| | |

Filed by Tokyo Electron Limited Pursuant to Rule 425 Under the Securities Act of 1933 And Deemed Filed Pursuant to Rule 14a-12 Under the Securities Exchange Act of 1934 Subject Company: Tokyo Electron Limited; TEL-Applied Holdings B.V. ; Applied Materials, Inc. Commission File No. 132-02780 |

| | 1 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | | | |

| | ISIN | | JP3571400005 |

| | SEDOL | | 6895675 |

| | TSE | | 8035 |

May 29, 2014

NOTICE OF FISCAL YEAR 2014 (the 51ST FY)

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Our Shareholders:

We are pleased to announce that the 51st Annual General Meeting of Shareholders (the “AGM”) of Tokyo Electron Limited (“TEL”) will be held on Friday, June 20, 2014, at 10:00 a.m. Japan standard time, at ANA InterContinental Tokyo, located at 1-12-33 Akasaka, Minato-ku, Tokyo.

Shareholders will also be asked to vote upon the following Agenda:

| 1: | Approval of the Share Exchange Agreement between the Company and TEL Japan GK regarding the Business Combination with Applied Materials |

| 2: | Election of Nine Corporate Directors |

As part of our ongoing effort to improve the quality of communications with our foreign investors and to increase the participation of those investors at the AGM,Tokyo Electron Limited has appointed IR Japan, Inc. as our Global Information Agent in connection with the shareholder meeting. We realize that many shareholders do not vote at Japanese Shareholders Meeting due to the volume of meetings and timing concerns. Therefore, we attach special importance to your vote, and hope that you will continue to distinguish yourselves from many institutions, who, unfortunately, do not participate.

Should you have any questions, please contact IR Japan, Inc.’s New York Branch at (1) -646-495-5059 or Tokyo Head Quarters at (81) -3-3796-1185, or e-mail tobna@irjapan.net. The English language proxy material is available on Tokyo Electron’s website at“http://www.tel.com/”, for your reference and convenience.

IT IS IMPORTANT THAT YOU PARTICIPATE AT THE 2014 AGM, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. IF YOU ARE UNABLE TO ATTEND THE AGM, PLEASE CONTACT YOUR BROKER OR CUSTODIAN WITH YOUR VOTING INSTRUCTIONS AS SOON AS POSSIBLE.

*NOTE: A shareholder is entitled to vote per unit of shares, with each unit consisting of one hundred (100) shares.

Sincerely,

Tetsuro Higashi

Chairman of the Board, President & CEO

Tokyo Electron Limited

This is a summary translation of a notice in Japanese language distributed to Japanese shareholders and provided for the convenience of foreign shareholders. The Japanese version is the official, legal document. Please vote by voting form or Internet websites etc. by 5:30 p.m. on Thursday, June 19, 2014 (Japan standard time).

| | |

| | 2 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

Information Relating to Annual General Meeting of Shareholders

Proposal and information

Items to be reported:

| | 1. | Report on the business report, the consolidated financial statements for FY2014 (the 51st FY; from April 1, 2013 to March 31, 2014), and the reports of Accounting Auditors and the Audit & Supervisory Board on the results of audits for consolidated financial statements. |

| | 2. | Report on the financial statements for FY2014 (the 51st FY; from April 1, 2013 to March 31, 2014). |

Proposal 1: Approval of the Share Exchange Agreement between the Company and TEL Japan GK regarding the Business Combination with Applied Materials

