UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22714

Eaton Vance Series Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

July 31

Date of Fiscal Year End

July 31, 2015

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Emerging Markets Debt Opportunities Fund

Annual Report

July 31, 2015

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund is considered to be a commodity pool operator under CFTC regulations. The Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor. The CFTC has neither reviewed nor approved the Fund’s investment strategies.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report July 31, 2015

Eaton Vance

Emerging Markets Debt Opportunities Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 32 | |

| |

Federal Tax Information | | | 33 | |

| |

Board of Trustees’ Contract Approval | | | 34 | |

| |

Management and Organization | | | 37 | |

| |

Important Notices | | | 40 | |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Management’s Discussion of Fund Performance1

Economic and Market Conditions

Government bond markets in emerging countries, as measured by the JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified Index,2 returned -16.68 for the fiscal year ended July 31, 2015. During the period, macroeconomic headwinds pushed local interest rates higher and made currencies weaker in most emerging markets.

One of the strongest headwinds was slowing growth in China, the world’s second-largest economy. The Chinese government took steps to stimulate growth, such as cutting interest rates and bank reserve requirements. Nonetheless, industrial production, retail sales and other key segments of the economy remained sluggish. The slowdown in China contributed to a broad selloff in commodities, which hurt financial markets in emerging countries that export raw materials. Oil was particularly weak, falling more than 50% amid waning global demand, rising U.S. production and the decision of the Organization of the Petroleum Exporting Countries (OPEC) not to lower output.

Expectations surrounding U.S. monetary policy were an additional challenge for emerging markets. After ending its monthly bond purchases in October 2014, the Federal Reserve began contemplating its first interest rate increase since June 2006. The central bank ultimately held short-term rates near zero throughout the fiscal year. However, longer rates climbed higher during the second half of the period as improvement in the U.S. economy led many investors to believe that a rate hike was imminent. Rising bond yields in the United States made yields on emerging market government debt look less attractive and also diminished the appeal of commodities.

Fund Performance

For the fiscal year ended July 31, 2015, Eaton Vance Emerging Markets Debt Opportunities Fund (the Fund) (formerly, Eaton Vance Institutional Emerging Markets Debt Fund) shares at net asset value (NAV) had a total return of -4.55%. The Fund was considerably more resilient than the JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified Index (the Index) due to its significant underweight exposure to countries in the Index, in favor of exposure to out-of-Index countries. When market conditions are unfavorable as they were this period, countries in the Index tend to underperform out-of-Index

countries because they are more vulnerable to investor outflows.

Being underweight Russia and Turkey helped make Central and Eastern Europe the best-performing region on a relative basis. Russian assets were negatively impacted by plummeting oil prices and new Western economic sanctions related to the crisis in Ukraine. Turkish markets were hurt by ongoing political turmoil and the country’s proximity to Iraq and Syria, which fueled concerns that it might be drawn into the conflict between the United States and the Islamic State of Iraq and Syria (ISIS).

Latin America made the second-largest contribution to relative return, helped by underweights in Brazil and Colombia. The Fund benefited from its relatively low exposure to the Brazilian real, which weakened because of substantial price declines in oil, soybeans and other commodities, coupled with worries about slowing growth and an investigation into corruption at state-run energy company Petrobras. Falling oil prices were the main driver of weakness in Colombia. The generally positive results in Latin America were tempered by an investment in Venezuelan dollar-denominated bonds, an out-of-Index position that was the biggest detractor in the Fund. Venezuela is an oil exporter, and the drop in oil caused the yield on these bonds to widen dramatically versus comparable-maturity U.S. Treasurys.

Asia added almost as much to relative results as Latin America, mainly due to underweight positions in oil producers Malaysia and Indonesia. Out-of-Index exposure to Bangladesh was another plus. The economy of Bangladesh has performed better than many other developing economies, in part because the country has increased its global presence as a low-cost manufacturer.

Sub-Saharan Africa made a positive, albeit more modest, contribution to Fund performance versus the Index. Within the region, the positive effect of an underweight in commodity-rich South Africa offset the negative effect of an out-of-Index position in Zambia, which was affected by declining copper prices and political uncertainty. Out-of-Index exposure to the Middle East North Africa region was a slight drag on relative returns.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Performance2,3

Portfolio Managers John R. Baur, Michael A. Cirami, CFA and Eric A. Stein, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Since

Inception | |

Fund at NAV | | | 02/04/2013 | | | | 02/04/2013 | | | | –4.55 | % | | | — | | | | –0.89 | % |

JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified | | | — | | | | — | | | | –16.68 | % | | | –0.65 | % | | | –9.18 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | | | | | |

Gross | | | | | | | | | | | | | | | | | | | 1.86 | % |

Net | | | | | | | | | | | | | | | | | | | 0.85 | |

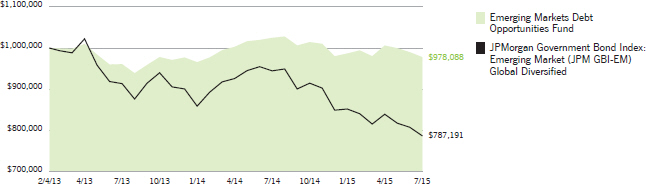

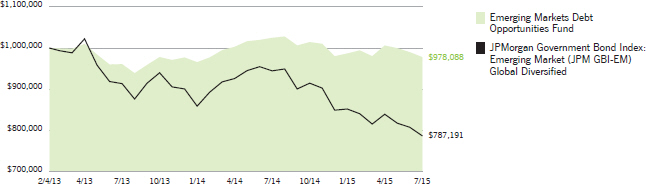

Growth of $1,000,000

This graph shows the change in value of a hypothetical investment of $1,000,000 in the Emerging Markets Debt Opportunities Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Fund Profile

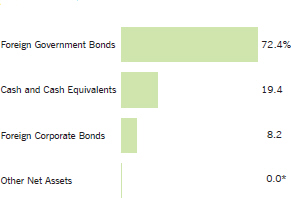

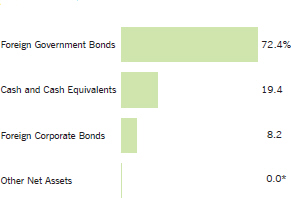

Asset Allocation (% of net assets)5

| * | Amount is less than 0.05%. |

Foreign Currency Exposure (% of net assets)6

| | | | | | | | | | |

Mexico | | | 6.8 | % | | Malaysia | | | 1.8 | % |

| | | |

Serbia | | | 6.4 | | | Uruguay | | | 1.7 | |

| | | |

Zambia | | | 5.8 | | | Brazil | | | 1.7 | |

| | | |

India | | | 5.1 | | | Chile | | | 1.5 | |

| | | |

Poland | | | 4.1 | | | Colombia | | | 1.3 | |

| | | |

Philippines | | | 3.3 | | | Albania | | | 1.0 | |

| | | |

Bangladesh | | | 3.1 | | | Other | | | 1.1 | * |

| | | |

Turkey | | | 3.0 | | | Euro | | | –13.9 | |

| | | |

Romania | | | 2.1 | | | Total Long | | | 55.7 | |

| | | |

Dominican Republic | | | 2.0 | | | Total Short | | | –14.0 | |

| | | |

Indonesia | | | 1.9 | | | Total Net | | | 41.7 | |

| | | |

Lebanon | | | 1.9 | | | | | | | |

| * | Includes amounts each less than 1.0% or –1.0%, as applicable. |

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | JPMorgan Government Bond Index: Emerging Market (JPM GBI–EM) Global Diversified is an unmanaged index of local-currency bonds with maturities of more than one year issued by emerging markets governments. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. The Fund has no sales charge. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 4 | Source: Fund prospectus. Net expense ratio reflects a contractual expense reimbursement that continues through 11/30/16. Without the reimbursement, if applicable, performance would have been lower. |

