Filed by Tokyo Electron Limited

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Tokyo Electron Limited; Applied Materials, Inc.; TEL-Applied Holdings B.V.

Commission File No. 132-02780

[Translation]

May 14, 2014

| | | | | | |

| To whom it may concern | | | | |

| | | |

| | Company: | | | | Tokyo Electron Limited |

| | | |

| | Representative: | | | | Tetsuro Higashi |

| | | | | | President and Representative Director |

| | | | | | (Code No: 8035, First Section of the |

| | | | | | Tokyo Stock Exchange) |

| | | |

| | Person to Contact: | | | | Yuki Maejima |

| | | | | | Director of General Affairs Dept. |

| | | | | | (TEL 03-5561-7000) |

Notice regarding the Execution of the Share Exchange Agreement between Tokyo

Electron Limited and TEL Japan GK regarding the Business Combination between Tokyo

Electron Limited and Applied Materials, Inc.

As announced in the press release “Notice Regarding the Execution of an Agreement to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated September 24, 2013, the press release “(Addition) Notice Concerning Added Disclosure for the ‘Notice Regarding the Execution of an Agreement to Combine Tokyo Electron Limited and Applied Materials, Inc.’ ” dated October 2, 2013, and the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014, Tokyo Electron Limited (President and Representative Director: Tetsuro Higashi) (“Tokyo Electron”) agreed with Applied Materials, Inc. (President and CEO: Gary Dickerson) (“Applied Materials”) to combine their respective businesses through a merger of equals (the “Business Combination”) and executed a business combination agreement (the “Business Combination Agreement”).

As a part of the Business Combination, a share exchange (the “Tokyo Electron Share Exchange”) will be effected between Tokyo Electron and newly-formed TEL Japan GK (Representative Partner: Tokyo Electron) (see Note), pursuant to which (1) TEL Japan GK will become a wholly-owning parent company of Tokyo Electron and (2) Tokyo Electron will become a wholly-owned subsidiary of TEL Japan GK, and the consideration for share exchange will be the ordinary shares of a holding company organized under the laws of the Netherlands to be the wholly owning parent company of Tokyo Electron and Applied Materials after the Business Combination (“HoldCo”). Pursuant to an approval by a board of directors’ meeting of Tokyo Electron held today, Tokyo Electron executed a share exchange agreement with TEL Japan GK (the “Tokyo Electron Share Exchange Agreement”) with respect to the Tokyo Electron Share Exchange in accordance with the provision of the Business Combination Agreement.

(Note) As announced in the press release “Notice Regarding the Incorporation of Subsidiaries in Preparation for Business Combination with Applied Materials, Inc.” dated December 18, 2013 and the press release “(Amendment) Notice Concerning Amendments to the ‘Notice Regarding the Incorporation of Subsidiaries in Preparation for Business Combination with Applied Materials, Inc.’” dated February 15, 2014, the board of directors of Tokyo Electron had decided to incorporate TEL Japan GK. TEL Japan GK was incorporated on May 1, 2014.

The effective date of the Tokyo Electron Share Exchange is set for September 24, 2014 in the current Tokyo Electron Share Exchange Agreement. However, since the Tokyo Electron Share Exchange is a part of the Business Combination and the Business Combination Agreement provides various conditions precedent for closing, the timing of consummation of which are dependent on the satisfaction or waiver of various conditions under the Business Combination Agreement. The Business Combination, including Tokyo Electron Share Exchange, shall

take place generally on a date to be designated jointly by Tokyo Electron and Applied Materials, which shall be no later than the 10th business day after the satisfaction or waiver of each of all the conditions set forth in the Business Combination Agreement. Therefore, the effective date set forth in current Tokyo Electron Share Exchange is tentative and may be changed to a different date depending on when the conditions of the Business Combination are satisfied or waived (see Note). Pursuant to the Companies Act of Japan, in the event that the effective date of the Tokyo Electron Share Exchange is changed, Tokyo Electron will issue a public notice of the new effective date of the Tokyo Electron Share Exchange no later than the day preceding the effective date set before the change.

| | | | |

| |

| (Note ) | | The specific process to change the effective date will be as follows: |

| |

| | In the case where it turns out that the conditions precedent of the Business Combination will have not yet been satisfied or waived as of the effective date (September 24, 2014) set forth in the current Tokyo Electron Share Exchange Agreement, Tokyo Electron and Applied Materials plan to postpone the effective date to a later date after September 24, 2014, before which date each of all the conditions precedent of the Business Combination Agreement are expected to have been satisfied or waived. After that, when the timing of the satisfaction or waiver of each of all of the conditions can be predicted, the effective date will be finalized and set on an appropriate date. |

Considering the delisting process for the Tokyo Electron shares, the listing process for the HoldCo shares, and other necessary procedures, Tokyo Electron and Applied Materials plan to, in accordance with the Business Combination Agreement, set the effective date of the Tokyo Electron Triangular Share Exchange as the 10th business day after the satisfaction or waiver of all the conditions precedent of the Business Combination Agreement unless otherwise agreed by the parties. Tokyo Electron will announce the final effective date of the Tokyo Electron Triangular Share Exchange as soon as it is determined. The Tokyo Electron Share Exchange requires the approval of the annual general meeting of shareholders of Tokyo Electron that will be held on June 20, 2014. The ordinary shares of Tokyo Electron are expected to be delisted from the Tokyo Stock Exchange (the “TSE”) prior to the effective date of the Tokyo Electron Share Exchange. The date of the delisting will be determined by the TSE considering the status of the finalization of the effective date of the Tokyo Electron Share Exchange.

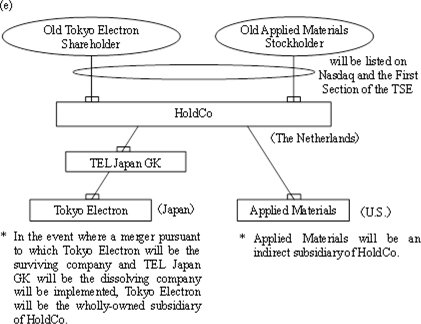

In addition, Tokyo Electron intends to implement the merger as an intragroup reorganization after the Business Combination, which will be effective on the same date as the effective date of the Tokyo Electron Share Exchange. Under this merger, Tokyo Electron will be the surviving company and TEL Japan GK will be the dissolving company. In the event that the merger is implemented, Tokyo Electron will become a direct wholly-owned subsidiary of HoldCo, while Tokyo Electron will become an indirect wholly-owned subsidiary of HoldCo as of immediately after the Tokyo Electron Share Exchange.

| 1. | Purpose of the Tokyo Electron Share Exchange |

Since the Tokyo Electron Share Exchange is one element of the Business Combination, the purpose of the Tokyo Electron Share Exchange is the same as that of the Business Combination. The purpose of the Business Combination is as described in “1. Background and Purpose of the Business Combination” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.”

