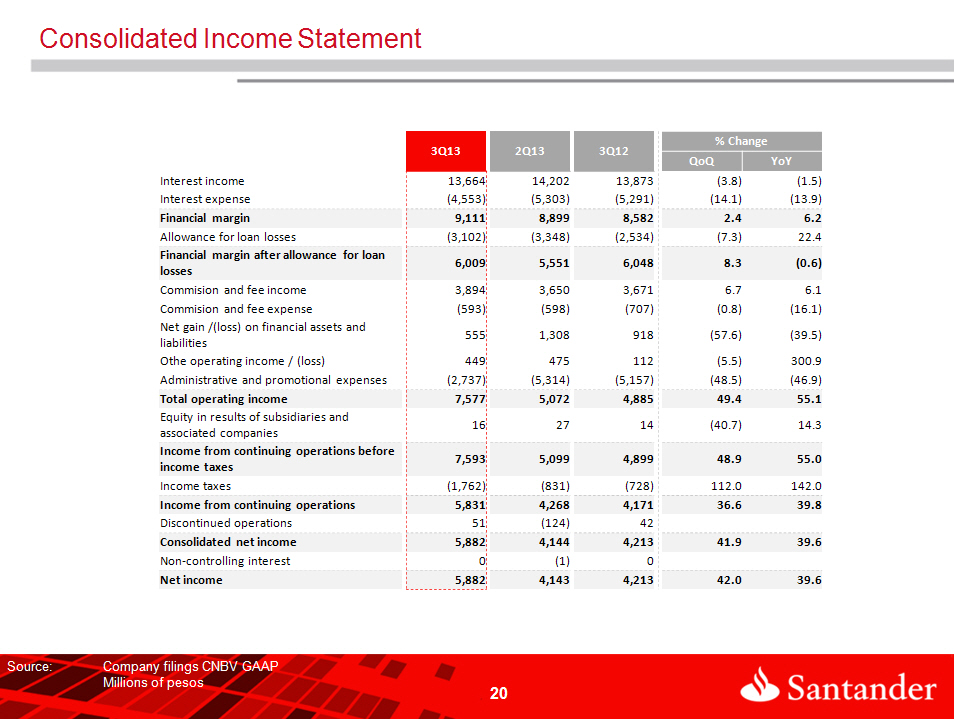

ANALYSIS OF THIRD QUARTER 2013 CONSOLIDATED RESULTS

Net Income

| Grupo Financiero Santander México | | | | | | |

| Income Statement | | | | | | |

| Millions of Mexican Pesos | | | | | % Change | | | % Change |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| | | | | | | | | | |

| Net interest income | 9,111 | 8,899 | 8,582 | | 2.4 | 6.2 | 26,646 | 25,081 | 6.2 |

| Provision for loan losses | (3,102) | (3,348) | (2,534) | | 7.3 | (22.4) | (9,254) | (6,496) | 42.5 |

| Net interest income after provisions for loan losses | 6,009 | 5,551 | 6,048 | | 8.3 | (0.6) | 17,392 | 18,585 | (6.4) |

| Commission and fee income, net | 3,301 | 3,052 | 2,964 | | 8.2 | 11.4 | 9,571 | 8,616 | 11.1 |

| Gains (losses) on financial assets and liabilities | 555 | 1,308 | 918 | | (57.6) | (39.5) | 2,912 | 1,776 | 64.0 |

| Other operating income (expenses) | 449 | 475 | 112 | | (5.5) | 300.9 | 1,319 | 2,834 | (53.5) |

| Administrative and promotional expenses | (2,737) | (5,314) | (5,157) | | 48.5 | 46.9 | (13,339) | (14,144) | (5.7) |

| Operating income | 7,577 | 5,072 | 4,885 | | 49.4 | 55.1 | 17,855 | 17,667 | 1.1 |

| Equity in results of associated companies | 16 | 27 | 14 | | (40.7) | 14.3 | 58 | 50 | 16.0 |

| Operating income before taxes | 7,593 | 5,099 | 4,899 | | 48.9 | 55.0 | 17,913 | 17,717 | 1.1 |

| Current and deferred income taxes | (1,762) | (831) | (728) | | (112.0) | (142.0) | (3,145) | (3,286) | (4.3) |

| Income from continuing operations | 5,831 | 4,268 | 4,171 | | 36.6 | 39.8 | 14,768 | 14,431 | 2.3 |

| Profit from discontinued operations, net | 51 | (124) | 42 | | 141.1 | 21.4 | (25) | 80 | 131.3 |

| Non-controlling interest | 0 | (1) | 0 | | 100.0 | 0.0 | (1) | (1) | 0.0 |

| Net income | 5,882 | 4,143 | 4,213 | | 42.0 | 39.6 | 14,742 | 14,510 | 1.6 |

During 3Q13, Santander México reported net income of Ps.5,882 million, representing 39.6% and 42.0% YoY and sequential increases, respectively. These comparisons, however, are impacted by certain items.

Items before taxes that impacted net income during 3Q13 are:

| · | An extraordinary non-cash regulatory benefit of Ps.2,935 million to account for a mandatory regulatory change in legal criteria regarding employee profit sharing (EPS) future payments, which resulted in a recognition of a deferred EPS asset with a corresponding credit to administrative and promotional expenses; |

| · | Incremental expenses of Ps.154 million related to the branch expansion; and |

| · | A cash expense of Ps.132 million in relation to the employee profit share payment of the taxable income for the nine-month period ending September 2013, in order to comply with the newly established legal criteria. |

Additionally, 3Q12 was affected by the following pre-tax item:

| · | Ps.130 million resulting from normalizing expenses downward, in order to make this line comparable with the methodology adopted in 2013 |

Finally, during 2Q13 certain items negatively impacted net income, including:

| · | Ps.330 million pre-tax of provisions for loan losses related to the exposure to homebuilders; |

| | 3Q.13 | EARNINGS RELEASE | 9 |

| | | |

| | |  |

| · | Ps.178 million after tax, related to a price adjustment made to the sale of the insurance business to Zurich, which was registered in the income statement line of Profit from discontinued operations; and |

| · | Ps.142 million pre-tax of expenses related to the branch expansion |

Excluding these items, comparable net income during 3Q13 would have decreased 6.4% and 13.4% YoY and QoQ, respectively.

| | Grupo Financiero Santander México | | | | | | | | |

| | Net Income Adjustments | | | | | | | | |

| | Million Pesos | | | | | | % Change | | % Change |

| | | 3Q13 | 2Q13 | | 3Q12 | | QoQ | | YoY |

| | Net income | 5,882 | 4,143 | | 4,213 | | 42.0 | | 39.6 |

| | Net regulatory EPS effect on expenses | (2,803) | | | | | | | |

| | Zurich price adjustment (after-tax) | | 178 | | | | | | |

| | Provisions for loan losses related to homebuilders | | 330 | | | | | | |

| | Expenses regularization | | | | 130 | | | | |

| | Branch expansion | 154 | 142 | | | | | | |

| | Adjusted net income (before taxes) | 3,233 | 4,793 | | 4,343 | | | | |

| | Income taxes | 795 | (142) | | (39) | | | | |

| | Adjusted net income (after taxes) | 4,028 | 4,651 | | 4,304 | | (13.4) | | (6.4) |

Net interest income for 3Q13 rose to Ps.9,111 million, representing a YoY increase of Ps.529 million, or 6.2%. On a sequential basis, net interest income increased Ps.212 million, or 2.4%.

Interest income decreased 1.5%, or Ps.209 million, YoY to Ps.13,664 million in 3Q13 from Ps.13,873 million in 3Q12. This was primarily driven by growth in the Bank’s business volume, which resulted in a Ps.544 million or 5.6% increase in interest income from the loan portfolio, which was more than offset by a YoY decrease of Ps.497 million, or 17.6%, in the investment securities, together with a decline of Ps.150 million or 21.9% in sale and repurchase agreements. Interest expense decreased 13.9%, or Ps.738 million, reaching Ps.4,553 million in 3Q13 compared with Ps.5,291 million in 3Q12, mainly driven by a Ps.814 million decrease in interest expense on our sale and repurchase agreements.

Provisions for loan losses for the quarter were Ps.3,102 million, representing a YoY increase of Ps.568 million, or 22.4%, and a sequential decrease of Ps.246 million, or 7.3%. Excluding the Ps.330 million provision for the homebuilders in 2Q13, provisions would have increased by 2.8% sequentially, in line with the net interest income and business growth, while provisions for 3Q12 would remain as reported, as there was no effect from the homebuilders sector. The YoY growth is partially affected by the change in the methodology in provisions, which is more stringent and requires higher levels of provisioning in the commercial loan portfolio.

The NPL ratio in 3Q13 was 2.84%, a 123 bps increase from the 1.61% level reported in 3Q12 and 41 bps above the 2.43% achieved in 2Q13. The NPL ratio reported in 3Q13 continues to reflect our exposure to the homebuilders. Excluding the impact of the homebuilders, the NPL ratio for 3Q13 and 2Q13 would have been 1.97% and 1.98%, respectively, while the NPL ratio for 3Q12 remains as reported, as there was no effect from the homebuilders sector. The current NPL ratio reflects loan portfolio growth combined with Santander Mexico’s stringent credit scoring model and ongoing monitoring of the quality of its loan portfolio.

| | 3Q.13 | EARNINGS RELEASE | 10 |

| | | |

| | |  |

The coverage ratio for the quarter decreased to 146.6% from 205.4% and 180.0% in 3Q12 and 2Q13, respectively.

