PRELIMINARY PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| | |

| [X] | Preliminary Proxy Statement |

| | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [ ] | Definitive Proxy Statement |

| | |

| [ ] | Definitive Additional Materials |

| | |

| [ ] | Soliciting Material Pursuant to Rule 14a-1 |

SHARESPOST 100 FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| | |

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials: |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

SHARESPOST 100 FUND

555 Montgomery Street

Suite 1400, San Francisco

CA 94111

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

[●], 2020

Dear Shareholder,

On Tuesday, December 1, 2020, SharesPost 100 Fund (the “Fund”) will hold a Special Meeting of Shareholders (the “Special Meeting”) virtually at 9:00 a.m. Pacific time.

We are holding the Special Meeting to consider and vote upon a proposal to approve a new investment advisory agreement between the Fund and Liberty Street Advisors, Inc.

Only shareholders of record who owned shares at the close of business on October 9, 2020 are entitled to vote their shares at the Special Meeting or any adjournment or postponement thereof. The proxy statement and proxy card will be provided to shareholders on or about [●].

By Order of the Board of Trustees,

| /s/ Kevin Moss | |

| Kevin Moss | |

| President | |

It is important that your shares be represented and voted at the Special Meeting, whether or not you attend the Special Meeting. You may authorize your proxy by marking your votes on the enclosed proxy card, signing and dating it, and mailing it in the business reply envelope provided. You may also authorize your proxy by telephone or on the Internet by following the instructions on the enclosed proxy card. If you attend the Special Meeting, you may withdraw your proxy and vote virtually at the Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 1, 2020:

The proxy statement is available at [●].

TABLE OF CONTENTS

| | Page |

| NOTICE OF SPECIAL MEETING OF SHAREHOLDERS | [3] |

| INFORMATION ABOUT THE MEETING AND VOTE | [5] |

| PROPOSAL – APPROVAL OF NEW ADVISORY AGREEMENT | [11] |

| OTHER BUSINESS | [17] |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | [17] |

| INVESTMENT ADVISOR, ADMINISTRATOR AND PRINCIPAL UNDERWRITER | [17] |

| ANNUAL AND SEMIANNUAL REPORTS | [18] |

| EXHIBITS | |

| EXHIBIT A | BENEFICIAL OWNERSHIP INFORMATION | |

| EXHIBIT B | NEW ADVISORY AGREEMENT | |

SHARESPOST 100 FUND

555 Montgomery Street

Suite 1400, San Francisco

CA 94111

SPECIAL MEETING OF SHAREHOLDERS

To Be Held On December 1, 2020

PROXY STATEMENT

INFORMATION ABOUT THE MEETING AND VOTE

We encourage you to read the full text of the enclosed proxy statement. However, we thought it would be helpful to provide brief answers to some questions.

Why is a Special Meeting of Shareholders being held?

The Board of Trustees of the Fund (the “Board”) has called for a special meeting of shareholders (the “Special Meeting”) to obtain shareholder approval for a new advisory agreement appointing Liberty Street Advisors, Inc. (“Liberty”) as the investment advisor to SharesPost 100 Fund (the “Fund”).

On October 2, 2020 the Board held a meeting to evaluate the New Advisory Agreement. After careful consideration, the Board, including all of the Independent Trustees (as defined herein), unanimously approved the New Advisory Agreement. You are being asked to vote on the proposal to approve the New Advisory Agreement (the “Proposal”).

This proxy statement contains information relevant to your consideration of the Proposal.

What is the date of the Special Meeting and where will it be held?

The Special Meeting will be held virtually on Tuesday, December 1, 2020 and commence at 9:00 a.m. Pacific time. This proxy statement and the accompanying materials are being provided to shareholders of record described below on or about [●], 2020.

What will I be voting on at the Special Meeting?

At the Special Meeting, you will be asked to vote on the approval of the New Advisory Agreement between the Fund and Liberty.

What will the advisory fees be under the New Advisory Agreement?

The proposal to approve the New Advisory Agreement does not seek any increase in fee rates, and the proposed compensation structure is the same as under the current investment advisory agreement (the “Current Advisory Agreement”) between the Fund and SP Investments Management, LLC (“SPIM”) with the exception that advisory fees will be paid monthly instead of quarterly. In addition, if the Proposal is approved, the Fund would enter into a new expense limitation agreement (the “New Expense Limitation Agreement”) with Liberty that would cap Fund expenses at the same ratios under the current expense limitation agreement between the Fund and SPIM (the “Current Expense Limitation Agreement”) for a period of at least two years.

What will happen if the New Advisory Agreement is not approved by shareholders?

In the event that shareholders do not approve the New Advisory Agreement, SPIM will continue to serve as the investment advisor to the Fund and may consider a range of options, which may include seeking another investment adviser or liquidating the Fund.

Who is entitled to vote at the Special Meeting?

Only shareholders of record as of the close of business on October 9, 2020, which we refer to as the “Record Date,” are entitled to notice of, to attend and to vote at, the Special Meeting and any postponements or adjournments thereof. As of the Record Date, there were [●] Class A, [●] Class L and [●] Class I shares of the Fund outstanding held by approximately [●] holders of record entitled to vote at the Special Meeting.

How many votes do I have?

Each Class A, Class L and Class I share has one vote on the proposal to approve the New Advisory Agreement at the Special Meeting or any postponement or adjournment thereof. Fractional Shares shall be entitled to a vote of such fraction. All Classes will vote together as one class with respect to the Proposal.

Do I have any appraisal rights in connection with my shares and the proposal contained herein?

No. Shareholders do not have any appraisal rights in connection with their shares and the proposal contained herein.

