UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-22718 |

| | |

| Two Roads Shared Trust |

| (Exact name of registrant as specified in charter) |

| |

| 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

| | |

| The Corporation Trust Company |

| 1209 Orange Street, Wilmington, DE 19801 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 631-490-4300 | |

| | | |

| Date of fiscal year end: | 10/31 | |

| | | |

| Date of reporting period: | 10/31/2024 | |

Item 1. Reports to Stockholders.

(a)

Redwood AlphaFactor Tactical International Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood AlphaFactor Tactical International Fund for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $130 | 1.20% |

|---|

How did the Fund perform during the reporting period?

During the Redwood AlphaFactor® Tactical International Fund’s (the “Fund”) During the fiscal year, international equity markets experienced a significant upswing as Central Banks around the world initiated rate cuts materialized, boosting investor confidence and propelling global stock indices to new highs. This resurgence was supported by favorable economic indicators and policy shifts across various regions. However, concerns about potential recessions and geopolitical tensions, such as trade disputes and regional conflicts, introduced caution among investors, leading to increased market volatility. Despite these challenges, the overall trend remained positive, reflecting a renewed appetite for risk in the international equity landscape.

The Fund posted a gain of 16.80% (Source: Ultimus), underperforming its benchmark, the MSCI All Country World ex-US Index** (MSCI ACWI ex-US), which returned 24.33% (Source: Ultimus). Following our quantitative risk-managed process, the broad rally in international equities resulted in the Fund remaining fully exposed to international equities for the entire period. An additional positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). The Fund will continue to implement its disciplined quantitative stock selection and risk management process.

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a quantitative approach, aiming to minimize the subjectivity of investing.

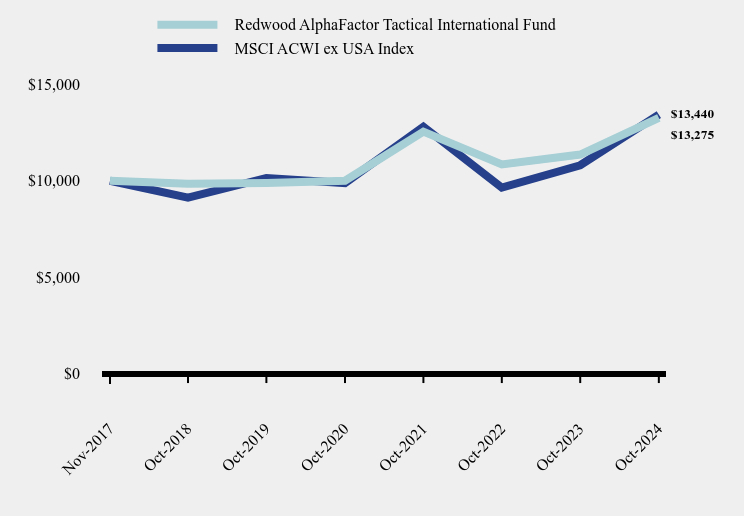

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Redwood AlphaFactor Tactical International Fund | MSCI ACWI ex USA Index |

|---|

| Nov-2017 | $10,000 | $10,000 |

|---|

| Oct-2018 | $9,842 | $9,120 |

|---|

| Oct-2019 | $9,880 | $10,147 |

|---|

| Oct-2020 | $10,006 | $9,882 |

|---|

| Oct-2021 | $12,555 | $12,814 |

|---|

| Oct-2022 | $10,848 | $9,645 |

|---|

| Oct-2023 | $11,366 | $10,809 |

|---|

| Oct-2024 | $13,275 | $13,440 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (November 2, 2017) |

|---|

| Redwood AlphaFactor Tactical International Fund | 16.80% | 6.08% | 4.13% |

|---|

| MSCI ACWI ex USA Index | 24.33% | 5.78% | 4.32% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $197,273,788 |

|---|

| Number of Portfolio Holdings | 75 |

|---|

| Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $1,513,131 |

|---|

| Portfolio Turnover | 49% |

|---|

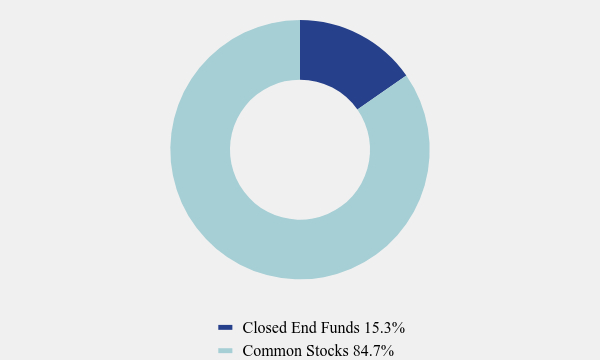

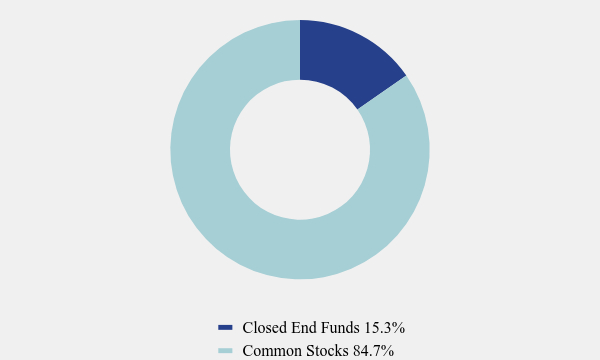

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 15.3% |

| Common Stocks | 84.7% |

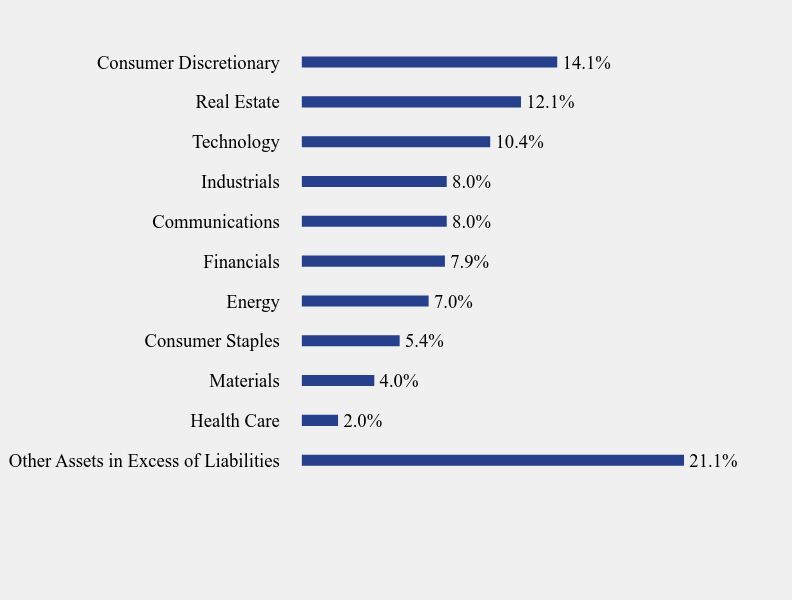

What did the Fund invest in?

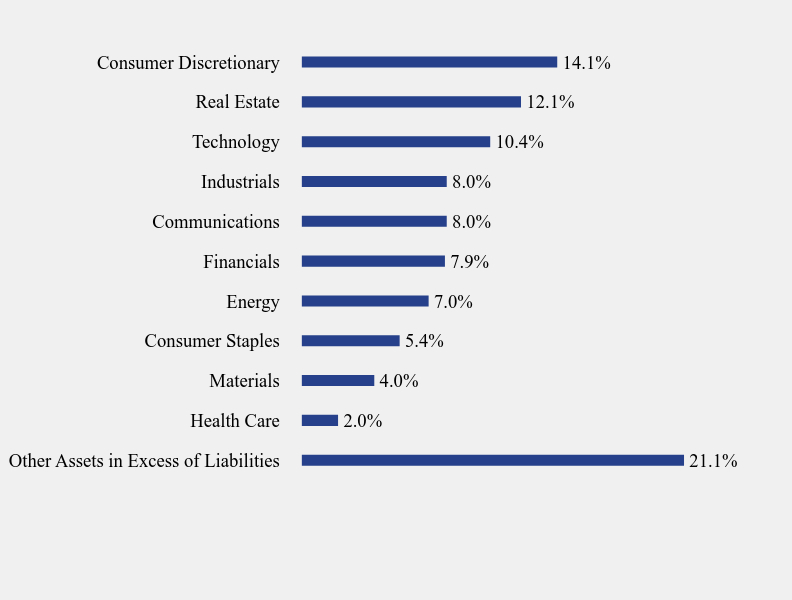

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 21.1% |

| Health Care | 2.0% |

| Materials | 4.0% |

| Consumer Staples | 5.4% |

| Energy | 7.0% |

| Financials | 7.9% |

| Communications | 8.0% |

| Industrials | 8.0% |

| Technology | 10.4% |

| Real Estate | 12.1% |

| Consumer Discretionary | 14.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Redwood Real Estate Income Fund, Class I | 12.1% |

| Evergreen Marine Corp Taiwan Ltd. | 2.0% |

| Asustek Computer, Inc. | 1.7% |

| Quanta Computer Inc | 1.5% |

| Uni-President Enterprises Corporation | 1.4% |

| Singapore Exchange Ltd. | 1.3% |

| Novatek Microelectronics Corporation | 1.3% |

| Seres Group Company Ltd. | 1.1% |

| United Tractors Tbk P.T. | 1.0% |

| Shell plc | 1.0% |

No material changes occurred during the year ended October 31, 2024.

Redwood AlphaFactor Tactical International Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood AlphaFactor Tactical International Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood AlphaFactor Tactical International Fund for the period of November 1, 2023 to December 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $157 | 1.45% |

|---|

How did the Fund perform during the reporting period?

During the Redwood AlphaFactor® Tactical International Fund’s (the “Fund”) During the fiscal year, international equity markets experienced a significant upswing as Central Banks around the world initiated rate cuts materialized, boosting investor confidence and propelling global stock indices to new highs. This resurgence was supported by favorable economic indicators and policy shifts across various regions. However, concerns about potential recessions and geopolitical tensions, such as trade disputes and regional conflicts, introduced caution among investors, leading to increased market volatility. Despite these challenges, the overall trend remained positive, reflecting a renewed appetite for risk in the international equity landscape.

The Fund posted a gain of 16.80% (Source: Ultimus), underperforming its benchmark, the MSCI All Country World ex-US Index** (MSCI ACWI ex-US), which returned 24.33% (Source: Ultimus). Following our quantitative risk-managed process, the broad rally in international equities resulted in the Fund remaining fully exposed to international equities for the entire period. An additional positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). The Fund will continue to implement its disciplined quantitative stock selection and risk management process.

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a quantitative approach, aiming to minimize the subjectivity of investing.