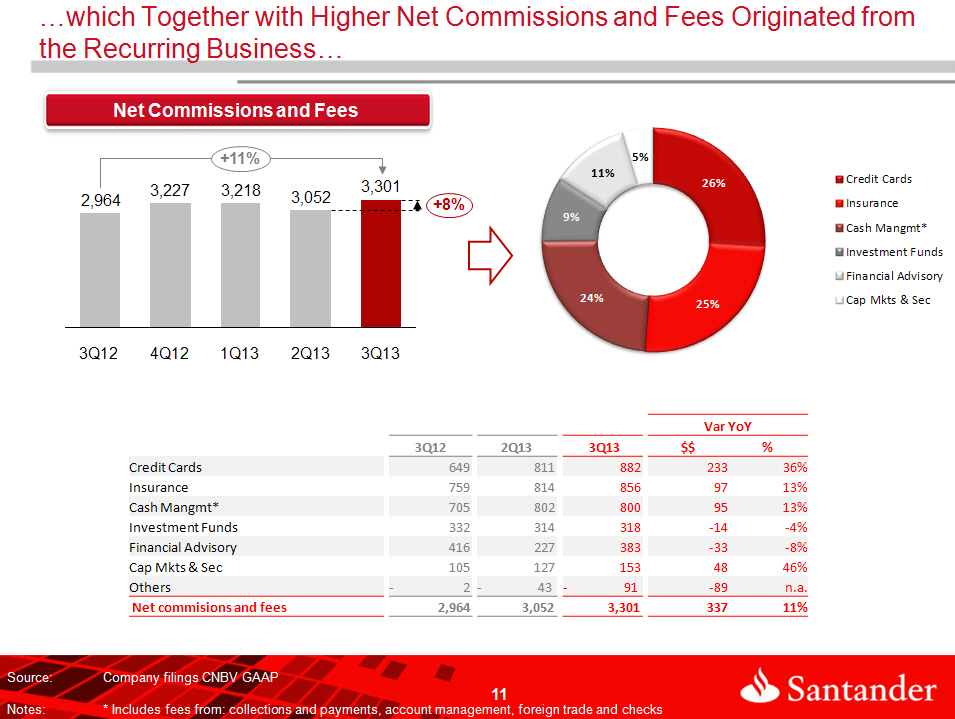

Net commissions and fee income for 3Q13 amounted to Ps.3,301 million, rising 11.4% YoY, and 8.2% sequentially. The sequential increase was mainly due to a positive performance in commissions from financial advisory services, credit cards and insurance brokerage, which were up 68.7%, 8.8% and 5.2%, respectively.

During 3Q13, Santander México reported a Ps.555 million net gain from financial assets and liabilities, compared with a gain of Ps.918 million in 3Q12 and a gain of Ps.1,308 million in 2Q13. Net gain on financial assets and liabilities in 3Q13 is mainly explained by trading losses of Ps.226 million principally related to derivatives positions, which were more than offset by valuation gains of Ps.781 million, also mainly related to derivatives.

Other operating income in 3Q13 totaled Ps.449 million, up from Ps.112 million in 3Q12, mainly due to a Ps.207 million decline in charge-offs. Sequentially, other income in 3Q13 decreased Ps.26 million from Ps.475 million in 2Q13.

Administrative and promotional expenses in 3Q13 amounted to Ps.2,737 million. Expenses in 3Q13 reflect a net extraordinary benefit of Ps.2,803 million (pre-tax) related to a mandatory regulatory change in legal criteria regarding employee profit sharing future payments. Adjusting for the extraordinary benefit in 3Q13, administrative and promotional expenses grew YoY by 7.4%, or Ps.383 million, consistent with the growth of our business and the ongoing branch expansion. Additionally, the adoption in 2013 of an internal initiative to normalize the booking of expenses throughout the year remains in place. Sequentially, expenses in 3Q13 rose by Ps.226 million, or 4.3%.

Operating income in 3Q13 totaled Ps.7,577 million. Excluding the Ps.2,803 million (pre-tax) net extraordinary benefit, operating income would have been Ps.4,774 million, representing a YoY decrease of Ps.111 million, or 2.3%, and a sequential decrease of Ps.298 million, or 5.9%, mainly due to lower trading gains as a result of capital market volatility.

Net income in 3Q13 amounted to Ps.5,882 million, an increase of 39.6% from 3Q12. On a sequential basis, net income increased 42.0%. Excluding the net impact of non-comparable items, normalized net income would have decreased 6.4% YoY.

| | 3Q.13 | EARNINGS RELEASE | 11 |

| | | |

| | |  |

Net Interest Income

| Grupo Financiero Santander México | | | | | | |

| Net Interest Income | | | | | | | | | |

| Millions of Mexican Pesos | | | | | % Change | | | | % Change |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| Funds Available | 477 | 551 | 574 | | (13.4) | (16.9) | 1,602 | 1,848 | (13.3) |

| Margin accounts | 90 | 94 | 99 | | (4.3) | (9.1) | 280 | 312 | (10.3) |

| Interest from investment in securities | 2,326 | 2,599 | 2,823 | | (10.5) | (17.6) | 6,954 | 9,384 | (25.9) |

| Loan portfolio – excluding credit cards | 7,677 | 7,521 | 7,399 | | 2.1 | 3.8 | 22,727 | 21,261 | 6.9 |

| Credit card loan portfolio | 2,362 | 2,343 | 2,141 | | 0.8 | 10.3 | 7,022 | 5,943 | 18.2 |

| Loan origination fees | 196 | 217 | 151 | | (9.7) | 29.8 | 603 | 482 | 25.1 |

| Sale and repurchase agreements | 536 | 877 | 686 | | (38.9) | (21.9) | 2,285 | 1,899 | 20.3 |

| Interest Income | 13,664 | 14,202 | 13,873 | | (3.8) | (1.5) | 41,473 | 41,129 | 0.8 |

| | | | | | | | | | |

| Average Earning Assets* | | | | | | | 686,432 | 671,752 | |

| | | | | | | | | | |

| Customer deposits – Demand deposits | (816) | (685) | (595) | | (19.1) | (37.1) | (2,103) | (1,657) | 26.9 |

| Customer deposits – Time deposits | (1,303) | (1,439) | (1,386) | | 9.5 | 6.0 | (4,193) | (4,112) | 2.0 |

| Credit instruments issued | (326) | (341) | (304) | | 4.4 | (7.2) | (1,132) | (896) | 26.3 |

| Interbank loans | (172) | (165) | (256) | | (4.2) | 32.8 | (514) | (549) | 6.4 |

| Sale and repurchase agreements | (1,936) | (2,673) | (2,750) | | 27.6 | 29.6 | (6,885) | (8,834) | (22.1) |

| Interest Expense | (4,553) | (5,303) | (5,291) | | 14.1 | 13.9 | (14,827) | (16,048) | (7.6) |

| | | | | | | | | | |

| Net Interest Income | 9,111 | 8,899 | 8,582 | | 2.4 | 6.2 | 26,646 | 25,081 | 6.2 |

| *Includes Funds Available, Margin Accounts, Investment in securities, Loan portfolio and Sale and repurchase agreements |

Net interest income in 3Q13 amounted to Ps.9,111 million, representing a QoQ increase of Ps.212 million, or 2.4%, and a YoY increase of Ps.529 million, or 6.2%.

Net interest margin ratio calculated with daily average interest-earning assets for 3Q13 was 5.18%, versus 5.05% in 2Q13, and 20 bps higher than 3Q12.

The YoY increase in net interest income for the quarter is explained by the combined effect of the Ps.209 million decrease in interest income, from Ps.13,873 million in 3Q12 to Ps.13,664 million in 3Q13, more than offset by a Ps.738 million decrease in interest expense, from Ps.5,291 million in 3Q12 to Ps.4,553 million in 3Q13. The YoY increase in net interest income is mainly explained by a decrease in average-earning assets of Ps.505 million, along with a decline in the average interest rate by 12 bps; combined with a decline in the average-bearing liabilities of Ps.8,191 million with a 46 bps lower average cost.

The sequential increase in net interest income resulted mainly from the Ps.538 million decrease in interest income, from Ps.14,202 million in 2Q13 to Ps.13,664 million in 3Q13, which was more than offset by a Ps.750 million decrease in interest expense, from Ps.5,303 million in 2Q13 to Ps.4,553 million in 3Q13. This is explained by a decrease of Ps.62,486 million in average-earnings assets and a 41 bps increase in the average interest rate

| | 3Q.13 | EARNINGS RELEASE | 12 |

| | | |

| | |  |

earned, combined with a decrease of Ps.66,735 million in interest-bearing liabilities and a decline of 14 bps in the average interest rate paid.

Interest Income

Interest income declined YoY by 1.5%, or Ps.209 million, from Ps.13,873 million in 3Q12 to Ps.13,664 million in 3Q13, principally due to a decline of Ps.497 million in interest income on our investment in securities portfolio, together with decreases of Ps.150 million and Ps.97 million on our sales and repurchase agreements and funds available, respectively. These decreases were partially offset by a Ps.544 million increase on the recurring loan portfolio.

