Exhibit 99.5

Exhibit 99.5

| | | |

| | |

| | McGrathNicol |

| | Transaction Advisory |

| | | ABN 83 160 621 054 |

| | | Level 12,20 Martine Place |

| | | Sydney NSW 2000, Australia |

| | | GPO Box 9986 |

| | | Sydney NSW 2000, Australia |

16 January 2020 | | | T+61 2 9338 2600 |

The Directors | | | F+61 2 9338 2699 |

Benitec Biopharma Limited | | | mvgrathnicol.com |

Level 14, 114 William Street | | | |

Melbourne VIC 3000 | | | |

Independent Expert’s Report

Dear Directors,

| 1.1.1 | Benitec Biopharma Limited (Benitec) is a clinical-stage biotechnology company focused on the development of novel genetic medicines. Benitec’s head company is currently located in Melbourne, Victoria, Australia, however it has laboratories in Hayward, California, United States of America (US), and collaborators and licensees around the world. | |

| 1.1.2 | On 27 November 2019, Benitec announced its intention to re-domicile from Australia to the US. The restructure will be implemented via a scheme of arrangement and will involve incorporation of Benitec Biopharma Inc. (Holdco) as the ultimate holding company of Benitec (Proposed Scheme). Holdco will be incorporated in accordance with the laws of the US state of Delaware. | |

| 1.1.3 | Under the Proposed Scheme, Holdco will acquire all of the ordinary shares in Benitec (Benitec Shares) (including such Benitec Shares underlying the American Depositary Shares (ADSs) on issue) and holders of Benitec Shares (Benitec Shareholders) will receive one new share of ordinary stock (Holdco Share) in exchange for every 300 Benitec Shares held. | |

| 1.1.4 | Benitec is currently listed on the Australian Securities Exchange (ASX) and has ADSs (and certain warrants) listed on the Nasdaq Capital Market (Nasdaq). Following implementation of the Proposed Scheme, Holdco will become the ultimate parent company of Benitec and Benitec will be delisted from the ASX. It is intended that Holdco will be a public reporting company in the US with Holdco Shares being listed for trading on the Nasdaq promptly following the implementation of the Proposed Scheme, subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco. | |

| 1.1.5 | The underlying business of Benitec will not change as a result of the Proposed Scheme. In addition, the underlying ownership interests of Benitec Shareholders will also not change as a result of the Proposed Scheme1. | |

| 1.1.6 | Implementation of the Proposed Scheme is subject to a number of conditions precedent, including approval by Benitec Shareholders by the requisite majority and Court approval of the Proposed Scheme. Further detail in relation to conditions precedent and their status is included in Sections 7.1 and 8.4 of the Scheme Booklet. | |

1 With the exception of Benitec Shareholders deemed to be “Ineligible Foreign Shareholders” for the purpose of the Proposed Scheme as defined in Section 9.1 of the Scheme Booklet as being those shareholders whose address is in a place outside Australia, New Zealand, Hong Kong, Singapore or the US. Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Proposed Scheme will be sold with the proceeds being remitted to those shareholders (less any brokerage fees).

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 2 |

Exhibit 99.5

| 1.2.1 | The Directors of Benitec have requested that McGrathNicol Transaction Advisory Pty Ltd (McGrathNicol) provide an Independent Expert’s Report in relation to the Proposed Scheme, indicating whether in our opinion the Proposed Scheme is in the best interests of Benitec Shareholders. | |

| 1.2.2 | Our Independent Expert’s Report has been prepared to assist Benitec Shareholders to form the view as to whether to approve the Proposed Scheme. McGrathNicol is independent of Benitec and has no involvement with, or interest in, the outcome of the Proposed Scheme other than the preparation of this report. | |

| 1.3 | Summary and conclusion |

| 1.3.1 | In our opinion, the Proposed Scheme is in the best interests of Benitec Shareholders. | |

| 1.3.2 | In forming our opinion, we compared the potential advantages and disadvantages to Benitec Shareholders should the Proposed Scheme proceed. In our opinion, the advantages of the Proposed Scheme outweigh the disadvantages, both of which are summarised below and set out in more detail in Section 5. | |

| 1.3.3 | The key advantages to Benitec Shareholders should the Proposed Scheme proceed include: | |

| (a) | Companies trading on the Nasdaq generally trade at higher earnings multiples than those trading on the ASX. |

| (b) | Given Benitec’s current business and the majority of its employees are currently located in the US, the re- domiciliation is expected to streamline operations, generating estimated cost savings in excess of |

$750,000 per annum once implemented.

| (c) | The re-domiciliation is expected to reduce overhead costs, particularly in respect of compliance, audit and insurance costs associated with its current dual listing on the ASX and Nasdaq. |

| (d) | The re-domiciliation may improve attractiveness of Benitec as a potential acquisition target and create additional opportunities with potential licensing or joint venture partners. |

| (e) | A primary listing in the US will allow Holdco greater access to US capital markets which are substantially larger than in Australia, resulting in the potential ability for Holdco to raise equity capital and access a broader range of investors who may only be interested in a direct investment in a US listed company. |

| (f) | The Directors of Benitec unanimously recommend that Benitec Shareholders vote in favour of the Proposed Scheme. |

| 1.3.4 | The key disadvantages to Benitec Shareholders should the Proposed Scheme proceed include: | |

| (a) | Benitec Shareholders may wish to retain their Benitec Shares, which are listed on the ASX due to familiarity with ASX trading practices. |

| (b) | There will be differences in the rights attaching to the Benitec Shares as compared to the rights attaching to the Holdco Shares. |

| (c) | Should the Proposed Scheme be implemented, Holdco Shareholders will have an increased level of exposure to a litigious environment given Holdco will be a US public company and not an Australian listed company. |

| (d) | Although we understand roll-over relief may be available, there may be US federal and Australian taxation consequences for some Benitec Shareholders if the Proposed Scheme is implemented. |

| (e) | The costs associated with the Proposed Scheme have been estimated by the Directors to be approximately $650,000. Notwithstanding, approximately $550,000 of these costs are expected to be incurred regardless of whether the Proposed Scheme is approved by Benitec Shareholders. |

| (f) | Benitec Shareholders who are Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Proposed Scheme will be sold with the proceeds being remitted to those shareholders (less any brokerage fees). |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 3 |

Exhibit 99.5

| 1.4 | Consent and other matters |

| 1.4.1 | Our report is to be read in conjunction with the Scheme Booklet in which this report is included, and is prepared for the exclusive purpose of assisting Benitec Shareholders. This report should not be used for any other purpose. | |

| 1.4.2 | McGrathNicol consents to the issue of this report in its form and context and consents to its inclusion in the Scheme Booklet. | |

| 1.4.3 | This report constitutes general financial product advice only and in undertaking our assessment, we have considered the likely impact of the Proposed Scheme to Benitec Shareholders as a whole. We have not considered the potential impact of the Proposed Scheme on individual shareholders. Individual shareholders have different financial circumstances and it is neither practicable nor possible to consider the implications of the Proposed Scheme on individual shareholders. | |

| 1.4.4 | The decision of whether or not to approve the Proposed Scheme is a matter for each shareholder based on, amongst other things, their own views, their risk profile, liquidity preference, investment strategy and tax position. Individual shareholders should therefore consider the appropriateness of our opinion to their specific circumstances before acting on it. If shareholders are in doubt about the action they should take, they should seek their own professional advice. | |

| 1.5.1 | This letter is a summary of McGrathNicol’s opinion on the Proposed Scheme. This letter should be read in conjunction with the detailed report and appendices as attached. Unless the context requires otherwise, references to “we”, “our” and similar terms refer to McGrathNicol. For the avoidance of doubt, all amounts presented are in Australian dollars (AUD) unless otherwise indicated. | |

|

Yours faithfully |

|

McGrathNicol Transaction Advisory Pty Ltd |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 4 |