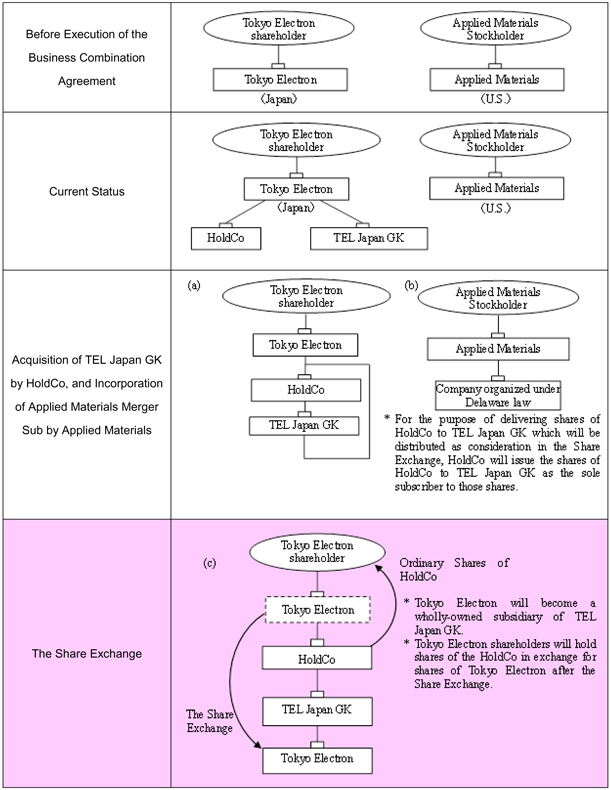

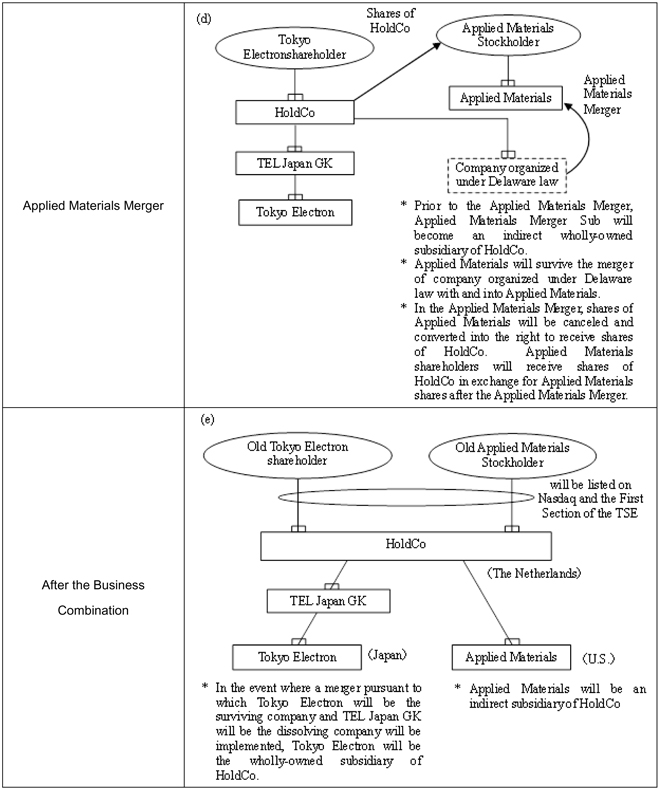

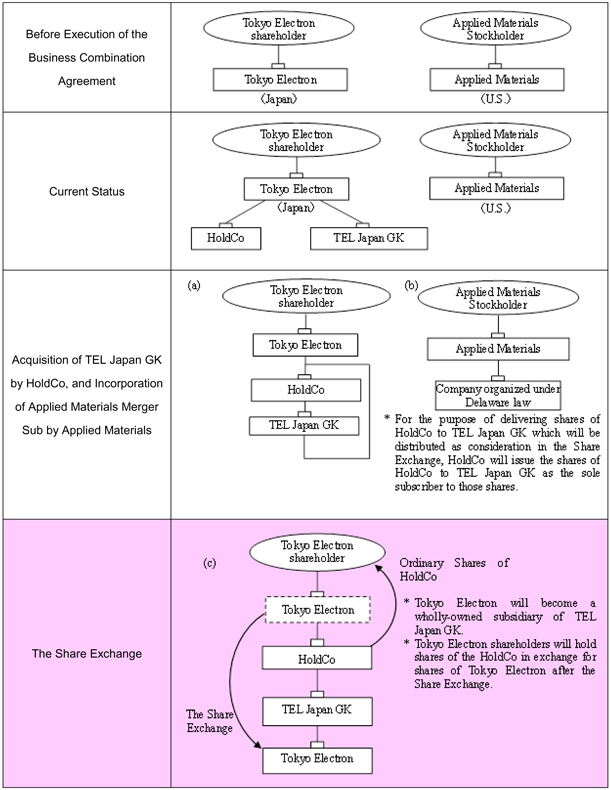

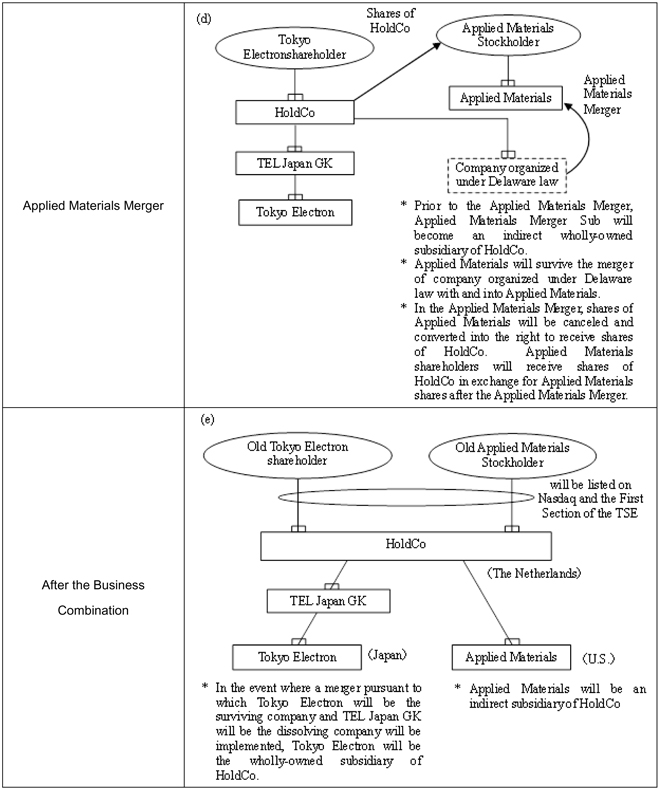

Tokyo Electron Limited (the “Company” or “Tokyo Electron”) agreed to a business combination through a merger of equals with Applied Materials, Inc. (“Applied Materials”) and executed a business combination agreement dated September 24, 2013 (as amended, the “Business Combination Agreement”) with Applied Materials. Upon consummation of the business combination, the Company will implement a triangular share exchange, and Applied Materials will implement a triangular merger. As a result, each of the Company and Applied Materials will be wholly owned subsidiaries of a holding company organized under the laws of the Netherlands (“HoldCo”). Pursuant to the business combination, among other things, the Company will enter into a share exchange with TEL Japan GK, which was established for the purpose of the business combination whereby the Company will become a wholly owned subsidiary of HoldCo. Accordingly, the Company executed a share exchange agreement with TEL Japan GK as of May 14, 2014.

The effective date of the share exchange to be approved at this general meeting is set for September 24, 2014 in the current share exchange agreement, which is tentative. In order for the business combination, including the share exchange, to be consummated, each of the conditions precedent (for example, the approval to consummate the business combination from the Companies’ respective shareholders and the approval of certain governmental regulators and authorities under applicable competition laws in Japan, the U.S. and other countries) set forth in the Business Combination Agreement must be satisfied or waived, and it is uncertain when each of all the conditions will be satisfied or waived. Accordingly, the timing of consummation of the share exchange is dependent on the satisfaction or waiver of these conditions. See below under “4. Outline of the Share Exchange Agreement” for further information regarding how the effective date of the share exchange will be set, announced and, if necessary, adjusted prior to consummation of the business combination.

We would like the shareholders to approve the share exchange agreement. Approval of the shareholders is a condition to the consummation of the business combination and is required under the Companies Act of Japan in order to consummate the share exchange.

| | |

| | 3 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

1. Reason for Share Exchange

Since their foundation, the Company and Applied Materials have been innovators in semiconductor and display technology for more than 50 years. Today, mobile devices, including PCs, smartphones and tablets, have made significant advances, and the demand for faster technology innovation, for the diversification of technology, and for the cost efficiencies has reached levels not yet seen in the past.

To support the industries’ continued growth toward creating a more enriched society, we need to meet new technological challenges with better solutions quickly at lower cost. The purpose of the business combination is to provide innovative solutions that will achieve better device performance and yield enhancement and cost improvement to meet these challenges.

Through the business combination, both the Company and Applied Materials will combine a wide variety of human resources and technologies in the semiconductor and display manufacture industry, and aim to be a leading company that will bring new material innovations in the cutting-edge areas, including transistor, interconnect layers, advanced packaging and display.

The business combination will be implemented through the following steps.

| (i) | The Company and TEL Japan GK will effect the share exchange pursuant to the share exchange agreement to be approved at this general meeting (pursuant to which each issued and outstanding share of the Company (excluding the treasury shares held by the Company ) will be exchanged for 3.25 ordinary shares of HoldCo). |

As a result of this share exchange, the Company will become a wholly owned subsidiary of TEL Japan GK. The Company will also become an (indirect) wholly owned subsidiary of HoldCo since TEL Japan GK will be a wholly owned subsidiary of HoldCo as of the effective time of the share exchange. (See Attachment 4, “The Share Exchange”.)

| (ii) | Applied Materials and a company organized under Delaware law which will be indirectly owned by HoldCo will be involved in a triangular merger (pursuant to which Applied Materials will be the surviving company and the other company will be the dissolving company and each issued and outstanding share of Applied Materials (excluding the treasury shares held by Applied Materials) will be converted into the right to receive one ordinary share of HoldCo.) (See Attachment 4, “Applied Materials Merger”.) |

| (iii) | The ordinary shares of HoldCo are expected to be listed on the Tokyo Stock Exchange (the “TSE”) and the Nasdaq Global Select Market (“Nasdaq”). (See Attachment 4, “After the business combination”) |

The Company intends to implement the merger as an intragroup reorganization after the business combination, which will be effective on the same date as the effective date of the share exchange. Under this merger, the Company will be the surviving company and TEL Japan GK will be the dissolving company, which is not subject to an approval of this general meeting. In the event that the merger is implemented, the Company will become a direct wholly owned subsidiary of HoldCo, while the Company will become an indirect wholly owned subsidiary of HoldCo as of immediately after the share exchange.

| | |

| | 4 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

2. Outline of HoldCo after the consummation of the Business Combination

| | | | |

| Company Name (Note 1) | | TEL-Applied Holdings B.V. (tentative) |

| Head office | | Both in Tokyo, Japan and Santa Clara, California |

| Country of company registration | | The Netherlands |

| Securities Exchange in which HoldCo will be listing | | TSE and Nasdaq Shares of HoldCo will be traded in Japanese yen and one trading unit is one share in TSE. |

| Place of a general meeting | | The Netherlands |

| Directors and officers (Note 2) | | Chairman of the Board of Directors | | Tetsuro Higashi (Current Chairman, President and Representative Director, CEO of Tokyo Electron) |

| | | Vice Chairman of the Board of Directors | | Tetsuo Tsuneishi (Current Vice Chairman of Tokyo Electron) Michael Splinter (Current Executive Chairman of Applied Materials) |

| | | CEO | | Gary Dickerson (Current President and CEO of Applied Materials) |

| | | CFO | | Robert Halliday (Applied Materials’ current CFO) |

| Board of directors | | The board of directors will be made up of eleven directors (seven of the directors are independent directors). Five of the directors will be designated by the Company (three of the directors designated by the Company will be independent directors). Five of the directors are designated by Applied Materials (three of the directors designated by Applied Materials will be independent directors). One of the directors will be designated jointly by the Company and Applied Materials and will be an independent director. |

| Dividend | | Whether any dividends are declared or paid to holders of HoldCo ordinary shares, and the amounts of any dividends that are declared or paid, will be determined after the consummation of the Business Combination. The currency of any dividends received by the shareholders who will own the ordinary shares of HoldCo through the Japan Securities Depository Center Inc will be converted into yen after the dividend payment by the Company. |

| Repurchase of shares | | HoldCo intends to commence a $3.0 billion stock repurchase program targeted to be executed within 12 months following the consummation of business combination. |

| | (Note 1) | The Company and Applied Materials will change the name of HoldCo prior to, or in conjunction with, the closing of the business combination. |

| | (Note 2) | CEO means Chief Executive Officer, CFO Chief Financial Officer. |

| | |

| | 5 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

3. Timeline of the Share Exchange

| | |

| Execution of the Business Combination Agreement | | September 24, 2013 |

| Record Date of the shareholders meeting of Tokyo Electron | | March 31, 2014 |

| Date when the board of directors of Tokyo Electron resolved to approve the Share Exchange Agreement | | May 14, 2014 |

| Date of the shareholders meetings of Tokyo Electron where the share exchange agreement will be submitted for approval | | June 20, 2014 |

| Delisting Date (Tokyo Electron) | | September 18, 2014

(not final) (Note 1) |

| Effective Date of the Share Exchange | | September 24, 2014

(not final) (Note 2) |

| Closing for the Business Combination (Effective Date) | | September 24, 2014

(not final) |

| Listing Date of the HoldCo (TSE, First Section (foreign)) | | September 24, 2014

(not final) |

| | (Note 1) | The date of the delisting will be determined by the TSE considering the status of the finalization of the effective date of the Share Exchange. In response to the change of the effective date of the Share Exchange, the delisting date will also be changed. Generally, the delisting date is expected to be three business days prior to the effective date of the Share Exchange. |

| | (Note 2) | As described in the beginning section of this proposal, the effective date set as of today is not final, and there is a possibility that the current effective date will be changed to a different date. |

| | (Note 3) | The shareholders will be advised in detail of the affairs regarding the share exchange via mail after this general meeting. |

| | (Note 4) | In order to consummate the Business Combination, the approval of the Business Combination Agreement at a general meeting of shareholders of Applied Materials is required. The date of the general meeting of shareholders of Applied Materials to approve the Business Combination Agreement will be June 23, 2014 (California time). |

4. Outline of the Share Exchange Agreement

<Summary>

The share exchange agreement to be approved at this general meeting is executed in order to implement 1 (i) (the share exchange pursuant to the share exchange agreement between the Company and TEL Japan GK) above. The share exchange agreement is executed between the Company and TEL Japan GK, and includes the following terms: (a) TEL Japan GK will obtain all of the issued and outstanding shares of the Company and (b) the shareholders of the Company will receive 3.25 ordinary shares, nominal value of €0.01 per ordinary share.