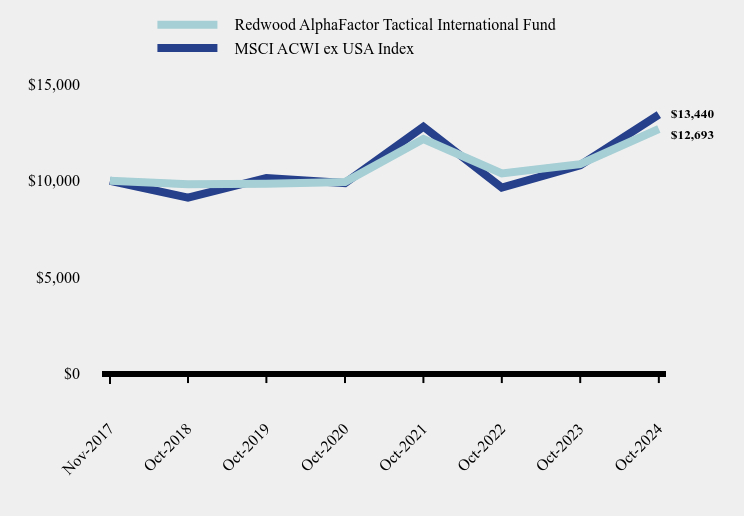

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Redwood AlphaFactor Tactical International Fund | MSCI ACWI ex USA Index |

|---|

| Nov-2017 | $10,000 | $10,000 |

|---|

| Oct-2018 | $9,821 | $9,120 |

|---|

| Oct-2019 | $9,839 | $10,147 |

|---|

| Oct-2020 | $9,939 | $9,882 |

|---|

| Oct-2021 | $12,171 | $12,814 |

|---|

| Oct-2022 | $10,380 | $9,645 |

|---|

| Oct-2023 | $10,867 | $10,809 |

|---|

| Oct-2024 | $12,693 | $13,440 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (November 2, 2017) |

|---|

| Redwood AlphaFactor Tactical International Fund | 16.80% | 5.23% | 3.47% |

|---|

| MSCI ACWI ex USA Index | 24.33% | 5.78% | 4.32% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $197,273,788 |

|---|

| Number of Portfolio Holdings | 75 |

|---|

| Advisory Fee #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value ((history)) | $1,513,131 |

|---|

| Portfolio Turnover | 49% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 15.3% |

| Common Stocks | 84.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 21.1% |

| Health Care | 2.0% |

| Materials | 4.0% |

| Consumer Staples | 5.4% |

| Energy | 7.0% |

| Financials | 7.9% |

| Communications | 8.0% |

| Industrials | 8.0% |

| Technology | 10.4% |

| Real Estate | 12.1% |

| Consumer Discretionary | 14.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Redwood Real Estate Income Fund, Class I | 12.1% |

| Evergreen Marine Corp Taiwan Ltd. | 2.0% |

| Asustek Computer, Inc. | 1.7% |

| Quanta Computer Inc | 1.5% |

| Uni-President Enterprises Corporation | 1.4% |

| Singapore Exchange Ltd. | 1.3% |

| Novatek Microelectronics Corporation | 1.3% |

| Seres Group Company Ltd. | 1.1% |

| United Tractors Tbk P.T. | 1.0% |

| Shell plc | 1.0% |

No material changes occurred during the year ended October 31, 2024.

Redwood AlphaFactor Tactical International Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Managed Municipal Income Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Managed Municipal Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $105 | 1.00% |

|---|

How did the Fund perform during the reporting period?

During the Redwood Managed Municipal Income Fund’s (the “Fund”) fiscal year, bond markets faced a complex environment as the Federal Reserve’s anticipated rate cuts materialized, directly impacting the demand for fixed-income securities. U.S. Treasury fell overall driven by resilient economic data and tempered expectations for further cuts. Both investment-grade and high-yield municipal bonds performed strongly.

The Fund's Class I shares returned 9.55% (Source: Ultimus). Utilizing our quantitative risk-managed process, the Fund began the period in a defensive position. This approach caused the Fund to miss a significant rally in high-yield municipal bonds early in the period. However, the Fund subsequently shifted back into a risk position, gaining exposure to high-yield municipal bonds, which accounted for the majority of its total return. Another notable contributor to the Fund’s performance was the addition of the Redwood Real Estate Income Fund (ticker: CREMX), an affiliated short-duration private debt fund. The Fund performed in line with its benchmark, the Bloomberg Municipal Bond Index, which returned 9.70% (Source: Ultimus). Although the Fund was not fully exposed to high-yield municipal bonds for the entire period, their outperformance relative to investment-grade municipal bonds significantly supported the Fund’s overall return.

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a quantitative approach, aiming to minimize the subjectivity of investing.

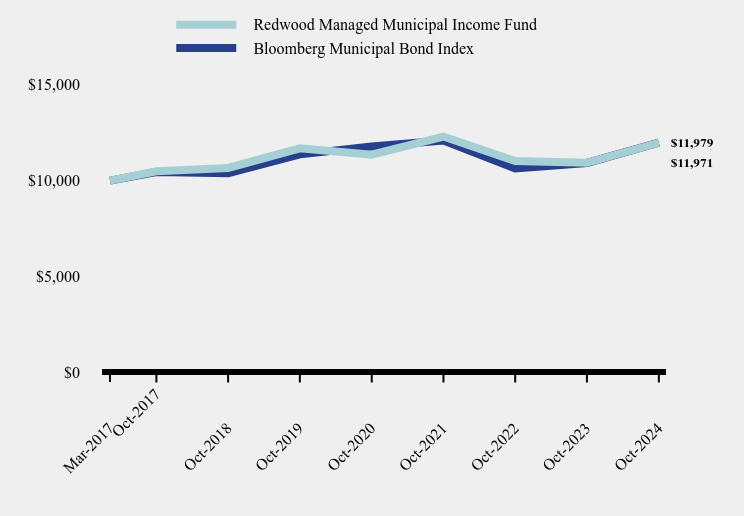

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Redwood Managed Municipal Income Fund | Bloomberg Municipal Bond Index |

|---|

| Mar-2017 | $10,000 | $10,000 |

|---|

| Oct-2017 | $10,487 | $10,443 |

|---|

| Oct-2018 | $10,658 | $10,389 |

|---|

| Oct-2019 | $11,684 | $11,368 |

|---|

| Oct-2020 | $11,351 | $11,776 |

|---|

| Oct-2021 | $12,293 | $12,087 |

|---|

| Oct-2022 | $11,019 | $10,639 |

|---|

| Oct-2023 | $10,927 | $10,920 |

|---|

| Oct-2024 | $11,971 | $11,979 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (March 9, 2017) |

|---|

| Redwood Managed Municipal Income Fund | 9.55% | 0.49% | 2.38% |

|---|

| Bloomberg Municipal Bond Index | 9.70% | 1.05% | 2.39% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $135,643,524 |

|---|

| Number of Portfolio Holdings | 20 |

|---|

| Advisory Fee (net of waivers) | $764,611 |

|---|

| Portfolio Turnover | 135% |

|---|

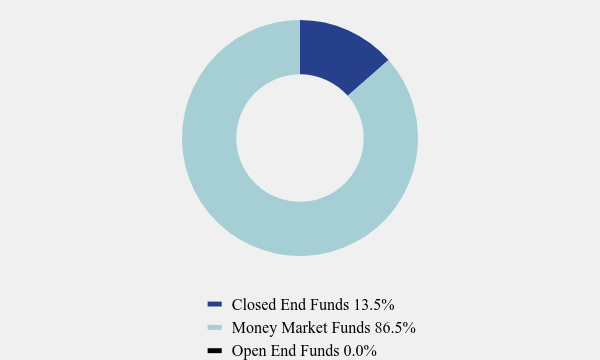

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 13.5% |

| Money Market Funds | 86.5% |

| Open End Funds | 0.0% |

What did the Fund invest in?

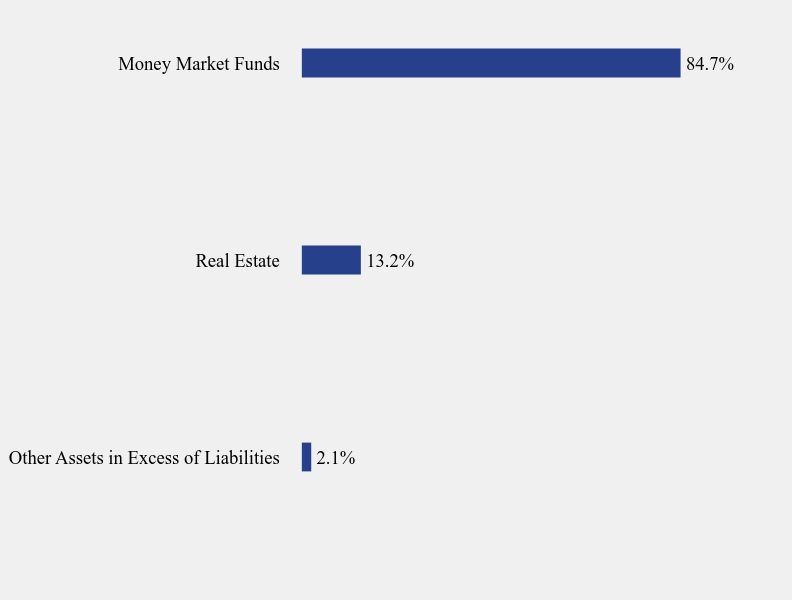

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.1% |

| Real Estate | 13.2% |

| Money Market Funds | 84.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| BlackRock Liquidity Funds MuniCash, Institutional Class | 28.3% |

| JPMorgan Municipal Money Market Fund, Agency Class | 28.2% |

| JPMorgan Tax Free Money Market Fund, Agency Class | 28.2% |

| Redwood Real Estate Income Fund, Class I | 13.2% |

| MainStay MacKay High Yield Municipal Bond Fund, Class I | 0.0% |

| BlackRock High Yield Municipal Fund, Institutional Class | 0.0% |

| Northern High Yield Municipal Fund, USD Class | 0.0% |

| American Century High-Yield Municipal Fund, Class I | 0.0% |

| Western Asset Municipal High Income Fund, Class I | 0.0% |

| Pioneer High Income Municipal Fund, Class Y | 0.0% |

No material changes occurred during the year ended October 31, 2024.

Redwood Managed Municipal Income Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Managed Volatility Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $173 | 1.63% |

|---|

How did the Fund perform during the reporting period?

During the Redwood Managed Volatility Fund’s (the “Fund”) fiscal year, bond markets faced a complex environment as the Federal Reserve’s anticipated rate cuts materialized, directly impacting the demand for fixed-income securities. U.S. Treasury fell overall driven by resilient economic data and tempered expectations for further cuts. Corporate bonds performed strongly, with investment-grade spreads tightening to 36 basis points and high-yield spreads narrowing to their lowest point since 2021.

The Fund's Class I shares, Class N shares and Class Y shares returned 11.94%, 11.57% and 12.05%, respectively (Source: Ultimus). Following our quantitative risk-managed process, the Fund followed the trend of high-yield corporates higher, and as a result remained in risk assets for the entire duration. This resulted in the Fund being exposed to risk assets for the entirety of the period. The Fund derived its total return primarily from high-yield corporate bond mutual funds as well as from derivative products, such as CDX, tied to U.S. corporate high-yield bond exposure. A positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). These exposures resulted in the fund outperforming in comparison to its benchmark, the BofA 3-5 Year Treasury Index which returned 6.84% (Source: Ultimus).

