UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22742

(Investment Company Act File Number)

Principal Real Estate Income Fund

(Exact Name of Registrant as Specified in Charter)

1290 Broadway, Suite 1000

Denver, CO 80203

(Address of Principal Executive Offices)

Brendan Hamill

Principal Real Estate Income Fund

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and Address of Agent for Service)

(303) 623-2577

(Registrant’s Telephone Number)

Date of Fiscal Year End: October 31

Date of Reporting Period: April 30, 2022

| Item 1. | Reports to Stockholders. |

Section 19(b) disclosure

April 30, 2022 (Unaudited)

The Principal Real Estate Income Fund (the “Fund”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a plan, consistent with the Fund’s investment objectives and policies, to support a level monthly distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund distributed between $0.0875-$0.10 per share on a monthly basis during the six months ended April 30, 2022.

The fixed amount distributed per share is subject to change at the discretion of the Fund’s Board. Effective November 2021, the monthly distribution rate was changed to $0.0875 per share. Effective February 2022, the monthly distribution rate was changed to $0.10 per share. Effective May 2022, the monthly distribution rate was changed to $0.105 per share. Under the Plan, the Fund will distribute all available investment income to its shareholders, consistent with the Fund’s primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Fund’s Plan at any time without prior notice if it deems such action to be in the best interest of either the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if a Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Fund’s prospectus for a more complete description of its risks.

Please refer to the Additional Information section in this shareholder report for a cumulative summary of the Section 19(a) notices for the Fund’s current fiscal period. Section 19(a) notices for the Fund, as applicable, are available on the Principal Real Estate Income Fund’s website; www.principalcef.com.

Table of contents

| Performance Overview | 2 |

| Statement of Investments | 10 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Statement of Cash Flows | 19 |

| Financial Highlights | 20 |

| Notes to Financial Statements | 23 |

| Dividend Reinvestment Plan | 34 |

| Additional Information | |

| Portfolio holdings | 36 |

| Proxy voting | 36 |

| Section 19(a) notices | 36 |

| Stockholder meeting results | 37 |

| Unaudited tax information | 37 |

| Licensing agreement | 38 |

| Custodian and transfer agent | 38 |

| Legal counsel | 38 |

| Independent registered public accounting firm | 38 |

| Privacy Policy | 39 |

www.principalcef.com

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

PERFORMANCE OVERVIEW

Principal Real Estate Income Fund (“PGZ” or the “Fund”) was launched June 25, 2013. As of April 30, 2022 the Fund was 62.46% allocated to commercial mortgage backed securities (“CMBS”) and 36.38% in U.S. and International real estate securities, primarily real estate investment trusts (“REITs”). For the 6-month period ended April 30, 2022, the Fund delivered a net return, at market price, of -3.41%, assuming dividends are reinvested back into the Fund, based on the closing share price of $14.41 on April 30, 2022. This compares to the return of the S&P 500® Index, over the same time-period, of -9.66% assuming dividends are reinvested into the index. This also compares to the return of the Bloomberg U.S. Aggregate Bond Index of -9.47%.

The April 30, 2022 closing market price of $14.41 represented a 11.43% discount to the Fund's Net Asset Value (“NAV”). This compares to an average 3.19% discount for equity real estate closed-end funds and a 1.14% discount for mortgage-backed securities closed-end funds (source: Bloomberg).

Based on NAV, the Fund returned -4.95%, including dividends, for the 6-month period ended April 30, 2022. The themes that dominated the market during this period were continued supply chain challenges, persistent inflation, the actual and expected response from the Fed to fight inflation and Russia invading Ukraine at the end of February. Inflation was already becoming a major issue for consumers in the U.S. heading into the period, but the Russian invasion added higher oil and gasoline prices to the list of concerns. The pressures of rising wages and prices resulted in core inflation increasing at the highest rate in 30 years at the end of period. This puts inflation expectations and the Fed’s response to those expectations as the theme that will dominate the outlook for the next six to twelve months. The market responses to these events were interest rates being driven higher by 150bps to a peak of 2.94% to end the period, CMBS credit spreads gapping wider and a strong sell-off in REIT prices. Volatility trended higher reflecting the pessimism that came into the market. During the period, the VIX averaged 23 with a spike to 36 early March. While volatility did see several spikes after that, the magnitude of subsequent spikes trended higher through the end of the period.

Commercial real estate, including CMBS, was one of the asset classes most impacted by the economic shut down associated with the nation’s response to COVID-19 and most impacted by the distribution of multiple vaccines that helped drive the re-opening of the economy. Hotel and retail properties that were basically shut down due to COVID-19 and have since reopened have benefited the most from the resumption of leisure and business travel and consumers back out shopping. These were the property types that were most under stress with CMBS loan delinquencies peaking in July 2020 at 25% for hotels and 15% for retail. As of March 31, 2022, delinquencies on hotels and retail were 10% and 7% respectively. CMBS delinquencies have been trending lower as borrowers who were granted forbearance by the special servicers to get them to the other side of COVID-19 have brought loans current and the most distressed loans have started to be liquidated through foreclosure. The pace of new defaults has slowed materially, as well, as borrowers who were able to make it through the crisis were in a better position with the re-opening of the economy starting sooner than expected. This positive change in fundamental performance and market sentiment over the past 12 months is now being overshadowed by negative market sentiment on the outlook for the economy.

Despite volatility in equity markets due to inflation concerns, sharply higher bond yields, more hawkish than anticipated central bank rhetoric, geopolitical conflict, and recession fears, global REITs have held up relatively well, exhibiting more resilience versus general equities. Among real estate stocks, value has generally outperformed more defensive growth sectors. Thus, by style, higher yielding, higher leveraged, and higher volatility stocks outperformed. Asia was the best regional performer given the larger preponderance of outperforming value stocks, such as property developers. Europe was the worst performer, hurt by the outbreak of conflict in the Ukraine and currency headwinds. In the Americas, REITs ended modestly lower despite a sharp increase in interest rates as economic conditions remained favorable and continued to feature robust labor markets and strength in retail sales. Hotels and student housing were the only sectors to end with positive returns, while more defensive residential, industrial, data centers, and self-storage lagged.

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

CMBS

The CMBS holdings within the Fund returned -0.98% for the 6 months ended April 30, 2022. The main driver of returns for the period was wider AAA CMBS spreads, steepening of the credit curve, material increases in interest rates and the shorter duration and higher yield profile of the portfolio. Credit spreads came under pressure as economic growth concerns and recession fears started to rise when the Fed started signaling an aggressive stance on fighting record inflation levels. Bond fund outflows also pressured credit spreads as selling overwhelmed demand. The uncertainty around how different markets and property types would recover from the pandemic has now been replaced with the uncertainty on how markets and property types might be impacted by a recession. This change has brought concerns about systematic risk back into the market which is driving loss expectations and credit spreads higher.

For the 6-month period ending April 30, 2022, AAA spreads widened 35-40bps, AA spreads widened 60-65bps, A spreads widened 70-75bps, BBB- spreads widened 150-155bps and BB spreads tightened over 200bps in response to the change in market sentiment, higher interest rates and limited new issue supply. CMBS delinquencies peaked July 2020 at just over 9.3% and has since improved every month since, ending the period at 4.1% driven by the continued recovery of commercial real estate fundamentals post the pandemic. Even with the move wider in CMBS spreads, investment grade spreads remain tight of the wide levels set in the 2nd quarter of 2020 reflecting the fact that the range of loan level loss expectations are lower than the period following the start of the pandemic. The direction of spreads does indicate a higher probability that the Fed’s response to inflation will result in a recession in the U.S.