The effective date of the share exchange is set for September 24, 2014 in the current share exchange agreement to be approved. However, the share exchange is a part of the business combination and the Business Combination Agreement provides various conditions precedent for closing, the timing of consummation of which are dependent on the satisfaction or waiver of various conditions under the Business Combination Agreement. The business combination, including the share exchange, shall take place generally on a date to be designated jointly by the Company and Applied Materials, which shall be no later than the 10th business day after the satisfaction or waiver of each of all the conditions set forth in the Business Combination Agreement. Therefore, the effective date set forth in the current share exchange agreement is tentative and may be changed to a different date depending on when the conditions of the business combination are satisfied or waived (see Note). Pursuant to the Companies Act of Japan, in the event that the effective date of the share exchange is changed, the Company will issue a public notice of the new effective date of the share exchange no later than the day preceding the effective date set before the change.

| | |

| | 6 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (Note) | The specific process to change the effective date will be as follows: |

In the case where it turns out that the conditions precedent of the business combination will have not yet been satisfied or waived as of the effective date (September 24, 2014) set forth in the current share exchange agreement, the Company and Applied Materials plan to postpone the effective date to a later date after September 24, 2014, before which date each of all the conditions precedent of the Business Combination Agreement are expected to have been satisfied or waived. After that, when the timing of the satisfaction or waiver of each of the conditions can be predicted, the effective date will be finalized and set on an appropriate date. Considering the delisting process for the Tokyo Electron shares, the listing process for the HoldCo shares, and other necessary procedures, Tokyo Electron and Applied Materials plan to, in accordance with the Business Combination Agreement, set the effective date of the share exchange as the 10th business day after the satisfaction or waiver of all the conditions precedent of the Business Combination Agreement unless otherwise agreed by the parties. Tokyo Electron will announce the final effective date of the Tokyo Electron Triangular Share Exchange as soon as it is determined.

The share exchange agreement is as follows:

TEL SHARE EXCHANGE AGREEMENT

TEL JAPAN GK, agodo kaisha having its offices at 3-1 Akasaka 5-chome, Minato-ku, Tokyo (“TEL Exchange Sub”), andTOKYO ELECTRON LIMITED, akabushiki kaisha having its offices at 3-1 Akasaka 5-chome, Minato-ku, Tokyo (“TEL”), hereby execute the following Share Exchange Agreement (hereinafter referred to as this “Agreement”) as of May 14, 2014 (the “Execution Date”). Immediately preceding the effective time of the TEL Share Exchange (as defined in Article 1 below), TEL Exchange Sub will become a wholly owned direct subsidiary of TEL-Applied Holdings B.V., abesloten vennootschap organized under laws of the Netherlands having its office at Kerkenbos 1015, Unit C, 6546 BB, Nijmegen, The Netherlands, which prior to the TEL Share Exchange shall have converted to anaamloze vennootschap (“HoldCo”).

Article 1 (SHARE EXCHANGE)

TEL Exchange Sub and TEL shall execute a share-for-share exchange as a result of which TEL Exchange Sub shall become the direct parent company of TEL and TEL shall become a wholly owned subsidiary of TEL Exchange Sub (the “TEL Share Exchange”). As a result of the TEL Share Exchange, TEL Exchange Sub will acquire all of the issued stock of TEL, other than any stock already owned by TEL Exchange Sub, if any, in exchange for ordinary shares, 0.01 euro nominal value per share, of HoldCo (the “HoldCo Ordinary Shares”) in the manner described in Article 2 below.

Article 2 (SHARES TO BE DELIVERED IN TEL SHARE EXCHANGE AND ALLOTMENT)

| 2.1 | Upon consummation of the TEL Share Exchange, TEL Exchange Sub shall deliver to the shareholders of TEL (excluding, if applicable, TEL Exchange Sub) as of the time (the “Reference Time”) immediately preceding the time when TEL Exchange Sub acquires the entire issued stock of TEL (except the stock of TEL already owned by TEL Exchange Sub, if any) the number of HoldCo Ordinary Shares obtained by multiplying the total number of shares of common stock of TEL (“TEL Common Stock”) owned by the shareholders of TEL (other than TEL Exchange Sub) as of the Reference Time by 3.25 (the “TEL Exchange Ratio”). |

| 2.2 | Upon the execution of the TEL Share Exchange, TEL Exchange Sub shall allot to each shareholder of TEL (other than TEL Exchange Sub) as of the Reference Time the number of HoldCo Ordinary Shares obtained by multiplying the number of shares of TEL Common Stock owned by each such shareholder as of the Reference Time by the TEL Exchange Ratio. |

| | |

| | 7 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| 2.3 | Notwithstanding the foregoing, no fractional HoldCo Ordinary Shares shall be delivered in connection with the TEL Share Exchange. Accordingly, any holder of TEL Common Stock who would otherwise be entitled to receive a fraction of a HoldCo Ordinary Share (after aggregating all fractional HoldCo Ordinary Shares deliverable to such holder) at the Effective Date (as defined in Article 3 below) shall, in lieu of such fraction of a HoldCo Ordinary Share, be paid in cash the yen amount (rounded as necessary up to the nearest whole yen) equal to: (i) the fraction of a HoldCo Ordinary Share such TEL stockholder would otherwise have been entitled to receive pursuant to Section 2.2; multiplied by (ii) the quotient of (A) the volume-weighted average price per share of TEL Common Stock on the Tokyo Stock Exchange for the five consecutive trading days preceding (but not including) the date on which TEL Common Stock is delisted from the Tokyo Stock Exchange prior to the Effective Date divided by (B) the TEL Exchange Ratio. |

Article 3 (EFFECTIVE DATE)

The TEL Share Exchange shall become effective at the later of 12:01 am JST on September 24, 2014 (hereinafter referred to as the “Effective Date”) or the time when each of conditions set forth in Article 6 is satisfied or waived on the Effective Date; provided, however, that the Effective Date may be modified upon consultation and agreement between TEL Exchange Sub and TEL in the event such modification is necessary under the applicable procedural requirements for the TEL Share Exchange or for other reasons.

Article 4 (CANCELLATION OF TREASURY STOCK)

TEL shall cancel all of its treasury stock held by TEL as of the Reference Time (including the treasury stock acquired by TEL as a result of the exercise of dissenting shareholders’ appraisal rights in connection with the TEL Share Exchange pursuant to Article 785, Paragraph 1 of the Companies Act (Act No. 86 of 2005) of Japan) pursuant to the approval of the TEL Board prior to the Effective Date in accordance with applicable laws and regulations.

Article 5 (AMENDMENT AND TERMINATION OF AGREEMENT)

During the period beginning on the Execution Date and ending on the Effective Date, this Agreement may be modified or terminated only upon mutual written agreement of both parties hereto after mutual consultation.

Article 6 (EFFECTIVENESS OF THE SHARE EXCHANGE)

The TEL Share Exchange shall become effective if each of the following conditions is satisfied or waived: (i) the approval of the TEL Share Exchange by the general meeting of shareholders of TEL and the competent authorities as required by applicable laws and regulations shall have been obtained; (ii) TEL Exchange Sub shall have become a wholly owned direct subsidiary of HoldCo; and (iii) TEL Exchange Sub shall have been able to deliver to TEL shareholders the number of HoldCo Ordinary Shares necessary to effect the TEL Share Exchange in accordance with the terms of this Agreement.

Article 7 (ACQUISITION OF HOLDCO ORDINARY SHARES BY TEL EXCHANGE SUB)

TEL Exchange Sub shall acquire sufficient HoldCo Ordinary Shares, without any security interests or other encumbrances, to deliver all HoldCo Ordinary Shares to be delivered in the TEL Share Exchange in accordance with Article 2 of this Agreement prior to the effective time of the TEL Share Exchange.

| | |

| | 8 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

Article 8 (CONSULTATION)

Except as provided in this Agreement, any matter which is necessary for consummation of the TEL Share Exchange shall be determined through consultation and agreement between TEL Exchange Sub and TEL consistent with the purpose and intent of this Agreement.

Article 9 (GOVERNING LAW)

This Agreement shall be governed by and construed in accordance with the laws of Japan.