| 5 | Other net assets represent other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

| 6 | Currency exposures include all foreign exchange denominated assets, currency derivatives and commodities (including commodity derivatives). Total exposures may exceed 100% due to implicit leverage created by derivatives. |

| | Fund profile subject to change due to active management. |

| | Important Notice to Shareholders |

| | Effective September 3, 2015, the name of the Fund changed to Eaton Vance Emerging Markets Debt Opportunities Fund. Concurrent with the name change, the Fund began offering Class A and Class I shares and the Fund’s existing share class was designated as Class R6 shares. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2015 – July 31, 2015).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value (2/1/15) | | | Ending Account Value (7/31/15) | | | Expenses Paid During Period* (2/1/15 – 7/31/15) | | | Annualized Expense Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 991.20 | | | $ | 4.20 | ** | | | 0.85 | % |

| | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.26 | ** | | | 0.85 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on January 31, 2015. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Portfolio of Investments

| | | | | | | | | | |

| Foreign Government Bonds — 66.1% | |

| | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Albania — 1.0% | |

Albania Government Bond, 8.90%, 7/24/25 | | ALL | | | 52,000 | | | $ | 411,806 | |

Republic of Albania, 8.93%, 4/23/25 | | ALL | | | 10,200 | | | | 82,094 | |

| | | | | | | | | | | |

Total Albania | | | | | | | | $ | 493,900 | |

| | | | | | | | | | | |

|

Angola — 0.5% | |

Republic of Angola Via Northern Lights III BV, 7.00%, 8/16/19(1) | | USD | | | 250 | | | $ | 249,300 | |

| | | | | | | | | | | |

Total Angola | | | | | | | | $ | 249,300 | |

| | | | | | | | | | | |

|

Argentina — 3.9% | |

Republic of Argentina, 7.00%, 10/3/15 | | USD | | | 947 | | | $ | 941,209 | |

Republic of Argentina,

8.28%, 12/31/33(2)(3) | | USD | | | 1,141 | | | | 947,681 | |

| | | | | | | | | | | |

Total Argentina | | | | | | | | $ | 1,888,890 | |

| | | | | | | | | | | |

|

Armenia — 0.4% | |

Republic of Armenia, 7.15%, 3/26/25(1) | | USD | | | 200 | | | $ | 198,740 | |

| | | | | | | | | | | |

Total Armenia | | | | | | | | $ | 198,740 | |

| | | | | | | | | | | |

|

Bangladesh — 3.1% | |

Bangladesh Treasury Bond, 11.45%, 6/6/17 | | BDT | | | 18,300 | | | $ | 250,350 | |

Bangladesh Treasury Bond, 11.50%, 8/8/17 | | BDT | | | 44,100 | | | | 606,025 | |

Bangladesh Treasury Bond, 11.52%, 12/5/17 | | BDT | | | 34,600 | | | | 478,937 | |

Bangladesh Treasury Bond, 11.62%, 1/2/18 | | BDT | | | 10,000 | | | | 138,905 | |

| | | | | | | | | | | |

Total Bangladesh | | | | | | | | $ | 1,474,217 | |

| | | | | | | | | | | |

|

Barbados — 2.1% | |

Barbados Government International Bond, 6.625%, 12/5/35(1) | | USD | | | 617 | | | $ | 569,182 | |

Barbados Government International Bond, 6.625%, 12/5/35(4) | | USD | | | 493 | | | | 454,793 | |

| | | | | | | | | | | |

Total Barbados | | | | | | | | $ | 1,023,975 | |

| | | | | | | | | | | |

|

Bosnia and Herzegovina — 0.8% | |

Republic of Srpska, 1.50%, 10/30/23 | | BAM | | | 437 | | | $ | 198,293 | |

Republic of Srpska, 1.50%, 6/9/25 | | BAM | | | 98 | | | | 41,446 | |

Republic of Srpska, 1.50%, 9/25/26 | | BAM | | | 421 | | | | 167,329 | |

| | | | | | | | | | | |

Total Bosnia and Herzegovina | | | | | | | | $ | 407,068 | |

| | | | | | | | | | | |

|

Brazil — 0.5% | |

Letra Tesouro do Nacional Bill, 0.00%, 1/1/17 | | BRL | | | 1,000 | | | $ | 244,314 | |

| | | | | | | | | | | |

Total Brazil | | | | | | | | $ | 244,314 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Colombia — 2.2% | |

Republic of Colombia, 5.00%, 6/15/45 | | USD | | | 648 | | | $ | 604,260 | |

Titulos De Tesoreria B, 11.00%, 7/24/20 | | COP | | | 1,046,200 | | | | 438,099 | |

| | | | | | | | | | | |

Total Colombia | | | | | | | | $ | 1,042,359 | |

| | | | | | | | | | | |

|

Dominican Republic — 2.7% | |

Dominican Republic Central Bank Note, 12.00%, 4/5/19(4) | | DOP | | | 610 | | | $ | 14,306 | |

Dominican Republic International Bond, 9.04%, 1/23/18(1) | | USD | | | 306 | | | | 331,525 | |

Dominican Republic International Bond, 11.50%, 5/10/24(4) | | DOP | | | 6,000 | | | | 142,017 | |

Dominican Republic International Bond, 14.00%, 4/30/21(4) | | DOP | | | 2,300 | | | | 58,709 | |

Dominican Republic International Bond, 14.50%, 2/10/23(1) | | DOP | | | 1,100 | | | | 29,214 | |

Dominican Republic International Bond, 14.50%, 2/10/23(4) | | DOP | | | 100 | | | | 2,656 | |

Dominican Republic International Bond, 15.95%, 6/4/21(4) | | DOP | | | 3,500 | | | | 97,666 | |

Dominican Republic International Bond, 18.50%, 2/4/28(1) | | DOP | | | 19,700 | | | | 628,870 | |

