Exhibit 99.3

ENERGY TRANSFER PARTNERS, L.P.

AND SUNOCO LP RETAIL DROP DOWN

PIPE INVESTOR PRESENTATION

November 11, 2015

SUNOCOLP

ENERGY TRANSFER

ENERGY TRANSFER

Private and Confidential

FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES SUNOCOLP

Some of the statements in this presentation constitute “forward-looking statements” about Sunoco LP (“SUN”), Energy Transfer Equity, L.P. (“ETE”), Energy Transfer Partners, L.P. (“ETP”), and their respective affiliates that involve risks, uncertainties and assumptions, including, without limitation, our discussion and analysis of our financial condition and results of operations and our expectations regarding the acquisition of ETP’s remaining wholesale fuel and retail assets (the “Retail Acquisition”). These forward-looking statements generally can be identified by use of phrases such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “forecast” or other similar words or phrases in conjunction with a discussion of future operating or financial performance. Descriptions of SUN’s, ETE’s, ETP’s and their respective affiliates’ objectives, goals, targets, plans, strategies, costs, anticipated capital expenditures, expected cost savings, potential acquisitions and related financial projections are also forward-looking statements. These statements represent present expectations or beliefs concerning future events and are not guarantees. Such statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

We caution that forward-looking statements involve risks and uncertainties and are qualified by important factors that could cause actual events or results to differ materially from those expressed or implied in any such forward-looking statements.

For a discussion of these factors and other risks and uncertainties, please refer to SUN’s, ETE’s and ETP’s filings with the Securities and Exchange Commission (the“SEC”), including those contained in SUN’s 2014 Annual Report on Form10-K and Quarterly Reports on Form10-Q which are available at the SEC’s website at www.sec.gov.

This presentation includes certain projections that assume that the proposed Retail Acquisition will be completed. The Retail Acquisition is expected to close in Q1 2016 and will be subject to customary closing conditions. The PIPE financing referenced herein is not contingent upon the closing of the Retail Acquisition.

This presentation includes certain non-GAAP financial measures as defined under SEC Regulation G. A reconciliation of those measures to the most directly comparable GAAP measures is provided in the appendix to this presentation. We define EBITDA as net income before net interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. Distributable cash flow represents Adjusted EBITDA less cash interest expense, cash tax expense, maintenance capital expenditures, and other non-cash adjustments.

2

EXECUTIVE SUMMARY SUNOCOLP

Energy Transfer Partners, L.P. (“ETP”) has proposed to sell its remaining Wholesale Fuel and Retail Assets to SUN for a total purchase price of $2,226mm – Implied 2015E EBITDA multiple of ~8.5x

The transaction is expected to be immediately accretive for SUN to both DCF and Distributions per Unit for 2016 and beyond, relative to Consensus Estimates

The transaction benefits SUN unitholders by providing scale and asset diversity, increasing EBITDA significantly and allowing the partnership to continue to grow its distribution profile

The transaction benefits ETP unitholders by providing liquidity in the form of cash proceeds to fund a portion of its capital program

The transaction is subject to review by each partnership’s conflicts / special committee

Anticipate transaction announcement on November 16th and anticipate closing transaction in Q1 2016

3

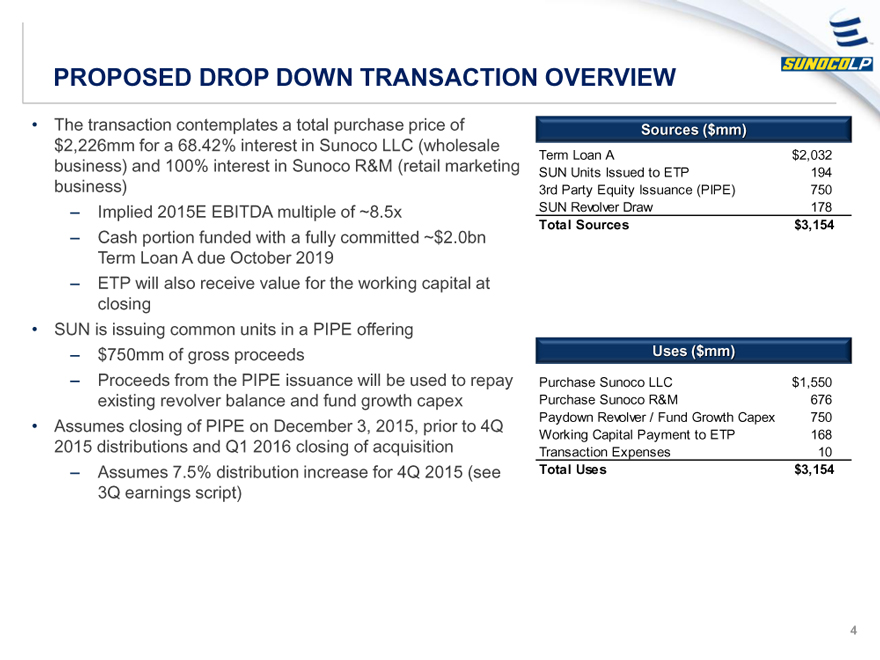

PROPOSED DROP DOWN TRANSACTION OVERVIEW SUNOCOLP

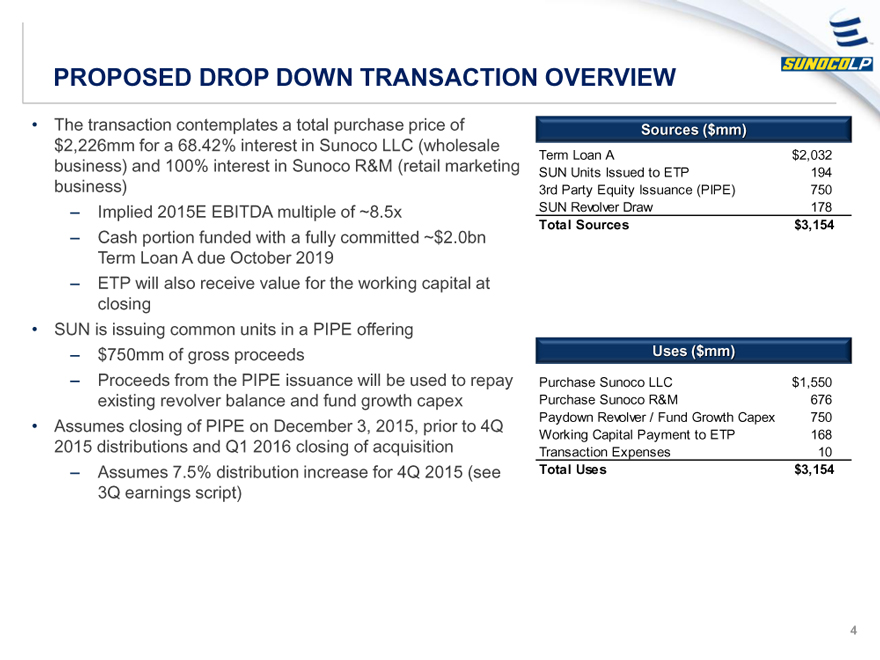

The transaction contemplates a total purchase price of $2,226mm for a 68.42% interest in Sunoco LLC (wholesale business) and 100% interest in Sunoco R&M (retail marketing business)

– Implied 2015E EBITDA multiple of ~8.5x

– Cash portion funded with a fully committed ~$2.0bn Term Loan A due October 2019

– ETP will also receive value for the working capital at closing

SUN is issuing common units in a PIPE offering

– $750mm of gross proceeds

– Proceeds from the PIPE issuance will be used to repay existing revolver balance and fund growth capex

Assumes closing of PIPE on December 3, 2015, prior to 4Q 2015 distributions and Q1 2016 closing of acquisition

– Assumes 7.5% distribution increase for 4Q 2015 (see 3Q earnings script)

Sources ($mm Term Loan A $2,032

SUN Units Issued to ETP 194

3rd Party Equity Issuance (PIPE) 750

SUN Revolver Draw 178

Total Sources $3,154

Uses ($mm) Purchase Sunoco LLC $1,550

Purchase Sunoco R&M 676

Paydown Revolver / Fund Growth Capex 750

Working Capital Payment to ETP 168

Transaction Expenses 10

Total Uses $3,154

4

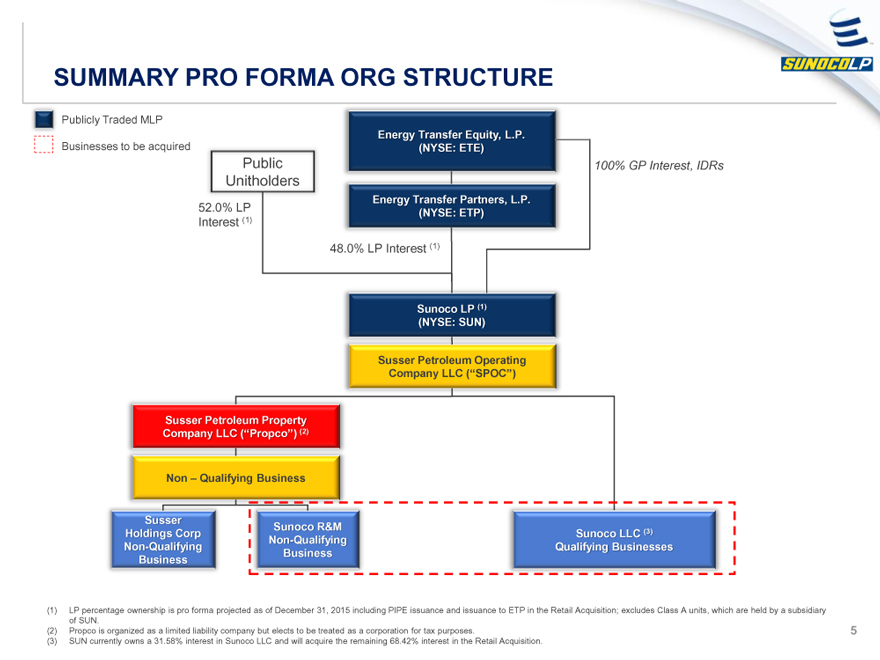

SUMMARY PRO FORMA ORG STRUCTURE SUNOCOLP

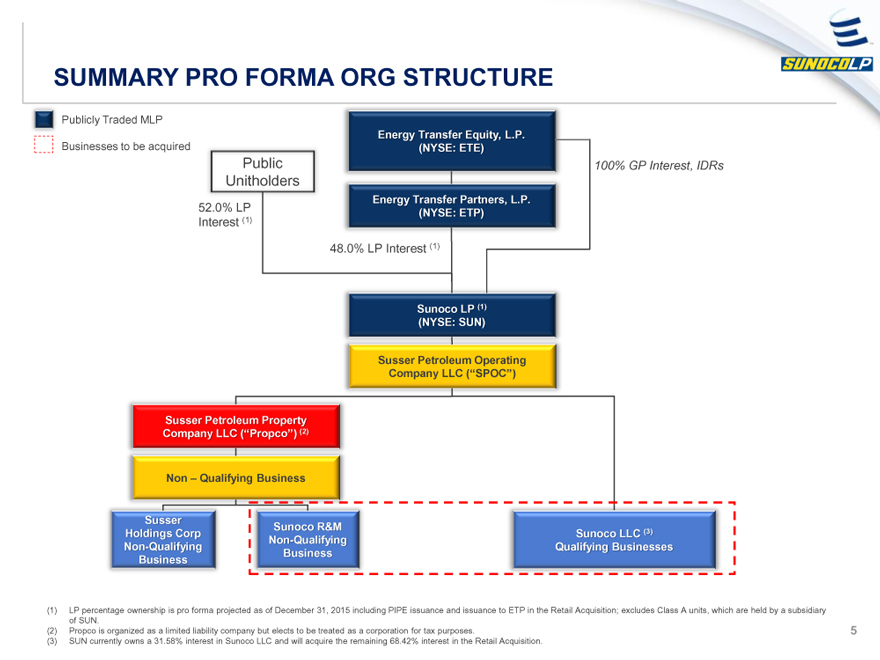

Publicly Traded MLP

Businesses to be acquired

Energy Transfer Equity, L.P.