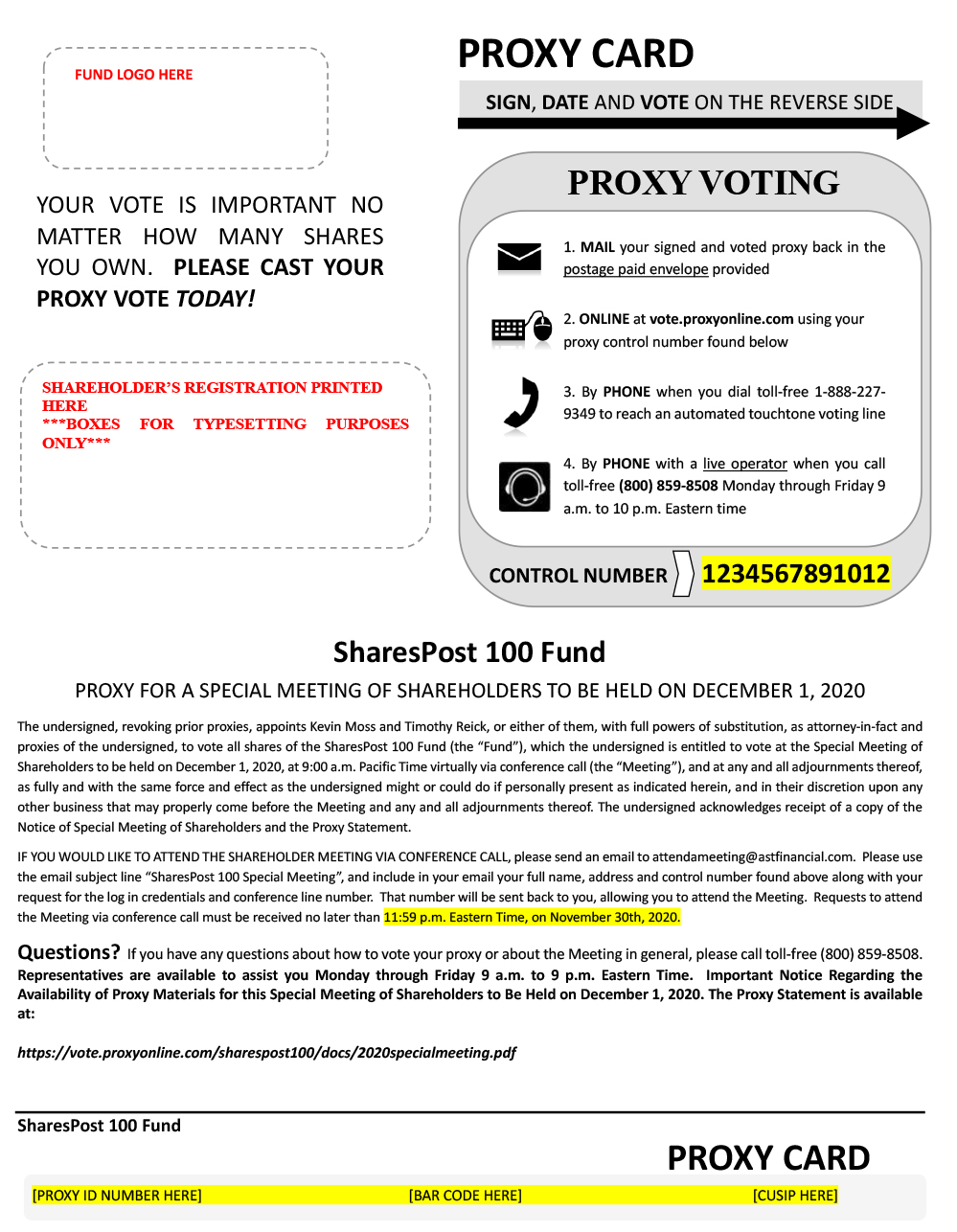

How may I vote?

You may vote virtually at the Special Meeting or by authorizing a proxy by telephone, on the Internet or by mail in accordance with the instructions provided below. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the Meeting, you must first obtain a legal proxy from your financial intermediary and you will be asked to provide that legal proxy prior to voting. The legal proxy must be received by [●] before 11:59 p.m., Eastern time, on November 30, 2020, which is the day before the Special Meeting.

Your vote is important. By authorizing a proxy promptly, the expense of a second mailing or additional solicitations by other means, including, in person and by telephone, facsimile and email, will be avoided.

You may authorize your proxy:

| • | By Internet (log on to the Internet site listed on your proxy card) |

| • | By telephone (call the toll free number listed on your proxy card) |

| • | By mail (using the enclosed postage prepaid envelope). Please allow sufficient time for your proxy card to be timely received prior to 11:59 p.m., Eastern time, on November 30, 2020, which is the day before the Special Meeting. |

| • | At the shareholder meeting over the Internet. The shareholder meeting will be held entirely online in light of the on-going public health concerns regarding the COVID-19 pandemic. Shareholders of record as of October 9, 2020 will be able to attend and participate in the shareholder meeting online or by telephone. Please see instructions below. Even if you plan to attend the shareholder meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to attend the shareholder meeting online. Please see the “How do I Attend the Virtual Meeting?” section below for more details regarding the logistics of the virtual format of the Special Meeting. |

Shares represented by valid proxies will be voted at the Special Meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted “FOR” the proposal to approve the New Advisory Agreement.

The Board does not intend to present, and has no information indicating that others will present, any business at the Special Meeting, other than as set forth in this proxy statement. However, if other matters requiring the vote of shareholders come before the Special Meeting, the persons named as proxies will vote your shares in such manner as they may determine in their discretion.

How can I change my vote or revoke a proxy?

You may revoke your proxy and change your vote any time before voting occurs at the Special Meeting. You may change your vote using the Internet or telephone methods described herein, prior to 11:59 p.m., Eastern time, on November 30, 2020, which is the day before the Special Meeting, in which case only your latest Internet or telephone proxy will be counted. Alternatively, you may revoke your proxy and change your vote by signing and returning a new proxy dated as of a later date, or by attending the Special Meeting and voting virtually. However, your attendance at the Special Meeting will not automatically revoke your proxy, unless you properly vote at the Special Meeting, or specifically request that your prior proxy be revoked by delivering, prior to the time at which voting occurs at the Special Meeting, a written notice of revocation to AST Fund Solutions, LLC (the “Solicitor”), the Fund’s proxy solicitor, at the following address: AST Fund Solutions, LLC, Attention: SharesPost 100 Fund, 48 Wall Street, 22nd Floor, New York, NY 10005. If you hold Fund shares through an intermediary (such as a broker, bank, adviser or custodian), please consult with the intermediary regarding your ability to revoke voting instructions after they have been provided.

How do I attend the Virtual Meeting?

To attend, vote and/or submit any questions at the Special Meeting, please register by sending an email to attendameeting@astfinancial.com containing your full name, address and control number found on your voting form. Please indicate SharesPost 100 Fund in the subject line. Shareholders will receive an email containing instructions for attending the Special Meeting after registering. We encourage you to vote over the Internet or by telephone in advance of the meeting by using the voting control number that appears on your proxy card. Your vote is extremely important. If you have questions, please call the Solicitor toll-free at (800) 859-8508. Requests to attend the Special Meeting via conference call must be received no later than 11:59 p.m. Eastern time, on November 30, 2020.

Record Owners. If you are a shareholder of record of the Fund and wish to attend and vote at the Meeting, follow the instructions above and provide the control number found on the proxy card you received prior to voting.

Beneficial Owners. If you hold your shares through an intermediary, such as a bank or broker, you may follow the instructions above to participate in the meeting. Please be aware if your shares are held through a financial intermediary, and you wish to vote at the Special Meeting, you must first obtain a legal proxy from your financial intermediary and you will be asked to provide that legal proxy prior to voting. The legal proxy must be received by [●] before 11:59 p.m., Eastern time, on November 30, 2020, which is the day before the Special Meeting.

Access to the Audio Webcast of the Meeting. The live audio webcast of the meeting will begin promptly at 9:00 a.m., Pacific time, on December 1, 2020. Online access to the audio webcast will open approximately [30] minutes prior to the start of the meeting to allow time for you to log in and test the computer audio system. We encourage shareholders to access the meeting at least [15] minutes prior to the start time. Your vote is very important to us. Whether or not you plan to participate in the Special Meeting, we encourage you to vote your shares prior to the Special Meeting by one of the methods described on your proxy card.

Will my vote make a difference?

Yes. Your vote is needed to ensure the proposal can be acted upon. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and will save significant additional expenses associated with soliciting shareholder votes.

What constitutes a “quorum”?

The presence virtually or by proxy of the holders of one third of the Fund’s shares entitled to vote on any matter at the Special Meeting will constitute a quorum for the transaction of business.

Abstentions, if any, will be included when determining the presence of a quorum. Uninstructed shares, as discussed below, will not be counted as shares present for purposes of determining quorum.