Exhibit 99.5

Contents

Report sections | | Page |

| | | | |

1 | | Executive summary | | 2 |

| | | | |

1.1 | | Introduction | | 2 |

| | | | |

1.2 | | Purpose | | 3 |

| | | | |

1.3 | | Summary and conclusion | | 3 |

| | | | |

1.4 | | Consent and other matters | | 4 |

| | | | |

1.5 | | Other | | 4 |

| | | | |

2 | | Details of the Proposed Scheme | | 6 |

| | | | |

2.1 | | Background | | 6 |

| | | | |

2.2 | | Proposed Scheme | | 6 |

| | | | |

3 | | Scope of our report | | 7 |

| | | | |

3.1 | | Purpose of the report | | 7 |

| | | | |

3.2 | | Basis of assessment | | 7 |

| | | | |

3.3 | | Limitations and reliance on information | | 8 |

| | | | |

4 | | Profile of Benitec | | 9 |

| | | | |

4.1 | | Background | | 9 |

| | | | |

4.2 | | Historical financial performance | | 10 |

| | | | |

4.3 | | Historical financial position | | 11 |

| | | | |

4.4 | | Statement of cash flows | | 12 |

| | | | |

4.5 | | Share capital structure | | 13 |

| | | | |

4.6 | | Share trading history | | 14 |

| | | | |

5 | | Evaluation of the Proposed Scheme | | 17 |

| | | | |

5.1 | | Conclusion | | 17 |

| | | | |

5.2 | | Advantages of the Proposed Scheme | | 17 |

| | | | |

5.3 | | Disadvantages of the Proposed Scheme | | 18 |

| | | | |

6 | | Glossary | | 19 |

| | | | |

7 | | Qualifications, Declarations and Consents | | 20 |

| | | | |

7.1 | | Qualifications | | 20 |

| | | | |

7.2 | | Independence | | 20 |

| | | | |

7.3 | | Consent and other matters | | 21 |

| | | | |

7.4 | | Information relied on and limitations | | 21 |

| | | | |

Appendices | | |

| | | | |

A | | Financial services guide | | 22 |

| | | | |

A.1 | | Purpose of this guide | | 22 |

| | | | |

A.2 | | Financial services we are authorised to provide | | 22 |

| | | | |

A.3 | | General financial product advice | | 22 |

| | | | |

A.4 | | Remuneration for our services | | 22 |

| | | | |

A.5 | | Associations and relationships | | 22 |

| | | | |

A.6 | | Complaints process | | 23 |

| | | | |

A.7 | | Compensation arrangements | | 23 |

| | | | |

B | | Information relied upon | | 23 |

| | | | |

B.1 | | Publicly available information | | 23 |

| | | | |

B.2 | | Non-public information | | 23 |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 5 |

Exhibit 99.5

| 2 | Details of the Proposed Scheme |

| 2.1.1 | Benitec is a clinical-stage biotechnology company focused on the development of novel genetic medicines currently listed on the ASX and Nasdaq. Benitec’s head company is located in Melbourne, Victoria, Australia with laboratories in Hayward, California, US, and collaborators and licensees around the world. | |

| 2.2.1 | On 27 November 2019, Benitec announced its intention to re-domicile from Australia to the US. To implement the re-domiciliation, Benitec has entered into a Scheme Implementation Agreement with Holdco, a new US company incorporated for the purposes of effecting the re-domiciliation. Under the terms of the Scheme Implementation Agreement, Holdco will acquire all of the Benitec Shares by way of a scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Cth) (Corporations Act), pursuant to which current holders of Benitec Shares will receive Scheme Consideration by way of one new Holdco Share in exchange for every 300 Benitec Shares held. | |

| 2.2.2 | If the Proposed Scheme is implemented, Benitec will become a wholly owned subsidiary of Holdco. Benitec will be de-listed from the ASX and Holdco will apply for the Holdco Shares to be listed on Nasdaq. | |

| 2.2.3 | Benitec Shareholders who are considered to be Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which these shareholders would otherwise be entitled to under the Proposed Scheme will be sold, with the proceeds being remitted to those shareholders (less brokerage fees) by way of a Share Sale Facility. Refer Section 3.4 of the Scheme Booklet for further detail. Benitec Management has advised that as at 14 January 2020, the number of shareholders expected to be deemed Ineligible Foreign Shareholders total 32, holding approximately 1,053,371 Benitec Shares in aggregate, representing approximately 0.33% of total Benitec Shares outstanding. | |

| 2.2.4 | Any fractional entitlements to Holdco Shares will not be issued to Benitec Shareholders and will be aggregated and sold via the Share Sale Facility for the benefit of the relevant shareholder (less brokerage fees). If the number of fractional Holdco Shares is in aggregate, not a whole number, it will be rounded down to the nearest whole number of aggregate fractional Holdco Shares. | |

| 2.2.5 | Holders of ADSs (ADS Holders) will be entitled to vote and participate in the Proposed Scheme (through the ADS depositary, being the Bank of New York Mellon). If the Proposed Scheme is implemented, Benitec intends on terminating the ADS program. The ADS depository will call for surrender of all outstanding ADSs and will deliver Holdco Shares and any proceeds from the Share Sale Facility (resulting from the sale of fractional entitlements) to ADS Holders upon surrender of their ADSs and payment of any fee for such surrender. | |

| 2.2.6 | Implementation of the Proposed Scheme is subject to a number of conditions precedent, including approval by Benitec Shareholders by the requisite majority and Court approval of the Proposed Scheme. Further detail in relation to conditions precedent and their status is included in Sections 7.1 and 8.4 of the Scheme Booklet. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 6 |

Exhibit 99.5

| 3.1.1 | Section 411 of the Corporations Act governs schemes of arrangement between companies and their members. When a scheme of arrangement is proposed under Section 411 of the Corporations Act, Section 412(1) of the Corporations Act requires that an explanatory statement accompanies the Notices of Scheme Meeting relating to the proposed scheme of arrangement which includes information that is material to the making of a decision by a member whether or not to agree to the proposed scheme. | |

| 3.1.2 | It is anticipated that Benitec and Holdco will have the same Directors. Under Part 3 Schedule 8 of the Corporations Regulations the explanatory statement to be sent to shareholders as part of the Notices of Scheme Meeting must include a report by an expert where the parties to the proposed scheme have a common director(s). | |

| 3.1.3 | The independent expert must state whether, in the expert’s opinion, the proposed scheme of arrangement is in the best interests of the members of the body as a whole and set out the expert’s reasons for forming that opinion. | |

| 3.1.4 | In accordance with the above, Benitec has appointed McGrathNicol as an independent expert to express an opinion addressing whether or not the terms of the Proposed Scheme are fair and reasonable to Benitec Shareholders. | |

| 3.1.5 | Our Independent Expert’s Report has been prepared to assist Benitec Shareholders in forming the view as to whether to approve the Proposed Scheme. | |

| 3.2.1 | In undertaking our work we have considered the requirements of the Corporations Act and relevant Regulatory Guides issued by the Australian Securities and Investment Commission (ASIC). | |

| 3.2.2 | McGrathNicol has had regard to ASIC Regulatory Guide 111 “Content of expert’s reports” (RG 111) in relation to the content of Independent Expert’s Reports. RG 111 requires an Independent Expert’s Report to be prepared in connection with change of control transactions. Given the underlying ownership interests of Benitec Shareholders will not change as a result of the Proposed Scheme2, in our opinion the Proposed Scheme does not represent a change of control transaction. | |

| 3.2.3 | RG 111.35 and RG 111.36 state that where there is no change of control in the underlying ownership interests of security holders or selective treatment of security holders, the issue of ‘value’ may be of secondary importance: | |