(NYSE: ETE)

Public 100% GP Interest, IDRs

Unitholders

Energy Transfer Partners, L.P.

52.0% LP (NYSE: ETP)

Interest (1)

48.0% LP Interest (1)

Sunoco LP (1)

(NYSE: SUN(

Susser Petroleum Operating

Company LLC (“SPOC”)

Susser Petroleum Property

Company LLC (“Propco”) (2)

Non – Qualifying Business

Susser Holdings Corp Non-Qualifying Business

Sunoco R&M Non-Qualifying Business

Sunoco LLC (3) Qualifying Businesses

(1) LP percentage ownership is pro forma projected as of December 31, 2015 including PIPE issuance and issuance to ETP in the Retail Acquisition; excludes Class A units, which are held by a subsidiary of SUN.

(2) Propco is organized as a limited liability company but elects to be treated as a corporation for tax purposes.

(3) SUN currently owns a 31.58% interest in Sunoco LLC and will acquire the remaining 68.42% interest in the Retail Acquisition.

5

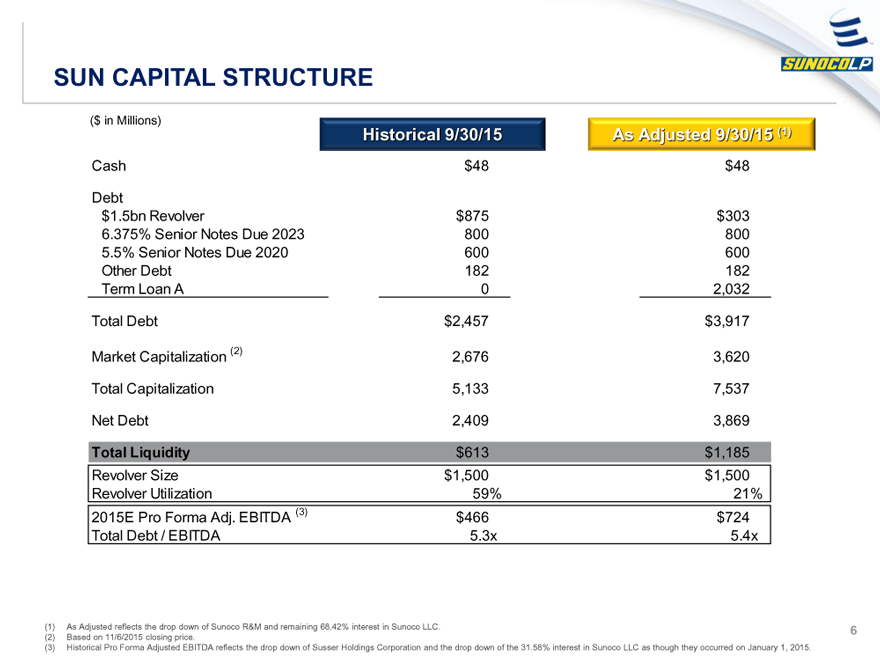

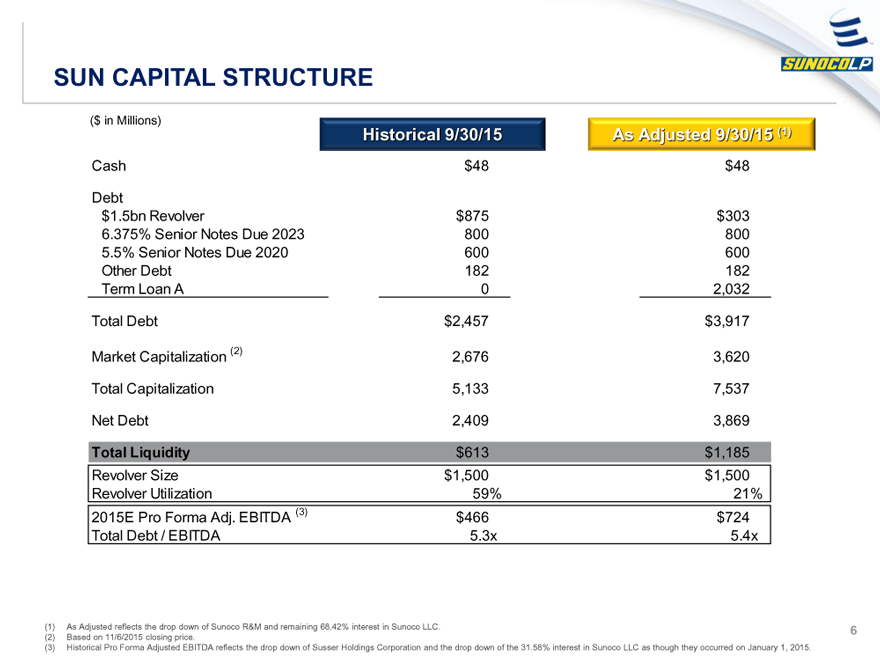

SUN CAPITAL STRUCTURE SUNOCOLP

($ in Millions)

Historical 9/30/15 As Adjusted 9/30/15 (1)

Cash $48 $48

Debt

$1.5bn Revolver $875 $303

6.375% Senior Notes Due 2023 800 800

5.5% Senior Notes Due 2020 600 600

Other Debt 182 182

Term Loan A 0 2,032

Total Debt $2,457 $3,917

Market Capitalization (2) 2,676 3,620

Total Capitalization 5,133 7,537

Net Debt 2,409 3,869

Total Liquidity $613 $1,185

Revolver Size $1,500 $1,500

Revolver Utilization 59% 21%

2015E Pro Forma Adj. EBITDA (3) $466 $724

Total Debt / EBITDA 5.3x 5.4x

(1) As Adjusted reflects the drop down of Sunoco R&M and remaining 68.42% interest in Sunoco LLC.

(2) Based on 11/6/2015 closing price.

(3) Historical Pro Forma Adjusted EBITDA reflects the drop down of Susser Holdings Corporation and the drop down of the 31.58% interest in Sunoco LLC as though they occurred on January 1, 2015.

6

APPENDIX

ENERGY TRANSFER

7

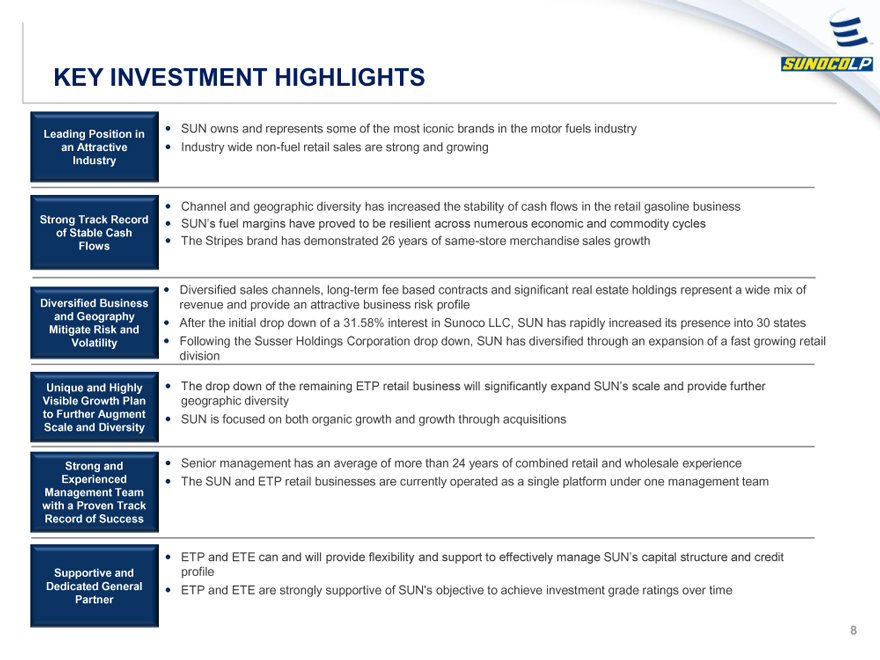

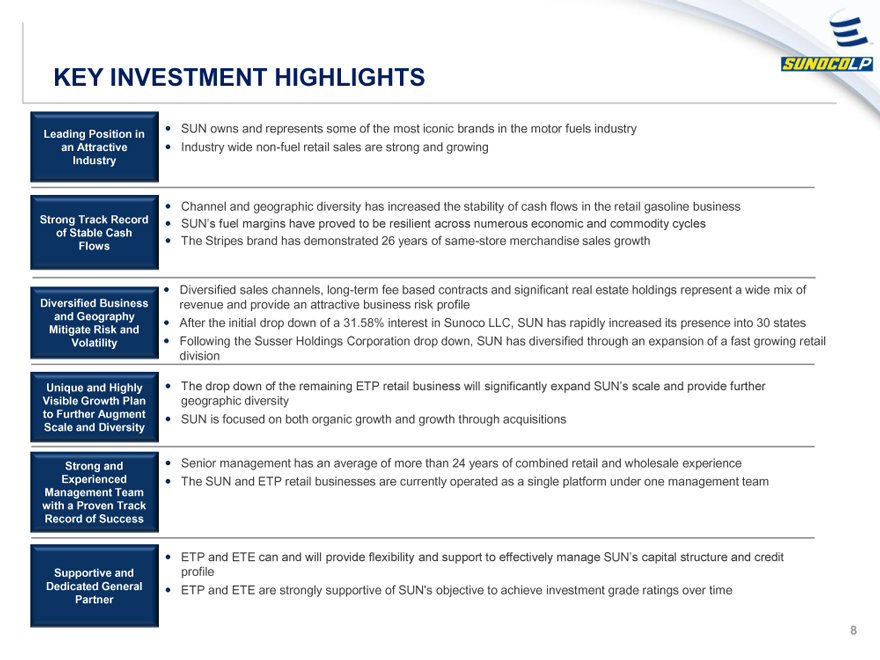

KEY INVESTMENT HIGHLIGHTS SUNOCOLP

Leading Position in an Attractive Industry

SUN owns and represents some of the most iconic brands in the motor fuels industry

