UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22725

Priority Income Fund, Inc.

(Exact name of registrant as specified in charter)

10 East 40th Street, 42nd Floor

New York, NY 10016

(Address of principal executive offices)

M. Grier Eliasek

Chief Executive Officer

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 448-0702

Date of fiscal year end: June 30

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

The semi-annual report to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, for the six months ended December 31, 2022 is filed herewith.

Semi-Annual Report

December 31, 2022

priorityincomefund.com

Priority Income Fund, Inc. (the “Company”) is an externally managed, non-diversified, closed-end investment management company registered under the Investment Company Act of 1940, as amended. The Company has elected to be treated for tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended.

INVESTMENT OBJECTIVE

The Company’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation. We expect to seek to achieve our investment objective by investing, under normal circumstances, at least 80% of our total assets in senior secured loans made to companies whose debt is rated below investment grade or, in limited circumstances, unrated, which we collectively refer to as “Senior Secured Loans,” with an emphasis on current income. Our investments may take the form of the purchase of Senior Secured Loans (either in the primary or secondary markets) or through investments in the equity and junior debt tranches of collateralized loan obligation (“CLO”) vehicles that in turn own pools of Senior Secured Loans. The Company intends to invest in both the primary and secondary markets.

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| Index to Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 4

Letter to Stockholders

Dear Stockholders,

We are pleased to present this semi-annual report of Priority Income Fund, Inc. (“we,” “us,” “our,” the “Company”, the “Fund” or “Priority”) for the six months ended December 31, 2022. Priority has provided its stockholders cash distributions each month for over eight years, and Priority recently increased its quarterly bonus distributions to stockholders for the ninth time since August 2020.

Priority paid to our stockholders a dividend yield for the period ended December 31, 2022 of 11.1%, based on the “Class R Shares” offering price of $12.13 at December 31, 2022, 11.8% based on the “Class RIA Shares” offering price of $11.40 at December 31, 2022 and 11.9% based on the “Class I Shares” offering price of $11.31 at December 31, 2022.

Priority Update

In this semi-annual report, we refer to “Senior Secured Loans” collectively as senior secured loans made primarily to U.S. companies whose debt is rated below investment grade or, in some circumstances, unrated.

Federal Reserve rate hikes in response to inflation pressures helped to drive a dynamic calendar year 2022. In a rising rate environment, one would expect floating rate assets to retain significant value in comparison with fixed rate assets, with such expectation proving out. While few risk assets demonstrated complete safe haven qualities in 2022, interest rate sensitive investments such as the S&P 500 and HYG, a high yield bond ETF, returned -18.1% and -11.0% respectively, while the Morningstar LSTA US Leveraged Loan TR Index of senior secured floating rate loans significantly outperformed, declining only 0.6% in 2022 by comparison.

Priority benefited from loan asset outperformance given that floating rate loans comprise the bulk of the underlying assets in Priority’s CLO positions. The Fund’s shareholder distributions more than offset declines in NAV between December 31, 2021 and December 31, 2022 to end the calendar year with a positive total return of 0.95% based on starting net asset value per share and assuming reinvestment of all shareholder distributions.

We believe Priority outperformed multiple broader markets, including the S&P 500, in 2022 due to a combination of the aforementioned loan asset outperformance as well as certain proactive strategies, including:

–An increased focus on CLO equity positions characterized by lower spread portfolios and more years remaining until the end of their reinvestment period.

–Opportunistic buying of CLO debt tranches rated at inception as ‘BB’ investments by rating agencies including S&P, Moody’s, and Fitch, with a weighted average discount from par of over 13% and an underwritten internal rate of return of 13.9% to maturity.

–Prudent risk management with a reduction in Fund level leverage during the year.

Market volatility in 2022 allowed Priority to achieve equity like returns in CLO debt tranches, increasing the Fund’s resistance to defaults while also creating an opportunity to build NAV given our purchases of these debt investments were made at levels significantly below par. We anticipate continuing to grow our CLO debt book should the discounted opportunity persist.

We actively invested throughout the calendar year:

–Since the end of our June 2022 fiscal year, Priority invested in 6 CLO equity investments totaling $18.9 million in cost basis and 18 CLO debt investments totaling $44.3 million in cost basis.

–For full calendar year 2022, Priority invested in (i) 28 CLO equity investments totaling $146.1 million in cost basis and (ii) 19 CLO debt investments totaling $44.3 million in cost basis.

Furthermore, despite challenging capital market conditions in calendar year 2022, Priority closed on two financing transactions:

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 5

–In February 2022, we issued our Series L (NYSE: PRIF PRL) preferred, resulting in gross proceeds of $27.5 million and representing our twelfth issuance of preferred stock, each issuance with a difference maturity date, over the prior four years. We utilized the net proceeds from the offering of PRIF PRL to acquire investments in accordance with our investment objective and strategies and for general working capital purposes.

–In September 2022, we closed on a $40 million senior secured revolving credit facility with a new lender, refinancing our previously existing $35 million facility. The Fund has an accordion feature to increase the facility size to $75 million if mutually agreed by the Fund and facility provider. In addition to increasing the Fund’s access to financing, the facility enhances the fund’s financial flexibility with a longer maturity and a lower drawn and undrawn interest rate.

We increased Fund liquidity through our new revolving credit facility, increased cash balances, and reduced leverage to position Priority to capitalize on opportunities during a potentially volatile calendar year 2023.

CLO Market Commentary

The Russia/Ukraine war, inflationary pressures, and the corresponding Fed response introduced volatility which began in Q1 and persisted throughout 2022. Despite such volatility, market CLO issuance in 2022 remained robust with $129.3 billion issued1, even though such issuance was below the record level of $187.1 billion1 in 2021. CLOs represented 69%1 of the buyer base in the institutional Senior Secured Loan market for full year 2022, highlighting the importance of the CLO market.

Secondary CLO trading exhibited volatility during 2022, with CLO BB debt trading in a 16-point range, from a high index price of 97.56 on January 21, 2022 to a trough index price of 81.59 on October 13, 20222, even though such assets pay floating rate interest that increased dramatically throughout the year. Other parts of CLO capital structures exhibited heightened price and spread volatility as well2.

We believe the widening of CLO liabilities contributed to a decline in CLO refinance and reset activity in 2022 after a fast paced 2021. A CLO refinancing is an occurrence where all or part of the CLO liabilities are refinanced at a lower spread without a change in CLO maturity. A CLO reset is an occurrence where all of the CLO liabilities are refinanced and the CLO reinvestment period is extended typically by two to five years.

We expect in 2023 CLO primary activity will likely be stressed by continued volatility but remain robust by historical standards. CLO research analysts are projecting 2023 CLO issuance to decline modestly from 2022 levels:

–Barclays: $117 billion3

–Bank of America Merrill Lynch: $90 billion4

–Citigroup: $120 billion5

–JP Morgan: $120 billion6

–Morgan Stanley: $100 billion7

–Nomura: $90 billion8

Looking ahead to 2023, we expect the macroeconomic picture to remain uncertain, with defaults likely increasing from historically low levels. While that may put some pressure on the loan and CLO markets, we also anticipate such factors to present enhanced opportunities for Priority to invest at discounted prices.

In addition, we believe that long-term fundamentals for the investments held by Priority remain attractive: (1) Priority continued to increase its number of investments with 203 investments as of December 31, 2022 (the highest count achieved to date), (2) Priority’s portfolio trailing twelve month (“TTM”) default rate as of December 31, 2022 stood at 0.76%, and (3) we believe CLO managers are able to capitalize on loan price volatility to increase portfolio spreads and buy loans at discounted prices.

Dividend Policy

To qualify for U.S federal income tax treatment as a regulated investment company, the Company is required to pay out distributions as determined in accordance with federal income tax regulations. In certain periods, we expect the income distributable pursuant to these regulations, which we refer to as distributable income, to be higher or lower than our reportable accounting income. In addition to net investment income, our dividend policy considers in part our estimate of our distributable income, which includes (1) interest income from our underlying collateralized loan obligation (“CLO”) debt and equity investments, (2) recognition of certain mark-to-market gains or losses to the extent that the fair market value of our CLO investments is determined to deviate from its adjusted tax basis, and (3) acceleration of unamortized fees and expenses

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 6

following the refinancing or reset of a CLO’s liabilities. As a result, distributable income may differ from accounting income, as expressed by net investment income. Our distributions may exceed our earnings, and portions of the distributions that we make may therefore be a return of the money that you originally invested and represent a return of capital to you for tax purposes.

M. Grier Eliasek

Chairman and Chief Executive Officer

The Senior Secured Loans in which we invest are made primarily to U.S. companies whose debt is rated below investment grade or, in some circumstances, unrated. These investments, which are often referred to as “junk” or “high yield,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and illiquid.

This letter may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future performance of Priority Income Fund, Inc. Words such as “believes,” “expects,” and “future” or similar expressions are intended to identify forward-looking statements. Any such statements, other than statements of historical fact, are highly likely to be affected by the global impact of the spread of COVID-19 or unknowable future events and conditions, including elements of the future that are or are not under the control of Priority Income Fund, Inc., and that Priority Income Fund, Inc. may or may not have considered. Accordingly, such statements cannot be guarantees or assurances of any aspect of future performance and involve a number of risks and uncertainties, including the impact of COVID-19 and related changes in base interest rates and significant market volatility on our business, our industry, and the global economy. Actual developments and results may vary materially from any forward-looking statements. Such statements speak only as of the time when made. Priority Income Fund, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any performance information quoted above represents past performance. We caution investors that the past performance described above is not indicative of and does not guarantee future returns. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. Current performance information may be different than the performance data presented above. Index and asset class performance quoted above does not reflect the fees, expenses or taxes that a stockholder may incur. The results described above may not be representative of our portfolio.