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a disciplined, quantitative approach, aiming to minimize the subjectivity of investing.

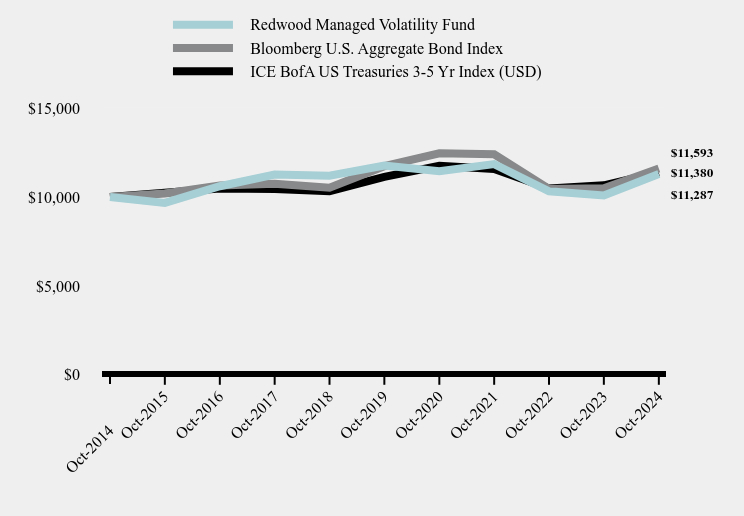

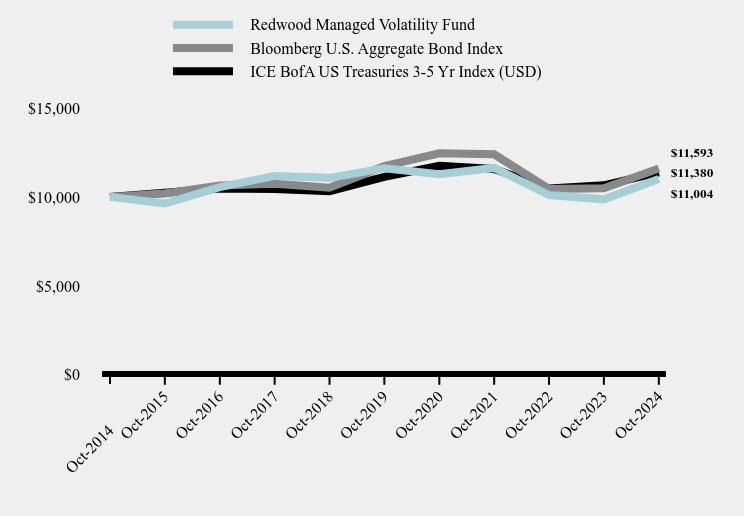

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Redwood Managed Volatility Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA US Treasuries 3-5 Yr Index (USD) |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2015 | $9,661 | $10,196 | $10,229 |

|---|

| Oct-2016 | $10,600 | $10,641 | $10,473 |

|---|

| Oct-2017 | $11,261 | $10,737 | $10,449 |

|---|

| Oct-2018 | $11,188 | $10,517 | $10,322 |

|---|

| Oct-2019 | $11,758 | $11,727 | $11,129 |

|---|

| Oct-2020 | $11,448 | $12,453 | $11,753 |

|---|

| Oct-2021 | $11,841 | $12,393 | $11,574 |

|---|

| Oct-2022 | $10,313 | $10,450 | $10,470 |

|---|

| Oct-2023 | $10,083 | $10,487 | $10,651 |

|---|

| Oct-2024 | $11,287 | $11,593 | $11,380 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Redwood Managed Volatility Fund | 11.94% | -0.81% | 1.22% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| ICE BofA US Treasuries 3-5 Yr Index (USD) | 6.84% | 0.45% | 1.30% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $148,532,214 |

|---|

| Number of Portfolio Holdings | 139 |

|---|

| Advisory Fee | $1,839,299 |

|---|

| Portfolio Turnover | 43% |

|---|

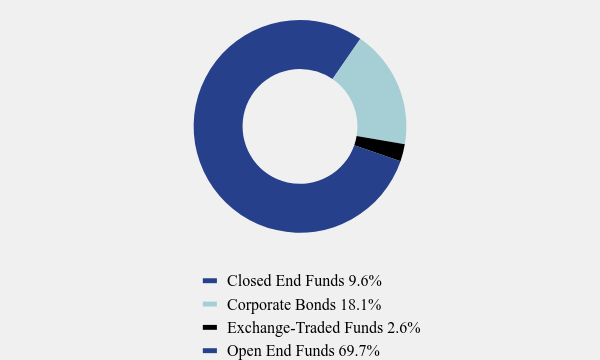

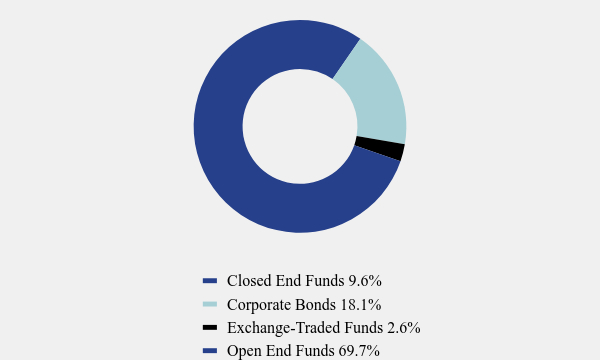

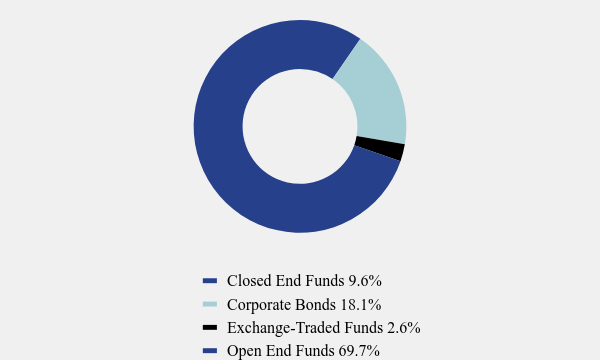

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 9.6% |

| Corporate Bonds | 18.1% |

| Exchange-Traded Funds | 2.6% |

| Open End Funds | 69.7% |

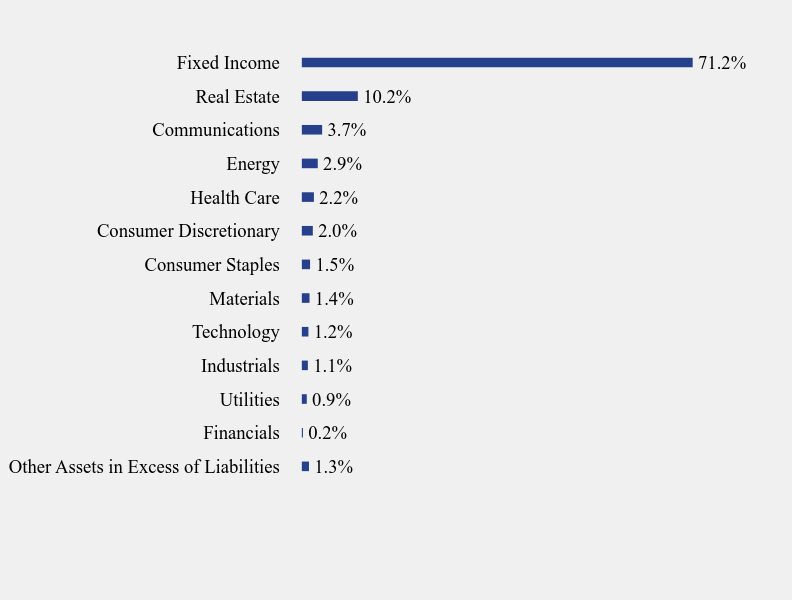

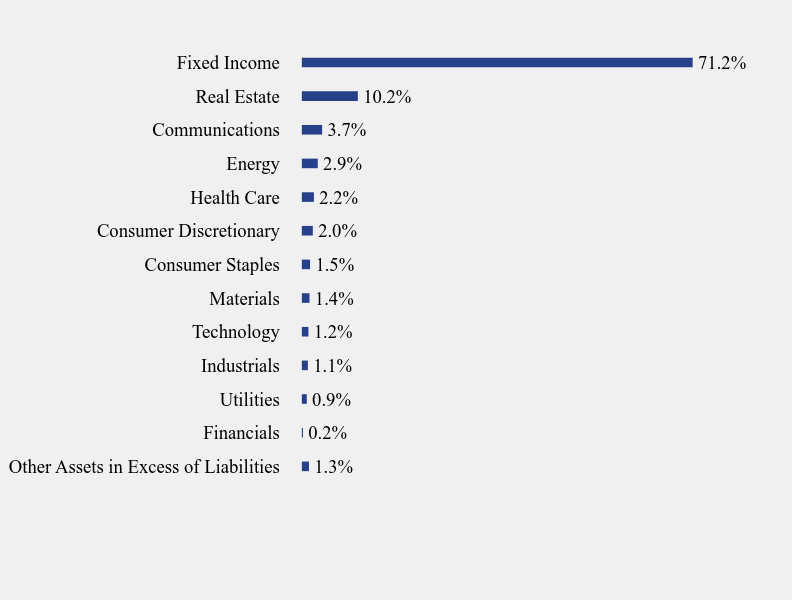

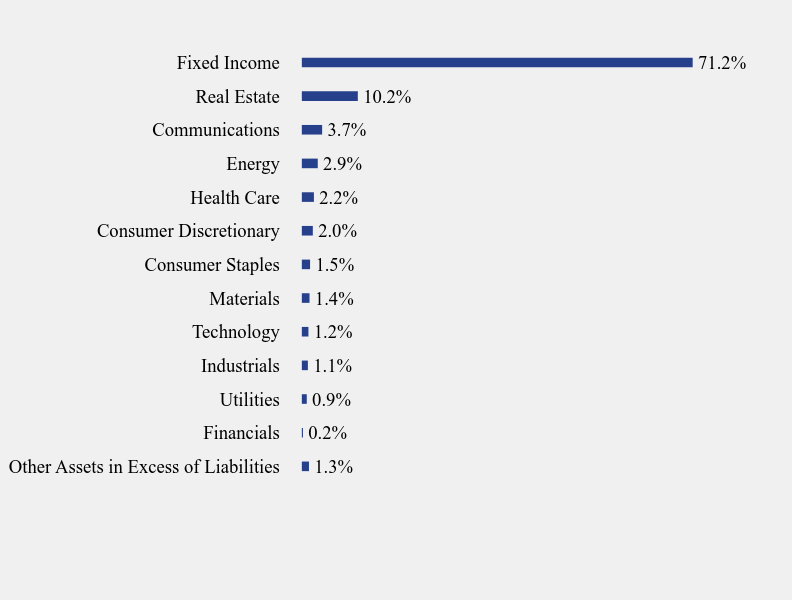

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Financials | 0.2% |

| Utilities | 0.9% |

| Industrials | 1.1% |

| Technology | 1.2% |

| Materials | 1.4% |

| Consumer Staples | 1.5% |

| Consumer Discretionary | 2.0% |

| Health Care | 2.2% |

| Energy | 2.9% |

| Communications | 3.7% |

| Real Estate | 10.2% |

| Fixed Income | 71.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Vanguard High-Yield Corporate Fund, Admiral Class | 21.9% |

| American High-Income Trust, Class F-3 | 13.9% |

| Blackrock Series Fund V-BlackRock High Yield Portfolio, Institutional Class | 13.7% |

| Redwood Real Estate Income Fund, Class I | 9.5% |

| Lord Abbett High Yield Fund, Class I | 6.9% |

| Principal High Income Fund | 6.8% |

| MainStay MacKay High Yield Corporate Bond Fund, Class I | 5.4% |

| VanEck Fallen Angel High Yield Bond ETF | 1.4% |

| SPDR Portfolio High Yield Bond ETF | 1.2% |

| Transocean, Inc. | 0.3% |

No material changes occurred during the year ended October 31, 2024.