On a sequential basis, interest income decreased 3.8% from Ps.14,202 million in 2Q13, reflecting declines of Ps.273 million in interest from investment in securities and of Ps.341 million on sale and repurchase agreements, while interest income on the loan portfolio increased Ps.154 million.

The average interest rate on interest-earning assets declined in 3Q13 to 8.24%, representing a 12 bps decrease from 8.36% in 3Q12 and a 41 bps increase from 7.83% in 2Q13.

3Q13 average interest-earning assets declined QoQ by Ps.62,486 million, or 8.6%, mainly driven by the following decreases: a Ps.31,700 million in debtors under sale and repurchase agreements; a Ps.27,736 million in investments in securities; a Ps.13,673 million in funds available; and Ps. 2,434 million in margin accounts. These decreases were partially offset by a Ps.13,057 million increase in the average volume of the loan portfolio including credit cards.

The breakdown of interest income for 3Q13 is as follows: loan portfolio, which is considered the main source of recurring income, accounts for 74.9%; investment in securities 17.0%; and other items 8.1%.

The evolution of the loan portfolio continues to show a steady positive trend, accentuating diversification across segments and growth in all core businesses, despite the economic slowdown in Mexico observed over recent months.

| | 3Q.13 | EARNINGS RELEASE | 13 |

| | | |

| | |  |

Loan Portfolio

The total loan portfolio rose YoY by 10.3%, or Ps.35,412 million, to Ps.378,795 million in 3Q13. On a sequential basis, the total loan portfolio increased 3.7%, or Ps.13,435 million. During the quarter, Santander México posted a slight pick-up in loan growth, expanding its portfolio by 10.3% YoY this quarter from 7.8% YoY in 2Q13, despite the lower economic activity in Mexico in the first nine months of the year. In this context, strategic segments, specifically SMEs and mortgages, grew above market, while the credit card segment grew in line with the market and consumer grew at a slower pace, reflecting Santander Mexico’s decision to take a conservative approach aligned with prudent risk management.

| Grupo Financiero Santander México | | | | | | | |

| Loan Portfolio Breakdown | | | | | | | | |

| Millions of Mexican Pesos | 3Q13 | % | | 2Q13 | % | | 3Q12 | % |

| | | | | | | | | |

| Commercial | 198,343 | 52.4% | | 189,259 | 51.8% | | 176,564 | 51.4% |

| Government | 29,994 | 7.9% | | 30,965 | 8.5% | | 35,121 | 10.2% |

| Consumer | 65,400 | 17.3% | | 63,464 | 17.4% | | 59,996 | 17.5% |

| Credit cards | 37,975 | 10.0% | | 36,904 | 10.1% | | 34,208 | 10.0% |

| Other consumer | 27,425 | 7.2% | | 26,560 | 7.3% | | 25,788 | 7.5% |

| Mortgages | 74,297 | 19.6% | | 72,787 | 19.9% | | 66,172 | 19.3% |

| Total Performing Loan | 368,034 | 97.2% | | 356,475 | 97.6% | | 337,853 | 98.4% |

| | | | | | | | | |

| | | | | | | | | |

| Commercial | 5,608 | 1.5% | | 3,899 | 1.1% | | 1,402 | 0.4% |

| Government | 0 | 0.0% | | 0 | 0.0% | | 0 | 0.0% |

| Consumer | 2,668 | 0.7% | | 2,606 | 0.7% | | 2,053 | 0.6% |

| Credit cards | 1,372 | 0.4% | | 1,349 | 0.4% | | 1,055 | 0.3% |

| Other consumer | 1,296 | 0.3% | | 1,257 | 0.3% | | 998 | 0.3% |

| Mortgages | 2,485 | 0.7% | | 2,380 | 0.7% | | 2,075 | 0.6% |

| Total Non-Performing Loan | 10,761 | 2.8% | | 8,885 | 2.4% | | 5,530 | 1.6% |

| | | | | | | | | |

| Total Loan Portfolio | 378,795 | 100.0% | | 365,360 | 100.0% | | 343,383 | 100.0% |

The Commercial Portfolio is comprised of loans to business and commercial entities, as well as loans to government entities and financial institutions, and represents 61.8% of the total loan portfolio. Excluding loans to government entities, the commercial loan portfolio accounted for 53.8% of the total loan portfolio. As of 3Q13, commercial loans increased 14.6% YoY, principally reflecting the 28.6% and 13.1% increases in SMEs and the middle market segment, respectively, while loans to corporates showed an upturn increasing 8.3% compared to the 5.3% YoY decline in 2Q13. On a sequential basis, excluding loans to government entities, the commercial loan portfolio increased 5.6%, principally supported by the performance of corporates, middle-market and SMEs during the quarter, which increased 6.8%, 3.6% and 4.9%, respectively.

The Individual Loan Portfolio, comprised of mortgages, consumer and credit card loans, represents 38.2% of the total loan portfolio. Credit card, consumer and mortgage loans represent 10.4%, 7.6%, and 20.3% of the total loan portfolio, respectively, and increased YoY by 11.6%, 7.2%, and 12.5%, respectively. Our mortgage loan strategy focuses on targeting the middle income and residential segments, which this quarter increased 2.1% sequentially. Consumer loans increased 3.0% sequentially, showing a 2.9% increase in credit card loans, while the rest of the consumer loan portfolio grew 3.2%, reflecting a conservative pace aligned to our prudent risk management policies.

| | 3Q.13 | EARNINGS RELEASE | 14 |

| | | |

| | |  |

The acquisition of ING Hipotecaria remains on target and is expected to close by year-end.

Interest Expense

Interest expense decreased 13.9%, or Ps.738 million, to Ps.4,553 million in 3Q13, compared with Ps.5,291 million in 3Q12, mainly driven by a Ps.814 million decrease in interest expense on our sale and repurchase agreements, which more than offset the increase of Ps.221 million in interest paid on demand deposits.

On a sequential basis, interest expense decreased Ps.750 million, mainly reflecting a decrease in the average volume of sale and repurchase agreements, as well as time deposits. Average interest-bearing liabilities decreased Ps.66,735 million, or 10.4%, mainly explained by a Ps.75,035 million decline in repurchase agreements, and a Ps.7,067 million decrease in time deposits, partially offset by a Ps.18,815 million increase in demand deposits.

The average interest rate on interest-bearing liabilities declined in 3Q13 to 3.16%, representing a 46 bps decrease from 3.62% in 3Q12 and a 14 bps decrease compared with 3.30% in 2Q13.

The Ps.4,553 million in interest expenses paid in 3Q13 is broken down as follows: sale and repurchase agreements 42.5%, time deposits 28.6%, demand deposits 17.9%, credit instruments issued 7.2% and interbank loans 3.8%.

Total deposits at the end of 3Q13 amounted to Ps.389,517 million, representing a 15.8% increase YoY and a 2.9% expansion QoQ. Santander México continues to implement its strategy of enhancing customer service in accordance with the needs of each segment. Additionally, the introduction of campaigns for SMEs and middle-market segments, as well as of new investment products targeted to middle and high-income clients, largely contributed to this performance. As of 3Q13, demand deposits reached Ps.240,940 million, an increase of 24.0% YoY and 10.2% sequentially. Total time deposits reached Ps.148,577 million, an increase of 4.7% YoY and a decline of 7.2% QoQ.

Interest expense on demand deposits amounted to Ps.816 million during 3Q13, representing a YoY increase of 37.1.% and a sequential increase of 19.1%. The YoY increase in 3Q13 was mainly driven by a higher average balance in demand deposits, combined with a 20 bps increase in the average interest rate paid.

Interest paid on time deposits declined 6.0% YoY to Ps.1,303 million. On a sequential basis, interest paid on time deposits decreased 9.5%. The YoY increase reflects an increase in average volume partially offset by a 52 bps decrease in average interest rate paid.

| | 3Q.13 | EARNINGS RELEASE | 15 |

| | | |

| | |  |

Asset Quality

Non-performing loans (NPL) at the end of 3Q13 increased by Ps.5,231 million, or 94.6% YoY, to Ps.10,761 million, and also increased on a sequential basis by 21.1%, or Ps.1,876 million. The breakdown of the non-performing loan portfolio is as follows: commercial loans 52.1%, consumer loans 24.8%, and mortgage loans 23.1%.

The YoY increase in non-performing loans primarily reflects growth of the loan portfolio, particularly the higher participation of consumer loans, credit card loans, mortgage loans and SMEs loans in the overall mix. On a sequential basis, commercial loans reported the highest increase in non-performing loans, principally reflecting the exposure to the homebuilder sector.

| Grupo Financiero Santander México | | | | | |

| Asset Quality | | | | | | |

| Millions of Mexican Pesos | | | | | | |

| | | | | | Change % |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY |

| Total Loans | 378,795 | 365,360 | 343,383 | | 3.68 | 10.31 |

| Performing Loans | 368,034 | 356,475 | 337,853 | | 3.24 | 8.93 |

| Non-performing Loans | 10,761 | 8,885 | 5,530 | | 21.11 | 94.59 |

| | | | | | | |

| Allowance for loan losses | (15,779) | (15,989) | (11,360) | | (1.31) | 38.90 |

| | | | | | | |

| Non-performing loan ratio | 2.84% | 2.43% | 1.61% | | 41bps | 123bps |

| Coverage ratio | 146.6 | 180 | 205.4 | | (3,340)bps | (5,880)bps |

| | 3Q.13 | EARNINGS RELEASE | 16 |

| | | |

| | |  |

The NPL ratio for 3Q13 stood at 2.84%, a 123 bps increase from the level reported in 3Q12 and 41 bps from the 2.43% level in 2Q13. This increase continues to reflect the exposure to the homebuilder sector. However, this NPL ratio level also continues to reflect Santander México’s strict monitoring and portfolio quality assessment processes, which allows the adjustment of loan origination through approval policies in accordance with the performance of the loan portfolio. The NPL ratio excluding the impact of the homebuilders, the NPL ratio for 3Q13 and 2Q13 would have been 1.97% and 1.98%, respectively, while the NPL ratio for 3Q12 remains as reported, as there was no effect from the homebuilders sector.