If a quorum is not present or the Fund wishes to solicit additional votes, the Fund may adjourn the Special Meeting to a date not more than 180 days after the Record Date without further notice, other than announcement at the Special Meeting, to solicit additional proxies. The persons named as proxies will vote those proxies “FOR” such adjournment absent contrary instructions. Any business that might have been transacted at the Special Meeting as originally noticed may be transacted at any adjourned meetings at which a quorum is present.

What vote is required to approve the Proposal?

Shareholders are entitled to cast one vote for each share held and fractional votes for each fractional share held. Because the proposal is at the Fund level, shareholders of Class A, Class L and Class I shares of the Fund will vote together as a single class.

Approval of the New Advisory Agreement requires the affirmative vote of the holders of a majority of the outstanding shares of the Fund entitled to vote at the Special Meeting. The 1940 Act defines “a majority of outstanding voting securities” of the Fund as (a) 67% or more of the voting securities present at the Special Meeting if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy or (b) more than 50% of the outstanding voting securities of the Fund, whichever is less.

Shareholders of Record

If you are a shareholder of record, your properly executed proxy received prior to 11:59 p.m., Eastern time, on November 30, 2020, which is the day before the Special Meeting, and not duly revoked, will be voted in accordance with your instructions marked thereon. However, if you sign and return a proxy card without giving specific voting instructions, then the persons named as proxies will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement. With respect to any other business that may be properly presented for a vote at the Special Meeting, the persons named as proxies will vote your shares in such manner as they may determine in their discretion.

Broker-controlled shares

If you are a beneficial owner of Fund shares held by a broker or other custodian, you may instruct the broker or other custodian that holds your shares as to how to vote your shares via the voting instruction form included with this proxy statement. All voting instruction forms timely received by the broker or other custodian that holds your shares, and not duly revoked, will be voted in accordance with the instructions marked thereon. However, if you do not provide your broker or other custodian of your shares with specific voting instructions, then your shares are referred to as “uninstructed shares”. Uninstructed shares will not be counted as shares present at the Special Meeting. The broker or other custodian cannot vote uninstructed shares on a “non-routine” matter, such as the New Advisory Agreement proposal, and will inform the inspector of election that it does not have the authority to vote on such matters with respect to your shares. As a result, in order for your vote to be counted on the New Advisory Agreement proposal, you must submit your voting instruction form to your broker or other custodian.

As previously noted, please be aware if your shares are held through a financial intermediary, and you wish to vote at the Special Meeting, you must first obtain a legal proxy from your financial intermediary and you will be asked to provide that legal proxy prior to voting.

Principal Shareholders

As of the Record Date, to the knowledge of the Fund, no person is a beneficial owner or a shareholder of record of more than 5% of the voting securities of the Fund, except as set forth in Exhibit A.

Will the Fund incur expenses in connection with the Special Meeting or the Proposal?

No. SPIM and Liberty have agreed to pay all costs associated with the solicitation of proxies for the Special Meeting. AST Fund Solutions, LLC has been retained by SPIM and Liberty to assist in the solicitation of proxies at an expected cost that will not exceed $60,000 in the aggregate, plus the reimbursement of Solicitor’s reasonable out-of-pocket expenses.

In addition to the solicitation of proxies by mail, proxies may be solicited by other means, including, by telephone, facsimile and email, by Solicitor and/or by trustees, officers and employees of the Fund, SPIM and/or Liberty and affiliates of SPIM and/or Liberty, none of whom will receive any additional compensation for their services.

In addition, neither the Fund nor its shareholders will bear any other costs associated with the Proposal.

What does it mean if I receive more than one proxy card?

Some of your shares may be registered differently or held in a different account. You should authorize a proxy to vote the shares in each of your accounts by mail, by telephone or via the Internet. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your shareholder accounts in the future, you should call us at [●]. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a shareholder.

Only one proxy statement will be delivered to multiple shareholders sharing an address, unless the Fund has received contrary instructions. The Fund will furnish, upon written or oral request, a separate copy of the proxy statement to a shareholder at a shared address to which a single proxy statement was delivered. Requests for a separate proxy statement, and notifications to the Fund that a shareholder wishes to receive separate copies in the future, should be made in writing to the Fund at UMB Fund Services, Inc., PO Box 2175, Milwaukee, WI 53201-2175 or by calling toll-free (800) 859-8508. Multiple shareholders who are sharing an address and currently receiving multiple proxy statements may request to receive only one copy of such proxy statement by calling toll-free (800) 859-8508.

How does the Board recommend voting on the Proposal?

The Board, including all of the Independent Trustees, recommends that you vote “FOR” the New Advisory Agreement.

PROPOSAL – APPROVAL OF NEW ADVISORY AGREEMENT

Background

On August 28, 2020, SPIM, Liberty and SP Holdings Group, Inc., the successor of the parent entity of SPIM (“SP Holdings Group”), executed an Advisor Transition Support Agreement (the “Transition Agreement”). Subject to the terms and conditions thereof, in exchange for certain compensation, SPIM has agreed to use its reasonable best efforts to cause (i) the engagement of Liberty as the investment advisor to the Fund; (ii) the execution and delivery of the New Advisory Agreement; (iii) the termination of the Current Advisory Agreement; (iv) the execution of the New Expense Limitation Agreement; and (v) the receipt of the approvals required for the foregoing. Such required approvals consist of (i) the approval by the Board of Trustees of the Fund (the “Board”), including all of the Independent Trustees (as defined herein); and (ii) the approval by the shareholders of the Fund. Pursuant to the Transition Agreement, SPIM has also agreed to provide certain transition services to Liberty.

On October 2, 2020, the Board held a meeting to evaluate the New Advisory Agreement. After careful consideration, the Board, including all of the Independent Trustees, approved the New Advisory Agreement and recommended that the shareholders of the Fund approve the New Advisory Agreement.

Shareholder Approval of the New Advisory Agreement

The Fund is seeking shareholder approval of the New Advisory Agreement between the Fund and Liberty, which, if approved by the Fund’s shareholders, will replace the Current Advisory Agreement between the Fund and SPIM. Under the New Advisory Agreement, Liberty will serve as the Fund’s investment advisor.

The 1940 Act requires that a new investment advisory agreement be approved by both a majority of trustees who are not parties to such contract or agreement or interested persons of any such party and “a majority of the outstanding voting securities,” as such terms are defined under the 1940 Act. The Board, including all of the Independent Trustees, has unanimously approved the New Advisory Agreement and believes it to be in the best interest of the Fund and its shareholders. The Board is currently composed of two trustees, each of whom is not an “interested person” of the Fund or Liberty as defined in the 1940 Act (the “Independent Trustees”). If approved by a majority of the Fund’s outstanding shares (as defined under the 1940 Act) at the Special Meeting, Liberty is expected to become the Fund’s investment advisor under the New Advisory Agreement in the fourth quarter of 2020.

The shareholders of the Fund are being asked at the Special Meeting to approve the New Advisory Agreement between the Fund and Liberty for an initial term of two years. If the Fund enters into the New Advisory Agreement, the Current Advisory Agreement would be terminated at the time of entry into the New Advisory Agreement. The Board believes that the approval of the New Advisory Agreement is in the best interest of the Fund and its shareholders.