1 Morningstar / Pitchbook / LCD

2 Palmer Square BB Price Index

3 Barclays – Global CLOs, Light at the end of 1H

4 BofA Global Research – 2023 Year Ahead Outlook - CLO

5 Citigroup – Global CLO Market 2023 Outlook - CLO

6 J.P. Morgan – CLO 2023 Outlook

7 Morgan Stanley – 2023 Global Securitized Product Outlook

8 Nomura – 2023 CLO Outlook

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 7

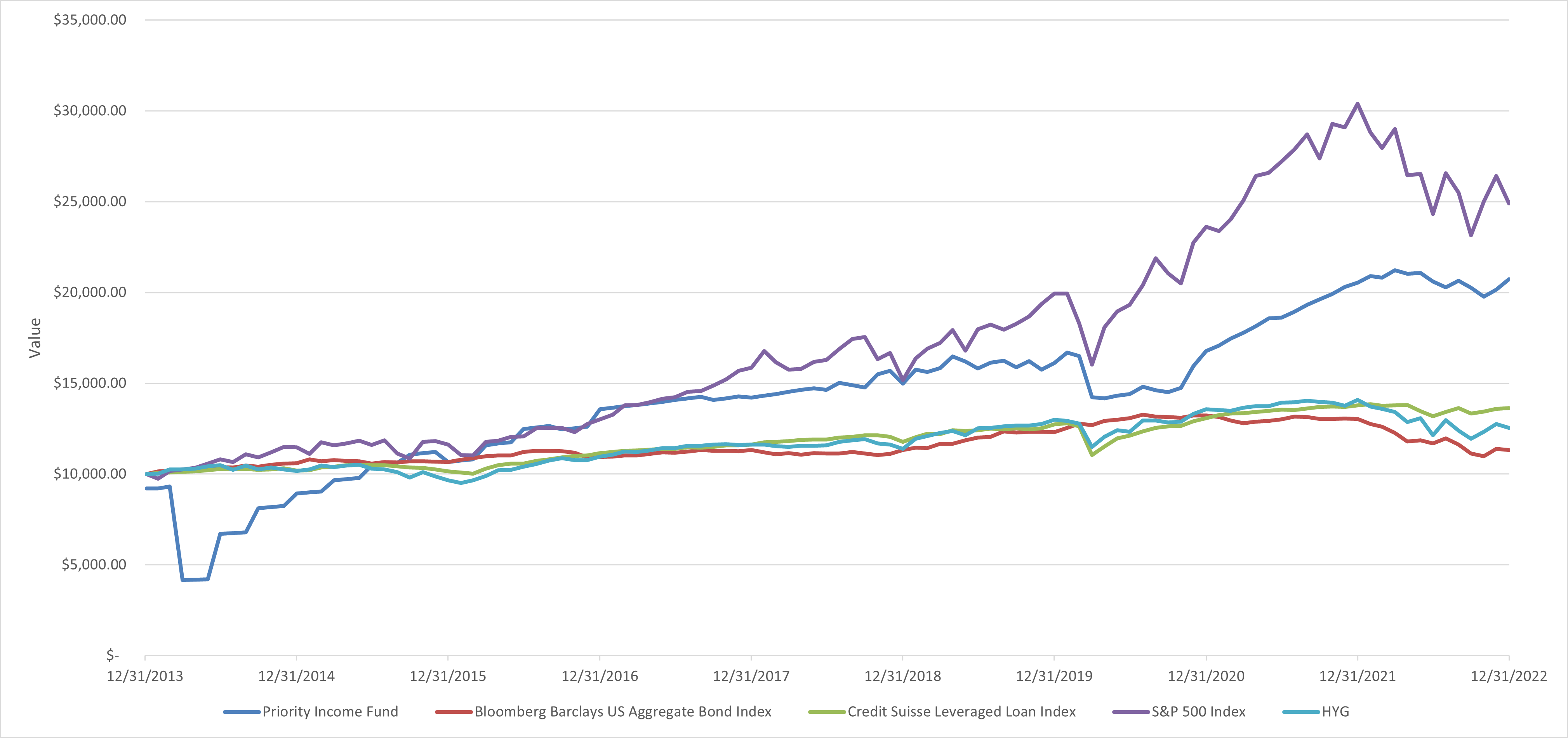

Comparison of change in value of a $10,000 investment in Priority Income Fund with a hypothetical investment of $10,000 in the Bloomberg Barclays US Aggregate Bond Index, Credit Suisse Leveraged Loan Index, and S&P 500® Index.

Past performance is not predictive of future performance. Current and future results may be lower or higher than those shown. The results shown are before taxes on fund distributions and sale of fund shares.

The above graph compares a hypothetical $10,000 investment made in Priority Income Fund on 1/6/14 (inception date) to a hypothetical investment of $10,000 made in the Bloomberg Barclays US Aggregate Bond Index, Credit Suisse Leverage Loan Index, and S&P 500® Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class R shares. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). The Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index. These factors can contribute to the indices potentially outperforming the Fund. Further information relating to fund performance is contained in the Financial Highlights section of the Fund’s prospectus and elsewhere in this report.

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns as of December 31, 2022 | |

| | Inception Date | | 1 Year | | 5 Year | | From Inception | |

| Priority Income Fund, Inc. | | | | | | | | | |

| with maximum sales charge | | 1/3/2014 | | (6.16) | % | | 4.63 | % | | 8.44 | % | |

without sales charge(1) | | 1/3/2014 | | 0.63 | % | | 6.39 | % | | 9.45 | % | |

| | | | | | | | | |

| Bloomberg Barclays US Aggregate Bond Index | | 1/3/2014 | | (13.02) | % | | 0.02 | % | | 1.40 | % | * |

| Credit Suisse Leveraged Loan Index | | 1/3/2014 | | (1.06) | % | | 3.24 | % | | 3.52 | % | * |

| S&P 500 Index | | 1/3/2014 | | (18.10) | % | | 9.43 | % | | 10.67 | % | * |

| | | | | | | | | |

*Index date is based on the inception date of the fund.

(1)Calculated based off of the net offing price.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon sale or repurchase. Current performance may be lower or higher than the performance quoted. Go to www.priorityincomefund.com for the Fund’s most recent return information. The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class R shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses.

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 9

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio Composition - At a Glance |

| | | | | | | | |

| Top Ten Holdings | | | | | | | | |

| As of December 31, 2022 | | | | | | | | |

| | | | | | | | |

| Portfolio Investment | | Investment | | Legal Maturity | | Fair Value | | % of Net Assets |

| Cedar Funding IV CLO, Ltd. | | Subordinated Notes | | 7/23/2030 | | $ | 19,430,882 | | | 3.4 | % |

| Voya CLO 2022-1, Ltd. | | Subordinated Notes | | 4/20/2035 | | $ | 14,883,194 | | | 2.6 | % |

| CIFC Funding 2017-IV, Ltd. | | Subordinated Notes | | 10/24/2030 | | $ | 14,781,551 | | | 2.6 | % |

| Voya CLO 2018-1, Ltd. | | Subordinated Notes | | 4/18/2031 | | $ | 14,265,793 | | | 2.5 | % |

| Neuberger Berman CLO XVI-S, Ltd. | | Subordinated Notes | | 4/17/2034 | | $ | 13,694,206 | | | 2.4 | % |

| Madison Park Funding XIV, Ltd. | | Subordinated Notes | | 10/22/2030 | | $ | 13,515,907 | | | 2.4 | % |

| Columbia Cent CLO 29 Limited | | Subordinated Notes | | 10/20/2034 | | $ | 13,375,426 | | | 2.3 | % |

| Cedar Funding XI CLO, Ltd. | | Subordinated Notes | | 6/1/2032 | | $ | 13,199,285 | | | 2.3 | % |

| Voya CLO 2019-1, Ltd. | | Subordinated Notes | | 4/15/2031 | | $ | 12,857,995 | | | 2.2 | % |

| Sound Point CLO XVII, Ltd. | | Subordinated Notes | | 10/20/2030 | | $ | 11,972,684 | | | 2.1 | % |

Portfolio Composition

| | | | | |

| Number of Loans Underlying the Company’s CLO Investments | 2,014 | |

| Dollar Amount of Loans Underlying the Company’s CLO Investments | $87.9 billion |

| Percentage of Collateral Underlying the Company’s CLO Investments that are in Default | 0.52 | % |

| Last Twelve Months Default Rate of Collateral Underlying the Company’s CLO Investments | 0.76 | % |

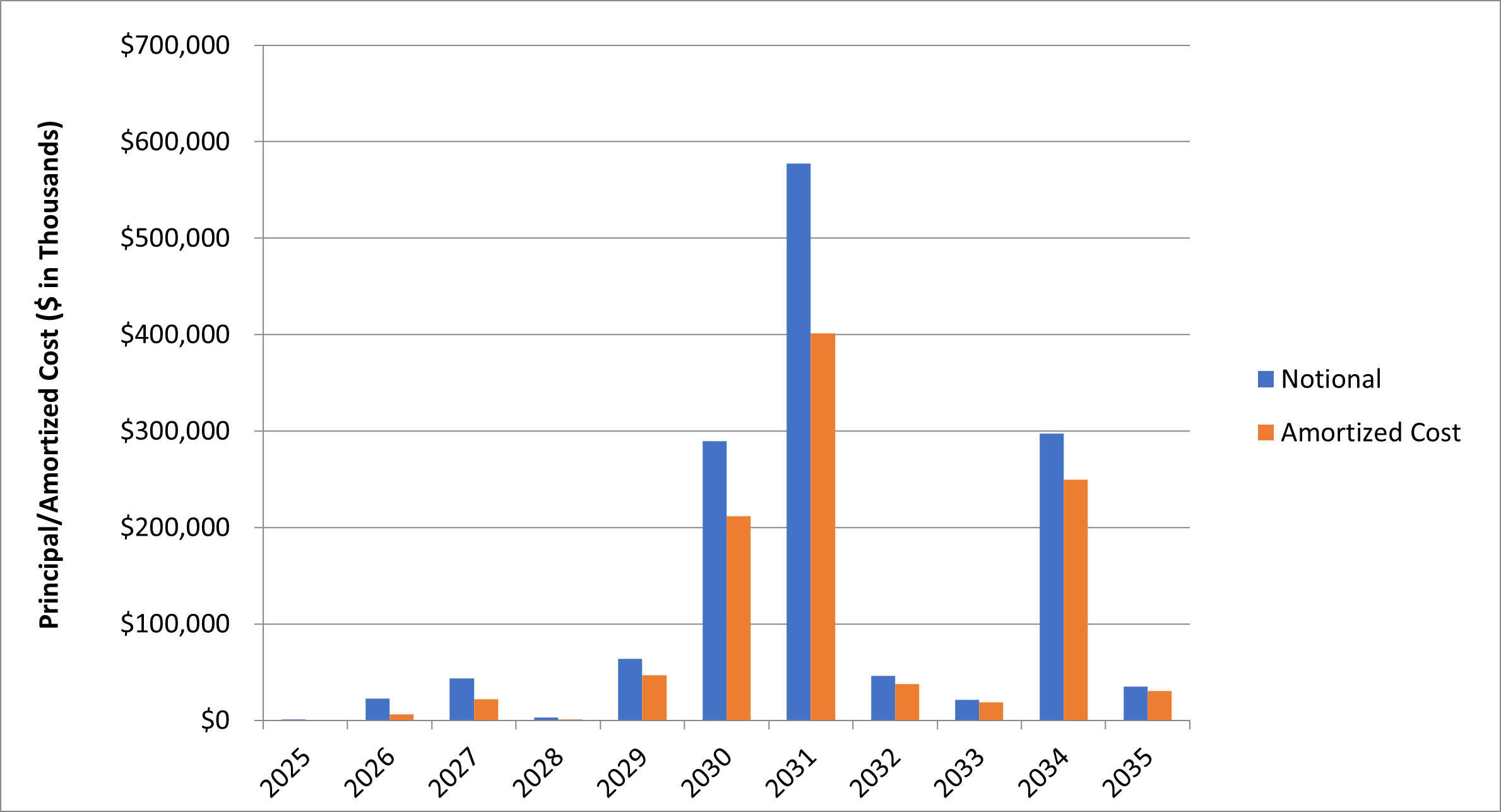

Legal Maturity of Portfolio Securities

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 10

Collateral Summary

| | | | | |

| Number of loans underlying the Company’s CLO investments | 2,014 |

| Largest exposure to any individual borrower | 0.90 | % |

| Average individual borrower exposure | 0.06 | % |

| Aggregate exposure to 10 largest borrowers | 5.79 | % |

| Aggregate exposure to senior secured loans | 100 | % |

| Weighted average stated spread | 3.50 | % |

| Weighted average LIBOR floor | 0.70 | % |

| Weighted average percentage of floating rate loans with LIBOR floors | 57.38 | % |

| Weighted average credit rating of underlying collateral based on average Moody’s rating | B1/B2 |

| Weighted average maturity of underlying collateral | 4.3 years |

| U.S. dollar currency exposure | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Underlying Secured Loan Rating Distribution (Moody’s / S&P)(1) |

| Quarter-End | Aaa/AAA | Aa/AA | A/A | Baa/BBB | Ba/BB | B/B | Caa/CCC and Lower | Unrated |

| December 31, 2022 | 0.00% / 0.00% | 0.00% / 0.00% | 0.07% / 0.01% | 1.92% / 1.25% | 24.95% / 21.39% | 66.69% / 69.84% | 5.07% / 5.17% | 0.51% / 1.56% |