The performance of the CMBS holdings within the Fund reflects this turnaround in market sentiment from the optimistic outlook for real estate after recovering from the impact of the pandemic on demand for space. Commercial real estate is at an interesting crossroad after a strong recovery from the pandemic and ahead of a potential slowdown in the economy and recession. Questions around the longer-term impact of work-from-home on the demand for office space is also starting to impact investor sentiment. The near-term direction of CMBS prices is going to be driven by broader risk sentiment as the Fed looks to walk the thin line between slowing down the economy to fight inflation and pushing the economy into a recession. This fear of recession is expected to overshadow the strong improvement in real estate fundamentals during the period which potentially won’t be fully appreciated until the current rate cycle plays out.

| Semi-Annual Report | April 30, 2022 | 3 |

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

GLOBAL REAL ESTATE SECURITIES

The global real estate securities holdings within the fund returned approximately -6.5%, during the trailing six months ending April 30, 2022.

On an absolute basis, our portfolio’s exposure to underperforming defensive sectors such as U.S. apartments (Essex Property Trust) and global industrial (Industrial Logistics Properties Trust, Plymouth Industrial REIT, Prologis, and SEGRO), detracted from total returns. Our exposure in China (Sunac Services) was another detractor on continued China growth and geopolitical concerns due to rising default risks among developers and slowdown in property sales. A preference for outperforming gaming REITs (VICI Properties and MGM Growth Properties) within U.S. net lease was a top contributor to total returns. Exposure to senior housing and skilled nursing REITs in U.S. healthcare (Ventas and Sabra Healthcare REIT) was also contributed, as these stocks benefited from signals of occupancy rebound and better than expected earnings reports.

Energy shortages and supply chain bottlenecks are raising concerns over inflation persistence. This is forcing the hand of central bankers’ hands around the world to taper or embark on rate hikes even as uncertainties remain over the spread of the Omicron COVID variant and markets grapple with the fallout from Russia’s invasion of Ukraine. The government-induced slowdown in the Chinese economy due to the broad regulatory crackdown and policy tightening towards the property sector is an additional uncertainty. Despite these challenges, economic data, although decelerating, remains fairly robust with the U.S. consumer still holding up quite well. As such, the focus of central bankers is likely to remain on taming inflation for now, exacerbating concerns that monetary tightening will squelch the already slowing economy. Concerns over the trajectory of rate hikes and quantitative tightening coupled with uncertainty over the growth outlook, geo-political risks and margin pressures from inflation are likely to mean more volatility for equity markets in the months ahead.

The factors pushing up inflation are a mix of both transitory and structural ones. The transitory factors include the supply chain bottlenecks sparked by COVID-19 related lockdowns and travel restrictions, as well as the pull forward of demand for goods driven by work from home. The structural factors are the supply side tightness in commodities as a result of the transition to green energy as well as wage pressures from reduced labor mobility due to rising geopolitical tensions driving a push for supply chain self-sufficiency within countries. While the structural forces will linger, we expect the transitory inflationary forces to abate somewhat as the reopening trajectory around the world continues on the back of higher vaccination rates, medical advancements, and greater herd immunity. The switch of demand away from goods to services as economies reopen and pent up demand asserts itself should also help. As we move into the second half of 2022, the low inflationary base from last year will be behind us, making comps easier and we would expect to see inflation decline on a year-on-year basis.

With the market now pricing in the equivalent of seven 25 bps rate hikes over the remaining five Fed meetings for this year, it would seem as if a significant tightening of financial conditions has already been imputed. It is thus possible that the market may have turned overly hawkish on rate hikes in the short term, especially if inflation starts to moderate on a year-on-year basis and growth concerns continue to skew risk sentiment to the defensive. This could provide some support to rate sensitive stocks that have lagged year to date. Beyond this, the outlook for long term interest rates and physical property will depend on where inflation eventually settles, as well as how economies weather this concerted round of monetary tightening. While we expect inflation to moderate year on year, we do think it will stabilize at levels higher than historical trend because of some of the structural factors discussed earlier.

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

Under a base case scenario of above trend inflation accompanied by solid growth, physical property should function well as an inflation hedge, which is well supported by historical precedent. Not only do rents and occupancies rise with growth, but inflation also increases the replacement costs of property assets and hence property values. This should allow property stocks to tolerate the rise in interest rates and the accompanying Fed quantitative tightening well. Clearly, there are a range of uncertainties that could change this outcome, not least the conflict in Ukraine further exacerbating the tightness in commodity supply and driving prices higher, creating upside risks to inflation and potential downside risks for growth. An unrelentless pace of central bank rate hikes to ward off inflation is the other key risk especially if growth is already challenged. This stagflationary scenario would negatively impact not just property stocks but broader risk assets.

The Fund intends to make regular monthly distributions to stockholders at a constant and fixed (but not guaranteed) rate. The Board of Trustees approve the distribution and may adjust it from time to time. The monthly distribution amount paid from November 1, 2021 to January 31, 2022 was $0.0875 per share. The Fund paid $0.010 per share monthly between February 1, 2022 and April 30, 2022.

At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return of capital, in addition to current net investment income. There is no guarantee that the Fund's current distribution policy will reduce or eliminate the Fund's market price discount to its net asset value per share and the Fund's trustees have no fiduciary duty to take action, or to consider taking any action, to narrow any such discount. The distribution policy may be changed or discontinued without notice.

References:

The Premium/Discount is the amount (stated in dollars or percent) by which the selling or purchase price of a fund is greater than (premium) or less than (discount) its face amount/value or net asset value (NAV).

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. The duration number is a calculation involving present value, yield, coupon, final maturity and call features. The bigger the duration number, the greater the interest-rate risk or reward for bond prices. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices.

S&P 500® Index – A large cap U.S. equities index that includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

Bloomberg U.S. Aggregate Bond Index – A broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed rate taxable bond market, including Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS.

| Semi-Annual Report | April 30, 2022 | 5 |

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

Morningstar Developed Markets Index – An index that captures the performance of the stocks located in the developed countries across the world. Stocks in the index are weighted by their float capital, which removes corporate cross ownership, government holdings and other locked-in shares.

Basis point (bps) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

A bond rating is a grade given to bonds by private, independent ratings services that indicates their credit quality. Investment grade bonds range from AAA to BBB- and will usually see bond yields increase as ratings decrease.

Issuance information – JPMorgan

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

PERFORMANCE as of April 30, 2022

| TOTAL RETURNS(1) | CUMULATIVE | AVERAGE ANNUAL |

| Fund | 6 Month | 1 Year | 3 Year | 5 Year | Since

Inception(2) |

| Net Asset Value (NAV)(3)(5) | -4.95% | 4.12% | -0.74% | 4.81% | 6.93% |

| Market Price(4) | -3.41% | 1.69% | -0.90% | 3.60% | 4.92% |

| Bloomberg U.S. Aggregate Bond Index | -9.47% | -8.51% | 0.38% | 1.20% | 2.02% |

| Morningstar Developed Markets Index | -11.62% | -4.41% | 10.37% | 10.27% | 10.44% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on June 25, 2013. |

| (3) | Performance returns are net of management fees and other Fund expenses. |

| (4) | Market price is the value at which the Fund trades on an exchange. This market price can be higher or lower than its NAV. |

| (5) | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such the NAV and total return for shareholder transactions reported to the market may differ from the NAV for financial reporting purposes. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 855.838.9485.

Total Annual Expense Ratio as a Percentage of Net Assets Attributable to Common Shares including interest expense, as of April 30, 2022, 2.67%.