The coverage ratio for the quarter decreased to 146.6% from 205.4% in 3Q12, and from 180.0% in 2Q13.

During 3Q13, provisions for loan losses amounted to Ps.3,102 million, which represented an increase of Ps.568 million, or 22.4%, YoY and a decrease of Ps.246 million, or 7.3%, on a sequential basis. Excluding the Ps.330 million provision for the homebuilders in 2Q13, provisions would have increased by 2.8% sequentially, in line with the net interest income and the business growth, while provisions for 3Q12 would remain as reported, as there was no effect from the homebuilders sector. The YoY growth is partially affected by the change in the methodology in provisions, which is more stringent and requires higher levels of provisioning in the commercial portfolio.

| | 3Q.13 | EARNINGS RELEASE | 17 |

| | | |

| | |  |

Commission and Fee Income (Net)

| Grupo Financiero Santander México | | | | | | |

| Net Commission and Fee Income | | | | | | |

| Millions of Mexican Pesos | | | | | | | | | |

| | | | | | % Change | | | % Change |

| Commission and fee income | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| Credit and debit cards | 1,129 | 1,072 | 1,026 | | 5.3 | 10.0 | 3,238 | 2,816 | 15.0 |

| Cash management | 199 | 179 | 176 | | 11.2 | 13.1 | 548 | 526 | 4.2 |

| Collection and payment services | 402 | 399 | 347 | | 0.8 | 15.9 | 1,192 | 1,083 | 10.1 |

| Investment fund management | 334 | 330 | 349 | | 1.2 | (4.3) | 987 | 1,105 | (10.7) |

| Insurance | 882 | 840 | 783 | | 5.0 | 12.6 | 2,540 | 2,193 | 15.8 |

| Capital markets and securities activities | 173 | 186 | 151 | | (7.0) | 14.6 | 529 | 468 | 13.0 |

| Checks | 76 | 82 | 86 | | (7.3) | (11.6) | 240 | 265 | (9.4) |

| Foreign trade | 131 | 153 | 126 | | (14.4) | 4.0 | 430 | 397 | 8.3 |

| Financial advisory services | 391 | 232 | 432 | | 68.5 | (9.5) | 1,123 | 1,073 | 4.7 |

| Other commissions and fees | 177 | 177 | 195 | | 0.0 | (9.2) | 539 | 584 | (7.7) |

| Total | 3,894 | 3,650 | 3,671 | | 6.7 | 6.1 | 11,366 | 10,510 | 8.1 |

| | | | | | | | | | |

| Commission and fee expense | | | | | | | | | |

| Credit and debit cards | (247) | (261) | (377) | | 5.4 | 34.5 | (693) | (1,039) | (33.3) |

| Investment fund management | (16) | (16) | (17) | | 0.0 | 5.9 | (49) | (46) | 6.5 |

| Insurance | (26) | (26) | (24) | | 0.0 | (8.3) | (79) | (69) | 14.5 |

| Capital markets and securities activities | (20) | (59) | (46) | | 66.1 | 56.5 | (114) | (121) | (5.8) |

| Checks | (8) | (8) | (9) | | 0.0 | 11.1 | (24) | (27) | (11.1) |

| Foreign trade | 0 | (3) | (21) | | 100.0 | 100.0 | (7) | (21) | (66.7) |

| Financial advisory services | (8) | (5) | (16) | | (60.0) | 50.0 | (95) | (35) | 171.4 |

| Other commissions and fees | (268) | (220) | (197) | | (21.8) | (36.0) | (734) | (536) | 36.9 |

| Total | (593) | (598) | (707) | | 0.8 | 16.1 | (1,795) | (1,894) | (5.2) |

| | | | | | | | | | |

| Commission and Fee Income, net | 3,301 | 3,052 | 2,964 | | 8.2 | 11.4 | 9,571 | 8,616 | 11.1 |

In 3Q13, net commission and fee income totaled Ps.3,301 million, representing a YoY increase of 11.4%, or Ps.337 million. This improvement principally reflects the following YoY increases: 35.9%, or Ps.233 million in credit card fees; 12.8%, or Ps.97 million in insurance brokerage fees; and 15.9%, or Ps.55 million in collection and payments services.

Compared to 2Q13, net commission and fee income increased 8.2%, or Ps.249 million, mainly reflecting the following sequential increases: 68.7%, or Ps.156 million in financial advisory services; 8.8%, or Ps.71 million in credit cards; and 5.2%, or Ps.42 million in insurance brokerage fees.

| | 3Q.13 | EARNINGS RELEASE | 18 |

| | | |

| | |  |

Net gain (loss) on financial assets and liabilities

| Grupo Financiero Santander México | | | | | | |

| Net gain (loss) on financial assets and liabilities | | | | | | |

| Millions of Mexican Pesos | | | | | % Change | | | % Change |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| Valuation | | | | | | | | | |

| Foreign currencies | (187) | 231 | (110) | | (181.0) | (70.0) | (34) | (81) | 58.0 |

| Derivatives | 865 | (3,447) | (10) | | 125.1 | 8,750.0 | (3,383) | (4) | (84,475.0) |

| Shares | 66 | (545) | (2) | | 112.1 | 3,400.0 | (585) | 109 | (636.7) |

| Debt instruments | 37 | (1,921) | 526 | | 101.9 | (93.0) | 430 | 1,026 | (58.1) |

| Subtotal | 781 | (5,682) | 404 | | 113.7 | 93.3 | (3,572) | 1,050 | (440.2) |

| | | | | | | | | | |

| Trading | | | | | | | | | |

| Foreign currencies | 110 | 242 | 190 | | (54.5) | (42.1) | 388 | 528 | (26.5) |

| Derivatives | (262) | 6,078 | 338 | | (104.3) | (177.5) | 6,844 | (311) | 2,300.6 |

| Shares | 15 | (575) | 136 | | 102.6 | (89.0) | (105) | 723 | (114.5) |

| Debt instruments | (89) | 1,245 | (150) | | (107.1) | 40.7 | (643) | (214) | (200.5) |

| Subtotal | (226) | 6,990 | 514 | | (103.2) | (144.0) | 6,484 | 726 | 793.1 |

| | | | | | | | | | |

| Total | 555 | 1,308 | 918 | | (58) | (40) | 2,912 | 1,776 | 64.0 |

In 3Q13, Santander México recorded a net gain on financial assets and liabilities of Ps.555 million, compared with a net gain of Ps.918 million in 3Q12 and a net gain of Ps.1,308 million in 2Q13. The net gain on financial assets and liabilities in 3Q13 is mainly explained by a trading loss of Ps.226 million principally related to derivatives and debt instruments, which were more than offset by a Ps.781 million valuation gains principally related to derivatives.

The Ps.226 million loss in trading, was principally driven by derivatives and debt instruments, which registered negative results of Ps.262 million and Ps.89 million, respectively. These were, partially offset by gains in foreign exchange and shares instruments, which amounted to Ps.110 million and Ps.15 million, respectively.

The Ps.781 million gain in valuation, was mainly explained by gains in derivatives, shares and debt instruments of Ps.865 million, Ps.66 million and Ps.37 million, respectively. These gains were partially offset by a loss of Ps.187 million in the valuation foreign currencies.

| | 3Q.13 | EARNINGS RELEASE | 19 |

| | | |

| | |  |

Other Operating Income (Expense)

| Grupo Financiero Santander México | | | | | | |

| Other Operating Income (Expense) | | | | | | |

| Millions of Mexican Pesos | | | | | % Change | | | % Change |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| | | | | | | | | | |

| Recoveries of loans previously charged-off | 493 | 474 | 467 | | 4.0 | 5.6 | 1,494 | 1,365 | 9.5 |

| Income from sale of fixed assets | 3 | 0 | 0 | | 0.0 | 0.0 | 3 | 1,732 | (99.8) |

| Allowance for loan losses released | 0 | 0 | 0 | | 0.0 | 0.0 | 0 | 378 | (100.0) |

| Cancellation of liabilities and reserves | 80 | 84 | 43 | | (4.8) | 86.0 | 231 | 155 | 49.0 |

| Interest on personnel loans | 30 | 30 | 31 | | 0.0 | (3.2) | 93 | 90 | 3.3 |

| Foreclosed assets reserve | 4 | (8) | (6) | | 150.0 | 166.7 | (9) | (29) | 69.0 |

| Profit from sale of foreclosed assets | 44 | 38 | 44 | | 15.8 | 0.0 | 112 | 112 | 0.0 |

| Technical advisory services | 18 | 14 | 48 | | 28.6 | (62.5) | 69 | 145 | (52.4) |

| Portfolio recovery legal expenses and costs | (116) | (152) | (117) | | 23.7 | 0.9 | (344) | (431) | 20.2 |

| Charge-offs | (108) | (103) | (315) | | (4.9) | 65.7 | (390) | (599) | 34.9 |

| Provision for legal and tax contingencies | (57) | 33 | (96) | | (272.7) | 40.6 | (85) | (198) | 57.1 |

| IPAB (indemnity) provisions and payments | (2) | (3) | (3) | | 33.3 | 33.3 | (8) | (35) | 77.1 |

| Other | 60 | 68 | 16 | | (11.8) | 275.0 | 153 | 149 | 2.7 |

| | | | | | | | | | |

| Other Operating Income (Expense) | 449 | 475 | 112 | | (5.5) | 300.9 | 1,319 | 2,834 | (53.5) |