Industry wide non-fuel retail sales are strong and growing

Strong Track Record of Stable Cash Flows

Channel and geographic diversity has increased the stability of cash flows in the retail gasoline business

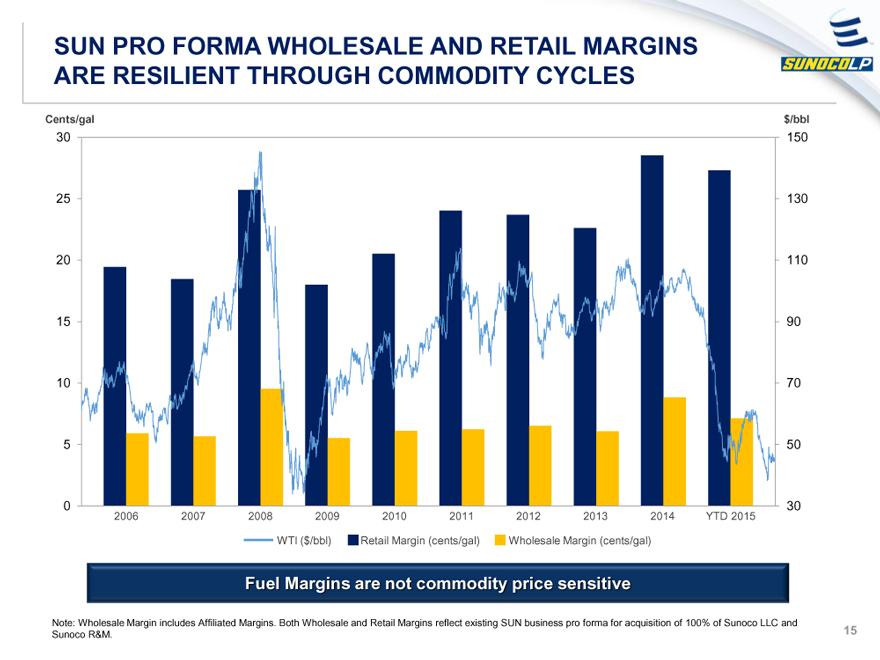

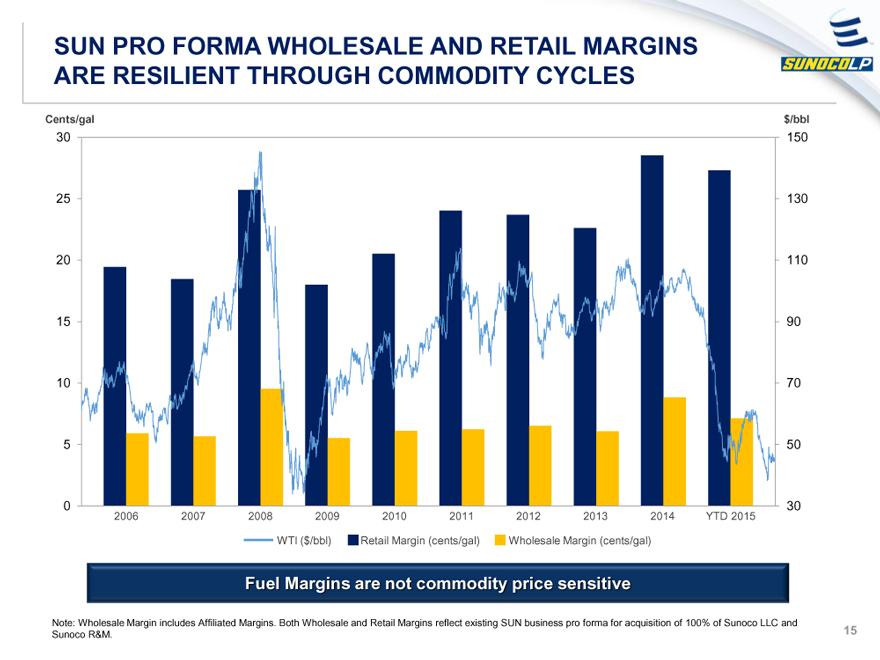

SUN’s fuel margins have proved to be resilient across numerous economic and commodity cycles

The Stripes brand has demonstrated 26 years of same-store merchandise sales growth

Diversified Business and Geography Mitigate Risk and Volatility

Diversified sales channels, long-term fee based contracts and significant real estate holdings represent a wide mix of revenue and provide an attractive business risk profile

After the initial drop down of a 31.58% interest in Sunoco LLC, SUN has rapidly increased its presence into 30 states

Following the Susser Holdings Corporation drop down, SUN has diversified through an expansion of a fast growing retail

division

Unique and Highly Visible Growth Plan to Further Augment Scale and Diversity

The drop down of the remaining ETP retail business will significantly expand SUN’s scale and provide further geographic diversity

SUN is focused on both organic growth and growth through acquisitions

Strong and Experienced Management Team with a Proven Track Record of Success

Senior management has an average of more than 24 years of combined retail and wholesale experience

The SUN and ETP retail businesses are currently operated as a single platform under one management team

Supportive and Dedicated General Partner

ETP and ETE can and will provide flexibility and support to effectively manage SUN’s capital structure and credit profile

ETP and ETE are strongly supportive of SUN’s objective to achieve investment grade ratings over time

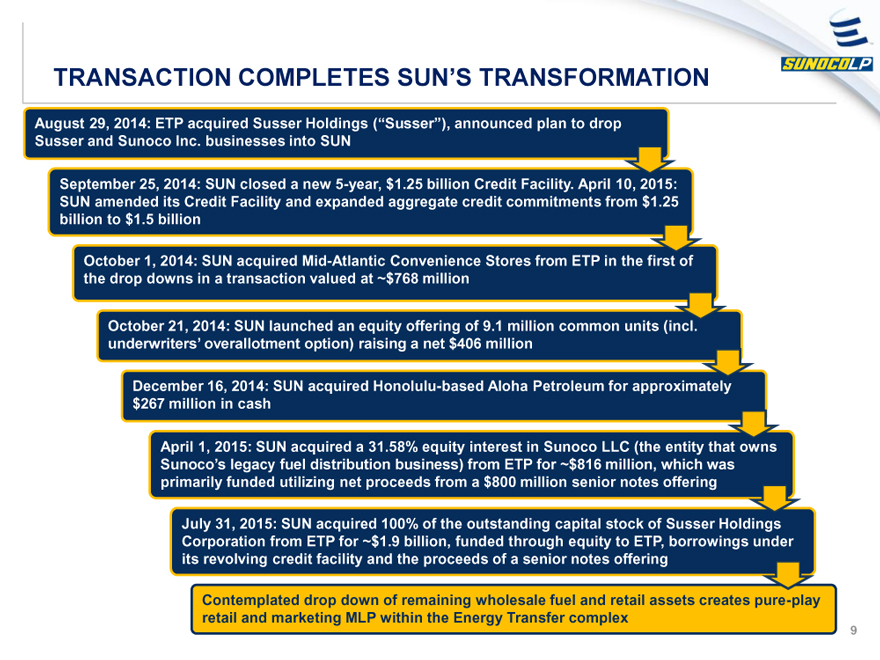

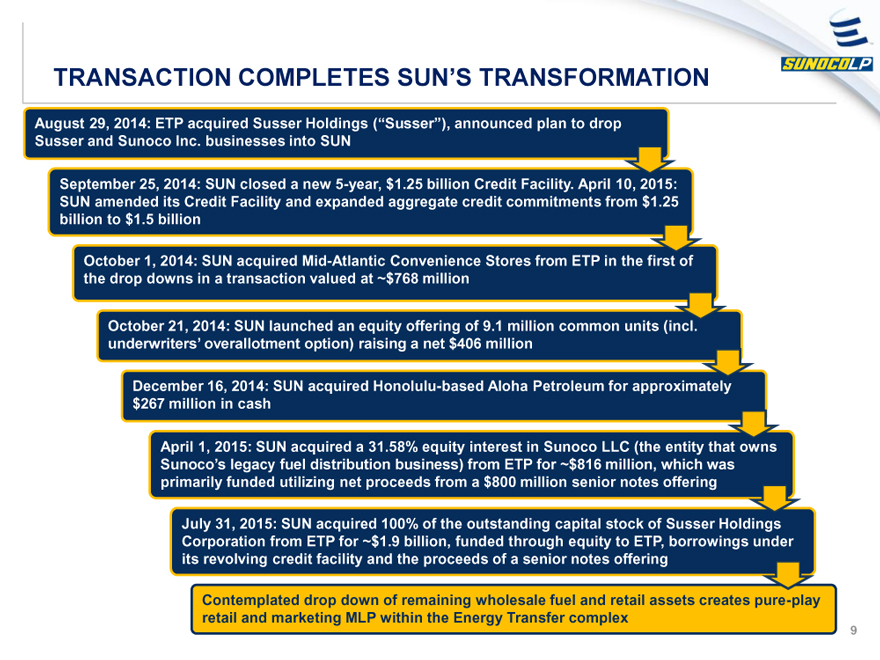

TRANSACTION COMPLETES SUN’S TRANSFORMATION SUNOCOLP

August 29, 2014: ETP acquired Susser Holdings (“Susser”), announced plan to drop Susser and Sunoco Inc. businesses into SUN

September 25, 2014: SUN closed a new 5-year, $1.25 billion Credit Facility. April 10, 2015: SUN amended its Credit Facility and expanded aggregate credit commitments from $1.25 billion to $1.5 billion

October 1, 2014: SUN acquired Mid-Atlantic Convenience Stores from ETP in the first of the drop downs in a transaction valued at ~$768 million

October 21, 2014: SUN launched an equity offering of 9.1 million common units (incl. underwriters’ overallotment option) raising a net $406 million

December 16, 2014: SUN acquired Honolulu-based Aloha Petroleum for approximately $267 million in cash

April 1, 2015: SUN acquired a 31.58% equity interest in Sunoco LLC (the entity that owns Sunoco’s legacy fuel distribution business) from ETP for ~$816 million, which was primarily funded utilizing net proceeds from a $800 million senior notes offering

July 31, 2015: SUN acquired 100% of the outstanding capital stock of Susser Holdings Corporation from ETP for ~$1.9 billion, funded through equity to ETP, borrowings under its revolving credit facility and the proceeds of a senior notes offering