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Managed Volatility Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $200 | 1.89% |

|---|

How did the Fund perform during the reporting period?

During the Redwood Managed Volatility Fund’s (the “Fund”) fiscal year, bond markets faced a complex environment as the Federal Reserve’s anticipated rate cuts materialized, directly impacting the demand for fixed-income securities. U.S. Treasury fell overall driven by resilient economic data and tempered expectations for further cuts. Corporate bonds performed strongly, with investment-grade spreads tightening to 36 basis points and high-yield spreads narrowing to their lowest point since 2021.

The Fund's Class I shares, Class N shares and Class Y shares returned 11.94%, 11.57% and 12.05%, respectively (Source: Ultimus). Following our quantitative risk-managed process, the Fund followed the trend of high-yield corporates higher, and as a result remained in risk assets for the entire duration. This resulted in the Fund being exposed to risk assets for the entirety of the period. The Fund derived its total return primarily from high-yield corporate bond mutual funds as well as from derivative products, such as CDX, tied to U.S. corporate high-yield bond exposure. A positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). These exposures resulted in the fund outperforming in comparison to its benchmark, the BofA 3-5 Year Treasury Index which returned 6.84% (Source: Ultimus).

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a disciplined, quantitative approach, aiming to minimize the subjectivity of investing.

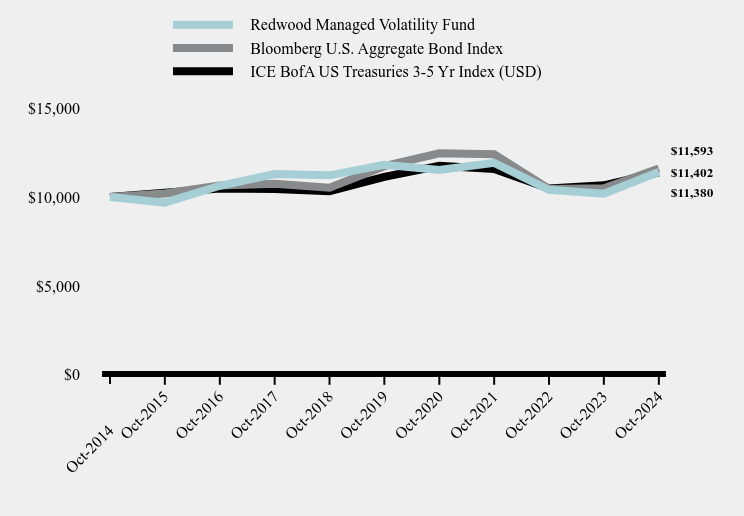

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Redwood Managed Volatility Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA US Treasuries 3-5 Yr Index (USD) |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2015 | $9,631 | $10,196 | $10,229 |

|---|

| Oct-2016 | $10,547 | $10,641 | $10,473 |

|---|

| Oct-2017 | $11,179 | $10,737 | $10,449 |

|---|

| Oct-2018 | $11,070 | $10,517 | $10,322 |

|---|

| Oct-2019 | $11,615 | $11,727 | $11,129 |

|---|

| Oct-2020 | $11,278 | $12,453 | $11,753 |

|---|

| Oct-2021 | $11,630 | $12,393 | $11,574 |

|---|

| Oct-2022 | $10,109 | $10,450 | $10,470 |

|---|

| Oct-2023 | $9,864 | $10,487 | $10,651 |

|---|

| Oct-2024 | $11,004 | $11,593 | $11,380 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Redwood Managed Volatility Fund | 11.57% | -1.07% | 0.96% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| ICE BofA US Treasuries 3-5 Yr Index (USD) | 6.84% | 0.45% | 1.30% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $148,532,214 |

|---|

| Number of Portfolio Holdings | 139 |

|---|

| Advisory Fee | $1,839,299 |

|---|

| Portfolio Turnover | 43% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 9.6% |

| Corporate Bonds | 18.1% |

| Exchange-Traded Funds | 2.6% |

| Open End Funds | 69.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Financials | 0.2% |

| Utilities | 0.9% |

| Industrials | 1.1% |

| Technology | 1.2% |

| Materials | 1.4% |

| Consumer Staples | 1.5% |

| Consumer Discretionary | 2.0% |

| Health Care | 2.2% |

| Energy | 2.9% |

| Communications | 3.7% |

| Real Estate | 10.2% |

| Fixed Income | 71.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Vanguard High-Yield Corporate Fund, Admiral Class | 21.9% |

| American High-Income Trust, Class F-3 | 13.9% |

| Blackrock Series Fund V-BlackRock High Yield Portfolio, Institutional Class | 13.7% |

| Redwood Real Estate Income Fund, Class I | 9.5% |

| Lord Abbett High Yield Fund, Class I | 6.9% |

| Principal High Income Fund | 6.8% |

| MainStay MacKay High Yield Corporate Bond Fund, Class I | 5.4% |

| VanEck Fallen Angel High Yield Bond ETF | 1.4% |

| SPDR Portfolio High Yield Bond ETF | 1.2% |

| Transocean, Inc. | 0.3% |

No material changes occurred during the year ended October 31, 2024.

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Managed Volatility Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class Y | $178 | 1.68% |

|---|

How did the Fund perform during the reporting period?

During the Redwood Managed Volatility Fund’s (the “Fund”) fiscal year, bond markets faced a complex environment as the Federal Reserve’s anticipated rate cuts materialized, directly impacting the demand for fixed-income securities. U.S. Treasury fell overall driven by resilient economic data and tempered expectations for further cuts. Corporate bonds performed strongly, with investment-grade spreads tightening to 36 basis points and high-yield spreads narrowing to their lowest point since 2021.

The Fund's Class I shares, Class N shares and Class Y shares returned 11.94%, 11.57% and 12.05%, respectively (Source: Ultimus). Following our quantitative risk-managed process, the Fund followed the trend of high-yield corporates higher, and as a result remained in risk assets for the entire duration. This resulted in the Fund being exposed to risk assets for the entirety of the period. The Fund derived its total return primarily from high-yield corporate bond mutual funds as well as from derivative products, such as CDX, tied to U.S. corporate high-yield bond exposure. A positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). These exposures resulted in the fund outperforming in comparison to its benchmark, the BofA 3-5 Year Treasury Index which returned 6.84% (Source: Ultimus).

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a disciplined, quantitative approach, aiming to minimize the subjectivity of investing.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Redwood Managed Volatility Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA US Treasuries 3-5 Yr Index (USD) |

|---|

| Oct-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2015 | $9,675 | $10,196 | $10,229 |

|---|

| Oct-2016 | $10,625 | $10,641 | $10,473 |

|---|

| Oct-2017 | $11,284 | $10,737 | $10,449 |

|---|

| Oct-2018 | $11,211 | $10,517 | $10,322 |

|---|

| Oct-2019 | $11,810 | $11,727 | $11,129 |

|---|

| Oct-2020 | $11,509 | $12,453 | $11,753 |

|---|

| Oct-2021 | $11,916 | $12,393 | $11,574 |

|---|

| Oct-2022 | $10,396 | $10,450 | $10,470 |

|---|

| Oct-2023 | $10,176 | $10,487 | $10,651 |

|---|

| Oct-2024 | $11,402 | $11,593 | $11,380 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Redwood Managed Volatility Fund | 12.05% | -0.70% | 1.32% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

|---|

| ICE BofA US Treasuries 3-5 Yr Index (USD) | 6.84% | 0.45% | 1.30% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $148,532,214 |

|---|

| Number of Portfolio Holdings | 139 |

|---|

| Advisory Fee | $1,839,299 |

|---|

| Portfolio Turnover | 43% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 9.6% |

| Corporate Bonds | 18.1% |

| Exchange-Traded Funds | 2.6% |

| Open End Funds | 69.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.3% |

| Financials | 0.2% |

| Utilities | 0.9% |

| Industrials | 1.1% |

| Technology | 1.2% |

| Materials | 1.4% |

| Consumer Staples | 1.5% |

| Consumer Discretionary | 2.0% |

| Health Care | 2.2% |

| Energy | 2.9% |

| Communications | 3.7% |

| Real Estate | 10.2% |

| Fixed Income | 71.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Vanguard High-Yield Corporate Fund, Admiral Class | 21.9% |

| American High-Income Trust, Class F-3 | 13.9% |

| Blackrock Series Fund V-BlackRock High Yield Portfolio, Institutional Class | 13.7% |

| Redwood Real Estate Income Fund, Class I | 9.5% |

| Lord Abbett High Yield Fund, Class I | 6.9% |

| Principal High Income Fund | 6.8% |

| MainStay MacKay High Yield Corporate Bond Fund, Class I | 5.4% |

| VanEck Fallen Angel High Yield Bond ETF | 1.4% |

| SPDR Portfolio High Yield Bond ETF | 1.2% |

| Transocean, Inc. | 0.3% |

No material changes occurred during the year ended October 31, 2024.

Redwood Managed Volatility Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Systematic Macro Trend Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Systematic Macro Trend Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $141 | 1.29% |

|---|

How did the Fund perform during the reporting period?

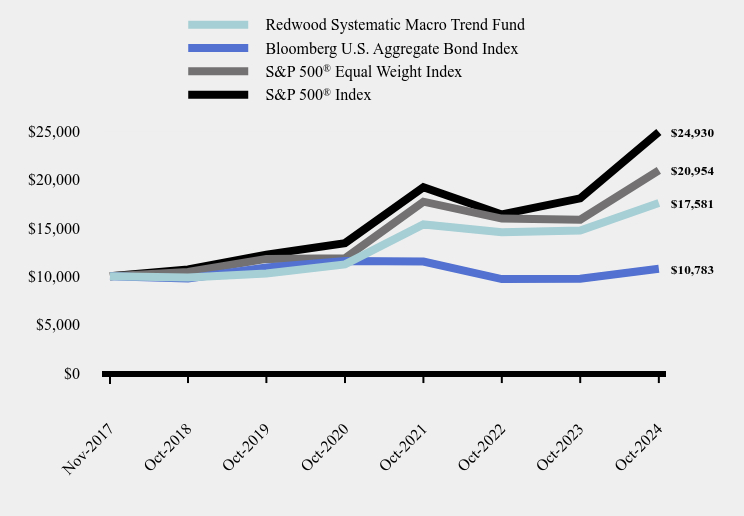

During the Redwood Systematic Macro Trend (“SMarT”) Fund’s (the “Fund”) fiscal year, risk markets extended their upward trajectory as the long-anticipated Federal Reserve rate cuts materialized, reigniting investor risk appetite and driving equity markets to all-time highs. Although favorable economic indicators and policy shifts helped buoy markets, concerns about potential recessions and geopolitical tensions introduced caution among investors.

