UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22714

Eaton Vance Series Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

July 31

Date of Fiscal Year End

January 31, 2018

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Emerging Markets Debt Opportunities Fund

Semiannual Report

January 31, 2018

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund is considered to be a commodity pool operator under CFTC regulations. The Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor. The CFTC has neither reviewed nor approved the Fund’s investment strategies.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Semiannual Report January 31, 2018

Eaton Vance

Emerging Markets Debt Opportunities Fund

Table of Contents

| | | | |

Performance | | | 2 | |

| |

Fund Profile | | | 2 | |

| |

Endnotes and Additional Disclosures | | | 3 | |

| |

Fund Expenses | | | 4 | |

| |

Financial Statements | | | 5 | |

| |

Officers and Directors | | | 28 | |

| |

Important Notices | | | 29 | |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Performance1,2

Portfolio Managers John R. Baur, Michael A. Cirami, CFA and Eric A. Stein, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Since

Inception | |

Class A at NAV | | | 09/03/2015 | | | | 02/04/2013 | | | | 6.46 | % | | | 13.70 | % | | | — | | | | 3.65 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | — | | | | 1.42 | | | | 8.28 | | | | — | | | | 2.64 | |

Class I at NAV | | | 09/03/2015 | | | | 02/04/2013 | | | | 6.59 | | | | 14.09 | | | | — | | | | 3.83 | |

Class R6 at NAV | | | 02/04/2013 | | | | 02/04/2013 | | | | 6.62 | | | | 14.17 | | | | — | | | | 3.79 | |

JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified | | | — | | | | — | | | | 6.86 | % | | | 17.72 | % | | | –0.82 | % | | | –0.89 | % |

Blended Index | | | — | | | | — | | | | 4.70 | | | | 12.65 | | | | 1.98 | | | | 1.98 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | Class A | | | Class I | | | Class R6 | |

Gross | | | | | | | | | | | | | | | 1.50 | % | | | 1.25 | % | | | 1.20 | % |

Net | | | | | | | | | | | | | | | 1.15 | | | | 0.90 | | | | 0.85 | |

Fund Profile

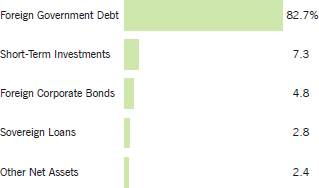

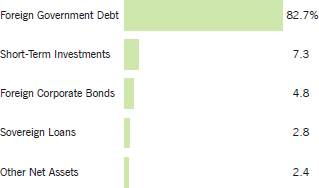

Asset Allocation (% of net assets)4

Foreign Currency Exposure (% of net assets)5

| | | | | | | | | | | | |

Egypt | | | 9.5 | % | | | | Uruguay | | | 3.9 | % |

| | | | |

Sri Lanka | | | 9.1 | | | | | India | | | 3.8 | |

| | | | |

Serbia | | | 7.3 | | | | | Peru | | | 3.5 | |

| | | | |

Dominican Republic | | | 6.8 | | | | | Indonesia | | | 3.1 | |

| | | | |

Russia | | | 6.8 | | | | | Ukraine | | | 2.1 | |

| | | | |

Nigeria | | | 6.0 | | | | | Uganda | | | 1.1 | |

| | | | |

Argentina | | | 4.2 | | | | | Other | | | 1.4 | * |

| | | | |

Turkey | | | 4.1 | | | | | Euro | | | –7.8 | |

| | | | |

Kazakhstan | | | 4.0 | | | | | Total Long | | | 84.6 | |

| | | | |

Georgia | | | 4.0 | | | | | Total Short | | | –7.8 | |

| | | | |

Colombia | | | 3.9 | | | | | Total Net | | | 76.8 | |

| * | Includes amounts each less than 1.0%. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Endnotes and Additional Disclosures

| 1 | JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified is an unmanaged index of local-currency bonds with maturities of more than one year issued by emerging markets governments. JPMorgan Emerging Market Bond Index (EMBI) Global Diversified is a market-cap weighted index that measures USD-denominated Brady Bonds, Eurobonds, and traded loans issued by sovereign entities. JPMorgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified is an unmanaged index of USD-denominated emerging market corporate bonds. The Blended Index consists of 50% JPMorgan Government Bond Index: Emerging Market (JPM GBI-EM) Global Diversified, 25% JPMorgan Emerging Market Bond Index (EMBI) Global Diversified and 25% JPMorgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at net asset value (NAV) do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. |

| | Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class A and Class I is linked to Class R6. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. Performance presented in the Financial Highlights included in the financial statements is not linked. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 11/30/18. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 4 | Other Net Assets represents other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

| 5 | Currency exposures include all foreign exchange denominated assets, currency derivatives and commodities (including commodity derivatives). Total exposures may exceed 100% due to implicit leverage created by derivatives. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2017 – January 31, 2018).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

(8/1/17) | | | Ending Account Value

(1/31/18) | | | Expenses Paid During Period*

(8/1/17 – 1/31/18) | | | Annualized Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,064.60 | | | $ | 5.98 | ** | | | 1.15 | % |

Class I | | $ | 1,000.00 | | | $ | 1,065.90 | | | $ | 4.69 | ** | | | 0.90 | % |

Class R6 | | $ | 1,000.00 | | | $ | 1,066.20 | | | $ | 4.43 | ** | | | 0.85 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,019.40 | | | $ | 5.85 | ** | | | 1.15 | % |

Class I | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.58 | ** | | | 0.90 | % |

Class R6 | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 4.33 | ** | | | 0.85 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2017. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited)

| | | | | | | | | | | | |

| Foreign Government Bonds — 54.2% | |

| | | |

| | | | | | | | | | | | |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Albania — 0.6% | |

Albania Government Bond, 8.90%, 7/24/25 | | | ALL | | | | 52,000 | | | $ | 546,260 | |

Albania Government Bond, 8.93%, 4/23/25 | | | ALL | | | | 4,735 | | | | 49,864 | |

| | | | | | | | | | | | | |

Total Albania | | | $ | 596,124 | |

| | | | | | | | | | | | | |

|

| Argentina — 0.5% | |

Argentina POM Politica Monetaria, 27.778%, (ARPP7DRR), 6/21/20(1) | | | ARS | | | | 8,700 | | | $ | 483,700 | |

| | | | | | | | | | | | | |

Total Argentina | | | $ | 483,700 | |

| | | | | | | | | | | | | |

|

| Barbados — 1.6% | |

Barbados Government International Bond, 6.625%, 12/5/35(2) | | | USD | | | | 1,110 | | | $ | 836,662 | |

Barbados Government International Bond, 7.00%, 8/4/22(2) | | | USD | | | | 116 | | | | 97,300 | |

Barbados Government International Bond, 7.25%, 12/15/21(2) | | | USD | | | | 684 | | | | 601,920 | |

| | | | | | | | | | | | | |

Total Barbados | | | $ | 1,535,882 | |

| | | | | | | | | | | | | |

|

| Bosnia and Herzegovina — 0.4% | |

Republic of Srpska, 1.50%, 10/30/23 | | | BAM | | | | 292 | | | $ | 173,041 | |

Republic of Srpska, 1.50%, 6/9/25 | | | BAM | | | | 78 | | | | 45,624 | |

Republic of Srpska, 1.50%, 9/25/26 | | | BAM | | | | 379 | | | | 217,771 | |

| | | | | | | | | | | | | |

Total Bosnia and Herzegovina | | | $ | 436,436 | |

| | | | | | | | | | | | | |

|

| Dominican Republic — 6.6% | |

Dominican Republic,

10.40%, 5/10/19(2) | | | DOP | | | | 151,200 | | | $ | 3,234,486 | |

Dominican Republic,

15.00%, 4/5/19(2) | | | DOP | | | | 70,000 | | | | 1,572,595 | |

Dominican Republic,

16.00%, 7/10/20(2) | | | DOP | | | | 71,100 | | | | 1,730,027 | |

| | | | | | | | | | | | | |

Total Dominican Republic | | | $ | 6,537,108 | |

| | | | | | | | | | | | | |

|

| El Salvador — 5.3% | |

Republic of El Salvador, 5.875%, 1/30/25(2) | | | USD | | | | 32 | | | $ | 32,240 | |

Republic of El Salvador, 6.375%, 1/18/27(2) | | | USD | | | | 2,094 | | | | 2,148,967 | |

Republic of El Salvador, 7.375%, 12/1/19(2) | | | USD | | | | 1,900 | | | | 2,002,125 | |

Republic of El Salvador, 7.65%, 6/15/35(2) | | | USD | | | | 109 | | | | 120,173 | |

