Exhibit 99.1

| |

THIS IS AN IMPORTANT DOCUMENT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN ANY DOUBT ABOUT HOW TO DEAL WITH THIS DOCUMENT, YOU SHOULD CONTACT YOUR BROKER OR FINANCIAL, TAXATION, LEGAL OR OTHER PROFESSIONAL ADVISER IMMEDIATELY. |

Benitec Biopharma Limited Scheme Booklet |

| |

This Scheme Booklet is for the proposed scheme of arrangement between Benitec Biopharma Limited (Benitec) and Benitec Shareholders in relation to the proposed re-domiciliation of Benitec to the United States. The Benitec Board unanimously recommends that you VOTE IN FAVOUR of the Scheme Resolution in the absence of a superior proposal. The Independent Expert has concluded that the Scheme is in the best interests of Benitec Shareholders. |

If you have any questions in relation to this Scheme Booklet or the Scheme, you should call the Benitec Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia) Monday to Friday between 8.30am and 5.00pm (AEDT).

|

LEGAL ADVISER

|

|

Disclaimer and important notices

General

This Scheme Booklet provides Benitec Shareholders with information about the proposed acquisition by Benitec Biopharma Inc. (Holdco) of all Benitec Shares by way of a scheme of arrangement to effect a re-domiciliation to the United States.

This Scheme Booklet is important and requires your immediate attention. You should read this Scheme Booklet in full before making any decision as to how to vote at the Scheme Meeting.

Nature of this document

This Scheme Booklet is the explanatory statement for the Scheme required by subsection 412(1) of the Corporations Act.

This Scheme Booklet does not constitute or contain an offer to Benitec Shareholders, or a solicitation of an offer from Benitec Shareholders, in any jurisdiction.

ASIC and ASX

A copy of this Scheme Booklet has been registered by ASIC for the purposes of subsection 412(6) of the Corporations Act. ASIC has been given the opportunity to comment on this Scheme Booklet in accordance with subsection 411(2) of the Corporations Act. Neither ASIC, nor any of its officers, takes any responsibility for the contents of this Scheme Booklet.

ASIC has been requested to provide a statement, in accordance with subsection 411(17)(b) of the Corporations Act, that it has no objection to the Scheme. If ASIC provides that statement, it will be produced to the Court at the Second Court Hearing.

A copy of this Scheme Booklet has been provided to ASX. Neither ASX, nor any of its officers, takes any responsibility for the contents of this Scheme Booklet.

Important notice associated with Court order under subsection 411(1) of the Corporations Act

The fact that, under subsection 411(1) of the Corporations Act, the Court has ordered that the Scheme Meeting be convened and has approved the explanatory statement required to accompany the Notice of Scheme Meeting does not mean that the Court:

• | has formed any view as to the merits of the proposed Scheme or as to how Benitec Shareholders should vote; or |

• | has prepared, or is responsible for the content of, the explanatory statement. |

Defined terms

Capitalised terms used in this Scheme Booklet are defined in Section 9.1 of this Scheme Booklet. Section 9.2 also sets out some rules of interpretation which apply to this Scheme Booklet.

Not an offer

This Scheme Booklet is not a disclosure document for the purposes of Chapter 6D of the Corporations Act and does not constitute, nor contain, an offer to Benitec Shareholders or a solicitation of an offer from Benitec Shareholders, in any jurisdiction.

No investment advice

This Scheme Booklet has been prepared without reference to the investment objectives, financial and taxation situation or particular needs of any Benitec Shareholder, or any other person. The information and recommendations contained in this Scheme Booklet do not constitute, and should not be taken as, financial product advice. The Benitec Board encourages you to seek independent legal, financial and taxation advice before making any investment decision and any decision as to whether or not to vote in favour of the Scheme Resolution.

This Scheme Booklet should be read in its entirety before making a decision on whether or not to vote in favour of the Scheme Resolution. In particular, it is important that you consider the potential risks if the Scheme does not proceed, as set out in Sections 3.11 and 6 of this Scheme Booklet, and the views of the Independent Expert set out in the Independent Expert's Report contained in Attachment A to this Scheme Booklet.

If you are in any doubt as to the course you should follow, you should consult an independent and appropriately licensed and authorised professional adviser.

Forward looking statements

This Scheme Booklet contains both historical and forward-looking statements (including in the Independent Expert’s Report). Forward looking statements or statements of intent in relation to future events in this Scheme Booklet (including in the Independent Expert's Report) should not be taken to be forecasts or predictions that those events will occur. Forward looking statements generally may be identified by the use of forward looking words such as 'believe', 'aim', 'expect', 'anticipate', 'intending', 'foreseeing', 'likely', 'should', 'planned', 'may', 'estimate', 'potential', or other similar words. Similarly, statements that describe the objectives, plans, goals, intentions or expectations of Benitec or Holdco are or may be forward looking statements. You should be aware that such statements are only opinions and are subject to inherent risks and uncertainties. Those risks and uncertainties include factors and risks specific to Benitec and Holdco and/or the industries in which they operate, as well as general economic conditions, prevailing exchange rates and interest rates and conditions in financial markets.

Actual events or results may differ materially from the events or results expressed or implied in any forward looking statement and deviations are both normal and to be expected. Neither Benitec, Holdco nor any of their respective officers, directors, employees or advisers nor any person named in this Scheme Booklet or involved in the preparation of this Scheme Booklet make any representation or warranty (either express or implied) as to the accuracy or likelihood of fulfilment of any forward looking statement, or any events or results expressed or implied in any forward looking statement. Accordingly, you are cautioned not to place undue reliance on those statements.

The forward looking statements in this Scheme Booklet reflect views held only at the date of this Scheme Booklet. Subject to any continuing obligations under the Listing Rules or the Corporations Act, Benitec, Holdco and their respective officers, directors, employees and advisers, disclaim any obligation or undertaking to distribute after the date of this Scheme Booklet any updates or revisions to any forward looking statements to reflect:

• | any change in expectations in relation to such statements; or |

• | any change in events, conditions or circumstances on which any such statement is based. |

Responsibility statement

Except as outlined below, the information contained in this Scheme Booklet has been provided by Benitec and is its responsibility alone. Except as outlined below, neither Holdco nor any of its respective officers, employees or advisers assume any responsibility for the accuracy or completeness of such information.

The Holdco Information has been prepared by, and is the responsibility of, Holdco. Neither Benitec nor any of its Subsidiaries, directors, officers, employees or advisers assume any responsibility for the accuracy or completeness of such information.

McGrathNicol Advisory Partnership has prepared the Independent Expert’s Report (as set out in Attachment A to this Scheme Booklet) and takes responsibility for that report. None of Benitec, its Subsidiaries, Holdco, nor their respective officers, employees or advisers assume any responsibility for the accuracy or completeness of the information contained in the Independent Expert's Report, except, in the case of Benitec, in relation to the information which it has provided to the Independent Expert.

No consenting party has withdrawn their consent to be named before the date of this Scheme Booklet.

Foreign jurisdictions

The release, publication or distribution of this Scheme Booklet in jurisdictions other than Australia may be restricted by law or regulation in such other jurisdictions and persons outside of Australia who come into possession of this Scheme Booklet should seek advice on and observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable laws or regulations.

This Scheme Booklet has been prepared in accordance with the laws of the Commonwealth of Australia and the information contained in this Scheme Booklet may not be the same as that which would have been disclosed if this Scheme Booklet had been prepared in accordance with the laws and regulations of a jurisdiction outside of Australia.

No action has been taken to register or qualify the Holdco Shares or otherwise permit a public offering of such securities in any jurisdiction outside Australia.

Based on the information available to Benitec as at the date of this Scheme Booklet, Scheme Shareholders whose addresses are shown in the Share Register on the Record Date as being in the following jurisdictions outside of Australia will be entitled to have Holdco Shares issued to them pursuant to the Scheme subject to the qualifications, if any, set out below and in Section 8.10 in respect of that jurisdiction:

• | any other person or jurisdiction in respect of which Benitec is satisfied, acting reasonably, that the laws of that place permit the offer and issue of Holdco Shares to that Scheme Shareholder and, in Holdco’s sole discretion, is not unduly onerous or impracticable for Holdco to do so. |

Nominees, custodians and other Benitec Shareholders who hold Benitec Shares on behalf of a beneficial owner resident outside of Australia, New Zealand, Hong Kong, Singapore or the United States may not forward this Scheme Booklet (or any accompanying documents) to anyone outside of these countries without the prior written consent of Benitec.