The Fund's Class I shares and Class N shares posted gains of 19.28% and 19.39%, respectively (Source: Ultimus). In response to the strong uptrend in equity markets, our quantitative risk-managed process strategically positioned the Fund to remain fully invested in risk assets throughout the period, capitalizing on favorable market conditions. The Fund derived its total return from a combination of exposures including U.S. equity, convertible bonds, preferred stock, high yield corporate bonds, domestic small-cap, and international small-cap stock. These exposures underperformed the large-cap equities that encompass the S&P 500 TR Index. A positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). The Fund will continue to implement its disciplined quantitative security selection and risk management process.

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a quantitative approach, aiming to minimize the subjectivity of investing.

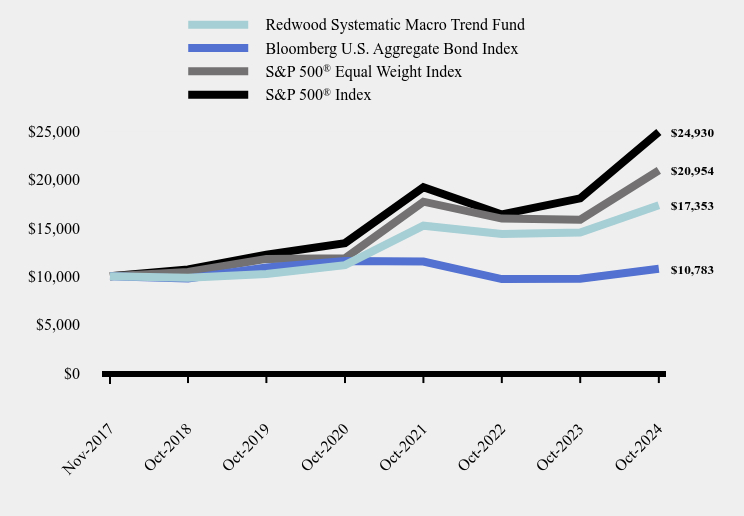

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Redwood Systematic Macro Trend Fund | Bloomberg U.S. Aggregate Bond Index | S&P 500® Equal Weight Index | S&P 500® Index |

|---|

| Nov-2017 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2018 | $9,873 | $9,782 | $10,459 | $10,714 |

|---|

| Oct-2019 | $10,284 | $10,908 | $11,802 | $12,249 |

|---|

| Oct-2020 | $11,236 | $11,583 | $11,872 | $13,439 |

|---|

| Oct-2021 | $15,369 | $11,527 | $17,722 | $19,206 |

|---|

| Oct-2022 | $14,555 | $9,719 | $15,975 | $16,400 |

|---|

| Oct-2023 | $14,740 | $9,754 | $15,860 | $18,063 |

|---|

| Oct-2024 | $17,581 | $10,783 | $20,954 | $24,930 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (November 2, 2017) |

|---|

| Redwood Systematic Macro Trend Fund | 19.28% | 11.32% | 8.40% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.08% |

|---|

S&P 500® Equal Weight Index | 32.12% | 12.17% | 11.16% |

|---|

S&P 500® Index | 38.02% | 15.27% | 13.95% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $245,552,617 |

|---|

| Number of Portfolio Holdings | 59 |

|---|

| Advisory Fee | $2,151,417 |

|---|

| Portfolio Turnover | 135% |

|---|

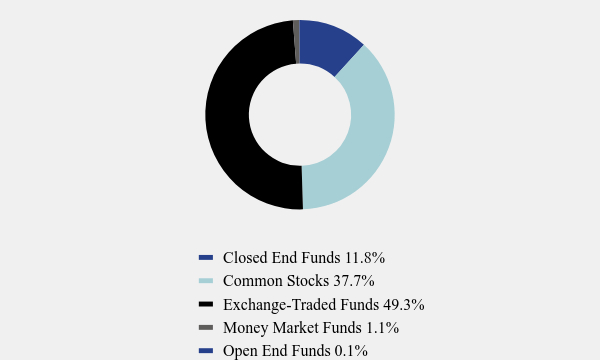

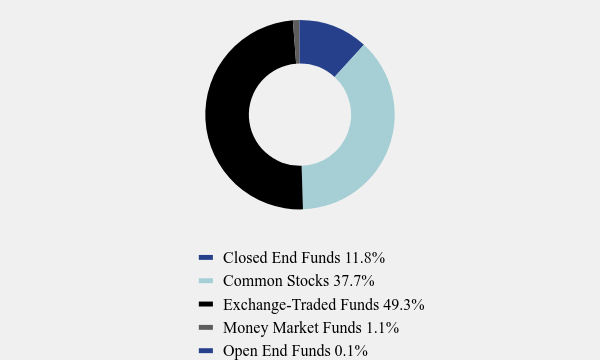

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 11.8% |

| Common Stocks | 37.7% |

| Exchange-Traded Funds | 49.3% |

| Money Market Funds | 1.1% |

| Open End Funds | 0.1% |

What did the Fund invest in?

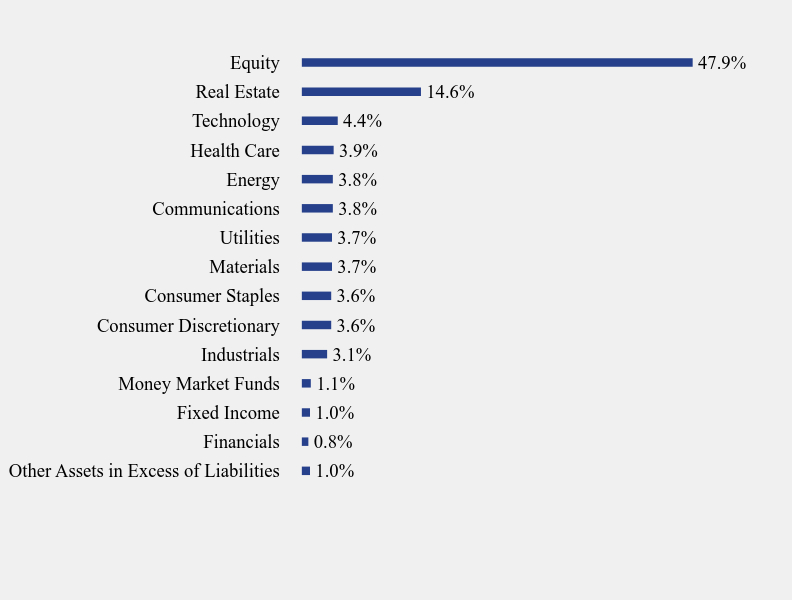

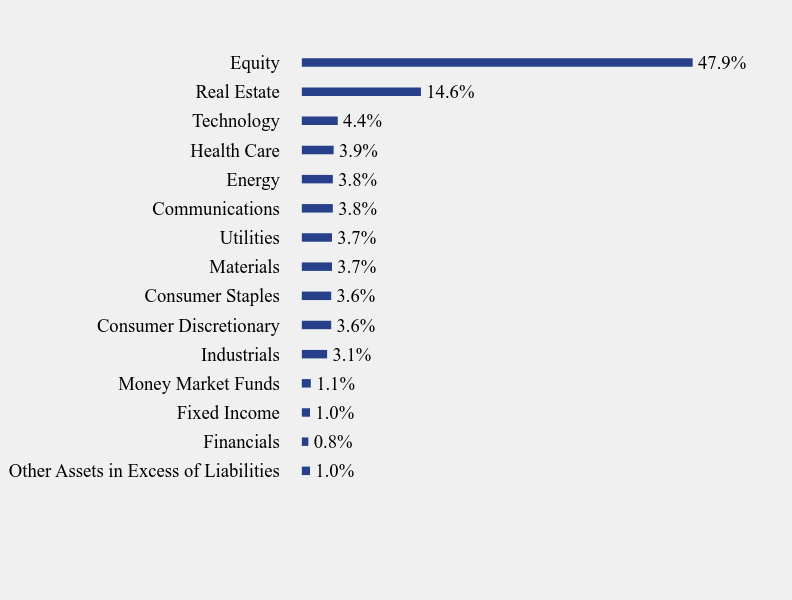

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.0% |

| Financials | 0.8% |

| Fixed Income | 1.0% |

| Money Market Funds | 1.1% |

| Industrials | 3.1% |

| Consumer Discretionary | 3.6% |

| Consumer Staples | 3.6% |

| Materials | 3.7% |

| Utilities | 3.7% |

| Communications | 3.8% |

| Energy | 3.8% |

| Health Care | 3.9% |

| Technology | 4.4% |

| Real Estate | 14.6% |

| Equity | 47.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| iShares Russell 2000 ETF | 41.1% |

| Redwood Real Estate Income Fund, Class I | 11.6% |

| Schwab International Small-Cap Equity ETF | 3.4% |

| Vanguard FTSE All World ex-US Small-Cap ETF | 3.4% |

| Goldman Sachs Financial Square Government Fund, Administration Shares | 1.1% |

| iShares 20+ Year Treasury Bond ETF | 1.0% |

| Snap-on, Inc. | 0.8% |

| Tapestry, Inc. | 0.8% |

| International Paper Company | 0.8% |

| Williams Companies, Inc. (The) | 0.8% |

No material changes occurred during the year ended October 31, 2024.

Redwood Systematic Macro Trend Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Redwood Systematic Macro Trend Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about Redwood Systematic Macro Trend Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.redwoodmutualfunds.com. You can also request this information by contacting us at 855-733-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $169 | 1.54% |

|---|

How did the Fund perform during the reporting period?

During the Redwood Systematic Macro Trend (“SMarT”) Fund’s (the “Fund”) fiscal year, risk markets extended their upward trajectory as the long-anticipated Federal Reserve rate cuts materialized, reigniting investor risk appetite and driving equity markets to all-time highs. Although favorable economic indicators and policy shifts helped buoy markets, concerns about potential recessions and geopolitical tensions introduced caution among investors.

The Fund's Class I shares and Class N shares posted gains of 19.28% and 19.39%, respectively (Source: Ultimus). In response to the strong uptrend in equity markets, our quantitative risk-managed process strategically positioned the Fund to remain fully invested in risk assets throughout the period, capitalizing on favorable market conditions. The Fund derived its total return from a combination of exposures including U.S. equity, convertible bonds, preferred stock, high yield corporate bonds, domestic small-cap, and international small-cap stock. These exposures underperformed the large-cap equities that encompass the S&P 500 TR Index. A positive contribution to Fund’s total return came from adding exposure to an affiliated, short duration, private debt fund, the Redwood Real Estate Income Fund (ticker: CREMX). The Fund will continue to implement its disciplined quantitative security selection and risk management process.