In 3Q13, other operating income increased to Ps.449 million from Ps.112 million in 3Q12, mainly due to a Ps.207 million decline in charge-offs. On a sequential basis, other operating income decreased Ps.26 million, from Ps.475 million in 2Q13.

| | 3Q.13 | EARNINGS RELEASE | 20 |

| | | |

| | |  |

Administrative and Promotional Expenses

Administrative and promotional expenses consist of personnel costs such as payroll and benefits, promotion and advertising expenses, and other general expenses. Personnel expenses consist mainly of salaries, social security contributions, bonuses and our long-term incentive plan for our executives. Other general expenses mainly consist of: expenses related to technology and systems, administrative services, which are mainly services outsourced in the areas of information technology, taxes and duties, professional fees, contributions to IPAB, rental of properties and hardware, advertising and communication, surveillance and cash courier services and expenses related to maintenance, conservation and repair, among others.

| Grupo Financiero Santander México | | | | | | |

| Administrative and Promotional Expenses | | | | | | |

| Millions of Mexican Pesos | | | | | % Change | | | % Change |

| | 3Q13 | 2Q13 | 3Q12 | | QoQ | YoY | 2013 | 2012 | 13/12 |

| Salaries and employee benefits | (277) | 2,392 | 2,160 | | (111.6) | (112.8) | 4,465 | 6,357 | (29.8) |

| Credit card operation | 65 | 69 | 100 | | (5.8) | (35.0) | 206 | 177 | 16.4 |

| Professional fees | 113 | 25 | 103 | | 352.0 | 9.7 | 274 | 359 | (23.7) |

| Leasehold | 369 | 352 | 339 | | 4.8 | 8.8 | 1,088 | 904 | 20.4 |

| Promotional and advertising expenses | 144 | 76 | 126 | | 89.5 | 14.3 | 381 | 325 | 17.2 |

| Taxes and duties | 307 | 322 | 307 | | (4.7) | 0.0 | 841 | 673 | 25.0 |

| Technology services (IT) | 521 | 540 | 502 | | (3.5) | 3.8 | 1,561 | 1,336 | 16.8 |

| Depreciation and amortization | 404 | 427 | 387 | | (5.4) | 4.4 | 1,213 | 1,136 | 6.8 |

| Contributions to bank savings protection system (IPAB) | 397 | 372 | 341 | | 6.7 | 16.4 | 1,129 | 987 | 14.4 |

| Cash protection | 155 | 193 | 147 | | (19.7) | 5.4 | 450 | 377 | 19.4 |

| Other services and expenses | 539 | 546 | 645 | | (1.3) | (16.4) | 1,731 | 1,513 | 14.4 |

| | | | | | | | | | |

| Total Administrative and Promotional Expenses | 2,737 | 5,314 | 5,157 | | (48.5) | (46.9) | 13,339 | 14,144 | (5.7) |

Administrative and promotional expenses in 3Q13 amounted to Ps.2,737 million. Expenses in 3Q13 reflect an extraordinary non-cash benefit of Ps.2,935 million related to a mandatory regulatory change in employee profit sharing future payments and a cash expense of Ps.132 million in relation to the employee profit share payment of the taxable income for the nine-month period ending September 2013, in order to comply with the newly established legal criteria (Please refer to the Relevant Events section for further details on this extraordinary item).

Going forward, the change in legal criteria regarding employee profit sharing payment, have two effects: i) the extraordinary Ps.2,935 million (pre-tax) non-cash income that will reverse as a non-cash personnel expense in subsequent years as the differences between tax and accounting balances converge; and ii) an incremental annual cost which is expected to represent around 1.0% of total administrative and promotional expenses.

Adjusting for the aforementioned extraordinary items in 3Q13, administrative and promotional expenses grew YoY by 6.9%, or Ps.383 million, consistent with the growth of our business and the ongoing branch expansion. Additionally, the adoption in 2013 of an internal initiative to normalize the booking of expenses throughout the year remains in place. Sequentially, expenses in 3Q13 rose by Ps.226 million, or 4.3%.

| | 3Q.13 | EARNINGS RELEASE | 21 |

| | | |

| | |  |

On a sequential basis, excluding the aforementioned net benefit, administrative and promotional expenses increased 4.3%, principally due to the following increases: Ps.134 million in salaries and employee benefits, Ps.88 million in professional fees, Ps.68 million in promotional and advertising expenses and Ps.17 million in leaseholds. These increases were partially offset by the following decreases: a Ps.38 million decrease in cash protection, Ps.23 million in depreciation and amortization and Ps.19 million in technology services.

Excluding the aforementioned items, which affected expenses in 3Q13, the efficiency ratio for 3Q13 was 39.9%, which compares to 36.9% in 3Q12 and 39.2% in 2Q13, while the recurrence ratio was 64.1%, below the 66.2% reported in 3Q12 and slightly above the 64.0% 2Q13.

Current and Deferred Taxes

Current and deferred income taxes in 3Q13 were Ps.1,761 million compared with Ps.728 million in 3Q12, and above the Ps.831 million reported in 2Q13.

| | 3Q.13 | EARNINGS RELEASE | 22 |

| | | |

| | |  |

Capitalization and ROAE

| Banco Santander México | | | | | |

| Capitalization | | | | | |

| Millions of Mexican Pesos | 3Q13 | | 2Q13 | | 3Q12 |

| Tier 1 | 81,439 | | 76,074 | | 73,570 |

| Tier 2 | 225 | | 205 | | 1,538 |

| Total Capital | 81,664 | | 76,279 | | 75,108 |

| | | | | | |

| Risk-Weighted Assets | | | | | |

| Credit Risk | 338,493 | | 322,323 | | 313,707 |

| Credit, Market, and Operational Risk | 520,638 | | 499,168 | | 519,647 |

| | | | | | |

| Credit Risk Ratios: | | | | | |

| Tier 1 (%) | 24.1 | | 23.6 | | 23.4 |

| Tier 2(%) | 0.0 | | 0.1 | | 0.5 |

| Capitalization Ratio (%) | 24.1 | | 23.7 | | 23.9 |

| | | | | | |

| Total Capital Ratios: | | | | | |

| Tier 1(%) | 15.6 | | 15.2 | | 14.2 |

| Tier 2 (%) | 0.0 | | 0.0 | | 0.3 |

| Capitalization Ratio (%) | 15.7 | | 15.3 | | 14.5 |

Banco Santander (México)’s preliminary capital ratio at period end 3Q13 was 15.7%, compared to 14.5% at period end 3Q12 and 15.3% at period end 2Q13.

The Core Capital ratio amounted to 15.6% at period end 3Q13, versus 14.2% at period end 3Q12 and 15.2% at period end 2Q13.

The capital ratio for 2Q13 was modified to reflect the final definition of the regulators, allowing generic allowances calculated under the incurred losses methodology to be considered as Tier II capital. Following this change, however, the capital ratio for 2Q13 calculated under the new methodology remains relatively unchanged from the one the previously published.

As of August 2013, Banco Santander México is classified within Category 1 in accordance with Article 134bis of the Mexican Banking Law, and remains in this category as per the preliminary results dated September 2013, which is the most recently available analysis.

3Q13 ROAE was 19.8%, versus 21.1% in 3Q12 and 18.5% in 2Q13. Excluding the aforementioned non-comparable items in 3Q12 and 3Q13, and the ones reported in previous quarters, normalized ROAE for 3Q12 and 3Q13 would have been 18.1% and 17.8%, respectively.

| | 3Q.13 | EARNINGS RELEASE | 23 |

| | | |

| | |  |

RELEVANT EVENTS & REPRESENTATIVE ACTIVITIES AND TRANSACTIONS

Meeting of the Board of Directors of Grupo Financiero Santander México

On July 25th, 2013 was held the meeting of the Board of Directors of Grupo Financiero Santander México, S.A.B. de C.V., it was agreed, among other things, (i) to be aware of the follow-up to the process of acquisition of ING Hipotecaria, S.A. de C.V. SOFOM, a non-regulated financial entity, by Banco Santander (Mexico), S.A., as well as (ii) the accession of Grupo Financiero Santander México to the Internal Government of Banco Santander, S.A., which establishes internal policies of the Company in relation to its head office, in accordance with the guidelines established by the European banking authorities, which allows standardized internal policies of various subsidiaries of Santander at a global level.

