UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM20-F

(Mark one)

| ☐ | Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 |

or

| ☒ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year ended June 30, 2016

or

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

| ☐ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 001-37518

Benitec Biopharma Limited

(Exact name of Registrant as specified in its charter)

Australia

(Jurisdiction of incorporation or organization)

99 Mount Street, Suite 1201

North Sydney, NSW, 2060, Australia

(Address of principal executive offices)

Greg West

Chief Executive Officer

99 Mount Street, Suite 1201

North Sydney, NSW, 2060, Australia

Tel: +61 2 9555 6986

Fax: +612 9818 2238

(Name, telephone,e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

American Depositary Shares, each representing twenty Ordinary Shares* | | The NASDAQ Capital Market |

| Warrants, each exercisable for one American Depositary Share | | The NASDAQ Capital Market |

| * | Not for trading, but only in connection with the registration of American Depositary Shares. |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the date of the close of the period covered by the annual report.

146,529,096 Ordinary Shares at June 30, 2016

Indicate by check mark if the registrant is awell-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) for the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 ofRegulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☐ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” inRule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ☐ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined inRule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Table of Contents

EXPLANATORY NOTES

Unless otherwise indicated or the context implies otherwise:

| | • | | “we,” “us,” “our” or “Benitec” refers to Benitec Biopharma Limited, an Australian corporation, and its subsidiaries; |

| | • | | “shares” or “ordinary shares” refers to our ordinary shares; |

| | • | | “ADSs” refers to American Depositary Shares, each of which represents 20 ordinary shares; |

| | • | | “ADRs” refers to American Depositary Receipts, which evidence the ADSs; and |

| | • | | “Warrant” refers to a warrant to purchase one ADS at an exercise price of US$5.50 per ADS, exercisable from the date of issuance until five years thereafter. |

Our reporting and functional currency is the Australian dollar. Solely for the convenience of the reader, this Annual Report on Form 20-F contains translations of some Australian dollar amounts into U.S. dollars at specified rates. Except as otherwise stated in this Annual Report on Form 20-F, all translations from Australian dollars to U.S. dollars are based on the rate published by the Reserve Bank of Australia on the date indicated. See Item 3.A “Key Information—Selected Financial Data.” No representation is made that the Australian dollar amounts referred to in this Annual Report on Form 20-F could have been or could be converted into U.S. dollars at such rate.

Unless otherwise noted, all industry and market data in this Annual Report on Form 20-F, including information provided by independent industry analysts, are presented in U.S. dollars. Unless otherwise noted, all other financial and other data related to Benitec Biopharma Limited in this Annual Report on Form 20-F are presented in Australian dollars. All references to “$” in this Annual Report on Form 20-F refer to Australian dollars or U.S. dollars, as the context requires based on the foregoing. All references to “A$” in this Annual Report on Form 20-F mean Australian dollars. All references to “US$” in this Annual Report on Form 20-F mean U.S. dollars.

Our fiscal year end is June 30. References to a particular “fiscal year” are to our fiscal year ended June 30 of that calendar year.

Unless otherwise indicated, the consolidated financial statements and related notes included in this Annual Report on Form 20-F have been prepared in accordance with International Accounting Standards and also comply with International Financial Reporting Standards, or IFRS, and interpretations issued by the International Accounting Standards Board, or IASB, which differ in certain significant respects from Generally Accepted Accounting Principles in the United States, or GAAP. See Item 3.A “Key Information—Selected Financial Data.”

TRADEMARKS AND TRADENAMES

We have proprietary and licensed rights to trademarks used in this Annual Report on Form 20-F which are important to our business, many of which are registered under applicable intellectual property laws. These trademarks are as follows:

| | • | | SILENCING GENES FOR LIFE® |

1

Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 20-F appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this Annual Report on Form 20-F is the property of its respective holder.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than statements of historical fact included in this Annual Report onForm 20-F, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this Annual Report on Form 20-F, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” or the negative of these terms, and similar expressions are intended to identify forward looking statements, although not all forward looking statements contain such identifying words. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report on Form 20-F, we caution you that these statements are based on a combination of facts and important factors currently known by us and our expectations of the future, about which we cannot be certain.

Forward-looking statements may include statements about:

| | • | | our plans to develop and potentially commercialize our product candidates; |

| | • | | the timing of the initiation and completion of preclinical studies and clinical trials; |

| | • | | the timing of patient enrollment and dosing in any future clinical trials; |

| | • | | the timing of the availability of data from clinical trials; |

| | • | | the timing of expected regulatory filings; |

| | • | | the development of novel AAV vectors; |

| | • | | expectations about the plans of licensees of our technology; |

| | • | | the clinical utility and potential attributes and benefits of ddRNAi and our product candidates, including the potential duration of treatment effects and the potential for a “one shot” cure; |

| | • | | potential future out-licenses and collaborations; |

| | • | | our expectations regarding expenses, ongoing losses, future revenue, capital needs and needs for additional financing; |

| | • | | the length of time over which we expect our cash and cash equivalents, including the proceeds from our U.S. initial public offering, to be sufficient; and |

| | • | | our intellectual property position and the duration of our patent portfolio. |

2

All forward-looking statements speak only as of the date of this Annual Report on Form 20-F. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward-looking statements we make in this Annual Report on Form 20-F are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will be achieved. We disclose important factors that could cause our actual results to differ materially from our expectations under Item 3.D “Key Information—Risk Factors” and elsewhere in this Annual Report on Form 20-F.

The forward-looking statements made in this Annual Report on Form 20-F relate only to events or information as of the date on which the statements are made in this Annual Report on Form 20-F. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

3

PART I

Item 1.Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

| A. | Selected Financial Data. |

The following tables set forth summary historical financial data for the periods indicated.

The consolidated statement of profit or loss and other comprehensive income data and consolidated statement of financial position data for and as of the fiscal years ended June 30, 2014, 2015 and 2016 are derived from the audited consolidated financial statements included in this Annual Report on Form 20-F. In our management’s opinion, these financial statements include all adjustments necessary for the fair presentation of our financial condition as of such dates and our results of operations for such periods.

Our financial statements have been prepared in Australian dollars and in accordance with International Financial Reporting Standards. Our financial statements comply with IFRS, as issued by the IASB.