Contemplated drop down of remaining wholesale fuel and retail assets creates pure-play retail and marketing MLP within the Energy Transfer complex

9

SUN IS WELL POSITIONED FOR LONG-TERM GROWTH IN UNITHOLDER VALUE SUNOCOLP

Diversified Business and Geography Mitigates Risk and Volatility

Strong Track Record of Stable Cash Flows

Leading Market Position with Iconic Brands

Drop down Transaction and Organic Growth Opportunities Augment Scale and Diversity

Supportive and Dedicated General Partner

Strong and Experienced Management Team with Proven Track Record of Success

10

SUMMARY SUNOCO LP STRATEGY SUNOCOLP

Stability

Significant amount of long-term fuel supply agreements

Historical stability of fuel margins

Fuel margins are not commodity price sensitive and have been resilient across economic and commodity cycles

Strong and resilient industry fundamentals

Large-cap investment grade sponsor

Significant real estate value

Prudent investment to drive organic growth

Visible Growth

Drop down transaction from ETP provides significant additional inventory, meaningful scale, and additional asset diversity

Ability to pursue combined retail / wholesale asset acquisitions in highly attractive markets

Organic expansion of convenience store and wholesale business

Financial capacity to execute long-term growth strategy

11

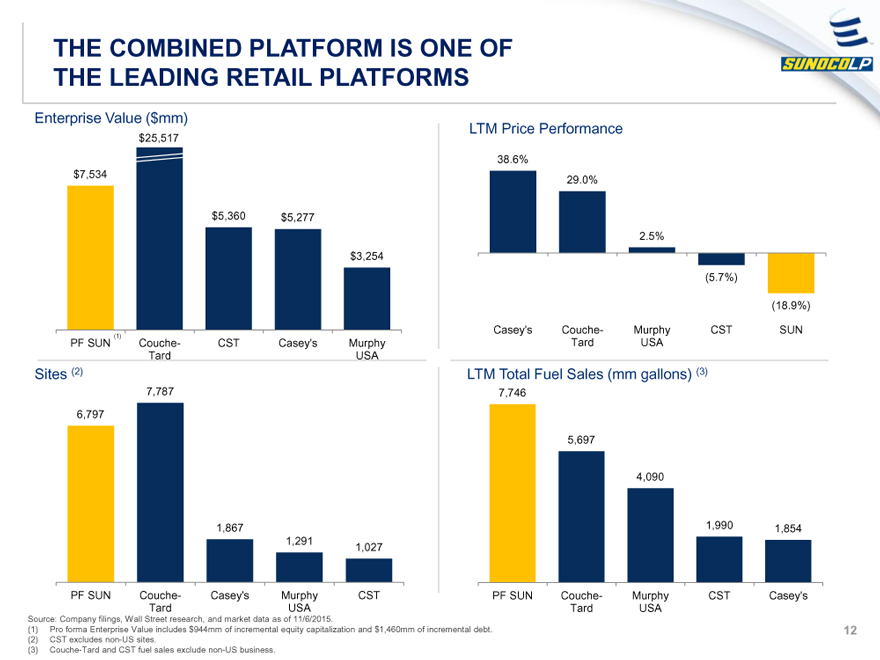

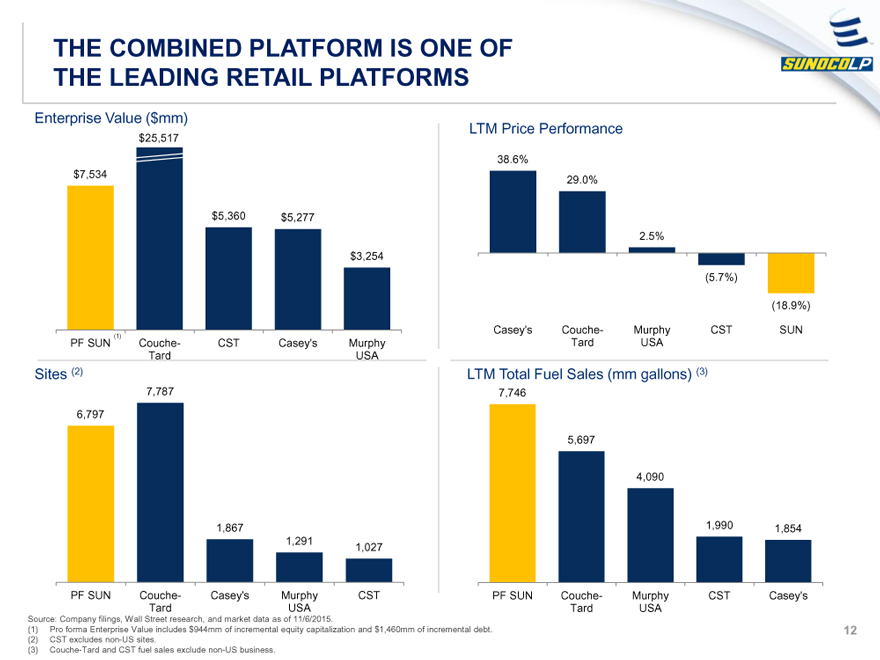

THE COMBINED PLATFORM IS ONE OF THE LEADING RETAIL PLATFORMS SUNOCOLP

Enterprise Value ($mm)

$7,534 $25,517 $5,360 $5,277 $3,254

PF SUN (1) Couche-Tard CST Casey’s Murphy USA

LTM Price Performance

38.6% 29.0% 2.5% (5.7%) (18.9%)

Casey’s Couche-Tard Murphy USA CST SUN

Sites (2)

6,797 7,787 1,867 1,291 1,027

PF SUN Couche-Tard Casey’s Murphy USA CST

LTM Total Fuel Sales (mm gallons) (3)

7,746 5,697 4,090 1,990 1,854

PF SUN Couche-Tard Murphy USA CST Casey’s

Source: Company filings, Wall Street research, and market data as of 11/6/2015.

(1) Pro forma Enterprise Value includes $944mm of incremental equity capitalization and $1,460mm of incremental debt.

(2) CST excludes non-US sites.

(3) Couche-Tard and CST fuel sales exclude non-US business.

12

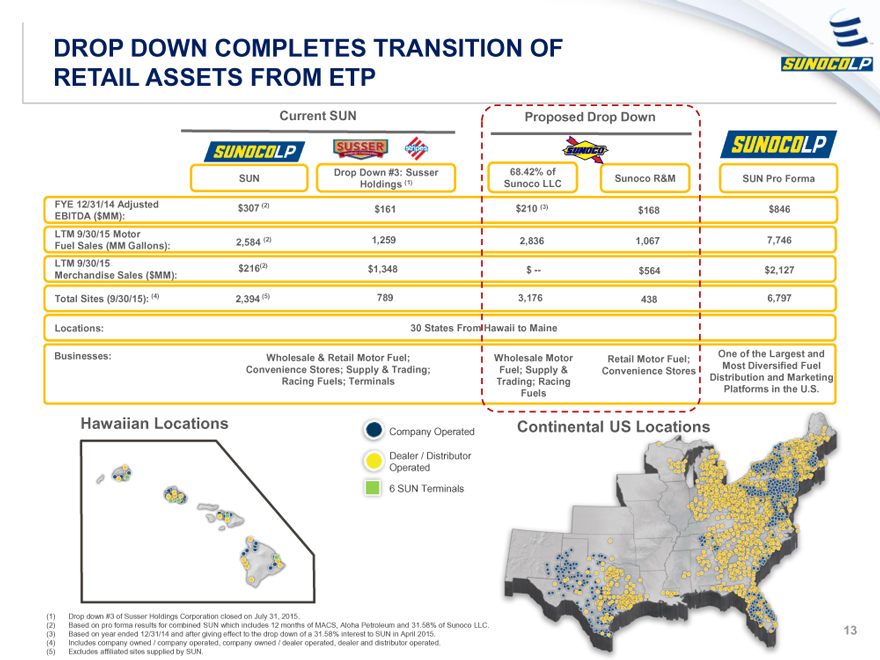

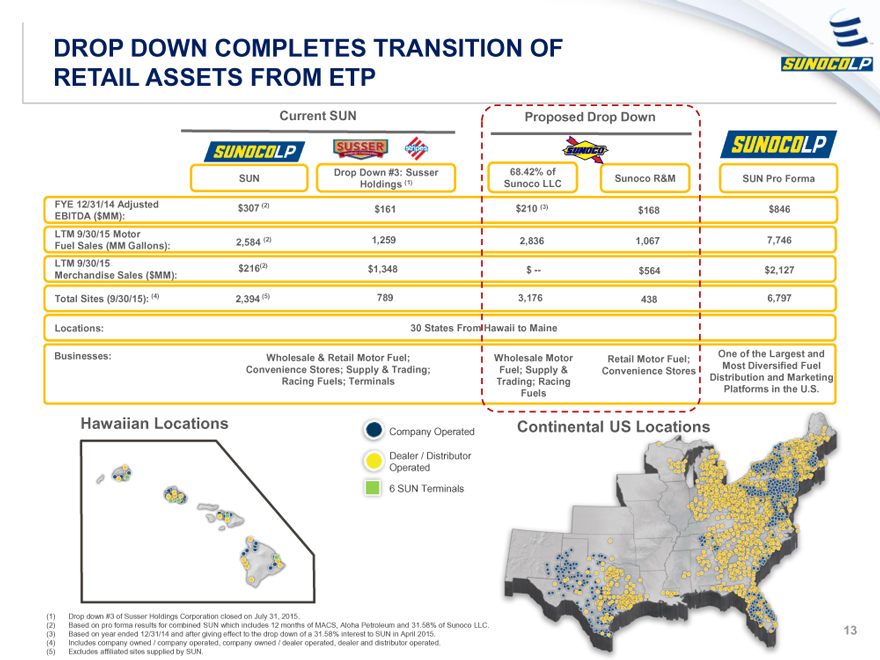

DROP DOWN COMPLETES TRANSITION OF RETAIL ASSETS FROM ETP SUNOCOLP

Current SUN Proposed Drop Down

SUNOCOLP SUSSER stripes SUNOCO SUNOCOLP

SUN Drop Down #3: Susser Holdings (1) 68.42% of Sunoco LLC Sunoco R&M SUN Pro Forma

FYE 12/31/14 Adjusted EBITDA ($MM): $307 (2) $161 $210 (3) $168 $846

LTM 9/30/15 Motor Fuel Sales (MM Gallons): 2,584 (2) 1,259 2,836 1,067 7,746

LTM 9/30/15 Merchandise Sales ($MM): $216 (2) $1,348 $-- $564 $2,127

Total Sites (9/30/15): (4) 2,394 (5) 789 3,176 438 6,797

Locations: 30 States From Hawaii to Maine

Businesses: Wholesale & Retail Motor Fuel; Convenience Stores; Supply & Trading; Racing Fuels; Terminals Wholesale Motor Fuel; Supply & Trading; Racing Fuels Retail Motor Fuel; Convenience Stores One of the Largest and Most Diversified Fuel Distribution and Marketing Platforms in the U.S.