IN WITNESS WHEREOF, two original copies of this Agreement have been prepared, and after affixing their seals on the date first written above, each party shall retain one copy.

|

TEL EXCHANGE SUB 3-1 Akasaka 5-chome, Minato-ku, Tokyo TEL Japan GK Representative Member Tokyo Electron Limited Executor (shokumu shikkousha) Tetsuro Higashi /s/ |

|

| TEL |

|

3-1 Akasaka 5-chome, Minato-ku, Tokyo Tokyo Electron Limited Representative Director, Chairman, President & Chief Executive Officer Tetsuro Higashi /s/ |

5. Summary of Items Listed under Article 184, Paragraph 1 of the Ordinance for Enforcement of the Companies Act (except for Items 5 and 6)

The share exchange agreement between the Company and TEL Japan GK to be approved is hereinafter referred to as the “Share Exchange Agreement”. The share exchange between the Company and TEL Japan GK set forth in the Share Exchange Agreement is hereinafter referred to as the “Share Exchange”. The business combination set forth in the Business Combination Agreement is hereinafter referred to as the “Business Combination”. The triangular merger, pursuant to which Applied Materials will be the surviving company and a company organized under Delaware law will be the dissolving company, and the consideration for merger will be the ordinary shares of the HoldCo is hereinafter referred to the “Applied Materials Merger” (which is effected in order to implement 1 (ii) above).

| (1) | Fairness of the Share Exchange Consideration |

| (A) | Total number or value of the Share Exchange consideration and allotment equivalence |

| | (i) | Details of Allotment Pursuant to the Share Exchange (“TEL Share Exchange Ratio”) |

| | |

| Number of HoldCo Ordinary Shares each Ordinary Share of Tokyo Electron will be Exchanged For Pursuant to the Share Exchange (See Note 1) | | 3.25 |

| Total Number of HoldCo Ordinary Shares to be Issued to the Company Shareholders in the Share Exchange (See Note 2) | | 582,406,373 |

| | (Note 1) | Pursuant to the terms of the Share Exchange Agreement, the Company shareholders will receive 3.25 ordinary shares of HoldCo in exchange for each share of the Company held by them immediately prior to the effective time of the Share Exchange. Notwithstanding |

| | |

| | 9 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | the foregoing, the Company will cancel all treasury shares held by it before the Share Exchange becomes effective but after the purchase of shares from dissenting shareholders, if any, who exercised appraisal rights provided under the Japanese Companies Act prior to the Share Exchange becoming effective. The share exchange ratio identified above has not been amended or modified since the execution of the Business Combination Agreement on September 24, 2013. |

| | (Note 2) | The number of new shares to be issued by HoldCo to the Company shareholders has been calculated based on the Company’s total number of outstanding shares excluding treasury shares (179,201,961 shares) as of March 31, 2014. |

| | (Note 3) | No fractional shares will be issued in connection with the Share Exchange. Shareholders of the Company who would be entitled to receive fractional shares of HoldCo will alternatively receive a cash payment calculated in accordance with the terms of the Share Exchange Agreement. |

| | (Note 4) | Handling of shares less than one unit |

There is no unit share system under the laws of the Netherlands, the jurisdiction of HoldCo’s incorporation.

| | (Note 5) | Allotment Pursuant to the Applied Materials Merger (Applied Conversion Ratio) is as follows: |

| | |

Number of HoldCo Ordinary Shares each Share of Applied Materials Common Stock will be Converted Into Pursuant to the Applied Materials Merger (See Note 5-1) | | 1 |

Total Number of HoldCo Ordinary Shares to be Issued to Applied Materials Stockholders in the Applied Materials Merger (See Note 5-2) | | 1,217,378,416 |

| | (Note 5-1) | Pursuant to the terms of the Business Combination Agreement, Applied Materials stockholders will receive one ordinary share of HoldCo for each share of Applied Materials common stock held by them as of immediately prior to the effective time of the Applied Materials Merger. Notwithstanding the foregoing, no ordinary shares of HoldCo will be paid or payable in respect of any treasury shares, shares of Applied Materials common stock held by Applied Materials or any of its subsidiaries or to dissenting stockholders who exercise appraisal rights under Delaware law, if available, in each case as of immediately prior to the effective time of the Applied Materials Merger. The share exchange ratio identified above has not been amended or modified since the execution of the Business Combination Agreement on September 24, 2013. |

| | (Note 5-2) | New shares to be issued by HoldCo to Applied Materials stockholders has been calculated based on Applied Materials’ total number of outstanding shares excluding treasury shares (1,217,378,416 shares) as of April 27, 2014. |

| | (Note 5-3) | No fractional shares will be issued in connection with the Applied Materials Merger. Stockholders of Applied Materials who would be entitled to receive fractional shares of HoldCo will alternatively receive a cash payment equal to such stockholder’s pro rata share of the proceeds of the fractional shares sold in a commercially reasonable manner. |

| | (ii) | Basis for Calculation |

The allotments of HoldCo ordinary shares to be made in the Share Exchange will be made pursuant to the share exchange ratio set forth in the Business Combination Agreement. In order to support their efforts to ensure the fairness of the share exchange ratio of the Business Combination from a financial point of view to the shareholders of the Company, the Company appointed Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. and its affiliates, including Morgan Stanley & Co. LLC (collectively “Mitsubishi UFJ Morgan Stanley”) as its independent financial advisor to perform a financial analysis of the share exchange ratio. Please see Attachment 1, “Analysis Outline of the Financial Advisor Regarding the Share Exchange Ratio,” with respect to the outline of the financial analysis relating to the share exchange ratio of the Business Combination conducted by Mitsubishi UFJ Morgan Stanley.

| | |

| | 10 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (iii) | Background of Calculation |

The allotments of HoldCo ordinary shares to be made in the Share Exchange will be made pursuant to the Business Combination. The Company carefully negotiated and discussed the TEL Share Exchange Ratio and Applied Conversion Ratio with Applied Materials, comprehensively taking into account various factors including but not limited to as the financial position, assets and business prospects of each of the Company and Applied Materials, with the Company referring to the financial analyses performed by Mitsubishi UFJ Morgan Stanley. Based on the foregoing factors, the Company came to a decision that the TEL Share Exchange Ratio set out in (i) above, was appropriate and reached agreement on the TEL Share Exchange Ratio with Applied Materials.

| | (iv) | Relationship with Financial Advisor |

Mitsubishi UFJ Morgan Stanley, which is acting as financial advisor to the Company, does not constitute a related party of the Company or Applied Materials, respectively, and does not have any material interest in connection with the Business Combination other than with respect to the fee it will receive for its services, a substantial portion of which is contingent upon the closing of the Business Combination.

| (B) | Reason for Selection of the Said Type of Asset as Share Exchange Consideration |

To achieve the objectives of the Business Combination, under which the Company and Applied Materials aim to be a leading company that will bring new material innovations in cutting-edge areas, the Company and Applied Materials will organize HoldCo in the Netherlands and become sister companies. The shareholders of the Company as of immediately prior to the consummation of the Business Combination will become shareholders of HoldCo, which will own the Company and Applied Materials as subsidiaries after the Business Combination, and may enjoy synergies created by the Business Combination as shareholders. Pursuant to the Business Combination, shares of the Company will be delisted from the TSE and the ordinary shares of HoldCo, which will be the consideration for the Business Combination, are expected to be listed on the TSE and Nasdaq.

| (C) | Matters to be Considered to Protect the Interests of the Company’s Shareholders |

As of the date the Share Exchange Agreement was executed, TEL Japan GK is a wholly owned subsidiary of the Company. Since the Share Exchange will be implemented as a part of the Business Combination between the Company and Applied Materials, the details of the share allotment under the Share Exchange had already been agreed between the Company and Applied Materials at the time the Business Combination Agreement was executed. The Company has taken the following measures to ensure fairness in agreeing with Applied Materials on the conditions for the Business Combination.

| | (i) | Measures to Ensure Fairness |

The Share Exchange will be implemented as a part of the Business Combination. In addition to receiving the financial analyses relating to the TEL Share Exchange Ratio described in (A)(ii) “Basis for Calculation”, the Company received a written opinion of Mitsubishi UFJ Morgan Stanley dated September 24, 2013, that, as of the date of the opinion and based upon and subject to certain conditions, including the assumptions described in Attachment 1, the share exchange ratio pursuant to the Business Combination was fair from a financial point of view to the shareholders of the Company (what is called Fairness Opinion).