You should read the selected consolidated financial data in conjunction with our consolidated financial statements and related notes included elsewhere in this Annual Report on Form 20-F, including Item 5. “Operating and Financial Review and Prospects” and “Item 18. Financial Statements.” Our historical results do not necessarily indicate our expected results for any future periods.

| | | | | | | | | | | | |

| (in thousands, except per share data) | | For the year ended June 30, | |

| | | 2016 | | | 2015 | | | 2014 | |

Statement of Profit or Loss and Other Comprehensive Income Data: | | | | | | | | | | | | |

Revenue: | | | | | | | | | | | | |

Revenue | | A$ | 464 | | | A$ | 1,081 | | | A$ | 598 | |

Other income | | | 3,590 | | | | 2,891 | | | | 776 | |

| | | | | | | | | | | | |

Total revenue | | | 4,054 | | | | 3,972 | | | | 1,374 | |

| | | | | | | | | | | | |

Costs and expenses: | | | | | | | | | | | | |

Royalties and license fees | | | (139 | ) | | | (40 | ) | | | (193 | ) |

Research and development | | | (13,287 | ) | | | (6,228 | ) | | | (3,758 | ) |

Employment related | | | (6,283 | ) | | | (3,425 | ) | | | (2,444 | ) |

Share based expenses | | | (1,746 | ) | | | (1,503 | ) | | | (355 | ) |

Travel related expenses | | | (1,023 | ) | | | (1,039 | ) | | | (585 | ) |

Consultants costs | | | (1,020 | ) | | | (882 | ) | | | (653 | ) |

Occupancy costs | | | (718 | ) | | | (275 | ) | | | (122 | ) |

Corporate expenses | | | (1,211 | ) | | | (1,018 | ) | | | (646 | ) |

Net loss foreign exchange | | | (414 | ) | | | — | | | | (111 | ) |

IPO costs | | | (1,191 | ) | | | (1,071 | ) | | | — | |

Write-off of clinical trial prepayment | | | (1,800 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

Loss before income tax | | | (24,778 | ) | | | (11,509 | ) | | | (7,493 | ) |

Income tax benefit | | | — | | | | — | | | | 454 | |

| | | | | | | | | | | | |

Loss for the period | | A$ | (24,778 | ) | | A$ | (11,509 | ) | | A$ | (7,039 | ) |

| | | | | | | | | | | | |

Loss per share, basic and diluted | | A$ | 0.1741 | | | A$ | (0.0996 | ) | | A$ | (0.0778 | ) |

Weighted-average shares outstanding, basic and diluted | | | 142,312,486 | | | | 115,507 | | | | 90,432 | |

4

| | | | | | | | | | | | |

| (in thousands) | | | | | | | | | |

| | | As of June 30, | |

| | | 2016 | | | 2015 | | | 2014 | |

Statement of Financial Position Data: | | | | | | | | | | | | |

Cash and cash equivalents | | A$ | 18,230 | | | A$ | 21,787 | | | A$ | 31,359 | |

Total current assets | | | 19,384 | | | | 25,064 | | | | 34,448 | |

Total assets | | | 19,890 | | | | 25,520 | | | | 34,496 | |

Total current liabilities | | | 1,035 | | | | 1,642 | | | | 955 | |

Total liabilities | | | 1,053 | | | | 1,642 | | | | 955 | |

Total equity | | | 18,837 | | | | 23,878 | | | | 33,541 | |

Exchange Rate Information

The Australian dollar is convertible into U.S. dollars at freely floating rates. There are no legal restrictions on the flow of Australian dollars between Australia and the United States. Any remittances of dividends or other payments by us to persons in the United States are not and will not be subject to any exchange controls.

Our financial statements are prepared and presented in Australian dollars.

The table below sets forth for the periods identified the number of U.S. dollars per Australian dollar as published by the Reserve Bank of Australia. We make no representation that any Australian dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Australian dollars, as the case may be, at any particular rate, the rates stated below, or at all. On October 24, 2016, the Australian dollar/U.S. dollar exchange rate was 0.7615.

| | | | | | | | | | | | | | | | |

| | | At Period

End (1) | | | Average

Rate (2) | | | High (3) | | | Low (4) | |

Fiscal year ended June 30, | | | | | | | | | | | | | | | | |

2016 | | | 0.7426 | | | | 0.7272 | | | | 0.7812 | | | | 0.6867 | |

2015 | | | 0.7680 | | | | 0.8293 | | | | 0.9458 | | | | 0.7590 | |

2014 | | | 0.9420 | | | | 0.9187 | | | | 0.9672 | | | | 0.8716 | |

2013 | | | 0.9275 | | | | 1.0271 | | | | 1.0593 | | | | 0.9202 | |

2012 | | | 1.0191 | | | | 1.0362 | | | | 1.1026 | | | | 0.9453 | |

Month ended: | | | | | | | | | | | | | | | | |

September 30, 2016 | | | 0.7630 | | | | 0.7595 | | | | 0.7698 | | | | 0.7469 | |

August 31, 2016 | | | 0.7514 | | | | 0.7630 | | | | 0.7711 | | | | 0.7514 | |

July 31, 2016 | | | 0.7522 | | | | 0.7526 | | | | 0.7626 | | | | 0.7436 | |

June 30, 2016 | | | 0.7426 | | | | 0.7396 | | | | 0.7533 | | | | 0.7239 | |

May 31, 2016 | | | 0.7242 | | | | 0.7322 | | | | 0.7607 | | | | 0.7160 | |

April 30, 2016 | | | 0.7655 | | | | 0.7662 | | | | 0.7812 | | | | 0.7535 | |

5

| (1) | Determined by the published rate on the last trading day of the month. |

| (2) | Determined by averaging the published rate on the last day of each full month during the fiscal year indicated or by averaging the published rates for all trading days during the month indicated, as applicable. |

| (3) | Determined by the highest published rate during the month. |

| (4) | Determined by the lowest published rate during the month. |

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

An investment in the ADSs involves significant risks. You should carefully consider the risks described below and the other information in this Annual Report on Form 20-F. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially and adversely affected, the trading price of the ADSs could decline and you could lose all or part of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have incurred significant net losses. We anticipate that we will continue to incur significant net losses for the foreseeable future and we may never achieve or maintain profitability.

We are a biotechnology company and have not yet generated significant revenue. We have incurred losses of A$7.0 million, A$11.5 million and A$24.8 million for the fiscal years ended June 30, 2014, 2015 and 2016, respectively. We have not generated any revenues from sales of any of our product candidates.

As of June 30, 2016, we had accumulated losses of A$131.4 million. We have devoted most of our financial resources to research and development, including our clinical and preclinical development activities. To date, we have financed our operations primarily through the issuance of equity securities, research and development grants from the Australian government and payments from our collaboration partners. We have not generated, and do not expect to generate, any significant revenue for the foreseeable future, and we expect to continue to incur significant operating losses for the foreseeable future due to the cost of research and development, preclinical studies and clinical trials and the regulatory approval process for product candidates. The amount of our future net losses is uncertain and will depend, in part, on the rate of our future expenditures. Our ability to continue operations will depend on, among other things, our ability to obtain funding through equity or debt financings, strategic collaborations or additional grants.