There are no plans to make changes to the portfolio management of the Fund or the Fund’s investment objective, strategies or policies immediately following the appointment of Liberty. Similarly, the Fund’s governance structure and service providers will also remain unchanged. If the Fund and Liberty enter into the New Advisory Agreement, you will still own the same amount and type of Fund shares. Importantly, certain key personnel of SPIM, including Christian Munafo and Kevin Moss, as well as the other members of the SPIM investment management group, who provide portfolio management services to the Fund, are expected to become employees of Liberty upon the effective date of the New Advisory Agreement and to continue to provide the same portfolio management services to the Fund with the support of Liberty’s resources.

The Current Advisory Agreement

Pursuant to the Current Advisory Agreement, SPIM is paid an advisory fee equal to 1.90% (annual rate) of the average daily net asset value of the Fund, which is paid quarterly in arrears. During the fiscal year ended December 31, 2019, the Fund incurred $3,506,326 in advisory fees, of which $1,467,342 were waived. The Current Investment Agreement, dated July 30, 2013, was last approved by shareholders of the Fund on [July 9, 2013].

Overview of the New Advisory Agreement

The material terms of the New Advisory Agreement will be identical to those of the Current Advisory Agreement, with the exception that advisory fees shall be paid monthly instead of quarterly. This summary description is qualified in its entirety by the complete text of the New Advisory Agreement, a copy of which is attached as Exhibit B to this proxy statement. The copy of the New Advisory Agreement attached as Exhibit B to this proxy statement is marked to show the changes against the Current Advisory Agreement.

Pursuant to the Current Advisory Agreement, SPIM provides the Fund with management and investment advisory services. Under the New Advisory Agreement, the management and investment advisory services currently provided by SPIM will instead be provided by Liberty. Similar to the Current Advisory Agreement, under the New Advisory Agreement Liberty will (i) act as investment advisor to the Fund and, subject to the supervision of the Board, manage the investment activities of the Fund; (ii) continually manage the assets of the Fund; (iii) determine the securities to be purchased, sold or otherwise disposed of by the Fund and the timing of such purchases, sales and dispositions; (iv) vote securities on behalf of the Fund; and (v) prepare materials and reports for use in connection with meetings of the Board.

If the New Advisory Agreement is approved, Liberty will be paid an advisory fee equal to 1.90% (annual rate) of the average daily net asset value of the Fund, monthly in arrears. In addition, Liberty has agreed to enter into the New Expense Limitation Agreement with respect to the Fund that, similar to the Current Expense Limitation Agreement, will cap the Fund’s net expense ratio at 2.50% of the average NAV of the Fund for Class A shares, 2.75% of the average NAV of the Fund for Class L shares and 2.25% of the average NAV of the Fund for Class I shares, for a period of two years and every year thereafter; provided that each such renewal is approved by the Board of Trustees. Similar to the Current Expense Limitation Agreement, Liberty may recoup from the Fund fees previously reduced or expenses previously reimbursed by Liberty with respect to the Fund pursuant to the New Expense Limitation Agreement if such recoupment does not cause the Fund to exceed the lesser of the New Expense Limitation or the expense limitation agreement in effect at the time of such reimbursement, and the reimbursement is made within three years of the date on which Liberty reduced the fee or incurred the expense.

The New Advisory Agreement, like the Current Advisory Agreement, provides that it will continue in force for an initial period of two years, and then from year to year thereafter, but only so long as its continuance is approved at least annually by the vote of a majority of the outstanding voting securities of the Fund, as defined by the 1940 Act and the rules thereunder, or by the Board; provided that in either event such continuance is also approved by the Independent Trustees by vote cast in person at a meeting called for the purpose of voting on such approval. Like the Current Advisory Agreement, the New Advisory Agreement automatically terminates on assignment unless such automatic termination shall be prevented by an exemptive order or rule by the SEC, and it is terminable by the Fund or the investment advisor upon 60 days’ prior written notice.

Under the Current Advisory Agreement, the Fund is required to bear all of its own expenses, including, without limitation: fees and expenses of Independent Trustees of the Fund; interest expense, taxes, fees and commissions of every kind; expenses of pricing Fund portfolio securities; expenses of issues, repurchase and redemption of shares of beneficial interest of the Fund; expenses of registering and qualifying the Fund and its shares under federal and state laws and regulations; charges of custodians, transfer agents, and fund administrators; expenses of preparing and distributing prospectuses; auditing and legal expenses; reports to shareholders; expenses of meetings of shareholders and proxy solicitations therefor; insurance expense; expenses relating to distributions; association membership dues; and such non-recurring items as may arise, including litigation to which the Fund is a party. Under the New Advisory Agreement, the Fund will continue to bear these same expenses.

The New Advisory Agreement, like the Current Advisory Agreement, provides that the investment advisor shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misconduct, bad faith, gross negligence or reckless disregard of its duties.

Information about Liberty

Liberty is a New York corporation with its main office located in New York, New York. Liberty is registered with the SEC under the Investment Advisers Act of 1940, as amended. Since 2007, Liberty has provided investment advisory services to investment companies registered under the 1940 Act. The services provided by Liberty to its clients generally include:

| • | designing the fund’s initial investment policies and developing evolutionary changes to such policies as appropriate for presentation to the Board of Trustees; |

| • | providing overall supervision for the general management and operations of the funds; |

| • | monitoring and supervising the activities of the sub-advisor for each fund; and |

| • | providing related administrative services. |

Liberty provides overall investment advisory services to mutual funds which are part of the Liberty Street Fund family (the “Mutual Funds”) within the series of Investment Managers Series Trust (the “Trust”), a management investment company registered under the 1940 Act, and oversees the sub-advisers to the Mutual Funds. Liberty also provides advisory services to one private placement fund. If the New Advisory Agreement is approved, Liberty expects to build out its advisory capabilities by adding the members of the SPIM investment management group, including Christian Munafo and Kevin Moss, and supporting the growth of the Fund. The names, titles, principal occupations, and address of the principal executive officers of Liberty are set forth below.

| Name and Address(1) | Title | Principal Occupations |

| Timothy W. Reick | CEO | CEO, Liberty; CEO and Co-Head of Sales, HRC Fund Associate, LLC and HRC Portfolio Solutions, LLC. |

| Victor J. Fontana, Sr. | President | President, Liberty; President & COO, HRC Fund Associate, LLC and HRC Portfolio Solutions, LLC. |

| Raymond A. Hill III | Chairman | Chairman, Liberty; Chairman & Co-Head of Sales, HRC Fund Associate, LLC and HRC Portfolio Solutions, LLC; CEO, Institutional Research Services, Inc, DBA PCS Research Services; Managing Member, MSRH, LLC. |

| Scott D. Daniels | Treasurer and CFO | Treasurer and CFO, Liberty; CFO, HRC Fund Associate, LLC and HRC Portfolio Solutions, LLC; Chairman/Senior Partner, S.D. Daniels & Company, P.C. |

| Victor J. Fontana, Jr. | Senior Vice President, Chief Operating Officer | SVP & COO, Liberty; Controller, HRC Fund Associate, LLC and HRC Portfolio Solutions, LLC. |

| Andrew P. Nowack | Chief Compliance Officer, General Counsel | CCO & General Counsel, Liberty and HRC Fund Associate, LLC, HRC Portfolio Solutions, LLC, and Institutional Research Services, Inc. dba PCS Research Services. |

| (1) | Each officer's address is in care of Liberty Street Advisors, Inc., 100 Wall Street, Floor 20, New York, NY 10005. |

Liberty has received verbal assurance from the staff of the SEC that it will not object if Liberty relies on an existing exemptive order issued to SPIM and the Fund on August 28, 2017 that permits the Fund, subject to certain conditions set forth in the application, to issue multiple classes of shares and to impose asset-based distribution and/or service fees, early withdrawal charges and repurchase fees, until the earlier of Liberty receiving its own exemptive order or 150 days from the execution of the New Advisory Agreement. Liberty will be seeking a similar exemptive order for itself and the Fund to maintain the Fund’s current share class structure. There is, however, no guarantee that the exemptive order will be granted.