Scheme Shareholders who are Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Scheme will be issued to the Sale Agent and sold through the Share Sale Facility, with the Share Sale Facility Proceeds being remitted to those Scheme Shareholders. Refer to Section 3.4 for further details on the Share Sale Facility.

Notice to Benitec Shareholders in the United States

The Holdco Shares have not been registered under the US Securities Act or under the securities laws of any state or other jurisdiction of the United States.

Holdco is relying on Section 3(a)(10) of the US Securities Act in connection with the consummation of the Scheme and the issuance of Holdco Shares. Section 3(a)(10) provides an exemption for registration of securities issued in exchange for other securities where the terms and conditions of the issuance and exchange have been approved by a court of competent jurisdiction, after a hearing upon the fairness of the terms and conditions of the issuance at which all persons to whom the securities will be issued have the right to appear. Approval of the Scheme by the Court will be relied upon by Benitec and Holdco for purposes of qualifying for the Section 3(a)(10) exemption.

This Scheme Booklet has not been filed with or reviewed by the SEC or any United States state securities authority and none of them has passed upon or endorsed the merits of the Scheme or the accuracy, adequacy or completeness of this Scheme Booklet. Any representation to the contrary is a criminal offence.

Financial amounts

All financial amounts in this Scheme Booklet are expressed in Australian currency unless otherwise stated.

Any discrepancies between totals in tables or financial statements, or in calculations, graphs or charts are due to rounding.

All financial and operational information set out in this Scheme Booklet is current as at the date of this Scheme Booklet, unless otherwise stated.

Notice regarding Second Court Hearing

At the Second Court Hearing, the Court will consider whether to approve the Scheme following the votes at the Scheme Meeting.

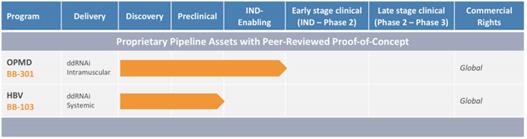

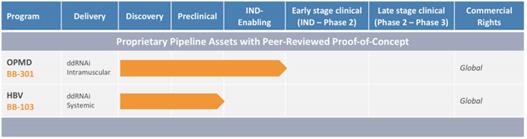

Charts and diagrams

Any diagrams, charts, graphs or tables appearing in this Scheme Booklet are illustrative only and may not be drawn to scale. Unless stated otherwise, all data contained in diagrams, charts, graphs and tables is based on information available as at the Last Practicable Date.

Timetable and dates

All times and dates referred to in this Scheme Booklet are references to times and dates in Australian Eastern Daylight Time (AEDT), unless otherwise indicated. All times and dates relating to the implementation of the Scheme referred to in this Scheme Booklet may change and, among other things, are subject to all necessary approvals from Regulatory Authorities.

Privacy

Benitec may collect personal information in the process of implementing the Scheme. The type of information that it may collect about you includes your name, contact details and information on your security holding in Benitec and the names of persons appointed by you to act as a proxy, attorney or corporate representative at the Scheme Meeting. The collection of some of this information is required or authorised by the Corporations Act.

The primary purpose of the collection of personal information is to assist Benitec to conduct the Scheme Meeting and implement the Scheme. Without this information, Benitec may be hindered in its ability to issue this Scheme Booklet and implement the Scheme. Personal information of the type described above may be disclosed to the Share Registry, third party service providers (including print and mail service providers and parties otherwise involved in the conduct of the Scheme Meeting), authorised securities brokers, professional advisers, related bodies corporate of Benitec, Regulatory Authorities, and also where disclosure is otherwise required or allowed by law.

Benitec Shareholders who are individuals and the other individuals in respect of whom personal information is collected as outlined above have certain rights to access the personal information collected in relation to them. If you would like to obtain details of the information about you held by Benitec, please contact the Share Registry.

Benitec Shareholders who appoint an individual as their proxy, corporate representative or attorney to vote at the Scheme Meeting should ensure that they inform such an individual of the matters outlined above.

Benitec Information Line

If you have any questions in relation to this Scheme Booklet or the Scheme, you should call the Benitec Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia) Monday to Friday between 8.30am and 5.00pm (AEDT).

Date of Scheme Booklet

This Scheme Booklet is dated 10 February 2020.

Contents

Table of contents

| | | | |

Important dates | | 1 |

Overview of this Scheme Booklet | | 2 |

Letter from the Executive Chairman | | 5 |

1 | Frequently asked questions | | 7 |

2 | Reasons to vote for/against the Scheme | | 17 |

| 2.1 | Introduction | | 17 |

| 2.2 | Why you should vote in favour of Scheme Resolution | | 17 |

| 2.3 | Why you may wish to vote against the Scheme | | 18 |

3 | Summary of the Scheme | | 20 |

| 3.1 | Background | | 20 |

| 3.2 | Scheme Consideration | | 20 |

| 3.3 | Selling Shareholders | | 20 |

| 3.4 | Share Sale Facility | | 21 |

| 3.5 | Withholding taxes under Share Sale Facility | | 22 |

| 3.6 | Admission of Holdco to Nasdaq | | 22 |

| 3.7 | Directors’ recommendation | | 22 |

| 3.8 | Voting intentions of the Directors | | 22 |

| 3.9 | Independent Expert’s conclusions | | 23 |

| 3.10 | Conditions to the Scheme | | 23 |

| 3.11 | Implications if the Scheme does not proceed | | 23 |

| 3.12 | Your choices as a Benitec Shareholder | | 24 |

| 3.13 | Copy of Share Register | | 25 |

| 3.14 | Warranty and power of attorney by Scheme Shareholder | | 25 |

| 3.15 | No brokerage or stamp duty | | 25 |

| 3.16 | Existing Benitec Shareholder instructions to Benitec | | 25 |

| 3.17 | Delisting of Benitec | | 25 |

4 | Profile of Benitec | | 26 |

| 4.1 | Introduction | | 26 |

| 4.2 | Benitec Board | | 26 |

| 4.3 | Senior management team | | 27 |

| 4.4 | Capital structure | | 27 |

| 4.5 | Interests of Directors in Benitec securities | | 29 |

| 4.6 | Interests of Directors in securities of Holdco | | 29 |

| 4.7 | Benefits and agreements | | 29 |

| 4.8 | Recent share price history | | 30 |

| 4.9 | Historical financial information | | 30 |

| 4.10 | Material changes to financial position | | 33 |

| 4.11 | Publicly available information about Benitec | | 33 |

5 | Profile of Holdco | | 36 |

| 5.1 | Overview | | 36 |

| 5.2 | Directors | | 36 |

| 5.3 | Capital Structure | | 36 |

| 5.4 | Rights and liabilities attaching to Holdco Shares | | 36 |

| 5.5 | Employee shares and options plan | | 37 |

| 5.6 | Differences between corporate laws | | 38 |

| 5.7 | Differences between Australian and US financial reporting | | 57 |

| | | | |

| 5.8 | Reporting obligations of Holdco | | 57 |

| 5.9 | Corporate governance structure | | 61 |

| 5.10 | Holdco’s intentions for Benitec’s business, assets and employees following implementation | | 61 |

6 | Risk Factors | | 62 |

| 6.1 | Introduction | | 62 |

| 6.2 | General market risks | | 62 |

| 6.3 | Specific risks relating to Benitec and the industries in which it operates | | 62 |

| 6.4 | Risks relating to holding Holdco Shares | | 65 |

| 6.5 | Risk factors which may prevent the Scheme from being implemented | | 66 |