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future. We anticipate that our expenses will increase substantially if and as we:

| | • | | continue our research and preclinical development of our product candidates; |

6

| | • | | expand the scope of our current preclinical studies for our product candidates or initiate clinical, additional preclinical or other studies for product candidates; |

| | • | | seek regulatory and marketing approvals for any of our product candidates that successfully complete clinical trials; |

| | • | | further develop the manufacturing process for our product candidates; |

| | • | | change or add additional manufacturers or suppliers; |

| | • | | seek to identify and validate additional product candidates; |

| | • | | acquire or in-license other product candidates and technologies, which may or may not include those related to our ddRNAi technology and delivery vectors for our therapeutic candidates; |

| | • | | maintain, protect and expand our intellectual property portfolio; |

| | • | | create additional infrastructure to support our operations as a public company in the United States and our product development and future commercialization efforts; and |

| | • | | experience any delays or encounter issues with any of the above. |

The net losses we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. In any particular quarter or quarters, our operating results could be below the expectations of securities analysts or investors, which could cause the price of the ADSs to decline.

We have never generated any revenue from product sales and may never be profitable.

Our ability to generate significant revenue and achieve profitability depends on our ability to, alone or with strategic collaboration partners, successfully complete the development of and obtain the regulatory approvals for our product candidates, to manufacture sufficient supply of our product candidates, to establish a sales and marketing organization or suitable third-party alternative for the marketing of any approved products and to successfully commercialize any approved products on commercially reasonable terms. All of these activities will require us to raise sufficient funds to finance business activities. We do not expect any milestone payments from our collaborative partners to be significant in the foreseeable future. In addition, we do not anticipate generating revenue from commercializing product candidates for the foreseeable future, if ever. Our ability to generate future revenues from commercializing product candidates depends heavily on our success in:

| | • | | establishing proof of concept in preclinical studies and clinical trials for our product candidates; |

| | • | | successfully initiating and completing clinical trials of our product candidates; |

| | • | | obtaining regulatory and marketing approvals for product candidates for which we complete clinical trials; |

| | • | | maintaining, protecting and expanding our intellectual property portfolio, and avoiding infringing on intellectual property of third parties; |

| | • | | establishing and maintaining successful licenses, collaborations and alliances with third parties; |

| | • | | developing a sustainable, scalable, reproducible and transferable manufacturing process for our product candidates; |

| | • | | establishing and maintaining supply and manufacturing relationships with third parties that can provide products and services adequate, in amount and quality, to support clinical development and commercialization of our product candidates, if approved; |

7

| | • | | launching and commercializing any product candidates for which we obtain regulatory and marketing approval, either by collaborating with a partner or, if launched independently, by establishing a sales, marketing and distribution infrastructure; |

| | • | | obtaining market acceptance of any product candidates that receive regulatory approval as viable treatment options; |

| | • | | obtaining favorable coverage and reimbursement rates for our products from third-party payors; |

| | • | | addressing any competing technological and market developments; |

| | • | | identifying and validating new product candidates; and |

| | • | | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter. |

The process of developing product candidates for ddRNAi-based therapeutics contains a number of inherent risks and uncertainties. For example, it may not be possible to identify a target region of a disease-associated gene that has not been previously identified and/or patented by others, resulting in restrictions on freedom to operate for that target sequence. Silencing the target gene may not ultimately result in curing the disease as there may be more factors contributing to the development of the disease than the target gene. Silencing the target gene using ddRNAi may lead to short-term or long-term adverse effects that were not predicted or observed in preclinical studies. The delivery of the DNA construct to the target cells may not be possible, or complete or adequate to provide sufficient therapeutic benefit.

Even if one or more of our product candidates is approved for commercial sale, we may incur significant costs associated with commercializing any approved product candidate. As one example, our expenses could increase beyond expectations if we are required by the Food and Drug Administration, or FDA, or other regulatory agencies, domestic or foreign, to perform clinical and other studies in addition to those that we currently anticipate. Even if we are able to generate revenues from the sale of any approved products, we may not become profitable and may need to obtain additional funding to continue operations, which could have an adverse effect on our business, financial condition, results of operations and prospects.

We will need to continue our efforts to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or discontinue our product development efforts or other operations.

Developing ddRNAi products is expensive, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance our product candidates in preclinical studies and in future clinical trials and as we undertake preclinical studies of new product candidates.

As of June 30, 2016, our cash and cash equivalents were A$18.2 million. We estimate that our cash and cash equivalents will be sufficient to fund our operations until approximately the fourth calendar quarter of calendar 2017. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government grants or other third-party funding, strategic alliances and licensing arrangements or a combination of these approaches. In addition, because the length of time and activities associated with successful development of our product candidates is highly uncertain, we are unable to estimate the actual funds we will require for development and any approved marketing and commercialization activities. In any event, we will require additional capital to obtain regulatory approval for our product candidates and to commercialize any product candidates that receive regulatory approval.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may compromise our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders, and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our ordinary shares, ADSs and Warrants to decline. If we incur indebtedness we may be required to agree to restrictive

8

covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could compromise our ability to conduct our business. We could also seek financing through arrangements with collaborative partners at an earlier stage than would otherwise be desirable and we may be required to relinquish rights to some or all of our technologies or product candidates or otherwise agree to terms unfavorable to us.

If we are unable to obtain funding on a timely basis or on acceptable terms, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any approved product candidates.

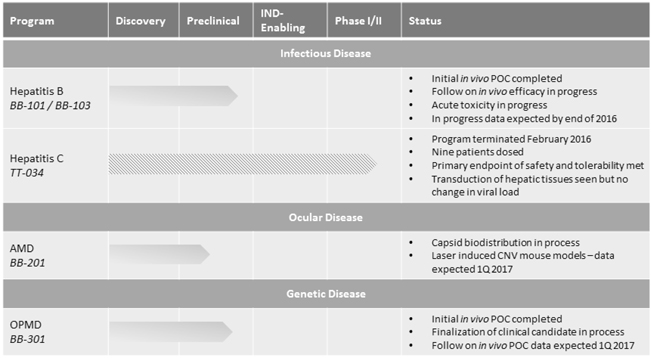

We will be unable to conclude clinical trials for our product candidates for hepatitis B, AMD and OPMD if we are unable to raise additional financing.

We plan to develop our pipeline of product candidates using our ddRNAi technology to deliver therapeutics for a number of life-threatening conditions. We intend to advance our product candidates for hepatitis B, AMD and OPMD through clinical trials, but we will need additional financing to do so. In order to complete the planned preclinical proof-of-concept studies for our lead product candidates and to build the infrastructure that we believe will be necessary to commercialize our lead product candidates, we will require substantial additional funding. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs for these product candidates.