Affiliated Brokers

For the year ended December 31, 2019, the Fund paid $49,020 in commissions to affiliated brokers of the Fund. All such amounts were paid to SharesPost Financial Corporation, which is an affiliate of the Fund because it is under common control with SPIM. The total commissions paid to affiliated brokers was equal to 30.29% of the Fund’s aggregate commissions for the fiscal year.

Adviser Covenants

Under the Transition Agreement, Liberty and SPIM have agreed to use their respective reasonable best efforts to comply with the following: (1) during the three-year period after the date of shareholder approval of the New Advisory Agreement, at least 75% of the members of the Fund’s board of trustees (or successor thereto by reorganization or otherwise) will not be “interested persons” (as defined in the 1940 Act) of Liberty or its predecessor; and (2) an “unfair burden,” as that term is described in the 1940 Act, will not be imposed on the Fund as a result of the transition or any express or implied terms, conditions, or understandings relating to such transition during the two-year period after the date of shareholder approval of the New Advisory Agreement.

Board Considerations

At a meeting held on October 2, 2020, the Board considered the approval of the New Advisory Agreement between the Fund and Liberty. Following its review and consideration, the Board determined that the terms of the New Advisory Agreement were fair and reasonable and that approval of the New Advisory Agreement was in the best interests of the Fund and its shareholders. The Board, including the Independent Trustees, unanimously approved the New Advisory Agreement for an initial two-year period.

In the course of their consideration of the New Advisory Agreement, the Independent Trustees met in executive session and were advised throughout the process by their independent counsel. The Independent Trustees evaluated the terms of the New Advisory Agreement and reviewed with counsel their duties and responsibilities in evaluating and approving the New Advisory Agreement. In considering the New Advisory Agreement, the Board reviewed the materials provided to it by Liberty, as supplemented based on requests of the Independent Trustees and by information provided orally at the meeting. As part of its evaluation, the Board, including the Independent Trustees, considered, among others, the following factors: (1) the nature, extent and quality of the services to be provided by the Liberty; (2) the comparative investment performance of the Fund; (3) the estimated cost of the services to be provided and the profits expected to be realized by Liberty from its relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund shareholders; and (5) any other benefits anticipated to be derived and identified by Liberty from its relationship with the Fund. The Independent Trustees considered Liberty’s written responses, as supplemented by Liberty’s additional oral responses at the meeting, and determined that the content of Liberty’s responses satisfied their requests for information to support their decision to consider and approve the New Advisory Agreement.

The Board reviewed the nature, extent and quality of the services to be provided under the Agreement by Liberty. The Board considered information provided by Liberty regarding its history, experience advising other registered funds, operations, compliance capabilities, facilities, organization and personnel, as well as the anticipated ability of Liberty to perform its duties under the New Advisory Agreement. The Board also considered the financial resources of Liberty and the staffing required to manage the Fund and provide oversight of the Fund’s third-party service providers. Based on these and other considerations, the Board determined that Liberty can provide advisory services that are appropriate in scope and extent in light of the Fund’s investment program and that appointment of Liberty is expected to result in services provided to the Fund that are at least equal in their nature, extent and quality to the services currently provided to the Fund.

In considering the investment performance of the Fund and Liberty, the Board considered that it is anticipated that all of the portfolio managers and other key investment personnel currently managing the Fund are expected to continue to do so following the appointment of Liberty as the Fund’s investment adviser. The Board noted that there is no expectation of change to the Fund’s investment objective, strategies or policies immediately following the appointment of Liberty. The Board reviewed the Fund’s performance for various trailing periods, and compared the Fund’s performance to other funds with similar investment strategies (“peer funds”). The Board took into consideration Liberty’s observation that the Fund’s investment strategy is highly distinct, and, as a result, the Fund has a significantly limited range of peers. The Board also took into consideration Liberty’s explanation of the methodology by which it identified the peer funds. The Board concluded that Liberty is capable of generating a level of investment performance that is appropriate in light of the Fund’s principal investment strategies.

In considering the cost of the services to be provided and the profits expected to be realized by Liberty from its relationship with the Fund, the Board considered that the terms and conditions of the New Advisory Agreement with Liberty, including the Fund’s contractual fee rate, will remain identical those of the Current Advisory Agreement, with the exception that advisory fees will be paid monthly instead of quarterly. The Board also noted that Liberty has agreed to limit the total expenses of each share class of the Fund at the same levels as the Current Expense Limitation Agreement for a period of two years. The Board considered the advisory fee rate and the total expense ratios of each share class of the Fund as compared to those of the peer funds. The Board noted that certain peer funds charge a base advisory fee similar to or below the Fund’s 1.9% management fee, but may also charge incentive fees of up to 20% of certain performance measures. The Board noted that the total expense ratios for Class A and Class I shares of the Fund were lower than the majority of the peer funds, which have net expense ratios of between 1.86% and 11.00%, and the expense ratio for Class L shares of the Fund was above two peers funds and below two peers funds. Further, the Board considered the overall profits expected to be realized by Liberty in connection with the operation of the Fund, as well as Liberty’s entrepreneurial efforts with respect to the Fund. On the basis of these and other considerations, together with the other information it considered, the Board determined that the advisory fee rate for the Fund was reasonable in light of the services to be provided.

The Board considered whether Liberty will realize economies of scale with respect to its management of the Fund and whether the Fund’s fee levels reflect such economies of scale. In this regard, the Board considered that Liberty has agreed to limit the total expenses of the Fund pursuant to the New Expense Limitation Agreement. The Board also noted that, due to the Fund’s asset size, advisory fee breakpoints did not appear to be appropriate at this time. The Board also noted Liberty’s belief that its affiliated broker-dealer, HRC Fund Associates, LLC (“HRC”), has the resources and relationships with financial intermediaries to potentially increase the Fund’s assets, and that Fund shareholders may benefit from future economies of scale based on any such growth. The Board Members concluded that they would have the opportunity to reexamine periodically the appropriateness of the advisory fees payable by the Fund to Liberty in light of any economies of scale experienced in the future.

The Board considered any potential fall-out benefits that might accrue to the benefit of Liberty or its affiliates. The Board noted that Liberty may receive other benefits from providing advisory services to the Fund and other intangible benefits resulting from a long-term relationship with the Fund. In addition, HRC is expected to derive benefits from the marketing of the Fund to financial professional intermediaries, which may benefit HRC’s reputation for attracting and engaging other funds and/or investment managers for its marketing services. The Board concluded that the potential fall-out benefits that might accrue to the benefit of Liberty were reasonable in light of the services to be provided.

The Board reviewed these considerations, taking into account the factors described and such other matters as deemed relevant, with no one factor being determinative, and with each trustee weighing the various factors independently. The Board concluded that approval of the New Advisory Agreement was in the best interests of the Fund and its shareholders and voted to approve the New Advisory Agreement for an initial two-year period.