Dominican Republic International Bond, 18.50%, 2/4/28(4) | | DOP | | | 100 | | | | 3,192 | |

| | | | | | | | | | | |

Total Dominican Republic | | | | | | | | $ | 1,308,155 | |

| | | | | | | | | | | |

|

Ecuador — 7.6% | |

Republic of Ecuador, 7.95%, 6/20/24(4) | | USD | | | 1,020 | | | $ | 859,350 | |

Republic of Ecuador,

9.375%, 12/15/15(1) | | USD | | | 1,508 | | | | 1,500,460 | |

Republic of Ecuador,

10.50%, 3/24/20(4) | | USD | | | 1,335 | | | | 1,278,316 | |

| | | | | | | | | | | |

Total Ecuador | | | | | | | | $ | 3,638,126 | |

| | | | | | | | | | | |

|

Fiji — 1.0% | |

Republic of Fiji, 9.00%, 3/15/16 | | USD | | | 465 | | | $ | 471,529 | |

| | | | | | | | | | | |

Total Fiji | | | | | | | | $ | 471,529 | |

| | | | | | | | | | | |

|

Indonesia — 1.4% | |

Indonesia Government Bond, 8.375%, 3/15/24 | | IDR | | | 2,516,000 | | | $ | 183,899 | |

Indonesia Government International Bond, 3.375%, 7/30/25(4) | | EUR | | | 456 | | | | 496,666 | |

| | | | | | | | | | | |

Total Indonesia | | | | | | | | $ | 680,565 | |

| | | | | | | | | | | |

|

Iraq — 1.9% | |

Republic of Iraq, 5.80%, 1/15/28(1) | | USD | | | 1,157 | | | $ | 924,096 | |

| | | | | | | | | | | |

Total Iraq | | | | | | | | $ | 924,096 | |

| | | | | | | | | | | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Portfolio of Investments — continued

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Ivory Coast — 1.0% | |

Ivory Coast, 6.375%, 3/3/28(4) | | USD | | | 490 | | | $ | 466,725 | |

| | | | | | | | | | | |

Total Ivory Coast | | | | | | | | $ | 466,725 | |

| | | | | | | | | | | |

|

Jamaica — 0.5% | |

Jamaica Government International Bond, 7.875%, 7/28/45 | | USD | | | 245 | | | $ | 243,775 | |

| | | | | | | | | | | |

Total Jamaica | | | | | | | | $ | 243,775 | |

| | | | | | | | | | | |

|

Kazakhstan — 1.2% | |

Kazakhstan Government International Bond, 5.125%, 7/21/25(4) | | USD | | | 560 | | | $ | 555,380 | |

| | | | | | | | | | | |

Total Kazakhstan | | | | | | | | $ | 555,380 | |

| | | | | | | | | | | |

|

Kenya — 0.6% | |

Kenya Infrastructure Bond, 11.00%, 10/12/26 | | KES | | | 5,900 | | | $ | 50,181 | |

Kenya Treasury Bond, 11.855%, 5/22/17 | | KES | | | 6,450 | | | | 65,069 | |

Republic of Kenya, 6.875%, 6/24/24(1) | | USD | | | 200 | | | | 197,300 | |

| | | | | | | | | | | |

Total Kenya | | | | | | | | $ | 312,550 | |

| | | | | | | | | | | |

|

Malaysia — 1.6% | |

Malaysia Government Bond, 3.314%, 10/31/17 | | MYR | | | 2,953 | | | $ | 773,945 | |

| | | | | | | | | | | |

Total Malaysia | | | | | | | | $ | 773,945 | |

| | | | | | | | | | | |

|

Mexico — 1.3% | |

Mexican Bonos, 10.00%, 12/5/24 | | MXN | | | 7,826 | | | $ | 623,726 | |

| | | | | | | | | | | |

Total Mexico | | | | | | | | $ | 623,726 | |

| | | | | | | | | | | |

|

Montenegro — 0.9% | |

Montenegro Government International Bond, 3.875%, 3/18/20(4) | | EUR | | | 425 | | | $ | 447,890 | |

| | | | | | | | | | | |

Total Montenegro | | | | | | | | $ | 447,890 | |

| | | | | | | | | | | |

|

Nigeria — 1.0% | |

Republic of Nigeria, 5.125%, 7/12/18(1) | | USD | | | 491 | | | $ | 489,532 | |

| | | | | | | | | | | |

Total Nigeria | | | | | | | | $ | 489,532 | |

| | | | | | | | | | | |

|

Pakistan — 0.4% | |

Islamic Republic of Pakistan, 7.25%, 4/15/19(4) | | USD | | | 200 | | | $ | 209,250 | |

| | | | | | | | | | | |

Total Pakistan | | | | | | | | $ | 209,250 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Paraguay — 1.0% | |

Republic of Paraguay,

6.10%, 8/11/44(4) | | USD | | | 230 | | | $ | 239,775 | |

Republic of Paraguay,

6.10%, 8/11/44(1) | | USD | | | 210 | | | | 218,925 | |

| | | | | | | | | | | |

Total Paraguay | | | | | | | | $ | 458,700 | |

| | | | | | | | | | | |

|

Philippines — 4.0% | |

Republic of the Philippines, 6.25%, 1/14/36 | | PHP | | | 77,000 | | | $ | 1,920,749 | |

| | | | | | | | | | | |

Total Philippines | | | | | | | | $ | 1,920,749 | |

| | | | | | | | | | | |

|

Poland — 3.5% | |

Poland Government Bond, 3.75%, 4/25/18 | | PLN | | | 1,540 | | | $ | 427,735 | |

Poland Government Bond, 5.50%, 10/25/19 | | PLN | | | 4,150 | | | | 1,242,766 | |

| | | | | | | | | | | |

Total Poland | | | | | | | | $ | 1,670,501 | |

| | | | | | | | | | | |

|

Romania — 1.5% | |

Romania Government Bond, 5.95%, 6/11/21 | | RON | | | 2,460 | | | $ | 702,809 | |

| | | | | | | | | | | |

Total Romania | | | | | | | | $ | 702,809 | |

| | | | | | | | | | | |

|

Serbia — 9.6% | |

Republic of Serbia, 5.25%, 11/21/17(1) | | USD | | | 223 | | | $ | 232,132 | |

Serbia Treasury Bond, 10.00%, 2/21/16 | | RSD | | | 38,740 | | | | 363,184 | |

Serbia Treasury Bond, 10.00%, 5/22/16 | | RSD | | | 29,400 | | | | 278,006 | |

Serbia Treasury Bond, 10.00%, 6/12/16 | | RSD | | | 13,780 | | | | 130,522 | |

Serbia Treasury Bond, 10.00%, 3/2/18 | | RSD | | | 15,570 | | | | 150,909 | |

Serbia Treasury Bond, 10.00%, 3/20/21 | | RSD | | | 184,850 | | | | 1,776,649 | |

Serbia Treasury Bond, 10.00%, 2/5/22 | | RSD | | | 178,340 | | | | 1,683,317 | |

| | | | | | | | | | | |

Total Serbia | | | | | | | | $ | 4,614,719 | |

| | | | | | | | | | | |

|

Sri Lanka — 2.0% | |

Republic of Sri Lanka,

6.00%, 1/14/19(1) | | USD | | | 460 | | | $ | 473,800 | |

Republic of Sri Lanka,

6.25%, 7/27/21(1) | | USD | | | 500 | | | | 511,875 | |

| | | | | | | | | | | |

Total Sri Lanka | | | | | | | | $ | 985,675 | |

| | | | | | | | | | | |

|

Uruguay — 1.4% | |

Monetary Regulation Bill, 0.00%, 4/21/16 | | UYU | | | 8,471 | | | $ | 271,251 | |