(1)Excludes structured product assets and newly issued transactions for which collateral data is not yet available. |

|

| Cash is included within the denominator of the above calculations, but is not rated by Moody’s/S&P. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 11

| | | | | | | | | | | | | | | | | | | | |

| Statement of Assets and Liabilities |

| As of December 31, 2022 |

| | | | | | |

| Assets | |

| Investments, at fair value (amortized cost $1,031,257,369) | $ | 877,370,288 | |

| Cash | 16,170,837 | |

| Restricted cash | 282,114 | |

| Interest receivable | 3,548,001 | |

| Receivable for capital shares sold | 2,977,178 | |

| Deferred common stock offering costs (Note 5) | 609,863 | |

| Deferred financing costs on Revolving Credit Facility (Note 11) | 381,076 | |

| Due from affiliate (Note 5) | 293,757 | |

| Prepaid expenses | 152,785 | |

| | | | Total assets | 901,785,899 | |

| | | | | | |

| Liabilities | |

| Mandatorily redeemable Term Preferred Stock; ($0.01 par value; 50,000,000 shares authorized; 1,094,065 Series D Term Preferred Stock outstanding with net offering costs of $427,127 and unamortized discount of $616,612; 1,233,428 Series F Term Preferred Stock outstanding with net offering costs of $118,562 and unamortized discount of $647,848; 1,472,000 Series G Term Preferred Stock outstanding with net offering costs of $204,548 and unamortized discount of $814,501; 1,196,000 Series H Term Preferred Stock outstanding with net offering costs of $221,602 and unamortized discount of $695,419; 1,600,000 Series I Term Preferred Stock outstanding with net offering costs of $204,141 and unamortized discount of $1,029,691; 1,580,000 Series J Term Preferred Stock outstanding with net offering costs of $230,083 and unamortized discount of $1,048,873; 1,100,000 Series L Term Preferred Stock outstanding with net offering costs of $279,352 and unamortized discount of $781,241) (Note 7) | 224,567,725 | |

| Notes payable (less unamortized discount and debt issuance costs of $1,118,523) (Note 12) | 28,881,477 | |

| Revolving Credit Facility (Note 11) | 11,800,000 | |

| Due to Adviser (Note 5) | 11,779,700 | |

| Dividends payable | 8,710,666 | |

| Accrued expenses | 1,246,566 | |

| Due to Administrator (Note 5) | 1,143,823 | |

| Due to affiliate (Note 5) | 348,198 | |

| Interest payable | 17,313 | |

| | | | Total liabilities | 288,495,468 | |

| Cumulative Preferred Stock, par value $0.01 per share (50,000,000 shares authorized; 1,600,000 Series K Cumulative Preferred Stock outstanding as of December 31, 2022) (Note 7) | 38,434,574 | |

| Commitments and contingencies (Note 10) | |

| Net Assets Applicable to Common Shares | $ | 574,855,857 | |

| |

| Components of net assets: | |

| Common stock, $0.01 par value; 150,000,000 shares authorized; 50,490,629 shares issued and | |

| outstanding (Note 4) | $ | 504,906 | |

| Paid-in capital in excess of par (Note 4) | 581,867,766 | |

| Total distributable earnings (Note 8) | (7,516,815) | |

| Net Assets Applicable to Common Shares | $ | 574,855,857 | |

| | | | | | |

| Net asset value per Common Share | $ | 11.39 | |

| See accompanying notes to financial statements. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 12

| | | | | | | | | | | | | | | | | | | | |

| Statement of Operations |

| For the six months ended December 31, 2022 |

| |

| Investment income | |

| Interest income from investments | $ | 93,902,190 | |

| | | | Total investment income | 93,902,190 | |

| Expenses | |

| Incentive fee (Note 5) | 13,798,309 | |

| Base management fee (Note 5) | 8,898,017 | |

| Total investment advisory fees | 22,696,326 | |

| |

| Preferred dividend expense | 7,913,634 | |

| Interest expense and credit facility expense | 1,642,541 | |

| Administrator costs (Note 5) | 1,628,837 | |

| Transfer agent fees and expenses | 955,312 | |

| Adviser shared service expense (Note 5) | 717,362 | |

| Valuation services | 700,172 | |

| Amortization of common stock offering costs (Note 5) | 476,719 | |

| Report and notice to shareholders | 357,276 | |

| Audit and tax expense | 341,200 | |

| Insurance expense | 135,207 | |

| Director fees | 112,500 | |

| General and administrative | 103,153 | |

| Legal expense | 5,435 | |

| Total expenses | 37,785,674 | |

| Net investment income | 56,116,516 | |

| Net realized and net change in unrealized gain (loss) on investments | |

| Net realized gain on investments | 173,067 | |

| Net change in unrealized gain (loss) on investments | (52,228,033) | |

| Net realized and net change in unrealized gain (loss) on investments | (52,054,966) | |

| Net realized loss on extinguishment of debt | (324,184) | |

| Net increase in net assets resulting from operations | 3,737,366 | |

| Dividends declared on Cumulative Preferred Stock | (1,400,000) | |

| Net Increase in Net Assets Resulting from Operations applicable to Common Stockholders | $ | 2,337,366 | |

| | | | | | |

| See accompanying notes to financial statements. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 13

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Statements of Changes in Net Assets and Temporary Equity |

| | | | | | | | |

| | | | | | Six Months Ended | | |

| | | | | | December 31, 2022 | Year Ended | |

| | | | | | (unaudited) | June 30, 2022 | |

| Net increase (decrease) in net assets resulting from operations applicable to Common Stockholders: | | | |

| Net investment income | $ | 56,116,516 | | $ | 73,406,226 | | |

| Net realized gain (loss) on investments | 173,067 | | (8,358,797) | | |

| Net change in gain (loss) appreciation on investments | (52,228,033) | | (14,484,658) | | |

| Net realized loss on repurchase of preferred stock | (324,184) | | (1,668,530) | | |

| | | | Net increase in net assets resulting from operations | 3,737,366 | | 48,894,241 | | |

| Distributions to common stockholders: | | | |

| Dividends from earnings (Notes 6 and 8) | (33,114,402) | | (53,587,685) | | |

| Return of capital (Notes 6 and 8) | — | | — | | |

| | | | Total distributions to common stockholders | (33,114,402) | | (53,587,685) | | |

| Distributions to Series K Cumulative Preferred stockholders: | | | |

| Dividends from earnings (Notes 6 and 8) | (1,400,000) | | (2,061,104) | | |

| | | | Total distributions to Series K Cumulative Preferred stockholders | (1,400,000) | | (2,061,104) | | |

| Capital transactions: | | | |

| Gross proceeds from shares sold (Note 4) | 89,283,071 | | 103,968,590 | | |

| Commissions and fees on shares sold (Note 5) | (4,151,909) | | (6,229,141) | | |

| Repurchase of common shares (Note 4) | (18,494,627) | | (30,291,138) | | |

| Reinvestment of distributions (Note 4) | 9,166,823 | | 20,851,185 | | |

| | | | Net increase in net assets from capital transactions | 75,803,358 | | 88,299,496 | | |

| | | | Total increase in net assets | 45,026,322 | | 81,544,948 | | |

| Net assets: | | | |

| Beginning of period | 529,829,535 | | 448,284,587 | | |

| End of period | $ | 574,855,857 | | $ | 529,829,535 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Six Months Ended | |

| | | | | | December 31, 2022 | Year Ended |

| | | | | | (unaudited) | June 30, 2022 |

| Preferred Stock Classified as Temporary Equity: | | |

| Proceeds from the issuance of Cumulative Preferred Stock (Note 7) | $ | — | | $ | 38,750,000 | |

| Cumulative Preferred Stock issuance costs, paid and deferred | — | | (315,426) | |

| Net increase in Temporary Equity from Cumulative Preferred Stock transactions | — | | 38,434,574 | |

| Temporary Equity: | | |

| Beginning of period | 38,434,574 | | — | |

| End of period | $ | 38,434,574 | | $ | 38,434,574 | |

| | | | | | | |

| See accompanying notes to financial statements. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 14

| | | | | | | | | | | | | | | | | | | | |

| Statement of Cash Flows |

| For the six months ended December 31, 2022 |

| |

| Cash flows used in operating activities: | |

| Net increase in net assets resulting from operations | $ | 3,737,366 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

| Amortization of common stock offering costs (Note 5) | 476,719 | |

| Accretion of purchase discount, net | (24,329,672) | |

| Amortization of term preferred stock deferred offering costs | 131,479 | |

| Amortization of term preferred stock discount | 469,858 | |

| Amortization of notes payable debt issuance costs | 6,390 | |

| Amortization of notes payable discount | 22,250 | |

| Amortization of deferred financing costs on Revolving Credit Facility (Note 11) | 67,076 | |

| Purchases of investments | (63,238,889) | |

| Repayments from investments | 3,930,524 | |

| Payment-in-kind interest | 406,277 | |

| Net realized gain on investments | (173,067) | |

| Net change in unrealized (gain) loss on investments | 52,228,033 | |

| Net realized loss on repurchase of preferred stock | 324,184 | |

| (Increase) Decrease in operating assets: | |

| Deferred common stock offering costs (Note 5) | (597,041) | |

| Interest receivable | (1,474,949) | |

| Due from affiliate (Note 5) | (131,009) | |

| Prepaid expenses | 102,493 | |

| Increase (Decrease) in operating liabilities: | |

| Due to adviser (Note 5) | 2,189,833 | |

| Accrued expenses | (122,126) | |

| Due to Administrator (Note 5) | 452,845 | |

| Due to affiliate (Note 5) | 14,514 | |

| Preferred dividend payable | (4,873) | |

| Interest payable | (183,655) | |

| Director fees payable | (75,000) | |

| Net cash used in operating activities | (25,770,440) | |

| Cash flows provided by financing activities: | |

| Gross proceeds from shares sold (Note 4) | 86,167,079 | |

| Commissions and fees on shares sold (Note 5) | (4,038,790) | |

| Distributions paid to common stockholders | (15,240,261) | |

| Repurchase of common shares (Note 4) | (18,448,176) | |

| Distributions paid to Cumulative Preferred Stockholders | (1,400,000) | |

| Borrowings under Revolving Credit Facility (Note 11) | 41,800,000 | |

| Repayments of Revolving Credit Facility (Note 11) | (54,800,000) | |

| Deferred financing costs on Revolving Credit Facility (Note 11) | (411,711) | |

| Notes payable debt issuance costs, paid and deferred | (3,750) | |

| Net cash provided by financing activities | 33,624,391 | |

| Net increase in cash and restricted cash | 7,853,951 | |

| Cash and restricted cash at beginning of period | 8,599,000 | |

| Cash and restricted cash at end of period | $ | 16,452,951 | |

| |

| Non-cash financing activity: | |

| Value of shares issued through reinvestment of distributions | $ | 9,166,823 | |

| Supplemental disclosure: | |

| Cash paid for interest | $ | 1,762,595 | |

| Cash paid for Term Preferred Stock and Cumulative Preferred Stock | $ | 8,717,170 | |

| | | | | | |

| Beginning of the period | |

| Cash | $ | 8,599,000 | |

| Restricted cash | — | |

| Cash and restricted cash at beginning of period | $ | 8,599,000 | |

| | | | | | |

| End of the period | |

| Cash | $ | 16,170,837 | |

| Restricted cash | 282,114 | |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 15

| | | | | | | | | | | | | | | | | | | | |

| Cash and restricted cash at end of period | $ | 16,452,951 | |

| See accompanying notes to financial statements. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Schedule of Investments |

| As of December 31, 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

Adams Mill CLO Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/15/2026 | | 7/3/2014 | | $ | 500,000 | | | $ | — | | | $ | — | | | — | % |

| AIMCO CLO 11, Ltd. | | Subordinated Notes | | 24.86 | % | | 10/17/2034 | | 4/4/2022 | | 5,000,000 | | | 5,157,108 | | | 4,929,696 | | | 0.9 | % |

| Apidos CLO XVIII-R | | Subordinated Notes | | 19.17 | % | | 10/22/2030 | | 9/26/2018 | | 410,000 | | | 517,038 | | | 380,097 | | | 0.1 | % |

| Apidos CLO XX | | Subordinated Notes | | 34.97 | % | | 7/16/2031 | | 3/4/2020 | | 12,500,000 | | | 7,310,917 | | | 7,279,032 | | | 1.3 | % |