7 | Implementing the Scheme | | 67 |

| 7.1 | Scheme Implementation Agreement | | 67 |

| 7.2 | Voting on the Scheme Resolution | | 68 |

| 7.3 | Court approval of the Scheme | | 68 |

| 7.4 | Deed Poll | | 68 |

| 7.5 | Effective Date | | 69 |

| 7.6 | Record Date and entitlement to Scheme Consideration | | 69 |

| 7.7 | Implementation of the Scheme | | 69 |

8 | Additional Information | | 70 |

| 8.1 | Effect of the transaction on Benitec’s material contracts | | 70 |

| 8.2 | Australian taxation Implications of the Scheme | | 70 |

| 8.3 | US federal taxation implications | | 74 |

| 8.4 | Disputes and litigation | | 79 |

| 8.5 | Status of Conditions Precedent | | 79 |

| 8.6 | Substantial shareholders of Benitec | | 80 |

| 8.7 | Consents to be named | | 80 |

| 8.8 | Intentions of Directors | | 81 |

| 8.9 | No unacceptable circumstances | | 81 |

| 8.10 | Foreign jurisdictions | | 81 |

| 8.11 | No other material information | | 83 |

| 8.12 | Supplementary disclosure statement | | 83 |

9 | Definitions and interpretation | | 85 |

| 9.1 | Definitions | | 85 |

| 9.2 | Interpretation | | 90 |

| Attachment A | | |

| Independent Expert’s Report | | |

| Attachment B | | |

| Deed Poll | | |

| Attachment C | | |

| Scheme of Arrangement | | |

| Attachment D | | |

| Notice of Scheme Meeting | | |

| Attachment E | | |

| Amended and Restated Scheme Implementation Agreement | | |

| Corporate directory | | |

Important dates

| |

Key dates

|

Date of this Scheme Booklet | Monday, 10 February 2020 |

Latest time and date for receipt of the Proxy Form (including

proxies lodged online) or powers of attorney by the Share

Registry for the Scheme Meeting | 10.00am (AEDT) on Tuesday, 24 March 2020 |

Time and date for determining eligibility to vote at the Scheme

Meeting | 7.00pm (AEDT) on Tuesday, 24 March 2020 |

Scheme Meeting | 10.00am (AEDT) on Thursday, 26 March 2020 |

If the Scheme Resolution is approved at the Scheme Meeting the following key dates will apply.

| |

Second Court Date

Court order lodged with ASIC and announcement to ASX Effective Date | Monday, 30 March 2020 |

Share Sale Facility election due | 5.00pm (AEST) on Monday, 6 April 2020 |

Record Date | 7.00pm (AEST) on Monday, 6 April 2020 |

Implementation Date Issue of Holdco Shares to Scheme Shareholders Trading of Holdco Shares on Nasdaq commences | Wednesday, 15 April 2020 |

Commencement of despatch to Scheme Shareholders of

statements confirming the issue of Holdco Shares | Wednesday, 22 April 2020 |

Share Sale Facility Proceeds will be distributed to relevant

Scheme Shareholders who participate in the Share Sale Facility | As soon as reasonably practicable, however this process may require several months |

All dates in the above timetable are indicative only and are subject to change. Benitec, in consultation with Holdco, may vary any or all of these dates and times and will provide reasonable notice of any such variation. Certain times and dates are conditional on the approval of the Scheme by Benitec Shareholders and the Court and may depend on factors outside of the control of Benitec. Any changes will be announced by Benitec to ASX and published on Benitec’s website at www.benitec.com.

1

Overview of this Scheme Booklet

What is this Scheme Booklet for?

This Scheme Booklet contains information about the proposed re-domiciliation of Benitec to the United States by way of the Scheme under which Holdco, a new US company incorporated in accordance with the laws of Delaware, will acquire all Benitec Shares (including such Benitec Shares underlying the American Depositary Shares (ADSs)).

Following implementation of the Scheme, Holdco will become the ultimate parent company of Benitec. It is intended that Holdco will be a public reporting company in the United States with Holdco Shares being listed for trading on Nasdaq on the Implementation Date, subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco.

This Scheme Booklet provides important information for Benitec Shareholders to consider before voting in favour of the Scheme Resolution at the relevant Scheme Meeting to be held at Grant Thornton, Collins Square, Tower 5, 727 Collins Street, Melbourne, Victoria 3008 at 10.00am (AEDT) on Thursday, 26 March 2020.

What will I be entitled to receive if the Scheme proceeds?

If the Scheme is implemented, Scheme Shareholders will receive one Holdco Share for every 300 Scheme Shares held as at the Record Date (Scheme Consideration).

Scheme Shareholders who are Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Scheme will be issued to the Sale Agent and sold through the Share Sale Facility, with the Share Sale Facility Proceeds being remitted to those Scheme Shareholders.

Any fractional entitlements to Holdco Shares will not be issued to Scheme Shareholders and will instead be aggregated and issued to the Sale Agent to be sold under the Share Sale Facility.

Benitec Shareholders holding less than 50,000 Benitec Shares as at the Record Date may also elect to have all of their Holdco Shares issued to the Sale Agent and sold under the Share Sale Facility.

Refer to Section 3.4 for further details on the Share Sale Facility.

What if I hold ADSs?

Holders of ADSs (ADS Holders) will be entitled to vote on the Scheme Resolution through the ADS Depositary. ADS Holders may not vote in person at the Scheme Meeting or by proxy other than through the ADS Depositary unless they surrender their ADSs and become holders of the underlying Benitec Shares prior to the date for determining entitlement to vote.

If the Scheme is implemented, Benitec intends to terminate the ADS program. The ADS Depositary has informed Benitec that it will call for surrender of all outstanding ADSs and will deliver the Holdco Shares and any Share Sale Facility Proceeds (from the sale of fractional entitlements) to ADS Holders upon surrender of their ADSs and payment of any fee for such surrender.

What should I do next?

Step 1: Read this Scheme Booklet in its entirety

You should read this Scheme Booklet carefully in full, including the reasons to vote in favour of or against the Scheme Resolution (as set out in Section 2), before making any decision on how to vote.

Answers to various frequently asked questions about the Scheme Resolution are set out in Section 1. If you have any additional queries about this Scheme Booklet or the Scheme please call the Benitec Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia) between 8.30am and 5.00pm (AEDT), visit www.benitec.com or contact your legal, financial, taxation or other professional adviser.

2

Step 2: Vote at the Scheme Meeting

Entitlement to vote

If you are registered as a Benitec Shareholder on the Share Register at 7.00pm (AEDT) on Tuesday, 24 March 2020, you will be entitled to attend and vote at the Scheme Meeting.

How to vote

In person:

To vote in person, you must attend the Scheme Meeting. All persons entitled to vote will be admitted and given a voting card at the point of entry to the meeting, once they have disclosed their name and address.

By proxy:

You may appoint one or two proxies by using the Proxy Form. Your proxy need not be another Benitec Shareholder. Each proxy will have the right to vote on the poll and also to speak at the Scheme Meeting.

A vote given in accordance with the terms of a proxy appointment is valid despite the revocation of that appointment, unless notice in writing of the revocation has been received by the Share Registry before the start or resumption of the meeting. A proxy is not revoked by the principal attending and taking part in the meeting, unless the principal actually votes at the meeting on the resolution for which the proxy was proposed to be used. If you wish to appoint a second proxy, a second proxy form should be used and you should clearly indicate on the second proxy form that it is a second proxy and not a revocation of your first proxy. You can obtain a second proxy form from the Share Registry.

If you appoint two proxies, each proxy should be appointed to represent a specified proportion of your voting rights. If you do not specify the proportions in the proxy forms, each proxy may exercise half of your votes with any fractions of votes disregarded.

If you return your Proxy Form:

• | without identifying a proxy on it, you will be taken to have appointed the chair of the meeting as your proxy to vote on your behalf; or |

• | with a proxy identified on it but your proxy does not attend the meeting, the chair of the meeting will act in place of your nominated proxy and vote in accordance with any directions on your Proxy Form. |

The chair of the meeting intends to vote all valid undirected proxies which nominate the chair in favour of the Scheme Resolution, in the absence of a superior proposal.

Proxies of Benitec Shareholders will be admitted to the Scheme Meeting and given a voting card on providing at the point of entry to the meeting, written evidence of their name and address.

Your appointment of a proxy does not preclude you from attending in person, revoking the proxy and voting at the Scheme Meeting.