Hawaiian Locations Company Operated Dealer / Distributor Operated 6 SUN Terminals

Continental US Locations

(1) Drop down #3 of Susser Holdings Corporation closed on July 31, 2015. (2) Based on pro forma results for combined SUN which includes 12 months of MACS, Aloha Petroleum and 31.58% of Sunoco LLC (3) Based on year ended 12/31/14 and after giving effect to the drop down of a 31.58% interest to SUN in April 2015. (4) Includes company owned / company operated, company owned / dealer operated, dealer and distributor operated. (5) Excludes affiliated sites supplied by SUN. 13

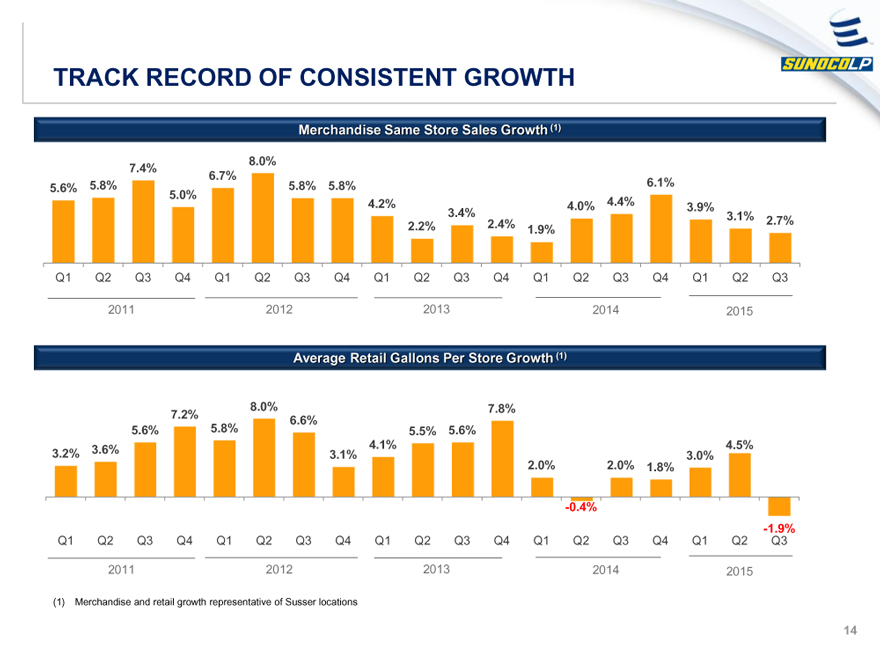

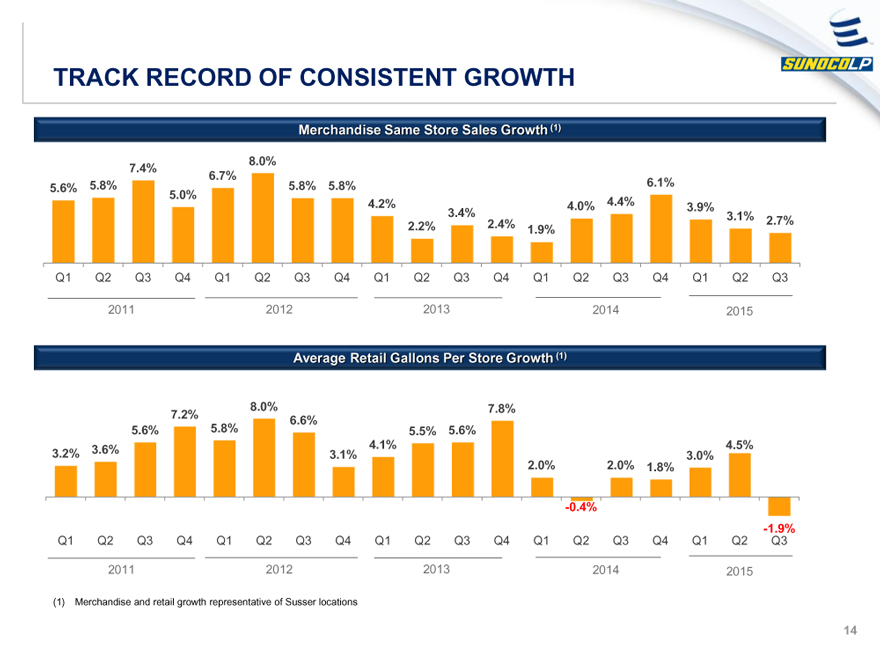

TRACK RECORD OF CONSISTENT GROWTH SUNOCOLP

Merchandise Same Store Sales Growth (1)

5.6% 5.8% 7.4% 5.0% 6.7% 8.0% 5.8% 5.8% 4.2% 2.2% 3.4% 2.4% 1.9% 4.0% 4.4% 6.1% 3.9% 3.1% 2.7%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2011 2012 2013 2014 2015

Average Retail Gallons Per Store Growth (1)

3.2% 3.6% 5.6% 7.2% 5.8% 8.0% 6.6% 3.1% 4.1% 5.5% 5.6% 7.8% 2.0% -0.4% 2.0% 1.8% 3.0% 4.5% -1.9%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2011 2012 2013 2014 2015

(1) Merchandise and retail growth representative of Susser locations 14

SUN PRO FORMA WHOLESALE AND RETAIL MARGINS ARE RESILIENT THROUGH COMMODITY CYCLES SUNOCOLP

Cents/gal $/bbl

30 150

25 130

20 110

15 90

10 70

5 50

0 30

2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD 2015

WTI ($/bbl) Retail Margin (cents/gal) Wholesale Margin (cents/gal)

Fuel Margins are not commodity price sensitive

Note: Wholesale Margin includes Affiliated Margins. Both Wholesale and Retail Margins reflect existing SUN business pro forma for acquisition of 100% of Sunoco LLC and Sunoco R&M. 15

DIVERSIFIED LINES OF BUSINESS GENERATE A PORTFOLIO OF STABLE CASH FLOWS SUNOCOLP

Gross Profit Contribution By Channel (LTM 9/30/15)

Current SUN (1) 6% 27% 42% 25%

Total = $1,372 million

SUN Pro Forma (2) 5% 31% 35% 28%

Total = $2,140 million

Retail Fuel Wholesale Fuel Merch & Other C-Store Rent

(1) Pro Forma results for combined SUN which includes MACS, Aloha Petroleum, and 31.58% of Sunoco LLC, and Susser.

(2) Pro Forma results for combined SUN which includes 100% of Sunoco LLC and 100% of Sunoco R&M.

16

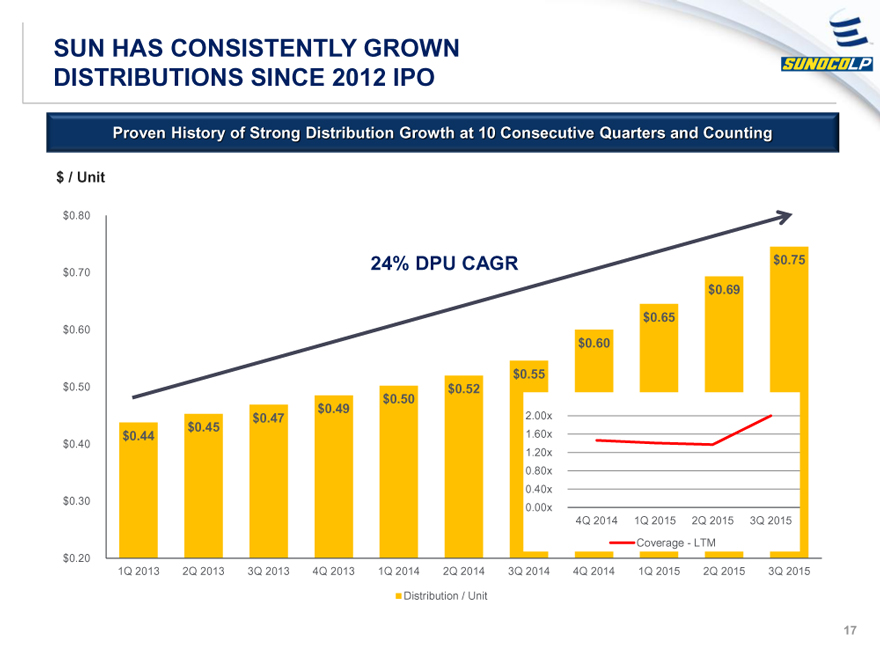

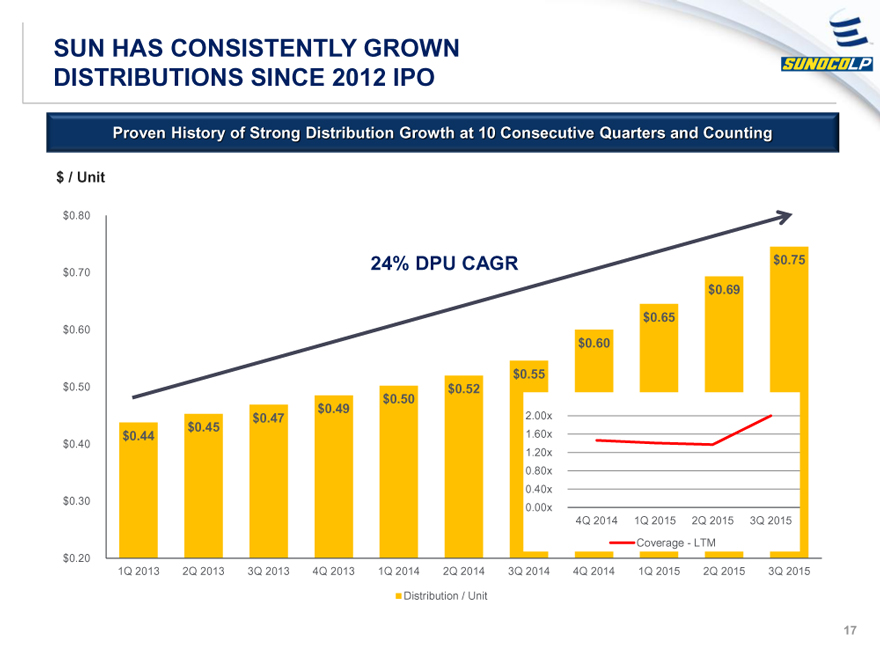

SUN HAS CONSISTENTLY GROWN DISTRIBUTIONS SINCE 2012 IPO SUNOCOLP

Proven History of Strong Distribution Growth at 10 Consecutive Quarters and Counting