2

| 2. | Outline of the Tokyo Electron Share Exchange |

| | (1) | Timeline of the Tokyo Electron Share Exchange |

| | |

| Execution of the Business Combination Agreement | | September 24, 2013 |

| | |

| Execution of the amendment agreement to the Business Combination Agreement | | February 15, 2014 |

| | |

| Record Date of the shareholders meeting of Tokyo Electron | | March 31, 2014 |

| | |

| Date when the board of directors of Tokyo Electron resolved to approve the Tokyo Electron Share Exchange Agreement | | May 14, 2014 |

| | |

| Date of the shareholders meetings of Tokyo Electron | | June 20, 2014 |

| | |

| Delisting Date (Tokyo Electron) | | September 18, 2014 (not final) (Note 1) |

| | |

| Effective Date of the Tokyo Electron Share Exchange | | September 24, 2014] (not final) (Note 2) |

| | |

| Closing for the Business Combination (Effective Date) | | September 24, 2014 (not final) |

| | |

| Listing Date of the HoldCo (TSE, First Section (foreign)) | | September 24, 2014 (not final) |

| | |

| (Note 1) | | The date of the delisting will be determined by the TSE considering the status of the finalization of the effective date of the Tokyo Electron Share Exchange. In response to the change of the effective date of the Tokyo Electron Share Exchange, the delisting date will also be changed |

| |

| (Note 2) | | As described in the beginning section of this press release, the effective date set as of today is not final, and there is a possibility that the current effective date will be changed to a different date. |

| |

| (Note 3) | | Tokyo Electron will cause HoldCo to file a Japanese registration statement with the Japanese Financial Services Agency in connection with the issuance of HoldCo ordinary shares in the Business Combination early in June, 2014. |

| |

| (Note 4) | | In order to consummate the Business Combination, the approval of the Business Combination Agreement at a general meeting of shareholders of Applied Materials is required. The date of the general meeting of shareholders of Applied Materials to approve the Business Combination Agreement will be June 23, 2014 (California time). |

| | (2) | Method of the Tokyo Electron Share Exchange |

Method of the Tokyo Electron Share Exchange is as described in “2. (1) Method of the Business Combination” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

The Business Combination will be structured as a business combination of equals. Subject to the terms and conditions of the Business Combination Agreement, pursuant to (1) the Tokyo Electron Share Exchange and (2) the Applied Materials Merger (defined below), Tokyo Electron and Applied Materials will become subsidiaries of HoldCo. The consideration in the Business Combination will be the ordinary shares of HoldCo. HoldCo is organized under the laws of the Netherlands, whose ordinary shares are expected to be listed on the TSE and Nasdaq. Tokyo Electron will be delisted from the TSE prior to the Tokyo Electron Share Exchange, and Applied Materials will be delisted from the Nasdaq in response to the consummation of the Applied Materials Merger.

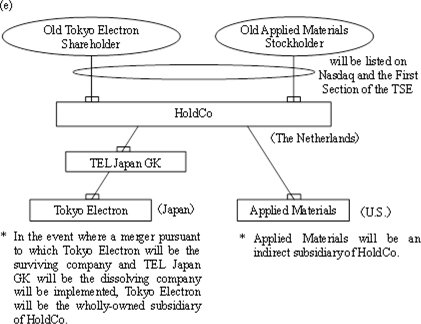

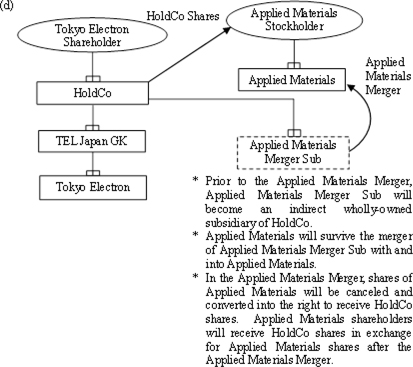

More specifically, upon the terms and subject to the conditions set forth in the Business Combination Agreement, the Companies intend to take the following steps in connection with the consummation of the Business Combination (see Attachment 1):

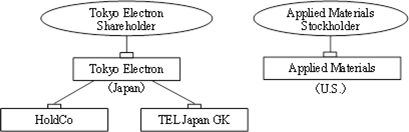

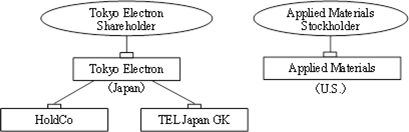

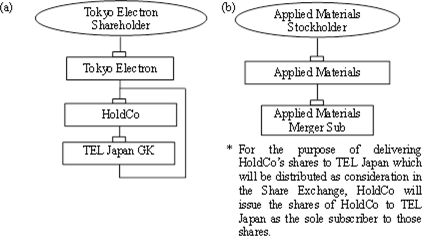

(a) Incorporation of TEL Japan GK (this has already been completed). (TEL Japan GK will become a wholly-owned subsidiary of HoldCo, prior to the Tokyo Electron Share Exchange.)

(b) Applied Materials will form a new Delaware limited liability company (“Applied Materials Merger Sub”). (Applied Materials Merger Sub will be an indirect wholly-owned subsidiary of Applied Materials, for the purpose of effecting the Applied Materials Merger.)

3

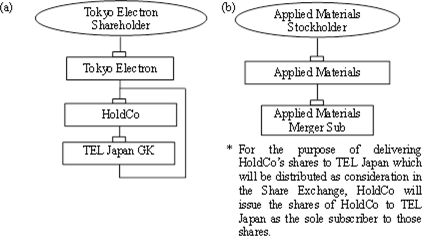

(c) Tokyo Electron and TEL Japan GK will effect the Tokyo Electron Share Exchange, pursuant to which each issued and outstanding share of Tokyo Electron will be exchanged for 3.25 ordinary shares of HoldCo and Tokyo Electron will be a wholly-owned subsidiary in the share exchange and TEL Japan GK will be a wholly-owning parent in the share exchange.

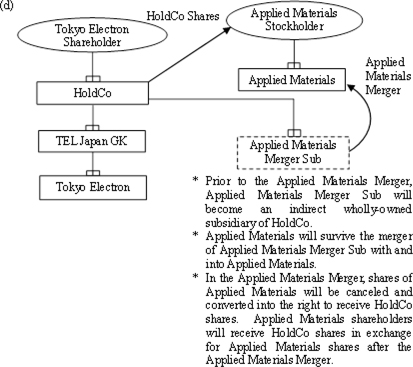

(d) On the condition that (c) above becomes effective, Applied Materials and Applied Materials Merger Sub will effect a triangular merger (“Applied Materials Merger”), with Applied Materials surviving the Applied Materials Merger as a subsidiary of HoldCo and each issued and outstanding share of Applied Materials will be converted into the right to receive one ordinary share of HoldCo.