Further, the Company retained Nishimura & Asahi and Jones Day as its legal advisors for matters relating to the Business Combination.

| | |

| | 11 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (ii) | Measures to Avoid Conflicts of Interests |

The Share Exchange will be implemented as a part of the Business Combination. There are no identified conflicts of interest between the Company and Applied Materials that will arise as a result of the Business Combination; accordingly, no special measures have been taken.

| (2) | Matters Concerning the Share Exchange Consideration |

| (A) | Provisions Equivalent to Articles of Association under Japanese Law |

The articles of association of HoldCo as of its incorporation on January 6, 2014, are as set forth in Attachment 2, Articles of Association of HoldCo (before the Business Combination). Prior to consummating the Business Combination, HoldCo will be converted from a private limited liability company (besloten vennootschap) organized under the laws of the Netherlands to a public limited liability company (naamloze vennootschap) organized under the laws of the Netherlands. In conjunction with the conversion, the articles of association of HoldCo will be amended. The articles of association of HoldCo as of the consummation of the Business Combination becomes effective will be as set forth in Attachment 3, Articles of Association of HoldCo (as of the consummation of the Business Combination).

| (B) | Rights Concerning Ordinary Shares of HoldCo |

Rights concerning the ordinary shares of HoldCo to be used as the Share Exchange consideration are listed below:

| | (i) | Entitlement to surplus dividend |

Each holder of ordinary shares of HoldCo is entitled to dividends in proportion to the number of shares held. In addition, the currency of the dividends received by the shareholders who will own the ordinary shares of HoldCo through the Japan Securities Depository Center Inc will be converted into yen after the dividend payment by the Company.

| | (ii) | Entitlement to distribution of residual property |

Each holder of ordinary shares of HoldCo is entitled to a proportionate share of any residual assets upon liquidation of HoldCo. Pursuant to the Articles of Association, the dividends by HoldCo will be paid in euro, dollar, yen or other currency decided by the board of directors of HoldCo.

| | (iii) | Voting right at a shareholders meeting |

Each of HoldCo’s ordinary shares will confer the right to attend and address the General Meeting of HoldCo’s shareholders, the right to request the board of directors of Holdco to provide information at General Meeting of HoldCo’s shareholders, and the right to cast one vote at the General Meeting of HoldCo’s shareholders. As a result, the number of votes that a shareholder may cast equals the number of HoldCo’s ordinary shares such shareholder holds. The cumulative voting is not applicable to HoldCo.

| | (iv) | Appraisal opposition rights of the shareholder in the event of a merger or similar events |

Dutch law provides that, to the extent that the acquiring company in a cross-border merger is organized under the laws of another member state of the European Union or the European Economic Area, a shareholder of a Dutch company that will disappear in a merger who has voted against the cross-border merger may file a claim with the Dutch company for compensation instead of receiving shares in the share capital of the acquiring company.

| | |

| | 12 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (v) | Right to inspect or ask for a copy of the Articles of Association and other materials (the material that shows electro-magnetic record(s), if the relevant data or material is recorded electro-magnetically) |

| | (I) | Articles of association |

HoldCo’s shareholders may view a copy of its articles of association and public securities filings under the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934 on the U.S. Securities and Exchange Commission’s webpage (http://www.sec.gov) or may request to be provided with a copy by HoldCo.

| | (II) | Annual accounts and the annual report |

Under Dutch law, the annual accounts of HoldCo will be submitted to the General Meeting of HoldCo’s shareholders for adoption and the annual report will be reported at the General Meeting. Each shareholder may inspect these materials, and upon its request be provided with a copy of the annual accounts free of charge at its corporate seat and such other locations as the board of directors of HoldCo determines.

| | (III) | Record of resolutions of the general meeting |

HoldCo’s board of directors will keep a record of all resolutions adopted by the General Meeting of HoldCo’s shareholders, which record will be available at its corporate seat and such other locations as the board of directors of HoldCo determines for inspection by shareholders. Each shareholder will upon its request be provided with a copy from such record.

Each shareholder of HoldCo may be provided upon its request with written evidence of the contents of the share register with regard to the shares registered in his name free of charge. Furthermore, the shareholders registry will be deposited at the offices of the HoldCo for inspection by the shareholders of HoldCo. However, the registry of the beneficial owners of HoldCo is not required to be deposited at the offices of the HoldCo under Dutch law.

| | (vi) | Anti-takeover measure |

Under Dutch law, HoldCo is permitted to take various protective measures within the limits set by Dutch law and Dutch case law. Pursuant to the articles of association of HoldCo that will be in effect after the Business Combination, in order to protect the interest of the shareholders, HoldCo may issue cumulative preference shares to a friendly party in such a manner as to (temporarily) dilute the interest of any potential acquirer aimed at creating a status quo that could be used by HoldCo board of directors to further discuss with the potential acquirer its future plans for HoldCo as well as to search for strategic alternatives.

| (C) | Language in Which Information is Provided to Shareholders |

Meetings of HoldCo’s shareholders will be conducted in the English language. The languages in which information is provided to HoldCo shareholders will be determined by the HoldCo’s board of directors. Japanese language will be one of such languages. The ordinary shares of HoldCo are expected to be listed on TSE in association with the Business Combination, and thus HoldCo will provide some information in Japanese in accordance with the TSE’s regulations.

| | |

| | 13 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| (D) | Total number of rights equivalent to the voting rights of the shareholders of HoldCo that shareholders will possess on the effective day of the Share Exchange (following consummation of the Business Combination) should there be a meeting equivalent to the shareholders meeting |

1,799,784,889 shares

The above number is calculated by aggregating the numbers specified in (a), (b) and (c) below.

| | (a) | Total number of voting rights of all shareholders of HoldCo immediately prior to the Business Combination |

100 shares (to be expected)

| | (b) | Number of voting rights of ordinary shares of HoldCo to be delivered to the Company shareholders with respect to the Share Exchange |

582,406,373 shares

| | * | The number specified in (b) above is calculated based on the total number of issued shares of the Company (excluding the treasury shares held by the Company) as of March 31, 2014 (179,201,961 shares) |

| | (c) | Number of voting rights of ordinary shares of HoldCo to be delivered to the shareholders of Applied Materials with respect to the Applied Materials Merger |

1,217,378,416

| | * | The number specified in (c) above is calculated based on the total number of issued shares of Applied Materials (excluding the treasury shares held by Applied Materials ) as of April 27, 2014 (1,217,378,416 shares). |

The numbers specified in (a), (b) and (c) above may fluctuate from the relevant date mentioned above to the date the Share Exchange becomes effective. In that case, the total number of rights equivalent to the voting rights of the shareholders of HoldCo that shareholders will possess on the effective day of the Share Exchange should there be a meeting equivalent to the shareholders meeting mentioned in (D) above will be affected by such fluctuation. For example, if, before the Share Exchange becomes effective, the dissenting shareholders of the Company exercise their appraisal rights, the Company’s share options (shinkabu-yoyakuken) are exercised, or holders of shares of less than one unit exercise their right to demand the sale of their shares, the total number specified above may fluctuate.

| (E) | Matters Concerning the Person(s), etc. Representing HoldCo |

| | (i) | Name and address of the person representing HoldCo |

| | |

| Name: | | Tetsuro Higashi (Current Chairman, President and Representative Director, CEO of the Company) |

| Position: | | Managing Director |

| Address: | | 3-1 Akasaka 5-chome, Minato-ku, Tokyo |

The person mentioned below will represent HoldCo after the Share Exchange and the Applied Materials Merger take effect.

| | |

| Name: | | Gary Dickerson (Current President and CEO of Applied Materials) |

| Position: | | Chief Executive Officer (CEO) |

| Address: | | 3050 Bowers Avenue, P.O. Box 58039, Santa Clara, CA 95052 |

| | |

| | 14 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (ii) | Names of Directors and Officers of HoldCo (other than the representative) |

Not applicable.

Upon consummation of the Business Combination, the board of directors of HoldCo will be a board of directors consisting initially of eleven directors. The following persons will be directors of HoldCo upon consummation of the Business Combination.

| | |

| Name | | Position |

| Tetsuro Higashi (Current Chairman, President and Representative Director, CEO of the Company) | | Chairman of the Board of Directors |

| Michael Splinter (Current Executive Chairman of Applied Materials) | | Vice Chairman of the Board of Directors |

| Tetsuo Tsuneishi (Current Vice Chairman and Representative of the Company) | | Vice Chairman of the Board of Directors |

| Gary Dickerson (Current President and CEO of Applied Materials) | | Member of the Board of Directors |

| Three individuals (in addition to Mr. Higashi and Mr. Tsuneishi) designated by the Company who qualify as “independent directors” under the applicable rules of Nasdaq and the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

| Three individuals (in addition to Mr. Dickerson and Mr. Splinter) designated by Applied Materials who qualify as “independent directors” under the applicable rules of Nasdaq and applicable rules of the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

| One individual designated jointly by the Company and Applied Materials who qualifies as an “independent director” under the applicable rules of Nasdaq and the U.S. Securities and Exchange Commission | | Member of the Board of Directors |

In addition, upon consummation of the Business Combination, Applied Materials’ current President and Chief Executive Officer, Gary Dickerson, will become the Chief Executive Officer of HoldCo and Applied Materials’ current Chief Financial Officer, Robert Halliday, will become the Chief Financial Officer of HoldCo.

