Exhibit 99.2

ENERGY TRANSFER PARTNERS, L.P.

AND SUNOCO LP RETAIL DROP DOWN

November 16, 2015

SUNOCOLP

ENERGY TRANSFER

ENERGY TRANSFER

SUNOCOLP

FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES

Some of the statements in this presentation constitute “forward-looking statements” about Sunoco LP (“SUN”), Energy Transfer Equity, L.P. (“ETE”), Energy Transfer Partners, L.P. (“ETP”), and their respective affiliates that involve risks, uncertainties and assumptions, including, without limitation, our discussion and analysis of our financial condition and results of operations and our expectations regarding the acquisition of ETP’s remaining wholesale fuel and retail assets (the “Retail Acquisition”). These forward-looking statements generally can be identified by use of phrases such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “forecast” or other similar words or phrases in conjunction with a discussion of future operating or financial performance. Descriptions of SUN’s, ETE’s, ETP’s and their respective affiliates’ objectives, goals, targets, plans, strategies, costs, anticipated capital expenditures, expected cost savings, potential acquisitions and related financial projections are also forward-looking statements. These statements represent present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

We caution that forward-looking statements involve risks and uncertainties and are qualified by important factors that could cause actual events or results to differ materially from those expressed or implied in any such forward-looking statements. For a discussion of these factors and other risks and uncertainties, please refer to SUN’s, ETE’s and ETP’s filings with the Securities and Exchange Commission (the“SEC”), including those contained in SUN’s 2014 Annual Report on Form10-K and Quarterly Reports on Form10-Q which are available at the SEC’s website at www.sec.gov.

This presentation includes certain projections that assume that the proposed Retail Acquisition will be completed. The Retail Acquisition is expected to close in Q1 2016 and will be subject to customary closing conditions. The PIPE financing referenced herein is not contingent upon the closing of the Retail Acquisition.

This presentation includes certain non-GAAP financial measures as defined under SEC Regulation G. A reconciliation of those measures to the most directly comparable GAAP measures is provided in the appendix to this presentation. We define EBITDA as net income before net interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. Distributable cash flow represents Adjusted EBITDA less cash interest expense, cash tax expense, maintenance capital expenditures, and other non-cash adjustments.

2

SUNOCOLP

DROPDOWN OF REMAINING WHOLESALE FUEL AND RETAIL ASSETS COMPLETES SUN’S TRANSFORMATION

This transaction completes the transformative dropdown strategy by Energy Transfer Partners, L.P. (“ETP”):

ETP’s Acquisition of Susser Holdings Corp. (“SUSS”) closed on August 29, 2014

The first dropdown from ETP, Mid Atlantic Convenience Stores (“MACS”) and Tigermarket for $768 million of cash and LP units, closed on October 1, 2014

The second dropdown from ETP, a 31.58% interest in the Sunoco, LLC wholesale business for $816 million of cash and LP units, closed on April 1, 2015

The third dropdown from ETP, a 100% interest in the Susser Holdings retail business for $1.9 billion of units and cash, closed on August 1, 2015

ETP will sell its remaining wholesale fuel and retail assets for a total purchase price of $2,226 million

$5.7 billion of dropdowns completed in just over 13 months

ETP has publicly announced its intention to retain ~44 million SUN units (46% LP interest)

This last transaction will be funded through $2.035 billion funded by a Term Loan A and a $750 million equity private placement

Consideration structure designed to maintain integrity of SUN’s credit ratings

ETP to receive $2.2 billion in cash (including assumed level of working capital)

This transaction will complete SUN’s transformation into one of the leading wholesale fuel and retail marketing platforms in the country with tremendous scale and diversity of supply and geography

3

SUNOCOLP

DROPDOWN OF REMAINING WHOLESALE FUEL AND RETAIL ASSETS COMPLETES SUN’S TRANSFORMATION

SUN continues its integration process and expects to execute this last dropdown seamlessly

ETP completed the GP / IDR exchange with ETE in July

SUN is now deconsolidated by ETP and for financial reporting purposes is consolidated by ETE

The transaction benefits SUN unitholders by providing additional scale, geographic and asset diversity, increasing pro forma EBITDA

SUN’s credit profile has already materially improved in just the past several months and will continue to strengthen as it continues to expand and diversify

Significantly increased liquidity with little drawn on $1.5 billion revolving credit facility

No additional equity financing is required by SUN in 2016

Anticipate closing transaction in Q1 2016

Transaction is immediately accretive to distributable cash flow and distributions for SUN