Total Annual Expense Ratio as a Percentage of Net Assets Attributable to Common Shares excluding interest expense, as of April 30, 2022, 2.16%.

The Fund is a closed-end fund and does not continuously issue shares for sale as open-end mutual funds do. Since the initial public offering, the Fund now trades only in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker and additional charges or commissions will apply. The share price of a closed-end fund is based on the market’s value.

Distributions may be paid from sources of income other than ordinary income, such as net realized short-term capital gains, net realized long-term capital gains and return of capital. Based on current estimates, distributions have been paid in the current fiscal year from net investment income and return of capital. The actual amounts and sources of the amounts for tax purposes will depend upon a Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year.

Indices are unmanaged; their returns do not reflect any fees, expenses, or sales charges.

An investor cannot invest directly in an index.

ALPS Advisors, Inc. is the investment adviser to the Fund.

ALPS Portfolio Solutions Distributor, Inc. is a FINRA member.

Principal Real Estate Investors, LLC is the investment sub-adviser to the Fund. Principal Real Estate Investors, LLC is not affiliated with ALPS Advisors, Inc. or any of its affiliates.

Secondary market support provided to the Fund by ALPS Advisors, Inc.’s affiliate, ALPS Portfolio Solutions Distributor, Inc., FINRA Member

| Semi-Annual Report | April 30, 2022 | 7 |

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

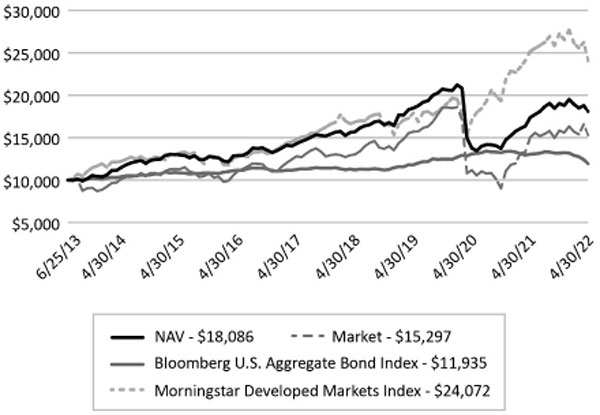

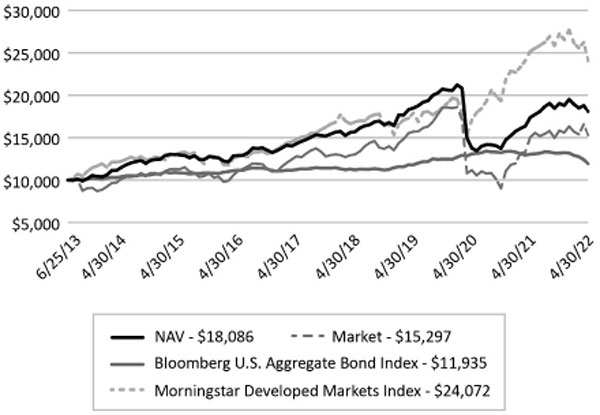

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares of beneficial interest at the closing market price (NYSE: PGZ) of $20.00 on June 25, 2013 (the date of commencement of operations), and tracking its progress through April 30, 2022.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

| Principal Real Estate Income Fund | Performance Overview |

| | April 30, 2022 (Unaudited) |

SECTOR ALLOCATION^

| ^ | Holdings are subject to change. |

Percentages are based on total investments of the Fund.

GEOGRAPHIC BREAKDOWN as of April 30, 2022

| | % of Total Investments |

| United States | 84.11% |

| Japan | 2.96% |

| Australia | 2.81% |

| Canada | 2.21% |

| Great Britain | 2.14% |

| Singapore | 1.37% |

| Hong Kong | 1.05% |

| Germany | 0.62% |

| Spain | 0.59% |

| Netherlands | 0.47% |

| China | 0.42% |

| France | 0.41% |

| South Korea | 0.25% |

| British Virgin Islands | 0.23% |

| Luxembourg | 0.21% |

| Poland | 0.15% |

| | 100.00% |

Holdings are subject to change.

| Semi-Annual Report | April 30, 2022 | 9 |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| | | | | | Value | |

| Description | | Shares | | | (Note 2) | |

| COMMON STOCKS (51.70%) | | | | | | | | |

| Building-Residential/Commercial (0.32%) | | | | | | | | |

| DR Horton, Inc. | | | 3,100 | | | $ | 215,729 | |

| Persimmon PLC | | | 5,400 | | | | 142,595 | |

| | | | | | | | 358,324 | |

| Hotels & Motels (0.22%) | | | | | | | | |

| Travel + Leisure Co. | | | 4,333 | | | | 240,395 | |

| | | | | | | | | |

| Investment Management/Advisory Services (0.63%) | | | | | | | | |

| Centuria Capital Group | | | 153,987 | | | | 304,638 | |

| RAM Essential Services Property Fund(a) | | | 576,408 | | | | 390,970 | |

| | | | | | | | 695,608 | |

| Real Estate Management/Services (1.80%) | | | | | | | | |

| ESR Kendall Square REIT Co., Ltd. | | | 67,560 | | | | 394,279 | |

| Mitsubishi Estate Co., Ltd. | | | 50,500 | | | | 732,936 | |

| Qualitas, Ltd.(b) | | | 245,475 | | | | 362,490 | |

| Vonovia SE | | | 12,500 | | | | 501,102 | |

| | | | | | | | 1,990,807 | |

| Real Estate Operation/Development (4.16%) | | | | | | | | |

| Aroundtown SA | | | 65,000 | | | | 329,008 | |

| Echo Investment SA | | | 318,924 | | | | 245,382 | |

| Hongkong Land Holdings, Ltd. | | | 116,800 | | | | 547,792 | |

| Midea Real Estate Holding, Ltd.(a)(c) | | | 205,000 | | | | 393,437 | |

| Mitsui Fudosan Co., Ltd. | | | 56,500 | | | | 1,195,305 | |

| New World Development Co., Ltd. | | | 190,500 | | | | 730,732 | |

| Sun Hung Kai Properties, Ltd. | | | 34,500 | | | | 399,869 | |

| TAG Immobilien AG | | | 24,466 | | | | 491,948 | |

| Zhongliang Holdings Group Co., Ltd.(a) | | | 879,500 | | | | 281,323 | |

| | | | | | | | 4,614,796 | |

| REITS-Apartments (7.49%) | | | | | | | | |

| Apartment Income REIT Corp. | | | 17,961 | | | | 883,142 | |

| AvalonBay Communities, Inc. | | | 5,800 | | | | 1,319,384 | |

| Daiwa House REIT Investment Corp. | | | 171 | | | | 415,065 | |

| Essex Property Trust, Inc. | | | 5,257 | | | | 1,730,973 | |

| Independence Realty Trust, Inc. | | | 55,470 | | | | 1,512,112 | |

| Invitation Homes, Inc. | | | 61,328 | | | | 2,442,081 | |

| | | | | | | | 8,302,757 | |

| REITS-Diversified (9.88%) | | | | | | | | |

| Activia Properties, Inc. | | | 151 | | | | 481,711 | |

| Arena REIT | | | 64,534 | | | | 221,143 | |

| Broadstone Net Lease, Inc. | | | 25,012 | | | | 517,498 | |

| Charter Hall Group | | | 18,532 | | | | 205,048 | |

| Covivio | | | 4,195 | | | | 300,714 | |

| Cromwell European Real Estate Investment Trust(a) | | | 226,160 | | | | 548,753 | |