Capital markets are infinitely complex. Every day, new information becomes available that changes the risk and return dynamic of any investment. We do not attempt to forecast or suggest what may lie ahead. Instead, we utilize a quantitative approach, aiming to minimize the subjectivity of investing.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Redwood Systematic Macro Trend Fund | Bloomberg U.S. Aggregate Bond Index | S&P 500® Equal Weight Index | S&P 500® Index |

|---|

| Nov-2017 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| Oct-2018 | $9,848 | $9,782 | $10,459 | $10,714 |

|---|

| Oct-2019 | $10,232 | $10,908 | $11,802 | $12,249 |

|---|

| Oct-2020 | $11,159 | $11,583 | $11,872 | $13,439 |

|---|

| Oct-2021 | $15,237 | $11,527 | $17,722 | $19,206 |

|---|

| Oct-2022 | $14,386 | $9,719 | $15,975 | $16,400 |

|---|

| Oct-2023 | $14,535 | $9,754 | $15,860 | $18,063 |

|---|

| Oct-2024 | $17,353 | $10,783 | $20,954 | $24,930 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (November 2, 2017) |

|---|

| Redwood Systematic Macro Trend Fund | 19.39% | 11.14% | 8.20% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.08% |

|---|

S&P 500® Equal Weight Index | 32.12% | 12.17% | 11.16% |

|---|

S&P 500® Index | 38.02% | 15.27% | 13.95% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $245,552,617 |

|---|

| Number of Portfolio Holdings | 59 |

|---|

| Advisory Fee | $2,151,417 |

|---|

| Portfolio Turnover | 135% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Closed End Funds | 11.8% |

| Common Stocks | 37.7% |

| Exchange-Traded Funds | 49.3% |

| Money Market Funds | 1.1% |

| Open End Funds | 0.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.0% |

| Financials | 0.8% |

| Fixed Income | 1.0% |

| Money Market Funds | 1.1% |

| Industrials | 3.1% |

| Consumer Discretionary | 3.6% |

| Consumer Staples | 3.6% |

| Materials | 3.7% |

| Utilities | 3.7% |

| Communications | 3.8% |

| Energy | 3.8% |

| Health Care | 3.9% |

| Technology | 4.4% |

| Real Estate | 14.6% |

| Equity | 47.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| iShares Russell 2000 ETF | 41.1% |

| Redwood Real Estate Income Fund, Class I | 11.6% |

| Schwab International Small-Cap Equity ETF | 3.4% |

| Vanguard FTSE All World ex-US Small-Cap ETF | 3.4% |

| Goldman Sachs Financial Square Government Fund, Administration Shares | 1.1% |

| iShares 20+ Year Treasury Bond ETF | 1.0% |

| Snap-on, Inc. | 0.8% |

| Tapestry, Inc. | 0.8% |

| International Paper Company | 0.8% |

| Williams Companies, Inc. (The) | 0.8% |

No material changes occurred during the year ended October 31, 2024.

Redwood Systematic Macro Trend Fund

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.redwoodmutualfunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

(b) Not applicable

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | N/A |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | N/A |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

| | (a)(1) The Registrant’s Board of Trustees has determined that Mark Gersten and Neil M. Kaufman are audit committee financial experts, as defined in Item 3 of Form N-CSR. Mr. Mark Gerstan and Mr. Neil M. Kaufman are independent for purposes of this Item. (a)(2) Not applicable. (a)(3) Not applicable. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| Trust Series | 2023 | 2024 |

| Redwood Managed Volatility Fund | $17,000 | $19,050 |

| Redwood Managed Municipal Income Fund | $17,000 | $18,750 |

| Redwood AlphaFactor® Tactical International Fund | $17,000 | $18,750 |

| Redwood Systematic Macro Trend Fund | $17,000 | $18,750 |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| | |

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| Trust Series | 2023 | 2024 |

| Redwood Managed Volatility Fund | $3,200 | $3,200 |

| Redwood Managed Municipal Income Fund | $3,200 | $3,200 |

| Redwood AlphaFactor® Tactical International Fund | $3,200 | $3,200 |

| Redwood Systematic Macro Trend Fund | $3,200 | $3,200 |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended October 31, 2023 and 2024 respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended October 31, 2023 and 2024 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2024 |

| Shares | | | | | | | | | Fair Value | |

| | | | | CLOSED END FUND — 9.5% | | | | | | | | |

| | | | | REAL ESTATE - 9.5% | | | | | | | | |

| | 560,040 | | | Redwood Real Estate Income Fund, Class I(a) | | | | | | $ | 14,045,800 | |

| | | | | | | | | | | | | |

| | | | | TOTAL CLOSED END FUND (Cost $14,001,000) | | | | | | | 14,045,800 | |

| | | | | | | | | | | | | |

| Shares | | | | | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 2.6% | | | | | | | | |

| | | | | FIXED INCOME - 2.6% | | | | | | | | |

| | 77,640 | | | SPDR Portfolio High Yield Bond ETF | | | | | | | 1,838,515 | |

| | 70,000 | | | VanEck Fallen Angel High Yield Bond ETF | | | | | | | 2,020,900 | |

| | | | | | | | | | | | 3,859,415 | |

| | | | | | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $3,877,804) | | | | | | | 3,859,415 | |

| | | | | | | | | | | | | |

| Shares | | | | | | | | | Fair Value | |

| | | | | OPEN END FUNDS — 68.6% | | | | | | | | |

| | | | | FIXED INCOME - 68.6% | | | | | | | | |

| | 2,115,076 | | | American High-Income Trust, Class F-3 | | | | | | | 20,727,748 | |

| | 2,847,634 | | | Blackrock Series Fund V-BlackRock High Yield Portfolio, Institutional Class | | | | | | | 20,360,583 | |

| | 1,584,700 | | | Lord Abbett High Yield Fund, Class I | | | | | | | 10,205,470 | |

| | 1,546,608 | | | MainStay MacKay High Yield Corporate Bond Fund, Class I | | | | | | | 8,073,294 | |

| | 1,231,041 | | | Principal High Income Fund | | | | | | | 10,057,603 | |

| | 5,964,065 | | | Vanguard High-Yield Corporate Fund, Admiral Class | | | | | | | 32,504,156 | |

| | | | | | | | | | | | 101,928,854 | |

| | | | | | | | | | | | | |

| | | | | TOTAL OPEN END FUNDS (Cost $96,546,967) | | | | | | | 101,928,854 | |

| | | | | | | | | | | | | |

| Principal | | | | | Coupon Rate | | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 0.2% | | | | | | | | |

| | 103,000 | | | Bombardier, Inc.(b) | | 7.8750 | | 04/15/27 | | | 103,267 | |

| | 186,000 | | | TransDigm, Inc. | | 5.5000 | | 11/15/27 | | | 184,491 | |

| | | | | | | | | | | | 287,758 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | |

| | | | | AUTOMOTIVE — 0.7% | | | | | | | | |

| | 47,000 | | | American Axle & Manufacturing, Inc. | | 6.2500 | | 03/15/26 | | $ | 46,978 | |

| | 388,000 | | | Ford Motor Company | | 4.3460 | | 12/08/26 | | | 381,832 | |

| | 177,000 | | | Ford Motor Company | | 4.7500 | | 01/15/43 | | | 143,667 | |

| | 165,000 | | | Ford Motor Company | | 5.2910 | | 12/08/46 | | | 144,308 | |

| | 403,000 | | | Goodyear Tire & Rubber Company (The) | | 5.0000 | | 05/31/26 | | | 396,430 | |

| | | | | | | | | | | | 1,113,215 | |

| | | | | BIOTECH & PHARMA — 0.3% | | | | | | | | |

| | 99,000 | | | 1375209 BC Ltd.(b) | | 9.0000 | | 01/30/28 | | | 98,924 | |

| | 179,000 | | | Bausch Health Companies, Inc.(b) | | 11.0000 | | 09/30/28 | | | 164,903 | |

| | 33,000 | | | Bausch Health Companies, Inc.(b) | | 14.0000 | | 10/15/30 | | | 29,370 | |

| | 127,000 | | | Endo Luxembourg Finance Company I Sarl / Endo US, Inc.(b),(c) | | — | | 04/01/29 | | | 80,709 | |

| | 188,000 | | | Par Pharmaceutical, Inc.(b),(c) | | — | | 04/01/27 | | | 122,535 | |

| | | | | | | | | | | | 496,441 | |

| | | | | CABLE & SATELLITE — 1.5% | | | | | | | | |

| | 398,000 | | | CCO Holdings, LLC / CCO Holdings Capital Corporation(b) | | 5.0000 | | 02/01/28 | | | 385,311 | |

| | 179,000 | | | CCO Holdings, LLC / CCO Holdings Capital Corporation(b) | | 5.3750 | | 06/01/29 | | | 171,029 | |

| | 185,000 | | | CCO Holdings, LLC / CCO Holdings Capital Corporation(b) | | 4.7500 | | 03/01/30 | | | 168,464 | |

| | 188,000 | | | CCO Holdings, LLC / CCO Holdings Capital Corporation(b) | | 4.5000 | | 08/15/30 | | | 168,071 | |

| | 192,000 | | | CCO Holdings, LLC / CCO Holdings Capital Corporation(b) | | 4.2500 | | 02/01/31 | | | 167,183 | |

| | 180,000 | | | DISH DBS Corporation | | 5.8750 | | 11/15/24 | | | 178,774 | |

| | 173,000 | | | DISH DBS Corporation | | 7.7500 | | 07/01/26 | | | 146,480 | |

| | 391,000 | | | DISH DBS Corporation | | 7.3750 | | 07/01/28 | | | 286,900 | |

| | 385,000 | | | Sirius XM Radio, Inc.(b) | | 5.5000 | | 07/01/29 | | | 373,746 | |

| | 192,000 | | | Sirius XM Radio, Inc.(b) | | 4.1250 | | 07/01/30 | | | 172,060 | |

| | | | | | | | | | | | 2,218,018 | |

| | | | | COMMERCIAL SUPPORT SERVICES — 0.1% | | | | | | | | |

| | 179,000 | | | Prime Security Services Borrower, LLC / Prime Finance, Inc.(b) | | 5.7500 | | 04/15/26 | | | 179,213 | |

| | | | | | | | | | | | | |

| | | | | CONTAINERS & PACKAGING — 0.5% | | | | | | | | |

| | 371,000 | | | Pactiv, LLC B | | 7.9500 | | 12/15/25 | | | 378,747 | |

| | 327,000 | | | Sealed Air Corporation(b) | | 6.8750 | | 07/15/33 | | | 346,717 | |

| | | | | | | | | | | | 725,464 | |

| | | | | ELECTRIC UTILITIES — 0.9% | | | | | | | | |

| | 414,000 | | | Calpine Corporation(b) | | 5.1250 | | 03/15/28 | | | 404,958 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | |

| | | | | ELECTRIC UTILITIES — 0.9% (Continued) | | | | | | | | |

| | 177,000 | | | FirstEnergy Corporation | | 3.9000 | | 07/15/27 | | $ | 172,969 | |

| | 403,000 | | | PG&E Corporation | | 5.0000 | | 07/01/28 | | | 394,253 | |

| | 403,000 | | | Vistra Operations Company, LLC(b) | | 5.5000 | | 09/01/26 | | | 402,022 | |