4

SUNOCOLP

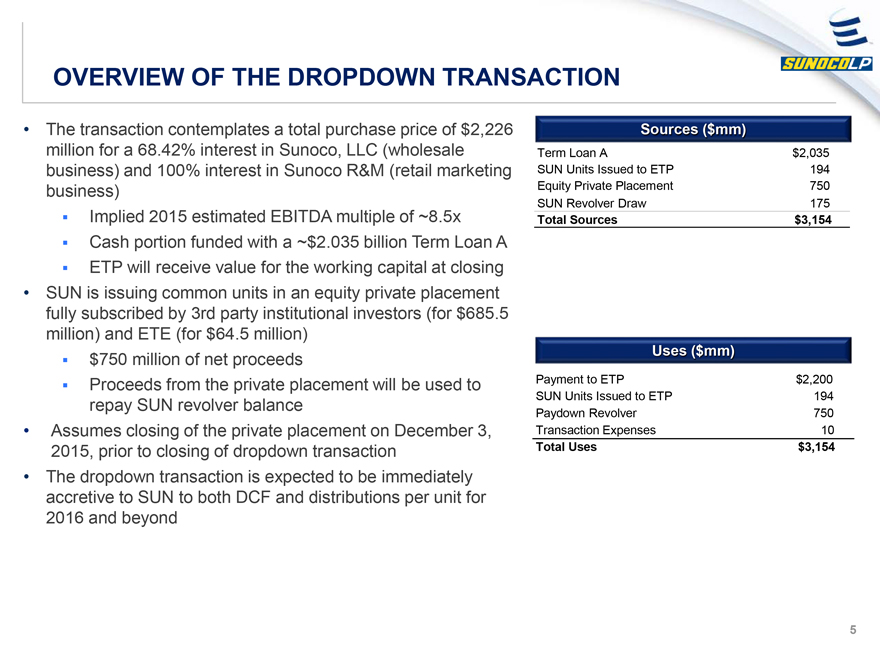

OVERVIEW OF THE DROPDOWN TRANSACTION

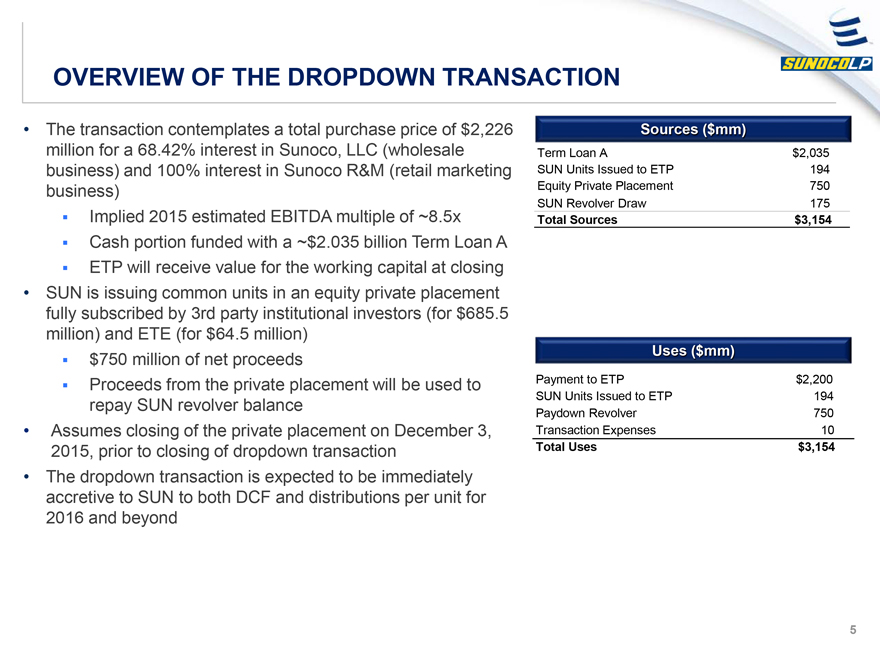

The transaction contemplates a total purchase price of $2,226 million for a 68.42% interest in Sunoco, LLC (wholesale business) and 100% interest in Sunoco R&M (retail marketing business)

Implied 2015 estimated EBITDA multiple of ~8.5x

Cash portion funded with a ~$2.035 billion Term Loan A

ETP will receive value for the working capital at closing

SUN is issuing common units in an equity private placement fully subscribed by 3rd party institutional investors (for $685.5 million) and ETE (for $64.5 million)