| Crown Castle International Corp. | | | 1,743 | | | | 322,821 | |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| | | | | | Value | |

| Description | | Shares | | | (Note 2) | |

| REITS-Diversified (continued) | | | | | | | | |

| Digital Core REIT Management Pte, Ltd.(b) | | | 424,691 | | | $ | 422,568 | |

| Ingenia Communities Group | | | 50,563 | | | | 167,551 | |

| InvenTrust Properties Corp. | | | 27,000 | | | | 817,830 | |

| Irongate Group | | | 364,606 | | | | 493,327 | |

| Life Science Reit PLC(b) | | | 362,630 | | | | 466,249 | |

| LondonMetric Property PLC | | | 85,649 | | | | 290,357 | |

| Merlin Properties Socimi SA | | | 53,963 | | | | 592,625 | |

| PRO Real Estate Investment Trust | | | 52,903 | | | | 291,972 | |

| Sekisui House Reit, Inc. | | | 886 | | | | 520,233 | |

| VICI Properties, Inc. | | | 131,246 | | | | 3,912,450 | |

| Weyerhaeuser Co. | | | 9,180 | | | | 378,400 | |

| | | | | | | | 10,951,250 | |

| REITS-Health Care (3.82%) | | | | | | | | |

| Healthcare Trust of America, Inc. | | | 20,027 | | | | 610,023 | |

| HealthCo REIT | | | 40,113 | | | | 55,833 | |

| Medical Properties Trust, Inc. | | | 32,134 | | | | 590,944 | |

| Physicians Realty Trust | | | 18,696 | | | | 320,450 | |

| Sabra Health Care REIT, Inc. | | | 85,793 | | | | 1,002,062 | |

| Ventas, Inc. | | | 29,826 | | | | 1,656,834 | |

| | | | | | | | 4,236,146 | |

| REITS-Hotels (0.90%) | | | | | | | | |

| Far East Hospitality Trust | | | 371,000 | | | | 179,739 | |

| Park Hotels & Resorts, Inc. | | | 28,765 | | | | 566,958 | |

| Sunstone Hotel Investors, Inc.(b) | | | 20,289 | | | | 248,540 | |

| | | | | | | | 995,237 | |

| REITS-Manufactured Homes (1.60%) | | | | | | | | |

| Sun Communities, Inc. | | | 10,087 | | | | 1,770,975 | |

| | | | | | | | | |

| REITS-Office Property (3.98%) | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 5,046 | | | | 919,179 | |

| Allied Properties Real Estate Investment Trust | | | 8,300 | | | | 269,614 | |

| Brandywine Realty Trust | | | 24,401 | | | | 284,760 | |

| Centuria Office REIT | | | 133,942 | | | | 208,200 | |

| Cousins Properties, Inc. | | | 8,878 | | | | 318,720 | |

| Daiwa Office Investment Corp. | | | 44 | | | | 249,540 | |

| Dexus | | | 72,184 | | | | 569,687 | |

| Inmobiliaria Colonial SA | | | 41,880 | | | | 352,126 | |

| Kilroy Realty Corp. | | | 6,881 | | | | 481,670 | |

| NSI NV | | | 19,358 | | | | 759,690 | |

| | | | | | | | 4,413,186 | |

| REITS-Regional Malls (0.32%) | | | | | | | | |

| Klepierre SA | | | 14,638 | | | | 353,013 | |

| Semi-Annual Report | April 30, 2022 | 11 |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| | | | | | Value | |

| Description | | Shares | | | (Note 2) | |

| REITS-Shopping Centers (1.88%) | | | | | | | | |

| Lendlease Global Commercial REIT | | | 385,867 | | | $ | 221,819 | |

| Saul Centers, Inc. | | | 36,000 | | | | 1,857,960 | |

| | | | | | | | 2,079,779 | |

| REITS-Single Tenant (0.65%) | | | | | | | | |

| Agree Realty Corp. | | | 4,424 | | | | 300,478 | |

| STORE Capital Corp. | | | 14,801 | | | | 420,793 | |

| | | | | | | | 721,271 | |

| REITS-Storage (1.88%) | | | | | | | | |

| Big Yellow Group PLC | | | 30,871 | | | | 555,108 | |

| CubeSmart | | | 24,641 | | | | 1,170,694 | |

| National Storage REIT | | | 197,475 | | | | 364,162 | |

| | | | | | | | 2,089,964 | |

| REITS-Storage/Warehousing (0.47%) | | | | | | | | |

| National Storage Affiliates Trust | | | 9,129 | | | | 516,701 | |

| | | | | | | | | |

| REITS-Warehouse/Industrials (11.28%) | | | | | | | | |

| AIMS AMP Capital Industrial REIT | | | 535,900 | | | | 550,257 | |

| Centuria Industrial REIT | | | 321,339 | | | | 905,896 | |

| CRE Logistics REIT, Inc. | | | 257 | | | | 394,486 | |

| Dream Industrial Real Estate Investment Trust | | | 96,600 | | | | 1,124,926 | |

| ESR-REIT | | | 979,471 | | | | 276,216 | |

| First Industrial Realty Trust, Inc. | | | 8,974 | | | | 520,492 | |

| Goodman Group | | | 15,657 | | | | 265,277 | |

| Industrial & Infrastructure Fund Investment Corp. | | | 352 | | | | 506,403 | |

| Industrial Logistics Properties Trust | | | 75,280 | | | | 1,216,525 | |

| Mitsubishi Estate Logistics REIT Investment Corp. | | | 71 | | | | 254,402 | |

| Nexus Industrial REIT | | | 122,000 | | | | 1,216,534 | |

| Plymouth Industrial REIT, Inc. | | | 38,783 | | | | 935,446 | |

| Prologis, Inc. | | | 11,393 | | | | 1,826,184 | |

| Segro PLC | | | 52,228 | | | | 881,675 | |

| SF Real Estate Investment Trust(a) | | | 944,000 | | | | 363,308 | |

| Summit Industrial Income REIT | | | 40,373 | | | | 639,230 | |

| Tritax Big Box REIT PLC | | | 206,744 | | | | 633,808 | |

| | | | | | | | 12,511,065 | |

| Storage (0.42%) | | | | | | | | |

| Safestore Holdings PLC | | | 29,692 | | | | 470,436 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $51,128,219) | | | | | | | 57,311,710 | |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| Description | | Shares | | | Value

(Note 2) | |

| PREFERRED STOCKS (0.93%) | | | | | | | | |

| REITS-Shopping Centers (0.93%) | | | | | | | | |

| RPT Realty, 7.25%(d) | | | 18,000 | | | $ | 1,040,670 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | | | | | |

| (Cost $701,643) | | | | | | | 1,040,670 | |

| Description | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2) | |

| COMMERCIAL MORTGAGE BACKED SECURITIES (90.38%) |

| Commercial Mortgage Backed Securities-Other (11.22%) | | | | | | |

| BANK: | | | | | | | | | | | | | | |

| 2020-BN29(c)(e)(f) | | | 0.804% | | | 12/15/30 | | $ | 11,896,750 | | | $ | 588,457 | |

| 2021-BN35(c)(e)(f) | | | 1.500% | | | 06/15/64 | | | 3,100,000 | | | | 325,478 | |

| Benchmark Mortgage Trust: | | | | | | | | | | | | | | |

| 2020-B22(c)(e)(f) | | | 1.535% | | | 10/15/30 | | | 7,717,000 | | | | 769,512 | |

| 2020-B20(c)(e)(f) | | | 1.664% | | | 10/15/30 | | | 7,126,000 | | | | 733,822 | |

| Citigroup Commercial Mortgage Trust: | | | | | | | | | | | | | | |

| 2019-GC43(c)(e)(f) | | | 0.741% | | | 11/10/29 | | | 2,500,000 | | | | 92,441 | |

| FHLMC Multifamily Structured Pass Through Certificates 2012-K052(e)(f) | | | 1.669% | | | 01/25/26 | | | 9,690,000 | | | | 489,769 | |

| Freddie Mac Multifamily Structured Pass Through Certificates: | | | | | | | | | | | | | | |

| 2020-K740(e) | | | 2.567% | | | 10/25/27 | | | 13,500,000 | | | | 1,519,491 | |

| 2020-K739(e) | | | 2.904% | | | 10/25/27 | | | 12,207,500 | | | | 1,515,058 | |