The Board recommends a vote “for” the new advisory agreement.

OTHER BUSINESS

The Board is not aware of any other matters that will be presented for action at the Special Meeting other than those set forth herein. Should any other matters requiring a vote of shareholders arise, proxies will be voted in the discretion of the persons named in the proxy card.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table presents certain information as of the Record Date, with respect to the beneficial ownership of the shares by (1) each existing trustee, (2) each existing executive officer and (3) all of the Fund’s existing trustees and existing executive officers as a group.

Unless otherwise indicated, to the Fund’s knowledge, all persons named in the table below have sole voting power and sole investment power with respect to the shares indicated as beneficially owned. In addition, unless otherwise indicated, the address for each person named below is c/o SP Investments Management, LLC, 555 Montgomery Street, Suite 1400, San Francisco, CA 94111.

| Name and Address of Beneficial Owner | | Number of

Shares Beneficially

Owned | | Percentage |

| Current Independent Trustees: | | | | |

| Robert Boulware | | [1721.197] | | [0]% |

| Mark Radcliffe | | [None] | | [0]% |

| Current Executive Officers: | | | | |

| Kevin Moss – President | | [●] | | [●]% |

| John “Jack” Sweeney – Principal Financial Officer | | [●] | | [●]% |

| Existing Trustees and Executive Officers as a group | | [●] | | [●]% |

INVESTMENT ADVISOR, ADMINISTRATOR AND PRINCIPAL UNDERWRITER

Set forth below are the names and addresses of the Fund’s investment advisor, administrator and distributor as of the date of this proxy statement:

INVESTMENT ADVISOR | ADMINISTRATOR | PRINCIPAL UNDERWRITER |

SP Investments Management, LLC 555 Montgomery Street, Suite 1400, San Francisco, CA 94111 | UMB Fund Services, Inc. 235 West Galena Street, Milwaukee, WI 53212 | Foreside Fund Services, LLC Three Canal Plaza, Suite 100, Portland, ME 04101 |

ANNUAL AND SEMIANNUAL REPORTS

Copies of the Fund’s most recent annual report and semi-annual report are available at our website at www.sharespost100fund.com or without charge upon request by calling us at 1-800-834-8707. You may also direct your request to SharesPost 100 Fund, Attention: Kevin Moss, 555 Montgomery Street, Suite 1400, San Francisco, CA 94111. Copies of such reports are also posted via EDGAR on the SEC’s website at www.sec.gov.

PLEASE VOTE PROMPTLY BY SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE ACCOMPANYING POSTAGE PAID RETURN ENVELOPE OR BY FOLLOWING THE INSTRUCTIONS PRINTED ON THE PROXY CARD, WHICH PROVIDES INSTRUCTIONS FOR AUTHORIZING A PROXY BY TELEPHONE OR THROUGH THE INTERNET. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

EXHIBIT A

PRINCIPAL SHAREHOLDERS OF THE FUND

As of October 9, 2020, the following persons were the owners of more than 5% of the outstanding shares of the Fund.

Name | Address | Percentage of Ownership in the

Fund |

| [●] | [●] | [●]% |

| [●] | [●] | [●]% |

| [●] | [●] | [●]% |

| [●] | [●] | [●]% |

EXHIBIT B

INVESTMENT ADVISORY AGREEMENT

THIS INVESTMENT ADVISORY AGREEMENT is made the30th[___] day ofJuly, 2013[____________], 20[___] (the “Agreement”), by and between SharesPost 100 Fund, a Delaware statutory trust (the “Company”), andSP Investments Management, LLC, a Delaware limited liability companyLiberty Street Advisors, Inc., a New York corporation (the “Investment Adviser”).

WHEREAS, the Companyintends to engage in business asis a closed-end, non-diversified management investment company, and is registeredas suchunder the Investment Company Act of 1940, as amended (the “1940 Act”) and operating as an interval fund; and

WHEREAS, the Investment Adviser is an investment adviser registeredas suchunder the Investment Advisers Act of 1940, as amended (the “Advisers Act”); and

WHEREAS, the Company desires to retain the Investment Adviser to act as its investment adviser pursuant to this Agreement; and

WHEREAS, the Investment Adviser desires to be retained to act as investment adviser to the Company pursuant to this Agreement;.

NOW, THEREFORE, in consideration of the terms and conditions hereinafter set forth, it is agreed, by and between the parties, as follows:

1. The Company hereby retains the Investment Adviser to:

(a)actAct as its investment adviser and, subject to the supervision and control of the Board of Trustees of the Company (the “Board,” and each member of the Board, a “Trustee”), manage the investment activities of the Company as hereinafter set forth. Without limiting the generality of the foregoing, the Investment Adviser shall: (i) obtain and evaluate such information and advice relating to the economy, securities markets, and securities as it deems necessary or useful to discharge its duties hereunder; (ii) continuously manage the assets of the Company in a manner consistent with (ix) applicable laws and regulations and (iiy) the investment objective, policies and restrictions of the Company, as set forth in the Registration Statement on Form N-2 filed by the Company with the Securities and Exchange Commission (the “SEC”) and as may be adopted or modified from time to time by the Board; (iii) determine the securities to be purchased, sold or otherwise disposed of by the Company and the timing of such purchases, sales and dispositions (and advising the Company’s Chief Compliance Officer of the same); (iv) invest discrete portions of the Company’s assets in individual companies (“Portfolio Companies”) and take such further action, including the placing of purchase and sale orders and the voting of securities on behalf of the Company, as the Investment Adviser shall deem necessary or appropriate. The Investment Adviser shall furnish to or place at the disposal of the Company such of the information, evaluations, analyses and opinions formulated or obtained by the Investment Adviser in the discharge of its duties as the Company may, from time to time, reasonably request; and.

(b) Subject to the supervision and control of the Board, provide, and the Investment Adviser hereby agrees to provide, certain management, administrative and other services tothe Company. Notwithstanding the appointment of the Investment Adviser to provide such services hereunder, the Board shall remain responsible for supervising and controlling the management, business and affairs ofthe Company. The management, administrative and other services to be provided by the Investment Adviser shall include:

| (i) | providing office space, telephone and utilities; |

| (ii) | providing administrative and secretarial, clerical and other personnel as necessary to provide the services required to be provided under this Agreement; |

| (iii) | supervising the entities which are retained by the Company to provide fund administration, transfer agent, custody, escrow and other services to the Company; |

| (iv) | handlinginvestorinquiries from investors or their representatives regarding the Company and providing investors or their representatives with information concerning their investments in the Company and capital account balances; |

| (v) | monitoring relations and communications between investors or their representatives and the Company; |

| (vi) | the drafting and updating of disclosure documents relating to the Company and preparing offering materials and ensuring their compliance with applicable laws; |

| (vii) | maintaining and updating investor information, such as change of address and employment[RESERVED]; |

| (viii) | assisting in the preparation and mailing ofinvestorsubscription documents to investors or their representatives and confirming the receipt of such documents; |

| (ix) | assisting in the preparation, review and approval of anyregulatory filings of the Company required under applicable law and filed with the SEC, state securities regulators and other federal and state regulatory authorities; |

| (x) | preparing reports to and other informational materials for shareholders of the Company (“Shareholders”) and assisting in the preparation of proxy statements and other Shareholder communications; |

| (xi) | monitoring compliance with regulatory requirements and with the Company’s investment objective, policies and restrictions as established by the Board; |

| (xii) | reviewing accounting records and financial reports of the Company, assisting with the preparation of the financial reports of the Company and acting as liaison with the Company’s accounting agent and independent auditors; |

| (xiii) | assisting in the preparation and filing of tax returns; |

| (xiv) | coordinating and organizing meetings of the Board and meetings of Shareholders, in each case when called by such persons; |

| (xv) | preparing materials and reports for use in connection with meetings of the Board; |

| (xvi) | maintaining and preserving those books and records of the Company not maintained by the Company’s fund administrator, accounting agent or custodian (which books and records shall be the property of the Company and shall be surrendered to the Company promptly upon request); |

| (xvii) | reviewing and arranging for payment of the expenses of the Company; |

| (xviii) | working with any counsel of the Company in response to any litigation, investigations or regulatory matters; and |

| (xix) | any additional services that the Investment Adviser and the Company’s Board shall agree to from time to time. |