Apidos CLO XXI(6)(7) | | Subordinated Notes | | — | % | | 7/19/2027 | | 5/13/2015 | | 5,000,000 | | | 1,613,720 | | | — | | | — | % |

| Apidos CLO XXII | | Subordinated Notes | | 27.26 | % | | 4/21/2031 | | 9/17/2015 | | 9,894,611 | | | 6,768,537 | | | 7,032,537 | | | 1.2 | % |

| Apidos CLO XXIV | | Subordinated Notes | | 33.62 | % | | 10/21/2030 | | 5/17/2019 | | 12,214,397 | | | 7,154,229 | | | 7,398,225 | | | 1.3 | % |

| Apidos CLO XXVI | | Subordinated Notes | | 19.03 | % | | 7/18/2029 | | 7/25/2019 | | 6,000,000 | | | 4,576,544 | | | 4,340,464 | | | 0.8 | % |

| Babson CLO Ltd. 2015-I | | Subordinated Notes | | 12.88 | % | | 1/20/2031 | | 4/1/2015 | | 3,400,000 | | | 2,051,651 | | | 1,477,783 | | | 0.3 | % |

Barings CLO Ltd. 2018-III(6) | | Subordinated Notes | | — | % | | 7/20/2029 | | 10/10/2014 | | 397,600 | | | 165,897 | | | 101,743 | | | 0.0 | % |

BlueMountain CLO 2012-2 Ltd.(6)(7) | | Subordinated Notes | | — | % | | 11/20/2028 | | 1/7/2015 | | 3,000,000 | | | 734,041 | | | — | | | — | % |

BlueMountain CLO 2013-2 Ltd.(6) | | Subordinated Notes | | — | % | | 10/22/2030 | | 10/1/2015 | | 1,900,000 | | | 1,351,687 | | | 859,735 | | | 0.1 | % |

| BlueMountain CLO XXVI Ltd. | | Subordinated Notes | | 24.26 | % | | 10/20/2034 | | 11/18/2021 | | 8,906,000 | | | 7,854,601 | | | 6,902,318 | | | 1.2 | % |

| BlueMountain CLO XXVIII Ltd. | | Subordinated Notes | | 25.35 | % | | 4/17/2034 | | 4/1/2022 | | 3,300,000 | | | 2,947,305 | | | 2,742,170 | | | 0.5 | % |

| BlueMountain CLO XXIX Ltd. | | Subordinated Notes | | 25.27 | % | | 7/25/2034 | | 12/15/2021 | | 6,000,000 | | | 5,702,969 | | | 5,130,963 | | | 0.9 | % |

| BlueMountain CLO XXXI Ltd. | | Subordinated Notes | | 26.78 | % | | 4/19/2034 | | 4/28/2022 | | 5,000,000 | | | 4,230,130 | | | 3,783,099 | | | 0.7 | % |

| BlueMountain CLO XXXII Ltd. | | Subordinated Notes | | 26.75 | % | | 10/16/2034 | | 2/18/2022 | | 12,000,000 | | | 10,080,993 | | | 9,006,081 | | | 1.6 | % |

| BlueMountain CLO XXXIV Ltd. | | Subordinated Notes | | 26.22 | % | | 4/20/2035 | | 3/23/2022 | | 5,700,000 | | | 5,611,833 | | | 5,104,470 | | | 0.9 | % |

| BlueMountain Fuji US CLO II Ltd. | | Subordinated Notes | | 11.69 | % | | 10/21/2030 | | 8/22/2017 | | 2,500,000 | | | 2,139,028 | | | 1,763,835 | | | 0.3 | % |

| California Street CLO IX, Ltd. | | Preference Shares | | 28.62 | % | | 7/16/2032 | | 12/13/2019 | | 4,670,000 | | | 2,407,380 | | | 2,325,452 | | | 0.4 | % |

| Carlyle Global Market Strategies CLO 2013-1, Ltd. | | Subordinated Notes | | 6.27 | % | | 8/14/2030 | | 6/23/2016 | | 17,550,000 | | | 11,014,240 | | | 8,193,823 | | | 1.4 | % |

| Carlyle Global Market Strategies CLO 2013-4, Ltd. | | Income Notes | | 13.99 | % | | 1/15/2031 | | 12/22/2016 | | 11,839,488 | | | 6,920,266 | | | 5,287,397 | | | 0.9 | % |

| Carlyle Global Market Strategies CLO 2014-1, Ltd. | | Income Notes | | 21.95 | % | | 4/17/2031 | | 2/25/2016 | | 12,870,000 | | | 8,104,531 | | | 7,692,486 | | | 1.3 | % |

| Carlyle Global Market Strategies CLO 2014-3-R, Ltd. | | Subordinated Notes | | 12.25 | % | | 7/28/2031 | | 5/23/2018 | | 15,000,000 | | | 12,649,845 | | | 9,952,010 | | | 1.7 | % |

| Carlyle Global Market Strategies CLO 2016-1, Ltd. | | Subordinated Notes | | 13.37 | % | | 4/20/2034 | | 3/16/2016 | | 6,844,556 | | | 6,159,212 | | | 5,124,219 | | | 0.9 | % |

| Carlyle Global Market Strategies CLO 2016-3, Ltd. | | Subordinated Notes | | 14.99 | % | | 7/20/2034 | | 8/8/2016 | | 3,245,614 | | | 2,835,858 | | | 2,614,568 | | | 0.5 | % |

| Carlyle Global Market Strategies CLO 2017-2, Ltd. | | Subordinated Notes | | 35.20 | % | | 7/21/2031 | | 1/4/2022 | | 4,450,000 | | | 2,546,652 | | | 2,301,412 | | | 0.4 | % |

| Carlyle Global Market Strategies CLO 2017-4, Ltd. | | Income Notes | | 31.83 | % | | 1/15/2030 | | 10/14/2021 | | 9,107,000 | | | 5,398,664 | | | 4,795,014 | | | 0.8 | % |

| Carlyle Global Market Strategies CLO 2017-5, Ltd. | | Subordinated Notes | | 12.19 | % | | 1/22/2030 | | 12/18/2017 | | 10,000,000 | | | 8,725,396 | | | 7,097,570 | | | 1.2 | % |

| Cedar Funding II CLO, Ltd. | | Subordinated Notes | | 18.33 | % | | 4/20/2034 | | 9/27/2017 | | 2,500,000 | | | 2,171,647 | | | 1,807,331 | | | 0.3 | % |

| Cedar Funding IV CLO, Ltd. | | Subordinated Notes | | 17.12 | % | | 7/23/2034 | | 6/19/2017 | | 26,698,229 | | | 21,959,638 | | | 19,430,881 | | | 3.5 | % |

| Cedar Funding V CLO, Ltd. | | Subordinated Notes | | 29.71 | % | | 7/17/2031 | | 10/15/2018 | | 7,358,000 | | | 7,561,708 | | | 7,207,454 | | | 1.3 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Cedar Funding VI CLO, Ltd. | | Subordinated Notes | | 19.20 | % | | 4/20/2034 | | 8/7/2017 | | $ | 6,722,117 | | | $ | 6,628,306 | | | $ | 5,318,796 | | | 0.9 | % |

| Cedar Funding X CLO, Ltd. | | Subordinated Notes | | 27.57 | % | | 10/20/2032 | | 1/12/2022 | | 10,775,000 | | | 9,524,020 | | | 8,750,730 | | | 1.5 | % |

| Cedar Funding XI CLO, Ltd. | | Subordinated Notes | | 28.44 | % | | 6/1/2032 | | 7/12/2021 | | 17,500,000 | | | 14,060,072 | | | 13,199,285 | | | 2.3 | % |

| Cedar Funding XII, Ltd. | | Subordinated Notes | | 23.67 | % | | 10/25/2034 | | 3/28/2022 | | 3,300,000 | | | 2,886,908 | | | 2,650,699 | | | 0.5 | % |

| Cedar Funding XIV, Ltd. | | Subordinated Notes | | 27.96 | % | | 7/15/2033 | | 4/7/2022 | | 10,000,000 | | | 7,958,385 | | | 7,339,707 | | | 1.3 | % |

| Cedar Funding XV, Ltd. | | Subordinated Notes | | 26.41 | % | | 4/20/2035 | | 7/25/2022 | | 5,000,000 | | | 3,789,333 | | | 3,598,172 | | | 0.6 | % |

Cent CLO 21 Limited(6) | | Subordinated Notes | | — | % | | 7/26/2030 | | 5/15/2014 | | 510,555 | | | 332,632 | | | 224,314 | | | 0.0 | % |

| CIFC Falcon 2019, Ltd. | | Subordinated Notes | | 22.24 | % | | 1/20/2033 | | 5/14/2021 | | 8,500,000 | | | 8,064,876 | | | 7,548,209 | | | 1.3 | % |

| CIFC Funding 2013-I, Ltd. | | Subordinated Notes | | 15.30 | % | | 7/16/2030 | | 6/1/2018 | | 3,000,000 | | | 1,820,912 | | | 1,565,107 | | | 0.3 | % |

| CIFC Funding 2013-II, Ltd. | | Income Notes | | 11.94 | % | | 10/18/2030 | | 2/6/2014 | | 305,000 | | | 170,093 | | | 121,302 | | | 0.0 | % |

| CIFC Funding 2013-III-R, Ltd. | | Subordinated Notes | | 31.68 | % | | 4/24/2031 | | 1/19/2021 | | 4,900,000 | | | 2,230,438 | | | 2,329,521 | | | 0.4 | % |

| CIFC Funding 2013-IV, Ltd. | | Subordinated Notes | | 20.35 | % | | 4/28/2031 | | 3/15/2019 | | 8,000,000 | | | 5,166,849 | | | 4,931,826 | | | 0.9 | % |

| CIFC Funding 2014, Ltd. | | Income Notes | | 16.17 | % | | 1/21/2031 | | 2/6/2014 | | 2,758,900 | | | 1,657,164 | | | 1,334,510 | | | 0.2 | % |

| CIFC Funding 2014-III, Ltd. | | Income Notes | | 19.46 | % | | 10/22/2031 | | 11/14/2016 | | 11,700,000 | | | 7,196,742 | | | 5,579,134 | | | 1.0 | % |

| CIFC Funding 2014-IV-R, Ltd. | | Income Notes | | 18.55 | % | | 1/17/2035 | | 8/5/2014 | | 4,833,031 | | | 3,093,752 | | | 2,570,445 | | | 0.4 | % |

| CIFC Funding 2015-I, Ltd. | | Subordinated Notes | | 18.01 | % | | 1/22/2031 | | 11/24/2015 | | 7,500,000 | | | 5,088,629 | | | 4,239,878 | | | 0.7 | % |