Republic of El Salvador, 7.75%, 1/24/23(2) | | | USD | | | | 61 | | | | 67,361 | |

Republic of El Salvador, 8.25%, 4/10/32(2) | | | USD | | | | 461 | | | | 538,218 | |

Republic of El Salvador, 8.625%, 2/28/29(2) | | | USD | | | | 245 | | | | 289,100 | |

| | | | | | | | | | | | | |

Total El Salvador | | | $ | 5,198,184 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Ethiopia — 0.3% | |

Federal Democratic Republic of Ethiopia, 6.625%, 12/11/24(2) | | | USD | | | | 270 | | | $ | 285,981 | |

| | | | | | | | | | | | | |

Total Ethiopia | | | $ | 285,981 | |

| | | | | | | | | | | | | |

|

| Fiji — 2.7% | |

Republic of Fiji, 6.625%, 10/2/20(2) | | | USD | | | | 2,649 | | | $ | 2,641,011 | |

| | | | | | | | | | | | | |

Total Fiji | | | $ | 2,641,011 | |

| | | | | | | | | | | | | |

|

| Georgia — 2.7% | |

Georgia Treasury Bond, 6.75%, 10/6/18 | | | GEL | | | | 75 | | | $ | 29,932 | |

Georgia Treasury Bond, 8.00%, 6/9/18 | | | GEL | | | | 321 | | | | 128,915 | |

Georgia Treasury Bond, 10.50%, 2/5/25 | | | GEL | | | | 966 | | | | 430,364 | |

Georgia Treasury Bond, 11.75%, 4/28/21 | | | GEL | | | | 1,746 | | | | 781,151 | |

Georgia Treasury Bond, 13.375%, 3/10/18 | | | GEL | | | | 1,270 | | | | 512,123 | |

Georgia Treasury Bond, 14.375%, 7/16/20 | | | GEL | | | | 1,689 | | | | 778,903 | |

| | | | | | | | | | | | | |

Total Georgia | | | $ | 2,661,388 | |

| | | | | | | | | | | | | |

|

| India — 3.1% | |

India Government Bond, 6.79%, 5/15/27 | | | INR | | | | 23,000 | | | $ | 342,557 | |

India Government Bond, 7.88%, 3/19/30 | | | INR | | | | 88,000 | | | | 1,392,905 | |

India Government Bond, 7.95%, 8/28/32 | | | INR | | | | 86,000 | | | | 1,368,411 | |

| | | | | | | | | | | | | |

Total India | | | $ | 3,103,873 | |

| | | | | | | | | | | | | |

|

| Indonesia — 3.6% | |

Indonesia Government Bond, 8.25%, 5/15/36 | | | IDR | | | | 920,000 | | | $ | 77,477 | |

Indonesia Government Bond, 8.75%, 5/15/31 | | | IDR | | | | 40,094,000 | | | | 3,476,800 | |

| | | | | | | | | | | | | |

Total Indonesia | | | $ | 3,554,277 | |

| | | | | | | | | | | | | |

|

| Peru — 3.4% | |

Peru Government Bond, 6.35%, 8/12/28 | | | PEN | | | | 2,758 | | | $ | 975,871 | |

Peru Government Bond, 8.20%, 8/12/26 | | | PEN | | | | 5,998 | | | | 2,369,370 | |

| | | | | | | | | | | | | |

Total Peru | | | $ | 3,345,241 | |

| | | | | | | | | | | | | |

|

| Russia — 2.8% | |

Russia Government Bond, 7.70%, 3/23/33 | | | RUB | | | | 150,000 | | | $ | 2,743,987 | |

| | | | | | | | | | | | | |

Total Russia | | | $ | 2,743,987 | |

| | | | | | | | | | | | | |

|

| Serbia — 8.2% | |

Serbia Treasury Bond, 5.75%, 7/21/23 | | | RSD | | | | 227,010 | | | $ | 2,547,415 | |

Serbia Treasury Bond, 10.00%, 3/20/21 | | | RSD | | | | 184,850 | | | | 2,263,840 | |

Serbia Treasury Bond, 10.00%, 2/5/22 | | | RSD | | | | 254,500 | | | | 3,231,593 | |

| | | | | | | | | | | | | |

Total Serbia | | | $ | 8,042,848 | |

| | | | | | | | | | | | | |

| | | | |

| | 5 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Seychelles — 0.3% | |

Republic of Seychelles, 8.00%, 1/1/26(2) | | | USD | | | | 284 | | | $ | 299,234 | |

| | | | | | | | | | | | | |

Total Seychelles | | | $ | 299,234 | |

| | | | | | | | | | | | | |

|

| Sri Lanka — 8.8% | |

Sri Lanka Government Bond, 8.50%, 5/1/19 | | | LKR | | | | 57,000 | | | $ | 367,666 | |

Sri Lanka Government Bond, 10.00%, 10/1/22 | | | LKR | | | | 78,020 | | | | 517,325 | |

Sri Lanka Government Bond, 10.25%, 3/15/25 | | | LKR | | | | 116,760 | | | | 777,535 | |

Sri Lanka Government Bond, 10.60%, 9/15/19 | | | LKR | | | | 59,000 | | | | 392,083 | |

Sri Lanka Government Bond, 10.75%, 3/1/21 | | | LKR | | | | 22,000 | | | | 148,253 | |

Sri Lanka Government Bond, 11.00%, 8/1/21 | | | LKR | | | | 93,000 | | | | 634,228 | |

Sri Lanka Government Bond, 11.00%, 8/1/24 | | | LKR | | | | 79,000 | | | | 548,086 | |

Sri Lanka Government Bond, 11.00%, 6/1/26 | | | LKR | | | | 137,970 | | | | 960,932 | |

Sri Lanka Government Bond, 11.00%, 5/15/30 | | | LKR | | | | 53,000 | | | | 370,300 | |

Sri Lanka Government Bond, 11.20%, 9/1/23 | | | LKR | | | | 21,000 | | | | 146,412 | |

Sri Lanka Government Bond, 11.40%, 1/1/24 | | | LKR | | | | 82,000 | | | | 573,800 | |

Sri Lanka Government Bond, 11.50%, 12/15/21 | | | LKR | | | | 69,000 | | | | 479,606 | |

Sri Lanka Government Bond, 11.50%, 5/15/23 | | | LKR | | | | 50,000 | | | | 349,037 | |

Sri Lanka Government Bond, 11.50%, 8/1/26 | | | LKR | | | | 131,000 | | | | 941,376 | |

Sri Lanka Government Bond, 11.50%, 9/1/28 | | | LKR | | | | 210,420 | | | | 1,515,177 | |

| | | | | | | | | | | | | |

Total Sri Lanka | | | $ | 8,721,816 | |

| | | | | | | | | | | | | |

|

| Suriname — 1.4% | |

Republic of Suriname, 9.25%, 10/26/26(2) | | | USD | | | | 1,329 | | | $ | 1,408,740 | |

| | | | | | | | | | | | | |

Total Suriname | | | $ | 1,408,740 | |

| | | | | | | | | | | | | |

|

| Thailand — 1.6% | |

Thailand Government Bond, 1.25%, 3/12/28(2)(3) | | | THB | | | | 51,681 | | | $ | 1,616,231 | |

| | | | | | | | | | | | | |

Total Thailand | | | $ | 1,616,231 | |

| | | | | | | | | | | | | |

|

| Uruguay — 0.3% | |

Republic of Uruguay, 8.50%, 3/15/28(2) | | | UYU | | | | 7,458 | | | $ | 257,410 | |

| | | | | | | | | | | | | |

Total Uruguay | | | $ | 257,410 | |

| | | | | | | | | | | | | |

| |

Total Foreign Government Bonds

(identified cost $50,840,344) | | | $ | 53,469,471 | |

| | | | | | | | | | | | |

| Foreign Corporate Bonds — 4.8% | |

|

| |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Argentina — 1.8% | |

Banco Hipotecario SA, 23.708%, (Badlar + 2.50%), 1/12/20(1)(2) | | | ARS | | | | 19,880 | | | $ | 998,334 | |