| | | | | | | | | | | | 1,374,202 | |

| | | | | ELECTRICAL EQUIPMENT — 0.3% | | | | | | | | |

| | 375,000 | | | WESCO Distribution, Inc.(b) | | 7.2500 | | 06/15/28 | | | 384,134 | |

| | | | | | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT — 0.1% | | | | | | | | |

| | 725,000 | | | Diamond Sports Group, LLC / Diamond Sports Finance Company(b),(c) | | 5.3750 | | 08/15/26 | | | 5,981 | |

| | 370,000 | | | Liberty Interactive, LLC | | 8.5000 | | 07/15/29 | | | 198,272 | |

| | | | | | | | | | | | 204,253 | |

| | | | | FOOD — 1.0% | | | | | | | | |

| | 185,000 | | | Kraft Heinz Foods Company | | 3.0000 | | 06/01/26 | | | 180,188 | |

| | 177,000 | | | Kraft Heinz Foods Company | | 3.8750 | | 05/15/27 | | | 173,623 | |

| | 135,000 | | | Kraft Heinz Foods Company | | 6.3750 | | 07/15/28 | | | 142,140 | |

| | 125,000 | | | Kraft Heinz Foods Company(b) | | 7.1250 | | 08/01/39 | | | 142,493 | |

| | 156,000 | | | Kraft Heinz Foods Company | | 5.0000 | | 06/04/42 | | | 145,337 | |

| | 150,000 | | | Kraft Heinz Foods Company | | 5.2000 | | 07/15/45 | | | 140,754 | |

| | 165,000 | | | Kraft Heinz Foods Company | | 4.3750 | | 06/01/46 | | | 138,464 | |

| | 154,000 | | | Kraft Heinz Foods Company | | 4.8750 | | 10/01/49 | | | 137,861 | |

| | 192,000 | | | Post Holdings, Inc.(b) | | 4.6250 | | 04/15/30 | | | 179,670 | |

| | 195,000 | | | Post Holdings, Inc.(b) | | 4.5000 | | 09/15/31 | | | 177,652 | |

| | | | | | | | | | | | 1,558,182 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS — 0.3% | | | | | | | | |

| | 415,000 | | | Louisiana-Pacific Corporation(b) | | 3.6250 | | 03/15/29 | | | 389,305 | |

| | | | | | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 1.9% | | | | | | | | |

| | 179,000 | | | Centene Corporation | | 4.6250 | | 12/15/29 | | | 171,205 | |

| | 186,000 | | | Centene Corporation | | 3.3750 | | 02/15/30 | | | 166,934 | |

| | 188,000 | | | Centene Corporation | | 3.0000 | | 10/15/30 | | | 162,999 | |

| | 195,000 | | | Centene Corporation | | 2.5000 | | 03/01/31 | | | 163,246 | |

| | 188,000 | | | CHS/Community Health Systems, Inc.(b) | | 6.8750 | | 04/15/29 | | | 158,964 | |

| | 408,000 | | | DaVita, Inc.(b) | | 4.6250 | | 06/01/30 | | | 375,852 | |

| | 203,000 | | | DaVita, Inc.(b) | | 3.7500 | | 02/15/31 | | | 176,710 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 1.9% (Continued) | | | | | | | | |

| | 173,000 | | | HCA, Inc. | | 5.3750 | | 02/01/25 | | $ | 173,021 | |

| | 364,000 | | | HCA, Inc. | | 5.8750 | | 02/15/26 | | | 366,599 | |

| | 163,000 | | | HCA, Inc. | | 5.6250 | | 09/01/28 | | | 166,421 | |

| | 183,000 | | | HCA, Inc. | | 3.5000 | | 09/01/30 | | | 167,858 | |

| | 183,000 | | | Tenet Healthcare Corporation | | 6.1250 | | 10/01/28 | | | 183,292 | |

| | 364,000 | | | Tenet Healthcare Corporation | | 6.8750 | | 11/15/31 | | | 390,674 | |

| | | | | | | | | | | | 2,823,775 | |

| | | | | HOME & OFFICE PRODUCTS — 0.1% | | | | | | | | |

| | 177,000 | | | Newell Brands, Inc. | | 5.7000 | | 04/01/26 | | | 177,518 | |

| | | | | | | | | | | | | |

| | | | | INSURANCE — 0.0%(d) | | | | | | | | |

| | 42,000 | | | MBIA, Inc. | | 6.6250 | | 10/01/28 | | | 40,698 | |

| | | | | | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES — 0.5% | | | | | | | | |

| | 168,000 | | | Netflix, Inc. | | 4.8750 | | 04/15/28 | | | 169,022 | |

| | 157,000 | | | Netflix, Inc. | | 5.8750 | | 11/15/28 | | | 164,054 | |

| | 354,000 | | | Netflix, Inc.(b) | | 4.8750 | | 06/15/30 | | | 356,148 | |

| | | | | | | | | | | | 689,224 | |

| | | | | LEISURE FACILITIES & SERVICES — 0.9% | | | | | | | | |

| | 197,000 | | | 1011778 BC ULC / New Red Finance, Inc.(b) | | 4.0000 | | 10/15/30 | | | 177,950 | |

| | 183,000 | | | Carnival Corporation(b) | | 7.6250 | | 03/01/26 | | | 184,398 | |

| | 188,000 | | | Carnival Corporation(b) | | 5.7500 | | 03/01/27 | | | 188,666 | |

| | 135,000 | | | Carnival Corporation | | 6.6500 | | 01/15/28 | | | 137,693 | |

| | 195,000 | | | Hilton Domestic Operating Company, Inc.(b) | | 3.6250 | | 02/15/32 | | | 171,286 | |

| | 189,000 | | | NCL Corporation Ltd.(b) | | 5.8750 | | 03/15/26 | | | 188,881 | |

| | 188,000 | | | Royal Caribbean Cruises Ltd.(b) | | 5.5000 | | 04/01/28 | | | 188,105 | |

| | | | | | | | | | | | 1,236,979 | |

| | | | | METALS & MINING — 0.3% | | | | | | | | |

| | 189,000 | | | FMG Resources August 2006 Pty Ltd.(b) | | 4.3750 | | 04/01/31 | | | 172,619 | |

| | 154,000 | | | Freeport-McMoRan, Inc. | | 5.4500 | | 03/15/43 | | | 148,027 | |

| | 185,000 | | | Novelis Corporation(b) | | 4.7500 | | 01/30/30 | | | 173,720 | |

| | | | | | | | | | | | 494,366 | |

| | | | | OIL & GAS PRODUCERS — 2.6% | | | | | | | | |

| | 204,000 | | | Apache Corporation | | 4.8750 | | 11/15/27 | | | 202,776 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | |

| | | | | OIL & GAS PRODUCERS — 2.6% (Continued) | | | | | | | | |

| | 171,000 | | | Apache Corporation | | 5.1000 | | 09/01/40 | | $ | 147,756 | |

| | 185,000 | | | Cheniere Energy Partners, L.P. | | 4.0000 | | 03/01/31 | | | 171,037 | |

| | 39,000 | | | Cheniere Energy, Inc.(b) | | 4.6250 | | 10/15/28 | | | 38,246 | |

| | 137,000 | | | Cheniere Energy, Inc. | | 4.6250 | | 10/15/28 | | | 134,353 | |

| | 179,000 | | | Comstock Resources, Inc.(b) | | 6.7500 | | 03/01/29 | | | 171,564 | |

| | 160,000 | | | Continental Resources Inc/OK(b) | | 5.7500 | | 01/15/31 | | | 160,259 | |

| | 180,000 | | | EQT Corporation | | 3.9000 | | 10/01/27 | | | 175,292 | |

| | 375,000 | | | Murphy Oil Corporation | | 7.0500 | | 05/01/29 | | | 393,561 | |

| | 415,000 | | | New Fortress Energy, Inc.(b) | | 6.7500 | | 09/15/25 | | | 414,465 | |

| | 197,000 | | | New Fortress Energy, Inc.(b) | | 6.5000 | | 09/30/26 | | | 182,638 | |

| | 379,000 | | | Occidental Petroleum Corporation | | 5.5500 | | 03/15/26 | | | 381,550 | |

| | 189,000 | | | Occidental Petroleum Corporation | | 3.5000 | | 08/15/29 | | | 173,278 | |

| | 143,000 | | | Occidental Petroleum Corporation | | 8.8750 | | 07/15/30 | | | 164,436 | |

| | 156,000 | | | Occidental Petroleum Corporation | | 6.6250 | | 09/01/30 | | | 163,846 | |

| | 160,000 | | | Occidental Petroleum Corporation | | 6.1250 | | 01/01/31 | | | 164,730 | |

| | 150,000 | | | Occidental Petroleum Corporation | | 6.4500 | | 09/15/36 | | | 155,189 | |

| | 304,000 | | | Ovintiv, Inc. | | 8.1250 | | 09/15/30 | | | 343,954 | |

| | 175,000 | | | Western Midstream Operating, L.P. | | 4.0500 | | 02/01/30 | | | 164,508 | |

| | | | | | | | | | | | 3,903,438 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT — 0.3% | | | | | | | | |

| | 449,000 | | | Transocean, Inc.(b) | | 8.0000 | | 02/01/27 | | | 448,053 | |

| | | | | | | | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 0.7% | | | | | | | | |

| | 402,000 | | | Iron Mountain, Inc.(b) | | 4.8750 | | 09/15/27 | | | 395,380 | |

| | 185,000 | | | Iron Mountain, Inc.(b) | | 5.2500 | | 07/15/30 | | | 179,284 | |

| | 189,000 | | | MPT Operating Partnership, L.P. / MPT Finance Corporation | | 3.5000 | | 03/15/31 | | | 134,021 | |

| | 186,000 | | | SBA Communications Corporation | | 3.8750 | | 02/15/27 | | | 180,153 | |

| | 200,000 | | | SBA Communications Corporation | | 3.1250 | | 02/01/29 | | | 182,136 | |

| | | | | | | | | | | | 1,070,974 | |

| | | | | RETAIL - CONSUMER STAPLES — 0.5% | | | | | | | | |

| | 195,000 | | | Albertsons Companies, Inc. / Safeway, Inc. / New Albertsons, L.P. / Albertsons, LLC(b) | | 3.5000 | | 03/15/29 | | | 180,354 | |

| | 294,000 | | | New Albertsons, L.P. | | 8.0000 | | 05/01/31 | | | 316,370 | |

| | 236,000 | | | Rite Aid Corporation B(c) | | 7.7000 | | 02/15/27 | | | 5,515 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES — 0.5% (Continued) | | | | | | | | |

| | 226,000 | | | Safeway, Inc. | | 7.2500 | | 02/01/31 | | $ | 231,197 | |

| | | | | | | | | | | | 733,436 | |

| | | | | RETAIL - DISCRETIONARY — 0.3% | | | | | | | | |

| | 189,000 | | | Michaels Companies, Inc. (The)(b) | | 7.8750 | | 05/01/29 | | | 100,564 | |