CIFC Funding 2015-III, Ltd.(6) | | Subordinated Notes | | — | % | | 4/19/2029 | | 5/29/2018 | | 10,000,000 | | | 5,142,612 | | | 3,783,529 | | | 0.7 | % |

| CIFC Funding 2015-IV, Ltd. | | Subordinated Notes | | 19.75 | % | | 4/20/2034 | | 4/27/2016 | | 22,930,000 | | | 13,289,428 | | | 11,009,198 | | | 1.9 | % |

| CIFC Funding 2016-I, Ltd. | | Subordinated Notes | | 27.94 | % | | 10/21/2031 | | 12/9/2016 | | 6,500,000 | | | 4,670,574 | | | 5,485,813 | | | 1.0 | % |

CIFC Funding 2017-I, Ltd.(6) | | Subordinated Notes | | — | % | | 4/20/2029 | | 2/3/2017 | | 8,000,000 | | | 6,206,120 | | | 4,820,630 | | | 0.8 | % |

| CIFC Funding 2017-IV, Ltd. | | Subordinated Notes | | 16.52 | % | | 10/24/2030 | | 8/14/2017 | | 18,000,000 | | | 17,329,388 | | | 14,781,550 | | | 2.7 | % |

| CIFC Funding 2018-II, Ltd. | | Subordinated Notes | | 43.13 | % | | 4/20/2031 | | 8/11/2022 | | 10,000,000 | | | 5,880,519 | | | 5,231,118 | | | 0.9 | % |

| CIFC Funding 2018-IV, Ltd. | | Subordinated Notes | | 31.03 | % | | 10/17/2031 | | 6/19/2020 | | 6,000,000 | | | 4,655,052 | | | 4,730,156 | | | 0.8 | % |

| CIFC Funding 2020-II, Ltd. | | Income Notes | | 30.05 | % | | 10/20/2034 | | 7/20/2020 | | 2,000,000 | | | 1,674,669 | | | 1,821,132 | | | 0.3 | % |

| CIFC Funding 2020-III, Ltd. | | Subordinated Notes | | 25.91 | % | | 10/20/2034 | | 9/11/2020 | | 7,350,000 | | | 6,896,377 | | | 7,035,879 | | | 1.2 | % |

| Columbia Cent CLO 29 Limited | | Subordinated Notes | | 27.18 | % | | 10/20/2034 | | 7/10/2020 | | 16,000,000 | | | 12,373,515 | | | 13,375,425 | | | 2.3 | % |

| Columbia Cent CLO 31 Limited | | Subordinated Notes | | 24.00 | % | | 4/20/2034 | | 2/1/2021 | | 12,100,000 | | | 10,520,167 | | | 9,847,934 | | | 1.7 | % |

| Dryden 86 CLO, Ltd. | | Subordinated Notes | | 27.95 | % | | 7/17/2034 | | 3/10/2022 | | 10,250,000 | | | 7,801,140 | | | 7,075,925 | | | 1.2 | % |

| Dryden 87 CLO, Ltd. | | Subordinated Notes | | 28.08 | % | | 5/22/2034 | | 3/10/2022 | | 4,000,000 | | | 3,594,740 | | | 3,238,199 | | | 0.6 | % |

| Dryden 95 CLO, Ltd. | | Subordinated Notes | | 27.28 | % | | 8/21/2034 | | 4/27/2022 | | 10,500,000 | | | 8,941,488 | | | 8,396,511 | | | 1.5 | % |

| Galaxy XIX CLO, Ltd. | | Subordinated Notes | | 10.85 | % | | 7/24/2030 | | 12/5/2016 | | 2,750,000 | | | 1,935,756 | | | 1,371,232 | | | 0.2 | % |

| Galaxy XX CLO, Ltd. | | Subordinated Notes | | 26.14 | % | | 4/21/2031 | | 5/28/2021 | | 2,000,000 | | | 1,628,629 | | | 1,508,991 | | | 0.3 | % |

| Galaxy XXI CLO, Ltd. | | Subordinated Notes | | 32.67 | % | | 4/21/2031 | | 5/28/2021 | | 4,775,000 | | | 3,054,326 | | | 2,808,504 | | | 0.5 | % |

| Galaxy XXVII CLO, Ltd. | | Subordinated Notes | | 39.15 | % | | 5/16/2031 | | 7/23/2021 | | 2,212,500 | | | 996,800 | | | 1,126,748 | | | 0.2 | % |

| Galaxy XXVIII CLO, Ltd. | | Subordinated Notes | | 34.68 | % | | 7/15/2031 | | 5/30/2014 | | 5,295,000 | | | 2,517,301 | | | 2,391,547 | | | 0.4 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| GoldenTree Loan Opportunities IX, Ltd. | | Subordinated Notes | | 2.81 | % | | 10/29/2029 | | 7/19/2017 | | $ | 3,250,000 | | | $ | 2,195,144 | | | $ | 1,888,689 | | | 0.3 | % |

Halcyon Loan Advisors Funding 2014-2 Ltd.(6) | | Subordinated Notes | | — | % | | 4/28/2025 | | 4/14/2014 | | 400,000 | | | 210,313 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2014-3 Ltd.(6) | | Subordinated Notes | | — | % | | 10/22/2025 | | 9/12/2014 | | 500,000 | | | 298,545 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-1 Ltd.(6) | | Subordinated Notes | | — | % | | 4/20/2027 | | 3/16/2015 | | 3,000,000 | | | 1,849,511 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-2 Ltd.(6) | | Subordinated Notes | | — | % | | 7/26/2027 | | 6/3/2015 | | 3,000,000 | | | 1,927,789 | | | — | | | — | % |

Halcyon Loan Advisors Funding 2015-3 Ltd.(6) | | Subordinated Notes | | — | % | | 10/18/2027 | | 7/27/2015 | | 7,000,000 | | | 5,329,399 | | | 31,187 | | | 0.0 | % |

| HarbourView CLO VII-R, Ltd. | | Subordinated Notes | | 5.63 | % | | 7/18/2031 | | 6/5/2015 | | 275,000 | | | 193,471 | | | 100,434 | | | 0.0 | % |

| Jefferson Mill CLO Ltd. | | Subordinated Notes | | 10.54 | % | | 10/20/2031 | | 6/30/2015 | | 6,049,689 | | | 4,624,107 | | | 3,316,620 | | | 0.6 | % |

LCM XV Limited Partnership(6) | | Income Notes | | — | % | | 7/19/2030 | | 1/28/2014 | | 250,000 | | | 150,967 | | | 108,434 | | | 0.0 | % |

| LCM XVI Limited Partnership | | Income Notes | | 11.10 | % | | 10/15/2031 | | 5/12/2014 | | 6,814,685 | | | 4,428,008 | | | 3,165,893 | | | 0.6 | % |

| LCM XVII Limited Partnership | | Income Notes | | 12.96 | % | | 10/15/2031 | | 9/17/2014 | | 1,000,000 | | | 693,393 | | | 514,788 | | | 0.1 | % |

| LCM XVIII Limited Partnership | | Income Notes | | 40.86 | % | | 7/20/2031 | | 10/29/2021 | | 12,195,000 | | | 5,108,652 | | | 4,171,724 | | | 0.7 | % |

| LCM XXVIII Limited Partnership | | Subordinated Notes | | 33.29 | % | | 10/21/2030 | | 10/29/2021 | | 2,000,000 | | | 1,256,262 | | | 1,064,207 | | | 0.2 | % |

| LCM XXXII Limited Partnership | | Income Notes | | 25.78 | % | | 7/20/2034 | | 3/2/2022 | | 10,390,000 | | | 8,593,463 | | | 7,493,331 | | | 1.3 | % |

| LCM XXXIV Limited Partnership | | Subordinated Notes | | 32.03 | % | | 10/20/2034 | | 8/4/2022 | | 2,395,000 | | | 1,720,500 | | | 1,577,711 | | | 0.3 | % |

Madison Park Funding XIII, Ltd.(6) | | Subordinated Notes | | — | % | | 4/19/2030 | | 2/3/2014 | | 13,000,000 | | | 7,352,815 | | | 6,332,059 | | | 1.1 | % |

| Madison Park Funding XIV, Ltd. | | Subordinated Notes | | 25.38 | % | | 10/22/2030 | | 7/3/2014 | | 23,750,000 | | | 16,382,483 | | | 13,515,906 | | | 2.4 | % |

| Madison Park Funding XL, Ltd. | | Subordinated Notes | | 41.90 | % | | 5/28/2030 | | 10/8/2020 | | 7,000,000 | | | 3,452,991 | | | 3,230,942 | | | 0.6 | % |

Mountain View CLO 2014-1 Ltd.(6) | | Income Notes | | — | % | | 10/15/2026 | | 8/29/2014 | | 1,000,000 | | | 497,106 | | | — | | | — | % |

| Mountain View CLO IX Ltd. | | Subordinated Notes | | 17.78 | % | | 7/15/2031 | | 5/13/2015 | | 8,815,500 | | | 4,517,073 | | | 4,050,216 | | | 0.7 | % |

| Neuberger Berman CLO XVI-S, Ltd. | | Subordinated Notes | | 28.08 | % | | 4/17/2034 | | 2/9/2022 | | 16,000,000 | | | 15,517,891 | | | 13,694,205 | | | 2.5 | % |

| Neuberger Berman CLO XXI, Ltd. | | Subordinated Notes | | 27.68 | % | | 4/20/2034 | | 2/16/2022 | | 8,501,407 | | | 7,111,750 | | | 6,046,602 | | | 1.1 | % |