You must deliver the signed and completed Proxy Form to the Share Registry by 10.00am (AEDT) on Tuesday, 24 March 2020 (or, if the meeting is adjourned or postponed, no later than 48 hours before the resumption of the meeting in relation to the resumed part of the meeting) in any of the following ways:

Benitec Shareholders may lodge their proxy online at www.investorvote.com.au and following the instructions on the website. You will require the information on your Proxy Form to lodge your proxy through the website.

(b) | by post in the provided envelope to the Share Registry: |

Computershare Investor Services Pty Limited

GPO Box 1282

Melbourne, Victoria 3001

Scan the QR Code on your Proxy Form and follow the prompts.

3

For Intermediary Online subscribers only (custodians) please visit

www.intermediaryonline.com to submit your voting intentions.

(e) | by fax to the Share Registry on 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia). |

If a voting form is completed under power of attorney or other authority, the power of attorney or other authority, or a certified copy of the power of attorney or other authority, must accompany the completed voting form unless the power of attorney or other authority has previously been noted by the Share Registry.

If you hold Benitec Shares jointly with one or more other persons, in order for your direct vote or proxy appointment to be valid, each of you must sign the voting form.

By attorney:

You may appoint an attorney to attend and vote at the Scheme Meeting on your behalf. Your attorney need not be another Benitec Shareholder. Each attorney will have the right to vote on the poll and also to speak at the Scheme Meeting.

The power of attorney appointing your attorney to attend and vote at the Scheme Meeting must be duly executed by you and specify your name, the company (that is, Benitec), and the attorney, and also specify the meeting at which the appointment may be used. The appointment may be a standing one.

The power of attorney, or a certified copy of the power of attorney, should be lodged at the registration desk on the day of the Scheme Meeting or delivered by post or by facsimile to the Share Registry before 10.00am (AEDT) on Tuesday, 24 March 2020 (or, if the meeting is adjourned or postponed, no later than 48 hours before the resumption of the meeting in relation to the resumed part of the meeting).

Attorneys of Benitec Shareholders will be admitted to the meeting and given a voting card on providing at the point of entry to the meeting, written evidence of their appointment, their name and address, and the name of their appointors.

Your appointment of an attorney does not preclude you from attending in person and voting at the meeting.

By corporate representative:

If you are a body corporate, you may appoint an individual to act as your body corporate representative. The appointment must comply with the requirements of section 250D of the Corporations Act, meaning that Benitec will require a certificate of appointment of body corporate representative to be executed by you in accordance with the Corporations Act.

A form of certificate may be obtained from the Share Registry by calling 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia). The certificate of appointment may set out restrictions on the representative’s powers.

If a certificate is completed under a power of attorney or other authority, the power of attorney or other authority, or a certified copy of the power of attorney or other authority, must accompany the completed certificate unless the power of attorney or other authority has previously been noted by the Share Registry.

Body corporate representatives of Benitec Shareholders will be admitted to the Scheme Meeting and given a voting card on providing at the point of entry to the meeting, written evidence of their appointment, their name and address and the name of their appointors.

Questions?

Further information on the Scheme Meeting can be found in the notice of meeting in Attachment D of this Scheme Booklet.

If you have any questions after reading this Scheme Booklet, please call the Benitec Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia) between 8.30am and 5.00pm (AEDT), or contact your legal, financial, taxation or other professional adviser.

4

Letter from the Executive Chairman

Dear Shareholders,

On 27 November 2019, Benitec announced its intention to re-domicile from Australia to the United States of America. Benitec is implementing a scheme of arrangement pursuant to which Benitec Biopharma Inc. (Holdco), a new company incorporated for the purpose of effecting the re-domiciliation, will acquire all Benitec Shares and in exchange Benitec Shareholders will receive 1 Holdco Share for every 300 Benitec Shares held as at the Record Date.

Holders of ADSs listed on Nasdaq will be entitled to vote and participate in the Scheme (through the Bank of New York Mellon, the ADS Depositary).

If the Scheme is implemented, Benitec will become a wholly owned subsidiary of Holdco. Promptly following implementation of the Scheme, Benitec will be delisted from ASX. Holdco Shares will be admitted to Nasdaq on the Implementation Date, subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco.

Reasons for re-domiciliation

After carefully considering the relative merits of the re-domiciliation, the Benitec Board is of the view that the advantages materially outweigh the disadvantages. In particular, the Benitec Board believes that the re-domiciliation would provide the following potential benefits:

• | streamline and reduce overhead costs of the group, particularly in respect of compliance, audit and insurance costs, estimated to generate cost savings in excess of A$750,000 per annum once fully implemented; |

• | align its corporate and operations structure, noting that the majority of Benitec’s current business and employees are already located in the US; |

• | provide access to a broader range of US investors in a market which is familiar with and has a stronger interest in early to mid-stage biotechnology companies, which may lead to a stronger valuation of Holdco over time and improve liquidity in trading of shares; and |

• | improve attractiveness as a potential target; and |

• | create additional opportunities with potential licensing or joint venture partners. |

You should carefully consider the reasons to vote for, and against, the Scheme Resolution set out in Section 2.

Independent Expert

Benitec has engaged McGrathNicol Advisory Partnership to prepare the Independent Expert’s Report for this Scheme Booklet.

The Independent Expert has concluded the Scheme is in the best interests of Benitec Shareholders.

A full copy of the Independent Expert’s Report is also included in Attachment A of this Scheme Booklet.

Recommendation of the Benitec Board

For the reasons set out in this Scheme Booklet, the Benitec Board unanimously recommends that you vote in favour of the Scheme Resolution, subject to no superior proposal emerging and the Independent Expert continuing to conclude the Scheme to be in the best interests of Benitec Shareholders.

Subject to those same qualifications, each member of the Benitec Board that holds or controls Benitec Shares intends to vote in favour of the Scheme.

The Benitec Board will carefully consider any proposal received from third parties in the context of a control transaction (or any other transaction) to determine whether it is a “superior proposal” in the best interests Benitec Shareholders, taking into account a range of relevant factors. As at the date of this Scheme Booklet, no superior proposal has emerged and the Directors are not aware of any superior proposal that is likely to emerge.

5

Your vote is important

Your vote is important regardless of how many Benitec Shares you own. If you wish for the Scheme to proceed, it is important that you vote in favour of the Scheme Resolution at the Scheme Meeting.

Further Information

This Scheme Booklet sets out important information regarding the Scheme, and I encourage you to consider it carefully and in its entirety.

If you require any further information, please call the Benitec Shareholder Information Line on 1300 850 505 (within Australia), or +61 3 9415 4000 (outside Australia) between 8:30am and 5:00pm (AEDT).

Conclusion

On behalf of the Benitec Board, I thank you for your continued support as a Benitec Shareholder. We encourage you to vote in favour of the Scheme, which we believe to be in the best interests of Benitec Shareholders.

Yours sincerely

Jerel A. Banks, M.D., Ph.D.

Executive Chairman and CEO

6

1 | Frequently asked questions |

This Section 1 answers some frequently asked questions about the Scheme. It is not intended to address all relevant issues for Benitec Shareholders. This Section 1 should be read together with all other parts of this Scheme Booklet (including the risk factors in Section 6).