Republic of Uruguay, 5.00%, 9/14/18(5) | | UYU | | | 2,121 | | | | 74,839 | |

Uruguay Notas Del Tesoro, 2.25%, 8/23/17(5) | | UYU | | | 9,820 | | | | 322,529 | |

| | | | | | | | | | | |

Total Uruguay | | | | | | | | $ | 668,619 | |

| | | | | | | | | | | |

|

Venezuela — 3.2% | |

Bolivarian Republic of Venezuela, 5.75%, 2/26/16(1) | | USD | | | 120 | | | $ | 97,350 | |

Bolivarian Republic of Venezuela, 9.25%, 9/15/27(2) | | USD | | | 1,315 | | | | 555,587 | |

Bolivarian Republic of Venezuela, 9.25%, 5/7/28(1) | | USD | | | 972 | | | | 363,416 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Portfolio of Investments — continued

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Venezuela (continued) | |

Bolivarian Republic of Venezuela, 11.95%, 8/5/31(1)(2) | | USD | | | 1,297 | | | $ | 544,782 | |

| | | | | | | | | | | |

Total Venezuela | | | | | | | | $ | 1,561,135 | |

| | | | | | | | | | | |

|

Zambia — 2.3% | |

Republic of Zambia,

8.50%, 4/14/24(4) | | USD | | | 220 | | | $ | 210,650 | |

Republic of Zambia,

8.97%, 7/30/27(4) | | USD | | | 265 | | | | 254,400 | |

Zambia Government Bond, 11.00%, 9/2/19 | | ZMW | | | 6,600 | | | | 620,420 | |

| | | | | | | | | | | |

Total Zambia | | | | | | | | $ | 1,085,470 | |

| | | | | | | | | | | |

| |

Total Foreign Government Bonds

(identified cost $34,138,665) | | | $ | 31,836,384 | |

| | | | | | | | | | | |

|

| Foreign Corporate Bonds — 8.2% | |

| | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

|

Azerbaijan — 0.4% | |

International Bank of Azerbaijan OJSC Via Rubrika Finance Co., Ltd., 6.17%, 5/10/17(1)(6) | | USD | | | 200 | | | $ | 195,750 | |

| | | | | | | | | | | |

Total Azerbaijan | | | | | | | | $ | 195,750 | |

| | | | | | | | | | | |

|

Brazil — 1.0% | |

Petrobras Global Finance BV, 2.00%, 5/20/16 | | USD | | | 120 | | | $ | 118,646 | |

Petrobras Global Finance BV, 6.25%, 3/17/24 | | USD | | | 396 | | | | 371,607 | |

| | | | | | | | | | | |

Total Brazil | | | | | | | | $ | 490,253 | |

| | | | | | | | | | | |

|

Colombia — 0.1% | |

Emgesa SA ESP, 8.75%, 1/25/21(1) | | COP | | | 86,000 | | | $ | 31,363 | |

| | | | | | | | | | | |

Total Colombia | | | | | | | | $ | 31,363 | |

| | | | | | | | | | | |

|

Georgia — 1.6% | |

Bank of Georgia JSC,

7.75%, 7/5/17(1) | | USD | | | 721 | | | $ | 751,700 | |

| | | | | | | | | | | |

Total Georgia | | | | | | | | $ | 751,700 | |

| | | | | | | | | | | |

|

Mexico — 0.2% | |

Petroleos Mexicanos, 7.19%, 9/12/24(4) | | MXN | | | 1,420 | | | $ | 86,765 | |

Petroleos Mexicanos, 7.65%, 11/24/21 | | MXN | | | 420 | | | | 26,963 | |

| | | | | | | | | | | |

Total Mexico | | | | | | | | $ | 113,728 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Russia — 3.0% | |

Gazprom OAO Via Gaz Capital SA, 4.30%, 11/12/15(4) | | USD | | | 500 | | | $ | 503,375 | |

Gazprom OAO Via Gaz Capital SA, 5.136%, 3/22/17(1) | | EUR | | | 832 | | | | 940,280 | |

| | | | | | | | | | | |

Total Russia | | | | | | | | $ | 1,443,655 | |

| | | | | | | | | | | |

|

South Korea — 0.1% | |

Export-Import Bank of Korea, 0.50%, 1/25/17 | | TRY | | | 220 | | | $ | 69,326 | |

| | | | | | | | | | | |

Total South Korea | | | | | | | | $ | 69,326 | |

| | | | | | | | | | | |

|

Sri Lanka — 1.0% | |

Bank of Ceylon, 6.875%, 5/3/17(1) | | USD | | | 231 | | | $ | 240,529 | |

National Savings Bank, 8.875%, 9/18/18(1) | | USD | | | 223 | | | | 241,397 | |

| | | | | | | | | | | |

Total Sri Lanka | | | | | | | | $ | 481,926 | |

| | | | | | | | | | | |

|

Supranational — 0.8% | |

Inter-American Development Bank, 7.35%, 9/12/18 | | IDR | | | 2,750,000 | | | $ | 194,824 | |

International Bank for Reconstruction & Development, 3.40%, 4/15/17(5) | | UYU | | | 4,945 | | | | 170,928 | |

International Finance Corp., 4.45%, 2/26/16 | | RUB | | | 1,400 | | | | 21,776 | |

| | | | | | | | | | | |

Total Supranational | | | | | | | | $ | 387,528 | |

| | | | | | | | | | | |

| |

Total Foreign Corporate Bonds

(identified cost $4,074,321) | | | $ | 3,965,229 | |

| | | | | | | | | | | |

|

| Sovereign Loans — 0.4% | |

| | | |

| | | | | | | | | | |

| Borrower | | | | Principal Amount (000’s omitted) | | | Value | |

|

Ethiopia — 0.4% | |

Ethiopian Railways Corporation (Federal Democratic Republic of Ethiopia guaranteed), 3.45%, Maturing

August 1, 2021(7)(8)(9)(10) | | | | $ | 200 | | | $ | 197,859 | |

| | | | | | | | | | | |

Total Ethiopia | | | | | | | | $ | 197,859 | |

| | | | | | | | | | | |

| |

Total Sovereign Loans

(identified cost $182,098) | | | $ | 197,859 | |

| | | | | | | | | | | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Portfolio of Investments — continued

| | | | | | | | | | |

| Short-Term Investments — 23.8% | |

|

| Foreign Government Securities — 6.3% | |

| | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | |

|

Brazil — 1.6% | |

Brazil Letras do Tesouro Nacional, 0.00%, 4/1/16 | | BRL | | | 2,956 | | | $ | 791,054 | |

| | | | | | | | | | | |

Total Brazil | | | | | | | | $ | 791,054 | |

| | | | | | | | | | | |

|

Lebanon — 1.9% | |

Lebanon Treasury Bill, 0.00%, 8/20/15 | | LBP | | | 653,640 | | | $ | 432,854 | |