“If the expert does not undertake such a valuation, to the extent reasonably practicable, and where it can do so with sufficient precision to assist security holders, the expert should quantify the advantages and disadvantages that it considers to be material”.

| 3.2.4 | RG 111.37 states where a transaction: | |

“involves a scheme of arrangement and the expert concludes that the advantages of the transaction outweigh the disadvantages, the expert should say that the scheme is in the best interests of members”.

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 7 |

Exhibit 99.5

| 3.3 | Limitations and reliance on information |

| 3.3.1 | McGrathNicol’s opinion is based on economic, share market, business and trading conditions prevailing at the date of this report. These conditions can change significantly over relatively short periods. If they did change materially, our opinion could vary significantly. | |

| 3.3.2 | This report is based upon financial and non-financial information provided by Benitec and its advisers. McGrathNicol has considered and relied upon this information and has no reason to believe that any material facts have been withheld. The information provided to McGrathNicol has been evaluated through analysis, inquiry and review for the purposes of forming an opinion as to whether the Proposed Scheme is in the best interests of Benitec shareholders. However, McGrathNicol does not warrant that its inquiries have identified or verified all of the matters that an audit, extensive examination or due diligence investigation might disclose. | |

| 3.3.3 | An important part of the information used in forming an opinion as to whether the Proposed Scheme is in the best interests of Benitec Shareholders is comprised of the opinions and judgement of Benitec Management. This type of information was evaluated through analysis, inquiry and review. However, such information is often not capable of external verification or validation and has not been independently verified. To the extent that there are taxation and legal issues relating to assets, properties, or business interests or issues relating to compliance with applicable laws, continuous disclosure rules, regulations, and policies, McGrathNicol: | |

| (a) | assumes no responsibility and offers no legal opinion or interpretation on any issue; and |

| (b) | has generally assumed that matters such as title, compliance with laws and regulations and contracts in place are in good standing and will remain so and that there are no legal proceedings, other than as publicly disclosed. |

2 With the exception of Ineligible Foreign Shareholders.

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 8 |

Exhibit 99.5

| 4.1.1 | Benitec is a clinical-stage biotechnology company focused on the development of novel genetic medicines. Benitec’s proprietary therapeutic technology platform (DNA-directed RNA interference (ddRNAi)) combines RNA interference with gene therapy for the goal of providing sustained, long-lasting silencing of disease-causing genes from a single administration. | |

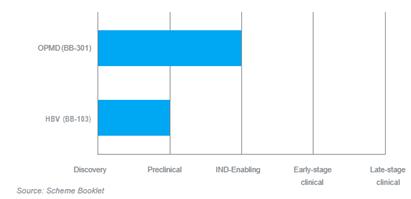

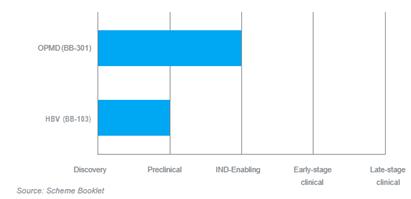

| 4.1.2 | The ddRNAi-based genetic medicines currently under development by Benitec and their development status is summarised below: | |

Figure 1: Benitec in-house program phases of development

| 4.1.3 | In respect of the above: | |

| (a) | BB-301 is Benitec’s primary asset and represents a product candidate with the aim to meaningfully improve the existing standard of care for a rare, chronic, life threatening form of muscular dystrophy oculopharyngeal muscular dystrophy (OPMD); and |

| (b) | BB-103 represents a gene silencing agent for chronic hepatitis B (HPV) virus infection. |

| 4.1.4 | We note the operations of Benitec are not expected to change should the Proposed Scheme be implemented. | |

| 4.1.5 | Benitec’s head company is currently located in Melbourne, Victoria, Australia, however it has laboratories in Hayward, California, US, and collaborators and licensees around the world. | |

| 4.1.6 | Benitec is a listed public company limited by shares, currently incorporated and domiciled in Australia. Benitec shares are currently listed on the ASX (ASX: BLT). Benitec also has ADSs which are traded on the Nasdaq (NASDAQCM: BNTC), and certain warrants which are also traded on the Nasdaq (NASDAQ: BNTCW). | |

| 4.1.7 | Benitec currently has 13 full-time equivalent employees, the majority of which are located in the US. Benitec announced the completion of a workforce reduction of approximately 50% on 31 July 2019 in an effort to streamline operations. Staff members key to the achievement of Benitec’s core research and development (R&D) goals relating to BB-301 were retained. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 9 |

Exhibit 99.5

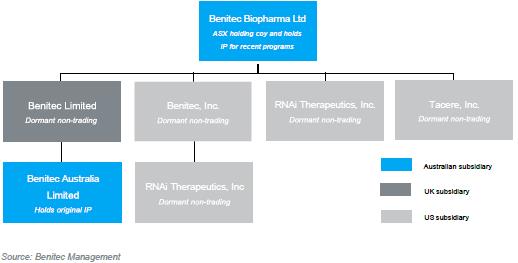

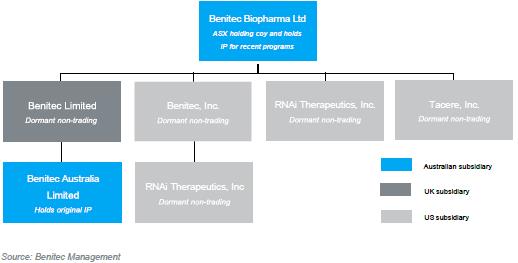

| 4.1.8 | Benitec is the holding company for a number of 100% owned dormant non-trading subsidiaries. The current company structure is provided below: | |

Figure 2: Corporate structure

| 4.1.9 | Should the Proposed Scheme be implemented, the above structure will change whereby Holdco will be interposed as the ultimate parent company of the group. | |

| 4.2 | Historical financial performance |

| 4.2.1 | A summary of the consolidated audited financial performance of Benitec for the three years ended 30 June 2019 is provided below: | |