YPF SA, 27.125%, (Badlar + 4.00%), 7/7/20(1)(2) | | | USD | | | | 990 | | | | 882,456 | |

| | | | | | | | | | | | | |

Total Argentina | | | $ | 1,880,790 | |

| | | | | | | | | | | | | |

|

| Belarus — 0.6% | |

Eurotorg, LLC Via Bonitron DAC, 8.75%, 10/30/22(2) | | | USD | | | | 500 | | | $ | 520,000 | |

| | | | | | | | | | | | | |

Total Belarus | | | $ | 520,000 | |

| | | | | | | | | | | | | |

|

| Bulgaria — 0.6% | |

Eurohold Bulgaria AD,

6.50%, 12/7/22(2) | | | EUR | | | | 500 | | | $ | 613,418 | |

| | | | | | | | | | | | | |

Total Bulgaria | | | $ | 613,418 | |

| | | | | | | | | | | | | |

|

| Georgia — 0.5% | |

Bank of Georgia JSC,

11.00%, 6/1/18 | | | GEL | | | | 640 | | | $ | 256,962 | |

Bank of Georgia JSC,

11.00%, 6/1/20(2) | | | GEL | | | | 500 | | | | 202,376 | |

| | | | | | | | | | | | | |

Total Georgia | | | $ | 459,338 | |

| | | | | | | | | | | | | |

|

| Honduras — 0.4% | |

Inversiones Atlantida SA, 8.25%, 7/28/22(2) | | | USD | | | | 340 | | | $ | 351,900 | |

| | | | | | | | | | | | | |

Total Honduras | | | $ | 351,900 | |

| | | | | | | | | | | | | |

|

| India — 0.1% | |

Power Finance Corp., Ltd., 7.47%, 9/16/21 | | | INR | | | | 4,000 | | | $ | 61,947 | |

Power Finance Corp., Ltd., 7.75%, 3/22/27 | | | INR | | | | 4,000 | | | | 62,896 | |

| | | | | | | | | | | | | |

Total India | | | $ | 124,843 | |

| | | | | | | | | | | | | |

|

| Indonesia — 0.2% | |

Jasa Marga (Persero) Tbk PT, 7.50%, 12/11/20(2) | | | IDR | | | | 2,720,000 | | | $ | 206,317 | |

| | | | | | | | | | | | | |

Total Indonesia | | | $ | 206,317 | |

| | | | | | | | | | | | | |

|

| Mexico — 0.6% | |

Cydsa SAB de CV, 6.25%, 10/4/27(2) | | | USD | | | | 500 | | | $ | 505,272 | |

Petroleos Mexicanos,

7.19%, 9/12/24(4) | | | MXN | | | | 1,420 | | | | 68,490 | |

Petroleos Mexicanos, 7.65%, 11/24/21 | | | MXN | | | | 420 | | | | 21,666 | |

| | | | | | | | | | | | | |

Total Mexico | | | $ | 595,428 | |

| | | | | | | | | | | | | |

| |

Total Foreign Corporate Bonds

(identified cost $5,212,978) | | | $ | 4,752,034 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Sovereign Loans — 3.2% | |

| | | |

| | | | | | | | | | | | |

| Borrower | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Barbados — 0.9% | |

Government of Barbados, Term Loan, 11.78%, (6 mo. USD LIBOR + 10.00%), Maturing December 20, 2019(1)(5) | | | USD | | | | 880 | | | $ | 874,877 | |

| | | | | | | | | | | | | |

Total Barbados | | | $ | 874,877 | |

| | | | | | | | | | | | | |

|

| Ethiopia — 0.2% | |

Ethiopian Railways Corporation (Federal Democratic Republic of Ethiopia guaranteed), Term Loan, 5.21%, (6 mo. USD LIBOR + 3.75%), Maturing August 1, 2021(1)(5) | | | USD | | | | 178 | | | $ | 174,844 | |

| | | | | | | | | | | | | |

Total Ethiopia | | | $ | 174,844 | |

| | | | | | | | | | | | | |

|

| Kenya — 0.1% | |

Government of Kenya, Term Loan, 6.53%, (6 mo. USD LIBOR + 5.00%), Maturing April 18, 2019(1) | | | USD | | | | 90 | | | $ | 90,000 | |

| | | | | | | | | | | | | |

Total Kenya | | | $ | 90,000 | |

| | | | | | | | | | | | | |

|

| Macedonia — 1.3% | |

Republic of Macedonia, Term Loan, 3.94%, (6 mo. EURIBOR + 4.50%), Maturing December 16, 2022(1)(6) | | | EUR | | | | 1,000 | | | $ | 1,280,544 | |

| | | | | | | | | | | | | |

Total Macedonia | | | $ | 1,280,544 | |

| | | | | | | | | | | | | |

|

| Tanzania — 0.7% | |

Government of the United Republic of Tanzania, Term Loan, 7.03%, (6 mo. USD LIBOR + 5.20%), Maturing June 23, 2022(1)(5) | | | USD | | | | 725 | | | $ | 739,018 | |

| | | | | | | | | | | | | |

Total Tanzania | | | $ | 739,018 | |

| | | | | | | | | | | | | |

| |

Total Sovereign Loans

(identified cost $2,935,701) | | | $ | 3,159,283 | |

|

| Short-Term Investments — 35.8% | |

|

| Foreign Government Securities — 28.5% | |

| | | |

| | | | | | | | | | | | |

| Security | | Principal Amount (000’s omitted) | | | Value | |

|

| Argentina — 2.8% | |

Banco Central Del Argentina, 0.00%, 2/21/18 | | | ARS | | | | 25,225 | | | $ | 1,266,016 | |

Banco Central Del Argentina, 0.00%, 3/21/18 | | | ARS | | | | 2,950 | | | | 145,265 | |

Banco Central Del Argentina, 0.00%, 4/18/18 | | | ARS | | | | 25,890 | | | | 1,249,504 | |

| | | | | | | | | | | | | |

Total Argentina | | | $ | 2,660,785 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Security | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Egypt — 10.0% | |

Egypt Treasury Bill, 0.00%, 2/6/18 | | | EGP | | | | 2,250 | | | $ | 127,532 | |

Egypt Treasury Bill, 0.00%, 2/13/18 | | | EGP | | | | 2,000 | | | | 112,527 | |

Egypt Treasury Bill, 0.00%, 2/20/18 | | | EGP | | | | 1,875 | | | | 105,627 | |

Egypt Treasury Bill, 0.00%, 4/10/18 | | | EGP | | | | 13,050 | | | | 719,781 | |

Egypt Treasury Bill, 0.00%, 4/17/18 | | | EGP | | | | 7,625 | | | | 419,205 | |

Egypt Treasury Bill, 0.00%, 4/24/18 | | | EGP | | | | 14,575 | | | | 792,922 | |

Egypt Treasury Bill, 0.00%, 5/1/18 | | | EGP | | | | 11,050 | | | | 599,187 | |

Egypt Treasury Bill, 0.00%, 5/8/18 | | | EGP | | | | 7,625 | | | | 415,180 | |

Egypt Treasury Bill, 0.00%, 5/15/18 | | | EGP | | | | 45,800 | | | | 2,467,494 | |

Egypt Treasury Bill, 0.00%, 5/22/18 | | | EGP | | | | 5,525 | | | | 296,709 | |

Egypt Treasury Bill, 0.00%, 5/29/18 | | | EGP | | | | 6,175 | | | | 330,560 | |

Egypt Treasury Bill, 0.00%, 6/5/18 | | | EGP | | | | 22,425 | | | | 1,196,652 | |

Egypt Treasury Bill, 0.00%, 7/17/18 | | | EGP | | | | 25,925 | | | | 1,360,782 | |

Egypt Treasury Bill, 0.00%, 7/24/18 | | | EGP | | | | 17,650 | | | | 921,593 | |

| | | | | | | | | | | | | |

Total Egypt | | | $ | 9,865,751 | |

| | | | | | | | | | | | | |

|

| Georgia — 0.7% | |

Georgia Treasury Bill, 0.00%, 2/1/18 | | | GEL | | | | 250 | | | $ | 100,180 | |

Georgia Treasury Bill, 0.00%, 4/5/18 | | | GEL | | | | 100 | | | | 39,575 | |

Georgia Treasury Bill, 0.00%, 5/3/18 | | | GEL | | | | 139 | | | | 54,709 | |

Georgia Treasury Bill, 0.00%, 5/10/18 | | | GEL | | | | 240 | | | | 94,326 | |

Georgia Treasury Bill, 0.00%, 6/14/18 | | | GEL | | | | 165 | | | | 64,410 | |

Georgia Treasury Bill, 0.00%, 7/19/18 | | | GEL | | | | 569 | | | | 220,587 | |

Georgia Treasury Bill, 0.00%, 12/6/18 | | | GEL | | | | 410 | | | | 154,691 | |

| | | | | | | | | | | | | |

Total Georgia | | | $ | 728,478 | |

| | | | | | | | | | | | | |

|

| Kazakhstan — 5.4% | |

National Bank of Kazakhstan Note, 0.00%, 2/14/18 | | | KZT | | | | 156,000 | | | $ | 481,092 | |