Octagon Investment Partners XIV, Ltd.(6) | | Income Notes | | — | % | | 7/16/2029 | | 12/1/2017 | | 6,150,000 | | | 3,121,174 | | | 2,345,252 | | | 0.4 | % |

| Octagon Investment Partners XV, Ltd. | | Income Notes | | 20.61 | % | | 7/19/2030 | | 5/23/2019 | | 8,937,544 | | | 4,933,928 | | | 4,882,711 | | | 0.8 | % |

| Octagon Investment Partners XVII, Ltd. | | Subordinated Notes | | 16.08 | % | | 1/27/2031 | | 6/28/2018 | | 16,153,000 | | | 8,004,333 | | | 6,401,898 | | | 1.1 | % |

| Octagon Investment Partners 18-R, Ltd. | | Subordinated Notes | | 15.13 | % | | 4/16/2031 | | 7/30/2015 | | 4,568,944 | | | 2,168,337 | | | 1,707,204 | | | 0.3 | % |

| Octagon Investment Partners 20-R, Ltd. | | Subordinated Notes | | 18.30 | % | | 5/12/2031 | | 4/25/2019 | | 3,500,000 | | | 2,983,309 | | | 2,277,363 | | | 0.4 | % |

| Octagon Investment Partners XXI, Ltd. | | Subordinated Notes | | 20.18 | % | | 2/14/2031 | | 1/6/2016 | | 13,822,188 | | | 8,509,105 | | | 6,487,615 | | | 1.1 | % |

| Octagon Investment Partners XXII, Ltd. | | Subordinated Notes | | 12.66 | % | | 1/22/2030 | | 11/12/2014 | | 6,625,000 | | | 4,813,881 | | | 3,519,011 | | | 0.6 | % |

| Octagon Investment Partners 27, Ltd. | | Subordinated Notes | | 19.48 | % | | 7/15/2030 | | 10/31/2018 | | 5,000,000 | | | 3,360,102 | | | 2,682,769 | | | 0.5 | % |

| Octagon Investment Partners 30, Ltd. | | Subordinated Notes | | 6.90 | % | | 3/18/2030 | | 11/16/2017 | | 9,525,000 | | | 7,641,105 | | | 6,503,984 | | | 1.1 | % |

| Octagon Investment Partners 31, Ltd. | | Subordinated Notes | | 11.14 | % | | 7/19/2030 | | 12/20/2019 | | 3,067,500 | | | 1,927,384 | | | 1,781,205 | | | 0.3 | % |

| Octagon Investment Partners 33, Ltd. | | Subordinated Notes | | 14.10 | % | | 1/20/2031 | | 7/9/2018 | | 2,850,000 | | | 2,341,419 | | | 1,912,837 | | | 0.3 | % |

| Octagon Investment Partners 36, Ltd. | | Subordinated Notes | | 24.19 | % | | 4/15/2031 | | 12/20/2019 | | 10,400,960 | | | 8,051,090 | | | 7,005,487 | | | 1.2 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Octagon Investment Partners 37, Ltd. | | Subordinated Notes | | 24.66 | % | | 7/25/2030 | | 3/17/2021 | | $ | 14,500,000 | | | $ | 11,231,307 | | | $ | 10,675,045 | | | 1.9 | % |

| Octagon Investment Partners 39, Ltd. | | Subordinated Notes | | 23.60 | % | | 10/21/2030 | | 1/9/2020 | | 10,250,000 | | | 8,176,298 | | | 7,716,611 | | | 1.3 | % |

| Octagon Loan Funding, Ltd. | | Subordinated Notes | | 20.63 | % | | 11/18/2031 | | 8/25/2014 | | 5,014,526 | | | 3,041,292 | | | 2,571,325 | | | 0.4 | % |

| OZLM VI, Ltd. | | Subordinated Notes | | 5.68 | % | | 4/17/2031 | | 10/31/2016 | | 15,688,991 | | | 10,775,452 | | | 6,897,060 | | | 1.2 | % |

OZLM VII, Ltd.(6) | | Subordinated Notes | | — | % | | 7/17/2029 | | 11/3/2015 | | 2,654,467 | | | 1,386,766 | | | 422,572 | | | 0.1 | % |

OZLM VIII, Ltd.(6) | | Subordinated Notes | | — | % | | 10/17/2029 | | 8/7/2014 | | 950,000 | | | 554,166 | | | 279,118 | | | 0.0 | % |

| OZLM IX, Ltd. | | Subordinated Notes | | 10.79 | % | | 10/20/2031 | | 2/22/2017 | | 15,000,000 | | | 11,029,883 | | | 7,667,053 | | | 1.3 | % |

OZLM XII, Ltd.(6) | | Subordinated Notes | | — | % | | 4/30/2027 | | 1/17/2017 | | 12,122,952 | | | 7,169,134 | | | 62,506 | | | 0.0 | % |

| OZLM XXII, Ltd. | | Subordinated Notes | | 9.49 | % | | 1/17/2031 | | 5/11/2017 | | 27,343,000 | | | 14,482,334 | | | 10,846,950 | | | 1.9 | % |

| Redding Ridge 3 CLO, Ltd. | | Preference Shares | | 23.13 | % | | 1/15/2030 | | 3/26/2021 | | 12,293,000 | | | 6,916,515 | | | 6,319,241 | | | 1.1 | % |

| Redding Ridge 4 CLO, Ltd. | | Subordinated Notes | | 22.02 | % | | 4/15/2030 | | 1/29/2021 | | 14,000,000 | | | 12,840,458 | | | 11,714,801 | | | 2.0 | % |

| Redding Ridge 5 CLO, Ltd. | | Subordinated Notes | | 24.36 | % | | 10/15/2031 | | 5/27/2021 | | 5,500,000 | | | 5,138,058 | | | 4,838,961 | | | 0.8 | % |

| Rockford Tower CLO 2021-3, Ltd. | | Subordinated Notes | | 23.02 | % | | 10/20/2034 | | 2/11/2022 | | 8,000,000 | | | 7,014,109 | | | 6,913,661 | | | 1.2 | % |

| Romark WM-R Ltd. | | Subordinated Notes | | 11.77 | % | | 4/21/2031 | | 4/11/2014 | | 490,713 | | | 354,112 | | | 254,409 | | | 0.0 | % |

| Sound Point CLO II, Ltd. | | Subordinated Notes | | 4.73 | % | | 1/26/2031 | | 5/16/2019 | | 21,053,778 | | | 10,398,368 | | | 7,539,577 | | | 1.3 | % |

| Sound Point CLO VII-R, Ltd. | | Subordinated Notes | | 15.78 | % | | 10/23/2031 | | 7/31/2019 | | 9,002,745 | | | 3,522,920 | | | 2,517,080 | | | 0.4 | % |

| Sound Point CLO XVII, Ltd. | | Subordinated Notes | | 5.00 | % | | 10/20/2030 | | 7/11/2018 | | 20,000,000 | | | 14,782,587 | | | 11,972,684 | | | 2.1 | % |

| Sound Point CLO XVIII, Ltd. | | Subordinated Notes | | 15.22 | % | | 1/20/2031 | | 10/29/2018 | | 15,563,500 | | | 11,156,743 | | | 9,870,658 | | | 1.7 | % |

| Sound Point CLO XIX, Ltd. | | Subordinated Notes | | 26.27 | % | | 4/15/2031 | | 9/23/2021 | | 7,500,000 | | | 4,285,670 | | | 3,906,022 | | | 0.7 | % |

| Sound Point CLO XX, Ltd. | | Subordinated Notes | | 24.03 | % | | 7/28/2031 | | 11/5/2021 | | 8,000,000 | | | 5,190,477 | | | 4,464,734 | | | 0.8 | % |

| Sound Point CLO XXIII, Ltd. | | Subordinated Notes | | 19.45 | % | | 7/17/2034 | | 8/27/2021 | | 5,915,000 | | | 4,478,280 | | | 4,195,406 | | | 0.7 | % |

Symphony CLO XIV, Ltd.(6) | | Subordinated Notes | | — | % | | 7/14/2026 | | 5/6/2014 | | 750,000 | | | 379,097 | | | 156,311 | | | 0.0 | % |

| Symphony CLO XVI, Ltd. | | Subordinated Notes | | 13.17 | % | | 10/15/2031 | | 7/1/2015 | | 5,000,000 | | | 4,066,521 | | | 3,089,145 | | | 0.5 | % |

| Symphony CLO XIX, Ltd. | | Subordinated Notes | | 23.62 | % | | 4/16/2031 | | 5/6/2021 | | 2,000,000 | | | 1,353,441 | | | 1,298,275 | | | 0.2 | % |

| TCI-Symphony CLO 2017-1, Ltd. | | Income Notes | | 26.73 | % | | 7/15/2030 | | 9/15/2020 | | 3,000,000 | | | 1,885,279 | | | 1,876,082 | | | 0.3 | % |

| TCW CLO 2021-2, Ltd. | | Subordinated Notes | | 29.39 | % | | 7/25/2034 | | 8/17/2022 | | 5,000,000 | | | 3,682,202 | | | 3,480,552 | | | 0.6 | % |

THL Credit Wind River 2013-1 CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 7/19/2030 | | 11/1/2017 | | 10,395,000 | | | 6,774,022 | | | 4,155,134 | | | 0.7 | % |

| THL Credit Wind River 2013-2 CLO, Ltd. | | Income Notes | | 7.74 | % | | 10/18/2030 | | 12/27/2017 | | 3,250,000 | | | 1,954,385 | | | 1,477,714 | | | 0.3 | % |

| THL Credit Wind River 2014-1 CLO, Ltd. | | Subordinated Notes | | 15.24 | % | | 7/18/2031 | | 7/11/2018 | | 11,800,000 | | | 6,904,601 | | | 5,512,300 | | | 1.0 | % |

| THL Credit Wind River 2014-2 CLO, Ltd. | | Income Notes | | 34.84 | % | | 1/15/2031 | | 1/22/2021 | | 7,550,000 | | | 2,657,879 | | | 2,517,521 | | | 0.4 | % |

| THL Credit Wind River 2017-4 CLO, Ltd. | | Subordinated Notes | | 28.41 | % | | 11/20/2030 | | 6/25/2020 | | 3,765,400 | | | 2,814,428 | | | 2,636,806 | | | 0.5 | % |

| THL Credit Wind River 2018-2 CLO, Ltd. | | Subordinated Notes | | 20.25 | % | | 7/15/2030 | | 3/11/2019 | | 8,884,000 | | | 7,824,332 | | | 6,621,258 | | | 1.2 | % |

| THL Credit Wind River 2018-3 CLO, Ltd. | | Subordinated Notes | | 22.89 | % | | 1/20/2031 | | 6/28/2019 | | 13,000,000 | | | 12,037,109 | | | 10,861,341 | | | 1.9 | % |

Venture XVIII CLO, Ltd.(6) | | Subordinated Notes | | — | % | | 10/15/2029 | | 7/16/2018 | | 4,750,000 | | | 2,772,058 | | | 1,705,226 | | | 0.3 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

| Collateralized Loan Obligation - Equity Class (Cayman Islands) |

| Venture 28A CLO, Ltd. | | Subordinated Notes | | 20.01 | % | | 10/20/2034 | | 7/16/2018 | | $ | 17,715,000 | | | $ | 13,465,476 | | | $ | 11,772,044 | | | 2.0 | % |

| Venture XXX CLO, Ltd. | | Subordinated Notes | | 16.70 | % | | 1/15/2031 | | 7/16/2018 | | 5,100,000 | | | 4,128,188 | | | 3,702,001 | | | 0.6 | % |

| Venture XXXII CLO, Ltd. | | Subordinated Notes | | 20.82 | % | | 7/18/2031 | | 10/9/2018 | | 7,929,328 | | | 7,216,055 | | | 5,921,248 | | | 1.0 | % |

| Venture XXXIV CLO, Ltd. | | Subordinated Notes | | 24.63 | % | | 10/15/2031 | | 7/30/2019 | | 13,903,000 | | | 11,179,329 | | | 10,518,595 | | | 1.8 | % |

| Venture 41 CLO, Ltd. | | Subordinated Notes | | 26.75 | % | | 1/20/2034 | | 1/26/2021 | | 8,249,375 | | | 7,548,647 | | | 6,811,183 | | | 1.2 | % |

| Venture 42 CLO, Ltd. | | Subordinated Notes | | 25.49 | % | | 4/17/2034 | | 11/5/2021 | | 15,000,000 | | | 13,320,771 | | | 11,742,187 | | | 2.0 | % |

| Venture 43 CLO, Ltd. | | Subordinated Notes | | 25.26 | % | | 4/17/2034 | | 9/1/2021 | | 12,000,000 | | | 9,883,377 | | | 9,395,183 | | | 1.6 | % |

| Voya IM CLO 2013-1, Ltd. | | Income Notes | | 3.13 | % | | 10/15/2030 | | 6/9/2016 | | 4,174,688 | | | 2,601,519 | | | 1,967,845 | | | 0.3 | % |

| Voya IM CLO 2013-3, Ltd. | | Subordinated Notes | | 4.19 | % | | 10/18/2031 | | 2/13/2015 | | 4,000,000 | | | 1,875,378 | | | 1,223,795 | | | 0.2 | % |

| Voya IM CLO 2014-1, Ltd. | | Subordinated Notes | | 2.91 | % | | 4/18/2031 | | 2/5/2014 | | 314,774 | | | 191,367 | | | 124,396 | | | 0.0 | % |