$750 million of net proceeds

Proceeds from the private placement will be used to repay SUN revolver balance

Assumes closing of the private placement on December 3, 2015, prior to closing of dropdown transaction

The dropdown transaction is expected to be immediately accretive to SUN to both DCF and distributions per unit for 2016 and beyond

Sources ($mm)

Term Loan A $2,035

SUN Units Issued to ETP 194

Equity Private Placement 750

SUN Revolver Draw 175

Total Sources $3,154

Uses ($mm)

Payment to ETP $2,200

SUN Units Issued to ETP 194

Paydown Revolver 750

Transaction Expenses 10

Total Uses $3,154

5

SUNOCOLP

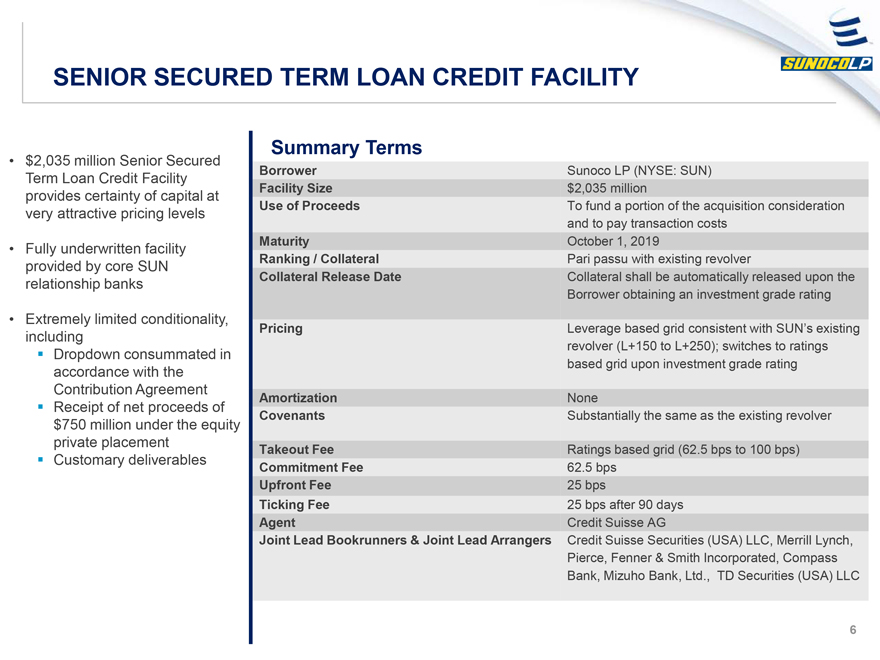

SENIOR SECURED TERM LOAN CREDIT FACILITY

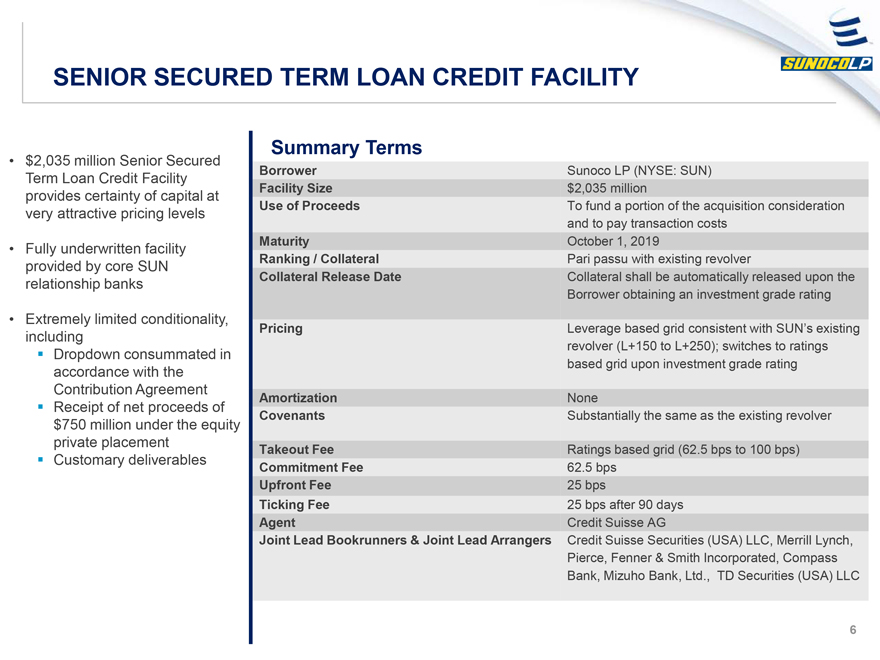

$2,035 million Senior Secured Term Loan Credit Facility provides certainty of capital at very attractive pricing levels