Special Shareholders’ Meeting for Series “F” Shares

On August 20, 2013 the Board of Directors of this Series approved:

| § | The resignation of Mr. Jesús María Zabalza as a Non Independent Member of the Board of Directors. |

| § | The resignation of Mr. Rodrigo Brand de Lara as Alternate Director, and his appointment as a Non Independent Member of the Board of Directors. |

| § | The reelection of the rest of the Members of the Board of Directors of this Share Series. |

General Ordinary Shareholders’ Meeting

On August 20, 2013 the Board of Directors approved to modify the terms and conditions of the Ninth Resolution adopted in the General Ordinary Annual Shareholder Meeting held on April 18, 2013, ratifying the payment of a cash dividend to the Shareholders of the Society, originating from the account of “Retained earnings”, by the amount of Ps.8,850 million, which will be paid as following:

a) A cash payment for the amount of Ps.3,950 million, on August 30, 2013.

b) A cash payment for the amount of Ps.4,900 million, on February 25, 2014.

The Board of Directors approved to modify the terms and conditions of the Tenth Resolution adopted in the General Ordinary Annual Shareholder Meeting held on April 18, 2013.

The Board of Directors approved the reelection of the Members of the Board of Directors.

Additionally, the General Ordinary Shareholders’ Meeting of the Company was notified by the Chairman of the Board of Directors, of the resignation of D. Luis Orvañanos Lascurain from the date of notification (July 31, 2013), from his position as Alternate Independent Director of the Board of Directors of the Company.

Change in Legal Criteria regarding Employee Profit Sharing Payment

We determine the employee’s profit sharing in our results of operations according to article 127, fraction III of the Federal Labor Law.

On August 2013, a Supreme Court case law derived from a contradiction of judicial resolutions was published in the Judicial Weekly of the Federation (Semanario Judicial de la Federación), establishing that only those employers that exclusively obtain their income from the administration of real property which produce rents or the recovery of loans and interest thereon are entitled to apply article 127, fraction III of the Federal Labor Law when determining employee profit sharing.

We have evaluated the effects of this decision on past fiscal years and have determined that it represents a remote contingency. Our evaluation is based on the profile of our collective labor agreements, the SAT criteria for not modifying collective labor agreements and the terms of the Amparo Law reform (Ley de Amparo), which establish that case law cannot be applied retroactively.

As a result of this change in legal criteria, we recognized a liability provision of Ps. 132 million and a deferred asset of Ps. 2,935 million with the corresponding net credit to personnel expenses during the third quarter of 2013.

Going forward, the change in legal criteria regarding employee profit sharing payment will have two effects: i) an extraordinary Ps.2,935 million (pre-tax) non-cash income item that will be accounted as a non-cash personnel expense in

| | 3Q.13 | EARNINGS RELEASE | 24 |

| | | |

| | |  |

subsequent years as the differences between the tax and accounting balances converge; and ii) an incremental annual cost which is expected to represent around 1.0% of our total administrative and promotional expenses.

Santander México is the First Bank in Mexico to Launch Vocal Print Authentication

Santander is the first bank in Mexico to launch Vocal Print Authentication to identify clients who contact the bank through telephone banking. This tool enhances security in transactions, facilitates access for customers and improves operational efficiency.

Santander Launches SMEs Campaign with a Rate of 8.0%

Santander México launched a new campaign for SMEs, offering a rate of 8.0%, which places it as the lowest financing rate for SMEs in the market. These loans are partially guaranteed by Nacional Financiera and Bancomext.

Pre-delivery Payment Finance with Volaris

Banco Santander México provided US$71.5 million in financing to Volaris for the pre-delivery payment of eight new Airbus A320 aircrafts. With this transaction, Santander consolidates its leadership position in structural finance for the aircraft industry in Mexico.

Initial Public Offering for Volaris

Santander México participated in Volaris’ Initial Public Offering (IPO), as Bookrunner for the local tranche and Co-Manager for the international tranche. This transaction amounted to US$398 million, and was 2.3 times oversubscribed with a 79% allocation in the international markets.

Santander México as Joint Bookrunner in the Equity Offering of OMA

Santander México participated as local and international Joint Bookrunner in OMA’s Equity Offering (Grupo Aeroportuario del Centro Norte) for Ps.2,760 million, which was allocated as follows: 60% in the international markets and 40% in the local market.

Santander México as Underwriter in Genomma Lab’s Debt Issuance

Banco Santander México acted as underwriter of Genomma Lab’s 5-year, Ps.2,000 million debt issuance.

| | 3Q.13 | EARNINGS RELEASE | 25 |

| | | |

| | |  |

AWARDS & RECOGNITION

Santander’s Client Service Ombudsman Department Receives 2013 CSR Best Practices Award

On October 23, 2013. Santander México’s Client Service Ombudsman Department was recognized for Best Practices in Corporate Social Responsibility (CSR) for 2013 in the category of “Business Ethics,” as granted by the Mexican Center for Philanthropy (Cemefi), the Alliance for Social Responsibility in Mexico (AliaRSE) and the Network SumaRSE.

Santander’s Legal Team Recognized by The American Lawyer

On September 23, 2013, the American Lawyer magazine recognized Santander’s legal team for their outstanding performance in the placement of 24.9% of the Group’s capital in the equity markets of Mexico and the U.S., which was the third largest equity offering in the world, and the largest in Mexico, in 2012.

Santander México Recognized as a Leader in SMEs Financing

On August 11, 2013 the Ministry of Economy (Secretaría de Economía) recognized Santander México as a leader in financing to SMEs, noting that the bank has placed the largest amount of credit in this segment.

"Best Bank in Mexico 2013" Euromoney”

On July 14, 2013 the prestigious Euromoney magazine awarded Bank Banco Santander as “Best Bank in Mexico” for the second consecutive year, reflecting Santander’s outstanding participation in most of the most important banking events in 2012. Santander was highlighted by two unprecedented operations in the Mexican financial system made in 2012: i) the 24.9% placement of group capital in the equity markets of Mexico and the U.S., which was the third largest equity offering in the world, and the largest in Mexico; and ii) the 10-year bond senior debt issuance which had the longest term and the lower cost for a Mexican bank.

Euromoney magazine, founded in 1969, is recognized worldwide as a leader in international banking and financial news, as well as for its excellence awards which are benchmark for the financial sector. These awards are decided by Euromoney editors based on objective data such as profitability, growth and efficiency, and the ability of each institution to address complex challenges in times like these.

| | 3Q.13 | EARNINGS RELEASE | 26 |

| | | |

| | |  |

RATING CONFIRMATION BY STANDARD AND POOR’S, MOODY’S and FITCH RATINGS

CREDIT RATINGS

| Banco Santander (México) | | | | | |

| Ratings | | | | | |

| | Standard & Poor´s | | Moody´s | | Fitch Ratings |

| Global Scale | | | | | |

| Foreign Currency | | | | | |

| Long Term | BBB | | Baa1 | | BBB+ |

| Short Term | A-2 | | P-2 | | F2 |

| | | | | | |

| Local Currency | | | | | |

| Long Term | BBB | | A3 | | BBB+ |

| Short Term | A-2 | | P-2 | | F2 |

| | | | | | |

| National Scale | | | | | |

| Long Term | mxAAA | | Aaa.mx | | AAA(mex) |

| Short Term | mxA-1+ | | Mx-1 | | F1+(mex) |

| | | | | | |

| Autonomous Credit Profile (SACP) | bbb+ | | - | | - |

| Rating viability (VR) | - | | - | | bbb+ |

| Support | - | | - | | 2 |

| Financial Strength | - | | C- | | - |

| Standalone BCA | - | | baa1 | | - |

| Outlook | Stable | | Stable | | Stable |

| | | | | | |

| Last publication: | 13-Jun-13 | | 14-Jun-13 | | 28-May-13 |

| Brokerage - Casa de Bolsa Santander |

| Ratings | | | |

| | Moody´s | | Fitch Ratings |

| Global Scale | | | |

| National Scale | | | |

| Long Term | A3 | | _ |

| Short Term | Prime-2 | | _ |

| | | | |

| National Scale | | | |

| Long Term | Aaa.mx | | AAA.mx |

| Short Term | Mx-1 | | F1+mx |

| | | | |

| Outlook | Stable | | Stable |

| | 3Q.13 | EARNINGS RELEASE | 27 |

| | | |

| | |  |

3Q13 EARNINGS CALL DIAL-IN INFORMATION

| Date: | Tuesday, October 29, 2013 |

| Time: | 8:30 AM (MCT); 10:30 AM (US ET) |

| Dial-in Numbers: | 1-866-416-5346 US & Canada; 1-913-312-0714 International & Mexico |

| Webcast: | https://viavid.webcasts.com/starthere.jsp?ei=1023969 |

| Replay: | Starting Tuesday, October 29, 2013 at 1:30pm US ET, and ending on Tuesday, November 5, 2013 at 11:59pm US ET Dial-in number: 1-866-416-5346 US & Canada; 1-913-312-0714 International & Mexico Access Code: 5073807 |

ANALYST COVERAGE

Actinver, Bank of America Merrill Lynch, Barclays, BBVA Bancomer, Citi, Credit Suisse, Deutsche Bank, EVA Dimensions, GBM, Goldman Sachs, HSBC, Independent Research, Interacciones, JP Morgan, Morgan Stanley, Morningstar, Nau Securities, RBC, Scotiabank, UBS and Vector.

Santander México is covered by the aforementioned analysts. Please note that any opinions, estimates or forecasts regarding the performance of Santander México issued by these analysts reflect their own views, and therefore do not represent the opinions, estimates or forecasts of Santander México or its management. Although Santander México may refer to or distribute such statements, this does not imply that Santander México agrees with or endorses any information, conclusions or recommendations included therein.