Question | Answer | More information |

The Scheme, the Scheme Consideration and the Directors’ recommendation |

What is the Scheme | The Scheme is a scheme of arrangement between

Benitec and the Scheme Shareholders. The purpose of implementing the Scheme is to re-

domicile Benitec to the United States so that the new

ultimate parent company of Benitec will be a United

States corporation. | A summary of the Scheme is set out in section 3. |

Why is Benitec re-domiciling to the US? | The Benitec Board believes that the re-domiciliation in

the United States is in the best interests of the Benitec Shareholders. | Section 2.2 sets out further information regarding the reasons for re-domiciliation. |

What is the recommendation of the Directors? | The Directors unanimously recommend that Benitec

Shareholders vote in favour of the Scheme in the

absence of a superior proposal and subject to the

Independent Expert continuing to conclude the Scheme

to be in the best interests of Benitec Shareholders. The Directors believe that the reasons for Benitec

Shareholders to vote in favour of the Scheme outweigh

any reasons to vote against them. The Directors encourage you to seek independent legal,

financial, taxation or other appropriate professional

advice before making an investment decision in relation

to your Benitec Shares. | Sections 2.2 and 3.7 set out further details of the Directors’ recommendation. |

What are the voting intentions of the Directors? | The Directors intend to vote in favour of the Scheme in

the absence of a superior proposal and subject to the

Independent Expert continuing to conclude the Scheme

to be in the best interests of Benitec Shareholders. | Details of the Relevant Interests of each Director in Benitec securities are set out in Section 4.5. |

What is the Scheme Consideration? | If the Scheme becomes Effective, Scheme Shareholders

will receive one Holdco Share for every 300 Benitec

Shares held on the Record Date. Fractional entitlements to Holdco Shares will be

aggregated and issued to the Sale Agent to be sold

under the Share Sale Facility. The Share Sale Facility

Proceeds for those fractional entitlements will be

distributed to the relevant Scheme Shareholders who

were entitled to the fractional entitlements. | Section 3.2 contains a summary of the Scheme Consideration. |

Am I entitled to receive the Scheme Consideration? | You are entitled to receive the Scheme Consideration for

each Benitec Share you hold at the Record Date

(currently expected to be 7:00pm (AEST) on Monday, 6

April 2020). Ineligible Foreign Shareholders will not be eligible to

receive Holdco Shares. Refer to the question ‘What if I

am an Ineligible Foreign Shareholder?’ below. | Section 3.2 contains a summary of the Scheme Consideration. |

7

What if I am an Ineligible Foreign Shareholder? | Holdco will not issue Holdco Shares to Ineligible Foreign

Shareholders, being Benitec Shareholders whose

address shown in the Share Register as at the Record

Date is outside Australia and its external territories, New

Zealand, Hong Kong, Singapore or the United States

unless Holdco is satisfied, acting reasonably, that the

laws of that place permit the offer and issue of Holdco

Shares to that Scheme Shareholder and, in Holdco’s sole

discretion, is not unduly onerous or impracticable for

Holdco to do so. Holdco Shares that cannot be issued to Ineligible Foreign

Shareholders will be issued to the Sale Agent and sold

under the Share Sale Facility. The Share Sale Facility

Proceeds will be distributed to the relevant Ineligible

Foreign Shareholders. | Section 3.4 provides further details in respect of the Share Sale Facility. |

What is a Selling Shareholder and how do I make a Sale Election? | If you hold less than 50,000 Benitec Shares as at the

Record Date, you may make a Sale Election to have the

Sale Agent sell your Holdco Shares under the Share

Sale Facility. If you make a valid Sale Election, the Holdco Shares you

would otherwise have received under the Scheme will be

issued to the Sale Agent and sold through the Share

Sale Facility. You will receive the Share Sale Facility

Proceeds in cash. To make a valid Sale Election you return the completed

Sale Election Form to the Share Registry by 5.00pm

(AEST) on Monday, 6 April 2020 in accordance with the

instructions on the Sale Election Form. | Refer to Section 3.3. |

Why has the exchange ratio of one Holdco Share for every 300 Benitec Shares been selected? | The ratio has been selected by Benitec and Holdco

having regard to: • the current trading price of Benitec Shares on ASX; • the theoretical trading price of Holdco Shares and

the trading price that is expected of a stock listed on

a major US stock exchange; and • the minimum trading price requirement of US$1.00

on the Nasdaq for all continued listings. | |

Are there any differences between my Benitec Shares and the Holdco Shares I will receive? | Yes, there are certain important differences between the

rights attaching to Benitec Shares and Holdco Shares,

respectively. The Benitec Shares are currently governed under the

Corporations Act, Benitec Constitution and the Listing

Rules. The Holdco Shares will be governed under the DGCL and

Holdco’s certificate of incorporation and by-laws. If

Holdco Shares are approved for trading on Nasdaq, they

will also be subject to the listing rules of Nasdaq. | Section 5.4 includes a summary of the rights and liabilities attaching to Holdco Shares. Refer to Section 5.6 for a summary on the differences between the company law regimes. |

When will I receive my Scheme Consideration? | If the Scheme is approved and implemented, you will

receive your Holdco Shares on the Implementation Date,

expected to be Wednesday, 15 April 2020. Statements detailing your holding of Holdco Shares are

expected to be despatched within 5 Business Days after

the Implementation Date. | Section 3.2 contains further information in respect of the payment of the Scheme Consideration. |

8

What is the Share Sale Facility? | Following the Implementation Date, the Sale Agent will

sell under the Share Sale Facility: • Holdco Shares that would have otherwise been

issued to Ineligible Foreign Shareholders; • Holdco Shares that would have otherwise been

issued to Selling Shareholders; and • aggregated fractional entitlements to Holdco Shares

that Scheme Shareholders would otherwise be

entitled to under the Scheme. Having regard to the current trading volume of Benitec

Shares on ASX and to ensure that the sale of Holdco

Shares takes place in an orderly market and does not

unnecessarily impact upon the price of Holdco Shares, it

is anticipated that the completion of the sale of Holdco

Shares through the Share Sale Facility and the

distribution of the Share Sale Facility Proceeds may

require several months. Interest will not be paid on any

Share Sale Facility Proceeds. There is no guarantee that there will be a liquid market for

Holdco Shares. Prices for Holdco Shares may rise and

fall during the sale period and will depend on many

factors, including the demand for and supply of Holdco

Shares. Benitec, Holdco and the Sale Agent cannot

guarantee the price that Holdco Shares will be sold for. The Share Sale Facility Proceeds will be distributed in

Australian dollars to Ineligible Foreign Shareholders,

Selling Shareholders and Scheme Shareholders who

would otherwise have fractional entitlements to Holdco

Shares as part of their Scheme Consideration. The

Share Sale Facility Proceeds will be calculated on a

volume weighted average price per Holdco Share, so that

each Scheme Shareholder entitled to such proceeds will

receive the same price per Holdco Share. US backup withholding may apply to Share Sale Facility

Proceeds payable to a US Holder if such holder fails to

provide its correct taxpayer identification number or

otherwise fails to certify its exemption from backup

withholding. Holders who are required to establish their

exempt status generally will be required to provide a

properly completed applicable IRS Form W-9 or W-8 to

Computershare by 5.00pm (AEST) on Monday, 6 April

2020. | Section 3.4 contains further information in respect of the Share Sale Facility. |

When can I start trading my Holdco Shares on Nasdaq? | Holdco will submit a listing application to Nasdaq in

February 2020. Trading on Nasdaq of Holdco Shares

issued as part of the Scheme Consideration is expected

to commence on the Implementation Date. You may be

unable to trade until you receive your holding statement

confirming the number of Holdco Shares you hold and

your Holder Account Number. It is the responsibility of

each Holdco Shareholder to confirm their holding before

trading in Holdco Shares. | |

What is Nasdaq? | The Nasdaq Capital Market. The ADS and certain

warrants issued by Benitec currently trade on this market. Given the existing listing on Nasdaq, the Benitec Board

considers that Nasdaq is the appropriate US stock

exchange to list Holdco Shares. | |

9

What is the opinion of the Independent Expert? | The Independent Expert has concluded that the Scheme

is in the best interests of Benitec Shareholders. | Attachment A contains the Independent Expert’s Report. |

What happens if the Independent Expert changes its opinion? | If the Independent Expert changes its opinion, this will be

announced to ASX and the Directors will carefully

consider the Independent Expert’s revised opinion and

advise you of their recommendation. | |

What will happen if the Scheme does not become Effective? | If the Scheme does not become Effective, Benitec

Shareholders will retain their Benitec Shares and Benitec

will continue as a company domiciled in Australia, with

Benitec Shares trading on ASX and the ADS and certain

warrants issued by Benitec trading on Nasdaq. The costs of the Scheme have been estimated by Benitec

to be approximately A$650,000. Approximately

A$550,000 of these costs are expected to be payable by

Benitec regardless of whether or not the Scheme

becomes Effective and is implemented. | Section 6 contains further information on the risk factors associated with an investment in Benitec. |

Can the Scheme be terminated? | The Scheme Implementation Agreement may be

terminated in certain circumstances, details of which are

summarised in Section 7.1(c). If the Scheme

Implementation Agreement is terminated, the Scheme will

not proceed. | Section 7.1(c) contains further information how the Scheme may be terminated. Attachment E contains a copy of the Scheme Implementation Agreement. |

What are my alternatives as a Benitec Shareholder? | As a Benitec Shareholder, you have the following choices

available: • vote in favour of the Scheme Resolution – this is the

course of action unanimously recommended by the

Directors, in the absence of a superior proposal; • vote against the Scheme Resolution; • sell your Benitec Shares on ASX (or Nasdaq in the

form of ADSs, as applicable); or • do nothing. For additional information on how to vote, please refer to

the Section “Overview of this Scheme Booklet”

(commencing on page 2). | Section 3.12 contains further information on your choices as a Benitec Shareholder. |

What if I am an ADS Holder? | If you are an ADS Holder, you can only give instructions

to the ADS Depositary to vote at the Scheme Meeting.