2. Without limiting the generality of Section 1 hereof, the Investment Advisershall be is authorized: (a) to open, maintain and close accounts in the name and on behalf of the Company with brokers and dealers as it determines are appropriate; (b) to select and place orders with brokers, dealers or other financial intermediaries for the execution, clearance or settlement of any transactions on behalf of the Company on such terms as the Investment Adviser considers appropriate and that are consistent with the policies of the Company; (c) to agree, subject to any policies adopted by the Board and to the provisions of applicable law, to such commissions, fees and other charges on behalf of the Company as it shall deem reasonable in the circumstances taking into account all such factors as it deems relevant (including the quality of research and other services made available to it even if such services are not for the exclusive benefit of the Company and the cost of such services does not represent the lowest cost available) and shall be under no obligation to combine or arrange orders so as to obtain reduced charges unless otherwise required under the federal securities laws; and (d) to pursue and implement the investment policies and strategies of the Company. The Investment Adviser may, subject to such procedures as may be adopted by the Board, use affiliates of the Investment Adviser as brokers to effect the Company’s securities transactions and the Company may pay such commissions to such brokers in such amounts as are permissible under applicable law.

3. Advisory Fee; Expenses.

(a) In consideration of the services provided by the Investment Adviser under this Agreement, the Company will pay the Investment Adviser a fee as indicated on Exhibit A (the “Advisory Fee”).

(b) The Investment Adviser is responsible for all costs and expenses associated with the provision of its services hereunder including, but not limited to: (i) expenses relating to thepreliminaryselection of Portfolio Companies; and (ii) fees of consultants retained by the Investment Adviser. The Investment Adviser shall, at its own expense, maintain such staff and employ or retain such personnel and consult with such other persons as may be necessary to render the services required to be provided by the Investment Adviser or furnished to the Company under this Agreement. Without limiting the generality of the foregoing, the staff and personnel of the Investment Adviser shall be deemed to include persons employed or otherwise retained by the Investment Adviser or made available to the Investment Adviser.

4. The Company will, from time to time, furnish or otherwise make available totheInvestment Adviser such financial reports, proxy statements, policies and procedures and other information relating to the business and affairs of the Company as the Investment Adviser may reasonably require in order to discharge its duties and obligations hereunder.

5. Except as provided herein or in another agreement between the Company andtheInvestment Adviser, the Company shall bear all of its own expenses, including, without limitation, fees and expenses of Trustees who are not “interested persons” (as defined by the 1940 Act and the rules thereunder, “Interested Persons”) of the Company or the Investment Adviser, interest expense, taxes, fees and commissions of every kind, expenses of pricing Company portfolio securities, expenses of issues, repurchase and redemption of shares of beneficial interest of the Company (“Shares”), expenses of registering and qualifying the Company and its Shares under federal and state laws and regulations, charges of custodians, transfer agents, and fund administrators, expenses of preparing and distributing prospectuses, auditing and legal expenses, reports to Shareholders, expenses of meetings of Shareholders and proxy solicitations therefor, insurance expense, expenses relating to distributions, association membership dues and such non-recurring items as may arise, including litigation to which the Company is a party.

6. The compensation provided to the Investment Adviser pursuant to Section 3(a) hereof shall be the entire compensation for the services provided by the Investment Adviser to the Company and the expenses assumed by the Investment Adviser under this Agreement.

7. The Investment Adviser will use its best efforts in the supervision and management of the investment activities of the Company and in providing services hereunder, but in the absence of willful misconduct, bad faith, gross negligence or reckless disregard of its obligations hereunder, the Investment Adviser, its directors, officers or employees and its affiliates, successors or other legal representatives (collectively, the “Affiliates”) shall not be liable to the Company for any error of judgment, for any mistake of law, for any act or omission by the Investment Adviser or any of its Affiliates or for any loss suffered by the Company.

Notwithstanding the foregoing, the Company shall not be deemed to have waived any rights it may have against the Investment Adviser under federal or state securities laws.

8. Indemnification.

(a)8. (a)The Company shall indemnify, defend, and hold harmless the Investment Adviser and its Affiliates and their respective affiliates, executors, heirs, assigns, successors or other legal representatives (each, an “Indemnified Person”) against any and all costs, losses, claims, damages or liabilities, joint or several, including, without limitation, reasonable attorneys’ fees and disbursements, resulting in any way from the performance or non-performance of any Indemnified Person’s duties with respect to the Company, except those resulting from the willful misconduct, bad faith or gross negligence of an Indemnified Person or the Indemnified Person’s reckless disregard of such duties, and in the case of criminal proceedings, unless such Indemnified Person had reasonable cause to believe its actions unlawful (collectively, “disabling conduct”). Indemnification shall be made following: (i) a final decision on the merits by a court or other body before which the proceeding was brought that the Indemnified Person was not liable by reason of disabling conduct, or (ii) a reasonable determination, based upon a review of the facts and reached by (A) the vote of a majority of the Trustees who are not parties to the proceeding, or (B) legal counsel selected by a vote of a majority of the Board in a written advice, that the Indemnified Person is entitled to indemnification hereunder. The Company shall, to the extent permitted by the 1940 Act and interpretations thereunder, advance to an Indemnified Person (to the extent that it has available assets and need not borrow to do so) reasonable attorneys’ fees and other costs and expenses incurred in connection with defense of any action or proceeding arising out of such performance or non-performance. The Investment Adviser agrees, and each other Indemnified Person will agree as a condition to any such advance, that in the event the Indemnified Person receives any such advance, the Indemnified Person shall reimburse the Company for such fees, costs and expenses to the extent that it shall be determined that the Indemnified Person was not entitled to indemnification under this Section 8.