$ / Unit

$0.80 $0.70 $0.60 $0.50 $0.40 $0.30 $0.20

$0.44 1Q 2013

$0.45 2Q 2013

$0.47 3Q 2013

$0.49 4Q 2013

24% DPU CAGR $0.50 1Q 2014

$0.52 2Q 2014

$0.55 2.00x 1.60x 1.20x 0.80x 0.40x 0.00x 3Q 2014

$0.60 4Q 2014 4Q 2014

$0.69 $0.65 1Q 2015 2Q 2015 Coverage - LTM 1Q 2015 2Q 2015

$0.75 3Q 2015 3Q 2015

Distribution / Unit

17

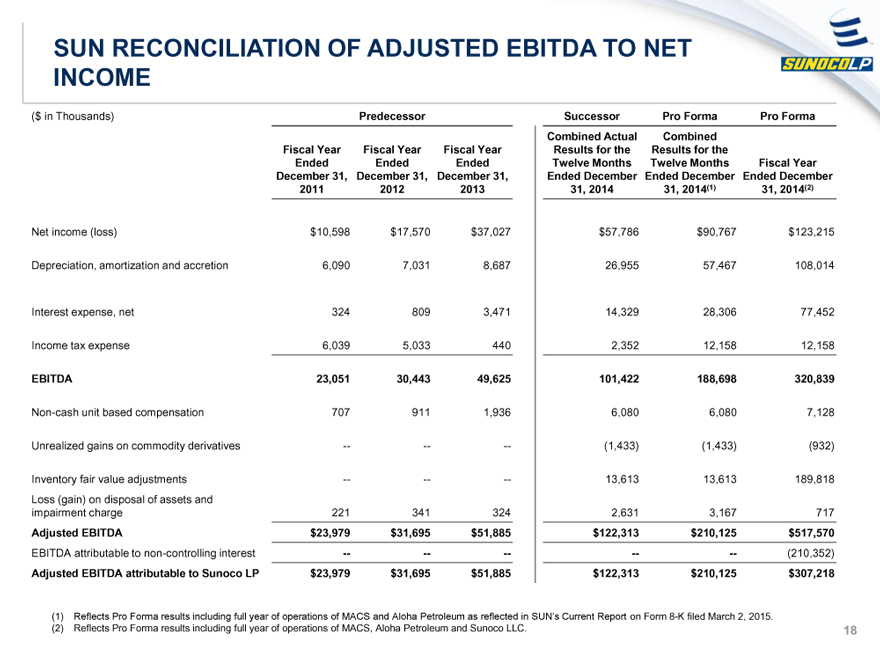

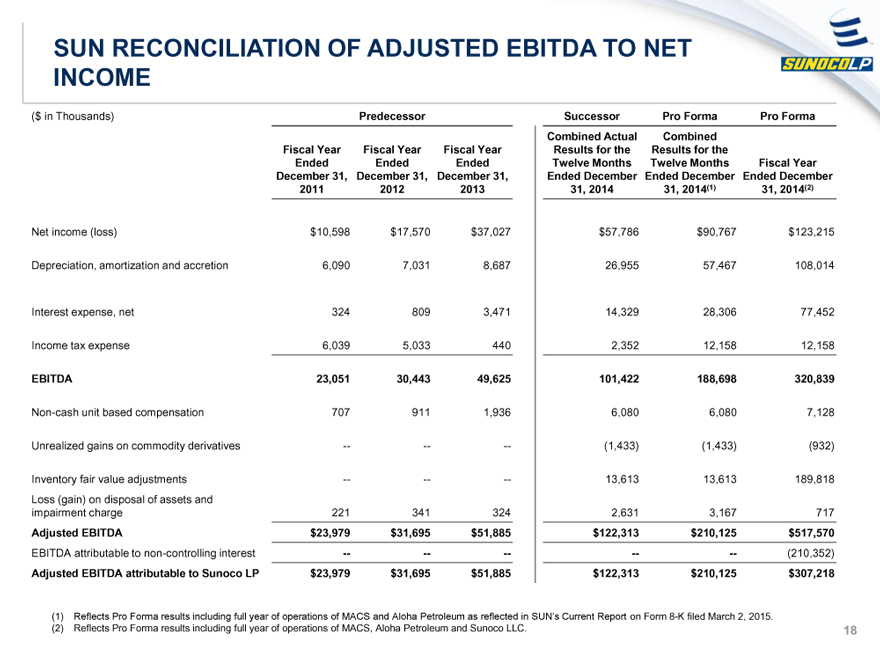

SUN RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME SUNOCOLP

($ in Thousands) Net income (loss) Depreciation, amortization and accretion Interest expense, net Income tax expense EBITDA Non-cash unit based compensation Unrealized gains on commodity derivatives Inventory fair value adjustments Loss (gain) on disposal of assets and impairment charge Adjusted EBITDA EBITDA attributable to non-controlling interest Adjusted EBITDA attributable to Sunoco LP

Predecessor Fiscal Year Fiscal Year Fiscal Year Ended Ended Ended December 31, December 31, December 31, 2011 2012 2013 $ 10,598 $ 17,570 $ 37,027 6,090 7,031 8,687 324 809 3,471 6,039 5,033 440 23,051 30,443 49,625 707 911 1,936 -- -- -- -- -- -- 221 341 324 $23,979 $31,695 $51,885 -- -- -- $23,979 $31,695 $51,885

Successor Combined Actual Results for the Twelve Months Ended December 31, 2014 $57,786 26,955 14,329 2,352 101,422 6,080 (1,433) 13,613 2,631 $122,313 -- $122,313

Pro Forma Combined Results for the Twelve Months Ended December 31, 2014(1) $90,767 57,467 28,306 12,158 188,698 6,080 (1,433) 13,613 3,167 $210,125 -- $210,125

Pro Forma Fiscal Year Ended December 31, 2014(2) $123,215 108,014 77,452 12,158 320,839 7,128 (932) 189,818 717 $517,570 (210,352) $307,218

(1) Reflects Pro Forma results including full year of operations of MACS and Aloha Petroleum as reflected in SUN’s Current Report on Form 8-K filed March 2, 2015.

(2) Reflects Pro Forma results including full year of operations of MACS, Aloha Petroleum and Sunoco LLC.

18

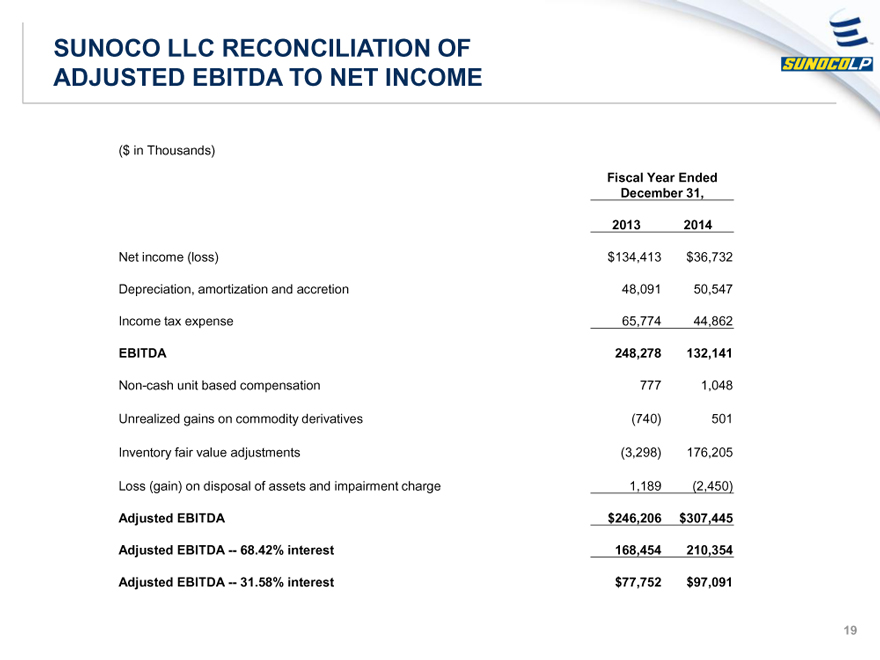

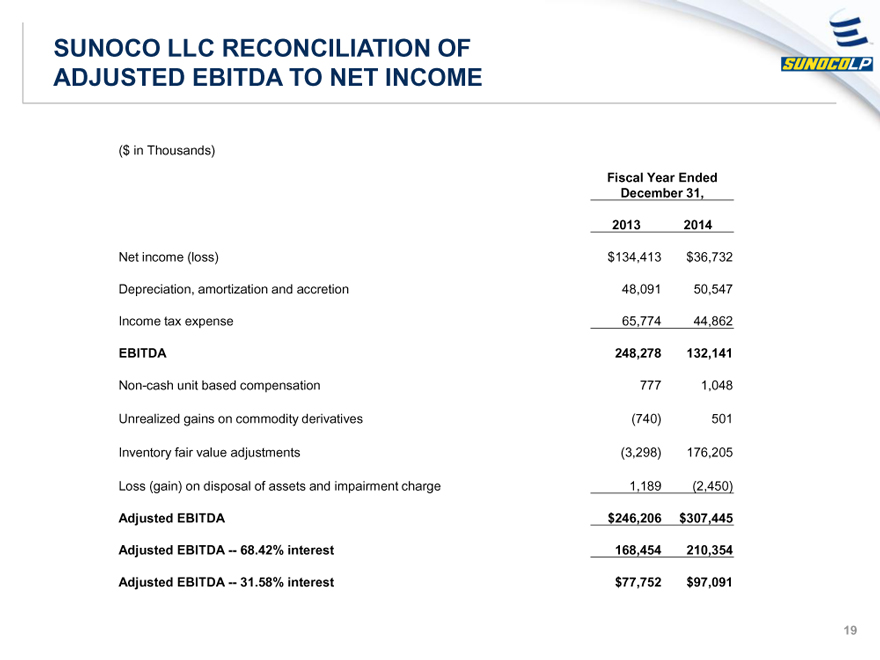

SUNOCO LLC RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME SUNOCOLP

($ in Thousands)

Fiscal Year Ended

December 31,

2013 2014

Net income (loss) $134,413 $36,732

Depreciation, amortization and accretion 48,091 50,547

Income tax expense 65,774 44,862

EBITDA 248,278 132,141

Non-cash unit based compensation 777 1,048

Unrealized gains on commodity derivatives (740) 501

Inventory fair value adjustments (3,298) 176,205

Loss (gain) on disposal of assets and impairment charge 1,189 (2,450)