We receive Australian government research and development grants. If we lose funding from these research and development grants, we may encounter difficulties in the funding of future research and development projects, which could harm our operating results.

We have historically received, and expect to continue to receive, grants through the Australian federal government’s Research and Development Tax Incentive program, under which the government provides a cash refund for the 43.5% (reduced from 45% at July 1, 2016) of eligible research and development expenditures by small Australian entities, which are defined as Australian entities with less than A$20 million in revenue, having a tax loss. The Research and Development Tax Incentive grant is made by the Australian federal government for eligible research and development purposes based on the filing of an annual application. We received Research and Development Tax Incentive grants in the fiscal years ended June 30, 2014, 2015 and 2016 of A$0.8 million, A$2.3 million and A$3.6 million, respectively. This grant is available for our research and development activities in Australia, as well as activities in the United States to the extent such U.S.-based expenses relate to our activities in Australia, do not exceed half the expenses for the relevant activities and are approved by the Australian government. To the extent our research and development expenditures are deemed to be “ineligible,” then our grants would decrease. In addition, the Australian government may in the future decide to modify the requirements of, reduce the amounts of the grants available under, or discontinue the Research and Development Tax Incentive program. For instance, the Australian government recently released findings and a panel recommendation that if implemented would reduce the amount of the grants available to small companies such as Benitec to a maximum of A$2 million per annum. Any such change in the Research and Development Tax Incentive program could have a material adverse effect on our future cash flows and financial position.

Risks Related to the Product Development and Regulatory Approval of Our Product Candidates

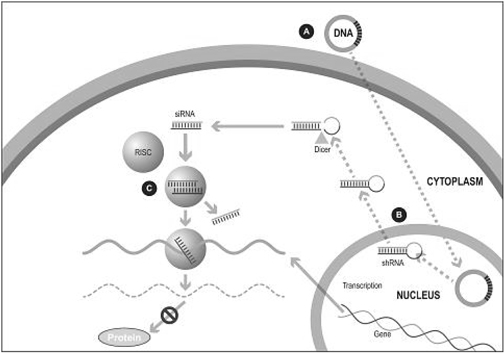

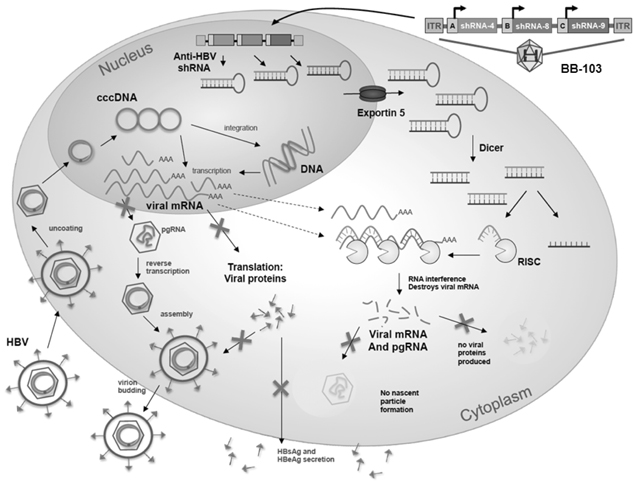

Our product candidates are based on ddRNAi technology. Currently, no product candidates utilizing ddRNAi technology have been approved for commercial sale and our approach to the development of ddRNAi technology may not result in safe, effective or marketable products.

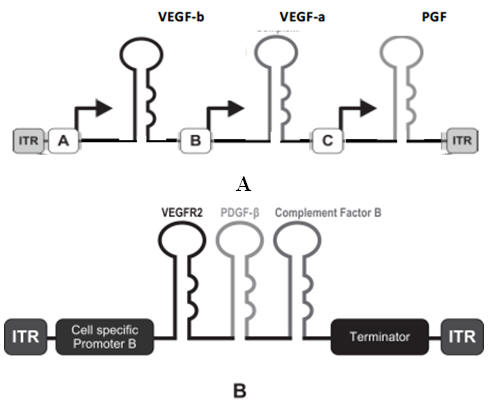

We have concentrated our product research and development efforts on our ddRNAi technology, and our future success depends on successful clinical development of this technology. We plan to develop a pipeline of product candidates using our ddRNAi technology and deliver therapeutics for a number of chronic and life-threatening conditions, including hepatitis B, age-related macular degeneration and OPMD.

The scientific research that forms the basis of our efforts to develop product candidates is based on the therapeutic use of ddRNAi, and the identification, optimization and delivery of ddRNAi-based product candidates is relatively new. The scientific evidence to support the feasibility of successfully developing therapeutic treatments based on ddRNAi is preliminary and limited. There can be no assurance that any development and technical problems we experience in the future will not cause significant delays or unanticipated costs, or that such development problems can be solved. We may be unable to reach agreement on favorable terms, or at all, with providers of vectors needed to optimize delivery of our product candidates to target disease cells and we may also experience unanticipated problems or delays in expanding our manufacturing capacity or transferring our manufacturing process to commercial partners, any of which may prevent us from completing our preclinical trials, initiating clinical trials or commercializing our products on a timely or profitable basis, if at all.

9

Only a few product candidates based on RNAi or ddRNAi have been tested in either animals or humans, and a number of clinical trials conducted by other companies using other forms of RNAi technologies have not been successful. We may discover that application of ddRNAi does not possess properties required for a therapeutic benefit, such as the ability to continually express shRNAs for the period of time required to be maximally effective or the ability of viral vectors or other technologies to effectively deliver ddRNAi constructs to target cells in therapeutically relevant concentrations. In addition, application of ddRNAi-based products in humans may result in safety problems. We currently have only limited data, and no conclusive evidence, to suggest that we can effectively produce effective therapeutic treatments using our ddRNAi technology.

We are early in our product development efforts and all of our current product candidates are still in preclinical development. We may not be able to obtain regulatory approvals for the commercialization of some or all of our product candidates.

The research, testing, manufacturing, labeling, approval, selling, marketing and distribution of biologics is subject to extensive regulation by the FDA and other regulatory authorities, and these regulations differ from country to country. We do not have any products on the market and are early in our development efforts. All of our product candidates are in preclinical development. All of our current and future product candidates are subject to the risks of failure typical for development of biologics. The development and approval process is expensive and can take many years to complete, and its outcome is inherently uncertain. In addition, the outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results.

We have not submitted an application, or received marketing approval, for any of our product candidates and will not submit any applications for marketing approval for several years. We have limited experience in conducting and managing clinical trials necessary to obtain regulatory approvals, including approval by the FDA. To receive approval, we must, among other things, demonstrate with evidence from clinical trials that the product candidate is both safe and effective for each indication for which approval is sought, and failure can occur in any stage of development. Satisfaction of the approval requirements typically takes several years and the time needed to satisfy them may vary substantially, based on the type, complexity and novelty of the pharmaceutical product. We cannot predict if or when we might receive regulatory approvals for any of our product candidates currently under development.