Lebanon Treasury Bill, 0.00%, 12/10/15 | | LBP | | | 268,900 | | | | 175,636 | |

Lebanon Treasury Bill, 0.00%, 1/7/16 | | LBP | | | 440,350 | | | | 286,584 | |

| | | | | | | | | | | |

Total Lebanon | | | | | | | | $ | 895,074 | |

| | | | | | | | | | | |

|

Macedonia — 1.5% | |

Republic of Macedonia, 4.625%, 12/8/15 | | EUR | | | 643 | | | $ | 707,093 | |

| | | | | | | | | | | |

Total Macedonia | | | | | | | | $ | 707,093 | |

| | | | | | | | | | | |

|

Mexico — 1.3% | |

Mexico Cetes, 0.00%, 9/17/15 | | MXN | | | 10,100 | | | $ | 624,507 | |

| | | | | | | | | | | |

Total Mexico | | | | | | | | $ | 624,507 | |

| | | | | | | | | | | |

| |

Total Foreign Government Securities

(identified cost $3,125,188) | | | $ | 3,017,728 | |

| | | | | | | | | | | |

|

| U.S. Treasury Obligations — 4.2% | |

| | | |

| | | | | | | | | | |

| Security | | | | Principal Amount (000’s omitted) | | | Value | |

U.S. Treasury Bill, 0.00%, 10/15/15(11) | | | | $ | 2,000 | | | $ | 1,999,858 | |

| | | | | | | | | | | |

| |

Total U.S. Treasury Obligations

(identified cost $1,999,958) | | | $ | 1,999,858 | |

| | | | | | | | | | | |

| | | | | | | | | | |

| Other — 13.3% | |

| | | |

| | | | | | | | | | |

| Description | | | | Interest

(000’s omitted) | | | Value | |

| | | | | | | | | | |

Eaton Vance Cash Reserves Fund, LLC, 0.20%(12) | | | | $ | 6,410 | | | $ | 6,409,739 | |

| | | | | | | | | | | |

| |

Total Other

(identified cost $6,409,739) | | | $ | 6,409,739 | |

| | | | | | | | | | | |

| |

Total Short-Term Investments

(identified cost $11,534,885) | | | $ | 11,427,325 | |

| | | | | | | | | | | |

| |

Total Investments — 98.5%

(identified cost $49,929,969) | | | $ | 47,426,797 | |

| | | | | | | | | | | |

| |

Less Unfunded Loan Commitments — (0.1)% | | | $ | (33,444 | ) |

| | | | | | | | | | | |

| |

Net Investments — 98.4%

(identified cost $49,896,525) | | | $ | 47,393,353 | |

| | | | | | | | | | | |

| |

Other Assets, Less Liabilities — 1.6% | | | $ | 747,167 | |

| | | | | | | | | | | |

| |

Net Assets — 100.0% | | | $ | 48,140,520 | |

| | | | | | | | | | | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| | | | |

| ALL | | – | | Albanian Lek |

| BAM | | – | | Bosnia - Herzegovina Convertible Mark |

| BDT | | – | | Bangladesh Taka |

| BRL | | – | | Brazilian Real |

| COP | | – | | Colombian Peso |

| DOP | | – | | Dominican Peso |

| EUR | | – | | Euro |

| IDR | | – | | Indonesian Rupiah |

| KES | | – | | Kenyan Shilling |

| LBP | | – | | Lebanese Pound |

| MXN | | – | | Mexican Peso |

| MYR | | – | | Malaysian Ringgit |

| PHP | | – | | Philippine Peso |

| PLN | | – | | Polish Zloty |

| RON | | – | | Romanian Leu |

| RSD | | – | | Serbian Dinar |

| RUB | | – | | Russian Ruble |

| TRY | | – | | New Turkish Lira |

| USD | | – | | United States Dollar |

| UYU | | – | | Uruguayan Peso |

| ZMW | | – | | Zambian Kwacha |

| | (1) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Portfolio of Investments — continued

| | At July 31, 2015, the aggregate value of these securities is $9,961,518 or 20.7% of the Fund’s net assets. |

| | (2) | Security (or a portion thereof) has been pledged for the benefit of the counterparty for reverse repurchase agreements. |

| | (4) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be sold in certain transactions (normally to qualified institutional buyers) and remain exempt from registration. At July 31, 2015, the aggregate value of these securities is $6,381,881 or 13.3% of the Fund’s net assets. |

| | (5) | Inflation-linked security whose principal is adjusted for inflation based on changes in a designated inflation index or inflation rate for the applicable country. Interest is calculated based on the inflation-adjusted principal. |

| | (6) | Variable rate security. The stated interest rate represents the rate in effect at July 31, 2015. |

| | (7) | Variable interest rate that updates semiannually based on changes to the London Interbank Offered Rate (LIBOR). The stated interest rate represents a weighted average rate at July 31, 2015. |

| | (8) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 10). |

| | (9) | Loan is subject to scheduled mandatory prepayments. Maturity date shown reflects the final maturity date. |

| (10) | Unfunded or partially unfunded loan commitments. See Note 1G for description. |

| (11) | Security (or a portion thereof) has been pledged to cover margin requirements on open financial futures contracts. |

| (12) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of July 31, 2015. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Statement of Assets and Liabilities

| | | | |

| Assets | | July 31, 2015 | |

Unaffiliated investments, at value (identified cost, $43,486,786) | | $ | 40,983,614 | |

Affiliated investment, at value (identified cost, $6,409,739) | | | 6,409,739 | |

Cash | | | 447,839 | |

Restricted cash* | | | 202,853 | |

Foreign currency, at value (identified cost, $266,527) | | | 261,668 | |

Interest receivable | | | 940,548 | |

Interest receivable from affiliated investment | | | 1,268 | |

Receivable for investments sold | | | 1,880 | |

Receivable for open forward foreign currency exchange contracts | | | 268,713 | |

Receivable for open swap contracts | | | 73,659 | |

Receivable for open non-deliverable bond forward contracts | | | 12,841 | |

Tax reclaims receivable | | | 18,225 | |

Receivable from affiliate | | | 22,346 | |

Total assets | | $ | 49,645,193 | |

| |

| Liabilities | | | | |

Payable for reverse repurchase agreements | | $ | 659,589 | |

Payable for variation margin on open financial futures contracts | | | 44,247 | |

Payable for variation margin on open centrally cleared swap contracts | | | 1,029 | |

Payable for open forward foreign currency exchange contracts | | | 493,735 | |

Payable for open swap contracts | | | 161,649 | |

Payable to affiliate: | | | | |

Investment adviser and administration fee | | | 26,786 | |

Accrued foreign capital gains taxes | | | 676 | |

Accrued expenses | | | 116,962 | |

Total liabilities | | $ | 1,504,673 | |

Net Assets | | $ | 48,140,520 | |

| |

| Sources of Net Assets | | | | |

Common shares, $0.001 par value, 1,000,000,000 shares authorized, 5,315,813 shares issued and outstanding | | $ | 5,316 | |