| (F) | Content of the materials equivalent to a balance sheet as of the date of incorporation of HoldCo |

Since HoldCo was incorporated on January 6, 2014, there is no period equivalent to the latest fiscal year. The content of the document equivalent to the balance sheet as of the date of incorporation of HoldCo is as follows:

| | | | |

| (as of January 6, 2014) | |

| | | Euro | |

| Assets | | | | |

Total assets | | € | — | |

| Liabilities and Stockholder’s Equity | | | | |

Total liabilities | | | — | |

Stockholder’s equity | | | | |

Ordinary shares (Note) | | | 1 | |

Additional paid-in capital | | | 5,022 | |

Due from shareholder | | | (1 | ) |

Accumulated deficit | | | (5,022 | ) |

Total stockholder’s equity | | | — | |

Commitments and contingencies | | | | |

Total liabilities and stockholder’s equity | | € | — | |

| | (Note) | Each of the ordinary shares of HoldCo has par value €0.01, and 100 ordinary shares of HoldCo are issued and outstanding. |

| | |

| | 15 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| (G) | Summary of the content of HoldCo’s materials equivalent to those listed under the items of Articles 118 and 119 of the Ordinance for Enforcement of the Companies Act for the period equivalent to the latest fiscal year. |

Since HoldCo was incorporated on January 6, 2014, and no period equivalent to the latest fiscal year has been completed, there are no applicable materials.

(Reference)

For the account settlement information of the Company and Applied Materials, which will be disclosed in the Securities Report of HoldCo for Listing Application on the Tokyo Stock Exchange (Part I) which will be available at the TSE’s webpage, and it has already been disclosed in the Registration Statement on Form S-4, which was declared effective by the U.S. Securities and Exchange Commission on May 13, 2014. Form S-4 is available at the U.S. Securities and Exchange Commission’s webpage (http://www.sec.gov), the Company’s webpage (http://www.tel.co.jp/ir/index.htm) and on EDINET (Electronic Disclosure for Investors’ NETwork).

| (H) | Content of the materials equivalent to the balance sheet for the period equivalent to past five full fiscal years. |

Since HoldCo was incorporated on January 6, 2014, and no period equivalent to the latest fiscal year has been completed, there are no applicable materials.

| (I) | Method of Cashing the Share Exchange Consideration and Market Price of the Share Exchange Consideration |

| | (i) | Market for transacting the Share Exchange consideration |

The TSE and Nasdaq (as scheduled)

| | (ii) | Parties acting as intermediary, broker or agent in the trading of the Share Exchange consideration |

Following registration with the U.S. Securities and Exchange Commission and the listing of the shares on the TSE and Nasdaq, the ordinary shares of HoldCo can be traded through entities such as (a) securities companies that are Japan Securities Depository Center Inc. participants and can handle foreign shares, (b) U.S. or other securities companies that participate in the Depository Trust Company, and (c) other brokerage. With respect to the handling of shares, please refer to the Japanese registration statement to be submitted by HoldCo, which will be disclosed on EDINET.

| | (iii) | Restriction on the transfer and other disposal of the Share Exchange consideration |

Not applicable.

| | (iv) | Market price of the Share Exchange transaction |

Not applicable; however, the shares of HoldCo are expected to be listed on the TSE and Nasdaq

| | |

| | 16 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | (v) | Procedure for receiving repayment when the Share Exchange consideration can be repaid with a treasury share purchase, equity buyback or other similar means |

Not applicable.

| (3) | Financial Statements, etc. |

| | (i) | Content of the balance sheet on the date of incorporation |

| | | | |

| (as of May 1, 2014) | |

| | | one million yen | |

Assets | | | | |

Cash and cash equivalents | | | 1 | |

Total asset | | | 1 | |

Liabilities | | | N/A | |

Net asset | | | | |

Stock holders’ equity | | | | |

Capital stock | | | 1 | |

Total liabilities and net asset | | | 1 | |

| | (ii) | Material Events that occurred after the date of incorporation that may affect the disposal of a material asset, burden of a material liability, or the position of the company’s assets |

On May 14, 2014, TEL Japan GK executed the Share Exchange Agreement with the Company for which shareholders’ approval is requested under this proposal.

| | (i) | Material Events that occurred after the last day of the latest fiscal year that may affect the disposal of a material asset, burden of a material liability, or the position of the company’s assets |

On May 14, 2014, the Company executed the Share Exchange Agreement with TEL Japan GK for which shareholders’ approval is requested under this proposal.

| | |

| | 17 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

Attachment 1

Analysis Outline of the Financial Advisor Regarding the Share Exchange Ratio

(Outline of Analysis by Financial Advisor of Tokyo Electron)

Mitsubishi UFJ Morgan Stanley analyzed the Share Exchange Ratio by performing valuation analyses based on Historical Exchange Ratio Analysis, Relative Contribution Analysis, Relative DCF Analysis and Selected Precedent Transactions Premium Analysis methodologies and comprehensively considered the results of such analyses.

In the Historical Exchange Ratio Analysis, Mitsubishi UFJ Morgan Stanley reviewed the implied Share Exchange Ratio in relation to the ratio of the daily closing market price of Tokyo Electron common stock on the Tokyo Stock Exchange converted into U.S. Dollars using a JPY/USD exchange rate as of each corresponding date to the daily closing market price of Applied Materials common stock on the Nasdaq as of such date, for various periods ending September 23, 2013. In the Relative DCF Analysis and Relative Contribution Analysis, Mitsubishi UFJ Morgan Stanley used financial projections of Tokyo Electron and Applied Materials on a stand-alone basis, without considering the effect of the Business Combination, both based on equity research estimates and based on forecasts delivered by the managements of Tokyo Electron and Applied Materials.

The following table summarizes the implied ranges of the Share Exchange Ratio calculated by Mitsubishi UFJ Morgan Stanley under each methodology (assuming that the exchange ratio per common stock of Applied Materials is set at 1).

| | |

| Methodology | | Implied Range of the Share Exchange Ratio |

Historical Exchange Ratio Analysis (3-Month Period)(Note 1) | | 2.68x - 3.43x |

Relative Contribution Analysis | | 0.98x - 3.70x |

Relative DCF Analysis | | 2.21x - 4.29x |

Selected Precedent Transactions Premium Analysis | | 2.78x - 3.67x |

As described in Measures to Ensure Fairness (5.(1)(C) (i) in this document), based on the request from the board of directors of Tokyo Electron, Mitsubishi UFJ Morgan Stanley delivered to the board of directors of Tokyo Electron a written opinion (“Fairness Opinion”) that, as of September 24, 2013, the Share Exchange Ratio agreed upon in the Business Combination Agreement was fair, from a financial point of view, to the holders of Tokyo Electron common stock.

The opinion of Mitsubishi UFJ Morgan Stanley in the Fairness Opinion is based upon and subject to various significant assumptions, disclaimers, matters considered and limitations described in the Fairness Opinion. Mitsubishi UFJ Morgan Stanley did not recommend any particular Share Exchange Ratio to Tokyo Electron or the board of directors of Tokyo Electron as the only appropriate Share Exchange Ratio.

For conditions and assumptions regarding the analyses and opinion, please see Note 2 below.

| (Note 1) | If either the Tokyo Stock Exchange or Nasdaq was closed while the other stock exchange was open, Mitsubishi UFJ Morgan Stanley applied the closing market price on the prior trading day to such day of the closing market price of those shares where the stock market is closed, to calculate the exchange ratio to review in relation to the implied Share Exchange Ratio, and deemed such day as a trading day. |

| (Note 2) | Mitsubishi UFJ Morgan Stanley’s Fairness Opinion and analysis and calculation of the above ranges of the Share Exchange Ratio as the basis thereof, is directed to Tokyo Electron’s board of directors and addresses only the fairness from a financial point of view of the Share Exchange Ratio pursuant to the Business Combination Agreement to holders of shares of common stock of Tokyo Electron as of the date of the Fairness Opinion. The Fairness Opinion and analysis do not address any other aspects of the transaction and do not constitute an opinion or recommendation to any shareholders of Tokyo Electron or Applied Materials as to how such shareholder should vote or act on any matter at any shareholder meeting with respect to the Business Combination. Mitsubishi UFJ Morgan Stanley did not recommend any specific Share Exchange Ratio to Tokyo |

| | |

| | 18 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| | Electron or its board of directors or that any specific Share Exchange Ratio constituted the only appropriate Share Exchange Ratio for the Business Combination. The Fairness Opinion and analysis do not purport to be an appraisal or to reflect the prices at which shares of common stock of Tokyo Electron, Applied Materials or HoldCo might actually trade. |