The FDA and foreign regulatory authorities also have substantial discretion in the pharmaceutical product approval process. The numbers, types and sizes of preclinical studies and clinical trials that will be required for regulatory approval varies depending on the product candidate, the disease or condition that the product candidate is designed to address and the regulations applicable to any particular product candidate. Approval policies, regulations or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions, and there may be varying interpretations of data obtained from preclinical studies or clinical trials, any of which may cause delays or limitations in the approval or the decision not to approve an application. Regulatory agencies can delay, limit or deny approval of a product candidate for many reasons, including:

| | • | | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of any future clinical trials; |

| | • | | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate is safe and effective for its proposed indication; |

| | • | | the results of any future clinical trials may not meet the level of statistical or clinical significance required by the FDA or comparable foreign regulatory authorities for approval; |

| | • | | the patients recruited for a particular clinical program may not be sufficiently broad or representative to assure safety in the full population for which we seek approval; |

10

| | • | | the results of any future clinical trials may not confirm the positive results from earlier preclinical studies or clinical trials; |

| | • | | we may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| | • | | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| | • | | the data collected from any future clinical trials of our product candidates may not be sufficient to the satisfaction of FDA or comparable foreign regulatory authorities to support the submission of a biologics license application, or BLA, or other comparable submission in foreign jurisdictions or to obtain regulatory approval in the United States or elsewhere; |

| | • | | the FDA or comparable foreign regulatory authorities may only agree to approve a product candidate under conditions that are so restrictive that the product is not commercially viable; |

| | • | | regulatory agencies might not approve or might require changes to our manufacturing processes or facilities; or |

| | • | | regulatory agencies may change their approval policies or adopt new regulations in a manner rendering our clinical data insufficient for approval. |

Any delay in obtaining or failure to obtain required approvals could materially and adversely affect our ability to generate revenue from the particular product candidate, which likely would result in significant harm to our financial position and adversely impact the price of the ADSs and Warrants. Furthermore, any regulatory approval to market a product may be subject to limitations on the indicated uses for which we may market the product. These limitations may limit the size of the market for the product.

We are not permitted to market our product candidates in the United States or in other countries until we receive approval of a BLA from the FDA or marketing approval from applicable regulatory authorities outside the United States. Obtaining approval of a BLA can be a lengthy, expensive and uncertain process. If we fail to obtain FDA approval to market our product candidates, we will be unable to sell our product candidates in the United States, which will significantly impair our ability to generate any revenues. In addition, failure to comply with FDA and non-U.S. regulatory requirements may, either before or after product approval, if any, subject us to administrative or judicially imposed sanctions, including:

| | • | | restrictions on our ability to conduct clinical trials, including full or partial clinical holds on ongoing or planned trials; |

| | • | | restrictions on the products, manufacturers or manufacturing process; |

| | • | | civil and criminal penalties; |

| | • | | suspension or withdrawal of regulatory approvals; |

| | • | | product seizures, detentions or import bans; |

| | • | | voluntary or mandatory product recalls and publicity requirements; |

| | • | | total or partial suspension of production; |

| | • | | imposition of restrictions on operations, including costly new manufacturing requirements; and |

| | • | | refusal to approve pending BLAs or supplements to approved BLAs. |

11

Even if we do receive regulatory approval to market a product candidate, any such approval may be subject to limitations on the indicated uses for which we may market the product. It is possible that none of our existing product candidates or any product candidates we may seek to develop in the future will ever obtain the appropriate regulatory approvals necessary for us or our collaborators to commence product sales. Any delay in obtaining, or an inability to obtain, applicable regulatory approvals would prevent us from commercializing our product candidates, generating revenues and achieving and sustaining profitability.

Because our product candidates are based on a novel technology, it is difficult to predict the time and cost of product candidate development as well as subsequently obtaining regulatory approval.

The clinical trial requirements of the FDA and comparable foreign regulatory authorities and the criteria these regulators use to determine the safety and efficacy of a product candidate vary substantially according to the type, complexity, novelty and intended use and market of such product candidates. The regulatory approval process for novel product candidates such as ours can be more expensive and take longer than for other pharmaceutical product candidates. The FDA and comparable foreign regulatory authorities have relatively limited experience with ddRNAi-based therapeutics, which makes it difficult to determine how long it will take or how much it will cost to obtain regulatory approvals for our product candidates in the United States or other countries. We and our current collaborators, or any future collaborators, may never receive approval to market and commercialize any product candidate. Even if we or a collaborator obtain regulatory approval, the approval may be for disease indications or patient populations that are not as broad as we intended or desired and may require labeling that includes significant use or distribution restrictions or safety warnings.

Regulatory requirements governing gene and cell therapy products have changed frequently and may continue to change in the future. For example, the FDA has established the Office of Tissues and Advanced Therapies (formerly Office of Cellular, Tissue and Gene Therapies) within its Center for Biologics Evaluation and Research, or CBER, to consolidate the review of gene therapy and related products, and the Cellular, Tissue and Gene Therapies Advisory Committee to advise CBER on its review. Gene therapy clinical trials conducted at institutions that receive funding for recombinant DNA research from the United States National Institutes of Health, or the NIH, are also subject to review by the NIH Office of Biotechnology Activities’ Recombinant DNA Advisory Committee, or the RAC. Although the FDA decides whether individual gene therapy protocols may proceed, the RAC review process can delay the initiation of a clinical trial, even if the FDA has reviewed the trial design and details and approved its initiation. Conversely, the FDA can put a proposed biological product on clinical hold even if the RAC has provided a favorable review of the product. Also, before a clinical trial can begin at any institution, that institution’s institutional review board, or IRB, and its institutional biosafety committee, or IBC, if it has one, have to review the proposed clinical trial to assess the safety of the trial. In addition, adverse developments in clinical trials of gene therapy products conducted by others may cause the FDA or comparable foreign regulatory bodies to change the requirements for approval of any of our product candidates.

These committees and advisory groups and the new guidelines they promulgate and new requirements they may impose may lengthen the clinical development and regulatory review process, require us to perform additional studies, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of these product candidates or lead to significant post-approval limitations or restrictions. As we advance our product candidates, we will be required to consult with these regulatory committees and advisory groups, and comply with applicable guidelines and requirements as they may change from time to time. If we fail to do so, we may be required to delay or discontinue development of our product candidates. These additional processes may result in a development, review and approval process that is longer than we otherwise would have expected for our product candidates. Delay or failure to obtain, or unexpected costs in obtaining, the regulatory approval necessary to bring a potential product to market would delay or prevent us from commercializing our product candidates, generating revenues and achieving and sustaining profitability.