Fully underwritten facility provided by core SUN relationship banks

Extremely limited conditionality, including

Dropdown consummated in accordance with the Contribution Agreement

Receipt of net proceeds of $750 million under the equity private placement

Customary deliverables

Summary Terms

Borrower Sunoco LP (NYSE: SUN)

Facility Size $2,035 million

Use of Proceeds To fund a portion of the acquisition consideration and to pay transaction costs

Maturity October 1, 2019

Ranking / Collateral Pari passu with existing revolver

Collateral Release Date Collateral shall be automatically released upon the Borrower obtaining an investment grade rating

Pricing Leverage based grid consistent with SUN’s existing revolver (L+150 to L+250); switches to ratings based grid upon investment grade rating

Amortization None

Covenants Substantially the same as the existing revolver

Takeout Fee Ratings based grid (62.5 bps to 100 bps)

Commitment Fee 62.5 bps

Upfront Fee 25 bps

Ticking Fee 25 bps after 90 days

Agent Credit Suisse AG

Joint Lead Bookrunners & Joint Lead Arrangers Credit Suisse Securities (USA) LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Compass Bank, Mizuho Bank, Ltd., TD Securities (USA) LLC

6

SUNOCOLP

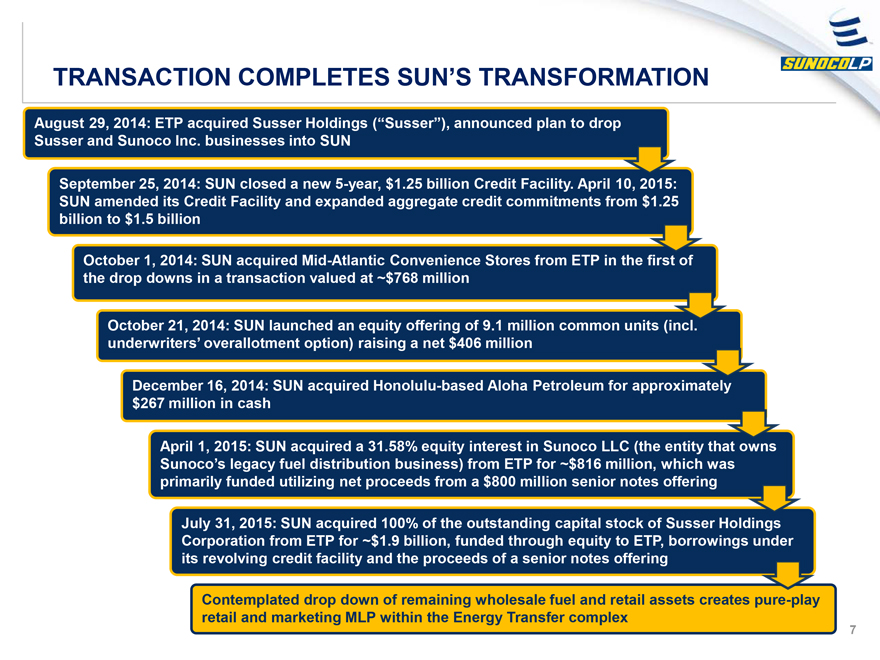

TRANSACTION COMPLETES SUN’S TRANSFORMATION

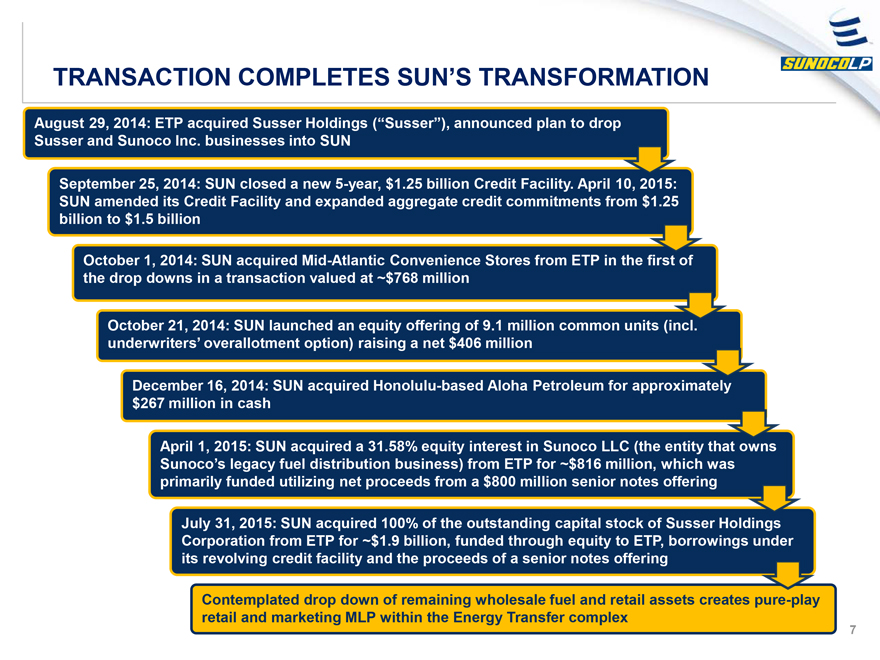

August 29, 2014: ETP acquired Susser Holdings (“Susser”), announced plan to drop

Susser and Sunoco Inc. businesses into SUN

September 25, 2014: SUN closed a new 5-year, $1.25 billion Credit Facility. April 10, 2015:

SUN amended its Credit Facility and expanded aggregate credit commitments from $1.25 billion to $1.5 billion

October 1, 2014: SUN acquired Mid-Atlantic Convenience Stores from ETP in the first of the drop downs in a transaction valued at ~$768 million

October 21, 2014: SUN launched an equity offering of 9.1 million common units (incl.underwriters’ overallotment option) raising a net $406 million

December 16, 2014: SUN acquired Honolulu-based Aloha Petroleum for approximately

$267 million in cash

April 1, 2015: SUN acquired a 31.58% equity interest in Sunoco LLC (the entity that owns

Sunoco’s legacy fuel distribution business) from ETP for ~$816 million, which was primarily funded utilizing net proceeds from a $800 million senior notes offering

July 31, 2015: SUN acquired 100% of the outstanding capital stock of Susser Holdings

Corporation from ETP for ~$1.9 billion, funded through equity to ETP, borrowings under its revolving credit facility and the proceeds of a senior notes offering

Contemplated drop down of remaining wholesale fuel and retail assets creates pure-play retail and marketing MLP within the Energy Transfer complex

7

SUNOCOLP

SUMMARY SUNOCO LP STRATEGY

Stability

Significant amount of long-term fuel supply agreements

Historical stability of fuel margins

Fuel margins are not commodity price sensitive and have been resilient across economic and commodity cycles

Strong and resilient industry fundamentals

Large-cap investment grade sponsor

Significant real estate value

Prudent investment to drive organic growth

Visible Growth

Ability to pursue combined retail / attractive wholesale asset acquisitions in highly markets