Table 1: Benitec financial performance

| | | |

Benitec Financial Performance | | | |

A$'000 | FY17A | FY18A | FY19A |

Revenue | 333 | 378 | 16,159 |

Other income | 10,507 | 4,087 | 1,350 |

Total income | 10,840 | 4,465 | 17,509 |

Employee benefits expense | (5,015) | (5,094) | (5,025) |

Research and development | (6,925) | (6,890) | (3,104) |

Corporate expenses | (1,540) | (1,360) | (1,884) |

Share-based expenses | (386) | (434) | (939) |

Consultants costs | (976) | (783) | (662) |

Occupancy costs | (550) | (587) | (648) |

Royalties and licence fees | (272) | (451) | (609) |

Travel related costs | (629) | (468) | (350) |

Foreign exchange realised loss | (98) | (39) | (106) |

Change in market value of listed investment | - | (41) | (28) |

Loss on disposal of fixed assets | (7) | (1) | (9) |

Foreign exchange unrealised loss | (168) | (5) | - |

Total expenses | (16,566) | (16,153) | (13,364) |

Reported EBITDA | (5,726) | (11,688) | 4,145 |

Depreciation | (217) | (194) | (221) |

Reported EBIT | (5,943) | (11,882) | 3,924 |

Interest received | 253 | 242 | 170 |

Reported profit / (loss) before income tax | (5,690) | (11,640) | 4,094 |

Source: Annual Reports

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 10 |

Exhibit 99.5

| 4.2.2 | In relation to Benitec’s historical financial performance, we note: | |

| (a) | Revenue relates to licensing revenue and royalties. In addition to its in-house development programs, Benitec has historically licensed its ddRNAi technology to companies who are developing therapeutic programs in other disease areas, including HIV / AIDS, cancer immunotherapy and intractable neuropathic pain. Revenue in FY19A included an upfront license payment of $14.2 million received in July 2018 in relation to an agreement with Axovant Sciences Ltd (Axovant) which was subsequently terminated on 6 June 2019 (effective 3 September 2019), as well as the reimbursement of labour costs of $1.5 million from Axovant. There are currently no material licensing agreements with third parties. |

| (b) | Other income predominantly relates to Australian Government R&D grants received. R&D grant income decreased from $4.0 million in FY18A to $907,000 in FY19A due to decreased R&D expenditure during the period. R&D grant income was high in FY17A as it included an amount relating to FY16A. Other income in FY18A and FY19A included unrealised foreign exchange gains of $87,000 and $443,000 respectively. |

| (c) | Employee benefits expense primarily relates to employee salaries, wages and superannuation, which has remained relatively consistent over the historical period. On 31 July 2019, Benitec announced the completion of a workforce reduction of approximately 50%. |

| (d) | R&D expenses in FY19A were offset by reimbursements of $4.7 million received from Axovant in relation to the OPMD program. |

| (e) | Share-based expenses increased in FY19A as a result of the issuance of options to Directors. |

| 4.3 | Historical financial position |

| 4.3.1 | A summary of the consolidated audited financial position of Benitec for the three years ended 30 June 2019 is provided below: | |

Table 2: Benitec financial position

| | | |

Benitec Financial Position | | | |

A$'000 | Jun17A | Jun18A | Jun19A |

Cash and cash equivalents | 17,375 | 16,085 | 22,411 |

Other financial assets | 100 | 130 | 181 |

Trade and other receivables | 4,406 | 4,255 | 3,616 |

Other current assets | 281 | 425 | 535 |

Total current assets | 22,162 | 20,895 | 26,743 |

Deposits non current | 59 | 125 | 13 |

Property, plant and equipment | 445 | 319 | 670 |

Total non current assets | 504 | 444 | 683 |

Total assets | 22,666 | 21,339 | 27,426 |

Trade and other payables | (919) | (2,376) | (3,556) |

Provisions | (206) | (171) | (210) |

Total current liabilities | (1,125) | (2,547) | (3,766) |

Provisions | (35) | (48) | - |

Total non current liabilities | (35) | (48) | - |

Total liabilities | (1,160) | (2,595) | (3,766) |

Net assets | 21,506 | 18,744 | 23,660 |

Source: Annual Reports

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 11 |

Exhibit 99.5

| (a) | Benitec had approximately $22.4 million in cash and cash equivalents (refer Section 4.5 below); |

| (b) | Other financial assets comprised a security deposit of $147,000 relating to credit cards and other deposits of $33,000; |

| (c) | Trade and other receivables predominantly related to R&D grants receivable; |

| (d) | Other current assets comprised prepayments relating to various insurance policies, Nasdaq and ASX annual fees and other licenses and subscription fees; |

| (e) | Property, plant and equipment comprised the written down value of plant and equipment of $634,000 and leasehold improvements of $63,000; |

| (f) | Trade and other payables relate to $2.1 million of trade creditors and $1.5 million of sundry creditors and accrued expenses; |

| (g) | Current provisions comprised employee benefits of $200,000 as well as a provision for make good of $10,000. Non current provisions relate to employee benefits (long service leave), however this balance was nil as at 30 June 2019 as there were no employees at Benitec eligible for long service leave at this date; and |

| 4.4 | Statement of cash flows |

| 4.4.1 | A summary of the consolidated audited statement of cash flows of Benitec for the three years ended 30 June 2019 and three months ended 30 September 2019 (unaudited) is provided below: | |

Table 3: Benitec statement of cash flows

| | | | |

Benitec Statement of Cash Flows | | | | |

A$'000 | FY17A | FY18A | FY19A | YTD Sept19A |

Receipts from customers | 333 | 237 | 17,664 | 349 |

Interest received | 242 | 246 | 164 | 37 |

Government grants | 6,274 | 4,112 | 4,121 | - |

Receipt of CRO prepayments | 791 | 109 | - | - |

Reimbursement from Axovant | - | - | - | 2,145 |

Payments to suppliers and employees | (15,944) | (14,498) | (16,092) | (4,073) |

Cash flows from operating activities | (8,304) | (9,794) | 5,857 | (1,542) |

Payments for plant and equipment | (171) | (83) | (576) | - |

Proceeds from disposal of plant and equipment | - | 2 | 6 | 1 |

Security deposits | (131) | - | - | |

Clinical trial deposit | - | (66) | - | |

Cash flows from investing activities | (302) | (147) | (570) | 1 |

Proceeds from issue of shares | 8,072 | 8,820 | - | 2,822 |

Proceeds from issue of pre-funded warrants | - | - | - | 398 |

IPO and share issue transaction costs | (133) | (313) | - | - |

Cash flows from financing activities | 7,939 | 8,507 | - | 3,220 |

Net (decrease)/increase in cash and cash equivalents | (667) | (1,434) | 5,287 | 1,679 |

Cash and cash equivalents at beginning of the period | 18,230 | 17,375 | 16,085 | 22,411 |

Effects of exchange rate changes on cash and cash equivalents | (188) | 144 | 1,039 | 542 |

Cash and cash equivalents at end of the period | 17,375 | 16,085 | 22,411 | 24,632 |

Source: Annual Reports, Appendix 4C dated 30 September 2019 | | | | |

| 4.4.2 | In relation to Benitec’s statement of cash flows, we note: | |

| (a) | Receipts from customers during FY19A included a license payment of $14.2 million received from Axovant; |

| (b) | As at 30 September 2019, Benitec’s cash position had increased from $22.4 million as at 30 June 2019 to $24.6 million driven by: |

| (i) | a reimbursement from Axovant of $2.1 million during year to date (YTD) 30 September 2019 following the termination of the license agreement; and | |

| (ii) | during September 2019, Benitec secured $3.2 million of additional funding through a Registered Direct Offering, providing Benitec additional operating capital to support advancement of BB-301. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 12 |

Exhibit 99.5

| 4.5 | Share capital structure |

| 4.5.1 | As at 14 January 2020, there were 321,287,026 ordinary Benitec Shares on issue (including in the form of ADSs). A summary of Benitec’s top ten shareholders as at 14 January 2020 is summarised in the table below: | |