Goldman Sachs Mortgage Securities Trust

2020-GSA2(c)(e)(f) | | | 1.477% | | | 01/10/31 | | | 7,000,000 | | | | 669,168 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | | | | | | | | | | | | | | |

| 2015-C28(e)(f) | | | 1.098% | | | 03/15/25 | | | 27,989,958 | | | | 563,371 | |

| 2013-C15(c)(e)(f) | | | 1.798% | | | 10/15/23 | | | 11,472,197 | | | | 225,783 | |

| 2006-CB17(e) | | | 5.489% | | | 12/12/43 | | | 514,860 | | | | 373,273 | |

| Morgan Stanley Bank of America Merrill Lynch Trust 2015-C20(c)(e)(f) | | | 1.751% | | | 02/15/25 | | | 23,967,000 | | | | 867,644 | |

| Morgan Stanley Capital I Trust: | | | | | | | | | | | | | | |

| 2016-UB11(c)(e)(f) | | | 1.500% | | | 08/15/26 | | | 13,495,500 | | | | 713,202 | |

| 2021-L5(c) | | | 2.500% | | | 05/15/31 | | | 1,400,000 | | | | 851,037 | |

| Wells Fargo Commercial Mortgage Trust: | | | | | | | | | | | | | | |

| 2022-C62(e)(f) | | | 0.047% | | | 04/15/55 | | | 45,827,000 | | | | 157,828 | |

| 2022-C62(e)(f) | | | 0.396% | | | 04/15/55 | | | 70,836,000 | | | | 1,986,738 | |

| | | | | | | | | | | | | | 12,442,072 | |

| | | | | | | | | | | | | | | |

| Commercial Mortgage Backed Securities-Subordinated (79.16%) | | | | | | | | | | | | | | |

| BANK: | | | | | | | | | | | | | | |

| 2021-BN35(c)(e) | | | 1.764% | | | 08/15/31 | | | 3,200,000 | | | | 1,782,001 | |

| Semi-Annual Report | April 30, 2022 | 13 |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| Description | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2) | |

| 2019-BN22(c)(e) | | | 2.076% | | | 11/15/62 | | $ | 2,000,000 | | | $ | 1,224,267 | |

| 2021-BN34(c) | | | 2.250% | | | 06/15/31 | | | 1,400,000 | | | | 829,043 | |

| 2020-BN29(c) | | | 2.500% | | | 12/15/30 | | | 3,300,000 | | | | 2,366,238 | |

| 2018-BN12(c)(e) | | | 3.047% | | | 05/15/28 | | | 2,500,000 | | | | 1,482,955 | |

| 2017-BNK5(c)(e) | | | 3.078% | | | 06/15/27 | | | 2,000,000 | | | | 1,643,538 | |

| 2017-BNK5(c)(e) | | | 4.378% | | | 07/15/27 | | | 7,500,000 | | | | 5,447,979 | |

| Bank of America Commercial Mortgage Trust 2008-1(e) | | 6.786% | | | 02/10/51 | | | 81,510 | | | | 80,244 | |

| Benchmark Mortgage Trust: | | | | | | | | | | | | | | |

| 2020-B20(c) | | | 2.000% | | | 10/15/30 | | | 1,800,000 | | | | 1,201,790 | |

| 2021-B29(c)(e) | | | 2.418% | | | 10/15/31 | | | 3,000,000 | | | | 1,735,180 | |

| 2018-B1(c)(e) | | | 3.000% | | | 01/15/28 | | | 3,500,000 | | | | 2,233,198 | |

| CFCRE Commercial Mortgage Trust 2016-C3(c)(e) | | | 3.052% | | | 01/10/26 | | | 6,484,000 | | | | 5,300,609 | |

| Citigroup Commercial Mortgage Trust: | | | | | | | | | | | | | | |

| 2019-GC41(c) | | | 3.000% | | | 08/10/29 | | | 2,800,000 | | | | 1,672,723 | |

| 2019-GC43(c) | | | 3.000% | | | 11/10/29 | | | 2,500,000 | | | | 1,501,656 | |

| Commercial Mortgage Trust: | | | | | | | | | | | | | | |

| 2014-UBS5(c) | | | 3.495% | | | 09/10/24 | | | 2,715,000 | | | | 2,349,279 | |

| 2013-LC6(c) | | | 3.500% | | | 01/10/23 | | | 1,350,000 | | | | 1,184,329 | |

| 2013-CR6(c)(e) | | | 4.222% | | | 02/10/23 | | | 8,568,000 | | | | 8,135,735 | |

| 2012-CR2(c) | | | 4.250% | | | 08/15/22 | | | 1,900,000 | | | | 1,535,908 | |

| 2013-LC6(c)(e) | | | 4.430% | | | 01/10/23 | | | 1,965,000 | | | | 1,926,026 | |

| 2012-CR5(c)(e) | | | 4.462% | | | 12/10/22 | | | 9,992,405 | | | | 8,741,348 | |

| 2014-CR17(c)(e) | | | 4.509% | | | 05/10/24 | | | 2,600,000 | | | | 1,455,656 | |

| 2014-UBS2(c)(e) | | | 5.173% | | | 02/10/24 | | | 2,932,500 | | | | 2,805,084 | |

| 2012-CR1(c)(e) | | | 5.452% | | | 05/15/22 | | | 5,274,000 | | | | 4,870,035 | |

| Goldman Sachs Mortgage Securities Trust: | | | | | | | | | | | | | | |

| 2020-GC47(c)(e) | | | 2.570% | | | 04/12/30 | | | 2,500,000 | | | | 1,641,268 | |

| 2013-GC14(c)(e) | | | 4.890% | | | 08/10/23 | | | 3,250,000 | | | | 2,715,113 | |

| 2014-GC20(c)(e) | | | 5.161% | | | 04/10/47 | | | 8,505,000 | | | | 5,031,592 | |

| 2013-GC16(c)(e) | | | 5.488% | | | 11/10/46 | | | 2,342,405 | | | | 2,294,719 | |

| 2012-GCJ7(c)(e) | | | 5.511% | | | 05/10/22 | | | 1,500,000 | | | | 1,485,896 | |

| 2010-C1(c)(e) | | | 5.635% | | | 08/10/43 | | | 3,250,000 | | | | 2,997,882 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | | | | | | | | | | | | | | |

| 2013-C15(c) | | | 3.500% | | | 10/15/23 | | | 2,500,000 | | | | 2,310,265 | |

| 2012-C6(c)(e) | | | 5.350% | | | 05/15/22 | | | 1,500,000 | | | | 1,176,254 | |

| Morgan Stanley Bank of America Merrill Lynch Trust 2013-C11(e) | | | 4.496% | | | 07/15/23 | | | 3,000,000 | | | | 2,923,838 | |