Positive results from preclinical studies of our product candidates are not necessarily predictive of the results of our planned clinical trials of our product candidates.

Positive results in preclinical proof-of-concept and animal studies of our product candidates may not result in positive results in clinical trials in humans. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical trials after achieving positive results in preclinical development or early stage clinical trials, and we cannot be certain that we will not face similar setbacks. These setbacks have been caused

12

by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including adverse events. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials nonetheless failed to obtain FDA or other regulatory authority approval. If we fail to produce positive results in our clinical trials of our product candidates, the development timeline and regulatory approval and commercialization prospects for our product candidates, and, correspondingly, our business and financial prospects, would be negatively impacted.

Issues that may impact ddRNAi delivery to the cell could adversely affect or limit our ability to develop and commercialize product candidates.

Successful clinical development of ddRNAi-based therapeutics is largely dependent on using the appropriate vectors to obtain therapeutically relevant concentrations of the DNA constructs that express the shRNAs in the appropriate target cells. To develop effective product candidates, we will need to license delivery technologies from third parties or develop delivery technologies with research collaborators. Although delivery technologies, including AAV vectors, have been identified and are well defined for specific tissue types, we continue to seek vectors with ideal delivery properties for other indications we are pursuing, including OPMD. The tissue tropism and other physical properties of AAV vectors are limited and may not be effective for other product candidates or delivery into a wide array of tissues types. AAV vectors can also trigger immune responses in some patients, and those patients will not derive clinical benefit from administration of a product candidate unless steps are taken to clinically address the issue. If we or our collaborators are not successful in identifying effective vectors for our product candidates, we may not succeed in developing marketable products. In addition, if we are unable to reach agreement on favorable terms, or at all, with providers of any effective vectors that we do identify, we may not succeed in completing our clinical trials or commercializing our products on a timely or profitable basis, if at all. We have only one such agreement in place that allows us to use a vector both for clinical trials and for commercialization, and that agreement is with respect to our program for the treatment of AMD.

We use AAV vectors as part of our ddRNAi approach for several indications. As such, we require licenses and the ability to manufacture large quantities of AAV particles under the FDA’s current good manufacturing practices, or cGMP, requirements and those of comparable foreign regulatory authorities in order to commercialize a product candidate using an AAV vector.

We may find it difficult to enroll patients in our clinical trials, and patients could discontinue their participation in any future clinical trials, which could delay or prevent any future clinical trials of our product candidates and make those trials more expensive to undertake.

Identifying and qualifying patients to participate in any future clinical trials of our product candidates is critical to our success. The timing of our clinical trials depends on the speed at which we can recruit patients to participate in testing our product candidates. Patients may be unwilling to participate in any future clinical trials because of negative publicity from adverse events in the biotechnology, RNAi or gene therapy industries. Patients may be unavailable for other reasons, including competitive clinical trials for similar patient populations, and the timeline for recruiting patients, conducting trials and obtaining regulatory approval of potential products may be delayed. If we have difficulty enrolling a sufficient number of patients to conduct any future clinical trials as planned, we may need to delay, limit or discontinue those clinical trials. Clinical trial delays could result in increased costs, slower product development, setbacks in testing the effectiveness of our technology or discontinuation of the clinical trials altogether.

We may not be able to identify, recruit and enroll a sufficient number of patients, or those with required or desired characteristics to achieve diversity in a trial, to complete any future clinical trials in a timely manner. Patient enrollment is affected by factors including:

| | • | | finding and diagnosing patients; |

| | • | | severity of the disease under investigation; |

| | • | | design of the clinical trial protocol; |

| | • | | size and nature of the patient population; |

13

| | • | | eligibility criteria for the trial in question; |

| | • | | perceived risks and benefits of the product candidate under study; |

| | • | | proximity and availability of clinical trial sites for prospective patients; |

| | • | | availability of competing therapies and clinical trials; |

| | • | | clinicians’ and patients’ perceptions of the potential advantages of the product being studied in relation to other available therapies, including any new products that may be approved for the indications we are investigating; |

| | • | | patient referral practices of physicians; and |

| | • | | ability to monitor patients adequately during and after treatment. |

For example, we experienced some difficulties in enrolling patients in our clinical trial of TT-034, which was discontinued for commercial reasons. These difficulties were due to several factors, including sudden changes in patients’ viral load, liver enzymes and other clinical parameters immediately prior to their dosing, as well as late withdrawal due to personal reasons. We believe the increased availability of new and effective therapies such as Sovaldi and Harvoni, which were recently approved for treatment of the hepatitis C virus, and the fact that the early lower-dose cohort patients receive a sub-therapeutic dose of TT-034, may also have been contributing factors. We may face similar difficulties enrolling patients in clinical trials for other product candidates for these and other reasons.

We or our collaborators plan to seek initial marketing approval for our product candidates in the United States, Australia and Europe. We may not be able to initiate or continue any future clinical trials in a timely manner if we cannot enroll a sufficient number of eligible patients to participate in the clinical trials required by the FDA or comparable foreign regulatory agencies. Our ability to successfully initiate, enroll and complete a clinical trial in any foreign country is subject to numerous risks unique to conducting business in foreign countries, including:

| | • | | difficulty in establishing or managing relationships with contract research organizations, or CROs, clinical sites and physicians; |

| | • | | different standards for the conduct of clinical trials; |

| | • | | our inability to locate and engage qualified local consultants, physicians and partners; and |

| | • | | the potential burden of complying with a variety of foreign laws, medical standards and regulatory requirements, including the regulation of pharmaceutical and biotechnology products and treatments. |

In addition, patients enrolled in any future clinical trials may discontinue their participation at any time during the trial as a result of a number of factors, including experiencing adverse events, which may or may not be judged related to our product candidates under evaluation. The discontinuation of patients in any one of our trials may cause us to delay or discontinue our clinical trial, or cause the results from that trial not to be positive or sufficient to support either partnering with a pharmaceutical company to further develop and commercialize the product candidate or filing for regulatory approval of the product candidate.

We may encounter substantial delays in any future clinical trials or we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities.