Table 4: Ten largest shareholders

| | |

Benitec Ten Largest Shareholders | | |

Shareholder | No. ordinary shares held | % total |

HSBC Custody Nominees | 80,037,844 | 24.91% |

Nant Capital LLC | 58,611,638 | 18.24% |

Merrill Lynch (Australia) | 30,174,393 | 9.39% |

J P Morgan Nominees Australia | 12,531,082 | 3.90% |

Jinxter Pty Ltd | 9,543,169 | 2.97% |

CS Fourth Nominees Pty Limited | 4,627,954 | 1.44% |

Chebena Pty Ltd | 4,428,648 | 1.38% |

Citicorp Nominees Pty Ltd | 3,691,809 | 1.15% |

BNP Paribas Nominees Pty Ltd | 3,105,806 | 0.97% |

Jinark Pty Ltd | 2,685,903 | 0.84% |

Ten largest shareholders | 209,438,246 | 65.19% |

Other | 111,848,780 | 34.81% |

Total shares outstanding | 321,287,026 | 100.00% |

Source: Management as at 14 January 2020 | | |

| 4.5.2 | In addition to ordinary shares on issue, Benitec also had the following securities on issue as at 15 January 2020: | |

| (a) | 22,015,000 unlisted options over Benitec Shares with exercise prices ranging from $0.196 to $1.25 and expiry dates ranging from 6 May 2020 to 16 May 2024. The unlisted options have been issued under Benitec’s Employee Share Option Plan to current employees and officers of Benitec. If the Proposed Scheme is implemented, an agreement will be entered into with the unlisted option holders whereby Holdco will assume the Employee Share Option Plan. |

| (b) | 57,490 quoted warrants (NASDAQ:BNTCW) convertible into one ADS per warrant (representing 11,498,000 Benitec Shares in aggregate) at an exercise price of US dollar (USD) $55.00 per ADS issued on exercise and an expiry date of 21 August 2020. Given the exercise price of the quoted warrants is significantly above the current trading price of the Benitec Shares and Benitec ADSs, the quoted warrants are out of the money and Benitec has formed the view that it would be unduly onerous or impractical to enter into a separate scheme of arrangement for these securities; and |

| (c) | 4 Purchase Warrants exercisable into 312,286 ADSs (equivalent to 64,257,200 Benitec Shares) exercisable at USD$7.00 per ADS issued on exercise and an expiry date of 6 December 2024. If the Proposed Scheme is implemented, an agreement will be entered into with the Purchase Warrant holders where the Purchase Warrants will be transferred to Holdco. |

| 4.5.3 | Benitec Shareholders should refer to Section 4.4 of the Scheme Booklet for further information in relation to the above. | |

| 4.5.4 | ADS Holders will be entitled to vote and participate in the Proposed Scheme (through the ADS depositary, being the Bank of New York Mellon). If the Proposed Scheme is implemented, Benitec intends on terminating the ADS program. The ADS depository will call for surrender of all outstanding ADSs and will deliver Holdco Shares and any proceeds from the Share Sale Facility (resulting from the sale of fractional entitlements) to ADS Holders upon surrender of their ADSs and payment of any fee for such surrender. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 13 |

Exhibit 99.5

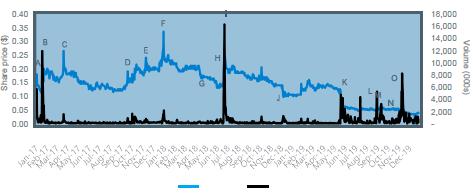

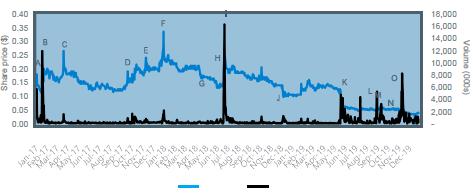

| 4.6.1 | Summarised below is Benitec’s share price and volume for the period 16 January 2017 to 15 January 2020: | |

Figure 3: Benitec’s share price movement and volume

| | |

Benitec Share Price and Volume Commentary |

Event | Date | Commentary |

A | 17-Jan-17 | Benitec receives Orphan Drug Designation in the European Union for BB-301 for the treatment of OPMD. |

B | 03-Feb-17 | Benitec announces amendment relating to the deferment of investment dates under the Nant Share Subscription Agreement. |

C | 05-Apr-17 | On 4 April 2017, Benitec announces the initial pre-clinical efficacy results of the OPMD program have been published in Nature Communications, an open access scientific journal. |

D | 18-Oct-17 | Benitec announces a new patent relating to the hepatitis B program has been issued in the US. |

E | 27-Nov-17 | Benitec provides update on OPMD orphan disease program - an application was submitted with the US Food and Drug Administration (FDA) seeking orphan drug designation for BB-301. |

F | 16-Jan-18 | On 15 January 2018, Benitec announces it had received US Orphan Drug Designation for BB-301. |

G | 08-May-18 | Benitec confirms the Offer Booklet and personalised entitlement and acceptance for in respect of a 1 for 2 pro rata renounceable entitlement offer at the same price as the private placement to Highbridge Capital Management LLC on 30 April 2018. |

H | 09-Jul-18 | Benitec enters trading halt and announces global licensing agreement with Axovant. |

I | 11-Jul-18 | Highbridge Capital Management LLC ceases to be a substantial shareholder, disposing of 8,608,240 shares on 9 July 2018. |

J | 21-Dec-18 | Benitec provides an update on BB-401 Cancer Treatment Program. BB-401 is currently undergoing evaluation in a Phase II clinical trial. |

K | 06-Jun-19 | Benitec enters trading halt and announces the termination of the License and Collaboration Agreement with Axovant. |

L | 16-Sep-19 | Benitec provides an update on BB-301 OPMD Program. Benitec plans to complete three non- clinical studies that will facilitate the filing of an Investigational New Drug application and the formal initiation of a Phase I clinical trial in patients suffering from OPMD. |

M | 24-Sep-19 | Benitec’s Chief Executive Officer Jerel A. Banks presents at the Landenburg Thalmann 2019 Healthcare Conference. |

N | 01-Oct-19 | Benitec announces USD$2.25 million Registered Direct Offering. |

O | 27-Nov-19 | Benitec announces its intention to re-domicile from Australia to the United States of America. |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 14 |

Exhibit 99.5

| 4.6.2 | Summarised below is Benitec’s ADS price and volume for the period 16 January 2017 to 15 January 2020. Benitec announced a 10:1 ratio change of the ADS program (effective 18 November 2019) As a result the number of ADSs on issue reduced to a number equal to 1/10 of the ADSs on issue prior to the change in the ADS ratio, however the total number of Benitec Shares represented by the ADSs remained the same. The ADS prices prior to 18 November 2019 in the figure below have been adjusted to reflect the ratio change: | |

Figure 4: Benitec’s ADS price movement and volume

| | |

Benitec ADS Price and Volume Commentary |

Event | Date | Commentary |

A | 17-Jan-17 | Benitec receives Orphan Drug Designation in the European Union for BB-301 for the treatment of OPMD. |

B | 03-Feb-17 | Benitec announces amendment relating to the deferment of investment dates under the Nant Share Subscription Agreement. |

C | 05-Apr-17 | On 4 April 2017, Benitec announces the initial pre-clinical efficacy results of the OPMD program have been published in Nature Communications, an open access scientific journal. |