DEFINITION OF RATIOS

ROAE: Annualized net income (9M13/3x4) divided by average equity (Average of 3Q13, 4Q12)

EFFICIENCY: Annualized administrative and promotional expenses divided by annualized gross operating income (before administrative and promotional expenses and net of allowances).

RECURRENCY: Annualized net fees divided by annualized administrative and promotional expenses (net of amortizations and depreciations).

NIM: Financial margin divided by daily average interest earnings assets.

| | 3Q.13 | EARNINGS RELEASE | 28 |

| | | |

| | |  |

ABOUT GRUPO FINANCIERO SANTANDER MEXICO, S.A.B. DE C.V. (NYSE: BSMX; BMV: SANMEX)

Grupo Financiero Santander Mexico, S.A.B. de C.V. (Santander Mexico), one of Mexico’s leading financial services holding companies, provides a wide range of financial and related services, including retail and commercial banking, securities brokerage, financial advisory and other related investment activities. Santander Mexico offers a multichannel financial services platform focused on mid- to high-income individuals and small- to medium-sized enterprises, while also providing integrated financial services to larger multinational companies in Mexico. As of September 30, 2013, Santander Mexico had total assets of Ps.806.3 billion under Mexican GAAP and more than 10.6 million customers. Headquartered in Mexico City, the Company operates 991 branches and 238 offices nationwide and has a total of 13,883 employees.

We, the undersigned under oath to tell the truth declare that, in the area of our corresponding functions, we prepared the information on Grupo Financiero Santander contained in this quarterly report, which to the best of our knowledge reasonably reflects its situation.

| MARCOS A. MARTINEZ GAVICA | | PEDRO JOSE MORENO CANTALEJO |

| Executive President and Chief Executive Officer | | Vice President of Administration and Finance |

| EMILIO DE EUSEBIO SAIZ | JESÚS GONZÁLEZ DEL REAL | JAVIER PLIEGO ALEGRÍA |

Deputy General Director of Intervention and Control Management | Executive Director – Controller | Executive Director of Internal Audit |

The financial information presented in this report has been obtained from the non-audited financial statements prepared in accordance with the General Nature Provisions applicable to Holding Corporations of Financial Groups which are subject to the supervision of the National Banking and Securities Commission on accounting procedures, published in the Federal Official Gazette on January 31, 2011. The exchange rate used to convert foreign currency transactions to pesos is PPs.13.1747.

INVESTOR RELATIONS CONTACT

Gerardo Freire Alvarado

+ 52 (55) 5269-1827

investor@santander.com.mx

LEGAL DISCLAIMER

Grupo Financiero Santander México cautions that this report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements could be found in various places throughout this reports and include, without limitation, statements regarding our intent, belief, targets or current expectations in connection with: asset growth and sources of funding; growth of our fee-based business; expansion of our distribution network; our focus on strategic businesses; our compound annual growth rate; our risk, efficiency and profitability targets; financing plans; competition; impact of regulation; exposure to market risks including interest rate risk, foreign exchange risk and equity price risk; exposure to credit risks including credit default risk and settlement risk; projected capital expenditures; capitalization requirements and level of reserves; liquidity; trends affecting the economy generally; and trends affecting our financial condition and our results of operations. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: changes in capital markets in general that may affect policies or attitudes towards lending to Mexico or Mexican companies; changes in economic conditions, in Mexico in particular, in the United States or globally; the monetary, foreign exchange and interest rate policies of the Mexican Central Bank (Banco de México); inflation; deflation; unemployment; unanticipated turbulence in interest rates; movements in foreign exchange rates; movements in equity prices or other rates or prices; changes in Mexican and foreign policies, legislation and regulations; changes in requirements to make contributions to, for the receipt of support from programs organized by or requiring deposits to be made or assessments observed or imposed by, the Mexican government; changes in taxes; competition, changes in competition and pricing environments; our inability to hedge certain risks economically; economic conditions that affect consumer spending and the ability of customers to comply with obligations; the adequacy of allowances for loans and other losses; increased default by borrowers; technological changes; changes in consumer spending and saving habits; increased costs; unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; changes in, or failure to comply with, banking regulations; and certain other factors indicated in the “Risk Factors” section of our Registration

| | 3Q.13 | EARNINGS RELEASE | 29 |

| | | |

| | |  |

Statement on Form F-1 (File No. 333-183409). The risk factors and other key factors that we have indicated in our past and future filings and reports, including those with the U.S. Securities and Exchange Commission, could adversely affect our business and financial performance.

Note: The information contained in this report is not audited. Nevertheless, the consolidated accounts are prepared on the basis of the accounting principles and regulations prescribed by the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores) for credit institutions, as amended (Mexican Banking GAAP). All figures presented are in nominal terms. Historical figures are not adjusted by inflation.

| | 3Q.13 | EARNINGS RELEASE | 30 |

| | | |

| | |  |

Grupo Financiero Santander México

| § | Consolidated Balance Sheet |

| § | Consolidated Statement of Income |

| § | Consolidated Statement of Changes in Stockholders’ Equity |

| § | Consolidated Statement of Cash Flows |

The information contained in this report and the financial statements of the Group’s subsidiaries may be consulted on the Internet website: www.santander.com.mx or through the following direct access:

http://www.santander.com.mx/ir/english/financial/quarterly.html

There is also information on Santander on the CNBV Website: www.cnbv.gob.mx

| | 3Q.13 | EARNINGS RELEASE | 31 |

| | | |

| | |  |

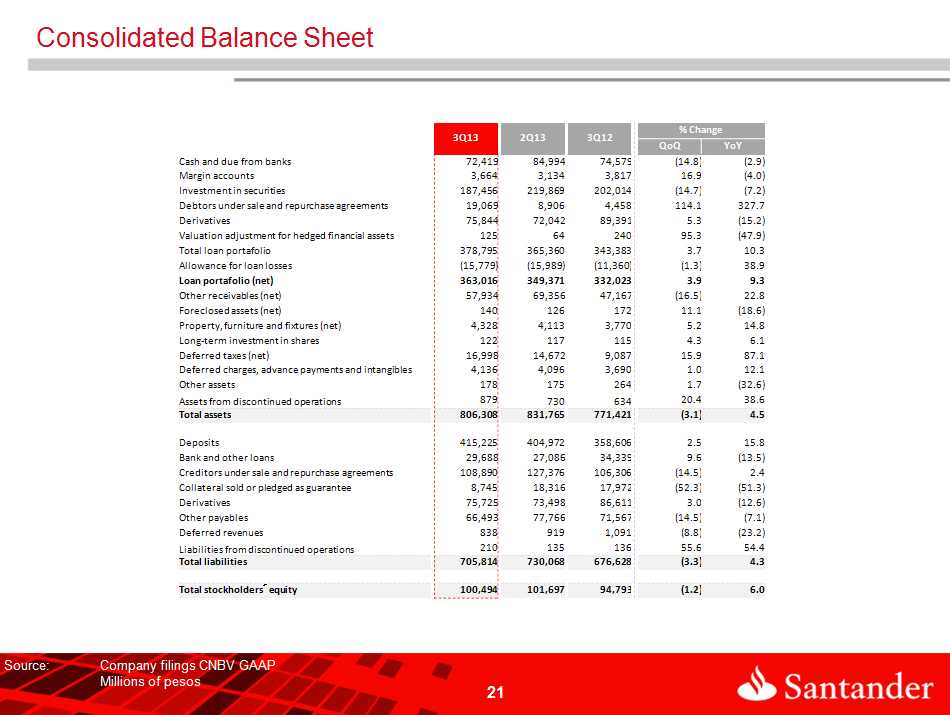

| Grupo Financiero Santander México | | | | | |

| Consolidated Balance Sheet | | | | | |

| Millions of Mexican Pesos | | | | | |

| | | 2013 | | 2012 |

| | Sep | Jun | Mar | | Dec | Sep | Jun | Mar |

| Assets | | | | | | | | |

| | | | | | | | | |

| Cash and due from banks | 72,419 | 84,994 | 102,461 | | 81,626 | 74,579 | 77,019 | 60,747 |

| | | | | | | | | |

| Margin accounts | 3,664 | 3,134 | 3,830 | | 3,995 | 3,817 | 4,534 | 4,187 |

| | | | | | | | | |

| Investment in securities | 187,456 | 219,869 | 201,150 | | 169,499 | 202,014 | 262,863 | 269,588 |

| Trading securities | 127,070 | 160,761 | 158,619 | | 117,036 | 141,986 | 203,124 | 202,726 |

| Securities available for sale | 55,132 | 53,908 | 37,384 | | 47,373 | 54,996 | 54,764 | 61,944 |

| Securities held to maturity | 5,254 | 5,200 | 5,147 | | 5,090 | 5,032 | 4,975 | 4,918 |

| | | | | | | | | |

| Debtors under sale and repurchase agreements | 19,069 | 8,906 | 21,148 | | 9,471 | 4,458 | 4,827 | 4,484 |

| | | | | | | | | |

| Derivatives | 75,844 | 72,042 | 94,565 | | 80,622 | 89,391 | 87,859 | 71,993 |

| Trading purposes | 75,691 | 71,810 | 94,178 | | 80,322 | 88,947 | 87,288 | 71,278 |