Organic expansion of convenience store and wholesale business

Financial capacity to execute long-term growth strategy

8

SUNOCOLP

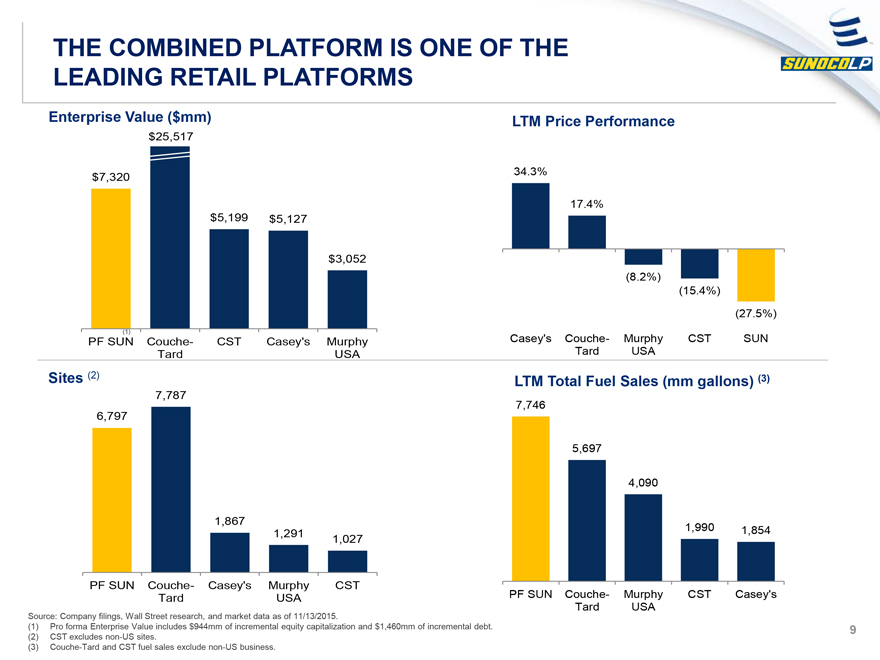

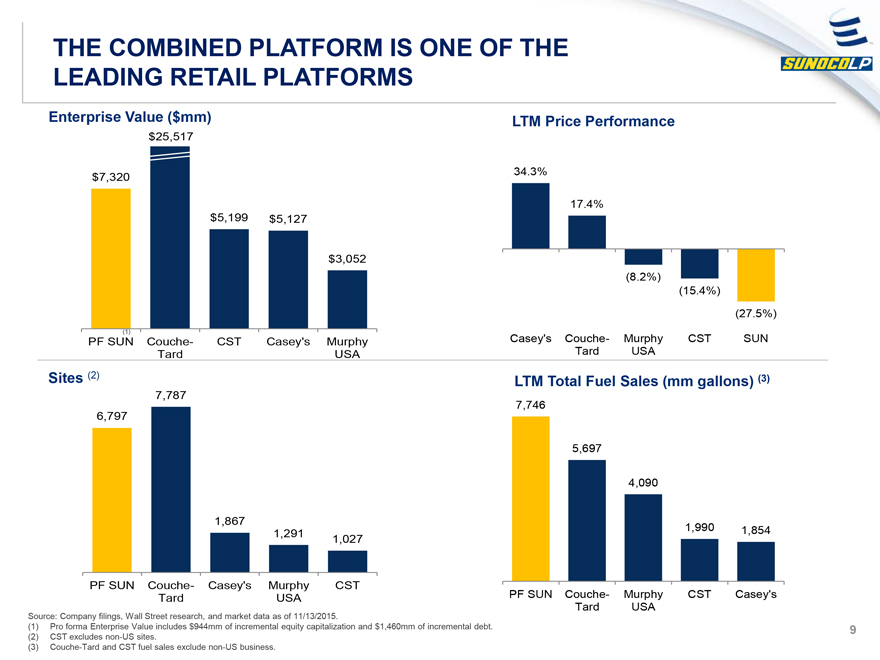

THE COMBINED PLATFORM IS ONE OF THE LEADING RETAIL PLATFORMS

Enterprise Value ($mm)

$25,517

$7,320

$5,199 $5,127

$3,052

(1)

PF SUN Couche-CST Casey’s Murphy

Tard USA

Sites (2)

7,787

6,797

1,867

1,291 1,027

PF SUN Couche-Casey’s Murphy CST

Tard USA

LTM Price Performance

34.3%

17.4%

(8.2%)

(15.4%)

(27.5%)

Casey’s Couche-Murphy CST SUN

Tard USA

LTM Total Fuel Sales (mm gallons) (3)

7,746

5,697

4,090

1,990 1,854

PF SUN Couche-Murphy CST Casey’s

Tard USA

Source: Company filings, Wall Street research, and market data as of 11/13/2015.

(1) Pro forma Enterprise Value includes $944mm of incremental equity capitalization and $1,460mm of incremental debt. (2) CST excludes non-US sites.

(3) Couche-Tard and CST fuel sales exclude non-US business.