D | 18-Oct-17 | Benitec announces a new patent relating to the hepatitis B program has been issued in the US. |

E | 16-Jan-18 | On 15 January 2018, Benitec announces it had received US Orphan Drug Designation for BB-301. |

F | 09-Jul-18 | Benitec enters trading halt and announces global licensing agreement with Axovant. |

G | 21-Dec-18 | Benitec provides an update on BB-401 Cancer Treatment Program. BB-401 is currently undergoing evaluation in a Phase II clinical trial. |

H | 16-Sep-19 | Benitec provides an update on BB-301 OPMD Program. Benitec plans to complete three non- clinical studies that will facilitate the filing of an Investigational New Drug application and the formal initiation of a Phase I clinical trial in patients suffering from OPMD. |

| 4.6.3 | Set out below is a summary of the volume weighted average prices (VWAPs) and volumes traded for Benitec Shares over a range of periods over the last 12 months: | |

Table 5: Recent share trading history

| | | | | | | | |

ASX:BLT - Recent share trading history - lookback as at 15 January 2020 |

| | Share price ($) | | Volume traded (#) | | |

| Low | Average | High | VWAP | Total | % | Average daily volume (#) | Average daily value ($) |

1 day | 0.038 | 0.038 | 0.038 | 0.038 | 666,900 | 0.23% | 666,900 | 25,342 |

1 week | 0.033 | 0.037 | 0.040 | 0.038 | 2,558,750 | 0.87% | 639,688 | 24,612 |

1 month | 0.033 | 0.035 | 0.040 | 0.036 | 12,806,070 | 4.34% | 640,304 | 22,863 |

2 months | 0.031 | 0.039 | 0.054 | 0.040 | 46,420,060 | 15.73% | 1,132,197 | 44,942 |

3 months | 0.031 | 0.044 | 0.056 | 0.041 | 53,551,200 | 18.14% | 823,865 | 34,153 |

6 months | 0.031 | 0.048 | 0.070 | 0.047 | 94,346,860 | 34.82% | 720,205 | 33,851 |

9 months | 0.031 | 0.066 | 0.145 | 0.052 | 123,234,470 | 47.23% | 648,602 | 33,900 |

12 months | 0.031 | 0.080 | 0.160 | 0.057 | 131,483,350 | 51.35% | 521,759 | 29,820 |

Source: Capital IQ | | | | | | | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 15 |

Exhibit 99.5

| 4.6.4 | As set out in the table above: | |

| (a) | The price of Benitec Shares declined from a high of $0.160 to $0.031 over the last 12 months. |

| (b) | The VWAP of Benitec Shares also declined over the last 12 months, from a high of $0.057 to $0.038. |

| (c) | Benitec Shares have demonstrated liquidity over the last 6 months, with approximately 34.82% of total shares on issue traded during the respective period. Further, Benitec Shares were traded on 252 of the 253 available ASX trading days. |

| (d) | The average daily volume of Benitec Shares traded over the last 12 months was 521,759 shares and average daily value traded was $29,582. |

| 4.6.5 | Set out below is a summary of the VWAPs and volumes traded for Benitec ADSs over a range of periods over the last 12 months: | |

Table 6: Recent share trading history

| | | | | | | |

NASDAQCM:BNTC - Recent share trading history - lookback as at 15 January 2020 |

Share price ($) |

| Low | Average | High | VWAP | Total volume traded (#) | Average daily volume (#) | Average daily value ($) |

1 day | 4.934 | 4.934 | 4.934 | 4.934 | 6,080 | 6,080 | 30,001 |

1 week | 4.830 | 5.002 | 5.170 | 5.028 | 57,020 | 11,404 | 57,340 |

1 month | 4.230 | 4.731 | 5.170 | 4.719 | 631,720 | 30,082 | 141,954 |

2 months | 4.230 | 5.129 | 6.300 | 5.070 | 1,024,170 | 25,604 | 129,821 |

3 months | 4.230 | 5.562 | 6.625 | 5.118 | 1,060,080 | 16,827 | 86,123 |

6 months | 4.230 | 6.318 | 9.200 | 6.062 | 1,578,140 | 12,727 | 77,145 |

9 months | 4.230 | 8.750 | 20.000 | 6.287 | 1,660,690 | 9,175 | 57,685 |

12 months | 4.230 | 10.922 | 21.900 | 6.593 | 1,703,130 | 7,217 | 47,576 |

Source: Capital IQ | | | | | | |

| (a) | The price of Benitec ADSs declined from a high of USD$21.900 to USD$4.230 over the last 12 months. |

| (b) | The VWAP of Benitec ADSs also declined over the last 12 months, from a high of USD$6.593 to USD$4.934. |

| (c) | The average daily volume of Benitec ADSs traded over the last 12 months was 7,217 shares and average daily value traded was $47,576. |

| (d) | Benitec ADSs were traded on 236 of the 251 available Nasdaq trading days. |

| 4.6.6 | Summarised below is Benitec’s share price and the price of Benitec ADSs (converted into AUD at the daily spot exchange rate) for the period 16 January 2017 to 15 January 2020: | |

Figure 5: Benitec’s share and ADS price movement

| 4.6.7 | As shown by the figure above, the Benitec Shares and Benitec ADSs have demonstrated relatively consistent price movements. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 16 |

Exhibit 99.5

| 5 | Evaluation of the Proposed Scheme |

| 5.1.1 | In our opinion, the Proposed Scheme is in the best interests of Benitec Shareholders. | |

| 5.1.2 | In forming our opinion we compared the potential advantages and disadvantages to Benitec Shareholders should the Proposed Scheme proceed. In our opinion, the advantages of the Proposed Scheme outweigh the disadvantages, both of which are summarised below. | |

| 5.2 | Advantages of the Proposed Scheme |

| 5.2.1 | The key advantages to Benitec Shareholders should the Proposed Scheme proceed include: | |

| (a) | Companies trading on the Nasdaq generally trade at higher earnings multiples than those trading on the ASX. As at 10 January 2020, the average enterprise value / earnings before interest, tax, depreciation and amortisation (EBITDA) multiple (excluding the maximum and minimum) for the last twelve months for those companies trading on the ASX was 18.6 times, compared with 22.6 times for those companies trading on the Nasdaq. Notwithstanding, with the exception of the financial year ending 30 June 2019, Benitec has incurred EBITDA losses (as is common for a biotechnology company with assets in similar development stages to Benitec). It should be noted that a rerating of Holdco shares as a result of the Proposed Scheme is not guaranteed. |

| (b) | Given Benitec’s current business and the majority of its employees are currently located in the US, the re- domiciliation is expected to streamline operations, generating estimated cost savings in excess of $750,000 per annum once implemented. The corporate and operating structure is also expected be more easily understandable to potential investors post implementation of the Proposed Scheme. |

| (c) | The re-domiciliation is expected to reduce overhead costs, particularly in respect of compliance, audit and insurance costs associated with its current dual listing on the ASX and Nasdaq. Post Proposed Scheme implementation, Benitec will be delisted from the ASX and Holdco Shares will be listed for trading on the Nasdaq (subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco). As such, Benitec will no longer be dual listed post implementation of the Proposed Scheme. |

| (d) | The re-domiciliation may improve attractiveness of Benitec as a potential acquisition target and create additional opportunities with potential licensing or joint venture partners given the US is considered to be one of the most active markets for transactions in the life sciences sector. The re-domiciliation would allow any potential control, licensing or other transaction to be completed more quickly and potentially with lower transactions costs. |

| (e) | A primary listing in the US will allow Holdco greater access to US capital markets which are substantially larger than in Australia resulting in the potential ability for Holdco to raise equity capital and access a broader range of investors who may only be interested in a direct investment in a US listed company. In addition, the Benitec Board believes the US market is familiar with and has a stronger interest in early to mid-stage biotechnology companies, which may lead to a stronger valuation of Holdco over time and improve liquidity in trading of shares. |

| (f) | The Directors of Benitec unanimously recommend that Benitec Shareholders vote in favour of the Proposed Scheme. The Directors that hold or control Benitec Shares intend to vote in favour of the Proposed Scheme. |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 17 |