National Bank of Kazakhstan Note, 0.00%, 3/16/18 | | | KZT | | | | 71,211 | | | | 217,972 | |

National Bank of Kazakhstan Note, 0.00%, 6/1/18 | | | KZT | | | | 515,140 | | | | 1,547,890 | |

National Bank of Kazakhstan Note, 0.00%, 7/27/18 | | | KZT | | | | 961,878 | | | | 2,855,588 | |

National Bank of Kazakhstan Note, 0.00%, 1/18/19 | | | KZT | | | | 81,000 | | | | 231,393 | |

| | | | | | | | | | | | | |

Total Kazakhstan | | | $ | 5,333,935 | |

| | | | | | | | | | | | | |

|

| Nigeria — 6.0% | |

Nigeria Treasury Bill, 0.00%, 3/15/18 | | | NGN | | | | 33,190 | | | $ | 90,460 | |

Nigeria Treasury Bill, 0.00%, 4/5/18 | | | NGN | | | | 97,110 | | | | 262,448 | |

Nigeria Treasury Bill, 0.00%, 4/12/18 | | | NGN | | | | 215,930 | | | | 582,137 | |

Nigeria Treasury Bill, 0.00%, 4/19/18 | | | NGN | | | | 165,950 | | | | 446,314 | |

Nigeria Treasury Bill, 0.00%, 5/3/18 | | | NGN | | | | 199,900 | | | | 534,559 | |

Nigeria Treasury Bill, 0.00%, 6/7/18 | | | NGN | | | | 694,870 | | | | 1,830,889 | |

Nigeria Treasury Bill, 0.00%, 6/28/18 | | | NGN | | | | 45,485 | | | | 118,747 | |

Nigeria Treasury Bill, 0.00%, 7/5/18 | | | NGN | | | | 80,110 | | | | 208,489 | |

Nigeria Treasury Bill, 0.00%, 7/12/18 | | | NGN | | | | 29,130 | | | | 75,600 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Security | | Principal Amount (000’s omitted) | | | Value | |

| | | | | | | | | | | | |

|

| Nigeria (continued) | |

Nigeria Treasury Bill, 0.00%, 7/19/18 | | | NGN | | | | 39,400 | | | $ | 101,969 | |

Nigeria Treasury Bill, 0.00%, 8/9/18 | | | NGN | | | | 90,971 | | | | 233,477 | |

Nigeria Treasury Bill, 0.00%, 8/16/18 | | | NGN | | | | 9,430 | | | | 24,135 | |

Nigeria Treasury Bill, 0.00%, 9/13/18 | | | NGN | | | | 49,500 | | | | 125,385 | |

Nigeria Treasury Bill, 0.00%, 9/20/18 | | | NGN | | | | 47,130 | | | | 119,051 | |

Nigeria Treasury Bill, 0.00%, 9/20/18 | | | NGN | | | | 81,039 | | | | 204,549 | |

Nigeria Treasury Bill, 0.00%, 9/27/18 | | | NGN | | | | 49,552 | | | | 124,727 | |

Nigeria Treasury Bill, 0.00%, 10/4/18 | | | NGN | | | | 40,519 | | | | 101,786 | |

Nigeria Treasury Bill, 0.00%, 10/18/18 | | | NGN | | | | 23,154 | | | | 57,843 | |

Nigeria Treasury Bill, 0.00%, 11/1/18 | | | NGN | | | | 91,733 | | | | 227,906 | |

Nigeria Treasury Bill, 0.00%, 1/17/19 | | | NGN | | | | 173,655 | | | | 418,704 | |

| | | | | | | | | | | | | |

Total Nigeria | | | $ | 5,889,175 | |

| | | | | | | | | | | | | |

|

| Uruguay — 3.6% | |

Banco Central Del Uruguay, 0.00%, 4/27/18 | | | UYU | | | | 23,554 | | | $ | 812,642 | |

Uruguay Treasury Bill, 0.00%, 3/28/18 | | | UYU | | | | 36,916 | | | | 1,283,602 | |

Uruguay Treasury Bill, 0.00%, 4/5/18 | | | UYU | | | | 20,403 | | | | 709,802 | |

Uruguay Treasury Bill, 0.00%, 6/1/18 | | | UYU | | | | 1,538 | | | | 52,534 | |

Uruguay Treasury Bill, 0.00%, 6/29/18 | | | UYU | | | | 1,887 | | | | 63,973 | |

Uruguay Treasury Bill, 0.00%, 9/21/18 | | | UYU | | | | 963 | | | | 32,141 | |

Uruguay Treasury Bill, 0.00%, 10/19/18 | | | UYU | | | | 18,403 | | | | 605,152 | |

| | | | | | | | | | | | | |

Total Uruguay | | | $ | 3,559,846 | |

| | | | | | | | | | | | | |

| |

Total Foreign Government Securities

(identified cost $28,054,897) | | | $ | 28,037,970 | |

|

| U.S. Treasury Obligations — 1.6% | |

| | | |

| | | | | | | | | | | | |

| Security | | Principal Amount (000’s omitted) | | | Value | |

U.S. Treasury Bill, 0.00%, 3/1/18(7) | | | | | | $ | 1,000 | | | $ | 998,924 | |

U.S. Treasury Bill, 0.00%, 5/24/18(7) | | | | | | | 600 | | | | 597,275 | |

| | | | | | | | | | | | | |

| |

Total U.S. Treasury Obligations

(identified cost $1,596,268) | | | $ | 1,596,199 | |

| | | | | | | | | | | | |

| Other — 5.7% | |

| | | |

| | | | | | | | | | | | |

| Description | | | Units | | | Value | |

| | | | | | | | | | | | |

Eaton Vance Cash Reserves Fund, LLC, 1.65%(8) | | | | | | | 5,598,084 | | | $ | 5,598,644 | |

| | | | | | | | | | | | | |

| |

Total Other

(identified cost $5,597,932) | | | $ | 5,598,644 | |

| |

Total Short-Term Investments

(identified cost $35,249,097) | | | $ | 35,232,813 | |

| |

Total Investments — 98.0%

(identified cost $94,238,120) | | | $ | 96,613,601 | |

| | | |

Less Unfunded Loan Commitments — (0.4)% | | | | | | | | | | $ | (346,041 | ) |

| | | |

Net Investments — 97.6%

(identified cost $93,892,079) | | | | | | | | | | $ | 96,267,560 | |

| |

Other Assets, Less Liabilities — 2.4% | | | $ | 2,359,610 | |

| |

Net Assets — 100.0% | | | $ | 98,627,170 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Variable rate security. The stated interest rate represents the rate in effect at January 31, 2018. |

| (2) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At January 31, 2018, the aggregate value of these securities is $24,059,854 or 24.4% of the Fund’s net assets. |

| (3) | Inflation-linked security whose principal is adjusted for inflation based on changes in a designated inflation index or inflation rate for the applicable country. Interest is calculated based on the inflation-adjusted principal. |

| (4) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At January 31, 2018, the aggregate value of these securities is $68,490 or 0.1% of the Fund’s net assets. |

| (5) | Loan is subject to scheduled mandatory prepayments. Maturity date shown reflects the final maturity date. |

| (6) | Unfunded or partially unfunded loan commitments. The stated interest rate reflects the weighted average of the reference rate and spread for the funded portion and the commitment fees on the portion of the loan that is unfunded. See Note 1F for description. |

| (7) | Security (or a portion thereof) has been pledged to cover collateral requirements on open derivative contracts. |

| (8) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of January 31, 2018. |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | |

| Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement Date | | | Unrealized Appreciation | | | Unrealized (Depreciation) | |

| | | | | | | |

| EUR | | | 1,676,091 | | | USD | | | 1,995,432 | | | Goldman Sachs International | | | 2/1/18 | | | $ | 85,519 | | | $ | — | |

| EUR | | | 800,995 | | | USD | | | 983,738 | | | Goldman Sachs International | | | 2/1/18 | | | | 10,737 | | | | — | |

| EUR | | | 346,158 | | | USD | | | 428,543 | | | Goldman Sachs International | | | 2/1/18 | | | | 1,229 | | | | — | |

| EUR | | | 2,477,086 | | | USD | | | 3,074,435 | | | Goldman Sachs International | | | 2/1/18 | | | | 990 | | | | — | |

| EUR | | | 555,558 | | | USD | | | 689,530 | | | Goldman Sachs International | | | 2/1/18 | | | | 222 | | | | — | |