Additional paid-in capital | | | 52,101,063 | |

Accumulated net realized loss | | | (1,303,563 | ) |

Accumulated undistributed net investment income | | | 467,534 | |

Net unrealized depreciation | | | (3,129,830 | ) |

Total | | $ | 48,140,520 | |

| |

| Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

($48,140,520 ÷ 5,315,813 common shares issued and outstanding) | | $ | 9.06 | |

| * | Represents restricted cash on deposit at the broker for open derivative contracts. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Statement of Operations

| | | | |

| Investment Income | | Year Ended July 31, 2015 | |

Interest (net of foreign taxes, $75,099) | | $ | 3,269,683 | |

Interest allocated from affiliated investment | | | 10,046 | |

Expenses allocated from affiliated investment | | | (882 | ) |

Total investment income | | $ | 3,278,847 | |

| |

| Expenses | | | | |

Investment adviser and administration fee | | $ | 319,364 | |

Directors’ fees and expenses | | | 3,010 | |

Custodian fee | | | 145,285 | |

Transfer and dividend disbursing agent fees | | | 855 | |

Legal and accounting services | | | 105,092 | |

Printing and postage | | | 8,385 | |

Registration fees | | | 29,738 | |

Miscellaneous | | | 20,022 | |

Total expenses | | $ | 631,751 | |

Deduct — | | | | |

Allocation of expenses to affiliate | | $ | 213,135 | |

Reduction of custodian fee | | | 21 | |

Total expense reductions | | $ | 213,156 | |

| |

Net expenses | | $ | 418,595 | |

| |

Net investment income | | $ | 2,860,252 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions (net of foreign capital gains taxes of $31,413) | | $ | (2,912,666 | ) |

Investment transactions allocated from affiliated investment | | | 27 | |

Financial futures contracts | | | (93,319 | ) |

Swap contracts | | | (52,655 | ) |

Foreign currency and forward foreign currency exchange contract transactions | | | 969,764 | |

Non-deliverable bond forward contracts | | | (5,595 | ) |

Net realized loss | | $ | (2,094,444 | ) |

Change in unrealized appreciation (depreciation) — | | | | |

Investments (including net increase of $676 in accrued foreign capital gains taxes) | | $ | (2,205,665 | ) |

Financial futures contracts | | | (283,296 | ) |

Swap contracts | | | (278,370 | ) |

Foreign currency and forward foreign currency exchange contracts | | | (348,555 | ) |

Non-deliverable bond forward contracts | | | 12,841 | |

Net change in unrealized appreciation (depreciation) | | $ | (3,103,045 | ) |

| |

Net realized and unrealized loss | | $ | (5,197,489 | ) |

| |

Net decrease in net assets from operations | | $ | (2,337,237 | ) |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended July 31, | |

| Increase (Decrease) in Net Assets | | 2015 | | | 2014 | |

From operations — | | | | | | | | |

Net investment income | | $ | 2,860,252 | | | $ | 1,014,209 | |

Net realized loss from investment transactions, financial futures contracts, swap contracts, foreign currency and forward foreign currency exchange contract transactions, and non-deliverable bond forward contracts | | | (2,094,444 | ) | | | (523,017 | ) |

Net change in unrealized appreciation (depreciation) from investments, financial futures contracts, swap contracts, foreign currency, forward foreign currency exchange contracts and non-deliverable bond forward contracts | | | (3,103,045 | ) | | | 801,485 | |

Net increase (decrease) in net assets from operations | | $ | (2,337,237 | ) | | $ | 1,292,677 | |

Distributions to shareholders — | | | | | | | | |

From net investment income | | $ | (1,845,761 | ) | | $ | (496,035 | ) |

From net realized gain | | | — | | | | (33,069 | ) |

Total distributions to shareholders | | $ | (1,845,761 | ) | | $ | (529,104 | ) |

Transactions in common shares — | | | | | | | | |

Proceeds from sale of shares | | $ | — | | | $ | 50,000,000 | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | 1,845,761 | | | | 529,104 | |

Cost of shares redeemed | | | — | | | | (15,333,371 | ) |

Net increase in net assets from Fund share transactions | | $ | 1,845,761 | | | $ | 35,195,733 | |

| | |

Net increase (decrease) in net assets | | $ | (2,337,237 | ) | | $ | 35,959,306 | |

| | |

| Net Assets | | | | | | | | |

At beginning of year | | $ | 50,477,757 | | | $ | 14,518,451 | |

At end of year | | $ | 48,140,520 | | | $ | 50,477,757 | |

| | |

Accumulated undistributed net investment income

included in net assets | | | | | | | | |

At end of year | | $ | 467,534 | | | $ | 375,824 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Financial Highlights

| | | | | | | | | | | | |

| | | Year Ended July 31, | | | Period Ended

July 31, 2013(1) | |

| | | 2015 | | | 2014 | | |

Net asset value — Beginning of period | | $ | 9.880 | | | $ | 9.610 | | | $ | 10.000 | |

| | | |

| Income (Loss) From Operations | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.546 | | | $ | 0.452 | | | $ | 0.173 | |

Net realized and unrealized gain (loss) | | | (1.005 | ) | | | 0.169 | | | | (0.563 | ) |

| | | |

Total income (loss) from operations | | $ | (0.459 | ) | | $ | 0.621 | | | $ | (0.390 | ) |

| | | |

| Less Distributions | | | | | | | | | | | | |

From net investment income | | $ | (0.361 | ) | | $ | (0.329 | ) | | $ | — | |

From net realized gain | | | — | | | | (0.022 | ) | | | — | |

| | | |

Total distributions | | $ | (0.361 | ) | | $ | (0.351 | ) | | $ | — | |

| | | |

Net asset value — End of period | | $ | 9.060 | | | $ | 9.880 | | | $ | 9.610 | |

| | | |

Total Return(3) | | | (4.55 | )% | | | 6.64 | % | | | (3.90 | )%(4) |

| | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 48,141 | | | $ | 50,478 | | | $ | 14,518 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | |

Expenses(5) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %(6) |

Net investment income | | | 5.82 | % | | | 4.66 | % | | | 3.58 | %(6) |

Portfolio Turnover | | | 74 | % | | | 90 | % | | | 0 | %(4) |

| (1) | For the period from commencement of operations on February 4, 2013 to July 31, 2013. |

| (2) | Computed using average common shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (5) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.43%, 1.01% and 2.16% of average daily net assets for the years ended July 31, 2015 and 2014 and the period from commencement of operations on February 4, 2013 to July 31, 2013, respectively). Absent this reimbursement, total return would be lower. |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Emerging Markets Debt Opportunities Fund (formerly, Eaton Vance Institutional Emerging Markets Debt Fund) (the Fund) is a non-diversified series of Eaton Vance Series Fund, Inc. (the Corporation). The Corporation is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund’s investment objective is total return. The Fund’s shares are offered to institutional investors and are sold at net asset value and are not subject to a sales charge.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Debt Obligations. Debt obligations (including short-term obligations with a remaining maturity of more than sixty days) are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term obligations purchased with a remaining maturity of sixty days or less (excluding those that are non-U.S. dollar denominated, which typically are valued by a pricing service or dealer quotes) are generally valued at amortized cost, which approximates market value.