Voya CLO 2014-3, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/24/2026 | | 4/10/2015 | | 7,000,000 | | | 2,853,170 | | | 121,592 | | | 0.0 | % |

| Voya CLO 2014-4, Ltd. | | Subordinated Notes | | 8.40 | % | | 7/14/2031 | | 11/10/2014 | | 1,000,000 | | | 655,510 | | | 431,588 | | | 0.1 | % |

Voya CLO 2015-2, Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/23/2027 | | 6/24/2015 | | 13,712,000 | | | 3,274,452 | | | 194,406 | | | 0.0 | % |

| Voya CLO 2016-1, Ltd. | | Subordinated Notes | | 13.34 | % | | 1/21/2031 | | 1/22/2016 | | 7,750,000 | | | 6,183,513 | | | 5,396,926 | | | 0.9 | % |

| Voya CLO 2016-3, Ltd. | | Subordinated Notes | | 13.10 | % | | 10/20/2031 | | 9/30/2016 | | 10,225,000 | | | 7,995,286 | | | 6,695,494 | | | 1.2 | % |

| Voya CLO 2017-3, Ltd. | | Subordinated Notes | | 14.72 | % | | 4/20/2034 | | 6/15/2017 | | 5,750,000 | | | 6,530,434 | | | 5,079,755 | | | 0.9 | % |

| Voya CLO 2017-4, Ltd. | | Subordinated Notes | | 28.32 | % | | 10/15/2030 | | 3/25/2021 | | 2,500,000 | | | 1,608,476 | | | 1,478,914 | | | 0.3 | % |

| Voya CLO 2018-1, Ltd. | | Subordinated Notes | | 18.66 | % | | 4/18/2031 | | 2/23/2018 | | 20,000,000 | | | 16,416,403 | | | 14,265,792 | | | 2.6 | % |

| Voya CLO 2018-2, Ltd. | | Subordinated Notes | | 30.91 | % | | 7/15/2031 | | 4/27/2021 | | 6,778,666 | | | 4,404,847 | | | 4,185,810 | | | 0.7 | % |

| Voya CLO 2018-4, Ltd. | | Subordinated Notes | | 33.47 | % | | 1/15/2032 | | 8/9/2021 | | 3,192,000 | | | 2,356,214 | | | 2,201,283 | | | 0.4 | % |

| Voya CLO 2019-1, Ltd. | | Subordinated Notes | | 24.82 | % | | 4/15/2031 | | 1/27/2020 | | 15,500,000 | | | 14,499,447 | | | 12,857,995 | | | 2.2 | % |

| Voya CLO 2020-1, Ltd. | | Subordinated Notes | | 25.38 | % | | 7/17/2034 | | 3/3/2022 | | 6,500,000 | | | 5,680,183 | | | 5,026,151 | | | 0.9 | % |

| Voya CLO 2022-1, Ltd. | | Subordinated Notes | | 25.93 | % | | 4/20/2035 | | 3/18/2022 | | 17,600,000 | | | 16,215,849 | | | 14,883,193 | | | 2.7 | % |

West CLO 2014-1 Ltd.(6)(7) | | Subordinated Notes | | — | % | | 7/17/2026 | | 6/24/2014 | | 13,375,000 | | | 2,586,143 | | | — | | | — | % |

| Total Collateralized Loan Obligation - Equity Class | | $ | 896,168,094 | | | $ | 754,044,320 | | | 131.2 | % |

| | | | | | | | | | | | | | | | |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| AGL CLO 21, Ltd. | | Class E Notes | | 11.65% (SOFR + 8.62%) | | 7/27/2035 | | 7/27/2022 | | $ | 1,000,000 | | | $ | 953,052 | | | $ | 980,219 | | | 0.2 | % |

| BlueMountain Fuji US CLO III Ltd. | | Class E Notes | | 9.28% (LIBOR + 5.20%) | | 1/15/2030 | | 9/9/2022 | | 2,000,000 | | | 1,668,501 | | | 1,688,585 | | | 0.3 | % |

| Cent CLO 21 Limited | | Class D-R2 Notes | | 10.66% (LIBOR + 6.30%) | | 7/26/2030 | | 7/29/2022 | | 7,000,000 | | | 5,783,240 | | | 6,239,244 | | | 1.1 | % |

| CIFC Funding 2013-III-R, Ltd. | | Class D Notes | | 10.22% (LIBOR + 5.90%) | | 4/24/2031 | | 9/9/2022 | | 1,675,000 | | | 1,428,707 | | | 1,469,885 | | | 0.3 | % |

| CIFC Funding 2014-III, Ltd. | | Class E-R2 Notes | | 10.42% (LIBOR + 6.10%) | | 10/22/2031 | | 9/16/2022 | | 1,125,000 | | | 955,737 | | | 1,072,747 | | | 0.2 | % |

| CIFC Funding 2015-I, Ltd. | | Class E-RR Notes | | 10.32% (LIBOR + 6.00%) | | 1/22/2031 | | 9/9/2022 | | 2,562,500 | | | 2,186,093 | | | 2,459,682 | | | 0.4 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| LCM XXIII Ltd. | | Class D Notes | | 11.29% (LIBOR + 7.05%) | | 10/19/2029 | | 8/19/2022 | | $ | 6,000,000 | | | $ | 5,150,864 | | | $ | 5,161,090 | | | 0.9 | % |

| Madison Park Funding XXIV, Ltd. | | Class E-R Notes | | 11.42% (SOFR + 7.46%) | | 10/19/2029 | | 8/19/2022 | | 5,000,000 | | | 4,700,783 | | | 4,872,912 | | | 0.8 | % |

| Madison Park Funding XL, Ltd. | | Class E-R Notes | | 11.19% (LIBOR + 6.45%) | | 5/28/2030 | | 9/9/2022 | | 3,460,000 | | | 3,055,514 | | | 3,282,062 | | | 0.6 | % |

| Neuberger Berman CLO XV, Ltd. | | Class E-R Notes | | 10.83% (LIBOR + 6.75%) | | 10/15/2029 | | 9/14/2022 | | 1,375,000 | | | 1,253,151 | | | 1,290,311 | | | 0.2 | % |

| Newark BSL CLO 2, Ltd. | | Class D Notes | | 10.66% (LIBOR + 6.30%) | | 7/25/2030 | | 7/27/2022 | | 3,000,000 | | | 2,681,792 | | | 2,797,849 | | | 0.5 | % |

| Sound Point CLO XIV, Ltd. | | Class E Notes | | 10.97% (LIBOR + 6.65%) | | 1/23/2029 | | 7/27/2022 | | 1,000,000 | | | 912,686 | | | 934,494 | | | 0.2 | % |

| Sound Point CLO XXV, Ltd. | | Class E-R Notes | | 11.31% (SOFR + 7.25%) | | 4/25/2033 | | 9/9/2022 | | 3,000,000 | | | 2,582,744 | | | 2,570,544 | | | 0.4 | % |

| Voya CLO 2017-1, Ltd. | | Class D Notes | | 10.18% (LIBOR + 6.10%) | | 4/17/2030 | | 9/9/2022 | | 2,500,000 | | | 2,078,667 | | | 2,123,491 | | | 0.4 | % |

| Apidos CLO XXIV | | Class E-R Notes | | 12.10% (LIBOR + 7.86%) | | 10/21/2030 | | 3/10/2020 | | 2,000,000 | | | 1,584,849 | | | 1,527,818 | | | 0.3 | % |

| BlueMountain CLO 2015-3 Ltd. | | Class E-R Notes | | 12.32% (LIBOR + 8.08%) | | 4/21/2031 | | 8/5/2022 | | 2,500,000 | | | 1,785,487 | | | 1,710,768 | | | 0.3 | % |

| California Street CLO IX, Ltd. | | Class F-R2 Notes | | 12.60% (LIBOR + 8.52%) | | 7/16/2032 | | 9/2/2020 | | 2,000,000 | | | 1,639,002 | | | 1,653,038 | | | 0.3 | % |

| Carlyle Global Market Strategies 2014-2-R, Ltd. | | Class E Notes | | 12.61% (LIBOR + 8.00%) | | 5/15/2031 | | 3/6/2019 | | 7,500,000 | | | 7,036,230 | | | 4,818,180 | | | 0.8 | % |

| Carlyle CLO 17, Ltd. | | Class E-R Notes | | 12.76% (LIBOR + 8.35%) | | 4/30/2031 | | 3/5/2019 | | 3,000,000 | | | 2,863,843 | | | 2,641,285 | | | 0.5 | % |

| Cent CLO 21 Limited | | Class E-R2 Notes | | 13.01% (LIBOR + 8.65%) | | 7/26/2030 | | 7/12/2018 | | 109,122 | | | 106,402 | | | 92,094 | | | 0.0 | % |

| CIFC Funding 2013-III-R, Ltd. | | Class E Notes | | 12.10% (LIBOR + 7.78%) | | 4/24/2031 | | 10/2/2020 | | 3,000,000 | | | 2,370,348 | | | 2,220,328 | | | 0.4 | % |

| CIFC Funding 2014-III, Ltd. | | Class F-R2 Notes | | 12.57% (LIBOR + 8.25%) | | 10/22/2031 | | 11/5/2021 | | 1,500,000 | | | 1,400,064 | | | 1,216,666 | | | 0.2 | % |

| CIFC Funding 2014-IV-R, Ltd. | | Class E-R Notes | | 13.26% (LIBOR + 9.18%) | | 1/17/2035 | | 12/20/2021 | | 778,684 | | | 756,201 | | | 721,477 | | | 0.1 | % |

| CIFC Funding 2014-V, Ltd. | | Class F-R2 Notes | | 12.58% (LIBOR + 8.50%) | | 10/17/2031 | | 9/17/2018 | | 750,000 | | | 746,862 | | | 644,969 | | | 0.1 | % |

| CIFC Funding 2015-I, Ltd. | | Class F-RR Notes | | 12.17% (LIBOR + 7.85%) | | 1/22/2031 | | 10/31/2019 | | 5,000,000 | | | 4,236,853 | | | 4,073,656 | | | 0.7 | % |

| CIFC Funding 2016-I, Ltd. | | Class F-R Notes | | 14.43% (LIBOR + 10.15%) | | 10/21/2031 | | 9/16/2019 | | 3,750,000 | | | 3,677,281 | | | 3,457,143 | | | 0.6 | % |

| Galaxy XXI CLO, Ltd. | | Class F-R Notes | | 11.49% (LIBOR + 7.25%) | | 4/21/2031 | | 3/8/2019 | | 6,000,000 | | | 5,201,038 | | | 5,092,835 | | | 0.9 | % |

| Galaxy XXII CLO, Ltd. | | Class F-RR Notes | | 12.88% (LIBOR + 8.80%) | | 4/17/2034 | | 8/8/2022 | | 1,500,000 | | | 1,209,089 | | | 1,243,852 | | | 0.2 | % |

| Galaxy XXVII CLO, Ltd. | | Class F Junior Notes | | 12.70% (LIBOR + 8.06%) | | 5/16/2031 | | 3/5/2019 | | 1,500,000 | | | 1,390,044 | | | 1,148,836 | | | 0.2 | % |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Investments(1)(5)(9) | | Investment | | Estimated Yield(2)/Interest Rate | | Legal Maturity | | Acquisition date | | Principal Amount | | Amortized Cost | | Fair Value(3)