Adjusted EBITDA $246,206 $307,445

Adjusted EBITDA -- 68.42% interest 168,454 210,354

Adjusted EBITDA -- 31.58% interest $77,752 $97,091

19

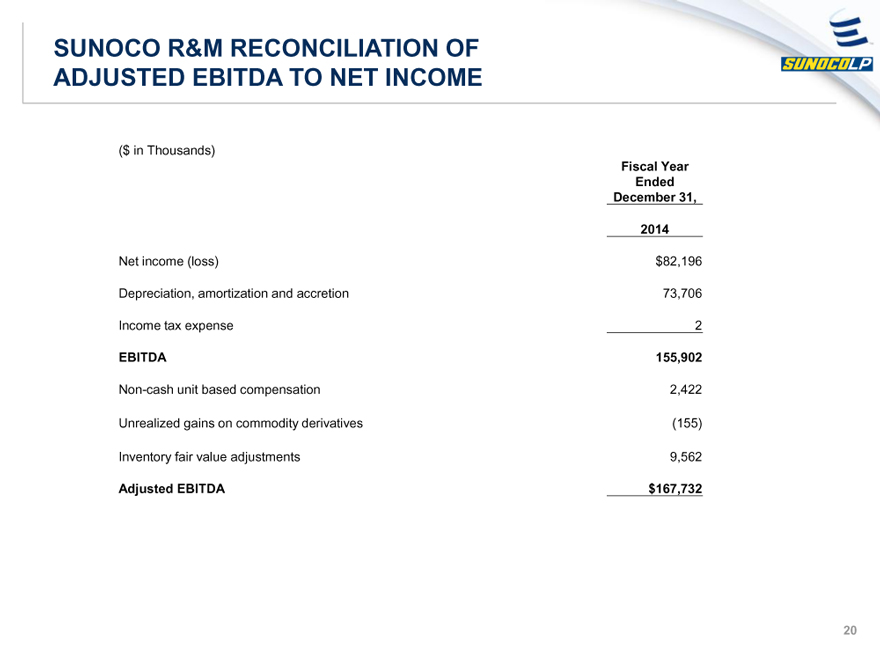

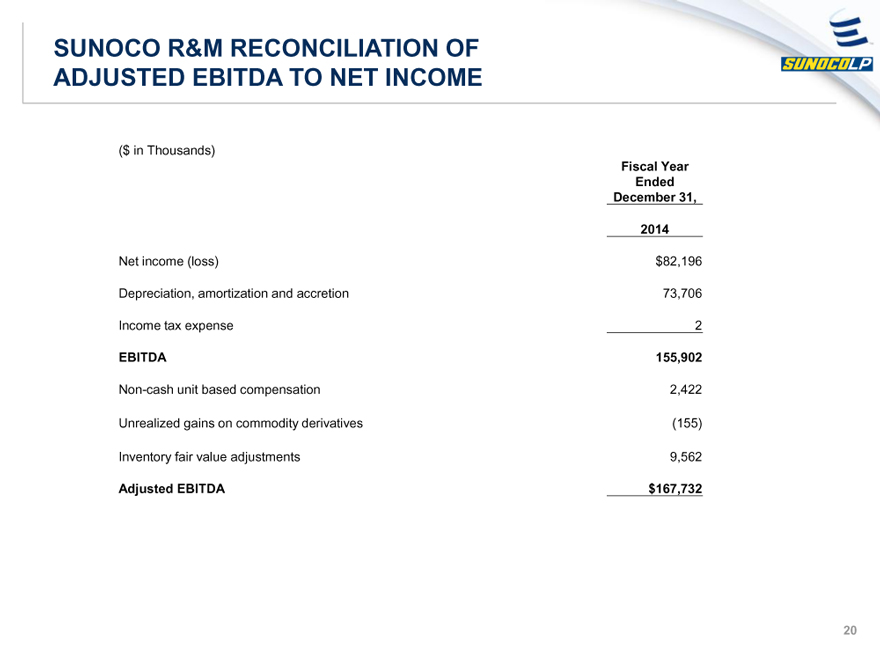

SUNOCO R&M RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME SUNOCOLP

($ in Thousands)

Fiscal Year

Ended

December 31,

2014

Net income (loss) $82,196

Depreciation, amortization and accretion 73,706

Income tax expense 2

EBITDA 155,902

Non-cash unit based compensation 2,422

Unrealized gains on commodity derivatives (155)

Inventory fair value adjustments 9,562

Adjusted EBITDA $167,732

20

SUSSER RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA SUNOCOLP

($ in Thousands)

Historical (1) Pro Forma Adjustments Pro Forma

Memo - EBITDA and DCF reconciliation Susser SUN (2) Adjustments (3) Susser

Fiscal Year Ended Fiscal Year Ended Fiscal Year Ended

December 31, December 31, December 31,

2014 2014 2014

Net income 129,200 (22,510) (148,204) (41,514)

Depreciation, amortization and accretion 79,996 (10,457) (4,438) 65,101

Interest expense, net 15,194 (4,767) 32,629 43,056

Income tax expense 76,442 (218) (11,502) 64,722

EBITDA 300,832 (37,952) (131,515) 131,365

Unit compensation 20,218 - - 20,218

Loss (gain) on disposal of assets and impairment charge 1,614 39 - 1,653

Equity investee gain (129,092) - 129,092 -

Unrealized gains on commodity derivatives (8,294) - - (8,294)

Inventory fair value adjustments 15,859 - - 15,859

Adjusted EBITDA (consolidated) 201,137 (37,913) (2,423) 160,801

Adj EBITDA attributable to NCI - - - -

Adj EBITDA attributable to Sunoco LP 201,137 (37,913) (2,423) 160,801

(1) Reflects combined results of the Predecessor and Successor period of Susser.

(2) To eliminate the eight months of SUN activity reflected in Susser’s historical financial statements prior to September 1, 2014.

(3) To eliminate the intercompany transactions between SUN and Susser during the last four months of 2014 after the ETP Merger.

21

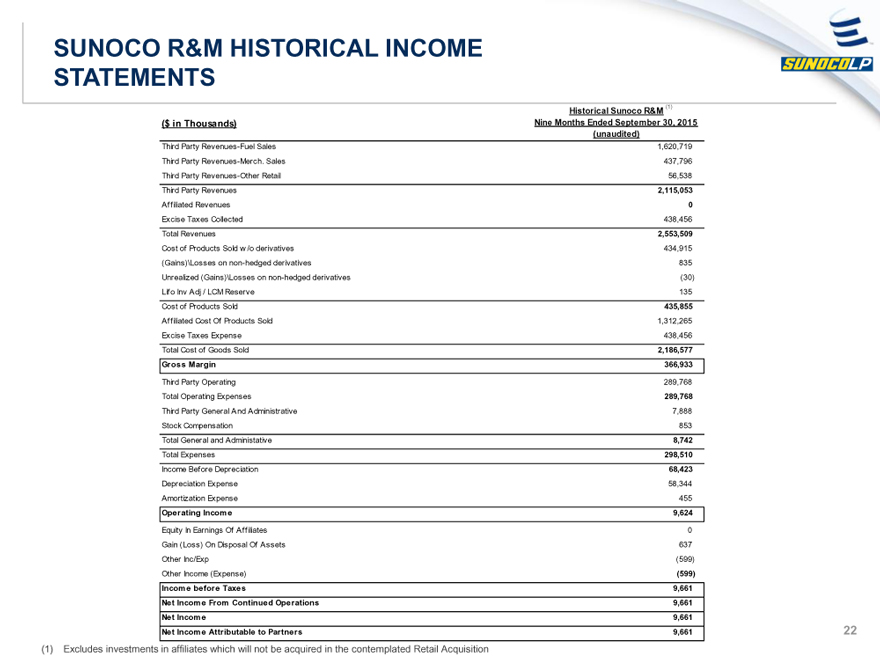

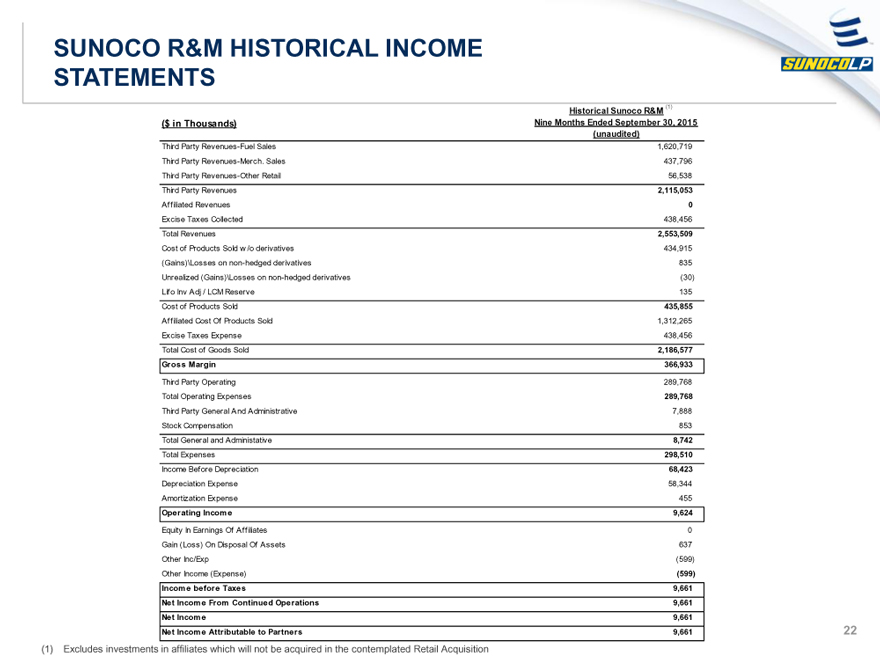

SUNOCO R&M HISTORICAL INCOME STATEMENTS SUNOCOLP

Historical Sunoco R&M (1)

($ in Thousands) Nine Months Ended September 30, 2015

(unaudited)

Third Party Revenues-Fuel Sales 1,620,719

Third Party Revenues-Merch. Sales 437,796

Third Party Revenues-Other Retail 56,538

Third Party Revenues 2,115,053

Affiliated Revenues 0

Excise Taxes Collected 438,456

Total Revenues 2,553,509

Cost of Products Sold w/o derivatives 434,915

(Gains)\Losses on non-hedged derivatives 835

Unrealized (Gains)\Losses on non-hedged derivatives (30)

Lifo Inv Adj / LCM Reserve 135

Cost of Products Sold 435,855

Affiliated Cost Of Products Sold 1,312,265

Excise Taxes Expense 438,456

Total Cost of Goods Sold 2,186,577

Gross Margin 366,933

Third Party Operating 289,768

Total Operating Expenses 289,768

Third Party General And Administrative 7,888

Stock Compensation 853

Total General and Administrative 8,742

Total Expenses 298,510

Income Before Depreciation 68,423

Depreciation Expense 58,344

Amortization Expense 455

Operating Income 9,624

Equity In Earnings Of Affiliates 0

Gain (Loss) On Disposal Of Assets 637

Other Inc/Exp (599)

Other Income (Expense) (599)