Derivatives. Financial futures contracts are valued at the closing settlement price established by the board of trade or exchange on which they are traded. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average asked prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund’s forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service. Non-deliverable bond forward contracts are generally valued based on the current price of the underlying bond as provided by a third party pricing service and current interest rates. Swaps (other than centrally cleared) are normally valued using valuations provided by a third party pricing service. Such pricing service valuations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract. Future cash flows on swaps are discounted to their present value using swap rates provided by electronic data services or by broker/dealers. Centrally cleared swaps are valued at the daily settlement price provided by the central clearing counterparty.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Fund’s Directors have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities.

Affiliated Fund. The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). The value of the Fund’s investment in Cash Reserves Fund reflects the Fund’s proportionate interest in its net assets. Cash Reserves Fund generally values its investment securities utilizing the amortized cost valuation technique in accordance with Rule 2a-7 under the 1940 Act. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium. If amortized cost is determined not to approximate fair value, Cash Reserves Fund may value its investment securities in the same manner as debt obligations described above.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Directors of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount. Inflation adjustments to the principal amount of inflation-adjusted bonds and notes are reflected as interest income. Withholding taxes on foreign interest and capital gains have been provided for in accordance with the Fund’s understanding of the applicable countries’ tax rules and rates.

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Notes to Financial Statements — continued

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

In addition to the requirements of the Internal Revenue Code, the Fund may also be subject to local taxes on the recognition of capital gains in certain countries. In determining the daily net asset value, the Fund estimates the accrual for such taxes, if any, based on the unrealized appreciation on certain portfolio securities and the related tax rates. Taxes attributable to unrealized appreciation are included in the change in unrealized appreciation (depreciation) on investments. Capital gains taxes on securities sold are included in net realized gain (loss) on investments.

As of July 31, 2015, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Fund. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Fund maintains with SSBT. All credit balances, if any, used to reduce the Fund’s custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

G Unfunded Loan Commitments — The Fund may enter into certain loan agreements all or a portion of which may be unfunded. The Fund is obligated to fund these commitments at the borrower’s discretion. These commitments are disclosed in the accompanying Portfolio of Investments. At July 31, 2015, the Fund had sufficient cash and/or securities to cover these commitments.

H Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

I Indemnifications — The Corporation’s Articles of Incorporation provide that no Director or officer of the Corporation shall be liable, to the fullest extent permitted by Maryland law and the 1940 Act, to the Corporation or to its shareholders for money damages. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

J Financial Futures Contracts — Upon entering into a financial futures contract, the Fund is required to deposit with the broker, either in cash or securities, an amount equal to a certain percentage of the contract amount (initial margin). Subsequent payments, known as variation margin, are made or received by the Fund each business day, depending on the daily fluctuations in the value of the underlying security, and are recorded as unrealized gains or losses by the Fund. Gains (losses) are realized upon the expiration or closing of the financial futures contracts. Should market conditions change unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. Futures contracts have minimal counterparty risk as they are exchange traded and the clearinghouse for the exchange is substituted as the counterparty, guaranteeing counterparty performance.

K Forward Foreign Currency Exchange and Non-Deliverable Bond Forward Contracts — The Fund may enter into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. The forward foreign currency exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded as unrealized until such time as the contracts have been closed. The Fund may also enter into non-deliverable bond forward contracts for the purchase of a bond denominated in a non-deliverable foreign currency at a fixed price on a future date. For non-deliverable bond forward contracts, unrealized gains and losses, based on changes in the value of the contract, and realized gains and losses are accounted for as described above. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from movements in the value of a foreign currency relative to the U.S. dollar.

L Interest Rate Swaps — Swap contracts are privately negotiated agreements between the Fund and a counterparty. Certain swap contracts may be centrally cleared (“centrally cleared swaps”), whereby all payments made or received by the Fund pursuant to the contract are with a central clearing party (CCP) rather than the original counterparty. The CCP guarantees the performance of the original parties to the contract. Upon entering into centrally cleared swaps, the Fund is required to deposit with the CCP, either in cash or securities, an amount of initial margin determined by the CCP, which is subject to adjustment.

Pursuant to interest rate swap agreements, the Fund either makes floating-rate payments to the counterparty (or CCP in the case of centrally cleared swaps) based on a benchmark interest rate in exchange for fixed-rate payments or the Fund makes fixed-rate payments to the counterparty (or CCP in the

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Notes to Financial Statements — continued

case of a centrally cleared swap) in exchange for payments on a floating benchmark interest rate. Payments received or made are recorded as realized gains or losses. During the term of the outstanding swap agreement, changes in the underlying value of the swap are recorded as unrealized gains or losses. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. The value of the swap is determined by changes in the relationship between two rates of interest. The Fund is exposed to credit loss in the event of non-performance by the swap counterparty. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP. Risk may also arise from movements in interest rates.

M Cross-Currency Swaps — Cross-currency swaps are interest rate swaps in which interest cash flows are exchanged between two parties based on the notional amounts of two different currencies. The notional amounts are typically determined based on the spot exchange rates at the inception of the trade. Cross-currency swaps also involve the exchange of the notional amounts at the start of the contract at the current spot rate with an agreement to re-exchange such amounts at a later date at either the same exchange rate, a specified rate or the then current spot rate. The entire principal value of a cross-currency swap is subject to the risk that the counterparty to the swap will default on its contractual delivery obligations.

N Repurchase Agreements — A repurchase agreement is the purchase by the Fund of securities from a counterparty in exchange for cash that is coupled with an agreement to resell those securities to the counterparty at a specified date and price. When a repurchase agreement is entered, the Fund typically receives securities with a value that equals or exceeds the repurchase price, including any accrued interest earned on the agreement. The value of such securities will be marked to market daily, and cash or additional securities will be exchanged between the parties as needed. Except in the case of a repurchase agreement entered to settle a short sale, the value of the securities delivered to the Fund will be at least equal to 90% of the repurchase price during the term of the repurchase agreement. The terms of a repurchase agreement entered to settle a short sale may provide that the cash purchase price paid by the Fund is more than the value of purchased securities that effectively collateralize the repurchase price payable by the counterparty. Since in such a transaction, the Fund normally will have used the purchased securities to settle the short sale, the Fund will segregate liquid assets equal to the marked to market value of the purchased securities that it is obligated to return to the counterparty under the repurchase agreement. In the event of insolvency of the counterparty to a repurchase agreement, recovery of the repurchase price owed to the Fund may be delayed. Such an insolvency also may result in a loss to the extent that the value of the purchased securities decreases during the delay or that value has otherwise not been maintained at an amount at least equal to the repurchase price.