| Wells Fargo Commercial Mortgage Trust: | | | | | | | | | | | | | | |

| 2015-NXS3(c) | | | 3.153% | | | 09/15/57 | | | 1,500,000 | | | | 1,347,072 | |

| 2017-C40(e) | | | 4.466% | | | 09/15/27 | | | 2,500,000 | | | | 2,331,641 | |

| | | | | | | | | | | | | | 87,760,361 | |

| Principal Real Estate Income Fund | Statement of Investments |

| | April 30, 2022 (Unaudited) |

| Description | | Value

(Note 2) | |

| TOTAL COMMERCIAL MORTGAGE BACKED SECURITIES | | | | |

| (Cost $104,298,256) | | | 100,202,433 | |

| Description | | 7-Day

Yield | | | Shares | | | Value

(Note 2) | |

| SHORT TERM INVESTMENTS (1.69%) | | | | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund - Premier Class | | | 0.317% | | | | 1,862,164 | | | $ | 1,862,164 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $1,862,164) | | | | | | | | | | | 1,862,164 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (144.70%) | | | | | | | | | | | | |

| (Cost $157,990,282) | | | | | | | | | | $ | 160,416,977 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets (-44.70%) | | | | | | | | | | | (49,552,170 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 110,864,807 | |

| (a) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of April 30, 2022, the aggregate value of those securities was $1,584,354 representing 1.43% of net assets. |

| (b) | Non-income producing security. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. The total value of Rule 144A securities amounts to $88,654,619, which represents approximately 79.97% of net assets as of April 30, 2022. |

| (d) | Security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (e) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at April 30, 2022. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (f) | Interest only security. |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2022 | 15 |

| Principal Real Estate Income Fund | |

| Statement of Assets and Liabilities | April 30, 2022 (Unaudited) |

| ASSETS: | | | |

| Investments, at value | | $ | 160,416,977 | |

| Foreign currency, at value (Cost $22,194) | | | 22,075 | |

| Interest receivable | | | 618,381 | |

| Dividends receivable | | | 159,507 | |

| Prepaid and other assets | | | 46,707 | |

| Total Assets | | | 161,263,647 | |

| | | | | |

| LIABILITIES: | | | | |

| Loan payable (Note 3) | | | 50,000,000 | |

| Interest and commitment fee due on loan payable | | | 30,144 | |

| Payable to adviser | | | 141,352 | |

| Payable to administrator | | | 66,923 | |

| Payable to transfer agent | | | 10,489 | |

| Payable for trustee fees | | | 36,788 | |

| Other payables | | | 113,144 | |

| Total Liabilities | | | 50,398,840 | |

| Net Assets | | $ | 110,864,807 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 125,962,180 | |

| Total distributable earnings/(accumulated deficit) | | | (15,097,373 | ) |

| Net Assets | | $ | 110,864,807 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 110,864,807 | |

| Common Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value per share) | | | 6,812,922 | |

| Net asset value per share | | $ | 16.27 | |

| | | | | |

| Cost of Investments | | $ | 157,990,282 | |

See Notes to Financial Statements.

| Principal Real Estate Income Fund | Statement of Operations |

| For the Six Months Ended April 30, 2022 (Unaudited) |

| INVESTMENT INCOME: | | | |

| Interest | | $ | 4,696,923 | |

| Dividends (net of foreign withholding tax of $37,752) | | | 1,140,902 | |

| Total Investment Income | | | 5,837,825 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 870,840 | |

| Interest on loan | | | 301,946 | |

| Commitment fee on loan | | | 12,569 | |

| Administration fees | | | 143,294 | |

| Transfer agent fees | | | 13,483 | |

| Audit fees | | | 17,467 | |

| Legal fees | | | 47,439 | |

| Custodian fees | | | 9,674 | |

| Trustee fees | | | 89,833 | |

| Printing fees | | | 19,483 | |

| Insurance fees | | | 17,666 | |

| Other | | | 16,648 | |

| Total Expenses | | | 1,560,342 | |

| Net Investment Income | | | 4,277,483 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 87,662 | |

| Foreign currency transactions | | | (6,644 | ) |

| Net realized gain | | | 81,018 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | (10,687,603 | ) |

| Translation of assets and liabilities denominated in foreign currencies | | | (4,676 | ) |

| Net change in unrealized appreciation/depreciation | | | (10,692,279 | ) |

| Net Realized and Unrealized Loss on Investments and Foreign Currency | | | (10,611,261 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (6,333,778 | ) |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2022 | 17 |

Principal Real Estate Income Fund

Statements of Changes in Net Assets

| | | For the Six

Months Ended

April 30, 2022

(Unaudited) | | | For the

Year Ended

October 31, 2021 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 4,277,483 | | | $ | 5,893,404 | |

| Net realized gain on investments and foreign currency transactions | | | 81,018 | | | | 152,277 | |

| Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (10,692,279 | ) | | | 27,309,185 | |

| Net increase/(decrease) in net assets resulting from operations | | | (6,333,778 | ) | | | 33,354,866 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions to shareholders | | | (3,832,269 | ) | | | (6,719,717 | ) |

| Decrease in net assets from distributions to | | | (3,832,269 | ) | | | (6,719,717 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (NOTE 6): | | | | | | | | |

| Cost of shares repurchased | | | – | | | | (1,117,243 | ) |

| Net decrease in net assets from capital share | | | – | | | | (1,117,243 | ) |

| | | | | | | | | |

| Net Increase/(Decrease) in Net Assets | | | (10,166,047 | ) | | | 25,517,906 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 121,030,854 | | | | 95,512,948 | |

| End of period | | $ | 110,864,807 | | | $ | 121,030,854 | |

| | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Shares outstanding - beginning of period | | | 6,812,922 | | | | 6,899,800 | |

| Shares repurchased (Note 6) | | | – | | | | (86,878 | ) |

| Net decrease in shares outstanding | | | – | | | | (86,878 | ) |

| Shares outstanding - end of period | | | 6,812,922 | | | | 6,812,922 | |

See Notes to Financial Statements.

| Principal Real Estate Income Fund | Statement of Cash Flows |

| | For the Six Months Ended April 30, 2022 (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets resulting from operations | | $ | (6,333,778 | ) |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchases of investment securities | | | (12,196,465 | ) |

| Proceeds from disposition of investment securities | | | 13,055,201 | |

| Net proceeds from short-term investment securities | | | (327,841 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | (87,662 | ) |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 10,687,603 | |

| Amortization of premiums and accretion of discounts on investments | | | (979,491 | ) |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (22,526 | ) |

| Dividends receivable | | | (55,367 | ) |

| Prepaid and other assets | | | (7,452 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Interest and commitment fee due on loan payable | | | (605 | ) |

| Payable to transfer agent | | | 7,740 | |

| Payable to adviser | | | (9,690 | ) |

| Payable to administrator | | | 28,785 | |

| Payable for trustee fees | | | (3,667 | ) |

| Other payables | | | 49,460 | |

| Net cash provided by operating activities | | $ | 3,804,245 | |

| | | | | |

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: | | | | |

| Cash distributions paid | | | (3,832,269 | ) |

| Net cash used in financing activities | | $ | (3,832,269 | ) |

| | | | | |

| Effect of exchange rates on cash | | $ | 9,379 | |

| | | | | |

| Net decrease in cash | | $ | (18,645 | ) |

| Cash and Foreign Currency, beginning balance | | $ | 40,720 | |

| Cash and Foreign Currency, ending balance | | $ | 22,075 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | |

| Cash paid during the period for interest from bank borrowing | | $ | 302,551 | |

See Notes to Financial Statements.

| Semi-Annual Report | April 30, 2022 | 19 |

Principal Real Estate Income Fund

| Net asset value - beginning of period |

| Income/(loss) from investment operations: |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total income/(loss) from investment operations |

| |

| Less distributions to shareholders: |

| From net investment income |

| From net realized gains |

| From tax return of capital |

| Total distributions |

| |

| Capital share transactions: |

| Impact of Capital Share Transactions |

| Total capital share transactions |

| Net increase/(decrease) in net asset value |

| Net asset value - end of period |

| Market price - end of period |

| |

| Total Return – Net Asset Value(b) |

| Total Return - Market Price(b) |

| |

| Supplemental Data: |

| Net assets, end of period (in thousands) |

| Ratios to Average Net Assets: |

| Total expenses |

| Total expenses excluding interest expense |

| Net investment income |

| Total expenses to average managed assets(d) |

| Portfolio turnover rate |

| Borrowings at End of Period |

| Aggregate Amount Outstanding (in thousands) |

| Asset Coverage Per $1,000 (in thousands) |

See Notes to Financial Statements.