You may not vote in person at the Scheme Meeting or by

proxy. If the Scheme is implemented, Benitec intends to

terminate the ADS program. The ADS Depositary has

informed Benitec that it will call for surrender of all

outstanding ADSs and will deliver the Holdco Shares and

any Share Sale Facility Proceeds (from the sale of

fractional entitlements) to ADS Holders upon surrender of

their ADSs and payment of any fee for such surrender. | |

Holdco |

10

Who is Holdco? | Holdco is a newly formed United States company

incorporated under the laws of the state of Delaware for

the specific purpose of becoming the ultimate parent

company of Benitec. It is intended that Holdco Shares will be listed for trading

on Nasdaq on the Implementation Date, subject to

authorisation for listing being obtained from Nasdaq and

official notice of issuance of Holdco Shares from Holdco

. | Section 5 contains further details about Holdco. |

Who will be the directors of Holdco following the implementation of the Scheme? | The board of Holdco will initially be the same as the

existing Benitec Board, being: • Dr Jerel Banks; • Mr Peter Francis; • Mr Kevin Buchi; and • Ms Megan Boston. Prior to implementation of the Scheme, Holdco intends to

appoint at least one additional independent non-

executive director to satisfy the Nasdaq listing rules. | Section 5 contains further details about Holdco. |

What are Holdco’s intentions for Benitec? | Following implementation of the Scheme, Benitec will

become a wholly owned subsidiary of Holdco and be

delisted from ASX. | Section 5 contains further details about Holdco’s current intentions for Benitec after the Scheme is implemented. |

Will there be changes to the strategy of the Benitec Group following implementation of the Scheme? | The Holdco Board currently intends to operate the

Benitec Group’s business in a manner consistent with

past practice, and to continue the employment of its

current employees, without any major change or

amendment, although the Holdco Board may undertake a

review of the Benitec Group following implementation of

the Scheme and consider whether there are appropriate

measures required to streamline its operations and

structure. Additionally, future economic, market and

business conditions may cause Holdco to make changes

it considers necessary and in the interests of its

shareholders. | Section 5 contains further details about Holdco’s current intentions for Benitec Group after the Scheme is implemented. |

11

The Conditions Precedent |

Are there any conditions to the Scheme? | There are a number of Conditions Precedent that will

need to be satisfied or waived (where capable of waiver)

before the Scheme can become Effective. As at the Last Practicable Date, the Conditions Precedent

which remain outstanding are (in summary): • ASIC and ASX to provide all reliefs, waivers,

confirmations, exemptions, consents or approvals to

implement the Scheme; • the Scheme Resolution being passed by Benitec

Shareholders by the Requisite Majority at the Scheme

Meeting; • Court approval of the Scheme; • all regulatory approvals and consents required from

any Regulatory Authority to implement the Scheme

are obtained; • Holdco Shares have been authorised for listing on

Nasdaq, subject to official notice of issuance following

the implementation of the Scheme; and • no other orders or restraints being issued by

Regulatory Authorities or the Court. As at the Last Practicable Date, the Directors are not

aware of any reason why these Conditions Precedent

would not be satisfied or waived with the agreement of

Holdco. | Section 7.1(b) contains further information on the Conditions Precedent, and Section 8.5 contains further information on the status of the Conditions Precedent. |

Voting for or against the Scheme |

Why should you vote in favour of the Scheme? | Reasons why you should vote in favour of the Scheme

include: • the Directors have unanimously recommended voting

in favour of the Scheme, in the absence of a superior

proposal; • the Independent Expert has concluded that the

Scheme is in the best interests of Benitec

Shareholders, in the absence of a superior proposal; • the re-domiciliation will streamline operations and

reduce costs, and align its corporate and operations

structure, estimated to generate cost savings in

excess of A$750,000 per annum once fully

implemented; • the re-domiciliation is likely to improve attractiveness

as a potential target; • the re-domiciliation is likely to create additional

opportunities with potential licensing partners; • the re-domiciliation will provide access to a broader

range of investors and may lead to a stronger

valuation of the Benitec Group and improved liquidity;

and • no superior proposal has been received as at the date

of this Scheme Booklet. | Sections 2.1 and 2.2 contain further information on why you should vote in favour of the Scheme. |

12

Why you may consider voting against the Scheme? | Reasons why you may consider voting against the

Scheme include: • you may disagree with the recommendation of the

Directors and the conclusions of the Independent

Expert; • You may wish to retain your Benitec Shares which are

listed on the ASX; • there will be increased exposure to US law and a

more litigious environment; and • there may be US federal income and Australian

taxation consequences for Benitec Shareholders if the

Scheme is implemented. | Sections 2.1 and 2.3 contain further information on why you may consider voting against the Scheme Resolution. |

The Scheme Meeting and voting |

When and where will the Scheme Meeting be held? | The Scheme Meeting will be held at 10.00am (AEDT) on

Thursday, 26 March 2020 at Grant Thornton, Collins

Square, Tower 5, 727 Collins Street, Melbourne, Victoria

3008. | The Notice of the Scheme Meeting contained in Attachment D contains further information on the Scheme Meeting. |

What will Benitec Shareholders be asked to vote on at the Scheme Meeting? | At the Scheme Meeting, Benitec Shareholders will be

asked to vote on whether to approve the Scheme by

voting on the Scheme Resolution. | The Scheme Resolution is set out in the Notice of the Scheme Meeting contained in Attachment D. |

What is the Benitec Shareholder approval threshold for the Scheme? | In order to become Effective, the Scheme must be

approved by: • a majority in number (more than 50%) of Benitec

Shareholders present and voting at the Scheme

Meeting;1 and • at least 75% of the total number of votes cast on the

Scheme Resolution by Benitec Shareholders present

and voting at the Scheme Meeting. Even if the Scheme is approved by the Requisite Majority

of Benitec Shareholders at the Scheme Meeting, the

Scheme is still subject to the approval of the Court (as

well as other Conditions Precedent). | The Notice of Scheme Meeting contained in Attachment D contain further information on the Scheme approval requirements. |

Am I entitled to vote at the Scheme Meeting? | If you are registered as a Benitec Shareholder on the

Share Register at 7:00pm (AEDT) on Tuesday, 24 March

2020, you will be entitled to attend and vote at the

Scheme Meeting. If you are an ADS Holder, you can only give instructions

to the ADS Depositary to vote at the Scheme Meeting.

You may not vote in person at the Scheme Meeting or by

proxy. | The Notice of the Scheme Meeting contained in Attachment D sets out further information on your entitlement to vote at the Scheme Meeting. |

1 | It should be noted that the Court has the power to waive this requirement. |

13

Should I vote? | Voting is not compulsory. However, the Directors

encourage all Benitec Shareholders to vote at the

Scheme Meeting. | Sections 2.2, 3.7 and 3.8 provide further information on the Directors’ recommendation and the Directors’ voting intentions. |

How can I vote if I cannot attend the Scheme Meeting? | If you would like to vote but cannot attend the Meeting in

person, you can vote by: • submitting your proxy online at the following link and

following the instructions: www.investorvote.com.au.