None of our proprietary product candidates are currently in clinical trials. Before obtaining marketing approval from regulatory authorities for the sale of any of our product candidates, we must conduct extensive clinical trials to demonstrate the safety and efficacy of the product candidates in humans. Clinical trials are expensive and time-consuming, and their outcome is uncertain. We cannot guarantee that any clinical trials will be initiated or conducted as planned or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. Events that may prevent successful or timely completion of clinical development include:

| | • | | inability to generate sufficient preclinical, toxicology or other data to support the initiation of human clinical trials; |

14

| | • | | delays in reaching consensus with regulatory agencies on trial design; |

| | • | | identifying, recruiting and training suitable clinical investigators; |

| | • | | delays in reaching agreement on acceptable terms with prospective CROs and clinical trial sites; |

| | • | | delays in obtaining required IRB or IBC approval at each clinical trial site; |

| | • | | delays in recruiting suitable patients to participate in our clinical trials; |

| | • | | imposition of a clinical hold by regulatory agencies, including after an inspection of our clinical trial operations or trial sites; |

| | • | | failure by our CROs, other third parties or us to adhere to clinical trial requirements; |

| | • | | failure to perform in accordance with the FDA’s good clinical practices, or GCP, or applicable regulatory requirements in other countries; |

| | • | | inability to manufacture, test, release, import or export for use sufficient quantities of our product candidates for use in clinical trials; |

| | • | | failure to manufacture our product candidate in accordance with cGMP requirements or applicable regulatory guidelines in other countries; |

| | • | | delays in the testing, validation and manufacturing of our product candidates; |

| | • | | delays in the delivery of our product candidates to the clinical trial sites; |

| | • | | delays in having patients complete participation in a trial or return for post-treatment follow-up; |

| | • | | clinical trial sites dropping out of a trial; |

| | • | | occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits; |

| | • | | changes in regulatory requirements and guidance that require amending or submitting new clinical trial protocols; or |

| | • | | clinical trials of our product candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or discontinue product development programs. |

Further, a clinical trial may be suspended or discontinued by us, our collaborators, the IRBs or the IBCs at the sites in which such trials are being conducted, the data safety monitoring board, or DSMB, for such trial, or by the FDA or comparable foreign regulatory authorities due to a number of factors, including the imposition of a clinical hold or termination of a trial due to failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, unforeseen safety issues or adverse side effects of our product candidate, or a product candidate from another company that shares similar properties, failure to demonstrate adequate benefit from using a product candidate, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. If we experience discontinuation of, or delays in the completion of, any clinical trial of our product candidates, the commercial prospects of our product candidates may be harmed, and our ability to generate product revenues from any of these product candidates may be eliminated or delayed. Furthermore, many of the factors that lead to a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

15

In addition, if we or our third-party collaborators make significant manufacturing or formulation changes to our product candidates, we or they may need to conduct additional studies to bridge the modified product candidates to earlier versions to ensure comparability and safety of the two different product candidates.

Any inability to successfully complete preclinical and clinical development could result in additional costs to us or impair our ability to commercialize our programs and product candidates. Clinical trial delays could also shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize our product candidates.

If the results of any future clinical trials are inconclusive or if there are safety concerns or adverse events associated with our product candidates, we may:

| | • | | fail to obtain, or be delayed in obtaining, marketing approval for our product candidates; |

| | • | | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| | • | | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

| | • | | need to change the way the product is administered; |

| | • | | be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing requirements; |

| | • | | have regulatory authorities withdraw their marketing approval of the product after granting it; |

| | • | | have regulatory authorities impose restrictions on distribution of the product in the form of a risk evaluation and mitigation strategy, or REMS, or modified REMS, that limit our ability to commercialize the product; |

| | • | | be subject to the addition of labeling statements, such as warnings or contraindications; |

| | • | | be sued and held liable for harm caused to patients; or |

| | • | | experience damage to our reputation. |

Any of these events could prevent us from achieving or maintaining market acceptance of our product candidates and impair our ability to commercialize our product candidates.

In addition, principal investigators for our clinical trials may serve as scientific advisors or consultants to us from time to time and may receive cash or equity compensation in connection with such services. If these relationships and any related compensation result in perceived or actual conflicts of interest, or the FDA concludes that the financial relationship may have affected the interpretation of any particular study, the integrity of the data generated at the applicable clinical trial site may be questioned and the utility of the clinical trial itself may be jeopardized, which could result in the delay or rejection of any BLA we submit to the FDA or any comparable foreign regulating authorities. Any such delay or rejection could prevent us from commercializing our product candidates.

Our product candidates and the process for administering our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any potential marketing approval.

Treatment with our product candidates may produce undesirable side effects or adverse reactions or events. For example, the AAV vector and related capsid protein, which we are currently using to deliver most of our ddRNAi product candidates, could cause adverse immunological side effects due to preexisting and/or recall

16

responses to the naturally occurring virus from which the vector is engineered, or to the DNA construct product itself. These responses may also interfere with therapeutic efficacy if not identified and managed optimally. Preexisting immune responses to AAV manifesting as neutralizing antibodies are common within the general population and may be a limitation to the enrollment of patients in gene therapy clinical trials using AAV vectors, the successful use of AAV vectors in gene therapy clinical trials and the market acceptance of product candidates, if approved, that are delivered using AAV vectors. Patients with neutralizing antibodies to AAV will not derive clinical benefit from administration of such a product candidate unless steps are taken to clinically address the issue and those treatments themselves may cause adverse effects. In previous clinical trials undertaken by other companies involving systemic administration of AAV viral vectors for gene therapy, some subjects experienced adverse events, including the development of a negative T cell response against the AAV capsid protein. If our vectors cause similar adverse events, we may be required to delay or discontinue further clinical development of our product candidates. It is also possible that we may discover new adverse events related to AAV or other vectors, which could potentially enhance the risk to patients who use our product candidates delivered with that vector.

If any such adverse events occur, any future clinical trials could be suspended or discontinued and the FDA or comparable foreign regulatory authorities could order us to cease further development or deny approval of our product candidates for any or all targeted indications. The product-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial. If we elect or are required to delay, suspend or discontinue any clinical trial of any of our product candidates, the commercial prospects of such product candidates will be harmed and our ability to generate product revenues from any of these product candidates will be delayed or eliminated. Any of these occurrences may harm our business, financial condition and prospects significantly.

Additionally, if any of our product candidates receive marketing approval, the FDA could require us to adopt a REMS to ensure that the benefits of the product outweigh its risks, which may include, among other things, a medication guide outlining the risks of gene therapies for distribution to patients and a communication plan to patients and healthcare practitioners. Other elements to assure safe use in a mandated REMS could include, but are not limited to, restrictions upon distribution and prescribing, additional prescriber training, establishment of patient registries and other measures that could limit commercialization of the product. Comparable foreign regulating authorities might require adoption of measures similar to a REMS. Furthermore, if we or others later identify undesirable side effects caused by our product candidate, a number of potentially significant negative consequences could result, including:

| | • | | regulatory authorities may withdraw approvals of such product candidate; |

| | • | | regulatory authorities may require additional warnings on the label; |

| | • | | we may be required to create a medication guide outlining the risks of such side effects for distribution to patients; |

| | • | | we may be required to change the way a product candidate is administered or conduct additional clinical trials; |

| | • | | we could be sued and held liable for harm caused to patients; and |

| | • | | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of our product candidates and could significantly harm our business, prospects, financial condition and results of operations.