Financial Highlights

For a share outstanding throughout the periods presented.

For the

Six Months

Ended

April 30, 2022

(Unaudited) | | | For the

Year Ended

October 31,

2021 | | | For the

Year Ended

October 31,

2020 | | | For the

Year Ended

October 31,

2019 | | | For the

Year Ended

October 31,

2018 | | | For the

Year Ended

October 31,

2017 | |

| $ | 17.76 | | | $ | 13.84 | | | $ | 22.86 | | | $ | 19.54 | | | $ | 19.40 | | | $ | 19.02 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.63 | | | | 0.86 | | | | 0.98 | | | | 1.12 | | | | 1.08 | | | | 0.99 | |

| | (1.56 | ) | | | 4.00 | | | | (8.68 | ) | | | 3.52 | | | | 0.38 | | | | 1.10 | |

| | (0.93 | ) | | | 4.86 | | | | (7.70 | ) | | | 4.64 | | | | 1.46 | | | | 2.09 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.56 | ) | | | (0.98 | ) | | | (0.95 | ) | | | (1.32 | ) | | | (1.18 | ) | | | (1.51 | ) |

| | – | | | | – | | | | (0.10 | ) | | | – | | | | – | | | | (0.03 | ) |

| | – | | | | – | | | | (0.27 | ) | | | – | | | | (0.14 | ) | | | (0.17 | ) |

| | (0.56 | ) | | | (0.98 | ) | | | (1.32 | ) | | | (1.32 | ) | | | (1.32 | ) | | | (1.71 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | – | | | | 0.04 | | | | – | | | | – | | | | – | | | | – | |

| | – | | | | 0.04 | | | | – | | | | – | | | | – | | | | – | |

| | (1.49 | ) | | | 3.92 | | | | (9.02 | ) | | | 3.32 | | | | 0.14 | | | | 0.38 | |

| $ | 16.27 | | | $ | 17.76 | | | $ | 13.84 | | | $ | 22.86 | | | $ | 19.54 | | | $ | 19.40 | |

| $ | 14.41 | | | $ | 15.48 | | | $ | 9.46 | | | $ | 21.40 | | | $ | 16.97 | | | $ | 17.09 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (4.95 | %) | | | 37.54 | % | | | (33.27 | %) | | | 25.53 | % | | | 8.67 | % | | | 12.46 | % |

| | (3.41 | %) | | | 75.38 | % | | | (51.28 | %) | | | 35.31 | % | | | 7.13 | % | | | 13.37 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 110,865 | | | $ | 121,031 | | | $ | 95,513 | | | $ | 157,717 | | | $ | 134,820 | | | $ | 133,886 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2.67 | %(c) | | | 2.61 | % | | | 2.92 | % | | | 3.45 | % | | | 3.41 | % | | | 3.03 | % |

| | 2.16 | %(c) | | | 2.16 | % | | | 2.13 | % | | | 2.02 | % | | | 2.09 | % | | | 2.06 | % |

| | 7.33 | %(c) | | | 6.11 | % | | | 5.59 | % | | | 5.31 | % | | | 5.49 | % | | | 5.18 | % |

| | 1.88 | %(c) | | | 1.86 | % | | | 2.08 | % | | | 2.44 | % | | | 2.36 | % | | | 2.09 | % |

| | 7 | %(e) | | | 39 | % | | | 38 | % | | | 17 | % | | | 37 | % | | | 45 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 50,000 | | | $ | 50,000 | | | $ | 40,500 | | | $ | 60,000 | | | $ | 60,000 | | | $ | 60,000 | |

| $ | 3,217 | | | $ | 3,421 | | | $ | 3,358 | | | $ | 3,629 | | | $ | 3,247 | | | $ | 3,231 | |

| Semi-Annual Report | April 30, 2022 | 21 |

Principal Real Estate Income Fund

| (a) | Calculated using average shares throughout the period. |

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported at Net Asset Value or Market Price. For purposes of this calculation, dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any. |

| (d) | Average managed assets represent net assets applicable to common shares plus average amount of borrowings during the period. |

See Notes to Financial Statements.

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

1. ORGANIZATION

Principal Real Estate Income Fund (the ‘‘Fund’’) is a Delaware statutory trust registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the ‘‘1940 Act’’).

The Fund’s investment objective is to seek to provide high current income, with capital appreciation as a secondary investment objective, by investing in commercial real estate related securities.

Investing in the Fund involves risks, including exposure to below-investment grade investments. The Fund’s net asset value per share will vary and its distribution rate may vary and both may be affected by numerous factors, including changes in the market spread over a specified benchmark, market interest rates and performance of the broader equity markets. Fluctuations in net asset value may be magnified as a result of the Fund’s use of leverage.

2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and reported amount of increase or decrease in net assets from operations during the period reported. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on April 30, 2022.

Portfolio Valuation: The net asset value per common share of the Fund is determined no less frequently than daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Fund’s net asset value per common share is calculated in the manner authorized by the Fund’s Board of Trustees (the “Board”). Net asset value per share is computed by dividing the value of the Fund’s total assets, less its liabilities by the number of shares outstanding.

The Board has established the following procedures for valuation of the Fund’s assets under normal market conditions. Marketable securities listed on foreign or U.S. securities exchanges generally are valued at closing sale prices or, if there were no sales, at the mean between the closing bid and ask prices on the exchange where such securities are primarily traded.

The Fund values commercial mortgage-backed securities ("CMBS") and other debt securities not traded in an organized market on the basis of valuations provided by an independent pricing service, approved by the Board, which uses information with respect to transactions in such securities, interest rate movements, new issue information, cash flows, yields, spreads, credit quality, and other pertinent information as determined by the pricing service, in determining value. If the independent primary or secondary pricing service is unable to provide a price for a security, if the price provided by the independent primary or secondary pricing service is deemed unreliable, or if events occurring after the close of the market for a security but before the time as of which the Fund values its common shares would materially affect net asset value, such security will be valued at its fair value as determined in good faith under procedures approved by the Board.

| Semi-Annual Report | April 30, 2022 | 23 |

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

When applicable, fair value of an investment is determined by the Fund’s Fair Valuation Committee as a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business data relating to the issuer, borrower, or counterparty; an evaluation of the forces which influence the market in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment; the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon payments, yield data/cash flow data; the quality, value and salability of collateral, if any, securing the investment; the business prospects of the issuer, borrower, or counterparty, as applicable, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s, or counterparty’s management; the prospects for the industry of the issuer, borrower, or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one or more independent broker quotes for the sale price of the portfolio security; and other relevant factors.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Certain dividend income from foreign securities will be recorded, in the exercise of reasonable diligence, as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date and may be subject to withholding taxes in these jurisdictions. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's understanding of the applicable country's tax rules and rates. Interest income, which includes amortization of premium and accretion of discount, is recorded on the accrual basis. Discounts and premiums on commercial mortgage backed securities purchased are accreted or amortized using the effective interest method. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the specific identification method for both financial reporting and tax purposes. Paydown gains and losses on mortgage-related and other asset-back securities, if any, are recorded as components of interest income in the Statement of Operations. Interest-only stripped mortgage-backed securities (“IO Strips”) are securities that receive only interest payments from a pool of mortgage loans. Little to no principal will be received by the Fund upon maturity of an IO Strip. Periodic adjustments are recorded to reduce the cost of the security until maturity, which are included in interest income.