(e) The ordinary shares of HoldCo are expected to be listed on the TSE and Nasdaq.

| (3) | Outline of the Allotment Pursuant to the Tokyo Electron Share Exchange |

Outline of the Allotment Pursuant to the Tokyo Electron Share Exchange is as described in “2. (3) (a) Holdco Share Exchange Ratio” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

| | (a) | Holdco Share Exchange Ratio |

| | |

| Number of HoldCo Ordinary Shares each Share of Tokyo Electron Common Stock will be Exchanged For Pursuant to the Tokyo Electron Share Exchange (see Note 1) | | 3.25 |

| Total Number of HoldCo Ordinary Shares to be Issued to Tokyo Electron Shareholders in the Tokyo Electron Share Exchange (see Note 2) | | 582,406,373 |

| | | | |

(Note 1) | | Pursuant to the terms of the Tokyo Electron Share Exchange Agreement, Tokyo Electron shareholders will receive 3.25 ordinary shares of HoldCo in exchange for each share of Tokyo Electron held by them immediately prior to the effective time of the Tokyo Electron Share Exchange. Notwithstanding the foregoing, Tokyo Electron will cancel all treasury shares held by it before the Tokyo Electron Share Exchange becomes effective but after the purchase of shares from dissenting shareholders, if any, who exercised appraisal rights provided under the Japanese Companies Act prior to the Tokyo Electron Share Exchange becoming effective. The share exchange ratio identified above has not been amended or modified since the execution of the Business Combination Agreement on September 24, 2013. |

| |

(Note 2) | | Number of new ordinary shares to be distributed by HoldCo to Tokyo Electron Shareholders (Scheduled) |

| |

| | The above has been calculated based on Tokyo Electron’s total number of outstanding shares excluding treasury shares (179,201,961 shares) as of March 31, 2014. |

| |

(Note 3) | | No fractional shares will be issued in connection with the Tokyo Electron Share Exchange. Shareholders of Tokyo Electron who would be entitled to receive fractional shares of HoldCo will receive in the alternative a cash payment calculated in accordance with the terms of the Tokyo Electron Share Exchange Agreement. |

| |

(Note 4) | | Handling Shares less than one unit There is no unit share system under the law of the Netherlands, the jurisdiction of HoldCo’s incorporation. |

| |

| (Note 5) | | HoldCo Share Exchange Ratio with respect to the Applied Materials Merger is as follows: |

4

| | |

| Number of HoldCo Ordinary Shares each Share of Applied Materials Common Stock will be Converted Into Pursuant to the Applied Materials Merger (see Note 5-1) | | 1 |

| Total Number of HoldCo Ordinary Shares to be Issued to Applied Materials Stockholders in the Applied Materials Merger (see Note 5-2) | | 1,217,378,415 |

| | | | |

| |

| (Note 5-1) | | Pursuant to the terms of the Business Combination Agreement, Applied Materials stockholders will receive one ordinary share of HoldCo for each share of Applied Materials common stock held by them as of immediately prior to the effective time of the Applied Materials Merger. Notwithstanding the foregoing, no ordinary shares of HoldCo will be paid or payable in respect of any treasury shares, shares of Applied Materials common stock held by Applied Materials or any of its subsidiaries or to dissenting stockholders who exercise appraisal rights under Delaware law, if available, in each case as of immediately prior to the effective time of the Applied Materials Merger. The share exchange ratio identified above has not been amended or modified since the execution of the Business Combination Agreement on September 24, 2013. |

| |

| (Note 5-2) | | Number of new ordinary shares to be distributed by HoldCo to Applied Materials Stockholders (Scheduled) |

| |

| | The above has been calculated based on Applied Materials’s total number of outstanding shares excluding treasury shares (1,217,378,415 shares) as of April 27, 2014. |

| |

| (Note 5-3) | | No fractional shares will be issued in connection with the Applied Materials Merger. Stockholders of Applied Materials who would be entitled to receive fractional shares of HoldCo will receive in the alternative a cash payment equal to such stockholder’s pro rata share of the proceeds of the fractional shares sold in a commercially reasonable manner. |

(b) Matters regarding consideration in the case where the consideration is the Share Certificate, etc. which is issued by the other company than the companies involved in a reorganization

(i) Outline of HoldCo, which will issue the ordinary shares as consideration

(A) Outline of HoldCo

Outline of HoldCo is as described in “2. (1) HoldCo (Post-amendment)” of the press release “(Amendment) Notice Concerning Amendments to the ‘Notice Regarding the Incorporation of Subsidiaries in Preparation for Business Combination with Applied Materials, Inc.’” dated February 15, 2014.

5

| | | | |

(1) Company Name | | TEL-Applied Holdings B.V. (Note 1) |

(2) Location of Main Office | | Kerkenbos 1015, Unit C, 6546 BB, Nijmegen, the Netherlands |

(3) Representative Director | | Gary Dickerson, CEO and Executive Director (as of the closing of the Business Combination) Tetsuro Higashi, Managing Director (as of the incorporation) |

(4) Business Operation | | Prior to consummation of the Business Combination, HoldCo will take care of the necessary preparations for the Business Combination and business incidental thereto. From and after the closing of the Business Combination, the primary function of HoldCo will be to serve as the holding company of Tokyo Electron and Applied Materials, to manage the businesses and companies of Tokyo Electron and Applied Materials, and to conduct business incidental thereto. |

(5) Capital Stock | | One euro (Note 2) |

(6) Establishment | | January 6, 2014 |

(7) End of Fiscal Year | | December 31 (Note 1) |

(8) Major Shareholders and Shareholding Ratio | | Tokyo Electron 100% |

(9) Relationship between Tokyo Electron and HoldCo | | Capital Relationship | | HoldCo was incorporated as Tokyo Electron’s wholly owned subsidiary and, after the Business Combination, will become the parent company of Tokyo Electron (after the Tokyo Electron Share Exchange) and Applied Materials (after the Applied Materials Merger). |

| | Personnel Relationship | | Tetsuro Higashi, Representative Director of Tokyo Electron, is the initial director of HoldCo. |

| | Business Relationship | | N/A |

| | | | |

| |

| (Note 1) | | The company’s name and fiscal year end is as of the date of incorporation. Tokyo Electron and Applied Materials will change the name of HoldCo and determine the fiscal year end of HoldCo prior to, or in conjunction with, the closing of the Business Combination. In addition, prior to consummation of the Business Combination, HoldCo will be converted from a private limited liability company (besloten vennootschap) organized under the laws of the Netherlands to a public limited liability company (naamloze vennootschap) organized under the laws of the Netherlands. |

| |

| (Note 2) | | The amount of capital stock is as of the date of incorporation. Prior to the Tokyo Electron Share Exchange, HoldCo will issue to TEL Japan GK an amount of ordinary shares of HoldCo necessary to provide the consideration for the Tokyo Electron Share Exchange. Accordingly, the amount of capital stock will be changed. |

6

| | (B) | Operation system of HoldCo |

Upon consummation of the Business Combination, the board of directors of HoldCo will be a board of directors consisting initially of eleven directors. The following persons will be directors of HoldCo upon consummation of the Business Combination.