| EUR | | | 384,129 | | | USD | | | 477,165 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (250 | ) |

| EUR | | | 174,729 | | | USD | | | 216,865 | | | Standard Chartered Bank | | | 2/1/18 | | | | 70 | | | | — | |

| USD | | | 429,634 | | | EUR | | | 346,158 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (138 | ) |

| USD | | | 476,762 | | | EUR | | | 384,129 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (154 | ) |

| USD | | | 994,155 | | | EUR | | | 800,995 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (320 | ) |

| USD | | | 2,080,280 | | | EUR | | | 1,676,091 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (670 | ) |

| USD | | | 656,947 | | | EUR | | | 555,558 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (32,806 | ) |

| USD | | | 2,929,154 | | | EUR | | | 2,477,086 | | | Goldman Sachs International | | | 2/1/18 | | | | — | | | | (146,271 | ) |

| USD | | | 207,718 | | | EUR | | | 174,729 | | | Standard Chartered Bank | | | 2/1/18 | | | | — | | | | (9,217 | ) |

| RUB | | | 11,000,000 | | | USD | | | 185,717 | | | Bank of America, N.A. | | | 2/6/18 | | | | 9,867 | | | | — | |

| RUB | | | 88,200,000 | | | USD | | | 1,437,887 | | | Bank of America, N.A. | | | 2/9/18 | | | | 129,733 | | | | — | |

| RUB | | | 70,000,000 | | | USD | | | 1,191,692 | | | ICBC Standard Bank plc | | | 2/12/18 | | | | 51,972 | | | | — | |

| RUB | | | 30,000,000 | | | USD | | | 509,165 | | | Morgan Stanley & Co. International PLC | | | 2/12/18 | | | | 23,834 | | | | — | |

| USD | | | 2,724,169 | | | RUB | | | 154,869,000 | | | Standard Chartered Bank | | | 2/12/18 | | | | — | | | | (27,332 | ) |

| COP | | | 293,330,000 | | | USD | | | 96,649 | | | BNP Paribas | | | 2/14/18 | | | | 6,641 | | | | — | |

| COP | | | 293,330,000 | | | USD | | | 96,649 | | | Standard Chartered Bank | | | 2/14/18 | | | | 6,641 | | | | — | |

| USD | | | 732,064 | | | IDR | | | 10,000,000,000 | | | Goldman Sachs International | | | 2/14/18 | | | | — | | | | (15,060 | ) |

| COP | | | 1,461,870,000 | | | USD | | | 483,247 | | | BNP Paribas | | | 2/15/18 | | | | 31,491 | | | | — | |

| COP | | | 1,067,440,000 | | | USD | | | 371,283 | | | Bank of America, N.A. | | | 2/16/18 | | | | 4,550 | | | | — | |

| ARS | | | 24,000,000 | | | USD | | | 1,312,336 | | | BNP Paribas | | | 2/28/18 | | | | — | | | | (106,003 | ) |

| USD | | | 549,602 | | | ARS | | | 10,000,000 | | | BNP Paribas | | | 2/28/18 | | | | 46,963 | | | | — | |

| USD | | | 383,030 | | | ARS | | | 7,042,000 | | | BNP Paribas | | | 2/28/18 | | | | 29,071 | | | | — | |

| USD | | | 378,461 | | | ARS | | | 6,958,000 | | | BNP Paribas | | | 2/28/18 | | | | 28,725 | | | | — | |

| TRY | | | 5,109,000 | | | USD | | | 1,274,185 | | | Goldman Sachs International | | | 3/5/18 | | | | 72,975 | | | | — | |

| TRY | | | 9,000,000 | | | USD | | | 2,274,972 | | | Standard Chartered Bank | | | 3/7/18 | | | | 96,782 | | | | — | |

| COP | | | 6,924,900,000 | | | USD | | | 2,385,429 | | | Standard Chartered Bank | | | 3/12/18 | | | | 48,980 | | | | — | |

| COP | | | 957,540,000 | | | USD | | | 329,845 | | | Standard Chartered Bank | | | 3/12/18 | | | | 6,773 | | | | — | |

| UGX | | | 4,153,500,000 | | | USD | | | 1,120,146 | | | ICBC Standard Bank plc | | | 3/13/18 | | | | 18,605 | | | | — | |

| MXN | | | 7,700,000 | | | USD | | | 392,304 | | | Barclays Bank PLC | | | 3/21/18 | | | | 18,223 | | | | — | |

| MXN | | | 4,249,768 | | | USD | | | 219,632 | | | Goldman Sachs International | | | 3/21/18 | | | | 6,946 | | | | — | |

| INR | | | 50,000,000 | | | USD | | | 779,666 | | | UBS AG | | | 3/26/18 | | | | 1,004 | | | | — | |

| USD | | | 343,695 | | | INR | | | 22,036,000 | | | Deutsche Bank AG | | | 3/26/18 | | | | — | | | | (362 | ) |

| USD | | | 623,199 | | | THB | | | 21,475,447 | | | Deutsche Bank AG | | | 3/26/18 | | | | — | | | | (63,339 | ) |

| USD | | | 780,965 | | | THB | | | 26,936,272 | | | Deutsche Bank AG | | | 3/26/18 | | | | — | | | | (80,148 | ) |

| RUB | | | 2,150,000 | | | USD | | | 37,335 | | | Deutsche Bank AG | | | 4/11/18 | | | | 589 | | | | — | |

| RUB | | | 16,531,000 | | | USD | | | 286,922 | | | Bank of America, N.A. | | | 4/12/18 | | | | 4,636 | | | | — | |

| EUR | | | 1,071,228 | | | RSD | | | 128,000,000 | | | Deutsche Bank AG | | | 4/24/18 | | | | 2,461 | | | | — | |

| TRY | | | 716,199 | | | USD | | | 184,564 | | | Standard Chartered Bank | | | 4/24/18 | | | | 1,544 | | | | — | |

| USD | | | 7,935,459 | | | EUR | | | 6,577,119 | | | Standard Chartered Bank | | | 5/24/18 | | | | — | | | | (292,234 | ) |

| USD | | | 51,935 | | | EUR | | | 42,038 | | | Standard Chartered Bank | | | 6/12/18 | | | | — | | | | (725 | ) |

| USD | | | 51,662 | | | EUR | | | 41,823 | | | Standard Chartered Bank | | | 6/12/18 | | | | — | | | | (728 | ) |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts (continued) | |

Currency

Purchased | | | Currency Sold | | | Counterparty | | Settlement Date | | | Unrealized Appreciation | | | Unrealized (Depreciation) | |

| USD | | | 450,395 | | | EUR | | | 364,400 | | | Standard Chartered Bank | | | 6/14/18 | | | $ | — | | | $ | (6,144 | ) |

| USD | | | 492,317 | | | EUR | | | 398,318 | | | Standard Chartered Bank | | | 6/14/18 | | | | — | | | | (6,716 | ) |

| USD | | | 617,995 | | | EUR | | | 500,000 | | | Standard Chartered Bank | | | 6/14/18 | | | | — | | | | (8,430 | ) |

| USD | | | 482,405 | | | EUR | | | 384,129 | | | Goldman Sachs International | | | 7/12/18 | | | | 175 | | | | — | |

| USD | | | 433,286 | | | EUR | | | 346,158 | | | Goldman Sachs International | | | 7/12/18 | | | | — | | | | (1,275 | ) |

| UAH | | | 29,512,000 | | | USD | | | 1,015,904 | | | Standard Chartered Bank | | | 7/30/18 | | | | 23,018 | | | | — | |

| USD | | | 1,482,397 | | | KZT | | | 480,000,000 | | | Standard Chartered Bank | | | 7/30/18 | | | | 22,119 | | | | — | |

| MAD | | | 810,000 | | | USD | | | 84,375 | | | BNP Paribas | | | 1/22/19 | | | | — | | | | (146 | ) |

| MAD | | | 811,000 | | | USD | | | 85,055 | | | BNP Paribas | | | 1/22/19 | | | | — | | | | (722 | ) |

| TRY | | | 560,801 | | | USD | | | 134,549 | | | Deutsche Bank AG | | | 1/28/19 | | | | — | | | | (209 | ) |

| TRY | | | 561,000 | | | USD | | | 134,565 | | | Standard Chartered Bank | | | 1/28/19 | | | | — | | | | (177 | ) |

| UAH | | | 15,446,000 | | | USD | | | 507,925 | | | Bank of America, N.A. | | | 1/29/19 | | | | 24,165 | | | | — | |

| UAH | | | 18,422,500 | | | USD | | | 628,754 | | | Goldman Sachs International | | | 1/30/19 | | | | 5,791 | | | | — | |

| | | | |

| | | | | | | | | | $ | 823,041 | | | $ | (799,576 | ) |

| | | | | | | | | | | | | | | | | | |

| Futures Contracts | |

| Description | | Number of Contracts | | | Position | | Expiration Month/Year | | | Notional Amount | | | Value/Net