If we are unable to successfully develop related diagnostics for our therapeutic product candidates, or experience significant delays in doing so, we may not achieve marketing approval or realize the full commercial potential of our therapeutic product candidates.

We may develop related diagnostics for some of our therapeutic product candidates. Such related diagnostics are subject to regulation by the FDA and comparable foreign regulatory authorities as medical devices and require separate regulatory approval or clearance prior to commercialization. Marketing approval or clearance of the diagnostic will require sufficient data to support its safety and efficacy. In addition, at least in some cases, the FDA and comparable foreign regulatory authorities may require the development and regulatory approval or clearance of a related diagnostic as a condition to approving our therapeutic product candidates. While we have

17

some, limited experience in developing diagnostics, we plan to rely in large part on third parties to perform these functions. We may seek to enter into arrangements with one or more third parties to create a related diagnostic for use with our current or future product candidates.

If we, or any third parties that we engage to assist us, are unable to successfully develop or obtain marketing approval or clearance for related diagnostics for our therapeutic product candidates, or experience delays in doing so:

| | • | | the development of relevant product candidates may be delayed or impaired altogether if we are unable to appropriately select patients for enrollment in our clinical trials; |

| | • | | our relevant therapeutic product candidate may not receive marketing approval if its effective use depends on a related diagnostic in the regulatory authority’s judgment; and |

| | • | | we may not realize the full commercial potential of any therapeutic product candidates that receive marketing approval if, among other reasons, we are unable to appropriately identify patients with the specific genetic alterations targeted by our therapeutic product candidates. |

If any of these events were to occur, our business would be harmed.

Even if we complete the necessary preclinical studies and clinical trials, we cannot predict when or if we will obtain regulatory approval to commercialize a product candidate or the approval may be for a more narrow indication than we expect.

We cannot commercialize a product until the appropriate regulatory authorities have reviewed and approved the product candidate. Even if our product candidates demonstrate safety and efficacy in clinical trials, the regulatory agencies may not complete their review processes in a timely manner, or we may not be able to obtain regulatory approval. Additional delays may result if an FDA Advisory Committee or comparable foreign regulatory authority recommends non-approval or restrictions on approval. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action, or changes in regulatory agency policy during the period of product development, clinical trials and the review process. Regulatory agencies also may approve a treatment candidate for fewer or more limited indications than requested, may not approve the price we intend to charge for our product candidate, may limit our ability to promote the product, may impose significant limitations upon the approval of the product, including, but not limited to, narrow indications, significant warnings, precautions or contraindications with respect to conditions of use, or may grant approval subject to the performance of post-marketing studies. In addition, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our product candidates. The FDA or comparable foreign regulatory authorities may impose a REMS or other conditions upon our approval that limit our ability to commercialize the product candidate.

Even if we obtain regulatory approval for a product candidate, our products will remain subject to regulatory scrutiny.

Even if we obtain regulatory approval in a jurisdiction, the regulatory authority may still impose significant restrictions on the indicated uses or marketing of our product candidates, or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the holder of an approved BLA is obligated to monitor and report to the FDA adverse events and any failure of a product to meet the specifications in the BLA. FDA guidance advises that patients treated with some types of gene therapy undergo follow-up observations for potential adverse events for as long as 15 years. The holder of an approved BLA must also submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling or manufacturing process. Advertising and promotional materials must comply with FDA rules and are subject to FDA review, in addition to other potentially applicable foreign, federal and state laws.

In addition, product manufacturers and their establishments, products and applications are subject to payment of user fees and continual review and periodic inspections by the FDA and comparable foreign regulatory authorities for compliance with cGMP and comparable foreign requirements, and adherence to commitments made in the BLA. If we or a regulatory agency discover previously unknown problems with a product such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions relative to that product or the manufacturing facility, including requiring recall or withdrawal of the product from the market or suspension of manufacturing.

18

If we fail to comply with applicable regulatory requirements following approval of any of our product candidates, a regulatory agency may:

| | • | | issue a warning letter asserting that we are in violation of the law; |

| | • | | seek an injunction or impose civil or criminal penalties or monetary fines; |

| | • | | suspend or withdraw regulatory approval; |

| | • | | suspend any ongoing clinical trials; |

| | • | | refuse to permit government reimbursement of our product by government-sponsored third-party payors; |

| | • | | refuse to approve a pending BLA or supplements to a BLA submitted by us for other indications or new product candidates; |

| | • | | refuse to allow us to enter into or continue supply contracts, including government contracts. |

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity. The occurrence of any event or penalty described above may inhibit our ability to commercialize our product candidates and generate revenues.

Even if we obtain and maintain approval for our product candidates from the FDA, we may never obtain approval for our product candidates outside of the United States, which would limit our market opportunities and adversely affect our business.

Approval of a product candidate in the United States by the FDA does not ensure approval of such product candidate by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. Sales of our product candidates outside of the United States will be subject to foreign regulatory requirements governing clinical trials and marketing approval. Even if the FDA grants marketing approval for a product candidate, comparable regulatory authorities of foreign countries must also approve the manufacturing and marketing of the product candidates in those countries. Approval procedures vary among jurisdictions and can involve requirements and administrative review periods different from, and greater than, those in the United States, including additional preclinical studies or clinical trials. In many countries outside the United States, a product candidate must be approved for reimbursement before it can be approved for sale in that country. In some cases, the price that we intend to charge for our products, if approved, is also subject to approval. Even if a product candidate is approved, the FDA or comparable regulatory authorities in other countries, as the case may be, may limit the indications for which the product may be marketed, require extensive warnings on the product labeling or require expensive and time-consuming clinical trials or reporting as conditions of approval. Regulatory authorities in countries outside of the United States also have requirements for approval of product candidates with which we must comply prior to marketing in those countries. Obtaining foreign regulatory approvals and compliance with foreign regulatory requirements could result in significant delays, difficulties and costs for us and could delay or prevent the introduction of our product candidates in certain countries.

Further, clinical trials conducted in one country may not be accepted by regulatory authorities in other countries. Regulatory approval of a product candidate in one country does not ensure approval in any other country, but a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory approval process in other countries. Also, regulatory approval for any of our product candidates may be withdrawn based on adverse events reported or regulatory decisions made in other countries. If we fail to comply with the regulatory requirements in international markets and/or fail to receive applicable marketing approvals, our target market will be reduced and our ability to realize the full market potential of our product candidates will be compromised and our business may be adversely affected.

19

Our future prospects are also dependent on our or our collaborators’ ability to successfully develop a pipeline of additional product candidates, and we and our collaborators may not be successful in efforts to use our platform technologies to identify or discover additional product candidates.