| | |

| Name | | Position |

| Tetsuro Higashi (Current Chairman, President and Representative Director, CEO of Tokyo Electron) | | Chairman of the Board of Directors |

| Michael Splinter (Current Executive Chairman of Applied Materials) | | Vice Chairman of the Board of Directors |

| Tetsuo Tsuneishi (Current Vice Chairman of Tokyo Electron) | | Vice Chairman of the Board of Directors |

| Gary Dickerson (Current President and CEO of Applied Materials) | | Member of the Board of Directors |

| Three individuals (in addition to Mr. Higashi and Mr. Tsuneishi) designated by Tokyo Electron who qualify as “independent directors” under the applicable rules of Nasdaq and the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

| Three individuals (in addition to Mr. Dickerson and Mr. Splinter) designated by Applied Materials who qualify as “independent directors” under the applicable rules of Nasdaq and applicable rules of the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

| One individual designated jointly by Tokyo Electron and Applied Materials who qualifies as an “independent director” under the applicable rules of Nasdaq and the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

In addition, upon consummation of the Business Combination, Applied Materials’ current President and Chief Executive Officer, Gary Dickerson, will become the Chief Executive Officer of HoldCo and Applied Materials’ current Chief Financial Officer, Robert Halliday, will become the Chief Financial Officer of HoldCo.

| | (C) | Effect of the Business Combination |

Effect of the Business Combination is as described in “5 (3) Effect of the Business Combination” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

| | (D) | Review in Relation to Actual Sustainability |

Review in Relation to Actual Sustainability is as described in “5 (4) Review in Relation to Actual Sustainability” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

| | (ii) | Appraisal Method of the consideration |

| | (A) | Market where consideration will be exchanged |

The TSE and Nasdaq (as scheduled)

7

| | (B) | Agency for the exchange |

Following registration with the U.S. Securities and Exchange Commission and the listing of the shares on the TSE and Nasdaq, the ordinary shares of HoldCo can be traded through entities such as (a) securities companies that are Japan Securities Depository Center Inc. participants and can handle foreign shares, (b) U.S. or other securities companies that participate in the Depository Trust Company, and (c) other brokerages.

| | (C) | Limitation on transfer or other disposal methods of consideration |

| | (D) | Approval by third parties in order to transfer the consideration or execute |

| | (E) | Market price of the consideration |

| | | Not applicable; however, the shares of HoldCo are expected to be listed on the TSE and Nasdaq |

| | (F) | Procedures for scenarios where it is possible to receive a refund for the consideration by obtaining treasury shares, refund the shareholding or other equivalent procedures |

| | (4) | Treatment of Tokyo Electron’s Share Options and Bonds with share options |

Treatment of Tokyo Electron’s Share Options and Bonds with share options is as described in “2. (4) Treatment of Share Options and Bonds with share options” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

Under the Tokyo Electron Share Exchange, share option holders of Tokyo Electron will not be allotted share options or cash to their share options of Tokyo Electron.

Pursuant to the terms of the Business Combination Agreement, all outstanding subscription rights to acquire shares of Tokyo Electron common stock will be acquired without compensation and canceled. Such stock option holders of Tokyo Electron are expected to receive subscription rights to acquire ordinary shares of HoldCo in accordance with the same exchange ratio applied in the Tokyo Electron Share Exchange in the separate process from the Tokyo Electron Share Exchange.

| | | There are no outstanding bonds with share options of Tokyo Electron. |

| | (Note) | Treatment of Applied Materials’ Share Options and Bonds with share options |

| | | Pursuant to the terms of the Business Combination, all outstanding options and other securities exercisable or convertible into shares of Applied Materials common stock will be converted into options and other securities exercisable or convertible into ordinary shares of HoldCo in accordance with the same conversion ratio applied in the Applied Materials Merger. |

| | | There are no outstanding bonds with share options of Applied Materials. |

| 3. | Basis for Calculation of the Allotment Pursuant to the Tokyo Electron Share Exchange |

There are no substantial changes to the statements disclosed in “Basis for Calculation of the Allotment Pursuant to the Business Combination” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

| | (1) | Reason for Selecting the Consideration |

To achieve the objectives of the Business Combination, under which Tokyo Electron and Applied Materials aim to be a leading company that will bring new material innovations in cutting-edge areas, Tokyo Electron and Applied Materials will organize HoldCo in the Netherlands and become sister companies. The shareholders of Tokyo Electron as of immediately prior to the consummation of the

8

Business Combination will become shareholders of HoldCo, which will own Tokyo Electron and Applied Materials as subsidiaries after the Business Combination, and may enjoy synergies created by the Business Combination as shareholders. Pursuant to the Business Combination, shares of Tokyo Electron will be delisted from the TSE and the ordinary shares of HoldCo, which will be the consideration for the Business Combination, are expected to be listed on the TSE and Nasdaq.

The allotment will be made pursuant to the share exchange ratio of the Business Combination (the “Share Exchange Ratio”). In order to support their efforts to ensure the fairness of the Share Exchange Ratio from a financial point of view to the shareholders of Tokyo Electron, Tokyo Electron appointed Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. and its affiliates, including Morgan Stanley & Co. LLC (collectively “Mitsubishi UFJ Morgan Stanley”), as its independent financial advisor to perform a financial analysis of the Share Exchange Ratio. Please see Attachment 2, “Analysis Outline of the Financial Advisor Regarding the Share Exchange Ratio” with respect to the outline of the financial analysis relating to the Share Exchange Ratio conducted by Mitsubishi UFJ Morgan Stanley regarding the Business Combination.

| | (3) | Background of Calculation |

The allotment will be made pursuant to the Share Exchange Ratio. Tokyo Electron carefully negotiated and discussed the Share Exchange Ratio with Applied Materials, comprehensively taking into account various factors including but not limited to the financial position, assets and business prospects of each of Tokyo Electron and Applied Materials, with Tokyo Electron referring to the financial analyses performed by Mitsubishi UFJ Morgan Stanley. Based on the foregoing factors, Tokyo Electron came to a decision that the Share Exchange Ratio set out in Section 2. (3) (a), “Share Exchange Ratio” was appropriate and reached agreement on the Share Exchange Ratio with Applied Materials.

| | (4) | Relationship with Financial Advisor |

Mitsubishi UFJ Morgan Stanley, which is acting as financial advisor to Tokyo Electron, does not constitute a related party of Tokyo Electron or Applied Materials respectively, and does not have any material interest in connection with the Business Combination other than with respect to the fee it will receive for its services, a substantial portion of which is contingent upon the closing of the Business Combination.

| | (5) | Estimate and Reasons for Delisting |

Ordinary shares of Tokyo Electron will be delisted from the TSE in accordance with applicable delisting criteria. Further, HoldCo will submit a listing application to the TSE and Nasdaq for the shares of HoldCo that will be the consideration for the Business Combination.

| | (6) | Measures to Ensure Fairness |

In addition to receiving the financial analyses relating to the Share Exchange Ratio described above, Tokyo Electron received a written opinion of Mitsubishi UFJ Morgan Stanley dated September 24, 2013, that, as of the date of the opinion and based upon and subject to various assumptions, procedures, factors, qualification and limitations set forth therein, including the assumptions described in Attachment 2, the Share Exchange Ratio pursuant to the Business Combination was fair from a financial point of view to the holders of common stock of Tokyo Electron (“Fairness Opinion”).