Unrealized Appreciation | |

|

Interest Rate Futures | |

| Euro-Bobl | | | 3 | | | Short | | | Mar-18 | | | $ | (485,880 | ) | | $ | 8,194 | |

| U.S. 5-Year Deliverable Interest Rate Swap | | | 13 | | | Short | | | Mar-18 | | | | (1,260,391 | ) | | | 19,857 | |

| U.S. 10-Year Deliverable Interest Rate Swap | | | 2 | | | Short | | | Mar-18 | | | | (190,375 | ) | | | 5,925 | |

| |

| | | | $ | 33,976 | |

Euro-Bobl: Medium-term debt securities issued by the Federal Republic of Germany with a term to maturity of 4.5 to 5 years.

| | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Interest Rate Swaps | |

| Counterparty | | Notional Amount (000’s omitted) | | | Fund Pays/Receives Floating Rate | | Floating Rate | | Annual Fixed Rate | | | Termination Date | | | Net Unrealized Appreciation

(Depreciation) | |

| | | | | | | |

| CME Group, Inc. | | MXN | | | 184,000 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 7.03

(pays monthly | %

) | | | 8/23/19 | | | $ | (130,887 | ) |

| CME Group, Inc. | | MXN | | | 47,127 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 7.70

(pays monthly | %

) | | | 1/24/20 | | | | (6,729 | ) |

| CME Group, Inc. | | MXN | | | 149,188 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 7.68

(pays monthly | %

) | | | 1/24/20 | | | | (22,798 | ) |

| CME Group, Inc. | | MXN | | | 34,000 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.08

(pays monthly | %

) | | | 4/30/26 | | | | (200,915 | ) |

| CME Group, Inc. | | MXN | | | 24,805 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.09

(pays monthly | %

) | | | 6/30/26 | | | | (148,134 | ) |

| CME Group, Inc. | | MXN | | | 7,639 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.19

(pays monthly | %

) | | | 7/20/26 | | | | (43,603 | ) |

| CME Group, Inc. | | MXN | | | 13,615 | | | Pays | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.19

(pays monthly | %

) | | | 7/20/26 | | | | (77,483 | ) |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Interest Rate Swaps (continued) | |

| Counterparty | | Notional Amount (000’s

omitted) | | | Fund Pays/Receives Floating Rate | | | Floating Rate | | Annual Fixed Rate | | | Termination Date | | | Net Unrealized Appreciation

(Depreciation) | |

| CME Group, Inc. | | MXN | | | 8,550 | | | | Pays | | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.46

(pays monthly | %

) | | | 9/24/26 | | | $ | (41,676 | ) |

| LCH. Clearnet | | EUR | | | 400 | | | | Receives | | | 6-month Euro Interbank Offered Rate (pays semi-annually) | |

| 1.00

(pays annually | %

)(1) | | | 3/21/23 | | | | 4,330 | |

| LCH.Clearnet | | USD | | | 2,650 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 1.75

(pays semi-annually | %

)(1) | | | 9/20/19 | | | | 12,469 | |

| LCH.Clearnet | | USD | | | 1,916 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 1.87

(pays semi-annually | %

) | | | 9/18/22 | | | | 49,825 | |

| LCH.Clearnet | | USD | | | 440 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 2.07

(pays semi-annually | %

) | | | 10/20/22 | | | | 7,505 | |

| LCH.Clearnet | | USD | | | 1,004 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 1.37

(pays semi-annually | %

) | | | 7/14/26 | | | | 101,324 | |

| LCH.Clearnet | | USD | | | 350 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 1.54

(pays semi-annually | %

) | | | 10/7/26 | | | | 30,316 | |

| LCH.Clearnet | | USD | | | 1,070 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 2.11

(pays semi-annually | %

) | | | 9/5/27 | | | | 49,368 | |

| LCH.Clearnet | | USD | | | 2,216 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 2.18

(pays semi-annually | %

) | | | 9/19/27 | | | | 91,243 | |

| LCH.Clearnet | | USD | | | 410 | | | | Receives | | | 3-month USD-LIBOR-BBA (pays quarterly) | |

| 2.32

(pays semi-annually | %

) | | | 10/4/27 | | | | 11,723 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | $ | (314,122 | ) |

|

| Interest Rate Swaps | |

| Counterparty | | Notional Amount (000’s omitted) | | | Fund Pays/Receives Floating Rate | | | Floating Rate | | Annual Fixed Rate | | | Termination Date | | | Net Unrealized Depreciation | |

| Bank of America, N.A. | | MXN | | | 2,844 | | | | Pays | | | Mexico Interbank TIIE 28 Day (pays monthly) | |

| 6.63

(pays monthly | %

) | | | 3/19/24 | | | $ | (8,375 | ) |

| Bank of America, N.A. | | THB | | | 70,000 | | | | Pays | | | 6-month THB Fixing Rate (pays semi-annually) | |

| 1.81

(pays semi-annually | %

) | | | 1/15/23 | | | | (17,893 | ) |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | $ | (26,268 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Default Swaps — Sell Protection | | | | |

Reference Entity | | Counterparty | | Notional Amount* (000’s omitted) | | | Contract Annual Fixed Rate** | | Termination Date | | | Current Market Annual Fixed Rate*** | | | Market Value | | | Unamortized Upfront Payments Received | | | Net Unrealized Appreciation | |

| | | | | | | | |

| Bahamas | | Deutsche Bank AG | | $ | 600 | | | 1.00% (pays quarterly)(1) | | | 6/20/22 | | | | 1.66 | % | | $ | (15,294 | ) | | $ | 47,276 | | | $ | 31,982 | |

| Turkey | | Goldman Sachs International | | | 1,750 | | | 1.00% (pays quarterly)(1) | | | 12/20/27 | | | | 2.60 | | | | (215,387 | ) | | | 249,933 | | | | 34,546 | |

| | | | | | | | |

Total | | | | $ | 2,350 | | | | | | | | | | | | | $ | (230,681 | ) | | $ | 297,209 | | | $ | 66,528 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Portfolio of Investments (Unaudited) — continued

| * | If the Fund is the seller of credit protection, the notional amount is the maximum potential amount of future payments the Fund could be required to make if a credit event, as defined in the credit default swap agreement, were to occur. At January 31, 2018, such maximum potential amount for all open credit default swaps in which the Fund is the seller was $2,350,000. |

| ** | The contract annual fixed rate represents the fixed rate of interest received by the Fund (as a seller of protection) on the notional amount of the credit default swap contract. |

| *** | Current market annual fixed rates, utilized in determining the net unrealized appreciation or depreciation as of period end, serve as an indicator of the market’s perception of the current status of the payment/performance risk associated with the credit derivative. The current market annual fixed rate of a particular reference entity reflects the cost, as quoted by the pricing vendor, of selling protection against default of that entity as of period end and may include upfront payments required to be made to enter into the agreement. The higher the fixed rate, the greater the market perceived risk of a credit event involving the reference entity. A rate identified as “Defaulted” indicates a credit event has occurred for the reference entity. |

| (1) | Upfront payment is exchanged with the counterparty as a result of the standardized trading coupon. |

Abbreviations:

| | | | |

| ARPP7DRR | | – | | Argentina Central Bank 7-day Repo Reference Rate |

| EURIBOR | | – | | Euro Interbank Offered Rate |

| LIBOR | | – | | London Interbank Offered Rate |

Currency Abbreviations:

| | | | |

| ALL | | – | | Albanian Lek |

| ARS | | – | | Argentine Peso |

| BAM | | – | | Bosnia-Herzegovina Convertible Mark |

| COP | | – | | Colombian Peso |

| DOP | | – | | Dominican Peso |

| EGP | | – | | Egyptian Pound |

| EUR | | – | | Euro |

| GEL | | – | | Georgian Lari |

| IDR | | – | | Indonesian Rupiah |

| INR | | – | | Indian Rupee |

| KZT | | – | | Kazakhstani Tenge |

| LKR | | – | | Sri Lankan Rupee |

| | | | |

| MAD | | – | | Moroccan Dirham |

| MXN | | – | | Mexican Peso |

| NGN | | – | | Nigerian Naira |

| PEN | | – | | Peruvian Sol |

| RSD | | – | | Serbian Dinar |

| RUB | | – | | Russian Ruble |

| THB | | – | | Thai Baht |

| TRY | | – | | New Turkish Lira |

| UAH | | – | | Ukrainian Hryvnia |

| UGX | | – | | Ugandan Shilling |

| USD | | – | | United States Dollar |

| UYU | | – | | Uruguayan Peso |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Statement of Assets and Liabilities (Unaudited)

| | | | |

| Assets | | January 31, 2018 | |

Unaffiliated investments, at value (identified cost, $88,294,147) | | $ | 90,668,916 | |