You will require the information on your Proxy Form

to lodge your proxy through the website; • by mailing a completed Proxy Form to the Share

Registry at Computershare Investor Services Pty

Limited, GPO Box 1282, Melbourne, Victoria 3001; • mobile voting through scanning the QR Code on your

Proxy Form and following the prompts; • for Intermediary Online subscribers only (custodians),

by visiting www.intermediaryonline.com to submit

your voting intentions; • faxing a completed Proxy Form to 1800 783 337

(within Australia) or +61 3 9473 2555 (outside Australia)); • appointing an attorney to attend and vote on your

behalf; or • appointing a corporate representative if that option is

applicable to you. | Refer to the Section “Overview of this Scheme Booklet” (commencing on page 2) |

Will Holdco vote at any of the Scheme Meeting? | Holdco is not a Benitec Shareholder and is not permitted

to vote at the Scheme Meeting. | Section 5 contains further details about the interests of Holdco in Benitec. |

When will the results of the Scheme Meeting be known? | The results of the Scheme Meeting are expected to be

available shortly after the conclusion of the meetings and

will be announced to ASX (www.asx.com.au) once

available. Even if the Scheme is approved by the Requisite Majority

at the Scheme Meeting, the Scheme is still subject to the

approval of the Court (as well as other Conditions

Precedent). | |

14

What happens if the Court does not approve the Scheme or the Scheme does not otherwise proceed? | If the Scheme Resolution is not approved, or if the

Scheme Resolution is approved but the Scheme is not

approved by the Court or a Condition Precedent is not

fulfilled or otherwise waived (if applicable), then the

Scheme will not become Effective and will not be

implemented. In such a scenario, Scheme Shareholders will not receive

the Scheme Consideration but will retain their Benitec

Shares. | Sections 3.11 and 6 contain further information on the implications for Benitec Shareholders if the Scheme does not become Effective. |

What happens to my Benitec Shares if I do not vote, or if I vote against the Scheme, and the Scheme becomes Effective? | If the Scheme Resolution is passed by the Requisite

Majorities at the Scheme Meeting, then, subject to the

other Conditions Precedents being satisfied or waived,

the Scheme will be implemented and will be binding on all

Benitec Shareholders, including those who did not vote,

or voted against the Scheme Resolution. | |

What do I do if I wish to oppose the Scheme? | If you, as a Benitec Shareholder, wish to oppose the

Scheme, you may: • attend the Scheme Meeting either in person or by

proxy and vote against the Scheme Resolution; and/or • if Benitec Shareholders pass the Scheme Resolution

and you wish to appear and be heard at the Second

Court Hearing and if so advised, oppose the approval

of the Scheme at the Second Court Hearing, you must

lodge a notice of intention to appear at the Second

Court Hearing, attend the hearing and indicate

opposition to the Scheme. | |

Other questions |

Can I sell my Benitec Shares now? | The existence of the Scheme does not preclude you from

selling some or all of your Benitec Shares on ASX (or on

Nasdaq in the form of ADSs) for cash, if you wish,

provided you do so before close of trading on ASX on the

Effective Date (currently proposed to be Monday, 30

March 2020) or, if sold in the form of ADSs, before the

close of trading on Nasdaq the date before the

Implementation Date (currently proposed to be

Wednesday, 15 April 2020). Benitec intends to apply to ASX for Benitec Shares to be

suspended from official quotation from the close of

trading on the Effective Date. You will not be able to sell

your Benitec Shares (except in the form of ADSs, if

applicable) on-market after this time. | Section 3.12 contains a summary of the choices available to Benitec Shareholders. |

Will I have to pay brokerage fees or stamp duty? | You will not have to pay brokerage fees or stamp duty in

connection with receiving whole Holdco Shares under the

Scheme. However, if you are an Ineligible Foreign Shareholder,

Selling Shareholder or if you are entitled to fractional

Holdco Shares, brokerage fees will be deducted from the

sale proceeds of Holdco Shares sold through the Share

Sale Facility by the Sale Agent. | |

15

What are the taxation implications of the Scheme? | Sections 8.2 and 8.3 contains information on the possible

tax treatment for Scheme Shareholders who are

Australian and United States residents, respectively. Tax consequences can vary according to a Scheme

Shareholder’s particular circumstances. Accordingly, your

decision to vote on the Scheme should be made only

after consultation with a financial, legal, taxation or other

professional adviser based on your own investment

objectives, financial situation, taxation position and

particular needs. | Sections 8.2 and 8.3 contains further information on certain tax implications which may be relevant to you. |

When will the Scheme becomes Effective? | Subject to satisfaction or waiver (if applicable) of the

Conditions Precedent, including the Scheme Resolution

being approved by the Requisite Majority at the Scheme

Meeting, and the Court, the Scheme will become

Effective on the Effective Date (currently expected to be

Monday, 30 March 2020) and will be implemented on the

Implementation Date (currently expected to be

Wednesday, 15 April 2020). | Section 7.5 contains further information on when the Scheme will become Effective. |

Where can I get further information? | For further information, you can call the Benitec

Shareholder Information Line on 1300 850 505 (within

Australia) or +61 3 9415 4000 (outside Australia) between

8.30am and 5.00pm (AEDT). If you are in doubt about anything in this Scheme Booklet,

please contact your financial, legal, taxation or other professional adviser. | |

16

2 | Reasons to vote for/against the Scheme |

The Scheme has a number of advantages and disadvantages which may affect Benitec Shareholders in different ways, depending on their individual circumstances. Benitec Shareholders should seek professional advice on their particular circumstances, as appropriate.

Section 2.2 provides a summary of some of the reasons why the Directors have unanimously recommended you vote in favour of the Scheme Resolution in the absence of a superior proposal.

Section 2.2 should be read in conjunction with Section 2.3 which sets out reasons why you may wish to vote against the Scheme Resolution.

You should read this Scheme Booklet in full, including the Independent Expert’s Report, before deciding how to vote at the Scheme Meeting. While the Directors acknowledge the reasons to vote against Scheme Resolution, they believe the advantages of the Scheme Resolution significantly outweigh the disadvantages.

2.2 | Why you should vote in favour of Scheme Resolution |

| ✓ | The Directors unanimously recommend that you vote in favour of the Scheme Resolution in the absence of a superior proposal |

The Directors unanimously recommend that Benitec Shareholders vote in favour of the Scheme, in the absence of a superior proposal, and have considered the advantages, disadvantages and risks associated with the Scheme in arriving at this recommendation.

Each member of the Benitec Board intends to vote for the Scheme in respect of their personal holdings of Benitec Shares, and any proxies placed at their discretion, in the absence of a superior proposal.

| ✓ | The Independent Expert has concluded that the Scheme is in the best interests of Benitec Shareholders in the absence of a superior proposal |

The Independent Expert has concluded that the Scheme is in the best interests of Benitec Shareholders as, in the Independent Expert’s opinion, the advantages of the Scheme outweigh the disadvantages, both of which are summarised in section 5 of the Independent Expert’s Report.

A copy of the Independent Expert’s Report is set out in Attachment A. Benitec Shareholders are encouraged to read the Independent Expert’s Report carefully, including the assumptions, qualifications and disclaimers on which the Independent Expert’s conclusions are based.

| ✓ | The re-domiciliation will streamline operations and reduce costs, and align its corporate and operations structure |

Benitec is currently admitted to both ASX and Nasdaq. Following implementation of the Scheme, Benitec will be delisted from ASX and Holdco will only be listed on Nasdaq, which will streamline and reduce overhead costs of the group, particularly in respect of compliance, audit and insurance costs, which are increased significantly due to Benitec’s dual-listing structure.

Benitec estimates that the re-domiciliation could generate cost savings in excess of A$750,000 per annum once fully implemented.

Benitec’s current business and the majority of employees are already located in the United States and the re-domiciliation will align its corporate and operations structure. This may make the overall structure more easily understandable by potential investors.

17

| ✓ | The re-domiciliation is likely to improve attractiveness as a potential target and its opportunities with potential licensing partners |

The Benitec Board believes that the re-domiciliation would improve the attractiveness of the Benitec Group as a potential acquisition target, given that the United States remains one of the most active markets for transactions in the life sciences sector. The Benitec Board also believes that the same logic would apply for potential licensing partners.

Re-domiciling to the United States would allow any potential control, licensing or other transaction to be completed more quickly and potentially with lower transaction costs.