Further, Tokyo Electron retained Nishimura & Asahi and Jones Day as its legal advisors for matters relating to the Business Combination.

9

| | (7) | Measures to Avoid Conflicts of Interests |

The Tokyo Electron Share Exchange is a part of the Business Combination. There are no identified conflicts of interests between Tokyo Electron and Applied Materials that will arise as a result of the Business Combination and accordingly, no special measures have been taken.

| 4. | Outline of the companies which involved in the Tokyo Electron Share Exchange |

| | Please see Attachment 3 “Outline of Tokyo Electron and TEL Japan GK”. |

| 5. | Post-Tokyo Electron Share Exchange Situation |

| | |

Company Name | | TEL Japan GK (Note 1) |

| | |

Location of Main Office | | 3-1 Akasaka 5-chome, Minato-ku, Tokyo |

| | |

Representative Partner | | Representative Partner TEL-Applied Holdings B.V. (Note 2) Executor Tetsuro Higashi Executor Hirofumi Kitayama |

| | |

Amount of Capital reserve | | not decided |

| | |

Amount of Net Assets | | not decided |

| | |

Amount of Total Assets | | not decided |

| | |

Business Operation | | • To manufacture, purchase and sell electronic products and parts, materials and appurtenances thereof; • To manufacture, purchase and sell physical and chemical appliances and parts, materials and appurtenances thereof; • To conduct research, development and consulting with respect to electronic products, physical and chemical appliances and parts, materials and appurtenances thereof; • To acquire and transfer patents and other industrial property rights and to act as an agent in connection therewith; and • To engage in any other business related to the foregoing. |

(Note 1) The company name is as of the date of incorporation. Tokyo Electron and Applied Materials will change the name of TEL Japan GK prior to, or in conjunction with, the closing of the Business Combination.

(Note 2) TEL-Applied Holdings B.V. is the name of HoldCo as of the date of incorporation. Tokyo Electron and Applied Materials will change the name prior to, or in conjunction with, the closing of the Business Combination. In addition, prior to consummation of the Business Combination, HoldCo will be converted from a private limited liability company (besloten vennootschap) organized under the laws of the Netherlands to a public limited liability company (naamloze vennootschap) organized under the laws of the Netherlands.

| 6. | Overview of Accounting Treatment |

Overview of Accounting Treatment is as described in “6. Overview of Accounting Treatment” of the press release “Notice Regarding the Scheme Change to Combine Tokyo Electron Limited and Applied Materials, Inc.” dated February 15, 2014.

Accounting of Tokyo Electron will be based on US-GAAP. Accounting treatment relating to the Business Combination has not yet been decided, and will be announced after it is determined.

The predicted impact on Tokyo Electron’s business for this fiscal year as a result of the Business Combination has not yet been fixed.

10

Attachment 1

Structure of the Business Combination

| | |

| | |

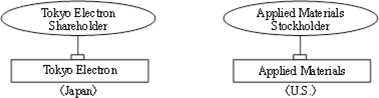

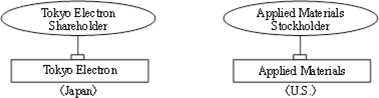

| Before Execution of the Business Combination Agreement | |

|

| | |

| Current Status | |

|

| | |

| Acquisition of TEL Japan GK by HoldCo, and Incorporation of Applied Materials Merger Sub by Applied Materials | |

|

| | |

| Tokyo Electron Share Exchange | |

|

11

| | |

| | |

Applied Materials Merger | |

|

| | |

After the Business Combination | |

|

12

Attachment 2

Analysis Outline of the Financial Advisor Regarding the Share Exchange Ratio

(Outline of Analysis by Financial Advisor of Tokyo Electron)

Mitsubishi UFJ Morgan Stanley analyzed the Share Exchange Ratio by performing valuation analyses based on Historical Exchange Ratio Analysis, Relative Contribution Analysis, Relative DCF Analysis and Selected Precedent Transactions Premium Analysis methodologies and comprehensively considered the results of such analyses.

In the Historical Exchange Ratio Analysis, Mitsubishi UFJ Morgan Stanley reviewed the implied Share Exchange Ratio in relation to the ratio of the daily closing market price of Tokyo Electron common stock on the Tokyo Stock Exchange converted into US Dollars using a JPY/USD exchange rate as of each corresponding date to the daily closing market price of Applied Materials common stock on the NASDAQ as of such date, for various periods ending September 23, 2013. In the Relative DCF Analysis and Relative Contribution Analysis, Mitsubishi UFJ Morgan Stanley used financial projections of Tokyo Electron and Applied Materials on a stand-alone basis, without considering the effect of the Business Combination, both based on equity research estimates and based on forecasts delivered by the managements of Tokyo Electron and Applied Materials.

The following table summarizes the implied ranges of the Share Exchange Ratio calculated by Mitsubishi UFJ Morgan Stanley under each methodology (assuming that the exchange ratio per common stock of Applied Materials is set at 1).

| | |

| Methodology | | Implied Range of the Share Exchange Ratio |

Historical Exchange Ratio Analysis (3-Month Period) (Note 1) | | 2.68x - 3.43x |

Relative Contribution Analysis | | 0.98x - 3.70x |

Relative DCF Analysis | | 2.21x - 4.29x |

Selected Precedent Transactions Premium Analysis | | 2.78x - 3.67x |

As described in Measures to Ensure Fairness (section 3.(6) of this press release), based on the request from the board of directors of Tokyo Electron, Mitsubishi UFJ Morgan Stanley delivered to the board of directors of Tokyo Electron a written opinion (“Fairness Opinion”) that, as of September 24, 2013, the Share Exchange Ratio agreed upon in the Business Combination Agreement was fair, from a financial point of view, to the holders of Tokyo Electron common stock.

The opinion of Mitsubishi UFJ Morgan Stanley in the Fairness Opinion is based upon and subject to various significant assumptions, disclaimers, matters considered and limitations described in the Fairness Opinion. Mitsubishi UFJ Morgan Stanley did not recommend any particular Share Exchange Ratio to Tokyo Electron or the board of directors of Tokyo Electron as the only appropriate Share Exchange Ratio.

For conditions and assumptions regarding the analyses and opinion, please see Note 2 below.

(Note 1) If either the Tokyo Stock Exchange or NASDAQ was closed while the other stock exchange was open, Mitsubishi UFJ Morgan Stanley applied the closing market price on the prior trading day to such day of the closing market price of those shares where the stock market is closed, to calculate the exchange ratio to review in relation to the implied Share Exchange Ratio, and deemed such day as a trading day.