Level 3 | | % of Net Assets |

Collateralized Loan Obligation - Debt Class (Cayman Islands)(4) |

| Galaxy XXVIII CLO, Ltd. | | Class F Junior Notes | | 12.56% (LIBOR + 8.48%) | | 7/15/2031 | | 6/29/2018 | | $ | 41,713 | | | $ | 40,207 | | | $ | 36,126 | | | 0.0 | % |

HarbourView CLO VII-R, Ltd.(8) | | Class F Notes | | 12.46% (LIBOR + 8.27%) | | 7/18/2031 | | 10/29/2018 | | 6,899,634 | | | 6,861,730 | | | 4,343,003 | | | 0.8 | % |

| Madison Park Funding XIII, Ltd. | | Class F-R Notes | | 12.18% (LIBOR + 7.95%) | | 4/19/2030 | | 10/25/2019 | | 2,000,000 | | | 1,781,560 | | | 1,595,053 | | | 0.3 | % |

| Madison Park Funding XIV, Ltd. | | Class F-R Notes | | 12.09% (LIBOR + 7.77%) | | 10/22/2030 | | 3/13/2020 | | 4,500,000 | | | 3,330,526 | | | 3,623,487 | | | 0.6 | % |

| Mountain View CLO IX Ltd. | | Class E Notes | | 12.10% (LIBOR + 8.02%) | | 7/15/2031 | | 10/29/2018 | | 3,625,000 | | | 3,582,867 | | | 2,543,368 | | | 0.4 | % |

| Octagon Investment Partners XVII, Ltd. | | Class F-R2 Notes | | 11.56% (LIBOR + 7.20%) | | 1/27/2031 | | 10/15/2019 | | 5,362,500 | | | 4,438,936 | | | 3,982,391 | | | 0.7 | % |

| Octagon Investment Partners 18-R, Ltd. | | Class E Notes | | 12.33% (LIBOR + 8.25%) | | 4/16/2031 | | 10/15/2019 | | 6,080,742 | | | 5,177,996 | | | 5,356,813 | | | 0.9 | % |

| Octagon Investment Partners XXII, Ltd. | | Class F-RR Notes | | 12.07% (LIBOR + 7.75%) | | 1/22/2030 | | 11/25/2019 | | 5,500,000 | | | 4,546,062 | | | 4,308,198 | | | 0.7 | % |

| OZLM VIII, Ltd. | | Class E-RR Notes | | 12.25% (LIBOR + 8.17%) | | 10/17/2029 | | 11/6/2018 | | 8,400,000 | | | 8,345,710 | | | 6,624,328 | | | 1.1 | % |

| Sound Point CLO IV-R, Ltd. | | Class F Notes | | 12.29% (LIBOR + 8.10%) | | 4/18/2031 | | 3/18/2019 | | 3,500,000 | | | 3,305,980 | | | 2,273,831 | | | 0.4 | % |

| THL Credit Wind River 2014-2 CLO, Ltd. | | Class F-R Notes | | 11.95% (LIBOR + 7.87%) | | 1/15/2031 | | 8/16/2022 | | 3,000,000 | | | 2,186,121 | | | 2,131,108 | | | 0.4 | % |

| Venture XIX CLO, Ltd. | | Class F-RR Notes | | 12.58% (LIBOR + 8.50%) | | 1/15/2032 | | 11/16/2018 | | 7,900,000 | | | 7,859,774 | | | 6,482,949 | | | 1.1 | % |

| Venture XXXIII CLO, Ltd. | | Class F Notes | | 12.08% (LIBOR + 8.00%) | | 7/15/2031 | | 12/3/2019 | | 2,500,000 | | | 1,998,777 | | | 1,852,807 | | | 0.3 | % |

| Voya IM CLO 2012-4, Ltd. | | Class E-R-R Notes | | 14.93% (LIBOR + 10.85%) | | 10/15/2030 | | 10/11/2019 | | 3,320,000 | | | 3,224,032 | | | 2,750,946 | | | 0.5 | % |

| Voya IM CLO 2014-1, Ltd. | | Class E-R2 Notes | | 12.54% (LIBOR + 8.35%) | | 4/18/2031 | | 4/11/2019 | | 8,787,500 | | | 7,013,873 | | | 6,215,500 | | | 1.1 | % |

| Total Collateralized Loan Obligation - Debt Class | | $ | 135,089,275 | | | $ | 123,325,968 | | | 21.4 | % |

| | | | | | | | | | | | | | | | |

| Total Portfolio Investments | | | | | | | | $ | 1,031,257,369 | | | $ | 877,370,288 | | | 152.6 | % |

| Assets, other than investments, less liabilities and Cumulative Preferred stock | | | | | | | | | | (302,514,431) | | | (52.6) | % |

| Net Assets applicable to Common Shares | | | | | | | | | | $ | 574,855,857 | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

(1) The Company does not "control" and is not an "affiliate" of any of the portfolio investments, each term as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). In general, under the 1940 Act, the Company would be presumed to "control" a portfolio company if the Company owned 25% or more of its voting securities and would be an "affiliate" of a portfolio company if the Company owned 5% or more of its voting securities. |

(2) The CLO subordinated notes, income notes and preferred shares are considered equity positions in the CLOs. The CLO equity investments are entitled to recurring distributions which are generally equal to the excess cash flow generated from the underlying investments after payment of the contractual payments to senior debt holders and CLO expenses. The current estimated yield, calculated using amortized cost, is based on the current projections of this excess cash flow taking into account assumptions which have been made regarding expected prepayments, losses and future reinvestment rates. These assumptions are periodically reviewed and adjusted. Ultimately, the actual yield may be higher or lower than the estimated yield if actual results differ from those used for the assumptions. |

(3) Fair value is determined by or under the direction of the Company’s Board of Directors. For intra-quarter end periods, the Company’s Board of Directors has designated the Advisor to fair value the Company’s investments. As of December 31, 2022, all of the Company’s investments were classified as Level 3. ASC 820 classifies such unobservable inputs used to measure fair value as Level 3 within the valuation hierarchy. See Notes 2 and 3 within the accompanying notes to financial statements for further discussion. |

(4) The interest rate on these investments is subject to the base rate of 3-Month LIBOR or 3-Month Term SOFR, as specified, which was 4.76729% and 4.58745% at December 31, 2022, respectively. The current base rates for each investment may be different from the reference rates on December 31, 2022. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(5) The securities in which the Company has invested were acquired in transactions that were exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). These securities may be resold only in transactions that are exempt from registration under the Securities Act. |

(6) The effective yield has been estimated to be 0% as expected future cash flows are anticipated to not be sufficient to repay the investment at cost. If the expected investment proceeds increase, there is a potential for future investment income from the investment. Distributions, once received, will be recognized as return of capital, and when called, any remaining unamortized investment costs will be written off if the actual distributions are less than the amortized investment cost. To the extent that the cost basis of the senior secured notes is fully recovered, any future distributions will be recorded as realized gains. |

(7) Security was called for redemption and the liquidation of the underlying loan portfolio is ongoing. |

(8) This investment has contractual payment-in-kind (“PIK”) interest. PIK interest computed at the contractual rate is accrued into income and reflected as receivable up to the capitalization date. |

(9) All investments are pledged as collateral for the Credit Facility (see Note 11). |

|

| See accompanying notes to financial statements. |

2023 SEMI-ANNUAL REPORT

PRIORITY INCOME FUND, INC. 24

Notes to Financial Statements (unaudited)

December 31, 2022

Note 1. Principal Business and Organization

Priority Income Fund, Inc., (the “Company,” “us,” “our,” or “we”) was incorporated under the general corporation laws of the State of Maryland on July 19, 2012 as an externally managed, nondiversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), and commenced operations on May 9, 2013. In addition, the Company has elected to be treated for tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). The Company’s investment objective is to generate current income, and as a secondary objective, long-term capital appreciation. We seek to achieve our investment objective by investing, under normal circumstances, in senior secured loans made to companies whose debt is rated below investment grade or, in limited circumstances, unrated (“Senior Secured Loans”) with an emphasis on current income. Our investments may take the form of the purchase of Senior Secured Loans (either in the primary or secondary markets) or through investments in the equity and junior debt tranches of collateralized loan obligation (“CLO”) vehicles that in turn own pools of Senior Secured Loans. The Company intends to invest in both the primary and secondary markets.

The Company is managed by Priority Senior Secured Income Management, LLC (the “Adviser”), which is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. The Adviser is 50% owned by Prospect Capital Management, L.P. (“PCM”) and 50% by Stratera Holdings, LLC (“Stratera Holdings”).

The Company is offering up to 100,000,000 shares of its common stock, on a best efforts basis. The Company commenced the offering on May 9, 2013, at an initial offering price of $15.00 per share, for an initial offering period of 36 months from the date of the commencement of the offering. On January 6, 2014, the Company satisfied its minimum offering requirement by raising over $2.5 million from selling shares to persons not affiliated with the Company or the Adviser (the “Minimum Offering Requirement”), and as a result, broke escrow and commenced making investments.

On February 9, 2016 the Company’s Board of Directors the (the “Board”) approved an 18-month extension to the offering period for the sale of the Company’s common shares through November 9, 2017. Subsequently, on May 30, 2017, the Board approved a continuation of the offering for an additional two years, extending the offering period for the sale of shares through November 2, 2019. On November 25, 2019, the Board approved an additional 18-month continuous public offering period through July 23, 2021. On April 30, 2021, due to the widespread impact of COVID-19 on the economy and financial markets, the Board approved a continuation of the offering through December 31, 2022. On November 3, 2022, the Board approved an extension of the offering until the date upon which 150,000,000 common shares have been sold in the course of our offerings, unless terminated or further extended or increased by the Board of Directors, in its sole discretion.

On December 21, 2018 the Board approved a definitive agreement (the “Merger Agreement”) pursuant to which the Company agreed, subject to the satisfaction of certain closing conditions, to acquire Stira Alcentra Global Credit Fund, a Delaware statutory trust (“Stira Alcentra”), in a common stock transaction (the “Stira Alcentra Acquisition”). The transaction was treated as an asset acquisition in accordance with ASC 805, Business Combinations. The transaction was completed on May 10, 2019.

Note 2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements.

Basis of Presentation

The accompanying financial statements have been prepared in accordance with United States generally accepted accounting principles (“GAAP”) pursuant to the requirements for reporting on Form N-CSR, ASC 946, Financial Services - Investment Companies (“ASC 946”), and Articles 6, 10 and 12 of Regulation S-X.

Reclassifications

Certain reclassifications have been made in the presentation of prior consolidated financial statements and accompanying notes to conform to the presentation as of and for the six months ended December 31, 2022.

Use of Estimates