Affiliated investment, at value (identified cost, $5,597,932) | | | 5,598,644 | |

Cash | | | 678,324 | |

Deposits for derivatives collateral — | | | | |

Financial futures contracts | | | 39,469 | |

Centrally cleared swap contracts | | | 723,133 | |

OTC derivatives | | | 130,000 | |

Foreign currency, at value (identified cost, $438,387) | | | 438,467 | |

Interest receivable | | | 1,671,738 | |

Dividends receivable from affiliated investment | | | 14,028 | |

Receivable for Fund shares sold | | | 166,436 | |

Receivable for variation margin on open financial futures contracts | | | 1,712 | |

Receivable for variation margin on open centrally cleared swap contracts | | | 44,624 | |

Receivable for open forward foreign currency exchange contracts | | | 823,041 | |

Receivable for open swap contracts | | | 66,528 | |

Tax reclaims receivable | | | 20,550 | |

Receivable from affiliate | | | 35,922 | |

Total assets | | $ | 101,121,532 | |

| |

| Liabilities | | | | |

Cash collateral due to broker | | $ | 130,000 | |

Payable for investments purchased | | | 899,147 | |

Payable for Fund shares redeemed | | | 73,495 | |

Payable for open forward foreign currency exchange contracts | | | 799,576 | |

Payable for open swap contracts | | | 26,268 | |

Premium received on open non-centrally cleared swap contracts | | | 297,209 | |

Payable to affiliate: | | | | |

Investment adviser and administration fee | | | 52,588 | |

Distribution and service fees | | | 347 | |

Accrued foreign capital gains taxes | | | 54,133 | |

Accrued expenses | | | 161,599 | |

Total liabilities | | $ | 2,494,362 | |

Net Assets | | $ | 98,627,170 | |

| |

| Sources of Net Assets | | | | |

Common shares, $0.001 par value, 1,000,000,000 shares authorized (see Note 7), 10,194,973 shares issued and outstanding | | $ | 10,195 | |

Additional paid-in capital | | | 97,041,066 | |

Accumulated distributions in excess of net investment income | | | (322,441 | ) |

Accumulated net realized loss | | | (201,416 | ) |

Net unrealized appreciation | | | 2,099,766 | |

Total | | $ | 98,627,170 | |

| |

| Class A Shares | | | | |

Net Assets | | $ | 1,926,977 | |

Shares Outstanding | | | 199,262 | |

Net Asset Value and Redemption Price Per Share | | | | |

(net assets ÷ shares outstanding) | | $ | 9.67 | |

Maximum Offering Price Per Share | | | | |

(100 ÷ 95.25 of net asset value per share) | | $ | 10.15 | |

| |

| Class I Shares | | | | |

Net Assets | | $ | 20,024,727 | |

Shares Outstanding | | | 2,064,736 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares outstanding) | | $ | 9.70 | |

| |

| Class R6 Shares | | | | |

Net Assets | | $ | 76,675,466 | |

Shares Outstanding | | | 7,930,975 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares outstanding) | | $ | 9.67 | |

On sales of $50,000 or more, the offering price of Class A shares is reduced.

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Statement of Operations (Unaudited)

| | | | |

| Investment Income | | Six Months Ended January 31, 2018 | |

Interest (net of foreign taxes, $96,646) | | $ | 3,457,178 | |

Dividends from affiliated investment | | | 43,269 | |

Total investment income | | $ | 3,500,447 | |

| |

| Expenses | | | | |

Investment adviser and administration fee | | $ | 271,057 | |

Distribution and service fees | | | | |

Class A | | | 1,281 | |

Directors’ fees and expenses | | | 2,125 | |

Custodian fee | | | 99,779 | |

Transfer and dividend disbursing agent fees | | | 5,681 | |

Legal and accounting services | | | 56,900 | |

Printing and postage | | | 6,306 | |

Registration fees | | | 25,894 | |

Miscellaneous | | | 13,518 | |

Total expenses | | $ | 482,541 | |

Deduct — | | | | |

Allocation of expenses to affiliate | | $ | 123,597 | |

Total expense reductions | | $ | 123,597 | |

| |

Net expenses | | $ | 358,944 | |

| |

Net investment income | | $ | 3,141,503 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | 966,200 | |

Investment transactions — affiliated investment | | | (610 | ) |

Financial futures contracts | | | (33,254 | ) |

Swap contracts | | | 58,304 | |

Foreign currency transactions | | | (128,188 | ) |

Forward foreign currency exchange contracts | | | (264,670 | ) |

Net realized gain | | $ | 597,782 | |

Change in unrealized appreciation (depreciation) — | | | | |

Investments (including net increase of $20,203 in accrued foreign capital gains taxes) | | $ | 1,201,447 | |

Investments — affiliated investment | | | 712 | |

Financial futures contracts | | | (2,231 | ) |

Swap contracts | | | (73,776 | ) |

Foreign currency | | | (1,721 | ) |

Forward foreign currency exchange contracts | | | 463,083 | |

Net change in unrealized appreciation (depreciation) | | $ | 1,587,514 | |

| |

Net realized and unrealized gain | | $ | 2,185,296 | |

| |

Net increase in net assets from operations | | $ | 5,326,799 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets | | Six Months Ended January 31, 2018

(Unaudited) | | | Year Ended July 31, 2017 | |

From operations — | | | | | | | | |

Net investment income | | $ | 3,141,503 | | | $ | 4,517,535 | |

Net realized gain | | | 597,782 | | | | 3,305,250 | |

Net change in unrealized appreciation (depreciation) | | | 1,587,514 | | | | (1,529,271 | ) |

Net increase in net assets from operations | | $ | 5,326,799 | | | $ | 6,293,514 | |

Distributions to shareholders — | | | | | | | | |

From net investment income | | | | | | | | |

Class A | | $ | (47,146 | ) | | $ | (12,453 | ) |

Class I | | | (416,108 | ) | | | (36,032 | ) |

Class R6 | | | (3,096,600 | ) | | | (5,617,516 | ) |

Total distributions to shareholders | | $ | (3,559,854 | ) | | $ | (5,666,001 | ) |

Transactions in common shares — | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | $ | 1,924,697 | | | $ | 295,438 | |

Class I | | | 19,285,346 | | | | 1,012,850 | |

Class R6 | | | 2,119,232 | | | | 4,289,587 | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | | | | | | |

Class A | | | 46,694 | | | | 12,407 | |

Class I | | | 416,108 | | | | 36,032 | |

Class R6 | | | 2,802,725 | | | | 4,405,618 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (389,535 | ) | | | (23,852 | ) |

Class I | | | (889,618 | ) | | | (42,881 | ) |

Class R6 | | | (830,340 | ) | | | (2,723,022 | ) |

Net increase in net assets from Fund share transactions | | $ | 24,485,309 | | | $ | 7,262,177 | |

| | |

Net increase in net assets | | $ | 26,252,254 | | | $ | 7,889,690 | |

| | |

| Net Assets | | | | | | | | |

At beginning of period | | $ | 72,374,916 | | | $ | 64,485,226 | |

At end of period | | $ | 98,627,170 | | | $ | 72,374,916 | |

| | |

Accumulated undistributed (distributions in excess of) net investment income included in net assets | | | | | | | | |

At end of period | | $ | (322,441 | ) | | $ | 95,910 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Financial Highlights

| | | | | | | | | | | | |

| | | Class A | |

| | | Six Months Ended

January 31, 2018

(Unaudited) | | | Year Ended

July 31, 2017 | | | Period Ended July 31, 2016(1) | |

Net asset value — Beginning of period | | $ | 9.460 | | | $ | 9.400 | | | $ | 8.730 | |

| | | |

| Income (Loss) From Operations | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.353 | | | $ | 0.608 | | | $ | 0.544 | |