Further, if in the event that the Benitec Group wished to acquire a target or asset, Benitec Group would also have the ability to issue Nasdaq listed Holdco Shares as consideration, which may be more attractive to certain third parties.

| ✓ | The re-domiciliation will provide access to a broader range of investors and may lead to a stronger valuation of the Benitec Group and improved liquidity |

The Directors consider that re-domiciling the Benitec Group to the United States would provide access to a broader range of investors in a market which is familiar with and has a stronger interest in earlier to mid-stage biotechnology companies, which may lead to a re-rating of the Benitec Group, a stronger market capitalisation/ valuation and improved liquidity in trading.

| ✓ | No superior proposal has been received as at the date of this Scheme Booklet |

As at the date of this Scheme Booklet, no superior proposal has emerged and the Directors are not aware of any superior proposal that is likely to emerge.

The Benitec Board will carefully consider any proposal received from third parties in the context of a control transaction (or any other transaction) to determine whether it is a “superior proposal” in the best interests Benitec Shareholders, taking into account a range of relevant factors.

2.3 | Why you may wish to vote against the Scheme |

| û | You may disagree with the Directors’ recommendation and the Independent Expert’s conclusion and believe that the Scheme Resolution are not in your best interests |

Despite the view of the Directors and the Independent Expert, you may believe that the Scheme is not in the best interests of Benitec Shareholders or not in your individual best interests.

Benitec Shareholders may believe that the opportunities available to Benitec and the potential returns will be superior as an ASX listed company in the long term. Benitec Shareholders may also believe that it is in the best interests of Benitec Shareholders for Benitec to remain as a company domiciled in Australia.

| û | You may wish to retain your Benitec Shares which are listed on the ASX |

You may wish to maintain your investment profile in an Australian publicly listed company on the ASX. Holdco Shares are proposed to be listed on Nasdaq and Holdco does not intend to maintain a Chess Depositary Interest (CDI) on the ASX. Accordingly, Holdco Shares will not be able to be traded on ASX and Benitec Shareholders located outside the US may not be as familiar with trading practices on Nasdaq as they might be with trading practices on the ASX.

You may not wish to hold shares in a publicly traded company domiciled in the United States. On implementation of the Scheme, Benitec Shareholders will become shareholders in Holdco, a company incorporated in Delaware in the US. Holdco is not subject to the provisions of the Corporations Act or the Listing Rules.

The rights of Holdco Shareholders will instead be governed by the laws of the State of Delaware, including the Delaware General Corporation Law (DGCL), US federal securities law, Nasdaq listing rules and Holdco’s certificate of incorporation and by-laws.

18

Scheme Shareholders receiving Holdco Shares as part of the Scheme Consideration under the Scheme may also have reduced takeover protection under Delaware and US laws, compared to the protection available under Australian law.

Currently, Australian resident Benitec Shareholders may take action to enforce the provisions of the Benitec Constitution or securities laws applicable to Benitec in Australian courts, applying Australian law. After implementation of the Scheme, such actions with respect to Holdco will be determined in accordance with US law, and in the courts of the State of Delaware.

Benitec Shareholders should refer to Section 5.4 for a summary of the rights and liabilities attaching to Holdco Shares and Section 5.6 for a summary on the differences between the company law regimes applicable to Benitec and Holdco.

| û | Increased exposure to a litigious environment |

Holdco may be exposed to increased litigation as a US public company, as the US legal environment is generally more litigious. Under Delaware law, a shareholder must meet certain eligibility and standing requirements to bring a derivative action, but settlement or dismissal of a derivative action requires the approval of the court and notice to shareholders of the proposed dismissal.

Shareholders in the US are entitled to commence class action suits on their own behalf and on behalf of any other similarly situated shareholders to enforce an obligation owed to the shareholders directly where the requirements for maintaining a class action under Delaware law have been met.

There is a risk that any material or costly dispute or litigation could adversely affect Holdco’s reputation, financial performance or value.

| û | There may be US federal and Australian taxation consequences for Benitec Shareholders if the Scheme is implemented |

Implementation of the Scheme may give rise to US federal and Australian taxation consequences for certain Benitec Shareholders.

These taxation consequences are dependent on the personal circumstances of each Benitec Shareholder. Accordingly, each Benitec Shareholder should seek their own taxation advice prior to voting on the Scheme.

Benitec Shareholders who are Australian and United States residents should refer to Sections 8.2 and 8.3 for a summary of certain potential tax implications of the Scheme.

19

Benitec is a company incorporated in Australia admitted to the ASX and Nasdaq. To effect the re-domiciliation to the United States, Benitec entered into a Scheme Implementation Agreement with Holdco, a corporation formed under the laws of Delaware, United States for the purpose of the re-domiciliation, under which Holdco will acquire all Benitec Shares, by way of a scheme of arrangement under Part 5.1 of the Corporations Act, pursuant to which Benitec Shareholders will receive Holdco Shares in exchange for the Benitec Shares.

If the Scheme is implemented, Benitec will be delisted from ASX and will become a wholly owned subsidiary of Holdco.

This Section 3 contains an overview of the Scheme, a copy of which is included in Attachment C.

A summary of the Scheme Implementation Agreement is included in Section 7 and a copy of the Scheme Implementation Agreement is in Attachment E to this Scheme Booklet.

If the Scheme becomes Effective, Scheme Shareholders will receive Scheme Consideration of one Holdco Share for every 300 Scheme Shares held as at the Record Date.

The Scheme Consideration will be issued on the Implementation Date.

Scheme Shareholders who are Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Scheme will be issued to the Sale Agent and sold through the Share Sale Facility, with the Share Sale Facility Proceeds being remitted to those Scheme Shareholders.

Any fractional entitlements to Holdco Shares will not be issued to Scheme Shareholders and will instead be aggregated and issued to the Sale Agent to be sold under the Share Sale Facility.

The Holdco Shares are currently expected to trade on Nasdaq on the Implementation Date, subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco.

The Implementation Date is currently expected to be Wednesday, 15 April 2020.

A holding statement detailing the issue of Holdco Shares is expected to be despatched to Scheme Shareholders within 5 Business Days after the Implementation Date.

Scheme Shareholders may be unable to trade until they receive the holding statement confirming the number of Holdco Shares held and their Holder Account Number. It is the responsibility of each Scheme Shareholder to confirm their holding before trading in their securities. Holdco Shareholders who sell their securities before they receive their holding statement do so at their own risk. Benitec and Holdco disclaim all liability (to the maximum extent permitted by law) to persons who trade Holdco Shares before receiving their holding statements.

Benitec Shareholders holding less than 50,000 Benitec Shares as at the Record Date may also elect to have all of their Holdco Shares issued to the Sale Agent and sold under the Share Sale Facility. To make a valid Sale Election you return the completed Sale Election Form to the Share Registry by 5.00pm (AEST) on Monday, 6 April 2020 in accordance with the instructions on the Sale Election Form. Once made, the Sale Election is irrevocable.

Participation in the Share Sale Facility is optional. If no Sale Election is made, or a Sale

Election is invalid, incomplete or it is received after the date specified on the Sale

20

Election Form, you will not be treated as a Selling Shareholder and will not participate in the Share Sale Facility. Instead, Scheme Shareholders will receive Holdco Shares as Scheme Consideration.

If a Benitec Shareholder holds one or more parcels of Benitec Shares as trustee or

nominee for, or otherwise on account of, another person, that Benitec Shareholder may

make separate elections in accordance with the election process in respect of each of those parcels. In order to make separate elections, the trustee or nominee must establish distinct holdings on the Share Register in respect of each parcel of Benitec Shares and must make a separate sale election in respect of each such parcel of Benitec Shares. However, the trustee or nominee may not accept instructions from an underlying beneficiary to make an election unless it is in respect of all parcels of Benitec Shares held by the trustee or nominee on behalf of that beneficiary, and the underlying beneficiary has confirmed to the trustee or nominee that its aggregated beneficial and legal holding of Benitec is less than 50,000 Benitec Shares.

Holdco will issue:

| • | the Holdco Shares that cannot be issued to Ineligible Foreign Shareholders; |

| • | the Holdco Shares of any Selling Shareholder; and |

| • | any fractional Holdco Shares, |

to the Sale Agent and sold for the benefit of the relevant person.