For purposes of the Fairness Opinion and its analysis, Mitsubishi UFJ Morgan Stanley has:

| | (a) | Reviewed certain publicly available financial statements and other business and financial information, including equity research estimates, of Tokyo Electron and Applied Materials, respectively; |

| | (b) | Reviewed certain internal financial statements and other financial and operating data concerning Tokyo Electron and Applied Materials, respectively; |

| | (c) | Reviewed certain financial projections delivered by the managements of Tokyo Electron and Applied Materials, respectively; |

| | (d) | Reviewed information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, prepared by the managements of Tokyo Electron and Applied Materials, respectively; |

| | (e) | Discussed the past and current operations and financial condition and the prospects of Applied Materials, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, with senior executives of Applied Materials; |

| | (f) | Discussed the past and current operations and financial condition and the prospects of Tokyo Electron, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, with senior executives of Tokyo Electron; |

| | (g) | Reviewed the pro forma impact of the Business Combination on Tokyo Electron’s earnings per share, cash flow, consolidated capitalization and financial ratios; |

| | (h) | Reviewed the reported prices and trading activity for Tokyo Electron common stock and Applied Materials common stock; |

| | (i) | Compared the financial performance of Tokyo Electron and Applied Materials and the prices and trading activity of Tokyo Electron common stock and Applied Materials common stock with that of certain other publicly-traded companies comparable with Tokyo Electron and Applied Materials, respectively, and their securities; |

| | (j) | Reviewed the financial terms, to the extent publicly available, of certain comparable transactions; |

| | (k) | Participated in certain discussions and negotiations among representatives of Tokyo Electron and Applied Materials and certain parties and their accounting, tax and legal advisors; |

| | (l) | Reviewed the Business Combination Agreement, substantially in the form of the draft dated September 23, 2013 and certain related documents; and |

| | (m) | Reviewed such other information and considered such other factors as Mitsubishi UFJ Morgan Stanley deemed appropriate. |

Mitsubishi UFJ Morgan Stanley assumed and relied upon, without independent verification, the accuracy and completeness of the information that was publicly available or supplied or otherwise made available to it by Tokyo Electron and Applied Materials, and formed a substantial basis for its Fairness Opinion and analysis. With respect to the financial projections, including information relating to certain strategic, financial and operational benefits anticipated from the Business Combination, Mitsubishi UFJ Morgan Stanley assumed that they have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the respective managements of Tokyo Electron and Applied Materials of the future financial performance of Tokyo Electron and Applied Materials. In addition, Mitsubishi UFJ Morgan Stanley assumed that the Business Combination will be consummated in accordance with the terms set forth in the Business Combination Agreement without any waiver, amendment or delay of any terms or conditions and that the exchange of Shares of Tokyo Electron common stock for HoldCo common stock at the Exchange Ratio will be non-taxable for the holders of shares of Tokyo Electron common stock. Mitsubishi UFJ Morgan Stanley assumed that in connection with the receipt of all the necessary governmental, regulatory or other approvals and consents required for the proposed Business Combination, no delays, limitations, conditions or restrictions will be imposed that would have a material adverse effect on the contemplated benefits expected to be derived in the proposed Business Combination. Mitsubishi UFJ Morgan Stanley is not a legal, accounting, tax, regulatory or actuarial advisor. Mitsubishi UFJ Morgan Stanley is a financial advisor only and relied upon, without independent verification, the assessment of Tokyo Electron and its legal, accounting and tax advisors with respect to legal, accounting, tax, regulatory or actuarial matters. Mitsubishi UFJ Morgan Stanley has not made any independent valuation or appraisal of the assets or liabilities of Tokyo Electron or Applied Materials, nor has Mitsubishi UFJ Morgan Stanley been furnished with any such valuations or appraisals. The analysis and Fairness Opinion of Mitsubishi UFJ Morgan Stanley was necessarily based on financial, economic, market and other conditions as in effect on, and the information made available to Mitsubishi UFJ Morgan Stanley as of, the date of the Fairness Opinion. Events occurring after such date might have an effect on the analysis and Fairness Opinion and the assumptions used in preparing it, and Mitsubishi UFJ Morgan Stanley has not assumed any obligation to update, revise or reaffirm its analysis and Fairness Opinion. In arriving at its Fairness Opinion, Mitsubishi UFJ Morgan Stanley was not authorized to solicit, and did not solicit, interest from any party with respect to any merger, business combination or other extraordinary transaction involving Tokyo Electron.

| | |

| | 19 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

The preparation of a fairness opinion and the analysis as the basis thereof is a complex process and is not necessarily susceptible to a partial analysis or summary description. In arriving at its opinion, Mitsubishi UFJ Morgan Stanley considered the results of all of its analyses as a whole and did not attribute any particular weight to any analysis or factor it considered. Mitsubishi UFJ Morgan Stanley believes that selecting any portion of its analyses, without considering all analyses as a whole, would create an incomplete view of the process underlying its analyses and opinion. In addition, Mitsubishi UFJ Morgan Stanley may have given various analyses and factors more or less weight than other analyses and factors, and may have deemed various assumptions more or less probable than other assumptions. As a result, the range of valuations resulting from any particular analysis described herein should not be taken to be Mitsubishi UFJ Morgan Stanley’s view of the actual value of Tokyo Electron or Applied Materials. In performing its analyses, Mitsubishi UFJ Morgan Stanley made numerous assumptions with respect to industry performance, general business and economic conditions and other matters, many of which are beyond the control of Tokyo Electron or Applied Materials. Any estimates contained in Mitsubishi UFJ Morgan Stanley’s analyses are not necessarily indicative of future results or actual values, which may be significantly more or less favorable than those suggested by these estimates. The summary contained herein describes the material analyses performed by Mitsubishi UFJ Morgan Stanley but does not purport to be a complete description of the analyses performed by Mitsubishi UFJ Morgan Stanley.

The Share Exchange Ratio was determined through arm’s length negotiations between Tokyo Electron and Applied Materials and was approved by Tokyo Electron’s board of directors. Mitsubishi UFJ Morgan Stanley’s analysis and Fairness Opinion and its presentation to Tokyo Electron’s representatives was only one of many factors taken into consideration by Tokyo Electron’s board of directors in deciding to approve the Business Combination. Consequently, the analyses as described herein should not be viewed as determinative of the opinion of Tokyo Electron’s board of directors with respect to the Share Exchange Ratio or of whether Tokyo Electron’s board of directors would have been willing to agree to a different share exchange ratio.

Mitsubishi UFJ Morgan Stanley has acted as financial advisor to the board of directors of Tokyo Electron in connection with this transaction and will receive a fee for its services, a substantial portion of which is contingent upon the closing of the Business Combination. In the past, Mitsubishi UFJ Morgan Stanley has provided financial advisory and financing services for Applied Materials and has received customary fees in connection with such services. Mitsubishi UFJ Morgan Stanley may also seek to provide such services to Tokyo Electron and Applied Materials or HoldCo in the future and would expect to receive fees for the rendering of these services.

Please note that Mitsubishi UFJ Morgan Stanley is a global financial services firm engaged in the banking (including financing for Tokyo Electron and Applied Materials), securities, trust, investment management, credit services and other financial businesses (collectively, “Financial Services”). Its securities business is engaged in securities underwriting, trading, and brokerage activities, foreign exchange, commodities and derivatives trading, as well as providing investment banking, financing and financial advisory services. In the ordinary course of its underwriting, trading, brokerage and financing activities, Mitsubishi UFJ Morgan Stanley may at any time hold long or short positions, may provide Financial Services to Tokyo Electron, Applied Materials, or companies that may be involved in this transaction and may trade or otherwise effect transactions, for its own account or the accounts of customers, in debt or equity securities or loans of Tokyo Electron, Applied Materials, or any company that may be involved in this transaction, or in any currency or commodity that may be involved in this transaction, or in any related derivative instrument. Mitsubishi UFJ Morgan Stanley, its directors and officers may also at any time invest on a principal basis or manage funds that invest on a principal basis, in debt or equity securities of Tokyo Electron, Applied Materials, or any company that may be involved in this transaction, or in any currency or commodity that may be involved in this transaction, or in any related derivative instrument. Further, Mitsubishi UFJ Morgan Stanley may at any time carry out ordinary course broking activities for Tokyo Electron, Applied Materials, or any company that may be involved in this transaction.

| | |

| | 20 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

Attachment 2

Articles of Association of the HoldCo (before the Business Combination)

Unofficial English Translation of Official Dutch Version

ARTICLES OF ASSOCIATION

TEL-APPLIED HOLDINGS B.V.

The following is an unofficial English translation of the articles of association of TEL-Applied Holdings B.V., having its corporate seat in Amsterdam, the Netherlands, as recorded in the Deed of Incorporation, executed on January 6, 2014.