Exhibit 99.5

| 5.3 | Disadvantages of the Proposed Scheme |

| 5.3.1 | The key disadvantages to Benitec Shareholders should the Proposed Scheme proceed include: | |

| (a) | Benitec Shareholders may wish to retain their Benitec Shares, which are listed on the ASX. Should the Proposed Scheme be implemented, existing Benitec Shareholders will hold shares in Holdco, which will be listed for trading on the Nasdaq (subject to authorisation for listing being obtained from Nasdaq and official notice of issuance of Holdco Shares from Holdco). Benitec shareholders located outside the US may not be as familiar with trading practices on the Nasdaq as they might be with trading practices on the ASX. |

| (b) | There will be differences in the rights attaching to the Benitec Shares as compared to the rights attaching to the Holdco Shares due to differences in the laws which govern the Benitec Shares compared to the laws which govern the Holdco Shares. The Benitec Shares are currently governed under the Corporations Act, Benitec Constitution and the ASX Listing Rules. The Holdco Shares will be governed under the Delaware General Corporation Law and Holdco’s certificate of incorporation and by-laws. Assuming Holdco shares are approved for trading on the Nasdaq, they will also be subject to the listing rules of Nasdaq. Benitec Shareholders should refer to Section 5.4 of the Scheme Booklet for a full comparison of the rights attaching to the Benitec Shares and Holdco Shares and Section 5.6 for a summary of the differences between the company law regimes. |

| (c) | Should the Proposed Scheme be implemented, Holdco Shareholders will have an increased level of exposure to a litigious environment given Holdco will be a US public company and not an Australian listed company. The US legal environment is generally considered more litigious than the Australian legal environment and there is a risk that any material or costly dispute or litigation could adversely affect Holdco’s reputation, financial performance or value. |

| (d) | Although we understand roll-over relief may be available, there may be US federal and Australian taxation consequences for some Benitec Shareholders if the Proposed Scheme is implemented. Benitec Shareholders should refer to Sections 8.2 and 8.3 of the Scheme Booklet for further detail. |

| (e) | The costs associated with the Proposed Scheme have been estimated by the Directors to be approximately $650,000. Notwithstanding, approximately $550,000 of these costs are expected to be incurred regardless of whether the Proposed Scheme is approved by Benitec Shareholders. We note these costs represent one off costs to Benitec. |

| (f) | Benitec Shareholders who are Ineligible Foreign Shareholders will not be issued Holdco Shares. Instead, the Holdco Shares to which Ineligible Foreign Shareholders would otherwise be entitled to under the Proposed Scheme will be sold by an agent via a Share Sale Facility with the proceeds being remitted to those shareholders (less any brokerage fees). Benitec Management has advised that as at the date of this report, the number of shareholders expected to be deemed Ineligible Foreign Shareholders total 32, holding approximately 1,053,371 Benitec Shares in aggregate, representing approximately 0.33% of total Benitec Shares outstanding. |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 18 |

Exhibit 99.5

ADSs | American Depositary Shares |

ADS Holders | Holders of Benitec ADSs |

AFSL | Australian Financial Services Licence |

AFCA | Australian Financial Complaints Authority |

APES | Accounting Profession & Ethical Standards |

ASIC | Australian Securities and Investments Commission |

ASX | Australian Securities Exchange |

ATO | Australian Taxation Office |

AUD | Australian dollar |

Axovant | Axovant Sciences Ltd |

Benitec | Benitec Biopharma Limited |

Benitec Shareholders | Holders of Benitec Shares |

Benitec Shares | Ordinary Shares in Benitec |

CA ANZ | Chartered Accountants Australia and New Zealand |

CAGR | Compound average growth rate |

Corporations Act | Corporations Act 2001 (Cth) |

ddRNAi | DNA-directed RNA interference |

EBIT | Earnings before interest and tax |

EBITDA | Earnings before interest, tax, depreciation and amortisation |

FDA | Food and Drug Administration |

FSG | The Financial Services Guide |

FY## | Financial year ended 30 June 20## |

Holdco | Benitec Biopharma Inc. |

Holdco Share | One new share of ordinary stock |

HPV | Hepatitis B |

Management | Management of Benitec |

McGrathNicol | McGrathNicol Transaction Advisory Pty Ltd |

Nasdaq` | Nasdaq Capital Markets |

OPMD | oculopharyngeal muscular dystrophy |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 19 |

Exhibit 99.5

Proposed Scheme | Incorporation of Holdco as the ultimate holding company of Benitec |

R&D | Research and development |

RG | ASIC Regulatory Guide |

RG 111 | ASIC Regulatory Guide 111 “Content of expert’s reports” |

RG 112 | ASIC Regulatory Guide 112 “Independence of Expert’s Reports” |

US | United States of America |

USD | US dollar |

VWAP | Volume weighted average price |

UK | United Kingdom |

YTD | Year to date |

| 7 | Qualifications, Declarations and Consents |

| 7.1.1 | McGrathNicol provides transactions advisory services in relation to due diligence, sale assistance, transaction management and valuation services, including the preparation of company and business valuations and the provision of independent advice and expert's reports. Our financial services guide is attached at Appendix A. | |

| 7.1.2 | Mr. Andrew Fressl, B.Com, CA, F.Fin is jointly responsible for this report. Andrew has over 20 years' experience advising public and private clients on their corporate finance transactions and has specific expertise in relation to acquisition and vendor due diligence, sell-side advisory and valuations. Andrew is also an accredited Business Valuation Specialist with the Chartered Accountants Australia and New Zealand (CA ANZ). | |

| 7.1.3 | Mr. David Barnaby, B.Com, CA, F.Fin is jointly responsible for this report. David has over 20 years' experience in relevant corporate advisory matters, including valuations. David Barnaby is an authorised representative of McGrathNicol Transaction Advisory Pty Ltd pursuant to its Australian Financial Services Licence (under Part 7.6 of the Corporations Act). | |

| 7.2.1 | Prior to accepting this engagement, McGrathNicol considered its independence with reference to the ASIC Regulatory Guide 112 “Independence of Expert’s Reports” (RG 112). McGrathNicol has no involvement with, or interest in, the outcome of the approval of the Proposed Scheme other than that of an independent expert. McGrathNicol is entitled to receive a fee based on commercial rates and including reimbursement of out-of- pocket expenses for the preparation of this report. | |

| 7.2.2 | Except for these fees, McGrathNicol will not be entitled to any other pecuniary or other benefit, whether direct or indirect, in connection with the issuing of this report. The payment of this fee is in no way contingent upon the success or failure of the Proposed Scheme. | |

| 7.2.3 | McGrathNicol has previously performed independent engagements for Benitec. Notwithstanding, McGrathNicol is not aware of any relationship with Benitec that would impact on its independence. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 20 |