Fair Value Measurements: Investments in the Fund are recorded at their estimated fair value. The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2022:

| Investments in Securities at Value* | | Level 1 -

Quoted Prices | | | Level 2 -

Other Significant Observable Inputs | | | Level 3 -

Significant Unobservable Inputs | | | Total | |

| Common Stocks | | $ | 57,311,710 | | | $ | – | | | $ | – | | | $ | 57,311,710 | |

| Preferred Stocks | | | 1,040,670 | | | | – | | | | – | | | | 1,040,670 | |

| Commercial Mortgage Backed Securities | | | – | | | | 100,202,433 | | | | – | | | | 100,202,433 | |

| Short Term Investments | | | 1,862,164 | | | | – | | | | – | | | | 1,862,164 | |

| Total | | $ | 60,214,544 | | | $ | 100,202,433 | | | $ | – | | | $ | 160,416,977 | |

| * | See Statement of Investments for industry classifications. |

The Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value, and there were no transfers into or out of Level 3, during the six months ended April 30, 2022.

Commercial Mortgage-Backed Securities: As part of its investments in commercial real estate related securities, the Fund will invest in CMBS which are subject to certain risks associated with direct investments in CMBS. A CMBS is a type of mortgage-backed security that is secured by a loan (or loans) on one or more interests in commercial real estate property. Investments in CMBS are subject to the various risks which relate to the pool of underlying assets in which the CMBS represents an interest. CMBS may be backed by obligations (including certificates of participation in obligations) that are principally secured by commercial real estate loans or interests therein having multi-family or commercial use. Securities backed by commercial real estate assets are subject to securities market risks as well as risks similar to those of direct ownership of commercial real estate loans because those securities derive their cash flows and value from the performance of the commercial real estate underlying such investments and/or the owners of such real estate.

| Semi-Annual Report | April 30, 2022 | 25 |

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

Real Estate Investment Trusts (“REITs”): As part of its investments in real estate related securities, the Fund will invest in REITs and is subject to certain risks associated with direct investment in REITs. REITs possess certain risks which differ from an investment in common stocks. REITs are financial vehicles that pool investors’ capital to acquire, develop and/or finance real estate and provide services to their tenants. REITs may concentrate their investments in specific geographic areas or in specific property types, e.g., regional malls, shopping centers, office buildings, apartment buildings and industrial warehouses. REITs may be affected by changes in the value of their underlying properties and by defaults by borrowers or tenants. REITs depend generally on their ability to generate cash flow to make distributions to shareowners, and certain REITs have self-liquidation provisions by which mortgages held may be paid in full and distributions of capital returns may be made at any time.

As REITs generally pay a higher rate of dividends than most other operating companies, to the extent application of the Fund’s investment strategy results in the Fund investing in REIT shares, the percentage of the Fund’s dividend income received from REIT shares will likely exceed the percentage of the Fund’s portfolio that is comprised of REIT shares. Distributions received by the Fund from REITs may consist of dividends, capital gains and/or return of capital.

Dividend income from REITs is recognized on the ex-dividend date. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported to the Fund after the end of the calendar year. Estimates are based on the most recent REIT distribution information available.

The performance of a REIT may be affected by its failure to qualify for tax-free pass-through of income under the Internal Revenue Code of 1986, as amended (the “Code”), or its failure to maintain exemption from registration under the 1940 Act. Due to the Fund’s investments in REITs, the Fund may also make distributions in excess of the Fund’s earnings and capital gains. Distributions, if any, in excess of the Fund’s earnings and profits will first reduce the adjusted tax basis of a holder’s common shares and, after that basis has been reduced to zero, will constitute capital gains to the common shareholder.

Concentration Risk: The Fund invests in companies in the real estate industry, which may include CMBS, REITs, REIT-like structures, and other securities that are secured by, or otherwise have exposure to, real estate. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly. Any market price movements, regulatory changes, or economic conditions affecting CMBS, REITs, REIT-like structures, and real estate more generally, will have a significant impact on the Fund’s performance.

Foreign Currency Risk: The Fund expects to invest in securities denominated or quoted in currencies other than the U.S. dollar. Changes in foreign currency exchange rates may affect the value of securities owned by the Fund, the unrealized appreciation or depreciation of investments and gains on and income from investments. Currencies of certain countries may be volatile and therefore may affect the value of securities denominated in such currencies, which means that the Fund’s net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. These risks often are heightened for investments in smaller, emerging capital markets.

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

The accounting records of the Fund are maintained in U.S. dollars. Prices of securities denominated in foreign currencies are translated into U.S. dollars at the closing rates of the exchanges at period end. Amounts related to the purchase and sale of foreign securities and investment income are translated at the rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period-end, resulting from changes in exchange rates.

A foreign currency contract is a commitment to purchase or sell a foreign currency at a future date, at a negotiated rate. The Fund may enter into foreign currency contracts to settle specific purchases or sales of securities denominated in a foreign currency and for protection from adverse exchange rate fluctuation. Risks to a Fund include the potential inability of the counterparty to meet the terms of the contract.

Market Disruption and Geopolitical Risk: The value of your investment in the Fund is based on the market prices of the securities the Fund holds. These prices change daily due to economic and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. These price movements, sometimes called volatility, may be greater or less depending on the types of securities the Fund owns and the markets in which the securities trade. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. The extent and nature of the impact on supply chains or economies and markets from these events is unknown, particularly if a health emergency or other similar event, such as the recent COVID-19 outbreak, persists for an extended period of time. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund’s portfolio. There is a risk that you may lose money by investing in the Fund.

| Semi-Annual Report | April 30, 2022 | 27 |

| Principal Real Estate Income Fund | Notes to Financial Statements |

April 30, 2022 (Unaudited)

Social, political, economic and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts and social unrest, may occur and could significantly impact issuers, industries, governments and other systems, including the financial markets. As global systems, economies and financial markets are increasingly interconnected, events that once had only local impact are now more likely to have regional or even global effects. Events that occur in one country, region or financial market will, more frequently, adversely impact issuers in other countries, regions or markets. These impacts can be exacerbated by failures of governments and societies to adequately respond to an emerging event or threat. These types of events quickly and significantly impact markets in the U.S. and across the globe leading to extreme market volatility and disruption. The extent and nature of the impact on supply chains or economies and markets from these events is unknown, particularly if a health emergency or other similar event, persists for an extended period of time. Such events could impact ALPS Advisors, Inc. ("AAI" or the "Adviser") investment advisory activities and services of other service providers, which in turn could adversely affect the Fund’s investments and other operations. The value of the Fund’s investments may decrease as a result of such events, particularly if these events adversely impact the operations and effectiveness of the Adviser or key service providers or if these events disrupt systems and processes necessary or beneficial to the investment advisory, other activities on behalf the Fund.

3. LEVERAGE