(Note 2) Mitsubishi UFJ Morgan Stanley’s Fairness Opinion and analysis and calculation of the above ranges of the Share Exchange Ratio as the basis thereof, is directed to Tokyo Electron’s board of directors and addresses only the fairness from a financial point of view of the Share Exchange Ratio pursuant to the Business Combination Agreement to holders of shares of common stock of Tokyo Electron as of the date of the Fairness Opinion. The Fairness Opinion and analysis do not address any other aspects of the transaction and do not constitute an opinion or recommendation to any shareholders of Tokyo Electron or Applied Materials as to how such shareholder should vote or act on any matter at any shareholder meeting with respect to the Business Combination. Mitsubishi UFJ Morgan Stanley did not recommend any specific Share Exchange Ratio to Tokyo Electron or its board of directors or that any specific Share Exchange Ratio constituted the only appropriate Share Exchange Ratio for the Business Combination. The Fairness Opinion and analysis do not purport to be an appraisal or to reflect the prices at which shares of common stock of Tokyo Electron, Applied Materials or HoldCo might actually trade.

13

For purposes of the Fairness Opinion and its analysis, Mitsubishi UFJ Morgan Stanley has:

| (a) | Reviewed certain publicly available financial statements and other business and financial information, including equity research estimates, of Tokyo Electron and Applied Materials, respectively; |

| (b) | Reviewed certain internal financial statements and other financial and operating data concerning Tokyo Electron and Applied Materials, respectively; |

| (c) | Reviewed certain financial projections delivered by the managements of Tokyo Electron and Applied Materials, respectively; |

| (d) | Reviewed information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, prepared by the managements of Tokyo Electron and Applied Materials, respectively; |

| (e) | Discussed the past and current operations and financial condition and the prospects of Applied Materials, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, with senior executives of Applied Materials; |

| (f) | Discussed the past and current operations and financial condition and the prospects of Tokyo Electron, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, with senior executives of Tokyo Electron; |

| (g) | Reviewed the pro forma impact of the Business Combination on Tokyo Electron’s earnings per share, cash flow, consolidated capitalization and financial ratios; |

| (h) | Reviewed the reported prices and trading activity for Tokyo Electron common stock and Applied Materials common stock; |

| (i) | Compared the financial performance of Tokyo Electron and Applied Materials and the prices and trading activity of Tokyo Electron common stock and Applied Materials common stock with that of certain other publicly-traded companies comparable with Tokyo Electron and Applied Materials, respectively, and their securities; |

| (j) | Reviewed the financial terms, to the extent publicly available, of certain comparable transactions; |

| (k) | Participated in certain discussions and negotiations among representatives of Tokyo Electron and Applied Materials and certain parties and their accounting, tax and legal advisors; |

| (l) | Reviewed the Business Combination Agreement, substantially in the form of the draft dated September 23, 2013, and certain related documents; and |

| (m) | Reviewed such other information and considered such other factors as Mitsubishi UFJ Morgan Stanley deemed appropriate. |

Mitsubishi UFJ Morgan Stanley assumed and relied upon, without independent verification, the accuracy and completeness of the information that was publicly available or supplied or otherwise made available to it by Tokyo Electron and Applied Materials, and formed a substantial basis for its Fairness Opinion and analysis. With respect to the financial projections, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, Mitsubishi UFJ Morgan Stanley assumed that they have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the respective managements of Tokyo Electron and Applied Materials of the future financial performance of Tokyo Electron and Applied Materials. In addition, Mitsubishi UFJ Morgan Stanley assumed that the Business Combination will be consummated in accordance with the terms set forth in the Business Combination Agreement without any waiver, amendment or delay of any terms or conditions and that the exchange of Shares of Tokyo Electron common stock for HoldCo common stock at the Exchange Ratio will be non-taxable for the holders of shares of Tokyo Electron common stock. Mitsubishi UFJ Morgan Stanley assumed that in connection with the receipt of all the necessary governmental, regulatory or other approvals and consents required for the proposed Business Combination, no delays, limitations, conditions or restrictions will be imposed that would have a material adverse effect on the contemplated benefits expected to be derived in the proposed Business Combination. Mitsubishi UFJ Morgan Stanley is not a legal, accounting, tax, regulatory or actuarial advisor. Mitsubishi UFJ Morgan Stanley is a financial advisor only and relied upon, without independent verification, the assessment of Tokyo Electron and its legal, accounting and tax advisors with respect to legal, accounting, tax, regulatory or actuarial matters. Mitsubishi UFJ Morgan Stanley has not made any independent valuation or appraisal of the assets or liabilities of Tokyo Electron or Applied Materials, nor has Mitsubishi UFJ Morgan Stanley been furnished with any such valuations or appraisals. The analysis and Fairness Opinion of Mitsubishi UFJ Morgan Stanley was necessarily based on financial, economic, market and other conditions as in effect on, and the information made available to Mitsubishi UFJ Morgan Stanley as of, the date of the Fairness Opinion. Events occurring after such date might have an effect on the analysis and Fairness Opinion and the assumptions used in preparing it, and Mitsubishi UFJ Morgan Stanley has not assumed any obligation to update, revise or reaffirm its analysis and Fairness Opinion. In arriving at its Fairness Opinion, Mitsubishi UFJ Morgan Stanley was not authorized to solicit, and did not solicit, interest from any party with respect to any merger, business combination or other extraordinary transaction involving Tokyo Electron.

The preparation of a fairness opinion and the analysis as the basis thereof is a complex process and is not necessarily susceptible to a partial analysis or summary description. In arriving at its opinion, Mitsubishi UFJ Morgan Stanley considered the results of all of its analyses as a whole and did not attribute any particular weight to any analysis or factor it considered. Mitsubishi UFJ Morgan Stanley believes that selecting any portion of its analyses, without considering all analyses as a whole, would create an incomplete view of the process underlying its analyses and opinion. In addition, Mitsubishi UFJ Morgan Stanley may have given various analyses and factors more or less weight than other analyses and factors, and may have deemed various assumptions more or less probable than other assumptions. As a result, the range of valuations resulting from any particular analysis described herein should not be taken to be Mitsubishi UFJ Morgan Stanley’s view of the actual value of Tokyo Electron or Applied Materials. In performing its analyses, Mitsubishi UFJ Morgan Stanley made numerous assumptions with respect to industry performance, general business and economic conditions and other matters, many of which are beyond the control of Tokyo Electron or Applied Materials. Any estimates contained in Mitsubishi UFJ Morgan Stanley’s analyses are not necessarily indicative of future results or actual values, which may be significantly more or less favorable than those suggested by these estimates. The summary contained herein describes the material analyses performed by Mitsubishi UFJ Morgan Stanley but does not purport to be a complete description of the analyses performed by Mitsubishi UFJ Morgan Stanley.

The Share Exchange Ratio was determined through arm’s length negotiations between Tokyo Electron and Applied Materials and was approved by Tokyo Electron’s board of directors. Mitsubishi UFJ Morgan Stanley’s analysis and Fairness Opinion and its presentation to Tokyo Electron’s representatives was only one of many factors taken into consideration by Tokyo Electron’s board of directors in deciding to approve the Business Combination. Consequently, the analyses as described herein should not be viewed as determinative of the opinion of Tokyo Electron’s board of directors with respect to the Share Exchange Ratio or of whether Tokyo Electron’s board of directors would have been willing to agree to a different share exchange ratio.