| Hedging purposes | 153 | 232 | 387 | | 300 | 444 | 571 | 715 |

| Valuation adjustment for hedged financial assets | 125 | 64 | 246 | | 210 | 240 | 220 | 139 |

| | | | | | | | | |

| Performing loan portfolio | | | | | | | | |

| Commercial loans | 228,337 | 220,224 | 213,471 | | 214,445 | 211,685 | 212,492 | 198,276 |

| Commercial or business activity | 196,431 | 188,480 | 175,379 | | 175,329 | 175,945 | 176,332 | 163,630 |

| Financial entities loans | 1,912 | 779 | 451 | | 407 | 619 | 606 | 1,934 |

| Government entities loans | 29,994 | 30,965 | 37,641 | | 38,709 | 35,121 | 35,554 | 32,712 |

| Consumer loans | 65,400 | 63,464 | 61,906 | | 61,603 | 59,996 | 57,043 | 52,857 |

| Mortgage loans | 74,297 | 72,787 | 70,448 | | 68,542 | 66,172 | 64,417 | 62,559 |

| Total performing loan portfolio | 368,034 | 356,475 | 345,825 | | 344,590 | 337,853 | 333,952 | 313,692 |

| | | | | | | | | |

| Nonperforming loan portfolio | | | | | | | | |

| Commercial loans | 5,608 | 3,899 | 1,823 | | 1,523 | 1,402 | 1,313 | 1,135 |

| Commercial or business activity | 5,608 | 3,899 | 1,815 | | 1,523 | 1,402 | 1,313 | 1,135 |

| Government entities loans | 0 | 0 | 8 | | 0 | 0 | 0 | 0 |

| Consumer loans | 2,668 | 2,606 | 2,261 | | 2,236 | 2,053 | 1,709 | 1,255 |

| Mortgage loans | 2,485 | 2,380 | 2,358 | | 2,334 | 2,075 | 1,931 | 1,982 |

| Total nonperforming portfolio | 10,761 | 8,885 | 6,442 | | 6,093 | 5,530 | 4,953 | 4,372 |

| Total loan portfolio | 378,795 | 365,360 | 352,267 | | 350,683 | 343,383 | 338,905 | 318,064 |

| | | | | | | | | |

| Allowance for loan losses | (15,779) | (15,989) | (11,954) | | (11,580) | (11,360) | (11,101) | (10,875) |

| Loan portfolio (net) | 363,016 | 349,371 | 340,313 | | 339,103 | 332,023 | 327,804 | 307,189 |

| | | | | | | | | |

| Other receivables (net) | 57,934 | 69,356 | 72,699 | | 45,884 | 47,167 | 55,640 | 46,677 |

| Foreclosed assets (net) | 140 | 126 | 136 | | 150 | 172 | 196 | 220 |

| Property, furniture and fixtures (net) | 4,328 | 4,113 | 4,058 | | 4,095 | 3,770 | 3,780 | 5,439 |

| Long-term investment in shares | 122 | 117 | 167 | | 134 | 115 | 101 | 157 |

| Deferred taxes and deferred profit sharing (net) | 16,998 | 14,672 | 11,049 | | 10,512 | 9,087 | 8,424 | 8,183 |

| Deferred charges, advance payments and intangibles | 4,136 | 4,096 | 4,141 | | 4,247 | 3,690 | 3,792 | 4,146 |

| Other assets | 178 | 175 | 169 | | 163 | 264 | 196 | 170 |

| Discontinued operations | 879 | 730 | 712 | | 626 | 634 | 544 | 628 |

| Total assets | 806,308 | 831,765 | 856,844 | | 750,337 | 771,421 | 837,799 | 783,947 |

| | 3Q.13 | EARNINGS RELEASE | 32 |

| | | |

| | |  |

| Grupo Financiero Santander México | | | | | | | | |

| Consolidated Balance Sheet | | | | | | | | |

| Millions of Mexican Pesos | | | | | | | | |

| | | | 2013 | | | | | 2012 |

| | Sep | Jun | Mar | | Dec | Sep | Jun | Mar |

| Liabilities | | | | | | | | |

| | | | | | | | | |

| Deposits | 415,225 | 404,972 | 411,092 | | 397,546 | 358,606 | 352,753 | 346,605 |

| Demand deposits | 240,940 | 218,593 | 226,503 | | 210,915 | 194,351 | 204,606 | 187,787 |

| Time deposits – Customers | 129,344 | 130,599 | 124,871 | | 125,584 | 120,034 | 117,184 | 122,816 |

| Time deposits – Money market | 19,233 | 29,498 | 23,546 | | 25,953 | 21,904 | 9,085 | 14,507 |

| Credit instruments issued | 25,708 | 26,282 | 36,172 | | 35,094 | 22,317 | 21,878 | 21,495 |

| | | | | | | | | |

| Bank and other loans | 29,688 | 27,086 | 31,094 | | 27,463 | 34,339 | 24,804 | 21,372 |

| Demand loans | 6,506 | 9,659 | 9,075 | | 8,240 | 5,916 | 6,851 | 5,949 |

| Short-term loans | 16,174 | 15,513 | 19,726 | | 16,767 | 26,092 | 15,704 | 13,278 |

| Long-term loans | 7,008 | 1,914 | 2,293 | | 2,456 | 2,331 | 2,249 | 2,145 |

| | | | | | | | | |

| Creditors under sale and repurchase agreements | 108,890 | 127,376 | 116,299 | | 73,290 | 106,306 | 168,227 | 189,299 |

| | | | | | | | | |

| Collateral sold or pledged as guarantee | 8,745 | 18,316 | 18,130 | | 6,853 | 17,972 | 18,766 | 14,104 |

| Securities loans | 8,745 | 18,316 | 18,130 | | 6,853 | 17,972 | 18,766 | 14,104 |

| | | | | | | | | |

| Derivatives | 75,725 | 73,498 | 92,751 | | 79,561 | 86,611 | 87,959 | 70,290 |

| Trading purposes | 73,955 | 72,264 | 91,132 | | 77,939 | 85,207 | 86,232 | 69,264 |

| Hedging purposes | 1,770 | 1,234 | 1,619 | | 1,622 | 1,404 | 1,727 | 1,026 |

| | | | | | | | | |

| Other payables | 66,493 | 77,766 | 83,789 | | 66,610 | 71,567 | 88,567 | 47,468 |

| Income taxes payable | 148 | 180 | 284 | | 440 | 720 | 335 | 841 |

| Employee profit sharing payable | 272 | 97 | 83 | | 169 | 115 | 81 | 61 |

| Creditors from settlement of transactions | 40,906 | 52,312 | 62,970 | | 38,604 | 47,308 | 52,492 | 24,013 |

| Creditors from collaterals received on cash | 4,781 | 4,215 | 6,158 | | 5,725 | 6,243 | 5,889 | 4,469 |

| Sundry creditors and other payables | 20,386 | 20,962 | 14,294 | | 21,672 | 17,181 | 29,770 | 18,084 |

| | | | | | | | | |

| Deferred revenues | 838 | 919 | 1,011 | | 1,041 | 1,091 | 1,096 | 1,385 |

| Discontinued operations | 210 | 135 | 159 | | 146 | 136 | 82 | 180 |

| | | | | | | | | |

| Total liabilities | 705,814 | 730,068 | 754,325 | | 652,510 | 676,628 | 742,254 | 690,703 |

| | | | | | | | | |

| Paid in capital | 47,908 | 47,881 | 47,776 | | 47,811 | 47,776 | 48,195 | 48,195 |

| Capital stock | 36,357 | 36,357 | 36,357 | | 36,357 | 36,357 | 36,357 | 36,357 |

| Share Premium | 11,551 | 11,524 | 11,419 | | 11,454 | 11,419 | 11,838 | 11,838 |

| | | | | | | | | |

| Other capital | 52,586 | 53,816 | 54,743 | | 50,016 | 47,017 | 47,350 | 45,049 |

| Capital reserves | 1,851 | 1,850 | 349 | | 349 | 349 | 349 | 108 |

| Retained earnings | 36,190 | 43,370 | 48,979 | | 31,068 | 31,038 | 35,311 | 38,541 |

| Result from valuation of securities available for sale, net | (99) | (215) | 762 | | 678 | 727 | 688 | 442 |

| Result from valuation of cash flow hedge instruments, net | (108) | (59) | (74) | | 90 | 382 | 690 | 932 |

| Net income | 14,742 | 8,860 | 4,717 | | 17,822 | 14,512 | 10,298 | 5,013 |

| Non-controlling interest | 10 | 10 | 10 | | 9 | 9 | 14 | 13 |

| Total stockholders´equity | 100,494 | 101,697 | 102,519 | | 97,827 | 94,793 | 95,545 | 93,244 |

| Total liabilities and stockholders´ equity | 806,308 | 831,765 | 856,844 | | 750,337 | 771,421 | 837,799 | 783,947 |

| | 3Q.13 | EARNINGS RELEASE | 33 |

| | | |

| | |  |

| Grupo Financiero Santander México |

| Consolidated Balance Sheet |

| Millions of Mexican Pesos |

| | | 2013 | | 2012 |

| | Sep | Jun | Mar | | Dec | Sep | Jun | Mar |

| Memorandum accounts | | | | | | | | |

| | | | | | | | | |

| FOR THIRD PARTIES | | | | | | | | |

| | | | | | | | | |

| Current client account | | | | | | | | |