9

SUNOCOLP

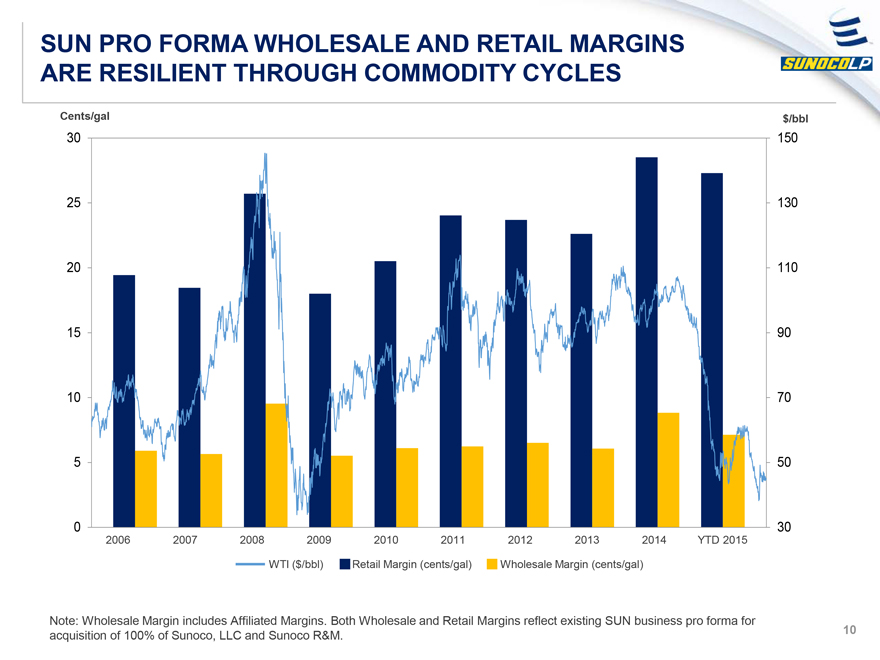

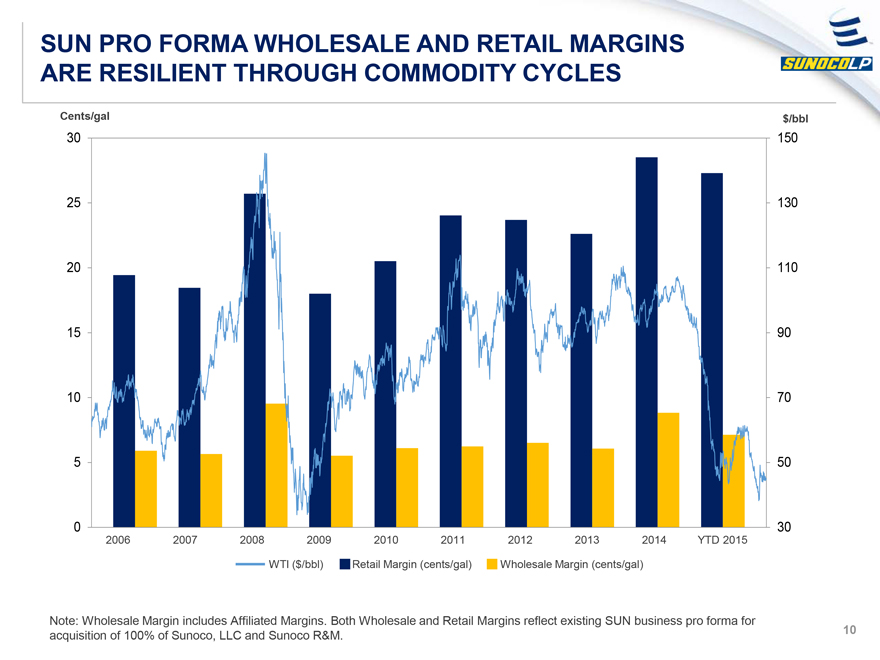

SUN PRO FORMA WHOLESALE AND RETAIL MARGINS ARE RESILIENT THROUGH COMMODITY CYCLES

Cents/gal $/bbl

30 150

25 130

20 110

15 90

10 70

5 50

0 30

2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD 2015

WTI ($/bbl) Retail Margin (cents/gal) Wholesale Margin (cents/gal)

Note: Wholesale Margin includes Affiliated Margins. Both Wholesale and Retail Margins reflect existing SUN business pro forma for acquisition of 100% of Sunoco, LLC and Sunoco R&M.