In this translation an attempt has been made to be as literal as possible without jeopardizing the overall continuity. Inevitably, differences may occur in the translation, and if so, the Netherlands text will by law govern.

| | |

| | 21 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

ARTICLES OF ASSOCIATION

Definitions and Interpretations

Article 1.

| 1.1 | In these Articles, the following terms will mean: |

| | a. | Share: means an ordinary share in the capital of the Company; |

| | b. | Shareholder: means a holder of one or more Shares; |

| | c. | General Meeting: means the corporate body of the Company formed by the Shareholders; |

| | d. | Director: means each member of the Board; |

| | e. | Company Group; means the Company together with its subsidiaries; |

| | f. | Annual Accounts: means for any financial year of the Company, the balance sheet and the profit and loss account of the Company for such financial year, plus the explanatory notes thereto; |

| | g. | Board: means the board of managing directors of the Company; |

| | h. | written/in writing: means in the form of, or transmitted via, any means of communication, including fax or e-mail, provided that the message is legible and reproducible; |

| | i. | Articles: means these articles of association (statuten) of the Company, as amended or restated from time to time in accordance with these Articles; |

| | j. | Distributable Equity: means the portion of the Company’s equity that exceeds the aggregate of the reserves that must be maintained pursuant to the laws of the Netherlands; |

| | k. | Company: means TEL-Applied Holdings B.V.; |

| | l. | Meeting Rights: means the rights to attend and address the General Meeting, either in person or by written proxy; and |

| | m. | Meeting Rights Holder: means a party who, pursuant to the law or these Articles, has the Meeting Rights. |

| 1.2 | Headings of clauses and other headings in these Articles are inserted for ease of reference and do not form part of these Articles for the purpose of its interpretation. |

Name and Corporate Seat

Article 2.

| 2.1 | The name of the Company is TEL-Applied Holdings B.V. |

| 2.2 | The Company has its corporate seat in Amsterdam, the Netherlands. |

Objects of the Company

Article 3.

The objects of the Company are:

| a. | to organize, participate in and manage, all in any way whatsoever, businesses and companies, including without limitation businesses and companies of which the objects are to establish and sustain a foundation in the area of precision material engineering where technology innovation creates added value to the Company’s customers, employees and Shareholders; |

| b. | to acquire or dispose of businesses and companies; |

| c. | to acquire or dispose of, and manage and exploit in any way whatsoever, real property and tangible and intangible assets; |

| d. | to borrow or otherwise raise funds; |

| e. | to lend monies to, or act as surety (or guarantor in any other manner) for the obligations of, businesses and companies forming part of the Company Group and third parties; |

| f. | to render administrative, technical, financial, economic or managerial services to the businesses and companies forming part of the Company Group and to third parties; and |

| g. | to perform any and all other activities of an industrial, financial or commercial nature; and whether or not in collaboration with third parties, to perform all other activities which directly and indirectly relate to those objects, all to be interpreted in the broadest sense. |

| | |

| | 22 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

Capital and Shares

Article 4.

| 4.1 | The Company has a share capital divided into one or more Shares, each with a nominal value of one euro cent (EUR 0.01). |

| 4.2 | All Shares will be in registered form. |

| 4.3 | The Shares will be numbered consecutively from 1 onwards. No share certificates will be issued for Shares. |

| 4.4 | No fractional Shares may be issued. |

Share Register

Article 5.

| 5.1 | With due observance of the applicable statutory provisions, a share register will be kept by or on behalf of the Company, which register will be regularly updated and, at the discretion of the Board, may, in whole or in part, be kept in more than one copy and at more than one address. |

| 5.2 | The name, address and such further information as required by law or considered appropriate by the Board of each Shareholder will be recorded in the share register. |

| 5.3 | The foregoing paragraphs of this Article 5 will equally apply to other Meeting Rights Holders. |

Issue of Shares

Article 6.

| 6.1 | The Company may only issue Shares pursuant to a resolution of (i) the General Meeting or (ii) the Board, if the Board has been authorized to do so by a resolution of the General Meeting for a fixed period not exceeding five years. Any such authorizing resolution must state the number of Shares that may be issued and may be extended, from time to time, for a period not exceeding five years. Unless any such authorizing resolution provides otherwise, it may not be withdrawn. |

| 6.2 | The provisions of paragraph 6.1 of these Articles will also apply to the granting of rights to subscribe to Shares, but will not apply to the issuance of Shares to a person who has exercised or is exercising a previously acquired right to subscribe to Shares. |

Terms and Conditions of New Share Issuances; No Pre-Emptive Rights

Article 7.

| 7.1 | If a resolution to issue Shares is adopted, the issue price of the Shares and the other conditions of the issue will also be determined. |

| 7.2 | A Shareholder has no pre-emptive rights upon an issue of Shares or upon a grant of rights to subscribe for Shares. |

Payment for Shares; Payment in Cash; Non-Cash Contribution

Article 8.

| 8.1 | On subscription for each Share payment must be made of its nominal value. The Company may require that the nominal value or a part thereof must first be paid after a certain period of time or after the Company has requested such payment. |

| 8.2 | Payment for a Share must be made in cash, except if and to the extent a non-cash contribution has been expressly agreed upon. |

| 8.3 | The Board will be authorized to perform legal acts relating to non-cash contributions on Shares and other legal acts as referred to in article 2:204 of the Netherlands Civil Code, without prior approval of the General Meeting. |

Repurchase of Shares

Article 9.

| 9.1 | The Company may only acquire Shares pursuant to a resolution of the Board. |

| 9.2 | Any acquisition by the Company of Shares that are not fully paid up shall be null and void. Acquisition of Shares is not permitted if and in so far as a result of such acquisition not at least one Share is held by a person other than - and for a purpose other than to benefit - the Company or any of the Company’s subsidiaries. |

| | |

| | 23 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku

Tokyo 107-6325, Japan

Tel.+81-3-5561-7000

| 9.3 | Unless it acquires such Shares for no consideration, the Company may not acquire fully paid-up Shares if the acquisition price is higher than the Distributable Equity or if the Board knows or could reasonably be expected to foresee that the acquisition would make the Company unable to continue paying any of its due and payable debts. |

| 9.4 | The provisions in the preceding paragraphs shall not apply to Shares acquired by the Company by operation of law. |

| 9.5 | Any acquisition of Shares at the expense of the reserves that must be maintained pursuant to law shall be null and void. |

Capital Reduction

Article 10.

The General Meeting may resolve to reduce the issued capital of the Company, either by a cancellation of Shares or by a reduction of the nominal value of the Shares by means of an amendment of the Articles. Such resolution shall have no effect as long as it has not been approved by the Board. The provisions of article 2:208, as well as article 2:216 paragraphs 2 up to and including 4 of the Netherlands Civil Code, shall apply accordingly to the aforementioned resolution of the Board.

Transfer of Shares

Article 11.

The transfer of Shares and the transfer – including the creation and disposal – of any restricted rights attached to Shares shall require a notarial deed to be executed for that purpose before a civil-law notary in the Netherlands, to which those involved are party.

Transferability of Shares

Article 12.

Shares can be transferred freely and without any restrictions as referred to in article 2:195 of the Netherlands Civil Code.

Board of Directors

Article 13.

| 13.1 | The Board consists of one or more Directors, with the actual number being determined by the General Meeting. |

| 13.2 | The Directors are appointed by the General Meeting. |

| 13.3 | The General Meeting determines the remuneration and other terms and conditions which apply to each Director. |

Duties and Powers of the Board

Article 14.

| 14.1 | The Board will be charged with the management of the Company as referred to in article 2:239 paragraph 1 of the Netherlands Civil Code. |

| 14.2 | The Board must conduct itself in accordance with the instructions of the General Meeting. The Board is obliged to follow these instructions unless the instructions are contrary to the best interests of the Company and the enterprise affiliated with the Company. |

Decision-Making of the Board

Article 15.

| 15.1 | In a meeting of the Board, each Director has a right to cast one vote. Unless otherwise expressly provided in these Articles, all resolutions by the Board will be adopted by a simple majority of the votes cast in a meeting where a majority of the Directors then in office and entitled to vote on such resolution is present or represented. |

| 15.2 | A Director may grant another Director a written proxy to represent him or her at the meeting. |

| 15.3 | The Board may adopt resolutions in writing without a formal meeting, provided that the proposed resolution is signed by all Directors then in office. |

| 15.4 | Where a Director has a personal interest which conflicts directly or indirectly with the interests of the Company or its business, such Director will not participate in the deliberations and decision-making process of the Board. If as a result of the previous sentence, no resolution of the Board can be adopted, such resolution may be adopted by one or more persons to be appointed for that purpose by a General Meeting. |

| 15.5 | Where one or more Directors are absent or prevented from acting, the remaining Director(s) will be charged with the entire management of the Company. Where all Directors are absent or prevented from acting, the Company will be managed temporarily by one or more persons to be appointed for that purpose by the General Meeting. Such persons appointed by the General Meeting will duly observe these Articles. |

| | |

| | 24 |

World Headquarters

3-1 Akasaka 5-chome, Minato-ku