Income before Taxes 9,661

Net Income From Continued Operations 9,661

Net Income 9,661

Net Income Attributable to Partners 9,661

(1) Excludes investments in affiliates which will not be acquired in the contemplated Retail Acquisition

22

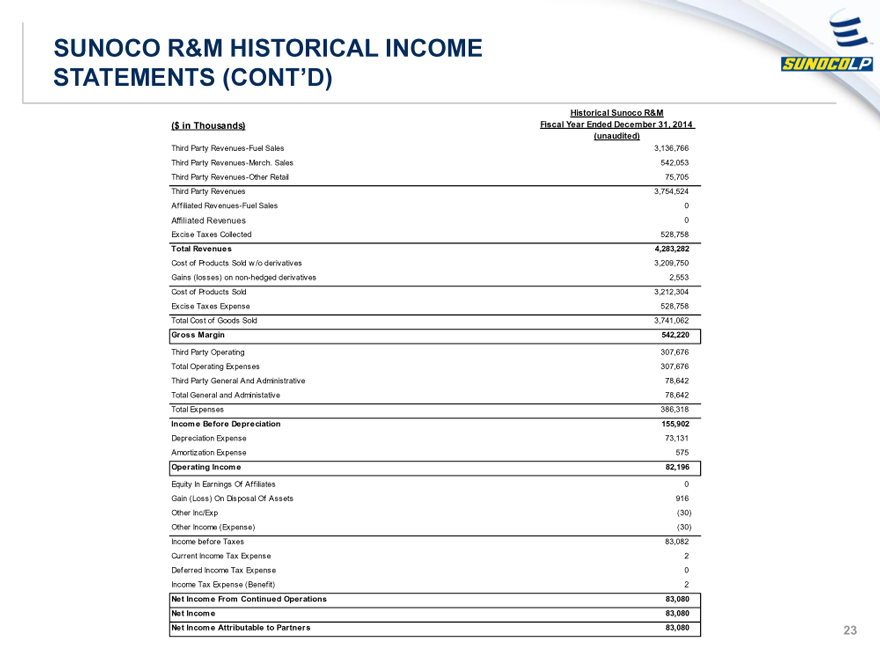

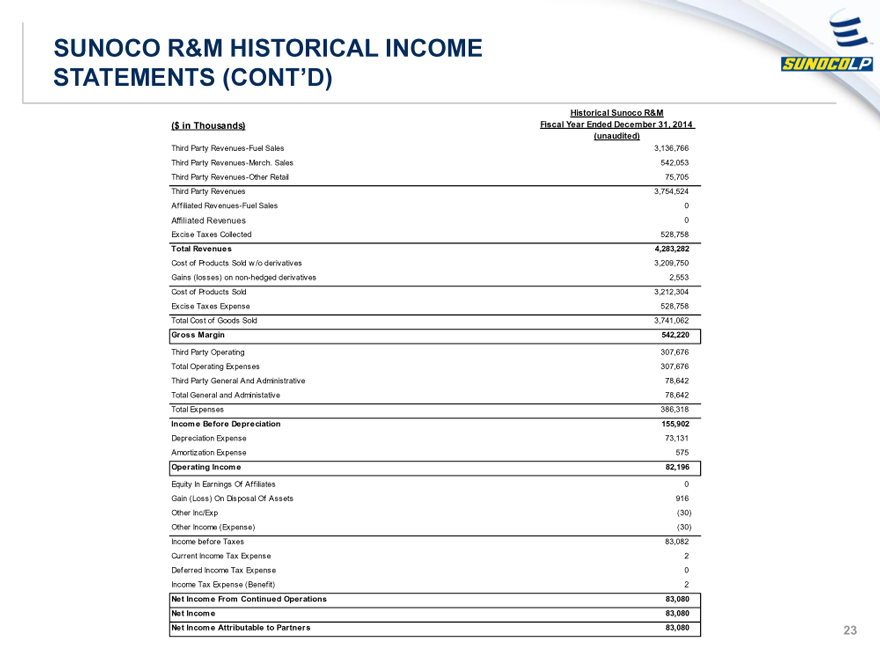

SUNOCO R&M HISTORICAL INCOME

STATEMENTS (CONT’D) SUNOCOLP

Historical Sunoco R&M

($ in Thousands) Fiscal Year Ended December 31, 2014

(unaudited)

Third Party Revenues-Fuel Sales 3,136,766

Third Party Revenues-Merch. Sales 542,053

Third Party Revenues-Other Retail 75,705

Third Party Revenues 3,754,524

Affiliated Revenues-Fuel Sales 0

Affiliated Revenues 0

Excise Taxes Collected 528,758

Total Revenues 4,283,282

Cost of Products Sold w/o derivatives 3,209,750

Gains (losses) on non-hedged derivatives 2,553

Cost of Products Sold 3,212,304

Excise Taxes Expense 528,758

Total Cost of Goods Sold 3,741,062

Gross Margin 542,220

Third Party Operating 307,676

Total Operating Expenses 307,676

Third Party General And Administrative 78,642

Total General and Administrative 78,642

Total Expenses 386,318

Income Before Depreciation 155,902

Depreciation Expense 73,131

Amortization Expense 575

Operating Income 82,196

Equity In Earnings Of Affiliates 0

Gain (Loss) On Disposal Of Assets 916

Other Inc/Exp (30)

Other Income (Expense) (30)

Income before Taxes 83,082

Current Income Tax Expense 2

Deferred Income Tax Expense 0

Income Tax Expense (Benefit) 2

Net Income From Continued Operations 83,080

Net Income 83,080

Net Income Attributable to Partners 83,080

23

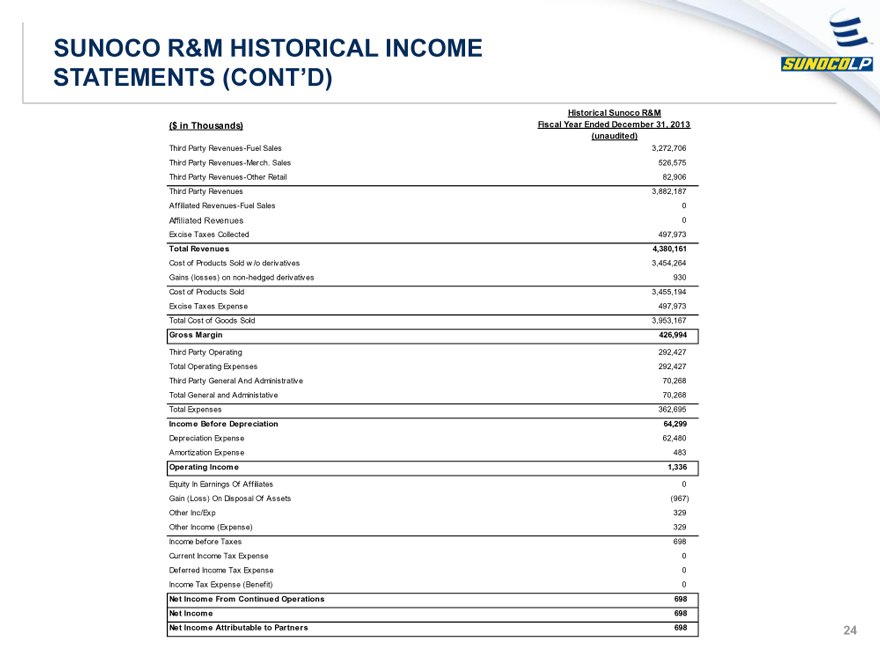

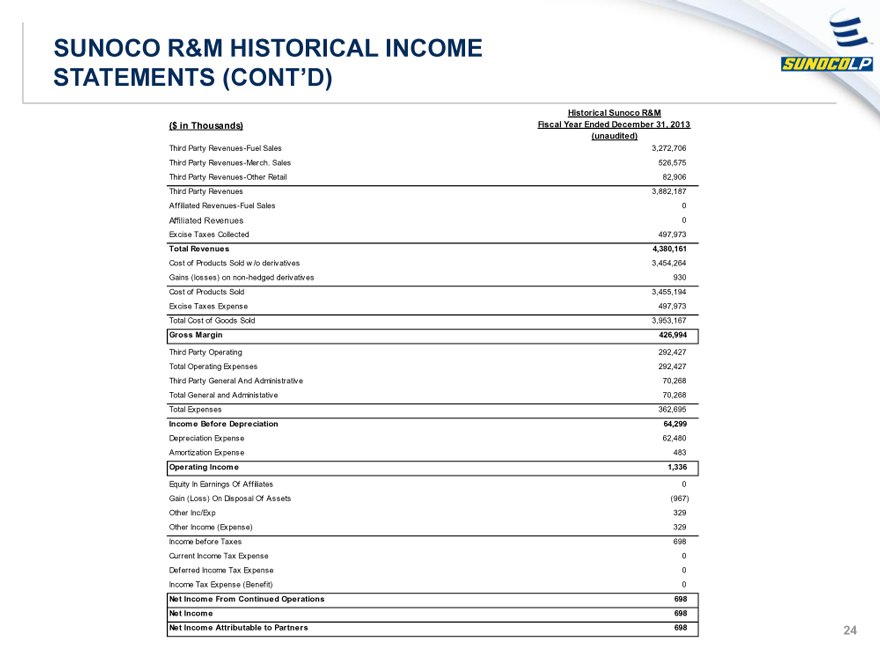

SUNOCO R&M HISTORICAL INCOME

STATEMENTS (CONT’D) SUNOCOLP

Historical Sunoco R&M

($ in Thousands) Fiscal Year Ended December 31, 2013

(unaudited)

Third Party Revenues-Fuel Sales 3,272,706

Third Party Revenues-Merch. Sales 526,575

Third Party Revenues-Other Retail 82,906

Third Party Revenues 3,882,187

Affiliated Revenues-Fuel Sales 0

Affiliated Revenues 0

Excise Taxes Collected 497,973

Total Revenues 4,380,161

Cost of Products Sold w/o derivatives 3,454,264

Gains (losses) on non-hedged derivatives 930

Cost of Products Sold 3,455,194

Excise Taxes Expense 497,973

Total Cost of Goods Sold 3,953,167

Gross Margin 426,994

Third Party Operating 292,427

Total Operating Expenses 292,427

Third Party General And Administrative 70,268

Total General and Administrative 70,268

Total Expenses 362,695

Income Before Depreciation 64,299

Depreciation Expense 62,480

Amortization Expense 483

Operating Income 1,336

Equity In Earnings Of Affiliates 0

Gain (Loss) On Disposal Of Assets (967)

Other Inc/Exp 329

Other Income (Expense) 329

Income before Taxes 698

Current Income Tax Expense 0

Deferred Income Tax Expense 0

Income Tax Expense (Benefit) 0

Net Income From Continued Operations 698

Net Income 698

Net Income Attributable to Partners 698

24