10

SUNOCOLP

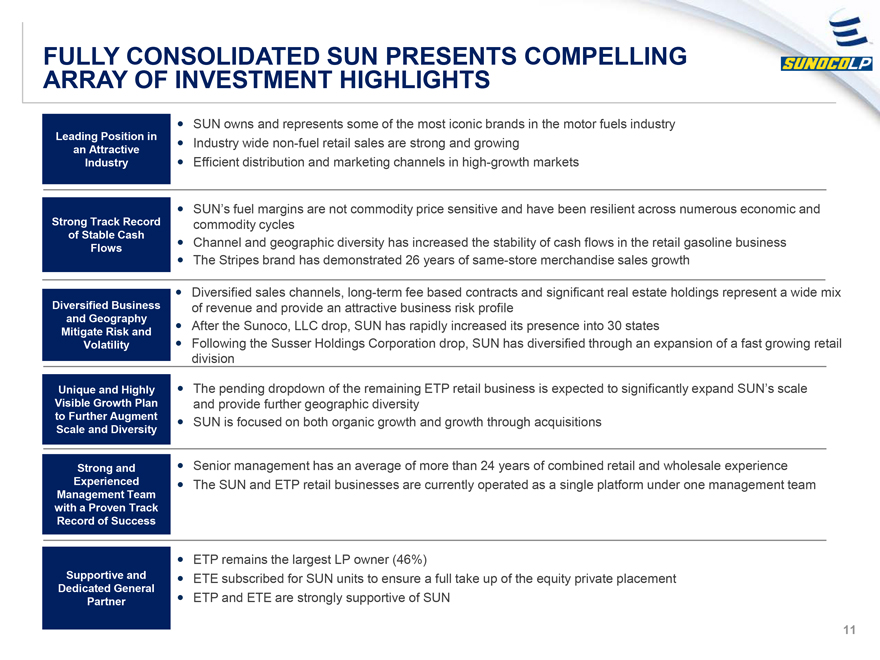

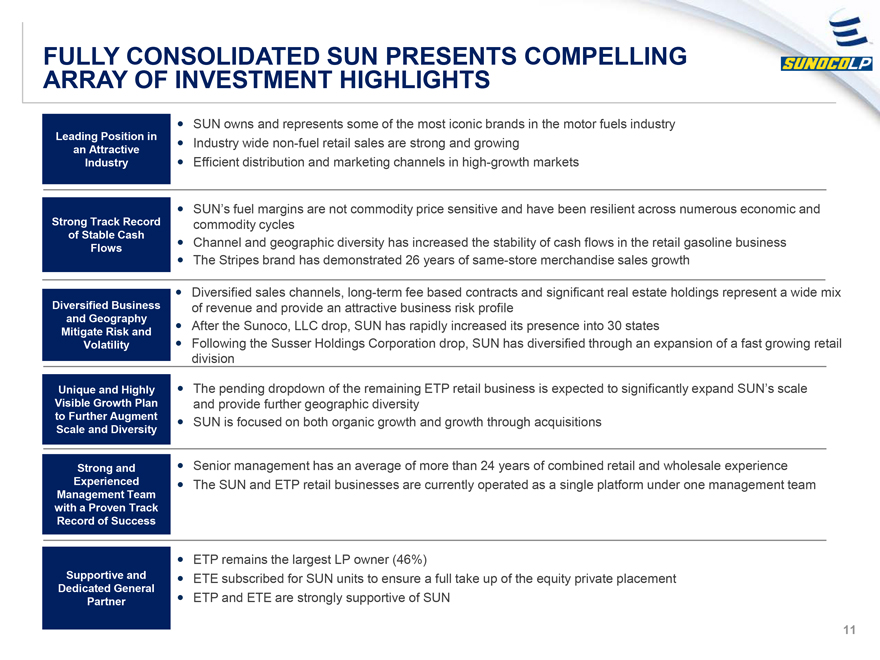

FULLY CONSOLIDATED SUN PRESENTS COMPELLING ARRAY OF INVESTMENT HIGHLIGHTS

Leading Position in an Attractive Industry

Strong Track Record of Stable Cash Flows

Diversified Business and Geography Mitigate Risk and Volatility

Unique and Highly Visible Growth Plan to Further Augment Scale and Diversity

Strong and Experienced Management Team with a Proven Track Record of Success

Supportive and Dedicated General Partner

SUN owns and represents some of the most iconic brands in the motor fuels industry

Industry wide non-fuel retail sales are strong and growing

Efficient distribution and marketing channels in high-growth markets

SUN’s fuel margins are not commodity price sensitive and have been resilient across numerous economic and commodity cycles

Channel and geographic diversity has increased the stability of cash flows in the retail gasoline business

The Stripes brand has demonstrated 26 years of same-store merchandise sales growth

Diversified sales channels, long-term fee based contracts and significant real estate holdings represent a wide mix of revenue and provide an attractive business risk profile

After the Sunoco, LLC drop, SUN has rapidly increased its presence into 30 states

Following the Susser Holdings Corporation drop, SUN has diversified through an expansion of a fast growing retail division

The pending dropdown of the remaining ETP retail business is expected to significantly expand SUN’s scale and provide further geographic diversity

SUN is focused on both organic growth and growth through acquisitions

Senior management has an average of more than 24 years of combined retail and wholesale experience

The SUN and ETP retail businesses are currently operated as a single platform under one management team

ETP remains the largest LP owner (46%)

ETE subscribed for SUN units to ensure a full take up of the equity private placement

ETP and ETE are strongly supportive of SUN

11