| | 371,663 | | | Staples, Inc.(b) | | 12.7500 | | 01/15/30 | | | 295,970 | |

| | | | | | | | | | | | 396,534 | |

| | | | | SEMICONDUCTORS — 0.3% | | | | | | | | |

| | 388,000 | | | Amkor Technology, Inc.(b) | | 6.6250 | | 09/15/27 | | | 389,874 | |

| | | | | | | | | | | | | |

| | | | | SPECIALTY FINANCE — 0.1% | | | | | | | | |

| | 168,000 | | | OneMain Finance Corporation | | 7.1250 | | 03/15/26 | | | 172,217 | |

| | | | | | | | | | | | | |

| | | | | STEEL — 0.3% | | | | | | | | |

| | 392,000 | | | United States Steel Corporation | | 6.6500 | | 06/01/37 | | | 398,278 | |

| | | | | | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE — 0.5% | | | | | | | | |

| | 324,000 | | | Dell, Inc. | | 7.1000 | | 04/15/28 | | | 348,754 | |

| | 186,000 | | | Imola Merger Corporation(b) | | 4.7500 | | 05/15/29 | | | 178,033 | |

| | 175,000 | | | Western Digital Corporation | | 4.7500 | | 02/15/26 | | | 173,068 | |

| | | | | | | | | | | | 699,855 | |

| | | | | TECHNOLOGY SERVICES — 0.4% | | | | | | | | |

| | 356,000 | | | Sabre GLBL, Inc.(b) | | 8.6250 | | 06/01/27 | | | 344,141 | |

| | 379,000 | | | Unisys Corporation(b) | | 6.8750 | | 11/01/27 | | | 370,884 | |

| | | | | | | | | | | | 715,025 | |

| | | | | TELECOMMUNICATIONS — 1.7% | | | | | | | | |

| | 173,000 | | | Embarq Corporation | | 7.9950 | | 06/01/36 | | | 74,383 | |

| | 406,000 | | | Frontier Communications Holdings, LLC(b) | | 5.0000 | | 05/01/28 | | | 399,778 | |

| | 152,000 | | | Sprint Capital Corporation | | 6.8750 | | 11/15/28 | | | 163,226 | |

| | 128,000 | | | Sprint Capital Corporation | | 8.7500 | | 03/15/32 | | | 154,929 | |

| | 165,000 | | | Sprint, LLC | | 7.6250 | | 02/15/25 | | | 165,052 | |

| | 341,000 | | | Sprint, LLC | | 7.6250 | | 03/01/26 | | | 349,853 | |

| | 157,000 | | | Telecom Italia Capital S.A. | | 7.2000 | | 07/18/36 | | | 159,331 | |

| | 152,000 | | | Telecom Italia Capital S.A. | | 7.7210 | | 06/04/38 | | | 158,434 | |

| | 185,000 | | | T-Mobile USA, Inc. | | 3.5000 | | 04/15/31 | | | 169,836 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 17.8% (Continued) | | | | | | | | | | |

| | | | | TELECOMMUNICATIONS — 1.7% (Continued) | | | | | | | | | | |

| | 160,000 | | | Vodafone Group plc(e) | | USSW5 + 4.873% | | 7.0000 | | 04/04/79 | | $ | 167,831 | |

| | 180,000 | | | Windstream Escrow, LLC / Windstream Escrow Finance Corporation(b) | | | | 7.7500 | | 08/15/28 | | | 181,144 | |

| | 197,000 | | | Zayo Group Holdings, Inc.(b) | | | | 4.0000 | | 03/01/27 | | | 175,656 | |

| | | | | | | | | | | | | | 2,319,453 | |

| | | | | TRANSPORTATION & LOGISTICS — 0.5% | | | | | | | | | | |

| | 91,500 | | | American Airlines, Inc./AAdvantage Loyalty IP Ltd.(b) | | | | 5.5000 | | 04/20/26 | | | 91,276 | |

| | 179,000 | | | American Airlines, Inc./AAdvantage Loyalty IP Ltd.(b) | | | | 5.7500 | | 04/20/29 | | | 177,393 | |

| | 163,000 | | | Delta Air Lines, Inc. | | | | 7.3750 | | 01/15/26 | | | 167,117 | |

| | 186,000 | | | United Airlines, Inc.(b) | | | | 4.3750 | | 04/15/26 | | | 182,711 | |

| | 186,000 | | | United Airlines, Inc.(b) | | | | 4.6250 | | 04/15/29 | | | 178,118 | |

| | | | | | | | | | | | | | 796,615 | |

| | | | | TOTAL CORPORATE BONDS (Cost $27,796,061) | | | | 26,436,497 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 98.5% (Cost $142,221,832) | | | $ | 146,270,566 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 1.5% | | | | 2,261,648 | |

| | | | | NET ASSETS - 100.0% | | | | | | | | $ | 148,532,214 | |

| ETF | - Exchange-Traded Fund |

| | |

| LLC | - Limited Liability Company |

| | |

| LP | - Limited Partnership |

| | |

| LTD | - Limited Company |

| | |

| PLC | - Public Limited Company |

| | |

| S.A. | - Société Anonyme |

| | |

| SPDR | - Standard & Poor’s Depositary Receipt |

| | |

| USSW5 | USD 5 Years Interest Rate Swap |

| (a) | Investment in affiliated issuer. Illiquid security. The total fair value of the security at October 31, 2024 was $14,045,800 representing 9.5% of net assets. |

| (b) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2024 the total market value of 144A securities is $12,566,801 or 8.5% of net assets. |

| (c) | Represents issuer in default on interest payments; non-income producing security and fair valued by Redwood Investment Management, LLC (the “Adviser”). |

| (d) | Percentage rounds to less than 0.1%. |

| (e) | Variable rate security; the rate shown represents the rate on October 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED VOLATILITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| CREDIT DEFAULT SWAP | |

| | | | | | | | | Pay/Receive | | | | | | | | Premiums Paid | | | Unrealized | |

| Reference Entity(f) | | Counterparty | | Fixed Rate | | Expiration Date | | Fixed Rate | | Notional Amount | | | Value | | | (Received) | | | Appreciation | |

To Sell Protection - CDX HY CDSI

S42 5Y PRC, pays Quarterly | | BNP Paribas | | 5.00% | | 6/20/2029 | | Pay | | $ | 22,000,000 | | | $ | 1,619,398 | | | $ | 1,365,857 | | | $ | 253,541 | |

| (f) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising of the referenced index. The swap itself does not have a credit rating, however the underlying holdings of the swap are comprised of non-investment grade entities, with ratings of B and BB. |

| TOTAL RETURN SWAPS(g) | |

| | | | | | | | | | | | | | Value/Unrealized | |

| Security | | Counterparty | | Number of Shares | | Notional Value | | | Interest Rate Payable | | Termination Date | | Depreciation | |

| Invesco High Yield Municipal Fund | | Barclays | | 12,752 | | $ | 112,222 | | | SOFR + 175 bps | | 4/20/2026 | | $ | (2,500 | ) |

| Nuveen High Yield Municipal Bond Fund | | Barclays | | 7,385 | | | 111,582 | | | SOFR + 175 bps | | 4/20/2026 | | | (2,455 | ) |

| TOTAL | | | | | | | | | | | | | | $ | (4,955 | ) |

| SOFR | - Secured Overnight Financing Rate |

| (g) | The swaps provide exposure to the total returns on the securities that are calculated on a daily basis. Under the terms of the swaps, the Adviser has the ability to periodically adjust the notional level of the swaps. In addition, the Fund will receive the total return on the securities, including dividends and provide a fee to the counterparty. Each total return swap pays monthly. |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED MUNICIPAL INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | CLOSED END FUND — 13.2% | | | | |

| | | | | REAL ESTATE - 13.2% | | | | |

| | 712,425 | | | Redwood Real Estate Income Fund, Class I(a) | | $ | 17,867,628 | |

| | | | | | | | | |

| | | | | TOTAL CLOSED END FUND (Cost $17,810,638) | | | 17,867,628 | |

| | | | | | | | | |

| | | | | OPEN END FUNDS — 0.0%(b) | | | | |

| | | | | FIXED INCOME - 0.0%(b) | | | | |

| | 125 | | | American Century High-Yield Municipal Fund, Class I | | | 1,113 | |

| | 126 | | | BlackRock High Yield Municipal Fund, Institutional Class | | | 1,146 | |

| | 108 | | | Goldman Sachs High Yield Municipal Fund, Institutional Class | | | 1,004 | |

| | 117 | | | Invesco High Yield Municipal Fund, Class Y | | | 1,009 | |

| | 147 | | | Invesco Rochester Municipal Opportunities Fund, Class Y | | | 1,007 | |

| | 92 | | | Lord Abbett High Yield Municipal Bond Fund, Class I | | | 1,007 | |

| | 753 | | | MainStay MacKay High Yield Municipal Bond Fund, Class I | | | 9,002 | |

| | 100 | | | MFS Municipal High Income Fund, Class I | | | 755 | |

| | 153 | | | Northern High Yield Municipal Fund, USD Class | | | 1,141 | |

| | 68 | | | Nuveen High Yield Municipal Bond Fund, Class I | | | 1,010 | |

| | 105 | | | Nuveen Short Duration High Yield Municipal Bond, Class I | | | 1,011 | |

| | 118 | | | PIMCO High Yield Municipal Bond Fund, Institutional Class | | | 1,011 | |

| | 177 | | | Pioneer High Income Municipal Fund, Class Y | | | 1,087 | |

| | 85 | | | Western Asset Municipal High Income Fund, Class I | | | 1,093 | |

| | | | | | | | 22,396 | |

| | | | | | | | | |

| | | | | TOTAL OPEN END FUNDS (Cost $21,877) | | | 22,396 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 84.7% | | | | |

| | | | | MONEY MARKET FUNDS - 84.7% | | | | |

| | 38,300,434 | | | BlackRock Liquidity Funds MuniCash, Institutional Class, 3.65%(c) | | | 38,304,264 | |

| | 38,304,216 | | | JPMorgan Municipal Money Market Fund, Agency Class, 3.61%(c) | | | 38,304,216 | |

| | 38,304,150 | | | JPMorgan Tax Free Money Market Fund, Agency Class, 3.46%(c) | | | 38,304,150 | |

| | | | | TOTAL MONEY MARKET FUNDS (Cost $114,912,630) | | | 114,912,630 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $114,912,630) | | | 114,912,630 | |

See accompanying notes which are an integral part of these financial statements.

| REDWOOD MANAGED MUNICIPAL INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | TOTAL INVESTMENTS - 97.9% (Cost $132,745,145) | | $ | 132,802,654 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 2.1% | | | 2,840,870 | |

| | | | | NET ASSETS - 100.0% | | $ | 135,643,524 | |

| (a) | Investment in affiliated issuer. Illiquid security. The total fair value of the security at October 31, 2024 was $17,867,628 representing 13.2% of net assets. |

| (b) | Percentage rounds to less than 0.1%. |

| (c) | Rate disclosed is the seven day effective yield as of October 31, 2024. |

| TOTAL RETURN SWAPS(d) | |

| | | | | | | | | | | | | | Value/Unrealized | |