14

Mitsubishi UFJ Morgan Stanley has acted as financial advisor to the board of directors of Tokyo Electron in connection with this transaction and will receive a fee for its services, a substantial portion of which is contingent upon the closing of the Business Combination. In the past, Mitsubishi UFJ Morgan Stanley has provided financial advisory and financing services for Applied Materials and has received customary fees in connection with such services. Mitsubishi UFJ Morgan Stanley may also seek to provide such services to Tokyo Electron and Applied Materials or HoldCo in the future and would expect to receive fees for the rendering of these services.

Please note that Mitsubishi UFJ Morgan Stanley is a global financial services firm engaged in the banking (including financing for Tokyo Electron and Applied Materials), securities, trust, investment management, credit services and other financial businesses (collectively, “Financial Services”). Its securities business is engaged in securities underwriting, trading, and brokerage activities, foreign exchange, commodities and derivatives trading, as well as providing investment banking, financing and financial advisory services. In the ordinary course of its underwriting, trading, brokerage and financing activities, Mitsubishi UFJ Morgan Stanley may at any time hold long or short positions, may provide Financial Services to Tokyo Electron, Applied Materials, or companies that may be involved in this transaction and may trade or otherwise effect transactions, for its own account or the accounts of customers, in debt or equity securities or loans of Tokyo Electron, Applied Materials, or any company that may be involved in this transaction, or in any currency or commodity that may be involved in this transaction, or in any related derivative instrument. Mitsubishi UFJ Morgan Stanley, its directors and officers may also at any time invest on a principal basis or manage funds that invest on a principal basis, in debt or equity securities of Tokyo Electron, Applied Materials, or any company that may be involved in this transaction, or in any currency or commodity that may be involved in this transaction, or in any related derivative instrument. Further, Mitsubishi UFJ Morgan Stanley may at any time carry out ordinary course broking activities for Tokyo Electron, Applied Materials, or any company that may be involved in this transaction.

15

Attachment 3

Description of Tokyo Electron and TEL Japan GK

| | | | | | | | | | |

| | | | | Tokyo Electron | | | TEL Japan GK |

| | | | |

| (1) | | Company Name | | Tokyo Electron Limited | | | TEL Japan GK |

| | | | |

| (2) | | Address | | 3-1 Akasaka 5-chome, Minato-ku, Tokyo | | | 3-1 Akasaka 5-chome, Minato-ku, Tokyo |

| | | | |

| (3) | | Representative Director | | Tetsuro Higashi | | | Representative Partner Tokyo Electron Executor Tetsuro Higashi Executor Hirofumi Kitayama |

| | | | |

| (4) | | Business Operation | | • Semiconductor Production Equipment • FPD Production Equipment | | | • To manufacture, purchase and sell electronic products and parts, materials and appurtenances thereof; • To manufacture, purchase and sell physical and chemical appliances and parts, materials and appurtenances thereof; • To conduct research, development and consulting with respect to electronic products, physical and chemical appliances and parts, materials and appurtenances thereof; • To acquire and transfer patents and other industrial property rights and to act as an agent in connection therewith; and • To engage in any other business related to the foregoing. |

| | | | |

| (5) | | Capital Stock | | JPY 54,961 million | | | JPY1,000,000 |

| | | | |

| (6) | | Established | | April 6, 1951 (Incorporation) November 11, 1963 (Start of Business) | | | May 1, 2014 |

| | | | |

| (7) | | Number of Issued Stock | | 180,610,911 (As of March 31, 2014) | | | Not Applicable |

| | | | |

| (8) | | End of Fiscal Year | | March 31 | | | December 31 |

| | | | |

| (9) | | Headcounts | | (Consolidated Basis) 12,304 (As of March 31, 2014) (Non-consolidated Basis) 1,542 (As of March 31, 2014) | | | Not Applicable |

| | | | |

| (10) | | Main Banks | | • The Bank of Tokyo-Mitsubushi UFJ • Sumitomo Mitsui Banking Corporation | | | Not Applicable |

| (11) | | Major Shareholders (Major Partners) and Shareholding Ratio (Interest Ratio) (For Tokyo Electron, each shareholder’s shareholding ratio is calculated by dividing the number of shares held by shareholders as of March 31, 2014 by the total number of issued shares (excluding treasury shares) as of March 31, 2014.) | | The Master Trust Bank of Japan, Ltd. (trust account) | | | 10.68% | | | HoldCo 100% (See Note 1) |

| | | | Japan Trustee Services Bank, Ltd. (trust account) | | | 6.51% | | |

| | | | Tokyo Broadcasting System Holdings, Inc. | | | 4.31% | | |

| | | | The Bank of New York Mellon as Depositary Bank for DR Holders | | | 3.74% | | |

| | | | Deutsche Bank Trust Company Americas | | | 2.94% | | |

| | | | BNP Paribas | | | 1.95% | | |

| | | | Mitsubishi UFJ Morgan Stanley | | | 1.82% | | |

| | | | State Street Bank and Trust Company 505225 | | | 1.65% | | |

| | | | The Bank of New York Mellon SA/NV 10 | | | 1.64% | | |

| | | | Trust & Custody Services Bank, Ltd. | | | 1.33% | | |

16

| | | | | | | | | | | | | | | | |

| (12) | | Relationship between Tokyo Electron and TEL Japan GK |

| | | |

| | | Capital Relationship | |

| TEL Japan GK will be incorporated as a wholly owned subsidiary of Tokyo

Electron. Prior to the Tokyo Electron Share Exchange, TEL Japan GK will become a

wholly owned subsidiary of HoldCo. |

| | | |

| | | Personnel Relationship | |

| Tetsuro Higashi and Hirofumi Kitayama, Representative Directors of Tokyo

Electron, will be Executors of the Tokyo Electron Share Exchange Sub. |

| | | |

| | | Business Relationship | | | No business relationship which should be disclosed between the Companies. |

| | | |

| | | Whether either company fall within the Related Party of the other | | | Not Applicable |

| | |

| (13) | | Operating Results and Financial Status for the Latest 3 Years |

| | | | |

| | | Fiscal Year | | Tokyo Electron (Consolidated Basis) | | | TEL Japan GK |

| | | | | March 2012 | | | | March 2013 | | | | March 2014 | | | Not Applicable |

| | | Consolidated Net Assets | | | 598,602 | | | | 605,127 | | | | 590,613 | | |

| | | Consolidated Total Assets | | | 783,610 | | | | 775,527 | | | | 828,591 | | |

| | | Consolidated Net Assets per Share | | | 3,275.14 | | | | 3,309.58 | | | | 3,225,92 | | |

| | | Consolidated Sales Amount | | | 633,091 | | | | 497,299 | | | | 612,170 | | |

| | | Consolidated Operating Income | | | 60,443 | | | | 12,548 | | | | 32,204 | | |

| | | Consolidated Ordinary Income | | | 64,046 | | | | 16,696 | | | | 35,487 | | |

| | | Consolidated Net Income (D Loss) | | | 36,725 | | | | 6,076 | | | | D 19,408 | | |

| | | Consolidated Net Income per

Share (D Loss) | | | 205.04 | | | | 33.91 | | | | D 108.31 | | |

| | | Dividend per Share | | | 80.00 | | | | 51.00 | | | | 50.00 | | |

(Note: Numbers are in millions of Japanese Yen; however, for Consolidated Net Assets per Share, Consolidated Net Income per Share and Dividend per Share, numbers are in Japanese Yen.)