(b) The Investment Adviser agrees to indemnify, defend, and hold harmless the Company and its respective Trustees, affiliates, employees and agents (each, a “Company Party” and collectively, the “Company Parties”) against any and all costs, losses, claims, damages or liabilities, joint or several, including, without limitation, reasonable attorneys’ fees and disbursements, resulting in any way from the performance or non-performance of any Company Party’s duties with respect to the Investment Adviser, except those resulting from the willful misconduct, bad faith or gross negligence of a Company Party or the Company Party’s reckless disregard of such duties, and in the case of criminal proceedings, unless such Company Party had reasonable cause to believe its actions unlawful (collectively, “disabling Company conduct”). Indemnification shall be made following: (i) a final decision on the merits by a court or other body before which the proceeding was brought that the Company Party was not liable by reason of disabling Company conduct, or (ii) a reasonable determination, based upon a review of the facts and reached by (A) the vote of a majority of the Investment Adviser’s directors who are not parties to the proceeding, or (B) legal counsel selected by a vote of a majority of the Investment Adviser’s board in a written advice, that the Company Party is entitled to indemnification hereunder. The Investment Adviser shall, to the extent permitted by the 1940 Act and interpretations thereunder, advance to a Company Party (to the extent that it has available assets and need not borrow to do so) reasonable attorneys’ fees and other costs and expenses incurred in connection with defense of any action or proceeding arising out of such performance or non-performance. The Company agrees, and each other Company Party will agree as a condition to any such advance, that in the event the Company Party receives any such advance, the Company Party shall reimburse the Investment Adviser for such fees, costs and expenses to the extent that it shall be determined that the Company Party was not entitled to indemnification under this Section 8.

(c) Notwithstanding any of the foregoing to the contrary, the provisions of this Section 8 shall not be construed so as to relieve an Indemnified Person or a Company Party of, or provide indemnification with respect to, any liability (including liability under federal securities laws, which, under certain circumstances, impose liability even on persons who act in good faith) to the extent (but only to the extent) that such liability may not be waived, limited or modified under applicable law or that such indemnification would be in violation of applicable law, but shall be construed so as to effectuate the provisions of this Section 8 to the fullest extent permitted by law.

9. Nothing contained in this Agreement shall prevent the Investment Adviser oranyan “affiliated person” (as such term is defined in the 1940 Act) of the Investment Adviser from acting as investment adviser or manager for any other person, firm or corporation and except as required by applicable law (including Rule 17j-1 under the 1940 Act) shall not in any way bind or restrict the Investment Adviser or any such “affiliated person” from buying, selling or trading any securities or commodities for their own accounts or for the account of others for whom they may be acting. Nothing in this Agreement shall limit or restrict the right of any member, officer or employee of the Investment Adviser to engage in any other business or to devote his or her time and attention in part to the management or other aspects of any other business whether of a similar or dissimilar nature.

10. Term.

(a) This Agreement will take effect on the date first set forth above. Unless earlier terminated pursuant to this Section 10, this Agreement shall remain in effect for a period of two (2) years from such date and shall continue in effect from year to year thereafter; provided that such continuance is approved at least annually by the vote of a majority of the outstanding voting securities of the Company, as defined by the 1940 Act and the rules thereunder, or by the Board; and, provided, further, that in either event such continuance is also approved by a majority of Trustees who are not parties to this Agreement or Interested Persons of any such party (the “Independent Trustees”), by vote cast in person at a meeting called for the purpose of voting on such approval. The Company may at any time, without payment of any penalty, terminate this Agreement upon sixty (60) days’ prior written notice to the Investment Adviser, either by majority vote of the Board or by the vote of a majority of the outstanding voting securities of the Company (as defined by the 1940 Act and the rules thereunder). The Investment Adviser may at any time, without payment of penalty, terminate this Agreement upon sixty (60) days’ prior written notice to the Company.

(b) If terminated, the Investment Adviser will be entitled to any unpaid fees through the date of termination calculated in accordance with Exhibit A. (b) If terminated, the Investment Adviser will be entitled to the pro rated portion (calculated by the number of days that this Agreement was in effect during the quarter in which the termination of this Agreement was effective, divided by the number of days in the quarter in which the termination of this Agreement was effective) of any unpaid fee pursuant to Section 3(a).

11. [RESERVED]

11. The Company acknowledges and agrees that (i) the name “SharesPost” (the “Name”) is the property of the Investment Adviser or its Affiliates and in no respect shall the right to use the Name be deemed an asset of the Company; (ii) the Company’s authority to use the Name may be withdrawn by the Investment Adviser or its Affiliates at any time without compensation to the Company; (iii) the Company has no right to license, sublicense, assign or otherwise transfer any right, title or interest in or to the Name; and (iv) all goodwill and similar value associated with the Name is owned by, and shall accrue solely for the benefit of the Investment Adviser or its Affiliates. Subject to this Section 11, the Adviser hereby grants to the Company, and the Company hereby accepts, a non-exclusive, non-assignable, royalty-free license to use the Name as part of the legal name of the Company and otherwise in connection with the conduct by the Company of investment activities in accordance with the customs of the investment fund industry.

12. This Agreement shall be binding upon and inure to the benefit of each party hereto, each Indemnified Person and their respective successors and permitted assigns. This Agreement shall automatically terminate in the event of its assignment (to the extent required by the 1940 Act and the rules thereunder) unless such automatic termination shall be prevented by an exemptive order or rule by the SEC.

13. Any notice, offer, consent, or demand permitted or required to be made under this Agreement to any party hereto shall be made in writing signed by the person giving such notice and shall be deemed to have been given if (i) sent by United States certified or registered mail, return receipt requested, when received, (ii) personally delivered, when received, (iii) sent by United States Express Mail or overnight courier, on the second following business day, or (iv) sent by facsimile or electronic mail, upon confirmation of delivery to the intended recipient.

14. This Agreement may be amended only by written agreement of the parties. Any amendment shall be required to be approved by the Board and by a majority of the Independent Trustees in accordance with the provisions of Section 15(c) of the 1940 Act and the rules thereunder. If required by the 1940 Act, any amendment shall also be required to be approved by such vote of Shareholders as is required by the 1940 Act and the rules thereunder.

15. This Agreement shall be construed in accordance with the laws of the State of New York and the applicable provisions of the Advisers Act and the 1940 Act. To the extent the applicable law of the State of New York, or any of the provisions herein, conflict with the applicable provisions of the 1940 Act, the latter shall control.

16. The Company represents that this Agreement has been duly approved by the Board, including a majority of the Independent Trustees, and thesole initial ShareholderShareholders of the Company, in accordance with the requirements of the 1940 Act and the rules thereunder.

17. The parties to this Agreement agree that the obligations of the Company under this Agreement shall not be binding upon any of the Trustees, any Shareholders or their affiliates, any officers, employees or agents, whether past, present or future, of the Company, individually, but are binding only upon the assets and property of the Company.

18. This Agreement embodies the entire understanding of the parties.

{The remainder of this page has been intentionally left blank}

IN WITNESS WHEREOF, the parties hereto have executed and deliveredthisAgreement on the day and year first above written.

SHARESPOST 100 FUND

By: | /s/ Sven Weber | | | | | |

| | | | | | | |

| By: | __________________ | | | | | |

| Name: | Sven Weber | | | | | |

Title: | President | | | | | |

| | | | | | | |

| | | | SP INVESTMENTS MANAGEMENT, LLC | |

| | | | | | | |

| | | | By: | /s/ Sven Weber | |

| | | | | Name: | Sven Weber | |

| | | | | Title: | Managing Director | |

| | | | | | | |

| LIBERTY STREET ADVISORS, INC. | | | | | |

| | | | | | | |

| By: | __________________ | | | | | |

| Name: | | | | | | |

| Title: | | | | | | |

EXHIBIT A

Investment Advisory Agreement

Following are the Advisory Fees that are the subject of this Agreement:

Advisory Fees

The Advisory Fee shall accrue daily ata rate equal to 0.475% (a 1.90%an annual rate) of 1.90% of the average daily calculated net asset value of the Company, and shall be paidquarterlymonthly in arrears.