Net realized and unrealized gain | | | 0.247 | | | | 0.214 | | | | 0.244 | |

| | | |

Total income from operations | | $ | 0.600 | | | $ | 0.822 | | | $ | 0.788 | |

| | | |

| Less Distributions | | | | | | | | | | | | |

From net investment income | | $ | (0.390 | ) | | $ | (0.762 | ) | | $ | (0.118 | ) |

| | | |

Total distributions | | $ | (0.390 | ) | | $ | (0.762 | ) | | $ | (0.118 | ) |

| | | |

Net asset value — End of period | | $ | 9.670 | | | $ | 9.460 | | | $ | 9.400 | |

| | | |

Total Return(3)(4) | | | 6.46 | %(5) | | | 9.18 | % | | | 9.16 | %(5) |

| | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 1,927 | | | $ | 330 | | | $ | 45 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | |

Expenses(4) | | | 1.15 | %(6) | | | 1.16 | %(7) | | | 1.15 | %(6) |

Net investment income | | | 7.27 | %(6) | | | 6.46 | % | | | 6.74 | %(6) |

Portfolio Turnover | | | 28 | %(5) | | | 70 | % | | | 85 | %(8) |

| (1) | For the period from commencement of operations on September 3, 2015 to July 31, 2016. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.30%, 0.34% and 1.15% of average daily net assets for the

six months ended January 31, 2018, the year ended July 31, 2017 and the period from commencement of operations on September 3, 2015 to July 31, 2016, respectively). Absent this reimbursement, total return would be lower. |

| (7) | Includes interest expense of 0.01% for the year ended July 31, 2017. |

| (8) | For the year ended July 31, 2016. |

| | | | |

| | 16 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Financial Highlights — continued

| | | | | | | | | | | | |

| | | Class I | |

| | | Six Months Ended

January 31, 2018

(Unaudited) | | | Year Ended

July 31, 2017 | | | Period Ended July 31, 2016(1) | |

Net asset value — Beginning of period | | $ | 9.490 | | | $ | 9.420 | | | $ | 8.730 | |

| | | |

| Income (Loss) From Operations | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.368 | | | $ | 0.649 | | | $ | 0.560 | |

Net realized and unrealized gain | | | 0.246 | | | | 0.204 | | | | 0.270 | |

| | | |

Total income from operations | | $ | 0.614 | | | $ | 0.853 | | | $ | 0.830 | |

| | | |

| Less Distributions | | | | | | | | | | | | |

From net investment income | | $ | (0.404 | ) | | $ | (0.783 | ) | | $ | (0.140 | ) |

| | | |

Total distributions | | $ | (0.404 | ) | | $ | (0.783 | ) | | $ | (0.140 | ) |

| | | |

Net asset value — End of period | | $ | 9.700 | | | $ | 9.490 | | | $ | 9.420 | |

| | | |

Total Return(3)(4) | | | 6.59 | %(5) | | | 9.51 | % | | | 9.67 | %(5) |

| | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 20,025 | | | $ | 1,060 | | | $ | 34 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | |

Expenses(4) | | | 0.90 | %(6) | | | 0.91 | %(7) | | | 0.90 | %(6) |

Net investment income | | | 7.56 | %(6) | | | 6.90 | % | | | 6.84 | %(6) |

Portfolio Turnover | | | 28 | %(5) | | | 70 | % | | | 85 | %(8) |

| (1) | For the period from commencement of operations on September 3, 2015 to July 31, 2016. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.30%, 0.34% and 1.15% of average daily net assets for the

six months ended January 31, 2018, the year ended July 31, 2017 and the period from commencement of operations on September 3, 2015 to July 31, 2016, respectively). Absent this reimbursement, total return would be lower. |

| (7) | Includes interest expense of 0.01% for the year ended July 31, 2017. |

| (8) | For the year ended July 31, 2016. |

| | | | |

| | 17 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class R6 | |

| | | Six Months Ended

January 31, 2018

(Unaudited) | | | Year Ended July 31, | | | Period Ended July 31, 2013(1) | |

| | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | |

Net asset value — Beginning of period | | $ | 9.460 | | | $ | 9.390 | | | $ | 9.060 | | | $ | 9.880 | | | $ | 9.610 | | | $ | 10.000 | |

| | | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.363 | | | $ | 0.625 | | | $ | 0.591 | | | $ | 0.546 | | | $ | 0.452 | | | $ | 0.173 | |

Net realized and unrealized gain (loss) | | | 0.252 | | | | 0.230 | | | | (0.119 | )(3) | | | (1.005 | ) | | | 0.169 | | | | (0.563 | ) |

| | | | | | |

Total income (loss) from operations | | $ | 0.615 | | | $ | 0.855 | | | $ | 0.472 | | | $ | (0.459 | ) | | $ | 0.621 | | | $ | (0.390 | ) |

| | | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.405 | ) | | $ | (0.785 | ) | | $ | (0.142 | ) | | $ | (0.361 | ) | | $ | (0.329 | ) | | $ | — | |

From net realized gain | | | — | | | | — | | | | — | | | | — | | | | (0.022 | ) | | | — | |

| | | | | | |

Total distributions | | $ | (0.405 | ) | | $ | (0.785 | ) | | $ | (0.142 | ) | | $ | (0.361 | ) | | $ | (0.351 | ) | | $ | — | |

| | | | | | |

Net asset value — End of period | | $ | 9.670 | | | $ | 9.460 | | | $ | 9.390 | | | $ | 9.060 | | | $ | 9.880 | | | $ | 9.610 | |

| | | | | | |

Total Return(4)(5) | | | 6.62 | %(6) | | | 9.57 | % | | | 5.37 | % | | | (4.55 | )% | | | 6.64 | % | | | (3.90 | )%(6) |

| | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 76,675 | | | $ | 70,985 | | | $ | 64,407 | | | $ | 48,141 | | | $ | 50,478 | | | $ | 14,518 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses(5)(7) | | | 0.85 | %(8) | | | 0.86 | %(9) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %(8) |

Net investment income | | | 7.50 | %(8) | | | 6.65 | % | | | 6.68 | % | | | 5.82 | % | | | 4.66 | % | | | 3.58 | %(8) |

Portfolio Turnover | | | 28 | %(6) | | | 70 | % | | | 85 | % | | | 74 | % | | | 90 | % | | | 0 | %(6) |

| (1) | For the period from commencement of operations on February 4, 2013 to July 31, 2013. |

| (2) | Computed using average shares outstanding. |

| (3) | The per share amount is not in accord with the net realized and unrealized gain (loss) on investments for the period because of the timing of sales of Fund shares and the amount of the per share realized and unrealized gains and losses at such time. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (5) | The investment adviser and administrator reimbursed certain operating expenses (equal to 0.30%, 0.34%, 0.49%, 0.43%, 1.01% and 2.16% of average daily net assets for the six months ended January 31, 2018, the years ended July 31, 2017, 2016, 2015 and 2014 and the period from commencement of operations on February 4, 2013 to July 31, 2013, respectively). Absent this reimbursement, total return would be lower. |

| (7) | Excludes the effect of custody fee credits, if any, of less than 0.005%. Effective September 1, 2015, custody fee credits, which were earned on cash deposit balances, were discontinued by the custodian. |

| (9) | Includes interest expense of 0.01% for the year ended July 31, 2017. |

| | | | |

| | 18 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Opportunities Fund

January 31, 2018

Notes to Financial Statements (Unaudited)

1 Significant Accounting Policies

Eaton Vance Emerging Markets Debt Opportunities Fund (the Fund) is a non-diversified series of Eaton Vance Series Fund, Inc. (the Corporation). The Corporation is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund’s investment objective is total return. Effective September 3, 2015, the Fund designated its existing shares as Class R6 and established two new classes of shares named Class A and Class I. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class I and Class R6 shares are sold at net asset value and are not subject to a sales charge. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Sub-accounting, recordkeeping and similar administrative fees payable to financial intermediaries, which are a component of transfer and dividend disbursing agent fees on the Statement of Operations, are not allocated to Class R6 shares. Each class of shares differs in its distribution plan and certain other class-specific expenses.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Debt Obligations. Debt obligations are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term obligations purchased with a remaining maturity of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value.

Derivatives. Financial futures contracts are valued at the closing settlement price established by the board of trade or exchange on which they are traded. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average asked prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund’s forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service. Non-deliverable bond forward contracts are generally valued based on the current price of the underlying bond as provided by a third party pricing service and current interest rates. Swaps are normally valued using valuations provided by a third party pricing service. Such pricing service valuations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract, and in the case of credit default swaps, based on credit spread quotations obtained from broker/dealers and expected default recovery rates determined by the pricing service using proprietary models. Future cash flows on swaps are discounted to their present value using swap rates provided by electronic data services or by broker/dealers.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads.

Affiliated Fund. The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Directors of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.