| | |

| (Note 1) | | TEL Japan GK was incorporated as a wholly owned subsidiary of Tokyo Electron on May 1, 2014. Prior to the Tokyo Electron Share Exchange, TEL Japan GK will become a wholly owned subsidiary of HoldCo. |

17

Forward-Looking Statements

This communication contains forward-looking statements, including but not limited to those regarding the proposed business combination between Applied Materials, Inc. (“Applied Materials”), and Tokyo Electron Limited (“Tokyo Electron”) (the “Business Combination”) and the transactions related thereto. These statements may discuss the anticipated manner, terms and conditions upon which the Business Combination will be consummated, the persons to be appointed officers and directors of TEL-Applied Holdings B.V., a Dutch private limited liability corporation (“HoldCo”), trends and the future performance of their businesses, the synergies of Applied Materials and Tokyo Electron, and similar things. Forward-looking statements may contain words such as “expect,” “believe,” “may,” “can,” “should,” “will,” “forecast,” “anticipate” or similar expressions, and include the assumptions that underlie such statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the ability of the parties to consummate the Business Combination in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Business Combination, including the ability to secure regulatory approvals in a timely manner or at all, and approval by Applied Materials’ and Tokyo Electron’s stockholders; the possibility of litigation (including related to the Business Combination itself); Applied Materials’ and Tokyo Electron’s ability to successfully integrate their operations, product lines, corporate structures, transfer pricing policies, technology and employees and realize synergies, savings and growth expected to result from the Business Combination; unknown, underestimated or undisclosed commitments or liabilities; the potential impact of the announcement or consummation of the proposed transactions on the parties’ relationships with third parties; the level of demand for the combined companies’ products, which is subject to many factors, including uncertain global economic and industry conditions, demand for electronic products and semiconductors, and customers’ new technology and capacity requirements; Applied Materials’ and Tokyo Electron’s ability to (i) develop, deliver and support a broad range of products, expand their markets and develop new markets, (ii) timely align their cost structures with business conditions, and (iii) attract, motivate and retain key employees; and other risks described in the Applied Materials’ filings with the Securities & Exchange Commission (the “SEC”), Tokyo Electron’s filings with the Financial Services Agency of Japan and the registration statement on Form S-4 (the “Registration Statement”) filed with the SEC by HoldCo and declared effective on May 13, 2014. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. Except as required under applicable law, none of Applied Materials, Tokyo Electron or HoldCo undertakes any obligation to update any forward-looking statements.

No Offer or Solicitation

This announcement is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and applicable regulations in the Netherlands and Japan.

Additional Information and Where to Find It

HoldCo has filed the Registration Statement with the SEC, which includes a definitive prospectus with respect to HoldCo’s ordinary shares to be issued in the Business Combination and a definitive proxy statement of Applied Materials in connection with the Business Combination. The registration statement was declared effective by the SEC on May 13, 2014. Applied Materials and Tokyo Electron plan to provide to their respective stockholders or shareholders, as applicable, the definitive prospectus with respect to HoldCo’s ordinary shares to be issued in the Business Combination and, with respect to Applied Materials stockholders, the definitive proxy statement of Applied Materials in connection with the Business Combination. SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE DEFINITIVE PROSPECTUS AND DEFINITIVE PROXY STATEMENT FILED

18

WITH THE SEC CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT APPLIED MATERIALS, TOKYO ELECTRON, HOLDCO, THE BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Registration Statement, the definitive prospectus and the definitive proxy statement and other relevant materials and any other documents filed by Applied Materials, HoldCo or Tokyo Electron with the SEC free of charge at the SEC’s web site at www.sec.gov. In addition, security holders may obtain free copies of the Registration Statement and other documents filed with the SEC from Applied Materials or Tokyo Electron by contacting either (1) Investor Relations by mail at Applied Materials, Inc., 3050 Bowers Avenue M/S 1261, P.O. Box 58039, Santa Clara, CA 95054-3299, Attn: Investor Relations Department, by telephone at 408-748-5227, or by going to Applied Materials’ Investor Relations page on its corporate web site at www.appliedmaterials.com or (2) for media inquiries: Tokyo Electron’s Public Relations Group, by mail at Tokyo Electron Limited, Akasaka Biz Tower, 3-1 Akasaka 5-chome, Minato-ku, Tokyo 107-6325, by telephone at +81-3-5561-7004, or by email at telpr@tel.com; and for analyst inquiries: Tokyo Electron’s Investor Relations Group, by mail at Tokyo Electron Limited, Akasaka Biz Tower, 3-1 Akasaka 5-chome, Minato-ku, Tokyo 107-6325, by telephone at +81-3-5561-7383, or by email at telir@tel.com, or by going to Tokyo Electron’s Investor Relations page on its corporate web site at www.tel.com.

Participants in the Solicitation

Applied Materials, Tokyo Electron, HoldCo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Applied Materials’ stockholders in connection with the proposed Business Combination. Information about Applied Materials’ directors and executive officers is set forth in Applied Materials’ Proxy Statement on Schedule 14A for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on January 21, 2014, and its Annual Report on Form 10-K for the fiscal year ended October 27, 2013, which was filed with the SEC on December 4, 2013. These documents are available free of charge at the SEC’s web site at www.sec.gov, and from Applied Materials by contacting Investor Relations by mail at Applied Materials, Inc., 3050 Bowers Avenue M/S 1261, P.O. Box 58039, Santa Clara, CA 95054-3299, Attn: Investor Relations Department, or by going to Applied Materials’ Investor Relations page on its corporate web site at www.appliedmaterials.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed Business Combination is included in the Registration Statement and definitive proxy statement and other relevant materials filed with the SEC when they become available.

About Applied Materials

Applied Materials, Inc. (Nasdaq: AMAT) is the global leader in providing innovative equipment, services and software to enable the manufacture of advanced semiconductor, flat panel display and solar photovoltaic products. Our technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world. Learn more at www.appliedmaterials.com.

About Tokyo Electron

Tokyo Electron Limited (TSE: 8035), established in 1963, is a global supplier of semiconductor and flat panel display production equipment, and a provider of technical support and services for semiconductor, flat panel display and photovoltaic panel production equipment worldwide. TEL has located research & development, manufacturing, sales, and service locations all over the world. http://www.tel.com

19