O Reverse Repurchase Agreements — Under a reverse repurchase agreement, the Fund temporarily transfers possession of a portfolio security to another party, such as a bank or broker/dealer, in return for cash. At the same time, the Fund agrees to repurchase the security at an agreed upon time and price, which reflects an interest payment. Because the Fund retains effective control over the transferred security, the transaction is accounted for as a secured borrowing. The Fund may enter into such agreements when it is able to invest the cash acquired at a rate higher than the cost of the agreement, which would increase earned income. When the Fund enters into a reverse repurchase agreement, any fluctuations in the market value of either the securities transferred to another party or the securities in which the proceeds may be invested would affect the market value of the Fund’s assets. Because reverse repurchase agreements may be considered to be the practical equivalent of borrowing funds, they constitute a form of leverage. The Fund segregates cash or liquid assets equal to its obligation to repurchase the security during the term of the agreement. In the event the counterparty to a reverse repurchase agreement becomes insolvent, recovery of the security transferred by the Fund may be delayed or the Fund may incur a loss equal to the amount by which the value of the security transferred by the Fund exceeds the repurchase price payable by the Fund.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make at least one distribution annually (normally in December) of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on the ex-dividend date. Shareholders may reinvest income and capital gain distributions in additional shares of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the years ended July 31, 2015 and July 31, 2014 was as follows:

| | | | | | | | |

| | | Year Ended July 31, | |

| | | 2015 | | | 2014 | |

| | |

Distributions declared from: | | | | | | | | |

Ordinary income | | $ | 1,845,761 | | | $ | 482,711 | |

Long-term capital gains | | $ | — | | | $ | 46,393 | |

During the year ended July 31, 2015, accumulated net realized loss was decreased by $935,144, accumulated undistributed net investment income was decreased by $922,781 and paid-in capital was decreased by $12,363 due to differences between book and tax accounting, primarily for foreign currency

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Notes to Financial Statements — continued

gain (loss), foreign capital gains taxes, swap contracts, premium amortization, accretion of market discount and investments in partnerships. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of July 31, 2015, the components of distributable earnings (accumulated losses) and unrealized appreciation (depreciation) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 398,338 | |

Deferred capital losses | | $ | (1,316,239 | ) |

Net unrealized depreciation | | $ | (3,047,958 | ) |

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to foreign currency transactions, futures contracts, investments in partnerships, tax straddle transactions, premium amortization and accretion of market discount.

At July 31, 2015, the Fund, for federal income tax purposes, had deferred capital losses of $1,316,239 which will reduce its taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. The deferred capital losses are treated as arising on the first day of the Fund’s next taxable year and retain the same short-term or long-term character as when originally deferred. Of the deferred capital losses at July 31, 2015, $900,760 are short-term and $415,479 are long-term.

The cost and unrealized appreciation (depreciation) of investments of the Fund at July 31, 2015, as determined on a federal income tax basis, were as follows:

| | | | |

| |

Aggregate cost | | $ | 50,171,625 | |

| |

Gross unrealized appreciation | | $ | 4,393,805 | |

Gross unrealized depreciation | | | (7,172,077 | ) |

| |

Net unrealized depreciation | | $ | (2,778,272 | ) |

3 Investment Adviser and Administration Fee and Other Transactions with Affiliates

The investment adviser and administration fee is earned by EVM as compensation for investment advisory and administrative services rendered to the Fund. The fee is computed at an annual rate of 0.65% of the Fund’s average daily net assets up to $500 million and is payable monthly. On net assets of $500 million and over, the annual fee is reduced. For the year ended July 31, 2015, the Fund’s investment adviser and administration fee amounted to $319,364 or 0.65% of the Fund’s average daily net assets. The Fund invests its cash in Cash Reserves Fund. EVM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

EVM has agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceed 0.85% of the Fund’s average daily net assets. This agreement may be changed or terminated after November 30, 2016. Pursuant to this agreement, EVM was allocated $213,135 of the Fund’s operating expenses for the year ended July 31, 2015.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended July 31, 2015, EVM earned $12 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations.

Directors and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser and administration fee. Directors of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Directors Deferred Compensation Plan. For the year ended July 31, 2015, no significant amounts have been deferred. Certain officers and Directors of the Fund are officers of EVM.

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $31,149,736 and $24,921,322, respectively, for the year ended July 31, 2015.

Eaton Vance

Emerging Markets Debt Opportunities Fund

July 31, 2015

Notes to Financial Statements — continued

5 Common Shares

The Corporation’s Articles of Incorporation permit the Directors to issue one billion full and fractional common shares of the Fund ($0.001 par value per share). Transactions in Fund shares were as follows:

| | | | | | | | |

| | | Year Ended July 31, | |

| | | 2015 | | | 2014 | |

| | |

Sales | | | — | | | | 5,107,252 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 208,561 | | | | 56,228 | |

Redemptions | | | — | | | | (1,566,228 | ) |

| | |

Net increase | | | 208,561 | | | | 3,597,252 | |

At July 31, 2015, Eaton Vance Short Duration Strategic Income Fund owned 100% of the outstanding shares of the Fund.

6 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities. These financial instruments may include forward foreign currency exchange contracts, non-deliverable bond forward contracts, financial futures contracts and swap contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and do not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered.

A summary of obligations under these financial instruments at July 31, 2015 is as follows:

| | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | |

| | | | | | |

| | | | | | | | | | | | | | | | | | |

| Settlement Date | | Deliver | | In Exchange For | | Counterparty | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | | | Net Unrealized

Appreciation

(Depreciation) | |

| | | | | | |

| 8/4/15 | | Brazilian Real

512,000 | | United States Dollar

150,854 | | BNP Paribas | | $ | 1,320 | | | $ | — | | | $ | 1,320 | |

| 8/4/15 | | Brazilian Real

796,000 | | United States Dollar

245,467 | | Morgan Stanley & Co. International PLC | | | 12,987 | | | | — | | | | 12,987 | |

| 8/4/15 | | Brazilian Real

1,242,000 | | United States Dollar

365,940 | | Morgan Stanley & Co. International PLC | | | 3,201 | | | | — | | | | 3,201 | |

| 8/4/15 | | Brazilian Real

1,537,000 | | United States Dollar

477,552 | | Standard Chartered Bank | | | 28,655 | | | | — | | | | 28,655 | |

| 8/4/15 | | Brazilian Real

1,821,000 | | United States Dollar

536,535 | | Standard Chartered Bank | | | 4,693 | | | | — | | | | 4,693 | |

| 8/4/15 | | Brazilian Real

1,242,000 | | United States Dollar

364,758 | | Standard Chartered Bank | | | 2,019 | | | | — | | | | 2,019 | |

| 8/4/15 | | Euro

667,953 | | Polish Zloty

2,771,673 | | BNP Paribas | | | 1,202 | | | | — | | | | 1,202 | |

| 8/4/15 | | Polish Zloty

929,673 | | Euro

224,431 | | BNP Paribas | | | 21 | | | | — | | | | 21 | |

| 8/4/15 | | Polish Zloty

1,842,000 | | Euro