Exhibit 99.5

| 7.3 | Consent and other matters |

| 7.3.1 | Our report is to be read in conjunction with the Scheme Booklet in which this report is included, and is prepared for the exclusive purpose of assisting Benitec Shareholders. This report should not be used for any other purpose. | |

| 7.3.2 | McGrathNicol consents to the issue of this report in its form and context and consents to its inclusion in the Scheme Booklet. | |

| 7.3.3 | This report constitutes general financial product advice only and in undertaking our assessment, we have considered the likely impact of the Proposed Scheme to Benitec Shareholders as a whole. We have not considered the potential impact of the Proposed Scheme on individual Benitec Shareholders. Individual Benitec Shareholders have different financial circumstances and it is neither practicable nor possible to consider the implications of the Proposed Scheme on individual Benitec Shareholders. | |

| 7.3.4 | The decision of whether or not to approve the Proposed Scheme is a matter for each Benitec Shareholder based on their own views and expectations about future market conditions, risk profile and investment strategy. If Benitec Shareholders are in doubt about the action they should take, they should seek their own professional advice. | |

| 7.4 | Information relied on and limitations |

| 7.4.1 | This report includes all references to information utilised, the valuation approaches and methodologies adopted, assumptions relied upon and conclusions reached. | |

| 7.4.2 | In preparing this report, we relied on information provided by the Management of Benitec set out at Appendix B. | |

| 7.4.3 | An important part of the information used in forming an opinion as to fairness and reasonableness is comprised of the opinions and judgement of Benitec Management. This type of information was evaluated through analysis, inquiry and review. However, such information is often not capable of external verification or validation and has not been independently verified. | |

| 7.4.4 | We did not perform an audit of the information provided, however, evaluated the information through analysis and discussions with Benitec Management. McGrathNicol does not warrant that our evaluation has identified or verified all of the matters that an audit, extensive examination or due diligence investigation may disclose. The information we relied on was not independently verified. | |

| 7.4.5 | McGrathNicol has no reason to believe any material facts have been withheld. Should we become aware that information we have relied upon is materially misstated or of any factors that alter our assumptions, we reserve the right to alter our valuation and conclusions. | |

| 7.4.6 | Should circumstances change, or if new information becomes available post the date of this report, we reserve the right to amend our calculations. | |

| 7.4.7 | To the extent that there are tax and legal issues relating to assets, properties or business interests or issues relating to compliance with applicable laws, regulations, and policies, McGrathNicol: | |

| (a) | assumes no responsibility and offers no tax and legal opinion or interpretation on any issue; and |

| (b) | has generally assumed that matters such as title, compliance with laws and regulations and contracts in place are in good standing and will remain so. |

| 7.4.8 | This report has been prepared for Benitec Shareholders. It should not be disclosed to any other party without our consent in writing. It may not otherwise be reproduced in whole or in part or supplied to any other party, without our consent in writing. We do not assume any responsibility or liability for any losses suffered by Benitec Shareholders, their advisers or any unauthorised user, as a result of circulation, publication, reproduction or other use of this report contrary to the provisions of this paragraph. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 21 |

Exhibit 99.5

| A | Financial services guide |

| A.1.1 | This Financial Services Guide (FSG) provides you with important information to assist you in deciding how to use our report. It provides you with information about us, the financial services we offer, our dispute resolution process and how we are remunerated. | |

| A.1.2 | We act on behalf of Benitec Biopharma Limited, to whom this report is addressed.; Where you are not the addressee we are required to issue you this FSG under the Corporations Act and the terms of our Australian Financial Services Licence (AFSL) as a result of our client providing you with a copy of our report. | |

| A.2 | Financial services we are authorised to provide |

| A.2.1 | We are authorised to provide general financial product advice in relation to securities, and to arrange for another person to issue, apply for, acquire, vary or dispose of securities to retail and wholesale clients. | |

| A.3 | General financial product advice |

| A.3.1 | Our report provides general financial product advice only. In preparing this Report, we have not taken into account your personal circumstances including financial situation or needs. You should consider whether any advice contained in our report is appropriate for you, having regard to your own personal objectives, financial situation or needs. | |

| A.3.2 | We provide no financial services directly to retail clients and receive no remuneration from retail clients for financial services. We do not provide any personal retail financial product advice to retail investors nor do we provide market-related advice to retail investors. You were provided with a copy of our report because of your connection to the matters in respect of which we have been engaged to report. | |

| A.4 | Remuneration for our services |

| A.4.1 | Our fees have been agreed with our client on a fixed fee or a time cost basis, and we may also be reimbursed for our out of pocket expenses. Our fees for this engagement are estimated to be $50,000 plus GST. We will not receive any other commission, fee or benefit in connection with the provision of the report. | |

| A.4.2 | The remuneration provided to our directors, authorised representatives and the partners, officers and employees of our associated entities is based on their overall performance and contribution over the course of a financial year. No commissions are paid in respect of the provision of financial product advice. | |

| A.5 | Associations and relationships |

| A.5.1 | McGrathNicol is a group of independent entities operating in association. We and our associated entities do not have any formal associations or relationships with any entities that are issuers of financial products but may provide professional services to issuers of financial products in the ordinary course of business. | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 22 |

Exhibit 99.5

| A.6.1 | If you have any concerns regarding our report, please let us know. If you wish to lodge a formal complaint, you may do so in writing to: The Risk and Professional Practice Partner, McGrathNicol, GPO Box 9986, Sydney NSW 2000 or complaint@mcgrathnicol.com. We will respond to your complaint promptly. | |

| A.6.2 | If you are not satisfied with our response or the steps we have taken to resolve your complaint, you may contact the Australian Financial Complaints Authority (AFCA). AFCA provides free advice and assistance to consumers to assist them to resolve complaints relating to the financial services industry. AFCA can be contacted on 1800 931 678 or GPO Box 3, Melbourne VIC 3001, or info@afca.org.au. Further details may be obtained from www.afca.org.au. | |

| A.7 | Compensation arrangements |

| A.7.1 | We hold professional indemnity insurance that covers the services we provide. This insurance as required by section 912B of the Corporations Act. | |

| A.7.2 | McGrathNicol Transaction Advisory Pty Ltd, ABN 83 160 621 054, AFSL 436347 of Level 12, 20 Martin Place, Sydney, NSW 2000. | |

| B.1 | Publicly available information: |

| B.1.1 | Benitec’s website: https://benitec.com/ | |

| B.1.2 | Benitec’s annual reports for FY17, FY18 and FY19 | |

| B.1.3 | Benitec’s 30 September 2019 Quarterly Activity Report | |

| B.1.4 | Benitec’s ASX announcements | |

| B.1.5 | Financial information from Capital IQ | |

| B.2 | Non-public information: |

| B.2.1 | Advanced draft of the Benitec Scheme Booklet, including the summary taxation and legal implications of the Proposed Scheme | |

| B.2.2 | Benitec’s shareholder register as at 14 January 2020 | |

| B.2.3 | Benitec group structure | |

| B.2.4 | Discussions with Management of Benitec | |

| | | | |

| | | | |

| | Benitec Biopharma Limited Independent Expert’s Report | | 23 |